CMMF Fact Sheet September 2020

By Research Team, Oct 1, 2020

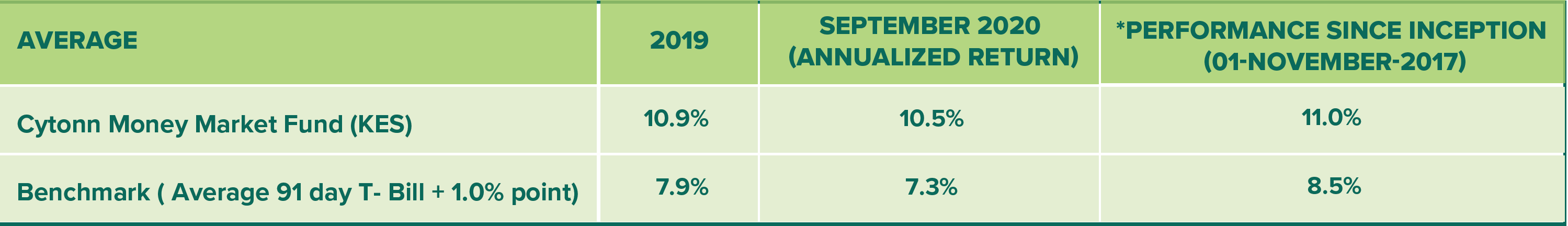

1. FUND PERFOMANCE

* Percentage you can expect to earn with the fund during one year of investment on basis of the so far realized monthly returns since inception.

2. FUND MANAGER’S REPORT AND OUTLOOK

Fund Objective

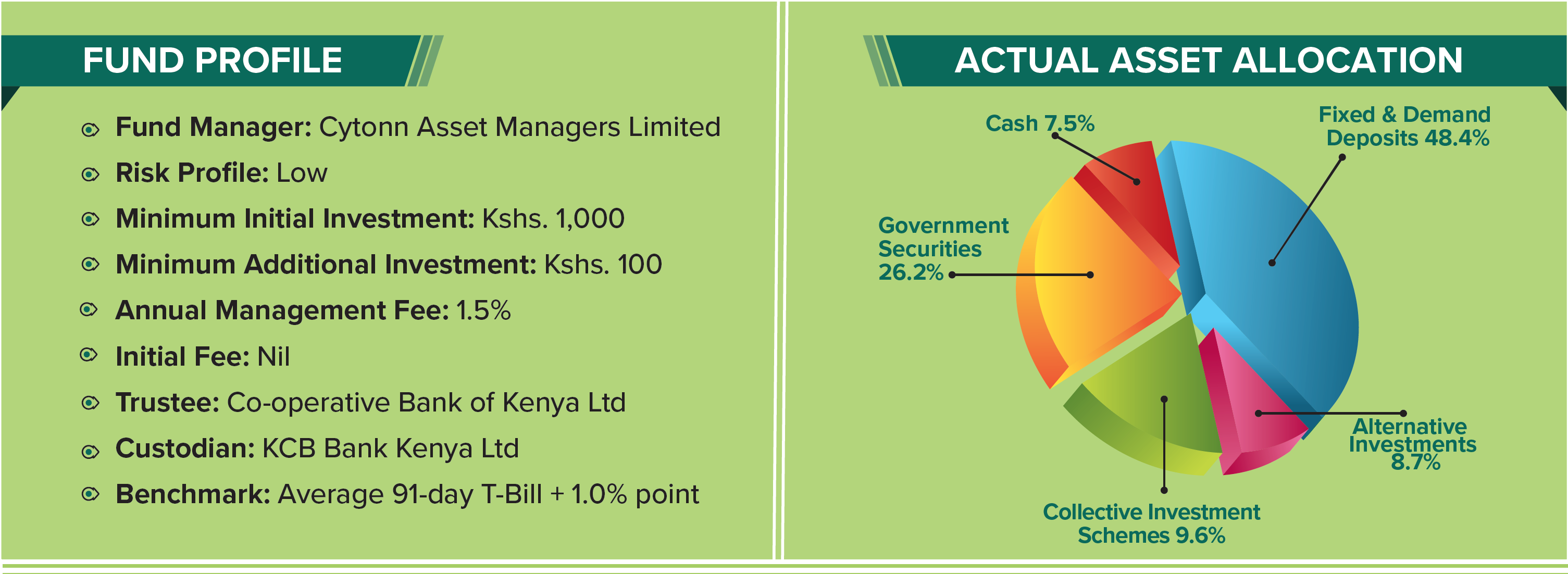

The Cytonn Money Market Fund is a low-risk fund that seeks to obtain a high level of current income while protecting investor’s capital and liquidity.

Portfolio Strategy

The portfolio objective will be to outperform the income yield available on money market call accounts and fixed deposit accounts by investing in interest-bearing securities and other short-term money market instruments. These securities are usually available to the wholesale or institutional clients. The Fund will also be managed conservatively with active management of duration, credit and liquidity risks.

Portfolio Performance

The Cytonn Money Market Fund successfully delivered above-market returns in September 2020, averaging 10.5% p.a. The Fund outperformed the industry average and its benchmark of 91-day T-Bill+1% points at 7.3%.

Economic report and outlook

According to Kenya National Bureau of Statistics (KNBS), the economy recorded subdued growth of 4.9% in Q1’2020, lower than 5.5% in Q1’2019 a 2-year low, mainly supported by the Agricultural sector which recorded a slightly faster growth of 4.9%, compared to 4.7% seen in Q1’2019, coupled with slower growth in other sectors attributable to eects emanating from the COVID-19 pandemic. During the month, there was a marginal downward readjustment on the yield curve, which saw the FTSE NSE Kenya Government Bond Index gain by 0.1%, taking the YTD performance to a 1.2% gain. The downward readjustment is mainly attributable to increased demand, due to the bias by banks towards government securities as opposed to lending due to increased credit risk. Inflation has remained within the Central Bank’s target of between 2.5% and 7.5%, with the September y/y inflation coming in at 4.2%, a decline from 4.4% in August, driven by a 0.1% decline in the Housing Water, Electricity, Gas and other fuels’ index coupled with a 0.01% decline in the Transport index. During the month, the Kenyan shilling remained under pressure against the US dollar, losing by 0.3%, to close the month at Kshs 108.5 from Kshs 108.2 in August, mainly attributable to increased end-month importer dollar demand amidst lackluster dollar inflows Going forward, Cytonn Asset Managers Limited (CAML) expects the Cytonn Money Market Fund (CMMF) to continue to deliver above-average returns leveraging on optimal asset allocation in line with the Fund’s Investment Policy Statement.

As of 30th September 2020, cash, bank deposits and government securities constituted 82.1% of the portfolio

Disclaimer: Past performance is not a guarantee of future performance and the value of the fund will fluctuate from time to time.