Kenya Listed Insurance H1’2019 Report, & Cytonn Weekly #46/2019

By Research Team, Nov 17, 2019

Executive Summary

Fixed Income

T-bills were undersubscribed during the week, with the subscription rate coming in at 57.7%, down from 132.6% the previous week. The yield on the 91-day papers increased by 0.3% points to 6.7%, from 6.4% the previous week, while the 182-day paper increased by 0.5% points to 7.8%, from 7.3% the previous week. The increase in yields on the 91-day and 182-day papers can be partly attributable to the expected increase in interest rates due to the recent interest rate cap repeal. The 364-day paper however remained unchanged at 9.8%. The Energy & Petroleum Regulatory Authority released the monthly statement on the maximum retail fuel prices in Kenya effective from 15th November to 14th December 2019. The key take-outs from the statement were that petrol prices have increased by 2.4% to Kshs 110.6 per litre, from Kshs 108.1 per litre previously, while diesel prices have increased by 2.6% to Kshs 104.6 per litre, from Kshs 102.0 per litre previously, and kerosene prices have increased by 2.9% to Kshs 104.1 per litre from Kshs 101.1 per litre;

Equities

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 declining by 2.4%, 3.1% and 2.7%, respectively, taking their YTD performance to gains/(losses) of (6.4%), 11.1% and 8.5%, for NASI, NSE 20 and NSE 25, respectively. The performance in NASI was driven by losses recorded by stocks with BAT, Barclays Bank of Kenya, Co-operative Bank and Safaricom recording losses of 8.3%, 6.7%, 4.5%, and 4.2%, respectively. In the listed banking sector, Equity Group, KCB Group and Co-operative Bank released their Q3’2019 results, where they all recorded increases in their core earnings per share by 10.4%, 6.2% and 5.5%, respectively;

Real Estate

During the week, the Central Bank of Kenya (CBK) released the Bank Supervision Annual Report 2018, which tracks the Kenyan residential mortgage market. As per the report, the number of mortgages in Kenya increased by 1.2% in 2018 to 26,504, from 26,187 in 2017. In the residential sector, Superior Homes Kenya launched its Kshs 7.0 bn residential development located on 105-acres at Vipingo Ridge in Kilifi County, while in the retail sector, Quickmart, a local supermarket chain, opened their latest outlet on Magadi Road in Ongata Rongai, Kajiado County;

Focus of the Week

Following the release of H1’2019 results by insurance companies, this week we analyse the performance of the 6 listed insurance companies in the country, identify the key factors that influenced their performance, and give our outlook for the insurance sector going forward.

- You can now make instant withdrawals from your Cytonn Money Market Fund account, just dial *809#, a wallet that stands to earn you up to 11% pa

- David Kingoo, Senior Risk and Compliance Associate was on Metropol TV to talk about how the markets are now performing. Watch David here

- David Kingoo, Senior Risk and Compliance Associate was Citizen TV to talk about the Interest rate cap. Watch David here

- Joyce Wacu, research analyst, was on Metropol TV to talk about the real estate industry and how the rate cup affects it. Watch Joyce here

- Shiv A. Arora, Head-Private Equity Real Estate attended a panel discussion at Rusinga School. Take a look at the event note here

- Edwin H. Dande, CEO Cytonn Investments attended the Tällberg Workshop & Tällberg/Eliasson Global Leadership Forum hosted by Strathmore Business School and the Nairobi Senate as a Panelist. For a summary of the event, read here

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com. The site is open between 8 am - 5 pm, 7-days a week for site visits;

- Cytonn Money Market Fund closed the week at an average yield of 11.0% p.a. To subscribe, just dial *809#;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- It's often easy to dream about a happy and comfortable retirement. The challenge lies in developing plans to bring those dreams to reality. A wealth of information from experts could go a long way in guiding you to actualizing your retirement dreams. Join our Head of Pensions on Saturday, 23rd November from 9 am to 11 am at the Chancery for more insights on how to retire on your own terms. We have repeat sessions on Tuesday 26th November from 9 am to 11 am and on Thursday 28th from 4:30 pm to 6:30 pm. To RSVP visit: com/pwmt

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills were undersubscribed, with the subscription rate coming in at 57.7%, down from 132.6% the previous week. The yield on the 91-day papers increased by 0.3% points to 6.7%, from 6.4% while the 182-day paper increased by 0.5% points to 7.8%, from 7.3% the previous week. The increase in yields on the 91-day and 182-day papers can be attributed to expected increase in interest rates due to the recent interest rate cap repeal. The 364-day paper however remained unchanged at 9.8%. The acceptance rate increased to 99.9% from 83.5%, recorded the previous week, with the government accepting Kshs 13.8 bn of the Kshs 13.9 bn bids received.

Last week, the National Treasury announced that it will issue a 10-year Kshs 50.0 bn bond (FXD 4/2019/10) with market-determined coupon rates for Budgetary Support purposes. The period of sale is from 6th November 2019 to 19th November 2019. As per the historical trend, we expect the market to maintain a bias towards the 10-year bond mainly driven by the perception that risks may not be adequately priced on the longer end of the yield curve, which is relatively flat due to saturation of long-term bonds. Our recommended bidding range is 11.7% - 11.9%, given that bonds with the same tenor are currently trading at 11.7%.

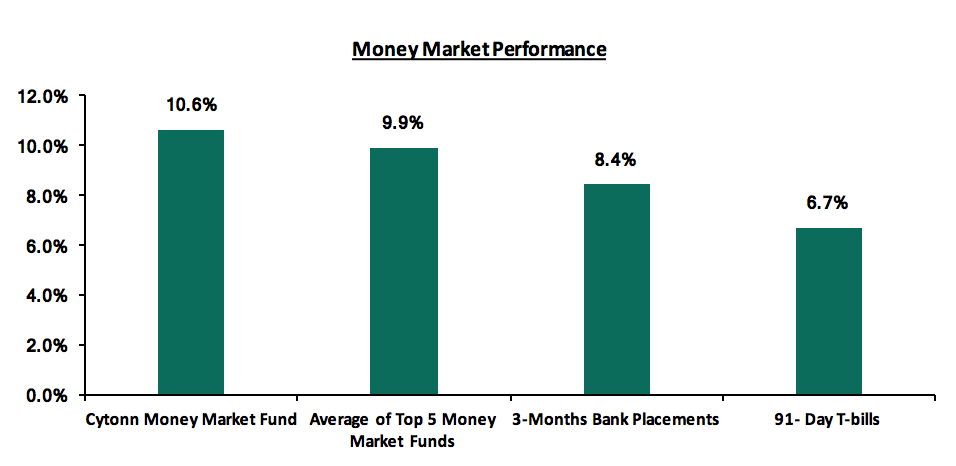

In the money markets, 3-month bank placements ended the week at 8.4%, from 8.5% recorded in the previous week, (based on what we have been offered by various banks), the 91-day T-bill came in at 6.7% from 6.4% recorded the previous week, while the average of Top 5 Money Market Funds came in at 9.9%, from 10.0% recorded in the previous week. The Cytonn Money Market Fund closed the week at 10.6%, from 10.9% recorded the previous week.

Liquidity:

During the week, the average interbank rate dropped to 3.6%, from 4.9% recorded the previous week, pointing to increasing liquidity in the money markets, largely supported by government payments. This saw commercial banks excess reserves come in at Kshs 14.5 bn in relation to the 5.25% cash reserves requirement (CRR). The average interbank volumes increased by 30.3% to Kshs 12.7 bn, from Kshs 9.7 bn recorded the previous week.

Kenya Eurobonds:

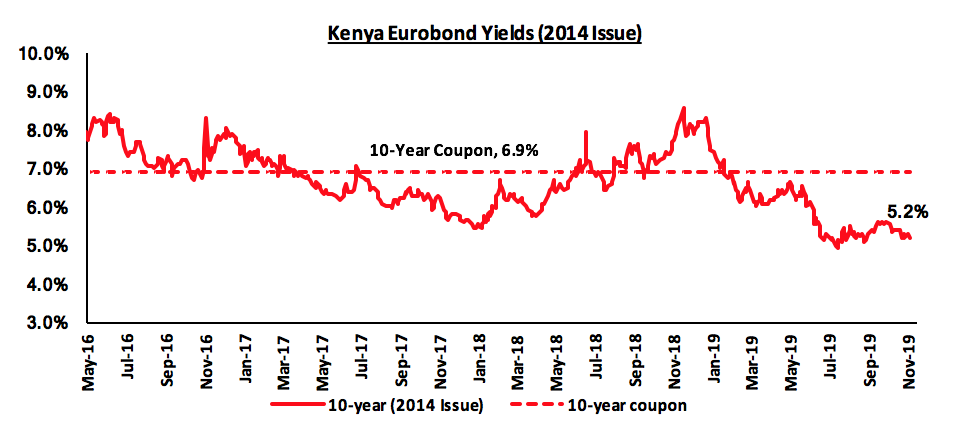

According to Reuters, the yield on the 10-year Eurobond issued in June 2014 remained unchanged at 5.2%. We attribute the stabilization across all the Kenya Eurobonds to easing risk concerns over the economy by investors following the news of the interest rate cap repeal, which is seen as likely to stimulate credit growth and economic growth.

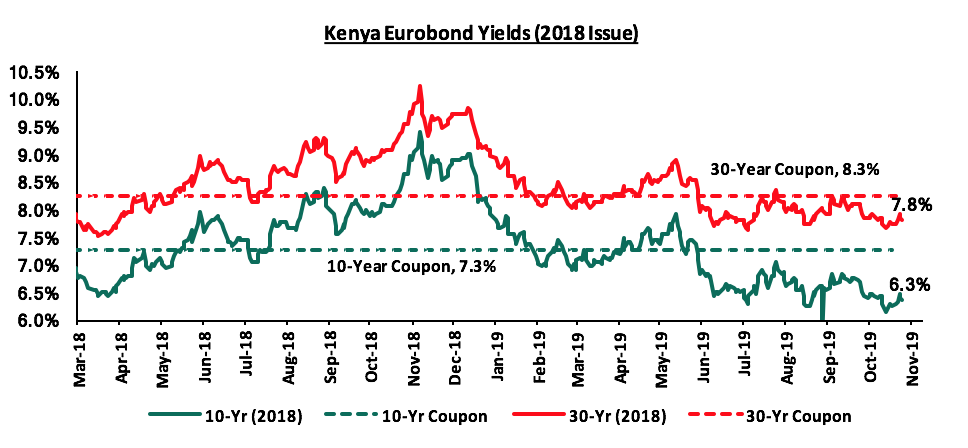

During the week, the yield on the 10-year and 30-year Eurobond remained unchanged at 6.3% and 7.8% respectively.

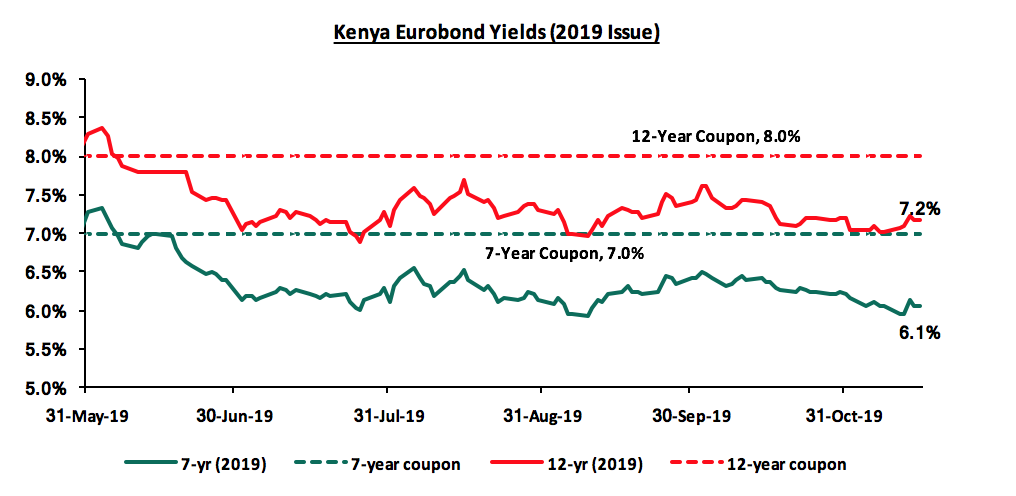

During the week, the yields on the 7-year Eurobond remained unchanged at 6.1% while yields on the 12-year Eurobond increased by 0.2% points to 7.2% from 7.0% the previous week.

Kenya Shilling:

During the week, the Kenya Shilling appreciated by 0.7% against the US Dollar to close at Kshs 102.1, from Kshs 102.8 recorded in the previous week. The appreciation was attributed to inflows from offshore investors buying banking stocks after parliament removed a cap on commercial lending rate. On an YTD basis, the shilling has depreciated by 0.2% against the dollar, in comparison to the 1.3% appreciation in 2018. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that Kenya’s current account deficit improved by 11.8% during Q2’2019, coming in at a deficit of Kshs 107.6 bn, from Kshs 122.0 bn in Q2’2018, equivalent to 6.2% of GDP, from 7.6% recorded in Q2’2018. This was mainly driven by the narrowing of the country’s merchandise trade deficit by 1.7% and a rise in secondary income (transfers) balance by 5.1%,

- Improving diaspora remittances, which have increased cumulatively by 8.0% in the 12-months to September 2019 to USD 2.8 bn, from USD 2.6 bn recorded in a similar period of review in 2018,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 8.9 bn (equivalent to 5.6-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Weekly Highlight:

The Energy & Petroleum Regulatory Authority released their monthly statement on the maximum retail fuel prices in Kenya effective from 15th November 2019 to 14th December 2019. Below are the key take-outs from the statement;

- Petrol prices have increased by 2.4% to Kshs 110.6 per litre, from Kshs 108.1 per litre previously,

- Diesel prices have increased by 2.6% to Kshs 104.6 per litre, from Kshs 102.0 per litre, previously, and,

- Kerosene prices have increased by 2.9% to Kshs 104.1 per litre, from Kshs 101.1 per litre previously.

The changes in prices are attributable to:

- An increase in the average landing costs of imported diesel by 2.1% to USD 502.2 per cubic metre in October 2019, from 491.9 per cubic metre in September 2019, and Kerosene increasing by 2.7% to USD 499.9 in October from USD 486.6 per cubic metre in September 2019, and,

- An increase in the average landing cost of imported super petrol by 0.9% to USD 463.2 in October, from USD 459.3 per cubic metre in September 2019. The increase was however offset by the 0.2% appreciation of the mean monthly US Dollar to Kenya Shilling exchange rate to Kshs 103.5 in October from Kshs 103.8 in September.

We expect a rise in the transport index, which carries a weighting of 8.7% in the total consumer price index (CPI), due to the increase in petrol and diesel pump prices. We shall publish our inflation projections in next week’s report.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 30.8% behind its domestic borrowing target, having borrowed Kshs 83.9 bn against a pro-rated target of Kshs 121.3 bn. We expect an improvement in private sector credit growth considering the repeal of the interest rate cap. This will result in increased competition for bank funds from both the private and public sectors, resulting in upward pressure on interest rates. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance

During the week, the equities market was on a downward trend with NASI, NSE 20 and NSE 25 declining by 2.4%, 3.1% and 2.7%, respectively, taking their YTD performance to gains/(losses) of (6.4%), 11.1% and 8.5%, respectively. The performance in NASI was driven by losses recorded by large-cap stocks, with BAT, Barclays Bank of Kenya, Co-operative Bank and Safaricom recording losses during the week of 8.3%, 6.7%, 4.5%, and 4.2%, respectively.

Equities turnover decreased by 54.6% during the week to USD 26.4 mn, from USD 58.3 mn the previous week, taking the YTD turnover to USD 1,326.8 mn. Foreign investors remained net buyers for the week, with a net buying position of USD 2.3 mn, a 134.1% increase from a net selling position of USD 6.6 mn recorded the previous week.

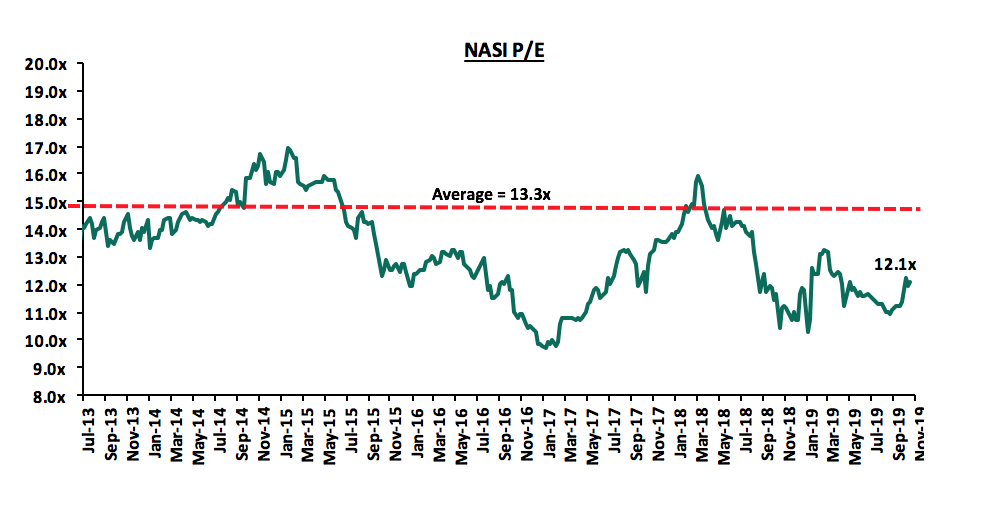

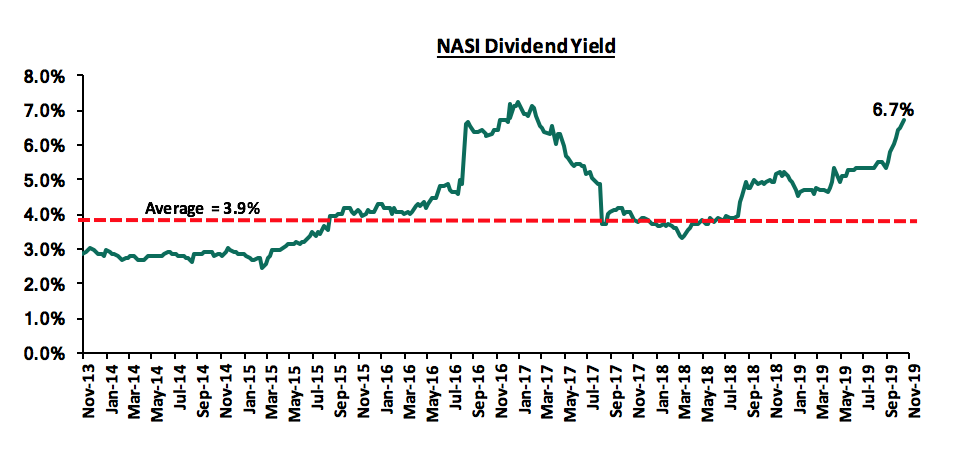

The market is currently trading at a price to earnings ratio (P/E) of 12.1x, 9.0% below the historical average of 13.3x, and a dividend yield of 6.7%, 2.8% points above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 12.1x is 24.7% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 45.8% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Earnings Releases

Equity Group Holdings Plc released Q3’2019 results:

Equity Group Holdings Plc released their Q3’2019 results, recording a 10.4% increase in core earnings per share to Kshs 4.6, from Kshs 4.2 in Q3’2018, attributed to an 11.2% increase in total operating income to Kshs 54.8 bn from Kshs 49.3 bn in Q3’2018. Key highlights of the performance from Q3’2018 to Q3’2019 include:

- Core earnings per share increased by 10.4% to Kshs 4.6, from Kshs 4.2 in Q3’2018, slower than our projections of a 13.3% increase to Kshs 4.8. The performance was driven by an 11.2% increase in total operating income. The variance in core earnings per share growth against our expectations was largely due to a slower growth in total operating income by 11.2% to Kshs 54.8 bn, from Kshs 49.3 bn in Q3’2018, which was not in line with our expectation of a 12.3% increase to Kshs 55.4 bn,

- Total operating income recorded an 11.2% growth to Kshs 54.8 bn, from Kshs 49.3 bn in Q3’2018. This was driven by a 13.7% growth in Non-Funded Income (NFI) to Kshs 22.6 bn, from Kshs 19.8 bn in Q3’2018, coupled with a 9.5% growth in Net Interest Income to Kshs 32.3 bn, from Kshs 29.5 bn in Q3’2018,

- Interest income increased by 11.2% to Kshs 42.8 bn, from 38.5 bn in Q3’2018. This was driven by a 12.5% increase in interest income on loans and advances to Kshs 29.0 bn, from Kshs 25.8 bn in Q3’2018. Interest income on government securities, on the other hand, increased by 4.1% to Kshs 12.6 bn, from Kshs 12.1 bn in Q3’2018. The slightly stronger growth in interest income on loans as compared to interest from government securities is indicative of the benefits accruing to Equity Group Holding’s strategy to increase lending to the private sector, focusing on Small and Medium Enterprises. The yield on interest earning assets, however, declined by 0.2% points to 10.9%, from 11.1% in Q3’2018,

- Interest expense rose by 16.8% to Kshs 10.5 bn, from Kshs 9.0 bn in Q3’2018, following the 15.4% increase in the interest expense on customer deposits to Kshs 8.1 bn, from Kshs 7.0 bn in Q3’2018, coupled with an 42.2% increase in interest expense on placements to Kshs 0.5 bn from Kshs 0.4 bn in Q3’2018, and a 17.5% increase in other interest expenses to Kshs 1.9 bn, from Kshs 1.6 bn in Q3’2018. The cost of funds, however, declined to 2.6%, from 2.7% in Q3’2018, owing to a faster increase in interest bearing liabilities that rose by 18.7% to Kshs 544.4 bn, from Kshs 458.5 bn in Q3’2018. Consequently, the Net Interest Margin (NIM) declined to 8.4%, from 8.5% in Q3’2018,

- Non-Funded Income (NFI) recorded a 13.7% growth to Kshs 22.6 bn, from Kshs 19.8 bn in Q3’2018. The growth was mainly driven by the 21.7% increase in other fees to Kshs 11.4 bn, from Kshs 9.4 bn in Q3’2018. The growth was also supported by the 19.9% growth in forex trading income to Kshs 2.8 bn, from Kshs 2.4 bn in Q3’2018, and a 5.3% growth in other income to Kshs 4.0 bn, from Kshs 3.8 bn in Q3’2018, with management noting that the forex income segment benefitted from increased flows from the diaspora. Fees and commissions on loans, on the other hand, increased marginally by 0.4% points to Kshs 4.29 bn, from Kshs 4.28 bn in Q3’2018,

- The revenue mix shifted to 59:41 from 60:40 funded to non-funded income, owing to the faster growth in NFI as compared to growth in NII,

- Total operating expenses rose by 11.7% to Kshs 30.0 bn, from Kshs 26.9 bn in Q3’2018, largely driven by a 41.8% increase in Loan Loss Provisions (LLP) to Kshs 1.9 bn, from Kshs 1.3 bn in Q3’2018, coupled with a 12.8% rise in staff costs to Kshs 9.3 bn, from Kshs 8.3 bn in Q3’2018, and a 8.9% growth in other operating expenses to Kshs 18.9 bn, from Kshs 17.3 bn in Q3’2018

- As a result, the Cost to Income Ratio (CIR) deteriorated to 54.8%, from 54.6% in Q3’2018 However, without LLP, the cost to income ratio improved to 51.4%, from 51.9% in Q3’2018,

- Profit before tax increased by 10.6% to Kshs 24.8 bn, up from Kshs 22.4 bn in Q3’2018. Profit after tax recorded a 10.4% growth to Kshs 17.5 bn, from Kshs 15.8 bn, with the difference in growth attributable to the marginal increase in the effective tax rate to 29.5% from 29.4% in Q3’2018,

- The balance sheet recorded an expansion as total assets grew by 20.8% to Kshs 677.1 bn, from Kshs 560.4 bn in Q3’2018. The growth was supported by a 21.0% growth in loans and advances to Kshs 348.9 bn, from Kshs 288.4 bn in Q3’2018, coupled with a 7.7% growth in government securities to Kshs 135.1 bn, from Kshs 125.3 bn in Q3’2018. The growth was also driven by merger and acquisition activity with the bank announcing entering into a non-binding agreement with shareholders of Democratic Republic Bank of Congo to acquire a majority stake, a move which will see it increase its market share in Congo, having expanded into the region through its subsidiary, Equity Bank Congo. The bank has also entered into a binding term sheet agreement with Atlas Mara Ltd to acquire certain banking assets in Rwanda, Zambia, Tanzania and Mozambique,

- Total liabilities recorded a 21.0% growth to Kshs 568.4 bn, from Kshs 469.7 bn in Q3’2018, supported by a 18.9% growth in customer deposits, which rose to Kshs 478.1 bn, from Kshs 402.2 bn in Q3’2018, coupled with the 114.0% growth in other liabilities to Kshs 24.0 bn, from Kshs 11.2 bn in Q3’2018,

- The growth in both loans and deposits led to a marginal increase in the loan to deposit ratio to 73.0%, from 71.7% in Q3’2018, attributable to the faster growth in loans compared to deposits,

- Gross Non-Performing Loans (NPLs) increased by 15.4% to Kshs 30.5 bn in Q3’2019, from Kshs 26.5 bn in Q3’2018. The NPL ratio, however, improved to 8.4% in Q3’2019 from 8.9% in Q3’2018, attributable to a 21.5% growth in gross loans which outpaced the 15.4% growth in NPLs. The slight improvement in asset quality was largely attributed to a drop in the Large Enterprise sector’s contribution to total NPL, from 14.7% to 9.2% in Q3’2019. The group’s Tanzania subsidiary contributed 27.5% of the NPLs, with South Sudan and Kenya contributing 23.5% and 8.0%, respectively. General Loan Loss Provisions increased by 31.9% to Kshs 10.0 bn, from Kshs 7.6 bn in Q3’2018, thus, the NPL coverage improved to 45.8% in Q3’2019, from 38.9% in Q3’2018,

- Shareholder’s funds recorded a 19.9% growth to Kshs 107.7 bn, from Kshs 89.8 bn in Q3’2018, supported by an 18.1% increase in retained earnings to Kshs 94.8 bn, from Kshs 80.3 bn in Q3’2018,

- Equity Group remains sufficiently capitalized with a core capital to risk-weighted assets ratio of 16.7%, 6.2% points above the statutory requirement of 10.5%. In addition, the total capital to risk-weighted assets ratio came in at 20.5%, exceeding the statutory requirement of 14.5% by 6.0% points. Adjusting for IFRS 9, the core capital to risk weighted assets stood at 17.5%, while total capital to risk-weighted assets came in at 21.2%, and,

- The bank currently has a Return on Average Assets (ROaA) of 3.9%, and a Return on Average Equity (ROaE) of 21.3%.

Key Take-Outs:

- The bank’s geographical diversification strategy has continued to emerge as a net positive, with the bank’s various subsidiaries in Uganda, DRC, Rwanda, Tanzania and South Sudan cumulatively contributing 18.0% of the bank’s total profitability and 27.0% of the group’s total asset base. Equity Group Holdings opened a commercial representative office in Addis Ababa, Ethiopia, and expected to commence operations in July. This is line with the bank’s strategy to expand into 9 African countries within the year, with the Ethiopian market being the first phase of regional expansion drive to attain Pan African status,

- Increased innovation and digitization have seen 97.0% of all transactions of the bank being done on alternative channels, with mobile transactions taking up 77.0% of all transactions, and agency banking contributing 12.0% of all transactions. However, in terms of value of transactions, branches contributed 50.0% of the value of all transactions, with agency banking and mobile contributing 16.0% and 16.0%, respectively,

- The bank’s asset quality improved, with the NPL ratio improving to 8.4% in Q3’2019, from 8.9% in Q3’2018. The main sectors that contributed to the NPLs are large enterprises and SMEs. In terms of the regional distribution of NPLs, the regions with the highest NPLs were Tanzania at 27.5% of their loan book, followed by South Sudan at 23.5% of their loan book. With the repeal of interest rate cap in Kenya, due to the Group’s focus on lending to the Small and Medium Enterprises (SMEs), we expect a slight deterioration of the loan book quality as the Group is set to lend more towards trade and real estate sectors.

Going forward, we expect the bank’s growth to be further propelled by;

- Channelled diversification: This is likely to further improve on efficiency, with emphasis on alternative channels of transactions, as the bank rides on the digital revolution wave, thereby further improving the cost to income ratio by cost rationalization and revenue expansion. This will likely propel the bank’s prospects of achieving sustainable growth, as it replicates its successful business model across its various regional subsidiaries, and,

- The bank’s operating model of enhancing balance sheet agility: This is likely to place the bank in a prime position to take advantage of any opportunities that may arise, such as attractive inorganic growth via acquisitions or fast lending in the event of a repeal of the interest rate cap. The bank’s balance sheet agility is seen given the bank’s high liquidity ratio of 54.2%.

For more information, see our Equity Group Holdings Q3'2019 Earnings Note

KCB Group released Q3’2019 results:

KCB Group released their Q3’2019 results, recording a 6.2% increase in core earnings per share to Kshs 6.3, from Kshs 5.9 in Q3’2018, attributed to a 10.0% increase in total operating income to Kshs 59.7 bn, from Kshs 54.2 bn in Q3’2018. Key highlights of the performance from Q3’2018 to Q3’2019 include:

- Core earnings per share increased by 6.2% to Kshs 6.3, from Kshs 5.9 in Q3’2018, driven by a 10.0% growth in total operating income to Kshs 59.7 bn from Kshs 54.2 bn in Q3’2018. The growth in core earnings per share was not in line with our expectations of an 8.6% growth, with the variance being attributable to the 13.4% increase in total expenses to Kshs 32.5 bn from Kshs 28.6 bn in Q3’2018, which exceeded our expectations of a 6.2% increase,

- Total operating income increased by 10.0% to Kshs 59.7 bn, from Kshs 54.2 bn in Q3’2018. This was due to a 16.9% increase in Non-Funded Income (NFI) to Kshs 21.0 bn, from Kshs 17.9 bn in Q3’2018, coupled with a 6.5% increase in Net Interest Income (NII) to Kshs 38.7 bn from Kshs 36.3 bn in Q3’2018,

- Interest income increased by 4.6% to Kshs 51.4 bn, from Kshs 49.2 bn in Q3’2018. This was driven by a 4.7% increase in interest income from government securities to Kshs 10.2 bn, from Kshs 9.7 bn in Q3’2018, coupled with a 3.7% increase in interest income on loans and advances to Kshs 40.5 bn, from Kshs 39.0 bn in Q3’2018. The yield on interest-earning assets however declined to 11.0% from 11.4% in Q3’2018 attributed to a decline in yields on government securities as well as a decline in lending rates, which saw interest income growing by only 4.6% despite interest earning assets growing by 7.9%,

- Interest expenses declined by 0.8% to Kshs 12.8 bn, from Kshs 12.9 bn in Q3’2018, following an 8.1% decline in interest expense on deposits and placements from banking institutions to Kshs 1.5 bn, from Kshs 1.6 bn in Q3’2018. However, there was a 0.3% rise in interest expense on customer deposits to Kshs 11.31 bn from Kshs 11.28 bn in Q3’2018. The cost of funds thus declined to 2.9% from 3.2% in Q3’2018. The Net Interest Margin (NIM) declined to 8.2%, from 8.5% in Q3’2018, due to the faster growth of interest earning assets that outpaced the growth in Net Interest Income (NII),

- Non-Funded Income (NFI) increased by 16.9% to Kshs 21.0 bn, from Kshs 17.9 bn in Q3’2018. The increase was mainly driven by a 78.9% rise in fees and commissions on loans to Kshs 7.9 bn, from Kshs 4.4 bn in Q3’2018. The growth was however weighed down by the 5.5% and 5.8% declines in other fees and forex trading income to Kshs 6.2 bn and Kshs 3.5 bn from Kshs 6.6 bn and Kshs 3.7 bn, respectively. As a result, the revenue mix shifted to 65:35 from 67:33 funded to non-funded income, due to the faster growth in NFI compared to NII,

- Total operating expenses increased by 13.4% to Kshs 32.5 bn, from Kshs 28.6 bn, largely driven by a 224.2% rise in Loan Loss Provisions (LLP) to Kshs 5.8 bn in Q3’2019, from Kshs 1.8 bn in Q3’2018, coupled with a 6.2% rise in staff costs to Kshs 13.6 bn in Q3’2019, from Kshs 12.8 bn in Q3’2018,

- Due to the faster growth of total operating expenses that outpaced the growth in operating income, Cost to Income Ratio (CIR) deteriorated to 54.4%, from 52.8% in Q3’2018. Without LLP however, the cost to income ratio improved, to 44.7%, from 49.5% in Q3’2018,

- Profit before tax increased by 6.1% to Kshs 19.2 bn, up from Kshs 18.0 bn in Q3’2018. Profit after tax grew by 6.2% to Kshs 19.2 bn in Q3’2019, from Kshs 18.0 bn in Q3’2018 with the effective tax rate remaining unchanged at 29.5%,

- The balance sheet recorded an expansion as total assets increased by 11.7% to Kshs 764.3 bn, from Kshs 684.2 bn in Q3’2018. This growth was largely driven by an 11.7% increase in the loan book to Kshs 486.4 bn from Kshs 435.3 bn in Q3’2018. Investment in government and other securities also recorded a 7.5% growth to Kshs 128.5 bn, from Kshs 119.6 bn in Q3’2018,

- Total liabilities rose by 11.1% to Kshs 643.1 bn, from Kshs 578.7 bn in Q3’2018, driven by an 11.4% increase in deposits to Kshs 586.7 bn, from Kshs 526.8 bn in Q3’2018. Deposits per branch increased by 10.9% to Kshs 2.3 bn from Kshs 2.0 bn in Q3’2018, with the number of branches having increased to 258 from 257 in Q3’2018,

- The faster growth in loans as compared to deposits led to a rise in the loan to deposit ratio to 82.9% from 82.6% in Q3’2018,

- Gross Non-Performing Loans (NPLs) rose by 22.4% to Kshs 42.6 bn in Q3’2019 from Kshs 34.8 bn in Q3’2019. The NPL ratio thus deteriorated to 8.3% from 7.6% in Q3’2018 due to the faster growth in Gross Non-Performing Loans (NPLs) which outpaced the growth in loans. General Loan Loss Provisions increased by 15.0% to Kshs 19.2 bn, from Kshs 16.7 bn in Q3’2018. The NPL coverage however declined to 56.5% from 60.4% in Q3’2018 due to the faster growth in Gross Non-Performing Loans (NPLs) which outpaced the growth in General Loan Loss Provisions,

- Shareholders’ funds increased by 15.0% to Kshs 121.2 bn in Q3’2019, from Kshs 105.5 bn in Q3’2018, as retained earnings grew by 27.8% y/y to Kshs 101.1 bn, from Kshs 79.1 bn in Q3’2018,

- KCB Group is currently sufficiently capitalized with a core capital to risk-weighted assets ratio of 18.1%, 7.6% above the statutory requirement of 10.5%. In addition, the total capital to risk-weighted assets ratio was 19.5%, exceeding the statutory requirement of 14.5% by 5.0%. Adjusting for IFRS 9, the core capital to risk weighted assets stood at 18.7%, while total capital to risk-weighted assets came in at 20.1%, and,

- The bank currently has a Return on Average Assets (ROaA) of 3.6%, and a Return on Average Equity (ROaE) of 22.2%.

Key Take-Outs:

- The bank’s asset quality deteriorated, with the NPL ratio increasing to 8.3%, from 7.6% in Q3’2018, due to the faster growth in Gross Non-Performing Loans (NPLs), which outpaced the growth in loans. The deterioration of the NPL ratio was mainly attributed to a deterioration in the corporate loan book’s NPL ratio to 10.4% in Q3’2019 from in 9.6% in Q3’2018, the mortgage loan book to 9.4% from 7.5% in Q3’2018 as well as the SME and Micro loan book, which deteriorated to 14.7% in Q3’2019, from 14.3% in Q3’2018, respectively, and,

- There was an improvement in operational efficiency as evidenced by the decline in the Cost to Income Ratio (CIR) without LLP to 44.7% in Q3’2019, from 49.5% in Q3’2018. This has mainly been driven by increased innovation and digitization which is evidenced by 95.0% of total transactions been performed outside the branch. This is comprising of 75.0% on mobile, 15.0% on agency, internet and POS and 5.0% on the ATM, while only 5.0% was performed by branch tellers. This has facilitated the faster growth of transactional income while maintaining a slower pace in the growth of operating expenses. This has also seen a 141.0% growth in non-branch revenue to over Kshs 8.6 bn.

Going forward, we expect the bank’s growth to be driven by:

- Increased channelled diversification: This is likely to help the bank to continue improving its operational efficiency. The benefits of this are already being felt, as the bank aligned its staff head count to its operational needs. Continued emphasis on these alternative channels of transactions, as the bank rides on the digital revolution wave, will likely lead to further cost to income ratio improvements by cost rationalization and NFI expansion.

For more information, see our KCB Group Q3'2019 Earnings Note

Co-operative Bank released Q3’2019 results:

Co-operative Bank released their Q3’2019 results, recording a 5.5% increase in core earnings per share to Kshs 1.6, from Kshs 1.5 in Q3’2018, attributed to a 10.0% increase in total operating income to Kshs 35.2 bn, from Kshs 32.3 bn in Q3’2018. Key highlights of the performance from Q3’2018 to Q3’2019 include:

- Core earnings per share increased by 5.5% to Kshs 1.6 in Q3’2019, from Kshs 1.5 in Q3’2018, which was not in line with our projections of a 7.3% increase. The performance was driven by a 9.1% increase in total operating income to Kshs 35.2 bn in Q3’2019, from Kshs 32.3 in Q3’2018 and an 11.3% increase in total operating expenses. The variance in core earnings per share growth against our expectations was largely due to the 11.3% rise in total operating expenses to Kshs 19.8 bn in Q3’2019, from Kshs 17.8 bn in Q3’2018, which was not in line with our expectation of an 8.0% increase to Kshs 19.2 bn,

- Total operating income increased by 9.1% to Kshs 35.2 bn in Q3’2019 from Kshs 32.3 bn in Q3’2018. This was due to a 33.3% increase in Non-Funded Income (NFI) to Kshs 14.1 bn from Kshs 10.6 bn in Q3’2018. The growth was however mitigated by the 2.7% decline in Net Interest Income (NII) to Kshs 21.2 bn from Kshs 21.7 bn in Q3’2018,

- Interest income declined by 1.6% to Kshs 30.4 bn in Q3’2019, from Kshs 30.9 bn in Q3’2018. This was caused by a 33.7% decline in interest income from loans and advances to Kshs 21.8 bn, from Kshs 32.9 bn in Q3’2018, as well as the 16.2% decrease in interest income from government securities to Kshs 8.2bn from Kshs 9.8 bn in Q3’2018. The yield on interest-earning assets thus declined to 11.5%, from 11.9% in Q3’2018,

- Interest expense rose marginally by 0.9% to Kshs 9.2 bn in Q3’2019, from Kshs 9.1 bn in Q3’2018, largely due to a 34.2% rise in other interest expenses to Kshs 1.2 bn from Kshs 0.9 bn in Q3’2018. Interest expense on customer deposits, however, decreased by 2.5% to Kshs 8.0 bn, from Kshs 8.2 bn in Q3 2018. Whereas, interest expense on bank placements recorded a decline of 25.6% to 35.5 mn, from 47.7 mn in Q3’2018. The cost of funds declined to 3.6%, from 3.8% in Q3’2018, owing to a 9.2% increase in interest-bearing liabilities to Kshs 353.5 bn, from Kshs 323.6 bn in Q3’2018 despite the 0.9% decline in interest expense,

- Non-interest Income rose by 33.3 % to Kshs 14.1 bn in Q3’2019, from Kshs 10.6 bn in Q3’2018. The increase was mainly driven by the 37.8% increase in fees and commissions on loans to Kshs 1.8 bn, from Kshs 1.3 bn in Q3’2018, as well as, a 48.3% increase in other fees to 9.8 bn from 6.6 bn in Q3’2018. The improvement in NFI was however weighed down by the 7.7% decline in forex trading income to Kshs 1.6 bn, from Kshs 1.8 bn in Q3’2018. As a consequence, the revenue mix shifted to 60:40, from 67:33 funded to non-funded income in Q3’2018 owing to the fast growth in NFI compared to NII,

- Total operating expenses increased by 11.3% to Kshs 19.8 bn in Q3’2019, from Kshs 17.8 bn in Q3’2018, largely driven by the 66.8% rise in Loan Loss Provisions (LLP) to Kshs 2.1 bn from Kshs 1.3 bn in Q3’2018, coupled with the staff costs increase of 12.1% to Kshs 9.1 bn in Q3’2019 from Kshs 8.1 bn in Q3’2018,

- The Cost to Income Ratio (CIR) deteriorated to 56.2%, from 55.1% in Q3’2018, following the faster rise in total operating expenses that outpaced total operating income. Without LLP, the cost to income ratio improved to 50.2%, from 51.2% in Q3’2018,

- The bank registered a growth of 5.5% in profit after tax to Kshs 10.9 bn in Q3’2019, from Kshs 10.3 bn in Q3’2018 and a 5.5% growth in profit before tax to Kshs 15.5 bn, from Kshs 14.6 bn in Q3’2018 with the similarity in growth attributable to the unchanged effective tax rate of 29.6% in both Q3’2019 and Q3’2018,

- The balance sheet recorded an expansion as total assets grew by 9.1% to Kshs 440.8 bn in Q3’2019 from Kshs 404.2 bn in Q3’2018 owing to the increases in government securities by 13.6% to Kshs 94.6 bn in Q3’2019, from Kshs 83.3 bn, coupled with increase in placements by 47.5% to Kshs 24.3 from Kshs 16.5 bn, and, an increase in net loans and advances by 5.8% to Kshs 268.9 bn in Q3’2019, from Kshs 254.2 bn in Q3’2018,

- Total liabilities grew by 9.9% to Kshs 365.4 bn in Q3’2019 from Kshs 332.5 bn in Q3’2018 which was largely attributable to the 8.9% rise in customer deposits to Kshs 322.5 bn in Q3’2019, from Kshs 296.1 bn in Q3’2018,

- Borrowings rose by 14.4% to Kshs 29.7 bn, from Kshs 26.0 bn in Q3’2018,

- The faster 8.9% growth in deposits which outpaced the 5.8% growth in net loans and advances, led to a decline in the loan to deposit ratio to 83.4%, from 85.9% in Q3’2018,

- Gross Non-Performing Loans (NPLs) increased by 1.3% to Kshs 30.1 bn in Q3’2019, from Kshs 29.7 bn in Q3’2018. The NPL ratio however improved to 10.5% in Q3’2019, from 11.2% in Q3’2018 owing to a faster growth in gross loans by 7.7% outpacing the 1.3% growth in gross non-performing loans

- General Loan Loss Provisions increased by 15.2% to Kshs 11.4 bn, from Kshs 9.9 bn in Q3’2018. The NPL coverage ratio thus improved to 55.5% in Q3’2019 from 36.8% in Q3’2018, due to the faster growth in General Loan Loss Provisions which outpaced the growth in Gross Non-Performing Loans (NPLs)

- Shareholders’ funds increased by 4.3% to Kshs 73.9 bn in Q3’2019 from Kshs 70.9 bn in Q3’2018, mainly driven by a 3.1% increase in the retained earnings to Kshs 64.4 bn, from Kshs 62.5 bn in Q3’2018,

- Co-operative Bank remains sufficiently capitalized with a core capital to risk-weighted assets ratio of 15.4%, 4.9% points above the statutory requirement of 10.5%. In addition, the total capital to risk-weighted assets ratio came in at 15.7%, exceeding the statutory requirement of 14.5% by 1.2% points.

- The bank currently has a Return on Average Assets (ROaA) of 3.2%, and a Return on Average Equity (ROaE) of 18.4%.

Key Take-Outs:

- Non-Funded Income (NFI) rose by 33.3 % to Kshs 14.1 bn in Q3’2019, from Kshs 10.6 bn in Q3’2018 exceeding the industry average growth of 21.3%. The increase was mainly driven by the 37.8% increase in fees and commissions on loans to Kshs 1.8 bn, from Kshs 1.3 bn in Q3’2018, as well as, a 48.3% increase in other fees to Kshs 9.8 bn from Kshs 6.6 bn. The improvement in NFI was however weighed down by the 7.7% decline in forex trading income to Kshs 1.6 bn, from Kshs 1.8 bn in Q3’2018. As a consequence, the revenue mix shifted to 60:40, from 67:33 funded to non-funded income in Q3’2018 owing to the fast growth in NFI which was attributable to increased activity in Bancassurance and advisory and training services, compared to NII, and,

- The bank’s asset quality improved, with the NPL ratio decreasing to 10.5% in Q3’2019, from 11.2% in Q3’2018 owing to a faster growth in gross loans by 7.7% outpacing the 1.3% growth in gross non-performing loans which is attributable to the implementation of credit management strategies implemented since the beginning of the year such as adherence to credit risk appetite and limits, credit risk early warning indicators, proper credit appraisal and approval mechanisms.

Going forward, we expect the bank’s growth to be driven by:

- Refocus on the core operations: Prior to Q3’2019 the bank preferred to diversify to increase NFI due to the declining interest income however, now that there is potential for increasing interest income, the bank should refocus on lending to private sector which will not only increase interest income but also, it will increase fees and commissions on loans,

- Maximization of the interest rate cap repeal: With the repeal of the interest rate cap the bank does not have to focus on cherry-picking loans to ensure proper credit management, instead, they can price loans according to the level of risk which will increase their loans to deposits ratio and interest income,

- Improved cost efficiency through technology: If the focus is placed more on online platforms and e-platforms the bank could be able to reduce costs especially staff costs which increased by 12.1%.

For more information, see our Co-operative Bank Q3'2019 Earnings Note

The table below summarizes the performance of listed banks that have released their Q3’2019 results:

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

Equity Group |

10.4% |

11.2% |

16.8% |

9.5% |

8.4% |

13.7% |

41.1% |

15.0% |

18.9% |

7.8% |

73.0% |

21.0% |

22.8% |

|

KCB Group |

6.2% |

4.6% |

(0.8%) |

6.5% |

8.2% |

16.9% |

35.2% |

28.5% |

11.4% |

7.5% |

82.9% |

11.7% |

22.2% |

|

Co-operative Bank |

5.5% |

(1.6%) |

0.9% |

(2.7%) |

8.3% |

33.3% |

40.0% |

46.6% |

8.9% |

13.6% |

83.4% |

5.8% |

18.4% |

|

NBK |

(4.7%) |

4.7% |

(8.2%) |

11.6% |

7.2% |

(4.6%) |

23.8% |

4.5% |

(11.1%) |

(17.1%) |

58.0% |

(0.3%) |

5.5% |

|

Q3'2019 Mkt Weighted Average* |

7.8% |

6.1% |

6.9% |

5.9% |

8.3% |

18.9% |

38.6% |

26.5% |

13.9% |

8.8% |

78.8% |

14.3% |

21.6% |

|

Q3'2018 Mkt Weighted Average** |

16.2% |

6.1% |

12.5% |

3.8% |

8.0% |

5.9% |

34.5% |

0.6% |

7.4% |

17.8% |

75.3% |

4.2% |

18.8% |

|

*Market cap weighted as at 15/11/2019 |

|||||||||||||

|

**Market cap weighted as at 30/11/2018 |

|||||||||||||

Key takeaways from the table above include:

- The four listed Kenyan banks that have released their results recorded an 7.8% average increase in core Earnings Per Share (EPS), compared to an increase of 16.2% in Q3’2018 for all listed banks. Consequently, the Return on Average Equity (ROaE) increased to 21.6%, from 18.8% in Q3’2018,

- The banks recorded stronger deposit growth, which came in at 13.9%, faster than the 7.4% growth recorded in the sector in Q3’2018. Interest expenses increased at a slower pace of 6.9%, compared to 12.5% in Q3’2018, indicating the banks have been able to mobilize relatively cheaper deposits,

- Average loan growth came in at 14.3%, which was faster than the 4.2% recorded in the sector in Q3’2018, indicating that there was an improvement in credit extension by the banks. Government securities recorded a growth of 8.8% y/y, which was slower compared to the loans, and a decline from the 17.8% recorded in the sector in Q3’2018. This highlights that banks are beginning to adjust their business models back to private sector lending as opposed to investing in government securities, as the yields on government securities declined during the year. Interest income increased by 6.1%, similar to the growth receorded in the sector in Q3’2018. Consequently, the Net Interest Income (NII) grew by 5.9% compared to a growth of 3.8% in the sector in Q3’2018,

- The banks recorded a Net Interest Margin of 8.3%, 30 bps higher than 8.0% the sector recorded in Q3’2018, this can be attributed to the faster growth in loans compared to lower yielding governement securities, and,

- Non Funded Income grew by 18.9% y/y, faster than the 5.9% recorded in the sector in Q3’2018. The growth in NFI was boosted by the total fee and commission income which improved by 26.5%, compared to the 0.6% growth recorded in the sector Q3’2018, owing to the faster loan growth.

Universe of Coverage

Below is a summary of our universe of coverage:

|

Banks |

Price at 8/11/2019 |

Price at 15/11/2019 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Sanlam |

17.0 |

17.0 |

0.0% |

(14.8%) |

29.0 |

0.0% |

70.6% |

0.7x |

Buy |

|

I&M Holdings*** |

50.0 |

49.1 |

(1.9%) |

5.9% |

79.8 |

8.0% |

70.6% |

0.8x |

Buy |

|

Diamond Trust Bank |

120.0 |

115.3 |

(4.0%) |

(27.2%) |

175.6 |

2.3% |

54.6% |

0.6x |

Buy |

|

Kenya Reinsurance |

3.1 |

3.1 |

(0.6%) |

(17.2%) |

3.8 |

14.4% |

34.6% |

0.3x |

Buy |

|

KCB Group*** |

49.9 |

50.3 |

0.7% |

12.1% |

61.4 |

7.0% |

29.1% |

1.3x |

Buy |

|

CIC Group |

3.2 |

3.2 |

(2.2%) |

(20.5%) |

3.8 |

4.1% |

24.4% |

1.1x |

Buy |

|

Jubilee holdings |

350.3 |

350.0 |

(0.1%) |

(13.5%) |

418.5 |

2.6% |

22.1% |

0.9x |

Buy |

|

Britam |

7.4 |

7.5 |

1.1% |

(30.2%) |

8.8 |

0.0% |

17.3% |

0.7x |

Accumulate |

|

NCBA |

34.9 |

34.0 |

(2.6%) |

7.7% |

37.9 |

4.4% |

16.0% |

0.7x |

Accumulate |

|

Equity Group*** |

48.9 |

47.5 |

(2.9%) |

7.5% |

53.0 |

4.2% |

15.9% |

1.9x |

Accumulate |

|

Barclays Bank*** |

12.7 |

11.9 |

(6.7%) |

0.0% |

12.6 |

9.3% |

15.4% |

1.5x |

Accumulate |

|

Standard Chartered |

202.3 |

200.0 |

(1.1%) |

2.7% |

208.0 |

9.5% |

13.5% |

1.5x |

Accumulate |

|

Liberty Holdings |

10.3 |

10.5 |

1.9% |

(24.7%) |

11.3 |

4.8% |

12.4% |

0.7x |

Accumulate |

|

Co-op Bank*** |

15.7 |

15.0 |

(4.5%) |

(16.8%) |

15.0 |

6.7% |

6.6% |

1.3x |

Hold |

|

Stanbic Holdings |

110.0 |

109.5 |

(0.5%) |

5.8% |

100.5 |

4.4% |

(3.8%) |

1.2x |

Sell |

|

HF Group |

7.2 |

6.7 |

(7.8%) |

27.1% |

2.8 |

0.0% |

(58.5%) |

0.3x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

|||||||||

We are “Positive” on equities for investors as the sustained price declines has seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

I. Industry Report

During the week, the Central Bank of Kenya (CBK) released the Bank Supervision Annual Report 2018, which tracks the Kenyan residential mortgage market, including a residential mortgage market survey, which noted increased demand for mortgage loans in 2018 due to perceived affordability of the interest on mortgage loans. Key take-outs from the report were:

- The number of mortgage loan accounts increased by 1.2% to 26,504 mortgage loans in 2018 from 26,187 in 2017, with average interest rates at 12.4% in 2018, 6.3% points down from an average of 18.7% in 2017,

- The value of mortgage loan assets outstanding increased by 0.8% to Kshs 224.9 bn in 2018, from Kshs 223.2 bn in 2017, attributable to an increased appetite for homeownership,

- Mortgage uptake is expected to record an increase with the implementation of the affordable housing program and the formation of Kenya Mortgage Refinance Company (KMRC) by the Kenyan Government.

A summary of the trend in the mortgage market is as below:

(all values in Kshs unless stated otherwise)

|

7-year Mortgage KPI Trends in Kenya |

|||||||||

|

Year |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

7-year CAGR |

|

Outstanding Mortgages |

90.4 bn |

119.6 bn |

138.1 bn |

164.0 bn |

203.3 bn |

219.9 bn |

223.2 bn |

224.9 bn |

13.9% |

|

Non- performing Mortgages |

3.0 bn |

6.8 bn |

8.5 bn |

10.8 bn |

11.7 bn |

22.0 bn |

27.3 bn |

38.1 bn |

43.8% |

|

Average Mortgage Size |

5.6 mn |

6.4 mn |

6.9 mn |

7.5 mn |

8.3 mn |

9.1 mn |

10.9 mn |

8.48 mn |

6.1% |

|

Number of Mortgages |

16,029 |

18,587 |

19,879 |

22,013 |

24,458 |

24,058 |

26,187 |

26,504 |

7.4% |

|

Annual Change in No. of mortgages |

16.0% |

7.0% |

10.7% |

11.1% |

(1.6%) |

8.8% |

1.2% |

||

Source: Central Bank of Kenya

Despite the major challenges slowing the mortgage market including the high cost of housing units, high cost of land for construction, and difficulties with property registration, the overall mortgage market is expected to improve driven by, (i) implementation of affordable housing program by the government, (ii) the availability of low cost housing solutions, (iii) availability of affordable long term loans through initiatives such as the Kenya Mortgage Refinance Company (KMRC), and, (iv) government incentives for low cost housing solutions.

II. Residential Sector

During the week, Superior Homes Kenya launched its Kshs 7.0 bn residential development dubbed “Pazuri” located on 105-acres at Vipingo Ridge in Kilifi County. The project will consist of 372 units of 2-bed, 3-bed bungalows, and 4-bed villas of 110 SQM, 163 SQM, and 220 SQM, respectively. The units will be priced at Kshs 11.9 mn, Kshs 14.9 mn and Kshs 18.9 mn, respectively, translating to an average price of Kshs 95,695 per SQM. The prices are 20.3% lower than the upper mid-end residential average of Kshs 115,199 per SQM in neighboring Mombasa County according to the Cytonn Mombasa Investment Opportunity Report 2018, attributed to more affordable development land. The prices are however 16.1% higher than a similar project in Vipingo dubbed Awali Estate which are part of a mixed-use project ‘Vipingo Development’ by Centum, which are currently selling an average price of Kshs 82,411 per SQM.

|

Price Comparison of Mombasa & Vipingo Residential Developments |

||

|

|

Average Size (SQM) |

Average Price Per SQM (Kshs) |

|

Pazuri |

164 |

95,695 |

|

Awali Estate |

182 |

82,411 |

|

Mombasa |

189 |

115,199 |

Cytonn Research

Vipingo area in Kilifi County is a major attraction to Kenya’s middle class and holiday travelers and has seen the continued demand for luxury residential homes supported by, (i) the area’s recognition as a major tourist destination in Kenya, due to its rich cultural heritage and proximity to the Indian Ocean, and (ii) the improving infrastructure in the region including charter flights from Nairobi to Vipingo airstrip.

Continued investment in the area is also attributed to high land capital appreciation, which recorded 6.9% in 2017, compared to the average appreciation of 7.4%, according to Hass Consult County Land Report 2018. Land prices in Kilifi County are also considerably lower, averaging Kshs 15.7 mn per acre compared to land in neighboring Mombasa County at Kshs 49.8 mn per acre.

The table below shows the counties with the highest land appreciation in 2017

(all values in Kshs unless stated otherwise)

|

Top 10 Counties with Highest Land Appreciation 2017 |

|||

|

|

County |

Average Land Price 2017 |

Annual Capital Appreciation |

|

1 |

Kisumu |

6.9 mn |

14.1% |

|

2 |

Mombasa |

49.7 mn |

9.9% |

|

3 |

Nakuru |

4.6 mn |

9.5% |

|

4 |

Machakos |

13.3 mn |

8.4% |

|

5 |

Kiambu |

32.3 mn |

7.3% |

|

6 |

Kilifi |

15.7 mn |

6.9% |

|

7 |

Kwale |

10.0 mn |

6.6% |

|

8 |

Nairobi |

189.0 mn |

4.2% |

|

9 |

Uasin Gishu |

5.2 mn |

3.8% |

|

10 |

Kajiado |

9.7 mn |

3.0% |

Hass Consult Land Report 2018

iii. Retail Sector

During the week, Quickmart, a local supermarket chain, opened their latest outlet on Magadi Road in Ongata Rongai, Kajiado County. The 24,000 SQFT standalone structure built by the retailer is its twelfth outlet after Lavington and Waiyaki Way opened in January 2019 and August 2019, respectively. Satellite towns such as Ongata Rongai, Ruiru and Ruaka are increasingly attracting retailers driven by (i) affordability of land prices at Kshs 25.5 mn per acre compared to the average land prices of Kshs 134.0 mn per acre within Nairobi as at September 2019, (ii) positive demographics with these areas acting as the Nairobi dormitory areas thus creating demand for consumer goods & retail services, and, (iii) relatively low-priced retail spaces at Kshs 131.4 per SQFT.

According to the Cytonn Retail Sector Report 2019, the average rents in satellite towns came in Kshs 131.4 per SQFT in 2019, 28.3% lower than the market average of Kshs 168.6 per SQFT in 2019. However, occupancy rates in the formal retail market in satellite towns declined by 3.4% points to 70.3% in 2019, from 73.7% in 2018, attributed to competition from informal retail spaces. In the past few months, we have witnessed increased retail activity in satellite towns by local retailers such as Naivas Supermarket and Artcaffe, a restaurant chain, who opened locations in Ongata Rongai Town and Kitengela Town, respectively. We expect the continued interest in satellite towns to boost the formal retail sector leading to higher occupancies and improved performance of the retail sector.

The table below shows the performance of the Nairobi Metropolitan Area (NMA) retail market between 2018 and 2019:

(all values in Kshs unless stated otherwise)

|

Summary of NMA’s Retail Market Performance 2018-2019 |

|||||||||

|

Location |

Rent Per SQFT 2019 |

Occupancy Rate 2019 |

Rental Yield 2019 |

Rent Per SQFT 2018 |

Occupancy Rate 2018 |

Rental Yield 2018 |

Change in Rents |

Change in Occupancy |

Change in Rental Yields |

|

Kilimani |

170.4 |

87.2% |

9.9% |

167.1 |

97.0% |

10.7% |

2.0% |

(9.8%) |

(0.9%) |

|

Ngong Road |

179.4 |

83.1% |

9.2% |

175.4 |

88.8% |

9.7% |

2.3% |

(5.7%) |

(0.5%) |

|

Westlands |

203.6 |

84.6% |

9.2% |

219.2 |

88.2% |

12.2% |

(7.1%) |

(3.6%) |

(3.0%) |

|

Karen |

207.9 |

77.0% |

9.1% |

224.9 |

88.8% |

11.0% |

(7.6%) |

(11.8%) |

(1.9%) |

|

Eastlands |

145.0 |

74.5% |

7.5% |

153.3 |

64.8% |

6.8% |

(5.4%) |

9.7% |

0.7% |

|

Thika road |

165.4 |

73.5% |

7.5% |

177.3 |

75.5% |

8.3% |

(6.7%) |

(2.0%) |

(0.8%) |

|

Kiambu Road |

166.0 |

61.7% |

6.8% |

182.8 |

69.5% |

8.1% |

(9.2%) |

(7.8%) |

(1.4%) |

|

Msa Road |

148.1 |

64.0% |

6.3% |

161.5 |

72.4% |

7.9% |

(8.3%) |

(8.4%) |

(1.6%) |

|

Satellite Towns |

131.4 |

70.3% |

6.0% |

142.1 |

73.7% |

6.7% |

(7.5%) |

(3.4%) |

(0.7%) |

|

Average |

168.6 |

75.1% |

8.0% |

178.2 |

79.8% |

9.0% |

(5.4%) |

(4.7%) |

(1.0%) |

|

Occupancy rates in the formal retail market in satellite towns declined by 3.4% points to 70.3% in 2019 from 73.7% in 2018 attributed to competition from informal retail spaces |

|||||||||

Source: Cytonn Research 2019

IV. Infrastructure Sector

During the week, Transport Secretary James Macharia announced that the railway track from Nairobi to Kisumu would be upgraded at a cost of Kshs 3.8 bn. The project, which is expected to start in the coming months, will connect from Nakuru to the Kisumu port and will mainly be used to ferry cargo to neighboring countries. The announcement comes after the Chinese Government declined to fund Phase 2B (Nakuru-Kisumu) of the Standard Gauge Railway (SGR). We expect the project to play a key role in economic growth by enhancing connectivity, increasing revenue generation and creating employment opportunities. It will open up previously inaccessible areas improving connectivity and thus lead to increased demand for property resulting in an increase in property prices.

Other highlights include:

- Irish investors were in Nairobi this week for a two-day trade mission worth Kshs 4.8 billion in investment deals with more than 40 companies dealing in education, construction and financial technology. Kenya’s demographic trends and growth has attracted large amounts of foreign direct investments (FDI) with Kenya being among the top five recipients of foreign direct investments in Africa thus driving domestic investment projects, according to EY Attractiveness Report 2018. We expect continued foreign participation and direct investments in Kenya driven by the improving macroeconomic environment, with the country’s GDP growing by 6.3% in 2018, 1.4% points higher than 4.9% recorded in 2017, and Kenya’s positioning as a regional and continental hub thus making it a preferred investment destination.

We expect a continued increase in activities in the real estate sector driven by; (i) Kenya’s improving macroeconomic environment, with the country’s GDP growing by 6.3% in 2018, 1.4% points higher than 4.9% recorded in 2017, (ii) increased foreign direct investments, (iii) positive demographics such as a high population growth rate of 2.5%, 1.4% point higher than global averages of 1.2%, and, (iv) the relatively high urbanization rate in Kenya at 4.4% compared to the global average of 2.1%, necessitating the need for adequate housing and retail facilities in the urban areas.

Following the release of the H1’2019 results by Kenyan insurance firms, the Cytonn Financial Services Research Team undertook an analysis on the financial performance of the listed insurance companies and the key factors that drove the performance of the sector. In this report, we assess the main trends in the sector, and areas that will be crucial for growth and stability going forward, seeking to give a view on which insurance firms are the most attractive and stable for investment. As a result, we shall address the following:

- Key Themes that Shaped the Insurance Sector in H1’2019,

- Industry Highlights and Challenges,

- Performance of The Listed Insurance Sector in H1’2019, and,

- Conclusion & Outlook of the Insurance Sector.

Section I: Key Themes that Shaped the Insurance Sector in H1’2019

The Kenyan economy expanded by 5.6% in H1’2019, lower than the growth of 6.4% recorded in H1’2018, with the financial services sector and insurance sector registering the most improved growth of 2.1% points, to 6.7% in H1’2019, from 4.6% in H1’2018. Key highlights from the industry performance for the Insurance sector in H1’2019 are as below:

The insurance sector has benefited from (i) convenience and efficiency through adoption of alternative channels for both distribution and premium collection such as Bancassurance and improved agency networks, (ii) advancement in technology and innovation making it possible to make premium payments through mobile phones, and (iii) a growing middle class, which has led to increased disposable income, thereby increasing demand for insurance products and services. These factors have been key in driving growth of the sector.

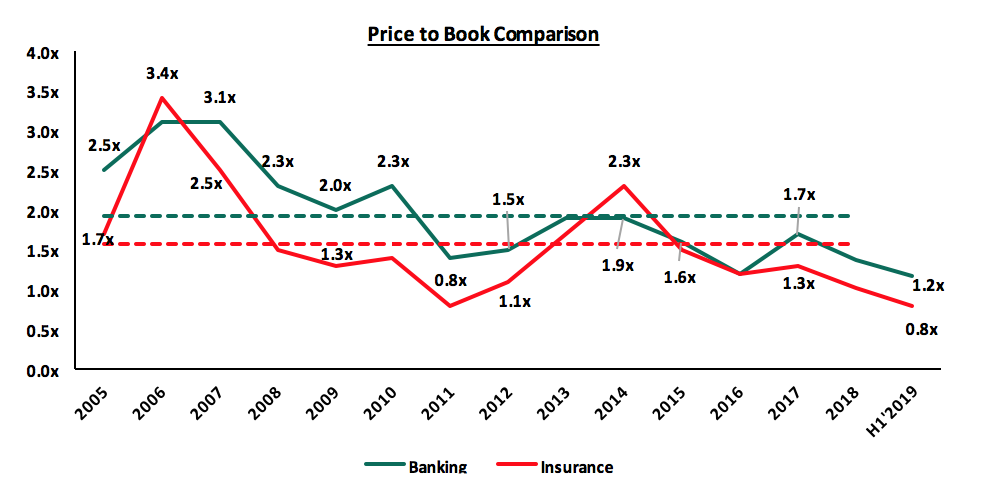

On valuations, listed insurance companies are trading at a price to book of 0.8x, lower than listed banks at 1.2x, with both lower than their historical averages of 1.6x for the insurance sector and 1.9x for the banking sector. This indicates that both sectors are attractive for long-term investors supported by the strong economic fundamentals and favourable investment environment.

In the last five years, the life insurance market in Kenya has experienced growth in both the level of direct premiums as well as in the equity held by the industry constituents shaped by the following themes;

A.Technology and Innovation

Although the industry has been slow in adopting digital trends, H1’2019 has seen insurance companies increasingly take advantage of digital transformation to drive growth and increase insurance penetration in the country. Below are some of the digital trends in the insurance sector;

- Innovation - Insurance underwriting involves evaluating the risk and exposures of prospective clients and thus, through technology, insurers are able to automate manual processes and duplicity of information across data gathering, risk profiling and pricing of the policy. Mobile phones also offer a new way of distributing insurance products to consumers who are not online and cannot be served through traditional distribution methods such as agents. The current number of mobile subscribers, according to Communications Authority of Kenya (CAK), stands at 51.0 mn and is expected to grow to 60.0 mn subscribers in 5 years. This implies that insurance companies have potential to increase market reach through mobile phones. East Africa has seen innovation such as M-tiba which primarily operates via mobile phones to reach the masses, and,

- Big Data and Artificial Intelligence - Artificial Intelligence (AI) is applied in the insurance industry in areas such as customer experience, process optimization and product innovation. By leveraging on AI, insurance companies are able to optimally use the data they collect to identify and recognize patterns, and anticipate actions. AI is also used to provide personalized insurance products by analysing behaviours of customers and improving customer experience by offering a seamless automated buying experience. The use of AI to curb fraud has also seen traction in the global insurance space in investigating the legitimacy of claims and identifying those that are fraudulent. The process of handling and inspecting claims manually is cumbersome and imperfect. However, insurance companies can mirror the steps taken by Kenindia Assurance in the use of AI to fast-track claims resolution through anomaly detection, sentiment detection, text analytics and a self-service portal. The use of Big Data and Artificial Intelligence is expected to increase significantly over the coming years at par with the pace at which the digital space in Kenya is increasing, with insurance companies leveraging on the opportunities created.

B. Regulation

To ensure that the sector benefits from a globally competitive financial services sector, the sector has to remain efficient, flexible and responsive to emerging trends through effectively addressing identified problems. Regulations used for the insurance sector in Kenya include the Insurance Act cap 487 and its accompanying schedule and regulations. In H1’2019, regulation remained a key aspect affecting the insurance sector and the key themes in the regulatory environment include;

- IFRS 9 - IAS 39, Financial Instruments Recognition and Measurement was replaced with IFRS 9, Financial Instruments to address, classification and measurement of financial instruments, impairment and hedge accounting. The guideline recommends an entity to measure the loss allowance at an amount equal to lifetime expected credit losses for receivables. Large players such as Jubilee Insurance and Kenya Re, who implemented IFRS 9 experienced increased impairments between 5.0% and 40.0%, with many insurance companies using a simplified loss rate approach in determining the provisions for premium receivables, with most opting to delay implementation of IFRS 9 to January 2022. IFRS 9 will enable insurance companies develop appropriate models for their customer debtors and develop plans that will help them lower their credit risk in the future,

- IFRS 17- The standard establishes the principle for recognition, measurement, presentation and disclosure of insurance contracts with the objective of ensuring insurance companies provide relevant information that faithfully represents the contracts with an effective date of January 2022 or earlier. The standard is expected to give better information on profitability by providing more insights about current and future profitability of insurance contracts. Separation of financial and insurance results in the income statement will allow for better analysis of core performance for the entities and allow for better comparability of insurance companies,

- Risk Based Supervision - IRA has been implementing risk-based supervision through guidelines that require insurers to maintain a capital adequacy ratio of at least 200.0% of the minimum capital by 2020. The regulation requires insurers to monitor the capital adequacy and solvency margins on a quarterly basis, with the main objective being to safeguard the insurer’s ability to continue as a going concern and provide shareholders with adequate returns. We expect more mergers within the industry as smaller companies struggle to meet the minimum capital adequacy ratios. We also expect insurance companies to adopt prudential practices in managing risk and reduction of premium undercutting in the industry as insurers will now have to price risk appropriately, and,

- Amendments to the Kenya Insurance Act - In June 2019, IRA made amendments under valuation of technical provisions for life insurance business and capital adequacy guidelines. The assumption under interest rate risk for life valuation was revised from 20.0% to 10.0%, and the insurance risk factors relating to interest rate risk margin for capital adequacy was revised from 10.0% to 18.0%. The implication of this amendment is that that insurers will need to be wary and look out for and manage various interest rate stress factors to remain well within the assumptions set forth in the guidelines.

C. Capital Raising

The move to a risk based capital adequacy framework is likely to lead to capital raising initiatives by some players in the sector to shore up capital. The solvency margins on the listed insurance space have declined to 26.9% in H1’2019 from 27.9% recorded in 2018, indicating that assets have been growing faster than shareholder’s funds. With the new capital adequacy assessment framework, capital is likely to be critical to ensuring stability and solvency of the sector to ensure the businesses are a going concern. In 2018, Swiss RE acquired 50.0 mn shares in Britam Holdings equivalent to a 13.8% stake, bringing the total stake at Britam to stands at 15.8%. Although the parties did not disclose the value of transaction, the market valued the transaction of Kshs 425.0 mn.

Section II: Industry Highlights and Challenges

Following the stable growth achieved by the insurance sector over the last decade, we expect the sector to transition into a more stable sector on the back of an improving economy and heightened regulations, which will enhance the capacity of the sector to sustain profitability. The following activities were undertaken by the Insurance Regulatory Authority (IRA), in line with their mandate of regulating and promoting development of the insurance sector;

I. Merger & Acquisition activity

The insurance sector is booming with mergers and acquisitions mainly with companies trying to protect their market share in a competitive environment. Some of the M&A deals include the acquisition of a 13.8% stake in Britam by Swiss Re, acquisition of Kenya First Assurance by Barclays Africa Group for USD 29.0 mn and Africa Merchant Assurance seeking to raise USD 5.0 mn - USD 7.0 mn through a stake sale. The insurance sector is likely to experience more mergers and acquisitions with many insurers trying to meet the solvency requirements by June 2020.

II. Override Commissions

Overriding commission is commission paid by the insurer to an agent for premium volume produced by other agents. The IRA, through a circular in January, cautioned insurers and brokers against the payment of commissions and administrative fees above the limits prescribed by the Insurance Act, in order to win and retain businesses. This was aimed at promoting fair competition within the sector.

III. Industry Circulars

IRA issued circular no. IC/04/2019 - Implementation of Integrated Custom Management Systems (iCMS), which informed insurance companies on roll out of iCMS by KRA and requested them to provide KRA with details of persons who will be created in iCMS. The aim of iCMS is to improve trade facilitation and meeting increased needs for compliance.

IV. Recently Developed or Repackaged Insurance Products

In Q2’2019, 8 new or repackaged insurance products were filed by various insurance companies and approved by IRA. Britam had three products approved in the period of review. Under general insurance, Britam’s Milele health plan, Britam’s group critical illness product under life assurance and group last expense also under life assurance. Other insurance companies with new products in the period included Monarch and Geminia under general insurance. Sanlam and Barclays life had products under long term insurers.

Industry Challenges:

- Fraud: Insurance fraud is an intentional deception committed by an applicant or policy holder for financial gain. Fraud is still one of the biggest challenges faced by the insurance industry. Estimates indicate that 25.0% of insurance industry income are fraudulently claimed, with motor and medical claims being the most common. Medical fraud was particularly prevalent perpetrated in various ways such as collusion between policy holders and health service providers, inflated medical bills and hospitals making patients take unnecessary tests. In Q2’2019, 30 fraud cases were reported, with 27 cases pending investigation, 2 cases pending before court and 1 had already been finalized, the sector has been adopting the use of block chain and artificial intelligence to curb fraud within the sector,

- Premium Undercutting: Premium undercutting is the practice where an insurance company secretly offers clients unrealistically low premiums in order to gain competitive advantage and to protect their market share is the major driver of underwriting losses suffered by the industry. Increased cut throat competition resulting from low insurance penetration and low product differentiation has led to industry players undercutting product pricing despite the risk that comes with product mispricing, and,

- Regional regulators: Subsidiaries of Kenyan insurance companies are facing challenges in the areas of operation. For instance, in Tanzania, insurance brokers are required to be at least two-thirds (66%) owned and controlled by citizens of Tanzania. In Kenya, regulation on capital has made it difficult for smaller insurance companies to continue operating without increasing their capital or merging in order to raise their capital base.

Section III: Performance of the Listed Insurance Sector in H1’2019

The table below highlights the performance of the listed insurance sector, showing the performance using several metrics, and the key take-outs of the performance.

|

Listed Insurance Companies H1'2019 Earnings and Growth Metrics |

||||||||

|

Insurance Company |

Core EPS Growth |

Net Premium Growth |

Claims Growth |

Loss Ratio |

Expense Ratio |

Combined Ratio |

ROaA |

ROaE |

|

Britam Holdings |

50.0% |

(0.4%) |

(12.1%) |

59.3% |

70.5% |

129.8% |

(1.4%) |

(6.1%) |

|

Liberty Holdings |

45.8% |

3.4% |

(0.5%) |

80.3% |

71.7% |

152.0% |

1.7% |

8.3% |

|

Jubilee Holdings |

(1.6%) |

7.7% |

(8.5%) |

94.1% |

31.4% |

125.5% |

3.5% |

14.8% |

|

Kenya Re |

(12.5%) |

16.6% |

48.8% |

67.3% |

41.0% |

108.3% |

4.7% |

7.4% |

|

CIC Group |

(95.2%) |

0.4% |

7.9% |

70.9% |

49.9% |

184.8% |

(0.9%) |

(3.7%) |

|

Sanlam Kenya* |

N/A |

10.8% |

(18.8%) |

72.1% |

63.4% |

135.5% |

0.7% |

10.0% |

|

H1'2019 Weighted Average** |

3.2% |

5.7% |

0.0% |

77.2% |

49.1% |

133.7% |

1.6% |

5.7% |

|

H1'2018 Weighted Average** |

(0.6%) |

(8.2%) |

(1.8%) |

84.2% |

60.2% |

144.4% |

0.9% |

3.9% |

|

*Sanlam's EPS cannot be calculated since it has registered losses in H1'2018 |

||||||||

|

**The weighted average is based on Market Cap as at 22nd October 2019 |

||||||||

The key take-outs from the above table include;

- The average core EPS growth increased by 3.8% points in H1’2019 to 3.2%, from (0.6%) in H1’2018,

- The premiums grew by 5.7% in H1’2019, compared to a decline of 8.2% in H1’2018, while claims remained flat on a weighted average basis,

- The loss ratio across the sector decreased to 77.2% in H1’2019, from 84.2% in H1’2018, owing to introduction of tough measures by market players to reduce fraudulent claims,

- The expense ratio decreased to 49.1% in H1’2019, from 60.2% in H1’2018, owing to a decrease in operating expenses through cost rationalization and awareness,

- The insurance core business still remains unprofitable, with a combined ratio of 133.7% as at H1’2019, compared to 144.4% in H1’2018, and,

- On average, the insurance sector has delivered a Return on Average Equity of 5.7%, an increase from 3.9% in H1’2018.

Based on the Cytonn H1’2019 Insurance Report, we ranked insurance firms from a franchise value and from a future growth opportunity perspective with the former getting a weight of 40% and the latter a weight of 60%.

Important to note is that Kenya Re was not considered in the below rankings given it is a re-insurance company, and not a listed insurance company that undertakes traditional life & general underwriting business.

The ranking is as follows;

|

Cytonn Listed Insurance Companies H1’2019 Comprehensive Ranking |

||||

|

Insurance Company |

Franchise Value Total Score |

Intrinsic Value Total Score |

Weighted Score |

Rank |

|

Jubilee Holdings |

9 |

1 |

4.2 |

1 |

|

Sanlam Kenya |

13 |

2 |

6.4 |

2 |

|

Liberty Holdings |

17 |

3 |

8.6 |

3 |

|

Britam Holdings |

16 |

5 |

9.4 |

4 |

|

CIC Group |

20 |

4 |

10.4 |

5 |

From the above table:

- Jubilee Holdings took the Top Position, ranking top in the franchise score category on the back of a strong combined ratio, indicating better capacity to generate profits from its core business. The only factor holding Jubilee back is its loss ratio, which is the highest among listed companies,

- Sanlam Kenya took 2nd Position, on the back of a strong franchise score, driven by the highest Return on Average Equity,

- Liberty & Britam Holdings came in 3rd and 4th Position, respectively, with weaker franchise scores, as a result of lower returns on assets and equity for (Britam Holdings) and high loss and expense ratios for (Liberty), and,

- CIC came in 5th Position on the back of weak franchise rankings scores.

For the H1’2019 Insurance Report, please download it here

Section IV: Conclusion & Outlook of the Insurance Sector

The sector continues to undergo transition mainly on the digital transformation and regulation front, which is critical for stability and sustainability of a conducive business environment for one of the key sectors of Kenya’s economy. We are of the view that insurance companies have a lot they can do in order to register considerable growth and improve the level of penetration in the country to the 2018 continental average of 3.5%, namely:

- We expect the synergy between banks and insurance companies to offer Bancassurance to continue, with penetration levels in insurance companies still low. Insurance companies will still want to leverage on the penetration of bank products to also push insurance products. Integration of mobile money payments to allow for policy payments is also expected to continue because of convenience which it provides and also mobile phone penetration in the country is high therefore insurance companies will want to leverage this to improve penetration,

- Technology and innovation capabilities are set to continue being the key anchors of growth for Sub-Saharan Africa in the coming years and thus it would be a great move for the sector to continue adopting mobile and online underwriting platforms enhancing convenience to customers in taking insurance policies thus raising the uptake of insurance products, and,

- We also expect that there will be increased regulation in the sector, as well as increased consolidation to reduce duplication of products by insurance companies. These efforts will improve revenue channels for insurance firms and uptake of insurance products to enhance the sustainability of profitability.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.