Kenya FY’2024 GDP Note

By Research Team, Oct 15, 2025

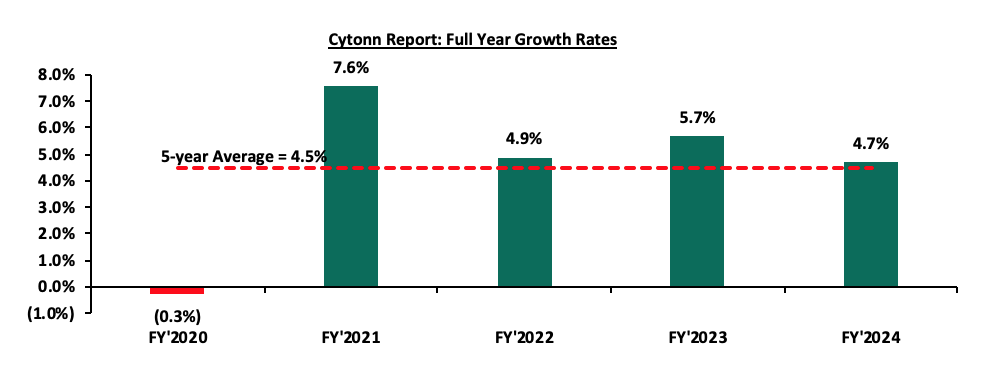

The Kenya National Bureau of Statistics (KNBS) released the 2025 Economic Survey Report, highlighting that the Kenyan economy recorded a 4.7% growth in FY’2024, slower than the 5.7% growth recorded in FY’2023. The main contributor to Kenyan GDP remains to be the Agriculture, fishing and forestry sector which grew by 4.6% in FY’2024, lower than the 6.6% expansion recorded in FY’2023. All sectors in FY’2024, except Mining and Quarrying and Construction recorded positive growths, with varying magnitudes across activities. Most sectors recorded declining growth rates compared to FY’2023 with Accommodation and Food Services, Construction and Information and Communication recording the highest declines of 7.9%, 3.7% and 3.3% points, respectively. Other sectors that recorded a contraction in growth rate, from what was recorded in FY’2023 were Professional administration, Mining and Quarrying and Financial and Insurance services of 3.3%, 2.7% and 2.5% points respectively. The chart below shows the full year Kenyan GDP growth rates;

Source: KNBS

The table below shows the growth of the various sectors and their overall contribution to GDP:

|

Cytonn Report: FY’2023 and FY’2024 GDP Contribution and Growth rates |

||||

|

Sector |

Contribution FY'2023 |

Contribution FY'2024 |

FY'2023 Growth |

FY'2024 Growth |

|

Agriculture and Forestry |

17.1% |

17.1% |

6.6% |

4.6% |

|

Real estate |

10.2% |

10.3% |

7.3% |

5.3% |

|

Transport and Storage |

9.6% |

9.5% |

5.5% |

4.4% |

|

Financial & Insurance |

9.5% |

9.8% |

10.1% |

7.6% |

|

Wholesale and retail trade |

8.1% |

8.0% |

3.3% |

3.8% |

|

Taxes on Products |

8.4% |

8.4% |

3.2% |

4.4% |

|

Manufacturing |

8.2% |

8.0% |

2.2% |

2.8% |

|

Public administration |

6.0% |

6.2% |

5.0% |

8.2% |

|

Construction |

5.7% |

5.4% |

3.0% |

(0.7%) |

|

Education |

4.8% |

4.8% |

2.9% |

3.9% |

|

Information and Communication |

3.4% |

3.4% |

10.3% |

7.0% |

|

Professional admin |

2.8% |

2.9% |

9.5% |

6.2% |

|

Electricity and Water Supply |

2.4% |

2.4% |

3.2% |

1.9% |

|

Health |

2.2% |

2.2% |

4.5% |

6.3% |

|

Other services |

2.1% |

2.1% |

4.3% |

4.7% |

|

Accommodation & Food Services |

1.3% |

1.6% |

33.6% |

25.7% |

|

Mining and quarrying |

1.0% |

0.9% |

(6.5%) |

(9.2%) |

|

Financial Services Indirectly Measured |

(2.8%) |

(3.0%) |

2.7% |

9.0% |

|

GDP at Market Prices |

100.0% |

100.0% |

5.7% |

4.7% |

Source: KNBS

The key take-outs from the report are:

- Sectoral contribution to growth: The biggest gainer in terms of sectoral contribution to GDP was the Accommodation and food services sector, increasing by 0.3% points to 1.6% in FY’2024 from 1.3% in FY’2023, while the Construction was the biggest loser, declining by 0.3% points to 5.4% in FY’2024, from 5.7% in FY’2023. Real Estate was the second largest contributor to GDP at 10.3% in FY’2024, up from 10.2% recorded in FY’2023, indicating sustained growth. The Accommodation and Food Services sector recorded the highest growth rate in FY’2024 growing by 25.7%, albeit slower than the 33.6% growth recorded in FY’2023.

- Slowed growth in the Agricultural Sector: Agriculture and Forestry recorded a growth of 4.6% in FY’2024. The performance was a decrease of 2.0% points, from the expansion of 6.6% recorded in FY’2023. Additionally, the sector remains the major contributor to GDP, with the sectoral contribution to GDP marginally decreasing by 0.01% to remain relatively unchanged from 17.1% recorded in FY’2023.The decline in growth was mainly on the back of;

- The quantity of fresh horticultural produce exports decreasing by 14.1% to 402.2 thousand tonnes during the year from 468.4 thousand tonnes in 2023

The sector’s growth was however supported by;

- Sugarcane production increased significantly by 68.7% to stand at 9.4 mn tonnes in 2024, from the 5.6 mn tonnes registered last year

- Coffee production increased by 1.6% to 49.5 thousand tonnes in 2024, from 48.7 thousand tonnes in 2023

- Decelerated growth in the electricity and water supply sector - The Electricity and Water Supply sector recorded a slowed growth of 1.9% in FY’2024 compared to a 3.2% growth in FY’2023, with the sectoral contribution to GDP marginally decreasing to 2.4% in FY’2024, relatively unchanged from FY’2023. Notably, total electricity generation and import increased by 5.1% to 14,101.9 Gigawatt hour (GWh) in FY’2024, from 13,423.6 GWh in FY’2023. The sector’s performance was curtailed by a decline in production from geothermal, wind and solar sources; growth was supported by an increase in hydroelectric power;

- Electricity generated from geothermal sources decreased by 8.0% in 2024 to 5,551.0 GWh compared to 6,032.1 GWh in 2023

- Similarly, electricity generated from wind and solar declined by 10.5% and 6.3% to stand at 1,797.7 GWh and 460.4 GWh, respectively, in the period under review

However, the sector’s growth was supported by increase in hydroelectric power;

- Hydroelectric generation increased by 36.2% to 3630.7 GWh in FY’2024 from 2666.7 GWh recorded in FY’2023,

- Significant growth in the Accommodation and Food Service sector: Accommodation and Food Services sector is the only sector that recorded double digit growth in FY’2024, having expanded by 25.7%, albeit slower than the 33.6% recorded in FY’2023. Additionally, the contribution to GDP increased by 0.3% points, to 1.6% in FY’2024, from 1.3% recorded in FY’2023. Some of the notable improvements include:

- International visitor arrivals through the two major airports, the Jomo Kenyatta International Airport (JKIA) and Mombasa International Airport (MIA) rose by 12.1% in FY’2024 to stand at 1,832,800 visitors compared to 1,635,300 visitors in FY’2023

- Reduced growth in the Financial and Insurance Services Sector: The Financial and Insurance sector growth rate slowed down by 2.5% points to 7.6% in FY’2024 compared to the 10.1% in FY’2023, attributable to the rise in cost of credit during the period. However, the contribution to GDP increased by 0.3% points to 9.8% in FY 2024 from the 9.5% recorded in FY’2023. Some of the notable improvements include:

- Broad money supply (M3) grew by 1.0% to Kshs 6.2 trillion as at end of December 2024, from Kshs 6.0 trillion recorded as at the end of December 2023.

- The NSE 20 Share Index rose by 33.9% to 2,010.7 points in December 2024 from 1,501.2 points in December 2023, signaling improved performance in the equity market.

- The number of shares traded in the Nairobi Securities Exchange increased significantly by 31.8% to 4,937.5 mn in December 2024 from 3,745.2 mn in December 2023. Similarly, the total value of traded shares increased by 20.2% in December 2024 to 106.0 billion from 88.2 billion in December 2023

- Contraction in the construction sector: The construction sector recorded a contraction rate of 0.7% in FY’2024 compared to 3.0% growth in the same period last year. Similarly, the contribution to GDP decreased by 0.3% points, to 5.4% in FY’2024, from 5.7% recorded in FY’2023.

- Credit extended to enterprises in the construction sector declined by 14.2% to stand at Kshs 528.0 billion as at December 2024, from Kshs 602.7 billion in FY’2023,

- Cement consumption declined by 7.2% to stand at 8,537.0 thousand metric tonnes in FY 2024 from 9,195.8 thousand metric tonnes in the corresponding period of 2023,

- Private sector employment in construction declined by 1.3% to 223,400 employees in FY’2024 from 226,300 employees in FY’2023

- Decelerated growth in the Transport and Storage Sector: The Transport and Storage sector registered a decelerated growth rate of 1.1% points to 4.4% in FY’2024 compared to the 5.5% in FY’2023. Additionally, the contribution to GDP decreased by 0.02% points, to 9.5% in FY’2024, from 9.6% recorded in FY’2023. Growth in the sector was weighed down by:

- The number of passengers transported via Standard Gauge Railway (SGR) declined by 10.3% to 2.4 mn in 2024 from 2.7 mn in 2023

- Similarly, the revenue from freight haulage via SGR decreased by 4.8% to Kshs 14.0 bn in FY’2024 from Kshs 14.7 bn in FY’2023

- The number of newly registered road motor vehicles declined by 21.4% to 93,646 in 2024 from 119,205 in 2023

However, growth in this sector was supported by;

- A rise in Mombasa Port throughput by 13.9% to 40,986 thousand metric tonnes in the period under review from 35,978 thousand metric tonnes in 2023

- The consumption of light diesel increased by 1.4% to 2,193.0 thousand tonnes FY’2024 from 2,163.6 thousand tonnes in the same period last year. This underlines the growth in the sector.

- Additionally, the prices of diesel declined by 1.1% to Kshs 178.3 per litre in the period under review from Kshs 180.3 per litre in 2023

- Continued growth in the Information and Communication sector: The Information and Communication sector recorded an expansion rate of 7.0% in FY’2024 albeit slower than the 10.3% growth recorded in the same period last year. Similarly, the contribution to GDP increased by 0.1% points, to remain unchanged from the 3.4% registered in FY’2023.

- The number of mobile money transactions increased by 10.6% to 2,681.9. 9 mn in 2024 from 2,424.0 mn in 2023 with the value increasing to Kshs 8,697.7 bn in 2024 from Kshs 7,954.0 bn in 2023.

- On voice call traffic, total domestic calls increased by 16.9% to 103.8 bn minutes in 2024 from 88.8 bn minutes registered in 2023.

- The total international outgoing telephone traffic increased by 3.2% to 721.3 mn minutes from 699.3 mn minutes while the volume of international incoming telephone traffic rose by 58.5% to 532.5 mn minutes in 2024 from 335.9 mn minutes in 2023.

- The total utilized bandwidth increased to 13.4 bn Mbps in 2024 from 11.0 mn Mbps in 2023 largely attributable to inclusion of satellite bandwidth during the year.

In 2025, Kenya's economy is projected to grow at a faster pace, estimated between 5.2%-5.4%. This optimistic outlook is attributed to improved business activity, supported by a stronger and more stable Kenyan Shilling, reduced borrowing costs, and the relatively lower inflation rates. However, the growth trajectory faces challenges from a tough business environment characterized by increasing taxes and a high cost of living. Despite these hurdles, recent economic developments provide a more favorable outlook. The Central Bank of Kenya (CBK) made a significant policy move in April 2025 by lowering the Central Bank Rate (CBR) by 75 basis points to 10.00%, marking the fifth consecutive rate cut. This accommodative monetary policy stance aims to stimulate private sector lending and boost economic activity. Inflation, while still within the CBK's target range of 2.5% to 7.5%, has been on an upward trend. In April 2025, the year-on-year inflation rate increased by 0.5% points to 4.1%, from 3.6% in March. This rise is primarily driven by higher food prices, particularly in the food and non-alcoholic beverages category. Despite the gradual rise, inflation remains well within the CBK's target range, providing some assurance for economic stability. The CBK's accommodative monetary policy is expected to alleviate some pressure on the cost of credit, thereby improving access to affordable borrowing. This environment is conducive to increased investment spending by both individuals and businesses, contributing positively to economic activity. The agricultural sector, Kenya's largest contributor to GDP, is anticipated to continue supporting growth due to favorable rainfall. While risks of rising fuel prices persist due to global geopolitical tensions, the overall inflation outlook is more favorable, bolstering optimism for the economic outlook.

In our view, the economy’s growth is largely pegged to how quickly inflationary pressures in the country stabilizes, and the sustainability of the strengthening of the Kenyan Shilling. We expect the reduced fuel prices to continue reducing production costs, leading to lower food prices in the country. However, growth is likely to be weighed down by increased taxation by the government thereby decreasing the purchasing power of consumers. As a result, we forecast a 5.2%-5.4% economic growth rate in 2025.