Cytonn Weekly #01/2018

By Cytonn Investments Team, Jan 7, 2018

Executive Summary

Fixed Income

Treasury bills were undersubscribed this week, with the overall subscription rate coming in at 85.3%, compared to 80.8%, the previous week. The yields on the 91 and 364-day papers remained unchanged at 8.1% and 11.2%, respectively, while the yield on the 182-day paper rose to 10.7% from 10.6%, the previous week. The Kenyan economy is well on the path to recovery after a challenging operating environment in 2017, with Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI) rising to 53.0 in the month of December from 42.8 in November, being the first time the indicator has shown positive growth since April 2017, recorded at 50.3;

Equities

During the week, the equities market was on an upward trend with NASI and NSE 25 gaining 1.7% and 1.5%, respectively, while NSE 20 remained unchanged, taking their YTD performance to 1.7%, 1.5% and 0.0% for NASI, NSE 25, and NSE 20, respectively. For the last twelve months (LTM), NASI, NSE 25, and NSE 20 have gained 31.7%, 26.9% and 16.3%, respectively. The Central Bank of Kenya (CBK) has released draft guidelines seeking to create a framework that will allow banks a 5-year period to factor in the impact of additional provisions occasioned by the adoption of the new accounting standard, International Financial Reporting Standards (IFRS) 9, which requires banks to adopt a more forward looking approach in provisioning for bad loans;

Private Equity

Catalyst Principal Partners, a Nairobi Based Private Equity firm, has secured a USD 15.0 mn investment from the African Development Bank (AfDB) for their Catalyst Fund II, which is targeting a fund size of USD 175.0 mn. M-PAYG, a Danish venture-backed start-up, that aims to connect the lower income to renewable energy in a flexible pay-as-you-go model, has opened an office in Kenya, seeking to begin operations in February 2018;

Real Estate

Tuskys has announced a 3-year plan to open 100 more stores in Kenya and Uganda at a cost of Kshs 3.0 bn, translating to an average cost of Kshs 83.3 mn per store. The Nairobi Institute of Business Studies (NIBS) also announced plans to build a 5-star hotel in Kileleshwa at a construction cost of Kshs 400.0 mn.

- To attend our weekly site briefs and visits focussing on how to identify and create wealth through investment grade real estate, please sign up here for site visits

- Our Investments Manager, Maurice Oduor, discussed the 2018 outlook for Kenya’s economy. Watch Maurice Oduor on KTN here

- Our Investments Analyst, Patrick Mumu, discussed financial management, investments, and how to create wealth. Watch Patrick on Ebru TV here

- We continue to showcase our real estate developments through weekly site visits. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. The site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Key to note is that our cost of capital is priced off the loan markets where all-in pricing ranges from 16.0% to 20.0% and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our Private Wealth Management training (largely covering financial planning and structured products). Due to increased demand, we have changed the trainings to weekly from the bi-weekly schedule. The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the trainings for their teams. The Wealth Management Trainings are run by the Cytonn Foundation under its financial literacy pillar, and if interested in the training for your employees or investment group please get in touch with us through clientservices@cytonn.comor book through this link Wealth Management Training. To view the Wealth Management Training topics click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of investment-ready projects

- To invest in any of our current or upcoming real estate projects, please visit Cytonn Real Estate

- Cytonn Towers, where we are only selling residential units in the first phase of residential apartments, is currently about 20.0% sold. See Cytonn Towers

- The Alma, which is 55.0% sold. See The Alma

- Amara Ridge has currently 100.0% uptake. See Amara Ridge

- Situ Village is currently 22.0% sold. See Situ Village

- The Ridge (Phase 1) is currently 31.0% sold. See The Ridge

- Taraji Heights is currently 14.0% sold. See Taraji Heights

- RiverRun Estates (Phase 1) is currently 11.0% sold. See RiverRun Estates

- With over 10 investment ready projects worth over Kshs 82.0 billon of project value, we shall be very selective on new real estate projects going forward, only focusing on Joint Ventures and real estate opportunities with deep value. We are increasingly focused on private equity deals. Should you have any deals in banking, insurance, education, hospitality and technology sectors, kindly email a teaser to PE@cytonn.com

- We continue to beef up the team with ongoing hires for a Portfolio Manager, Investment Associate and Senior Investment Analyst - Cytonn Financial Services, among others. Visit our website Careers at Cytonn to apply.

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 85.3%, from 80.8%, the previous week, as liquidity remained tight in the money market, mainly as a result of Reverse Repo Maturities and Tax Transfers from Banks worth Kshs 35.5 bn and Kshs 17.0 bn, respectively. The subscription rates for the 91, 182 and 364-day papers came in at 89.6%, 97.5%, and 71.4% compared to 130.2%, 80.4%, and 61.5%, respectively, the previous week. The yields on the 91 and 364-day papers remained unchanged at 8.1% and 11.2%, respectively, while the yield on the 182-day paper rose to 10.7%, from 10.6% the previous week. The overall acceptance rate rose to 88.9%, compared to 78.0% the previous week, with the government accepting a total of Kshs 18.2 bn of the Kshs 20.5 bn worth of bids received, against the Kshs 24.0 bn on offer. The government is still behind its domestic borrowing target for the current fiscal year, having borrowed Kshs 83.6 bn, against a target of Kshs 213.0 bn (assuming a pro-rated borrowing target throughout the financial year of Kshs 410.2 bn budgeted for the full financial year as per the Cabinet-approved 2017 Budget Review and Outlook Paper (BROP)). The usage of the Central bank overdraft facility remains high as it stands at Kshs 42.3 bn compared to a nil overdraft at the beginning of this fiscal year.

Liquidity in the money market remained tight during the week with a net liquidity withdrawal of Kshs 7.6 bn, compared to a net withdrawal of Kshs 6.0 bn the previous week. The liquidity reductions were due to Kshs 35.5 bn worth of Reverse Repo Maturities and Kshs 17.0 bn of Tax Transfer. The CBK was active in the Repo market, injecting Kshs 22.8 bn through Reverse Repo to counter the tight liquidity. Despite this, the average interbank rate declined to 7.1% from 7.6% recorded the previous week, and the average volumes traded in the interbank market increased by 56.2% to Kshs 21.4 bn from Kshs 13.7 bn the previous week.

Below is a summary of the money market activity during the week:

|

all values in Kshs bn, unless stated otherwise |

|||

|

Weekly Liquidity Position – Kenya |

|||

|

Liquidity Injection |

|

Liquidity Reduction |

|

|

Government Payments |

30.7 |

Transfer from Banks - Taxes |

17.0 |

|

Reverse Repo Purchases |

22.8 |

T-bills (Primary issues) |

15.1 |

|

T-bills Redemptions |

14.3 |

Reverse Repo Maturities |

35.5 |

|

OMO Tap Sales |

7.8 |

||

|

Total Liquidity Injection |

67.8 |

Total Liquidity Withdrawal |

75.4 |

|

Net Liquidity Injection |

|

|

(7.6) |

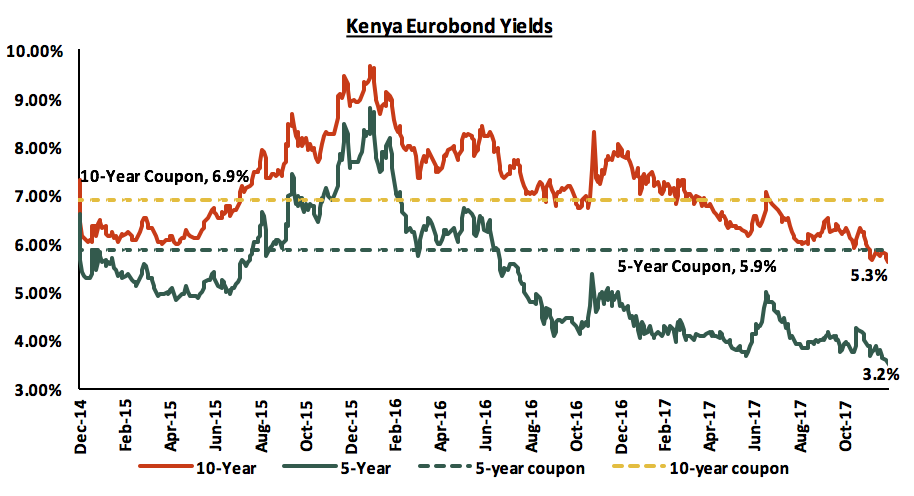

According to Bloomberg, yields on the 5-year and 10-year Eurobonds declined during the week by 20 bps and 30 bps, to close at 3.2% and 5.3%, from 3.4% and 5.6% the previous week, respectively. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 5.6% points and 4.3% points for the 5-year and 10-year Eurobonds, respectively, due to the relatively stable macroeconomic conditions in the country. The declining Eurobond yields and stable rating by Standard & Poor (S&P) are indications that Kenya’s macro-economic environment remains stable and hence an attractive investment destination. However, concerns from Moody’s and the International Monetary Fund (IMF) around Kenya’s rising debt to GDP levels may see Kenya receive a downgraded sovereign credit rating.

The Kenya Shilling depreciated marginally by 0.1% against the US Dollar during the week to close at Kshs 103.3 from Kshs 103.2 the previous week, due to increased dollar demand from importers. For the last twelve months (LTM), the shilling has depreciated by 0.5% against the US Dollar. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by (i) expected calm in the political front as the government settles into office, (ii) the weakening of the USD in the global markets as indicated by the US Dollar Index, which shed 9.9% in 2017, and 0.1% YTD, and (iii) the CBK’s intervention activities, as they have sufficient forex reserves, currently at USD 7.1 bn (equivalent to 4.7 months of import cover).

The Kenyan economy is well on the path to recovery after a challenging operating environment in 2017, with the drought and the prolonged election period being the key challenges experienced. According to the Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI), the index rose to 53.0 in the month of December from 42.8 in November, being the first time the indicator has shown positive growth since April, recorded at 50.3, an indication of better economic sentiments. A PMI reading of above the 50-point mark indicates expansion, while a reading below 50 indicates contraction. Firms reported growth in production, new orders, stocks of purchases and employment; reversing a generally downward trend since May 2017. Private sector economic activity is expected to rebound in 2018, supported by (i) the favourable weather conditions spurring agricultural activity, (ii) easing of political uncertainty now that the elections have been concluded and the president sworn into office, and (iii) inflation at 4.5% as at December 2017, remaining within the government target range of 2.5% - 7.5% that is considered favourable for economic growth.

Rates in the fixed income market have remained stable, and we expect this to continue in the short-term as the government rejects expensive bids despite being behind their borrowing target. However, a budget deficit that is likely to result from depressed revenue collection creates uncertainty in the interest rate environment as any additional borrowing in the domestic market to plug the deficit could lead to upward pressure on interest rates. Our view is that investors should be biased towards short-to medium term fixed income instruments to reduce duration risk.

During the week, the equities market was on an upward trend with NASI and NSE 25 gaining 1.7% and 1.5%, respectively, while NSE 20 remained unchanged, taking their YTD performance to 1.7%, 1.5% and 0.0% for NASI, NSE 25 and NSE 20, respectively. For the last twelve months (LTM), NASI, NSE 25 and NSE 20 have gained 31.7%, 26.9% and 16.3%, respectively. This week’s performance was driven by gains of 4.7% and 1.9% by Safaricom and Co-operative Bank, respectively. Since the February 2015 peak, the market has lost 1.9% and 32.5% for NASI and NSE 20, respectively.

Equities turnover increased significantly by 107.4% to USD 17.6 mn from USD 8.5 mn the previous week. Foreign investors remained net sellers with a net outflow of USD 1.7 mn compared to a net outflow of USD 0.2 mn recorded the previous week. We expect the market to remain supported by improved investor sentiment this year, as investors take advantage of the attractive stock valuations.

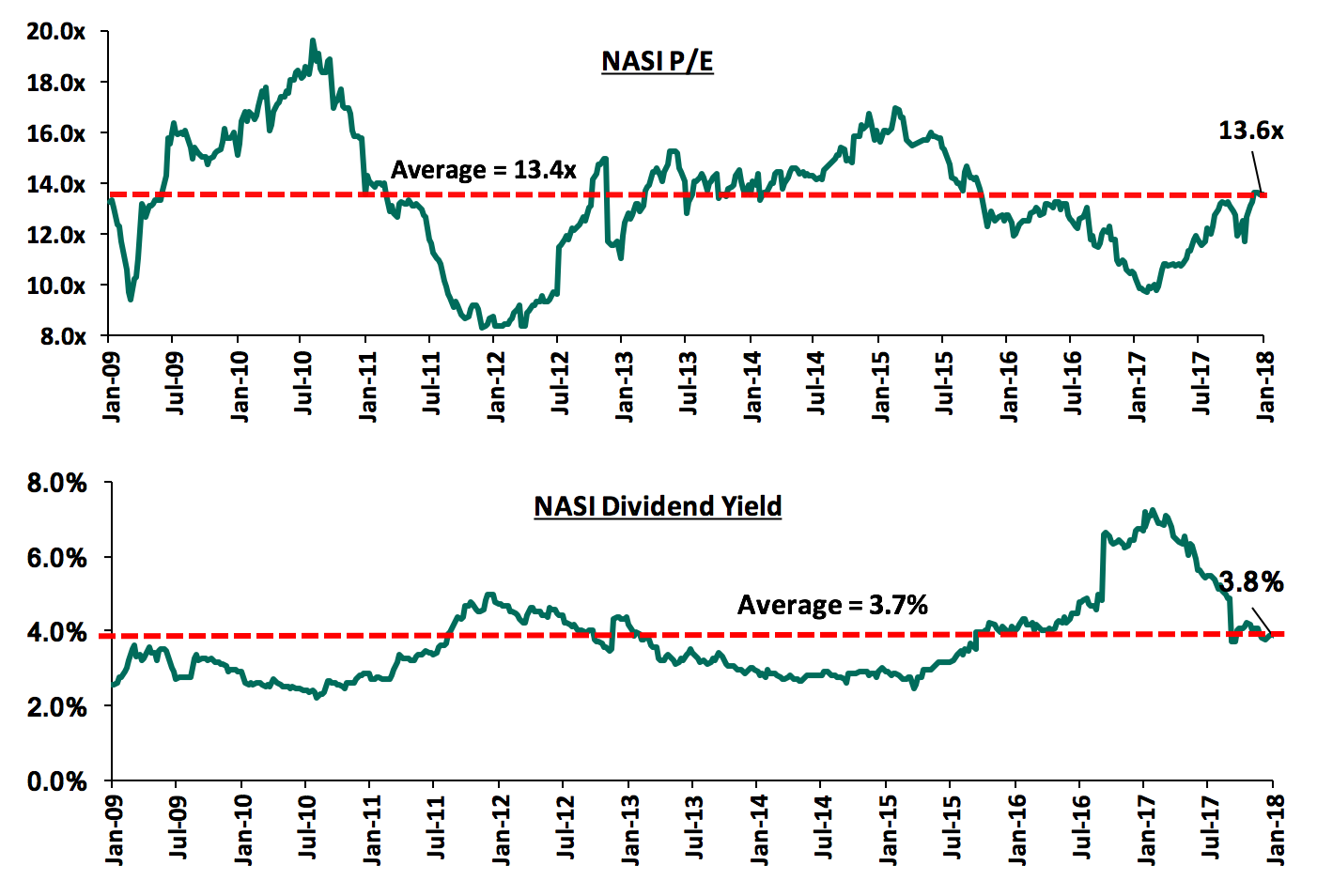

The market is currently trading at a price to earnings ratio (P/E) of 13.6x, slightly above the historical average of 13.4x, and a dividend yield of 3.8%, compared to a historical average of 3.7%. In our view, there still exist pockets of value in the market, with the current P/E valuation being 19.9% below the most recent peak of 16.9x in February 2015. The current P/E valuation of 13.6x is 39.7% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 63.1% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

The Central Bank of Kenya (CBK) has released draft guidelines seeking to create a framework that will allow banks a 5-year period to factor in the impact of additional provisions occasioned by the adoption of the new accounting standard, International Financial Reporting Standards (IFRS) 9, which requires banks to adopt a more forward looking approach in provisioning for bad loans. The new standard, which came into effect on 1st January 2018, stipulates that banks globally should implement a forward-looking approach to estimate credit losses, compared to the current International Accounting Standards (IAS) 39, which only requires banks to provide for loans after they have become non-performing. Under IFRS 9, loans that fall due by more than a day will require reclassification and more provisioning unlike under IAS 39 where loans were reclassified after they fell 90 days due. To cushion banks from the expected reduction in core capital due to increased provisioning, the CBK has proposed recouping of expected credit losses charged on the income over the five-year period. Additionally, the CBK proposes that banks should disclose in their published financials their core and total capital ratios both before and after additional expected credit losses. If the framework is adopted by the industry, it will be a relief to the smaller banks with low retained earnings as the strict application of the new requirements would have required them to raise capital and cut on lending to avoid taking in more risk. However, given the negative effects of interest rate cap on the entire banking sector, with the listed banks reporting an 8.2% decline in core earnings per share for Q3’2017 compared to a growth of 15.1% in Q3’2016, we are still of the view that some smaller banks will find it difficult to survive in this environment forcing them to be acquired by the larger, more stable banks.

CBK and Kenya Deposit Insurance Corporation (KDIC) announced receipt and acceptance of a binding offer from SBM Holdings with respect to Chase Bank Limited (In Receivership) (CBLR). The offer includes acquisition of certain assets and matching with liabilities from CBLR, and will ensure transfer of staff and branches, and 75.0% of the value of deposits currently under moratorium. CBK and KDIC have remained committed in seeing the completion of CBLR restructuring plan, which was due for completion by end of 2017, in an open and transparent manner, all in an effort to protect the interest of depositors and creditors, as well as enhance stability of Kenya’s banking sector. We expect the operationalisation of the offer to strengthen the banking sector and increase competitiveness given the increased market share by SBM Holdings with the initial acquisition of Fidelity Bank in May 2017.

During the week, Britam Holdings and HF Group issued profit warnings for their expected FY’2017 earnings projecting that the earnings will be at least 25.0% lower than the FY’2016 earnings, taking the number of companies that issued profit warnings for year ended December 2017 to 9, compared to 11 companies in 2016. The reasons cited for the poor performance were as below;

- Britam Holdings attributed the expected decline in earnings to a change in valuation method of long-term liabilities to Gross Premium Valuation (GPV) methodology from the previously applied Net Premium Valuation (NPV) methodology, which resulted in a one-off increase in FY’2016 earnings by Kshs 5.2 bn as highlighted in our Cytonn Weekly #12/2017. Britam’s earnings per share for FY’2016 came in at Kshs 1.1 from a loss per share of Kshs 0.5 in FY’2015, and

- HF Group attributed the anticipated decline in earnings to (i) the effects of interest rate capping and the unfavourable macro-economic environment, which resulted in declining credit growth, and (ii) slow processing of transactions at the Ministry of Lands Registries, which in turn slowed liquidation of some project loans.

Britam Holdings registered a 44.1% decline in core earnings per share in H1’2017, while HF Group posted a decline of 80.9% in Q3’2017, which makes the announcement of profit warnings for FY’2017 earnings not surprising. Britam is the top shareholder at HF Group with a 19.5% shareholding. Both companies are however optimistic that they will experience a turn-around in 2018 driven by key strategic initiatives. HF Group is leveraging on adoption of digital channels and scaling up on provision of affordable and decent housing to drive growth in 2018, while Britam Holdings remains keen on executing their 2016-2020 strategy, which focuses on growth and diversification of revenue streams, increasing local and regional presence, and innovation.

Below is our Equities Universe of Coverage:

|

all prices in Kshs unless stated otherwise |

||||||||

|

No. |

Company |

Price as at 29/12/17 |

Price as at 05/01/18 |

w/w Change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ (Downside)** |

|

1. |

NIC*** |

33.8 |

36.5 |

8.1% |

8.1% |

61.4 |

3.4% |

71.6% |

|

2. |

DTBK |

192.0 |

193.0 |

0.5% |

0.5% |

281.7 |

1.4% |

47.4% |

|

3. |

KCB Group |

42.8 |

42.8 |

0.0% |

0.0% |

59.7 |

7.0% |

46.7% |

|

4. |

Barclays |

9.6 |

9.6 |

(0.5%) |

(0.5%) |

12.8 |

10.4% |

44.5% |

|

5. |

Kenya Re |

18.1 |

19.5 |

7.5% |

7.5% |

24.4 |

3.9% |

29.4% |

|

6. |

I&M Holdings |

127.0 |

119.0 |

(6.3%) |

(6.3%) |

150.4 |

2.5% |

28.9% |

|

7. |

Co-op Bank |

16.0 |

16.3 |

1.9% |

1.9% |

18.6 |

5.7% |

19.7% |

|

8. |

HF Group*** |

10.4 |

10.0 |

(3.8%) |

(3.8%) |

11.7 |

0.9% |

18.1% |

|

9. |

Liberty |

12.2 |

14.0 |

14.3% |

14.3% |

16.4 |

0.0% |

17.6% |

|

10. |

Jubilee Insurance |

499.0 |

500.0 |

0.2% |

0.2% |

575.4 |

1.7% |

16.8% |

|

11. |

Britam |

13.4 |

13.7 |

2.6% |

2.6% |

15.2 |

1.7% |

12.6% |

|

12. |

CIC Group |

5.6 |

5.7 |

1.8% |

1.8% |

6.2 |

1.8% |

10.5% |

|

13. |

Equity Group |

39.8 |

40.3 |

1.3% |

1.3% |

42.3 |

4.5% |

9.6% |

|

14. |

Sanlam Kenya |

27.8 |

29.8 |

7.2% |

7.2% |

31.4 |

1.0% |

6.4% |

|

15. |

Stanbic Holdings |

81.0 |

81.0 |

0.0% |

0.0% |

79.0 |

5.1% |

2.7% |

|

16. |

Standard Chartered |

208.0 |

206.0 |

(1.0%) |

(1.0%) |

201.1 |

4.3% |

1.9% |

|

17. |

NBK |

9.4 |

9.3 |

(1.1%) |

(1.1%) |

5.6 |

0.0% |

(39.8%) |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates holds a stake For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 9th largest shareholder |

||||||||

We remain neutral on equities for investors with short-term investment horizon, but are positive for investors with a long-term investment horizon since, despite the lower earnings growth prospects for 2017, the market has rallied and brought the market P/E closer to its historical average. Pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for long-term investors.

Catalyst Principal Partners, a Nairobi Based Private Equity firm, has secured a USD 15.0 mn investment from the African Development Bank (AfDB) for their Catalyst Fund II. The fund, targeting a close of USD 175.0 mn, will be deployed in the local mid-market segment across FMCG, financial services, and healthcare. AfDB being the anchor investor in Catalyst Fund I, targets a participation of 8.6% in Catalyst Fund II, while still maintaining a governance role in the fund. Catalyst Fund I, having closed at USD 123.0 mn, is currently invested in 9 companies most notably Jamii Bora Bank and Goodlife Pharmacy in Kenya (former Mimosa Pharmacy), and Zenufa Pharmaceuticals, Effco (plant hire and distribution company) and Chai Bora in Tanzania. Catalyst, being able to raise additional funds from AfDB, a return investor, indicates local private equity expertise in fundraising, deal sourcing and monitoring of investments. It also highlights the high level of governance in local private equity firms. These qualities are preferable to global institutional investors as they need to partner with local companies that display both technical prowess and best governance practices.

M-PAYG, in its expansion strategy to cover the entire East African region, has opened up an office in Nairobi, to roll out its strategy next month in Kenya. M-PAYG, which is a Danish venture-backed start-up, aims to connect the lower income to renewable energy in a flexible pay as you go model. The system allows off-grid low-income households and businesses to access solar energy through small-scale mobile repayments (Weekly or monthly mobile repayments). With the Kenya Government’s electrification target of 100%, off grid energy solutions such as solar, are increasingly becoming more significant in the government plan. This is to be achieved through a combination of increased connectivity of homes to the national grid and off-grid solar power solutions for remote villages, largely by private investors. In addition, Solar equipment is tax exempt as part of government’s incentive to spur uptake, seen to provide the country with the shortest route towards a 100% electrification rate. Private Equity investors have also shown keen interest in renewable energy, with the recent investment in Berkeley Energy and M-KOPA, as informed by the fact that (i) only 30% of the African population have access to power, and (ii) 315 mn rural citizens are expected to get access to electricity by 2040, with 70% of this population expected to get connected through off-grid systems such as solar power.

A deal to fund Uchumi by a New York-based Private Equity fund, Kuramo Capital, has collapsed at the final stages of negotiations due to disagreement over the timing of cash injection and concerns over the Treasury’s intended sale of its 14.7% stake in the retailer. Kuramo controls a portfolio of over Kshs 30.9 bn and is the single-largest shareholder at TransCentury having acquired 25% of the firm for Kshs 2.0 bn. Following the collapse of talks with Kuramo, Uchumi has begun talks with a new Asian equity investor who is expected to inject funds required to clear the retailer’s huge debts and restock the business. We view the pursued private equity deals as the best way to revive the struggling retailer as it results in improved governance of the firm, which is the root cause of Uchumi’s downfall, in addition to funding the business.

Private equity investments in Africa remains robust as evidenced by the increasing investor interest attributed to (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Sahara Africa’s private markets, (iii) the attractive valuations in Sub Sahara Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub Sahara Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

The retail sector is expected to record increased activity in 2018 as seen through retail chains unveiling expansion plans, with Tuskys announcing a 3-year plan to increase its foothold by 56.3% to 100 new stores in Kenya and Uganda by 2020, from 64 stores presently. The expansion plan, which will cost the retailer Kshs 3.0 bn, will anchor on technology, innovation and strategic partnerships with leading technology and related solutions providers. The move highlights the expansion trend by several retailers including Naivas and international retailers such as Manix Clothes Stores, French retailer Carrefour, Botswana retailer Choppies and South Africa retailer Game. It provides an opportunity for development of retail space, and is an indication of a positive outlook on the sector that is supported by (i) an expanding middle class in the region with high purchasing power in both countries, (ii) a conducive macro-economic environment with GDP growth at a 5-year average of 5.4% and projected by the International Monetary Fund (IMF) to come in at 5.0% in 2017 for Kenya and 4.4% for Uganda, and (iii) a low retail penetration rate of 35.0% in Kenya and 20.0% in Uganda (according to the Oxford Business Group Retail Sector Ranks) that incentivizes local retailers. Other activities in the retail sector this week include:

- Rams Supermarket opened an outlet at Taj Mall, Embakasi, as its new anchor tenant. The retail store that originates from Commonwealth’s, St. Kitts and Nevis is set to fill the gap left by struggling retail chain Uchumi,

- Botswana retail chain, Choppies, plans to acquire the retail space once occupied by Nakumatt at the Nanyuki Mall after it was evicted due to rent arrears. This follows other evictions at TRM, Garden City Mall, Lifestyle, Eldoret, Meru and Junction that continue to cast the future of the struggling retailer into doubt, and

- Naivas Supermarket, the country’s leading retailer, is set to open a new 24hr retail stall in Naivasha along the busy Naivasha- Nairobi highway. The store that is set to open in June will be the 3rd in the region after Kubwa and Ndogo Naivasha.

The above is a clear indication of a bullish view on the sector as both local and international retailers continue to compete to gain traction in the Kenyan market. However, supermarkets need to address issues on corporate governance and ambitious expansion projections to avoid challenges faced by the struggling retailers, Nakumatt and Uchumi.

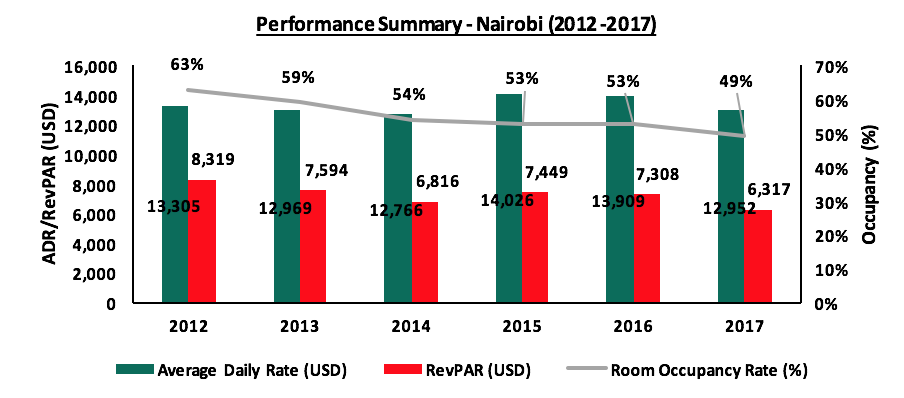

In the hospitality sector, with funding from Equity Bank, the Nairobi Institute of Business Studies (NIBS) plans to set up a 5-star hotel in the high-end surburb of Kileleshwa by 2019 at a construction cost of Kshs 400.0 mn (excluding the cost of land), with the hotel expected to serve commercial clients and offer practical knowledge and internship to the institute’s hospitality students. The new development will add to the supply of 5-star hotel rooms that currently stands at 44.0% of the total top-rated (3, 4 and 5-star) hotel rooms in Nairobi and is likely to increase competition in the sector with at least 2,945 additional rooms expected to be complete by 2020, according to the Cytonn Hospitality Report 2017. Investors have continued to cash in on the hospitality sector supported by demand, evidenced by the increase in international arrivals by 13.5% in 2016 and in conference tourism by 16.5% in 2016. In terms of performance, the hospitality sector had stabilised in 2016, as shown in the graph below, following a 5-year decline between 2011 and 2015 mainly due to insecurity. In 2017, the sector was temporarily affected by the political tension leading to reduced demand, and thus is expected to recover in 2018 given the conclusion of the elections. The table below highlights performance for the sector:

Source: Cytonn Research 2017

Other highlights in the hospitality sector this week include the stoppage of the development of tourist facilities in the Maasai Mara Game Reserve by the Narok County Administration, with the Governor citing congestion by the facilities and further adding that they pose a risk to wildlife survival. The County Government also placed a moratorium within protected areas, breeding areas and wild animal gorges, as a cushion for the world famous game reserve.

Our outlook for the hospitality sector in 2018 remains positive supported by: (i) improved security and political calm with the conclusion of the elections, (ii) aggressive marketing by the Kenya Tourism Board that is expected to continue in 2018 thus generating buy-in from USA, Europe and emerging Asian and African markets, and (iii) increased government incentives such as the elimination of VAT charges on national park fees and removal of visa fees for children under 16-years, all factors that will boost demand for hotel services.

Other highlights in real estate this week include:

- According to the dailies, Tatu City, a multi-billion master-planned project in Ruiru, terminated a local contractor, Ongata Works Ltd, who then moved to court to challenge their termination. We are of the view that the matter needs to be resolved expeditiously to prevent any delay of the master-planned project.

Tatu City has since clarified that the contract was terminated due to non-performance and that Ongata Works is just one of the contractors on site, all construction works continue unhindered.

We expect the real the estate sector to pick up as developers try to recover the losses incurred during the turbulent 2017, given the stable macroeconomic environment after the conclusion of the general elections and increased appetite by developers to the sector indicating growth.