Alternative Financing in Real Estate Development Report, and Cytonn Weekly #52/2024

By Research team, Dec 29, 2024

Executive Summary

Fixed Income

During the week, T-bills were undersubscribed for the third consecutive week, with the overall undersubscription rate coming in at 20.3%, albeit lower than the undersubscription rate of 54.5% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 2.2 bn against the offered Kshs 4.0 bn, translating to an undersubscription rate of 56.1%, significantly lower than the oversubscription rate of 157.9% recorded the previous week. The subscription rates for the 182-day and 364-day papers decreased to 4.4% and 21.9% respectively from to 30.4% and 37.3% recorded the previous week. The government accepted a total of Kshs 4.8 bn worth of bids out of Kshs 4.9 bn bids received, translating to an acceptance rate of 99.3%. The yields on the government papers recorded a mixed performance, with the yield on the 182-day paper remaining unchanged at 10.0%, while the yields on the 364-day and 91-day papers decreased by 12.8 bps and 6.0 bps to 11.4% and 9.9% respectively, from 11.5% and 10.0% respectively recorded the previous week;

Also, we are projecting the y/y inflation rate for December 2024 to decrease within the range of 2.4% - 2.7% mainly on the back of reduced fuel prices in December, with maximum allowed price for Super Petrol, Diesel and Kerosene decreasing by Kshs 4.4, Kshs 3.0 and Kshs 3.0 respectively, and the stability of the Kenyan Shilling having recorded a 0.3% month-to-date appreciation as of 27th December 2024 to Kshs 129.3 from Kshs 129.6, and a 17.6% year-to-date gain, from the Kshs 157.0 recorded at the beginning of the year;

Equities

During the week, the equities market was on an upward trajectory, with NASI gaining the most by 2.2%, while During the week, the equities market was on an upward trajectory, with NSE 20 gaining the most by 3.9%, while NSE 25, NASI and NSE 10 gained by 1.7%, 0.6% and 0.6% respectively, taking the YTD performance to gains of 40.3%, 40.1%, 33.1% and 31.4% for NSE 25, NSE 10, NASI and NSE 20 respectively. The equities market performance was mainly driven by gains recorded by large-cap stocks such as DTB-K, BAT and Stanbic of 7.9%, 6.1%, and 3.5% respectively. The gains were however weighed down by losses recorded by large-cap stocks such as Safaricom of 2.8%;

Real Estate

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 31st October 2024. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 31st October 2024, representing a 45.0% loss from the Kshs 20.0 inception price;

Focus of the Week

This week, we shift our focus to alternative financing available for real estate firms who are looking to develop properties. Kenya’s Real Estate sector is one of the economic sectors that that has realized remarkable growth and improvement over the past years. However, development of projects has proven to be a challenge as evidenced by various projects stalling, and hence surpassing their stipulated timelines. Key to note, Real Estate investments are capital intensive, and as such require massive funding to complete. However, the over-reliance on traditional sources of financing Real Estate projects such as debt financing continue to be a challenge in sourcing funds for developments mainly due to difficulty in accessing credit loans, coupled with the burden of being in debt. Therefore as our focus this week, we shall do a recap of our 2022 topical on Alternative Financing for Real Estate Developments, in order to identify the various sources of financing for Real Estate developments with a keen eye on the alternative financing for Real Estate. The topical will therefore cover the following;

Investment Updates:

- Weekly Rates: Cytonn Money Market Fund closed the week at a yield of 16.8 % p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Tuesday, from 7:00 pm to 8:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

During the week, T-bills were undersubscribed for the third consecutive week, with the overall undersubscription rate coming in at 20.3%, albeit lower than the undersubscription rate of 54.5% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 2.2 bn against the offered Kshs 4.0 bn, translating to an undersubscription rate of 56.1%, significantly lower than the oversubscription rate of 157.9% recorded the previous week. The subscription rates for the 182-day and 364-day papers decreased to 4.4% and 21.9% respectively from to 30.4% and 37.3% recorded the previous week. The government accepted a total of Kshs 4.8 bn worth of bids out of Kshs 4.9 bn bids received, translating to an acceptance rate of 99.3%. The yields on the government papers recorded a mixed performance, with the yield on the 182-day paper remaining unchanged at 10.0%, while the yields on the 364-day and 91-day papers decreased by 12.8 bps and 6.0 bps to 11.4% and 9.9% respectively, from 11.5% and 10.0% respectively recorded the previous week. The chart below shows the yield growth rate for the 91-day paper over the period:

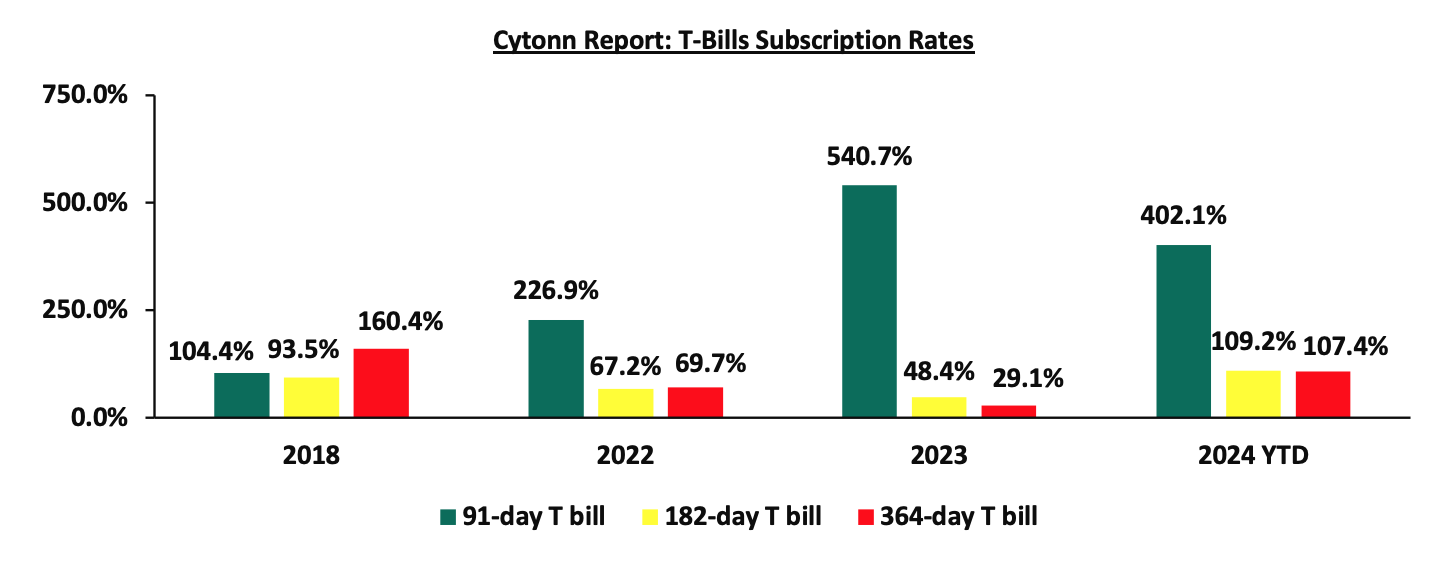

The chart below compares the overall average T-bill subscription rates obtained in 2018, 2022, 2023, and 2024 Year-to-date (YTD):

Money Market Performance:

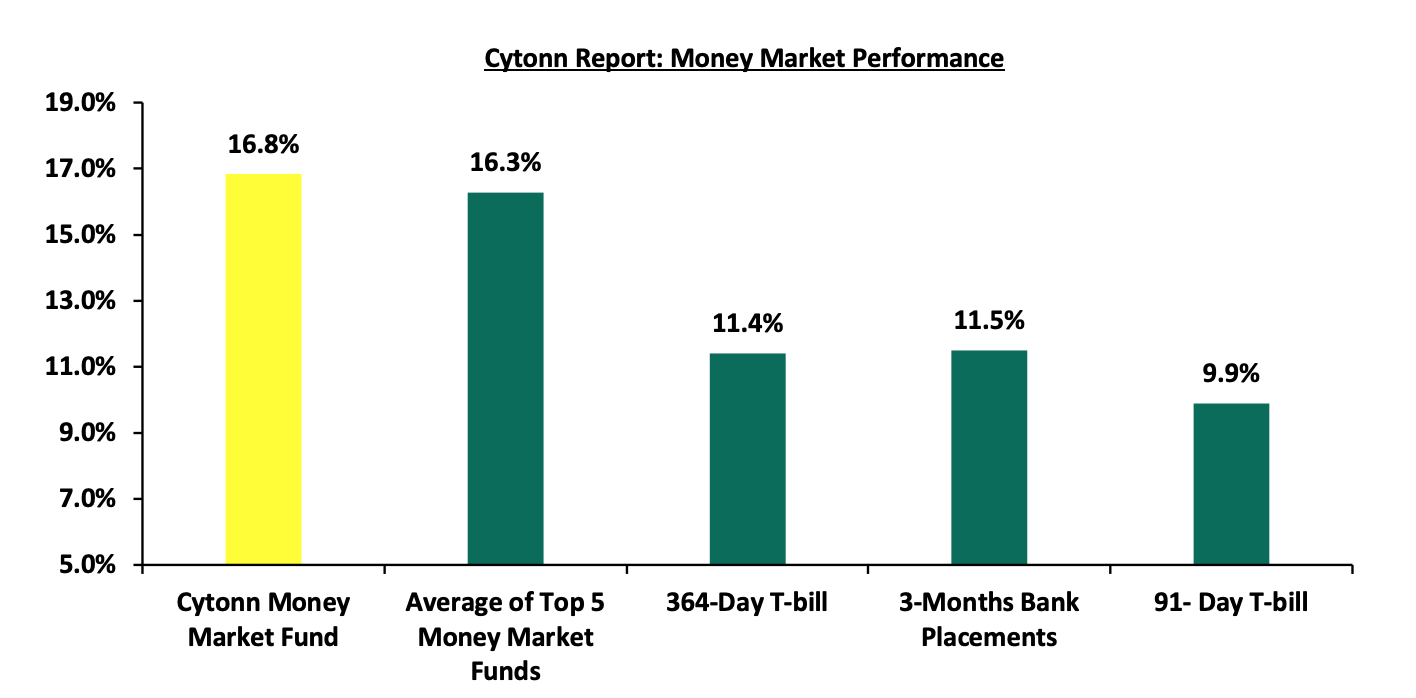

In the money markets, 3-month bank placements ended the week at 11.5% (based on what we have been offered by various banks), and yields on the government papers recorded a mixed performance, with the yields on the 364-day and 91-day papers decreased by 12.8 bps and 6.0 bps to 11.4% and 9.9% respectively from 11.5% and 10.0% respectively recorded the previous week.The yield on the Cytonn Money Market Fund decreased by 24.0 bps to close the week at 16.8% from 17.1% recorded the previous week, while the average yields on the Top 5 Money Market Funds decreased by 16.2 bps to close the week at 16.3%, from 16.4% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 28th November 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 28th December 2024 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn App) |

16.8% |

|

2 |

Lofty-Corban Money Market Fund |

16.5% |

|

3 |

Gulfcap Money Market Fund |

16.3% |

|

4 |

Etica Money Market Fund |

16.1% |

|

5 |

Kuza Money Market fund |

15.7% |

|

6 |

Ndovu Money Market Fund |

15.5% |

|

7 |

Orient Kasha Money Market Fund |

15.3% |

|

8 |

Arvocap Money Market Fund |

15.2% |

|

9 |

Mali Money Market Fund |

15.2% |

|

10 |

Faulu Money Market Fund |

14.5% |

|

11 |

Sanlam Money Market Fund |

14.1% |

|

12 |

Madison Money Market Fund |

14.0% |

|

13 |

Dry Associates Money Market Fund |

13.9% |

|

14 |

Genghis Money Market Fund |

13.7% |

|

15 |

Jubilee Money Market Fund |

13.6% |

|

16 |

Enwealth Money Market Fund |

13.6% |

|

17 |

GenAfrica Money Market Fund |

13.5% |

|

18 |

Co-op Money Market Fund |

13.3% |

|

19 |

KCB Money Market Fund |

13.3% |

|

20 |

Nabo Africa Money Market Fund |

13.3% |

|

21 |

Apollo Money Market Fund |

13.2% |

|

22 |

British-American Money Market Fund |

13.1% |

|

23 |

Old Mutual Money Market Fund |

13.0% |

|

24 |

ICEA Lion Money Market Fund |

13.0% |

|

25 |

CIC Money Market Fund |

12.9% |

|

26 |

Absa Shilling Money Market Fund |

12.7% |

|

27 |

Ziidi Money Market Fund |

12.7% |

|

28 |

Mayfair Money Market Fund |

12.3% |

|

29 |

AA Kenya Shillings Fund |

12.2% |

|

30 |

Stanbic Money Market Fund |

11.8% |

|

31 |

Equity Money Market Fund |

8.7% |

Source: Business Daily

Liquidity:

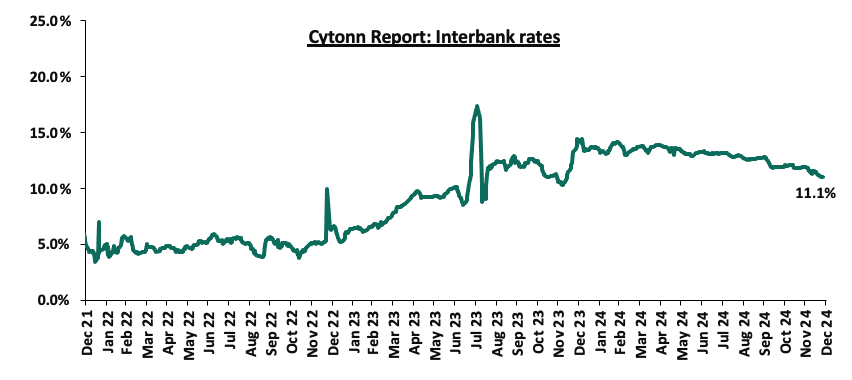

During the week, liquidity in the money markets eased, with the average interbank rate decreasing by 24.7 bps, to 11.1% from the 11.3% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded increased marginally by 2.4% to Kshs 34.4 bn from Kshs 33.6 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Kenya’s Eurobonds were on an upward trajectory, with the yield on the 13-year Eurobond issued in 2021 increasing the most by 13.5 bps to 10.0% from 9.9% recorded the previous week. The table below shows the summary performance of the Kenyan Eurobonds as of 26th December 2024;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2018 |

2019 |

2021 |

2024 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

|

Years to Maturity |

3.2 |

23.2 |

2.4 |

7.4 |

9.5 |

6.2 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

|

1-Jan-24 |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

|

|

2-Dec-24 |

8.6% |

8.6% |

7.9% |

9.7% |

10.1% |

9.8% |

|

19-Dec-24 |

8.9% |

10.2% |

8.2% |

9.9% |

9.9% |

9.9% |

|

20-Dec-24 |

8.9% |

10.2% |

8.2% |

9.9% |

10.0% |

10.0% |

|

23-Dec-24 |

9.0% |

10.3% |

8.3% |

10.0% |

10.1% |

10.1% |

|

24-Dec-24 |

9.0% |

10.3% |

8.3% |

10.0% |

10.1% |

10.1% |

|

25-Dec-24 |

9.0% |

10.3% |

8.3% |

10.0% |

10.1% |

10.1% |

|

26-Dec-24 |

9.0% |

10.2% |

8.3% |

9.9% |

10.0% |

10.0% |

|

Weekly Change |

0.1% |

0.0% |

0.1% |

0.0% |

0.1% |

0.1% |

|

MTD Change |

0.3% |

1.6% |

0.3% |

0.3% |

(0.0%) |

0.2% |

|

YTD Change |

(0.9%) |

0.1% |

(1.8%) |

0.0% |

0.5% |

- |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling appreciated marginally against the US Dollar by 0.3 bps, to close the week at Kshs 129.3, relatively unchanged from the previous week. On a year-to-date basis, the shilling has appreciated by 17.6% against the dollar, a contrast to the 26.8% depreciation recorded in 2023.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,872.0 mn in the 12 months to November 2024, 16.7% higher than the USD 4,175.0 mn recorded over the same period in 2023. In the November 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 53.4% in the period, and,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 14.9% in the 12 months to October 2024, compared to a similar period in 2023.

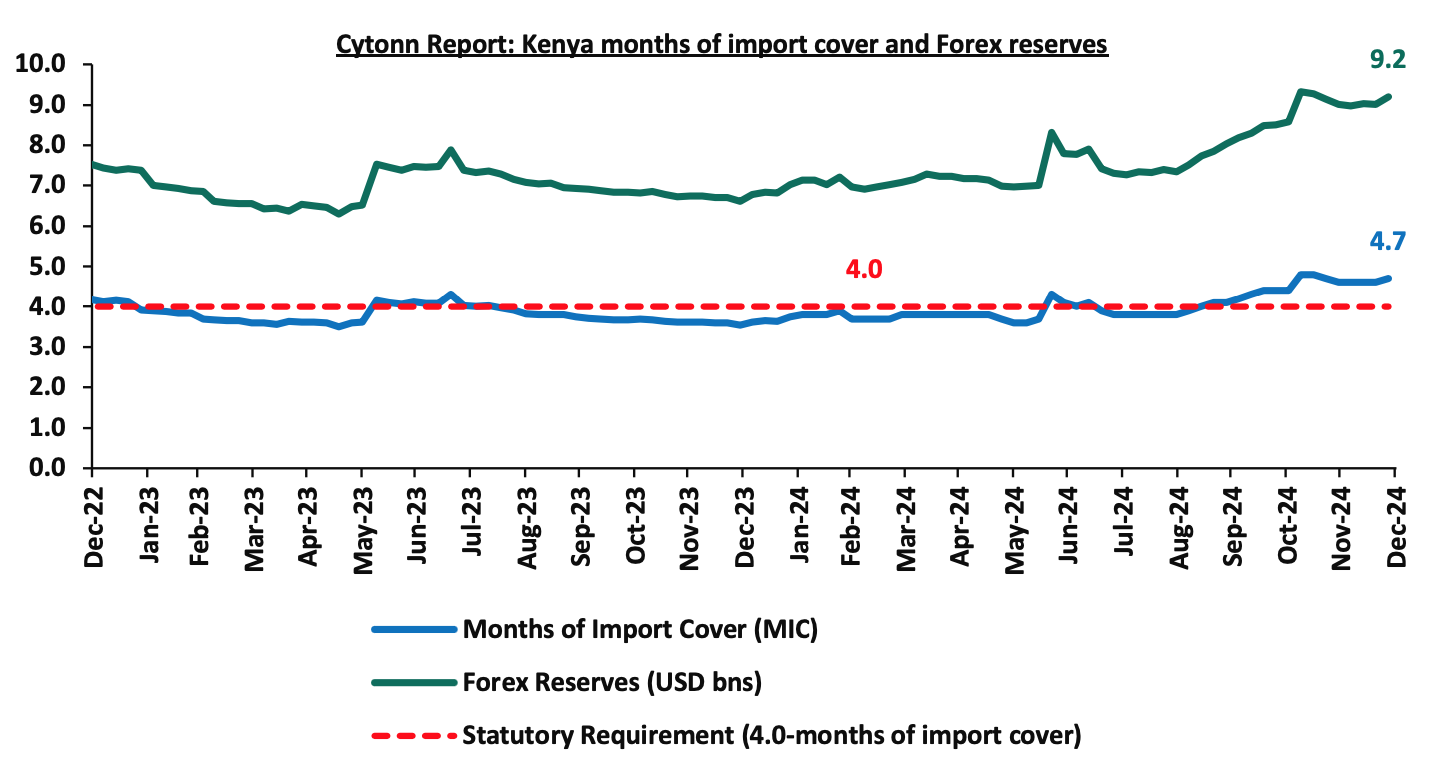

- Improved forex reserves currently at USD 9.2 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2025 as a result of:

- An ever-present current account deficit which came at 3.8% of GDP in Q2’2024 from 3.7% recorded in Q2’2023, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.2% of Kenya’s external debt is US Dollar-denominated as of June 2024.

Key to note, Kenya’s forex reserves increased by 2.1% during the week, to USD 9.2 bn from the USD 9.0 bn recorded in the previous week, equivalent to 4.7 months of import cover, from 4.6 months recorded last week, and above the statutory requirement of maintaining at least 4.0-months of import cover. The recent increase in forex reserves is primarily attributed to the disbursement from the International Monetary Fund (IMF). On October 30, 2024, the IMF approved a combined disbursement of around USD 606.1 mn following the successful completion of Kenya’s seventh and eighth reviews under the Extended Fund Facility (EFF), Extended Credit Facility (ECF), and Resilience and Sustainability Facility (RSF) arrangements. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights

- December 2024 Inflation Projection

We are projecting the y/y inflation rate for December 2024 to decrease within the range of 2.4% - 2.7% mainly on the back of:

- Reduced Fuel Prices in December– In their last fuel prices release, EPRA announced that the maximum allowed price for Super Petrol, Diesel and Kerosene decreased by Kshs 4.4, Kshs 3.0 and Kshs 3.0 respectively. Consequently, Super Petrol, Diesel and Kerosene will continue to retail at Kshs 176.3, Kshs 165.1 and Kshs 148.4 per litre respectively, from Kshs 180.7, Kshs. 168.1 and Kshs 151.4 per litre respectively. This followed the government's efforts to stabilize pump prices through the petroleum pump price stabilization mechanism which expended Kshs 9.9 bn in the FY2023/24 to cushion the increases applied to the petroleum pump prices, and further supported by a stronger Shilling . This stability in fuel prices is likely to provide a stabilizing effect on consumer purchasing power as well as business operational costs, since fuel is a major input cost for businesses, and,

- Slight appreciation of the Kenya Shilling against the US Dollar – The Kenya Shilling has recorded a 0.3% month-to-date appreciation as of 27th December 2024 to Kshs 129.3 from Kshs 129.6, and a 17.6% year-to-date gain from the Kshs 157.0 recorded at the beginning of the year. This appreciation in the exchange rate, though slight, could decrease inflationary pressures.

We, however, expect that inflation rate will, however, be supported by:

- The decrease in the Central Bank Rate (CBR) by 75.0 bps to 11.25% from 12.00% – Earlier this year, the monetary policy committee noted that, there was need to tighten the monetary policy following the sustained depreciation of the Kenyan shilling as well as the heightened inflationary pressures. Over a number of meetings, the CBK Monetary Policy Committee raised the rates to a high of 13.00%, with cuts starting in the August meeting, which cut the CBR by 25 bps to 12.75%. In their last meeting on 5th December 2024, the committee went for an even bigger cut, reducing the CBK rate by 75.0 bps to 11.00% from 12.00%. This reduction in the CBR is likely to increase the money supply through lower borrowing costs, which may cause a slight rise in inflation rates as the effects of the CBR gradually take hold in the broader economy, and,

- Increase in electricity prices – In December 2024, EPRA announced the electricity prices would increase due to several factors. A fuel energy cost charge of 357.0 cents per kWh was imposed based on fuel price variations and energy generation from diesel and steam plants, while a foreign exchange fluctuation adjustment of 101.4 cents per kWh reflected currency exchange losses across KenGen, KPLC, and Independent Power Producers. Additionally, a Water Resource Management Authority (WRMA) levy of 1.4 cents per kWh was applied, based on hydropower energy purchases from plants with a capacity of 1MW or more. These adjustments impact all meter readings taken in December 2024

Going forward, we expect inflationary pressures to remain anchored in the short term, remaining within the CBK’s target range of 2.5%-7.5% aided by the reduced fuel prices and stability in the exchange rate. However, risks remain, particularly from the potential for increased demand-driven inflation due to accommodative monetary policy. The decision to lower the CBR to 11.25% during the latest MPC meeting will likely increase money supply, in turn increasing inflation, especially with further cuts expected in the coming meetings. The CBK’s ability to balance growth and inflation through close monitoring of both inflation and exchange rate stability will be key to maintaining inflation within the target range.

Rates in the Fixed Income market have been on a downward trend given the continued low demand for cash by the government and the improved liquidity in the money market. The government is 175.9% ahead of its prorated net domestic borrowing target of Kshs 204.2 bn, and 37.9% ahead of the total FY’2024/25 net domestic borrowing target of Kshs 408.4 bn, having a net borrowing position of Kshs 563.3 bn. However, we expect a continued downward readjustment of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to normalize in the medium-term and hence investors are expected to shift towards the long-term papers to lock in the high returns.

Market Performance:

During the week, the equities market was on an upward trajectory, with NSE 20 gaining the most by 3.9%, while NSE 25, NASI and NSE 10 gained by 1.7%, 0.6% and 0.6% respectively, taking the YTD performance to gains of 40.3%, 40.1%, 33.1% and 31.4% for NSE 25, NSE 10, NASI and NSE 20 respectively. The equities market performance was mainly driven by gains recorded by large-cap stocks such as DTB-K, BAT and Stanbic of 7.9%, 6.1%, and 3.5% respectively. The gains were however weighed down by losses recorded by large-cap stocks such as Safaricom of 2.8%;

During the week, equities turnover decreased significantly by 98.9% to USD 2.1 mn from USD 190.2 mn recorded the previous week, taking the YTD turnover to USD 790.8 mn. Foreign investors remained net sellers this week, with a net selling position of USD 0.9 mn, from a net selling position of USD 2.4 mn recorded the previous week, taking the YTD net selling position to USD 16.9 mn.

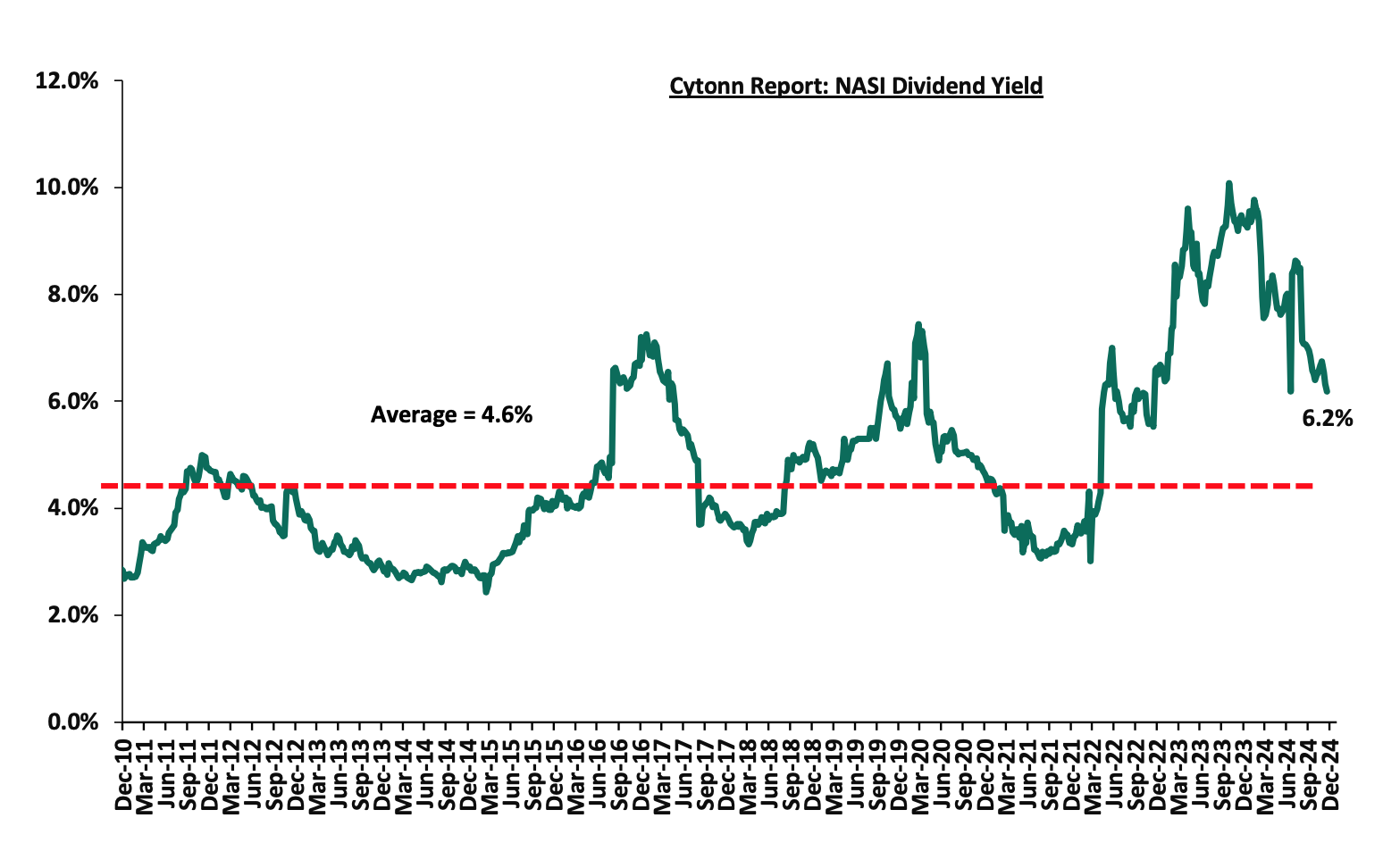

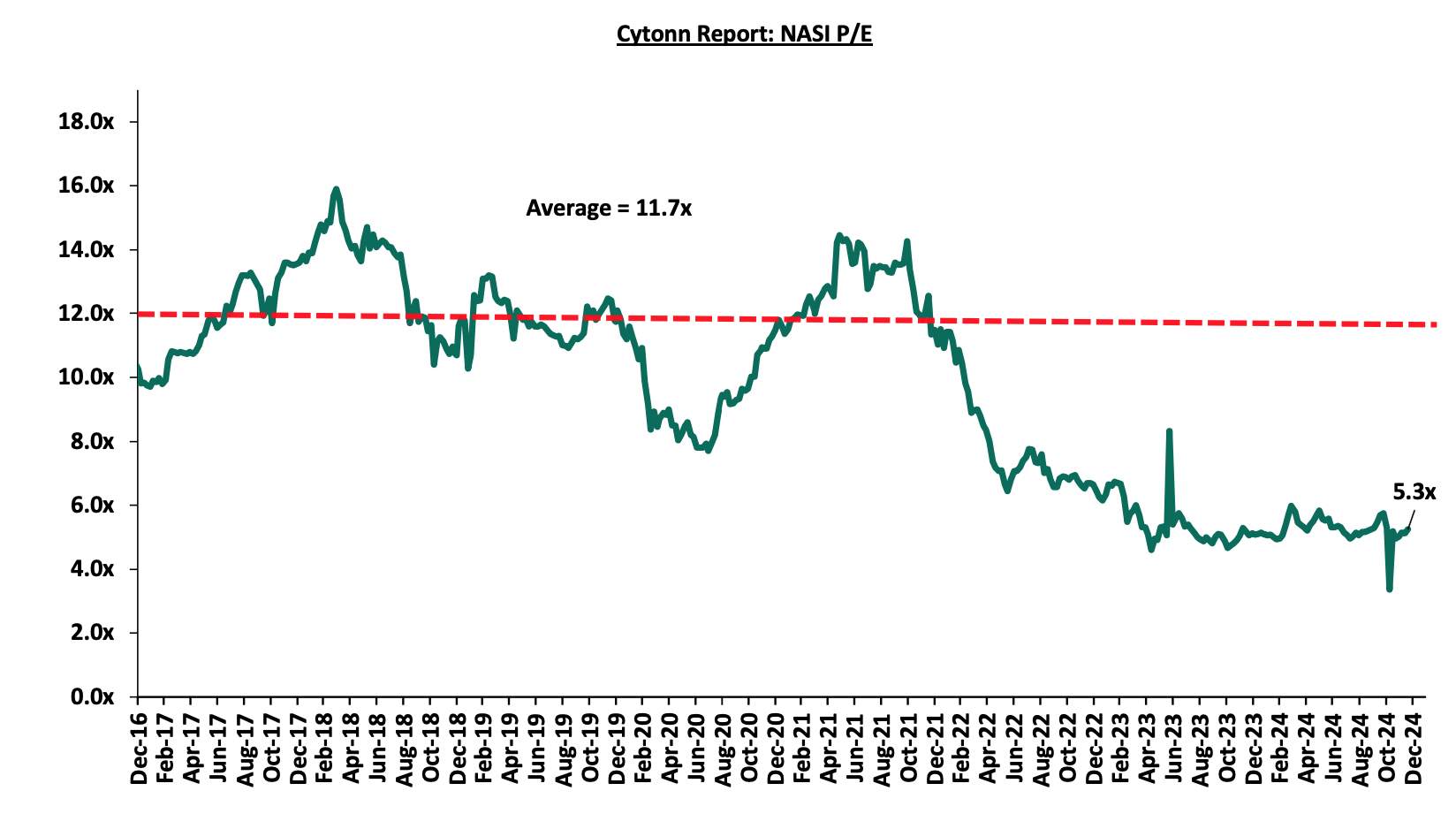

The market is currently trading at a price-to-earnings ratio (P/E) of 5.3x, 54.9% below the historical average of 11.7x, and a dividend yield of 6.2%, 1.6% points above the historical average of 4.6%. Key to note, NASI’s PEG ratio currently stands at 0.7x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued.

The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

||||||||||

|

Company |

Price as at 20/12/2024 |

Price as at 27/12/2024 |

w/w change |

YTD Change |

Year Open 2024 |

Target Price* |

Dividend Yield*** |

Upside/ Downside** |

P/TBv Multiple |

Average |

|

Jubilee Holdings |

168.3 |

171.0 |

1.6% |

(7.6%) |

316.8 |

260.7 |

8.4% |

60.8% |

0.3x |

Buy |

|

Equity Group |

46.0 |

46.2 |

0.4% |

34.9% |

52.8 |

60.2 |

8.7% |

39.1% |

0.9x |

Buy |

|

CIC Group |

2.1 |

2.2 |

2.9% |

(6.1%) |

2.2 |

2.8 |

6.0% |

36.3% |

0.7x |

Buy |

|

Co-op Bank |

15.6 |

15.9 |

2.3% |

40.1% |

13.0 |

18.8 |

9.4% |

27.7% |

0.7x |

Buy |

|

KCB Group |

39.7 |

40.0 |

0.8% |

82.0% |

45.6 |

50.3 |

0.0% |

25.9% |

0.6x |

Buy |

|

Britam |

5.8 |

6.0 |

3.1% |

16.0% |

7.6 |

7.5 |

0.0% |

25.8% |

0.8x |

Buy |

|

NCBA |

46.9 |

48.0 |

2.2% |

23.4% |

25.5 |

53.2 |

9.9% |

20.9% |

0.9x |

Buy |

|

ABSA Bank |

16.9 |

17.4 |

3.3% |

50.6% |

11.8 |

19.1 |

8.9% |

18.7% |

1.4x |

Accumulate |

|

Stanbic Holdings |

135.3 |

140.0 |

3.5% |

32.1% |

87.0 |

145.3 |

11.0% |

14.8% |

0.9x |

Accumulate |

|

Standard Chartered Bank |

272.8 |

281.3 |

3.1% |

75.5% |

0.0 |

291.2 |

10.3% |

13.8% |

1.9x |

Accumulate |

|

Diamond Trust Bank |

63.3 |

68.3 |

7.9% |

52.5% |

59.5 |

71.1 |

7.3% |

11.5% |

0.3x |

Accumulate |

|

I&M Group |

31.8 |

35.9 |

12.9% |

105.4% |

21.4 |

32.3 |

7.1% |

(2.8%) |

0.7x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Dividend Yield is calculated using FY’2023 Dividends |

||||||||||

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery. With the market currently being undervalued for its future growth (PEG Ratio at 0.7x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current foreign investors’ sell-offs to continue weighing down the equities outlook in the short term.

- Real Estate Investments Trusts (REITs)

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 31st October 2024. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs s 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at Kshs s 12.3 mn and Kshs 31.6 mn shares, respectively, with a turnover of Kshs 311.5 mn and Kshs 702.7 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 31st October 2024, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 138,600 shares for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015.

REITs offer various benefits, such as tax exemptions, diversified portfolios, and stable long-term profits. However, the ongoing decline in the performance of Kenyan REITs and the restructuring of their business portfolios are hindering significant previous investments. Additional general challenges include:

- Insufficient understanding of the investment instrument among investors leading to a slower uptake of REIT products,

- Lengthy approval processes for REIT creation,

- High minimum capital requirements of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, essentially limiting the licensed REIT Trustee to banks only

- The rigidity of choice between either a D-REIT or and I-REIT forces managers to form two REITs, rather than having one Hybrid REIT that can allocate between development and income earning properties

- Limiting the type of legal entity that can form a REIT to only a trust company, as opposed to allowing other entities such as partnerships, and companies,

- We need to give time before REITS are required to list – they would be allowed to stay private for a few years before the requirement to list given that not all companies maybe comfortable with listing on day one, and,

- Minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs. The significant capital requirements still make REITs relatively inaccessible to smaller retail investors compared to other investment vehicles like unit trusts or government bonds, all of which continue to limit the performance of Kenyan REITs.

We expect Kenya’s Real Estate sector to remain on a growth trend, supported by: i) demand for housing sustained by positive demographics, such as urbanization and population growth rates of 3.7% p.a and 2.0% p.a, respectively, against the global average of 1.7% p.a and 0.9% p.a, respectively, as at 2023, ii) activities by the government under the Affordable Housing Program (AHP) iii) heightened activities by private players in the residential sector. However, challenges such as rising construction costs, strain on infrastructure development (including drainage systems), high capital requirements for REITs, and existing oversupply in select Real Estate sectors will continue to hinder the sector’s optimal performance by limiting developments and investments.

In analyzing the alternative financing in Real Estate, we discuss the following;

- Overview of the Real Estate Sector in Kenya,

- Traditional Financing for Real Estate Developments,

- Alternative Financing for Real Estate Developments,

- Case Study: South Africa’s Real Estate Investment Market (REIT) Market,

- Recommendations: Measures to Increasing Access to Real Estate Development Funding, and,

- Conclusion.

Section I: Overview of the Real Estate Sector in Kenya

The Real Estate sector in Kenya has grown over the years to become one of the largest contributors to the country’s Gross Domestic Product (GDP), supported by factors such as; i) positive demographics including higher urbanization and population growth rates of 3.7% p.a and 2.0% p.a, respectively, against the global average of 1.7% p.a and 0.9% p.a, respectively, as at 2023, ii) government’s sustained efforts to promote infrastructural development, opening up new areas for investments, iii) emphasis to provide affordable housing by the government through programs such as the Affordable Housing Program (AHP), iv) increased investment by both local and foreign investors, and, v) increased accessibility to low-interest loans provided by entities such as Kenya Mortgage Refinance Company (KMRC) among others.

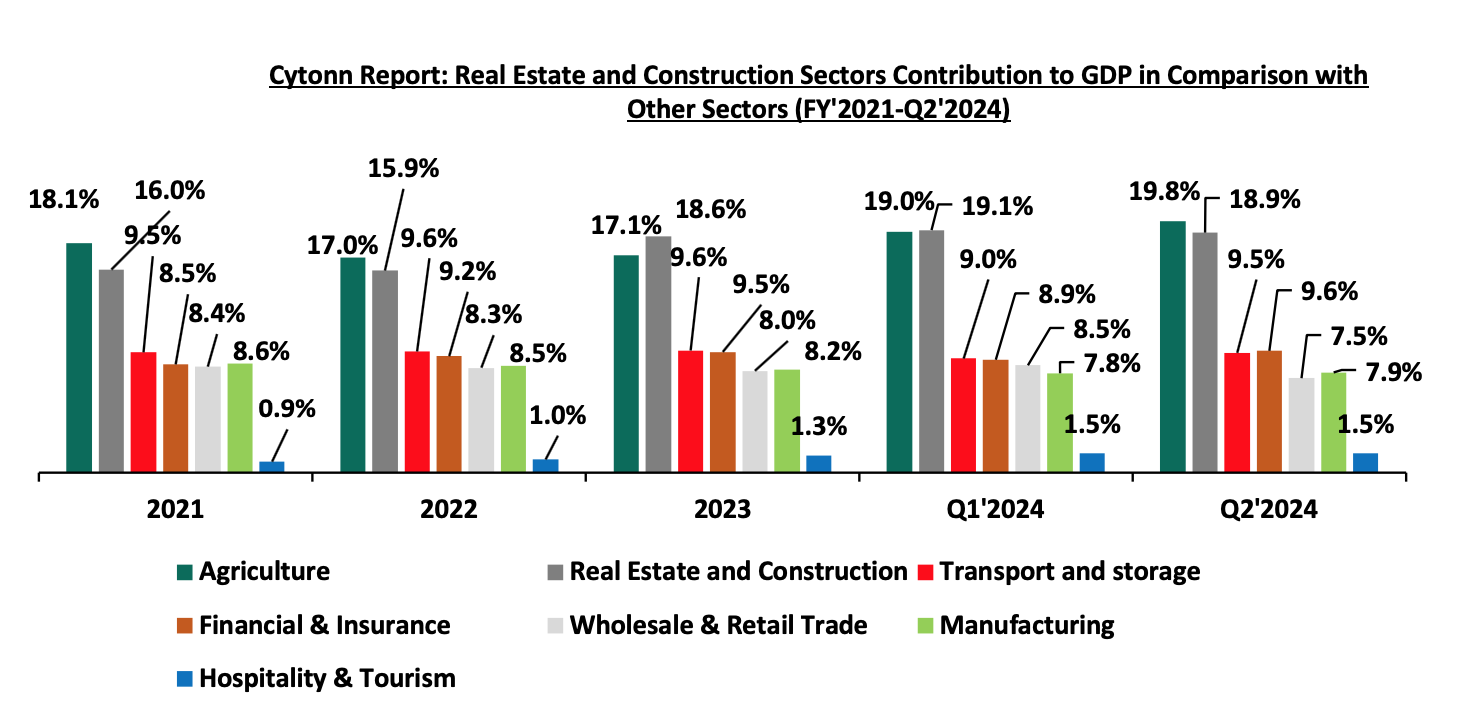

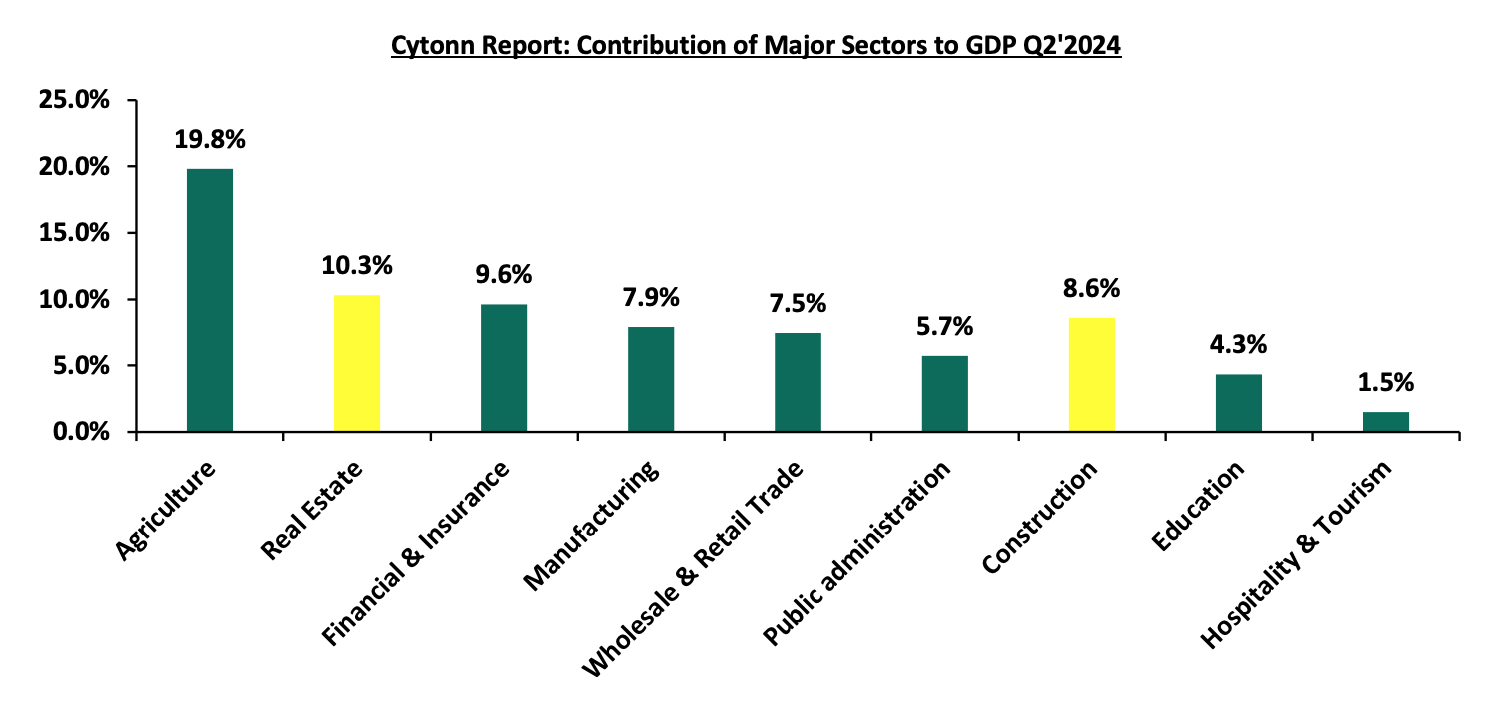

As we assess the growth in the Kenyan property market, it is imperative to recognize the growth achieved by the Real Estate sector, collaboratively with the construction sector, given their interdependence and inherent correlation. Construction and Real Estate sectors jointly contributed to 18.9% to the country’s GDP in Q2’2024, subsequently being the second largest contributors after Agriculture which contributed 19.8%. The performance surpassed major and perennial sector contributors including transport at 9.5%, financial services and insurance at 9.6%, and manufacturing which contributed 7.9%. The performance of the two sectors confirms their importance to the Kenyan economy, and additionally draws a positive outlook. The graph below shows the trend of the Real Estate and Construction sectors contribution to GDP between FY’2021 and Q2’2024;

Source: Kenya National Bureau of Statistics (KNBS)

Below is a graph highlighting the top sectoral contributors to GDP in Q2’2024;

Source: Kenya National Bureau of Statistics (KNBS)

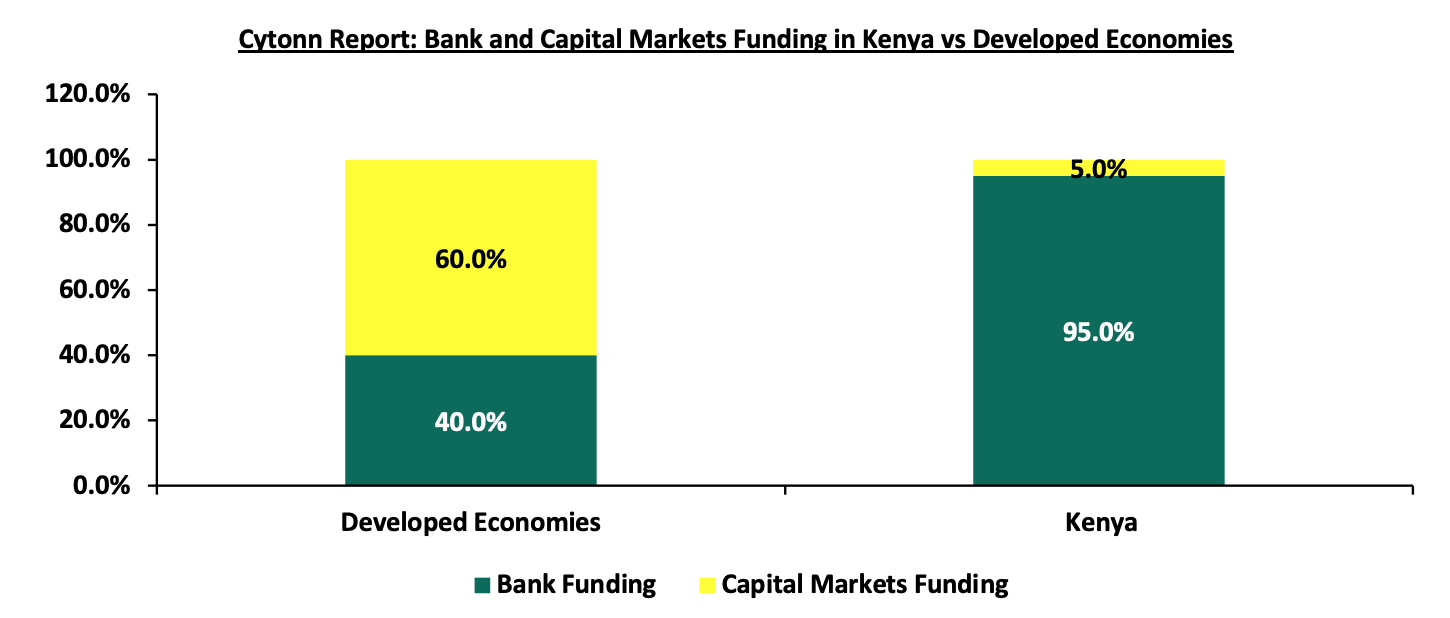

Despite the aforementioned growth and positive performance, several challenges hinder the optimal performance of the Real Estate sector. These challenges include Construction costs which increased by 17.6% in H1’2024, primarily due to higher prices for key materials, which could hinder sector development. Oversupply of physical space exists in various sectors, leading to prolonged vacancy rates. The REITs market in Kenya faces challenges like large capital requirements, prolonged approval processes, and limited investor knowledge. Rising interest rates have made borrowing more expensive, reducing demand for mortgages and developer financing. Lenders are tightening their requirements, leading to constrained financing for developers and an increase in Non-Performing Loans (NPLs) which stands at Kshs 114.3 bn in Q2’2024, equivalent to 22.7% of total loans advanced to the sector. Underdeveloped capital markets limit funding for real estate projects, with banks providing nearly 95.0% of funding for developers in Kenya. To address the funding gap, players in the Real Estate sector have increasingly turned to alternative financing methods like Real Estate Investment Trusts (REITs). In 2013, the Capital Markets Authority (CMA) introduced a detailed framework and regulations for REITs, enabling developers to secure capital through this investment avenue.

Kenya's Real Estate sector has been expanding due to ongoing construction activities driven by strong demand for real estate developments. The residential market is significantly under-supplied, with an 80.0% housing deficit; only 50,000 units are delivered annually against an estimated need for 250,000 units per year. Additionally, the formal retail market in Kenya is still in its nascent stages, with a penetration rate of approximately 35.0% as of 2021. Despite the high demand, developers in Kenya encounter limited financing options, with local banks providing nearly 95.0% of construction financing, in stark contrast to the 40.0% typically seen in developed countries. To bridge the funding gap, developers are increasingly turning to alternative financing methods. The graph below illustrates the comparison of construction financing in Kenya versus developed economies;

Source: World Bank, Capital Markets Authority (CMA)

Section II: Traditional Financing for Real Estate Developments

Real estate development in Kenya is a dynamic sector that demands significant capital investment. Traditional financing methods remain crucial for developers aiming to undertake projects ranging from residential housing to large commercial developments. This article explores various traditional financing options within the Kenyan context, offering detailed insights into their features, advantages, and challenges. These options include:

- Commercial Bank Loans

Commercial banks in Kenya are a primary source of funding for real estate development. These loans are typically structured as long-term debt, with the property often serving as collateral. Prominent banks such as KCB, Equity Bank, and Co-operative Bank offer products specifically designed for developers.

Commercial bank loans are characterized by structured repayment terms that range from 5 to 30 years, depending on the loan size and purpose. Interest rates can be fixed or variable, with the latter often influenced by the Central Bank of Kenya (CBK) base rate. Borrowers are required to provide significant security, commonly in the form of the property under development or other valuable assets. Banks also demand detailed financial records, project plans, and proof of repayment capacity.

These loans provide access to substantial funding for large-scale projects and offer predictable repayment schedules that assist in long-term financial planning. Additionally, the legal frameworks governing such loans protect both parties, ensuring transparency and reliability. This option however, can be challenging since the approval process can be lengthy, involving strict assessments of creditworthiness and project feasibility. For instance, , the interest rate charge average was o 14.3% in 2023, ranging between 8.7% to 18.6% according to Bank Supervision Annual Report 2023, increasing the cost of borrowing, especially during periods of economic volatility leading to increase an in non-performing loans (NPLs).

- Mortgage Loans

Mortgages are a widely used option for financing both real estate purchases and developments. Institutions like Kenya Mortgage Refinance Company (KMRC), Housing Finance Company (HFC) and NCBA cater to residential and commercial real estate developers with tailored mortgage products.

Mortgage loans offer long-term financing options spanning 15 to 25 years. Borrowers may choose between fixed-rate and adjustable-rate mortgages, depending on their risk tolerance and financial forecasts. These loans are secured by the property itself, with monthly repayment plans designed to match the borrower’s income flow. Additional costs, such as valuation, legal fees, and down payments, are factored into the financing arrangement.

Mortgages provide affordable and structured repayment plans, making them suitable for salaried individuals and businesses with stable incomes. Competitive interest rates and the ability to spread costs over an extended period make this a practical choice for many. Despite these advantages, mortgages are faced by challenges such as initial costs, including legal and administrative fees, can be high. Moreover, informal sector earners may face challenges meeting stringent eligibility criteria due to irregular income documentation.

- Construction Loans

Construction loans are designed to fund the building phase of a real estate project. These short-term facilities are common among developers undertaking projects like gated communities, apartments, or commercial complexes. Typically lasting 1 to 3 years, construction loans disburse funds in tranches linked to specific construction milestones. Borrowers are required to present detailed project plans, budgets, and permits before approval. The interest rates on these loans are higher than those of standard loans, reflecting the elevated risk involved in construction projects.

The flexibility of these loans allows developers to access funds as needed, reducing interest costs on unused amounts. This aligns borrowing with project timelines and cash flow requirements.

Developers must ensure meticulous project planning to meet milestone requirements. Transitioning from construction loans to permanent financing upon project completion can also be complex and time-sensitive.

- Bridge Loans and Savings and Credit Co-operatives (SACCOs)

Bridge loans provide short-term financing for developers awaiting long-term funding or the sale of an asset. These loans are particularly useful in Kenya’s fast-growing markets like Nairobi and Mombasa. Bridge loans typically have repayment periods of 6 to 24 months and are secured by existing assets. The approval process is quick, but the interest rates are higher, often exceeding 15.0%. These loans help cover gaps in funding, ensuring projects remain on schedule. These loans are usually offered by banks and non-bank financial institutes. This funding option offer developers rapid access to capital, which is critical for seizing time-sensitive opportunities or maintaining momentum during transitional phases. However, high interest rates and fees make these loans an expensive option. Delays in securing long-term financing can lead to repayment difficulties and increased costs.

SACCOs play a significant role in financing real estate development, particularly for small- and medium-scale developers. Organizations like Stima SACCO and Mhasibu SACCO are known for their competitive loan products. SACCO loans are tied to the member’s savings, typically offering up to three times the savings balance. Interest rates are lower than commercial bank rates, often ranging between 10.0% and 12.0%. Repayment terms are flexible, catering to individual needs. SACCOs promote a savings culture among members while providing accessible loans to those with limited credit histories. The straightforward loan application process is an added benefit. Some of the disadvantages for the SACCOs includes: Loan amounts may not be sufficient for large-scale developments, and the reliance on membership contributions can delay fund disbursement.

- Government-backed Loans and Initiatives

The Kenyan government has introduced various initiatives to encourage real estate development, particularly in the affordable housing sector. Programs under the Kenya Mortgage Refinance Company (KMRC) and the Affordable Housing Scheme are prominent examples. These loans offer subsidized interest rates and extended repayment terms. They are designed to support specific sectors, such as low-income housing. Developers must meet stringent eligibility criteria, including adherence to government-set pricing models. Government-backed loans reduce the cost of borrowing and incentivize socially beneficial projects. They provide critical support for developers focused on addressing Kenya’s housing deficit. The limited availability of funds and bureaucratic processes can slow down approvals and project implementation.

- Equity Financing

Equity financing involves raising capital by selling ownership stakes in a project to investors. This approach is increasingly popular among developers in high-value areas like Westlands and Kilimani. Unlike debt financing, equity financing does not require repayment. Instead, investors share in the project’s profits. Terms are flexible and negotiated between the developer and the investors, often involving detailed agreements on profit sharing and project timelines. Equity financing reduces the developer’s debt burden, allowing them to focus on execution. It also attracts investors with expertise and networks that can enhance the project’s success. Developers, however, must relinquish partial ownership and control. If the project performs exceptionally well, profit sharing may result in higher costs than traditional financing.

In Kenya, traditional financing options provide a robust foundation for real estate development. The choice of financing depends on the project’s scale, risk profile, and timelines. Developers often combine multiple financing methods to optimize their capital structures and navigate the dynamic real estate market. As the sector continues to grow, leveraging these traditional avenues alongside emerging financing models will be critical to meeting Kenya’s housing and commercial needs.

- Pre-Sales

Pre-sales investments involve purchase of properties before or during their construction phases. In Kenya, this approach has gained popularity as it allows investors to acquire properties at prices significantly lower than their anticipated market value upon completion, thereby benefiting from potential capital appreciation. Developers also benefit by securing necessary funding through early sales, facilitating project completion. However, off-plan investments come with certain risks, including: i) Market fluctuations can lead to a decrease in property value by the time of completion, ii) Developers may encounter challenges that delay or halt the project, iii) Investors failing to meet payment obligations can cause project delays or stalling.

In Kenya, the off-plan property market has been expanding, with developers offering various incentives to attract buyers. For instance, some developers provide flexible payment plans, allowing buyers to pay in installments as the project progresses. Additionally, off-plan properties often come with customization options, enabling buyers to influence design aspects to suit their preferences.

Despite these advantages, it's crucial for potential investors to conduct thorough due diligence. This includes researching the developer's track record, understanding the terms of the sale agreement, and assessing the project's feasibility. Engaging with real estate professionals and legal advisors can provide valuable insights and help mitigate risks associated with off-plan investments. While off-plan investments in Kenya offer opportunities for capital appreciation and favorable purchase terms, they also carry inherent risks that require careful consideration and proactive management.

Section III: Alternative financing for Real Estate development in Kenya,

The evolving nature of Kenya’s real estate market has spurred developers to explore alternative financing options beyond traditional methods. These options cater to diverse project needs, offering flexibility and innovative approaches to raising capital. This article examines some of the prominent alternative financing methods in Kenya, detailing their features, benefits, and challenges.

- Private Equity Funding

Private equity (PE) funding has emerged as a viable option for developers seeking substantial capital for large-scale real estate projects. This method involves securing investments from private equity firms or high-net-worth individuals in exchange for a stake in the project. The flexibility of PE funding allows developers to access significant resources without the constraints of traditional loans. Investors often bring valuable expertise and networks, which can enhance project execution and profitability. However, this method requires developers to relinquish partial control of their projects and share profits, which may not appeal to all

- Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) represent an innovative financing avenue for real estate development in Kenya. REITs provide a structured mechanism for pooling resources from multiple investors to finance or acquire income-generating real estate assets. The Capital Markets Authority (CMA) regulates REITs in Kenya, ensuring transparency and investor protection. Despite being relatively new in the Kenyan financial market, REITs have shown potential as a transformative tool for real estate financing.

In Kenya, REITs are classified into two main types:

- Development REITs (D-REITs): These focus on financing the construction of new real estate projects. Developers utilize D-REITs to raise capital for large-scale projects, such as residential complexes, commercial buildings, or mixed-use developments. Investors in D-REITs anticipate returns from the eventual sale or lease of the completed properties. Example of this REIT include Acorn D-REIT.

- Income REITs (I-REITs): These are designed for properties that generate consistent rental income. I-REITs appeal to investors seeking steady cash flow from established properties such as office buildings, shopping malls, or industrial parks.In Kenya examples of I-REITs include Acorn I-REIT and Stanbic Fahari I-REITs.

REITs in Kenya are governed by strict regulations aimed at safeguarding investors. They operate as collective investment schemes where a REIT manager oversees the fund's operations. Investors purchase units of the REIT, similar to shares in a company, granting them proportional ownership of the underlying real estate assets. These units are typically traded on the Nairobi Securities Exchange (NSE), providing liquidity and enabling investors to buy or sell their stakes easily.

REITs must allocate a significant portion of their income, often up to 90.0%to investors as dividends, making them attractive to those seeking regular income. Additionally, REITs benefit from tax incentives, such as exemptions on corporate tax, which enhance their appeal to both developers and investors.

REITs offer numerous advantages that make them a compelling option for real estate financing in Kenya:

- REITs provide developers with an efficient way to raise substantial capital without incurring debt. This is particularly beneficial for large-scale projects requiring significant upfront investment.

- By pooling funds from multiple investors, REITs distribute the risk associated with real estate investments. Individual investors are exposed to a diversified portfolio of properties rather than a single project.

- Unlike traditional real estate investments, REITs offer higher liquidity as units can be traded on the NSE. This enables investors to enter or exit their positions with relative ease.

- The mandatory dividend distribution ensures that investors receive consistent returns, making REITs an attractive option for income-focused individuals.

- REITs are managed by experienced professionals who oversee property acquisition, development, and management, reducing the operational burden on investors.

While REITs have significant potential, their adoption in Kenya has been slow due to several challenges:

- Many potential investors and developers are unfamiliar with how REITs operate or their benefits, hindering widespread participation.

- The stringent requirements for establishing and managing REITs can be daunting for developers and fund managers. These include high initial capital requirements and rigorous compliance standards.

- Concerns over transparency and governance have led to skepticism among some investors. Ensuring robust oversight and clear communication is essential to building trust.

- While REIT units are tradable, the relatively low participation in the Kenyan market can limit liquidity, especially during economic downturns.

The future of REITs in Kenya looks promising, especially with increasing demand for affordable housing and commercial spaces. As awareness grows and regulatory frameworks evolve, REITs are likely to play a more significant role in mobilizing capital for real estate development. Government support, including tax incentives and public awareness campaigns, could further stimulate the growth of this sector.

Real Estate Investment Trusts offer a powerful platform for bridging the financing gap in Kenya's real estate sector. By leveraging collective investment mechanisms, REITs provide developers with much-needed capital while offering investors a chance to participate in the lucrative property market. Addressing existing challenges and fostering a supportive environment will be crucial for realizing the full potential of REITs in transforming Kenya’s real estate landscape.

- Crowdfunding Platforms

Crowdfunding has gained traction in Kenya as a modern way to finance real estate projects. Developers leverage online platforms to raise small contributions from a large number of investors. This approach is particularly useful for smaller or community-based projects where traditional financing is challenging to obtain. Crowdfunding allows developers to engage with a broader audience, fostering community involvement and support. However, it requires a compelling pitch and robust marketing to attract investors. Additionally, regulatory frameworks governing crowdfunding in Kenya are still in their infancy, posing risks for both developers and investors.

- Joint Ventures

Joint Ventures (JVs) have become a cornerstone for real estate financing in Kenya, especially in scenarios requiring shared resources and expertise. A Joint Venture is a strategic partnership between two or more entities; typically developers and landowners to co-develop a project and share profits or benefits. These partnerships are particularly prevalent in Kenya due to high land costs and the capital-intensive nature of large-scale projects.

Joint Ventures in Kenya often involve landowners contributing their land as equity, while developers bring the capital, technical expertise, and project management skills. This arrangement minimizes the need for upfront cash investment by developers and ensures that landowners participate in the financial success of the development. Legal agreements outlining profit-sharing, roles, and dispute resolution mechanisms form the backbone of such partnerships, ensuring transparency and trust.

JVs offer a variety of benefits which include: i) Joint Ventures facilitate resource pooling, allowing parties to leverage each other's strengths ii) Developers reduce their financial burden by avoiding land acquisition costs, while landowners gain access to modern developments and potential property appreciation, iii) Furthermore, JVs promote risk-sharing, with each party bearing a portion of the financial and operational risks. Despite their advantages, they often face some challenges which include: i) JVs require meticulous planning and clear communication, ii) Disputes over profit distribution, project timelines, and management decisions are common and can derail projects, and, iv) Additionally, the complexity of drafting equitable agreements often necessitates professional legal and financial advisory, which adds to initial costs. Aligning the interests of all parties is critical to ensuring the venture’s success.

- Islamic Financing

Islamic financing has become an attractive alternative for developers in Kenya, particularly within Muslim-majority regions or communities. This Sharia-compliant financing method prohibits the charging of interest, focusing instead on profit-sharing or lease-based arrangements. Products such as Murabaha (cost-plus financing) and Ijarah (lease financing) enable developers to access funds ethically while adhering to Islamic principles. The growing presence of Islamic banks in Kenya has made these options more accessible. However, the complexity of structuring Sharia-compliant agreements and limited market penetration remain barriers to widespread adoption.

- Venture Capital

Venture Capital (VC) is an emerging financing option in Kenya’s real estate sector, targeting innovative and high-growth projects. Traditionally associated with startups, VC funding has found relevance in developments such as affordable housing and tech-driven real estate solutions.

VC firms provide significant capital to projects in exchange for equity stakes. They often focus on developments with unique value propositions, such as incorporating smart technologies or addressing housing shortages. Unlike traditional lenders, venture capitalists also offer strategic guidance, leveraging their expertise and networks to enhance project viabilityVenture Capital benefits includes: i) VC injects substantial funding into projects, enabling developers to undertake ambitious initiatives that might not be feasible with conventional loans, ii) the collaborative nature of VC funding provides developers access to mentorship and strategic partnerships, iii) the equity-based model means that developers are not burdened with immediate repayment obligations, offering flexibility during early project stages. Despite these advantages various challenges affect venture capital which includes, i) securing VC funding in Kenya remains competitive, with firms prioritizing projects that demonstrate scalability and innovation, ii) the expectation of high returns can exert pressure on developers to achieve rapid profitability. Furthermore, relinquishing equity means developers lose some control over their projects, which may not align with long-term goals

- Green Bonds

As environmental sustainability gains traction, Green Bonds are emerging as a preferred financing option for eco-friendly real estate projects in Kenya. These bonds are designed to raise capital exclusively for projects with environmental benefits, such as energy-efficient buildings and renewable energy integration. Green Bonds operate like traditional bonds but are tied to specific sustainability goals. Issuers must adhere to internationally recognized green bond standards, ensuring transparency and accountability. In Kenya, these bonds are gaining momentum as developers align with global environmental, social, and governance (ESG) trends. Acorn Holdings Limited Green bond was issued in October 2019 and give a return of 12.3% and this bond matured in October 2024.

Green Bonds attract environmentally conscious investors, offering developers access to a niche funding pool. They enhance a project’s marketability by showcasing its commitment to sustainability, which can appeal to tenants and buyers. Additionally, Green Bonds often come with favorable interest rates and government incentives, reducing the cost of financing. This financing option has some demerits such i) the issuance of Green Bonds in Kenya is still in its infancy, with limited awareness among developers and investors, ii) Adhering to stringent certification processes and standards can be time-consuming and costly iii) Furthermore, demonstrating measurable environmental impact requires robust monitoring systems, which can increase project complexity and costs.

Alternative financing options are reshaping Kenya’s real estate landscape, offering developers innovative ways to fund their projects. While each method has unique benefits and challenges, their strategic application can provide the necessary capital to drive growth in the sector. As developers continue to navigate an increasingly complex market, a balanced approach combining traditional and alternative financing methods will be essential for long-term success. By embracing these innovative methods, Kenya’s real estate sector can achieve sustainable growth while meeting diverse market demands. A strategic mix of these financing approaches can unlock new potentials and drive the industry forward

Section IV: Case study; REITs Performance in South Africa in 2024

- Overview of REITs performance in Sub-Saharan Africa

Real Estate Investment Trusts (REITs) have become a significant component of the real estate markets in Sub-Saharan Africa, offering investors opportunities to participate in the region's property sectors. Below is an overview of the REIT landscape across various Sub-Saharan African countries, including details on their establishment, registered REITs, industry size, and primary investment sectors.

|

Cytonn Report: Distribution of REITs investments in Sub-Saharan Africa |

||||

|

Country |

Year of Establishment |

Registered REITs |

Size of Industry (Mn USD) |

Primary Sectors Invested |

|

South Africa |

2013 |

33 |

21,359.0 |

Diversified, Retail, Office, Industrial |

|

Kenya |

2013 |

4 |

2,547.0 |

Retail, Commercial, Student accommodation |

|

Nigeria |

2007 |

3 |

131.0 |

Residential, Commercial |

|

Ghana |

2018 |

1 |

N/A |

Residential, Commercial |

|

Zambia |

2020 |

1 |

N/A |

Residential, Commercial |

Source: Center of Affordable Housing

The REIT markets in Sub-Saharan Africa are still developing, with South Africa leading in terms of market size and diversity of investment sectors. Other countries are gradually establishing their REIT frameworks, focusing on various property sectors, including commercial and residential real estate.

- REITS performance in South Africa

In 2024, Real Estate Investment Trusts (REITs) in South Africa have demonstrated remarkable resilience and growth, becoming a focal point for investors seeking strong returns amidst global economic uncertainties. The performance of REITs has been influenced by a mix of macroeconomic factors, strategic asset management, and evolving market dynamics.

South African REITs operate within a sophisticated framework regulated by the Johannesburg Stock Exchange (JSE), offering investors exposure to a diversified portfolio of income-generating properties. As of 2024, the market capitalization of the REIT sector has surpassed R 400.0 bn, reflecting robust investor confidence and recovery from previous economic downturns. This recovery is evident in the SA Property Index (SAPY), which has outperformed other asset classes, delivering year-to-date returns exceeding 30.0%.

The sector’s growth has been driven by a combination of favorable monetary policies, including interest rate cuts by the South African Reserve Bank, and strategic adjustments by REITs to optimize asset performance. Lower interest rates have reduced borrowing costs, enabling REITs to enhance their profitability and attract investment.

- Performance Drivers for REITs in South Africa

- Strategic Asset Management: Many REITs have undertaken significant asset optimization strategies, including divestment of non-core properties and reinvestment in high-performing assets. For example, Hyprop Investments has focused on bolstering its retail property portfolio, aligning with consumer demand shifts and improving occupancy rates. Similarly, Growthpoint Properties has diversified its portfolio geographically, leveraging its presence in both local and international markets.

- Interest rates and inflation: The reduction in interest rates has played a pivotal role in the sector’s resurgence. Lower rates have decreased the cost of debt, improved net operating income, and enhanced the overall value of property portfolios. Additionally, REITs in South Africa have shown resilience against inflationary pressures by adjusting rental agreements and incorporating rent escalations to maintain steady revenue streams.

- Sectoral shifts: Retail and industrial properties have emerged as high-performing sectors within the REITs space. Retail REITs have benefited from increased consumer spending, while industrial REITs have capitalized on the growing demand for logistics and warehousing facilities, driven by the e-commerce boom. Conversely, office spaces continue to face challenges due to remote work trends, prompting REITs to repurpose or reimagine these assets.

Despite their strong performance, South African REITs have encountered challenges, including; i) fluctuations in the global and domestic economy have created volatility in property valuations and rental income streams, ii) rising utility and maintenance costs have exerted pressure on profit margins, iii) adhering to stringent JSE listing requirements and tax regulations requires robust governance and financial planning ,and, iv) Certain segments, such as office spaces, continue to grapple with elevated vacancy levels, necessitating innovative leasing strategies

- Key players and their strategies

- Growthpoint Properties: Growthpoint remains a market leader, with a diversified portfolio spanning retail, office, and industrial properties. In 2024, the company announced significant investments in mixed-use precincts to address evolving tenant demands. Despite a 10.0% decline in annual distributable income due to high interest rates, Growthpoint’s strategic initiatives signal long-term growth potential.

- Hyprop Investments: Hyprop has outperformed expectations by focusing on retail assets, achieving higher foot traffic and sales turnovers in key shopping centers. Strategic disposals and reinvestments have enhanced its financial position and operational efficiency.

- Attacq Limited: Attacq has prioritized precinct developments, leveraging its expertise to create integrated, sustainable urban spaces. The company’s emphasis on mixed-use developments has positioned it favorably in the market.

South African REITs have showcased their ability to navigate complex market dynamics, delivering impressive returns and reaffirming their value proposition to investors. By embracing innovation, sustainability, and strategic asset management, REITs are poised to continue their trajectory of growth, contributing significantly to the country’s economic development. The outlook for South African REITs in 2024 and beyond remains positive. Key factors shaping the future of the REITs includes; i) increasing focus on ESG (Environmental, Social, and Governance) criteria will drive investments in green buildings and energy-efficient properties, ii) adoption of PropTech solutions will streamline operations and improve tenant experiences, and, iii) expanding into emerging sectors such as data centers and healthcare facilities offers growth opportunities. While challenges such as potential interest rate fluctuations and economic uncertainties persist, the sector’s adaptability and strategic foresight position it as a resilient and attractive investment avenue.

Section V: Recommendations

Increasing access to funding for real estate development requires a combination of government intervention, private sector innovation, and financial sector reforms. Below are detailed strategies to achieve this goal:

- Enhance government policies and incentives: Tax incentives can provide tax rebates, exemptions, or deductions to developers engaged in affordable housing or green building projects. For example, offering VAT exemptions on construction materials for low-income housing can significantly reduce project costs. Public-Private Partnerships (PPPs) allow governments to partner with private developers to execute large-scale projects, involving cost-sharing arrangements, risk mitigation mechanisms, and easier access to land. Establishing government-managed land banks ensures developers have access to affordable and strategically located land, reducing initial capital barriers. State or national housing funds can be created to provide subsidized loans for developers focused on affordable housing.

- Strengthen financial institutions: Development banks or financial institutions focused on real estate development can offer low-interest loans and technical assistance. Loan guarantee schemes, backed by the government, reduce risk for commercial banks and other lenders, encouraging them to provide credit to developers. Long-term financing products with extended repayment terms align better with project cash flows for real estate projects with long gestation periods. Governments can subsidize interest rates for loans directed toward high-impact real estate projects such as affordable housing or infrastructure-linked developments.

- Promote alternative funding sources: Real Estate Investment Trusts (REITs) allow developers to access pooled investments from multiple investors. Streamlined regulations and tax benefits can make REITs attractive to both local and foreign investors. Crowdfunding platforms connect developers with small-scale investors, allowing them to raise equity or debt capital from a broader pool. Green bonds, issued for environmentally sustainable real estate projects, can attract institutional investors seeking to meet ESG (Environmental, Social, and Governance) criteria. Securitization of mortgages provides banks and financial institutions with additional liquidity to lend to developers.

- Increase transparency and reduce risks: Streamlining and digitizing building codes, zoning laws, and project approval processes can reduce bureaucratic delays and associated costs. Governments must prioritize digitizing land records and expediting the issuance of title deeds to eliminate disputes and instill confidence among lenders and investors. Publicly accessible databases with real-time information on property prices, demand trends, and construction costs enable data-driven decision-making by developers and financiers.

- Encourage capacity building to create awareness: Training programs can be organized for developers on topics like financial planning, risk management, and sustainable construction practices. Advisory institutions or desks within financial institutions can guide developers on structuring projects and accessing funding. Knowledge-sharing platforms can create forums for developers, financiers, and policymakers to share insights and experiences.

- Facilitate access for small-scale developers: Microfinance institutions (MFIs) can develop tailored financial products for small and medium-sized developers to enable them to access affordable credit. Smaller developers can form cooperatives or joint ventures to pool resources and undertake larger projects. Technical and financial advisory support can be provided to small-scale developers to improve their creditworthiness and project management skills.

- Attract foreign direct investment (FDI): Simplifying investment processes by reducing red tape and creating single-window clearance systems for foreign investors can facilitate FDI. Incentives such as tax holidays, repatriation benefits, or preferential treatment in specific zones can attract foreign investment. Actively marketing the country’s real estate opportunities at international forums and trade fairs can also attract global investors.

- Digital innovations in financing: Blockchain can create transparent and secure systems for property transactions and financial records, reducing fraud and improving investor confidence. PropTech platforms can connect developers with lenders, investors, and service providers. Fintech innovations can provide faster, data-driven credit assessments for real estate projects through digital lending.

Implementing these measures can significantly improve access to funding for real estate development. This will not only stimulate economic growth but also address critical housing and infrastructure deficits. Collaboration between governments, private developers, financial institutions, and technology providers is essential to unlock the full potential of the real estate sector.

Section VI: Conclusion

Financial constraints remain a significant hurdle for developers in Kenya, primarily due to the limited availability of diverse financing options. Traditionally, real estate investments have relied on conventional funding sources such as debt financing, equity financing, and personal savings. While these methods have supported many projects, they are often insufficient to meet the growing demand for large-scale developments. To address this issue, developers can consider alternative financing mechanisms that have gained traction globally. These include Real Estate Investment Trusts (REITs), which pool funds from multiple investors to finance income-generating properties; structured financial products such as mortgage-backed securities; and Public-Private Partnerships (PPPs) that leverage collaboration between the public and private sectors to execute projects more efficiently.

Additionally, there is an urgent need for policy reforms to expand the role of capital markets in project financing. In Kenya, capital markets currently contribute a negligible 5.0% to real estate financing, a stark contrast to developed countries where they provide approximately 60.0% of funding. The remaining 40.0% in these markets typically comes from debt financing through banks, highlighting a balanced and robust financial ecosystem.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.