Kenya’s Public Debt, Should We Be Concerned? & Cytonn Weekly #7/2018

By Cytonn Research Team, Feb 18, 2018

Executive Summary

Fixed Income

Treasury bills were oversubscribed during the week, with the overall subscription rate coming in at 140.5%, compared to 132.3% recorded the previous week. Yields on the 91, 182 and 364-day papers remained unchanged at 8.0%, 10.4% and 11.2%, respectively. Citibank projects that the Kenyan economy will expand by 5.6% in 2018 driven by the recovery in the tourism and financial services sectors, and growth in manufacturing and construction due to stability in the business environment following the 2017 elections. The average Kenyan GDP growth from various research houses for 2018 is at 5.5%;

Equities

During the week, the equities market exhibited mixed trends with NASI and NSE 25 gaining 0.2% and 0.1%, respectively, while NSE 20 lost 0.7%, taking the YTD performance to 5.3% for both NASI and NSE 25, while NSE 20 is flat. For the last twelve months, NASI, NSE 25 and NSE 20 have gained 44.2%, 38.4% and 27.7%, respectively. The CBK has given banks a 5-year waiver to meet the higher capital requirements that will arise as a result of adoption of IFRS 9 as at 1st January 2018, proposing incremental provisions to be added back to earnings before computing core capital during the 5-year transition period to ease the impact on core capital;

Private Equity

Dubai Investments, a private equity company listed on the Dubai Financial Market, is set to invest USD 20.0 mn (Kshs 2.0 bn) in the consortium set to build a chain of Sabis-branded private schools in Africa. The consortium was previously made up of Centum Investment Company, Investbridge Capital and Sabis Education Network, and now includes Dubai Investments. In the financial services sector, Luxembourg-based private equity (PE) firm Fonds Européen de Financement Solidaire (Fefisol) has invested Kshs 100.0 mn in Musoni Microfinance Limited for an undisclosed stake;

Real Estate

During the week, the Kenyan real estate sector witnessed several developments in hospitality, with Hilton opening its Double Tree brand in line with its expansion plan, and Sarova Group of Hotels announcing plans to refurbish The Sarova Panafric Hotel, Nairobi. On infrastructure, construction of four roads linking The Garissa Highway to the upcoming Thika Bypass kicked off and this will see the opening of areas served by the roads and reduce traffic in Thika Town and its environs;

Focus of the Week

Kenya’s rising public debt has been a point of discussion in most macroeconomic outlook discussions, with organizations such as the World Bank, the International Monetary Fund (IMF), global credit rating agencies such as Moody’s Credit Rating Agency, and the African Development Bank (AfDB), among others, raising concerns. This week, we analyse Kenya’s public debt comprehensively with the aim of taking a view on whether the rising debt levels should be a point of concern.

- Our Investment Analyst, Stephanie Onchwati, discussed the performance of the Kenyan Shilling. Watch Stephanie on CNBC here

- On Wednesday, 15th February 2018, Cytonn Foundation, the Corporate Social Responsibility (CSR) arm of Cytonn Investments Management Plc, which focuses on giving back to the society through skill development, held a private Wealth Management Training (WMT) at the Meru University located in Meru County, as part of the Foundation’s financial literacy pillar. During the training, the University staff were taken through a financial planning session with a focus on 4 key pillars; Budgeting, Debt Management, Savings, and Investments in the various asset classes. See the Event Note here. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.comor book through this link Wealth Management Training. To view the Wealth Management Training topics, click here

- In the spirit of giving back to the society, Cytonn Investments Management Plc visited Grace Community Children’s Home on Saturday, 17th February 2018. Grace Community Children's Home is a non-governmental organization located in Kahawa West and provides basic needs and education to orphans and street children. See the Event Note here

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- To invest in any of our current or upcoming real estate projects, please visit Cytonn Real Estate

- Cytonn Towers, where we are only selling residential units in the first phase of residential apartments, is currently about 20.0% sold. See Cytonn Towers

- The Alma phase one which is 55.0% sold. See The Alma

- Amara Ridge has currently 100.0% uptake. See Amara Ridge

- Situ Village is currently 22.0% sold. See Situ Village

- The Ridge (Phase 1) is currently 31.0% sold. See The Ridge

- Taraji Heights is currently 14.0% sold. See Taraji Heights

- RiverRun Estates (Phase 1) is currently 11.0% sold. See RiverRun Estates

- With over 10 investment ready projects worth over Kshs 82.0 billon of project value, we shall be very selective on new real estate projects going forward, only focusing on Joint Ventures and real estate opportunities with deep value. We are increasingly focused on private equity deals. Should you have any deals in banking, insurance, education, hospitality and technology sectors, kindly email a teaser to PE@cytonn.com.

We continue to beef up the team with ongoing hires for: Operations Business Manager – Cytonn Institute of Building Technology, Software Architect, Business Administration Associate – Procurement, Merchandise Manager and Assistant Editor – Sharpcents Newsletter, among others. Visit the Careers section at Cytonn’s Website to apply.

Treasury bills were oversubscribed during the week, with the overall subscription rate coming in at 140.5%, compared to 132.3% recorded the previous week. The subscription rates for the 91, 182 and 364-day papers came in at 116.8%, 112.2%, and 178.3% compared to 52.4%, 125.1%, and 171.5%, respectively, the previous week. Yields on the 91, 182 and 364-day papers remained unchanged at 8.0% 10.4% and 11.2%, respectively. The overall acceptance rate declined to 81.4% compared to 99.7% the previous week, with the government accepting a total of Kshs 27.5 bn of the Kshs 33.7 bn worth of bids received, against the Kshs 24.0 bn on offer. The government is still behind its domestic borrowing target for the current fiscal year, having borrowed Kshs 192.3 bn, against a target of Kshs 260.3 bn (assuming a pro-rated borrowing target throughout the financial year of Kshs 410.2 bn). If the domestic borrowing target is revised downwards to Kshs 293.8 bn as per the Draft 2018 Budget Policy Statement (BPS) that is yet to receive Cabinet approval, the pro-rated target comes in at Kshs 186.4 bn, meaning the government will be ahead of its borrowing target.

The Kenyan Government has re-opened two bonds, FXD 1/2010/15 and FXD 2/2013/15, with effective tenors of 7.1 and 10.2 years, and coupons of 10.3% and 12.0%, respectively, in a bid to raise Kshs 40.0 bn for budgetary support. The weighted average yield accepted for the FXD 1/2008/15 (Re-open) and FXD 1/2017/10 (Re-open) with 5.3 and 9.6 years to maturity that were issued in December 2017 were at 0.04% and 0.26% above market, respectively. With (i) the government still behind its domestic borrowing, and (ii) the Kenya Revenue Authority (KRA) having fallen short of its collection target, meeting only 87.2% of its pro-rated half year 2017/18 fiscal year revenue collection target, having collected Kshs 712.2 bn compared to a target of Kshs 817.1 bn for the half year and Kshs 1.6 tn for the full fiscal year (43.6%), there exists the possibility of upward pressure on interest rates. However, should the Draft 2018 BPS get approved by the Cabinet, the government will be ahead of its domestic borrowing target and the Eurobond scheduled for issue in March should cover the external borrowing target if fully subscribed. Both avenues will plug in any deficits in collection by the KRA, resulting in no upward pressure on interest rates. 7 and 10-year tenure bonds are currently trading at a yield of 12.6% and 12.8% in the secondary market, respectively, and hence we see the average yield of the bonds coming in at between 12.6% and 12.8% for the FXD 1/2010/15 (re-open) and between 12.8% and 13.0% for the FXD 2/2013/15 (re-open).

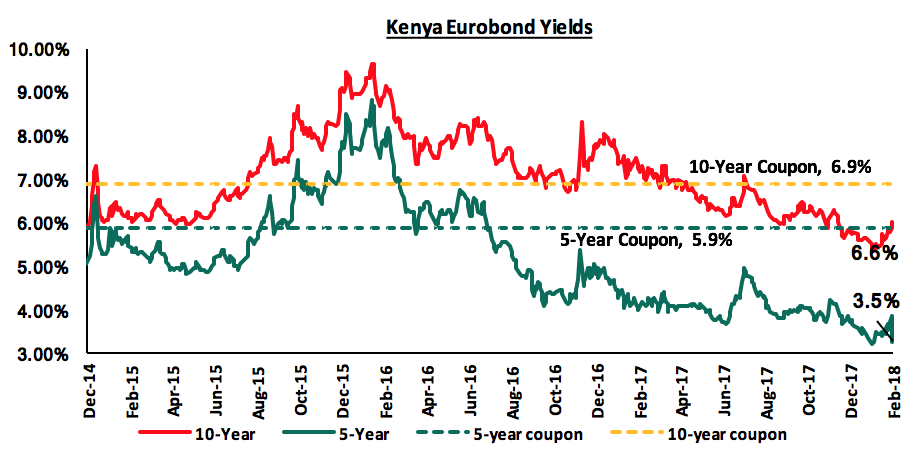

According to Bloomberg, the yield on the 5-year Eurobond declined by 10 bps to 3.5% from 3.6% while the yield on the 10-year Eurobond rose by 30 bps to close at 6.6% from 6.3%, respectively, the previous week. The different behaviour in yield movements of the two Eurobonds could mean that investors are confident in the short term but uncertain about Kenya’s ability to pay its debt in the medium term given the numerous warnings on debt sustainability that the country has received of late. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 5.3% points and 3.1% points for the 5-year and 10-year Eurobonds, respectively, due to the relatively stable macroeconomic conditions in the country.

The declining Eurobond yields and stable rating by Standard & Poor (S&P) and Fitch Ratings are indications that Kenya’s macro-economic environment remains stable and hence an attractive investment destination. During the week, S&P Global Ratings affirmed Kenya’s long-term foreign and local currency rating at ‘B+’, with a “stable” outlook, and short-term foreign and local currency rating at ‘B’. This is good because with the issue of Kenya’s 3rd Eurobond planned for March 2018, a stable outlook will serve to ensure the government obtains the funds at a cheaper rate. Members of the Treasury are already in the U.S. for the roadshow to market the Eurobond and test investor appetite. However, Moody’s has now officially downgraded the government’s issuer rating to “B2” from “B1” previously, based on the observation that as the country’s financing needs continue to grow and the government turns to external commercial loans to fund the deficit, (i) the country becomes more susceptible to external market conditions and shocks, and (ii) more pressure is likely to mount on the government’s liquidity and therefore ability to repay arising liabilities in good time. Moody’s retained a “stable” outlook supported by Kenya’s strong and relatively diversified economy. There are still concerns from the International Monetary Fund (IMF), World Bank and most recently the African Development Bank (AfDB) around Kenya’s rising debt levels. The IMF is set to meet with the National Treasury in the course of next week to discuss measures the government can put in place to ensure the budget deficit target of 6.0% of GDP in FY’2018/19 and further to 3.0% of GDP by FY’2021/22, as stated in the Draft 2018 BPS, is met.

The table below tracks sovereign credit ratings for the Kenyan Government by various global rating agencies. We shall be updating it as such going forward.

|

Kenya Sovereign Credit Rating |

|||||

|

No. |

Credit Rating Agency |

Long-term External & Internal Rating |

Short-term External & Internal Rating |

Overall Issuer Rating |

Outlook |

|

1. |

Fitch Ratings |

B+ |

B |

- |

Stable |

|

2. |

S&P Global Ratings |

B+ |

B |

- |

Stable |

|

3. |

Moody's |

- |

- |

B2 |

Stable |

The Kenya Shilling deprecated by 0.5% against the US Dollar during the week to Kshs 101.3, from Kshs 100.8 the previous week due to increased supply of the shilling and a rise in dollar demand by corporates. On a YTD basis, the shilling has gained 1.9% against the USD. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- Weakening of the USD in the global markets as indicated by the US Dollar Index, which shed 9.9% in 2017, and has shed 3.4% YTD, and,

- CBK’s intervention activities, as they have sufficient forex reserves, currently at USD 7.2 bn (equivalent to 4.8 months of import cover). Key to note is that the forex reserves have been gradually declining since April 2017, despite the marginal w/w improvement. Key to note is that the IMF is set to meet with the National Treasury in the course of next week to review the 3-year USD 1.5 bn standby credit facility which expires in March. The facility was granted on condition that the government worked on lowering its budget deficit to 3.7% of GDP by 2018/19, while projections as per the Draft 2018 BPS indicated a deficit of 6.0%.

Citibank project that the Kenyan economy will expand by 5.6% in 2018 driven by the recovery of the tourism and financial services sectors, and growth in manufacturing and construction, as the business environment continues to recover after the 2017 elections. Below is a table showing that the Kenyan economy is expected to grow by an average of 5.5% as projected by various research houses, global agencies and government organizations. We shall continue to update this table anytime growth outlook is adjusted by these organizations, or in the event of new research houses expressing a view.

|

Kenya 2018 GDP Growth Outlook |

||

|

No. |

Organization |

Jan-18 |

|

1. |

Central Bank of Kenya |

6.2% |

|

2. |

Kenya National Treasury |

*6.0% |

|

3. |

African Development Bank (AfDB) |

5.6% |

|

4. |

Stanbic Bank |

5.6% |

| 5. | Citibank |

5.6% |

|

6. |

International Monetary Fund (IMF) |

5.5% |

|

7. |

World Bank |

5.5% |

|

8. |

Fitch Ratings |

5.5% |

|

9. |

Barclays Africa Group Limited |

5.5% |

|

10. |

Cytonn Investments Management Plc |

5.4% |

|

11. |

Focus Economics |

5.3% |

|

12. |

Standard Chartered |

4.6% |

|

Average |

5.5% |

|

|

*expectation by the National Treasury was “above 6.0%”, not exactly 6.0% |

||

On inflation during the week:

- The Energy Regulatory Commission (ERC) released their revised monthly fuel prices, which saw the prices of kerosene, diesel and petrol increase by 2.6%, 2.3% and 1.5%, effective from 15th February to 14th March, brought about by an increase in landed costs by 4.7%, 4.3% and 4.1%, respectively. This takes Nairobi prices per litre to Kshs 76.8, Kshs 97.0 and Kshs 107.9, for Kerosene, Diesel and Petrol, respectively. The rise in landed costs is brought on by rising global oil prices, which have risen by 3.0% YTD to USD 68.9 per barrel in February from USD 66.9 per barrel at the close of 2017, following the decision by the Organization of the Petroleum Exporting Countries (OPEC) to extend supply cuts into 2018, despite increased production of shale in the U.S. This will directly affect transport costs and indirectly affect food prices in February, leading to a rise in m/m inflation. We expect fuel prices to continue to rise in the course of 2018 as global oil prices continue to recover,

- According to the Ministry of Environment and Natural Resources, there’s a possibility of a drought in the East African region that is usually brought about by La Nina, currently developing in the Equatorial Pacific Ocean. We expect pressure on food prices should this take place, however, as stated in our topical on Cost of Living, droughts are cyclical natural catastrophes that the government can strategically plan for and mitigate against through development of irrigation schemes, better budgetary disaster management allocation, investing in water reservoirs across the country, and proper national food storage facilities, among other long-term suggestions, and,

- Electricity costs are set to rise as well as Hydro-Electric Power (HEP) generation remains low and diesel-powered thermal generators being used to fill in the gap, leading to a rise in the cost of electricity production with the increase in the cost of diesel. In February, consumers will have to pay 4.7% more for a unit of electricity, now priced at Kshs 4.5 from Kshs 4.3 in January.

We expect inflation for the year 2018 to average 7.5%, as stated in our Annual Market Outlook 2018. We shall release our inflation projection for the month of February in next week’s report.

Rates in the fixed income market have remained stable as the government rejects expensive bids despite being behind their borrowing target. However, a budget deficit that is likely to result from depressed revenue collection creates uncertainty in the interest rate environment as any additional borrowing in the domestic market to plug the deficit could lead to upward pressure on interest rates. Our view is that investors should be biased towards short term fixed income instruments to reduce duration risk.

During the week, the equities market exhibited mixed trends with NASI and NSE 25 gaining 0.2% and 0.1%, respectively, while NSE 20 lost 0.7%, taking the YTD performance to 5.3% for both NASI and NSE 25, while NSE 20 is flat. For the last twelve months (LTM), NASI, NSE 25 and NSE 20 have gained 44.2%, 38.4% and 27.7%, respectively. This week’s performance was attributed to gains by select large-cap stocks such as Co-op Bank and KCB Group, which gained 1.0%, and 0.6%, respectively.

Equities turnover decreased significantly by 40.9% to USD 26.8 mn from USD 65.5 mn the previous week. We expect the market to remain supported by positive investor sentiment this year, as investors take advantage of the attractive stock valuations in select counters.

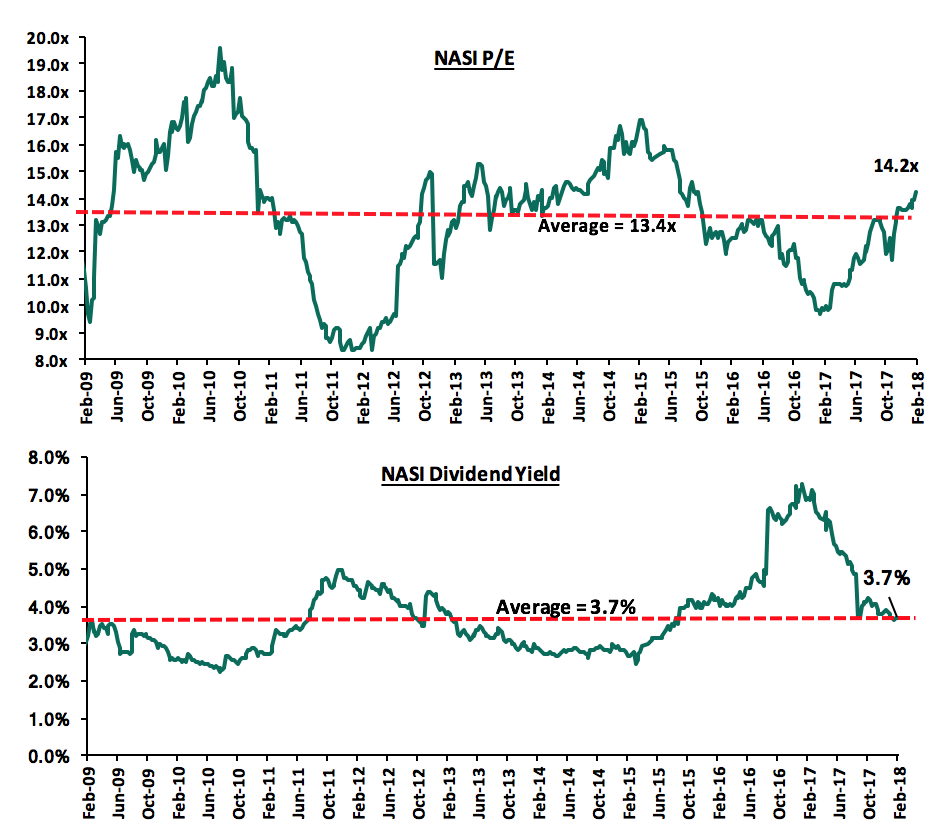

The market is currently trading at a price to earnings ratio (P/E) of 14.2x, which is 5.9% above the historical average of 13.4x, and a dividend yield of 3.7%, similar to the historical average of 3.7%. The current P/E valuation of 14.2x is 46.5% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 71.0% above the previous trough valuation of 8.3x experienced in December 2011. In our view, there still exist pockets of value in the market, with the current P/E valuation being 16.0% below the most recent peak of 16.9x in February 2015. The charts below indicate the historical P/E and dividend yields of the market.

Moody’s has downgraded credit ratings for 3 of the largest Kenyan commercial banks by market cap., to “B2” from “B1” previously, namely KCB Group, Equity Group and Co-operative Bank of Kenya. The move to downgrade the banks emanated from the downgrade of Kenya’s Government’s Issuer Rating to “B2” from “B1” previously. A downgraded credit rating for a corporate might make it difficult for the organization to negotiate for lower rates on corporate debt financing. However, we maintain our view that the banks still remain fundamentally strong, with capital adequacy ratios above statutory requirements and the banks being the top 3 out of 11 listed banks by franchise value as per our Q3’2017 Banking Sector Report.

The Kenya Parliamentary Budget Office (KPBO) has put in place a proposition to review the law capping interest rates in a bid to (i) boost private sector credit growth, which was at an average of 2.4% in 2017 compared to a 5-year average of 14.4%, and (ii) to increase flexibility of the Central Bank Rate (CBR), which has remained at 10.0% since the law was passed. This reiterates the World Bank’s initial concern that the rate-cap would undermine the effectiveness of monetary policy. For the proposal to go through, it would need to go through the National Assembly and get approval from President before the Banking (Amendment) Act, 2015 can be amended. As we have previously mentioned in our topicals on the interest rate cap, with the latest one being the Update on Effect of Interest Rate Cap on Credit Growth & Cost, amending or even repealing the Act would be key in sparking private sector credit growth and in turn boosting economic growth, and hence we are of the view that the proposal is likely to go through and the law amended.

The CBK has given banks a 5-year waiver to meet the higher capital requirements that will arise as a result of adoption of IFRS 9 as at 1st January 2018, proposing incremental provisions to be added back to earnings before computing core capital during the 5-year transition period, to ease the impact on core capital. As stated in our topical on The IFRS 9 Transition: A Road to Vigilance?, we noted that implementation would result in an estimated 30.0% increase in Non-Performing Loans (NPLs), which banks will pass on to their balance sheet, first reducing the statutory reserve item in the balance sheet before affecting the retained earnings, and hence, a reduction in Tier I capital, which would probably see some banks operate below the regulatory minimum requirements. From our analysis in the topical, while the large banks will have few problems navigating through IFRS 9, there are 3 banks that are already undercapitalised, namely NBK, Spire Bank and Consolidated Bank; we expect them to be the most affected banks. This waiver will allow banks that will fall below capital requirements ample time to raise capital. We maintain the view that banks will have to be prudent in loan disbursement, as well as in providing for loans, following a relatively challenging operating environment, where banks are finding it increasingly difficult to price for risk. After the 5-year period, and during the capital raising period, those banks that will have failed to meet the capital requirements and are unable to raise additional capital might be forced to merge or be acquired to survive.

The deadline for commercial banks to upload collateral on all their outstanding loans in one common register has lapsed. Borrowers will be able to access multiple loans on the same collateral; however, this is dependent on whether all commercial banks have uploaded this information onto the register. This, and the Movable Property Security Rights Act that essentially allows borrowers to use movable property as collateral for credit, are among efforts towards making credit cheaper and more accessible. With banks still finding it difficult to price loans with the interest rate cap as is, it would be necessary for the Banking (Amendment) Act, 2015 to be repealed or at least significantly reviewed in order for this and other efforts to result in an increase in private sector credit growth which averages 2.4% for 2017 compared to a 5-year average of 14.4%.

Standard Chartered Bank Kenya (SCBK) has launched a mortgage facility accessible at 13.0% p.a. in Kenya Shillings and 6.0% p.a. in USD, with the lender intending to loan out Kshs 4.0 bn in loans over the next 2-months. Customers will benefit from the lower than market rate for 2-years after which the loans will be re-priced back to market. This comes in an era of interest rate caps that has led to a reduction in private sector lending by commercial banks who have found it difficult to price risk with lending rates capped at 14.0% since the law was introduced, thus resulting in a private sector credit growth slumping to an average of 2.4% in 2017 compared to a 5-year average of 14.4%, as noted in our topical, The Total Cost of Credit Post Rate-Cap. As per the Cost of Credit website, the Annual Percentage Rate (APR) for a mortgage from SCBK has not yet been uploaded, which would effectively give us the true cost of credit for the facility. Once uploaded, we shall give an update on whether the facility is actually cheap in comparison to other mortgage facilities offered in the market. We however note that the annual interest rate of 13.0% p.a. is 100 bps cheaper than mortgage facilities in the market, at 14.0%. Should the bank and other charges added on top be at par, the SCBK mortgage will be the cheapest in the market, paving the way for bank efforts to improve credit access by the private sector and private sector credit growth in the long run.

Data from the CBK indicates that the value of mobile transactions increased by 8.4% to Kshs 3.6 tn in 2017 from Kshs 3.4 tn in 2016, driven by (i) a 15.9% increase in the number of transactions to Kshs 1.5 bn from Kshs 1.3 bn, and (ii) a 14.6% increase in number of accounts to 33.3 mn in December 2017 from 29.1 mn in December 2016. Data from the Communications Authority of Kenya (CAK) suggests growth is mostly driven by M-commerce transactions as opposed to Person-to-Person (P2P) transactions, with the former increasing by 60.0% in Q3’2017 as compared to the latter, which experienced a 14.7% increase in the same period. The rising mobile money trend has resulted in banks innovating through provision of mobile-banking services and companies like Safaricom thriving through income streams from transaction fees. We expect the trend to continue to grow as mobile phone penetration continues to grow and other players from the fintech space enter the market, like Telkom Kenya that is set to re-launch its mobile money platform.

Safaricom has launched a new music streaming mobile phone application named “Songa” in a bid to introduce a new income line rooted in the music business. The application will earn from user subscription fees based on a 3-tiered model with daily, weekly and monthly subscribers paying Kshs 25, Kshs 150 and Kshs 499, respectively, for the service, and compete with existing players in the market such as Mdundo, Spotify, Boomplay available on Tecno handsets, Apple Music available on i-Phones, and Tidal. Proceeds will be shared by Safaricom, musicians and the platform providers. This will serve to increase the telco’s revenue in the long-term and diversify its revenue streams further, given they already have voice & SMS, mobile data, M-Pesa and recently home and business data.

In an effort to keep our rankings of companies on the Cytonn Corporate Governance Ranking (Cytonn CGR) Report up-to-date, we continually update the rankings whenever there are changes on any of the 24 metrics that we track, and how this affects the company ranking. This week,

- Bamburi Cement appointed two Executive Directors to the board; Mr Seddiq Hassani and Mr Nicolas George. Mr Hassani is also Bamburi’s new Managing Director and Mr George will head Hima Cement Limited, the firm’s Uganda subsidiary. Bamburi’s score based on our 24 metrics has declined to 66.7% from 70.8%, following an increase in the board size to an even number 10 from an odd number 9 and worsening board gender diversity in the board to 30.0% from 33.3% previously as the extra addition to the board was male while the number of female members remained 3. Bamburi now ranks at Position 22 from Position 21,

- BOC Group’s Managing Director, Millicent Onyonyi, resigned, effective 30th April 2018, after 2-years of service to the firm as the MD. With her replacement yet to be appointed and her resignation yet to be effective, BOC remains at Position 36 with a comprehensive score of 60.4% in our CGI ranking, and,

- The CBK moved to make it difficult for former managers of failed banks to join other banks as part of the managerial team, in line with prudential guidelines that require banks to seek regulator-approval before making any senior-level appointments. This has locked out 10 former Chase Bank executives and 1 Dubai Bank manager from attaining management positions at Sidian and Gulf African banks. The move by the CBK, in our opinion, is a step that seeks to uphold corporate governance standards in the sector, as it continues to tighten regulation and oversight.

Below is our Equities Universe of Financial Services Coverage:

|

all prices in Kshs unless stated otherwise |

||||||||

|

No. |

Company |

Price as at 09/02/18 |

Price as at 16/02/18 |

w/w Change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ (Downside)** |

|

1. |

NIC*** |

35.8 |

36.0 |

0.7% |

6.7% |

61.4 |

3.5% |

74.1% |

|

2. |

KCB Group |

45.3 |

45.5 |

0.6% |

6.4% |

59.7 |

6.6% |

37.8% |

|

3. |

DTBK |

210.0 |

210.0 |

0.0% |

9.4% |

281.7 |

1.3% |

35.4% |

|

4. |

Barclays |

10.6 |

10.7 |

0.5% |

10.9% |

12.8 |

9.4% |

29.6% |

|

5. |

Kenya Re |

19.6 |

19.5 |

(0.5%) |

7.7% |

24.4 |

3.8% |

29.0% |

|

6. |

I&M Holdings |

119.0 |

120.0 |

0.8% |

(5.5%) |

150.4 |

2.5% |

27.9% |

|

7. |

Liberty Holdings |

12.7 |

13.0 |

2.4% |

6.6% |

16.4 |

0.0% |

26.2% |

|

8. |

Britam |

13.0 |

12.5 |

(3.5%) |

(6.4%) |

15.2 |

1.8% |

23.4% |

|

9. |

CIC Group |

5.5 |

5.3 |

(3.6%) |

(5.4%) |

6.2 |

1.8% |

18.8% |

|

10. |

Jubilee Insurance |

500.0 |

505.0 |

1.0% |

1.2% |

575.4 |

1.7% |

15.7% |

|

11. |

Co-op Bank |

17.0 |

17.1 |

0.6% |

6.9% |

18.6 |

5.4% |

14.2% |

|

12. |

HF Group*** |

10.6 |

10.7 |

0.9% |

2.9% |

11.7 |

0.8% |

10.4% |

|

13. |

Sanlam Kenya |

28.3 |

29.0 |

2.7% |

4.5% |

31.4 |

1.1% |

9.2% |

|

14. |

Equity Group |

43.3 |

42.8 |

(1.2%) |

7.5% |

42.3 |

4.2% |

3.1% |

|

15. |

Stanbic Holdings |

81.0 |

81.0 |

0.0% |

0.0% |

79.0 |

5.1% |

2.7% |

|

16. |

Standard Chartered |

207.0 |

207.0 |

0.0% |

(0.5%) |

201.1 |

4.3% |

1.4% |

|

17. |

NBK |

9.0 |

8.5 |

(5.6%) |

(9.6%) |

5.6 |

0.0% |

(34.1%) |

|

*Target Price as per Cytonn Analyst estimates |

||||||||

|

**Upside / (Downside) is adjusted for Dividend Yield |

||||||||

|

***Banks in which Cytonn and/or its affiliates holds a stake |

||||||||

|

For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 6th largest shareholder |

||||||||

We maintain a “NEUTRAL” recommendation on equities for investors with short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors like Financial Services, and with expectations of higher corporate earnings this year, the market will be cheaper for long-term investors hence we are “POSITIVE” for investors with long-term horizon.

Dubai Investments, a private equity company listed on the Dubai Financial Market, is set to invest USD 20 mn (Kshs 2.0 bn) in the consortium set to build a chain of Sabis-branded private schools in Africa. The consortium was previously made up of Centum Investment Company, Investbridge Capital and Sabis Education Network. Prior to the investment, 40.0% of the consortium was owned by Centum, 40.0% by Investbridge and 20.0% by Sabis. The value of investment by each party and the new shareholding after the investment by Dubai Investments is undisclosed. The consortium, which is investing through the holding company Africa Crest Education (ACE), is building its first school in Runda, Nairobi, and is expected to have its first admission in September 2018, and will offer the SABIS International curriculum for Kindergarten to Grade 12 level, and is expected to have a capacity of 2,000 students. The investment by Dubai Investments indicates the growing interest in the education sector in Sub Saharan Africa. Other investors who are setting up institutions in Kenya include:

- Johannesburg Stock Exchange listed firm, Advtech, who is set to open a school in Tatu City under its Crawford Schools brand, offering the THRASS (Teaching, Handwriting, Reading, and Spelling Skills) education system which focuses on pre-primary education,

- South Africa based Nova Pioneer, who have set up a Primary and Secondary School in Tatu City offering the 8-4-4 curriculum, and

- Cytonn Investments, through its education affiliate Cytonn Education Services (CES), who are looking to provide education for all levels, from the Early Childhood Development Education (ECDE) to Tertiary Education, beginning with a Technical College branded, Cytonn Technical College.

We expect to see an increase in investment in the education sector in Sub-Saharan Africa, as investors are motivated by (i) increasing demand for quality and affordable education, with the Gross Enrolment Ratio (GER) having doubled in the last 10-years to 8.5% in 2016 from 4.5% in 2006 according to a report, “The Business of Education in Africa” by Caerus Capital, and (ii) support, such as ease of approvals, offered to investors in the education sector by governments looking to meet Sustainable Development Goals (SDGs) targets of universal access to tertiary education.

Luxembourg-based private equity (PE) firm Fonds Européen de Financement Solidaire (Fefisol) has invested Kshs 100.0 mn in Musoni Microfinance Limited for an undisclosed stake. Musoni targets small-scale farmers and the informal sector and offers loans at an interest rate of 1.83% per month for group loans and 1.67% per month for individual loans. The investment by Fefisol will be used to grow their loan book, which stood at Kshs 1.2 bn as at January 2018. The investment by Fefisol will support Musoni’s objective of achieving competitive low-cost lending in the country at a time where bank funding continues to be relatively expensive (with the cheapest banks having an average Annual Percentage Rate (APR) of 15.1% while the most expensive banks having an average APR of 18.7% as at January 2018) and the private sector credit growth remains below the government target of 18.3%, having come in at 2.4% in December. As highlighted in our write up titled The Total Cost of Credit Post Rate Cap, in Kenya, bank funding accounts for 95% of business funding compared to 40% business funding by banks in developed markets, which highlights the need to diversify funding sources, and enable borrowers to tap into alternative avenues of funding that are more flexible and pocket-friendly.

Private equity investments in Africa remains robust as evidenced by the growing number of successful exits. The increasing investor interest is attributed to (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

The hospitality sector in Kenya continued on its upward trajectory with global chain Hilton Group opening its 4-star Double Tree by Hilton brand along Ngong’ Road, following the takeover and rebranding of Amber Hotel. This will be the franchise’s third hotel in Nairobi, with the others being Hilton Hotel in the CBD, opened in 1969 and Hilton Garden Inn along Mombasa Road, which opened last week. The hotel will be run under a franchise arrangement and will have 109 keys and 350 SQM of conference space. It is part of the Group’s 5-year strategy to convert 100 hotels in Africa into Hilton Brands at a cost of Kshs 5.0 bn. In addition to this hotel, Hilton plans to open a 5-star hotel in the upcoming Pinnacle Towers in Upper Hill. Nairobi has witnessed an increase in the number of internationally branded hotels, as international brands seek to tap into the growing tourist numbers and the increase in conferencing activities as a result of Nairobi’s positioning as a regional hub, increased marketing activities by the Kenya Tourism Board and improve security situation in the country over the last 2-years. We thus expect an increase in international hotel numbers with the room supply increasing by 22.8% as per our Annual Real Estate Outlook 2018. Other international hotel chains expected to open hotels this year include Movenpick Hotel in Westlands in Q1’2018, and City Lodge to fully open in Two Rivers Mall in 2018.

The table below shows recent internationally branded hotel openings in Nairobi;

|

Recent Internationally Branded Hotel Openings in Nairobi |

|||||

|

Operator |

Name |

Location |

Rating |

Rooms |

Year Opened |

|

Sarovar |

Lazizi Premiere |

Mombasa Rd |

4 |

144 |

2017 |

|

Carlson Rezidor |

Park Inn |

Westlands |

3 |

140 |

2017 |

|

Best Western |

Four Points by Sheraton |

Kilimani |

4 |

96 |

2017 |

|

Four Points by Sheraton |

JKIA |

4 |

194 |

2017 |

|

|

Accor Hotels |

Pullman |

Westlands |

5 |

340 |

2017 |

|

City Lodge |

City Lodge |

Kiambu/Limuru Rd |

3 |

170 |

2018 |

|

Hilton |

Hilton Garden Inn |

Mombasa Road |

3 |

175 |

2018 |

|

Hilton |

Double Tree |

Ngong Road |

4 |

109 |

2018 |

|

Carlson Rezidor |

*Radisson Residence |

Kilimani |

5 |

123 |

2018 |

|

Movenpick Hotels and Resorts |

*Movenpick |

Westlands |

5 |

223 |

2018 |

|

*Montave |

Upperhill |

5 |

168 |

2018 |

|

|

Total |

|

|

1,882 |

||

|

Internationally branded hotels have been on an expansion offensive in the city with a total of 1,882 internationally branded hotel rooms expected to come to the market by the end of 2018 contributing to 63.8% of total top rated (3,4 and 5 star) rooms expected to come to the market by 2020. The brands are attracted by the increase in international arrivals which have grown by 6.2% between 2016 and 2017 mainly as a result of improving security, increased marketing by the Kenya Tourism Board (KTB), and the growth in the MICE sector as Nairobi positions itself as a regional hub. *Hotels not in operation |

|||||

Source: Cytonn Hospitality Report 2017

Still in the hospitality sector, Sarova Group of Hotels announced plans to undertake a Kshs 1.0 bn refurbishment of Sarova Panafric Hotel, Nairobi. The hotel, which first opened in 1965, has 162 keys and is the latest among several local hotels which have embarked on refurbishment and expansion, with the other local hotels being; Ole Sereni, which is increasing its room capacity with an additional 148 keys, Nairobi Serena Hotel, which is undergoing refurbishment and expansion that will see its room inventory increase from 183 to 199 keys, and Sarova Whitesands Beach Hotel, Mombasa, which has successfully been refurbished and has a total of 335 hotel rooms. In our opinion, these refurbishment and expansion activities are driven by i) the need for the hotels to match the quality standards currently being offered in the market, and improve their facilities which have depreciated over time, so as to remain competitive in the wake of stiff competition from global brands such as Radisson Blu and Mariott which are coming into the Kenyan Market, and ii) the need to increase room capacity to meet the growing demand for accommodation as a result of an increase in tourist arrivals, with international arrivals increasing to 1.5 mn in 2017 compared to 1.3 mn in 2016,

The upgrading of facilities will lead to higher quality offering in the Kenyan hospitality market and thus making the sector competitive globally and more attractive and comfortable for tourists. Last week, Fairmont Mara Safari Club in the Maasai Mara National Reserve, was ranked the 11th best in Africa and among the top 50 best hotels in the world, marketing the country’s hospitality sector.

We expect increased activities in the hospitality sector this year driven by (i) the stabilizing political situation, (ii) sustained international business and travel tourism, (iii) growth of Meetings, Incentives, Conferences and Events (MICE) tourism, where the number of conferences held in the country increased by 16.5% in 2016 compared to a 3.0% increase in 2015, iv) domestic tourism, which has also grown with Kenyans accounting for 54.2% of total bed nights in 2016 compared to 53.7% in 2015, v) government incentives to boost the sector such as removal of Value Added Tax (VAT) Charges on National Park fees, capping of Kenya Wildlife Services (KWS) Park fees at USD 60 down from USD 90 and scrapping of visa fees for children under the age of 16-years, and (vi) continued marketing to reach new markets such as Asia and America, all factors that will increase demand for hospitality services.

During the week, the government began the construction of four link roads that will connect the Garissa Highway to the upcoming Thika Bypass. The roads are: Engen to Kiganjo Junction Road, Broadway-Athena Link Road, BAT-Kiganjo Link Road and the Kivulini-Kiganjo Road. On completion, the Bypass will ease traffic on Garissa Road, Thika Town and its environs by offering alternative routes into Thika Town. This will also open up areas such as Kiganjo, Kiang’ombe, Kiandutu and Athena in Kiambu County to investors, and thus encourage real estate development. Improved trunk infrastructure especially roads improves access to various areas thus resulting in increased real estate development. For instance, Ruiru has witnessed developments such as Tatu City by Rendeavour and Riverrun Estates by Cytonn Investments, buoyed by accessibility through the Thika Superhighway, and as well Ruaka and its environs witnessed an increase in real estate development as a result of completion of the Northern Bypass with developments such as The Alma and Taraji Heights by Cytonn Investments, and Two Rivers Mall by Centum. Areas along the Thika Bypass such as Kiganjo and Kiang’ombe may thus record an increase in real estate development activities.

Other highlights of the week include;

- Crystal Rivers, a mixed-use development by Safaricom Pension Scheme in Athi River, is set to open its doors in June this year. The Kshs 4.2 bn mixed-use-development brings to the market 200,000 SQFT of commercial space, 138 townhouses, and 260 apartments,

- CIC Group plans to put up a Kshs 2.8bn housing project on a 200-acre parcel of land near Tatu City. According to the master plan, 13-acres are set for high-end family units, 56-acres for medium density hosting 224 families, and 21-acres for medium density housing 168 families on quarter plots. In addition, 10-acres will host high rise apartments for 700 families while equal acreage has been marked for commercial development of offices, a retail mall as well as high rise apartments. 21-acres have also been set aside for a recreational park and 30-acres for ecological restoration. The firm has recently forwarded an environmental impact assessment (EIA) report seeking to build on the plot and is awaiting approval from National Environmental Management Authority (NEMA).

We expect increased activities in the real estate sector driven by i) Political calmness following the conclusion of 2017 elections ii) Economic recovery with the GDP projected to come in between 5.3% and 5.5% compared to the expected 4.7% in 2017 iii) Sustained Infrastructural Development and iv) Incentives such as tax relief of 15.0% for developers putting up more than 100 affordable housing units p.a, the scrapping of the land title search fees, NEMA and digitization of Lands Ministry.

Over the last few years, Kenya’s rising public debt has been a point of discussion in most macroeconomic outlook discussions, with organizations such as the World Bank, the International Monetary Fund (IMF), global credit rating agencies (Moody’s Credit Rating Agency, S&P Global Ratings, and Fitch Ratings) and the African Development Bank (AfDB), among others, raising concerns. Most recently, on 14th February 2018, Moody’s downgraded the government’s issuer rating to “B2” from “B1” previously, based on the observation that as the country’s financing needs continue to grow and the government turns to external commercial loans to fund the deficit, more pressure is likely to mount on the government’s liquidity and therefore ability to repay arising liabilities in good time. The credit rating agency however retained a “stable” outlook supported by Kenya’s strong and relatively diversified economy. The National Treasury however refuted the rating, claiming the analysis was not well informed. In totality, concerns have centred around the following areas:

- Kenya’s public debt to GDP is estimated at 56.2% in 2017 (rising from 44.0% 5-years ago, and 38.4% 10-years ago), and that we will use approx. 40.3% of our revenue raised from tax collection to finance debt payments in the fiscal year 2017/18,

- Globally accepted debt levels as per the IMF for frontier economies is 50.0% of GDP, and Kenya is 6.2% above those levels,

- The rising debt levels could result in a debt crisis,

- Possible liquidity pressure could arise from the large government debt instrument maturities, especially the 5-year Eurobond due in June 2019 that could result in further borrowing to pay off,

- As we borrow more from global markets, we become more susceptible to external market conditions and market shocks, and,

- The public debt to GDP ratio could soar above 60.0% by June 2018 unless proper policies are put in place to control this by the government.

We have previously written about our concerns on Kenya’s debt in the below publications:

- Kenya’s Debt Levels: Are we on a Sustainable Path? – In May 2016, we wrote about the rising debt levels and concluded that Kenya lied within the safer bounds in terms of debt levels but needed to look into risks associated with the changing funding patterns that could see the debt levels rise, and,

- Kenyan Debt Sustainability – In December 2016, we wrote about Kenya’s debt level, questioning its sustainability, and concluded that the government needed to reduce the amount of public debt, giving suggestions as to how this could be achieved.

This week, we seek to take a view on whether the rising debt levels should be a point of concern. We start by analyzing Kenya’s current debt profile and an outlook on the same, and then look at a few case studies of countries that have been through the same scrutiny. We finally conclude with an analysis of 5 metrics highlighting whether we should be worried, and give our recommendations on how Kenya can reduce its debt exposure.

Kenya’s Current Debt Profile

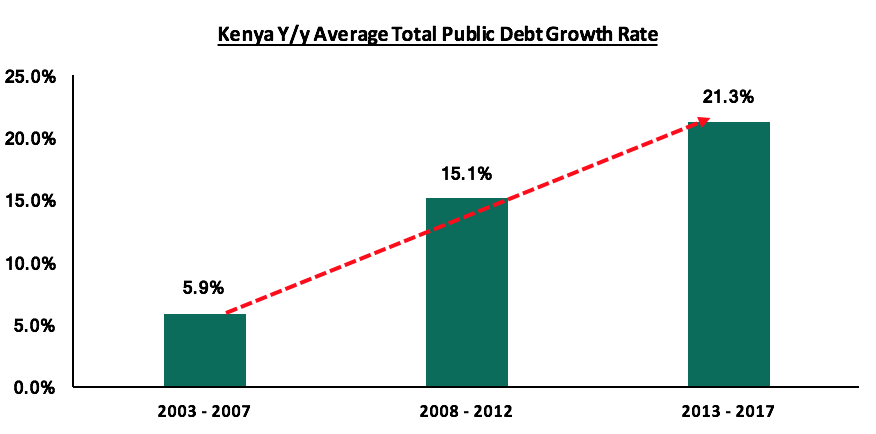

According to the 2018 Draft Budget Policy Statement, Kenya’s Public Debt to GDP ratio for the fiscal year 2017/18 is estimated to come in at 53.0%, while the IMF gives an estimate of 56.2% for 2017. Kenya’s total debt burden has been rising steadily, increasing by 22.2% y/y in November 2017 to Kshs 4.6 tn from Kshs 3.8 tn in November 2016. As can be seen in the graph below, in the 5-years from 2013 – 2017, the y/y average growth rate of Kenya’s total debt burden was 21.3%, up from the 2008-2012 5-year average of 15.1%, and the 2003-2007 5-year average of 5.9%; indicating that public debt has been growing at an increasing rate over the years. This is of concern when compared with GDP growth, which has been growing by 5.9% on average over the last 7-years.

The rising government debt has been driven by:

- An ever-expansionary budget over the years with the government embarking on infrastructural spending on projects that are expected to develop the country and spur economic growth, and,

- A shortfall in tax revenue that has resulted in a widening budget deficit despite goals to reduce this to 3.4% of GDP by the fiscal year 2020/21; the deficit, which currently stands at 7.9% of GDP, is being plugged in through borrowing both locally and from the external market.

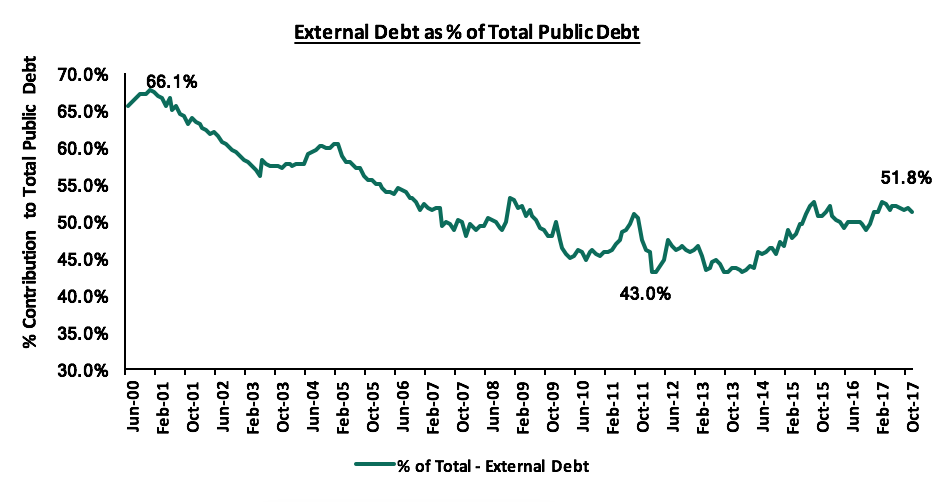

The ideal debt mix for any given country would contain more of domestic debt as international markets borrowings should be handled with caution since too much borrowing or reliance on global markets opens up the country to international economic trends, which could negatively affect the economy due to exogenous shocks. It is imperative that we be cautious on external borrowing if we are to achieve long term economic stability. Kenya’s external to domestic government debt mix stood at 52:48 as at November 2017, a huge improvement from 66:34 in June 2000, but a drop from 43:57 in March 2012 as indicated in the chart below:

While too much debt in general is detrimental to a country’s ability to repay, external debt is of more concern as it is exposed to external as well as internal risks. Due to this, we decided to take a closer look at the composition of Kenya’s external debt. First is to understand the two types of loans: Concessional loans are those extended at more favourable rates than market rates and are extended by non-profit organisations such as the IMF, African Development Bank and Fund(ADB & ADF) e.t.c., compared to non-concessional loans, which are agreed at commercial terms, with all market and country risk premiums fully factored in. An ideal mix would be to have more of concessional debt, as non-concessional debt is likely to negatively affect the economy as the foreign financing from commercial banks is relatively expensive, which would then lead to an increase in Kenya’s public debt service, meaning a higher percentage of the country’s revenue collections would go towards interest payments as opposed to development expenditure. Looking at Kenya’s external debt profile in respect to this, we note that:

- China remains Kenya’s largest bilateral lender, having lent Kenya a total of Kshs 520 bn as at December 2017, compared to Japan at Kshs 82.5 bn and France at Kshs 62.3 bn,

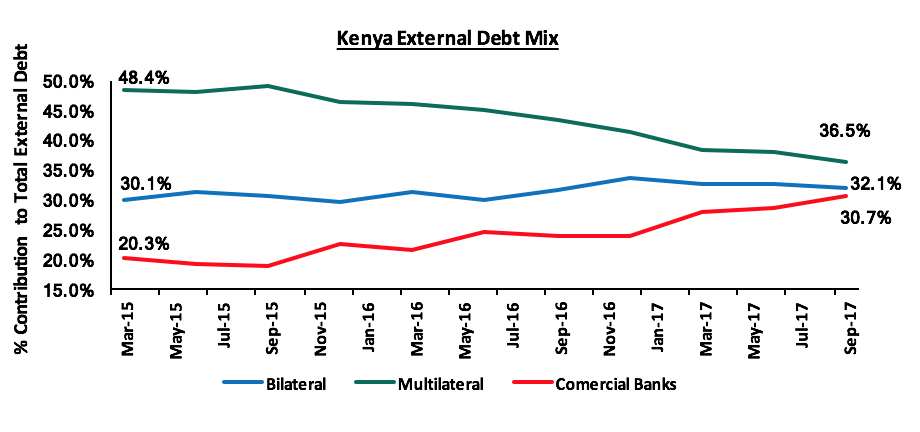

- Foreign debt from commercial banks, which is largely non-concessional, has been rising steadily from a 20.3% contribution in March 2015 to 30.7% in September 2017, and,

- Multilateral foreign debt, which is largely composed of concessional facilities from organizations such as the International Development Association (IDA) and the ADB & ADF, has been on a steady decline, from 48.4% to 36.5% in the same periods.

This is illustrated in the chart below:

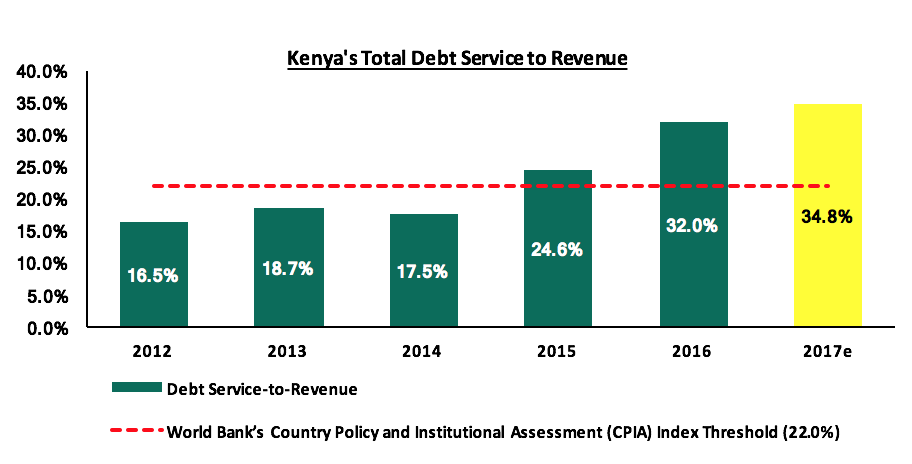

This has resulted in a steady increase in the public debt service-to-revenue ratio, which has increased to an estimate of 34.8% in 2017 from 16.5% in 2012 as shown in the chart below. It is estimated that Kshs 658.2 bn will be paid in loans in the current fiscal year 2017/18, which is 40.3% of the Kshs 1.6 tn revenue target.

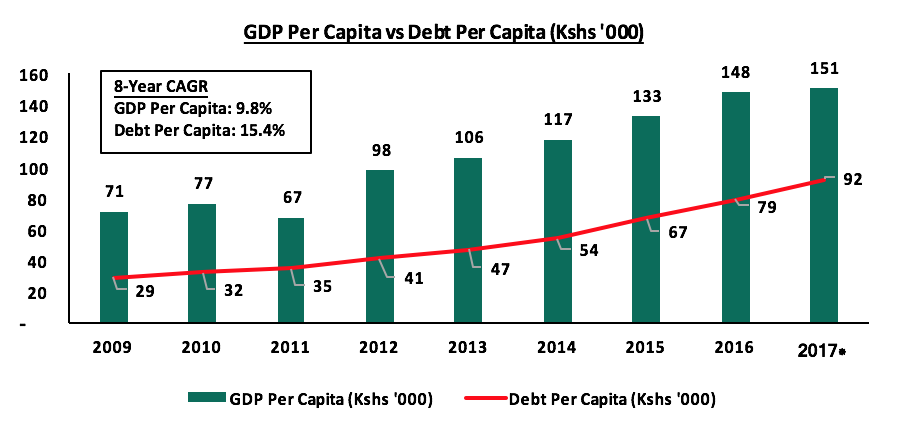

GDP per capita has managed to stay above debt per capita over the years, with the 2017 estimates being at Kshs 151,000 and Kshs 92,000, respectively. However, debt per capita has grown faster at an 8-year CAGR of 15.4% as compared to GDP per capital at 9.8%, as shown in the chart below:

*2017 estimates assumed a GDP growth rate of 4.7% as per Cytonn Projection and a population growth rate of 2.6% as per the World Bank 2016 Estimate. Total Public Debt is as of November 2017

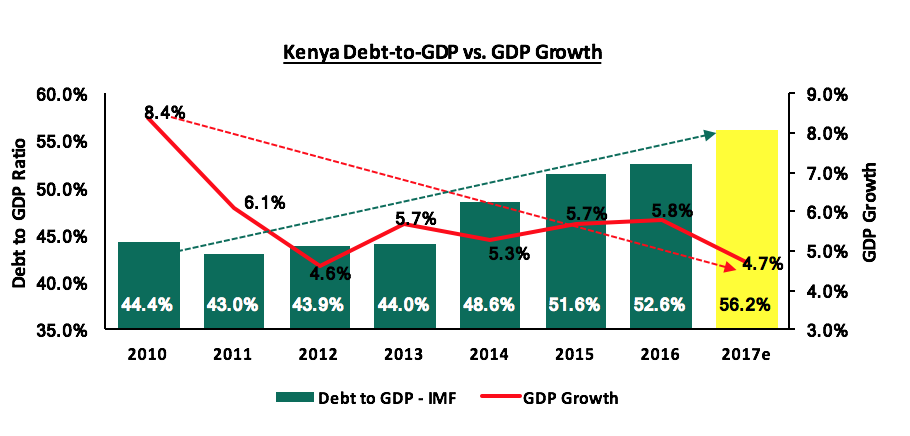

While some might argue that the borrowed funds are channelled towards development spending, on projects that are expected to eventually pay off by sparking faster economic growth, we have not seen the increase in public debt to GDP resulting in increased GDP growth yet as indicated in the chart below. With the 2017 expected public debt to GDP at its highest, GDP growth is expected to hit its 2nd lowest point in 8-years:

Looking at the Sub-Saharan Africa economies that are expected to drive growth in 2017 and 2018, (i) Ethiopia has managed to maintain higher growth rates despite rising debt levels, while (ii) Ghana experienced its lowest GDP growth rates from 2014 to 2016 when its public debt to GDP ratio was at its highest, leading to intervention by the IMF. Ghana’s public debt situation is currently being looked at as a possible crisis caused by plummeting global commodity prices and their over-reliance on commodities, and public funds being placed in projects that have not ensured the borrowed money can be paid out in time. Mozambique on the other hand is in an actual crisis after defaulting on debt payments and its debt-to-GDP ratio hitting 113.6% in 2016 with Kenya still at 52.6% in the same period. We shall therefore look at the case of Ghana and Mozambique, focusing on events leading to the intervention by the IMF and the debt crisis, respectively.

The Case of Ghana

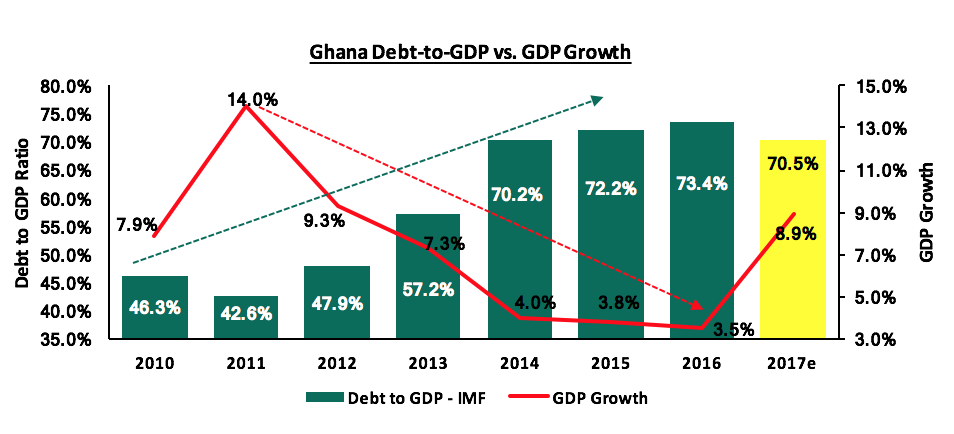

Ghana’s risk of debt crisis stemmed from a gradual but steady rise in public borrowing on the back of oil discovery and thriving of global commodity prices, seeing as Ghana is commodity-dependent, big on cocoa and gold exports; the 3 (oil, cocoa and gold) currently contribute to over 80.0% of exports. Following the beginning of the decline of commodity prices in 2013 coupled with a depreciating Cedi against the USD, Ghana continued to borrow to deal with this. Failure to invest amounts borrowed in projects that would yield economic returns and unwise debt management, featuring increased non-concessional borrowing, resulted in the historical high debt to GDP ratio of 73.4% recorded in 2016. The IMF and World Bank’s joint Debt Sustainability Assessment of Ghana rated the debt distress level at moderate from May 2007 to February 2015. From March 2015, this was bumped up to high risk following an increase of the debt-to-GDP ratio to 70.2% in 2014 and a sharp decline in GDP growth to 4.0% as (i) global commodity prices remained low, and (ii) Ghana’s focus on commodities had resulted in a negligence of the manufacturing sector whose contribution to GDP declined to 5.0% in 2014 from 10.0% in 2006. This is illustrated in the chart below:

The Ghanaian Government got to a point where it was borrowing mainly to pay back maturing debt instruments and plug in the deficit arising from dismal revenue collection in 2013. During this period, the Cedi depreciated by 92.6% against the USD. The IMF stepped in to bail out lenders in April 2015 through concessional loans, and by introducing reforms that had to be adopted by the government such as reduction of government expenditure and increases in tax rates to boost revenue collected and reduce the budget deficit. With these measures in place, the budget deficit is expected to reduce to about 4.5% of GDP by 2018, from 6.5% as per their 2018 Budget Statement, effectively reducing annual borrowing and the government debt-to-GDP ratio below the 50.0% threshold, but Ghana still remains a country in high risk of debt distress.

Kenya can take the following lessons from Ghana’s situation up until the point of IMF intervention:

- The government should invest borrowed funds in projects with high enough economic returns to guarantee debt repayments, and,

- Kenya should diversify its economy, reducing overreliance on agricultural produce, which are commodities and subject to fluctuation of global commodity prices and changes in climate which are beyond the control of the government. It is however important to note that Kenya is moving towards a better diversified economy, with agriculture contributing 18.8% of GDP as at Q3’2017 compared to 23.7% in 2010 and 31.3% in 2000, and other sectors such as tourism, manufacturing, construction and real estate supporting the economy and driving growth.

The Case of Mozambique

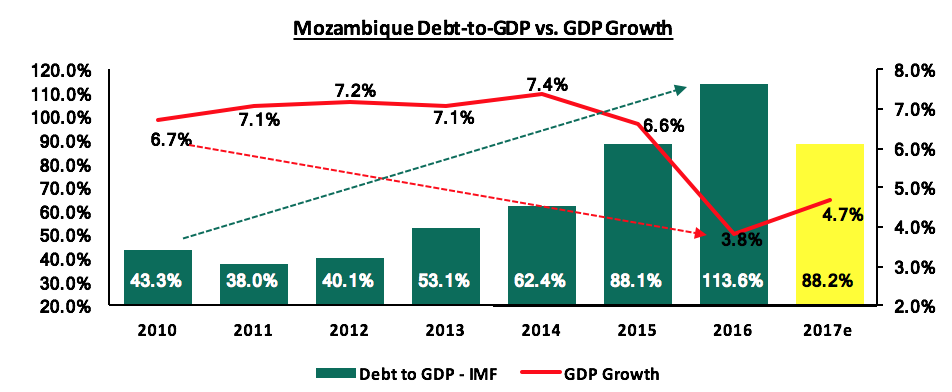

Mozambique’s debt crisis is more often referred to as a debt scandal given the events that led up to a tailspin of defaults. It all begun in 2013 when USD 2.0 bn in government-guaranteed debt was raised for fishing and maritime security projects, arranged by Switzerland’s Credit Suisse and Russia’s VTB Capital and channelled to 3 Mozambican companies i.e. EMATUM (Mozambique Tuna Company), ProIndicus and MAM (Mozambique Asset Management). April 2016 saw the uncovering of about USD 1.4 bn worth of government debt that had not been declared, leading to the IMF withholding the loan programme, and the Metical depreciating by 34.5% against the USD by the end of the year; an occurrence that would serve to make the payment of external debt more expensive. Other prospective donors grew skeptical following the IMF’s action and halted any ongoing budgetary support discussions. Come mid-January 2017, the government defaulted on an interest payment worth USD 60.0 mn, launching an audit of the country’s public external debt by Kroll, a multinational risk management firm, in a bid to hold all those involved in the fraudulent deal accountable. The results of the audit revealed how the loans were issued and discrepancies in asset value but failed to reveal how loan proceeds were utilized by the three companies. For the IMF and other lenders to resume lending to Mozambique, it was recommended that the country introduce strong policies to enhance transparency and accountability going forward. By the end of 2016, the public debt-to-GDP ratio had hit 113.6%, GDP growth had fallen by almost half to 3.8%, inflation rose to 19.2%, above the government set target of 5.0% - 6.0%, and investors demanded higher yields for shorter term papers as they priced in the risk of default, with the 3-month T-bill yielding 12.9% while the 5-year T-bond was at 8.0%.

Kenya can take a few lessons from the circumstances that led to Mozambique’s debt crisis, which include:

- Taking the fight against corruption seriously given there was unconfirmed speculation around how the funds obtained from the two Kenyan Eurobond issues in 2014 were utilized, and,

- Review and re-inforce the external debt obtaining process to ensure it is loop-hole free, transparent and accountable.

What do we expect for Kenya in 2018?

According to the Draft 2018 Budget Policy Statement, the government maintains that the country’s public debt is currently still sustainable, but outlines the following measures it will take to maintain this:

- Taking steps to narrow the budget deficit through better revenue mobilization, with plans to revamp the Income Tax Act, further improve on tax administration by the KRA and expand the tax base by targeting the informal sector,

- Borrow only for development expenditure, while maximizing on external concessional loans and keeping commercial loans limited only to projects with very high economic returns, and,

- Minimizing foreign exchange risk that external loans are exposed to, by diversifying the currency structure and composition of external debt.

These measures, if implemented, will serve to reduce the public debt levels while boosting economic growth. However, international organizations still remain skeptical with forecasts indicating that public debt could shoot past 60.0% of GDP by June 2018, especially with the expected March 10-year Eurobond issue.

Should we be concerned?

From the case studies, we note some similarities between the public debt scenarios of the two countries (Ghana and Mozambique) and Kenya as explained below:

- Debt-to-GDP Ratio is upwards slopping, yet GDP growth is downwards sloping,

- Like Ghana in 2013, Kenya seems to be borrowing to pay back maturing obligations, with (a) the 8-year commercial loan of Kshs 77.0 bn from the Eastern and Southern Africa Trade and Development Bank (TDB), formerly PTA Bank, taken on to pay off debt holders of the 2015 syndicated loan who declined to extend maturity, and (b) the March 2018 Eurobond that is expected to be used to offset the maturing USD 750 mn from the 5-year Eurobond issued in 2014 that matures in June 2019 and a USD 800.0 mn syndicated loan that was taken in 2016,

- GDP growth is commodity-dependent with Kenya still reliant on agriculture like Mozambique with oil & gas and Ghana with oil, coca and gold, and,

- The return on debt-funded investments is questionable.

To answer the question as to whether we should be concerned, we have put together a table of metrics, indicating the level of concern based on the current and projected situation.

|

No. |

Metric |

Narrative |

Level of Concern |

|

1. |

Total Government Debt to GDP |

The 2017 Ratio is estimated at 56.2%, up from 52.6% in 2016 and 44.4% in 2010; above the EAC Monetary Union Protocol, the World Bank Country Policy and Institutional Assessment Index, and the IMF threshold of 50.0%. Moody's projects that the ratio will surpass 60.0% by June 2018 unless decisive policies are implemented by the government. The government has outlined sound measures which are pegged on actual implementation but plan to issue a USD 1.5 – 3.0 bn 10 – 15 year Eurobond in March 2018 |

High |

|

2. |

Total Debt Service to Revenue |

The 2017 ratio is estimated at 34.8% up from 16.5% in 2012, and above the 22.0% IMF threshold. IMF estimates show that it will remain above the threshold in the short to medium term and we expect it to rise in tandem with continued non-concessional borrowing. In the year 2015/16, the KRA met its collection target, but years before that and the year after the KRA has failed to meet its target. For the half of the fiscal year 2017/18, the KRA collected Kshs 712.2 bn in revenue, meeting 43.6% of its target of Kshs 1.6 tn. With an expectation of subdued corporate earnings, we don’t expect them to meet their target for 2017/18. With revenue collections lower than expected and non-concessional debt rising, this ratio is also expected to rise |

High |

|

3. |

Total Public Debt Mix |

The external to domestic debt ratio was at 52:48 in November 2017, with more external debt susceptible to external shock. Given the narrow rift however, should the government be prudent in reducing the amount borrowed externally, tables can easily be turned. However, with the expected Eurobond issue, this seems to be unlikely in the short term |

Medium |

|

4. |

External Debt Mix |

Commercial borrowing has been rising steadily while largely concessional multilateral loans have been declining steadily and should this persist, expensive commercial loans could end up being the largest component of external debt, hence increasing the debt service. Foreign debt from commercial banks, which is largely non-concessional, has been rising steadily from 20.3% contribution in March 2015 to 30.7% in September 2017 |

High |

|

5. |

Current Account Balance |

The current account balance worsened to 7.0% of GDP in Q3’2017 from 6.2% recorded in Q2’2016 and 6.0% in Q3’2016, to Kshs 145.4 bn, attributable to imports rising by 20.3% to Kshs 450.9 bn from Kshs 374.8 bn in Q3’2016. Currency risk exists when the shilling depreciates, effectively increasing foreign debt service obligations owed. The CBK has managed to keep the currency stable against the USD, having only depreciating by 0.7% in 2017 and appreciating by 1.9% YTD. The CBK will continue to support the Shilling in the short term through its sufficient reserves of USD 7.1 bn (equivalent to 4.7 months of import cover) |

Medium |

Of the 5 metrics we have taken into account, 3 suggest High concern while 2 suggest Medium concern bringing our conclusion to: Yes, we should be concerned about the country’s debt levels “Unless decisive policies are implemented by the government.”, as Moody’s would put it.

Suggestions for such decisive policies include:

- Improving revenue collection mechanisms to maximize the amount collected in revenue, which will lead to a narrowing budget deficit and reduced total borrowing. Measures outlines in the Draft 2018 BPS such as a complete overhaul of the current Income Tax Act and strengthening tax administration and expansion of the tax base, if implemented, should be an initial step in the right direction,

- Repeal the interest rate cap legislation, which would in turn improve private sector credit growth and in turn improve GDP growth while enabling involvement the private sector in economic development. There is already a step in this direction by the Kenya Parliamentary Budget Office (KPBO), which has put in place a proposition to review the law capping interest rates

- Building an export-driven economy by encouraging growth in the manufacturing sector to increase the value-added exports and hence the value of our exports vis-à-vis imports, leading to an improving current account deficit,

- Restructuring the debt mix to ensure less is borrowed from external sources, ensuring a larger percentage of foreign borrowing is concessional in order to reduce amounts paid in debt service and diversifying currency sources of foreign borrowing in order to diversify currency risk on externally borrowed funds. As per the Draft 2018 BPS, the government plans on adopting a deliberate approach in diversifying currency structure so as to hedge against exchange rate risks especially for new loan commitments. External commercial borrowing will also be limited to development projects with high financial and economic returns, a move that will ensure the more expensive debt is invested in projects that yield more than the market rate charged,

- The government should encourage private sector involvement in development projects in order to reduce the strain on government expenditure and hence borrowing, (as of today, other than in energy, we have not been able to consummate any Public-Private Partnerships (PPPs) in areas such as real estate and housing),

- Better governance and accountability to reduce wastage and corruption levels. We hope that the recent steps by the president to strengthen key institutions of probity, such as the office of the Director of Public Prosecution (DPP), Directorate of Criminal Investigations (DCI) and Attorney General should go a long way in enhancing governance, transparency and accountability around public resources, and,

- Making the public investment procedure more efficient through better administration of borrowed funds and improvement of project selection, fund allocation, monitoring and evaluation; and decreasing opportunities for corruption scandals surrounding large borrowed sums.

Disclaimer: The views expressed in this publication, are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only, and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.