Enhancing the Effectiveness of Kenya’s Housing Fund, & Cytonn Weekly #32/2024

By Research Team, Aug 11, 2024

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed for the third consecutive week, with the overall oversubscription rate coming in at 163.7%, higher than the oversubscription rate of 101.7% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 12.5 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 313.7%, albeit lower than the oversubscription rate of 371.5% recorded the previous week. The subscription rates for the 182-day and 364-day papers increased significantly to 193.1% and 74.4% respectively from the 84.7% and 10.8% respectively recorded the previous week. The government accepted a total of Kshs 34.3 bn worth of bids out of Kshs 39.3 bn bids received, translating to an acceptance rate of 87.4%. The yields on the government papers were on a downward trajectory, with the yields on the 364-day, 182-day, and 91-day papers decreasing by 0.7 bps, 13.5 bps, and 17.1 bps to 16.9%, 16.7%, and 15.8% respectively from 16.9%, 16.9% and 16.0% respectively recorded the previous week;

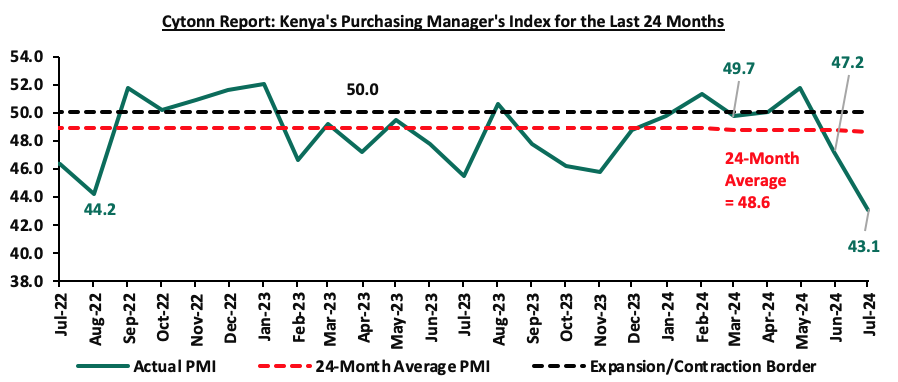

During the week, Stanbic Bank released its monthly Purchasing Managers Index (PMI) highlighting that the index for the month of July 2024 sharply deteriorated, coming in at 43.1, below the 50.0 neutral for the second consecutive month, down from 47.2 in June 2024, signaling a deterioration in the operating conditions across Kenya;

During the week, the Monetary Policy Committee (MPC) met to review the outcome of its previous policy decisions against a backdrop of an improved global outlook for growth, easing in inflation in advanced economies as well as heightened geopolitical tensions. The MPC decided to lower the CBR rate by 25.0 bps to 12.75%, from 13.00% which was in line with our expectation for the MPC to lower the CBR rate;

Equities

During the week, the equities market was on a downward trajectory, with NSE 20 being the biggest decliner by 1.5%, while NSE 10, NSE 25, and NASI declined by 1.4%, 1.3%, and 1.2% respectively, taking the YTD performance to gains of 16.6%, 14.5%, 11.0% and 8.3% for NSE 10, NSE 25, NASI, and NSE 20 respectively. The equities market performance was driven by losses recorded by large-cap stocks such as KCB Group, BAT, and DTB-K of 2.6%, 2.2%, and 2.2% respectively. The performance was, however, supported by gains recorded by large-cap stocks such as NCBA and Stanbic of 1.0% and 0.4% respectively;

During the week, Stanbic Holdings PLC released their H1’2024 Financial Results for the period ending 30th June 2024, recording a 2.3% increase in Profit After Tax (PAT) to Kshs 7.2 bn, from Kshs 7.1 bn recorded in H1’2023. The performance was mainly driven by a 4.2% increase in Net-Interest Income to Kshs 12.6 bn in H1’2024, from Kshs 12.1 bn recorded in H1’2023, but was weighed down by a 15.1% decrease in Non-Interest Income to Kshs 7.6 bn from Kshs 8.9 bn recorded in H1’2023;

Real Estate

During the week, the Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) June 2024 Reports, which highlighted the performance of major economic indicators. Additionally, the Central Bank of Kenya (CBK) released the Q1’2024 Quarterly Economic Review which highlighted the status and performance of Kenya’s economy during the period under review;

During the week, Beulah City, a Nairobi-based developer in collaboration with AMS properties and KCB bank as a finance partner, announced the launch of its inaugural 1074 affordable units housing project along Wanyee road, off Naivasha road in Nairobi;

During the week, President William Ruto launched the tarmacking of the 25-kilometre Rukuriri-Kathageri-Kanyaumbora road in Embu county. Upon completion, the road is expected to further Embu’s agricultural vibrancy, improve livelihoods, and unlock the region’s economic potential. Additionally, The Dongo Kundu Bypass was officially opened to the public following its handover by the contractor to the government. This Kshs 40 bn project, undertaken by the China Civil Engineering Construction Corporation (CCECC), began in 2018 and features a 17.5-kilometer road with three bridges;

During the week, Taita-Taveta County is set to achieve an economic milestone with the approval of a Kshs 11.0 bn steel plant by Devki Steel Mills Limited and will be completed within eight months. The plant is set to be constructed in Manga area, Voi. Narendra Raval of Devki Steel Mills was officially handed a 500-acre parcel of land to commence the construction of the plant;

Under the Real Estate Investment Trusts during the week, Acorn Holding, a student accommodation developer in Nairobi announced a bid to raise Kshs 2.8 bn in new capital for its development and investment real estate trusts (REITs) by February 2025 to fund the development and acquisition of new properties;

Additionally, on the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 9th August 2024. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at Kshs 12.3 mn and Kshs 31.6 mn shares, respectively, with a turnover of Kshs 311.5 mn and Kshs 702.7 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 9th August, 2024, representing a 45.0% loss from the Kshs 20.0 inception price;

Focus of the Week

The Housing Fund initiative is a cornerstone of Kenya’s Affordable Housing Program (AHP), aimed at addressing the nation’s significant housing deficit. Despite its critical role, the Housing Fund has faced numerous challenges that have hindered its effectiveness and acceptability among the public. By systematically addressing these challenges through targeted recommendations, the Housing Fund can be revitalized to better serve its purpose and achieve the government's housing objectives;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 18.25% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Monday, from 10:00 am to 12:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

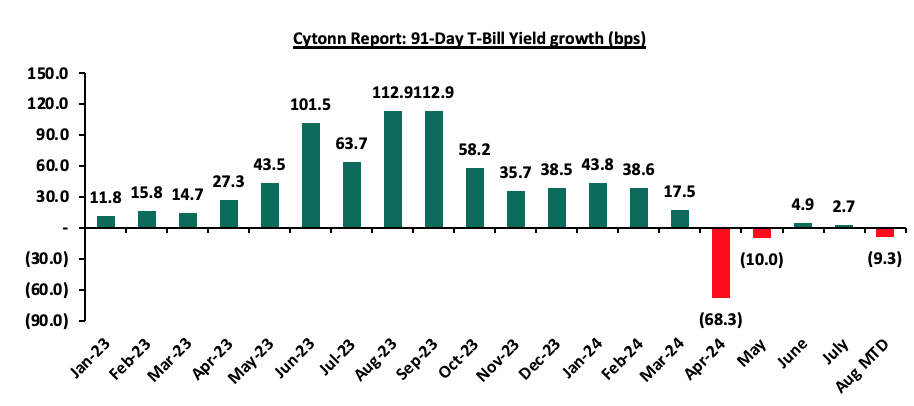

During the week, T-bills were oversubscribed for the third consecutive week, with the overall oversubscription rate coming in at 163.7%, higher than the oversubscription rate of 101.7% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 12.5 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 313.7%, albeit lower than the oversubscription rate of 371.5% recorded the previous week. The subscription rates for the 182-day and 364-day papers increased significantly to 193.1% and 74.4% respectively from the 84.7% and 10.8% respectively, recorded the previous week. The government accepted a total of Kshs 34.3 bn worth of bids out of Kshs 39.3 bn bids received, translating to an acceptance rate of 87.4%. The yields on the government papers were on a downward trajectory, with the yields on the 364-day, 182-day, and 91-day papers decreasing by 0.7 bps, 13.5 bps, and 17.1 bps to 16.9%, 16.7%, and 15.8% respectively from 16.9%, 16.9% and 16.0% respectively recorded the previous week. The chart below shows the yield growth rate for the 91-day paper over the period:

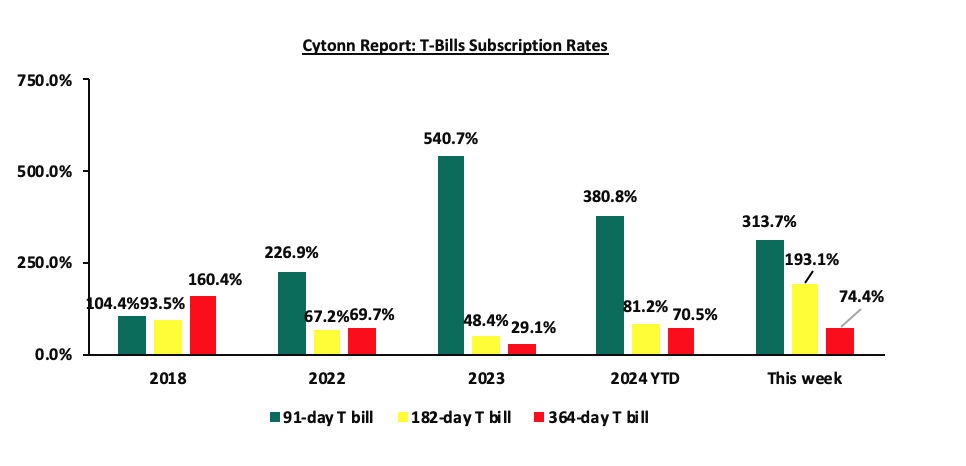

The chart below compares the overall average T-bill subscription rates obtained in 2018, 2022, 2023, and 2024 Year-to-date (YTD):

Money Market Performance:

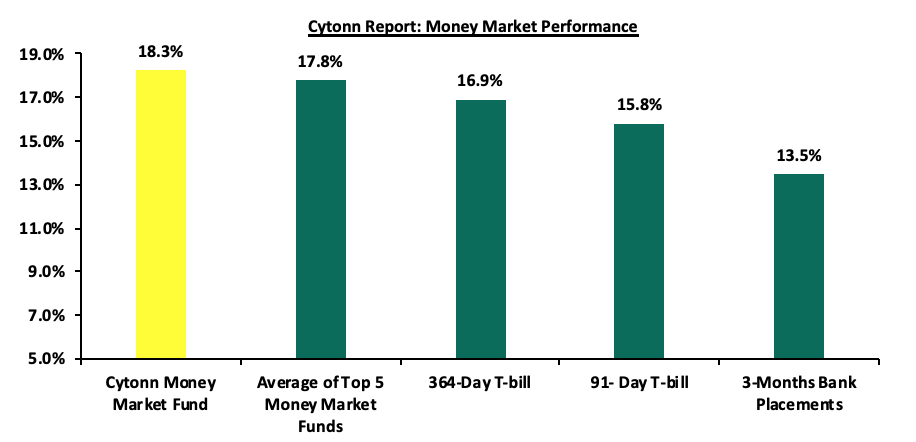

In the money markets, 3-month bank placements ended the week at 13.5% (based on what we have been offered by various banks), and the yields on the government papers were on a downward trajectory, with the yields on the 364-day and 91-day papers decreasing by 0.7 bps and 17.1 bps to 16.9% and 15.8% from 16.9% and 16.0% respectively recorded the previous week. The yields on the Cytonn Money Market Fund decreased marginally by 9.0 bps to close the week at 18.3% remaining relatively unchanged from last week, while the average yields on the Top 5 Money Market Funds decreased by 4.6 bps to remain relatively unchanged from the 17.8% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 9th August 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 9th August 2024 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn app) |

18.3% |

|

2 |

Etica Money Market Fund |

18.3% |

|

3 |

Lofty-Corban Money Market Fund |

18.2% |

|

4 |

Kuza Money Market fund |

17.1% |

|

5 |

Arvocap Money Market Fund |

17.1% |

|

6 |

GenAfrica Money Market Fund |

16.8% |

|

7 |

Sanlam Money Market Fund |

16.4% |

|

8 |

Nabo Africa Money Market Fund |

16.4% |

|

9 |

GenCap Hela Imara Money Market Fund |

16.2% |

|

10 |

Jubilee Money Market Fund |

16.0% |

|

11 |

Enwealth Money Market Fund |

16.0% |

|

12 |

Co-op Money Market Fund |

15.7% |

|

13 |

Apollo Money Market Fund |

15.6% |

|

14 |

Absa Shilling Money Market Fund |

15.5% |

|

15 |

Mayfair Money Market Fund |

15.4% |

|

16 |

KCB Money Market Fund |

15.3% |

|

17 |

Madison Money Market Fund |

15.3% |

|

18 |

AA Kenya Shillings Fund |

15.2% |

|

19 |

Mali Money Market Fund |

15.1% |

|

20 |

Orient Kasha Money Market Fund |

14.6% |

|

21 |

Dry Associates Money Market Fund |

14.0% |

|

22 |

ICEA Lion Money Market Fund |

13.8% |

|

23 |

CIC Money Market Fund |

13.7% |

|

24 |

Old Mutual Money Market Fund |

13.6% |

|

25 |

Equity Money Market Fund |

13.6% |

|

26 |

British-American Money Market Fund |

13.4% |

Source: Business Daily

Liquidity:

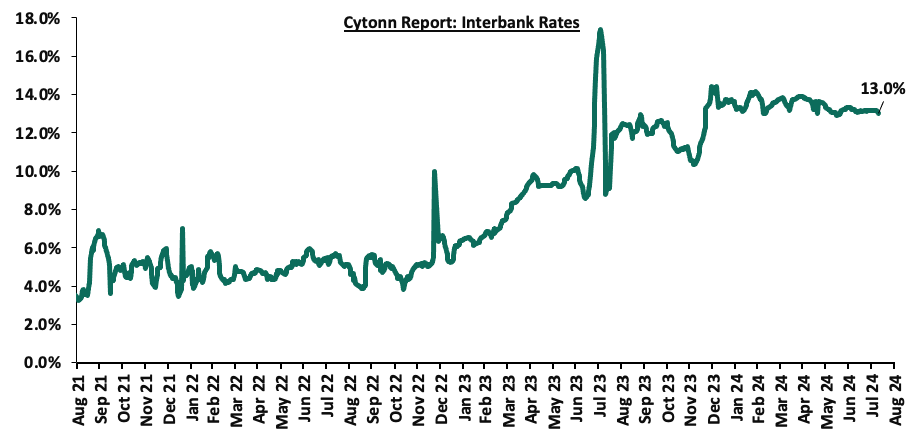

During the week, liquidity in the money markets marginally eased, with the average interbank rate decreasing by 4.4 bps, to 13.1% from the 13.2% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded decreased by 0.9% to Kshs 33.7 bn from Kshs 34.0 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Eurobonds were on an upward trajectory, with the yields on the 7-year Eurobond issued in 2019 increasing the most by 80.0 bps to 11.4% from 10.6% recorded the previous week, partly attributable to the recent downgrading of Kenya’s credit rating by Fitch Ratings, few days after Moody’s downgrade. The table below shows the summary of the performance of the Kenyan Eurobonds as of 8th August 2024;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2018 |

2019 |

2021 |

2024 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

|

Years to Maturity |

3.6 |

23.6 |

2.8 |

7.8 |

9.9 |

6.5 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

|

1-Jan-24 |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

|

|

1-Aug-24 |

10.7% |

11.1% |

10.6% |

11.0% |

10.9% |

11.1% |

|

2-Aug-24 |

11.0% |

11.3% |

10.8% |

11.2% |

11.2% |

11.3% |

|

5-Aug-24 |

11.5% |

11.7% |

11.3% |

11.6% |

11.6% |

11.8% |

|

6-Aug-24 |

11.5% |

11.6% |

11.3% |

11.7% |

11.6% |

11.8% |

|

7-Aug-24 |

11.5% |

11.6% |

11.4% |

11.6% |

11.5% |

11.7% |

|

8-Aug-24 |

11.5% |

11.6% |

11.4% |

11.6% |

11.5% |

11.7% |

|

Weekly Change |

0.8% |

0.5% |

0.8% |

0.6% |

0.6% |

0.7% |

|

MTD Change |

0.8% |

0.5% |

0.8% |

0.6% |

0.6% |

0.7% |

|

YTD Change |

1.7% |

1.4% |

1.3% |

1.7% |

2.0% |

11.7% |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling appreciated against the US Dollar by 0.5%, to close at Kshs 129.3, from Kshs 129.9 recorded the previous week. On a year-to-date basis, the shilling has appreciated by 17.7% against the dollar, a contrast to the 26.8% depreciation recorded in 2023.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,535.0 mn in the 12 months to June 2024, 12.9% higher than the USD 4,017.0 mn recorded over the same period in 2023, which has continued to cushion the shilling against further depreciation. In the June 2024 diaspora remittances figures, the US remained the largest source of remittances to Kenya accounting for 54.0% in the period, and,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 27.2% in the 12 months to June 2024, from the arrivals recorded during a similar period in 2023.

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 3.2% of GDP in Q1’2024 from 3.0% recorded in Q1’2023,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.9% of Kenya’s external debt is US Dollar-denominated as of March 2024, and,

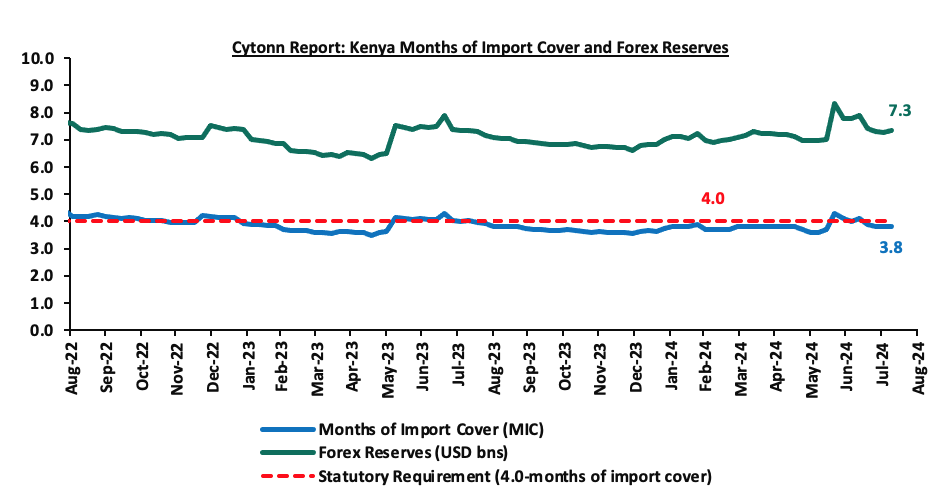

- Dwindling forex reserves currently at USD 7.3 bn (equivalent to 3.8-months of import cover), which is below the statutory requirement of maintaining at least 4.0-months of import cover, and also lower than EAC region’s convergence criteria of 4.5-months of import cover.

Key to note, Kenya’s forex reserves increased by 0.9% during the week to remain relatively unchanged at USD 7.3 bn recorded the previous week, equivalent to 3.8 months of import cover, remaining unchanged from last week, and below the statutory requirement of maintaining at least 4.0-months of import cover. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights

- Stanbic Bank’s July 2024 Purchasing Manager’s Index (PMI)

During the week, Stanbic Bank released its monthly Purchasing Managers Index (PMI) highlighting that the index for the month of July 2024 sharply deteriorated, coming in at 43.1, below the 50.0 neutral for the second consecutive month, down from 47.2 in June 2024, signaling a deterioration in the operating conditions across Kenya at the start of the third quarter. This was the second sharpest decline recorded in seven months. Private sector output dropped markedly in the month of July, reflecting a renewed and steep fall in new business intakes. On a year-to-date basis, the index recorded a 13.1% decline from the 49.8 recorded in January 2024. On a y/y basis, the index recorded a 5.3 % decline from the 45.5 recorded in July 2023. This sharp decline in the general business environment is mainly attributable to the anti-government protests in Kenya which caused disruption in the private sector in the month of July.

Disruption from the protests impacted the ability of suppliers to deliver items to companies and the completion of projects by Kenyan firms themselves. As a result, suppliers' delivery times lengthened for the first time in ten months, and backlogs of work accumulated to the greatest extent since March 2023. Despite the ease in inflation coming in at 4.3% in July 2024, from 4.6% in June 2024, well below the CBK’s preferred target of 5.0%, and remaining within the Central Bank of Kenya (CBK) target range of 2.5% to 7.5% for the thirteenth consecutive, the business environment still remained constrained, partly due to the high taxes and increased cost of living. Notably, the prices for Super Petrol, Diesel, and Kerosene decreased by Kshs 1.0, Kshs 1.5 and Kshs 1.3 each respectively, and will retail at Kshs 188.8, Kshs 171.6 and Kshs 161.8 per litre respectively from the June 2024 prices of Kshs 189.8, Kshs 173.1 and Kshs 163.1 respectively.

Input costs rose for the second consecutive month, leading to another increase in selling prices attributable to higher taxation on products. Output prices were also up modestly and for the third successive month. While some firms increased charges in response to higher input costs, others lowered selling prices in a bid to boost sales. In July, companies reduced their purchasing activities and input inventories but continued to increase their workforce. However, the rate of job creation was minimal, marking the slowest growth in the current seven-month trend of rising employment levels. Business activity decreased across the sectors covered, with the sharpest decline in agriculture. Manufacturing was the only category to post a rise in output.

Business confidence dropped and was the second-lowest on record, only marginally above the series nadir posted in February. Those companies that remained optimistic about the outlook for business activity generally linked this to plans to open new branches.

Key to note, a PMI reading of above 50.0 indicates an improvement in the business conditions, while readings below 50.0 indicate a deterioration. The chart below summarizes the evolution of PMI over the last 24 months:

Going forward, we expect the business climate to be restrained in the short to medium term as a result of the continued unrest following the anti-government protests and an overall rise in the cost of living. However, we expect firms to benefit from reduced inflationary pressures and an appreciating Shilling, which will lower input prices.

- Monetary Policy Committee (MPC) August Meeting

The monetary policy committee met on August 6, 2024, to review the outcome of its previous policy decisions against a backdrop of improved global outlook for growth, easing in inflation in advanced economies as well as the persistent geopolitical tensions. The MPC decided to lower the CBR rate by 25.0 bps to 12.75%, from 13.00% which was in line with our expectation for the MPC to lower the CBR rate. Our expectation to cut the rate was mainly on the back of rate cuts by some major economies, a stable exchange rate, anchored inflationary pressures, with inflation coming in at 4.3% in July 2024 from 4.6% in June, remaining within the CBK preferred range of 2.5%-7.5% for the thirteenth consecutive month, as well as the need to support the economy by adopting an accommodative policy that will ease financing activities. Key to note, the MPC had maintained the CBR rate at 13.0% in the previous meeting in June. Below are some of the key highlights from the August meeting:

- The overall inflation eased by 0.3% points to 4.3% in July 2024, from 4.6% in June 2024, positioning it at below the mid-point of the preferred CBK range of 2.5%-7.5%, mainly driven by the decline in fuel inflation. Fuel inflation decreased to 4.5% in July 2024 from 6.4% in June 2024, largely attributable to a downward adjustment in pump prices and lower electricity tariffs. The food inflation remained unchanged at 5.6% in July and June 2024, attributable largely to declines in prices of a key non-vegetable food items i.e. maize, sugar and wheat flour, that offset the price increase of a few vegetables i.e. tomatoes, Irish potatoes and cabbages. The non-food non-fuel inflation slightly decreased to 3.3% in July 2024 from 3.4% in June 2024, reflecting the impact of the monetary policy measures. We expect the overall inflation to remain within the CBK’s preferred range of 2.5%-7.5%, mainly on the back of a strengthened currency, reduced fuel prices and reduced electricity prices,

- The recently released Quarterly Gross Domestic Product Report, for Q1’2024 showed continued strong performance of the Kenyan economy, with real GDP growing by 5.0%, although slower than the growth of 5.5% recorded a similar period in 2023. This was attributable to a strong growth in the agriculture sector due to favourable weather conditions that boosted crop and livestock production and resilient performance of the services sector, particularly wholesale and retail trade, accommodation and food services, financial and insurance, information and communication, and real estate. The economy is expected to continue to strengthen in 2024, supported by resilient services sector, sustained performance in agriculture, and enhanced exports. However, this positive outlook is tempered by potential risks, including geopolitical tensions,

- Goods exports increased by 5.0% in the 12 months to June 2024, compared to a similar period in 2023, reflecting a rise in exports of agricultural commodities and re-exports. Receipts from tea and fruits and vegetables exports increased by 4.6% and 12.1% respectively, while re-exports grew by 56.5% in the period. Notably, exports increased 11.8% in the first half of 2024 compared to the same period in 2023. Imports declined by 3.3% in the 12 months to June 2024 compared to a similar period in 2023, mainly reflecting lower imports across all categories except sugar, machinery and transport equipment, crude materials, and miscellaneous manufactures. However, imports increased by 3.6% in the first six months of 2024 compared to the same period in 2023. Tourist arrivals improved by 27.2% in the 12 months to June 2024, compared to a similar period in 2023. Remittances totalled USD 4,535.5 mn in the 12 months to June 2024 and were 12.9% higher compared to USD 4,017.1 mn in a similar period in 2023. The current account deficit is estimated at 3.7% of GDP in the 12 months to June 2024, down from 4.2% of GDP in a similar period in 2023, and is projected at 4.0% of GDP in 2024, reflecting improvement in exports of agricultural products, sustained remittances, recovery in imports supported by a stable exchange rate and effects of regional trade integration initiatives,

- The CBK foreign exchange reserves, which currently stand at USD 7,340 mn representing 3.8 months of import cover, continue to provide adequate cover and a buffer against any short-term shocks in the foreign exchange market,

- The banking sector remains stable and resilient, with strong liquidity and capital adequacy ratios. The ratio of gross non-performing loans (NPLs) to gross loans increased to 16.3% in June 2024 compared to 16.1% in April 2024, attributable to the 1.5% decrease in gross loans, that outpaced the 0.7% decrease in gross non-performing loans (NPLs) between the two periods. Decreases in NPLs were noted in the agriculture, real estate, manufacturing, transport and communication, trade and building and construction sectors. Banks have continued to make adequate,

- The CEOs Survey and Market Perceptions Survey conducted ahead of the MPC meeting revealed a positive outlook on business activity for the next year. Participants of the survey expressed concerns about the impact of the recent protests on economic activities, high cost of doing business and the impact of geopolitical uncertainties on the economy. Despite this, they remained optimistic that economic growth would remain resilient and improve in 2024, supported by increased agricultural production, and a stable macroeconomic activity reflected in the low inflation rate and stability in the exchange rate,

- The Survey of the Agriculture Sector for July 2024 revealed an expectation by respondents that inflation was expected to remain unchanged or decrease in the next three months due to expected rise in food supply due to expected harvests, stable exchange rate, and lower fuel prices,

- Global growth is expected to continue to recover, attributable to strong growth in the United States and improved growth in several large and emerging markets, particularly India and China. Additionally, headline inflation rates have moderated, with central banks in some major economies lowering their interest rates. Food inflation has continued to decline due to an improved supply of key food items, particularly sugar and cereals. International oil prices have moderated but the risk premium from the Middle East conflict has increased following the recent escalation,

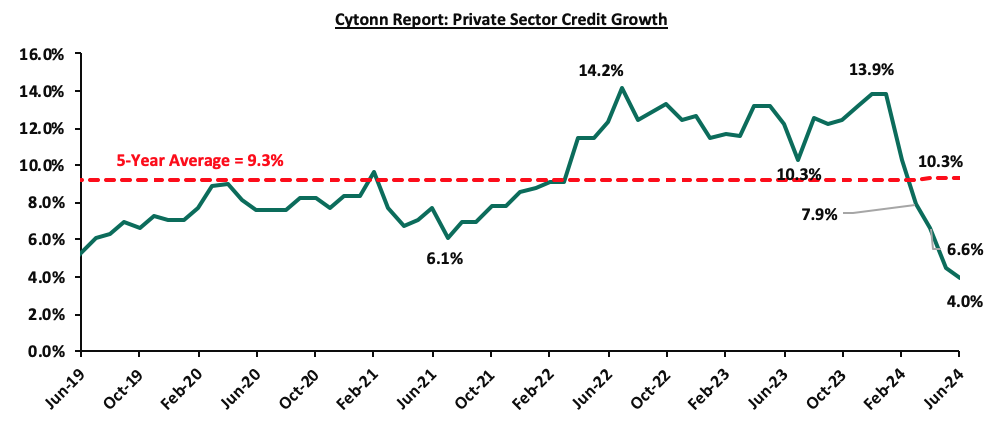

- Growth in private sector credit decreased to 4.0% in June 2024 from 4.5% in May 2024, mainly attributed to exchange rate valuation effects on foreign currency-denominated loans due to the appreciation of the Shilling. In June, local currency loans increased by 10.2%, while foreign currency loans, which make up around 26.0% of total loans, decreased by 13.3%. The chart below shows the movement of the private sector credit growth over the last five years:

- The Committee acknowledged the results of implementing the FY’2024/25 Government Budget and the FY’2024/25 Supplementary Budget I. These measures are anticipated to further support fiscal consolidation, reducing the fiscal deficit to 4.3% of GDP in FY’2024/25, from 5.6% of GDP in FY’2023/24. This medium-term fiscal consolidation is expected to decrease debt vulnerabilities and improve the debt/GDP ratio, steering it toward a more sustainable position.

The MPC noted that its previous measures have successfully reduced overall inflation to below the mid-point of the target range of 2.5%-7.5%, stabilized the exchange rate, and anchored inflationary expectations. The Committee also noted a moderation in NFNF inflation, while central banks in several major economies have reduced interest rates in response to easing inflationary pressures, with signs that others may soon follow suit. Consequently, the MPC concluded that there was scope for a gradual easing of monetary policy, while maintaining exchange rate stability, which we expect to gradually ease the interest rates in the country. The MPC will closely monitor the impact of its policy measures, as well as developments in the global and domestic economy, and stands ready to take further action as necessary in line with its mandate. We anticipate that the reduction in the CBR rate will start to lower borrowing costs, leading to increased spending and an uptick in the business environment as well as reduced debt servicing costs for the government, as the MPC closely monitors inflation and exchange rate stability to ensure the continuation of the current trend of stability and eased inflation. The Committee will meet again in October 2024.

Rates in the Fixed Income market have been on an upward trend given the continued high demand for cash by the government and the occasional liquidity tightness in the money market. The government is 14.3% ahead of its prorated net domestic borrowing target of Kshs 49.5 bn, having a net borrowing position of Kshs 56.6 bn. However, we expect a downward readjustment of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to normalize in the medium to long-term and hence investors are expected to shift towards the long-term papers to lock in the high returns.

Market Performance:

During the week, the equities market was on a downward trajectory, with NSE 20 being the biggest decliner by 1.5%, while NSE 10, NSE 25, and NASI declined by 1.4%, 1.3%, and 1.2% each, taking the YTD performance to gains of 16.6%, 14.5%, 11.0% and 8.3% for NSE 10, NSE 25, NASI, and NSE 20 respectively. The equities market performance was driven by losses recorded by large-cap stocks such as KCB Group, BAT, and DTB-K of 2.6%, 2.2%, and 2.2% respectively. The performance was, however, supported by gains recorded by large-cap stocks such as NCBA and Stanbic of 1.0% and 0.4% respectively.

During the week, equities turnover increased by 58.6% to USD 14.8 mn from USD 9.3 mn recorded the previous week, taking the YTD total turnover to USD 410.5 mn. Foreign investors became net buyers for the first time in four weeks with a net buying position of USD 3.1 mn, from a net selling position of USD 2.5 mn recorded the previous week, taking the YTD foreign net buying position to USD 4.1 mn.

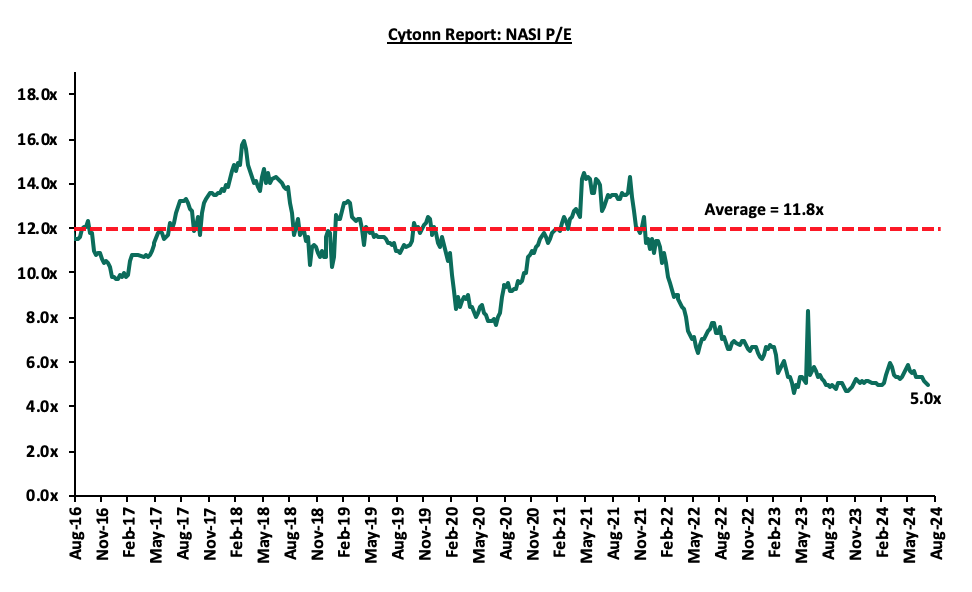

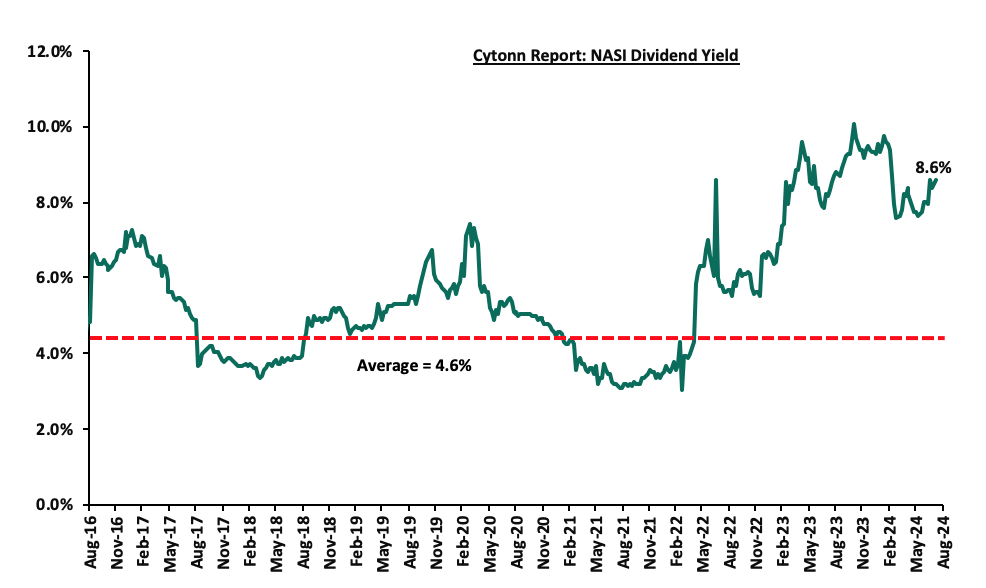

The market is currently trading at a price-to-earnings ratio (P/E) of 5.0x, 58.1% below the historical average of 11.8x. The dividend yield stands at 8.6%, 4.0% points above the historical average of 4.6%. Key to note, NASI’s PEG ratio currently stands at 0.6x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

||||||||||

|

Company |

Price as at 02/08/2024 |

Price as at 09/08/2025 |

w/w change |

YTD Change |

Year Open 2024 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Jubilee Holdings |

160.0 |

152.5 |

(4.7%) |

(17.6%) |

185.0 |

260.7 |

9.4% |

80.3% |

0.2x |

Buy |

|

Equity Group*** |

40.5 |

40.0 |

(1.2%) |

16.8% |

34.2 |

60.2 |

10.0% |

60.7% |

0.8x |

Buy |

|

Diamond Trust Bank*** |

46.0 |

45.0 |

(2.2%) |

0.6% |

44.8 |

65.2 |

11.1% |

56.0% |

0.2x |

Buy |

|

KCB Group*** |

30.8 |

30.0 |

(2.6%) |

36.7% |

22.0 |

46.7 |

0.0% |

55.5% |

0.5x |

Buy |

|

NCBA*** |

39.1 |

39.5 |

1.0% |

1.5% |

38.9 |

55.2 |

12.0% |

52.0% |

0.7x |

Buy |

|

Co-op Bank*** |

12.9 |

12.7 |

(1.6%) |

11.5% |

11.4 |

17.2 |

11.9% |

47.8% |

0.6x |

Buy |

|

CIC Group |

2.1 |

2.0 |

(6.1%) |

(12.2%) |

2.3 |

2.8 |

6.5% |

45.8% |

0.6x |

Buy |

|

I&M Group*** |

20.7 |

20.4 |

(1.5%) |

16.6% |

17.5 |

25.5 |

12.5% |

37.8% |

0.4x |

Buy |

|

Stanbic Holdings |

116.5 |

117.0 |

0.4% |

10.4% |

106.0 |

145.3 |

13.1% |

37.3% |

0.8x |

Buy |

|

Britam |

5.7 |

5.5 |

(3.2%) |

7.0% |

5.1 |

7.5 |

0.0% |

36.4% |

0.8x |

Buy |

|

ABSA Bank*** |

14.0 |

14.0 |

0.0% |

21.2% |

11.6 |

17.3 |

11.1% |

34.6% |

1.1x |

Buy |

|

Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

||||||||||

Weekly Highlights

- Stanbic Holdings PLC H1’2024 Financial Performance

During the week, Stanbic Holdings PLC released their H1’2024 Financial Results for the period ending 30th June 2024, recording a 2.3% increase in Profit After Tax (PAT) to Kshs 7.2 bn, from Kshs 7.1 bn recorded in H1’2023. The performance was mainly driven by a 4.2% increase in Net-Interest Income to Kshs 12.6 bn in H1’2024, from Kshs 12.1 bn recorded in H1’2023, but was weighed down by a 15.1% decrease in Non-Interest Income to Kshs 7.6 bn from Kshs 8.9 bn recorded in H1’2023.

Below is a summary of their H1’2024 results;

|

Cytonn Report: Stanbic Holdings Income Statement |

|||

|

Item (All figures in Bns) |

H1'2023 |

H1'2024 |

y/y change |

|

Net Interest Income |

12.1 |

12.6 |

4.2% |

|

Non-Interest Income |

8.9 |

7.6 |

15.1% |

|

Operating Income |

20.9 |

20.1 |

4.0% |

|

Loan Loss Provisions |

(2.5) |

(2.0) |

(21.7%) |

|

Staff Costs |

(3.8) |

(4.3) |

11.4% |

|

Other OPEX |

(4.9) |

(3.9) |

(21.0%) |

|

Total OPEX |

(11.2) |

(10.1) |

(10.1%) |

|

Profit Before Tax |

9.7 |

10.0 |

3.0% |

|

Profit After Tax |

7.1 |

7.2 |

2.3% |

|

Dividend Per Share |

1.2 |

1.8 |

60.0% |

Source: Stanbic Holdings PLC H1’2024 financial statements

|

Cytonn Report: Stanbic Holdings Balance Sheet |

|||

|

Item (All figures in Bns) |

H1'2023 |

H1'2024 |

y/y change |

|

Customer Net Loans |

244.1 |

238.2 |

(2.4%) |

|

Gov't Securities |

54.0 |

42.7 |

(21.0%) |

|

Total Assets |

384.3 |

497.9 |

29.6% |

|

Customer Deposits |

273.0 |

355.6 |

30.3% |

|

Borrowings |

12.3 |

10.5 |

(15.0%) |

|

Total liabilities |

320.3 |

428.6 |

33.8% |

|

Shareholder funds |

64.0 |

69.4 |

8.5% |

|

Minority interest |

0.0 |

0.0 |

0.0% |

|

Total equity |

64.0 |

69.4 |

8.5% |

Source: Stanbic Holdings PLC H1’2024 financial statements

For a more detailed analysis, see our Stanbic Holdings PLC H1’2024 Earnings Note

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery. With the market currently being undervalued for its future growth (PEG Ratio at 0.8x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors’ sell-offs to continue weighing down the equities outlook in the short term.

- Industry Report

During the week, the Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) June 2024 Reports, which highlighted the performance of major economic indicators. Key highlights related to the Real Estate sector include;

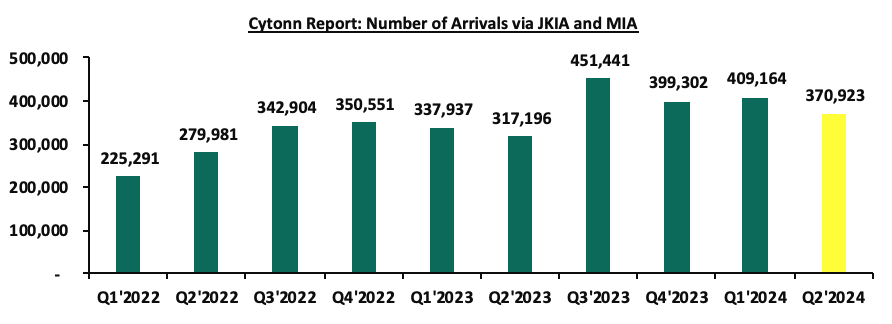

- In June 2024, the number of arrivals was 149,922, reflecting a 27.4% increase from 117,639 in May 2024. On a year-on-year basis, this represented a 13.3% increase compared to 132,297 arrivals in June 2023. The improved performance can be attributed to several factors; i) recovery in the global tourism industry coupled with a strong marketing campaign, ii) visa openness following the introduction of the Electronic Tourist Authorization (ETA) at the beginning of the year, iii) improvements in air connectivity through introduction of new routes and more frequencies by major airlines and the introduction of direct flights by three new airlines—IndiGo (Mumbai-Nairobi), Fly Dubai (Dubai-Mombasa), and Airlink (Johannesburg-Nairobi), iv) the creation of specialized tourism offerings such as cruise, adventure, cultural, and sports tourism, and, v) expanded global promotion of Kenya's tourism by the Ministry of Tourism and the Kenya Tourism Board using platforms like Magical Kenya. On a q/q basis, the performance represented a 9.3% decrease to 370923 in Q2’2024 from 409,164 arrivals recorded in Q1’2024. The performance can be attributed to the ongoing anti-government protests. The chart below shows the number of international arrivals in Kenya between Q1’2022 and Q2’2024;

Source: Kenya National Bureau of Statistics (KNBS)

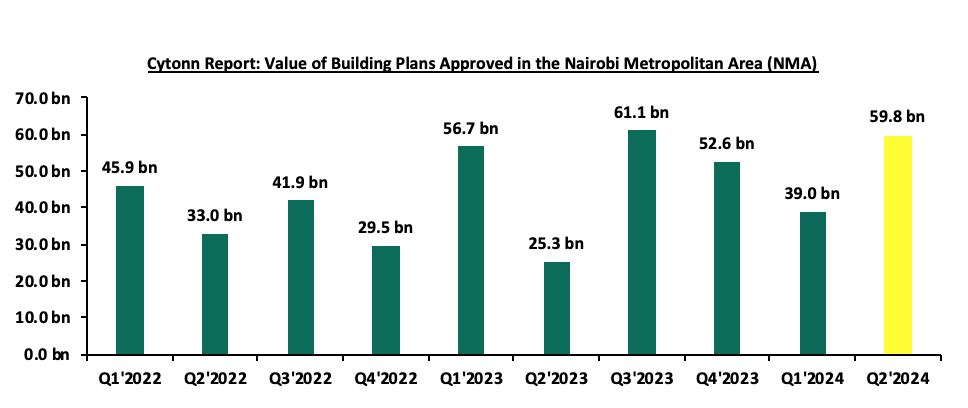

- The total value of building plans approved in the Nairobi Metropolitan Area (NMA) increased y/y basis by 136.1% to Kshs 59.8 bn in Q2’2024, from Kshs 25.3 bn recorded in Q2’2023. In addition, on a q/q basis, the performance represented a 53.2% increase from Kshs 39.0 bn recorded in Q1’2024. The increase in performance was attributable to; clearing of pending approvals by the Nairobi County Government which made significant progress in clearing a backlog which led to a notable increase in the number of approved building plans; the push to address housing shortages has led to increased construction activity, there was a continued inflow of investments into the Real Estate sector, further driving the value of building plans. Investors were attracted by the potential for returns in Kenya's growing urban centers, especially in the Nairobi Metropolitan Area. The chart below shows the value of building plans approved in the Nairobi Metropolitan Area (NMA) between Q1’2022 and Q2’2024;

Source: Kenya National Bureau of Statistics (KNBS)

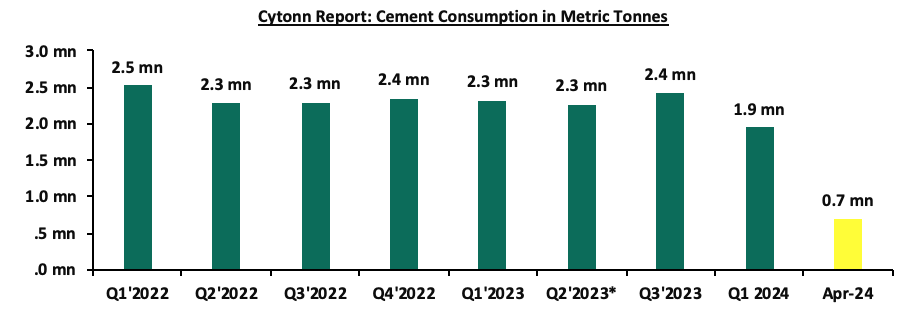

Source: Kenya National Bureau of Statistics (KNBS) - The consumption of cement came in at 0.7 mn metric tonnes in April 2024, a 7.0% increase from 0.65 mn metric tonnes recorded in March 2024. On a y/y basis, the performance represented a 5.5% decrease from 0.74 mn metric tonnes recorded in April 2023. The decline in performance was attributable to; i) increased costs of the construction, which increased by 41.7% to Kshs 900 from Kshs 650 per 50 kg bag. The chart below shows cement consumption in metric tonnes in Kenya between Q1’2022 and April 2024;

Source: Kenya National Bureau of Statistics (KNBS)

Additionally, the Central Bank of Kenya (CBK) released their Q1’2024 Quarterly Economic Review which highlighted the status and performance of Kenya’s economy during the period under review. The following were the key take outs from the report, with regard to the Real Estate and related sectors;

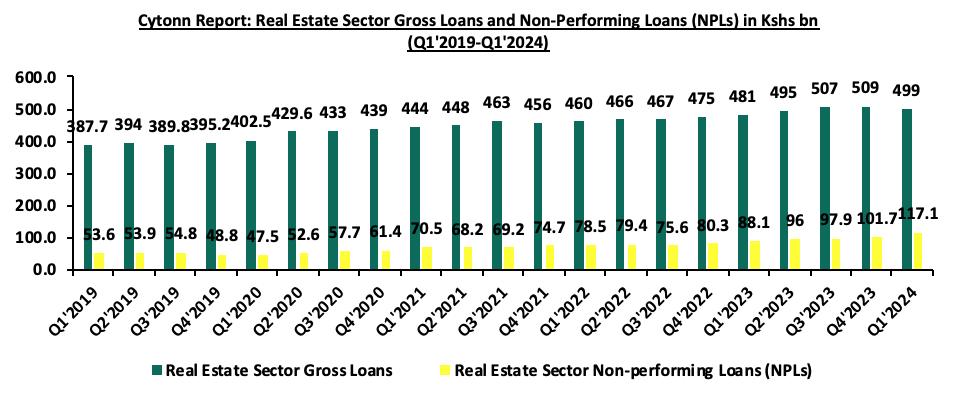

- The year-on-year (y/y) gross loans advanced to the Real Estate sector increased by 3.7% to Kshs 499.0 bn in Q1’2024, from Kshs 481.0 bn in Q1’2023. The advanced loans also represented a 2.0% quarter-on-quarter (q/q) decrease from Kshs 509.0 bn realized in Q4’2023. The decrease can be attributable to a 25.9% decrease in value of buildings approved to Kshs 39.0 bn in Q1’2024 from Kshs 52.6 bn in Q4’2023 in the Nairobi Metropolitan Area (NMA),

- The gross Non-Performing Loans (NPLs) in the Real Estate sector realized a q/q increase of 15.0% to Kshs 117.1 bn in Q1’2024, from Kshs 101.70 bn in Q4’2023. This can be attributed to; i) delayed repayments resulting from a challenging business environment), iii) higher existing taxes and new tax implementations, and, iv) increased loan interest payments following central bank rate hikes. The graph below shows the Gross Loans advanced to the Real Estate sector against Non-Performing Loans in the sector from Q1’2019 to Q1’2024;

Source: Central Bank of Kenya (CBK)

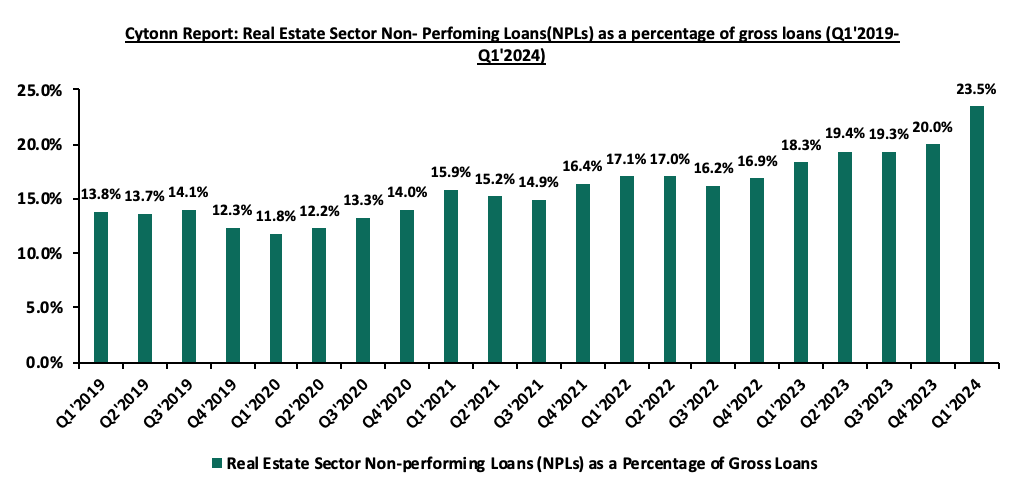

The graph below shows the Non-Performing Loans as a percentage of Gross Loans advanced to the Real Estate sector from Q1’2019 to Q1’2024;

Source: Central Bank of Kenya (CBK)

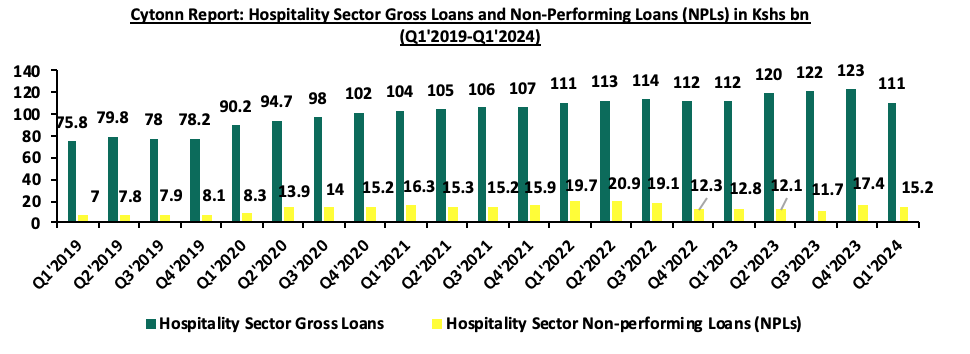

- The gross loans advanced to the hospitality sector decreased by 0.9% to Kshs 111.0 bn in Q1’2024, from Kshs 112.0 bn in Q1’2023 on a y/y basis. On a q/q basis, the performance also represented a 9.8%-points decrease to Kshs 111.0 bn recorded in Q1’2024 from Kshs 123.0 bn in Q4’2023. The decrease can be attributed to year-round repayment of outstanding loans, as the sector experiences recovery post-COVID-19 Pandemic, coupled with the tightening of the monetary policies whereby the MPC decided to raise the CBR rate by 50 basis points to 13.0% from 12.5% in February 2024, thus increasing the cost of borrowing for individuals and businesses in the hospitality industry during the Q1’ 2024 period,

- Gross NPLs in the hospitality sector reduced on a y/y basis by 15.8% to Kshs 15.2 bn in Q1’2024 from Kshs 12.8 bn in Q1’2023. The performance can be attributed to; i) the sector expansion by 28.0% in Q1’2024 on the back of increased international arrivals through Jomo Kenyatta International Airport (JKIA) and Moi International Airport (MIA) on a y/y basis by 10.4% to 409,164 in Q1’2024, from the 370,570 visitors recorded in Q1'2023 on the back of receding adverse effects of COVID-19 pandemic leading to increased tourism activities in the sector. The graph below shows Gross Loans advanced to the Hospitality sector against Non-Performing Loans in the sector from Q1’2019 to Q1’2024;

Source: Central Bank of Kenya (CBK)

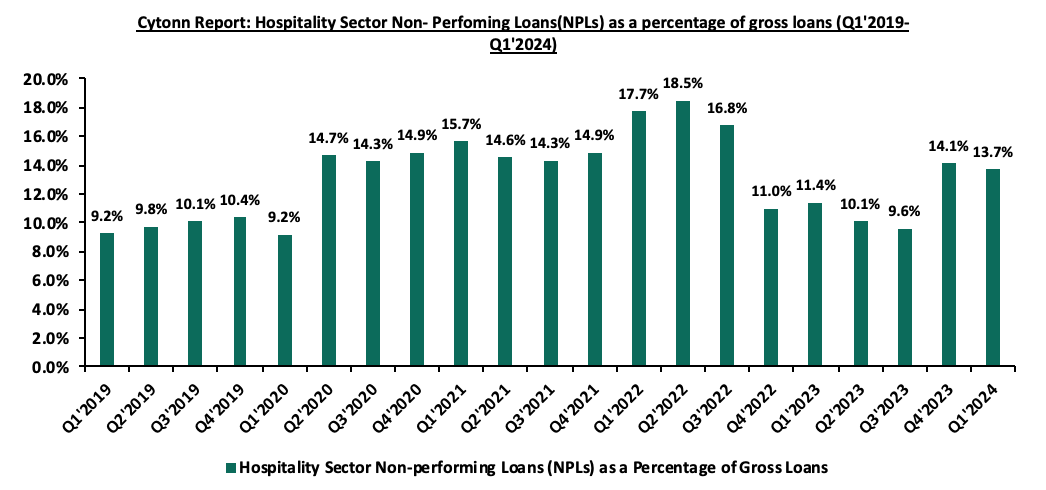

The graph below shows the Non-Performing Loans as a percentage of Gross Loans advanced to the Hospitality sector from Q1’2019 to Q1’2024;

Source: Central Bank of Kenya (CBK)

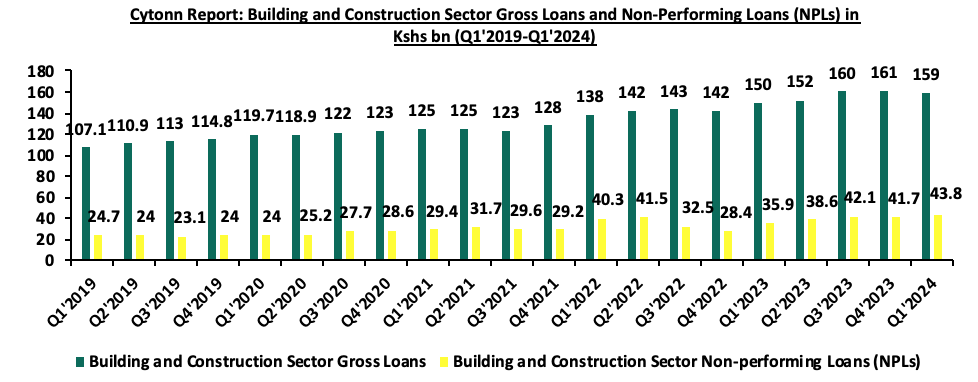

- Gross loans advanced to the building and construction sector recorded a y/y growth of 5.7% to Kshs 159.0 bn in Q1’2024, from Kshs 150.0 bn in Q1’2023. This also represented a 1.3% q/q decrease from Kshs 161.0 bn recorded in Q4’2023. The y/y performances were mainly driven by continuous construction activities particularly in the housing and infrastructure sectors by both private and public sectors. Furthermore, construction costs per SQFT increased by 21.0% averaging at Kshs 11,414.0 in H1’ 2024 from Kshs 9,365 in H1’2023, necessitating the need for more funding, and,

- Gross NPLs in the building and construction sector increased by 18.0% on a y/y to Kshs 43.8 bn in Q1’2024 from Kshs 35.9 bn in Q1’2023 basis on the back of operational challenges such as project delays in the Real Estate and hospitality sectors. These challenges were exacerbated by economic challenges, including inflationary pressures and the weakening shilling, which have impacted the ability of businesses in the building and construction sector to service their loans. The performance represents a 4.8% q/q increase from Kshs 41.7 bn recorded in Q4’2023 amid delays in approval of construction projects by the relevant authorities. The graph below shows Gross Loans advanced to the Hospitality sector against Non-Performing Loans in the sector from Q1’2019 to Q1’2024;

Source: Central Bank of Kenya (CBK)

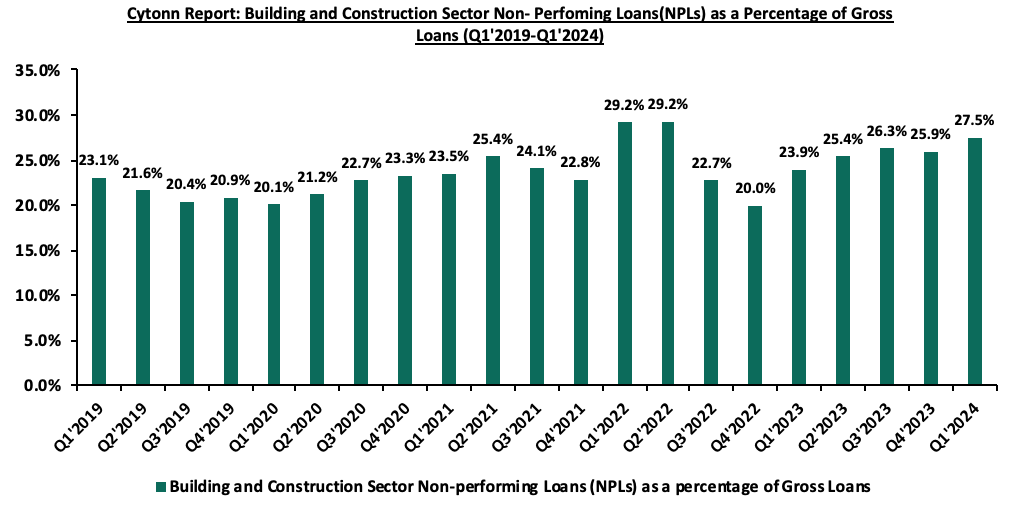

The graph below shows the Non-Performing Loans as a percentage of Gross Loans advanced to the Building and Construction sector from Q1’2019 to Q1’2024;

Source: Central Bank of Kenya (CBK)

- Residential Sector

During the week, Beulah City, a Nairobi-based developer in collaboration with AMS properties and KCB bank as a finance partner, announced the launch of its inaugural affordable housing project along Wanyee road, off Naivasha road in Nairobi. The project, named Ikhaya Beulah Genesis, is set to commence and is expected to be complete by the end of 2.5 years. The project will comprise 1074 affordable units ranging from studios to spacious 1 and 2-bedroom residences catering to diverse lifestyle needs. The prices are set to start at Kshs 2.1 mn for a 20.0 SQM studio unit, 2.6 mn for a 25.0 SQM studio unit, 4.2 mn for a 40.0 SQM 1-bedroom unit, and 6.3 mn for a 60.0 SQM 2-bedroom unit. Additionally, the project is expected to encompass a reliable borehole system, 600,000 liters water storage facility, on-site management office, ample parking, power backup, and 24/7 manned security, among several other amenities. Kenya Commercial Bank (KCB) as the designated finance partner offers an affordable mortgage loan with flexible terms. Borrowers enjoy up to 25 years for repayment, financing of up to 105% of the property's value, and competitive interest rates tailored to their financial situation. This flexibility aims to make homeownership more accessible for Kenyans.

|

Cytonn Report: Ikhaya Beulah Genesis Affordable Housing Project by Beulah City |

||||

|

# |

Typology |

Size (SQM) |

Price (Kshs in mn) |

Price per SQM |

|

1 |

Studio |

20 |

2.1 |

105,000 |

|

2 |

Studio |

25 |

2.6 |

104,000 |

|

3 |

1-bedroom |

40 |

4.2 |

105,000 |

|

4 |

2-bedroom |

60 |

6.3 |

105,000 |

|

|

Average |

36.3 |

3.8 |

104,750 |

|

Cytonn Report: Ikhaya Beulah Genesis Affordable Housing Project by Beulah City |

||||||

|

# |

Typology |

Size (SQM) |

Price (Kshs in mns) |

Price per SQM |

Price per SQM for Government Affordable Houses |

Variance in Price per SQM (%) |

|

1 |

Studio |

20 |

2.1 |

105,000 |

|

|

|

2 |

Studio |

25 |

2.6 |

104,000 |

|

|

|

3 |

1-bedroom |

40 |

4.2 |

105,000 |

33,333 |

215% |

|

4 |

2-bedroom |

60 |

6.3 |

105,000 |

50,000 |

110% |

|

|

Average |

36.3 |

3.8 |

104,750 |

41,667 |

151% |

The affordable housing project mentioned above is notably more expensive compared to the government's Affordable Housing Program (AHP). When it comes to affordability, the average unit price of Kshs 104,750 per SQM is 151% higher than the government’s average of Kshs 41,667 per SQM.

Beulah City highlighted that their project aims to create a vibrant community which will foster social interaction and meaningful connections among residents. From recreational rooftop terraces to gyms and dedicated play areas for kids, the project is set to provide ample opportunities for residents to engage and enjoy.

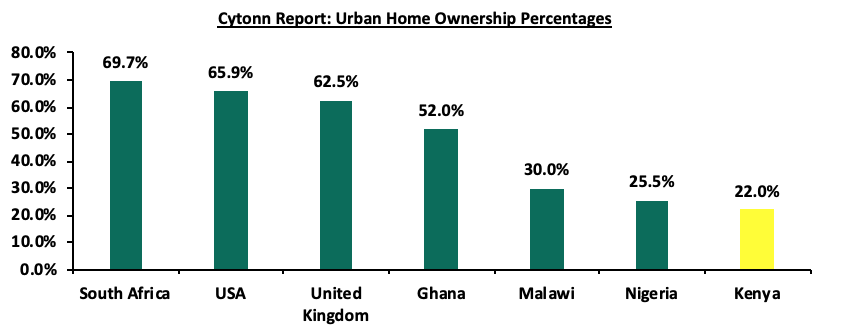

We expect heightened activities in the residential Real Estate sector supported by the government initiatives in the residential sector, especially through the Affordable Housing Agenda and demand for housing driven by the growing population and high urbanization rate currently at 3.7% per annum. The Affordable Housing Program (AHP) in Kenya, part of the Big Four Agenda, targets building 250,000 affordable homes annually. However, homeownership still remains low, with only 21.3% of urban residents owning homes compared to a national average of 61.3%, forcing 78.7% to rely on rentals due to high property prices and limited access to finance.

- Infrastructure Development

During the week, President William Ruto launched the tarmacking of the 25-kilometre Rukuriri-Kathageri-Kanyaumbora road in Embu county. Upon completion, the road is expected to further Embu’s agricultural vibrancy, improve livelihoods, and unlock the region’s economic potential. The upgrading of the road is in line with the President’s mandate to guarantee every citizen access to resources, opportunities, and essential services such as health and education.

The Dongo Kundu Bypass was officially opened to the public following its handover by the contractor to the government. This Kshs 40 bn project, undertaken by the China Civil Engineering Construction Corporation (CCECC), began in 2018 and features a 17.5-kilometer road with three bridges. The bypass connects Miritini in Mombasa County to Kwale County, significantly enhancing the region’s connectivity with the Standard Gauge Railway (SGR) and Moi International Airport in Mombasa. This new route offers direct access between the airport, Mombasa, and the SGR Miritini terminal to the South Coast, which is expected to boost tourism and hospitality in the area. Phase II of the project covers an 8.96-kilometer stretch of dual carriageway, starting from the Mwache interchange. The bypass is anticipated to be a game-changer in the region's infrastructure, facilitating smoother and more efficient travel.

We expect the infrastructure sector in Kenya will continue to play a crucial role in promoting economic activities, supported by the government's commitment to construct and rehabilitate essential infrastructure such as roads, bridges, railways, airports, and affordable housing units, and strengthen diplomatic ties and partnerships with neighboring nations to foster mutual development.

- Industrial Sector

During the week, Taita-Taveta County is set to achieve an economic milestone with the approval of a Kshs 11.0 bn steel plant by Devki Steel Mills Limited and will be completed within eight months. The plant is set to be constructed in Manga area, Voi. Narendra Raval of Devki Steel Mills was officially handed a 500-acre parcel of land to commence the construction of the plant. The plant is projected to generate thousands of direct and indirect employment opportunities, offering a lifeline to many struggling residents. 3,000 residents will be employed, with over 2,000 direct jobs expected once the plant becomes operational. In return, this will improve the economic status of the region.

We expect the establishment of the steel plant will transform lives by creating jobs, improving infrastructure, and stimulating local businesses around Taita-Taveta County.

- Real Estate Investments Trusts (REITs)

- Acorn Holdings Cash Call

During the week, Acorn Holdings, a student hostel developer in Nairobi announced a bid to raise Kshs 2.8 bn in new capital for its development and income Real Estate Investment Trusts (REITS) by February 2025 to fund the development and acquisition of new properties. The firm targets Kshs 1.9 bn for the Acorn student accommodation I-REIT and Kshs 810.0 mn for the D-REIT, which is set to be raised through a combination of a rights issue that closed on 31st July and an open market offer which continues until February 2025. Acorn offered an open market price of Kshs 24.54 for the D-REIT and Kshs 22.03 for the I-REIT with existing unit holders enjoying a discount of 0.6% during the rights issue offer period which has since expired.

The recent offer by Acorn Holdings forms the third supplemental cash call made by the firm since inception of the REITs, following similar issuances in 2022 and 2023 making this strategy the primary capital raising instrument for the company. As at the end of June 2024, the ASA D-REIT holds 11 properties under different development stages, with a total valuation of Kshs 10.9 bn. These properties include two hostels in Karen under the company’s Qwetu and Qejani brands, which the firm expects to offload to the I-Reit by the end of Q1’2025. Similarly, the ASA I-REIT holds a portfolio of 7 hostels with a combined valuation of Kshs 10.3 bn as at June 2024 with the most recent acquisitions being the Qwetu Hurlingham in September 2023 and Qwetu Aberdare Heights II in January 2024.

On the debt side, the D-REIT currently has an outstanding Kshs 1.86 bn green bond issued in October 2019, which financed eight hostel projects. The company had acquired Kshs 5.7 bn and has been making early repayments before the debt matures in November 2024. In February 2022, the D-REIT contracted a Kshs 6.7 bn loan from Absa Bank to fund 10 hostel projects, out of which Kshs 1.0 bn had been drawn down by June 2024 for ongoing projects at Juja, Kenyatta University and Hurlingham.

We anticipate the student accommodation market to continue improving as enrollment into universities and tertiary institutions remains resilient. The Kenya National Bureau of Statistics (KNBS) highlighted that University enrollment for the 2023/2024 academic year increased by 3.0% year-on-year to 579,046 students from 561,674 in 2022/2023. For Technical, Vocational Education, and Training (TVET) institutions, student enrollment in the 2023/2024 academic year increased by 14.0% year-on-year to 642,726 students from 552,744 in 2022/2023.

- REIT Weekly Performance

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 9th August 2024. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at Kshs 12.3 mn and Kshs 31.6 mn shares, respectively, with a turnover of Kshs 311.5 mn and Kshs 702.7 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 9th August, 2024, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 138,600 for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015.

REITs offer various benefits, such as tax exemptions, diversified portfolios, and stable long-term profits. However, the ongoing decline in the performance of Kenyan REITs and the restructuring of their business portfolios are hindering significant previous investments. Additional general challenges include: i) insufficient understanding of the investment instrument among investors, ii) lengthy approval processes for REIT creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and iv) minimum investment amounts set at Kshs 5.0 mn for the Investment REITs, all of which continue to limit the performance of the Kenyan REITs market.

We expect the performance of Kenya’s Real Estate sector to be sustained by: i) increased investment from local and international investors, particularly in the residential sectors ii) favorable demographics in the country, leading to higher demand for housing and Real Estate, (iii) government infrastructure development projects e.g. roads, opening up satellite towns for investment, and iv) ongoing residential developments under the Affordable Housing Agenda, aiming to reduce the annual housing deficit in the country which is currently at 80.0%. However, challenges such as rising construction costs, strain on infrastructure development, and high capital demands in the REITs sector will continue to impede the sector’s optimal performance by restricting developments and investments.

As reported by the World Bank, Kenya's urbanization rate stood at 3.7% in 2023, surpassing the global average of 1.7%. Additionally, the country's annual population growth rate averaged 2.0%, higher than the global average of 0.9%. This rapid urbanization and population growth have created a substantial demand for housing in Kenya, which greatly outstrips the available supply. The Centre for Affordable Housing Finance Africa (CAHF) estimates that Kenya faces an annual housing deficit of 80.0%. Currently, only 50,000 new houses are built each year, while the demand stands at approximately 250,000 units, leaving a shortfall of about 200,000 homes annually. The Centre for Affordable Housing Finance in Africa (CAHF) reports that 61.3% of Kenyans own homes, compared to other African countries like Angola and Algeria with 75.4% and 74.8% national home ownership rates respectively. The national homeownership rate stands at approximately 21.3% in urban areas sprawling the national average of 61.3% while 78.7% of urban dwellers rent. The government's push for affordable housing aims to improve this rate by making homes more accessible to lower and middle-income earners. The graph below shows the home ownership percentages for different countries compared to Kenya;

Source: Centre for Affordable Housing Finance Africa (CAHF), US Census Bureau, UK Office for National Statistics

To address this significant gap, the government launched various programs, policies, and strategies aimed at ensuring there is adequate housing for all citizens. Some of these initiatives included the following:

- Kenya Slum Upgrading Programme (KENSUP), designed to enhance the living conditions of residents in informal settlements across the country. The program focuses on constructing low-cost housing, installing social and physical infrastructure, promoting income-generating activities, improving tenant security, and managing the environment and solid waste through community and resource mobilization,

- Affordable Housing Programme (AHP), part of the Big Four Agenda, is a government initiative focused on boosting Kenya’s economic growth. The AHP aims to reduce the housing shortage in the country by leveraging both public and private resources to build affordable homes. The AHP aims to achieve this goal through several strategies, including;

- Incentives to Developers: These include: i) providing land to county governments for affordable housing construction, ii) exempting VAT on imported and locally purchased construction materials for affordable housing, iii) offering a reduced corporate tax rate of 15.0% for developers building over 100 units, iv) exempting first-time buyers from stamp duty (4.0% in urban areas and 2.0% in rural areas), and v) providing a 15.0% tax relief on savings to encourage home ownership contributions. These measures aim to advance the government’s goal of delivering affordable housing to Kenyans,

- The Kenya Mortgage Refinancing Company (KMRC): established in 2018 and operational since 2020, aims to provide long-term financing to primary mortgage lenders like banks, microfinance institutions, and SACCOs at low, fixed interest rates. KMRC’s goal is to enhance access to affordable housing finance by supplying lenders with the necessary liquidity to offer affordable mortgages to Kenyans. By August 2023, KMRC had disbursed Kshs 7.2 bn to nine primary mortgage lenders,

- The National Housing Development Fund (NHDF): established in 2018 via the Finance Act and managed by the National Housing Corporation (NHC), aims to gather funds from various sources to provide affordable housing for Kenyans. The fund helps mitigate risks for private developers by guaranteeing the purchase of units, facilitates buyer uptake by offering affordable financing options, and allows mortgage and cash buyers to save for affordable homes through the Home Ownership Savings Plan (HOSP), and,

- The Affordable Housing Levy: it was established on March 2024 through the assent of the Affordable Housing Act, 2024 (Act). The Act introduced the affordable housing levy at the rate of 1.5% on the gross salary of an employee, with a matching contribution from the employer. The National Assembly Finance and Planning Committee recommended the conversion of the NHDF into a levy, which meant that the money collected by the Kenya Revenue Authority (KRA) will not be refunded after collection. The Act established the Affordable Housing Fund (Housing Fund) into which the Levy, monies appropriated by the National Assembly, gifts and grants, voluntary contributions, investments made by the Fund, loans approved by the Cabinet Secretary in charge of the National Treasury and other incomes will be paid. The purpose of the Fund is to provide funds for the development of affordable housing and associated social and physical infrastructure.

The Housing Fund plays a critical role in the AHP initiative, which is part of the broader Big Four Agenda, by facilitating the financing and development of affordable housing projects across the country. The Housing Act Cap 117 1967 stipulates that a Housing Fund is a public funding platform for affordable housing. The amount of contributions to the fund is determined by the Parliament and may be changed periodically and be either rendered voluntary or mandatory. The fund is intended to:

- Mobilize Resources: Pool resources from various stakeholders, including the government, private sector, and international donors, to finance housing projects.

- Subsidize Housing Costs: Lower the cost of housing for beneficiaries through subsidies and financial incentives, making home ownership more accessible.

- Provide Infrastructure: Support the development of essential infrastructure such as roads, water, and electricity to create well-serviced residential areas.

- Stimulate Economic Growth: Generate employment opportunities in the construction and real estate sectors, contributing to broader economic growth.

One of the key features of the Housing Fund is its focus on inclusivity. The fund is designed to cater to a wide range of income groups, with different financing options available to suit the needs of various contributors. For instance, low-income earners can access subsidized loans with favorable repayment terms, while middle-income earners can benefit from affordable mortgage options. This approach ensures that the benefits of the Housing Fund are distributed equitably across different segments of the population. Despite its noble objectives, the Housing Fund has encountered several challenges that hinder its effectiveness. These challenges will be discussed in detail in the subsequent sections. By addressing these challenges and implementing strategic recommendations, the Housing Fund can be optimized to achieve its full potential and significantly contribute to resolving Kenya's housing crisis.

Section I: Challenges Faced by the Housing Fund

- Public Awareness and Perception

- Lack of Information Dissemination: One of the primary challenges is the inadequate dissemination of information regarding the Housing Fund. Many Kenyans, particularly those in the low and middle-income brackets (the intended beneficiaries) are not fully informed about the Housing Fund, its objectives, benefits, and how to access it. This lack of awareness stems from insufficient outreach efforts and poorly executed public education campaigns. When potential beneficiaries are unaware of the existence or the benefits of the Housing Fund, they are unlikely to participate. This leads to lower-than-expected uptake of housing units and underutilization of the resources allocated to the fund. In the absence of clear and accurate information from credible sources, misinformation spreads leading to misconceptions about the Housing Fund, further discouraging participation,

- Misconceptions and Mistrust: There is a widespread mistrust and misconceptions surrounding the Housing Fund. These issues are rooted in historical precedents where similar government initiatives have been marred by corruption, mismanagement, and unfulfilled promises. As a result, the public is skeptical about the Housing Fund's ability to deliver on its promises. The perceived lack of transparency in how the Housing Fund operates exacerbates public mistrust. Without clear communication on how funds are allocated, spent, and the progress of housing projects, the public is left to speculate, often assuming the worst. Many potential beneficiaries view the process of applying for and benefiting from the Housing Fund as overly complicated and bureaucratic. This perception discourages participation, as people feel they may not have the resources or knowledge to navigate the system successfully. Negative media coverage has further eroded public trust in the Housing Fund. Reports highlighting issues such as the National Housing Corporation’s (NHC) Kshs 1.3 bn in unsold housing stock, the Kenya Development Corporation’s (KDC) Kshs 490.0 mn in unsold units, and senior officials within the NHC allegedly manipulating the allocation process to their advantage have all contributed to growing public doubt. Additionally, stalled projects like the Starehe Point 1 Affordable Housing project, along with widespread reports of mismanagement and corruption, have only added to the mistrust. In 2017, the media also revealed that the NHC had Kshs 251.0 mn tied up in dormant projects, including Kanyakwar II in Kisumu and Makande Estate in Mombasa. Such reports amplify public fears and doubts, making it increasingly difficult to garner the necessary support for the Housing Fund. These factors collectively create a challenging environment for the Housing Fund to gain the trust and participation it needs to succeed,

- Financial Incentives

- Insufficient Incentives for Employers and Employees: The Housing Fund Regulations require mandatory contributions from both employers and employees, creating a system where these contributions accrue in individual Housing Fund Accounts. While this system is intended to build savings towards home ownership, the incentives for employers and employees to participate are not robust enough. Many employees and employers view the mandatory contributions as an additional financial burden rather than a beneficial investment. The lack of immediate or tangible benefits reduces the willingness of both parties to fully engage with the Housing Fund. While voluntary members can also contribute to the Housing Fund, the incentives for doing so are minimal, especially for those who are self-employed or not formally employed. Without attractive incentives, voluntary participation rates remain low, limiting the fund's overall effectiveness.

- Administrative and Operational Efficiency

- Inefficient Fund Management: Efficient fund management is essential to ensure that the resources allocated to the Housing Fund are utilized effectively and that the intended benefits reach the target population. However, the Housing Fund has encountered significant challenges in this area, raising concerns about mismanagement and the proper use of funds. The operations of the Housing Fund are often hindered by bureaucratic red tape. Complex and lengthy approval processes can delay project implementation, leading to increased costs and missed deadlines. This inefficiency is further compounded by the involvement of multiple government agencies, each with its own set of regulations and procedures. Our Affordable Housing Agencies Report highlighted a critical issue: the existence of various agencies with overlapping mandates, creating a sense of competition on both the supply and demand sides of the affordable housing agenda. For instance, the National Housing Corporation (NHC) is tasked with lending grants to local authorities, providing loans to individuals and organizations, acquiring land, and constructing and managing buildings for affordable housing. Meanwhile, the Kenya Mortgage Refinance Company (KMRC) is responsible for providing long-term funds to primary mortgage lenders (PMLs) to increase the availability of affordable home loans. Additionally, the State Department of Housing is charged with developing and managing affordable housing projects. These overlapping roles lead to confusion and inefficiencies in fund management, making it difficult to fulfill the Housing Fund’s objectives effectively. The lack of clear delineation of responsibilities among these agencies results in fragmented efforts and hinders the overall success of the affordable housing initiative,

- Lack of Transparency: There have been concerns about the transparency of the Housing Fund’s financial management. Without clear and accessible records of how funds are being spent, it is difficult for stakeholders to hold the managing bodies accountable, which can lead to misallocation or misuse of resources. Concerns have been raised about the transparency of the Housing Fund’s financial management, particularly in May 2024, when it was revealed that Kshs 20.0 bn from the fund had been invested in Treasury Bills. This decision, intended as a short-term measure to prevent funds from remaining idle during the legal disputes over the housing levy, sparked debate. Members of Parliament questioned whether the proper procedures were followed and whether the Housing Levy Fund Board was adequately consulted. While the Ministry of Housing defended the move as low-risk, the situation underscores broader issues of transparency and the challenges in managing large sums of collected funds that are not immediately deployable for housing projects. Further, it is not clear regarding the allocation of the approximately Kshs 6.5 bn in monthly contributions. Moreover, detailed information about the number of units currently under construction, broken down by project, is also not available. This lack of clarity makes it difficult for the public to vet the government’s communication of 103,000 houses under development.

- Market Dynamics

- Access to Finance: Rising non-performing mortgage loans (NPLs) signal major challenges in accessing finance, with outstanding NPLs increasing from Ksh 37.8 bn in 2022 to Ksh 8 bn in 2023. This rise reflects economic difficulties and the high cost of financing, making lenders more cautious and leading to stricter lending criteria. Consequently, securing mortgages has become harder for potential homeowners. In 2023, the average mortgage interest rate surged from 12.3% to 14.3%, with some rates reaching as high as 18.6%. These higher rates make mortgages less affordable, especially for low and middle-income earners—the primary targets of the Housing Fund. As borrowing costs rise, fewer people can afford mortgages, shrinking the pool of potential homeowners and slowing the housing market, including Housing Fund projects. Additionally, the lack of affordable long-term financing, compounded by low income levels and high property prices, significantly impedes access to homeownership. Many potential buyers struggle to save for a down payment or qualify for a mortgage, putting homeownership out of reach for a large portion of the population the Housing Fund aims to support.

Section II: Recommendations for Improving the Fund’s Acceptability

- Strengthening Public Awareness and Perception

- Launch Comprehensive Public Education Campaigns: To address the challenge of inadequate information dissemination, the Housing Fund should launch targeted public education campaigns. These campaigns should use a multi-channel approach, including social media, traditional media (radio, TV, newspapers), community outreach programs, and partnerships with local leaders to ensure that information reaches all segments of the population, particularly low and middle-income earners. The campaigns should focus on educating the public about the objectives, benefits, and accessibility of the Housing Fund. This will help dispel misconceptions and build a positive perception of the fund,

- Increase Transparency Through Regular Reporting: To combat public mistrust, the Housing Fund must commit to transparency in its operations. Regular updates on fund utilization, project progress, and the allocation of resources should be made publicly available. These reports could be published on the Boma Yangu website, shared through media outlets, and discussed in public forums. Transparent communication will help build trust with the public by demonstrating that the fund is managed responsibly and that the benefits are reaching the intended beneficiaries.

- Enhancing Financial Incentives

- Introduce a Tiered System of Levy Deduction: China’s Housing Provident Fund (HPF) allows cities to set different contribution rates based on their urban area limits, with major cities typically having higher rates than other parts of the country. Kenya’s Housing Fund could adopt a similar approach by implementing a tiered deduction system. For example, employees in Nairobi, Mombasa, and other large urban centers could face higher deduction percentages, while those in smaller towns and rural areas would have lower rates. This tiered system could be tailored to reflect the varying costs of housing and average incomes across different regions, ensuring that the levy is both affordable and fair for all employees, regardless of where they live,

- Introduce Tangible Benefits for Contributors: To enhance participation and address the lack of incentives for employers and employees, the Housing Fund should introduce immediate and tangible benefits for contributors. For instance, contributors could be offered preferential interest rates on home loans, tax incentives, or the option to use their contributions as collateral for other types of loans. A successful model can be seen in Singapore’s Central Provident Fund (CPF), a comprehensive social security system with a housing component. CPF contributors can use their savings to purchase homes, access preferential interest rates on public housing loans (HDB flats), and even use their contributions as collateral for home loans. Additionally, the Singaporean government provides grants and subsidies to further reduce housing costs. In Malaysia, Employees Provident Fund (EPF) contributors can withdraw from their retirement savings to purchase homes or to reduce or settle their housing loans. They also benefit from preferential interest rates for home loans under various government-backed housing schemes, such as the MyHome Scheme. By implementing similar benefits, the Housing Fund would become more attractive, encouraging both mandatory and voluntary contributions and ultimately strengthening the fund’s impact,

- Flexible Contribution Schemes: The Housing Fund should offer flexible contribution schemes that cater to different income levels. For instance, self-employed individuals and informal sector workers could be allowed to make irregular contributions that align with their income patterns. This flexibility would encourage more people to participate in the Housing Fund, particularly those who may not have a steady income,

- Expand Access to Voluntary Contributions: To increase voluntary participation, the Housing Fund should actively promote the benefits of voluntary contributions and provide incentives such as matching contributions or bonus interest rates for long-term savings.

- Improving Administrative and Operational Efficiency

- Streamline Fund Management and Reduce Bureaucracy: To improve operational efficiency, the Housing Fund must streamline its management processes. This can be achieved by simplifying the approval processes, reducing redundancies, and clearly defining the roles and responsibilities of all agencies involved in the affordable housing agenda. By eliminating overlapping mandates and fostering better inter-agency coordination, the fund can reduce delays, cut costs, and ensure that resources are allocated efficiently,

- Establish Clear Accountability Mechanisms: The Housing Fund should implement robust accountability mechanisms to ensure that funds are used effectively and for their intended purposes. This could include regular audits, performance evaluations, and the establishment of an independent oversight body to monitor the fund’s activities. By holding fund managers and implementing agencies accountable, the risk of mismanagement and corruption can be minimized, leading to better outcomes for the Housing Fund. The Housing Levy Fund Board should also prioritize the allocation of funds to ongoing and ready-to-launch housing projects to ensure that collected funds are promptly utilized for their intended purpose. They should avoid holding large sums in reserve or investing in non-construction activities, unless absolutely necessary and with full transparency,

- Adapting to Market Dynamics

- Implement Targeted Subsidies for Low-Income Earners: The UK’s Help to Buy scheme offers an equity loan in which the government lends a percentage of the property’s cost, thereby reducing the down payment required from the buyer. This scheme is specifically aimed at first-time buyers and those with limited income. Similarly, the Housing Fund should introduce targeted subsidies for low-income earners to bridge the affordability gap. These subsidies could help cover a portion of the down payment, lower monthly mortgage payments, or offer reduced interest rates for eligible applicants. By making housing more affordable for those who need it most, the fund can boost participation and decrease the number of unsold units,

- Conduct Regular Market Research and Feasibility Studies: To ensure that housing projects align with market needs, the Housing Fund should conduct regular market research and feasibility studies. These studies should analyze housing demand, income levels, location preferences, and economic conditions. By basing project decisions on solid data, the fund can better match supply with demand, avoid resource wastage, and ensure that projects are financially viable.

- Supplement the public housing fund program with a private housing fund program: We need to develop a private housing fund framework that allows investors and employees to contribute to privately managed housing funds; same way we have private pension funds. This will enable capital formation in the private sector to help alleviate the housing challenges.

Section III: Conclusion