Home Ownership Savings Plan, “HOSP”, Schemes in Kenya, & Cytonn Weekly #37/2019

By Research Team, Sep 15, 2019

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, but with the subscription rate rising to 78.6%, from 62.6% recorded the previous week. The undersubscription is partly attributable to a continued period of tightened liquidity in the money market as a result of tax payments with Pay as You Earn (PAYE) having been due as at the start of the week of 9th September 2019, and banks trading cautiously in the interbank market in order to meet their CRR requirements for the cycle ending August 14th. The yield on the 91-day paper declined by 6.0 bps to 6.3% while the yields on the 182-day and 364-day papers rose by 14.8 bps and 6.2 bps to 7.1% and 9.6%, respectively. The National Treasury’s mobile-based bond, M-Akiba, which was reopened in August managed to raise Kshs 263.0 mn, meeting 52.6% of its Kshs 500.0 mn target, and bringing the total amounts raised to date to Kshs 1.0 bn since the 1st issuance in 2017, against the Kshs 1.9 bn floated, resulting in an overall subscription rate of 52.6%;

Equities

During the week, the equities market recorded a mixed performance with NASI and NSE 25 gaining by 0.9% and 1.0%, respectively, while NSE 20 declined by 3.6%, taking their YTD performance to gains/ (declines) of 2.4%, (17.7%) and (3.0%), for NASI, NSE 20 and NSE 25, respectively. During the week, the Insurance Regulatory Authority released the Q2’2019 Insurance Industry Report, highlighting the 138.8% rise in profit after tax to Kshs 5.7 bn, from Kshs 2.4 bn in Q2’2018. Equity Group holdings announced they have entered into a binding Term Sheet with the shareholders of Banque Commerciale du Congo (BCDC) to acquire a controlling stake in the Congo-based lender;

Private Equity

During the week, Amethis, an Africa-focused investment fund manager, acquired a stake in Veranda Leisure & Hospitality (VLH), a subsidiary of Rogers Group, a listed company on the Stock Exchange of Mauritius. In fundraising, Americans for Community Co-operation in Other Nations, through its seed-stage investment arm, Accion Venture Lab, raised USD 23.0 mn (Kshs 2.4 bn), for a new FinTech start-up fund, which will invest in FinTech start-ups across the globe and look to allocate roughly 25% - 30% to Africa;

Real Estate

During the week, Safaricom Investment Co-operative (SIC) unveiled its gated community development, dubbed “The Zaria Village” situated in Kiambu County. Abbott, a US-based healthcare company, announced the opening of its Kenyan office at The Watermark Business Park, in Karen. Marriott International, an American multinational hotel chain, signed a franchise agreement with Aleph Hospitality, a hotel management company to add Bluewater Hotels located in Kisumu to its portfolio;

Focus of the Week

Affordability is regarded as the main constraint to Kenya’s severe housing shortage, which is a direct result of the barely accommodating housing finance system. The government has attempted to solve this by introducing various measures over the past three decades including mortgage reliefs, the establishment of the Kenyan Mortgage Refinancing System (which we wrote about here), Home Ownership Savings Plan, among others. This week, we look at the housing finance system in Kenya, focusing on Home Ownership Savings Plans, (“HOSP”), what they are, their benefits and limitations, and conclude with our recommendations on how to improve their impact in Kenya especially with respect to the government’s Affordable Housing initiative.

- Following the licensing of our regulated affiliate, Cytonn Asset Managers Limited, we are transitioning to an agency model and are looking for agents for our regional markets – Kisumu, Nakuru, Mt. Kenya, and Mombasa. If you have an existing financial services sales business and interested in being an agent in any of these regions, please email us at ifa@cytonn.com;

- Cytonn Money Market Fund closed the week at an average yield of 11.0% p.a. To subscribe, just dial *809#;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved over 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor’s Tourand for more information, email us at sales@cytonn.com;

- Following the completion and handover of Amara Ridge in Karen, we have now launched our next Karen project, dubbed Applewood, a Kshs 2.5 bn residential development located in Miotoni, Karen. This signature development shall comprise luxury homes, each sitting on 1/2 acre. We invite you to the exhibition of Applewood which is ongoing at the Amara Ridge Clubhouse (Location pin: https://goo.gl/maps/B3GVnu8pHyn) or at the Applewood Sales Centre on Miotoni Road (Location pin: https://goo.gl/maps/ZfABuGjFo1z) from 9:00 am to 5:00 pm daily. Call 0709 101 000 or email resales@cytonn.comto reserve a villa! See Video here;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Trainingtopics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained undersubscribed, but with the subscription rate rising to 78.6%, from 62.6% recorded the previous week. The undersubscription is partly attributable to a continued period of tightened liquidity in the money market as a result of tax payments with Pay as You Earn (PAYE) having been due as at the start of the week of 9th September 2019, and banks trading cautiously in the interbank market in order to meet their CRR requirements for the cycle ending August 14th. The yield on the 91-day paper declined by 6.0 bps to 6.3% while the yields on the 182-day and 364-day papers rose by 14.8 bps and 6.2 bps to 7.1% and 9.6%, respectively. The acceptance rate declined to 77.3%, from 99.9% recorded the previous week, with the government accepting Kshs 14.6 bn out of the Kshs 18.6 bn worth of bids received.

The National Treasury’s mobile-based bond, M-Akiba, which was reopened in August managed to raise Kshs 263.0 mn, meeting 52.6% of its Kshs 500.0 mn target, bringing the total amounts raised to date to Kshs 1.0 bn since its 1st issuance in 2017 against the Kshs 1.9 bn floated, resulting in an overall subscription rate of 52.6%. The M-Akiba initiative sought to leverage on the increased mobile phone penetration to deepen financial inclusion with its terms being favourable to retail investors with the minimum subscription set at Kshs 3,000 compared to the other infrastructure bonds, whose minimum subscription amount is set at Kshs 100,000, with the bond offering an interest rate of 10.0% that is tax-free, currently with a tenor of 1 year with the maturity date set at 7th September 2020 and is thus trading at a discount compared to a 364-day T-bill which has a similar tenor to maturity that currently trading at a yield of 9.6%.

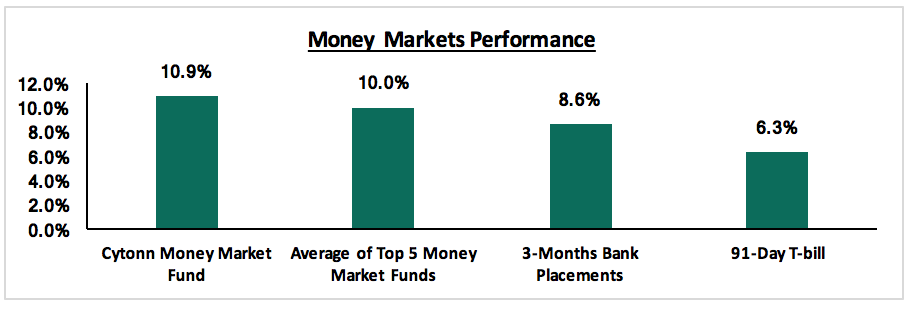

In the money markets, 3-month bank placements ended the week at 8.6% (based on what we have been offered by various banks), the 91-day T-bill came in at 6.3%, while the average of Top 5 Money Market Funds came in at 10.0%, compared to 10.1% last week, with the Cytonn Money Market Fund closing the week at 10.9%, a decline from 11.0% last week.

Liquidity:

During the week, the average interbank rate increased to 6.4%, from 5.5% recorded the previous week, pointing to tightened liquidity conditions in the money market attributable to tax payments with Pay as You Earn (PAYE) having been due as at the start of the week on 9th September, and banks trading cautiously in the interbank market in order to meet their CRR requirements for the cycle ending August 14th. This saw commercial banks’ excess reserves decline to come in at Kshs 4.1 bn in relation to the 5.25% cash reserves requirement (CRR), from Kshs 6.6 bn the previous week. The average volumes traded in the interbank market increased by 35.8% to Kshs 10.1 bn, from Kshs 7.4 bn the previous week.

Kenya Eurobonds:

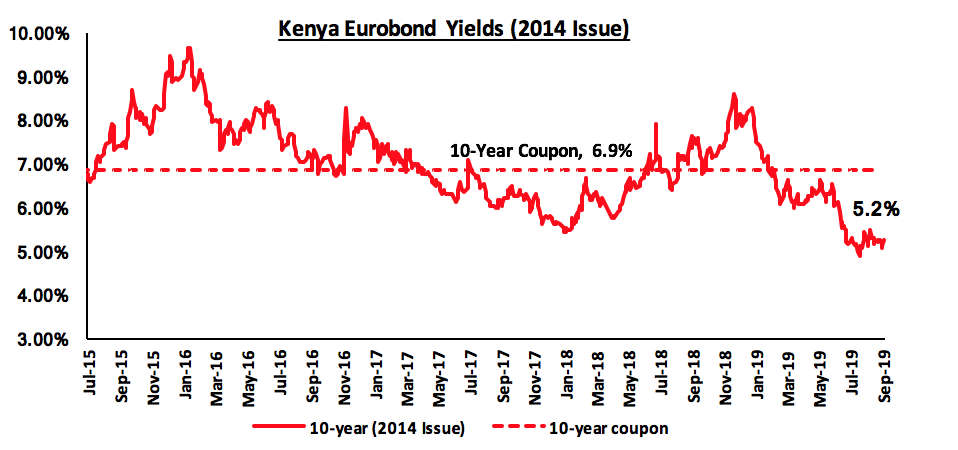

According to Reuters, the yield on the 10-year Eurobond issued in 2014 increased by 0.1% points to 5.2% during the week, from 5.1% the previous week, following news that Global rating firm Moody’s could further lower Kenya’s creditworthiness currently at ‘B2 stable’ following the completion of their periodic review on Kenya, where they raised concern over the country's very low fiscal strength, ballooning debt and rampant corruption.

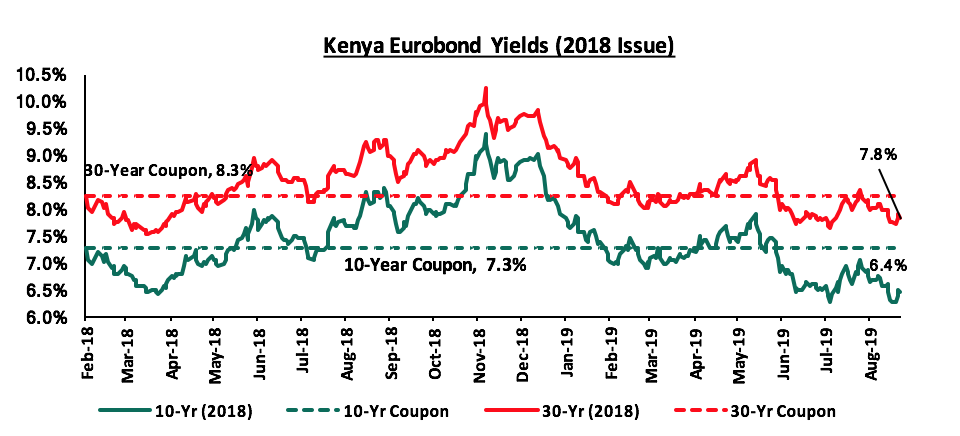

During the week, the yield on the 2018, 10-year and 30-year Eurobond both increased by 0.1% points to 6.4% and 7.8%, from 6.3% and 7.7% recorded the previous week, respectively.

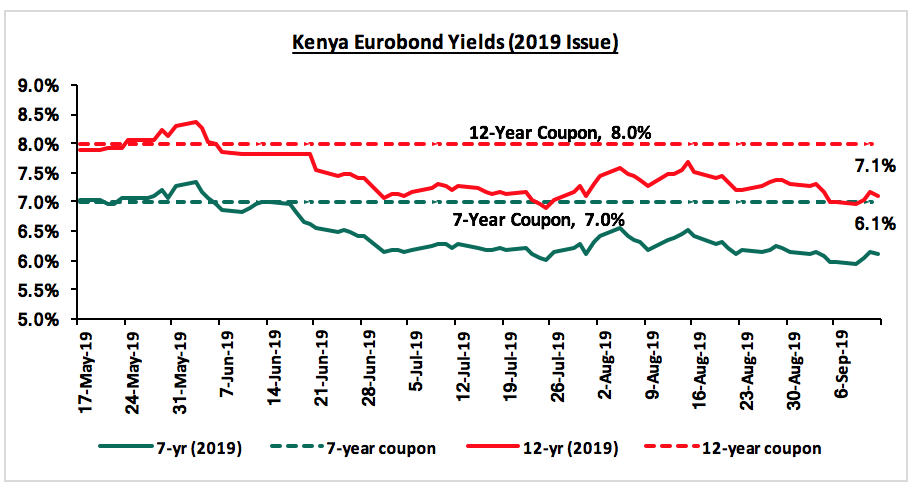

During the week, the yields on both the 7-year and 12-year Eurobonds rose by 0.1% points to come in at 6.1% and 7.1%, from 6.0% and 7.0% recorded the previous week, respectively.

Kenya Shilling:

During the week, the Kenya Shilling appreciated by 0.1% against the US Dollar to close at Kshs 103.8, from Kshs 103.9 recorded the previous week, supported by inflows from diaspora remittances amidst thin dollar demand from merchandise importers. On a YTD basis, the shilling has depreciated by 2.0% against the dollar, in comparison to the 1.3% appreciation in 2018. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that the current account deficit narrowed to 4.2% of GDP in the 12-months to July 2019, from 5.0% recorded in December 2018. The decline has been attributed to the resilient performance of exports particularly horticulture and coffee, strong diaspora remittances, and higher receipts from tourism and transport services. Growth of imports also slowed mainly due to lower imports of food,

- Improving diaspora remittances, which have increased cumulatively by 11.1% in the 12-months to July 2019 to USD 2.8 bn, from USD 2.5 bn recorded in a similar period of review in 2018. The rise is due to:

- Increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and,

- New partnerships between international money remittance providers and local commercial banks making the process more convenient,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 9.2 bn (equivalent to 5.8-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Weekly Highlight:

The Energy and Petroleum Regulatory Authority released their monthly statement on the maximum retail fuel prices in Kenya effective from 15th September 2019 to 14th October 2019. Below are the key take-outs from the statement:

- Petrol prices have increased by 0.2% to Kshs 112.8 from Kshs 112.5 per litre previously, while diesel prices have increased by 2.4% to Kshs 103.4 from Kshs 100.6, previously,

- Kerosene prices, however, have declined by 3.2% to Kshs 100.6 from Kshs 104.0 per litre

The changes in prices are attributable to:

- A decline in the average landing cost of imported super petrol by 0.2% to USD 497.4 in August from USD 498.5 per cubic metre in July 2019. The decline was however offset by the 0.1% depreciation of the mean monthly US Dollar to Kenya Shilling exchange rate to Kshs 103.4 in August from Kshs 103.3 in July, and

- An increase in the average landing costs of imported diesel by 4.4% to USD 503.6 per cubic metre in August 2019, from 482.5 per cubic metre in July 2019, and Kerosene declining by 5.6% to USD 484.3 in August from USD 513.1 per cubic metre in July 2019.

We expect a rise in the transport index, which carries a weighting of 8.7% in the total consumer price index (CPI), due to the increase in petrol and diesel pump prices. We shall publish our inflation projections in next week’s report .

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. A budget deficit is likely to result from depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Despite this, we do not expect upward pressure on interest rates due to increased demand for government securities, driven by improved liquidity in the market owing to the relatively high debt maturities. Our view is that investors should be biased towards medium-term fixed income instruments to reduce duration risk associated with long-term debt, coupled with the relatively flat yield curve on the long-end due to saturation of long-term bonds.

Market Performance:

During the week, the equities market recorded a mixed performance with NASI and NSE 25 gaining by 0.9% and 1.0%, respectively while NSE 20 declined by 3.6%, taking their YTD performance to gains/ (declines) of 2.4%, (17.7%) and (3.0%), for NASI, NSE 20 and NSE 25, respectively. The performance in NASI was driven by gains in Co-operative Bank, Equity Group and EABL, which rose by 5.8%, 2.3% and 2.1%, respectively. The gains were weighed down by declines recorded in Bamburi, Diamond Trust Bank Kenya (DTBK) and Barclays Bank Kenya (BBK) of 5.5%, 2.6% and 1.8%, respectively.

Equities turnover declined by 42.6% during the week to USD 17.2 mn, from USD 30.1 mn the previous week, taking the YTD turnover to USD 1.0 bn. Foreign investors remained net sellers for the week, with the net selling position increasing by 198.8%, to USD 1.3 mn, from a net selling position of USD 0.4 mn the previous week.

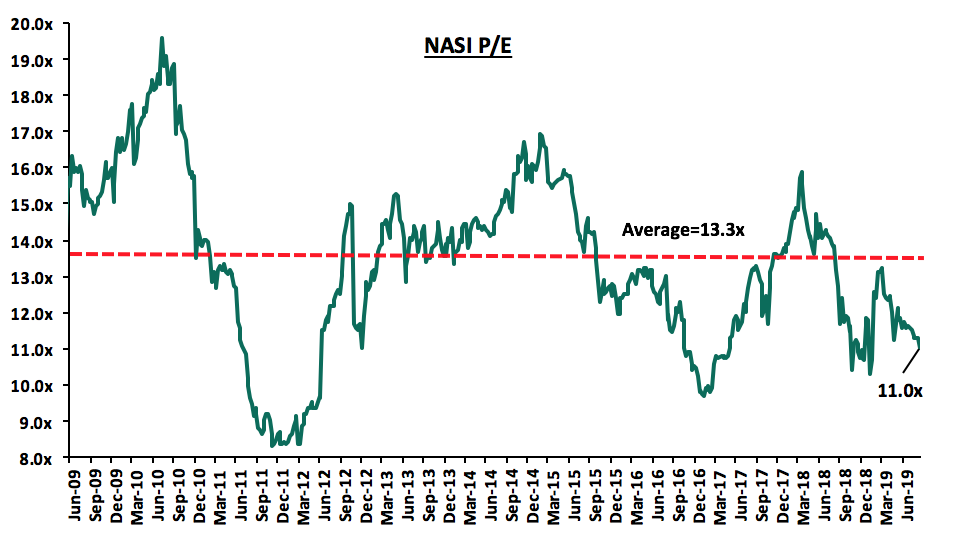

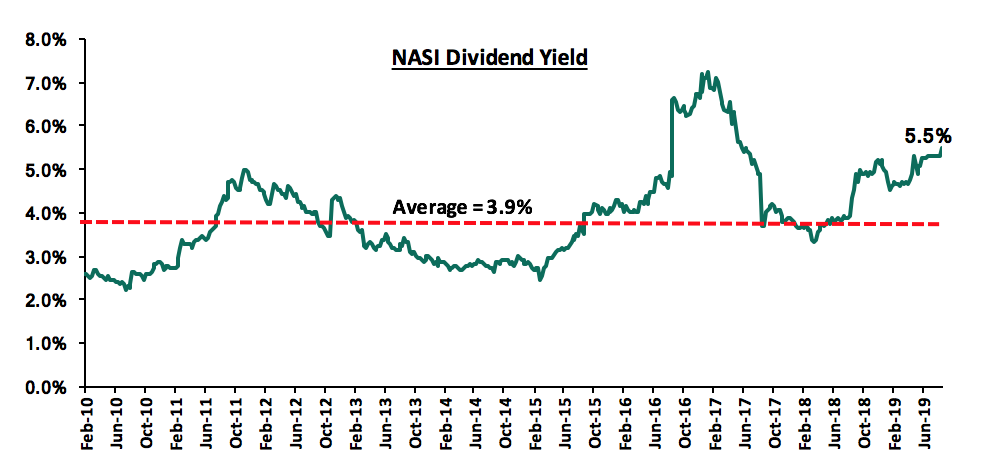

The market is currently trading at a price to earnings ratio (P/E) of 11.0x, 17.3% below the historical average of 13.3x, and a dividend yield of 5.5%, above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 11.0x is 13.4% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 32.5% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlights

During the week, the Insurance Regulatory Authority (IRA) released the Q2’2019 Insurance Industry Report, highlighting the improvement in the sector’s profit after tax, which rose by 138.8% to Kshs 5.7 bn, from Kshs 2.4 bn in Q2’2018. Key highlights of the performance during the period include:

- The performance was largely supported by the 4.4% rise in gross premium income to Kshs 117.3 bn, from Kshs 112.4 bn in Q2’2018, which outpaced the marginal 1.6% rise in claims expense to Kshs 54.7 bn, from Kshs 53.8 bn in Q2’2018,

- Commission expense declined by 2.3% to Kshs 5.4 bn, from Kshs 5.5 bn in Q2’2018,

- The industry’s combined ratio was 102.8%, with a loss ratio at 64.2% and an expense ratio at 38.6%, indicating the underwriting business still remains unprofitable. This is comparable to a combined ratio of 106.0% in Q2’2018, where the industry had a loss ratio of 65.3% and an expense ratio of 40.7%,

- The industry recorded an expansion of the balance sheet, as shown by 7.6% rise in total assets to Kshs 672.1 bn, from Kshs 624.6 bn in Q2’2018, largely supported by the 9.1% increase in investment securities to Kshs 556.3 bn, from Kshs 509.7 bn in Q2’2018, with 60.0% of the investment portfolio held in government securities, 15.0% in investment property and 9.3% in bank deposits, and 7.0% in quoted ordinary shares, and the remaining 8.7% in loan and mortgages, unquoted ordinary shares and investments in subsidiaries,

- Total liabilities rose by 8.8% to Kshs 514.3 bn, from Kshs 474 bn in Q2’2018, largely driven by the 13.6% rise in insurance contract liabilities to Kshs 348.7 bn, from Kshs 307.1 bn in Q2’2018, and,

- Shareholders equity rose by 4.0% to Kshs 157.8 bn, from Kshs 151.8 bn, driven by the 12.0% rise in retained earnings to Kshs 62.0 bn, from Kshs 55.4 bn, in Q2’2018, with the increase weighed down by the 29.8% decline in the revaluation reserve to Kshs 4.0 bn, from Kshs 5.8 bn in Q2’2018.

We note that the sector’s performance was largely supported by investment income, as has been the case with the sector, as the investment yield rose to 5.1%, from Kshs 4.4% in Q2’2018. The sector’s underwriting losses of Kshs 1.3 bn in Q2’2019, albeit a 52.8% decline, from the Kshs 2.7 bn loss recorded in Q2’2018, highlight the profitability challenges that still remain in underwriting, with the industry largely weighed down by price undercutting from intense rivalry amongst firms.

During the week, Equity Group Holdings entered into a binding Term Sheet with shareholders of Banque Commerciale du Congo (BCDC), for the purchase of a controlling stake in the Congo-based lender. The proposed transaction is pending the completion of the various due diligence, agreements between the two parties, and granting of necessary approvals by the Capital Markets Authority (CMA), Central Bank of Kenya (CBK), Central Bank of Congo and the Competition Authority of Congo. Equity Group Holdings has continued its regional diversification drive by venturing and focusing in Congo, where the bank acquired Pro Credit Bank in September 2015, a Small Medium Enterprise (SME)-focused bank for Kshs 4.5 bn, for a 79.0% stake, effectively valuing the bank at Kshs 5.7 bn, compared to the equity position of Kshs 2.9 bn, implying a P/B multiple of 2.0x. With the pending transaction of BCDC, which had assets of USD 706.0 mn, deposits of USD 485 mn, and shareholders’ equity of USD 73 mn, Equity Group would be acquiring the second-largest bank by assets in Congo, with a branch network of 29 branches. The bank recorded a Return on Equity (ROE) of 11.0%, Return on Assets (ROA) of 1.2%, and a Cost to Income Ratio (CIR) of 70.0% as at FY’2017. Comparing with Equity Group Congo, which recorded an ROE of 17.9%, ROA of 1.9% and CIR of 70.9%, we view that the subsidiary would still require improvements in operational efficiency to improve on its bottom line. Equity Group holdings recorded an ROE of 22.1%, ROA of 3.5% and CIR of 54.8% as at H1’2018, with the relatively high ROE compared to the banking sector average of 19.5%, attributable to Equity Group’s utilization of its assets, as well as relatively high operational efficiency better than the average banking sector CIR, of 55.1%. Assuming the transaction were to be conducted at a 2.0x P/B, similar to the initial acquisition of Pro Credit Bank, it would mean that Equity Group would pay USD 146.0 mn, based on FY’2017 equity position of USD 73 mn. We are of the view that the bank would essentially increase its foothold in the Congo market if the transaction is successful. The bank would likely be looking to employ the same strategy as the Kenyan market, by pushing its retail banking unit through the digital and alternative transaction channels. We view that this presents Equity Group with headroom for growth, with Congo having an adult population of 40.0 mn, with only 14.8 mn (37.0%) having access to any form of financial service thus availing a significant unaddressed segment of the market.

Co-operative Bank of Kenya indicated its plan to open 5 new additional branches during the week, which will bring the total branch network to 160. Co-operative bank will buck the trend of branch closures seen in the listed banking sector space. With a deposit per branch ratio of Kshs 2.1 bn as at H1’2019, lower than the listed bank average of Kshs 3.3 bn. The bank’s strategy of increasing its branch network is largely to support the bank’s advisory and support network for SMEs and Saccos, with 88.0% of the transactions done outside the branches, with branches reduced to handling high-value transactions. With a cost to income ratio of 54.8%, the bank remains one of the most efficient banks, below the industry average of 55.1%. The bank is likely looking to increase its penetration in areas it does not have a presence, such as Kapenguria, Maralal and Chogoria, as it continues to lag behind its major competitors Equity Group and KCB Group who have 283 branches and 257 branches, respectively, and possibly aid the bank in deposit mobilization.

Universe of Coverage

|

Banks |

Price as at 6/09/2019 |

Price as at 13/09/2019 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/Downside** |

P/TBv Multiple |

Recommendation |

|

KCB Group*** |

38.2 |

38.5 |

0.8% |

2.8% |

56.3 |

9.1% |

56.3% |

1.0x |

Buy |

|

Diamond Trust Bank |

113.5 |

110.5 |

(2.6%) |

(29.4%) |

180.8 |

2.4% |

55.9% |

0.6x |

Buy |

|

Sanlam |

18.0 |

19.0 |

5.3% |

(13.9%) |

29.0 |

0.0% |

53.0% |

0.7x |

Buy |

|

Kenya Reinsurance |

2.9 |

2.8 |

(2.4%) |

(18.6%) |

3.8 |

5.3% |

37.3% |

0.3x |

Buy |

|

Equity Group*** |

37.1 |

37.9 |

2.3% |

8.8% |

49.2 |

5.3% |

31.7% |

1.6x |

Buy |

|

Britam |

7.1 |

7.0 |

(1.4%) |

(31.2%) |

8.8 |

5.0% |

31.1% |

0.8x |

Buy |

|

CIC Group |

3.2 |

3.1 |

(2.8%) |

(20.2%) |

3.8 |

4.2% |

27.6% |

1.2x |

Buy |

|

Co-operative Bank*** |

11.3 |

12.0 |

5.8% |

(16.4%) |

14.1 |

8.4% |

25.6% |

1.0x |

Buy |

|

Barclays Bank*** |

11.0 |

10.8 |

(1.8%) |

(1.8%) |

12.0 |

10.2% |

25.3% |

1.3x |

Buy |

|

I&M Holdings |

46.5 |

45.7 |

(1.8%) |

7.4% |

63.5 |

7.7% |

23.1% |

0.8x |

Buy |

|

NIC Group |

28.1 |

28.1 |

0.0% |

0.9% |

36.3 |

3.6% |

22.3% |

0.6x |

Buy |

|

Liberty Holdings |

9.7 |

10.0 |

3.1% |

(22.6%) |

11.3 |

5.0% |

18.2% |

0.8x |

Accumulate |

|

Jubilee Holdings |

370.0 |

370.0 |

0.0% |

(8.6%) |

418.5 |

2.4% |

15.5% |

1.1x |

Accumulate |

|

Stanbic Holdings |

96.0 |

96.0 |

0.0% |

5.8% |

94.9 |

6.1% |

1.9% |

1.1x |

Lighten |

|

Standard Chartered |

195.5 |

196.0 |

0.3% |

0.8% |

183.5 |

6.4% |

0.7% |

1.4x |

Lighten |

|

National Bank |

4.1 |

4.1 |

0.0% |

(22.6%) |

3.5 |

0.0% |

(15.4%) |

0.2x |

Sell |

|

HF Group |

4.4 |

5.5 |

25.0% |

(0.7%) |

2.9 |

0.0% |

(47.3%) |

0.2x |

Sell |

|

|

|

|

|

|

|

|

|

|

|

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in

|

|||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

During the week, Amethis, an Africa-focused investment fund manager, acquired a stake in Veranda Leisure & Hospitality (VLH), a subsidiary of Rogers Group, a listed company on the Stock Exchange of Mauritius. The financial details of the transaction have not been disclosed. VLH is a Mauritius-based hotel and leisure company that focuses on hotels in the upscale and mid-range segments operating under Heritage Resorts and Veranda Resorts. Currently, the company operates seven properties with a total of 802 rooms. Rodgers Group is a Mauritius based international services and investment company that specialises in FinTech, hospitality, property and logistics.

The investment from Amethis will mainly be directed towards projects under VLH through new leisure activities and accommodation offerings. Through the Heritage brand, the company is working on the development of the Bel Ombre region, highlighting its cultural and historical heritage. The transaction will contribute to the growth of Rodgers Group’s hospitality activities, diversification of its portfolio and expansion of its geographical footprint in the region. This marks the second investment that Amethis has undertaken with Rodgers Group with the first being the acquisition of approximately one third share capital of Velogic, which is a leading logistics and transport company and a subsidiary of Rodgers Group. In our view, the support from Amethis will allow VLH to accelerate their goals of expansion mainly in the Bel Ombre region. The hospitality sector is set to continue showing positive performance supported by the vibrant international and domestic tourism in the continent.

Fundraising

In fundraising, Accion, through its seed-stage investment arm, Accion Venture Lab, raised USD 23.0 mn (Kshs 2.4 bn), for a new FinTech start-up fund. The capital for the new fund was raised through contributions from various participants including Ford Foundation, Prudential Financial, Blue Haven Initiative, Visa Inc. and Proparco (the development finance institution of the French Government). The firm intends to allocate approximately 25% - 30% of the funds to Africa where their focus will be on start-ups that leverage technology to increase the reach, quality and affordability of financial services for the under-served.

Accion Venture Lab was founded in 2012 with USD 10.0 mn in capital, with the mandate to boost financial inclusion on a global scale. Today, the company has a portfolio of 36 FinTech start-up investments across five continents. Accion Venture Lab stands out as a fund since it gives an equal pitch footing to FinTech ventures across the board, emerging and developed markets from Lagos to London. In our view, the successful fundraising done by Accion will allow it to actualize its goals of improving financial inclusion considering their focus on Africa, which has the largest share of the world’s unbanked population. For the FinTech sector, this poses as an opportunity for innovative start-ups to scale up in their respective industries.

We maintain a positive outlook on private equity investments in Africa as evidenced by the increasing investor interest, which is attributed to; (i) economic growth, which is projected to improve in Africa’s most developed PE markets, (ii) attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, and (iii) attractive valuations in Sub Saharan Africa’s markets compared to global markets. Going forward, the increasing investor interest, stable macro-economic and political environment will continue to boost deal flow into African markets.

- Residential Sector

During the week, Safaricom Investment Co-operative (SIC) unveiled its gated community development, dubbed “The Zaria Village”. The development located in Kiambu County off the Ruiru-Kiambu bypass is set on 120-acres and will consist of a commercial centre, kindergarten and 331 quarter-acre plots, with guidelines on the particular detached units to be developed on the plots provided. The project is sub-divided into three distinct zones namely Green Gem, Grey Pearl and Golden Rod, with starting prices of Kshs 6.95 mn, Kshs 7.15 mn, and Kshs 7.35 mn per quarter-acre, respectively. Buyers will then select their preferred detached unit designs from the four pre-approved house plans i.e. Zara, Zaira, Zayana and Zazi with plinth areas of 288 SQM, 416 SQM, 292 SQM and 386 SQM, respectively, and the prices of the respective units are yet to be disclosed.

This is an indication that Kiambu County as an investment node continues to attract developers. This is attributed to: (i) the affordability of land for development with the price per acre of Kshs 21.3 mn as at H1’2019 in comparison to other satellite towns such as Ruaka at Kshs 80.3 mn, (ii) infrastructural developments with the Northern Bypass completed in 2016, enhancing ease of access to areas such Ruiru and the Thika Superhighway, (iii) a growing demand for residential units from the working class from Nairobi CBD and Thika towns environs, (iv) attractive returns on investments, and most importantly, (v) the compelling demographics of the county where 6 of the 10 fastest-growing mid-sized towns in Kenya are located in Kiambu County.

|

Top 10 Fastest-growing Mid-sized Towns in Kenya (Number of People) |

|||||

|

# |

Area |

1999 |

2009 |

Growth |

County |

|

1 |

Kikuyu |

10,000 |

190,208 |

1,802.1% |

Kiambu |

|

2 |

Karuri |

11,228 |

99,739 |

788.3% |

Kiambu |

|

3 |

Ngong |

12,110 |

104,073 |

759.4% |

Kajiado |

|

4 |

Limuru |

10,000 |

61,336 |

513.4% |

Kiambu |

|

5 |

Kitengela |

10,000 |

58,167 |

481.7% |

Kajiado |

|

6 |

Kiambu |

13,832 |

76,093 |

450.1% |

Kiambu |

|

7 |

Mavoko |

22,716 |

110,396 |

386.0% |

Machakos |

|

8 |

Juja |

10,000 |

40,446 |

304.5% |

Kiambu |

|

9 |

Kimilili |

10,279 |

41,115 |

300.0% |

Bungoma |

|

10 |

Ruiru |

79,935 |

236,961 |

196.4% |

Kiambu |

Source: Afrika Economics

According to Cytonn (NMA) Residential Report 2018/2019, Ruiru posted attractive returns in 2018, with an average total return of 6.0% in comparison to the overall residential market’s average of 4.7%.

The table below shows the performance of detached units in satellite towns in H1’2019:

(All Values in Kshs Unless Stated Otherwise)

|

Detached Units Performance H1'2019 – Top 5: Satellite Towns |

|||||||

|

Area |

Price per SQM H1'2019 |

Rent per SQM H1'2019 |

Annual Uptake H1'2019 |

Occupancy H1’2019 |

Rental Yield H1'2019 |

Annual Price Appreciation H1'2019 |

Total Returns H1’2019 |

|

Ruiru |

99,064 |

353 |

17.1% |

79.6% |

5.1% |

0.9% |

6.0% |

|

Athi River |

92,054 |

406 |

19.3% |

79.6% |

4.5% |

0.6% |

5.0% |

|

Ngong |

64,843 |

238 |

19.4% |

72.8% |

3.2% |

1.6% |

4.8% |

|

Kitengela |

73,919 |

446 |

17.7% |

66.1% |

3.1% |

1.2% |

4.3% |

|

Juja |

73,182 |

260 |

16.6% |

61.9% |

2.7% |

(2.1%) |

0.7% |

|

Average |

80,612 |

341 |

18.0% |

72.0% |

3.7% |

0.4% |

4.1% |

Source: Cytonn Research 2019

We expect the residential sector in satellite areas to continue gaining popularity in Kenya, supported by (i) relatively high returns to investors, (ii) growing middle class creating demand for housing units, and (iii) infrastructure improvements, and thus attractive performance going forward.

ii . Commercial Office Sector

Abbott, a US-based healthcare company, announced the opening of its first Kenyan office at The Watermark Business Park, in Karen. The office will serve as the organization’s headquarters for operations within East Africa. Karen is among the best performing office nodes within the Nairobi Metropolitan Area. According to Cytonn NMA Commercial Office Report 2019, it recorded rental yields of 9.2% in 2018, 1.1% points above the average yield of 8.1%. The Karen office market appeals to a number of businesses and multinational companies supported by (i) its proximity to the CBD and other business nodes, (ii) relatively good infrastructure network, (iii) availability of social amenities with shopping malls such as the Hub and Waterfront, and (iv) exclusivity enabled by the restricted zoning regulations thereby attracting differentiated high quality and serviced office concepts.

The table below shows the Commercial Office Market performance in 2018:

(All Values in Kshs Unless Stated Otherwise)

|

Commercial Office Market Performance 2018 |

||||

|

Commercial Nodes |

Price Kshs/ SQFT FY 2018 |

Rent Kshs/SQFT FY 2018 |

Occupancy FY 2018 (%) |

Rental Yield (%) FY 2018 |

|

Gigiri |

13,833 |

141 |

88.3% |

10.5% |

|

Karen |

13,666 |

118 |

88.6% |

9.2% |

|

Westlands |

12,050 |

110 |

82.1% |

9.0% |

|

Parklands |

12,494 |

102 |

86.0% |

8.4% |

|

Kilimani |

13,525 |

99 |

88.3% |

8.0% |

|

Upperhill |

12,560 |

100 |

80.7% |

7.9% |

|

Nairobi CBD |

12,425 |

89 |

88.3% |

7.6% |

|

Thika Road |

12,517 |

86 |

81.5% |

6.7% |

|

Msa Road |

11,400 |

79 |

65.6% |

5.8% |

|

Average |

12,719 |

103 |

83.3% |

8.1% |

|

Karen was among the best performing nodes recording rental yields of 9.2%, 1.1% higher than the average yield of 8.1%. This was attributed to increased demand by businesses and multinational companies due to proximity to CBD and other business nodes, high-quality office space and relatively good infrastructure network |

||||

Source: Cytonn Research 2019

iii . Hospitality Sector

During the week, Marriott International, an American multinational hotel chain, signed a franchise agreement with Aleph Hospitality, a Dubai-based hotel management company to add Bluewater Hotels located in Kisumu to its portfolio. The franchise that will operate under the name, “Protea Hotel by Marriott”, has 125 rooms and includes amenities such as food outlets, swimming pool gym and meeting space.

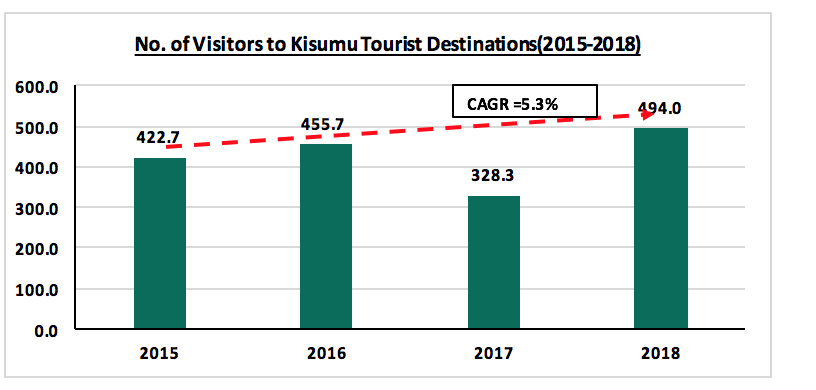

The increased interest in Kisumu’s hospitality sector by hospitality firms such as Mariott International and Simba Hospitality Group is sparked by a vibrant tourism sector, which has shown a steady rise in tourism numbers since 2015, recording a CAGR of 5.3% in tourist numbers visiting museums, historical sites and the Impala Sanctuary, to 494,000 in 2018 from 422,700 in 2015 according to KNBS Economic Survey 2019.

Source: KNBS 2019

Kisumu is recognized as one of the major tourist destinations in Kenya, partly due to its numerous attractions such as Lake Victoria, national parks such as the Impala Sanctuary and its rich cultural heritage.

The tourist activities have resulted in a vibrant economy boosting the hospitality and retail sectors as a result of long-stay visitors.

Marriott International intends to increase its footprint in Africa to 200 hotels by the end of 2023 through its diverse brand portfolio which includes Sheraton Hotels & Resorts, Protea Hotels, St. Regis and JW Marriott brands. The increased interest in Africa is driven by (i) an improved macroeconomic environment, (ii) positive demographics, (iii) rising income amongst the middle class, and (iv) increased political stability. The hotel chain made its entry into the Kenyan market with the opening of Four Points by Sheraton Nairobi. Properties added into its Kenyan portfolio are as shown below:

|

Marriott International Portfolio in Kenya |

|||

|

|

Hotel |

Location |

Year |

|

1 |

Four Points by Sheraton |

Nairobi Airport |

2017 |

|

2 |

Four Points by Sheraton |

Kilimani, Nairobi |

2017 |

|

3 |

Sankara Hotel |

Westlands, Nairobi |

2019 |

|

4 |

Bluewater Hotels |

Kisumu |

2019 |

|

5 |

JW Marriott* |

Westlands, Nairobi |

2020 |

|

*Set to open in 2020 |

|||

We expect the Kenyan hospitality sector to continue recording increased activities supported by: (i) improved hotel standards with the entry of global hotel brands, (ii) the continued marketing of Kenya as an experience destination, and (iii) improved security, which continues to boost tourists’ confidence in the country and thus making it a preferred travel destination for both business and holiday travelers.

We expect the real estate sector to continue recording activities fuelled by the continued entry and expansion multinational firms, availability of development class land and the existing demand for housing units in the middle- and low-income bracket.

Housing is an important aspect of the economy. However, this has been a challenge in Kenya with a housing deficit of 2.0 mn units, with demand growing at 200,000 units per annum, but supply only providing 50,000 units per annum as per the National Housing Corporation (NHC). The Ministry of Housing indicates that 83.0% of the existing housing supply is for the high income and upper-middle-income segments, with only 15.0% for the lower-middle and 2.0% for the low-income population. The Kenyan Government, through their Big 4 Agenda, which covers affordable housing as one of the pillars have, therefore, been seeking to deliver 500,000 units by 2022, costing between Kshs 0.6 mn and Kshs 3.0 mn aimed at 74.5% of Kenyans earning below Kshs 50,000 per month. However, financing for end-buyers towards the purchase of affordable housing remains a challenge in Kenya, both on the absolute value of the unit, and the financing structures available for a first-time buyer to access capital towards their unit purchase.

In this topical, we seek to demystify the issue of affordability in Kenya, with a focus on Home Ownership Savings Plans, and as such we shall cover the following:

- Challenges with Affordability of Housing in Kenya,

- Availability of Affordability Options in Kenya,

- Introduction and Historical Development of Home Ownership Savings Plans in Kenya,

- House Savings Plans in Other Countries,

- The Benefits and Limitations of Home Ownership Savings Plan Schemes, and,

- How to Improve Home Ownership Savings Plan in Kenya.

Section I: Challenges with Affordability of Housing in Kenya

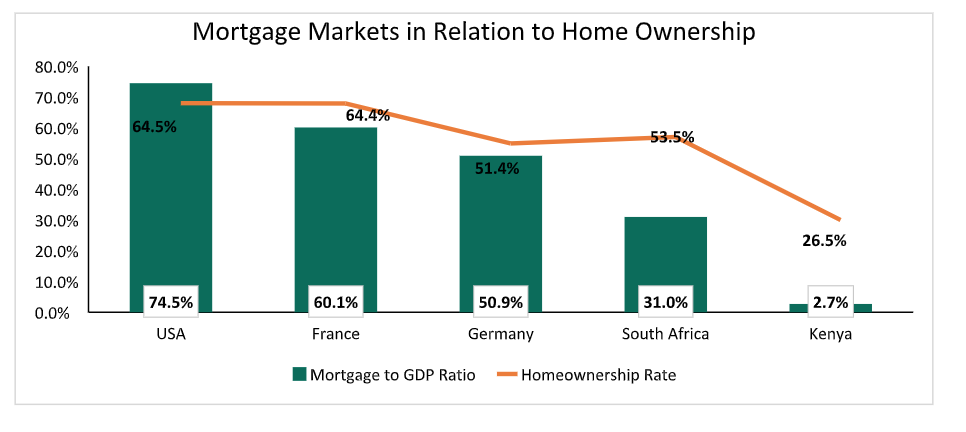

According to the 2015/16 Kenya Integrated Household Budget Survey (KIHBS), only 26.1% of Kenyans living in urban areas own the homes they live in. This is in comparison to countries like South Africa with 53.5% or the United States with 64.5%. This is attributable to the unaffordability of housing units in the market. Those who own homes rely mainly on savings and other sources of financing including mortgage loans, commercial bank loans, and local investment groups commonly referred to as chamas, and Savings & Credit Co-operative Societies (SACCOs).

Access to housing finance in Kenya remains lacking mainly due to:

- Low-income levels that cannot service a mortgage - according to Kenya National Bureau of Statistics, only 2.9% of Kenyans earn above Kshs 100,000 per month,

- Soaring property prices boosted by the demand-supply forces,

- Exclusion of informal sector employees who, as per KNBS data, make up approximately 83.4% of Kenya’s workforce, due to insufficient credit risk information,

- Lack of capital markets funding, which tend to be long-term, and can enable real estate purchases for end-buyers,

- High-interest rates and deposit requirements for mortgage loans, which lockout majority of potential borrowers, and,

- Underdeveloped mortgage market - According to Central Bank of Kenya, there were only 26,187 mortgages in Kenya as at December 2017 out of a total adult population of approximately 23 mn persons, with the mortgage to GDP ratio standing at 2.7% compared to countries such as South Africa and USA, which have a ratio of above 30.0% and 70.0%, respectively.

Section II: Availability of Affordability Options in Kenya

To enable homeownership, the government for the past three decades has continued to introduce policy and fiscal reforms aimed at enhancing homeownership. Key among them are:

- Mortgage Relief: As per the 1995 Income Tax Act cap 470, borrowing money from a registered financial institution to purchase a home or to improve a home guarantees the borrower a tax relief on interests paid to the registered financial institution of up to a maximum of Kshs 300,000 p.a.,

- Home Ownership Savings Plan, “HOSP”: Introduced in 1995 in the Income Tax Act, Home Ownership Savings Plan is a tax instrument aimed at first time homebuyers, where savings with a Registered Home Ownership Savings Plan for a maximum of ten-years allows the subscribers tax rebates of up to Kshs 8,000 per month or Kshs 96,000 annually and tax relief on interest income of up to Kshs 3.0 mn after the ten-years,

- National Housing Development Fund: The Housing Fund was established under the Housing Act 2018 Section 6 (1), under the control of National Housing Corporation (NHC) as provided for in Housing Act Cap 117. The aim of the fund is to allow mortgage and cash buyers to save towards the purchase of an affordable home through the affordable housing Home Ownership Savings Plan,

- Affordable Housing Relief: The Income Tax Act was amended in 2018 to allow 15.0% tax relief up to a maximum of Kshs 108,000 p.a., or Kshs 9,000 p.m., to affordable home buyers,

- Stamp Duty Act: Amended in 2018, the Act allows for exemption of first-time homebuyers under the affordable housing scheme from paying the Stamp Duty Tax, which is normally set at 2.0% - 4.0% of the property value depending on location, and,

- Kenya Mortgage Refinancing Company: The company is set to enhance mortgage affordability in Kenya by enabling long-term loans at attractive market rates through the provision of affordable long-term funding and capital market access to primary mortgage lenders such as banks and financial co-operatives,

However, the development of the Kenyan housing finance market has been relatively slow, and not up to pace with the registered housing demand backlog creating the need for more reforms.

Section III: Introduction and Historical Development of Home Ownership Savings Plans in Kenya

Of the various legislations in place to enhance affordability, this note focuses on the Home Ownership Savings Plan. The Income Tax Act cap 470 defines a Home Ownership Savings Plan (HOSP) as a savings plan established by an ‘approved institution’ and registered with the commissioner for Income Tax for receiving and holding funds in trust for depositors. It is a tax-sheltered savings, plan whose main objective was to enable individual depositors to save for home acquisition or development and was introduced in Kenya in 1995. As per Section 22C (8) of the Income Tax Act, an ‘approved institution’ means a bank or financial institution registered under the Banking Act (Cap. 488), an insurance company licensed under the Insurance Act (Cap. 487) or a building society registered under the Building Societies Act (Cap. 489).

The regulation was effective on 1st January 1996, and from the initial regulations, depositors were allowed tax rebates of Kshs 4,000 per month maximum or Kshs 48,000 per annum (effectively reducing an individual’s taxable income by the amount of their monthly contribution) with the condition that it is with a Registered Home Ownership Savings Plan. In 2007, the Income Tax Act was amended to allow any interest earned on the deposits to be tax exempted upon withdrawal albeit at a maximum of Kshs 3.0 mn.

However, as part of the government’s measures to fulfill its pledge to promote low-cost housing, the tax-deductible contributions by a depositor to a registered home ownership savings plan were increased from Kshs 48,000 to Kshs 96,000 annually (Kshs 4,000 per month to Kshs 8,000 per month), effective 1st July 2018, and effective for an individual’s savings for the subsequent ten-years. Registered Home Ownership Savings accounts in Kenya are restricted to first time home buyers and to purchase of a ‘permanent house’, which the Income Tax Act defines as a residential house that a financial institution would accept as collateral for a mortgage, and includes any part or portion of a building, used or constructed, adapted or designed to be used solely for human habitation. The accumulated funds are withdrawn tax-free to strictly purchase or construct a house. However, if the depositor utilizes the funds for any other purpose other than to acquire a house, they become taxable in the year of withdrawal.

So far, unfortunately only one institution, Housing Finance Company (HFC), offers Home Ownership Savings Plans in Kenya. It is not clear why other banks have not offered HOSP, and we also believe it is important that other savings vehicles such as Money Market Funds and investment banks should qualify as Home Ownership Savings Plans.

Section IV: House Savings Plans in Other Countries

Globally, Home Ownership Savings Plan are referred to as Contractual Savings for Housing (CSH) schemes, which are defined as a contractual agreement between a financial institution and a customer that grants the customer the right to obtain a preferential mortgage after a minimal saving period (World Bank). Depending on the contractual agreement and the laws of a country, these savings can be used for land acquisition, housing construction, home improvement, or to purchase a new home. Globally, they are characterized by contractual deposits, tax deductions for mortgage interest payments and tax exclusion for capital gains for owner-occupier residential property, government subsidies, and direct provision of homeownership loans for low and middle-income households.

There are two main types of CSH schemes:

- Closed systems, where home loans are funded wholly with savings pooled together by the individual under the CSH scheme, and,

- Open systems, where a lender is permitted to access other funding sources (such as capital markets) in case the inflow of savings is not enough to meet loan demands.

Contractual Savings for Housing Schemes originated in Europe where they have been considerably successful. For instance, the French Plan Épargne Logement (PEL) and the German Bauspar system, both established in the 20th century.

Although not very common in Africa, Contractual Savings for Housing has been adopted in countries like Nigeria, Tunisia, Ethiopia, and Morocco:

- In Nigeria, depositors are required to save with the Nigerian National Housing Fund (NHF) for at least six months before acquiring a home loan from the fund

- In Morocco, only banks are permitted to offer CSH schemes where the maximum amount that can be saved is Kshs 4.0 mn. Depositors, who must be first time home buyers, are required to make a minimum deposit of Kshs 5,000 and subsequent top-ups of at least Kshs 30,000 per year. At the end of the savings phase, the depositor can acquire a loan of at least three times their savings. The interest rate charged on these loans is 0.5% points lower than the interest rate applied to a normal housing loan

- In Ethiopia, CSH scheme has been relatively successful enabling uptake of over 175,000 affordable units since 2006. The scheme was introduced by the government in a bid to provide housing for low and mid-income families and promote a culture of savings among Ethiopians. However, these funds are used for government’s affordable housing project, together with proceeds from housing bonds, and therefore subscribers are strictly limited to purchasing a house under the government’s Integrated Urban Housing Development Program (IUHDP). The scheme, managed by the state-owned Commercial Bank of Ethiopia (CBE), offers three saving options depending on an individual’s income class, with minimum monthly contributions of Kshs 800 to Kshs 12,200 for 3-7 years, which are remunerated at approximately 6.0%. Subscribers are then offered a housing loan with repayment periods of 17-25 years and interest rates of 7.5% - 9.5%, in comparison to 18.0% offered by other financial institutions

Generally, CSH schemes are still nascent in Africa and with minimal success. This attributable to (i) lack of public knowledge, (ii) general lack of appropriate regulatory and technical structures, and (iii) they are mainly led by government-controlled institutions whereas, in developed countries such as France and Germany, they are mainly managed by private financial institutions and building societies, with minimal government restrictions.

Section V: The Benefits and Limitations of HOSP Schemes

Home Ownership Savings Plans have various benefits for the lenders, government and the savers. For the government, the schemes alleviate the housing problem by availing the much-needed housing finance. As it is, there exists a direct correlation between the existing housing finance system and the level of informal settlements in the country which the World Bank estimated to be 61.0% of urban dwellers as at 2017.

Benefits for Mortgage Lenders:

- Minimal Credit Risk: To a large extent, Home Ownership Saving Plans minimize credit risk, as depositors can demonstrate their ability to make timely payments by saving a portion of their income throughout an extended period. As a result, lending to a HOSP subscriber is often less risky than lending to other borrowers. In Ethiopia, there were zero non-performing loans (NPLs) under the CSH plan as of November 2014, as reported by Commercial Bank of Ethiopia (CBE) officials,

- Lower Loan-to-Value Ratio: Given the substantial down payments made by subscribers through their consistent savings, the loan-to-value (LTV) ratio is often significantly lower, which reduces the probability of mortgage defaults.

Benefits for HOSP Subscribers:

- Tax Rebates: According to the Income Tax Act, individuals in a Registered Home Savings Plan are guaranteed tax rebates of up to Kshs 8,000 per month or Kshs 96,000 per annum, while interest income of up to Kshs 3.0 mn are tax-exempt upon withdrawal. With this, assuming a median income of Kshs 50,000, an individual depositing Kshs 8,000 per month with a registered HOSP account pays 28.1% less PAYE (Pay as You Earn) than one without HOSP account, as shown below:

|

PAYE Remittances Scenario |

||

|

HOSP Employee |

||

|

Monthly Gross Salary |

|

50,000 |

|

HOSP Remittance (Kshs) |

8,000 |

|

|

PAYE (Kshs) |

|

5,459 |

|

|

||

|

Non-HOSP Employee |

||

|

Monthly Gross Salary |

|

50,000 |

|

HOSP Remittance (Kshs) |

- |

|

|

PAYE (Kshs) |

|

7,596 |

ii. Credit Profile: The contracted savings made by a subscriber act as proof to the financial institution of their creditworthiness, thus raising their chances of accessing a mortgage loan upon maturity of the savings, and,

iii. Positive Savings Culture: With an effective regulatory environment, the scheme encourages a savings culture which ultimately makes it easier for an individual to acquire a home by efficiently raising a deposit for a house loan. According to the World Bank, inability to raise deposits required to access mortgage has been proven as one of the reasons behind the small number of home loans, necessitating the need for tax incentives to boost savings for property acquisition.

In spite of this, Home Ownership Savings Plan in Kenya has not been very successful in its overarching objective which was to avail housing finance and promote a culture of savings for aspiring homeowners. This is evidenced by the fact that only one institution currently offers the product, the low homeownership rates in the country as illustrated above, and the relatively low mortgage uptake with 26,187 mortgage accounts recorded as at 2017, despite the existing housing deficit estimated at 2.0 mn by the National Housing Corporation.

The major limitations have been:

- Few Product Offerings: According to the Income Tax Act the product is restricted to a few approved institutions. These include; a bank or financial institution registered under the Banking Act, an insurance company licensed under the Insurance Act or a building society registered under the Building Societies Act. So far, only one institution, Housing Finance Company (HFC), offers the product and at relatively unattractive rates as there is no other competition. For the past two decades, the scheme has been a preserve of specialist lending institutions such as banks and building societies as stipulated in the Income Tax Act since 1996. Linking the schemes to capital market capable of offering attractive rates to depositors will enhance financial liberalization and assist low-income earners to efficiently save towards homeownership as part of the overall development strategy,

- Relatively Low Yields: Currently banks offer interest rates of 7.0% on average for fixed savings accounts. This in comparison to the inflation rate which has been oscillating between 4.1% - 6.6% means much of the benefits accrued are eroded,

- Little Public Knowledge: With the product being offered by one institution, Housing Finance, there is little information available to the public about Home Ownership Savings Plan. Fewer people know that it is one of the ways of reducing payable tax in Kenya,

- Savings/Loan Mismatch: In countries such as Ethiopia, individuals are required to either save 10%, 20%, or 40% of the unit value and the remainder is issued out as a loan. However, under the Kenyan framework, getting a mortgage after the ten years is not guaranteed. This means savers have to have other funding options such as other personal savings, SACCO loan, inheritance or other methods,

- Mortgage Market/Housing Deficit Mismatch: The availability of mortgage products is a prerequisite for Home Ownership Savings Plans to be fully effective as upon maturity the savings only serve as a deposit. House prices in Kenya are relatively high in comparison to what individuals can afford to save due to the low-income levels, necessitating the need for more funding options after the saving period. Additionally, mortgage interest rates must be close to the savings return rate. As it is, few banking institutions offer mortgages, evidenced by the few mortgages registered and the interest rates are considered to be relatively high in comparison to the yields they offer for savings accounts,

- Liquidity Risk: In Kenya where the median income is relatively low at Kshs 50,000, the savings and the loan repayments could also be insufficient to fund more loan demands from subscribers completing their savings phase creating a liquidity risk for the deposit-taking institutions. The tax rebates incentivize savers meaning the product would have a high demand if properly placed in Kenya. This was the case in Ethiopia where the house savings scheme as of 2013 had a waiting list of 900,000 subscribers.

To stimulate the housing finance segment, there is a need to close the large gap in the sector which can be fulfilled by creating access to other innovative financial markets products which have more compelling returns.

Section VI: How to Improve Home Ownership Savings Plan in Kenya

To improve housing affordability, there is a need to provide channels through which individuals in the low and middle-income bracket can use to raise capital to purchase homes. Collective Investment Schemes are common among this population, as individuals are required to make relatively low contributions and are able to top-up their savings through a flexible and accommodative program in terms of minimum amounts. However, under the current law, CIS schemes are not considered under the Home Ownership Savings Plans (HOSP) in spite of their potential to revolutionize housing finance. For instance, the money market funds offer relatively attractive risk-adjusted returns with competitive rates of as high as 11.0%. Additionally, the rates are not fixed which means they are always up to pace with the macro-economic environment conditions unlike the fixed rates offered by banks and other financial institutions. Essentially, collective investment schemes are pools of funds that are managed on behalf of investors by a professional money manager. They are specialized market players licensed to mobilize savings through financial assets and to enhance access to capital markets by small investors. They include unit trusts, mutual funds, investment trusts et al. For investors, they offer a unique opportunity in terms of professional management, economies of scale, and diversification of portfolio and risk. Fund managers invest in various industries and sectors;therefore, the portfolio gets diversified, resulting in relatively high returns as compared to banks which largely generate returns from lending members’ deposits.In Kenya, most banks require borrowers to provide cash equivalent to 15% of the value of a home before accessing mortgages, which leads to most people borrowing from savings and loan cooperatives, which are funded by member deposits. Under the affordable housing initiative, homebuyers will be required to pay a 12.5% deposit.

Below we illustrate an individual savings plan for a three-bedroom unit under the affordable housing scheme, whose cost is set at Kshs 3.0 mn, through: (i) a bank-based HOSP, which is likely to offer a 2.5% return per annum, (ii) the National Housing Development Fund, and (iii) a Fund Manager’s Collective Investment Scheme such as a money market fund offering 10.0% yield per annum; the purpose of the example is to show how long it would take save the requisite Kshs 375,000 over a 5 year period:

(All Values in Kshs Unless Stated Otherwise)

|

Saving Scenarios Under a Bank-based HOSP, a Collective Investment Scheme, and the National Housing Development Fund |

|||

|

|

Collective Investment Schemes (CIS) |

Bank-based HOSP |

National Housing Development Fund (NHDF) |

|

House Value |

3,000,000 |

3,000,000 |

3,000,000 |

|

12.5% Deposit |

375,000 |

375,000 |

375,000 |

|

Tenor (Years) |

5 |

5 |

5 |

|

Rate of Return |

10.0% |

2.5% |

0.0% |

|

Monthly Payments |

4,843 |

5,874 |

6,250 |

|

· For a 12.5% deposit of Kshs 375,000, assuming a five-year savings period, a depositor with NHDF is required to make monthly deposits of at least Kshs 6,250. This is 29.1% more than Kshs 4,843 required of an individual investing with a money market fund, which offers 10.0% yield per annum. On the other hand, a depositor saving with Registered HOSP such as a bank would get an interest rate of about 2.5% p.a. and therefore, would have to make monthly deposits of Kshs 5,874, which is 21.3% more than CIS deposits |

|||

To boost Home Ownership Savings Plan in Kenya, a well-developed capital market and income tax framework are required to enable a sustainable, low-cost capital raising mechanism for affordable housing in Kenya for both developers and potential homeowners. This can be achieved through:

- Creating adequate consumer information, which is imperative to encourage households to take up the various incentives offered. Additionally, households should have adequate information to make comparisons and make informed decisions when choosing a depositing institution,

- Fund Managers and Investment Banks should qualify as HOSP approved institutions, Section 22 C (8) Income Tax Act 2018,

- Collective Investment Scheme Trustees should not only be banks but a person who holds a license issued by the Authority, Regulation 26 (1) and (2) Capital Markets (CIS) Regulations 2011,

- Allow for specialized Collective Investment Schemes that can focus on investing only in the specific sectors such as the housing sector by amending CMA Act CIS Regulations 139 (1) to allow setting up of specialized collective investment schemes for investment in a specific sector or for a specific purpose.

In conclusion, HOSP is a very commendable and important initiative towards the President’s Big Four Agenda of providing affordable housing. However, for HOSP to have an impact we need to:

- Expand HOSP eligible savings to include capital markets savings, and

- Educate potential homeowners on HOSP benefits.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.