Cytonn 2020 Markets Outlook- Real Estate Sector

By Cytonn Investments, Jan 12, 2020

Executive Summary:

Residential Sector: Our outlook on residential sector performance remains NEUTRAL. We expect that uptake as well as development activity will remain subdued as the negative effects of a sluggish economy persist into the year. Investment opportunity is in low to mid-end markets such as Athi River, Ruaka and Thindigua, for potential buyers, and upper mid-end markets such as Parklands for rental property;

Commercial Office Sector: Our outlook for the commercial sector is NEGATIVE as the sector’s performance continues to be constrained by oversupply of 5.6 mn SQFT as at 2019. The sector however has pockets of value in zones with low supply and high returns such as Gigiri, and in differentiated concepts such as serviced offices, which record relatively high rental yields of up to 13.4% p.a.;

Retail Sector: We have a NEUTRAL outlook for the sector with a bias towards negative due to existing oversupply of space estimated at 2.8 mn SQFT. We remain optimistic that the sector’s performance will be cushioned by the entry of international retailers and the expansion of local retailers such as Naivas and Tuskys. The investment opportunity is in Kenyan County headquarters in some markets such as Kiambu and Mt. Kenya that have an estimated retail space demand of 0.8mn and 0.2mn SQFT, respectively;

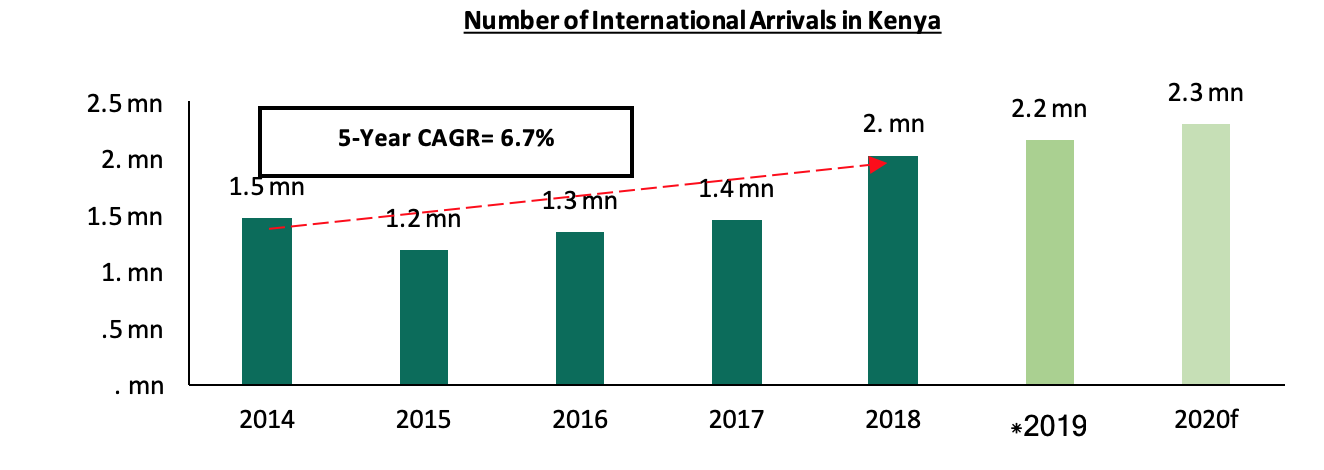

Hospitality Sector: Our outlook for serviced apartments is POSITIVE. Given the country’s political stability and the continued marketing of Kenya as an experience destination, we expect the number of international arrivals to grow annually by 6.7% to approximately 2.3 mn in 2020, from the estimated 2.2 mn in 2019. The investment opportunity is in (i) Westlands & Parklands, and (ii) Kilimani submarkets, which recorded relatively high rental yields of 10.8% and 9.5% in 2019, respectively;

Land Sector: We have a POSITIVE outlook for the land sector. We expect an annual capital appreciation of 3.9% in 2020, fueled by the growing demand for development land especially in the satellite towns, and the improving infrastructure for instance the dualling of the Northern by-pass which on completion is expected to opened up areas such as Ruaka for development, and the dualling of Ngong Road phase 2 which will enhance access to areas such as Lang’ata, Karen and Dagoretti. The investment opportunity within the Nairobi Metropolitan Area land sector lies in satellite towns (unserviced land) such as Utawala and Limuru, and suburbs such as Karen, Kitisuru, Runda and Kilimani supported by the relatively high annual capital appreciation of above 10.0%;

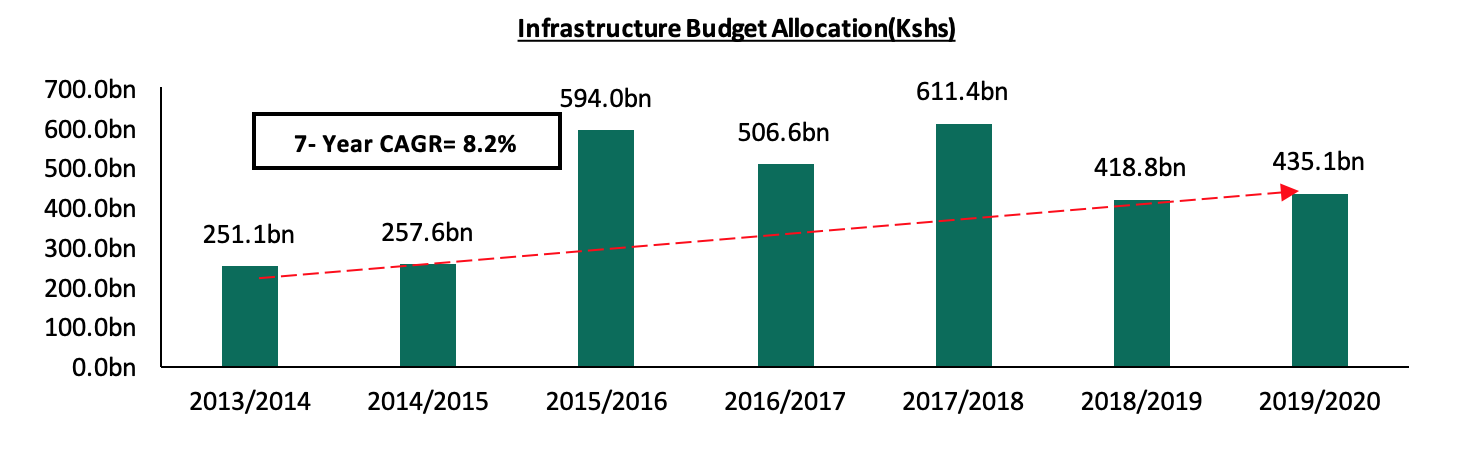

Infrastructure Sector: We have a POSITIVE outlook for the infrastructure sector, given the demonstrated government commitment towards transforming the country to middle-income status by 2030 through infrastructural upgrades. We expect execution of the planned infrastructure development such as sewer connection in Ruiru and Kitengela, water improvement program and the ongoing road and power projects in the pipeline, which will open these areas for real estate development;

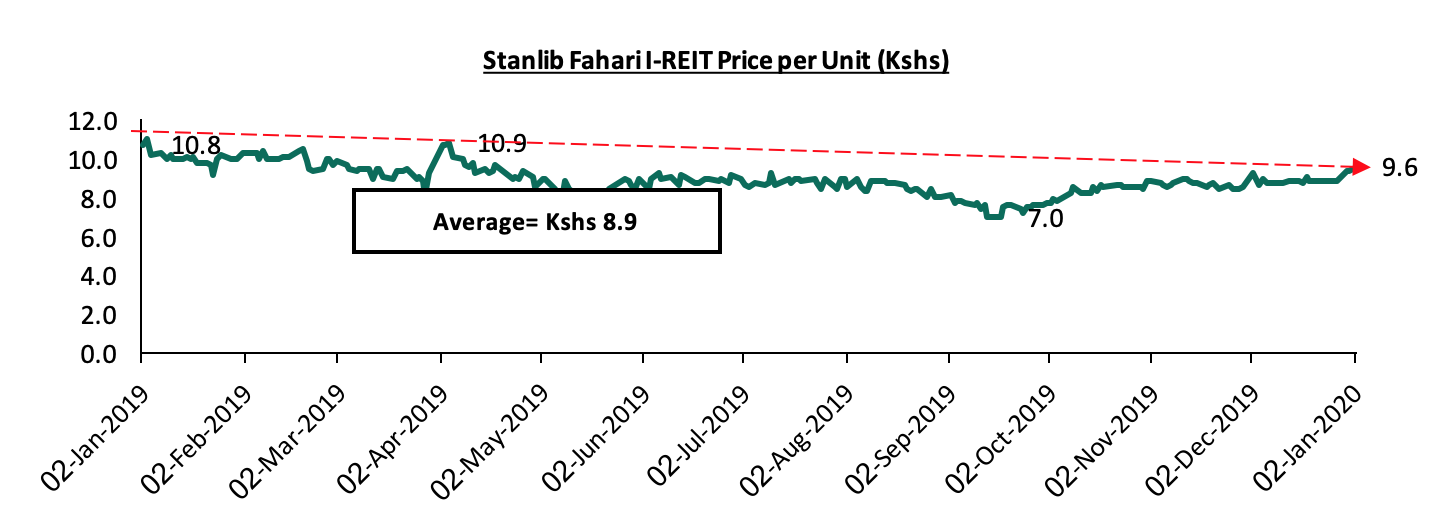

Listed Real Estate Sector: We retain a NEGATIVE outlook for the REIT market due to insufficient market structures and poor market sentiment. We expect real estate stakeholders such as the East Africa Forum for Alternative Investments and REITs Association of Kenya to continue working at improving the market sentiment on REITs, coupled with government efforts to improve the regulatory structures surrounding the REIT market.

Real Estate

In 2019, the real estate sector grew by 4.8% on average from Q1’2019 to Q3’2019, 0.3% points higher than the growth rate recorded over the same period in 2018, according to Kenya National Bureau of Statistics (KNBS) Quarterly Gross Domestic Product Report Q3'2019. The growth was supported by:

- Continued National Government support for the affordable housing initiative,

- Increased entry of multinational corporations and retailers into the country,

- Infrastructural improvements, boosting Nairobi’s positioning as a regional hub,

- Rapid population growth, creating demand for more properties, especially housing, and,

- Improving the macroeconomic environment, with the country’s GDP growing by 6.3% in 2018, 1.4% points higher than the 4.9% recorded in 2017 and is expected to come in at 5.6% in 2019 according to Cytonn Research.

In terms of performance, commercial office, retail, residential, mixed-use developments and serviced apartments sectors registered average rental yields of 7.5%, 7.8%, 5.0%, 7.3%, and 7.6%, respectively, resulting to an average rental yield for the real estate market of 7.0%, 0.4% points lower compared to 7.4% recorded in 2018. Therefore, with a capital appreciation for existing properties at 2.0%, average total returns came in at 9.0%, 2.2% points decline from 11.2% recorded in 2018. For a detailed review of 2019 performance, see Cytonn Annual Real Estate Markets Review Note 2019.

In 2020, we expect the key drivers of real estate to be as follows:

- Improving Macroeconomic Environment - The country’s GDP grew by 6.3% in 2018, 1.4% points higher than the 4.9% recorded in 2017 and is expected to come in at 5.6% and 5.7% in 2019 and 2020, respectively, according to Cytonn Research. We expect that the improvement will enhance the growth of business and thus increased real estate activities,

- Attractive Demographic Profile – Demographic trends such as (i) rapid urbanization, currently at 4.3% p.a. in Kenya, against global and Sub-Saharan averages of 2.0% and 4.1%, respectively, (ii) an expanding middle class evidenced by growth in net disposable income, which increased to Kshs 7.1 tn in 2017 from Kshs 6.6 tn in 2016, and (iii) rapid population growth rates currently at 2.2%, 1.3% points higher than global averages of 0.9%, will continue to support demand in the real estate sector, and,

- Sustained Infrastructural Development – The government increased the 2019/2020 budget allocation towards infrastructural development to Kshs 435.1 bn, 3.9% higher than 418.8 bn allocated for FY 2018/19, which shows the government’s efforts aimed at transforming the country to middle-income status by 2030 through infrastructural upgrades, which we expect will continue opening up new areas for real estate development and boosting performance in upcoming markets, especially satellite towns in Kenya.

Despite the above drivers, the sector is expected to be constrained by;

- Delay in Processing of Construction Permits - Continued delays in the processing of construction permits by some Kenyan County Governments, namely, Nairobi, Kisumu, Kiambu, and Mombasa, was a major setback for private developers in 2019 as it resulted in prolonged project implementation timelines. Given that the issue is yet to be resolved, we expect this to continue crippling the sector in 2020,

- Oversupply in Select Sectors - The real estate sector has witnessed increased space supply over the last 5-years;

- Increased supply in the middle and high-end residential sector (houses with prices above Kshs. 119,535 per SQM) with a decreasing effective demand, hence recording 3.4% points decline in annual uptake from 22.8% in 2018 to 19.4% in 2019,

- The commercial office sector has an oversupply of 5.2 mn SQFT and this is expected to grow to 5.6 mn SQFT in 2020, with completion of buildings such as Kenya Institute of Supplies Management(KISM) headquarters along Ngong Road and Parliament Tower in the CBD,

- The retail sector, which has an existing oversupply of 2.8 mn SQFT.

- Inaccessibility and Unaffordability of Off-take financing - Access to mortgages in Kenya remains low mainly due to; (i) low-income levels that cannot service a mortgage, (ii) relatively high property prices, (iii) high interest rates and deposit requirements which lock out many borrowers, (iv) exclusion of the informal sector due to insufficient credit risk information, and (v) lack of capital markets funding towards real estate purchases for end buyers. According to Central Bank of Kenya, there were only 26,504 active mortgage accounts in Kenya as at December 2018 against a total adult population of approximately 23 mn persons, leading to low real estate uptake,

- Ineffectiveness of Public-Private Partnerships (PPPs) for Housing Development - The government has previously enlisted the help of the private sector for financing and development of affordable housing. This has however not achieved the optimal intended objective this far as a result of; (i) regulatory hindrances such as lack of a mechanism to transfer public land to a Special Purpose Vehicle (SPV) to facilitate access to private capital through the use of the land as security, (ii) lack of clarity on returns and revenue-sharing, (iii) the extended time-frame of PPPs while private developers prefer to exit projects within 3-5 years, and (iv) bureaucracy and slow approval processes,

- Despite being successfully launched in 2019, we expect the KMRC to face challenges such; (i) difficulty in raising funds through issuing of bonds, due to competition from government instruments such as treasury bills and government stocks, (ii) prolonged due diligence processes due to bureaucracy in departments offering critical services such as registration of properties, (iii) lack of access to long term funding, and (iv) a high cost of debt as the investors of the mortgage-backed bonds are likely to demand a relatively high rental yield of approximately 13.5%%, assuming a 1.0%-point margin above the minimum of the risk-free rate for a 15-year bond, which currently stands at 12.5%, yet KMRC’s target is providing mortgages at 9.0% interest. For more details, see our KMRC Topical,

- The unavailability of proper guidelines on the way forward for the newly approved institutions that can hold Home Ownership Savings Plan (HOSP) deposits. These include; (i) the general framework for business principles and general contract terms with respect to institutions that offer HOSPs, (ii) rules on permissible business activities by the Fund Managers, (iii) approved methods of investing the savings whether in the stock market or government securities, and (iv) guidelines on granting of loans after the ten years have elapsed and the appropriate loan-to-value ratio. For more details, see HOSP Update Topical, and

- Restrictive Capital Markets Structure: The current capital market structure is restrictive for market players looking to raise capital and deploying it towards real estate. The primary reason for the same is that Kenyan businesses currently face challenges raising capital due to dominance by the banking sector. Some of the challenges include:

- Conflicts of interest as only banks are currently licensed to be Trustees of Collective Investment Schemes (CIS’s) in Kenya, and this can lead to frustration of market players,

- There are players in the banking sector that are firmly in control of the capital markets. Similar to the way the banking sector has undergone reforms and in recent times been liberalized, there need to be similar reforms in the capital markets,

- A lot of capital raised towards real estate comes in the form of private offers. However, there is still not a lot of clarity on private offers and private equity for raising capital towards real estate, which needs to be provided, as not every offer needs to be regulated. This will ultimately lead to more private sector players raising and deploying capital to real estate,

- In order to spur deployment of capital towards growing homeownership, the Finance Bill of 2019 had a number of key measures. One of which was Inclusion of Unit Trust Fund Managers as Registered Home Ownership Savings Plan in the Finance Bill 2019. However, unless operationalized and specialized funds approved by CMA, there will be no benefit towards the Affordable Housing Big 4 Agenda. The effective date was January 1, 2020, and there has been no movement at all.

In 2020, some of the key factors expected to shape the real estate sector include;

- The Affordable Housing Initiative - The Kenyan Government’s affordable housing initiative focused on delivering 500,000 units by end of 2022, is expected to push developers’ effort towards the provision of more housing for the lower middle- and low-income earners segment. In support of the initiative, several tax incentives through the Financial Act of 2019, which include;

For developers:

- A reduction in the Import Declaration Fee (IDF) on inputs for the construction of houses under the affordable housing scheme approved by the CS Finance from 2% to 1.5%,

- Exemption of companies implementing projects under the affordable housing scheme from the application of thin capitalization rules, and

- Exemption of good supplied for the direct and exclusive use houses under the affordable housing scheme approved by the Cabinet Secretary (CS) for Finance from Value Added Tax (VAT),

For home buyers:

- An exemption of stamp duty for the transfer of a house constructed under the affordable housing scheme,

- Exemption from income tax of withdrawals from the NHDF to purchase a house by a first-time homeowner and,

- Exemption of the National Housing Development Fund from income Tax.

With the above tax and policy reforms, we expect more potential homeowners to join the affordable housing program in 2020, given the significantly reduced financial burden in the strive towards homeownership, and developers and other private sector players taking up affordable housing projects as they are bound to maximize on the reduced costs.

In addition, the government allocated Kshs 10.5 bn of the Kenya National Budget 2019/20 in support of the initiative and hence we expect increased development activities in 2020,

- Improved Mortgage Market – Following the National Treasury launch of the Kenya Mortgage Refinancing Company (KMRC) in 2019 and its successful mobilization of capital, we expect the institution to become fully operational in 2020, stimulating the mortgage market by enabling lenders to offer long-term mortgages. In addition, we expect the recent interest rate cap repealing will result in borrowers being able to access housing finance as banks increase credit advancement to the private sector,

- Devolution - Devolution has led to the increased population at County Government headquarters and neighboring towns through the relocation of County Government officials and businesses creating demand for commercial office and retail spaces as well as residential units. In addition, counties were allocated Kshs 371.6 bn in the 2019/2020, and we expect this to support infrastructural development,

- Government Partnerships – In 2020, the government is expected to enter into various partnerships such as Public Private Partnerships (PPPs), County Government & National Government partnerships and government & government partnerships, which we expect will support development and financing for the real estate sector, especially affordable housing and infrastructure.

The table below summarizes our outlook on the various real estate themes and the possible impact on the business environment in 2020:

Thematic Performance Review and Outlook

|

Thematic Performance Review and Outlook |

|||

|

Theme |

2019 Performance |

2020 Outlook |

Effect |

|

Residential |

• The residential market recorded a 3.4%-point drop in annual uptake, as more homebuyers opted for rental units amid a tough economic environment • However, average occupancy rates increased by 4.7% points resulting in a 0.3% points increase in average rental yields • Overall, apartments performed better with average total returns to investors of 6.8% compared to detached units with 5.3% • Apartments continued to be in high demand evidenced by average annual uptake and occupancy rates of 20.2% and 88.7%, respectively, in comparison to detached units with 18.7% and 82.6%, respectively |

• We expect that uptake will remain subdued as the negative effects of a sluggish economy persist into the year. However, renters market will continue to perform reasonably well and thus, occupancy rates will remain stable as development activity in matured markets such as Nairobi’s upper mid-end and high-end areas such as Kilimani, Upperhill, Parklands and others, also remains modest amid decline in available land for development • In 2020, we expect lower mid-end markets such as Riruta, Ruaka, Athi River, Runda Mumwe and Ridgeways, to continue attracting buyers and more developers owing to their relative affordability and good infrastructure • The sector will be highly defined by the focus on affordable housing, which we expect will begin to peak this year as the government rushes to deliver its 500,000 units promise in the next two years and the private sector becomes more engaged |

Neutral |

|

Commercial Office |

· The performance of commercial office sector performance softened recording 0.6% points and 3.1% points’ y/y decline in average rental yields and occupancy rates, to 7.5% and 80.2% in 2019, from 8.1% and 83.3%, respectively, in 2018 · Most notable openings included Xinhua Tower in Kilimani, Park Medical Centre in Parklands and Garden City Business Park along Thika Road · There’s an oversupply in the sector with the Nairobi region having an oversupply of 5.6 mn SQFT in 2019, that is forecasted to increase to 5.8 mn SQFT in 2020 |

· We forecast a decline of the average rental yield to 7.3% from 7.5% in 2019 as a result of the oversupply with the average occupancy rates expected to decline by 2.0% points from 80.2% to 78.2% · We expect monthly rental charges to stagnate at Kshs. 96 per SQFT per Month, just as the market has been charging over the last three years, as the market absorbs the current vacant stock of 5.6mn SQFT · The investment opportunity is in Grade A offices in zones with low supply and high returns such as Gigiri and in differentiated concepts such as serviced offices recording relatively high rental yields of up to 13.4% |

Negative |

|

Retail Sector |

· The performance of the retail sector softened with rental yields declining by 1.2% points to 7.8% in 2019 from 9.0% due to constrained consumer spending power and an introduction of 0.4 mn SQFT of retail space into the Nairobi Metropolitan Area (NMA) market · Retail spaces introduced in 2019 included The Well in Karen and the expansion of Sarit Centre in Westlands · Occupancy rates declined by 3.1% points, to 80.2% in 2019 from 83.3% in 2018 while rental rates recorded a 4.5% decline to Kshs 96 per SQFT in 2019 from Kshs 101 per SQFT in 2018 |

· We expect a drop in retail returns by 0.4% points as a result of the retail space oversupply currently at 2.8mn SQFT · We expect occupancy rates to decline by 2.2% points to 73.7% and rents to soften by 2.1% to Kshs 171.9 from Kshs 175.5 in 2019 · We forecast continued expansion efforts by both local and international retailers due to attractive rents and vacant spaces left by troubled retailers such as Nakumatt and Choppies, · The opportunity remains in county headquarters in some markets such as Kiambu and Mt. Kenya that have retail space demand of 0.8mn and 0.2mn SQFT, respectively, |

Neutral |

|

Hospitality Sector |

· In 2019, the hospitality sector registered improvement in performance, evidenced by the 0.2% points increase in the serviced apartments rental yield to 7.6%, from 7.4% recorded in 2018, attributable to increased demand, which triggered an increase in charge rates · The improved performance was supported by a stable political environment and improved security, thus making Nairobi an ideal destination for both business and holiday travelers

|

· Given the country’s improved security, political stability, the continued marketing of Kenya as an experience destination and improved air transport and flight operations we expect the number of international arrivals to grow by an annual appreciation of 6.7% to approximately 2.3 mn in 2020, resulting in a greater demand for hospitality services · We, therefore, expect occupancy rates for serviced apartments to grow to above 80%, with the investment opportunity being in Westlands & Parklands and Kilimani submarkets, which recorded relatively high rental yields of above 10.8% and 9.5%, respectively, in 2019 |

Positive |

|

Land Sector |

· In 2019, asking land prices within the NMA recorded an 8- year CAGR of 11.9% and a 2.0% y/y asking price change · The performance was driven mainly by; (i) the growing demand for development land especially in the satellite towns as developers strive to drive the government’s Big Four government agenda on the provision of affordable housing, (ii) improving infrastructure, and (iii) reduced supply of development class land at affordable prices in areas close to the Nairobi CBD |

· In 2020, we expect an annual capital appreciation of 3.9% in 2019, fueled by; (i) the growing demand for development land, (ii) improving infrastructure with projects such as the expansion of Waiyaki Way and the dualling of the Northern by-pass, set for completion in 2020, and (iii) positive demographics · For 2020, the investment opportunity within the Nairobi Metropolitan Area land sector lies in satellite towns (unserviced land) such as Utawala and Limuru, and suburbs such as Karen, Kitisuru, Runda and Kilimani supported by the relatively high annual capital appreciation of above 10.0% |

Positive |

|

Infrastructure |

· The infrastructural sector remained vibrant in 2019, in line with the country’s economic expansion goals to make Kenya the African hub for transportation, industrial, and service sectors · The government expenditure continued to increase, albeit at a decreasing rate following the realization of majority of the projects such as the completion of Phase 2A of the Standard Gauge Railway (SGR) project and the Outer Ring Exchange |

· The government allocated Kshs 435.1 bn in 2019/2020, which is 3.9% higher than 418.8 bn allocated for FY 2018/19 budget to infrastructural development · The increased allocation shows the government’s efforts aimed at transforming the country to middle-income status by 2030 · We expect execution of the planned infrastructure development such as sewer connection in Ruiru and Kitengela, water improvement program and the ongoing road projects such as the dualling of Ngong Road Phase 2 and the expansion of Waiyaki Way which will open up areas for development

|

Positive |

|

Listed Real Estate |

· In 2019, the Fahari I-REIT closed the year at Kshs 9.4 per share, 6.9% lower than its opening price of Kshs 10.1 per share · The REIT’s value declined by 16.0% y/y trading at an average of Kshs 8.9 per share in comparison to Kshs 10.6 in 2018 · The poor performance is attributable to; (i) opacity of the exact returns from the underlying assets, (ii) the negative sentiments currently engulfing the sector given the poor performance of Fahari and Fusion REIT (FRED), (iii) inadequate investor knowledge, and (iv) lack of institutional support for REITs |

· Having opened the year with a trading price of Kshs 9.2 we expect the REIT to continue trading at low prices and in low volumes in 2020 |

Negative |

Our outlook is positive for three themes, neutral for two and negative for two, thus, the general outlook for the sector in 2020 is NEUTRAL. The sector will be supported by; (i) the National Government’s support for the affordable housing initiative, (ii) continued entry and expansion of international retailers into the country, (iii) improving infrastructure, and (iv) the improving macroeconomic environment. The real estate sector has pockets of value in themes such as housing for lower-middle to low-income earners in the residential sector, land in satellite towns and differentiated concepts such as serviced apartments and serviced offices.

- Residential Sector

The residential sector recorded sluggish growth, largely attributable to slow property demand as homebuyers’ spending power remained below average property prices amid a tough economic environment. This resulted to softened price appreciation, which averaged at 1.1% in comparison to 4.2% in 2018. However, investor returns were cushioned by the rise in occupancy rates driven by an increase in renters coupled by a slowdown in housing inventory leading to an increase in rental yields. Total returns as a result came in at 6.1% (price appreciation-1.1%, rental yield – 5.0%) in 2019, in comparison to 8.9% in 2018 (Price appreciation – 4.2%, rental yield – 4.7%).

In 2020, we expect the sector’s change in performance to remain flat and select markets to continue exhibiting a positive performance supported by their appeal to local homebuyers or foreign clientele, based on location and accessibility, availability of key amenities such as shopping facilities and schools, as well as availability for affordable land for development.

The table below summarizes the various factors that will affect the demand side of residential real estate.

Demand

Of the five factors, we expect to affect residential demand, two are positive, one is negative, and two is neutral with a bias to positive, thus our outlook for residential demand this year is neutral with bias to positive.

|

Residential Demand |

||

|

Metric |

2020 Outlook |

Effect |

|

Demographics |

· Currently, the deficit in the Nairobi Metropolitan Area is expected to come in at 2.1 mn units in 2020, owing to a rapid population growth rate averaging at 2.2% p.a. for the last 5-years compared to a global average of 1.2% p.a. · This coupled by a relatively high urbanization rate at 4.3%, as per the World Bank, compared to the global and SSA averages of 2.1% and 4.1%, respectively, will continue to sustain demand for more dwelling units with 70.7% of the demand being in the lower mid-end and low-end segments, who according to KNBS, earn below Kshs 50,000 p.m. |

Positive |

|

Infrastructure |

· In 2020, we expect the anticipated completion of infrastructural projects such as the ongoing Ngong Road upgrade, expansion of the Northern bypass and completion of the Western bypass, as well as water and sewer enhancements in high density areas, which will help boost demand for residential properties in the affected areas such as Ruaka, Ruiru, and Kikuyu |

Positive |

|

Investor Returns |

· In 2019, the residential sector recorded a decline in investor returns to 6.1% from 8.9% in 2018 on account of decline in demand · We expect investors to focus on; (i) lower mid-end markets in line with the affordable housing initiative in areas such as Ruiru, Athi River, Syokimau and (ii) upper mid-end markets, where rental yields were relatively high, such as Runda Mumwe, Ridgeways, Parklands, and Kileleshwa |

Neutral |

|

Purchasing Power |

· Amidst massive job losses and sluggish wage growth, we expect buyers’ spending power to remain subdued. However, we are optimistic that the removal of the interest rate cap will improve access to credit |

Negative |

|

Access to Credit |

· Subject to the full operationalization of the Kenya Mortgage Refinance Company (KMRC), we expect growth in the local mortgage market, which has remained subdued since the enactment of the stifling interest rate cap law with mortgage accounts in 2018 having grown by a mere 1.2% to 26,504 from 26,187 in 2017 · The KMRC is expected to boost the local mortgage market especially coupled by the scrapping of the interest rate cap law. However, it remains unclear when the facility will be fully operational |

Neutral |

Supply

The table below summarizes the various factors that will influence the supply side of residential real estate in 2020. Of the five factors that we expect to shape residential supply, one is negative, two are neutral, whereas two are positive, and thus, our outlook is neutral.

|

Residential Supply Outlook |

||

|

Metric |

2020 Outlook |

Effect |

|

Developer Returns |

· In 2019, the residential market recorded slower uptake averaging 19.4% from 22.8% in 2018, affecting the rate of price growth. However, occupancy averaged 85.7%, a significant uptick from 2018, which posted 81.0%, and this helped to cushion developer returns as rental yields saw a marginal growth of 0.3% points to 5.0% from 4.7% in 2018 · We also note that developer returns for institutional grade real estate remain high at above 20% p.a. Developers are likely to invest in research in order to identify market niches to ensure profitability of their projects |

Neutral |

|

Access to Financing |

· According to Central Bank of Kenya, non-performing loans in the mortgage industry grew by 39.6% in 2018 in comparison to 24.0% in 2017 highlighting the sector’s financial constraints · Affordable housing developers’ construction funding, which was to be availed in form of government offtake guarantees, had been pegged on the success of the National Housing Development Fund (NHDF) which has so far had minimal success · We, therefore, expect developers to continue experiencing barriers to adequate financial access, which is expected to affect housing supply in 2020 |

Negative |

|

Development Costs |

· We expect the asking land price correction in the Upper- mid end residential market to continue in 2020 amid less demand for land as developers scale back on building activity owing to (i) limited access to funding options, (ii) oversupply in key commercial office, retail nodes and various upper mid-end residential markets, as well as (iii) delays in construction permits · The government also introduced a raft of measures intended to ease the cost of development for affordable housing developers such as exemption of VAT for affordable housing construction materials, 50.0% corporate tax cut and the anticipated land and bulk infrastructure provision · However, the development costs for conventional real estate properties are likely to remain high |

Neutral |

|

Infrastructure |

· In 2020, we expect the completion of ongoing infrastructural projects such as the dualling of Ngong Road, as well as water and sewer enhancements in high density areas to boost new developments in areas such as Ruaka, Ruiru, and areas served by Ngong Road and Waiyaki Way |

Positive |

|

Government Incentives |

· With the growing focus towards plugging the housing deficit, we expect to see more government incentives geared towards creating an enabling environment for home-buyers and developers such as those introduced in the Financial Act 2019 including exemption of VAT for affordable housing construction materials, exemption of companies implementing projects under the affordable housing scheme from the application of thin capitalization rules, and reduction of Import Declaration Fee on construction materials from 2.0% to 1.5% |

Positive |

Our outlook for the residential sector remains neutral. On the supply side, our outlook is neutral, as we expect developers to slow down on construction activity in the top-tier residential areas, focusing on providing low mid-end range properties where majority of the housing demand lies, as they also capitalize on government incentives especially in satellite towns with relatively high returns. On the demand side, our outlook is neutral with a bias to positive, as we expect a surge in demand for rental property. However, we expect that the market for buyers will be buoyed by government incentives and property offers from developers on inventory that has been in the market for long. Overall, the sector’s performance is likely to remain stable especially with respect to prices and uptake, while occupancy rates are expected to continue growing albeit at a slow rate.

Investment opportunities are in areas that continue to exhibit growing demand from homebuyers offering investors above-average returns and relatively quick uptake supported by availability for land for development, whereas demand is boosted by presence social amenities and relatively good infrastructure.

- Commercial Office Sector

In 2020, we expect the commercial office sector to continue attracting investors driven by Kenya’s positioning as a regional hub thus, attracting multinational firms leading to increased demand for office space, especially grade A, coupled by the improving macroeconomic environment, with the country’s GDP projected to grow by 5.6% and 5.7% in 2019 and 2020, respectively, according to Cytonn Research.

However, the sector’s performance remains constrained attributed to a surplus of office space that stood at 5.6 mn SQFT as at 2019, creating a bargaining chip for tenants and forcing developers to reduce or maintain prices and rents in order to remain competitive and attract occupants to their office spaces.

We expect the performance of the commercial office theme to decline slightly in 2020 with average rent, price, occupancy and yields rates coming in at Kshs 96 per SQFT, Kshs 12,600 per SQFT, 78.2% and 7.3%, respectively, from Kshs 96 per SQFT, Kshs 12,638 per SQFT, 80.2% and 7.5%, respectively, in 2019 mainly due to the current office oversupply and incoming supply with the expected opening of Kenya Institute of Supplies Management Headquarters (KISM) Headquarters along Ngong Road and Parliament Tower in the Nairobi CBD in 2020.

The table below summarizes the office performance from 2013 to 2019 and our forecast for 2020:

|

Summary of Commercial Office Returns in Nairobi Over Time kuku |

||||||||||

|

Year |

FY'13 |

FY’15 |

FY’16 |

FY’17 |

FY'18 |

FY’19 |

Annualized Change 2013-2019 |

2020F |

Reason for Forecast |

Outlook |

|

Occupancy (%) |

90.0% |

89.0% |

88.0% |

82.6% |

83.3% |

80.2% |

(2.0%) points |

78.2% |

We expect occupancy rates to stagnate or decline slightly by 2.0% points to average at approximately 78.2% in 2020 given the current oversupply of 5.6mn SQFT in 2019 and expected to increase to 5.8mn in 2020 |

Negative |

|

Asking Rents (Kshs/Sqft) |

95 |

97 |

103 |

101 |

101 |

96 |

0.3% |

95 |

Despite a 0.3% growth in asking prices over the last 5-years, we expect monthly rental charges to soften slightly reducing by 0.3% to Kshs. 95 per SQFT per month, as property managers reduce or maintain their rents to attract occupants to their office spaces |

Negative |

|

Average Prices (Kshs/Sqft) |

12,433 |

12,776 |

13,003 |

12,649 |

12,573 |

12,638 |

0.3% |

12,600 |

Despite the annual growth in asking prices by 0.3% between 2013 and 2019, we expect the prices to soften slightly by 0.3% to average at Kshs 12,600 in 2019 as the market absorbs the current stock |

Neutral |

|

Average Rental Yields (%) |

8.3% |

8.1% |

8.4% |

7.9% |

8.1% |

7.5% |

(0.2%) points |

7.3% |

We expect office yields to average at 7.3%, 0.2% points lower than 2019 average of 7.5% in the Nairobi market mainly as a result of increase in supply and thus lower occupancy rates |

Negative |

|

· We expect the performance of the commercial office theme to decline slightly in 2020 with average rent, price, occupancy and yields rates coming in at Kshs 96 per SQFT, Kshs 12,600 per SQFT, 78.2% and 7.3%, respectively, from Kshs 96 per SQFT, Kshs 12,638 per SQFT, 80.2% and 7.5%, respectively, in 2019 mainly due to the current office oversupply at 5.6 mn SQFT and increasing supply with the expected opening of the KISM Headquarters along Ngong Road and Parliament Tower in the Nairobi CBD. There are pockets of value for investment in the sector in concepts with low supply and high returns such as Serviced offices, which have rental yields of 13.4% |

||||||||||

Source: Cytonn Research

Our outlook for the commercial sector is NEGATIVE as the sector’s performance continues to be constrained by oversupply of 5.6 mn SQFT as at 2019. The sector however has pockets of value for Grade A offices in zones with low supply and high returns such as Gigiri and in differentiated concepts such as serviced offices recording relatively high rental yields of up to 13.4%.

- Retail Sector

In 2020, we expect the retail sector to continue to exhibit growth driven by;

- The continued expansion of local retailers such as Naivas and Tuskys and international retailers such as Carrefour and Shoprite taking up vacant spaces left by troubled retailers such as Nakumatt and Choppies,

- Anticipated private sector credit growth with the recent repeal of the interest rate cap,

Increasing purchasing power with GDP per Capita growing at a rate of 7.9% p.a. over the last 5-years, However we expect the sector’s performance to soften, with asking rents, occupancy rates and yields declining by 2.1%, 2.2% points and 0.4% points, respectively, to average at Kshs. 171.9, 73.4% and 7.4%, respectively. This is attributed to the existing oversupply of space estimated at 2.8 mn SQFT.

The table below summarizes the retail performance from 2016 to 2019 and our forecast for 2020;

|

Nairobi’s Retail Sector Performance 2016-2020F |

||||||||

|

Item |

FY’16 |

FY’17 |

FY' 18 |

FY’19 |

Annualized Change 2016-2019 |

2020F |

Reason for Forecast |

Outlook |

|

Asking Rents (Kshs/SQFT) |

186.9 |

185.2 |

178.2 |

175.5 |

(2.1%) |

171.9 |

We expect asking rents to soften by 2.1% to Kshs 171.9 from Kshs 175.5 as a result of the retail space oversupply currently at 2.8mn SQFT |

Negative |

|

Supply in Nairobi (mn SQFT) |

5.9 |

6.2 |

6.5 |

7.3 |

5.7% |

7.3 |

Supply of retail space has grown at an average rate of 5.7% p.a from 2016 to 2019 and due to no incoming retail supply in 2020, is expected to remain at 7.3 mn SQFT |

Neutral |

|

Occupancy (%) |

89.3% |

80.3% |

79.8% |

75.9% |

(2.2%) points |

73.7% |

Due to the current oversupply of retail space at 2.8 mn SQFT we expect occupancy rates to decline by 2.2% points to 73.7% |

Negative |

|

Average Rental Yields |

10.0% |

9.6% |

9.0% |

7.8% |

(0.4%) points |

7.4% |

We expect a drop in rental yields by 0.4% points to 7.4% as a result of lower rental rates and a drop in occupancy rates, |

Negative |

|

· The performance of the retail sector is expected to soften, with asking rents, occupancy rates and yields declining by 2.1%, 2.2% points and 0.7% points, respectively, to average at Kshs. 171.9, 73.4% and 7.4%. |

||||||||

Source: Cytonn Research

Based on the above, our retail performance outlook is negative. However, we have a general NEUTRAL outlook for the sector as we remain optimistic that the sector’s performance will be cushioned by increased entry of international retailers into the Kenyan market and the expansion efforts by local retailers such as Naivas and Tuskys as they take advantage of the attractive rental rates. The investment opportunity is in county headquarters in some markets such as Kiambu and Mt. Kenya that have retail space demand of 0.8mn and 0.2mn SQFT, respectively.

- Hospitality Sector

In 2019, the hospitality sector registered improvement in performance, evidenced by the 0.2% points increase in the serviced apartments rental yield to 7.6%, from 7.4% recorded in 2018, attributable to increased demand, which triggered an increase in charge rates. The improved performance was on overall been supported by the stable political environment and improved security, thus making Nairobi an ideal destination for both business and holiday travelers. According to the Leading Economic Indicators (LEI) September 2019, the total number of visitors arriving through Jomo Kenyatta (JKIA) and Moi International Airports (MIA) came in at 1.2 mn persons for the period between January and September 2019, 5.4% higher than 1.1 mn persons during the same period in 2018.

In 2020, we expect the sector to record increased activities, driven by;

- Improved Security - Kenya’s security has continued to improve evidenced mainly by the reduced terrorist attacks. This will continue to boost tourists’ confidence in the country, making it a preferred travel destination for both business and holiday travelers,

- Improving air travel- In 2019, various airlines operating in Kenya increased their flights frequency driven by increased tourist arrivals into the country, for both holiday and business, we expect this to result in a growing number of tourist arrivals thus increased demand for accommodation and other hospitality services, boosting the performance of the hospitality sector,

- Growth of Meetings, Incentives, Conferences and Exhibitions (MICE) Tourism - According to KNBS Economic Survey 2019, local conferences grew by 7.9% in 2018 to 4,147, from 3,844 in 2017, while international conferences grew by 6.8% to 204, from 191 in 2017, signaling a growth in the MICE tourism sector, which has continued to drive the hospitality sector. The growth in the sector has been largely enabled by presence of conferencing facilities such as the Kenyatta International Convention Centre (KICC), which was crowned as the leading meetings and conference center in Africa at the World Travel Awards 2019, and we expect this to continue encouraging growth of MICE in 2020, and

- Travel Tourism - Holiday travelers are the main drivers of Kenya’s hospitality sector, accounting for approximately 71.2% of international arrivals over the last 5-years. In 2018, the number of tourist arrivals came in at 2.0 mn, 42.9% higher than the 1.4 mn recorded in 2017.

The graph below shows the growth of the numbers over the years;

We expect the number of tourist arrivals to come in at approximately 2.2 mn for 2019, and grow even further in 2020, enhancing demand for food and accommodation services, thus boosting the hospitality sector, with the investment opportunity being in Westlands & Parklands and Kilimani submarkets, which recorded relatively high rental yields of above 10.8% and 9.5%, respectively.

Nevertheless, the sector is likely to continue facing challenges, mainly;

- Issuance of travel advisories with the United States of America travel advisory highlighting some areas in Kenya such as Kilifi, Lamu, Kibera, Eastleigh, and the Somali border as high-risk crime and terrorism prone areas, despite an elongated prevalence of peace in the country, and

- Delayed infrastructural projects which continue to cripple access to areas, for example with the dragging expansion of Malindi Airport, which continues to result in reduced number of tourist arrivals at the East African coast due to lack of direct flights to airport.

We retain a POSITIVE outlook for the hospitality sector, as we expect continued demand for hospitality services with occupancy rates in the serviced apartments sector coming in at up to 80%, and a resultant average market rental yield of 7.6%.

- Land

In 2019, the land sector recorded increased activities as investors continued to take up development class land despite the tough economic environment. Land priced within the Nairobi Metropolitan Area recorded an 8- year CAGR of 11.9% and a 2.0% y/y asking price change in 2019. The performance was driven mainly by; (i) the growing demand for development land especially in the satellite towns such as Ruiru and Syokimau as developers strive to drive the government’s Big Four government agenda on the provision of affordable housing, and (ii) improving infrastructure which opened up areas for development.

In 2020, we expect the performance to remain positive, with an expected annual capital appreciation of 3.9% driven by:

- The improving infrastructure such as road networks as the Kenyan Government continues to intensify efforts to improve infrastructure in the country, evidenced by the significant 2019/2020 national budget allocation of Kshs 435.1 bn, 3.9% higher than 418.8 bn allocated for FY 2018/19 to infrastructural development,

- Investor demand for development land especially in satellite towns where infrastructure has been improving, in addition to land in these areas being relatively affordable and available in bulk, and

- Positive demographics with Kenya’s population growth rate at 2.2% p.a compared to the 1.2% global average, rapid urbanization at 4.3% p.a compared to the SSA average of 4.1%, and the growing middle class, which has continued to create demand for development land.

However, main challenges likely to face the sector include; (i) delay in processing of construction permits which continues to discourage investors, (ii) relatively high land costs of up to Kshs 500 mn per acre in areas such as Upperhill, hence impacting on financial viability on returns to investors as rental charges remain flat, (iii) relatively high land rates, specifically in Nairobi County following the capping of the new land rates at 1.0% of the current value of the plots as opposed to using the 1980 valuation, where property owners previously paid land rates at 25.0% of the unimproved site value, and (iv) delayed infrastructural projects which continues to cripple access to areas.

The summary of the previous performance of the theme and 2020 outlook is as outlined below:

All values in Kshs unless stated otherwise

|

Summary of the Performance Review and Outlook across all regions |

||||||

|

Segments/Nodes |

*Price in 2011 |

2018 |

2019 |

2020f |

8-Year CAGR |

Annual Capital appreciation(2020)f |

|

Satellite Towns - Unserviced Land |

9m |

23m |

25m |

27m |

13.6% |

7.0% |

|

Nairobi Suburbs - Low Rise Residential Areas |

56m |

86m |

92m |

96m |

6.4% |

4.4% |

|

Nairobi Suburbs - High rise residential Areas |

46m |

135m |

137m |

143m |

14.7% |

3.9% |

|

Satellite Towns - Site and service schemes |

6m |

14m |

14m |

15m |

11.5% |

2.4% |

|

Nairobi Suburbs - Commercial Areas |

156m |

493m |

429m |

436m |

13.5% |

1.8% |

|

Average |

11.9% |

3.9% |

||||

|

||||||

Source: Cytonn Research

The investment opportunity in the Nairobi Metropolitan Area land sector lies in satellite towns (unserviced land) such as Utawala and Limuru, and suburbs such as Karen, Kitisuru, Runda and Kilimani supported by the relatively high annual capital appreciation of above 10.0%.

We retain a POSITIVE outlook for the land sector with a bias to satellite towns, with unserviced land prices expected to record a 7.0% annual appreciation in 2020, due to the high demand boosted by their affordability, availability of development land and the improving infrastructure in the areas.

- Infrastructure Sector

The infrastructural sector remained vibrant in 2019, in line with the country’s economic expansion goals to make Kenya the African hub for transportation, industrial, and service sectors. The government expenditure continued to increase, albeit at a decreasing rate following the realization of majority of the projects such as the completion of Phase 2A of the Standard Gauge Railway (SGR) project and the Outer Ring Interchange.

The budget allocation towards infrastructural development has been growing by a 7-year CAGR of 8.2% to Kshs 435.1 bn in 2019/2020 from Kshs 251.1 bn in 2013/14. The increased allocation shows the government’s efforts aimed at transforming the country to middle-income status by 2030. For the financial year 2019/20, the infrastructure sector was allocated Kshs 435.1 bn, 3.9% higher than 418.8 bn allocated for FY 2018/19.

The budget allocation to infrastructure development over the years has been as shown below:

Source: The National Treasury

Some of the projects in the 2020 pipeline include; (i) the Jomo Kenyatta International Airport (JKIA) -Westlands Expressway, an 18.6-kilometer road project, which will start at JKIA and terminate at James Gichuru, along Waiyaki Way Road, in Westlands, (ii) a 40-km 400kv power line which is set to power Konza City, as well as Kajiado, Makueni, and Machakos Counties, and, (iii) 17.4 km Western Bypass, a Kshs 17 bn project starts from Gitaru- linking the Northern bypass to the Southern Bypass - and terminates at Ruaka, in Kiambu County.

Our outlook for the sector is thus positive, supported by the execution of the planned infrastructure development such as sewer connection in Ruiru and Kitengela, water improvement program and the above mentioned road and power projects in the pipeline. We expect that continued government efforts to improve the infrastructure, will result in the opening up of more areas for real estate for development.

With the Government of Kenya’s economic transformation agenda, we expect to see more infrastructural projects being unveiled, which in turn will boost the real estate sector’s performance and also lead to opening up of more areas for real estate development.

- Listed Real Estate Outlook

In 2019, the Fahari I-REIT closed the year at Kshs 9.4 per share, 6.9% lower than its opening price of Kshs 10.1 per share. The REIT’s value declined by 16.0% y/y trading at an average of Kshs 8.9 per share in comparison to Kshs 10.6 in 2018. The poor performance is attributable to; (i) opacity of the exact returns from the underlying assets, (ii) the negative sentiments currently engulfing the sector given the poor performance of Fahari and Fusion REIT (FRED), (iii) inadequate investor knowledge, and (iv) lack of institutional support for REITs.

Having opened the year with a trading price of Kshs 9.6 we expect the REIT to continue trading at low prices and in low volumes in 2020, attributed to the above mentioned factors, in addition to unsteadiness in the market following the recent sale to ICEA Lion Asset Management.

Source: Thomson Reuters

We retain a NEGATIVE outlook for the REIT market due to the insufficient market structures and poor market sentiment, however, attempts by key real estate industry players in the region such as East Africa Forum for Structured products and REITs Association of Kenya to improve the market sentiment on REITs and other alternative investments, government efforts to improve the regulatory structures and the need for capital by developers is expected to drive uptake of the REIT.

THE KEY AREAS OF OPPORTUNITIES BY THEME IN REAL ESTATE SECTOR

Based on returns, factors such as supply, demand, infrastructure, land prices and availability of social amenities the following are the ideal areas for investment;

|

The Key Areas of Opportunities by Theme in Real Estate Sector |

|||

|

Sector |

Themes |

Locations |

Reasons |

|

Residential Sector |

High End- (Detached) |

Runda, Karen |

Annual returns at 6.4% and 5.5%, respectively, against the high-end market average of 5.0% For speculative buyers, Karen and Kitisuru recorded the highest annual uptake in this segment with 21.0% and 21.8%, respectively, against the high-end market average of 19.9% |

|

Upper- Mid End (Detached) |

Runda Mumwe, Ridgeways/Garden Estate |

Relatively high uptake at 22.7% and 25.0%, respectively. The areas also have relatively low supply coupled by availability of development land in comparison to other upper mid-end areas such as Lavington and Lang’ata |

|

|

Upper Mid- End (Apartments) |

Parklands, Kileleshwa |

Relatively high annual returns of 7.5% and 7.1%, respectively, against upper mid-end market average of 6.1% |

|

|

Low End (Detached) |

Athi River, Kitengela |

Relatively high returns averaging 7.1% and 7.0%, respectively, in comparison to the respective market average of 6.6% |

|

|

Low End (Apartments) |

Thindigua, Athi River |

Relatively high annual returns at 8.2% and 7.6%, respectively, against lower mid-end market average of 6.5% |

|

|

Commercial Office Sector |

Grade A Offices |

Gigiri, Karen |

Relatively low supply, proximity to commercial hubs and high yields of 9.2% and 8.3%, respectively |

|

Serviced Offices |

Westlands |

Prime commercial hubs with high occupancy of 85.5% and yields of 15.8% |

|

|

Retail Sector |

Suburban Malls |

Counties such as Mt. Kenya Regions and Kiambu |

Mt. Kenya Regions and Kiambu with attractive yields at 8.6% and 8.0% and occupancy rates at 82.3% and 79.4%, respectively |

|

Mixed Use Developments (MUDs) |

MUD |

Kilimani, Limuru Road |

Affluent neighborhoods with high rental yield return of 9.1% and 8.0%, respectively |

|

Hospitality Sector |

Serviced Apartments |

Westlands & Parklands, Kilimani |

Relatively high rental yields of above 10.8% and 9.5%, respectively, compared to the market average of 7.6% |

|

Land Sector |

Satellite Towns |

Utawala and Limuru |

Relatively high capital appreciation of above 10.0% y/y, the provision of trunk infrastructure such as road networks and the growing demand for development land |

|

Suburbs |

Karen, Runda, Kitisuru and Kilimani |

Relatively high capital appreciation of above 10.0% y/y and proximity to amenities |

|

Source: Cytonn Research