Home Ownership Savings Plan (HOSP) Update, & Cytonn Weekly #51

By Research Team, Dec 22, 2019

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 64.1%, up from 53.5% the previous week. This is down from an average of 125.4% from January 2019 to November 7th 2019 before the repeal of the rate cap; and 54.0% lower than the YTD average of 118.1%, hence the undersubscription is attributable to reduced participation by banks who are now lending to the private sector, after the repeal of the interest rate cap. The yield on the 91-day, 182-day and 364-day paper remained unchanged at 7.2%, 8.1% and 9.8%, respectively. During the week, an Egyptian investment firm, EFG Hermes Holding, released their 2020 Yearbook. According to the report, the firm expects the Central Bank of Kenya (CBK) to cut the benchmark rate by between 50-100 basis points by the end of the first quarter of 2020. They believe monetary easing will continue into early 2020 driven by the MPC’s most recent decision to cut the policy rate by 50 basis points, the positive sentiment after the repeal of the interest rate cap, and based on their inflation projection standing between 4% - 5%;

Equities

During the week, the equities market recorded mixed performance with NASI and NSE 25 recording gains of 2.1% and 2.0%, respectively, while NSE 20 recorded a loss of 0.2%, taking their YTD performance to gains/(losses) of 16.7%, (8.8%) and 13.1%, for the NASI, NSE 20 and NSE 25, respectively. During the week, listed companies CIC Insurance, Kenya Airways, Standard Media Group and the Nairobi Stock Exchange (NSE) issued profit warnings, expecting earnings for the financial year 2019 to decline by more than 25.0% compared to 2018, attributable to a tough operating environment; this brings the number of NSE listed companies that have issued profit warnings to 10;

Real Estate

During the week, 88 Nairobi Condominium, a Kshs 5.2 bn residential project in Upper Hill, by Lordship Africa Group was reported to have stalled, following a delay in approvals by the Nairobi City County Council. In the hospitality sector, Dubai-based independent hotel management company Aleph Hospitality began operations of a 101-key Best Western Plus Westlands hotel in Nairobi, marking Aleph Hospitality’s debut in Kenya, while Sunset Paradise Holiday Homes, through an undisclosed local investment consortium, is set to put up a 300 pax capacity conference facility in Shanzu, Mombasa;

Focus of the Week

This week we revisit our topical on Home Ownership Savings Plan following the enactment of the Finance Act 2019 on 7th November 2019. The Finance Act introduced into law several amendments touching on the affordable housing initiative, including amendments of the Income Tax Act to include Fund Managers or Investment Banks registered under the Capital Markets Act as approved institutions to hold deposits of a Home Ownership and Savings Plan (HOSP).

- Weekly Rates:

- Cytonn Money Market Fund closed the week at an average yield of 10.9% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield 14.2% p.a. To subscribe, email us at sales@cytonn.com;

- Beatrice Mwangi, Real Estate Research Analyst, was on Metropol TV to discuss the real estate sector, hospitality and the Kenyan Government housing agenda. Watch Beatrice here

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 64.1%, up from 53.5% the previous week. This is down from an average of 125.4% from January 2019 to November 7th 2019 before the repeal of the rate cap; and 54.0% lower than the YTD average of 118.1%, hence the undersubscription is attributable to reduced participation by banks who are now lending to the private sector, after the repeal of the interest rate cap. The yield on the 91-day, 182-day and 364-day paper remained unchanged at 7.2%, 8.1% and 9.8%, respectively. The acceptance rate increased very slightly to 99.4%, from 99.2% recorded the previous week, with the government accepting Kshs 15.3 bn of the Kshs 15.4 bn bids received.

The National Treasury opened a tap-sale for a 5-year bond of Kshs 9.7 bn (FXD 3/2019/5) during the week, with a coupon rate of 11.5%. The bond was slightly oversubscribed, with the subscription rate coming in at 100.3% and the bond yield coming in at 11.5%. The continued high demand for short tenor bonds has been attributable to the negative bias by investors on longer-tenor bonds due to the relatively flat yield curve on the long-end brought about by the saturation of long-term bonds, coupled with the duration risk associated with long-term papers, thus making the short tenor bonds more attractive. The acceptance rate on the tap sale was 100.0%, with the government accepting the whole Kshs 9.7 bn worth of bids received.

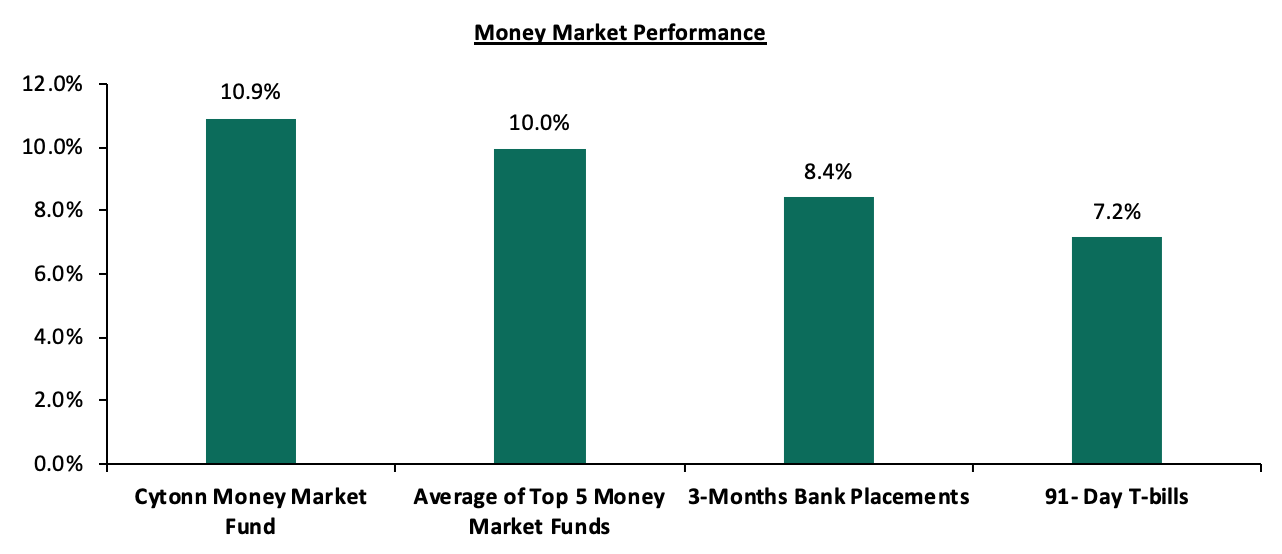

In the money markets, 3-month bank placements ended the week at 8.4% (based on what we have been offered by various banks), the 91-day T-bill came in at 7.2%, while the average of Top 5 Money Market Funds came in at 10.0%, unchanged from the previous week. The yield on the Cytonn Money Market Fund remained unchanged at 10.9%.

Liquidity:

During the week, the average interbank rate decreased to 5.5%, from 6.6% recorded the previous week, pointing to increased liquidity in the money markets, this performance was mainly driven by government payments and net redemptions of government securities which came in at Kshs 0.5 bn. This saw commercial banks excess reserves come in at Kshs 13.1 bn in relation to the 5.25% cash reserves requirement (CRR). The average interbank volumes decreased by 32.0% to Kshs 18.5 bn, from Kshs 27.3 bn recorded the previous week.

Kenya Eurobonds:

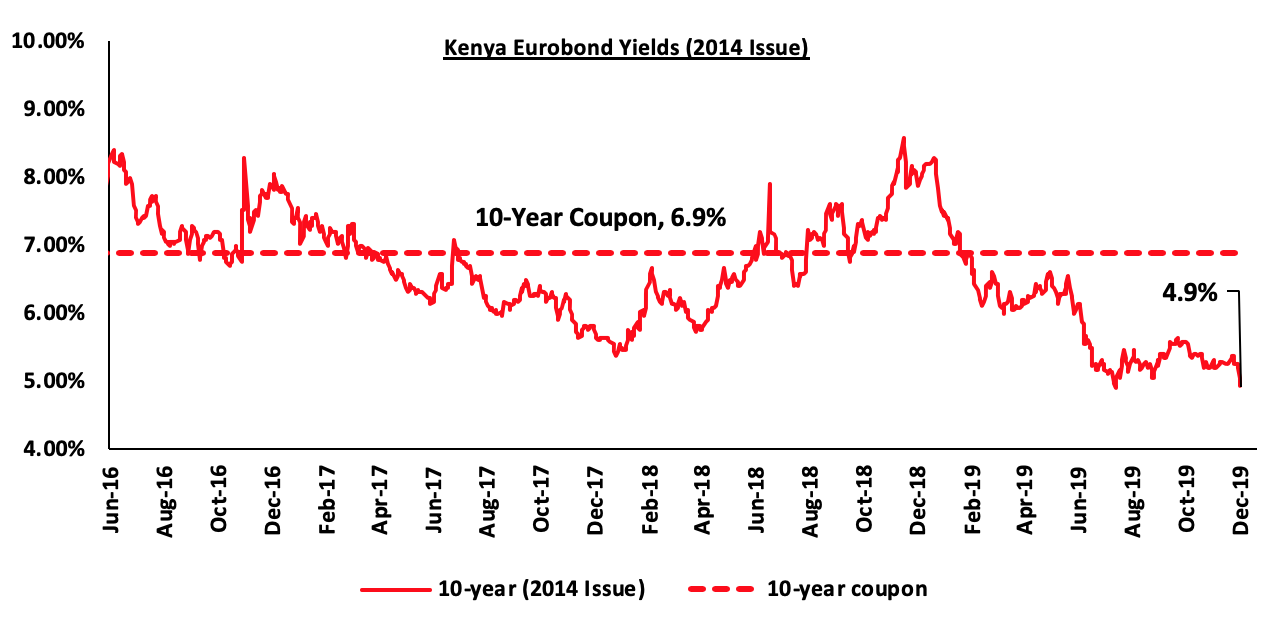

According to Reuters, the yield on the 10-year Eurobond issued in June 2014, remained unchanged at 4.9%, recorded in the previous week.

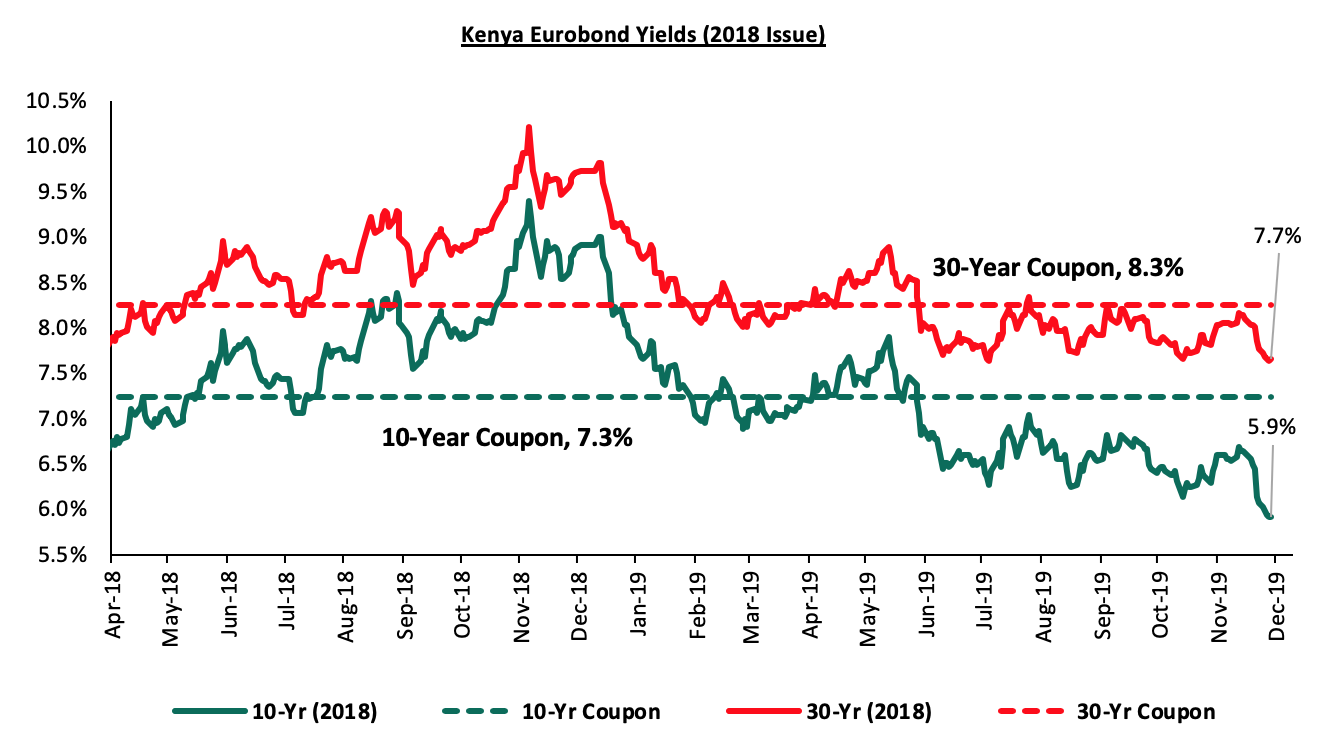

During the week, the yields on the 10-year Eurobond and the 30-year Eurobond both decreased by 0.2% points and 0.1% points, to 5.9% and 7.7%, from 6.1% and 7.8%, respectively. The decline in Kenyan Eurobond yields since last week has been attributed to the release of the country’s credit rating by Fitch Ratings which was “B+”, highlighting the country’s stable outlook, despite the high levels of debt.

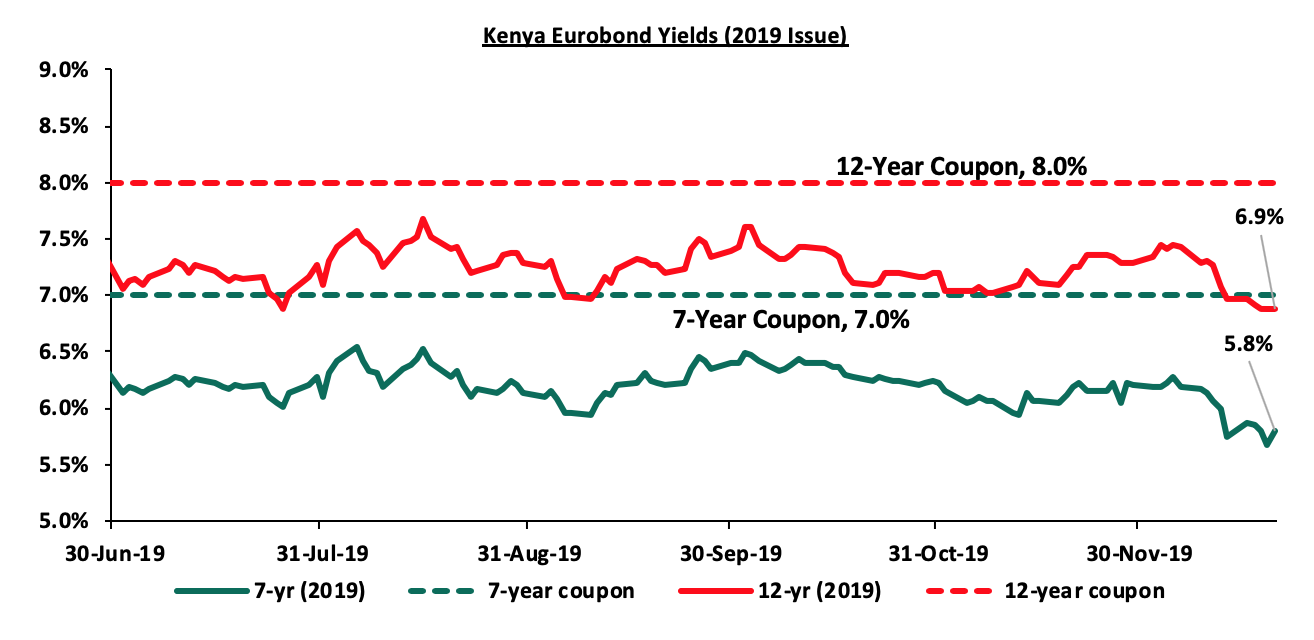

During the week, the yield on the 7-year Eurobond decreased by 0.1% points to 5.8%, from 5.9% recorded the previous week, while the yield on the 12-year Eurobond decreased by 0.1% points to 6.9%, from 7.0% recorded the previous week.

Kenya Shilling:

During the week, the Kenya Shilling appreciated by 0.9% against the US Dollar to close at Kshs 100.7, from 101.7 recorded the previous week, mostly supported by inflows from tourism and diaspora remittances amid slow demand from importers. On a YTD basis, the shilling has appreciated by 1.1% against the dollar, in comparison to the 1.3% appreciation in 2018. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that Kenya’s current account deficit improved by 11.8% during Q2’2019, coming in at a deficit of Kshs 107.6 bn, from Kshs 122.0 bn in Q2’2018, equivalent to 6.2% of GDP, from 7.6% recorded in Q2’2018. This was mainly driven by the narrowing of the country’s merchandise trade deficit by 1.7% and a rise in secondary income (transfers) balance by 5.1%,

- Improving diaspora remittances, which have increased cumulatively by 7.0% in the 12-months to October 2019 to USD 2.8 bn, from USD 2.6 bn recorded in a similar period of review in 2018,

- Foreign capital inflows, with investors looking to participate in the equities market,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 8.8 bn (equivalent to 5.4-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Weekly Highlights:

During the week, an Egyptian investment firm, EFG Hermes Holding predicted in their 2020 Yearbook that, the Central Bank of Kenya (CBK) could cut the benchmark rate by between 50-100 basis points by the end of the first quarter of 2020. They believe monetary easing will continue into early 2020 driven by; the MPC’s most recent decision to cut the policy rate by 50 basis points, the positive sentiment after the repeal of the interest rate cap and based on their inflation projection standing between 4% - 5%. Local institutions have been focusing on investing in fixed income for the better part of 2019. Going forward after the removal of the rate cap, it is expected that money will be directed towards the equities markets to reduce the exposure to fixed income securities and take advantage of the current interest rate environment. Further to this, it is expected that credit growth will continue to increase gradually as banks are now free to price loans based on a borrower’s risk profile. In our view, the CBK will eventually reduce its policy rate by around 50 bps but further into the year, reason being, there remains some opacity in terms of response from the banks and consumers.

From the last MPC briefing, the Central Bank of Kenya (CBK) Governor indicated that following the interest rate cap repeal, re-learning by Banks and consumers was essential so that the market can react appropriately to any monetary policy. The Monetary Policy Committee, in its assessment, had noted that the implementation of the interest rate cap had weakened the transmission of monetary policy and thus had made it difficult for the CBK to adjust the monetary policy in response to economic developments, mainly because any alteration to the CBR would directly affect credit conditions.

The Central Bank of Kenya (CBK) Governor also indicated that they were re-calibrating their models so as to determine the effect of changes in the CBR on the other macro-economic indicators such as GDP and inflation over a certain period. Based on this, we believe the MPC will hold the rates steady at first as they monitor the market reactions of the previous cut.

Inflation Projections:

We are projecting the Y/Y inflation rate for the month of December to come in within the range of 4.8% - 5.2%, compared to 5.6% recorded in November. The Y/Y inflation for the month of December is expected to fall due to the base effect. The M/M inflation is however expected to rise driven by:

- An increase in the food and non-alcoholic beverages index, which has a weighting of 36.0%, mainly driven by the higher food prices especially vegetable prices with the highest rise recorded in tomato prices, and,

- Despite the 1.0% and 2.7% declines recorded in petrol and diesel prices to Kshs 109.5 and Kshs 101.8 from Kshs 110.6 and Kshs 104.6, recorded in November, respectively, we still expect the transport index to be on the rise due to an increase in local and international flight charges as well as bus and matatu fares due to increased demand associated with Christmas festivities.

Going forward, we expect the inflation rate to remain within the government set range of 2.5% - 7.5%.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 5.8% ahead of its domestic borrowing target, having borrowed Kshs 158.8 bn against a pro-rated target of Kshs 150.2 bn. We expect an improvement in private sector credit growth considering the repeal of the interest rate cap. This will result in increased competition for bank funds from both the private and public sectors, resulting in upward pressure on interest rates. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance

During the week, the equities market recorded mixed performance with NASI and NSE 25 recording gains of 2.1% and 2.0%, respectively, while NSE 20 recorded a loss of 0.2%, taking their YTD performance to gains/(losses) of 16.7%, (8.8%) and 13.1%, for the NASI, NSE 20 and NSE 25, respectively. The performance in NASI was driven by gains recorded by large-cap stocks such as Equity Group, Safaricom and KCB Group of 3.4%, 3.3%, and 1.9%, respectively.

Equities turnover increased by 26.6% during the week to USD 41.8 mn, from USD 33.0 mn the previous week, taking the YTD turnover to USD 1,486.5 mn. Foreign investors became net buyers for the week, with a net buying position of USD 6.7 mn, a 40.6% improvement from a net buying position of USD 4.7 mn recorded the previous week.

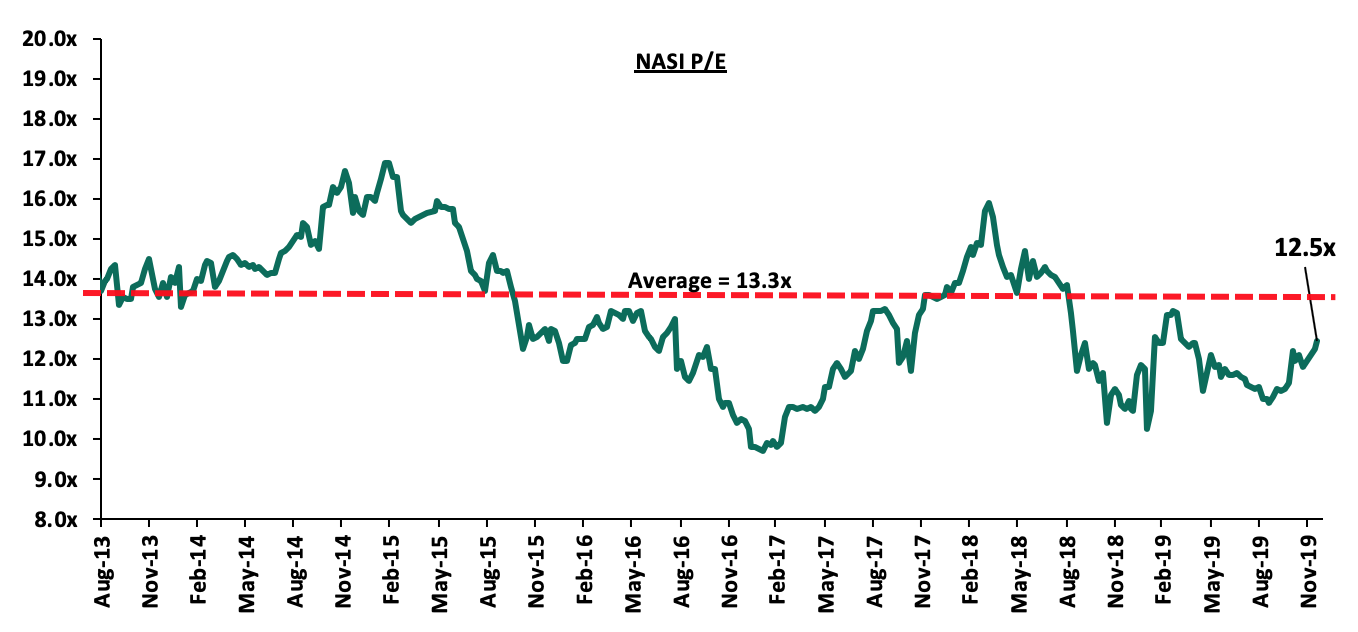

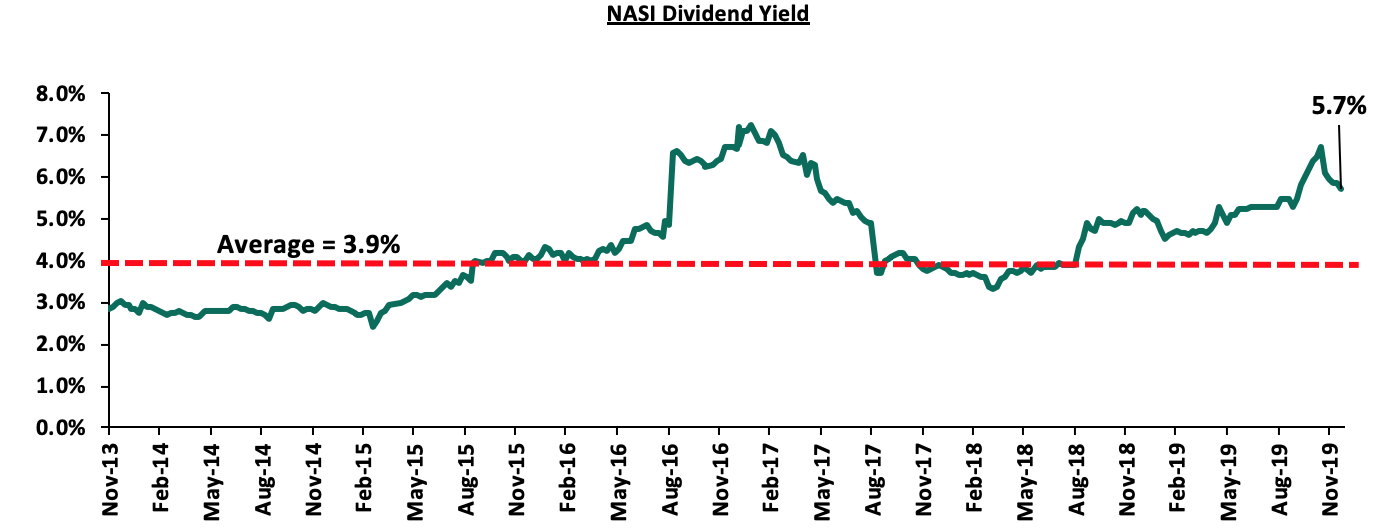

The market is currently trading at a price to earnings ratio (P/E) of 12.5x, 5.9% below the historical average of 13.3x, and a dividend yield of 5.7%, 1.8% points above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 12.5x is 28.7% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 50.4% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, listed companies CIC Insurance, Kenya Airways, Standard Media Group and the Nairobi Stock Exchange (NSE) issued profit warnings, expecting earnings for the financial year 2019 to decline by more than 25.0% compared to 2018, attributable to a tough operating environment, which affected the top-line revenue, coupled with rising inefficiencies, consequently leading to declines in net income. Over the last few years, companies have continued to face economic challenges that has seen firms restructure their staffing, with others declaring redundancies, and others opting for outright closure. The table below shows some of the listed companies that undertook restructuring in 2019:

|

Kenya Listed Companies Restructuring 2019 |

|

|

Company |

Staff Retrenchment |

|

East Africa Portland Cement |

800* |

|

Stanbic Bank of Kenya |

88 |

|

East Africa Breweries Limited |

100 |

|

Sanlam Kenya |

19 |

|

Mumias Sugar** |

All staff |

|

*EAPC declared all its staff redundant and required them to reapply under new terms **Mumias Sugar was placed in receivership on 20th September 2019 |

|

The decline in performance is attributable to dynamics including low spending power among consumers coupled with delayed disbursement of public funds to government agencies, which in turn leads delayed payments of bills owed to suppliers. So far in 2019, 10 listed companies have issued profits warnings to investors, compared to 8 that did in 2018, with Kenya Power and Lighting Company issuing consecutive warnings over the last 2-years. The table below shows companies that have issued profit warnings in 2019 and those that issued profit warnings in 2018,

|

Companies that have issued profit warnings |

|||

|

No |

2019 |

No |

2018 |

|

1 |

Kenya Power and Lighting Company |

1 |

Kenya Power and Lighting Company |

|

2 |

BOC Kenya Plc |

2 |

Britam Holdings |

|

3 |

UAP Holdings Limited |

3 |

HF Group |

|

4 |

Nairobi Stock Exchange |

4 |

Deacons East Africa Plc |

|

5 |

Eaagads |

5 |

Bamburi Cement |

|

6 |

Williamson Tea Kenya |

6 |

Sanlam |

|

7 |

Standard Group Plc |

7 |

UAP-Old Mutual |

|

8 |

CIC Insurance |

8 |

Sameer Africa |

|

9 |

Kenya Airways |

|

|

|

10 |

Kapchorua Tea |

|

|

In terms of sector-specific challenges, listed companies in the insurance sector such as CIC Insurance have witnessed a declining trend in profitability attributed to the capping of interest rates in 2016, which resulted in a ripple effect on business, owing to the fact that lending to insurable investment projects and assets remained constrained. Further, diminishing disposable income on account of tough economic times has slowed down the uptake of insurance products, evidenced by the drop of insurance penetration rate to a 15-year low of 2.4% of GDP in 2019 from a high of 3.4% recorded in 2013. In the energy and petroleum sector, Kenya Power and Lighting Company, despite controlling power supply in the country, continues to face operating challenges stemming from an increase in non-fuel costs as the company implements its long-term strategy of growing cheaper and cleaner renewable energy to cut cost of energy to consumers. Challenges in the agricultural sector, on the other hand, has seen listed companies such as Eaagads, Kapchorua Tea and Williamson Tea, issue profit warning statements this year citing uneven and unpredictable weather patterns coupled with lack of control over the aggressive and rising labour costs, amid depressed prices for tea and coffee. We expect listed companies to continue issuing profit warnings in the coming financial year on account of an increasingly challenging macro-economic environment, with World Bank’s 2020 GDP projections for the country expected to grow marginally by 0.1% points to 5.9%, from 2019’s projection of a 5.8% growth. Furthermore, with public spending expected to tighten in 2020 in line with the government’s target to narrow the fiscal deficit to 6.2%, we expect the performance of companies in key sectors such as commercial, agriculture and manufacturing to be affected.

Universe of Coverage

|

Banks |

Price at 13/12/2019 |

Price at 20/12/2019 |

w/w change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

110.00 |

108.25 |

(1.6%) |

189.0 |

2.4% |

74.2% |

0.5x |

Buy |

|

Kenya Reinsurance |

3.10 |

2.88 |

(7.1%) |

4.8 |

15.6% |

70.5% |

0.3x |

Buy |

|

I&M Holdings*** |

50.00 |

50.25 |

0.5% |

75.2 |

7.8% |

58.2% |

0.8x |

Buy |

|

Jubilee Holdings |

350.75 |

341.00 |

(2.8%) |

453.4 |

2.6% |

31.9% |

1.1x |

Buy |

|

Sanlam |

16.50 |

17.15 |

3.9% |

21.7 |

0.0% |

31.5% |

0.7x |

Buy |

|

KCB Group*** |

52.25 |

53.25 |

1.9% |

64.2 |

6.6% |

29.4% |

1.4x |

Buy |

|

Co-op Bank*** |

15.55 |

15.75 |

1.3% |

18.1 |

6.3% |

22.7% |

1.3x |

Buy |

|

Standard Chartered |

201.50 |

200.75 |

(0.4%) |

211.6 |

9.5% |

14.5% |

1.5x |

Accumulate |

|

Equity Group*** |

51.25 |

53.00 |

3.4% |

56.7 |

3.8% |

14.4% |

1.9x |

Accumulate |

|

NCBA |

33.80 |

34.15 |

1.0% |

37.0 |

4.4% |

13.9% |

0.8x |

Accumulate |

|

Barclays Bank*** |

13.00 |

13.10 |

0.8% |

13.0 |

8.4% |

8.4% |

1.7x |

Hold |

|

Stanbic Holdings |

100.00 |

102.00 |

2.0% |

103.1 |

4.7% |

7.8% |

1.1x |

Hold |

|

Liberty Holdings |

10.50 |

9.72 |

(7.4%) |

10.1 |

5.1% |

1.0% |

0.9x |

Lighten |

|

CIC Group |

3.00 |

2.89 |

(3.7%) |

2.6 |

4.5% |

(7.5%) |

1.1x |

Sell |

|

Britam |

8.20 |

8.48 |

3.4% |

6.8 |

0.0% |

(17.6%) |

0.8x |

Sell |

|

HF Group |

5.54 |

5.92 |

6.9% |

4.2 |

0.0% |

(24.2%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

- Residential Sector

During the week, 88 Nairobi Condominium, a Kshs 5.2 bn residential project in Upper Hill, by Lordship Africa Group was reported to have stalled, following a delay in approvals by Nairobi City County Council. As per the plan, the 44-floor Upper Hill Tower, will comprise of 288 residential units priced between Kshs 11.0 mn to Kshs 30.0 mn, depending on the typology. The project was set for completion by mid-2020. According to the group’s chairman Jonathan Jackson, the project has stalled following delayed approvals from the Nairobi City Council, thus affected the implementation plans. The delay in the processing of construction permits by some county governments such as Nairobi and Kiambu, continues to affect developers by prolonging project implementation timelines. The delays have mainly been because of the e-permit system downtime, inadequate staffing, and suspension of planning committees of the Nairobi, Kisumu, Kiambu, and Mombasa County Governments. Currently, construction permits in Kenya can take as long as two years, and the lack of improvements of the administration system has continued to cripple the ease of doing business in the construction industry. In October, the delay in permits prompted the industry players such as the Architectural Association of Kenya (AAK) and the Kenya Private Developers Association (KPDA) to call for an immediate resolution of the matter (see Cytonn’s Q3’2019 Market Review for more information on this). The value of building approvals for the first half of 2019 (January to June) increased by 20.3% to Kshs 121.3 bn, from Kshs 100.8 bn during the same period in 2018, according to KNBS Leading Economic Indicator October 2019. Delays in the approval system ultimately leads to unnecessarily high development costs for private developers, and is thus a major setback to the real estate sector.

- Hospitality Sector

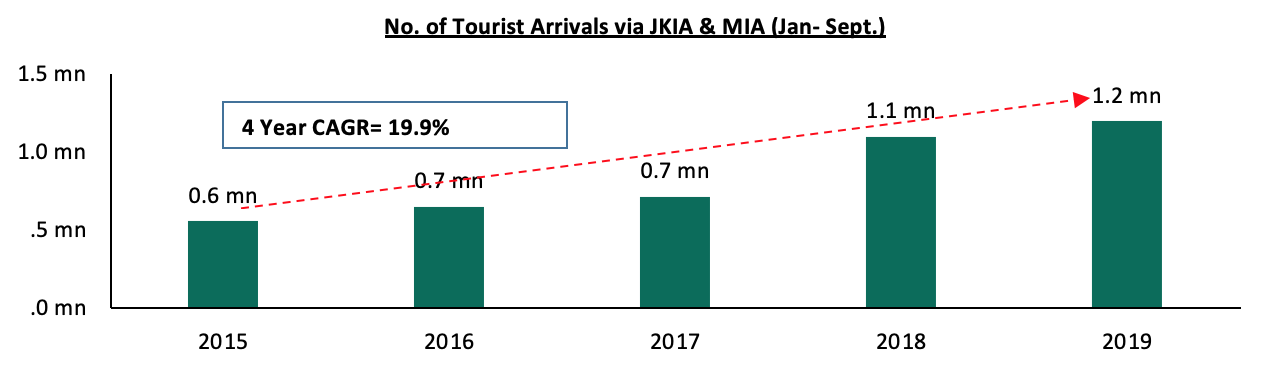

During the week, Dubai-based independent hotel management company Aleph Hospitality, began operations of a 101-key Best Western Plus Westlands hotel in Nairobi, marking Aleph Hospitality’s debut in Kenya. In addition to accommodation, the hotel offers conferencing space, a gym, and two food and beverage outlets. Aleph Hospitality has already signed management contracts for three other hotels in the country, which are currently under development and include; the 125-key Protea Hotel by Marriott in Kisumu, and two other undisclosed hotels in Nairobi and Mombasa. This is an indication of the continued investor interest in the Kenyan hospitality sector, fueled by the continued demand for hospitality facilities and services. According to the Leading Economic Indicators (LEI) September 2019, the total number of visitors arriving through Jomo Kenyatta (JKIA) and Moi International Airports (MIA) increased by 5.4% from 1.1 mn persons for the period between January to September 2018, to 1.2 mn persons during the same period in 2019. We attribute the continued growth of the sector to the calm political environment and the improved security, which have continued to boost tourists’ and investors’ confidence in the country and thus, making it not only a preferred travel destination for both business and holiday travelers, but also an ideal area for investment. The graph below shows the growth of the number of international arrivals over time:

Source: Kenya National Bureau of Statistics

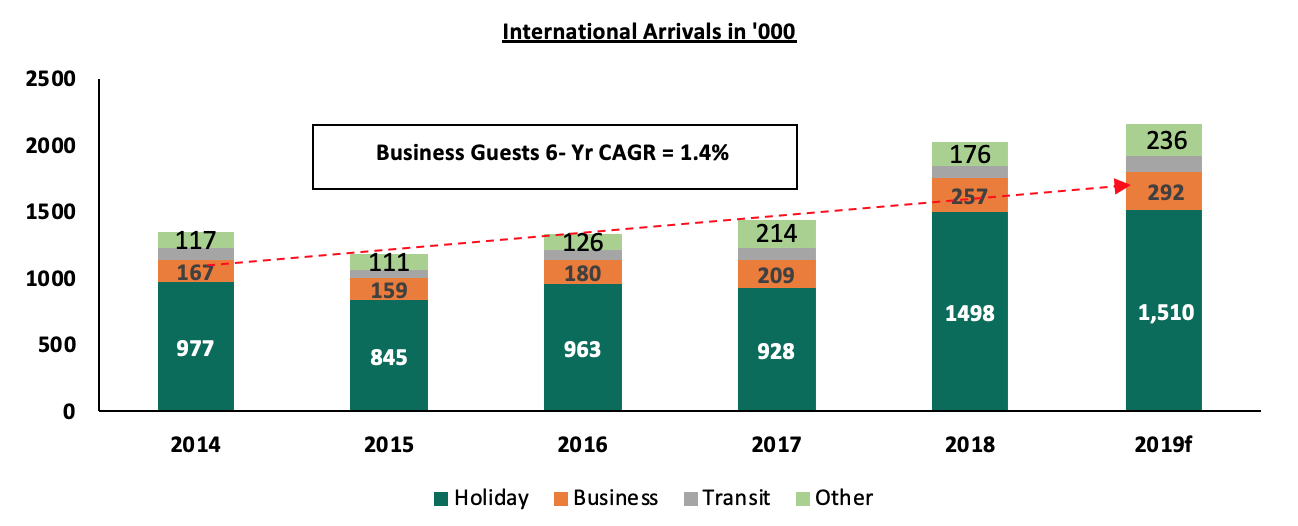

Sunset Paradise Holiday Homes, through an undisclosed local investment consortium, is set to put up a 300 pax capacity conference facility in Shanzu, Mombasa. The facility will complement the rest of development, which includes approximately 150 furnished apartments, a swimming pool, restaurant, gym, club house and cyber café. According to the director, the diversification is aimed at leveraging on the growing number of tourist arrivals into Kenya mainly on business travel. According to KNBS Economic Survey 2019, local conferences grew by 7.9% in 2018 to 4,147, from 3,844 in 2017, while international conferences grew by 6.8% to 204, from 191 in 2017. In terms of tourist arrivals on business purpose, the number increased by 23.0% to 0.3 mn in 2018, from 0.2 mn in 2017, and we expect the same to increase even further in 2019. The graph below shows the growth over the years:

Source: Kenya National Bureau of Statistics

The above is an indication that Kenya continues to present an attractive investment opportunity for investors focusing on the hospitality sector. This is owing to the continued demand for hospitality services and facilities driven by;

- An Elongated Prevalence of Peace in the Country - This has boosted tourists’ confidence in the country, making it a preferred travel destination for both business and holiday travelers,

- Recognition of Kenya as a Regional Hub - This is supported by the strategic geo-positioning of Kenya, in addition to the improving infrastructure, which sets it up as a preferable regional hub for the East Africa, Community, thus continuing to enhance the growth of business travelers into the region, and,

- Positive Accolades - Kenya’s hospitality facilities continue to receive global recognition, boosting the country’s status as a preferred travel destination globally while promoting it as an attractive investment opportunity for international players. For instance, Nairobi was crowned as Africa’s leading business travel destination, while Nairobi’s own KICC was awarded as the leading meetings and conference destination during the 2019 World Travel Awards.

Despite challenges such as delayed infrastructural projects that have cripple access to areas, for example with the dragging expansion of Malindi Airport, which continues to result in reduced number of tourist arrivals at the East African coast due to lack of direct flights to airport, we still expect the hospitality sector to continue recording increased investment activities with the entry fueled by the above factors, and a resultant improved performance of the sector which is as a key contributor to the Kenyan economy.

We expect the real estate sector to continue recording activities mainly in the hospitality sector, evidenced by the continued entry and expansion of local and multinationals firms into the market. Nevertheless, we expect the sector to be negatively phased by delays in building approvals which cripples implementation of plans. For potential investors, the hospitality sector presents an investment opportunity in both accommodation and conferencing, supported by the growing number of tourist arrivals both on holiday and business.

This week we revisit our 15th September 2019 topical on Home Ownership Savings Plan, following the enactment of the Finance Act 2019 on 7th November 2019; the Act included Fund Managers or Investment Banks registered under the Capital Markets Act as approved institutions to hold deposits of a Home Ownership and Savings Plan (HOSP). The act will be effected as from January 2020. As such, we revisit the following:

- An Overview of the Affordable Housing Initiative and Home Ownership in Kenya,

- Background of Home Ownership Savings Plans in Kenya,

- Recent Development with regards to HOSP as in the Finance Act 2019,

- Impact of HOSP on the Affordable Housing Initiative,

- Areas that need to be focused on to make HOSP effective,

- Our Expectations Going Forward, and Conclusion.

Section I: An Overview of the Affordable Housing Initiative and Home Ownership in Kenya

The Kenyan Government established the Affordable Housing Initiative, as one of its Big Four pillars to promote long-term economic development, focused on delivering 0.5 mn housing units for the lower and middle-income population segments by 2022. The main goal was to improve homeownership especially in urban areas where homeownership rate stands at 26.1% according to the 2015/16 Kenya Integrated Household Budget Survey (KIHBS) with 61% living in informal settlements according to World Bank. This is in comparison to countries like South Africa where homeownership is at 53.5% or the United States at 64.5%. The National Housing Corporation estimates that the country has a housing deficit of approximately 2.0 mn units, which grows by 200,000 units per annum. This is largely driven by a rapid population growth rate at 2.5% p.a. with an urbanization rate at 4.3%, compared to 1.2% and 2.0% globally, respectively, with 97.1% of the population also earning below Kshs 100,000 per month according to KNBS. This is worsened by other factors such as:

- Inadequate credit supply and high cost of funding for first-time buyers to access capital towards housing unit purchase,

- Soaring property prices boosted by the demand-supply forces,

- Exclusion of informal sector employees due to insufficient credit risk information, despite making up approximately 83.4% of Kenya’s workforce according to KNBS,

- Lack of capital markets funding, which tend to be long-term, and can enable real estate purchases for end-buyers, and,

- High-interest rates and deposit requirements for mortgage loans, which lockout majority of potential borrowers.

Section II: Background of the Home Ownership Savings Plan (HOSP)

We previously wrote about Home Ownership Savings Plan (HOSP) in our topical dated 15th September 2019, with the link here, where we covered what it is, its benefits and limitations. To recap, according to the Income Tax Act cap 470, a Home Ownership Savings Plan (HOSP) is a savings plan established by an ‘approved institution’ and registered with the commissioner for Income Tax for receiving and holding funds in trust for depositors. Introduced in 1995, its main objective was to aid in housing finance for first-time homebuyers and promote a culture of savings for aspiring homeowners.

Registered Home Ownership Savings accounts in Kenya are restricted to first time home buyers and to purchase of a ‘permanent house’, which the Income Tax Act defines as a residential house that a financial institution would accept as collateral for a mortgage, and includes any part or portion of a building, used or constructed, adapted or designed to be used solely for human habitation. The accumulated funds are withdrawn tax-free to strictly purchase or construct a house. However, if the depositor utilizes the funds for any other purpose other than to acquire a house, they become taxable in the year of withdrawal.

So far, the government put in place measures to fulfil its pledge to promote low-cost housing. Some of the measures included:

- Increase of tax rebates issued to depositors to Kshs 96,000 from Kshs 48,000 annually (Kshs 8,000 per month from Kshs 4,000 per month) as per the initial Home Ownership Savings Plan (HOSP) regulations in 1995,

- Formation of the Kenya Mortgage Refinancing Company (KMRC) whose main function is enhancing mortgage affordability by enabling long-term loans at attractive market rates through the provision of affordable long-term funding and capital market access to primary mortgage lenders such as banks and financial co-operatives; as per our Kenya Mortgage Refinancing Company Update of 28th April 2018, KMRC would reduce the monthly mortgage by about 14%, thereby improving affordability,

- Establishment of the National Housing Development Fund (NHDF). The fund was established under the Housing Act 2018 Section 6 (1), under the control of National Housing Corporation (NHC) as provided for in the Housing Act Cap 117. The aim of the fund is to allow mortgage and cash buyers to save towards the purchase of an affordable home through the Home Ownership Savings Plan (HOSP). Individuals who will have made contributions to the housing fund will be given the priority to buy low-cost houses, and,

- Tax relief for mortgage borrowers. As per the 1995 Income Tax Act cap 470, borrowing money from a registered financial institution to purchase a home or to improve a home guarantees the borrower a tax relief on interests paid to the registered financial institution of up to a maximum of Kshs 300,000 p.a.

Despite the above, some of the factors that have hindered the success of the Home Ownership Savings Plan in Kenya include:

- Few Product Offerings: For the past two decades, the scheme was a preserve of specialist lending institutions such as banks and building societies as stipulated in the Income Tax Act since 1996, restricting the number of products offered. Linking the schemes to capital market capable of offering attractive rates to depositors will enhance financial liberalization and assist low-income earners to efficiently save towards homeownership as part of the overall development strategy,

- Relatively Low Yields: Currently banks offer interest rates of 4.6% on average for fixed savings accounts. This in comparison to the inflation rate, which has been oscillating between 3.8% - 6.6% in 2019, means much of the benefits accrued are eroded,

- Little Public Knowledge: There is limited information available to the public about Home Ownership Savings Plan,

- Mortgage Market/Housing Deficit Mismatch: The availability of housing loans is a prerequisite for Home Ownership Savings Plans to be fully effective as upon maturity the savings only serve as a deposit. House prices in Kenya are relatively high in comparison to what individuals can afford to save due to the low-income levels, necessitating the need for more funding options after the saving period. Additionally, mortgage interest rates must be close to the savings return rate. As it is, few banking institutions offer mortgages, evidenced by the few mortgages registered and the interest rates are relatively high in comparison to the yields they offer for savings accounts, and,

- Liquidity Risk: In Kenya where the median income is relatively low at Kshs 50,000 p.m., the savings and the loan repayments could also be insufficient to fund more loan demands from subscribers completing their savings phase creating a liquidity risk for the deposit-taking institutions. The tax rebates incentivize savers meaning the product would have a high demand if properly placed in Kenya. This was the case in Ethiopia where the house savings scheme as of 2013 had a waiting list of 900,000 subscribers.

Section III: Recent Development with regards to HOSP as in the Finance Act 2019

In light of the above stumbling blocks, on 7th November 2019, the president of the Republic of Kenya assented the Finance Act of 2019, introducing into law several amendments touching on the affordable housing initiative. Among them, a section of the Income Tax Act was amended, to include Fund Managers or Investment Banks registered under the Capital Markets Act as approved institutions to hold deposits of a Home Ownership and Savings Plan (HOSP). This is in addition to the adoption of the Capital Markets Authority (CMA) investment guidelines to guide the investment of deposits held in a registered HOSP. Previously, HOSP guidelines only recognized prudential guidelines provided by the Central Bank of Kenya (CBK).

The amendment was aimed at deepening the capital markets, in addition to enabling the use of funds raised to fund the affordable housing initiative as part of the Big 4 Agenda. Previously, savings in CMA approved products, such as Money Market Funds didn’t qualify as HOSP, and contributors towards the HOSP only had the option of making saving through banks and financial institutions, which paid relatively low interest.

The amendment thus paved way for inspiring homeowners to make savings for the purchase of a home through Money Market Funds, through which their money gains interest over time, with the current top 5 money market funds’ yield averaging at 10.0%. This lightens the burden for the homeowners who will also pay rent for the house they will be living in during the construction period, in addition to benefiting from the tax rebates associated with the HOSP program.

Section IV: Impact of HOSP on the Affordable Housing Initiative

Globally, Home Ownership Savings Plan is also referred to as Contractual Savings for Housing (CSH) schemes. The other countries providing it in Africa include; Nigeria, Tunisia, Ethiopia, and Morocco. Contractual Savings for Housing (CSH) schemes function as an agreement between a financial institution and the buyer granting them the right to obtain a preferential mortgage after a minimal saving period. However, the CSH schemes have had minimal success attributable to; (i) lack of public knowledge, (ii) general lack of appropriate regulatory and technical structures, and (iii) they are mainly led by government-controlled institutions whereas, in developed countries such as France and Germany, they are mainly managed by private financial institutions and building societies, with minimal government restrictions.

The unique selling point of contractual home savings schemes such as HOSP has been the fact that interest rates on deposits and loans are not only fixed once the contract has been signed, but they are often below-market rates. The instrument is also an efficient way of mobilizing long-term liabilities for financial institutions, which means that, its providers are able to offer long-term fixed-rate loans, thus boosting the mortgage market. Additionally, allowing private firms to offer HOSP will ensure that the instrument is efficient in its objective coupled with the fact that CISs activities will be overseen by the Capital markets Authority (CMA).

In Kenya, the Home Ownership Savings Plan is thus expected to boost homeownership through the following;

- Providing a flexible platform for savings towards home purchase: Homeowners are able to make savings for the purchase of a home over time for example through Money Market Funds, which require a low capital outlay e.g. of Kshs 1,000 and through which the money gains interest over time with yields averaging at 10.0%. This lightens the burden for the homeowners who are also paying rent for the house they are living in during the construction period, in addition to benefiting from the tax rebates associated with the HOSP program. Funds raised under the scheme would also be able to serve as the mandatory 12.5% deposit under the affordable housing programme.

Below we illustrate an individual savings plan for a three-bedroom unit under the affordable housing scheme, whose cost is set at Kshs 3.0 mn, through (i) a bank-based HOSP, which is likely to offer a 2.5% return per annum, and (ii) a Fund Manager’s Collective Investment Scheme such as a money market fund offering 10.0% yield per annum; the purpose of the example is to show how long it would take save the requisite Kshs 375,000 over a 5-year period:

(All Values in Kshs Unless Stated Otherwise)

|

Saving Scenarios Under a Collective Investment Scheme and Bank-based HOSP |

||

|

|

Collective Investment Schemes (CIS) |

Bank-based HOSP |

|

House Value |

3,000,000 |

3,000,000 |

|

12.5% Deposit |

375,000 |

375,000 |

|

Tenor (Years) |

5 |

5 |

|

Rate of Return |

10.0% |

2.5% |

|

Monthly Payments |

4,843 |

5,874 |

As can be seen in the table above, for a 12.5% deposit of Kshs 375,000, assuming a five-year savings period, an individual investing with a money market fund, which offers 10.0% yield per annum will be required to make monthly deposits of Kshs 4,843. This is 21.3% less than monthly deposits of Kshs 5,874 by a depositor saving with Registered HOSP such as a bank at an interest rate of about 2.5% p.a.

- Offering tax advantage to savers: According to the Income Tax Act, individuals in a Registered Home Savings Plan are guaranteed tax rebates of up to Kshs 8,000 per month or Kshs 96,000 per annum, while interest income of up to Kshs 3.0 mn is tax-exempt upon withdrawal. With this, assuming a median income of Kshs 50,000, an individual depositing Kshs 8,000 per month with a registered HOSP account pays 28.1% less PAYE (Pay as You Earn) than one without HOSP account, as shown below:

(All Values in Kshs Unless Stated Otherwise)

|

PAYE Remittances Scenario |

||

|

|

HOSP Employee |

Non-HOSP Employee |

|

Monthly Gross Salary (Kshs) |

50,000 |

50,000 |

|

HOSP Remittance (Kshs) |

8,000 |

- |

|

PAYE (Kshs) |

5,459 |

7,596 |

|

Taxable Income (Kshs) |

42,000 |

50,000 |

- Development of a Credit Profile: The contracted savings made by a subscriber act as proof to the financial institution of their creditworthiness, thus raising their chances of accessing a mortgage loan upon maturity of the savings, and,

- Promoting a positive Savings Culture: With an effective regulatory environment, the scheme encourages a savings culture which ultimately makes it easier for an individual to acquire a home by efficiently raising a deposit for a house loan. According to the World Bank, inability to raise deposits required to access mortgage has been proven as one of the reasons behind the small number of home loans, necessitating the need for tax incentives to boost savings for property acquisition.

Section V: Areas that need to be focused on to make HOSP effective

First, all funding instruments tend to thrive in a stable environment. It is, therefore, imperative for HOSP to have a stable macroeconomic environment to ensure the system works properly and encourages people to save. Moreover, the inflation rate should be neither too volatile nor too high. Second, there is a need for proper guidelines on the way forward especially with respect to the newly approved institutions. The CMA Act should provide the standard terms and conditions addressing the following:

- The general framework for business principles and general contract terms with respect to institutions that offer HOSPs,

- Rules on permissible business activities by the Fund Managers,

- Approved methods of investing the savings whether in the stock market or government securities, and,

- Guidelines on granting of loans after the ten years have elapsed and the appropriate loan-to-value ratio.

Overall, as the government attempts to provide housing for all, there is a need for:

- KMRC to be operationalized; the institution will allow long tenor mortgages, and improve affordability by an estimated 14%, as discussed in our topical KMRC Update. With a HOSP structure in place, this will also ensure a two-pillar housing finance system which should ensure the majority of Kenyans have no challenges accessing funds,

- Operationalization of the many legislations passed so that affordable housing developers can begin to access the incentives so that they can deliver the needed units. For example, the legislation to reduce corporate tax to 15% from 30% for those building at least 100 affordable housing units was passed in 2017, however, up to today, it is not clear how this tax incentive can be accessed. Thus far, with the many legislations introduced by the government, there are no application forms for developers and the application criteria remain unknown, so it remains an incentive on paper, but inaccessible, and,

- Passing regulations that open up capital markets funding of real estate through Collective Investment Schemes regulated by the Capital Markets Authority. Specifically, (a) pass legislation allowing for specialized collective investment schemes that are focused on real estate, and (b) allow for non-banks to be Trustees just as in the case with Pensions schemes, the current regulation, that a scheme trustee must be a bank, restricts the market not to mention that it is discriminatory and unconstitutional.

Section VI: Our Expectations Going Forward, and Conclusion

We expect the Home Ownership Savings Plan to have the following effects in the near and longer-term:

Short-term;

- We expect more institutions to accept the HOSP funds, thus creating a competitive environment, which will eventually result in market players offering relatively high rates with the aim of staying competitive. This will result in more options for savers and competitive interest rates,

- We expect the Home Ownership Saving Plans to stimulate a savings culture especially among the young population and low-income households who will use the scheme as a major savings vehicle towards the purchase of a home given the flexibility, the guaranteed tax rebates of up to Kshs 8,000 per month or Kshs 96,000 per annum and tax-exemption of interest income of up to Kshs 3.0 mn which will also incentivize the individuals.

The duration for homeownership savings plans in Kenya is a maximum of ten-years. Assuming that’s how long median and low-income earners will require to have decent savings, we expect the following in the long-term impacts;

- HOSP is expected to alleviate the housing problem by providing housing finance for home-buyers. According to the World Bank, the inability to raise deposits required to access mortgage has been proven as one of the reasons behind the small number of home loans, necessitating the need for tax incentives to boost savings for property acquisition,

- We expect Home Ownership Saving Plans to minimize credit risk, as depositors can demonstrate their ability to make timely payments by saving a portion of their income throughout an extended period. This raises their chances of accessing a mortgage loan upon maturity of the savings,

- We expect HOSP to stimulate the mortgage market by providing a platform where a potential home buyer can accumulate the required deposit over time, in addition to growing their credit profile thus enhancing their eligibility for a mortgage loan.

In conclusion, we expect the Home Ownership Saving Plan (HOSP) to continue drawing potential home buyers mainly due to its flexible platform and tax rebates for contributors. In addition, once the recent inclusion of Fund Managers and Investment banks as approved institutions to hold HOSP deposits is effected as from January 2020, we expect it to result in an enlarged umbrella of financial savings that will enhance the raising of funds for the Big Four Agenda on the provision of affordable housing. The long-term, as well as closed nature of HOSP schemes, will help attract long-term finance helping institutions to avoid the usual mismatch between the maturity of deposits and housing loans, thus making it a sustainable funding instrument.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.