CMMF Fact Sheet December 2020

By Research Team, Jan 19, 2021

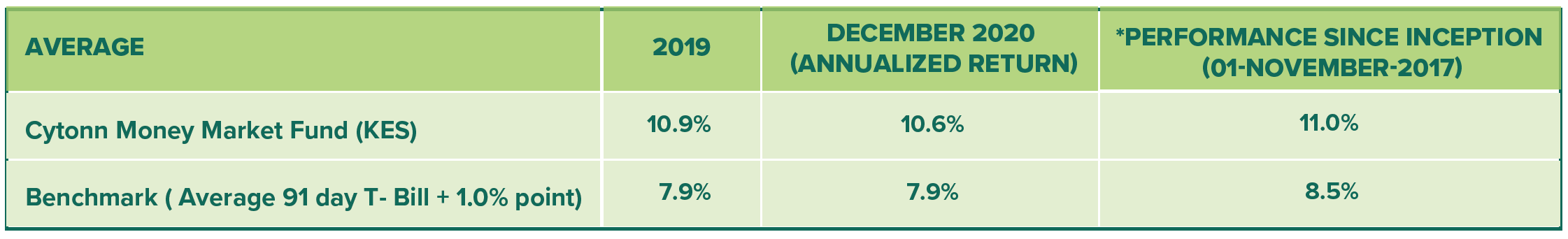

FUND PERFORMANCE

FUND MANAGERS REPORT AND OUTLOOK

Fund Objective

The Cytonn Money Market Fund is a low-risk fund that seeks to obtain a high level of current income while protecting investor’s capital and liquidity.

Portfolio Strategy

The portfolio objective will be to outperform the income yield available on money market call accounts and fixed deposit accounts by investing in interest-bearing securities and other short-term money market instruments. These securities are usually available to the wholesale or institutional clients. The Fund will also be managed conservatively with active management of duration, credit and liquidity risks.

Economic Report and Outlook

According to Kenya National Bureau of Statistics (KNBS), the Kenyan economy recorded a 5.7% contraction in Q2’2020 down from a growth of 5.3% recorded in a similar period of review in 2019. This was the first contraction since the Q3’2001 when the country recorded a 2.5% contraction. The overall performance was cushioned by growths in Agriculture, Forestry and Fishing activities which grew by 6.4%; Financial and Insurance activities, 1.7%; Construction, 3.9%; Real Estate Activities, 2.2% and Mining and Quarrying activities, 10.0%. Accommodation & tourism and the Education sectors were the hardest hit, declining by 83.3% and 56.2% respectively. During the month, there was an upward readjustment on the yield curve, which saw the FTSE NSE Kenya Government Bond Index shed 0.3%, taking the YTD performance to a 2.6% gain. Yields on shorter dated papers were on the rise with the 91-day, 182-day and 364-day papers gaining by 19.9 bps, 21.0 bps, and 18.7 bps, to 6.9%, 7.4% and 8.3%, respectively. During the month, the Kenyan shilling gained by 0.8% against the US dollar, losing by 1.1%, to close the month at Kshs 109.2 from Kshs 110.1 in November, partly attributable to the easing of the US dollar against other world currencies as well as support activities by the Central Bank of Kenya.

Going forward, Cytonn Asset Managers Limited (CAML) expects the Cytonn Money Market Fund (CMMF) to continue to deliver above-average returns leveraging on optimal asset allocation in line with the Fund’s Investment Policy Statement.

Portfolio Performance

The Cytonn Money Market Fund successfully delivered above-market returns in December 2020, averaging 10.6% p.a. The Fund outperformed the industry average and its benchmark of 91-day T-Bill+1% points at 7.9%.

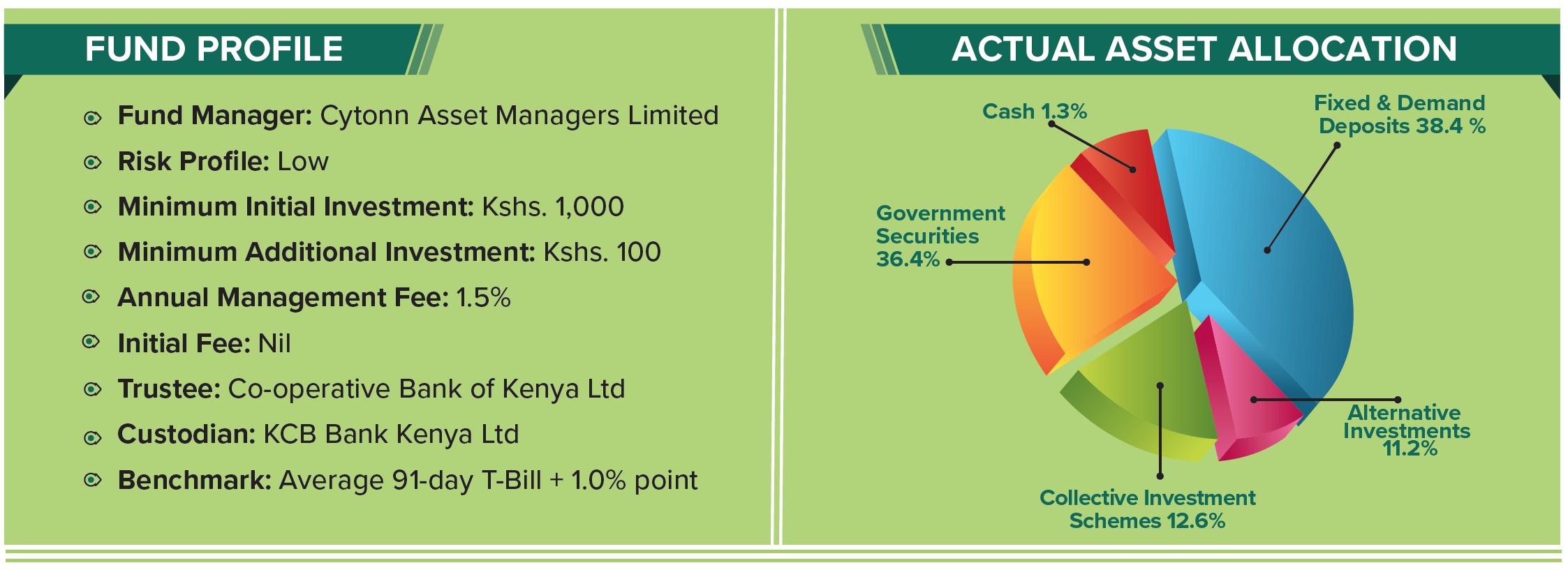

As of 31st December 2020, cash, bank deposits and government securities constituted 76.1% of the portfolio

FUND PROFILE

- Fund Manager: Cytonn Asset Managers Limited

- Risk Profile: Low

- Minimum Initial Investment: 1,000

- Minimum Additional Investment: 100

- Annual Management Fee:1.5%

- Initial Fee: Nil

- Inception Date: 01- November-2017

- Trustee: Co-operative Bank of Kenya Ltd

- Custodian: KCB Bank Kenya Ltd

- Benchmark: Average 91-day T-Bill plus 1.0% points

Actual Asset Allocation

Disclaimer: Percentage you can expect to earn with the fund during one year of investment on basis of the so far realized monthly returns since inception.