Cytonn Weekly #49/2023

By Research, Dec 10, 2023

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed for the sixth consecutive week, with the overall subscription rate coming in at 156.9%, higher than the subscription rate of 100.3% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 31.4 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 786.1%, higher than the oversubscription rate of 485.0%, recorded the previous week. The subscription rates for the 182-day and 364-day papers recorded mixed performance with the 182-day paper increasing to 54.1%, from 27.0%, while the 364-day paper decreased to 8.0% from 19.7% recorded the previous week. The government accepted a total of Kshs 35.5 bn worth of bids out of Kshs 37.7 bn of bids received, translating to an acceptance rate of 94.3%. The yields on the government papers were on an upward trajectory, with the yields on the 91-day, 182-day, and 364-day papers increasing by 10.5 bps, 19.8 bps, and 6.8 bps to 15.6%, 15.7%, and 15.8% respectively;

In the primary bond market, the Central Bank of Kenya released the auction results for the tap sale of the newly issued infrastructure bond IFB1/2023/6.5 with a tenor to maturity of 6.5 years. The tap sale was oversubscribed, receiving bids worth Kshs 47.2 bn at face value against the offered Kshs 25.0 bn, translating to an oversubscription rate of 189.0%. The government accepted bids worth Kshs 47.9 bn at cost, translating to an acceptance rate of 101.3%. The coupon rate and the allocated average rate for accepted bids for the IFB1/2023/6.5 are both set at 17.9%,

During the week, the Monetary Policy Committee met on December 5, 2023, to review the outcome of its previous policy decisions against a backdrop of continued global uncertainties, volatility in global oil prices, a weak global growth outlook as well geopolitical tensions. The MPC decided to raise the CBR rate by 2.0% points to 12.5% from 10.5%, mainly on the back of the persistent depreciation of the Kenya Shilling;

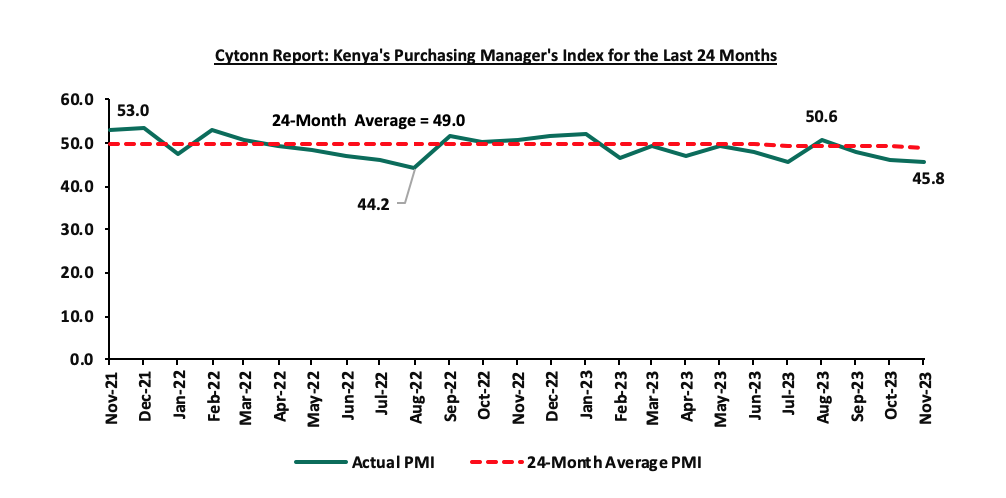

Also, during the week, Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of November 2023 deteriorated further, coming in at 45.8, down from 46.2 in October 2023, signaling a stronger downturn of the business environment for the second month of Q4’2023;

Equities

During the week, the equities market was on an upward trajectory, with NASI gaining the most by 1.8%, while NSE 20 and NSE 25 gained by 1.3% and 1.1% respectively, while NSE 10 remained unchanged. The equities market performance was driven by gains recorded by large-cap stocks such as Bamburi, Stanbic Bank, ABSA Bank and Safaricom of 18.0%, 6.1%, 5.0% and 3.6% respectively. The gains were, however, weighed down by losses recorded by large-cap stocks such as Cooperative Bank, NCBA Bank, EABL and BAT of 2.6%, 2.6%, 1.8% and 1.6% respectively;

Real Estate

During the week, French retailer Carrefour Supermarket, opened a new outlet located at the Promenade Mall in Nyali, Mombasa;

In statutory reviews, the Affordable Housing Bill of 2023 was tabled to the National Assembly. This proposal attempts to provide a legal framework for the establishment of the Affordable Housing Fund and subsequent imposition of the Affordable Housing Levy;

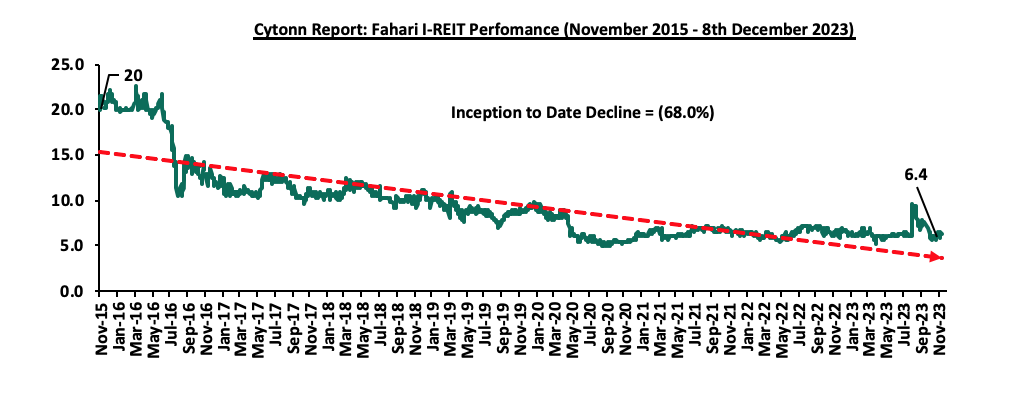

In the regulated Real Estate Funds sector, under the Real Estate Investment Trusts (REITs) segment, Fahari I-REIT closed the week trading at an average price of Kshs 6.4 per share in the Nairobi Securities Exchange, representing a 9.6% increase from the Kshs 5.8 recorded the previous week;

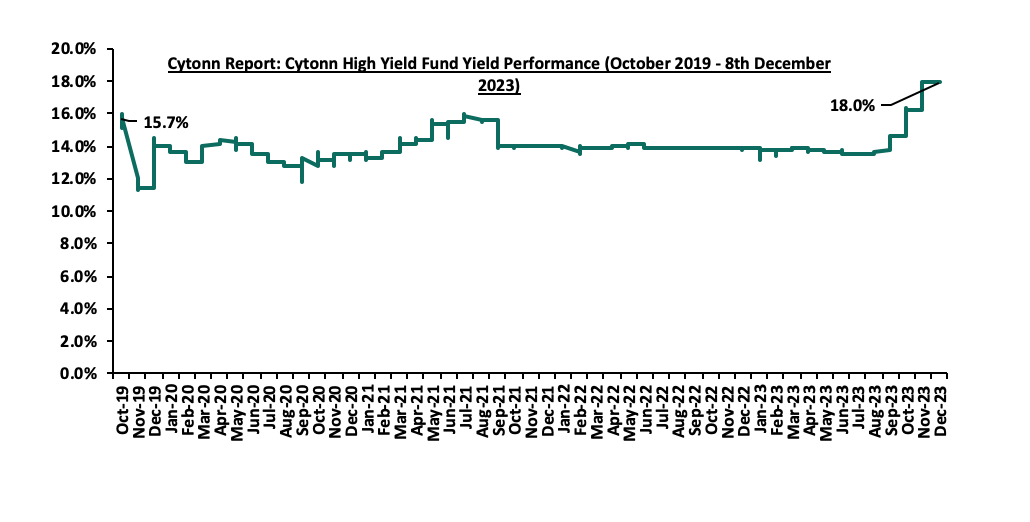

On the Unquoted Securities Platform as at 1st December 2023, Acorn D-REIT and I-REIT traded at Kshs 25.3 and Kshs 21.7 per unit respectively, a 26.6% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. In addition, Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 18.0%, remaining relatively unchanged from the previous week;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 15.44% p.a To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 17.95% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Monday, from 9:00 am to 11:00 am. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

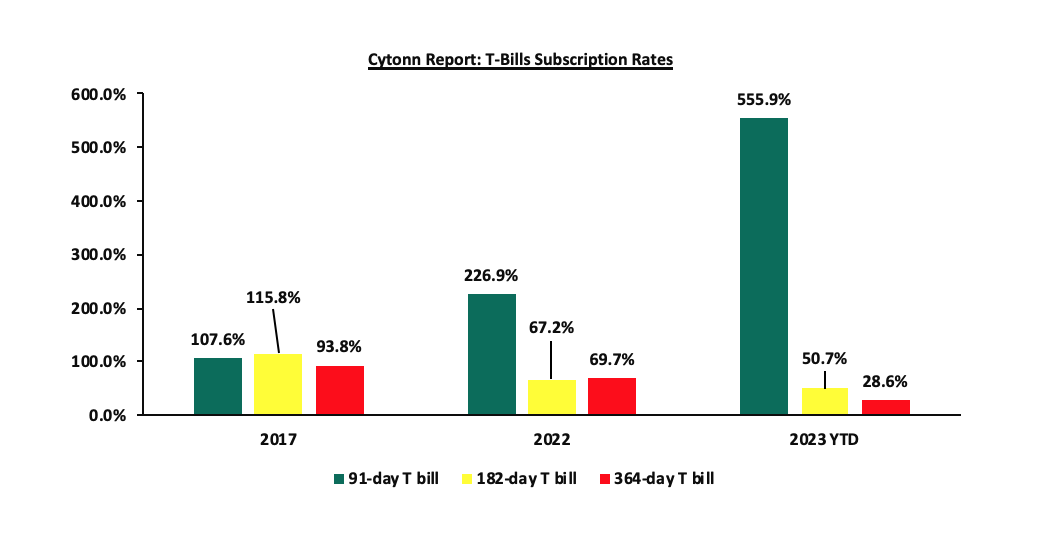

During the week, T-bills were oversubscribed for the sixth consecutive week, with the overall subscription rate coming in at 156.9%, higher than the subscription rate of 100.3% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 31.4 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 786.1%, higher than the oversubscription rate of 485.0%, recorded the previous week. The subscription rates for the 182-day and 364-day papers recorded mixed performance with the 182-day paper increasing to 54.1%, from 27.0%, while the 364-day paper decreased to 8.0% from 19.7% recorded the previous week. The government accepted a total of Kshs 35.5 bn worth of bids out of Kshs 37.7 bn of bids received, translating to an acceptance rate of 94.3%. The yields on the government papers were on an upward trajectory, with the yields on the 91-day, 182-day, and 364-day papers increasing by 10.5 bps, 19.8 bps, and 6.8 bps to 15.6%, 15.7%, and 15.8% respectively. The chart below compares the overall average T-bill subscription rates obtained in 2017, 2022, and 2023 Year-to-date (YTD):

In the primary bond market, the Central Bank of Kenya released the auction results for the tap sale of the newly issued infrastructure bond IFB1/2023/6.5 with a tenor to maturity of 6.5 years. The tap sale was oversubscribed, receiving bids worth Kshs 47.2 bn at face value against the offered Kshs 25.0 bn, translating to an oversubscription rate of 189.0%. The government accepted bids worth Kshs 47.9 bn at cost, translating to an acceptance rate of 101.3%. The coupon rate and the allocated average rate for accepted bids for the IFB1/2023/6.5 are both set at 17.9%,

Money Market Performance:

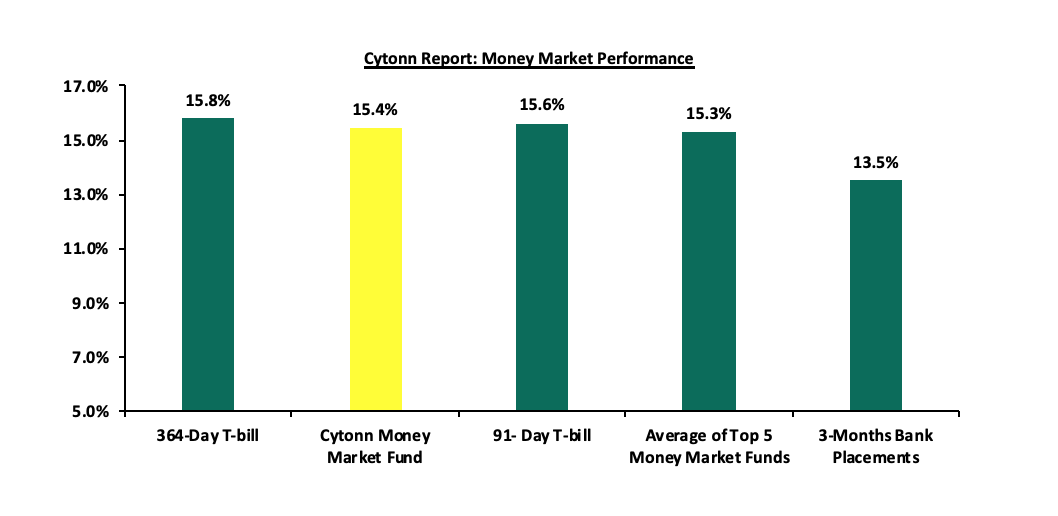

In the money markets, 3-month bank placements ended the week at 13.5% (based on what we have been offered by various banks), and the yields on the 364-day paper increased by 6.8 bps to 15.8% and 91-day T-bill yield increased by 10.5 bps to 15.6%. The yields of the Cytonn Money Market Fund decreased by 18.0 bps to 15.4% from 15.6% recorded the previous week, and the average yields on the Top 5 Money Market Funds increased by 10.2 bps to 15.3%, from 15.2% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 8th December 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 8th December 2023 |

||

|

Rank |

Fund Manager |

Effective Annual |

|

1 |

Etica Money Market Fund |

15.9% |

|

2 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn app) |

15.4% |

|

3 |

GenAfrica Money Market Fund |

15.4% |

|

4 |

Lofty-Corban Money Market Fund |

15.2% |

|

5 |

Nabo Africa Money Market Fund |

14.5% |

|

6 |

Enwealth Money Market Fund |

14.4% |

|

7 |

Sanlam Money Market Fund |

14.3% |

|

8 |

Apollo Money Market Fund |

14.3% |

|

9 |

Madison Money Market Fund |

13.9% |

|

10 |

AA Kenya Shillings Fund |

13.7% |

|

11 |

Jubilee Money Market Fund |

13.6% |

|

12 |

Co-op Money Market Fund |

13.6% |

|

13 |

GenCap Hela Imara Money Market Fund |

13.2% |

|

14 |

Kuza Money Market fund |

13.2% |

|

15 |

Old Mutual Money Market Fund |

12.9% |

|

16 |

Absa Shilling Money Market Fund |

12.8% |

|

17 |

KCB Money Market Fund |

12.2% |

|

18 |

Orient Kasha Money Market Fund |

12.1% |

|

19 |

Dry Associates Money Market Fund |

12.1% |

|

20 |

Mayfair Money Market Fund |

12.1% |

|

21 |

CIC Money Market Fund |

11.8% |

|

22 |

ICEA Lion Money Market Fund |

11.6% |

|

23 |

Equity Money Market Fund |

11.5% |

|

24 |

Mali Money Market Fund |

10.5% |

|

25 |

British-American Money Market Fund |

9.2% |

Source: Business Daily

Liquidity:

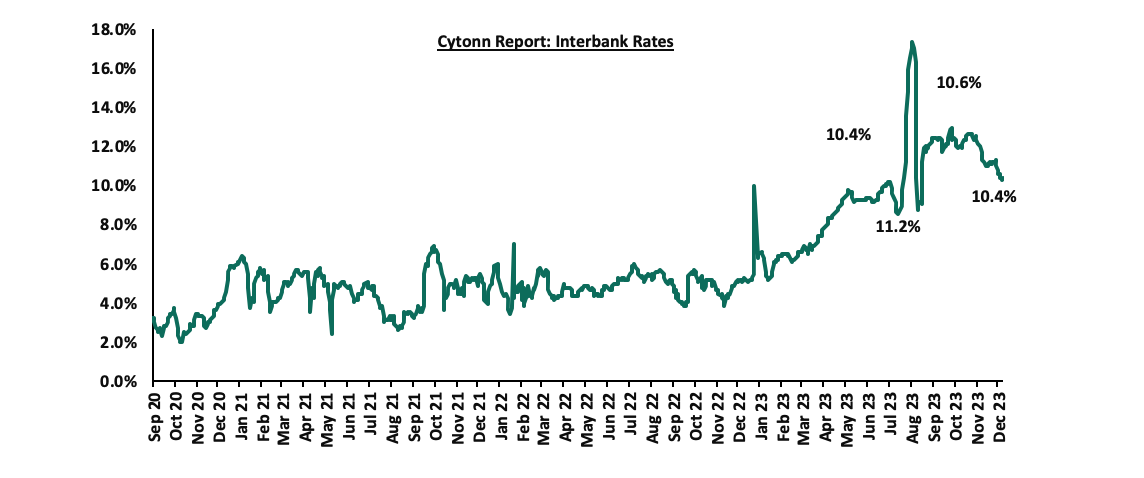

During the week, liquidity in the money markets slightly eased, with the average interbank rate decreasing to 10.4% from 11.0% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded increased by 50.6% to Kshs 20.6 bn from Kshs 13.7 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded mixed performances, with the yields on the 10-year Eurobond issued in 2018 and the 7-year bond issued in 2019 declining the most by 0.4% points each, to 11.0% and 11.5% from 11.4% and 11.9% respectively recorded the previous week, while the yields on the 10-year Eurobond issued in 2014 increased the most by 0.3% points to 14.4% from 14.1% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 7th December 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Tenor |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD) |

2.0 bn |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

|

Years to Maturity |

0.5 |

4.2 |

24.2 |

3.5 |

8.5 |

10.5 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

02-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

01-Dec-23 |

14.4% |

11.3% |

11.2% |

11.8% |

11.2% |

10.6% |

|

30-Nov-23 |

14.1% |

11.4% |

11.2% |

11.9% |

11.2% |

10.6% |

|

01-Dec-23 |

14.4% |

11.3% |

11.2% |

11.8% |

11.2% |

10.6% |

|

04-Dec-23 |

14.7% |

11.2% |

11.1% |

11.7% |

11.1% |

10.5% |

|

05-Dec-23 |

14.2% |

11.0% |

11.1% |

11.6% |

11.1% |

10.4% |

|

06-Dec-23 |

14.3% |

11.0% |

11.0% |

11.5% |

11.0% |

10.4% |

|

07-Dec-23 |

14.4% |

11.0% |

11.0% |

11.5% |

11.2% |

10.4% |

|

Weekly Change |

0.3% |

(0.4%) |

(0.2%) |

(0.4%) |

- |

(0.2%) |

|

MTD Change |

(0.0%) |

(0.3%) |

(0.2%) |

(0.3%) |

0.1% |

(0.2%) |

|

YTD Change |

1.5% |

0.5% |

0.2% |

0.6% |

0.5% |

0.5% |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling depreciated against the US Dollar by 0.1% to close at Kshs 153.3, from Kshs 153.2 recorded the previous week. On a year-to-date basis, the shilling has depreciated by 24.2% against the dollar, adding to the 9.0% depreciation recorded in 2022. We expect the shilling to remain under pressure in 2023 as a result of:

- An ever-present current account deficit which came at 3.7% of GDP in Q2’2023 from 6.0% recorded in a similar period last year,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.1% of Kenya’s external debt was US Dollar denominated as of June 2023, and,

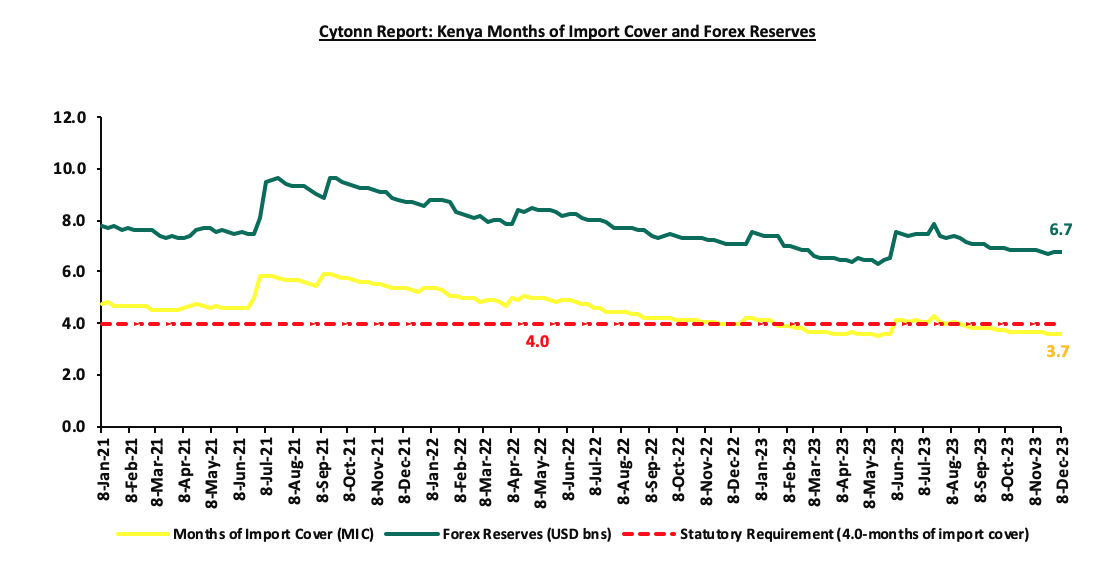

- Dwindling forex reserves, currently at USD 6.7 mn (equivalent to 3.6-months of import cover), which is below the statutory requirement of maintaining at least 4.0-months of import cover.

The shilling is however expected to be supported by:

- Diaspora remittances standing at a cumulative USD 3,462.4 mn as of October 2023, 4.1% higher than the USD 3,325.1 mn recorded over the same period in 2022, which has continued to cushion the shilling against further depreciation. In the October 2023 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 57.0% in the period, and,

- The tourism inflow receipts which came in at USD 268.1 mn in 2022, a significant 82.9% increase from USD 146.5 mn inflow receipts recorded in 2021, and tourist arrivals improved by 34.1% in the 12 months to October 2023, compared to a similar period in 2022.

Key to note, Kenya’s forex reserves remained relatively unchanged during the week at USD 6.7 mn recorded the previous week, equivalent to 3.6 months of import cover same as the previous week, and remained below the statutory requirement of maintaining at least 4.0 months of import cover. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights

- Monetary Policy Committee (MPC) December Meeting

The monetary policy committee met on December 5, 2023, to review the outcome of its previous policy decisions against a backdrop of continued global uncertainties, volatility in global oil prices, a weak global growth outlook as well geopolitical tensions. The MPC decided to raise the CBR rate by 2.0% points to 12.5% from 10.5%, which was contrary to our expectation for the MPC to retain the CBR rate at 10.5%. Our expectation to maintain the rate at 10.5% was mainly on the back of an eased inflation rate, coming in at 6.8% in November from 6.9% in October, remaining within the CBK preferred range of 2.5%-7.5% for the fifth consecutive month, as well as easing depreciation of the Shilling against the dollar, having depreciated by 1.7% in November compared to 1.9% in September. The MPC had maintained its rate in the previous meeting. Below are some of the key highlights from the December meeting:

- The overall inflation marginally eased to 6.8% in November 2023, from 6.9% in October 2023, to remain on the higher bound of the preferred CBK range of 2.5%-7.5%, mainly driven by a slight decline in food and Non-food non-fuel (NFNF) inflation. The food inflation declined slightly to 7.6% in November 2023 from 7.8% in October 2023, attributable largely to lower prices of key non-vegetable food items, particularly maize and wheat flour following improved food supply due to the ongoing harvests and government measures to zero-rate key food imports. The decrease was weighed down by an increase in the prices of a few vegetables, particularly onions, tomatoes, and carrots. Fuel inflation increased to 15.5% in November from 14.8% in October, largely attributable to increased international prices of fuel and depreciation in the shilling exchange rate. We expect the overall inflation to tighten further in the short-term, on the back of increased landing fuel prices resulting from the depreciation of the Shilling against the dollar,

- Goods exports declined by 2.0% in the 12 months to October 2023, compared to a similar period in 2022. Receipts from chemicals and manufactured exports increased by 5.1% and 13.9 percent, respectively attributable to increased regional demand. Imports declined by 14.9% in the 12 months to October 2023 compared to a growth of 14.7% in a similar period in 2022, mainly reflecting lower imports across all categories except food. Tourist arrivals improved by 34.1% in the 12 months to October 2023, compared to a similar period in 2022. Remittances totaled USD 4,165.0 million in the 12 months to October 2023 and were 4.2% higher compared to a similar period in 2022. The current account deficit is estimated at 3.7% of GDP in the 12 months to October 2023, and is projected at 4.1% of GDP in 2023 and 4.2% of GDP in 2024,

- The CBK foreign exchange reserves, which currently stand at USD 6,746.0 mn representing 3.6 months of import cover, continue to provide adequate cover and a buffer against any short-term shocks in the foreign exchange market,

- The banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans, however, increased to 15.3% in October 2023 compared to 13.8% in October 2022. Increases in NPLs were noted in the manufacturing, trade, personal and household, building and construction, and transport and communication sectors. However, banks have continued to make adequate provisions for the NPLs,

- The CEOs Survey and Market Perceptions Survey conducted ahead of the MPC meeting revealed a positive outlook on business activity for the next year. Participants of the survey expressed concerns about low demand for goods and a difficult business environment attributed to the weakening of the Kenya shilling, taxation, and higher energy costs. Despite this, they remained optimistic that economic growth would remain resilient in 2023 and improve in 2024, supported by increased agricultural production,

- The Survey of the Agriculture Sector revealed an expectation by respondents that the prices of key food items were expected to decline due to improved supply caused by the ongoing rains. Nevertheless, respondents of the survey expect prices of some consumer goods to rise in the coming months due to higher transport and energy costs attributed to the increase in fuel prices, and a rise in import costs due to the depreciation of the currency’s value,

- Global growth is expected to decrease by 0.1% points to 2.9% in 2024 from 3.0% in 2023, attributable to the impact of high-interest rates in advanced economies, weakening demand, particularly in China and the Eurozone, heightened geopolitical tensions particularly the ongoing Israel-Palestinian conflict as well as the Russia-Ukraine war, which continue to weigh down on economic activity. Additionally, headline inflation rates in advanced economies have continued to ease, but remain above their respective core inflationary targets. Global food prices have declined from the peak levels witnessed in 2022, except for a few items such as sugar and rice,

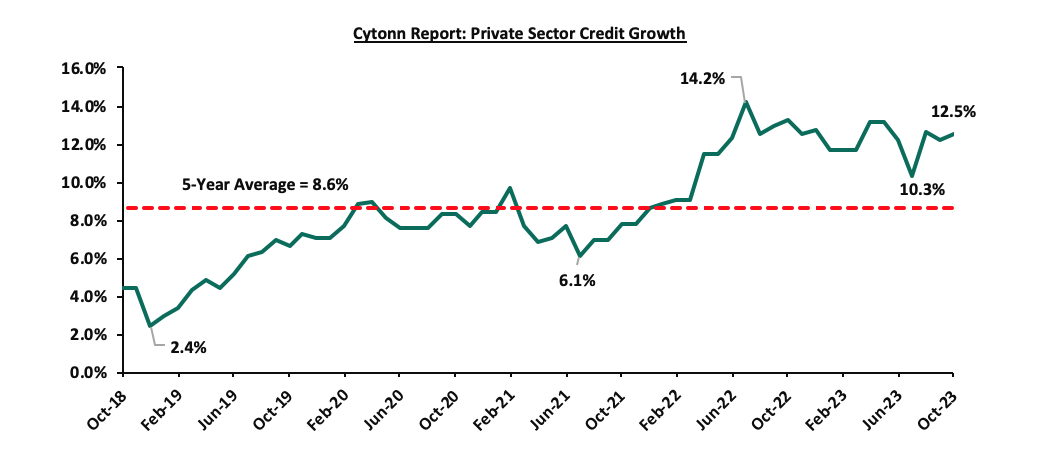

- Growth in private sector credit increased marginally to 12.5% in October 2023 from 12.2% in September, mainly attributed to credit growth in the manufacturing, transport and communication, trade, and consumer durables sectors which grew by 18.4%, 16.2%, 9.9% and 10.8% respectively. The number of loan applications and approvals remained strong, reflecting sustained demand, particularly for working capital requirements. The chart below shows the movement of the private sector credit growth over the last five years:

- The Committee noted the ongoing implementation of the FY2023/24 Government Budget, as well as the revised budget for the fiscal year which continues to reinforce fiscal consolidation.

The MPC noted the impact of the continued depreciation of the Kenyan Shilling against the dollar on domestic prices of goods and its ripple effect on the cost of living and purchasing power of consumers. Despite inflation easing marginally to 6.8% in November 2023, the committee noted concerningly that the exchange rate depreciation contributed about 3.0% points of this. Additionally, the Committee noted that public sector external debt service has risen, thereby offsetting some of the gains made towards the Government’s strong fiscal consolidation. The continued weakening of the exchange rate is also contributing to a significant increase in the Kenya shilling value of foreign currency-denominated debt. The MPC concluded that it will closely monitor the impact of the policy measures as well as developments in the global and domestic economy and stands ready to further tighten monetary policy as necessary to ensure price and exchange rate stability are achieved, in line with its mandate. The Committee will meet again in February 2024.

- Stanbic Bank’s November 2023 Purchasing Manager’s Index (PMI)

During the week, Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of November 2023 deteriorated further, coming in at 45.8, down from 46.2 in October 2023, signaling a stronger downturn of the business environment for the second month of Q4’2023. On a year-to-year basis, the index recorded a 10.0% deterioration from the 50.9 recorded in November 2022. The strong downturn of the general business environment is mainly attributable to the elevated inflationary pressure experienced in the country, with inflation remaining within the upper bound of the Central Bank of Kenya (CBK) target range of 2.5%–7.5%, coming in at 6.8% in November, a slight ease from 6.9% in October. This was mainly on the back of a slight decrease in diesel and kerosene prices by an average of Kshs 2.0 per litre, while petrol prices remained unchanged. The fuel prices however still remain relatively high, with the aggressive depreciation of the Kenyan shilling, having depreciated against the dollar by 1.7% in the month of November as well as higher taxes. As such, input costs remained near record levels after rising at the quickest pace in history last month, resulting from the deterioration of the Shilling against the dollar, which led to price pressures. Consequently, demand worsened as heightened prices resulted to an erosion of purchasing power, leading to a decline in new businesses.

Additionally, besides the agricultural sector, the manufacturing, wholesale, and retail sectors’ output and new orders declined at a faster rate compared to October, as firms adjusted to reduced demand by cutting their workforce, resulting to the highest rate of workforce cut, with higher rates only registered during the first COVID-19 lockdown. Construction recorded the highest decline in output and new business activities.

Notably, exports continued to perform strongly, helping to compensate for the weak domestic output, as demand from Asia and Europe still remained greater. Key to note, a PMI reading of above 50.0 indicates an improvement in the business conditions, while readings below 50.0 indicate a deterioration. The chart below summarizes the evolution of PMI over the last 24 months:

Going forward, we anticipate that the business environment will be constrained in the short to medium term as a result of the persistent depreciation of the Kenyan Shilling, hence heightened importation and manufacturing costs resulting to increased inflation. Furthermore, fuel prices remain high as well as food prices, putting inflationary pressures on the private sector. Additionally, the increased taxation, with the possibility of further upward tax adjustments, is expected to continue restricting the country's economic environment. As a result, the number of new enterprises is projected to remain limited as customers reduce their spending due to a lack of purchasing power. Notably, the general improvement in business environment is heavily reliant on Kenya's currency stability, given that the country's high cost of production is mostly attributable to the high import cost of goods owing to the poor performance of the shilling.

Rates in the Fixed Income market have been on an upward trend given the continued high demand for cash by the government and the occasional liquidity tightness in the money market. The government is 24.2% ahead of its prorated net domestic borrowing target of Kshs 139.8 bn, having a net borrowing position of Kshs 173.6 bn out of the domestic net borrowing target of Kshs 316.0 bn for the FY’2023/2024. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to maintain the fiscal surplus through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the week, the equities market was on an upward trajectory, with NASI gaining the most by 1.8%, while NSE 20 and NSE 25 gained by 1.3% and 1.1% respectively, while NSE 10 remained unchanged. The equities market performance was driven by gains recorded by large-cap stocks such as Bamburi, Stanbic Bank, ABSA Bank and Safaricom of 18.0%, 6.1%, 5.0% and 3.6% respectively. The gains were, however, weighed down by losses recorded by large-cap stocks such as Cooperative Bank, NCBA Bank, EABL and BAT of 2.6%, 2.6%, 1.8% and 1.6% respectively.

During the week, equities turnover increased by 16.3% to USD 8.8 mn from USD 7.6 mn recorded the previous week, taking the YTD total turnover to USD 638.4 mn. Foreign investors remained net sellers for the second consecutive week with a net selling position of USD 5.6 mn, from a net selling position of USD 0.5 mn recorded the previous week, taking the YTD foreign net selling position to USD 293.8 mn.

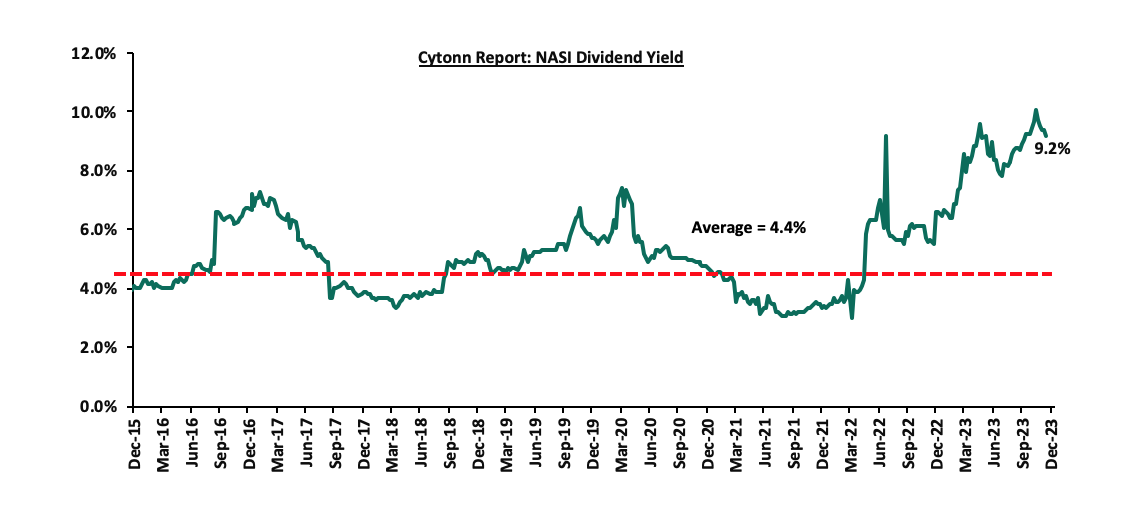

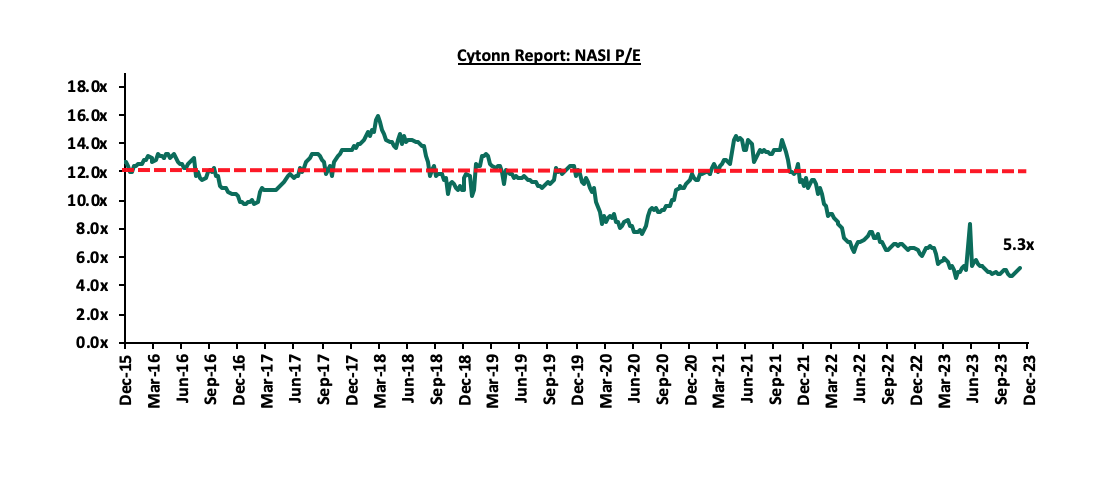

The market is currently trading at a price-to-earnings ratio (P/E) of 5.3x, 56.5% below the historical average of 12.1x. The dividend yield stands at 9.2%, 4.8% points above the historical average of 4.4%. Key to note, NASI’s PEG ratio currently stands at 0.7x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of coverage:

|

Company |

Price as at 1/12/2023 |

Price as at 8/12/2023 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

KCB Group*** |

19.0 |

19.3 |

1.6% |

(49.7%) |

30.7 |

10.4% |

69.4% |

0.3x |

Buy |

|

Liberty Holdings |

3.9 |

3.6 |

(7.9%) |

(28.6%) |

5.9 |

0.0% |

64.4% |

0.3x |

Buy |

|

Kenya Reinsurance |

1.8 |

1.8 |

(3.3%) |

(5.9%) |

2.5 |

11.0% |

53.6% |

0.1x |

Buy |

|

Jubilee Holdings |

182.0 |

185.0 |

1.6% |

(6.9%) |

260.7 |

6.6% |

47.5% |

0.3x |

Buy |

|

ABSA Bank*** |

11.0 |

11.5 |

5.0% |

(5.7%) |

14.8 |

12.3% |

41.0% |

0.9x |

Buy |

|

Sanlam |

7.5 |

7.3 |

(2.4%) |

(23.8%) |

10.3 |

0.0% |

41.0% |

2.1x |

Buy |

|

I&M Group*** |

17.4 |

17.5 |

0.9% |

2.6% |

21.8 |

13.0% |

37.5% |

0.4x |

Buy |

|

Diamond Trust Bank*** |

45.8 |

46.0 |

0.5% |

(7.7%) |

58.1 |

10.9% |

37.2% |

0.2x |

Buy |

|

Co-op Bank*** |

11.4 |

11.1 |

(2.6%) |

(8.3%) |

13.5 |

13.2% |

34.8% |

0.5x |

Buy |

|

NCBA*** |

39.0 |

38.0 |

(2.6%) |

(2.4%) |

43.2 |

10.9% |

24.6% |

0.8x |

Buy |

|

Equity Group*** |

38.0 |

37.9 |

(0.3%) |

(15.9%) |

42.6 |

10.5% |

22.9% |

0.8x |

Buy |

|

Stanbic Holdings |

102.0 |

108.3 |

6.1% |

6.1% |

118.2 |

12.4% |

21.5% |

0.8x |

Buy |

|

Standard Chartered*** |

158.5 |

161.0 |

1.6% |

11.0% |

170.9 |

13.9% |

20.0% |

1.1x |

Buy |

|

Britam |

5.1 |

5.0 |

(1.6%) |

(3.5%) |

6.0 |

0.0% |

18.9% |

0.7x |

Accumulate |

|

CIC Group |

2.4 |

2.3 |

(5.0%) |

20.4% |

2.5 |

5.4% |

14.1% |

0.7x |

Accumulate |

|

HF Group |

3.9 |

3.6 |

(8.9%) |

14.0% |

3.2 |

0.0% |

(10.9%) |

0.2x |

Sell |

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently being undervalued to its future growth (PEG Ratio at 0.7x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the equities outlook in the short term.

- Retail Sector

During the week, French retailer Carrefour Supermarket opened a new outlet located at the Promenade Mall in Nyali, Mombasa. This latest addition becomes the third Carrefour outlet in the coastal region, showcasing the franchise's aggressive expansion strategy within the Kenyan market. The new store, spanning over 1,500 SQM, aims to cater to diverse shopper needs, offering an extensive range of product categories, from groceries to everyday essentials. Additionally, the retailer showed commitment to support local communities by welcoming of 50 new colleagues to the store. Carrefour's substantial growth from 19 branches in December 2022 to 22 presently signifies its dedication to expanding its footprint in the Kenyan market and reflects a strategic approach to meet evolving consumer demands. Carrefour's aggressive expansion also encompasses a focus on growing its online shopping arm, aligning with the burgeoning e-commerce trend in Kenya. Notably, most of Carrefour's stores are situated in Nairobi, strategically positioned within suburban malls such as the Hub, Garden City, Two Rivers, Sarit, and Galleria Mall.

Carrefour, alongside Naivas and QuickMart, has launched additional stores during the year, aiming to broaden their market reach by capitalizing on Kenya's limited formal retail presence, which was recorded at 30.0% as of 2018. This expansion strategy also capitalizes on gaps created by the departure of earlier retailers like Nakumatt, Uchumi, Shoprite, and Choppies Supermarkets from the market. The following table outlines the current store counts of major local and international supermarket chains operating in Kenya;

|

Cytonn Report: Main Local and International Retail Supermarket Chains |

|||||||||

|

Name of retailer |

Category |

Branches as at FY’2018 |

Branches as at FY’2019 |

Branches as at FY’2020 |

Branches as at FY’2021 |

Branches as at FY’2022 |

Branches as at FY’2023 |

Closed Branches |

Current Branches |

|

Naivas |

Hybrid |

46 |

61 |

69 |

79 |

91 |

9 |

0 |

100 |

|

Quick Mart |

Hybrid** |

10 |

29 |

37 |

48 |

55 |

4 |

0 |

59 |

|

Chandarana |

Local |

14 |

19 |

20 |

23 |

26 |

0 |

0 |

26 |

|

Carrefour |

International |

6 |

7 |

9 |

16 |

19 |

3 |

0 |

22 |

|

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

12 |

1 |

0 |

13 |

|

Tuskys |

Local |

53 |

64 |

64 |

6 |

6 |

0 |

59 |

5 |

|

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

3 |

0 |

|

Uchumi |

Local |

37 |

37 |

37 |

2 |

2 |

0 |

35 |

2 |

|

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

0 |

15 |

0 |

|

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

0 |

4 |

0 |

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

0 |

65 |

0 |

|

Total |

|

257 |

313 |

334 |

189 |

211 |

17 |

181 |

227 |

|

*51% owned by IBL Group (Mauritius), Proparco (France), and DEG (Germany), while 49% owned by Gakiwawa Family (Kenya) |

|||||||||

|

**More than 50% owned by Adenia Partners (Mauritius), while Less than 50% owned by Kinuthia Family (Kenya) |

|||||||||

Source: Cytonn Research

Going forward, we expect to continue witnessing more expansions by both local and international retailers as they seek to establish market dominance and take up existing gaps left by retailers who exited such as Uchumi, Shoprite, Game Stores, and Choppies supermarkets. Additionally, we expect the performance of the sector will be supported by increased foreign investments into the Kenyan retail market.

- Statutory Reviews

During the week, the Affordable Housing Bill of 2023 was tabled to the National Assembly by Majority Leader Kimani Ichung’wah. With its introduction at the First Reading, this proposal attempts to provide a legal framework for the establishment of the Affordable Housing Fund and subsequent imposition of the Affordable Housing Levy, which the High Court recently ruled unconstitutional. This bill, if passed, endeavors to solidify the legality of the 1.5% Housing Levy, extending its application beyond salaried earners and outlining a framework for fund management.

The key features of the Affordable Housing Bill, 2023, include:

- Expanded Tax Scope: The Bill extends the levy to cover incomes beyond monthly salaries, targeting a levy of 1.5% of gross salaries or gross income not previously subject to the housing levy, bridging a previous criticism of its narrow focus on salaried individuals,

- Affordable Housing Levy: The purpose of the Levy shall be to provide funds for the development of affordable housing and associated social and physical infrastructure, as well as the provision of affordable housing financing to Kenyans. Additionally, the Bill categorizes affordable housing units into three main sub-classes including; social housing, affordable housing and affordable market housing units whose interest rates on loan issued under the affordable financing scheme shall be 3.0% for social and affordable housing respectively, and up to 9.0% for affordable market housing units,

- Penalties for Non-Remittance: Employers who fail to remit the Housing Levy will face heightened penalties. The proposed penalty is increased from the previous 2.0% set out in the Finance Act 2023 to 3.0%, and will be levied monthly on the unpaid amount to be recovered as a civil debt,

- Legal Framework for Levy Administration: The Bill outlines the proposed legal structures governing the administration of the fund, in line with Article 43(1)(b) of the Constitution, emphasizing the right to accessible and adequate housing,

- Eligibility and Allocation Criteria: The Bill defines and highlights provisions on the eligibility criteria and application procedure for affordable housing units. It provides that individuals eligible for Affordable Housing units must be Kenyan citizens, 18 years or older, and possess an identity card. To apply for a unit, proof of a requisite deposit set as a percentage of the affordable housing unit's value, a national ID copy, KRA PIN certificate, and additional required information must accompany the application,

- Affordable Housing Board: The levy will be managed by the Affordable Housing Board, consisting of various stakeholders, including non-public officers with qualifications in the built environment, finance, or law, as well as representatives from the Council of County Governors, Central Organization of Trade Unions, and Federation of Kenyan Employers, and,

- Affordable Housing Fund: The allocation from the Fund will be as follows: 30.0% to the National Housing Corporation for affordable housing programs, 30.0% to slum upgrading and affordable housing projects, 36.0 % to the State Department for institutional housing projects approved by the Cabinet, up to 2.0% for Levy collection, and up to 2.0% for Board administration, subject to approval by the Cabinet Secretary for the National Treasury.

By extending the levy's applicability to various income sources and imposing higher penalties for non-compliance, the bill aims to bolster funding for the affordable housing scheme. However, the bill's impact on operational logistics, nationwide execution, and how effectively it addresses the criticisms raised by the High Court remains a subject of scrutiny. If passed into law, it could herald significant changes in housing finance and accessibility, albeit potentially triggering challenges in execution and implementation at a national level.

- Regulated Real Estate Funds

- Real Estate Investments Trusts (REITs)

In the Nairobi Security Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.4 per share. The performance represents a 9.6% increase from Kshs 5.8 per share recorded last week, taking it to a 5.6% Year-to-Date (YTD) loss from Kshs 6.8 per share recorded on 3 January 2023. Additionally, the performance represents a 68.0% Inception-to-Date (ITD) loss from the Kshs 20.0 price. The dividend yield currently stands at 10.2%. The graph below shows Fahari I-REIT’s performance from November 2015 to 8th December 2023;

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.3 and Kshs 21.7 per unit, respectively, as of 1st December 2023. The performance represented a 26.6% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 30.7 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 633.8 mn, respectively, since inception in February 2021.

REITs provide various benefits like tax exemptions, diversified portfolios, and stable long-term profits. However, the continuous deterioration in performance of the Kenyan REITs and restructuring of their business portfolio is on top of other general challenges such as; i) inadequate comprehension of the investment instrument among investors, ii) prolonged approval processes for REITs creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and, iv) minimum investment amounts set at Kshs 5.0 mn, continue to limit the performance of the Kenyan REITs market.

- Cytonn High Yield Fund (CHYF)

Cytonn High Yield Fund (CHYF) closed the week with an annualized yield of 18.0%, remaining relatively unchanged the previous week. The performance represented a 4.1%-points Year-to-Date (YTD) increase from 13.9% yield recorded on 1st January 2023, and 2.3%-points Inception-to-Date (ITD) increase from the 15.7% yield. The graph below shows Cytonn High Yield Fund’s performance from November 2019 to 8th December 2023;

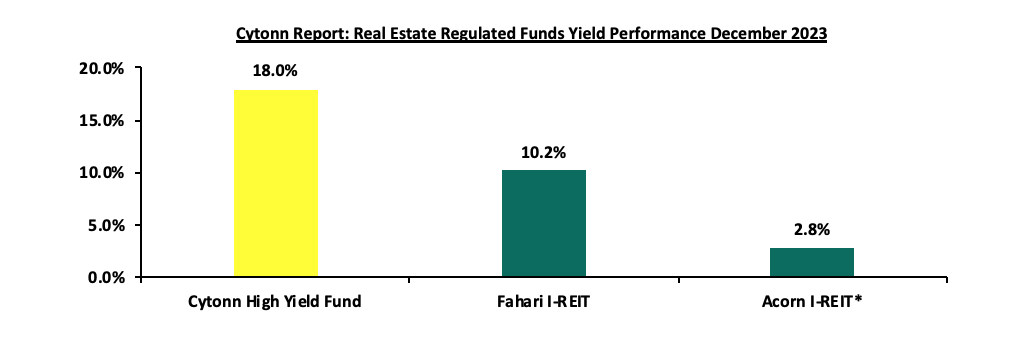

Notably, the CHYF has outperformed other regulated Real Estate funds with an annualized yield of 18.0%, as compared to Fahari I-REIT and Acorn I-REIT with yields of 10.2%, and 2.8% respectively. As such, the higher yields offered by CHYF makes the fund one of the best alternative investment resource in the Real Estate sector. The graph below shows the yield performance of the Regulated Real Estate Funds;

*H1’2023

Source: Cytonn Research

We expect the performance of Kenya’s Real Estate sector to be supported by factors such as; i) aggressive expansion strategies of both local and international retailers in strategic efforts to stamp market dominance, ii) government’s continued efforts to provide affordable housing to its citizens, and, iii) relatively positive demographics in the country increasing demand for housing. However, factors such as rising costs of construction, and, limited investor knowledge in REITs will continue to hinder optimal performance of the sector by limiting developments and investments.