CHYF Fact Sheet June 2020

By Research Team, Jul 1, 2020

1. FUND PERFOMANCE

|

AVERAGE |

2019 |

JUNE 2020 (ANNUALIZED RETURN) |

*PERFORMANCE SINCE INCEPTION (07-OCTOBER-2019) |

|

Cytonn High Yield Fund (CHYF) |

12.8% |

14.0% |

13.6% |

|

Benchmark (Average 182 day T- Bill + 5.0% points) |

12.7% |

12.9% |

13.0% |

*Historical Percentage you can expect to earn with the fund during one year of investment on basis of the so far realized monthly returns

2. FUND MANAGER’S REPORT AND OUTLOOK

Fund Objective

The Cytonn High Yield Fund is a specialized Collective Investment Scheme with exposure skewed towards investment in real estate assets. The Fund aims at capital preservation while earning high returns and maintaining sufficient liquidity. The Fund aims to achieve above average returns that not only beat inflation but are also better than the yields o"ered by both government securities and fixed deposit.

Portfolio Strategy

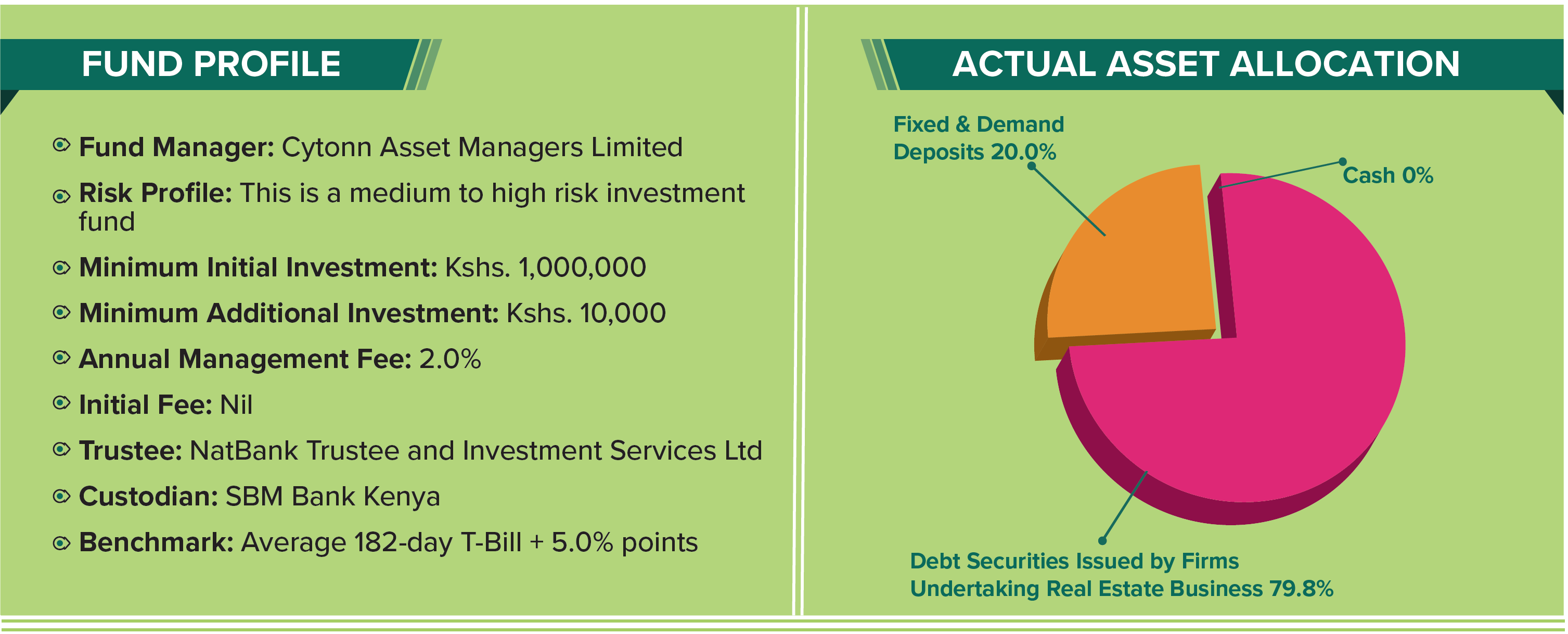

The fund will largely be invested in fixed income and real estate related securities. Being a specialized Fund, the Fund can invest up to 80.0% in real estate funds, but to ensure sufficient diversification no single investment should be more than 25.0% of the portfolio unless in special cases.

Economic report and outlook

Economic growth has remained subdued due to the ongoing COVID-19 pandemic, which has disrupted various sectors. According to the recent pronouncement, from the June Monetary Policy Committee press release, most recent economic indicators points that growth in Q1’2020 was strong, as the impact of COVID-19 virus was majorly pronounced in April 2020. There was however a notable recovery in the economy in May 2020 driven by increased agricultural output and exports. There has been pressure on interest rates with the yield curve shifting upwards from the December levels, which has seen the FTSE NSE Kenya Government Bond Index shed 1.0% YTD, this is despite a cumulative 1.5% points’ downward revision of the Central Bank Rate (CBR) since the beginning of the year to the current rate of 7.0%. On the short end of the yield curve, the Central Bank of Kenya has managed to maintain the yields relatively stable with the 91 day T-Bill declining to 6.7% in June, from 7.3% recorded in May. Inflation has remained within the Central Bank’s target of between 2.5% and 7.5%, with the June inflation coming in at 4.6% a decline from 5.3% in May, driven by a 1.3% decline in the food and non-alcoholic drinks’ Index, coupled with a 0.8% decline in the housing, water, electricity, gas and other fuels’ index. Slight pressure has been recorded on the Kenyan Shilling on the back of increased dollar demand from merchandise importers as the easing of coronavirus restrictions jumpstart economic activities, thus boosting demand for hard currency but we do not foresee further declines as the Central Bank remains active in the market to cushion the shilling.

Portfolio Performance

The Cytonn High Yield Fund successfully delivered above-market returns in June, averaging 14.0% against the benchmark return (Average 182-day T-Bill plus 5.0% points) at 12.9%.

Disclaimer: Past performance is not a guarantee of future performance and the value of the fund will fluctuate from time to time.