Cytonn 2021 Markets Outlook- Real Estate Sector

By Cytonn Research, Jan 17, 2021

Executive Summary

Cytonn 2021 Markets Outlook- Real Estate Sector

Residential sector: Our outlook for the residential sector is NEUTRAL. We expect the tough economic environment to continue affecting transaction volumes. For detached units, investment opportunity lies in areas such as Rosslyn, Ridgeways and Ruiru while for apartments, the investment opportunity lies in satellite towns such as Thindigua and Syokimau, as well as the upper mid-end segment in areas such as Kilimani;

Commercial Office Sector: Our outlook for the commercial sector is NEGATIVE as the sector’s performance continues to be constrained by oversupply of 6.3 mn SQFT of space as at 2020. The sector is also facing reduced demand as some firms downsize due to financial constrains while others embrace the working from home strategy amid the Covid-19 pandemic. The asking prices and rents are also expected to decline as landlords continue giving discounts and concessions to attract and retain clients;

Retail Sector: We have a NEUTRAL outlook for the sector with performance being constrained by; (i) the existing oversupply of space estimated at 2.0 mn SQFT, ii) dwindling demand for physical space due to shifting focus to e-commerce, iii) reduced purchasing power among consumers amid a tough economic environment, and iii) reduced rental rates. However, we remain optimistic that the sector’s performance will be cushioned by the continued expansion of local and international retail chains;

Hospitality Sector: Our outlook for the hospitality sector is NEUTRAL. Despite the sector being the hardest hit by the COVID-19 pandemic, it has begun to gradually recover supported by financial aid from the government through the Post Corona Hospitality Sector Recovery Stimulus by the Ministry of Tourism through the Tourism Finance Corporation (TFC) and other international agencies, repackaging of the tourism sector to appeal to domestic tourists and relaxation of travel advisories. We expect this to fuel resumption of activities and resultant improved performance in the medium term;

Land Sector: We have a POSITIVE outlook for the land sector. We expect an annual capital appreciation of 1.7% in 2021, with the performance being cushioned by; (i) the growing demand for development land especially in the satellite towns as developers strive to drive the government’s Big Four government agenda on the provision of affordable housing, (ii) improving infrastructure, and (iii) demand for development land by the growing middle-income population;

Infrastructure Sector: We have a NEUTRAL outlook for the infrastructure sector, despite the reduced budget allocation for the infrastructure sector with funds being redirected to dealing with the COVID-19 pandemic, the government continues to implement select projects and we expect this to open up areas for developments upon their completion thus boosting the real estate sector;

Listed Real Estate: Our outlook for the REIT market is NEGATIVE due to the continued poor performance of the REIT market. However, we are of the view that for the REIT market to pick, supportive framework needs to be put in place to increase investor appetite in the instrument.

Real Estate

In 2020, the real estate sector recorded moderate activities with a general decline in transactions attributed to the tough economic environment in the wake of the Covid-19 pandemic that had adverse effects on the sector. The effects of the pandemic were mainly felt in the sector from Q2’2020 with the real estate and construction recording a growth of 6.1% down from 13.2% growth recorded in Q2’2019.

The main factors that constrained performance of the real estate sector included;

- Constrained financing to developers due to the increased perceived risk levels,

- Business restructuring with some firms downsizing hence reducing occupancies and overall rental yields, and,

- Travel restrictions, attributed to the COVID-19 pandemic that led to a near cessation of international flights in a bid to minimize the spread of the virus which mainly affected the performance of the hospitality sector.

Despite the sluggish growth, performance of the real estate sector was cushioned by;

- Good demand given the positive demographics with Kenya’s high urbanization and population growth rates currently standing at 4.0% and 2.2%, compared to the global averages of 1.9% and 1.1%, respectively,

- Continued launch of affordable housing projects,

- Improved access to mortgage loans especially through the Kenya Mortgage Refinancing Company (KMRC),

- Improved infrastructure opening up areas for investment, and,

- Towards the end of the year, easing of travel restrictions as well the government’s post-COVID stimulus packages boosting the hospitality sector.

In 2020, the real estate sector recorded moderate activities with a general decline in concluded transactions. There was a decline in the performance of all the sectors, resulting to an average rental yield for the real estate market of 6.1%, 0.9% points lower compared to 7.0% recorded in 2019.

The table below is a summary of thematic performance of average rental yields in 2020 compared to 2019;

|

Real Estate Thematic Performance- Average Rental Yields |

|||

|

Theme |

Rental Yield FY’2020 |

Rental Yield FY’2019 |

Y/Y Change (% Points) |

|

Residential |

4.7% |

5.0% |

(0.3%) |

|

Commercial Office |

7.0% |

7.5% |

(0.5%) |

|

Retail |

7.5% |

7.8% |

(0.3%) |

|

Mixed_Use Developments (MUDs) |

7.1% |

7.3% |

(0.2%) |

|

Serviced Apartments |

4.0% |

7.6% |

(3.6%) |

|

Grand Average |

6.1% |

7.0% |

(0.9%) |

The decline is attributed to subdued performance across all sectors due to reduced sale and rental rates in a bid to attract and retain tenants amid a tough economic environment, as well as oversupply of approximately 6.3 mn SQFT of office space and 3.1 msn SQFT of retail space in the wake of reduced demand for physical space in the two sectors. For a detailed review of 2020 performance, see our Real Estate Annual Markets Review 2020 Note.

In 2021, we expect the key drivers of real estate to be as follows:

- The Affordable Housing Initiative: Increased activities are expected on the affordable housing front despite the reduced budget allocation in the FY’2020/21 National Budget, with an allocation of Kshs 6.9 bn, 34.3% lower than the Kshs 10.5 bn allocated in 2019/2020. The Kenyan Government through the Nairobi Metropolitan Service has so far launched phase two of the affordable housing programme in ten city estates under the Nairobi Urban regeneration project while other affordable housing projects such as Shauri Moyo, Makongeni and Starehe houses are underway,

- Infrastructural development: The government continues to implement select projects such as the Nairobi Express way, Nairobi-Western Bypass, Lamu Port and Lamu-Southern Sudan-Ethiopia Transport Corridor Project (LAPSSET), and, Mombasa Port Development Project and we expect these to open up areas for developments upon their completion thus boosting the real estate sector,

- Attractive Demographic Profile: Kenya has a relatively high population and urbanization growth rate of 4.0% and 2.2% against a global average of 1.9% and 1.1% according to the World Bank, and this is expected to continue to support demand in the real estate sector,

- Attractiveness of Kenya as a regional hub due to ease of doing business in Kenya: Kenya has been ranked position #56 by World Bank in the ease of doing business index. This is likely to boost investor confidence in Kenya thus driving foreign direct investment which is likely to boost the performance of the real estate especially on the infrastructure, commercial and retail sectors,

- Gradual Recovery of the Tourism Industry: The gradual recovery of the tourism industry is expected to boost the hospitality sector supported by financial aid from government through the Post-Corona Hospitality Sector Recovery Stimulus package offered by the Ministry of Tourism through the Tourism Finance Corporation (TFC), repackaging of the tourism sector to appeal to domestic tourists and relaxation of travel advisories, and,

- Provision of Affordable Mortgage Loans by Kenya Mortgage Refinance Corporation (KMRC): The establishment of the KMRC is expected to boost the mortgage market in Kenya through lending at relatively low interest rates of 5.0% to Primary Mortgage Lenders (PML’s) enabling them to write off loans at an interest rate of 7.0% which is lower than the current average interest rate of 12.0%.

- E-commerce: As a result of the government’s guidelines on social distancing due to the coronavirus pandemic retailers embraced online shopping evident by 8.6% growth in internet subscription rates according to Economic Survey 2020.This has further been enabled by mobile wallets gaining popularity, hence making online shopping more convenient. E-commerce is also supported by most businesses scaling down on physical retail space to reduce expenses amid tough economic times.

Despite the above drivers, the sector is expected to be constrained by the following factors in 2021:

- Oversupply in Select Sectors: The real estate sector has witnessed increased space supply over the last 5-years and this is likely to affect the demand of some of these sectors. Some of the affected sectors include;

- The commercial office sector which has an oversupply of 6.3m SQFT, and,

- The retail sector, which has an existing oversupply of 3.1 mn SQFT within Nairobi and 2.0 in the Kenya Retail market,

- Constrained Financing for Developers: Constrained financing to developers is a factor that is expected to negatively impact the performance of the real estate sector as financiers such as banks aim to limit exposure amidst increasing loan deferrals and defaults in the wake of the pandemic,

- Reduced Disposable Income: Reduced disposable income as a result of the tough economic times brought about by the COVID-19 pandemic is expected to affect uptake of property thus impacting on the performance of the real estate market,

- Kenya Mortgage and Refinance Company facing a challenge in limitation of housing options: Given the relatively low loan size of Kshs 4.0 for property within the Nairobi Metropolitan Area, potential homeowners will have few or no options of housing units within the NMA due to the relatively high property prices and low supply of affordable housing units thus forcing them to focus on housing units within satellite towns which are relatively affordable,

- Ineffectiveness of Public-Private Partnerships (PPPs) for Housing Development: This will continue to cause delays in delivery of affordable housing projects due factors such as to regulatory hindrances such as lack of a mechanism to transfer public land to a Special Purpose Vehicle (SPV) to facilitate access to private capital through the use of the land as security, lack of clarity on returns and revenue-sharing, bureaucracy and slow approval processes.

The table below summarizes our outlook on the various real estate themes and the possible impact on the business environment in 2021;

Thematic Performance Review and Outlook

|

Thematic Performance Review and Outlook |

|||

|

Theme |

2020 Performance |

2021 Outlook |

Effect |

|

Residential Sector |

|

|

Neutral |

|

Commercial Office Sector |

|

|

Negative |

|

Retail Sector |

|

|

Neutral |

|

Hospitality Sector |

|

|

Neutral |

|

Land Sector |

|

|

Positive |

|

Infrastructure Sector |

|

|

Neutral |

|

Listed Real Estate |

|

|

Negative |

Out of the seven sectors, the outlook is positive for one sector-land; neutral for four sectors-residential, retail, hospitality and infrastructure; and, negative for two sectors-commercial offices and listed real estate. Therefore, the overall outlook for the real estate sector is NEUTRAL, supported by; continued focus on the affordable housing initiative, the operationalization of KMRC, expansion of local and international retailers, the government’s post- COVID stimulus package set to boost performance of the hospitality sector, and, improvement of infrastructure opening up areas for investment. The sector will however continue to experience constraints such as oversupply of 6.3mn SQFT of office space 3.1mn SQFT within the NMA of retail space and sluggish performance of the REIT market.

- Residential Sector

Following a slow 2020, we expect the sector to register positive change in performance owing to reopening of the economy post-Covid, however, we expect no significant change in price of houses and rental yields due to the tough economic environment that continues to affect the purchasing power leading to slow uptake and reduced occupancy rates in select markets. Location and accessibility, availability of key amenities such as shopping facilities and schools, as well as availability of affordable land for development are among factors expected to continue boosting performance of some markets.

The table below summarizes the various factors that will affect the demand side of residential real estate.

Demand

Of the five factors, we expect to affect residential demand, one is positive, one is negative, and three are neutral, thus our outlook for residential demand this year is neutral due to the tough economic environment likely to affect demand for housing units.

|

Residential Demand |

||

|

Metric |

2021 Outlook |

Effect |

|

Demographics |

|

Positive |

|

Infrastructure |

|

Neutral |

|

Investor Returns |

|

Neutral |

|

Purchasing Power |

|

Negative |

|

Access to Credit |

|

Neutral |

Supply

The table below summarizes the various factors that will influence the supply side of residential real estate in 2021. Of the five factors that we expect to shape residential supply, one is negative, three are neutral with a bias to positive, and one is positive, and thus, our outlook is neutral with a bias to positive.

|

Residential Supply Outlook |

||

|

Metric |

2020 Outlook |

Effect |

|

Developer Returns |

|

Neutral |

|

Access to Financing |

|

Negative |

|

Development Costs |

|

Neutral |

|

Infrastructure |

|

Neutral |

|

Government Incentives |

|

Positive |

Our outlook for the residential sector remains NEUTRAL. On the supply side, our outlook is neutral with a bias to positive, as we expect increased activities on the residential front with incentives developers expected to positively contribute to construction activity in the low mid-end range properties where majority of the housing demand lies, as they also capitalize on government incentives especially in satellite towns with relatively high returns. On the demand side, our outlook is neutral, due to the tough economic environment. Investment opportunities lie in areas that continue to exhibit growing demand from homebuyers such as low mid end markets offering investors above-average returns and relatively high uptake.

- Commercial Office Sector

In 2021, we expect to continue witnessing subdued performance in office sector attributable to the existing oversupply of 6.3 mn SQFT as of 2020, the reduced demand of commercial office space as firms downsize as tey adopt the work from home initiative and reduce rental rates as property managers offer discounts and concessions to retain and attract clients.

We expect the performance of the commercial office theme to record declines in 2021 with average rent, price, occupancy and yields rates expected to come in at Kshs 92 per SQFT, Kshs 12,420 per SQFT, 75.0% and 6.8%, respectively, from Kshs 93 per SQFT, Kshs 12,479 per SQFT, 77.7% and 7.0%, respectively, in 2020.

The table below summarizes the commercial office performance from 2016 to 2020 and our forecast for 2021;

|

Summary of Commercial Office Returns in Nairobi Metropolitan Area (NMA) Over Time |

||||||||||

|

Year |

FY'15 |

FY’16 |

FY’17 |

FY’18 |

FY'19 |

FY’20 |

Annualized Change 2015-2020 |

2021F |

Reason for Forecast |

Outlook |

|

Occupancy (%) |

89.0% |

88.0% |

82.6% |

83.3% |

80.2% |

77.7% |

(2.7%) points |

75.0% |

We expect occupancy rates to record a decline by 2.7% points to average of approximately 75.0% in 2021 given the current oversupply of 6.3mn SQFT and tough economic environment impacting businesses |

Negative |

|

Asking Rents (Kshs/Sqft) |

97 |

103 |

101 |

101 |

96 |

93 |

(0.8%) |

92 |

We expect monthly rental charges to soften by 0.8% to Kshs 92 per SQFT per month due to reduced demand causing landlords to offer discounts to attract and maintain clients |

Negative |

|

Average Prices (Kshs/Sqft) |

12,776 |

13,003 |

12,649 |

12,573 |

12,638 |

12,479 |

(0.5%) |

12,420 |

we expect the prices to soften slightly by 0.5% to average at Kshs 12,420 per SQFT in 2021 as the COVID-19 continues to reduce the demand for space |

Negative |

|

Average Rental Yields (%) |

8.1% |

8.4% |

7.9% |

8.1% |

7.5% |

7.0% |

(0.2%) points |

6.8% |

We expect a decline in the rental yields by 0.2% points to 6.8% from 7.0% in 2020 in the Nairobi market mainly as a result of increase in supply and thus lower occupancy rates and decline in the rental charges and prices |

Negative |

|

||||||||||

Source: Cytonn Research

Our overall outlook for the NMA commercial office sector is NEGATIVE attributed to the reduced demand for commercial spaces brought about by the COVID-19 pandemic amid the tough economic environment as some firms downsize due to financial constrains while others embrace the working from home strategy.

- Retail Sector

In 2021, we expect the retail sector to continue to exhibit growth driven by:

- The continued expansion of local retailers such as Naivas and Quickmart, and international retailers such as Carrefour taking up prime spaces left by troubled retailers such as Tuskys,

- Continued improvement of infrastructure opening up areas for investment,

- Positive demographics, and,

- investor confidence due to the ease of doing business in Kenya, having been ranked position #56 by World Bank in the ease of doing business.

We however expect the sector’s performance to soften in 2021, with asking rents, occupancy rates and yields declining by 2.5%, 4.2% points and 0.6% points, respectively, to average at Kshs. 165, 71. 0%, and 6.9%, respectively. This is attributed to the existing oversupply of space estimated at 2.0 mn SQFT in the Kenya retail market and 3.1 mn SQFT in the Nairobi Metropolitan Area, reduced demand for physical retail space as we continue witnessing a shift towards ecommerce, and, the tough economic environment brought about by the COVID-19.

The table below summarizes the retail performance from 2016 to 2020 and our forecast for 2021;

|

Nairobi Metropolitan Area (NMA) Retail Sector Performance 2016-2021F |

|||||||||

|

Item |

FY’16 |

FY’17 |

FY' 18 |

FY’19 |

FY’2020 |

Annualized Change 2016-2020 |

2021F |

Reason for Forecast |

Outlook |

|

Asking Rents (Kshs/SQFT) |

187 |

185 |

178 |

176 |

169 |

(2.5%) |

165 |

We expect asking rents to soften by 2.5% to Kshs 165 per SQFT from Kshs 169 per SQFT as a result of the retail space oversupply currently at 3.1 mn SQFT and reduced demand for physical retail space |

Negative |

|

Supply in Nairobi (mn SQFT) |

5.9 |

6.2 |

6.5 |

7.3 |

7.3 |

5.5% |

7.3 |

We expect the space to supply to remain constant in 2021, as there is no incoming development |

Neutral |

|

Occupancy (%) |

89.3% |

80.3% |

79.8% |

75.9% |

75.2% |

(4.2%) points |

71.0% |

We expect occupancy rates to decline to 71.0% from 75.2% due to the current oversupply and reduced demand for physical space partially due to shift to e-commerce. We however expect the entry of international retailers and continued expansion by local retailers to cushion the sector |

Neutral |

|

Average Rental Yields |

10.0% |

9.6% |

9.0% |

7.8% |

7.5% |

(0.6%) points |

6.9% |

We expect a drop in rental yields by 0.6% points to 6.9% as a result of lower rental and occupancy rates |

Negative |

|

|||||||||

Source: Cytonn Research

Based on the above, we have a general NEUTRAL outlook for the sector with a bias towards the negative with the existing oversupply of space estimated at 3.1 mn SQFT continuing to affect occupancy rates, shift towards online shopping affecting demand for physical space, the expected reduction in rental rates as landlords offer rental concessions to retain tenant, and, exit by some local retailers such as Tuskys. On the upside, the sectors performance is expected to be cushioned by expansion of local and international retailers such as Naivas, Quickmart and Carrefour, infrastructural improvement, positive demographics, and, high demand for space in markets that are undersupplied such as Kiambu and Mt. Kenya that have retail space demand of 0.6mn and 0.7mn SQFT, respectively.

- Hospitality Sector

In 2020, the hospitality sector recorded subdued performance attributed to the COVID-19 pandemic which resulted in reduced demand for hospitality facilities and services given the overreliance on tourism and MICE. The hospitality sector recorded declines in performance evidenced by the decline in serviced apartment’s yields by 3.6% points to 4.0% from 7.6% in 2019. The occupancy rates also declined by 31.3% points to 48.0% from 79.4% while the monthly charges per SQM declined by 14.9% from Kshs 2,806 to Kshs 2,448 as facilities offered discounts to attract and maintain clients amid a tough economic environment.

Despite this, we expect the sector’s performance in 2021 to be cushioned by:

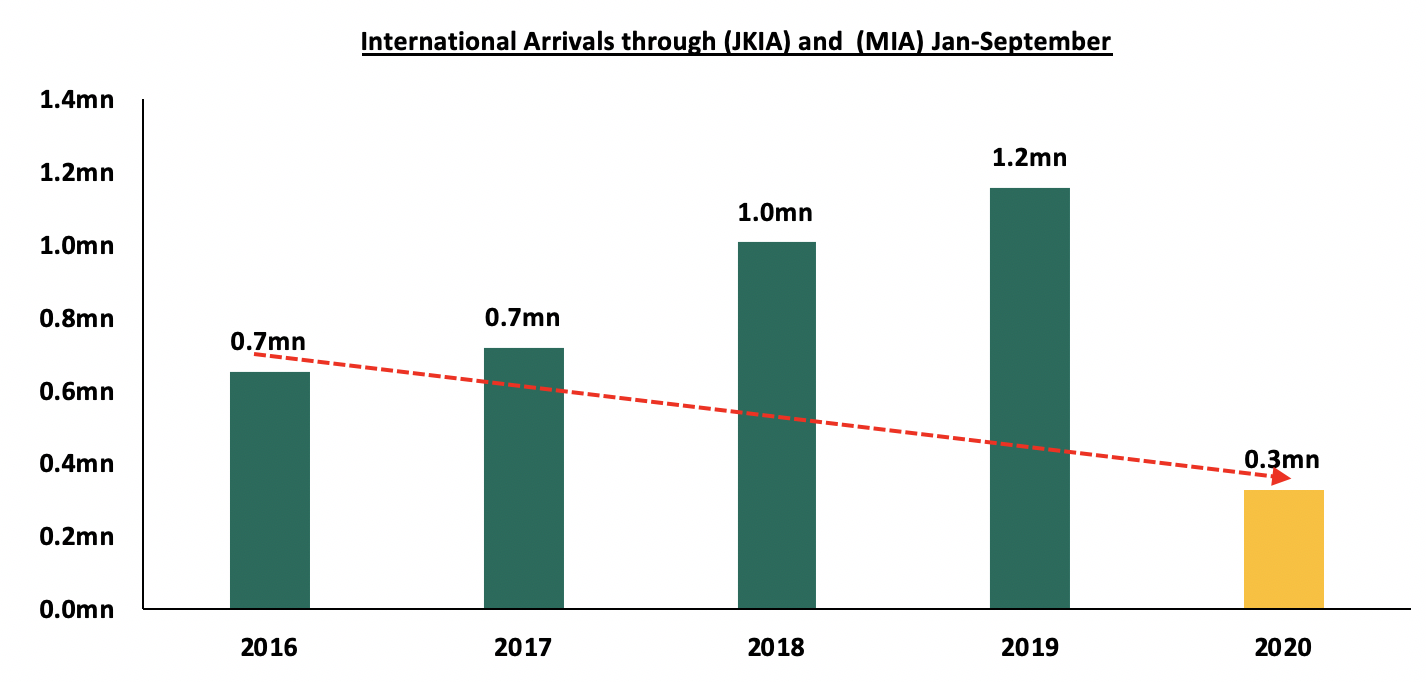

- Tourist arrivals- The number of international arrivals into the country through the main airports in Kenya; Jomo Kenyatta International Airport and Moi International Airport increased from 13,919 persons in August 2020 to 20,164 persons in September 2020 signaling the gradual recovery of the tourism industry thus enhancing the demand hospitality services and facilities.

The graph below shows the number of international arrivals in Kenya over the last five years:

Source: Kenya National Bureau of Statistics

- Improved security in Kenya - This is evidenced by reduced terrorist attacks thus boosting confidence of tourists in the country as a travel destination for both holiday and business travelers,

- Positive accolades - Kenya continues to receive global recognition despite the pandemic. Kenya was recently voted as Africa’s leading tourist destination in the World Travel Awards, supported by the epic savannah landscapes, wildlife, beaches and lakes among other tourist attraction centers,

- Post-Corona hospitality sector recovery stimulus package by the Ministry of Tourism aimed at offering financial aid to hotels and other establishments in the hospitality industry through the Tourism Finance Corporation (TFC),

- Recognition of Nairobi as a regional hub given its strategic geo-positioning

- Relaxation of travel advisories and reopening of Kenya’s key tourism markets - This is expected to enhance recovery of the tourism industry, and,

- Domestic Tourism - Repackaging of the tourism sector products to appeal to domestic tourists through making domestic travel more attractive through campaigns and media coverage.

Nevertheless, key challenges the sector is likely to continue facing include:

- Second wave of the COVID-19 pandemic which is likely to travel restrictions by most countries and people exercising more caution,

- Travel advisories as Kenya still suffers from risk prone travel advisories with countries such as the United States giving advisories due to the increased caution in Kenya due to crime, terrorism, health issues, and kidnapping, and,

- Reduced private sector lending as most lenders have pulled back or ceased new lending to business on overall with the Kenyan hospitality industry not exempted as a strategy of cushioning themselves against the pandemic.

We retain a NEUTRAL outlook for the hospitality sector, with the expected gradually recovery supported by financial aid from government through the Post-Corona Hospitality Sector Recovery Stimulus package, repackaging of the tourism sector to appeal to domestic tourists and relaxation of travel advisories.

- Land

The NMA land sector remained resilient in 2020 despite the tough economic environment evidenced by a 2.3% annual capital appreciation and 10.7% 9-year CAGR, indicating that investors still consider land a good investment asset in the long term. Asking land prices within satellite towns outperformed asking land prices in Nairobi suburbs recording an average annual capital appreciation of 5.4% and 0.2%, respectively, attributable to affordability of the former amid reduced disposable income amid economic slowdown, availability of land in bulk and the improving infrastructure opening up areas for development.

In 2021, we expect the performance to remain positive, with an expected annual capital appreciation of 1.7% driven by:

- The improving infrastructure with the implementation of select projects such as the Nairobi Expressway and the expansion of Waiyaki Way,

- The ease of conducting land transactions enabled by the continued digitization of the lands Ministry,

- Investor demand for development land especially in satellite towns where infrastructure has been improving, in addition to land in these areas being relatively affordable and available in bulk, and,

- Positive demographics with Kenya’s population growth rate at 2.2% p.a compared to the 1.2% global average, rapid urbanization at 4.3% p.a compared to the SSA average of 4.1%, and the growing middle class, which has continued to create demand for development land.

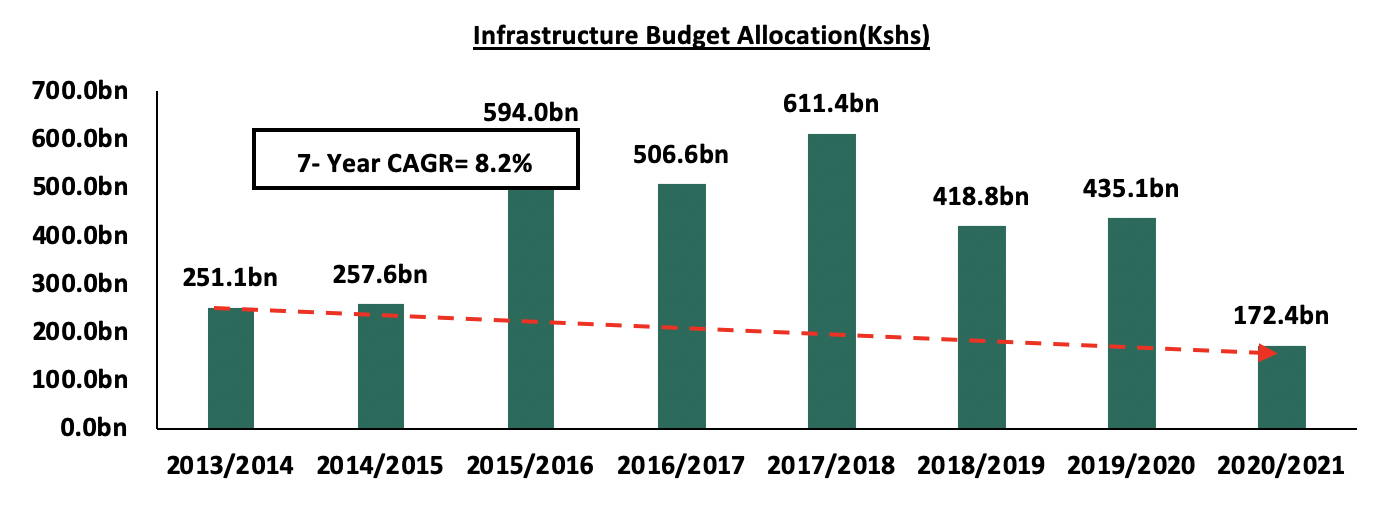

In spite of the above, main challenges likely to face the sector include; (i) reduced development activities within the real estate sector amid a tough economic environment, (ii) relatively high land costs of up to Kshs 500 mn per acre in areas such as Upperhill, hence impacting on financial viability on returns to investors as rental charges remain flat, (iii) relatively high land rates, specifically in Nairobi County following introduction of the new valuation system, and (iv) delayed infrastructural projects due to the reduced budget allocation for the infrastructure sector with funds being redirected to dealing with the COVID-19 pandemic- the sector was allocated Kshs 172.4 bn for FY 2020/21 60.4% lower than the Kshs 435.1 bn allocated in 2019/2020 budget.

The summary of the previous performance of the theme and 2021 outlook is as outlined below;

All values in Kshs unless stated otherwise

|

Nairobi Metropolitan Area Land Sector Outlook 2021 |

|||||||

|

Location |

*2016 |

*2017 |

*2018 |

*2019 |

*2020 |

2021f |

Annual Appreciation(2020f) |

|

Satellite Towns - Unserviced Land |

21m |

22m |

23m |

25m |

27m |

29m |

7.8% |

|

Satellite Towns - Site and service schemes |

14m |

15m |

14m |

14m |

15m |

15m |

3.3% |

|

Nairobi Suburbs - Low Rise Residential Areas |

106m |

109m |

86m |

92m |

94m |

98m |

2.4% |

|

Nairobi Suburbs - High rise residential Areas |

97m |

103m |

135m |

137m |

136m |

140m |

(1.3%) |

|

Nairobi Suburbs - Commercial Areas |

458m |

478m |

493m |

429m |

413m |

415m |

(3.6%) |

|

Average |

|

|

|

|

|

|

1.7% |

Source: Cytonn Research

The investment opportunity lies in Limuru and Ongata Rongai for unserviced land in satellite towns, which recorded an annualized capital appreciation of 10.8%% and 9.7%, respectively. For site and service schemes, Thika and Athi River with the highest annualized capital appreciation at 13.5% and 11.1%, respectively. However, for site and service the prices are lower due to the fewer list of sub markets unlike unserviced land which in includes market areas such as Ruaka whose prices are relatively high yet there is absence of site and service schemes.

We retain a POSITIVE outlook for the land sector with a bias to satellite towns, with unserviced land prices expected to record a 7.8% annual appreciation in 2021, due to the high demand boosted by their affordability, availability of development land and the improving infrastructure in the areas.

- Infrastructure Sector

The sector witnessed the launch of major infrastructural projects in 2020 in line with the country’s economic expansion goals to make Kenya the African hub for transportation, industrial, and service sectors. Despite the reduced budget allocation to the sector, the government launched projects such as the Nairobi Express way, two elevated carriage ways expected to link Nairobi CBD to Ngong Road, tarmacking of the first 7.0 km of Juja Farm Road, and, the Mombasa Port Development Project.

For financial year 2020/2021, the sector was allocated Kshs 172.4 bn, 60.4% lower than the 435.1 bn allocated in the 2019/2020 budget. This is the lowest allocation in the last 8 financial years attributed to a projected revenue shortfall brought about by slowdown in the economy due to disruptions by the COVID-19 pandemic which prompted diversion of funds towards mitigation of the pandemic. This is expected to slow down the implementation of some projects thus crippling the opening up of areas for development.

The budget allocation to infrastructure development over the years has been as shown below;

Source: The National Treasury

Our outlook for the sector is thus NEUTRAL, supported by the continued launch of infrastructure projects by the government which are expected to open up areas for development. However, the reduced budget allocation is likely to result to a slowdown in implementation of the projects.

- Listed Real Estate

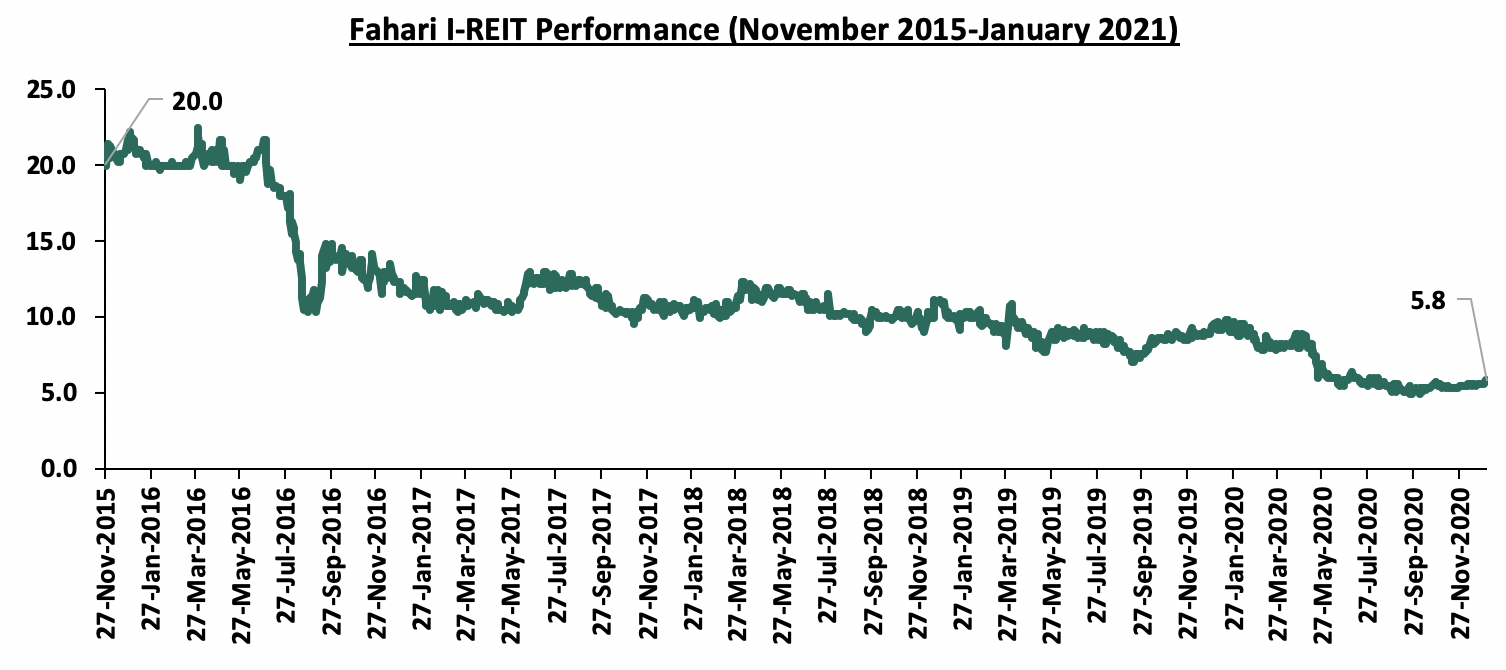

The Fahari I-REIT closed the year 2020 at Kshs 5.6 per share, trading at an average of Kshs 6.7 during the year compared to Kshs 8.9 in 2019. The REIT opened the year trading at Kshs 5.8 per share, representing a 71.0% drop from its initial price of Kshs 20.0 as at November 2015. The REIT market continues to perform poorly attributable to; i) the subdued performance of the real estate market, ii) insufficient institutional grade real estate assets, iii) low of investor appetite in the instrument, and iv) negative investor sentiments.

Source: Thomson Reuters

We expect listed real estate to continue performing poorly in 2021 with the Fahari I-REIT having opened the year with a low trading price of Kshs 5.8 coupled with the expected negative performance of the office and retail sectors and lack of investor appetite in the instrument due to negative investor sentiments. However, we are of the view that some effort is being put by institutions such as Acorn to boost the REIT market having conducted an roadshow in 2020 to educate potential investors on the same ahead of their plans to launch a D-REITand I-REIT in the next 3 years. Nevertheless, we expect the D-REIT market to be constrained by; (i) the high minimum investment amounts set at Kshs 5.0 mn, high minimum capital requirement for a trustee at Kshs 100.0 mn, and, iii)lengthy approval processes.

We retain a NEGATIVE outlook for the REIT market due to the continued poor performance of the REIT market. However, we are of the view that for the REIT market to pick, some of the supportive framework that can be put in place include; i) broadening the pool of trustees by reducing the minimum capital requirement which currently stands at Kshs 100.0 mn, ii) reducing the minimum investment amount for real state finance vehicles which is currently Kshs 5.0 mn, and, iii) removing the intense conflicts of interest between the governance of the Capital Markets Authority (CMA) and the fund structures so that there is more tolerance to constructive feedback.

THE KEY AREAS OF OPPORTUNITIES BY THEME IN REAL ESTATE SECTOR

Based on returns, factors such as supply, demand, infrastructure, land prices and availability of social amenities the following are the ideal areas for investment;

|

The Key Areas of Opportunities by Theme in Real Estate Sector |

|||

|

Sector |

Themes |

Locations |

Reasons |

|

Residential |

High End (Detached) |

Rosslyn, Kitisuru |

Relatively high annual returns averaging 6.3% and 5.8%, respectively compared to the market’s average of 4.4%, while the average rental yields stood at 4.6% and 3.9%,respectively compared to the market average of 3.8% and high occupancy rates averaging 91.7% and 89.1%, respectively |

|

Upper Mid- End (Detached) |

Ridgeways, South B/C |

Relatively high annul returns averaging 6.1% and 5.1%, respectively compared to the market’s average of 4.2%, with price appreciations of 0.9% and 0.8%, respectively compared to the markets price correction of (0.3%) |

|

|

Upper Mid-End (Apartments) |

Kilimani, Kileleshwa |

Relatively high annual returns averaging 6.2% and 5.8% in comparison to the market’s average of 5.2% with relatively high annual uptakes averaging 34.0% and 20.4% |

|

|

Lower Mid-End (Detached) |

Ruiru, Syokimau |

Relatively high annual returns averaging 6.0% and 5.7%, respectively with price appreciations of 2.2% and 1.5% respectively, compared to the market’s average of 0.1% |

|

|

Lower Mid-End (Apartments) |

Thindigua, Syokimau |

Relatively high annual returns averaging 7.5% and 6.9%, respectively compared to the market’s average of 5.5% |

|

|

Commercial Office Sector |

Grade A Offices |

Gigiri, Karen, Westlands |

Premium commercial hubs, infrastructural developments, ease of accessibility and high rental yields of 8.5%, 7.8% and 7.8%, respectively, against the market average of 7.0% |

|

Retail Sector |

Suburban Malls |

Counties such as Mt. Kenya Region |

Mt. Kenya Region has continued to offer attractive rental yields at 7.7% as of 2020 against the market average of 6.7% and occupancies of 78.0 against the market average of 76.6%. The undersupply of 0.7 mn SQFT signals demand. |

|

Mixed Use Developments (MUDs) |

MUD |

Westlands, Limuru Road, Karen |

High average MUD rental yields of 8.3%, 7.3% and & 7.3%, respectively |

|

Hospitality Sector |

Serviced Apartments |

Westlands & Parklands |

Relatively high rental yields of 6.1% against a market average of 4.0% and high occupancy rates. |

|

Land Sector |

Satellite Towns |

Thika, Athi River and Limuru |

Relatively high capital appreciation of above 10.0% y/y, fuelled by; i) continued focus on affordable housing, ii) affordability in comparison to Nairobi’s suburbs, and ii) improving infrastructure such as sewerage systems and roads such as Waiyaki Way. |

|

Suburbs |

Ridgeways, Kasarani |

Relatively high capital appreciation of approximately 8.7% and 8.1% y/y, respectively in 2020, proximity to amenities, affordability compared to other suburbs within the NMA |

|

|

|||

Source: Cytonn Research