Accelerating Funding to Affordable Housing, & Cytonn Weekly #21/2020

By Research Team, May 24, 2020

Executive Summary

Fixed Income

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 149.3%, up from 100.4% the previous week due to high liquidity in the money markets as well as the increased preference to shorter-dated papers. The subscription rate of the 91-day, 182-day, and 364-day papers increased to 271.0%, 104.9%, and 145.0%, respectively, from 191.8%, 44.9%, and 119.3% recorded the previous week, respectively. The recently issued five-year bond FXD1/2020/5 was undersubscribed with the overall subscription rate coming in at 68.6%. The May inflation is expected to remain stable around the 5.5% range in line with 5.6% recorded in April, as we expect the supply chain distortions to be countered by the reduction in oil prices. The Monetary Policy Committee (MPC) is set to meet on Wednesday, 29th May 2020, in our view they shall hold the Central Bank Rate stable as they await the recent two reductions to filter through into the economy. Also, during the week, the World Bank approved US Dollar 1.0 bn financing for Kenya to address the COVID-19 financing gap and support the economy through this period. This is the second-ever such lending from the World Bank after the first in May 2019 where the government received USD 750.0 mn for budgetary support;

Equities

During the week, the equities market was on an upward trend, with NASI, NSE 20 and NSE 25 gaining by 3.7%, 2.0% and 3.1%, respectively, taking their YTD performance to losses of 15.6%, 24.1% and 20.0%, for NASI, NSE 20 and NSE 25, respectively. During the week, the Central Bank of Kenya (CBK) presented to the Kenya Private Sector Alliance (KEPSA) The Status and Outlook of Kenya’s Banking Sector, which showed that the banking sector remains stable and resilient despite the ongoing challenges facing the economy. Also, the CBK announced the final acquisition of Imperial Bank’s assets and assumption of liabilities worth Kshs 3.2 bn each by KCB Group effective 2nd June 2020. KCB Group, Co-operative Bank, NCBA, and DTBK released their Q1’2020 financial results;

Real Estate

During the week the Ministry of Transport, Infrastructure, Housing and Urban Development published the new National Housing Development Fund Regulations 2020. In the retail sector, Car and General Kenya announced that it had secured Carrefour supermarket as the anchor tenant for its refurbished Nairobi Mega building located along Uhuru Highway. In the infrastructure sector, Water and sanitation Cabinet Secretary, Sicily Kariuki unveiled a Kshs 1.3bn Kiambu-Ruaka water supply and sewerage project. And in listed real estate, fund manager, ICEA Lion Asset Management (ILAM) announced the successful completion of its Stanlib Kenya Limited (SKL) transaction that will see it acquire the latter’s role of managing property fund, Stanlib Fahari I-REIT;

Focus of the Week

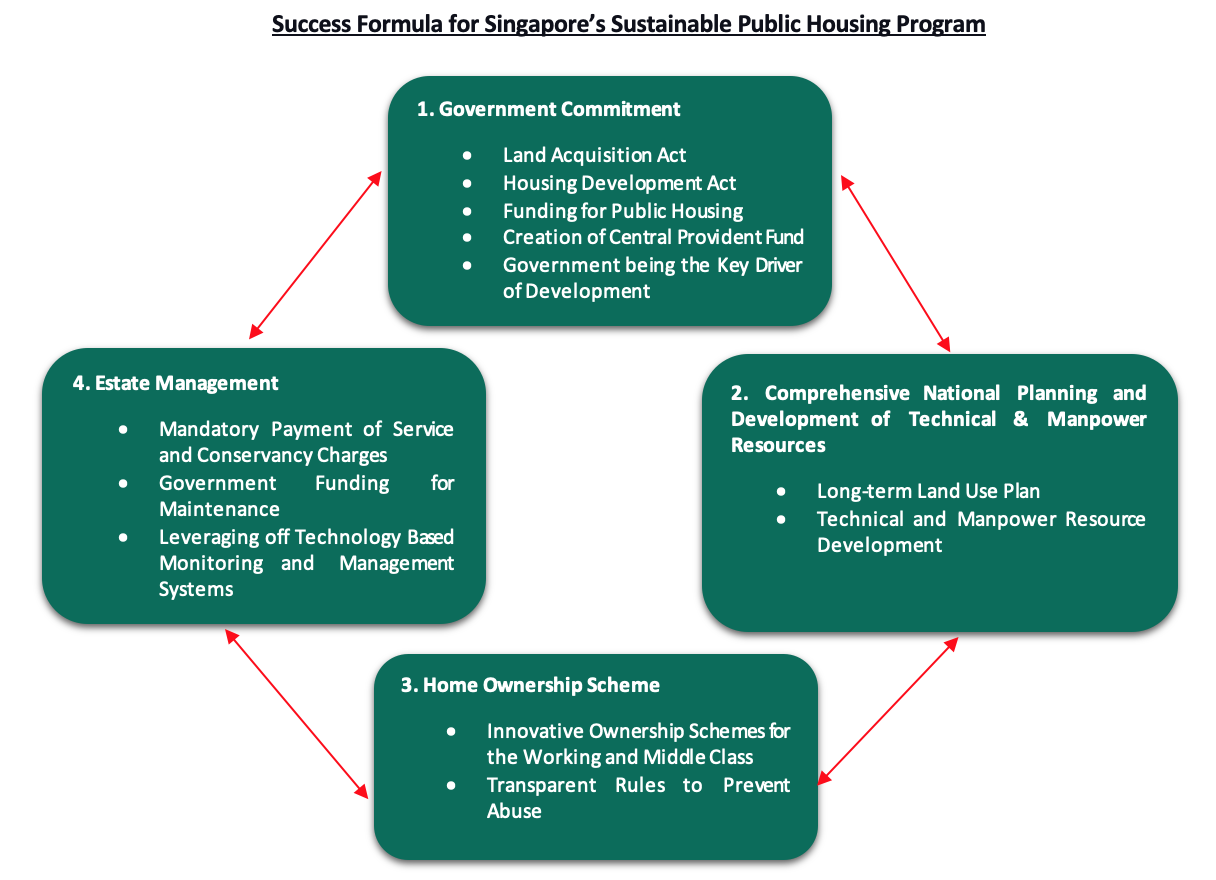

Kenya’s economy has seen significant growth with the GDP per capita increasing to Kshs 198,078 in 2019, a 137.5% growth from Kshs 83,393 in 2009, according to, Kenya National Bureau of Statistics. The growth has elevated the economy to middle-income status and in line with this, there has been an increase in demand for goods and services, including housing. According to the National Housing Corporation, the housing deficit in Kenya stands at 2.0 mn and continues to grow at a rate of 200,000 units a year while housing production is estimated at only 50,000 units a year, which is well below the annual demand. Affordability of housing remains a key challenge given the current high cost of construction, high cost of borrowing for end-user mortgages and insufficient access to financing. Through the affordable housing agenda by the Government of Kenya, institutions such as the Kenya Mortgage Refinance Company (KMRC) and the National Housing Development Fund (NHDF) were intended to enhance financing of the initiative. The recent proposed regulations by the Retirement Benefits Authority, RBA, will allow pensioners to use part of their pension towards purchasing houses. However, we are yet to see any improvement in mortgages being offered from the aforementioned initiatives. This week, we focus on ways of accelerating funding for affordable housing where we shall cover a brief introduction to housing in Kenya, challenges hindering the achievement of affordable housing, government initiatives towards the same, a case study on Singapore’s housing system and finally outline our recommendations with regard to accelerating funding towards the initiative.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.75% p.a. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.42% p.a. To subscribe, email us at sales@cytonn.com;

- Elizabeth Nkukuu, Chief Investment Officer at Cytonn Investments, was on Metropol TV talking about currency and interest rates outlook. Watch Elizabeth here;

- Michael Obaga, Senior Investment Consultant Cytonn Investments, was on Metropol TV to discuss how the Coronavirus pandemic has affected the government’s ability to continue with a lean budget. Watch Michael here;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running promotions:

- For Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit;

- For Phase 1: Get a 10% rent discount on units we manage for investors;

- For inquiries, please email us on clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The aim of the training is to grow financial literacy among the general public. To register for any of our Wealth Management Training, click here. Below is the list of the Wealth Management topics for this week:

- Tuesday, 26th May 2020: Investing in Loan Markets for Chamas and Saccos;

- Wednesday, 27th May 2020: Options for Your Pensions Upon Retirement - Annuity Vs Income Drawdown;

- Thursday, 28th May 2020: Managing Personal Financial Challenges in the COVID Environment;

- Friday, 29th May 2020: Accessing Affordable Housing Benefits;

- Saturday, 30th May 2020: Evaluating Money Market Fund Returns;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 149.3%, up from 100.4% the previous week. The oversubscription is partly attributable to the high liquidity in the money markets as well as the increased preference to shorter-dated papers by investors. The subscription rate for the 91-day, 182-day, and 364-day papers increased to 271.0%, 104.9%, and 145.0%, respectively, from 191.8%, 44.9%, and 119.3% recorded the previous week, respectively. The yields on the 91-day, 182-day, and 364-day papers all remained unchanged at 7.3%, 8.2%, and 9.2%, respectively. The acceptance rate declined to 74.1%, from 99.5% recorded the previous week, with the government accepting Kshs 26.6 bn of the Kshs 35.8 bn bids received.

The recently issued five-year bond, FXD1/2020/5, was undersubscribed, with the subscription rate coming in at 68.6%, as they received bids worth Kshs 20.6 bn, lower than the offered amount Kshs 30.0 bn. The yield on the bond came in at 11.7%, in-line with our recommended bidding range of 11.5% - 11.7%. Despite the undersubscription the government rejected high bids only accepting Kshs 8.9 bn out of the Kshs 20.6 bn worth of bids received, translating to an acceptance rate of 43.5%.

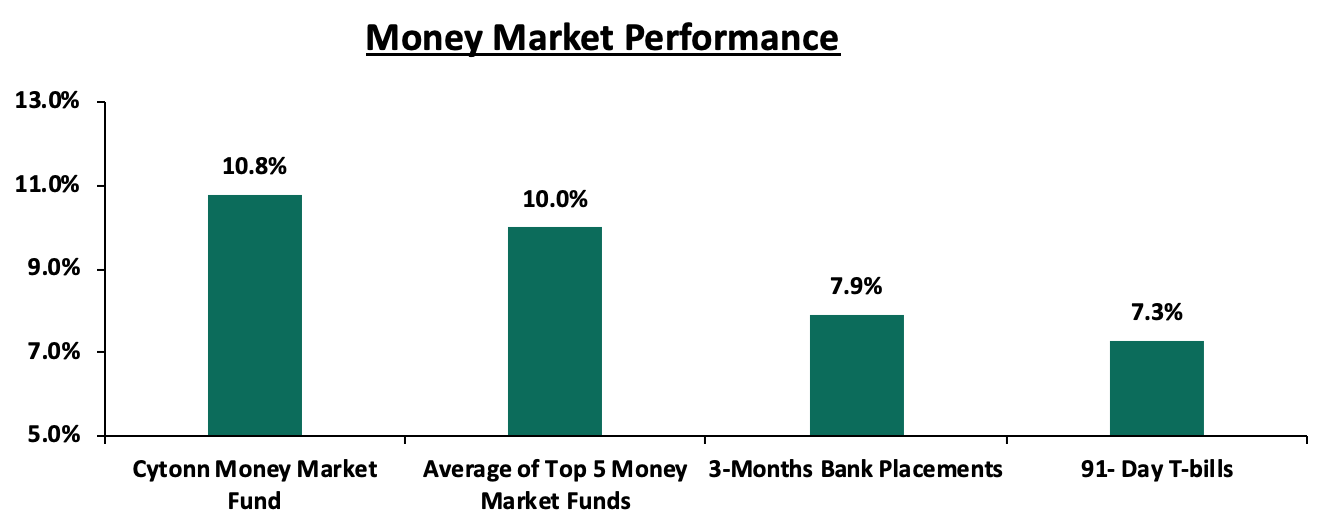

In the money markets, Yield on the short term papers remained unchanged at 7.9%, 7.3%, and 10.0% for 3-month bank placements, 91-day T-bill and the average yield of top 5 money market funds. The yield on the Cytonn Money Market Fund remained flat closing the week at 10.8%.

Liquidity:

During the week, liquidity remained high in the money market with the average interbank rate remaining unchanged at 4.2%, following the end of the monthly Cash Reserve Requirement (CRR) cycle and support from government payments. The average interbank volumes declined by 11.2% to Kshs 11.5 bn, from Kshs 12.9 bn recorded the previous week. The favourable liquidity in recent weeks has also partly been attributable to the reduction of the Cash Reserve Ratio (CRR) to 4.25%, from 5.25% previously, by the Monetary Policy Committee (MPC) during its March 2020 sitting, consequently freeing up Kshs 35.2 bn to provide additional liquidity to commercial banks for onward lending to distressed borrowers during the COVID-19 pandemic. Commercial banks’ excess reserves came in at Kshs 38.9 bn in relation to the 4.25% cash CRR.

Kenya Eurobonds:

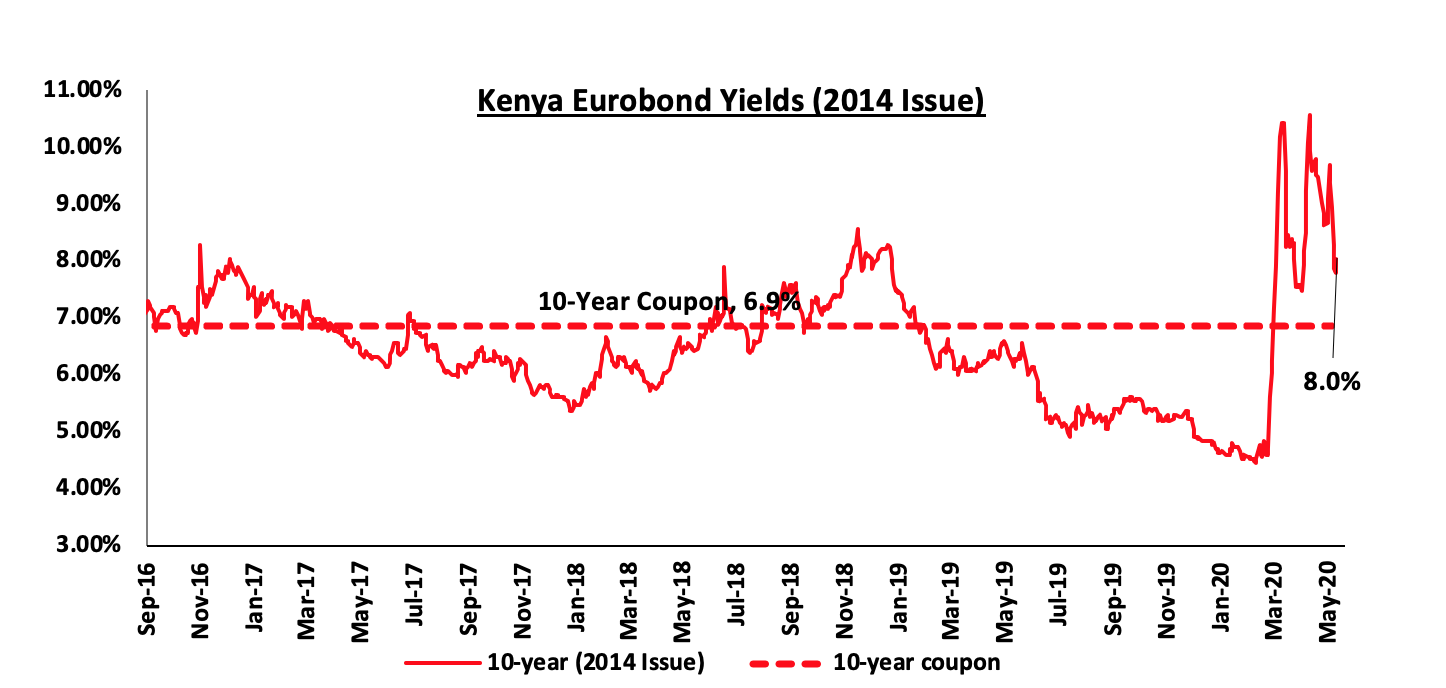

During the week, the yields on all the Eurobonds declined owing to improved investor sentiments as the market reacted to the news by the World Bank that they had approved USD 1.0 bn funding to support the economy. According to Reuters, the yields on the 10-year Eurobond issued in June 2014 declined by 1.4% points to 8.0%, from 9.4% recorded the previous week.

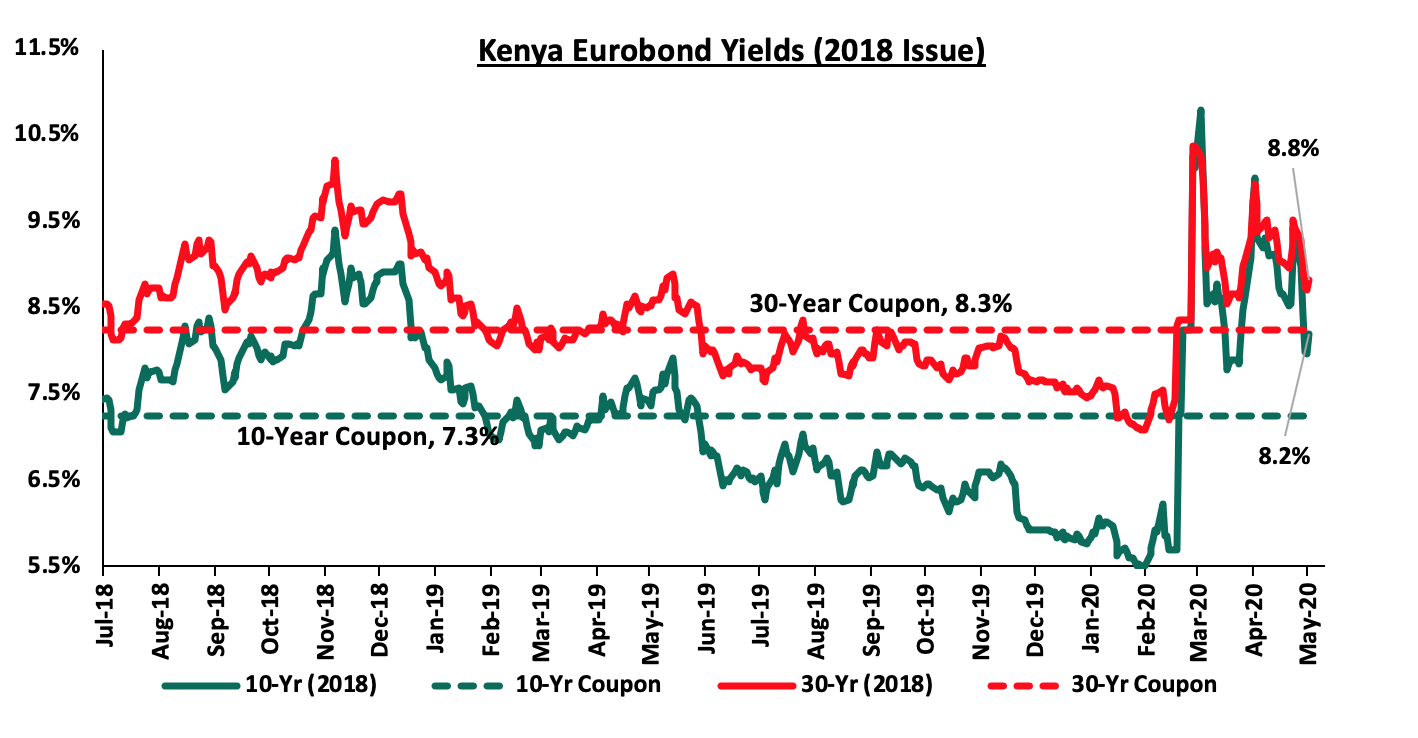

During the week, the yields on the 10-year and 30-year Eurobonds issued in 2018 declined by 1.1% points and 0.6% points to 8.2% and 8.8%, respectively, from 9.3% and 9.4% recorded previous week, respectively.

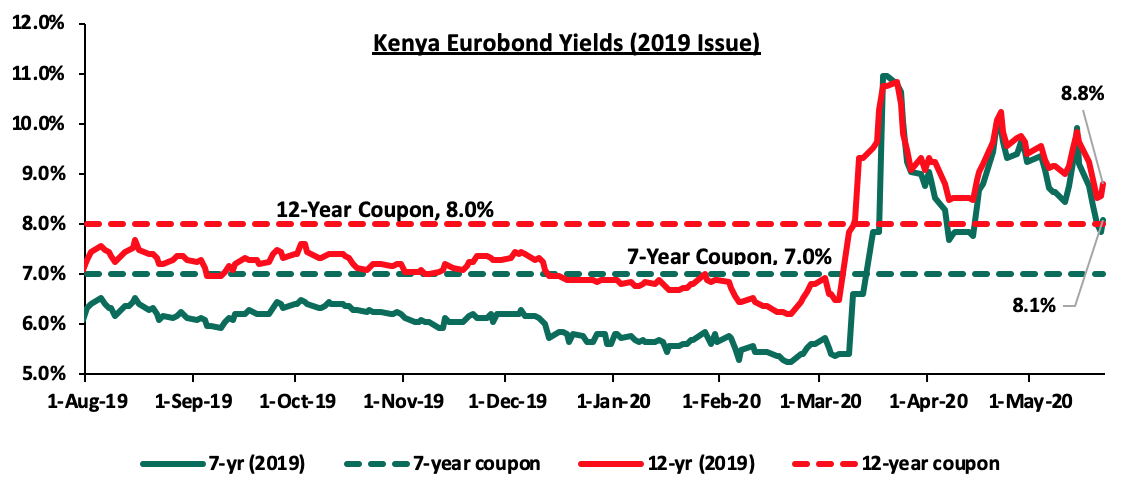

During the week, the yields on the 7-year and 12-year Eurobonds issued in 2019 declined by 1.1% points and 0.8% points, to 8.1% and 8.8%, respectively, from 9.2% and 9.6% recorded the previous week, respectively.

Kenya Shilling:

During the week, the Kenya Shilling remained relatively stable depreciating marginally by 0.1% against the US Dollar to close the week at Kshs 106.9, from Kshs 106.8, recorded the previous week. The shilling was supported by increased forex reserves, which rose to a four-month high USD 8.5 bn as the Central bank received the USD 750.0 mn from the International Monetary Fund for economic support. On a YTD basis, the shilling has depreciated by 5.5% against the dollar, in comparison to the 0.5% appreciation in 2019. We expect continued pressure on the shilling due to:

- High dollar demand from foreigners exiting the market as they direct their funds to safer havens,

- Increased demand as merchandise and energy sector importers beef up their hard currency positions amid a slowdown in foreign dollar currency inflows, and,

- Subdued diaspora remittances, due to the decline in economic activities globally coupled with increased prices of household items leading to lower disposable income.

The shilling is however expected to be supported by:

- High levels of forex reserves, currently at USD 8.5 mn (equivalent to 5.1-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. As a result of inflows from the IMF Rapid Credit Facility (RCF) approved during the week reserves rose by 8.7% to USD 8.4 mn from USD 7.8 mn,

Inflation Projection:

We are projecting the y/y inflation rate for May 2020 to remain stable within the range of 5.5% - 5.7%, compared to 5.6% recorded in April attributable to the following factors:

- The decline in oil prices (petrol prices by 10.3% and diesel prices by 19.7%), which has not led to a reduction in transport prices due to the measures taken by the government to curb the spread of COVID-19,

- Food prices have remained relatively stable during the month but there is an upward bias due to expected lower supply of foodstuffs as the effects of the locust invasion and recent floods take a toll on food production, and

- The reclassification of Food Index in the Consumer Price Index from 36.0% to 32.9%, which is expected to have an impact on the final inflation figures.

Monetary Policy:

The Monetary Policy Committee (MPC) is set to meet on Wednesday, 27th May 2020, to review the outcome of its previous policy decisions and recent economic developments, and to make a decision on the direction of the Central Bank Rate (CBR). In their previous meeting held on 29th April 2020, the committee decided to reconvene within a month for an early assessment of the impact of these measures and the evolution of the COVID-19 pandemic. In the last sitting, the MPC lowered the CBR by 25 bps to 7.00% from 7.25% after 1.00% revision the previous sitting. In their note, they indicated that the previous cut in CBR rate was having the intended outcome but they noted that the Coronavirus pandemic had continued to affect economic growth and as such, there would be a need to further cushion the economy. This was in line with our expectations as per our MPC Note.

During the meeting on Wednesday, 27th May 2020, we expect the MPC to maintain the Central Bank Rate (CBR) at 7.00%, with their decision mainly being supported by:

- High liquidity in the money markets from their previous action i.e. lowering of Cash Reserve Ratio (CRR) to 4.25%, from 5.25% in March 2020 meeting and the revision of the CBR rate by 25% over the previous two sittings,

- Inflation has remained stable and within the government target of 2.5% - 7.5%, and

- The need to monitor the effects the initial cuts will have on the economy as banks lend to businesses and individuals. Lower rates would make lending unattractive to banks as they might not reflect the true risk levels.

For our detailed MPC analysis, please see our MPC Note for the 27th May 2020 meeting here.

Weekly Highlight:

During the week, the World Bank approved US Dollar 1.0 bn financing for Kenya to address the COVID-19 financing gap and support the economy through this period. This is the second-ever such lending from the World Bank after the first in May 2019 where the government received USD 750.0 mn for budgetary support. The country undertook policy reforms to secure the financing and ultimately, directly benefit low-income households in the country. Through this policy, small scale farmers will benefit from better targeting of subsidized agricultural inputs through electronic vouchers. The supply of affordable housing is similarly expected to increase on the back of the updating of antiquated legislation that hindered the development of the housing market.

The approved financing will comprise of USD 750.0 mn credit from the International Development Association (IDA), to be repaid over 30 years after a 5 year grace period with 1.4% interest and a further loan of USD 250 from the International Bank for Reconstruction and Development (IBRD) which will attract a market-based interest of 2.0%. In our view, the move by the government is welcomed as it helps move the country’s loans to more concessional and commercial loans as opposed to bilateral and multilateral loans. Aside from the financial benefit, the initiative is also supporting more transparency in public financial management and as such, ordinary Kenyans will for the first time be able to review details of public procurement contracts through the public procurement information portal.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 17.7% behind of its current domestic borrowing target of 404.4bn, having borrowed Kshs 294.4 bn against a prorated target of Kshs 357.7 bn. The government had also borrowed 98.4 bn (42.3%) of the 232.8 bn foreign borrowing target, as at 31st March 2020. The uncertainty brought about by the novel Coronavirus will make it harder for the government to access foreign debt due to uncertainty affecting the global markets which might see investors attaching a high-risk premium on the country. A budget deficit is likely to result from the depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term fixed income securities to reduce duration risk.

Markets Performance

During the week, the equities market was on an upward trend, with NASI, NSE 20 and NSE 25 recording gains of 3.7%, 2.0% and 3.1%, respectively, taking their YTD performance to losses of 15.6%, 24.1%, and 20.0%, for NASI, NSE 20 and NSE 25, respectively. The performance of the NASI was driven by gains recorded by large-cap stocks, with Equity, Safaricom and KCB gaining by 7.3%, 6.1% and 1.8%, respectively, while both BAT and Bamburi recorded gains of 1.6%.

Equities turnover declined by 51.3% during the week to USD 22.5 mn, from USD 46.3 mn recorded the previous week, taking the YTD turnover to USD 671.5 mn. Foreign investors remained net sellers during the week, with the net selling position declining by 70.6% to USD 7.1 mn, from a net selling position of USD 24.0 mn recorded the previous week, a trend replicated in other emerging equity markets globally as foreign investors sold off riskier assets in favor of safe havens.

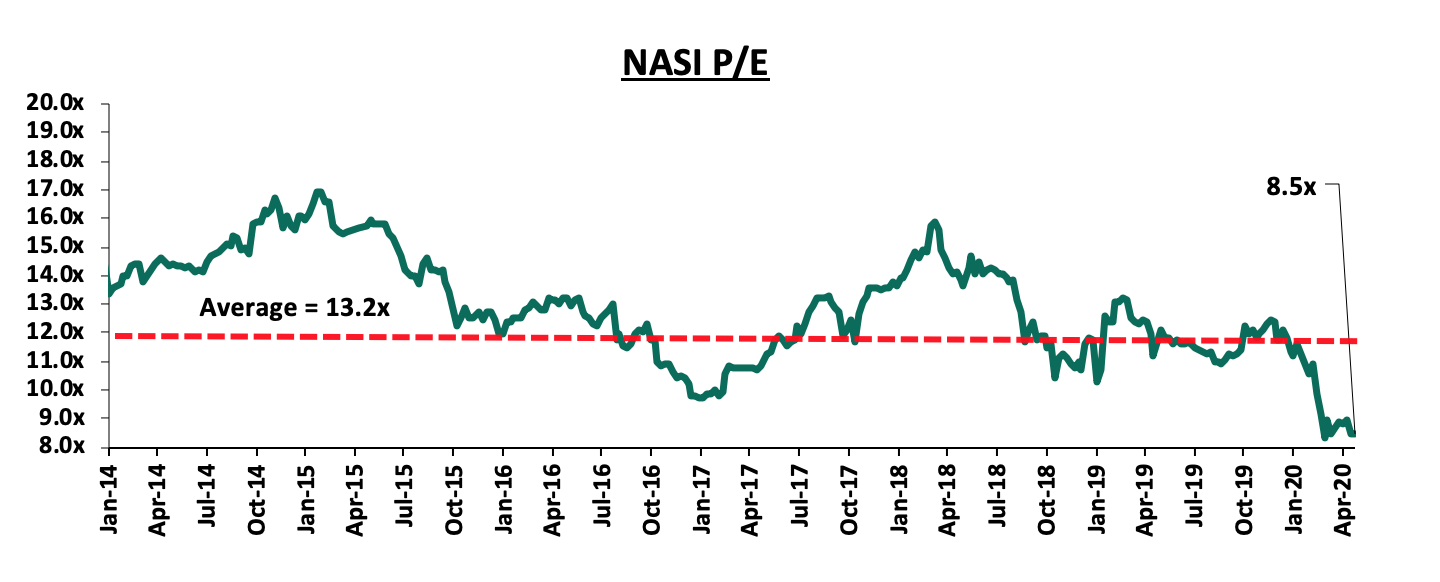

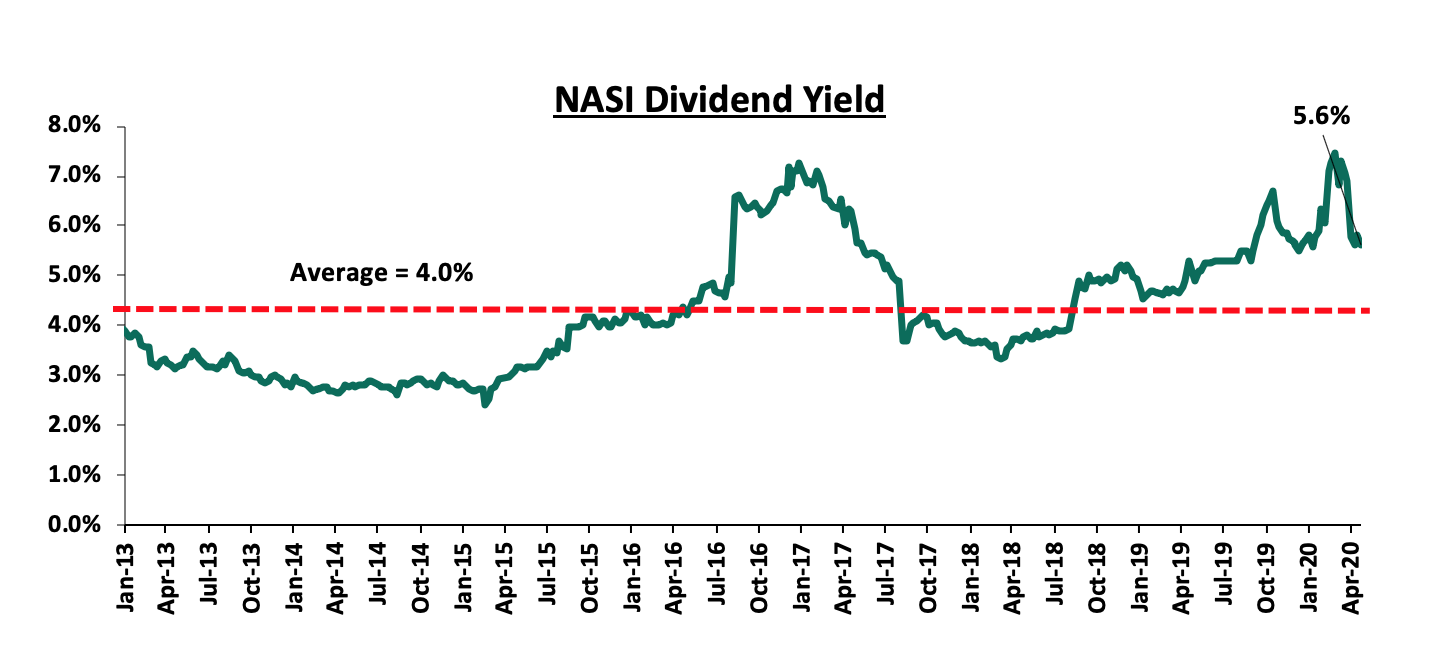

The market is currently trading at a price to earnings ratio (P/E) of 8.5x, 35.4% below the historical average of 13.2x. The current average dividend yield is at 5.6%, 1.6% points above the historical average of 4.0%. With the market trading at valuations below the historical average, we believe there are pockets of value in the market for investors with higher risk tolerance and are willing to wait. The current P/E valuation of 8.5x is 1.2% above the most recent valuation trough of 8.4x experienced in the last week of March 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, the Central Bank of Kenya (CBK) presented to the Kenya Private Sector Alliance (KEPSA) The Status and Outlook of Kenya’s Banking Sector. Below are some of the take-outs from the presentation by the CBK;

- As at the end of April 2020, the banking sector was stable and resilient as indicated by the strong liquidity ratio which stood at 51.2%, 31.2% points above the statutory minimum of 20.0% and strong capital adequacy ratios at 18.4%, 3.9% points above the statutory minimum of 14.5%,

- There was a slight deterioration in asset quality, with gross Non-Performing Loans (NPLs) ratio growing by 0.6% points to 13.1% in April 2020, from 12.5% in March 2020 and by 1.1% points from 12.0% recorded in December. This is an indication that the banking sector is feeling the adverse impact of the pandemic as a result of a slowdown in most economic sectors. Previously, in their announcement of additional measures to mitigate the adverse effects of the pandemic to the banking sector, the CBK announced it would be flexible concerning loan classification and provisioning for loans that were performing on 2nd March 2020 and whose repayment period was extended or restructured due to the pandemic,

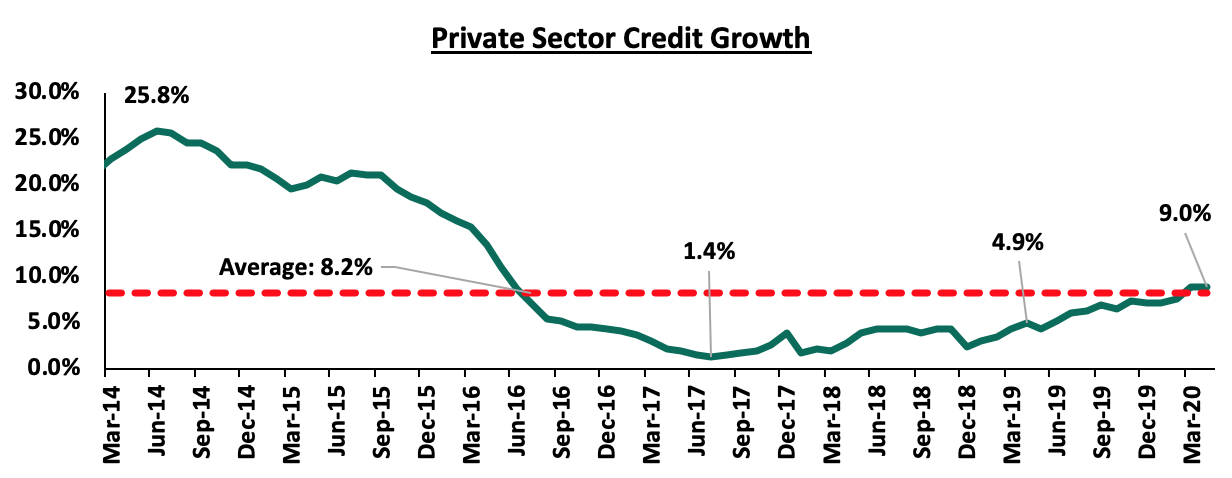

- Private sector credit grew by 9.0% in the 12 months to April, with strong growth in credit observed in manufacturing, trade, transport and communication, building and construction, and consumer durables. This is higher compared to the 4.9% recorded in the 12 months to April 2019, an indication that there has been an improvement in credit extension following the repeal of the interest rate cap in November 2019, as illustrated by the graph below,

- Personal/ household loans extended as at April 2020 grew by 9.4% to Kshs 102.5 bn from Kshs 9.9 bn as at March 2020 with most loans extended being for 9 to 12 months, which accounted for 47.7% of the loans extended in the personal/household sector. 26 out of 39 banks reported having extended personal/ household loans in April, an increase from 13 banks in March 2020, and,

- In April, restructured loans in the other ten sectors (excluding personal/ household loans) were worth Kshs 170.6 bn, accounting for 6.0% of the total Kshs 2.8 tn loan book as at April 2020, with Trade and Real Estate restructuring 26.3% and 18.6% of their loans, respectively, while both Tourism and Manufacturing restructured 13.6%.

In our view, the high Non-Performing Loans (NPLs), which stood at 10.5% as at the end of FY’2019, compared to the 5-year average of 8.2%, for the listed banking sector, is expected to increase in FY’2020 as businesses continue to be impacted by the pandemic. Bank’s earnings are also expected to take a hit as a result of reduced interest income and increased provisioning for bad debt. In our view, we believe a relaxation of provisioning rules, as part of the prudential guidelines would be welcomed. This might come in the form of adjustment to the loan classification in the different categories, (Normal and watch, Substandard, Doubtful Debts and Loss, where the loans are now classified as being impaired). Relaxation on the regulations when it comes to classification on how long before a loan is considered non-performing might see a reduction in the provisions’ requirements, consequently supporting Banks’ bottom line, as well as help conserve Bank's capital position.

In the presentation the CBK also disclosed that as at May 15th 2020, 18 commercial banks and 2 microfinance banks had been granted approval to access Kshs 29.1 bn (82.6% of the Kshs 35.2 bn), which was made available following the reduction in Cash Reserve Ration (CRR) by 1.0% points to 4.25% from 5.25%, this was a 65.3% increase from the Kshs 17.6 bn accessed by 11 commercial banks and one microfinance bank as at the end of April as highlighted in our Cytonn Weekly #19/2020. The table below shows the funding allocation by sector in the month of May compared to April 2020:

|

Sector Funding Allocation By Banks |

|||||

|

Economic Sector |

Total Amount (Kshs'000) |

% |

Total Amount (Kshs'000) |

% |

% Point Change |

|

Apr-20 |

May-20 |

||||

|

Tourism, Restaurant and Hotels |

8,018,521.0 |

45.6% |

10,033,540.0 |

34.5% |

(11.1%) |

|

Transport and Communication |

688,418.0 |

3.9% |

4,001,210.0 |

13.8% |

9.8% |

|

Trade |

1,825,080.0 |

10.4% |

3,600,272.0 |

12.4% |

2.0% |

|

Real Estate |

2,100,568.0 |

11.9% |

3,595,348.0 |

12.4% |

0.4% |

|

Manufacturing |

1,295,077.0 |

7.4% |

3,422,080.0 |

11.8% |

4.4% |

|

Agriculture |

2,937,148.0 |

16.7% |

3,172,524.0 |

10.9% |

(5.8%) |

|

Personal/Household |

593,786.0 |

3.4% |

1,041,368.0 |

3.6% |

0.2% |

|

Building and Construction |

97,084.0 |

0.6% |

143,919.0 |

0.5% |

(0.1%) |

|

Energy and Water |

17,142.0 |

0.1% |

31,368.0 |

0.1% |

0.0% |

|

Financial Services |

2,878.0 |

0.0% |

18,390.0 |

0.1% |

0.1% |

|

Mining and Quarrying |

16,206.0 |

0.1% |

16,206.0 |

0.1% |

0.0% |

|

Total |

17,591,908.0 |

100.0% |

29,076,225.0 |

100.0% |

|

Source: Central Bank

Key Take Outs:

- Tourism remained the main sector that has received funding, accounting for 34.5%, of funds provided by banks and is still considered the worst-hit sector of the economy by the ongoing pandemic,

- Funding reallocated to Agriculture accounted for 10.9%, a reduction from 16.7% seen in April as the sector continues to feel the impact of both COVID-19 and locust invasion,

- Transport and Communication recorded a 481.2% growth in funding requirements as the sector continues to be impacted by the restriction of movements into and out of major counties of Nairobi and Mombasa, and,

- Personal and household funding accounted for 3.6% of the funding as most individuals’ incomes continue to be affected by salary cuts and/or retrenchment by most businesses adversely affected by the global pandemic, especially Micro, Small and Medium Enterprises (MSMEs).

During the week, CBK also announced the acquisition of Imperial Bank’s assets and assumption of liabilities worth Kshs 3.2 bn each by KCB Group effective 2nd June 2020. The deal was officially sealed through the approval by CBK on 4th May 2020 and Treasury CS Ukur Yatani on 14th May 2020. The move will see Imperial Bank depositors paid a total of Kshs 3.2 bn over a period of 4 years and will have cumulatively recovered 37.3% of the deposits since 2015 when payments commenced, with a bulk of the deposits amounting to Kshs 53.3 bn remaining with Kenya Deposit Insurance Corporation (KDIC). The acquisition will see the assets and liabilities of KCB grow to Kshs 950.3 bn and Kshs 814.7 bn, respectively as shown below;

(All Values in Kshs Unless Stated Otherwise)

|

KCB Group Pro forma Financials |

|||

|

Balance Sheet |

KCB Group (Q1'2020) |

Imperial Bank |

Combined (Kshs bn) |

|

Total Assets |

947.1 |

3.2 |

950.3 |

|

Total Liabilities |

811.5 |

3.2 |

814.7 |

Source: KCB Group and Central Bank of Kenya

Imperial Bank was put under receivership (a process that can assist creditors to recover funds in default and can help troubled companies to avoid bankruptcy) in October 2015 due to inappropriate banking practices, with the CBK transferring Imperial Bank’s management and control to the KDIC.

Earnings Releases:

During the week, KCB Group, Co-operative Bank, NCBA, and DTBK released their Q1’2020 financial results. Below is a summary of their earnings:

KCB Group

Income Statement

- Core earnings per share rose by 8.4% to Kshs 1.95, from Kshs 1.80 in Q1’2019, driven by a 22.4% growth in total operating income to Kshs 23.0 bn, from Kshs 18.8 bn in Q1’2019. Total operating expenses grew by 36.7% to Kshs 14.0 bn, from Kshs 10.3 bn in Q1’2019. The growth in core earnings per share was not in line with our expectations of a 0.3% decrease, with the variance being attributable to the 22.4% increase in total operating income to Kshs 23.0 bn, from Kshs 18.8 bn in Q1’2020, which exceeded our expectations of a 0.7% increase,

- Total operating income rose by 22.4% to Kshs 23.0 bn, from Kshs 18.8 bn in Q1’2019. This was driven by a 30.5% rise in Non-Funded Income (NFI) to Kshs 7.9 bn, from Kshs 6.0 bn in Q1’2019, coupled with an 18.5% rise in Net Interest Income (NII) to Kshs 15.1 bn, from Kshs 12.7 bn in Q1’2019,

- Interest income grew by 20.4% to Kshs 20.2 bn, from Kshs 16.8 bn in Q1’2019. This was driven by 65.6% rise in interest income from government securities to Kshs 5.3 bn from Kshs 3.2 bn in Q1’2019, coupled with a 9.7% rise in interest income on loans and advances to Kshs 14.7 bn, from Kshs 13.4 bn in Q1’2019. The yield on interest-earning assets, however, declined to 10.8% from 11.2% in Q1’2019 attributable to a decline in lending rates, which saw trailing interest income grow by 15.4%, which was outpaced by the 19.8% growth recorded in the average interest-earning assets,

- Interest expense rose by 26.6% to Kshs 5.2 bn, from Kshs 4.1 bn in Q1’2019, following a 31.0% rise in interest expense on customer deposits to Kshs 4.7 bn from Kshs 3.6 bn in Q1’2019. Interest expense on deposits and placement from banking institutions, however, remained unchanged at Kshs 0.5 bn Q1’2020. The cost of funds, on the other hand, declined to 2.8% from 3.1% in Q1’2019 owing to a slower 11.7% growth in trailing interest expense, which grew slower than the 22.2% rise in the average interest-bearing liabilities. The Net Interest Margin (NIM) declined to 8.1% from 8.3% in Q1’2019, owing to the faster 19.8% growth in average interest-earning assets, which outpaced the 18.5% growth in Net Interest Income (NII),

- Non-Funded Income (NFI) rose by 30.5% to Kshs 7.9 bn, from Kshs 6.0 bn in Q1’2019. The increase was mainly driven by a 23.8% rise in fees and commissions on loans to Kshs 2.7 bn, from Kshs 2.2 bn in Q1’2019. As a result, the revenue mix shifted to 65:34 from 67:32 funded to non-funded income, due to the faster growth in NFI compared to NII,

- Total operating expenses grew by 36.7% to Kshs 14.0 bn, from Kshs 10.3 bn, largely driven by 25.5% rise in staff costs to Kshs 5.8 bn in Q1’2020, from Kshs 4.6 bn in Q1’2019, coupled with a 149.1% rise in Loan Loss Provisions (LLP) to Kshs 2.9 bn in Q1’2020, from Kshs 1.2 bn in Q1’2019. The increased provisioning levels were witnessed as the Group provided cover for downgraded facilities, with the expectation of an increase in defaults across sectors, brought about by the COVID-19 pandemic,

- Cost to Income Ratio (CIR) deteriorated to 61.1%, from 54.7% in Q1’2019 owing to the faster 36.7% rise in Total Operating Expenses to Kshs 14.0 bn from Kshs 10.3 bn in Q1’2019 which outpaced the 22.4% rise in Total Operating Income to Kshs 23.0 bn, from Kshs 18.8 bn in Q1’2019. Without LLP however, the cost to income ratio remained unchanged at 48.5% in Q1’2020, and,

- Profit before tax increased by 5.0% to Kshs 8.9 bn, up from Kshs 8.5 bn in Q1’2019. Profit after tax grew by 8.4% to Kshs 6.3 bn in Q1’2020, from Kshs 5.8 bn in Q1’2019 with the effective tax rate declining to 29.9% from 32.0% in Q1’2019,

Balance Sheet

- The balance sheet recorded an expansion as total assets grew by 30.5% to Kshs 947.1 bn, from Kshs 725.7 bn in Q1’2019. This growth was largely driven by a 52.0% increase in investment in government and other securities to Kshs 202.6 bn, from Kshs 133.3 bn in Q1’2019. The loan book also recorded a 19.3% growth to Kshs 553.9 bn, from Kshs 464.3 bn in Q1’2019. The strong balance sheet growth is also partly attributable to KCB consolidating assets following the acquisition of NBK,

- Total liabilities rose by 33.9% to Kshs 811.5 bn, from Kshs 606.2 bn in Q1’2019, driven by a 34.1% increase in customer deposits to Kshs 740.4 bn, from Kshs 552.2 bn in Q1’2019, with customer deposits from NBK amounting to Kshs 92.0 bn in Q1’2020. Deposits per branch rose by 4.8% to Kshs 2.2 bn from Kshs 2.1 bn in Q1’2019, with the number of branches having increased to 344 as at Q1’2020, from 258 in Q1’2019,

- The faster growth in deposits as compared to loans led to a decline in the loan to deposit ratio to 74.8%, from 84.1% in Q1’2019,

- Gross Non-Performing Loans (NPLs) rose by 70.5% to Kshs 66.2 bn in Q1’2020, from Kshs 38.8 bn in Q1’2019, attributable to the poor performance from the MSMEs segment of 16.4%, Mortgage segment of 8.3%, corporate segment of 8.2%, and Check-off loans of 2.4%. The NPL ratio thus deteriorated to 11.1%, from 8.0% in Q1’2019, due to the faster growth in Gross Non-Performing Loans (NPLs), which outpaced the growth in loans.

- General Loan Loss Provisions rose by 103.8% to Kshs 30.9 bn, from Kshs 15.2 bn in Q1’2019. The NPL coverage thus increased to 61.3%, from 51.0% in Q1’2019, due to the faster growth in General Loan Loss Provisions, which outpaced the growth in Gross Non-Performing Loans (NPLs),

- Shareholders’ funds increased by 13.5% to Kshs 135.5 bn in Q1’2020, from Kshs 119.5 bn in Q1’2019, as retained earnings grew by 8.6% y/y to Kshs 98.8 bn, from Kshs 91.0 bn in Q1’2019,

- KCB Group is currently sufficiently capitalized with a core capital to risk-weighted assets ratio of 17.1%, 6.6% points above the statutory requirement. In addition, the total capital to risk-weighted assets ratio was 19.0%, exceeding the statutory requirement by 4.5% points. Adjusting for IFRS 9, the core capital to risk-weighted assets stood at 17.1% while total capital to risk-weighted assets came in at 19.0%, and,

- The bank currently has a Return on Average Assets (ROaA) of 3.1%, and a Return on Average Equity (ROaE) of 20.1%.

Key Take-Outs:

- The group’s Profit after Tax (PAT) grew by 8.4% y/y to Kshs 6.3 bn from Kshs 5.8 bn in Q1’2019 attributable to the robust growth of Net Non-Interest Income (NII) of 22.4% to Kshs 23.0 bn from Kshs 18.8 bn. The growth in the Non-Interest Income was mainly attributable to the group’s ability to leverage on digital channels and the 65.0% growth in non-branch revenue to Kshs 2.8 bn. In Q1’2020, 97.0% of transactions were carried out outside the branch (73.0% on mobile, 20.0% on agency, Internet and POS and 4.0% on ATMs),

- Following the acquisition of National Bank of Kenya, the group’s asset quality remains under threat as seen in the increase of the groups Non- Performing Loans (NPL) ratio to 11.0% from 8.0% in Q1’2019. The significant rise is attributable to KCB’s acquisition of National Banks’ non-performing loans portfolio of Kshs 25.1 bn, and,

- Loan Loss Provisions increased by 149.1% to Kshs 2.9 bn from Kshs 1.2 bn. The increased provisioning levels were witnessed as the Group provided cover for downgraded facilities, with the expectation of an increase in defaults across sectors, brought about by the COVID-19 pandemic.

For a comprehensive analysis, please see our KCB Group Q1’2020 Earnings Note

Co-operative Bank

Income Statement

- Core earnings per share decreased marginally by 0.3% to Kshs 0.612 in Q1’2020, from Kshs 0.613 in Q1’2019, which was in line with our projections. The performance was driven by the 20.6% increase in total operating expenses, which grew faster than the 12.5% growth in total operating income in Q1’2020,

- Total operating income increased by 12.5% to Kshs 12.5 bn in Q1’2019, from Kshs 11.1 in Q1’2019. This was due to a 19.0% increase in Non-Interest Income to Kshs 5.0 bn from Kshs 4.2 bn in Q1’2019, coupled with an 8.5% growth in Net Interest Income (NII) to Kshs 7.5 bn from Kshs 6.9 bn in Q1’2019,

- Interest income rose by 4.5% to Kshs 10.5 bn in Q1’2020, from Kshs 10.1 bn in Q1’2019. The growth recorded was as a result of a 5.2% increase in interest income from loans and advances to Kshs 7.6 bn, from Kshs 7.2 bn in Q1’2019, as well as a 3.1% rise in interest income from government securities to Kshs 2.9 bn from Kshs 2.8 bn in Q1’2019. The yield on interest-earning assets, however, declined to 11.3%, from 11.9% in Q1’2019 due to the faster 9.0% growth in the average interest-earning assets that outpaced the 4.5% growth in interest income,

- Interest expense declined by 4.4% to Kshs 3.0 bn in Q1’2020, from Kshs 3.2 bn in Q1’2019, largely due to a 5.0% decline in interest expense from customer deposits to Kshs 2.6 bn from Kshs 2.8 bn in Q1’2019. Other interest expenses also declined by 1.8% to Kshs 382.7 mn from Kshs 389.7 mn in Q1’2019. Consequently, cost of funds declined to 3.4%, from 3.7% in Q1’2019, owing to the 4.4% decline in interest expense, which was outpaced by the 7.2% rise in average interest-bearing liabilities to Kshs 356.2 bn, from Kshs 323.1 bn in Q1’2019,

- Non-interest income rose by 19.0% to Kshs 5.0 bn in Q1’2020, from Kshs 4.2 bn in Q1’2019. The rise was mainly driven by a 31.0% increase in other fees and commissions from digital banking to 3.8 bn from 2.9 bn in Q1’2019, as well as a 14.0% rise in fees and commissions on loans to Kshs 0.6 bn, from Kshs 0.5 bn in Q1’2019 The growth in NFI was however weighed down by a 21.0% decline in forex trading income to Kshs 0.5 bn, from Kshs 0.6 bn in Q1’2019 as well as other income which declined by 29.1% to Kshs bn from Kshs in Q1’2019. As a consequence, the revenue mix shifted to 62:38, from 60:40 in Q1’2019 funded versus non-funded owing to the faster growth in NFI,

- Total operating expenses rose by 20.6% to Kshs 7.3 bn in Q1’2020, from Kshs 6.0 bn in Q1’2019, largely driven by the 79.5% rise in Loan Loss Provisions (LLP) to Kshs 0.9 bn from Kshs 0.5 bn in Q1’2019, coupled with a 25.0% rise in staff costs to Kshs 3.5 bn in Q1’2020 from Kshs 2.8 bn in Q1’2019. Key to note, the increased loan provisioning levels trend has been recorded in all banks that have released their financials as Banks’ cover for downgraded facilities, with the expectation of an increase in defaults across sectors, brought about by the COVID-19 pandemic,

- The Cost to Income Ratio (CIR) deteriorated to 58.1%, from 54.2% in Q1’2019, following the faster rise in total operating expenses that outpaced total operating profit. Without LLP, the cost to income ratio also deteriorated to 50.9% from 49.7% in Q1’2019,

- The bank registered a marginal 0.3% decline in profit after tax to Kshs 3.59 bn in Q1’2020 from Kshs 3.60 bn in Q1’2019. Profit before tax and exceptional items, on the other hand, grew by 3.7% to Kshs 3.7 bn from Kshs 3.6 bn in Q1’2019, with the effective tax rate increasing marginally to 29.9% in Q1’2020 from 29.6% seen in Q1’2019.

Balance Sheet

- The balance sheet recorded an expansion as total assets grew by 10.5% to Kshs 470.4 bn in Q1’2020 from Kshs 425.7 bn in Q1’2019, mainly attributable to the 11.5% growth in government securities to Kshs 115.9 bn in Q1’2020 from Kshs 103.9 bn, coupled with a 9.8% growth in net loans and advances to Kshs 276.2 bn in Q1’2020 from Kshs 251.6 bn in Q1’2019. Deposits placements also rose by 27.0% to Kshs 19.3 bn from Kshs 15.2bn,

- Total liabilities grew by 10.1% to Kshs 386.9 bn in Q1’2020 from Kshs 351.5 bn in Q1’2019, which was largely attributable to a 15.5% increase in borrowings to Kshs 27.4 bn from Kshs 23.7 bn in Q1’2019 and a 6.9% rise in customer deposits to Kshs 339.6 bn in Q1’2020 from Kshs 317.8 bn in Q1’2019.

- The faster 9.8% growth in net loans and advances which outpaced the 6.9% growth in deposits, led to a marginal increase in the loan to deposit ratio to 81.3%, from 79.2% in Q1’2019. Deposits per branch remained unchanged at Kshs 2.1 bn as the number of branches remained unchanged at 159 branches,

- Gross Non-Performing Loans (NPLs) increased by 7.1% to Kshs 31.8 bn in Q1’2020, from Kshs 29.7 bn in Q1’2020. The NPL ratio, however, improved to 10.8% in Q1’2020, from 11.1% in Q1’2019 owing to faster growth in gross loans by 9.9% outpacing the 7.1% growth in gross non-performing loans,

- General Loan Loss Provisions increased by 9.8% to Kshs 11.9 bn, from Kshs 10.9 bn in Q1’2019. The NPL coverage ratio thus increased to 54.8% in Q1’2020 from 52.2% in Q1’2019, due to the faster growth in General Loan Loss Provisions which outpaced the growth in Gross Non-Performing Loans (NPLs),

- Shareholders’ funds increased by 12.6% to Kshs 82.0 bn in Q1’2020 from Kshs 72.8 bn in Q1’2019, mainly driven by a 14.4% increase in the retained earnings to Kshs 66.9 bn, from Kshs 58.5 bn in Q1’2019,

- Co-operative Bank remains sufficiently capitalized with a core capital to risk-weighted assets ratio of 15.6%, 5.1% points above the statutory requirement of 10.5%. In addition, the total capital to risk-weighted assets ratio came in at 16.1%, exceeding the statutory requirement of 14.5% by 1.6% points. Adjusting for IFRS 9, the core capital to risk-weighted assets stood at 15.5%, while total capital to risk-weighted assets came in at 15.9%, and,

- The bank currently has a Return on Average Assets (ROaA) of 3.2%, and a Return on Average Equity (ROaE) of 18.5%.

Key Take-Outs:

- Non-Funded Income rose by rose by 19.0% to Kshs 5.0 bn in Q1’2020, from Kshs 4.2 bn in Q1’2019 below the industry average growth of 21.6%. The increase was mainly driven by the 31.0% increase in other fees and commissions to 3.8 bn from 2.9 bn in Q1’2019. As a consequence, the revenue mix shifted to 60:40, from 62:38 in Q1’2019 owing to the fast growth in NFI despite the repeal of the interest rate cap. The growth in NFI is below the current industry average of 21.6%, and,

- The bank’s asset quality improved, with the NPL ratio reducing to 10.8% in Q1’2020, from 11.1% in Q1’2019 owing to faster growth in gross loans by 9.9% outpacing the 7.1% growth in gross non-performing loans, which is attributable to the implementation of credit management strategies implemented since the beginning of the year such as adherence to credit risk appetite and limits, credit risk early warning indicators, proper credit appraisal, and approval mechanisms. The main sectors that contributed to Non-Performing Loans are Trade, Personal Consumer and Manufacturing sectors contributing 32.0%, 18.0%, and 16.0%, respectively, to total NPL.

Going forward, the factors that would drive the bank’s growth would be:

- Business Model Restructuring: The bank’s continued implementation of “Soaring Eagle” transformation initiatives is expected to drive growth and increase efficiency. The initiatives are set on the following eight key pillars; branch transformation, MSME transformation, sales force effectiveness, shared services and digitization, NPL management and credit processes, cost management, data analytics, and staff productivity. We expect the initiatives to culminate into improved revenue levels, and,

- Focus on diversification: The bank’s continued focus on channel diversification will likely continue to help the bank in generating profitability, as they continue to record increased usage and traffic. The focus on branch transformation and innovation centred on alternative channels will continue to drive NFI growth as well as transform braches to handle advisory, wealth management, and advisory services,

For a comprehensive analysis, please see our Co-op Bank Q1’2020 Earnings Note

Diamond Trust Bank Kenya

Income Statement

- Diamond Trust Bank Kenya released their Q1’2020 financial results, with core earnings per share increasing by 3.7% to Kshs 7.3, from Kshs 7.0 in Q1’2019, in line with our expectations. The performance was driven by the 3.0% increase in total operating income to Kshs 6.3 bn from Kshs 6.1 bn in Q1’2019 despite the 5.2% rise in total expenses,

- Total operating income increased by 3.0% to Kshs 6.3 bn from Kshs 6.1 bn in Q1’2019. This was due to a 3.4% increase in Non-Funded Income (NFI) to Kshs 1.6 bn, from Kshs 1.5 bn in Q1’2019, coupled with a, 2.9% increase in Net Interest Income (NII) to Kshs 4.7 bn, from Kshs 4.5 bn in Q1’2019,

- Interest income declined by 2.4% to Kshs 8.0 bn from Kshs 8.2 bn in Q1’2019. This was driven by a 1.8% decline in interest income from loans and advances to Kshs 4.8 bn, from Kshs 4.9 bn in Q1’2019, coupled up with a 1.2% decline in interest income from government securities to Kshs 3.11 bn from Kshs 3.14 bn in Q1’2019. The interest income from deposit placements declined by 72.0% to Kshs 26.4 mn from Kshs 94.4 mn in Q1’2019. The yield on interest-earning assets declined to 9.8% from 10.7% in Q1’2019, attributable to the 2.4% decline in interest income, despite the 1.7% growth in average interest-earning assets to Kshs 331.7 bn from Kshs 326.3 in Q1’2019,

- Interest expense declined by 9.0% to Kshs 3.3 bn from Kshs 3.6 bn in Q1’2019, following a 15.2% decline in interest expense on placement to Kshs 0.19 bn from Kshs 0.23 bn in Q1’2019, as well as a7.8% decline in interest expense on customer deposits to Kshs 2.8 bn from Kshs 3.0 bn in Q1’2019. Cost of funds declined to 4.5% from 5.0% in Q1’2019, owing to 9.0% decline in interest expenses, despite the 0.3% increase in average interest-bearing liabilities to Kshs 305.9 bn from Kshs 304.9 bn in Q1’2019. Net Interest Margin (NIM) declined to 5.7%, from 6.0% in Q1’2019 due to a 4.3% decline in trailing NII, despite the 1.7% growth in average Interest-Earning Assets,

- Non-Funded Income (NFI) rose by 3.4% to Kshs 1.6 bn, from Kshs 1.5 bn in Q1’2019. The increase was mainly driven by a 39.3% increase in fees and commissions to Kshs 0.4 bn from Kshs 0.3 in Q1’2019. The growth in NFI was however weighed down by the 13.1% decline in forex trading income, to Kshs 55.9 mn from Kshs 64.3 mn in Q1’2019. The revenue mix remained unchanged at 75:25 funded and non-funded,

- Total operating expenses increased by 5.2% to Kshs 3.3 bn from Kshs 3.2 bn in Q1’2019, largely driven by the 52.0% increase in Loan Loss Provisions (LLP) to Kshs 0.4 bn from Kshs 0.3 bn in Q1’2019, staff costs, which rose by 10.4% to Kshs 1.20 bn from Kshs 1.08 bn in Q1’2019. Other operating expenses however declined by 4.9% to Kshs 1.7 bn from Kshs 1.8 bn in Q1’2019,

- The Cost to Income Ratio (CIR) deteriorated to 52.9 %, from 51.8% in Q1’2019. However, without LLP, the cost to income ratio improved to 46.4%, from 47.4% in Q1’2019, highlighting improved efficiency levels,

- Profit before tax rose by 0.5% to Kshs 3.0 bn, from Kshs 2.9 bn in Q1’2019. Profit after tax grew by 3.7% to Kshs 2.04 bn in Q1’2020, from Kshs 1.97 bn in Q1’2019, with the effective tax rate declining to 30.9% from 33.0% in Q1’2019,

Balance Sheet

- The balance sheet recorded an expansion as total assets increased by 4.0% to Kshs 385.0 bn from Kshs 370.1 bn in Q1’2019. This growth was largely driven by a 6.7% increase in net loans to Kshs 201.3 bn from Kshs 188.6 bn in Q1’2019, coupled with a 1.9% increase in government securities to Kshs 128.2 bn from Kshs 125.8 bn in Q1’2019. The growth in assets was however slowed down by a 21.9% decline in placements to Kshs 8.6 bn from Kshs 11.1 bn in Q1’2019,

- Total liabilities rose by 2.8% to Kshs 318.1 bn from Kshs 309.3 bn in Q1’2019, driven by an 82.6% increase in placement liabilities to Kshs 23.4 bn from Kshs 12.8 bn in Q1’2019, coupled with the 20.3% increase in borrowings to Kshs 15.1 bn from Kshs 12.5 bn in Q1’2019. The growth was however slowed by the 20.7% decline in other liabilities to Kshs 6.9 bn from Kshs 8.7 bn in Q1’2019, coupled with a 0.9% decline in customer deposits to Kshs 272.8 bn from Kshs 275.3 bn in Q1’2019. Deposits per branch declined by 0.9% to Kshs 1.99 bn from Kshs 2.01 bn in Q1’2019, as the number of branches remaining unchanged at 137 in Q1’2020,

- Loans to deposit ratio increased to 73.8% from 68.5% in Q1’2019, owing to the 6.7% growth in net loans, with customer deposits having declined by 0.9% during the same period,

- Gross Non-Performing Loans (NPLs) rose by 15.7% to Kshs 16.6 bn in Q1’2020 from Kshs 14.4 bn in Q1’2019. Consequently, the NPL ratio deteriorated to 8.0% in Q1’2020 from 7.3% in Q1’2019 owing to slower growth in gross loans by 6.4% outpacing the 15.7% growth in gross non-performing loans. General Loan Loss Provisions declined by 14.5% to Kshs 4.5 bn from Kshs 5.3 bn in Q1’2019. Consequently, the NPL coverage declined to 42.4% in Q1’2020 from 50.7% in Q1’2019 due to the decline in General Loan Loss Provisions which was outpaced the growth in Gross Non-Performing Loans (NPLs),

- Shareholders’ funds increased by 10.1% to Kshs 61.0 bn in Q1’2020 from Kshs 55.5 bn in Q1’2019, largely due to the 11.9 % increase in the retained earnings to Kshs 49.1 bn, from Kshs 43.9 bn in Q1’2019,

- Diamond Trust Bank is currently sufficiently capitalized with a core capital to risk-weighted assets ratio of 19.3%, 8.8% points above the statutory requirement. In addition, the total capital to risk-weighted assets ratio was 21.0%, exceeding the statutory requirement by 6.5% points. Adjusting for IFRS 9, the core capital to risk-weighted assets stood at 19.7%, while total capital to risk-weighted assets came in at 21.5%,

- The bank currently has a Return on Average Assets (ROaA) of 1.9%, and a Return on Average Equity (ROaE) of 12.6%.

Key Take-Outs:

- The bank’s asset quality deteriorated, with the NPL ratio increasing to 8.0% from 7.3% in Q1’2019 owing to slower growth in gross loans by 6.4% outpacing the 15.7% growth in gross non-performing loans. The decline in asset quality is attributable to a 15.7% increase in the gross NPLs to Kshs 16.6 bn in Q1’2020 from Kshs 14.4 bn in Q1’2019,

- The bank recorded improved performance in NFI income, which recorded a 3.4% growth y/y, largely supported by the 67.2% growth in other non-interest income, coupled with a 39.3% increase in fees and commissions. Consequently, NFI contribution to total income rose by 0.1% to 25.4% from 25.3% in Q1’2019. This, however, remains below the current industry average of 21.6%,

- There was an improvement in efficiency levels as the cost to income ratio without LLP improved to 46.4%, from 47.4% in Q1’2019. The improvement was largely attributable to a 4.9% decline in other expenses.

Going forward, we expect the bank’s growth to be driven by:

- Geographical diversification: The bank’s forays into other markets such as Tanzania, Uganda, and Burundi, may aid the bank’s growth, given the lack of loan pricing controls in those markets. Continued focus on those markets would aid in alleviating the compressed interest income regime in the Kenyan market.

For a comprehensive analysis, please see our DTBK Q1’2020 Earnings Note

NCBA Group

Key to note: The financial statements of the bank have been prepared on a prospective basis (assuming a continuation of CBA), representing Q1’2020 results of NCBA bank (merged bank) with prior year comparatives (Q1’2019) being those of CBA bank. Hence, the results are not comparable on a like for like basis. As such, we have used proforma-combined financials for the two entities.

Income Statement

- Core earnings per share declined by 26.8% to Kshs 2.3 from Kshs 3.2 in Q1’2019, which was not in line with our projections of Kshs 1.6. The performance can be attributed to a 23.6% increase in total operating income to Kshs 10.9 bn from Kshs 8.8 bn in Q1’2019, coupled with the 49.8% increase in total operating expenses from Kshs 5.5 bn in Q1’2019 to Kshs 8.3 bn in Q1’2020,

- Total operating income increased by 23.6% to Kshs 10.9 bn in Q1’2020 from Kshs 8.8 bn in Q1’2019. This was due to a 49.7% increase in Non-Funded Income (NFI) to Kshs 5.4 bn in Q1’2020 from Kshs 3.6 bn recorded the previous year, coupled with a 5.5% increase in Net Interest Income (NII) to Kshs 5.5 bn from the Kshs 5.2 bn recorded in Q1’2019,

- Interest income rose by 6.8% to Kshs 10.2 bn from Kshs 9.5 bn in Q1’2019. This was mainly driven by a 39.1% rise in interest from loans and advances to Kshs 6.2 bn from Kshs 6.0 bn in 2019 coupled with an 11.8% rise in interest income on government securities to Kshs 3.8 bn in Q1’2020 from Kshs 3.4 bn in Q1’2019. Despite this, the yield on interest-earning assets declined to 6.3% in Q1’2020 from 9.8% in Q1’2019 due to the 32.6% decline in trailing interest income compared to 3.8% growth in average interest-earning assets to Kshs 412.4 bn from Kshs 397.3 bn in Q1’2019,

- Interest expense increased by 8.3% to Kshs 4.7 bn from Kshs 4.3 bn in Q1’2019, mainly attributable to an increase in interest expense on customer deposits by 14.1% to Kshs 4.2 bn from Kshs 3.6 bn in Q1’2019. The cost of funds fell to 3.1% from 4.8% in Q1’2019 owing to the 30.9% decline in trailing interest expense compared to the faster 6.7% growth in average interesting bearing liabilities. The Net Interest Margin came in at 3.3%, lower than the 5.2% seen in Q1’2019, due to the 34.1% decline in trailing NII compared to the faster 3.8% growth seen in the average interest-earning assets,

- Non-Funded Income rose by 49.7% to Kshs 5.4 bn from Kshs 3.6 bn in Q1’2019. The increase in NFI was driven by a 125.8% increase in fees and other commissions to Kshs 3.2 bn from Kshs 1.4 bn in Q1’2019, coupled with a 17.0% increase in forex trading income to Kshs 1.0 bn from Kshs 0.8 bn in Q1’2019. The revenue mix shifted to 50:50 funded to non-funded income in Q1’2020 from 59:41 in Q1’2019, owing to the faster increase in NFI compared to NII,

- Total operating expenses increased by 49.8% to Kshs 8.3 bn from Kshs 5.6 bn in Q1’2019, largely driven by a 404.3% increase in loan loss provision to Kshs 3.8 bn in Q1’2020 from Kshs 0.7 bn in Q1’2019, coupled with a 4.3% increase in other operating expenses to Kshs 2.9 bn in Q1’2020 from Kshs 2.7 bn in Q1’2019. The high increase in Loan loss provision is driven by the expectations of a significant increase in NPLs due to the economic fallouts caused by Coronavirus. However, the growth in total operating expenses was weighed down by an 18.4% decline in staff costs to Kshs 1.7 bn from Kshs 2.1 bn recorded in Q1’2019,

- The cost to income ratio deteriorated to 76.1% from 62.8% in Q1’2019. However, without LLP, the cost to income ratio improved to 41.5% from 54.3% in Q1’2019, highlighting improved efficiency

- Profit before tax declined by 26.5% to Kshs 2.4 bn from Kshs 3.3 bn in Q1’2019. Profit after tax declined by 26.8% to Kshs 1.6 bn in Q1’2020 from Kshs 2.2 bn in Q1’2019, with part of the variance being attributed to an exceptional item of Kshs 195.6 mn. The effective tax rate increased to 32.5% from 32.3% recorded in Q1’2019,

- The board of directors announced that it was changing its earlier recommendation to pay a cash dividend and instead recommend a bonus share issue where shareholders will receive one (1) share for every ten (10) shares held. This decision was mode considering the need to preserve capital for the stakeholders, in light of the challenges posed by the COVID-19 pandemic.

Balance Sheet

- The balance sheet recorded an expansion with a total assets growth of 9.2% to Kshs 509.6 bn from Kshs 466.8 bn in Q1’2019. This growth was largely driven by a 21.1% increase in government securities to Kshs 153.5 bn from the Kshs 126.8 bn recorded in Q1’2019. The loan book expanded by 3.9% to Kshs 245.9 bn in Q1’2020 from Kshs 240.6 bn in Q1’2019,

- Total liabilities rose by 10.4% to Kshs 440.8 bn from Kshs 399.1 bn in Q1’2019, driven by a 9.9% increase in customer deposits to Kshs 390.5 bn from Kshs 355.3 bn in Q1’2019. Placements decreased by 3.8% from the Kshs 9.2 bn recorded in Q1’2019 to Kshs 8.9 bn in Q1’2020. Deposits per branch stood at Kshs. 9.1 bn with the bank operating 43 branches,

- The faster 9.9% growth in deposits compared to the 2.2% growth in loans led to a decline in the loan to deposit ratio to 63.0% from 67.7% in Q1’2019,

- Gross non-performing loans increased by 31.8% to Kshs 38.8 bn in Q1’2020 from Kshs 29.5 bn in Q1’2019. Consequently, the NPL ratio deteriorated to 14.5% in Q1’2020 from 11.4% in Q1’2019.

- Shareholders’ funds increased by 1.9% to Kshs 68.6 bn in Q1’2020 from Kshs 67.0 bn in Q1’2019, as share premium grew by 199.3% to Kshs 22.2 bn from Kshs 7.4 bn recorded in Q1’2019, the growth was however weighed down by a 27.4% decline in retained earnings to Kshs 38.6 bn, from Kshs 53.5 bn in Q1’2019,

- NCBA Group is currently sufficiently capitalized with a core capital to risk-weighted assets ratio of 17.9%, 7.4% above the statutory requirement. In addition, the total capital to risk-weighted assets ratio was 18.5%, exceeding the statutory requirement by 4.0%. Adjusting for IFRS 9, the core capital to risk-weighted assets stood at 18.2%, while total capital to risk-weighted assets came in at 18.8%,

- NCBA Group currently has a return on average assets of 1.5% and a return on average equity of 10.7%.

Key Take-Outs:

- PAT and exceptional items decreased by 26.8% to Kshs 1.6 bn in Q1’2020, from the Kshs 2.2 bn recorded in Q1’2019, attributable to a 49.8% increase in Total operating expenses to Kshs 8.3 bn from Kshs 5.6 bn in Q1’2019, largely driven by a 404.3% increase in loan loss provision to Kshs 3.8 bn in Q1’2020 from Kshs 0.7 bn in Q1’2019. This was mitigated by the 23.6% increase in Total operating income to Kshs 10.9 bn in Q1’2020 from Kshs 8.8 bn in Q1’2019. This was due to a 49.7% increase in Non-Funded Income (NFI) to Kshs 5.4 bn in Q1’2020 from Kshs 3.6 bn recorded the previous year,

- NCBA’s Non-funded income (NFI) growth came in at 49.7%, higher than the industry average of 21.6%. As a result, the revenue mix shifted to 50:50 funded to non-funded income in Q1’2020 from 59:41 in Q1’2019, owing to the faster increase in NFI compared to NII,

- There was an improvement in efficiency levels as the cost to income ratio without LLP improved to 41.5% from 54.3% in Q1’2019. This was mainly attributable to the 18.4% decline in Staff costs to Kshs 1.7 bn from Kshs 2.1 bn recorded in Q1’2019.

Going forward, we expect the bank’s growth to be further driven by:

- The Bank is expected to continue increasing its synergy by capitalizing on the strengths of the previous entities. This can be seen through the use of their LOOP digital platform, which has allowed the bank to diversify its revenue streams.

For a comprehensive analysis, please see our NCBA Group Q1’2020 Earnings Note

The table below highlights the performance of the banks that have released so far, showing the performance using several metrics, and the key take-outs of the performance.

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

|

KCB |

8.4% |

20.4% |

26.6% |

18.5% |

8.1% |

30.5% |

34.4% |

23.8% |

34.1% |

52.0% |

74.8% |

19.3% |

20.1% |

|

|

DTBK |

3.7% |

(2.4%) |

(9.0%) |

2.9% |

5.7% |

3.4% |

25.4% |

39.3% |

(0.9%) |

1.9% |

73.8% |

6.7% |

12.6% |

|

|

Co-op |

(0.3%) |

4.5% |

(4.4%) |

8.5% |

8.2% |

19.0% |

39.9% |

14.0% |

6.9% |

11.5% |

81.3% |

9.8% |

18.5% |

|

|

NCBA*** |

(26.8%) |

6.8% |

8.3% |

5.5% |

3.3% |

49.7% |

49.7% |

125.8% |

9.9% |

21.1% |

63.0% |

3.9% |

10.7% |

|

|

Stanbic |

(33.5%) |

(7.1%) |

0.5% |

(11.0%) |

5.5% |

(29.2%) |

49.9% |

10.0% |

6.4% |

(11.5%) |

79.8% |

11.8% |

14.5% |

|

|

Q1'20 Mkt Weighted Average* |

(4.5%) |

9.4% |

10.3% |

9.4% |

6.9% |

21.6% |

39.3% |

36.6% |

17.7% |

25.9% |

75.1% |

12.7% |

17.0% |

|

|

Q1'19Mkt Weighted Average** |

12.2% |

3.6% |

2.5% |

4.5% |

8.0% |

10.7% |

36.0% |

11.2% |

11.0% |

16.1% |

74.0% |

7.7% |

19.2% |

|

|

*Market-cap-weighted as at 22/05/2020 |

||||||||||||||

|

**Market-cap-weighted as at 31/05/2019 *** The financial statements of the bank have been prepared on a prospective basis (assuming a continuation of CBA), representing Q1’2020 results of NCBA bank (merged bank) with prior year comparatives (Q1’2019) being those of CBA bank. Hence, the results are not comparable on a like for like basis. As such, we have used proforma-combined financials for the two entities. |

||||||||||||||

Key takeaways from the table above include:

- Five banks have released their Q1’2020 financial results, recording a (4.5%) average decrease in core Earnings Per Share (EPS), compared to a growth of 12.2% in Q1’2019 for the entire listed banking sector,

- The banks that have released results have recorded a deposit growth of 17.7%, faster than the 11.0% growth recorded in Q1’2019. The faster growth in deposits led to a faster 10.3% growth in interest expenses, compared to 2.5% in Q1’2019, indicating that banks struggled to mobilize relatively cheaper deposits amid the ongoing pandemic as most customers prefer liquidity,

- Average loan growth came in at 12.7%, which was faster than the 7.7% recorded in Q1’2019, with the growth in loans being accelerated following the repeal of interest rate cap in November 2019, coupled with increased demand in funding as businesses demand working capital to operate in the tough operating environment as a result of the pandemic. Government securities, on the other hand, recorded a growth of 25.9% y/y, which was faster compared to the loans, and the 16.1% growth recorded in Q1’2019. This highlights banks’ continued preference towards investing in government securities, which offer better risk-adjusted returns,

- Interest income increased by 9.4%, compared to a growth of 3.6% recorded in Q1’2019. The faster growth in interest income may be attributable to the 12.7% growth in loans and increased allocation to government securities. Consequently, the Net Interest Margin (NIM) now stands at 6.9%, compared to the 8.0% recorded in Q1’2019 for the whole listed banking sector, and,

- Non-Funded Income grew by 21.6% y/y, faster than 10.7% recorded in Q1’2019. The growth in NFI was supported by the 36.6% average increase in total fee and commission income, which was faster than the 11.2% growth recorded in Q1’2019.

Universe of Coverage

|

Banks |

Price at 15/05/2020 |

Price at 22/05/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

77.0 |

74.0 |

(3.9%) |

(32.1%) |

109.0 |

179.7 |

3.6% |

146.5% |

0.4x |

Buy |

|

Kenya Reinsurance |

2.4 |

2.4 |

0.0% |

(22.4%) |

3.0 |

4.8 |

4.7% |

108.9% |

0.2x |

Buy |

|

Jubilee Holdings |

249.5 |

250.0 |

0.2% |

(28.8%) |

351.0 |

453.4 |

3.6% |

84.9% |

0.9x |

Buy |

|

KCB Group*** |

35.7 |

36.3 |

1.8% |

(32.8%) |

54.0 |

55.8 |

9.6% |

63.4% |

0.9x |

Buy |

|

Equity Group*** |

33.7 |

36.2 |

7.3% |

(32.4%) |

53.5 |

55.3 |

6.9% |

59.9% |

1.2x |

Buy |

|

I&M Holdings*** |

49.3 |

49.4 |

0.2% |

(8.5%) |

54.0 |

73.6 |

5.2% |

54.1% |

0.7x |

Buy |

|

Co-op Bank*** |

12.9 |

12.6 |

(2.7%) |

(23.2%) |

16.4 |

18.2 |

8.0% |

53.0% |

1.0x |

Buy |

|

NCBA |

27.2 |

27.2 |

(0.2%) |

(26.3%) |

36.9 |

39.4 |

0.9% |

46.0% |

0.7x |

Buy |

|

Standard Chartered |

176.0 |

173.3 |

(1.6%) |

(14.4%) |

202.5 |

223.6 |

11.5% |

40.6% |

1.4x |

Buy |

|

Stanbic Holdings |

88.0 |

85.8 |

(2.6%) |

(21.5%) |

109.3 |

109.8 |

8.2% |

36.3% |

1.0x |

Buy |

|

Sanlam |

15.4 |

16.1 |

4.2% |

(6.7%) |

17.2 |

21.7 |

0.0% |

35.2% |

1.3x |

Buy |

|

ABSA Bank*** |

10.5 |

10.4 |

(1.4%) |

(22.5%) |

13.4 |

12.6 |

10.6% |

32.4% |

1.2x |

Buy |

|

Liberty Holdings |

7.5 |

8.3 |

10.7% |

(19.8%) |

10.4 |

10.1 |

0.0% |

21.2% |

0.7x |

Buy |

|

CIC Group |

2.2 |

2.3 |

7.8% |

(12.7%) |

2.7 |

2.6 |

0.0% |

12.8% |

0.8x |

Accumulate |

|

HF Group |

4.0 |

4.1 |

1.5% |

(37.3%) |

6.5 |

4.3 |

0.0% |

6.2% |

0.2x |

Hold |

|

Britam |

6.0 |

6.6 |

10.0% |

(26.4%) |

9.0 |

6.8 |

3.8% |

5.8% |

0.7x |

Hold |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/ or its affiliates are invested in |

||||||||||

We are “Neutral” on equities for investors because, despite the sustained price declines, which have seen the market P/E decline to below its historical average presenting investors with attractive valuations in the market, the economic outlook remains grim.

- Residential Sector

During the week, the Ministry of Transport, Infrastructure, Housing and Urban Development published the National Housing Development Fund Regulations 2020, for stakeholder input. The regulations are aimed at guiding the operationalization of the National Housing Development Fund (NHDF), which was established in 2018 in line with the government’s affordable housing initiative and under the mandate of the National Housing Corporation (NHC), to help bridge the affordable housing gap in Kenya by:

- Guaranteeing offtake to affordable housing by private developers, thus giving them the necessary liquidity to construct more units,

- Enabling end-buyer uptake by providing affordable housing finance solutions such as Tenant Purchase Schemes (TPS), and,

- It will also allow mortgage and cash buyers to save towards the purchase of an affordable home, in addition to issuing them with loans at an interest rate of up to 7.0% p.a. on a reducing balance basis,

In 2018, the government introduced the mandatory housing fund levy through the Finance Act 2018 but was faced with a lot of legal hurdles leading to the president’s directive in December 2019 to the National Treasury and Housing Ministry to make the contribution voluntary with immediate effect. The proposed regulations are, therefore, an alteration to the 2018 regulations, which have been revoked. The main differences are as below:

|

Housing Fund Regulations Alterations |

||

|

Factor |

2018 NHDF Regulations |

2020 NHDF Regulations |

|

Contributions |

|

|

|

Registration |

|

|

|

Loan Eligibility |

|

|

|

Access to Contributions |

|

|

|

Qualifications for a Home Under the Affordable Housing Scheme |

|

|

|

Offences and Penalties |

|

|

In our view, the Kenya National Housing and Development Fund is a great move by the government towards the actualization of affordable housing provision in Kenya, especially when the initiative is far behind its target timelines head of 2022. If well governed and implemented, we expect the fund to be successful in raising the targeted funds and the same channeled to facilitating housing in the country. However, for the government to realize its goal of delivering 500,000 affordable housing units, there is still a need to provide the right environment for private sector investment to supplement government initiatives.

- Retail Sector

During the week, Car and General Kenya, a local supplier of power generation, automotive and engineering products, announced that it had secured Carrefour supermarket as the anchor tenants for its refurbished Nairobi Mega property on Uhuru Highway. The 170,000 SQFT property was previously anchored by Nakumatt, which had occupied 40,000 SQFT. Carrefour is expected to set up by June this year, marking its 8th store in the country. The multinational retailer has continued to record massive growth in Kenya since its first store in 2016 and this has been due to; (i) ability to leverage its scale and operation know-how to become one of the leading retailers locally, which saw it record Kshs 18.7 bn in revenues as of 2019, 28.0% increase from 2018, (ii) adequate funding such as the Kshs 3.0 bn loan from Standard Bank Group earlier this month, and, (iii) availability of prime locations vacated by struggling supermarket chains such as Nakumatt and Uchumi. For retail sector investors, the continued expansion of stable local and international retailers such as Carrefour and Quickmart is a welcome move, especially following the increased vacancy rates in the sector driven by the fall of struggling retailers namely, Nakumatt, Uchumi and Choppies. We expect global retailers to continue showing interest in the Kenyan retail sector, mainly attracted by the increasing change in consumer tastes & preferences, relatively low formal penetration rates at 35.0%, and fast economic growth enabled by infrastructural developments.

Car and General also commenced the planning of the second development in Shanzu, Mombasa (details undisclosed) alongside other plans to divest non-core businesses as it seeks to expand its property portfolio. Local firms are increasingly diversifying their portfolios by venturing into real estate. Last week, Sameer Africa, a local company whose principal business is the importation and sale of tyres, announced that it would be turning its focus to its real estate business after closing down its loss-making tyre distribution business. This is an indication of investor confidence in the real estate sector, which has continued to record growth despite a tough economic environment. According to Kenya National Bureau of Statistics (KNBS) Economic Survey 2020 Report, the sector recorded improved growth of 5.3% in 2019 compared to 4.1% in 2018 and accounted for 6.9% contribution to GDP.

- Infrastructure

During the week, Water and sanitation Cabinet Secretary, Sicily Kariuki unveiled a Kshs 1.3 bn Kiambu-Ruaka water supply and sewerage project. The project will be implemented by the Athi Water Works Development Agency through funding by the African Development Bank (AfDB), under the Kenya Towns Sustainable Water Supply and Sanitation Programme and will involve the rehabilitation of Kiambu’s water treatment plant and the construction of 108 km of trunk and reticulation sewers in Kiambu and Ruaka. In our view, the provision of reliable water supply and sanitation will enhance the appeal of Ruaka and Kiambu supporting the continued real estate growth and performance in both areas. The newly unveiled project is expected to benefit more than 100,000 residents of Kiambu and Ruaka with the expansion of the sewerage infrastructure expected to increase the county’s wastewater management capacity while reducing pressure on the current systems, thus supporting the areas’ rapid population growth that is largely driven by Kenya’s workforce stationed in Nairobi.

|

Nairobi Metropolitan water and sewerage coverage in 2018 |

||

|

County |

Water coverage |

Sewerage coverage |

|

Nairobi |

78% |

50% |

|

Kiambu |

77% |

16% |

|

Machakos |

54% |

19% |

|

Murang'a |

52% |

5% |

|

Kajiado |

43% |

0% |

|

Average |

61% |

18% |

Source: Water Services Regulatory Board

The improvement of infrastructure is expected to spur the growth of real estate in the Kiambu County through;

- Opening up the County for Development – Prospective developers are likely to buy or rent properties in well-developed areas. A developed neighbourhood assures the buyer of property appreciation at a rate higher than the prevailing market rates, thus better returns in the case of an investor. Consequently, it opens up areas which were otherwise unattractive not only for settlement but also trade and commerce thus uplifting economic prospects,

- Reduced Development Costs - Infrastructural costs in Kenya account for approximately 25.6% of construction costs, according to a report by the Centre for Affordable Housing Finance in Africa. Therefore the provision of the same relieves the cost burden that would have otherwise been incurred by the developer, and this has been noted to significantly facilitate the development of affordable housing units, and

- Higher Property Values - availability of services and utilities in the county will enhance demand for property in the county thus resulting in increased property values.

- Statutory Review

During the week, the Ministry of Transport, Infrastructure, Housing, Urban Development and Public Works gazetted the National Construction Authority (Defects Liability) Regulations 2020, which introduced various changes to the defects liability period with regards to commercial buildings. Amongst the changes introduced, was a latent defects liability period for commercial buildings which shall be a minimum period of six years from completion of the regular defects liability period (which will now be referred to as the patent defects liability period). If approved, the regulations will give commercial buildings owners up to seven years to recall contractors back to the site to rectify flaws in projects. Key highlights from the regulations include:

- Every contract for the construction of a commercial building shall prescribe a patent defects liability period which shall be a minimum period of twelve months after practical completion (this is seen as an extension of the traditional defects liability period which usually lasts 6 months in Kenya),

- Every contract for the construction of a commercial building shall prescribe a latent defects liability period which shall be a minimum period of six years after the completion of the patent defects liability period,

- The contractor, sub-contractor and other relevant professionals shall be liable for the rectification of defects that become apparent during the latent defects liability period, and,

- The contractor and sub-contractor will obtain insurance cover for defects that may become apparent during the latent defects liability period while other relevant professionals shall obtain a professional indemnity cover for the same.

The regulations have been proposed to safeguard commercial property developers’ interests against sub-par construction work by negligent contractors, sub-contractors and project consultants. However, lack of adequate public participation before the drafting of the regulations is apparent as they contain a lot of grey areas which, if not addressed, may become the source of future site conflicts due to misinterpretation of the regulations. Consequently, during the week, the Institution of Construction Project Managers of Kenya (ICPMK), through a letter to Transport, Infrastructure, Housing, Urban Development and Public Works Cabinet Secretary James Macharia, raised concerns on the gazetting of the Regulations by the cabinet secretary, citing lack of public participation prior to the publication of the gazette notice. Below are areas that may need further clarification:

- The regulations only apply to commercial buildings. As per the regulations, a commercial building means “premises occupied wholly or partially for trade or business or rendering services for money or money's worth”. This omits buildings such as residential buildings, buildings by non-profit organizations, government buildings etc. It is not clear why the limitations of the defects liability period either patent or latent are restricted to commercial buildings only,

- The regulations define an owner as, “a person who enters into a contract with a contractor for the construction of a commercial building.” This does not address a situation where an agent enters into a contract on behalf of the owner or an occasion where the owner sells the commercial building before the latent defects liability period is over (6 years),

- The regulations state that the contractor, sub-contractor and other relevant professionals shall be liable for the rectification of patent defects that become apparent during the latent defects liability period. It, however, doesn’t specify the extent to which either of the stakeholders will be liable. It is not clear whether they will all be liable or whether a party is only liable where the defects cover their area of expertise,

- The regulations state that upon correction of defects by the relevant professionals, the owner shall certify that the relevant professional or sub-contractor has made good the defects identified. An assumption seems to have been made that all owners are construction savvy which then undermines the role of the architect who is considered to be the ‘supervisor’ in a construction project,

- The extension of the patent defects liability period from the previous 6 months to 12 months appears to be an unnecessarily long time which will make contractors wait longer for their last moiety of retention and certificate of completion, and,

- The contractor and sub-contractor will be required to obtain insurance cover for defects that may become apparent during the latent defects liability period whereas other relevant professionals shall obtain a professional indemnity cover for the same. It is not clear whose expense this will be.

In our view, there is need for extensive negotiations and all-inclusive participation by stakeholders in the construction sector to ensure proper integration of any new regulations with the existing construction laws thus limiting any grey areas.

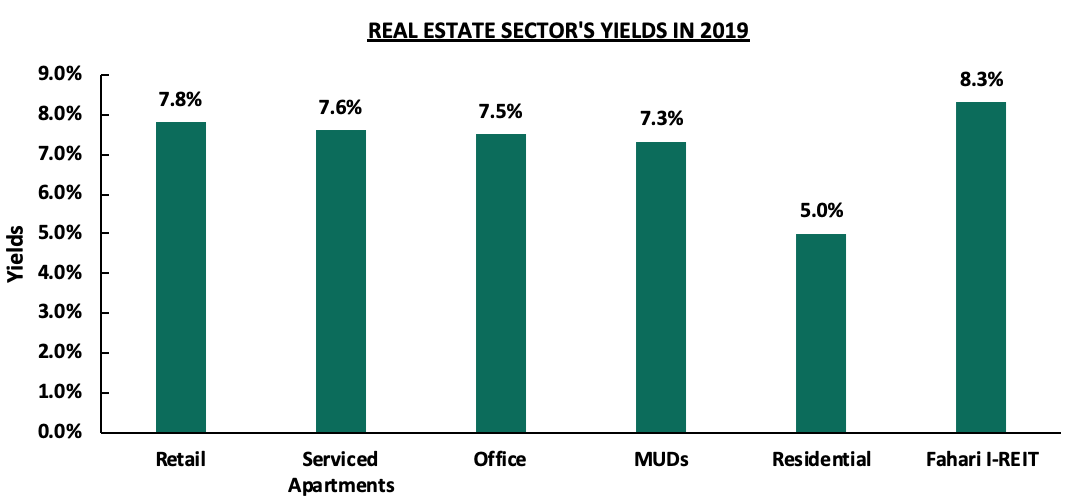

- Listed Real Estate