Impact of Coronavirus to the Kenyan Economy, & Cytonn Weekly #11/2020

By Cytonn Research, Mar 15, 2020

Executive Summary

Fixed Income

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 264.0%, up from 195.1% the previous week. The oversubscription is partly attributable to the continued favorable liquidity in the money market supported by government disbursements and local debt maturities. The recent Coronavirus outbreak has also seen increased demand for fixed-income securities, as investors move away from the equities market. We note the continued demand for the 364-day paper, having recorded the highest subscription rate, coming in at 460.4%, which we attribute to investors having a bias towards shorter-dated papers to avoid duration risk coupled with the flight from the equities market seen during the week. During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th March 2020 to 14th April 2020. Petrol prices have declined by 2.7% to Kshs 110.9 per litre, from Kshs 113.9 per litre previously, while diesel prices have decreased by 2.6% to Kshs 101.7 per litre, from Kshs 104.4 per litre previously. Kerosene prices have also declined by 7.0% to Kshs 95.5 per litre, from Kshs 102.7 per litre previously;

Equities

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 losing by 14.4%, 11.5% and 13.9%, respectively, taking their YTD performance to losses of 19.7%, 20.0% and 18.6%, for the NASI, NSE 20 and NSE 25, respectively. The YTD loss recorded by NSE 20 breaches the threshold of a bear market, which is a condition in which securities prices fall by 20.0% or more. During the week, Co-operative Bank of Kenya announced it has opened talks to acquire 100.0% stake in Jamii Bora Bank Limited. The announcement came months after Commercial Bank of Africa (CBA) dropped its cash buy-out offer and instead merged with NIC Bank to form NCBA Group. The Central Bank of Kenya (CBK) welcomed the transaction, citing it will enhance stability of the Kenyan Banking Sector and diversify the business models of the two institutions. This is in line with our Cytonn Q3’2019 Banking Sector Report, where we expect continued merger & acquisition activity in the banking sector. During the week, KCB Group released their FY’2019 financial results, with core earnings per share increasing by 4.9% to Kshs 7.8 from Kshs 7.5 in FY’2018, driven by a 17.4% growth in total operating income to Kshs 84.3 bn, from Kshs 71.8 bn in FY’2018;

Real Estate

During the week, Knight Frank released The 2020 Wealth Report, a report that shows wealth trends around the globe, which indicated that in 2019, Kenya recorded the fastest growth of high-net worth individuals (residents worth over Kshs 100.0 mn) in the world, with majority investing in property. According to the report, the number of high net-worth individuals in the country has grown by 263.0% since 2014, hitting 2,900 individuals as compared to the world average growth of 27.0%. In the residential sector, Mhasibu Sacco Society Limited, a local Sacco for accountants, launched two residential projects in Kisumu and Machakos, while Rama Homes, a local real estate firm, announced its intentions to break ground on its 50-unit residential development along Muhoho Avenue in South C. In the retail sector, Istikbal, a Turkish home furniture retailer, opened its first Kenyan showroom, at Panesar Center along Mombasa Road, and in the hospitality sector, Osmotic General Trading, an Ethiopian hospitality chain, announced its intentions to open its first Kenyan 60-room lodge in Masai Mara, Narok County;

Focus of the Week

This week, our focus is on the novel coronavirus (CO-VID 19), which has been the main topic of discussion and concern since the turn of the decade, with the first case of the virus being reported on 31st December 2019 in Wuhan, China. Initially, the virus was a major concern for the medical community in China since there was very little information about how the virus spread, the incubation period, or the severity of the disease. The virus has not only adversely affected the global community in matters of health but also, in terms of international trade, macroeconomic indicators, and financial markets. It is for this reason that we have chosen to discuss the impact the virus is likely to have on the Kenyan economy, with the first case reported in Kenya on 13thMarch 2020;

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.0% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.9% p.a. To subscribe, email us at sales@cytonn.com;

- David Kingoo, Senior Risk and Compliance Associate, Cytonn Investments, had an interview on Citizen Radio where he discussed Nakumatt Supermarket and its fall. Listen to David here;

- Beatrice Mwangi, Research Analyst, Cytonn Investments, was featured on K24 where she talked about how the oversupply of rental places in Nairobi County has led to many offices being left empty. Watch Beatrice here;

- Having completed and handed over Phase 1 of The Alma, and on track to hand over Phase 2, we have now turned our attention towards construction of The Ridge in Ridgeways. The Ridge is Cytonn’s 800-unit residential mixed-use development on the Northern Bypass. For more information, please email us at sales@cytonn.com. We are now running a promotion in Phase 1 of The Ridge: Buy a unit in Phase 1, and get a 5% discount with a 15% deposit in March;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained oversubscribed, with the subscription rate coming in at 264.0%, up from 195.1% the previous week. The oversubscription is partly attributable to the continued favorable liquidity in the money market supported by government disbursements and local debt maturities. The recent Coronavirus outbreak has also seen increased demand for fixed-income securities, as investors move away from the equities market. We note the continued demand for the 364-day paper, having recorded the highest subscription rate, coming in at 460.4%, which we attribute to investors having a bias towards shorter-dated papers to avoid duration risk coupled with the flight from the equities market seen during the week. The yield on the 91-day paper remained unchanged at 7.3%, while the yield on the 182-day and 364-day papers declined by 0.1% point and 0.2% points, to 8.1% and 9.1%, respectively, from the 8.2% and 9.3% recorded the previous week. The acceptance rate declined to 35.6%, from 46.0% recorded the previous week, with the government accepting Kshs 22.5 bn of the Kshs 63.4 bn bids received.

In the money markets, 3-month bank placements ended the week at 8.0% (based on what we have been offered by various banks), the 91-day T-bill remained unchanged at 7.3%, while the average of Top 5 Money Market Funds came in at 10.1%, down from 10.2% recorded the previous week. The yield on the Cytonn Money Market came in at 11.0%, unchanged from the previous week – you can invest and withdraw instantly, 24/7 by just dialling *809#.

Liquidity:

During the week, liquidity in the money markets remained favourable, while only declining marginally, as evidenced by a rise in the average interbank rate to 4.2%, from 4.0% recorded the previous week, attributed to banks trading cautiously in the interbank market in order to meet their CRR requirements for the cycle ending on 14th March. Commercial banks’ excess reserves came in at Kshs 15.9 bn in relation to the 5.25% cash reserves requirement (CRR). The average interbank volumes declined by 27.2% to Kshs 4.2 bn, from Kshs 5.7 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on all the Eurobonds increased significantly, an indication that investors are now attaching a higher risk premium on the country due to the anticipation of slower economic growth attributable to the locust invasion, coupled with the confirmation of the first case of the Coronavirus infection within Kenya’s borders. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 increased by 2.7% points to 7.2%, from 4.5% recorded the previous week.

During the week, the yields on the 10-year and 30-year Eurobonds issued in 2018, increased by 2.6% points and 1.2% points to 8.3% and 8.4%, respectively, from 5.7% and 7.2% recorded previous week.

During the week, the yields on the 7-year and 12-year Eurobonds issued in 2019 increased by 1.2% points and 2.8% points, to 6.6% and 9.3%, respectively, from 5.4% and 6.5% recorded the previous week.

Kenya Shilling:

The Kenya Shilling appreciated by 0.2% against the US Dollar to Kshs 102.4, from Kshs 102.6 recorded last week, due to reduced dollar demand from the merchandise traders. On an YTD basis, the shilling has depreciated by 1.0% against the dollar, in comparison to the 0.5% appreciation in 2019. In our view, the shilling should remain relatively stable against the dollar with a bias to a 2.4% depreciation by the end of 2020, with the sentiments being on the back of:

- Rising uncertainties in the global market due to the Coronavirus outbreak, which has seen the disruption of global supply chains. The shortage of imports from China for instance, which accounts for an estimated 21.0% of the country’s imports, is likely to cause local importers to look for alternative import markets, which may be more expensive and as such higher demand for the dollar from merchandise importers,

- Subdued diaspora remittances growth following the close of the 10.0% tax amnesty window in July 2019. We also foresee reduced diaspora remittances, owing to the decline in economic activities globally hence a reduction in disposable incomes. This coupled with increased prices of household items abroad might see a reduction in money expatriated into the country.

The shilling is however expected to be supported by:

- High levels of forex reserves, currently at USD 8.4 bn (equivalent to 5.1-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover,

- CBK’s supportive activities in the money markets, with the Central Bank of Kenya (CBK) having already indicated that it’s looking to purchase USD 400.0 mn from banks in the next four months, which will bolster the forex reserves that stood at USD 8.4 bn on 28th February 2020.

Weekly Highlight:

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum Retail Prices in Kenya for the period 15th March 2020 to 14th April 2020. Below are the key take-outs from the statement:

- Petrol prices have declined by 2.7% to Kshs 110.9 per litre from Kshs 113.9 per litre previously, while diesel prices have decreased by 2.6% to Kshs 101.7 per litre from Kshs 104.4 per litre. Kerosene prices decreased by 7.0% to Kshs 95.5 per litre from 102.7 per litre, previously, and,

- The changes in prices have been attributed to the decrease in the average landing cost of imported super petrol by 3.4% to USD 472.6 per ton in February 2020 from USD 489.4 per ton in January 2020. Landing costs for diesel and kerosene also decreased by 5.3% and 15.9% to USD 480.2 per ton and USD 421.2 per ton in February 2020, respectively, from USD 506.9 per ton and USD 495.3 per ton in January 2020.

We expect a decline in the transport index, which carries a weighting of 8.7% in the total consumer price index (CPI), due to the decrease in petrol and diesel prices. Consequently, the decrease in the transport index will ease inflationary pressures.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 42.3% ahead of its domestic borrowing target, having borrowed Kshs 312.4 bn against a pro-rated target of Kshs 219.5 bn. We expect an improvement in private sector credit growth considering the repeal of the interest rate cap. This will result in increased competition for bank funds from both the private and public sectors, resulting in upward pressure on interest rates. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 losing by 14.4%, 11.5% and 13.9%, respectively, taking their YTD performance to losses of 19.7%, 20.0% and 18.6%, for the NASI, NSE 20 and NSE 25, respectively. The YTD loss recorded by NSE 20 breach the threshold of a bear market, which is a condition in which securities prices fall by 20.0% or more The performance in NASI was driven by losses recorded by all large-cap stocks across all sectors with Safaricom, BAT, KCB, and Equity Bank recording losses of 17.5%, 16.5%, 15.1% and 14.6%, respectively. The losses are attributable to the ongoing Coronavirus pandemic, with Kenya confirming its first case, which triggered a panic sell-off by investors across the market. The Nairobi Securities Exchange in a public notice informed market participants and stakeholders that trading at the exchange had been halted on Friday 13th March 2020 after the NSE 20 dropped more than 5.0%, as per the provisions of Rule 9.4.1 (ii) of the NSE Equity Trading Rules. The provision provides that when the NSE 20 Share Index decreases by more than 5.0% at the opening session compared to its closing value or during the continuous session, compared to its opening value, the Exchange may temporarily halt trading for not more than 30 minutes. Trading will resume on Monday, 16th March 2020.

Equities turnover increased by 28.2% during the week to USD 54.7 mn, from USD 42.7 mn recorded the previous week, taking the YTD turnover to USD 341.0 mn. Foreign investors remained net sellers for the week, with a net selling position of USD 32.2 mn from a net selling position of USD 18.5 mn recorded the previous week. The trend reflects the global equity markets with foreign investors disposing of riskier assets in favor of safe havens.

The market is currently trading at a price to earnings ratio (P/E) of 9.9x, 25.2% below the historical average of 13.2x, and a dividend yield of 7.1%, 3.1% points above the historical average of 4.0%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 9.9x is 1.9% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 19.0% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

During the week, Co-operative Bank of Kenya announced it has opened talks to acquire 100.0% stake in Jamii Bora Bank Limited. The announcement came months after Commercial Bank of Africa (CBA), dropped its cash buy-out offer and instead, merged with NIC Bank to form NCBA Group. The Central Bank of Kenya (CBK) welcomed the transaction, citing it will enhance stability of the Kenyan Banking Sector and diversify the business models of the two institutions. Once completed, this will be the second bank acquisition in 2020, after the CBK gave a go-ahead to Nigerian lender, Access Bank PLC to acquire 100.0% stake in Transnational Bank PLC and will be the first acquisition for Co-operative Bank, which initially had preferred to grow organically. We believe that Co-operative Bank acted more out of corporate statesmanship to save a struggling bank and thereby strengthening the banking sector, as opposed to pursuit of an attractive strategic acquisition opportunity. This is in line with our expectation of continued consolidation in the Kenyan banking sector as players with depleted capital positions become acquired by their larger counterparts or merge together to form well-capitalized entities capable of navigating the relatively tough operating environment induced by stiff competition, as highlighted in our Q3’2019 Banking Sector Report.

Co-operative Bank of Kenya, a Tier 1 bank, had an asset base of Kshs 440.8 bn as at Q3’2019 and will see its asset base grow to Kshs 453.3 bn after the acquisition. Tier 1 banks are those that have a weighted index of 5.0% and above for the purposes of market share analysis. The weighted index of individual banks is weighted according to net assets, customer deposits, capital reserves, number of deposit accounts and loan accounts. Jointly, Tier I banks control almost 50.0% of the Kenyan banking sector market share. Jamii Bora Bank, JBB, on the other hand, a Tier III (category made up of small banks that control 8.4% of the market and have a weighted index of below 1.0%) had an asset base of Kshs 12.5 bn as at Q1’2018, which was the last time the bank published its financial results, and a strategic niche in Marginal, Small and Medium-size Farmer (MSMF) banking and microfinance. In our view, the deal, which is subject to regulatory approval, will have little impact on Co-operative Bank’s market share, however, it will see the bank expand its branches to 176 and benefit from Jamii Bora’s leasing business. However, we think the deal was more a matter of corporate statesmanship by Co-op Bank to save a struggling bank and thereby continued to strengthen the banking sector, as opposed to Co-op Bank seeking an attractive investment opportunity. Below is a table showing the combined proforma financials for the banks;

|

Combined Proforma Financials- Kenyan Banks |

|||

|

Balance Sheet |

Co-op Bank (Q3'19) |

Jamii Bora (Q1'18) |

Combined Entity (Kshs bn) |

|

Net Loans and Advances |

268.9 |

7.9 |

276.8 |

|

Total Assets |

440.8 |

12.5 |

453.3 |

|

Customer Deposits |

322.5 |

5.0 |

327.6 |

|

Gross Earnings |

15.5 |

(0.1) |

15.4 |

|

Net Income |

10.9 |

(0.1) |

10.8 |

|

No of branches |

159.0 |

17.0 |

176.0 |

During the week, Kenya Commercial Bank (KCB) also completed the compulsory buyout of dissenting minority shareholders of National Bank of Kenya (NBK) by issuing 4.4 mn shares at Kshs 48.2 per share, worth Kshs 212.0 mn to the holdouts, who were notified of the compulsory buyout that has now been concluded. Below is a summary of the deals that have either happened, been announced or expected to be concluded. Transactions have been carried out at an average P/BV of 1.4x at par with the currently listed banking sector average:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs. Bns) |

Transaction Stake |

Transaction Value |

P/Bv Multiple |

Date |

|

Co-operative Bank |

Jamii Bora Bank |

3.4 |

100.0% |

Undisclosed |

N/A |

Mar-20** |

|

Access Bank PLC (Nigeria) |

Transnational Bank PLC |

1.9 |

100.0% |

Undisclosed |

N/A |

Feb-20* |

|

Commercial International Bank |

Mayfair Bank |

1.1 |

Undisclosed |

Undisclosed |

N/A |

Dec-19** |

|

Oiko Credit |

Credit Bank |

3.0 |

22.8% |

1.0 |

1.5x |

Aug-19 |

|

KCB Group |

National Bank of Kenya |

7.0 |

100.0% |

6.6 |

0.9x |

Sep-19 |

|

CBA Group |

NIC Group |

33.5 |

53%:47% |

23.0 |

0.7x |

Sep-19 |

|

CBA Group*** |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan-19 |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan-19 |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank Ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3.0 |

100.0% |

5.0 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

75.7% |

1.4x |

||||

|

* Expected completion date **Announcement date *** Deals that were dropped |

||||||

The number of commercial banks in Kenya has now reduced to 40, as opposed to 43 banks from 5-years ago. The ratio of number of banks for Kenya’s 47.6 million people now stands at 0.8x, compared with a ratio of 0.9x, 5-years ago. The ratio is improving, however Kenya still remains overbanked.

The announced acquisition of Jamii Bora Bank (JBB) by Co-op Bank should reassure JBB clients, especially JBB depositors. Of particular interest is Amana Money Market Fund that had almost half of its assets at JBB; the completion of the transaction should allow the unit holders to access their deposits and get some liquidity. We still believe that a rescue of Amana Money Market Fund by an existing player would be the best solution for Amana unit holders. The suspension of withdrawal for Amana unit holders is not good for market sentiments and we strongly urge the relevant regulator and market players to work towards lifting the suspension; suspensions should not be taken lightly. As stated by the International Organizations of Securities Organizations,

“Suspension generally has an adverse impact on investor confidence, this may cause spillover effects. The fact of suspension in one Collective Investment Scheme, CIS, or a small group of CIS, increases concerns about further suspensions and may thus lead to disinvestments/withdrawals in other CIS possibly causing further CIS suspensions. Since confidence is crucial for the stability of the financial systems, it is possible that, in the case of a poor information/disclosure policy, the loss of investor confidence not only impacts the CIS industry but also affects other parts of the financial industry.”

Earnings Release

During the week, KCB Group released their combined KCB, National Bank of Kenya (NBK) FY’2019 financial results.

Income Statement

- Core earnings per share increased by 4.9% to Kshs 7.8, from Kshs 7.5 in FY’2018, driven by a 17.4% growth in total operating income to Kshs 84.3 bn, from Kshs 71.8 bn in FY’2018, coupled with a 24.9% rise in total operating expenses to Kshs 47.4 bn, from Kshs 37.9 bn in FY’2018. The growth in core earnings per share was not in line with our expectations of a 6.4% growth, with the variance being attributable to the 24.9% increase in total expenses to Kshs 47.4 bn, from Kshs 37.9 bn in FY’2018, which exceeded our expectations of a 10.8% increase.

- Total operating income rose by 17.4% to Kshs 84.3 bn, from Kshs 71.8 bn in FY’2018. This was driven by a 22.6% rise in Non-Funded Income (NFI) to Kshs 28.2 bn, from Kshs 23.0 bn in FY’2018, coupled with a 15.0% rise in Net Interest Income (NII) to Kshs 56.1 bn, from Kshs 48.8 bn in FY’2018,

- Interest income grew by 12.2% to Kshs 74.4 bn, from Kshs 66.3 bn in FY’2018. This was driven by a 12.0% rise in interest income on loans and advances to Kshs 59.0 bn, from Kshs 52.7 bn in FY’2018, coupled with an 8.3% rise in interest income from government securities to Kshs 14.1 bn from Kshs 13.0 bn in FY’2018. The yield on interest-earning assets, however, declined to 10.9% from 11.1% in FY’2018 attributable to a decline in yields on government securities as well as a decline in lending rates, which saw interest income growing by 12.2%, which was outpaced by the 14.8% growth recorded in the average interest-earning assets,

- Interest expense rose by 4.4% to Kshs 18.2 bn, from Kshs 17.5 bn in FY’2018, following a 5.2% rise in interest expense on customer deposits to Kshs 16.3 bn from Kshs 15.5 bn in FY’2018. Interest expense on deposits and placement from banking institutions however declined marginally by 1.6% to Kshs 1.95 bn from Kshs 1.99 bn in FY’2018. The cost of funds on the other hand declined to 2.8% from 3.2% in FY’2018 owing to a faster 18.4% rise in the average interest-bearing liabilities that outpaced the 4.4% rise in interest expenses. The Net Interest Margin (NIM) remained flat at 8.2%, owing to the 15.0% growth in Net Interest income (NII) matching the 14.8% growth in the average Interest earning assets,

- Non-Funded Income (NFI) rose by 22.6% to Kshs 28.2 bn, from Kshs 23.0 bn in FY’2018. The increase was mainly driven by a 23.4% rise in fees and commissions on loans to Kshs 9.2 bn, from Kshs 7.4 bn in FY’2018. As a result, the revenue mix shifted to 67:33 from 68:32 funded to non-funded income, due to the faster growth in NFI compared to NII,

- Total operating expenses grew by 24.9% to Kshs 47.4 bn, from Kshs 37.9 bn, largely driven by a 201.9% rise in Loan Loss Provisions (LLP) to Kshs 8.9 bn in FY’2019, from Kshs 2.9 bn in FY’2018, coupled with a 14.4% rise in staff costs to Kshs 19.5 bn in FY’2019, from Kshs 17.0 bn in FY’2018,

- Due to the 201.9% rise in Loan Loss Provisions (LLP), Cost to Income Ratio (CIR) deteriorated to 56.2%, from 52.8% in FY’2018. Without LLP however, the cost to income ratio improved, to 45.7%, from 48.7% in FY’2018, and,

- Profit before tax increased by 9.0% to Kshs 36.9 bn, up from Kshs 33.9 bn in FY’2018. Profit after tax grew by 4.9% to Kshs 25.2 bn in FY’2019, from Kshs 24.0 bn in FY’2018 with the effective tax rate rising to 31.8% from 29.1% in FY’2018, which the management attributed to the unwinding of massive deferred tax, which started in FY’2019, created as a result of the implementation of IFRS 9,

- The board of directors recommended a final dividend per share (DPS) of Kshs 2.5, translating to a total DPS of Kshs 3.5 for the year. At the current price of KES 42.7, this translates to a dividend yield of 8.2%.

Balance Sheet

- The balance sheet recorded an expansion as total assets grew by 25.8% to Kshs 898.6 bn, from Kshs 714.3 bn in FY’2018. This growth was largely driven by a 41.0% increase in investment in government and other securities to Kshs 169.2 bn, from Kshs 120.1 bn in FY’2018. The loan book also recorded a 17.4% growth to Kshs 535.4 bn, from Kshs 455.9 bn in FY’2018. The strong balance sheet growth is attributable to KCB acquiring NBK’s assets of Kshs 107.2 bn following the acquisition,

- Total liabilities rose by 28.0% to Kshs 768.8 bn, from Kshs 600.7 bn in FY’2018, driven by a 27.7% increase in customer deposits to Kshs 686.6 bn, from Kshs 537.5 bn in FY’2018, with customer deposits from NBK amounting to Kshs 86.9 bn. Deposits per branch declined by 3.6% to Kshs 2.0 bn from Kshs 2.1 bn in FY’2018, with the number of branches having increased to 342 as at the end of 2019, from 258 in FY’2018,

- The faster growth in deposits as compared to loans led to a decline in the loan to deposit ratio to 78.0%, from 84.8% in FY’2018,

- Gross Non-Performing Loans (NPLs) rose by 93.9% to Kshs 63.4 bn in FY’2019, from Kshs 32.7 bn in FY’2018. The NPL ratio thus deteriorated to 11.1%, from 6.9% in FY’2018, due to the faster growth in Gross Non-Performing Loans (NPLs), which outpaced the growth in loans. Consequently, general Loan Loss Provisions increased by 99.7% to Kshs 28.7 bn, from Kshs 14.4 bn in FY’2018. The NPL coverage increased to 59.5%, from 56.6% in FY’2018, due to the faster growth in General Loan Loss Provisions, which outpaced the growth in Gross Non-Performing Loans (NPLs),

- Shareholders’ funds increased by 14.1% to Kshs 129.7 bn in FY’2019, from Kshs 113.7 bn in FY’2018, as retained earnings grew by 9.6% y/y to Kshs 93.3 bn, from Kshs 85.2 bn in FY’2018,

- KCB Group is currently sufficiently capitalized with a core capital to risk-weighted assets ratio of 17.2%, 6.7% points above the statutory requirement. In addition, the total capital to risk-weighted assets ratio was 19.0%, exceeding the statutory requirement by 4.5% points. Adjusting for IFRS 9, the core capital to risk-weighted assets stood at 18.6%, while total capital to risk-weighted assets came in at 19.5%, and,

- The bank currently has a Return on Average Assets (ROaA) of 3.3%, and a Return on Average Equity (ROaE) of 20.7%.

Key Take-Outs:

- The bank’s asset quality deteriorated, with the NPL ratio increasing to 11.1%, from 6.9% in FY’2018, due to the faster growth in Gross Non-Performing Loans (NPLs), which outpaced the growth in loans. This was after the acquisition of NBK, which saw the non-performing loans portfolio of the Group rise by 93.9% to Kshs 63.4 bn. Management however indicated that, the bank had made recoveries amounting to Kshs 10.0 bn highlighting a payoff of initiatives put in place to clean up the balance sheet of NBK. KCB’s NPL growth was also attributed to a surge to increased uptake of mobile credit products which saw a deterioration in the SME and Micro loan book’s NPL ratio to 14.4% in FY’2019, from 13.0% in FY’2018,

- There was an improvement in operational efficiency as evidenced by the decline in the Cost to Income Ratio (CIR) without LLP to 45.7% in FY’2018, from 48.7% in FY’2018. This has mainly been driven by increased innovation and digitization has seen with 97.0% of total transactions performed outside the branch comprising of 78.0% on mobile, 15.0% on agency, internet and POS and 4.0% on the ATM, while branch tellers performed only 3.0% of the transactions. This has facilitated the faster growth of transactional income while maintaining a slower pace in the growth of operating expenses. This has also seen a 126.0% growth in non-branch revenue to over Kshs 12.0 bn, and,

- Non-interest income continued to drive growth coming in at 22.6% y/y to Kshs 28.2bn mainly supported by net fees and commissions, which rose by 39.4% to a combined Kshs 19.8 bn. We further note that the contribution of non-interest income to total income rose marginally by 140bps to 33.4%, which was below the 40.0% target by management.

For more analysis, please see our KCB Group FY’19 Earnings Note

The table below summarizes the performance of listed banks that have released their FY’19 results:

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

Stanbic Holdings |

1.6% |

8.1% |

7.1% |

10.7% |

5.2% |

14.0% |

46.1% |

11.7% |

2.4% |

(12.7%) |

85.1% |

9.3% |

13.6% |

|

KCB Group |

3.6% |

12.2% |

4.4% |

15.0% |

8.2% |

22.6% |

33.4% |

39.0% |

27.7% |

41.0% |

78.0% |

17.4% |

20.4% |

|

FY'19 Mkt Weighted Average* |

3.2% |

11.3% |

5.0% |

14.0% |

7.6% |

20.7% |

36.2% |

33.1% |

22.2% |

29.4% |

79.5% |

15.7% |

18.9% |

|

FY'18 Mkt Weighted Average** |

13.8% |

6.5% |

10.6% |

2.6% |

7.9% |

3.8% |

33.2% |

(1.0%) |

10.3% |

9.1% |

75.5% |

4.3% |

19.0% |

|

*Market cap weighted as at 13/03/2020 **Market cap weighted as at 31/12/2018 |

|||||||||||||

Universe of Coverage

|

Banks |

Price at 06/03/2020 |

Price at 13/03/2020 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

2.8 |

2.5 |

(9.6%) |

(16.5%) |

3.0 |

4.8 |

17.8% |

107.5% |

0.3x |

Buy |

|

Diamond Trust Bank |

100.0 |

93.8 |

(6.3%) |

(14.0%) |

109.0 |

189.0 |

2.8% |

104.4% |

0.5x |

Buy |

|

I&M Holdings*** |

50.0 |

46.3 |

(7.4%) |

(14.3%) |

54.0 |

75.2 |

8.4% |

70.8% |

0.8x |

Buy |

|

KCB Group*** |

45.0 |

42.7 |

(5.1%) |

(21.0%) |

54.0 |

64.2 |

8.2% |

58.7% |

1.2x |

Buy |

|

Sanlam |

17.0 |

14.0 |

(17.9%) |

(18.9%) |

17.2 |

21.7 |

0.0% |

55.6% |

0.6x |

Buy |

|

Jubilee Holdings |

338.0 |

302.5 |

(10.5%) |

(13.8%) |

351.0 |

453.4 |

3.0% |

52.9% |

1.0x |

Buy |

|

Co-op Bank*** |

13.6 |

13.3 |

(2.2%) |

(19.0%) |

16.4 |

18.1 |

7.5% |

44.2% |

1.1x |

Buy |

|

Equity Group*** |

45.3 |

41.9 |

(7.4%) |

(21.7%) |

53.5 |

56.7 |

4.8% |

40.1% |

1.6x |

Buy |

|

Liberty Holdings |

9.1 |

7.6 |

(16.2%) |

(26.2%) |

10.4 |

10.1 |

6.5% |

38.3% |

0.6x |

Buy |

|

NCBA |

33.1 |

30.0 |

(9.5%) |

(18.7%) |

36.9 |

37.0 |

5.0% |

28.5% |

0.7x |

Buy |

|

ABSA Bank*** |

13.0 |

11.6 |

(10.4%) |

(13.1%) |

13.4 |

13.0 |

9.5% |

21.6% |

1.5x |

Buy |

|

Standard Chartered |

200.5 |

190.0 |

(5.2%) |

(6.2%) |

202.5 |

211.6 |

10.0% |

21.4% |

1.4x |

Buy |

|

CIC Group |

2.6 |

2.3 |

(11.4%) |

(13.1%) |

2.7 |

2.6 |

5.6% |

18.8% |

0.8x |

Accumulate |

|

Stanbic Holdings |

115.0 |

95.5 |

(17.0%) |

(12.6%) |

109.3 |

103.1 |

7.4% |

15.3% |

1.0x |

Accumulate |

|

HF Group |

4.6 |

4.1 |

(9.5%) |

(36.2%) |

6.5 |

4.2 |

0.0% |

1.9% |

0.2x |

Lighten |

|

Britam |

7.3 |

6.8 |

(7.4%) |

(24.4%) |

9.0 |

6.8 |

0.0% |

(0.7%) |

0.7x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/(Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

- Industry Reports

During the week, Knight Frank released The 2020 Wealth Report, a report that tracks the global and local distribution of wealth among individuals of different economy classes over a period of time and highlighted that, overall, Kenya ranked #113 globally and #5 in Africa after Egypt, Nigeria, Tanzania and South Africa with 42 ultra-high net worth individuals (residents worth over Kshs 3.0 bn). Other key take-outs from the report were:

- In 2019, Kenya recorded the fastest growth of high net-worth individuals (individuals worth over Kshs 100.0 mn) coming in at 2,900 from 800 in 2014, with a five-year CAGR of 38.0%, in comparison to the global five-year CAGR of 12.8%. The report estimates that the individuals will grow by 16.0% to 3,369 by 2024,

- Globally, the ultra-high net wealth individual’s population is expected to swell by a further 27.0% to 650,000 by 2024, while in Kenya, the population is expected to grow by 14.0% to 48 individuals in 2024,

- Kenya ranked fourth among Africa’s high net-worth individuals as a top investment destination globally, and second in Africa after South Africa, and,

- According to the report, sectors gaining most attention from the high net-worth individuals are commercial office, hotels & leisure, development land, and residential, whereas most wealthy investors plan on increasing their investments towards properties, private equity and cryptocurrencies in the near future.

We expect the continued growth in wealthy individuals in Kenya to sustain demand in the real estate sector, especially for luxury properties, in sectors such as serviced apartments and high-end residential sector as well as emerging assets classes such as student housing.

- Residential Sector

During the week, Mhasibu Sacco Society Limited, a local Sacco for accountants, launched two projects namely:

- Kijani Hills in Kitanga, Machakos County. The project is a 9-acre parcel of unserviced land with each 1/8-acre plot retailing at Kshs 600,000 for both members and non-members, and,

- Western Hills in Riat Hills, Kisumu County. The project consists of 9-acres of unserviced land where each 1/8-acre plot will retail at Kshs 850,000 for both members and non-members.

Driven by the heightened demand for affordable housing, counties such as Kisumu, Machakos and Nyeri continue to attract real estate investors driven by; (i) the improving infrastructural development, (ii) the growing middle-income population, and (iii) the availability and affordability of development class land. Investments like this will continue to see counties transform into a more modern set up and this will lead to increased activities in the regions in terms of trade. This will drive up demand and uptake of property in these areas and in the long run an increase in property prices. We expect the land sector in other counties to continue seeing improved performance going forward fueled by (i) the continued demand for development land where it is available and more affordable, and (ii) improving infrastructure mainly the road network.

During the week, Rama Homes, a local real estate firm, announced its intentions to break ground on its 50-unit residential development along Muhoho Avenue in South C. The development dubbed ‘Rama Heights’ will consist of 130 SQM 3-bedroom and 150 SQM 4-bedroom apartments selling for Kshs 13.5 mn and Kshs 15.5 mn, respectively, translating to a price per SQM of Kshs 103,846 and Kshs 103,333, respectively.

The average price is 4.6% higher compared to the South C apartment market average of Kshs 99,059 per SQM as per our Nairobi Metropolitan Area Residential Report 2019. Suburbs such as South C appeal to investors due to; (i) accessibility to major business nodes such as Nairobi CBD, Upperhill and Kilimani, (ii) proximity to shopping facilities such as Naivas Supermarket and Nextgen Mall along Mombasa Road, and (iii) relaxation of zoning regulations allowing developers to maximize on returns, (which averaged at 5.6% in 2019 compared to the lower mid-end residential market average of 5.3%).

(All values in Kshs unless stated otherwise)

|

Nairobi Metropolitan Area Lower Mid-End Residential Performance |

||||||

|

Location

|

Average Price Per SQM

|

Average Rent Per SQM

|

Average Annual Uptake |

Average Annual Occupancy |

Average Rental Yield |

Total Returns

|

|

Langata |

97,012 |

544 |

15.0% |

85.4% |

5.5% |

6.8% |

|

South B/C |

99,059 |

497 |

20.6% |

88.8% |

4.8% |

5.6% |

|

Imara Daima |

63,203 |

354 |

22.3% |

98.9% |

5.6% |

5.4% |

|

Dagoretti |

89,807 |

627 |

16.5% |

88.7% |

5.1% |

5.1% |

|

Ngong Road |

99,800 |

508 |

20.7% |

84.7% |

4.5% |

5.4% |

|

Upper Kabete |

97,719 |

380 |

25.8% |

82.3% |

4.3% |

4.3% |

|

Kahawa West |

74,521 |

404 |

19.0% |

72.8% |

3.9% |

4.2% |

|

Average |

88,731 |

473 |

20.0% |

85.9% |

4.8% |

5.3% |

Source: Cytonn Research 2019

According to the KNBS Household Survey 2016, 90.0% of urban population in Kenya are renters. As such, we expect continued investment in the lower mid-end and low-end segments due to the persistent demand for affordable and quality rental housing units by the growing middle class and low-income bracket population.

- Retail Sector

During the week, Istikbal, a Turkish home furnish retailer, opened its first Kenyan outlet at Panesar Center along Mombasa Road. The 3500-SQFT store adds to the brand’s 1,600 stores spread across 90 countries including Egypt and Ghana. The retail store will deal in innovative furniture, carpets, mattresses, garden furniture and home textile among many others. Kenya continues to attract foreign players owing to (i) growing demand for international brands, (ii) the supply of high-quality retail spaces that meet international standards, and (iii) the expanding middle-income class population, with increasing disposable incomes creating demand for differentiated retail products. For setting up shop, Mombasa Road remains attractive to the international players due to; (i) provision of high-quality spaces in line with international standards for example Nextgen Mall, (ii) improved infrastructure i.e. the expansion of Mombasa Road facilitating easy access, particularly to key logistic hubs such as the Jomo Kenyatta International Airport, the Inland Container Depot (ICD), and the Standard Gauge Railway (SGR) station, and (iii) low average rental charges at Kshs 156 per SQFT, 11.6% lower than the market average of Kshs 176 per SQFT according to Cytonn’s Kenya Real Estate Retail Sector Report 2019. Other international retailers that have entered into the Kenyan retail market in the past year include Tendam group, Hugo Boss and Mango. The increased entry of multinational retailers is therefore a welcome move for developers who have been experiencing increasing vacancy rates due to the tough economic climate with occupancies declining by 3.9% points to 75.9% in 2019 from 79.8% in 2018, according to the Cytonn Annual Markets Review – 2019.

Even with the oversupply of retail office space by approximately 2.8 mn SQFT, we expect continued activities in the sector, supported by the continued entry of international retailers, which will buffer the sector in 2020.

- Hospitality Sector

During the week, Omotic General Trading, an Ethiopian hospitality chain, announced that it intends to open its first Kenyan 60-room lodge in Masai Mara, Narok County. The firm currently operates two similar lodges in Ethiopia. The entry of Omotic General Trading shows investor confidence in Kenya’s hospitality industry, especially in the Mara region, which is a home to wildlife and a robust cultural heritage. Narok County continues to attract hotelier investors driven by; (i) an increase in the number of visitors into the county. According to KNBS Economic Survey 2019, the number of visitors to popular attractions in Narok County such as Masai Mara increased by a 4-year CAGR of 15.1% from 166,000 in 2014 to 291,200 in 2018, (ii) tourist attractions such as the Masai Mara game reserve and Nguruman escarpment, and (iii) development of infrastructure such as Narok-Suswa road and Nairobi-Suswa Standard Gauge Railway (SGR) line, which has eased access into the area. The increase in the number of visitors in Masai Mara is shown in the figure below;

Source: KNBS 2019

We expect the sector to improve with greater demand for hospitality driven by; (i) political stability, (ii) continued marketing of Kenya as a tourist destination, (iii) improved flight operations, and (iv) improved security-boosting travelers’ confidence.

- Infrastructure Sector

During the week, a report by Kenya National Highways Authority highlighted that, the Dongo-Kundu phase II Bypass in Mombasa, which was launched in 2018, will be ready in 4-years.

The Kshs 28.0 bn project comes after the completion of the 10.1 km phase I, worth Kshs 11.0 bn, which was officially opened in June 2018. This project is part of Mombasa Port Area Road Development Project. It is expected to integrate the Port of Mombasa, Moi International Airport, Standard Gauge Railway Mombasa Terminus, and the Nairobi-Mombasa Highway, among other routes, reducing congestion and stimulating tourism in the region by providing easy access to accommodation facilities. The development is evidence of the continued government focus on improving transport infrastructure, especially roads, which are the most common means of transport in the country. According to Cytonn’s Nairobi Metropolitan Area Infrastructure Note 2019, the sector experienced a steady growth, which was fueled by; (i) availability of various forms of financing to support the sector, (ii) establishment of the governments public-private partnerships unit, and (iii) enhanced government incentives towards development of the sector.

We expect that with such a development in place, Mombasa county will be opened up to other areas for investment, thereby pushing property prices up, as the development will boost accessibility and reduce traffic snarl-ups, setting up the region to attract more investments, including real estate.

We expect the real estate sector to continue recording activities fueled by; (i) continued investment in the lower mid-end and low-end segments due to increased demand for residential units by the growing middle class and low income populations, (ii) increased entry and expansion of both local and international players, and (iii) infrastructural development which remains a top priority for the government with the aim of boosting the economy.

The novel coronavirus (COVID 19) has been the topic of discussion since the turn of the decade, with the first case of the virus being reported on 31stDecember 2019 in Wuhan, China. Initially, the virus was a major concern for the medical community since there was very little information about how the virus spread, the incubation period, or the severity of the disease. The rest of the world watched closely as China attempted to contain and eradicate the disease, which seemed like it would quickly be contained. With very little known about the virus at the time, it slowly spread to other nations and begun causing panic across the globe. Since then, the coronavirus has not only adversely affected the global community in matters of health but also, in terms of international trade, macroeconomic indicators, and financial markets. It is for this reason that we have chosen to discuss the impact the virus is likely to have on the Kenyan economy, with the first case reported in Kenya on 13thMarch 2020.

Therefore, we shall be discussing the following:

- Brief History on How the Pandemic Started and the Current State of Affairs

- How the Pandemic has Affected the Global Economy,

- Comparing Coronavirus & SARS – Impact So Far,

- The Effects in the Kenyan Economy,

- What Other Governments Have Done & What our Policy Makers Can do to Cushion the Impact, and,

- The Way Forward, Outlook and Conclusion.

- Brief History on How the Pandemic Started and the Current State of Affairs

The Coronavirus, better known as COVID-19 in the medical community, is a group of viruses that causes respiratory tract illnesses. The symptoms are severe cough, sneezing, and breathing difficulties. The virus broke out in the Wuhan district in China and slowly spread to other parts of the world. In 2020, China is already being defined by an outbreak of the Coronavirus with most economists forecasting the Q1’2020 GDP growth to come in at between 5.5% in an optimistic case and 4.5% in a pessimistic case, from the previously expected 5.9%. Currently, the disease has spread to over 104 countries with major economies such as Italy, Japan, South Korea, France, Spain, Australia, and the US having all reported multiple cases of the virus within their borders, and deaths related to the virus. The World Health Organization (WHO), on 11thMarch 2020, declared the outbreak a global pandemic raising the risk assessment of the outbreak to “very high”. A pandemic status is given to a disease epidemic that has spread across a large region across the globe and community spread is inevitable. China, the world’s second-largest economy, is a global manufacturing hub and with the country in lockdown, a majority of developed and developing economies are beginning to experience the negative effects of the virus due to the disruption of the global supply chain.

The fear of contracting the virus is also perceived to be spreading faster than the virus itself, having sparked fear across the globe with most people being driven by emotional contagion and rushing to stock up on items such as hand sanitizers, gloves and face masks, with online sales for these products having risen by 817.0% between January and February.

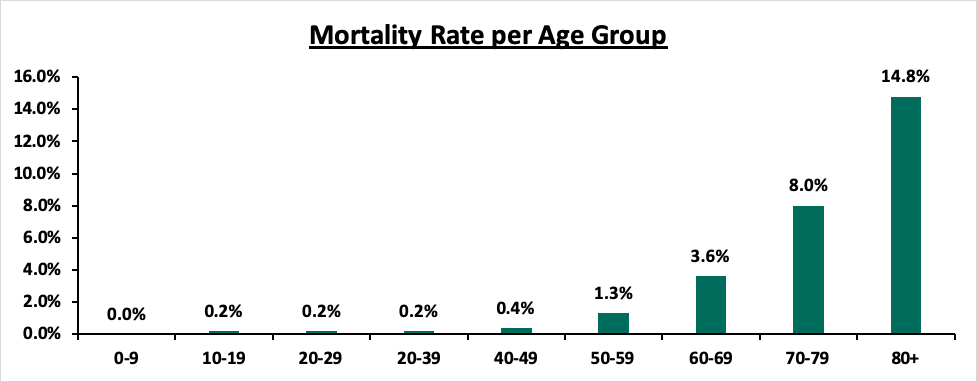

Most people are also stocking up on canned and non-perishable goods due to uncertainty about how the virus will affect the supply chain and fears of a lockdown. This emotional contagion has greatly amplified the effects of the pandemic on the global economy, even though a majority of people around the world remain largely unaffected. The medical practitioners put the mortality rate currently at 3.3% compared to other outbreaks such as the SARS virus, which had a mortality rate of approximately 9.6%. Mortality is more severe with those of age 60 and above with pre-existing medical conditions, with the younger population largely recovering.

The graph below shows mortality rate per age group;

Sources: China Centre for Disease Control & Prevention, Statista

- How the Pandemic has Affected the Global Economy

The rapid geographical spread of the coronavirus and the high infection rates have spread fear around the globe disrupting global economic activities. According to the Organization for Economic Cooperation and Development (OECD), the world economy is projected to grow by 2.4%, from an estimated 2.9% in 2019, the slowest pace since 2009, during the 2008/2009 financial crisis.

The virus has affected both developed and developing countries in terms of;

- International Trade

The virus has caused a lockdown in countries such as China, and now very recently Italy to contain the spread of the disease adversely affecting the global supply chain. China has been the world’s largest exporter since 2009 exporting USD 2.7 tn in 2018, which was approximately 10.8% of the world exports according to the World Bank. The disruption of the global supply chain is likely to cause input shortages causing most manufacturing plants and retailers to suspend operations. The demand for oil has also slowed down since the outbreak of the virus with major manufacturing hubs such as China and the US either shutting down or slowing down causing the oil prices to plummet down. As of 11thMarch, crude oil prices had declined by 48.0% YTD to USD 33.0 per barrel. In 2018, China and the US were the largest oil importers demanding 20.2% and 13.8% of the total global oil imports respectively. Despite being the largest exporter in the world, China is also a major importer of goods and services, importing 11.4% of the world’s total imports. Global economies that depend on China as a customer have already begun experiencing the effects of the lockdown due to the slowdown in demand.

- Financial and Commodity Markets

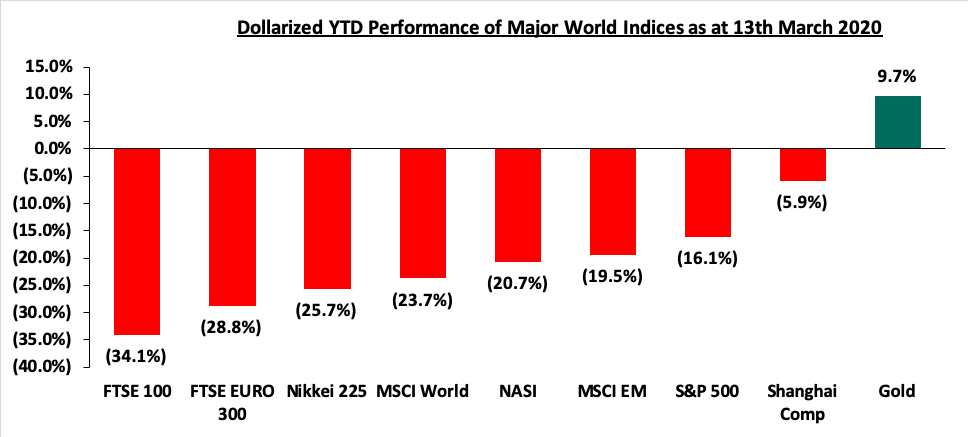

As the virus continues spreading to major economies around the world, most investors in the equities market have become net sellers, wiping out any year to date gains that major indices had made. Most investors have moved to place their money in safer haven assets such as gold, driving their prices upwards with the YTD performance of gold increasing by 9.7% as of 13th March 2020. The collapse of the oil prices mentioned earlier has also negatively affected the stock markets with investors rushing to dump stocks in the energy sector. The graph below shows the year to date performance, according to Reuters, of major indices as at 13th March 2019 with all the major world indices recording declines in their year to date performances. Companies focused on diagnosing, treating, and preventing the pandemic have however been recording gains in their stock prices. Some of these stocks include Vaxart Inc and Inovio Pharmaceuticals Inc, which have recorded YTD gains of 419.4%, and 196.0%, respectively.

The graph below shows the YTD performance of major world indices:

- Macroeconomic Indicators

As stated earlier, the global economic growth for 2020 is likely to come in at a slower pace due to the spread of the coronavirus. Most Central Banks around the world have taken a dovish monetary policy stance in a bid to boost the economy amid the negative macroeconomic effects emanating from the coronavirus outbreak. The table below shows how Central Banks of major global economies that have moved to cut interest rate so far;

|

No. |

Country |

Central Bank |

Reduction Margin |

Current. Rate |

|

1 |

USA |

Federal Reserve |

0.50% Points |

1.0%-1.25% |

|

2 |

Australia |

Reserve Bank of Australia |

0.25% Points |

0.5% |

|

3 |

China |

People’s Bank of China |

0.10% Points |

4.1% |

|

4 |

Malaysia |

Central Bank of Malaysia |

0.25% Points |

2.5% |

|

5 |

England |

Bank of England |

0.50% Points |

0.25% |

- Comparison of Coronavirus & SARS and the Impact So Far,

The SARS virus, which also originated from China in 2003 has striking similarities to the COVID-19 virus, with both being transmitted through respiratory droplets. Despite the mortality rate of the coronavirus being lower than other recent outbreaks, the virus is likely to affect the global economy in a major way mainly due to a longer incubation period and high infectious rate. The coronavirus has spread to all habitable continents of the globe affecting many more economies than the SARS virus hence, despite the low mortality rate, COVID-19 could affect the global economy more than the SARS virus.

When the SARS outbreak affected the globe, China was the sixth-largest economy accounting for only 4.2% of the world’s GDP as compared to now, when the country is the second-largest economy and accounting for 16.3% of the world’s GDP.

The table below shows the impact of Coronavirus so far and compares the impact on the SARS virus:

|

Measure |

Coronavirus |

SARS |

|

Global Cost of the Virus |

USD 43.0 bn of estimated Global economy loss |

USD 40.0 bn Global economy loss |

|

Impact on GDP |

0.25% decline in global GDP |

0.1% decline in global GDP |

|

Economy Recovery Time |

Potentially Longer than SARS |

5 Months |

|

Hotel Occupancy Rate |

85.0% decline in China |

82.0% decline in China |

|

Travel Disruption |

70.0% decline in passenger transport |

70.0% decline in passenger transport |

|

No. of Deaths so far |

5,602 |

774 |

|

Mortality Rate |

3.3% |

9.6% |

- The Effects so Far in the Kenyan Economy

The first case of Coronavirus infection within Kenya’s borders was reported on the 13th of March 2019. Despite this, the country had already begun experiencing the adverse economic effects of the pandemic.

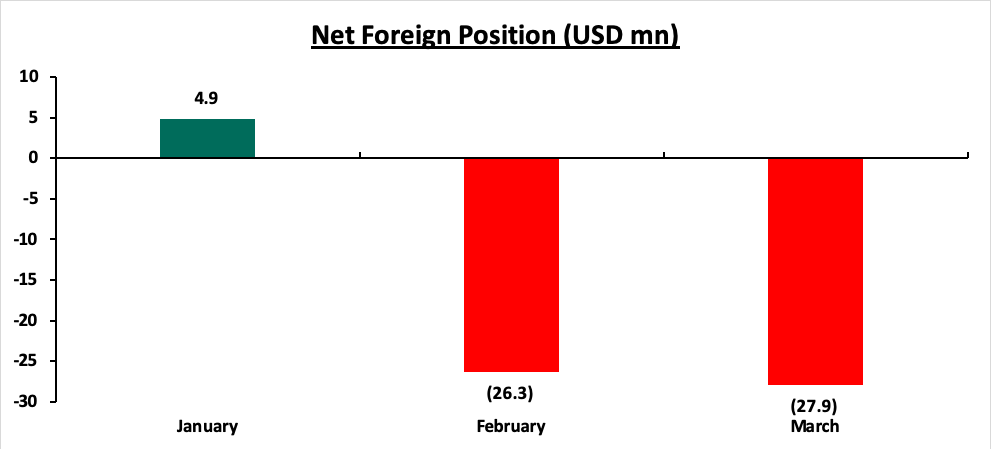

- Financial Markets: The first major hit the country experienced was the net selling position by investors in the stock markets. Most foreigners who had invested in the Kenyan stock market began selling their stocks as the virus began spreading to different parts of the globe. Many foreign investors, who often purchase blue-chip stocks, have been selling their equity holdings to purchase gold and fixed income securities due to the much uncertainty in the market. The graph below shows the net foreign position in the Kenyan equities market for the first three months of the year as of 12th March 2020;

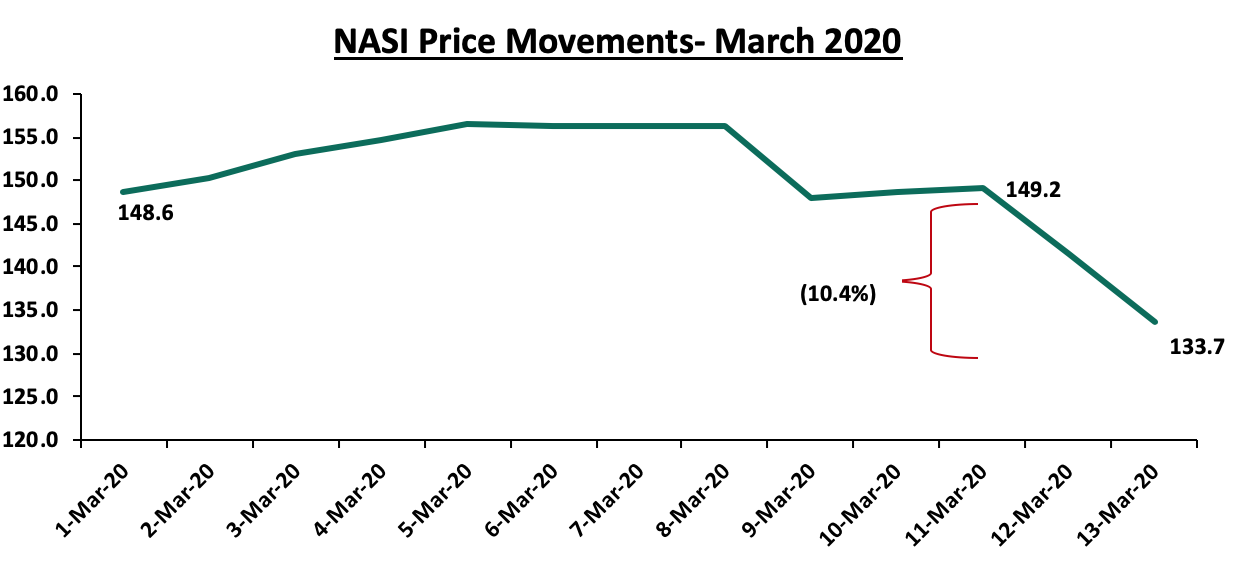

Immediately the first case of Coronavirus was reported in the country, the stock markets declined with stocks such as Safaricom and KCB declining by 5.4% and 7.0%, respectively, in one day. Trading in the NSE 20 was halted on 13th March 2020 after the NSE 20 dropped more than 5.0%, as per the provisions of Rule 9.4.1 (ii) of the NSE Equity Trading Rules. The graph below shows the NASI price movements in March 2020;

The NASI dropped by 10.4% between 11th March 2020 and 13th March 2020. The table below shows the performance on an YTD basis of large-cap stocks in Kenya as of 13th March 2020;

|

No |

Company |

Current Price (Kshs) |

YTD Performance |

|

1 |

Bamburi Cement Ltd |

50.00 |

(37.5%) |

|

2 |

Safaricom PLC |

24.35 |

(22.7%) |

|

3 |

Equity Group Holdings PLC |

41.90 |

(21.7%) |

|

4 |

KCB Group PLC |

42.65 |

(21.0%) |

|

5 |

British American Tobacco Kenya PLC |

401.50 |

(19.7%) |

|

6 |

The Co-operative Bank of Kenya Ltd |

13.25 |

(19.0%) |

|

7 |

NCBA Group PLC |

29.95 |

(18.7%) |

|

8 |

Diamond Trust Bank Kenya Ltd |

93.75 |

(14.0%) |

|

9 |

Absa Bank Kenya |

11.60 |

(13.1%) |

|

10 |

East African Breweries Ltd |

185.00 |

(6.8%) |

|

11 |

Standard Chartered Bank Kenya Ltd |

190.00 |

(6.2%) |

All large-cap stocks have recorded losses in terms of YTD performance majorly due to sell-off from investors moving to safer havens.

On the fixed income front, Government T-bills remained oversubscribed during the week with the subscription rate coming in at 264.0% with investors moving into the fixed income market to avoid uncertainty. All yields on shorter-dated government papers between the 1 and 7 years recorded YTD declines. On the other hand, Eurobond yields increased significantly this week, an indication that investors are now attaching a higher risk premium on the country due to the anticipation of slower economic growth attributable to the locust invasion, coupled up with the confirmation of the first case of the Coronavirus infection within Kenya’s borders. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 increased by 2.7% points to 7.2%, from 4.5% recorded the previous week while the yields on the 10-year and 30-year Eurobonds issued in 2018, increased by 2.6% points and 1.2% points to 8.3% and 8.4%, respectively, from 5.7% and 7.2% recorded previous week. Yields on the 7-year and 12-year Eurobonds issued in 2019 increased by 1.2% points and 2.8% points, to 6.6% and 9.3%, respectively, from 5.4% and 6.5% recorded the previous week.

- Disrupted Supply Chains: As mentioned earlier, the spread of the virus has also disrupted the global supply chain and Kenya has not been spared either. Imports from China account for approximately 21.0% of Kenya’s total imports and with the current lockdown, activities within the manufacturing sector are likely to be disrupted. The low supply of imports from China as well as South Korea especially in terms of electronics could see prices rise to exorbitant levels. Local supermarkets have already indicated that the prices of electronics, clothes, and furniture many of which are imported from China are likely to rise with media reports indicating that ships from China are yet to dock at the Mombasa port. The virus also affects the country’s exports of horticulture and agricultural goods mainly because of reduced consumer spending as well as shutdowns in major markets. The Kenya Association of Manufacturers has warned that the outbreak could cause a shortage of intermediate goods used to manufacture products that are exported. The decline in business conditions is already being felt according to Stanbic Bank’s Monthly Purchasing Manager’s Index (PMI) report having declined to 49.0 in February 2020 from 49.7 recorded in January 2020 majorly due to a decline in business conditions. A reading of above 50 indicates an improvement in the business environment, while a reading of below 50 indicates a worsening outlook.

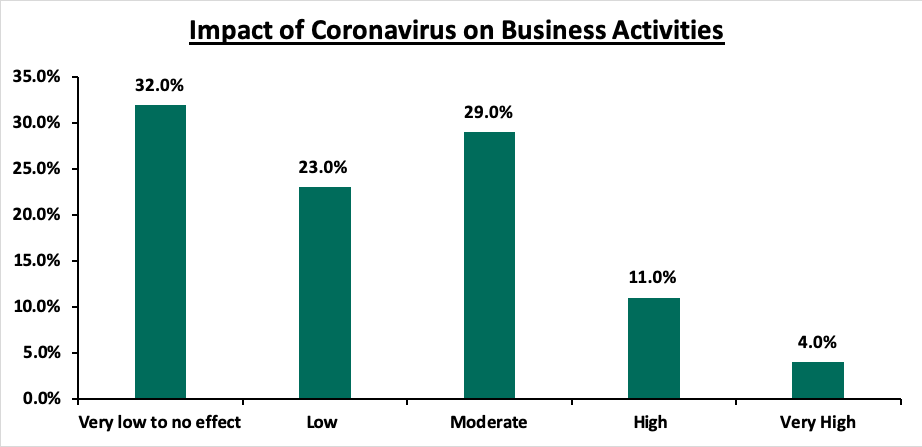

According to a report done by the Kenya Private Sector Alliance (KEPSA), 61.0% of businesses surveyed reported that the Coronavirus has had a direct negative impact on their businesses. The graph below shows the extent of impact on business activities from the coronavirus;

According to a report by KEPSA, most businesses expect to be disrupted in these various ways:

- Most companies foresee a situation where they will have to ask employees to work from home thus negatively affecting businesses in the service sector,

- Stock-outs and delayed deliveries due to the lockdown,

- Reduced demand for export products,

- Increased cost of goods which will consequently increase the overall cost of production,

- Reduced capital flows, restrictions on travel, and reduced staff time,

- Difficulty in obtaining credit from financial institutions as well as reduced ability to meet their loan interest payments, and,

- Slowed investment appetite from foreign and local investors.

- Macroeconomic Impact on Key Sectors of the Economy:

|

Key Sectors |

Impact |

Level of Impact |

|

Tourism Sector |

|

High |

|

Agricultural Sector |

|

High |

|

Manufacturing Sector |

|

High |

|

Health Sector |

|

High |

|

Wholesale and Retail Sector |

|

Moderate |

|

Finance and Insurance Sector |

|

Moderate |

|

Construction Sector |

|

Low |

|

Professional Services Sector |

|

Low |

From the above table the risk on 4 sectors is High, 2 Moderate and 2 Low, showing the significant impact of coronavirus on the Kenyan economy.

- Currency Volatility: The outbreak of the virus is likely to exert pressure on the shilling due to the lockdown in the global supply chains. The shortage of imports from China for instance, which accounts for an estimated 21.0% of the country’s imports, is likely to force local importers to look for alternative import markets, which may be more expensive and as such higher demand for the dollar from merchandise importers. The high demand for the dollar from foreigners exiting the market is also likely to cause the depreciation of the shilling, which we anticipate could be a 2.4% decline in the value of the shilling.

- Diaspora Remittances: We foresee reduced diaspora remittances as well, owing to the decline in economic activities globally hence a reduction in disposable incomes. This coupled with increased prices of household items abroad might see a reduction in money expatriated into the country. Diaspora remittances, which stood at USD 2.8 bn in 2019, have recently become the largest contributor to forex reserves, which the Central Bank uses to stabilize the currency. In order to prop up the forex reserves in anticipation of currency volatility, the Central Bank of Kenya (CBK) indicated that they are looking to purchase Kshs 40.5 bn from banks in the next four months, to bolster its dollar reserves currently at Kshs 8.4 bn as at 13th March 2020 amid rising uncertainty on global markets due to the coronavirus outbreak.

- Monetary Policy: In terms of monetary policy, the Monetary Policy Committee is set to meet on 23rdMarch 2020 to review the outcome of its previous policy decisions and recent economic developments. During the last meeting, the MPC cut the Central Bank rate by 0.25% to 8.25% from the previous 8.5%. Similar to other Central Banks around the world, the MPC is likely to adopt the status quo and cut the Central Bank Rate in a bid to boost the economy amid the uncertainty and supply chain shortages caused by the Coronavirus. The shortage of imports may cause prices to rise in the local market, which may lead to cost-push inflation. The MPC may choose to cut the rate to avail more money to importers who can import goods from alternative markets, other than China, as they may be more expensive, in a bid to reduce the supply side shortages.

Based on the impact to other economies, we believe that coronavirus may have a 10.0% to 25.0% impact on GDP growth for the year 2020. The 10.0% impact is an optimistic case in the event the outbreak is contained, and a 25.0% impact in the event it is not contained. Credit has to be given to the Kenyan Government on their swift handling of the medical side of the pandemic. However, work needs to be done on the business angle to ensure as little disruption as possible.

As such, the coronavirus could reduce Kenya’s GDP growth to a range of 4.3% to 5.2% for the year 2020 depending on the severity of the outbreak and economic implications for Kenya.

- What Other Governments Have Done & What our Policy Makers Can do to Cushion the Impact:

Governments worldwide have instituted measures to combat the effects of the pandemic as well as support businesses. Some of the measures include:

|

Country |

Measures Taken by the Government |

|

UK |

|

|

USA |

|

|

China |

|

|

Korea |

|

|

Italy |

|

|

Germany |

|

|

Singapore |

|

We believe the Kenyan Government can borrow a leaf from the governments mentioned above and possibly;

- Grant tax breaks to companies seeking to increase their capacity to produce import substitute goods, which could even mean zero-rating VAT for the next 3-months,

- Release VAT refunds to assist businesses with managing their cash flow,

- Encourage banks to give concessionary loans at low rates to facilitate businesses, and as well provide moratoriums on loans that are due,

- Announce and provide for a Business Stabilization Fund to cushion the impact of the coronavirus, especially for Small & Medium Enterprises (SME’s),

- Consider reducing corporate tax for industries that have been highly affected by the virus such as the aviation industry, or waiving corporate tax for a 3-month period as well as a reduction in payroll tax for the next 3 months for the low income bracket workers, and,

- Strengthen the local supply chain for traders to be able to access import substitute goods.

As mentioned in the previous section, we applaud the Kenyan Government for the swift and effective measures taken to control the medical side of the pandemic. Government now needs to look into measures to sustain economic output and implement measures to support businesses.

- The Way Forward, Outlook and Conclusion:

We believe the emotional contagion has and will continue to inhibit rationality even from the investor’s perspective. We believe that the psychological factor has played a major role in driving the current impact of the pandemic globally. For instance, many investors holding equity stocks in their portfolios globally have been quick to sell off their holdings thus incurring losses due to the plummeting prices. The misinformation about the virus has also added to this, as most people are unaware of what exactly the disease entails, the symptoms, prevention measures, and steps to be taken if one suspects they are infected. Medical practitioners are yet to understand much about the disease as well as fueling further the emotional contagion among the general public. The uncertainty has caused and may continue to cause most people to make irrational decisions and spread fear all around.

We believe the Kenyan government in conjunction with the Ministry of Health should take these necessary precautions to prevent a full-blown outbreak:

- Clear and effective communication, which has already been done by the Kenyan Government, for the medical side of the pandemic,

- Swift responses including quarantine and broad travel restrictions are effective for containment, and adequate preparedness by all health agencies given that the first case has already been reported,

- Promote social distancing as much as possible to reduce community transmission,

- Increase awareness to the public on the impact of the virus and especially on how spreading can be curbed. As such nationwide sensitization of citizens and businesses on sanitization initiatives and control/prevention measures are key which will also demystify most of the misinformation around the virus effectively control the emotional contagion,

- Businesses can explore alternative markets from where they can source for necessary supplies or consider sourcing locally, and,

- Local businesses can also develop virtual workstations and enlightening employees to be prepared to offer virtual services from their home to avoid the high risk of infection.

On the business front, we believe the virus has clearly illustrated the need for the country to explore alternatives and diversifying the supply chains to reduce dependency on one region. However, this is easier said than done due to the economies of scale and the low costs of production in China resulting in cheaper goods as compared to alternative markets. The virus has also the need for the government to support key sectors such as Manufacturing hence cushioning the economy. We believe this is a golden opportunity to push Buy Kenya Build Kenya mantra especially on goods that the country has a comparative advantage compared to its trading partners e.g. expanding the textile industry to substitute the imports from China.

If the global community can contain the virus and a successful vaccine developed, the global economy may recover before the end of the year and businesses may be able to make up for lost revenue during the period of the pandemic. If, however, countries are unable to contain the virus, and no vaccine is developed soon, the spread of the virus will rise significantly. According to the World Bank, a serve pandemic could result in a 5.0% decline in global GDP. Experts fear that should the effects of the virus continue to cause economic disruptions, the world may end up losing all gains financial markets have made in the past decade. The plunge in the markets caused by the coronavirus has been unprecedented in the past decade, in fact, the last time such a global bear run was witnessed in the world was Black Monday during the 1987 financial crisis. The emergence of China as a superpower in the world has seen it play a crucial role in the global supply chain and its economic slowdown as a result of the virus has adversely affected the global market. The fix for the developing recession is governments of respective countries to use tools in their disposal: monetary and fiscal policies, to ensure the local economies are stimulated through expansive policies and look for local substitutes of imports from nations such as China.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.