A Review of State-Owned Enterprises Privatization, & Cytonn Weekly #51/2025

By Research Team, Dec 21, 2025

Executive Summary

Fixed Income

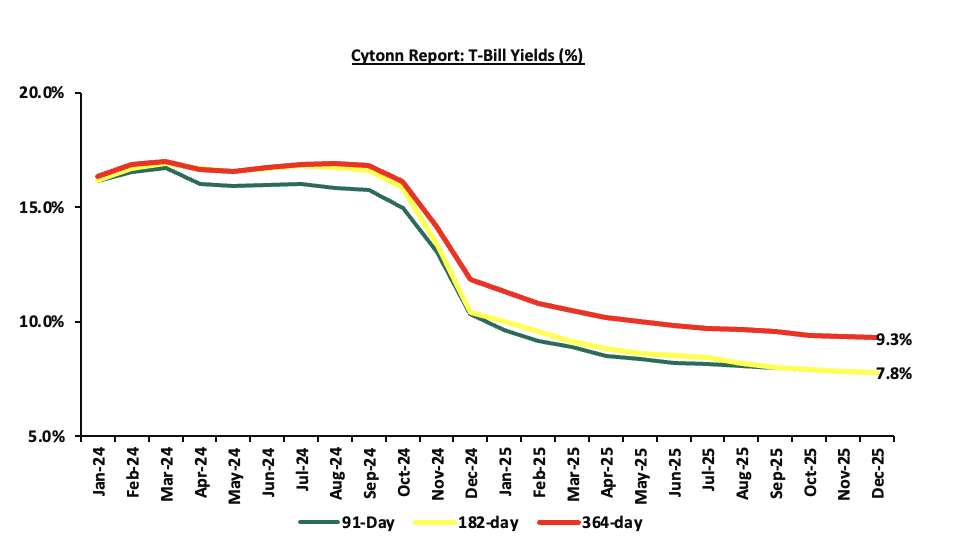

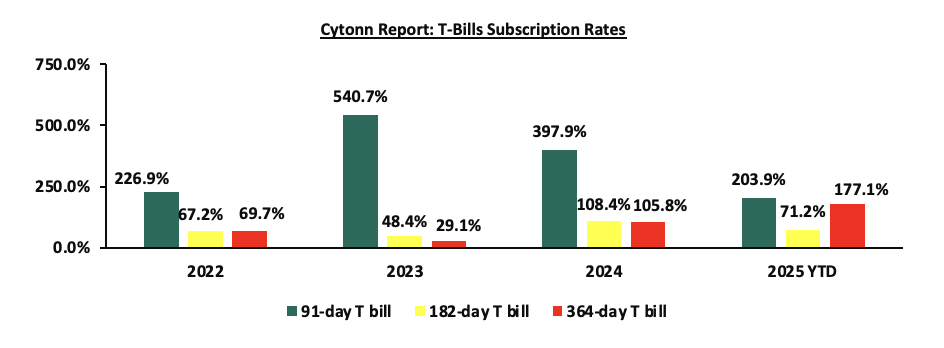

During the week, T-bills were undersubscribed for the first time in eleven weeks, with the overall subscription rate coming in at 67.3%, lower than the subscription rate of 135.7% recorded the previous week. Investors’ preference for the shorter 91-day paper waned, with the paper receiving bids worth Kshs 3.6 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 89.2%, significantly lower than the subscription rate of 187.7%, recorded the previous week. The subscription rates for the 182-day paper decreased to 13.9% from 22.4% recorded the previous week, while that of the 364-day papers decreased to 111.9% from 228.3% recorded the previous week. The government accepted a total of Kshs 16.14 bn worth of bids out of Kshs 16.15 bn bids received, translating to an acceptance rate of 99.96%. The yields on the government papers showed mixed performance with the yields on the 182-day paper remaining unchanged from the 7.8% recorded the previous week, while the 364-day and 91-day papers decreased by 0.7 bps and 0.5 bps to 9.23% and 7.77% respectively from the 9.24% and 7.78% recorded the previous week;

During the week, the National Treasury released the Draft 2026 Budget Policy Statement (BPS) in line with Section 25 of the Public Finance Management (PFM) Act, 2012, which mandates the Treasury to incorporate stakeholder and public views during the preparation of the BPS. Following this consultative process, the BPS is submitted to Cabinet for approval and subsequently presented to Parliament for discussion and adoption. The statement outlines priority economic policies, structural reforms, and sectoral expenditure programs to be implemented under the Medium-Term Expenditure Framework (FY 2025/26–2027/28);

During the week, the National Treasury gazetted the revenue and net expenditures for the fifth month of FY’2025/2026, ending 28th November 2025, highlighting that the total revenue collected as at the end of November 2025 amounted to Kshs 909.8 bn, equivalent to 34.6% of the original estimates of Kshs 2,627.1 bn for FY’2025/2026 and is 83.1% of the prorated estimates of Kshs 1,094.6 bn;

During the week, The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th December 2025 to 14th January 2026. Notably, the maximum allowed prices for Super Petrol, Diesel and Kerosene remained unchanged from the previous pricing cycle in November. Consequently, Super Petrol, Diesel and Kerosene will continue to retail at Kshs 184.5, Kshs 171.5 and Kshs 154.8 per litre respectively;

Equities

During the week, the equities market was on an upward trajectory, with NSE 10 gaining the most by 5.6% while NSE 25, NSE 20 and NASI gained by 5.3%, 4.6% and 3.9% respectively, taking the YTD performance to gains of 50.1%, 47.2%, 45.5% and 45.3% of NSE 20, NASI, NSE 25 and NSE 10 respectively. The equities market performance was mainly driven by gains recorded by large cap stocks such as EABL, NCBA and Cooperative Bank of 24.1%, 12.3% and 6.7% respectively. The performance was, however, weighed down by losses recorded by large-cap stocks such as DTB-K of 0.9%;

Also, during the week, the banking sector index increased by 3.7% to 197.2 from 190.1 recorded the previous week. This is attributable to gains recorded by stocks such as NCBA, Cooperative Bank and Standard Chartered of 12.3%, 6.7% and 4.5% respectively;

During the week, East African Breweries PLC issued a cautionary announcement after receiving notification from its parent company, Diageo plc, of a proposed disposal of its entire 65.0% stake in the company amounting to 514.0 mn shares to Asahi Group Holdings, subject to regulatory approvals in Kenya, Uganda and Tanzania. At a share price of Kshs 288.75 as of 19th December 2025, EABL’s total market capitalization is Kshs 228.3 bn, while Diageo’s stake alone is valued at Kshs 148.4 bn;

Real Estate

During the week, the State Department of Housing and Urban Development reported that the state has missed its affordable housing buyer registration and delivery targets, with 292,326 Kenyans registered on the Boma Yangu platform by June 2025, far below the government’s initial expectations of onboarding over 500,000 potential buyers. Official disclosures show that only 292,326 people had registered by end-June, while just 2,075 housing units had been completed under the Affordable Housing Programme (AHP) between July 2022 and June 2025, significantly undershooting targets of 250,000 units per year. The State attributes the slow progress to court cases, delays in passing housing regulations, and the lack of a legal framework to support Housing Levy collections, which constrained funding and construction momentum, despite Kshs 81.4 bn already spent on the programme and a long-term budget of Kshs 627.0 bn up to 2032;

During the week, the Cabinet approved a Kshs 5.0 tn infrastructure fund aimed at accelerating investment in critical projects, including roads, railways, ports, energy, water, irrigation, and digital infrastructure. The fund, to be anchored under the Sovereign Wealth Fund and structured to attract both local and foreign private capital, is intended to reduce reliance on public debt while fast-tracking development and job creation;

During the week, Africa Logistics Properties (ALP) received approval from the Capital Markets Authority (CMA) to proceed with a restricted offer for its ALP Industrial Real Estate Investment Trust (I-REIT), targeting professional investors only. The offer involves issuing up to 30 mn units at USD 1.0 per unit to raise up to USD 30.0 mn, alongside a promoter consideration of up to 15 mn units issued in exchange for seed logistics assets. The I-REIT will invest in modern Grade A and B warehousing and logistics facilities across East Africa, with initial seed assets located in Imara Daima and Tatu City, Nairobi. ALP Property Management will act as the REIT manager, with the Co-operative Bank of Kenya as the trustee, and the units are expected to be listed on the Nairobi Securities Exchange in March 2026 following the offer period and regulatory milestones. However, the expected yield on the IREIT is not yet disclosed;

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 27.4 and Kshs 23.2 per unit, respectively, as per the last updated data on 5th December 2025. The performance represented a 33.4% and 14.5% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.8 mn and 41.2 mn shares, respectively, with a turnover of Kshs 323.5 mn and Kshs 791.5 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 5th December 2025, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 1.2 mn shares for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015;

Focus of the Week

Privatization involves transferring government-owned assets to private owners to improve efficiency, reduce public debt, attract investment, and foster competition. Kenya's privatization efforts have stalled for years. This week we review the privatization of state-owned enterprises in Kenya.

Investment Updates:

- Weekly Rates:

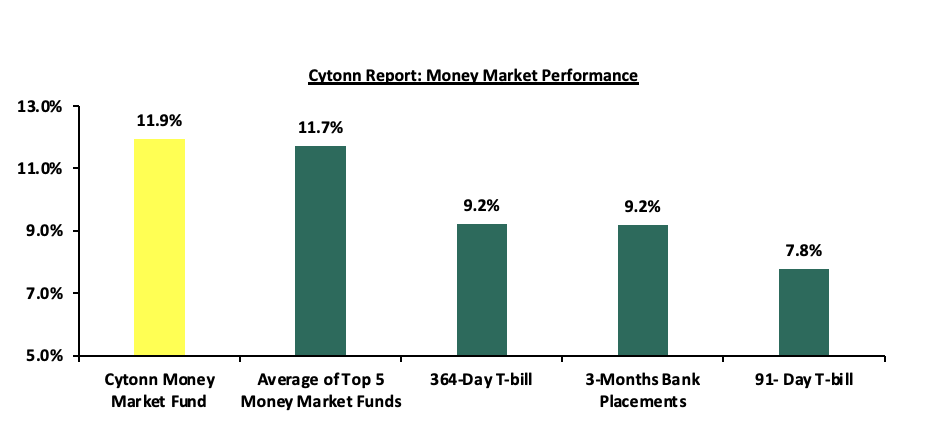

- Cytonn Money Market Fund closed the week at a yield of 11.9% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Tuesday, from 7:00 pm to 8:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

This week, T-bills were undersubscribed for the first time in eleven weeks, with the overall subscription rate coming in at 67.3%, lower than the subscription rate of 135.7% recorded the previous week. Investors’ preference for the shorter 91-day paper waned, with the paper receiving bids worth Kshs 3.6 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 89.2%, significantly lower than the subscription rate of 187.7%, recorded the previous week. The subscription rates for the 182-day paper decreased to 13.9% from 22.4% recorded the previous week, while that of the 364-day papers decreased to 111.9% from 228.3% recorded the previous week. The government accepted a total of Kshs 16.14 bn worth of bids out of Kshs 16.15 bn bids received, translating to an acceptance rate of 99.96%. The yields on the government papers showed mixed performance with the yields on the 182-day paper remaining unchanged from the 7.8% recorded the previous week, while the 364-day and 91-day papers decreased by 0.7 bps and 0.5 bps to 9.23% and 7.77% respectively from the 9.24% and 7.78% recorded the previous week.

The chart below shows the yield growth rate for the 91-day paper from December 2024 to December month-to-date:

The charts below show the performance of the 91-day, 182-day and 364-day papers from January 2024 to December 2025:

The chart below compares the overall average T-bill subscription rates obtained in 2022,2023, 2024 and 2025 Year-to-date (YTD):

Money Market Performance:

In the money markets, 3-month bank placements ended the week at 9.2% (based on what we have been offered by various banks). The yields on the 364-day and 91-day papers decreased by 0.7 bps and 0.5 bps to 9.23% and 7.77% respectively from the 9.24% and 7.78% recorded the previous week. The yield on the Cytonn Money Market Fund increased by 9.0 bps to 11.94% from the 11.85% recorded in the previous week, while the average yields on the Top 5 Money Market Funds increased by 8.8 bps to 11.7% from 11.6% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 19th December 2025:

|

Money Market Fund Yield for Fund Managers as published on 19th December 2025 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Nabo Africa Money Market Fund |

12.2% |

|

2 |

Cytonn Money Market Fund (Dial *809# or download Cytonn App) |

11.9% |

|

3 |

Arvocap Money Market Fund |

11.8% |

|

4 |

Etica Money Market Fund |

11.5% |

|

5 |

Enwealth Money Market Fund |

11.1% |

|

6 |

Lofty-Corban Money Market Fund |

11.1% |

|

7 |

Ndovu Money Market Fund |

11.1% |

|

8 |

Gulfcap Money Market Fund |

10.8% |

|

9 |

Kuza Money Market fund |

10.7% |

|

10 |

Jubilee Money Market Fund |

10.6% |

|

11 |

Old Mutual Money Market Fund |

10.6% |

|

12 |

Madison Money Market Fund |

10.1% |

|

13 |

British-American Money Market Fund |

9.6% |

|

14 |

Orient Kasha Money Market Fund |

9.6% |

|

15 |

Dry Associates Money Market Fund |

9.6% |

|

16 |

Apollo Money Market Fund |

9.5% |

|

17 |

KCB Money Market Fund |

9.5% |

|

18 |

SanlamAllianz Money Market Fund |

9.5% |

|

19 |

Faulu Money Market Fund |

9.4% |

|

20 |

GenAfrica Money Market Fund |

8.9% |

|

21 |

Genghis Money Market Fund |

8.8% |

|

22 |

CIC Money Market Fund |

8.5% |

|

23 |

ICEA Lion Money Market Fund |

8.5% |

|

24 |

CPF Money Market Fund |

8.5% |

|

25 |

Mali Money Market Fund |

8.2% |

|

26 |

Co-op Money Market Fund |

8.1% |

|

27 |

Absa Shilling Money Market Fund |

7.4% |

|

28 |

AA Kenya Shillings Fund |

6.6% |

|

29 |

Ziidi Money Market Fund |

6.4% |

|

30 |

Stanbic Money Market Fund |

6.1% |

|

31 |

Mayfair Money Market Fund |

5.7% |

|

32 |

Equity Money Market Fund |

5.0% |

Source: Business Daily

Liquidity:

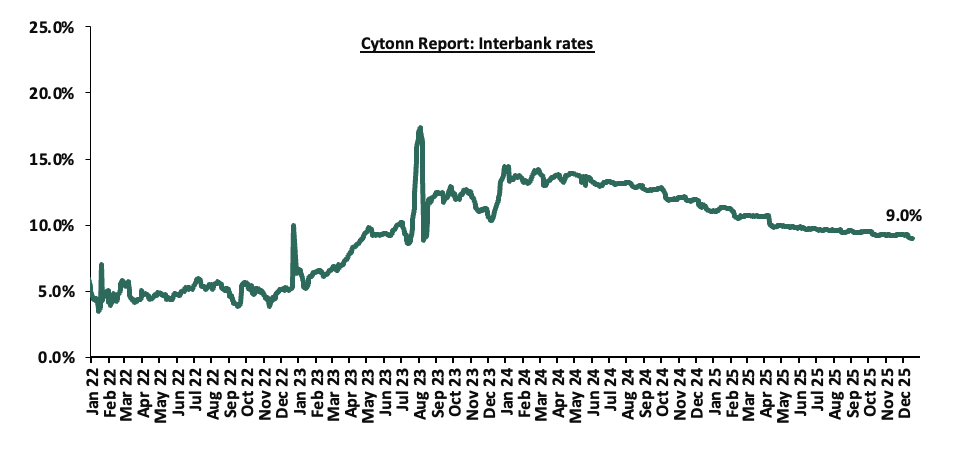

During the week, liquidity in the money markets eased with the average interbank rate decreasing by 21 bps to 9.0% from 9.2% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded decreased by 12.7% to Kshs 11.3 bn from Kshs 12.9 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on the Eurobonds were on a downward trajectory with the yield on the 12-year Eurobond issued in 2019 decreasing the most by 42.8 bps to 7.4% from 7.8% recorded the previous week. The table below shows the summary performance of the Kenyan Eurobonds as of 18th December 2025;

|

Cytonn Report: Kenya Eurobond Performance |

|||||||

|

|

2018 |

2019 |

2021 |

2024 |

2025 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

11-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

1.5 bn |

|

Years to Maturity |

2.5 |

22.5 |

1.7 |

6.7 |

8.8 |

5.5 |

10.5 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

9.9% |

|

2-Jan-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.1% |

|

|

4-Dec-25 |

6.2% |

9.1% |

- |

8.1% |

8.6% |

7.9% |

|

|

11-Dec-25 |

6.3% |

9.1% |

- |

7.8% |

8.4% |

7.8% |

|

|

15-Dec-25 |

6.3% |

8.9% |

- |

7.5% |

8.1% |

7.4% |

|

|

16-Dec-25 |

6.3% |

8.9% |

- |

7.5% |

8.1% |

7.4% |

|

|

17-Dec-25 |

6.3% |

9.0% |

- |

7.5% |

8.1% |

7.4% |

10.0% |

|

18-Dec-25 |

6.2% |

8.9% |

|

7.4% |

8.0% |

7.3% |

|

|

Weekly Change |

(0.1%) |

(0.2%) |

- |

(0.4%) |

(0.4%) |

(0.5%) |

0.0% |

|

MTD Change |

0.0% |

(0.2%) |

- |

(0.7%) |

(0.6%) |

(0.6%) |

0.0% |

|

YTD Change |

(2.9%) |

(1.3%) |

- |

(2.7%) |

(2.1%) |

(2.8%) |

0.0% |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling appreciated against the US Dollar by 16.2 bps, to close the week at Kshs 129.0, from Kshs 129.2 recorded the previous week. On a year-to-date basis, the shilling has appreciated by 27.2 bps against the dollar, lower than the 17.6% appreciation recorded in 2024.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 5,081.6 mn in the twelve months to October 2025, 5.8% higher than the USD 4,804.1 mn recorded over the same period in 2024. This has continued to cushion the shilling against further depreciation. In the October 2025 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 59.9% in the period,

- The tourism inflow receipts which are projected to reach KSh 560.0 bn in 2025 up from KSh 452.2 bn in 2024 a 23.9% increase, and owing to tourist arrivals that improved by 9.9% to 2,424,382 in the 12 months to June 2025 from 2,206,469 in the 12 months to June 2024, and,

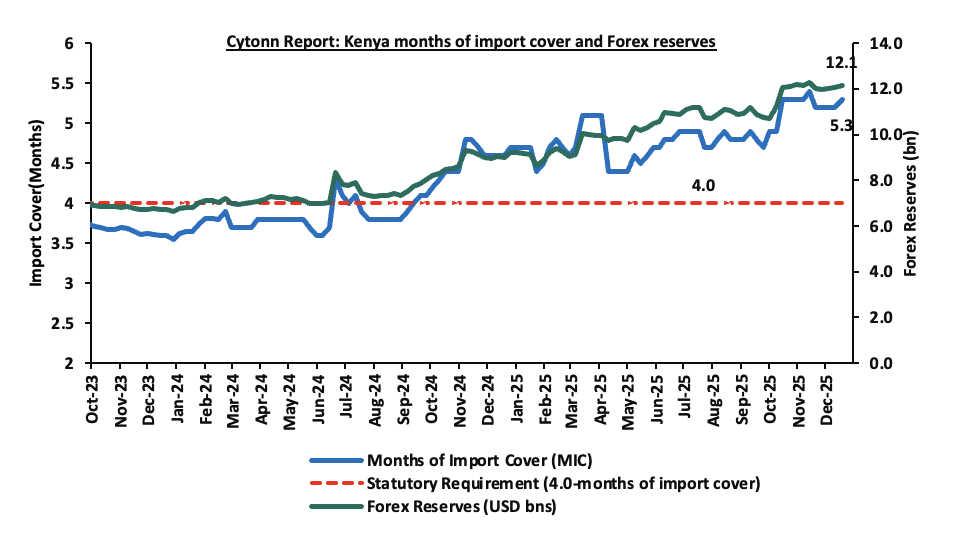

- Improved forex reserves currently at USD 12.1 bn (equivalent to 5.3-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2025 as a result of:

- An ever-present current account deficit which came at 2.2% of GDP in the twelve months to October 2025, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 59.7% of Kenya’s external debt is US Dollar-denominated as of June 2025.

Kenya’s forex reserves increased by 0.6% during the week to remain relatively unchanged from the USD 12.1 bn recorded the previous week, equivalent to 5.3 months of import cover, and above the statutory requirement of maintaining at least 4.0-months of import cover.

The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights

- The Draft 2026 Budget Policy Statement

The National Treasury released the Draft 2026 Budget Policy Statement (BPS) in line with Section 25 of the Public Finance Management (PFM) Act, 2012, which mandates the Treasury to incorporate stakeholder and public views during the preparation of the BPS. Following this consultative process, the BPS is submitted to Cabinet for approval and subsequently presented to Parliament for discussion and adoption. The statement outlines priority economic policies, structural reforms, and sectoral expenditure programs to be implemented under the Medium-Term Expenditure Framework (FY 2025/26–2027/28).

Below is a summary of the major changes as per the BPS 2026 from the expected FY’2026/2027 budget performance:

|

Comparison of 2025/26 and 2026/27 Fiscal Year Budgets as per the 2026 Budget Policy Statement |

||||

|

|

FY'2024/2025 Budget Outturn |

FY'2025/2026 (Budget) |

FY'2026/2027 BPS |

% change |

|

2025/26 to 2026/27 |

||||

|

Total revenue |

2,923.6 |

3,321.7 |

3,487.0 |

5.0% |

|

External grants |

33.3 |

47.2 |

48.8 |

3.4% |

|

Total revenue & external grants |

2,956.9 |

3,368.9 |

3,535.8 |

5.0% |

|

Recurrent expenditure |

2,948.4 |

3,134.1 |

3,431.2 |

9.5% |

|

Development expenditure & Net Lending |

582.9 |

649.0 |

759.1 |

17.0% |

|

County governments + contingencies |

444.6 |

484.8 |

446.6 |

(7.9%) |

|

Total expenditure |

3,975.9 |

4,269.9 |

4,641.9 |

8.7% |

|

Fiscal deficit including grants |

1,019.0 |

901.0 |

1,106.1 |

22.8% |

|

Deficit as % of GDP |

5.9% |

4.7% |

5.3% |

0.6% |

|

Net foreign borrowing |

179.7 |

287.4 |

99.5 |

(65.4%) |

|

Net domestic borrowing |

854.5 |

613.5 |

1006.6 |

64.1% |

|

Total borrowing |

1034.2 |

901.0 |

1106.1 |

22.8% |

|

GDP Estimate |

17,148.7 |

19,006.2 |

20,916.8 |

10.1% |

Key take-outs from the table include:

- Total revenue, including external grants, is projected to increase by 5.0% to Kshs 3,487.0 bn in FY’2026/27 from Kshs 3,321.7 bn in FY’2025/26. External grants are expected to rise by 3.4% to Kshs 48.8 bn, bringing total revenue and grants to Kshs 3,535.8 bn, a 5.0% increase.

- Total expenditure is projected to increase by 8.7% to Kshs 4,641.9 bn in FY’2026/27 from Kshs 4,269.9 bn in FY’2025/26.

- Development expenditure & net lending is set to rise by 17.0% to KSh 759.1 bn, while recurrent expenditure is projected to increase by 9.5% to Kshs 3,431.2 bn. Recurrent expenditure remains the largest share of total spending accounting for 73.9%, with development expenditure 16.4%.

- The fiscal deficit (including grants) is projected to increase to Kshs 1,106.1 bn in FY’2026/27 from Kshs 901.0 bn in FY 2025/26, with the deficit as a share of GDP rising to 5.3% from 4.7%.

- Total borrowing is projected to rise to Kshs 1,106.1 bn from Kshs 901.0 bn in FY’2025/26. This comprises net foreign borrowing of Kshs 99.5 bn and net domestic borrowing of Kshs 1,006.6 bn, reflecting the financing of the fiscal deficit.

- GDP is projected to grow by 10.1% to Kshs 20,916.8 bn in FY’2026/27 from Kshs 19,006.2 bn in FY’2025/26, providing some fiscal space for the planned expenditure increase.

The 2026/27 Budget Policy Statement is the fourth to be prepared under the current administration and aims to advance the Bottom-Up Economic Transformation Agenda. The BPS is formulated against a backdrop of moderating economic activity in FY’2026, with estimated GDP growth projected at 5.3% in FY’2026. Implementation of the budget will rely heavily on enhanced revenue mobilization, with the Treasury targeting revenues of Kshs 3,487.0 bn. The BPS emphasizes fiscal consolidation through reduced debt accumulation to ease the country’s overall debt burden. In line with the administration’s manifesto, recurrent expenditure is projected to increase by 9.5% to Kshs 3,431.2 bn, while development expenditure and net lending is set to rise by 17.0% to Kshs 759.1 bn to support key development priorities. The FY’2026/27 fiscal deficit is projected at Kshs 1,106.1 bn, to be financed through a mix of domestic and external borrowing, compared to Kshs 901.0 bn in the FY’2025/26 budget.

To read more of our analysis on the 2026 Draft BPS, please click 2026 Draft Budget Policy Statement Note

- November 2025 Exchequer Release

The National Treasury gazetted the revenue and net expenditures for the fifth month of FY’2025/2026, ending 28th November 2025. Below is a summary of the performance:

|

FY'2025/2026 Budget Outturn - As at 28th November 2025 |

||||||

|

Amounts in Kshs billions unless stated otherwise |

||||||

|

Item |

12-months Original Estimates |

Actual Receipts/Release |

Percentage Achieved |

Prorated |

% achieved of the Prorated |

|

|

Opening Balance |

|

6.4 |

|

|

|

|

|

Tax Revenue |

2,627.1 |

909.8 |

34.6% |

1,094.6 |

83.1% |

|

|

Non-Tax Revenue |

127.6 |

42.2 |

33.0% |

53.2 |

79.3% |

|

|

Total Revenue |

2,754.7 |

958.4 |

34.8% |

1,147.8 |

83.5% |

|

|

External Loans & Grants |

569.8 |

222.0 |

39.0% |

237.4 |

93.5% |

|

|

Domestic Borrowings |

1,098.3 |

622.7 |

56.7% |

457.6 |

136.1% |

|

|

Other Domestic Financing |

10.8 |

6.4 |

59.2% |

4.5 |

142.1% |

|

|

Total Financing |

1,678.9 |

851.1 |

50.7% |

699.5 |

121.7% |

|

|

Recurrent Exchequer issues |

1,470.4 |

594.6 |

40.4% |

612.7 |

97.1% |

|

|

CFS Exchequer Issues |

2,141.0 |

919.7 |

43.0% |

892.1 |

103.1% |

|

|

Development Expenditure & Net Lending |

407.1 |

121.8 |

29.9% |

169.6 |

71.8% |

|

|

County Governments + Contingencies |

415.0 |

137.0 |

33.0% |

172.9 |

79.2% |

|

|

Total Expenditure |

4,433.6 |

1,773.1 |

40.0% |

1,847.3 |

96.0% |

|

|

Fiscal Deficit excluding Grants |

1,678.9 |

814.7 |

48.5% |

699.5 |

116.5% |

|

|

Total Borrowing |

1,668.1 |

844.7 |

50.6% |

695.0 |

121.5% |

|

|

Public Debt |

1,901.4 |

865.8 |

45.5% |

792.2 |

109.3% |

|

The Key take-outs from the release include;

- Total revenue collected as at the end of November 2025 amounted to Kshs 958.4 bn, equivalent to 34.8% of the original estimates of Kshs 2,754.7 bn for FY’2025/2026 and is 83.5% of the prorated estimates of Kshs 1,147.8 bn. Cumulatively, tax revenues amounted to Kshs 909.8 bn, equivalent to 34.6% of the original estimates of Kshs 2,627.1 bn and 83.1% of the prorated estimates of Kshs 1,094.6 bn,

- Total financing amounted to Kshs 851.1 bn, equivalent to 50.7% of the original estimates of Kshs 1,678.9 bn and is equivalent to 121.7% of the prorated estimates of Kshs 699.5 bn. Additionally, domestic borrowing amounted to Kshs 622.7 bn, equivalent to 56.7% of the original estimates of Kshs 1,098.3 bn and is 136.1% of the prorated estimates of Kshs 457.6 bn,

- The total expenditure amounted to Kshs 1,773.1 bn, equivalent to 40.0% of the original estimates of Kshs 4,433.6 bn, and is 96.0% of the prorated target expenditure estimates of Kshs 1,773.1 bn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 594.6 bn, equivalent to 40.4% of the original estimates of Kshs 1,470.4 and are equivalent to 97.1% of the prorated estimates of Kshs 612.7 bn,

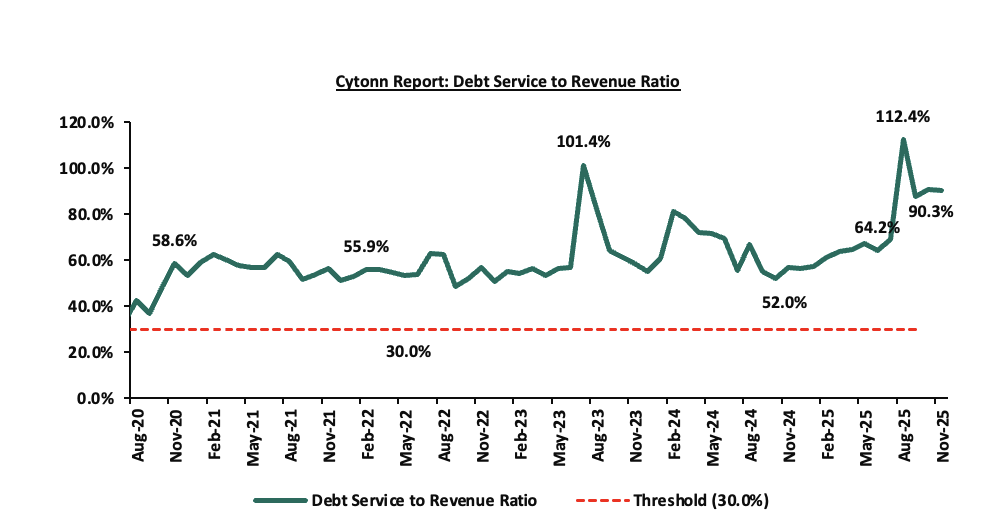

- Consolidated Fund Services (CFS) Exchequer issues came in at Kshs 919.7 bn, equivalent to 43.0% of the original estimates of Kshs 2,141.0 bn, and are 103.1% of the prorated amount of Kshs 892.1 bn. The cumulative public debt servicing cost amounted to Kshs 865.8 bn which is 45.5% of the original estimates of Kshs 1,901.4 bn and is 109.3% of the prorated estimates of Kshs 792.2 bn. Additionally, the Kshs 865.8 bn debt servicing cost is equivalent to 90.3% of the actual cumulative revenues collected as at the end of November 2025. The chart below shows the debt servicing cost to revenue ratio over the period;

- Total Borrowings as at the end of November 2025 amounted to Kshs 844.7 bn, equivalent to 50.6% of the original estimates of Kshs 1,668.1 bn for FY’2025/2026 and are 121.5% of the prorated estimates of Kshs 695.0 bn. The cumulative domestic borrowing of Kshs 1,098.3 bn comprises of Net Domestic Borrowing Kshs 634.8 bn and Internal Debt Redemptions (Rollovers) Kshs 463.5 bn.

The government underachieved its prorated revenue targets for the fifth month of the FY’2025/2026, achieving 83.5% of the prorated revenue targets in November 2025, lower than the 84.6% recorded in October 2025. This was driven by shortfall in both tax and non-tax revenues, which stood at 83.1% and 79.3% of prorated levels, respectively. External loans and grants remained significantly below target at 39.0%, increasing reliance on domestic borrowing, which came in at 136.1% of the prorated target. The business environment, however, showed signs of recovery, with the Purchasing Managers’ Index (PMI) rising to 55.0 in November 2025 from 52.5 in October 2025, marking the third consecutive month the index remained above the 50.0 neutral mark, signaling an improvement in business conditions. Expenditure absorption stood at 96.0% of prorated levels, with development spending still lagging at 71.8%, reflecting slow implementation of capital projects. Future revenue performance will depend on how quickly private sector activity continues to strengthen, supported by a stable Shilling, easing credit conditions following the 25.0 bps reduction in the Central Bank Rate to 9.0% in December 2025 from 9.25% in October, and continued efforts to broaden the tax base, curb evasion, and stimulate economic growth.

- Fuel Prices effective 15th December – 14th January 2025

During the week, The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th December 2025 to 14th January 2026. Notably, the maximum allowed prices for Super Petrol, Diesel and Kerosene remained unchanged from the previous pricing cycle in November. Consequently, Super Petrol, Diesel and Kerosene will continue to retail at Kshs 184.5, Kshs 171.5 and Kshs 154.8 per litre respectively.

Other key take-outs from the performance include,

- The average landing cost per cubic metre of Super Petrol decreased by 4.3% to USD 592.8 in November 2025 from USD 619.1 recorded in October 2025. However, the average landing cost of Diesel and Kerosene increased by 3.0% and 5.5% to USD 654.2 and USD 667.1 respectively from USD 635.1 and USD 632.2 respectively over the same period.

- The Kenyan Shilling slightly depreciated against the US Dollar by 0.2 bps to Kshs 129.8 in November 2025 from the Kshs 129.5 recorded in October 2025.

We note that fuel prices in the country have stabilized in recent months largely due to the government's efforts to stabilize pump prices through the petroleum pump price stabilization mechanism which expended Kshs 13.7 bn in the FY’2024/25 to cushion the increases applied to the petroleum pump prices, coupled with the stabilization of the Kenyan Shilling against the dollar and other major currencies. Additionally, the government increased spending through the price stabilization mechanism, subsidizing Kshs 5.7 and Kshs 9.1 per litre for Diesel and Kerosene, compared to Kshs 0.5, Kshs 2.3 and Kshs 4.2 for Petrol, Diesel and Kerosene in November which saw a stabilization in fuel prices for the period under review.

Going forward, we expect that fuel prices will stabilize in the coming months as a result of the government's efforts to mitigate the cost of petroleum through the pump price stabilization mechanism and a stable exchange rate. As such, we expect the business environment in the country to improve as fuel is a major input cost, as well as continued stability in inflationary pressures, with the inflation rate expected to remain within the CBK’s preferred target range of 2.5%-7.5% in the short to medium term.

Rates in the Fixed Income market have been on a downward trend due to high liquidity in the money market which allowed the government to front load most of its borrowing. The government is 119.1% ahead of its prorated net domestic borrowing target of Kshs 303.4 bn, having a net borrowing position of Kshs 664.7 bn (inclusive of T-bills). However, we expect a stabilization of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to stabilize in the short to medium-term and hence investors are expected to shift towards the long-term papers to lock in the high returns

Market Performance:

During the week, the equities market was on an upward trajectory, with NSE 10 gaining the most by 5.6% while NSE 25, NSE 20 and NASI gained by 5.3%, 4.6% and 3.9% respectively, taking the YTD performance to gains of 50.1%, 47.2%, 45.5% and 45.3% of NSE 20, NASI, NSE 25 and NSE 10 respectively. The equities market performance was mainly driven by gains recorded by large cap stocks such as EABL, NCBA and Cooperative Bank of 24.1%, 12.3% and 6.7% respectively. The performance was, however, weighed down by losses recorded by large-cap stocks such as DTB-K of 0.9%.

Also, during the week, the banking sector index increased by 3.7% to 197.2 from 190.1 recorded the previous week. This is attributable to gains recorded by stocks such as NCBA, Cooperative Bank and Standard Chartered of 12.3%, 6.7% and 4.5% respectively.

During the week, equities turnover increased by 87.0% to USD 60.2 mn from USD 32.2 mn recorded the previous week, taking the YTD total turnover to USD 1,094.2 mn. Foreign investors remained net buyers for the second consecutive week with a net buying position of USD 0.9 mn, from a net buying position of USD 2.7 mn recorded the previous week, taking the YTD foreign net selling position to USD 92.6 mn, compared to a net selling position of USD 16.9 mn recorded in 2024.

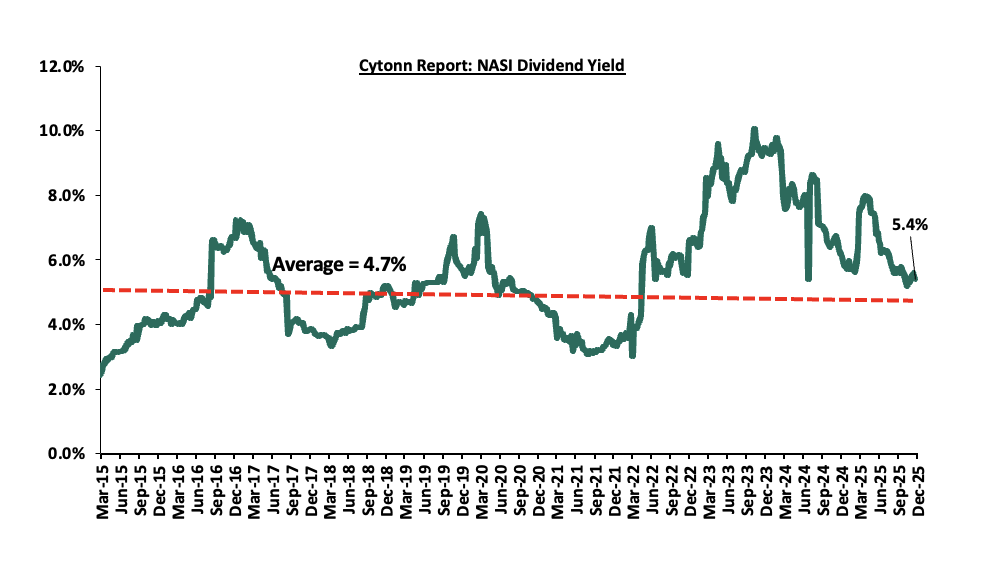

The market is currently trading at a price to earnings ratio (P/E) of 7.3x, 36.0% below the historical average of 11.3x. The dividend yield stands at 5.4%, 0.7% points above the historical average of 4.7%. Key to note, NASI’s PEG ratio currently stands at 0.9x, an indication that the market is slightly undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued.

The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

||||||||||

|

Company |

Price as at 11/12/2025 |

Price as at 19/12/2025 |

w/w change |

YTD Change |

Year Open 2025 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

ABSA Bank |

22.0 |

22.1 |

0.5% |

17.2% |

18.9 |

28.3 |

7.9% |

36.0% |

1.4x |

Buy |

|

I&M Group |

45.2 |

42.9 |

(5.1%) |

19.0% |

36.0 |

53.1 |

7.0% |

30.9% |

0.8x |

Buy |

|

Equity Group |

60.5 |

62.5 |

3.3% |

30.2% |

48.0 |

75.2 |

6.8% |

27.1% |

1.1x |

Buy |

|

Co-op Bank |

21.8 |

23.3 |

6.7% |

33.2% |

17.5 |

26.8 |

6.5% |

21.7% |

0.8x |

Buy |

|

NCBA |

79.3 |

89.0 |

12.3% |

74.5% |

51.0 |

101.3 |

6.2% |

20.0% |

1.4x |

Buy |

|

Diamond Trust Bank |

115.0 |

114.0 |

(0.9%) |

70.8% |

66.8 |

129.4 |

6.1% |

19.6% |

0.4x |

Accumulate |

|

Standard Chartered Bank |

287.0 |

300.0 |

4.5% |

5.2% |

285.3 |

307.9 |

15.0% |

17.6% |

1.7x |

Accumulate |

|

Stanbic Holdings |

193.8 |

195.5 |

0.9% |

39.9% |

139.8 |

205.5 |

10.6% |

15.7% |

1.2x |

Accumulate |

|

Jubilee Holdings |

326.8 |

311.8 |

(4.6%) |

78.4% |

174.8 |

333.5 |

4.3% |

11.3% |

0.5x |

Accumulate |

|

KCB Group |

59.8 |

62.3 |

4.2% |

46.8% |

42.4 |

65.8 |

4.8% |

10.5% |

0.8x |

Accumulate |

|

Britam |

8.8 |

8.9 |

1.4% |

52.6% |

5.8 |

9.5 |

0.0% |

7.2% |

0.8x |

Hold |

|

CIC Group |

4.5 |

4.4 |

(2.9%) |

103.7% |

2.1 |

4.0 |

3.0% |

(4.6%) |

1.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Dividend Yield is calculated using FY’2024 Dividends |

||||||||||

Weekly Highlights

- Proposed Sale of Diageo’s Shares in East African Breweries Limited (EABL)

During the week, East African Breweries PLC issued a cautionary announcement after receiving notification from its parent company, Diageo plc, of a proposed disposal of its entire 65.0% stake in the company amounting to 514.0 mn shares to Asahi Group Holdings, subject to regulatory approvals in Kenya, Uganda and Tanzania. At a share price of Kshs 288.75 as of 19th December 2025, EABL’s total market capitalization is Kshs 228.3 bn, while Diageo’s stake alone is valued at Kshs 148.4 bn.

Prior to the intention of sale of shares, Diageo owned 65.0% of the issued shares of EABL through its wholly-owned indirect subsidiary Diageo Kenya Limited, and 53.7% of the shares of UDV (Kenya) Limited through its wholly-owned subsidiary Diageo Great Britain Limited. Once Asahi’s application to the capital market authorities in Kenya, Uganda and Tanzania is approved, Asahi Group Limited will be the official majority shareholder in EABL with a 65.0% stake while the public shareholders will still maintain the 35.0% stake as broken down in the table below:

|

Cytonn Report: EABL’s Shareholding |

|||||

|

Before Acquisition |

After Acquisition |

||||

|

Name of Shareholder |

Number of shares |

% Shareholding |

Name of Shareholder |

Number of shares |

% Shareholding |

|

Diageo Kenya Limited |

514,003,331 |

65.0% |

Asahi Group Holdings |

514,003,331 |

65.0% |

|

Standard Chartered Kenya Nominees A/C KE004667 |

22,935,194 |

2.9% |

Standard Chartered Kenya Nominees A/C KE004667 |

22,935,194 |

2.9% |

|

Standard Chartered Kenya Non-Resd. A/C KE 10085 |

20,840,500 |

2.6% |

Standard Chartered Kenya Non-Resd. A/C KE 10085 |

20,840,500 |

2.6% |

|

Kenya Commercial Bank Nominees Ltd A/C 915BB |

9,757,254 |

1.2% |

Kenya Commercial Bank Nominees Ltd A/C 915BB |

9,757,254 |

1.2% |

|

Stanbic Nominees Limited R6631578 |

7,995,122 |

1.0% |

Stanbic Nominees Limited R6631578 |

7,995,122 |

1.0% |

|

Stanbic Nominees Ltd A/C NR1031436 |

7,941,502 |

1.0% |

Stanbic Nominees Ltd A/C NR1031436 |

7,941,502 |

1.0% |

|

Standard Chartered Kenya Nominees A/C KE22446 |

7,758,455 |

1.0% |

Standard Chartered Kenya Nominees A/C KE22446 |

7,758,455 |

1.0% |

|

Standard Chartered Kenya Nominees Non-Resd A/C 9866 |

5,981,912 |

0.8% |

Standard Chartered Kenya Nominees Non-Resd A/C 9866 |

5,981,912 |

0.8% |

|

Stanbic Nominees ltd A/C NR3530153 |

5,886,950 |

0.7% |

Stanbic Nominees ltd A/C NR3530153 |

5,886,950 |

0.7% |

|

Secretary To the Treasury - "PF" Account the Permanent |

4,829,436 |

0.6% |

Secretary To the Treasury - "PF" Account the Permanent |

4,829,436 |

0.6% |

|

Others |

182,844,700 |

23.1% |

Others |

182,844,700 |

23.1% |

|

Total |

790,774,356 |

100.0% |

|

790,774,356 |

100.0% |

Source: EABL Annual Report 2025

Asahi is a global beverage and food conglomerate headquartered in Tokyo, Japan. Asahi is listed on the Tokyo Stock Exchange and has a current market capitalization of JPY 2.6 tn and a revenue of JPY 2.9 bn as at FY’2024, equivalent to USD 17.0 bn and USD 19.0 bn respectively. Outside of its domestic Japanese market, Asahi markets its products across the globe in regions including Asia, Oceania, Europe and North America, offering a diverse portfolio of beer, alcoholic and non-alcoholic beverages and food products. Moreover, this transaction marks Asahi’s first significant investment in Africa and will serve as an important foundation of Asahi’s growth in the region.

In 2023, Diageo increased its shareholding in EABL to 65.0% through a tender offer made to shareholders. As of the time of the offer, Diageo had not expressed its intention to sell its stake in EABL and that this has come up this year due to developments that have affected Diageo’s business. In October 2025, EABL launched its Kshs 20.0 bn Medium Term Note (MTN) Programme, where the first tranche of notes an aggregate principal amount of Kshs 16.8 bn was issued on 18th November 2025. It is important to note that the MTN Program is an independent financing transaction where EABL had issued notes to creditors of the company and that the Diageo-Asahi transaction will have no impact on EABL’s financial performance and its ability to repay its obligations as far as the notes are concerned. Completion of the Proposed Transaction is subject to approval from Capital Market Authorities in Kenya, Uganda and Tanzania.

It is important to note that the Capital Markets Authority (CMA) has instructed EABL to explain the raising of the Kshs 16.8 bn through the MTN programme and the announcement of the exit of its parent firm within a span of 35 days. This comes after speculation that EABL had knowledge of Diageo’s planned exit but opted not to inform the bondholders. This has prompted regulatory action from CMA since the exit of a majority shareholder is deemed material information that ought to have been made public to the bondholders. In response, EABL issued a notice stating that it was not aware of Diageo’s planned exit from EABL when it issued the 5-year bond. With the MTN program being an independent financing position EABL has assured its creditors that Diageo’s exit will not have any effect on its balance sheet and its ability to repay its loan. Therefore, once CMA is satisfied that EABL did not conceal such material information, the Diageo-Asahi deal will proceed as planned.

The proposed disposal of Diageo’s 65.0% stake in EABL to Asahi Group Holdings represents a major shift in the company’s ownership structure and marks a new chapter for one of East Africa’s most significant consumer goods firms. Importantly, market sentiment has been notably positive since the announcement, with EABL’s share price rallying 19.3% gain from the pre-announcement price of Kshs 251.25 on 16th December 2025 to a high of Kshs 299.75 as of 18th December 2025, a level last seen in 6th June 2016 which recorded a high of Kshs 300.80. While the transaction is sizeable and strategically important, it does not alter EABL’s underlying operations, capital structure, or existing obligations, including its recently issued MTN program. Subject to regulatory approvals across the region, Asahi’s entry as the majority shareholder is likely to bring fresh strategic direction and long-term growth ambitions, particularly given its global footprint and first major foray into Africa. Overall, the transaction is more of a shareholder-level change than an operational disruption, with EABL well-positioned to maintain stability while potentially benefiting from Asahi’s global expertise and expansion strategy.

We are “Bullish” on the Equities markets in the short term due to current attractive valuations, lower yields on short-term government papers and expected global and local economic recovery, and, “Neutral” in the long term due to persistent foreign investor outflows. With the market currently trading at a discount to its future growth (PEG Ratio at 0.9x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the economic outlook in the short term.

- Residential Sector

- State Misses Affordable Housing Targets, Deepening Pressure in the Residential Market

During the week, the state department of housing and urban development reported that the State missed its affordable housing buyer registration and delivery targets, with 292,326 Kenyans registered on the Boma Yangu platform by June 2025, 41.5% below the government’s initial expectations of onboarding over 500,000 buyers. Official disclosures show that only 292,326 people registered by end-June, while just 2,075 housing units had been completed under the Affordable Housing Programme (AHP) between July 2022 and June 2025, significantly undershooting target of 250,000 units annually signifying 0.8% achievement of the target. The State attributes the slow progress to court cases, delays in passing housing regulations, and the lack of a legal framework to support Housing Levy collections, which constrained funding and construction momentum, despite Kshs 81.4 bn already spent on the programme and a long-term budget of Kshs 627.0 bn up to 2032.

We expect that the missed targets are likely to weigh on the residential sector by prolonging the supply deficit in affordable housing that stood at 2 million units by 2022, keeping pressure on rents and entry-level house prices, especially in urban areas. Delays in delivery and buyer uptake may dampen confidence among private developers and financiers, slowing new residential project launches or pushing developers to focus on higher-income segments perceived as less risky. At the same time, persistent unmet demand underscores a structural opportunity in affordable housing, suggesting that once regulatory clarity, funding mechanisms, and execution improve, the sector could see renewed activity, stronger public–private partnerships, and increased investment aimed at closing Kenya’s housing gap.

- Infrastructure Sector

- Cabinet Approves Kshs 5.0 tn Infrastructure Fund

During the week, the Cabinet approved a Kshs 5.0 tn infrastructure fund aimed at accelerating investment in critical projects, including roads, railways, ports, energy, water, irrigation, and digital infrastructure. The fund, to be anchored under the Sovereign Wealth Fund and structured to attract both local and foreign private capital, is intended to reduce reliance on public debt while fast-tracking development and job creation.

The National Infrastructure Fund will serve as the central vehicle for financing priority public infrastructure projects. It will be overseen by a competitively appointed board of directors and a chief executive officer to ensure strong governance, transparency and commercial discipline. Under the new framework, all proceeds from privatization will be ring-fenced exclusively for infrastructure projects that generate long-term public value.

We expect that the creation of the Kshs 5.0 tn infrastructure fund will significantly boost the infrastructure sector by unlocking large-scale, long-term financing for priority projects that have often stalled due to fiscal constraints and rising public debt. By crowding in private and institutional capital through the Sovereign Wealth Fund framework, the initiative can accelerate delivery of roads, rail, ports, energy, water, and digital infrastructure, improve project execution efficiency, and support local construction, engineering, and logistics firms. Over time, this could enhance productivity across the economy, lower the cost of doing business, and stimulate job creation, although its success will depend on strong governance, transparent project selection, and effective risk-sharing to ensure infrastructure investment does not crowd out funding for critical social sectors.

- Real Estate Investments Trusts

- Africa Logistics Properties received approval

During the week, Africa Logistics Properties (ALP) received approval from the Capital Markets Authority (CMA) to proceed with a restricted offer for its ALP Industrial Real Estate Investment Trust (I-REIT), targeting professional investors only. The offer involves issuing up to 30 mn units at USD 1.0 per unit to raise up to USD 30.0 mn, alongside a promoter consideration of up to 15 mn units issued in exchange for seed logistics assets. The I-REIT will invest in modern Grade A and B warehousing and logistics facilities across East Africa, with initial seed assets located in Imara Daima and Tatu City, Nairobi. ALP Property Management will act as the REIT manager, while the Co-operative Bank of Kenya as the trustee, and the units are expected to be listed on the Nairobi Securities Exchange in March 2026 following the offer period and regulatory milestones.

We expect that the ALP Industrial REIT will strengthen and diversify Kenya’s REIT industry by expanding it beyond the traditionally dominant retail and commercial office segments into industrial and logistics real estate, which is viewed as more resilient and demand-driven. Its focus on a restricted offer to professional investors may help improve pricing discipline, governance standards, and performance credibility, addressing some of the confidence challenges that have faced earlier REITs. If successful, the listing could serve as a proof point that sector-specific, income-focused REITs can attract capital, encouraging more developers to structure assets into REITs, deepening the pipeline, improving market depth on the NSE, and gradually restoring investor confidence in REITs as a viable long-term investment vehicle in Kenya.

- REITs Weekly Performance

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 27.4 and Kshs 23.2 per unit, respectively, as per the last updated data on 5th December 2025. The performance represented a 33.4% and 14.5% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.8 mn and 41.2 mn shares, respectively, with a turnover of Kshs 323.5 mn and Kshs 791.5 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 5th December 2025, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 1.2 mn shares for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015.

REITs offer various benefits, such as tax exemptions, diversified portfolios, and stable long-term profits. However, the ongoing decline in the performance of Kenyan REITs and the restructuring of their business portfolios are hindering significant previous investments. Additional general challenges include:

- Insufficient understanding of the investment instrument among investors leading to a slower uptake of REIT products,

- Lengthy approval processes for REIT creation,

- High minimum capital requirements of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, essentially limiting the licensed REIT Trustee to banks only

- The rigidity of choice between either a D-REIT or and I-REIT forces managers to form two REITs, rather than having one Hybrid REIT that can allocate between development and income earning properties

- Limiting the type of legal entity that can form a REIT to only a trust company, as opposed to allowing other entities such as partnerships, and companies,

- We need to give time before REITS are required to list – they would be allowed to stay private for a few years before the requirement to list given that not all companies maybe comfortable with listing on day one, and,

- Minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs. The significant capital requirements still make REITs relatively inaccessible to smaller retail investors compared to other investment vehicles like unit trusts or government bonds, all of which continue to limit the performance of Kenyan REITs.

We expect the performance of Kenya’s Real Estate sector to remain resilient, supported by several factors: i) Cabinet approval of the Kshs 5.0 tn infrastructure fund, (ii) There is also an improvement in the REITs market with CMA approval of the Africa Logistics Properties Industrial REIT. However, challenges such as weak investor appetite in listed REITs like ILAM Fahari I-REIT and high capital requirements will continue to constrain the sector’s optimal performance.

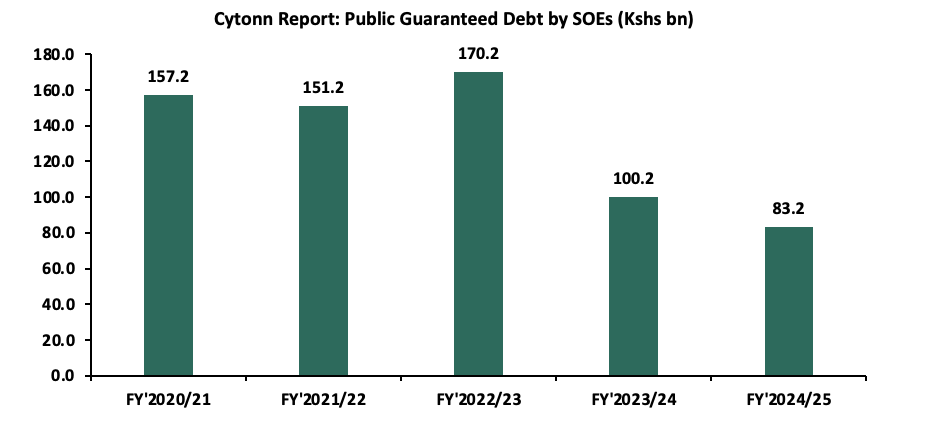

Privatization involves selling government-owned assets (including shares in state-owned companies) to private individuals or businesses. This excludes selling new shares to current shareholders or financial restructuring within a company that might reduce the government's ownership percentage. The proof of long-term inefficiencies, misconduct, poor financial management, and waste in state owned enterprises (SOEs) necessitates the need for privatization which typically tries to increase economic efficiency by increasing a company's performance, hence eliminating or reducing the need for government economic intervention, attract private investment and foster innovation. Furthermore, privatizations have been utilized to promote competition in monopolized industries. By transitioning from state control to private ownership, these enterprises are envisioned to become more agile, responsive to market dynamics, and better positioned to contribute significantly to the nation’s socio-economic development. SOEs fund their budgets through Government transfers (recurrent grants), Appropriation-in-Aid (A-in-A) and loans. As at the end of FY’2024/25, publicly guaranteed debt by SOEs stood at Kshs 83.2 bn, a 16.2% decrease from Kshs 100.2 bn in FY’2023/24, though it remains elevated despite the decline. As a result, privatization of state-owned enterprises (SOEs) has been identified as a fiscal enhancement option, and it is one of the requirements imposed by multilateral lenders such as the International Monetary Fund (IMF) for access to concessional lending facilities.

Kenya's privatization efforts have stalled for years. Although the previous government identified 11 state-owned companies for privatization in 2023, none were actually sold. However, the new regime is aiming to speed up the process to improve the government's financial health. In February 2024, Kenya’s Cabinet approved the sale of seven more state owned enterprises bringing the total number to eighteen. Additionally, the Privatization Bill 2025 was assented to the Privatization Act 2025 which replaced the Privatization Act 2023, introducing new regulatory dynamics for privatizing public companies in Kenya. The Act intends to establish the Privatization Authority, streamline the regulatory framework for privatization, prohibit unfair trade practices, and promote transparency and public participation in Kenya’s privatization programme. In this week’s focus, we shall cover the following:

- History of SOE Privatization of Kenya,

- The Privatization Act 2025,

- The benefits of privatizing state-owned enterprises in Kenya,

- The progress of SOE privatization in Kenya, and,

- Recommendations and conclusion.

Section I: History of SOE Privatization in Kenya

The history of privatization in Kenya reflects a journey from the initial enthusiasm for state control and ownership of enterprises to a recognition of the inefficiencies and limitations of such a model. After gaining independence in 1963, Kenya established parastatals driven by various national goals outlined in Sessional Paper No. 10 of 1965 on African Socialism and its application in Kenya. These goals included accelerating economic and social development, addressing regional economic imbalances, promoting indigenous entrepreneurship, and encouraging both Kenyan and foreign investments. However, over time, it became evident that the state-controlled enterprises had significant shortcomings. Reviews conducted in 1979 and 1982 highlighted widespread inefficiencies, financial mismanagement, and political interference within parastatals. There was a realization that state ownership stifled private sector initiatives, resulted in low productivity, and burdened the government with excessive fiscal responsibility.

In response to these challenges, the Kenyan government-initiated measures to reform its public enterprises. The enactment of the State Corporations Act was one such effort aimed at streamlining management. However, despite these efforts, the performance of most state corporations continued to decline due to reliance on limited public sector financing, over-employment, corruption, and mismanagement.

The turning point came in July 1992 with the issuance of the Policy Paper on Public Enterprise Reform and Privatization. This marked the beginning of a structured privatization program aimed at divesting the government's ownership of commercial enterprises. The program categorized enterprises into non-strategic and strategic ones, with the former slated for privatization. During the first phase of privatization, which concluded in 2002, most non-strategic commercial enterprises were either fully or partially privatized. However, the impact on the economy was limited due to institutional weaknesses and the exclusion of large strategic companies from privatization.

Subsequent phases of privatization, including initiatives under the Economic Recovery Strategy for Wealth and Employment Creation (ERSWEC) and Vision 2030, focused on key transactions such as initial public offers (IPOs), concessioning, and strategic partnerships. These transactions aimed to mobilize investment resources, modernize infrastructure, and support the country's economic recovery and development agenda. Privatization under Vision 2030 sought to enhance efficiency, competitiveness, and market orientation in Kenya's economy. It aimed to subject more production to market forces, attract investment for infrastructure development, and increase government revenue through privatization proceeds and improved enterprise performance. Under ERSWEC, a number of key privatizations took place as outlined in the table below;

|

Cytonn Report: Government of Kenya Completed Privatizations |

|||||

|

Company |

Year |

Method of Privatization |

Government Share Before |

Government Share After |

Sector |

|

Safaricom |

2008 |

IPO |

60.0% |

35.0% |

Telecommunication |

|

Kenya Reinsurance Corporation |

2007 |

IPO |

100.0% |

60.0% |

Insurance |

|

Telkom Kenya |

2007 |

Strategic Sale |

100.0% |

49.0% |

Telecommunication |

|

Kenya Electricity Generating Company |

2006 |

IPO |

100.0% |

70.0% |

Energy |

|

Kenya Railways Corporation |

2006 |

Concessioning |

100.0% |

100.0% |

Transport |

|

Mumias Sugar Company 2nd Offer |

2006 |

IPO |

38.4% |

20.0% |

Manufacturing |

Source: Privatization Commission of Kenya

The history of privatization in Kenya reflects a transition from state control to a more market-oriented approach, driven by the recognition of the limitations of state-owned enterprises and the need for greater private sector participation in the economy.

Section II: The Privatization Act 2023

Kenya’s privatization of StateOwned Enterprises (SOEs) is now governed by the Privatization Act 2025, which the President assented to in October 2025, replacing the 2023 Act, which had repealed the 2005 Act. The new Act establishes the Privatization Authority under the National Treasury to oversee asset sales, directs proceeds toward national development, and introduces a more transparent framework with public participation and parliamentary oversight, while also speeding up the process by reducing steps and eliminating certain formalities. Supporting policies include the GovernmentOwned Enterprises (GOE) Act, 2025, which establishes a framework that governs the performance, accountability, and management of governmentowned enterprises, ensuring they operate efficiently, transparently, and in line with constitutional principles.

- Objectives of the Act

The Act establishes Kenya’s modern framework for privatization, ensuring that the process is not only about transferring ownership but also about strengthening governance, promoting transparency, and aligning with national development priorities. Its roles include:

- Streamline the regulatory and institutional framework for the implementation of privatization programmes - The Act creates a clear and structured system for how privatization should be carried out. By defining the institutions responsible, the procedures to be followed, and the checks and balances required, it eliminates ambiguity and duplication. This ensures that privatization is implemented in a consistent, predictable, and legally sound manner, thereby boosting investor confidence and protecting public resources.

- Prohibit restrictive or unfair trade practices that undermine competition and public interest - Privatization is not meant to create monopolies or allow private actors to exploit markets. The Act explicitly prohibits practices that restrict fair competition, such as collusion, insider dealing, or discriminatory access. This ensures that privatization contributes to a healthy, competitive economy where efficiency and innovation thrive, while safeguarding consumers and the wider public interest.

- Promote openness and public participation in privatization programmes to build trust and accountability - Transparency is central to the Act. It requires that privatization processes be open to public scrutiny, with opportunities for stakeholders, including workers, communities, and civil society, to participate. This builds legitimacy and trust, ensuring that privatization decisions are not made behind closed doors but reflect the voices and concerns of the people affected.

- Safeguard national interests and strategic assets while enabling private sector efficiency and innovation - The Act recognizes that not all public assets should be privatized. Strategic enterprises, such as those tied to national security, essential infrastructure, or constitutional obligations are protected. At the same time, it encourages private sector involvement in areas where efficiency, innovation, and investment can deliver better outcomes. This balance ensures that Kenya’s sovereignty and long-term interests are preserved while unlocking private sector dynamism.

- Mobilize resources for economic growth and fiscal stability, reducing the burden of underperforming state enterprises - Many state-owned enterprises have historically drained public finances through inefficiency and losses. The Act positions privatization as a way to relieve this fiscal burden by attracting private capital, generating revenue for the government, and redirecting resources toward priority areas such as infrastructure, healthcare, and education. This role ties privatization directly to Kenya’s broader economic growth and fiscal sustainability agenda.

The Privatization Act, 2025 transforms privatization into a comprehensive governance reform. By combining efficiency, transparency, competition, and social safeguards, it ensures that privatization strengthens Kenya’s fiscal health while protecting citizens and national interests.

- Institutional Framework of the Act

The Privatization Act 2025 introduces significant changes to the process and oversight of privatization in Kenya. Here are the key features of the new Act:

- Formation of the Privatization Authority: The Act establishes the Privatization Authority to replace the existing Privatization Commission. This new authority is endowed with expanded duties and roles, aimed at providing centralized oversight of privatization initiatives. The Privatization Authority is mandated to advise the government on all matters of privatization, facilitate the implementation of related policies, and oversee the Privatization Programme by executing specific proposals. It collaborates with local and international organizations, prepares longterm divestiture plans, monitors and evaluates progress, ensures compliance with the Act, and performs any other functions conferred under this or other legislation. The Authority shall be managed by a Board comprising a chairperson appointed by the President, the Principal Secretary responsible for privatization (or representative), the AttorneyGeneral (or representative), six competitively appointed members, and the Managing Director as a nonvoting exofficio member,

- Appointments of the Members: Similar to the Privatization Act 2005, the Cabinet Secretary is responsible for appointing of the six members of the Privatization Authority while the President is in charge of appointing the Board’s chairperson. Members are required to possess relevant skills and competencies outlined in the Act,

- Privatization Programme: The Act mandates the Cabinet Secretary to develop a comprehensive privatization programme, employing specific criteria for identifying entities for privatization, subject to approval by the Cabinet and subsequently by the National Assembly. This includes considerations such as alignment with government policies, strategic importance, and potential benefits,

- Privatization Strategies and Agreements: The Authority is tasked with approving policies related to the Authority and creating detailed privatization proposals, including financial health, valuation, and socio-economic impact assessments. The Act introduces privatization methods such as share sales via public tendering and emphasizes competitive bidding processes overseen by a designated committee. Privatization agreements must be prepared and approved, with provisions for regulating potential monopolies,

- Objections and Appeals: Individuals dissatisfied with decisions or implementations under the Act can file objections, which are assessed according to specified procedures. Further appeals can be made to the Privatization Review Board and, if necessary, to the High Court, and,

- Proceeds of Privatization: All proceeds generated from the sale of shares directly owned by the National Government shall be remitted to the Consolidated Fund, ensuring that the revenues are centrally accounted for and utilized to support national development priorities, fiscal sustainability, and the overall public interest.

Although the Privatization Act, 2025 closely mirrors the 2023 Act, it introduces two notable differences and improvements, as highlighted in the table below:

|

Cytonn Report: Key Differences between the 2023 and 2025 Privatization Acts |

|||

|

# |

|

2023 Act |

2025 Act |

|

1. |

Parliamentary Approval |

Under the 2023 Act, the privatization programme was formulated by the Cabinet Secretary and approved by the Cabinet, with the National Assembly’s role limited to ratification before implementation. Parliament could refuse to ratify and provide reasons, but if no action was taken within 90 days, the programme was automatically deemed ratified |

The privatization programme under this Act requires approval from both the Cabinet and the National Assembly. The National Assembly is vested with the authority to reject or propose amendments to any privatization proposal. |

|

2. |

Board Composition |

The Board included the Principal Secretary to the National Treasury, the Principal Secretary for investment promotion, the Secretary to the State Corporations Advisory Committee, and four competitively appointed professionals with specific qualifications and experience. |

The Board composition was streamlined to include only the Principal Secretary responsible for privatization, the AttorneyGeneral, six competitively appointed members without prescribed qualifications, and excluded the Treasury, investment promotion, and State Corporations Advisory Committee representatives |

Source: Privatization Commission of Kenya

The Privatization Act, 2023 was declared unconstitutional, null and void by the High Court on 24th September 2024 due to lack of adequate public participation, the unconstitutionality of Section 22(5) on automatic ratification after 90 days without parliamentary action, and the unlawful decision to privatize the Kenyatta International Conference Centre, a protected national monument. The Kenyan Privatization Act of 2025 marks a significant refinement in the management and procedures governing privatization efforts within the country. Notable changes include the strengthening of the Privatization Authority as a corporate body vested with extensive powers and responsibilities, building on the reforms of 2023. This restructuring reinforces corporate governance through the establishment of a professional oversight board and key positions such as the managing director and corporate secretary, ensuring accountability and operational efficiency. Additionally, the Act continues to grant the Cabinet Secretary for the National Treasury a pivotal role in formulating and ratifying privatization programs, but now introduces clearer checks and timelines to streamline approvals and mitigate bureaucratic delays. Concerns remain, however, regarding the potential concentration of power in the Cabinet Secretary’s office and the risk of monopolization in certain sectors, prompting calls for stronger parliamentary oversight and enhanced safeguards to guarantee transparency and accountability.

Moreover, the Act refines the scope of privatization options, emphasizing Initial Public Offerings and negotiated sales while maintaining the exclusion of concessions, leases, and management contracts. It strengthens provisions aimed at preventing unregulated monopolies and embeds dispute resolution mechanisms to address conflicts arising from privatization transactions. Importantly, the Act allows for the utilization of privatization proceeds to offset costs, introduces stricter penalties for offenses such as falsified information, insider trading, or collusion, and aligns privatization with constitutional values of equity, inclusivity, and fiscal responsibility. While the Act represents a long-awaited reform to address inefficiencies in state-owned enterprises, concerns persist regarding the balance of power and the potential for abuse, underscoring the need for vigilant oversight.

Overall, the Privatization Act of 2025 represents a significant step forward in Kenya’s privatization framework, aiming to streamline processes, enhance efficiency, and stimulate economic growth while raising important questions about accountability, transparency, and the equitable distribution of benefits.

- Methods of Privatization of State-Owned Enterprises

The Privatization Act, 2025 outlines several approaches through which government-owned enterprises can be transferred to private ownership. Each method serves a distinct purpose in balancing efficiency, transparency, and public interest.

- Initial public offer of shares - This involves offering shares of the SOE to the public for the first time through the stock exchange. It allows broad participation, giving ordinary citizens and institutional investors a chance to own part of the enterprise. The IPO method promotes transparency, market discipline, and inclusivity, while also deepening capital markets. In the past, the Government of Kenya undertook IPOs in KenGen and Safaricom, divesting 25.0% and 30.0% of its shareholding while maintaining residual stakes of 35.0% and 70.0% respectively. These privatizations were driven by the need to generate revenue, plug budget deficits, and stimulate activity at the Nairobi Stock Exchange (NSE).

- Sale of shares by public tender - Here, the government invites bids (offers) from interested buyers and sells shares to the highest or most suitable bidder, following strict rules in the Public Procurement and Asset Disposal Act (PPADA). This method ensures competitive pricing and fairness, as the process is open and transparent. It is often used when the government wants to attract strategic investors with proven capacity to manage and grow the enterprise. An example of this privatization strategy is the strategic sale of Telkom Kenya in 2007, which was facilitated by the IFC through a restructuring package that emphasized transparency and the need to balance the interests of multiple stakeholders, both public and private.

- Sale resulting from the exercise of pre-emptive rights - Pre‑emptive rights give existing shareholders the first opportunity to buy additional shares before they are offered to the general public or other external third parties. In privatization, this means current investors or partners in the SOE can increase their stake when the government divests. This method protects existing shareholders from dilution and maintains continuity in ownership and governance. In 1997, General Motors was privatized through the exercise of preemptive rights, with shares sold to existing shareholders and the government receiving proceeds amounting to Kshs 333.5 mn.

- Such other method determined by the cabinet - The Act provides flexibility by allowing the Cabinet to approve alternative methods of privatization when necessary. This could include innovative approaches such as public share floatation, management and employee buyouts and any other method the Cabinet seems fit. Public Share Floatation is a privatization method where shares are offered to the general public through the stock market, while Management and Employee Buyouts involve managers or employees acquiring shares or assets of a stateowned enterprise to gain controlling ownership. The role of the Cabinet here is to ensure that privatization remains aligned with national interests, economic priorities, and constitutional safeguards.

These methods reflect a balance between market-driven approaches (IPO, tender) and protective mechanisms (pre‑emptive rights, Cabinet discretion). Together, they ensure privatization is not only about raising revenue but also about deepening capital markets, safeguarding fairness, and protecting strategic interests.

Section III: The Benefits of Privatizing State-Owned Enterprises in Kenya

- Reduced fiscal burden - According to the Annual Public Debt Management Report for FY’2024/25, the government’s outstanding guaranteed debt to SOEs stood at Kshs 83.2 bn as at the end of June 2025. The SOEs that had been issued guarantees by the government include Kenya Ports Authority (KPA), Kshs 46.2 bn (55.5%), Kenya Electricity Generation Company (KENGEN), Kshs 27.4 bn (32.9%), and Kenya Airways (KQ), Kshs 9.7 bn (11.6%) shown in the table below:

|

Cytonn Report: List of Guaranteed Stock Balances in FY’2024/2025 |

|||

|

|

Agency |

Amount (Kshs mn) |

Percentage |

|

1. |

Kenya Ports Authority |

46,159.0 |

55.5% |

|

2. |

Kenya Electricity Generating Company (KENGEN) |

27,392.0 |

32.9% |

|

3. |

Kenya Airways |

9,690.0 |

11.6% |

|

Total |

83,241.0 |

100.0% |

|

Source: National Treasury

Additionally, the total publicly guaranteed debt by SOEs has recorded a 5- year CAGR of (11.9%), decreasing to Kshs 83.2 bn as at the end of June 2025 from the Kshs 157.2 bn recorded as at the end of June 2021. The decline in governmentguaranteed debt by June 2025 was mainly due to repayments of outstanding guaranteed loans. In particular, after Kenya Airways defaulted on its USD 525.0 mn aircraft loan, the debt was novated to the Government, which then settled arrears and repaid Kshs 19.7 billion in FY2024/25, reducing the overall guaranteed debt stock. Below is a graph showing the total publicly guaranteed debt by SOEs over the last five years.

Source: National Treasury

Privatization can help alleviate the financial burden on the government by transferring the responsibility of financing and operating SOEs to the private sector. Government funding for other essential services like healthcare, education, and infrastructure development may be freed up as a result,

- Raising revenue - Revenue raising is a key reason for the privatization of SOEs. The most immediate form of revenue comes from the proceeds of the sale, where the government collects substantial capital from selling its interest in enterprises to private investors, especially in the case of large and successful SOEs. Over time, privatized companies tend to become more efficient and profitable under private ownership and market discipline, thereby generating higher corporate tax revenues for the government. In addition, the funds raised from privatization can be directed toward debt reduction, lowering future interest payments and easing the overall public debt burden. Finally, privatization demonstrates a government’s commitment to market‑oriented reforms, which attracts both domestic and foreign investment, stimulates economic activity, and broadens the tax base,

- Increased efficiency - Privatization has been a popular strategy for enhancing SOE performance. When the entity's ownership moves from the public to the private sector, it is exposed to a competitive environment that drives it to optimize profits and output. In addition, the corporation will have to report to investors on a regular basis in a standard format, making it open to scrutiny and criticism from analysts and investors as a means of promoting corporate efficiency and accountability. Privatization can also lead to higher service quality and customer satisfaction as businesses seek to match consumer wants and remain competitive in the market. This can result in improved products, services, and innovation, eventually benefiting customers,

- Reduced political interference in management of SOEs - Kenyan state-owned enterprises (SOEs) are regularly utilized for political patronage. Government leaders exploit these enterprises to reward supporters and enrich themselves, rather than delivering critical services for citizens. This has led to mismanagement, corruption, and poor service delivery. Privatization can limit government meddling and promote business-like administration of these firms. Private firms prioritize profit and great services over political agendas. This eliminates corruption and promotes transparent and responsible management of state-owned enterprises (SOEs),