Kenya's FY'2022-2023 Budget Review, & Cytonn Weekly #16.2022

By Research Team, Apr 24, 2022

Executive Summary

Fixed Income

During the week, T-bills subscription improved but still remained undersubscribed with the overall subscription rate coming in at 98.9%, up from the 48.6% recorded last week. The undersubscription was partly attributable to the concurrent bond issue, which recorded an oversubscription of 108.5%. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 8.2 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 204.5%, an increase from the 120.0% recorded the previous week. The subscription rate for the 182-day and 364-day papers increased to 90.2% and 65.4%, respectively, from 26.0% and 42.5%, recorded the previous week. The yields on the government papers were on an upward trajectory with yields on the 91-day, 182-day and 364-day papers increasing by 2.4 bps, 5.8 bps and 1.0 bps, to 7.4%, 8.4% and 9.8%, respectively. In the Primary Bond Market, the government released the auction results for the recently issued fifteen-year treasury bond, FXD1/2022/15, which recorded an oversubscription of 108.5%, receiving bids worth Kshs 32.5 bn out of the Kshs 30.0 bn on offer. The weighted average Interest rate of the accepted bids and the bond’s coupon was 13.9%.

We are projecting the y/y inflation rate for April 2022 to fall within the range of 5.8% - 6.2%, compared to the 5.6% recorded in March 2022, mainly driven by increasing fuel and food prices;

Equities

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 2.1%, 1.0% and 1.7%, respectively, taking their YTD performance to losses of 7.3%, 3.2% and 6.1% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by losses recorded by large cap stocks such as Safaricom of 3.1%, EABL and NCBA Group which both declined by 2.4% while Co-operative bank and KCB Group declined by 1.6% and 1.0%, respectively. The losses were however mitigated by gains recorded by other large cap stocks such as ABSA Bank Kenya of 1.6%;

Real Estate

During the week, the Ministry of Transport, Infrastructure, Housing, Urban Development and Public Works revealed plans to spend Kshs 151.0 mn in rehabilitation of four county airstrips according to the FY’2022/23 Budget Estimates. In statutory reviews, the Landlord and Tenant Bill of 2021 was tabled to the Senate for consideration having been passed by the National Assembly. In Listed Real Estate, the ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.3 per share. This represented a 4.5% and 1.6% Week-to-Date (WTD) and Year-to-Date (YTD) decline respectively, from Kshs 6.6 per share and Kshs 6.4 per share, respectively;

Focus of the Week

Following the release of the Kenya’s FY’2022/2023 National Budget, this week we analyze the fiscal components of the budget including revenue expectation, expenditure and public debt. We shall also look at the key tax changes and the expected impacts of the proposed Finance Bill.

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.57%. To invest, dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.00% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809#;

- Stellah Swakei, an Investments and Research Analyst, moderated a panel on Twitter Spaces to discuss ‘The Banking Sector Performance FY’202’1. The panel included Willis Nalwenge, the Lead Analyst at Kingdom Securities Ltd, and, Kevin Karobia, an Alternative Investment Analyst at Cytonn Investments. Listen to the conversation here,

- We continue to offer Wealth Management Training every Thursday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert through assignment of debt are welcome to consider one of the five projects currently available for assignment, click here for the latest term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills subscription improved but still remained undersubscribed with the overall subscription rate coming in at 98.9%, up from the 48.6% recorded last week. The undersubscription was partly attributable to the concurrent bond issue, which recorded an oversubscription of 108.5%. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 8.2 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 204.5%, an increase from the 120.0% recorded the previous week. The subscription rate for the 182-day and 364-day papers increased to 90.2% and 65.4%, respectively, from 26.0% and 42.5%, recorded the previous week. The yields on the government papers were on an upward trajectory with yields on the 91-day, 182-day and 364-day papers increasing by 2.4 bps, 5.8 bps and 1.0 bps, to 7.4%, 8.4% and 9.8%, respectively. The government accepted all the Kshs 23.7 bn worth of bids received, translating to an acceptance rate of 100.0%.

In the Primary Bond Market, the government released the auction results for the recently issued fifteen-year treasury bond, FXD1/2022/15, which recorded an oversubscription of 108.5%, partly attributable to the ample liquidity in the money markets, with the average interbank rate remaining relatively unchanged at 4.4% during the period of offer. The government sought to raise Kshs 30.0 bn for budgetary support, received bids worth Kshs 32.5 bn and accepted bids worth Kshs 27.6 bn, translating to an 84.9% acceptance rate. The bond had a coupon rate and a market weighted average rate of 13.9%.

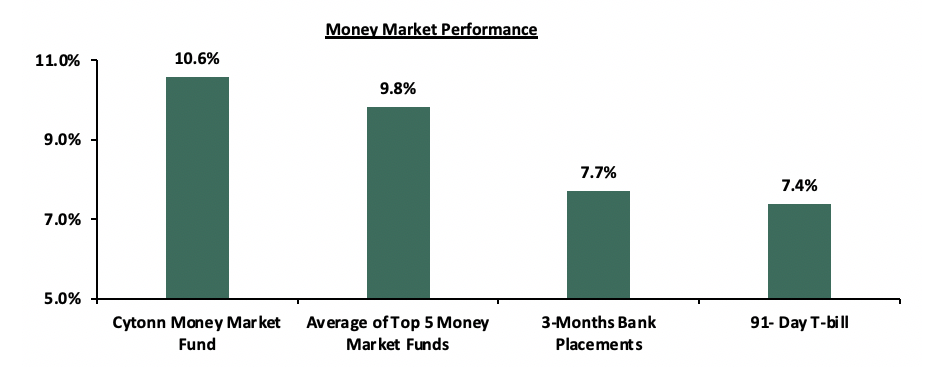

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 2.4 bps to 7.4%. The yield on the Cytonn Money Market Fund and average yield of the Top 5 Money Market Funds remained relatively unchanged at 10.6% and 9.8%, respectively, as recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 22nd April 2022:

|

Money Market Fund Yield for Fund Managers as published on 22nd April 2022 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.6% |

|

2 |

Zimele Money Market Fund |

9.9% |

|

3 |

Nabo Africa Money Market Fund |

9.8% |

|

4 |

Sanlam Money Market Fund |

9.4% |

|

5 |

Madison Money Market Fund |

9.3% |

|

6 |

Dry Associates Money Market Fund |

9.2% |

|

7 |

Apollo Money Market Fund |

9.2% |

|

8 |

CIC Money Market Fund |

9.0% |

|

9 |

Co-op Money Market Fund |

8.6% |

|

10 |

NCBA Money Market Fund |

8.4% |

|

11 |

ICEA Lion Money Market Fund |

8.4% |

|

12 |

Orient Kasha Money Market Fund |

8.4% |

|

13 |

GenCap Hela Imara Money Market Fund |

8.2% |

|

14 |

AA Kenya Shillings Fund |

7.9% |

|

15 |

Old Mutual Money Market Fund |

7.5% |

|

16 |

British-American Money Market Fund |

7.2% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets tightened, with the average interbank rate increasing to 4.6%, from 4.5%, recorded the previous week, partly attributable to tax remittances which offset government payments. The average interbank volumes traded increased by 80.8% to Kshs 26.2 bn, from Kshs 14.5 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Kenyan Eurobonds were on an upward trajectory, partly attributable to investors attaching higher risk premium on the country due to increasing inflationary pressures, local currency depreciation and risks abound the August 2022 elections. Yields on the 10-year bond issued in 2014, 10-year bond issued in 2018 and 12-year bond issued in 2019 all increased by 0.4% points to 7.6%, 9.1% and 9.6%, respectively. Similarly, yields on the 30-year bond issued in 2018 and 7-year bond issued in 2019 both increased by 0.3% points to 10.3% and 9.2% respectively, while yields on the 12-year bond issued in 2014 increased by 0.2% points to 9.3%. Below is a summary of the performance:

|

Kenya Eurobond Performance |

||||||

|

2014 |

2018 |

2019 |

2021 |

|||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

3-Jan-22 |

4.4% |

8.1% |

8.1% |

5.6% |

6.7% |

6.6% |

|

1-Apr-22 |

6.7% |

8.1% |

9.4% |

8.1% |

8.5% |

8.3% |

|

13-Apr-22 |

7.2% |

8.7% |

10.0% |

8.9% |

9.2% |

9.1% |

|

19-Apr-22 |

7.2% |

8.9% |

10.1% |

9.3% |

9.5% |

9.4% |

|

20-Apr-22 |

7.2% |

8.9% |

10.2% |

9.3% |

9.4% |

9.4% |

|

21-Apr-22 |

7.6% |

9.1% |

10.3% |

9.2% |

9.6% |

9.3% |

|

Weekly Change |

0.4% |

0.4% |

0.3% |

0.3% |

0.4% |

0.2% |

|

MTD Change |

0.9% |

1.0% |

0.9% |

1.1% |

1.1% |

1.0% |

|

YTD Change |

3.2% |

1.0% |

2.2% |

3.6% |

2.9% |

2.7% |

Source: CBK

Kenya Shilling:

During the week, the Kenyan shilling depreciated marginally by 0.1% against the US dollar, to close the week at Kshs 115.6, from Kshs 115.4 recorded the previous week, partly attributable to increased dollar demand from the oil and energy sectors. Key to note, this is the lowest the Kenyan shilling has ever depreciated against the dollar. On a year to date basis, the shilling has depreciated by 2.2% against the dollar, in comparison to the 3.6% depreciation recorded in 2021. We expect the shilling to remain under pressure in 2022 as a result of:

- Rising global crude oil prices on the back of supply constraints and geopolitical pressures at a time when demand is picking up with the easing of COVID-19 restrictions and as economies reopen. Key to note, risks abound the recovery following the emergence of the new COVID-19 variants,

- Increased demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally,

- An ever-present current account deficit due to an imbalance between imports and exports, with Kenya’s current account deficit estimated to come in at 5.6% of GDP in the 12 months to February 2022 compared to the 4.3% for a similar period in 2021. The wider deficit reflects a higher import bill, particularly for oil, which more than offset increased receipts from agricultural and services exports, and remittances, and,

- The aggressively growing government debt, with Kenya’s public debt having increased at a 10-year CAGR of 18.4% to Kshs 8.0 tn in December 2021, from Kshs 1.5 tn in December 2011 thus putting pressure on forex reserves to service some of the public debt.

The shilling is however expected to be supported by:

- High Forex reserves currently at USD 8.5 bn (equivalent to 5.0-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. In addition, the reserves were boosted by the USD 750.0 mn World Bank loan facility received in March 2022, and,

- Improving diaspora remittances evidenced by a 25.0% y/y increase to USD 363.6 mn as of March 2022, from USD 290.8 mn recorded over the same period in 2021, which has continued to cushion the shilling against further depreciation.

Weekly Highlight:

April 2022 inflation projections

We are projecting the y/y inflation rate for April 2022 to fall within the range of 5.8%-6.2%. The key drivers include:

- Increasing fuel prices - Fuel prices for the period 15th April 2022 to 14th May 2022 increased by 7.3% to Kshs 144.6 per litre for Super Petrol, 8.6% to Kshs 125.5 per litre for Diesel and 9.6% to Kshs 113.4 per litre for Kerosene. With fuel being a major contributor to Kenya's headline inflation, we expect the increasing fuel prices to continue to exerting upward pressure on the inflation basket,

- Increasing food prices - This was evidenced by the 9.9% y/y increase in the prices food & non-alcoholic beverages as of March 2022 due to increased costs of production. Food prices increased by 1.5% m/m from February 2022 mainly due to increases in the prices of cooking oil (salad), wheat flour and kale among other food items. Further, adverse weather conditions in most parts of the country have pushed the food prices upwards, and,

- The price of electricity which reduced by 15.7% in January 2022 marking the first phase of compliance with President Uhuru Kenyatta’s directive to cut the cost of electricity by 30.0% in order to reduce the cost of living. The reduction in electricity costs helped prices of goods remain stable during the month of March 2022 due to lower production costs. Additionally, the further 15.0% reduction in the cost of electricity is expected to be implemented once negotiations with Independent Power Producers (IPPs) are completed coupled with the Energy and Petroleum Regulatory Authority maintaining the Fuel Cost Charge at Kshs 4.3 per kilowatt hour from January 2022 will help mute energy inflationary pressures going forward.

Going forward, we expect the inflation rate to remain within the government’s set range of 2.5% - 7.5%. However, concerns remain high on the inflated import bill and widening trade deficit as global fuel prices continue to rise due to supply bottlenecks worsened by the geopolitical tensions arising from the Russia-Ukraine invasion. We expect increased inflationary pressure mainly due to the rising global fuel prices which are likely to deplete the fuel subsidy program currently in place. Further, the lower-than-expected rainfall being witnessed in majority of the country is expected to continue driving food prices upwards which will in turn continue to exert upward pressure on the inflation basket.

Rates in the Fixed Income market have remained stable due to the relatively ample liquidity in the money market. The government is 8.2% ahead of its prorated borrowing target of Kshs 547.1 bn having borrowed Kshs 591.8 bn of the Kshs 661.6 bn borrowing target for the FY’2021/2022. We expect a gradual economic recovery as evidenced by the revenue collections of Kshs 1.2 tn during the first eight months of the current fiscal year, which was equivalent to 100.8% of the prorated revenue collection target. However, despite the projected high budget deficit of 11.4% and the recent affirmation of the `B+’ rating with negative outlook by Fitch Ratings, we believe that the support from the IMF and World Bank will help the interest rate environment remain stable since the government is not desperate for cash. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Markets Performance

During the week, the equities market was on a downward trajectory, with NASI, NSE 20 and NSE 25 declining by 2.1%, 1.0% and 1.7%, respectively, taking their YTD performance to losses of 7.3%, 3.2% and 6.1% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was driven by losses recorded by large cap stocks such as Safaricom of 3.1%, EABL and NCBA Group which both declined by 2.4% while Co-operative bank and KCB Group declined by 1.6% and 1.0%, respectively. The losses were however mitigated by gains recorded by other large cap stocks such as ABSA Bank Kenya of 1.6%.

During the week, equities turnover increased by 44.8% to USD 16.8 mn, from USD 11.6 mn recorded the previous week, taking the YTD turnover to USD 286.2 mn. Foreign investors remained net sellers, with a net selling position of USD 6.5 mn, from a net selling position of USD 5.0 mn recorded the previous week, taking the YTD net selling position to USD 28.9 mn.

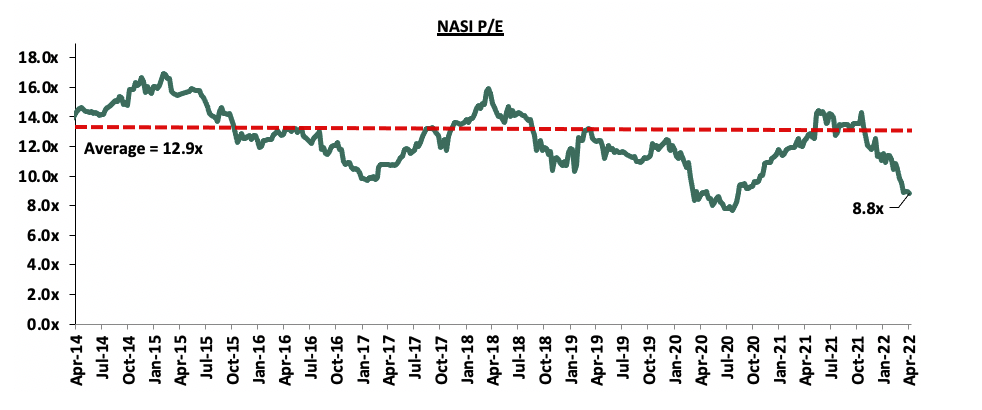

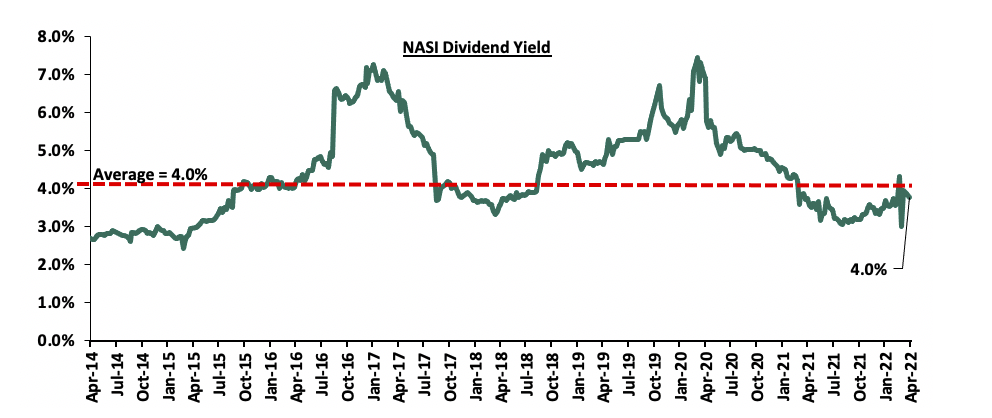

The market is currently trading at a price to earnings ratio (P/E) of 8.8x, 31.6% below the historical average of 12.9x, and a dividend yield of 4.0%, at par with the historical average of 4.0%. Key to note, NASI’s PEG ratio currently stands at 1.1x, an indication that the market is trading at a premium to its future earnings growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The current P/E valuation of 8.8x is 14.3% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market:

Cytonn Coverage:

|

Company |

Price as at 14/04/2022 |

Price as at 22/04/2022 |

w/w change |

YTD Change |

Year Open 2022 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

2.2 |

2.1 |

(2.7%) |

(7.0%) |

2.3 |

3.2 |

4.7% |

53.9% |

0.2x |

Buy |

|

Jubilee Holdings |

267.8 |

268.3 |

0.2% |

(15.3%) |

316.8 |

381.7 |

5.2% |

47.5% |

0.5x |

Buy |

|

Liberty Holdings |

5.9 |

5.5 |

(7.7%) |

(22.4%) |

7.1 |

7.7 |

0.0% |

39.8% |

0.4x |

Buy |

|

I&M Group*** |

20.4 |

20.0 |

(2.0%) |

(6.5%) |

21.4 |

25.4 |

7.5% |

34.4% |

0.6x |

Buy |

|

KCB Group*** |

43.5 |

43.0 |

(1.0%) |

(5.6%) |

45.6 |

50.5 |

7.0% |

24.4% |

0.9x |

Buy |

|

Co-op Bank*** |

12.9 |

12.7 |

(1.6%) |

(2.7%) |

13.0 |

14.6 |

7.9% |

23.2% |

1.0x |

Buy |

|

Diamond Trust Bank*** |

57.0 |

57.0 |

0.0% |

(4.2%) |

59.5 |

65.6 |

5.3% |

20.3% |

0.2x |

Buy |

|

NCBA*** |

26.9 |

26.2 |

(2.4%) |

2.9% |

25.5 |

28.2 |

11.5% |

19.0% |

0.6x |

Accumulate |

|

Equity Group*** |

50.0 |

49.8 |

(0.5%) |

(5.7%) |

52.8 |

56.2 |

6.0% |

18.9% |

1.3x |

Accumulate |

|

Britam |

6.6 |

6.8 |

2.1% |

(10.6%) |

7.6 |

7.9 |

0.0% |

16.5% |

1.1x |

Accumulate |

|

Stanbic Holdings |

104.3 |

100.0 |

(4.1%) |

14.9% |

87.0 |

107.2 |

9.0% |

16.2% |

0.9x |

Accumulate |

|

ABSA Bank*** |

12.4 |

12.6 |

1.6% |

7.2% |

11.8 |

13.4 |

8.7% |

15.2% |

1.3x |

Accumulate |

|

Sanlam |

11.0 |

10.8 |

(2.3%) |

(6.9%) |

11.6 |

12.1 |

0.0% |

12.2% |

1.1x |

Accumulate |

|

Standard Chartered*** |

144.3 |

145.0 |

0.5% |

11.5% |

130.0 |

147.1 |

9.7% |

11.1% |

1.1x |

Accumulate |

|

CIC Group |

2.1 |

2.1 |

0.5% |

(4.1%) |

2.2 |

1.9 |

0.0% |

(9.4%) |

0.7x |

Sell |

|

HF Group |

3.0 |

3.1 |

1.7% |

(19.7%) |

3.8 |

2.5 |

0.0% |

(19.0%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.1x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the discovery of new COVID-19 variants, the upcoming Kenyan general elections and the slow vaccine rollout to continue weighing down the economic outlook. On the upside, we believe that the relaxation of COVID-19 containment measures in the country will lead to improved investor sentiments.

I. Infrastructure

Recently, the State Department of Transport, revealed plans to spend Kshs 151.0 mn in rehabilitation of four county airstrips according to the FY’2022/23 Budget Estimates. The four airstrip rips include Suneka in Kisii County, Sagana in Nyeri County, Sironga in Nyamira County and Gombe Airstrip in Siaya County. The upgrades are aimed at accommodating larger aircrafts due to local airlines expanding to new routes as demand for air travel picks following the easing of COVID-19 restrictions thus boosting tourism. Tourism performance registered improvement in 2021 with inbound tourism earnings having grown to Kshs 146.5 bn from Kshs 88.6 bn in 2020, which represents a 65.4% growth and we expect more improvement in 2022.

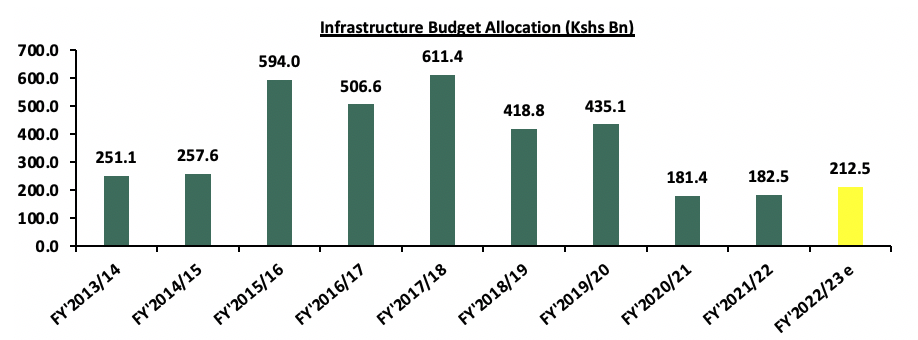

According to the proposed FY’2022/23 Budget Estimates, the State Department of Transport was allocated Kshs 1.4 bn in FY’2022/23 from Kshs 1.0 bn in FY’2021/22 , representing a 37.4% increase. The allocation to support rehabilitation of airstrips and expansion of airports came in Kshs 879.8 mn for FY’2022/21 from Kshs 447.4 mn in FY’2021/22. Infrastructure, was allocated Kshs 212.5 bn in the FY’2022/23 to support construction of roads and bridges as well as the rehabilitation and maintenance of roads, which is a 4.9% increase from Kshs 202.5 bn allocated in FY’2021/22. The graph below shows the budget allocation to the transport sector over last five financial years;

Source: National Treasury of Kenya

Transport and infrastructure development have proven to be a top priority for the Government of Kenya evidenced by the numerous ongoing and completed projects in the country such as; i) roads like the Nairobi Expressway and Western Bypass project, ii) Nairobi Commuter Rail project, and, iii) rehabilitation of airstrips, among others. We therefore expect a similar trend to continue being witnessed in the sector as a result of government’s aggressiveness to implement projects through various strategies including; i) issuing of infrastructure bonds to raise funds for construction, ii) initiating project partnerships such as Public Private Partnerships, and, iii) giving infrastructure priority in the FY’2022/23 budget allocations.

II.Statutory Reviews

During the week, the Landlord and Tenant Bill of 2021 was tabled to the Senate for consideration having been passed by the National Assembly. The Bill aims to consolidate the laws relating to renting of business and residential premises, regulating the relationship between the landlord and tenant in order to promote stability in the rental sector, and, establish tribunals to provide for the adjudication of disputes. Currently, these are captured under;

- The Rent Restriction Act Chapter 296 (RRA),

- The Distress for Rent Act Chapter 293 Laws of Kenya (DRA), and,

- the Landlord and Tenant (Shops, Hotels and Catering Establishments) Act Chapter 301 (LTA).

If the Bill is passed, this will lead to repeal of the above aforementioned Acts. This Bill applies to:

- All residential premises other than;

- excepted residential premises,

- residential premises leased on serviced tenancies i.e. premises let to an employer who provided the premises to an employee in connection with their employment, and,

- residential premises whose monthly rent does not exceed such amounts as prescribed by the Cabinet Secretary. It is expected that the rent limit to which the Bill will apply is likely to be increased from the current KES 2,500 provided under the RRA.

- A tenancy of the business premise which;

- is not reduced in writing, and,

- is reduced in writing is for a period not exceeding five year or contains a provision for termination other than breach of a covenant within five years of the commencement of the tenancy term. These are the tenancies currently known as controlled tenancies under the LTA which is earmarked for repeal should the Bill become law.

The key take-outs from the Bill include;

i. Rent

- The rent payable shall be determined by mutual agreement. Where there is no mutual agreement, a tribunal on application by either party will determine the rent based on comparable premises within the area which shall not be more than two years older than the premises whose rent is under consideration. This is expected to standardize rental rates in areas where speculation could affect occupancy of premises

ii. Rent Records

- A landlord or agent will keep rent records of the premise and share a copy with the tenant. The rent records will contain; a record of all the rent payments, rent payable, particulars of rented premises, and, details of the parties in the tenancy, and,

- If a landlord fails to keep records, they could pay a fine not exceeding one month’s rent of the premise. Even where a tenant dies or walks out on the premises while in rent arrears, a landlord will have to apply to a proposed tribunal to dispose of the belongings of the departed tenant. This will only be approved after an inventory of the items is taken by an officer of the tribunal. Excess proceeds from the sale of the tenant’s belongings can be claimed by the next of kin or an administrator of the deceased estate within six months of the auction.

iii. Procedure for increase and decrease of rent

- An increase in rent must be justifiable on account of either of the following; the landlord incurring a capital expenditure, inflation in the economy, where an additional service is provided to the premises, and, where land rates payable increases or becomes chargeable. For inflation based rent increases, the rate shall be based on the percentage change from year to year the KNBS inflation data for the previous calendar year, averaged over the twelve-month period that ends at the end of December of the previous calendar year,

- The landlord must issue a written notice to the tenant at least 90 days prior on their intention to increase rent. Failure to do so renders the rent increase invalid. Where a tenant does not object to this notice within 30 days after receipt, they are deemed to have accepted the increase. The landlord may increase rent once in 12 months for residential premises and once in 24 months for business premises, since the last day of rent increase or since the premises was first rented to the tenant, and,

- The landlord is also entitled to decrease rent where they are ceasing to offer any of the prescribed services to the tenant. Such a decrease must be proportional to the reduction of services provided.

To avoid issuing notice for rental increase, it may be prudent for the landlord to ensure that there is a rent escalation clause where the tenancy does not terminate. Additionally, it may be necessary to have surviving clauses in the tenancy agreement.

iv. Form of Tenancy Agreement

- The parties are free to adopt any form of tenancy agreement that they agree on as per the terms and conditions that shall be implied in all tenancies. These terms and conditions are listed in the Schedule of the Bill and reflect the ones recorded in the LTA,

- Parties may alter the terms and conditions of the tenancy by issuing a notice to the other party. This notice takes effect in 30 days after the date of issue in case of a residential tenancy, 60 days in case of a business tenancy or on the date specified in the notice, and,

- A landlord will not be able to use the land/premise next to the residential property to put up a business that would mess with the peace of the residents. They will be responsible for repairs electrical wirings, roofs, walls and drains while the tenant is in charge of making repairs internally and any decorations if need be.

v. Termination

- Like the RRA and LTA, the Bill provides that the landlord must give written notice of their intention to terminate to the tenant. This notice must provide the termination date; be signed by the landlord or their agent, and, provide the reasons for termination,

- The notice period in case of business tenancies is at least 24 months whereas it is a minimum of 12 months for residential tenancies. This is a notable departure from the LTA where the notice period is 2 months for business tenancies. The notices for termination must also be filed at the tribunal, and,

- The tenant is also entitled to terminate the tenancy by issuing a notice to the landlord at least 1 month to the end of the term for residential tenancies and at least 2 months to the end of a business tenancy,

- The landlord may terminate the tenancy where they require possession of the premises for occupation by themselves, intend to demolish the premises, convert the user of the property or undertake extensive renovations on the property. In such cases, the landlord issues a notice to the tenant specifying these reasons for termination; at least 60 days after the date of the notice where the landlord intends to occupy the premises, and, at least 120 days where they are carrying out works or changing the user of the property.

vi. Evictions

- The Bill seeks to stop landlords from evicting tenants without the authority of the Tribunal. A landlord who evicts a tenant or subjects them to any annoyance with the hopes of compelling them to pay or vacate the premises commits an offence and is liable to jail term of six months or a fine not exceeding two months’ rent of the premise,

- No landlord can, without legal process, seize the tenant’s property if they are unable to pay rent,

- A landlord can terminate a tenancy without going through the Tribunal if the landlord has given notice of not less than twelve months in case of a residential premise, a tenant sublets the premise without prior written consent from the landlord, a tenant defaults on paying rent for 3 consecutive months, and, the tenancy expires, and,

- Landlords will not be permitted to deprive the tenant of services such as water and electricity if they default on rent. Contravention of this provision will make the landlord liable on conviction to a fine not exceeding Kshs 10,000 or to a term of imprisonment not exceeding 6 months, or to both.

vii. Jurisdiction and Power of the Tribunals

- Presently, the Rent Tribunal and the Business Premises Rent Tribunal have the jurisdiction to decide on disputes surrounding these tenancies. These tribunals were established by the Cabinet Secretary whereas with the new Bill, the tribunals are to be established by the Chief Justice who determines their jurisdiction,

- The members of the tribunal are to be appointed by the Judicial Service Commission. Most notable from the powers listed in Section 5 of the Bill, the tribunals are empowered to grant injunctions, enforce its own orders and punish for contempt as any court of law which is not applicable to the. the current tribunals,

- The tribunals are to determine disputes within three months from the date in which the dispute was lodged. This is set to ease the delays in delivery of justice and decrease case backlog, and,

- Appeals lie at the High Court but only on points of law. This is a departure from the RRA where appeals lie at the Environmental and Land Court (ELC) on any point of law or in case of premises where the standard rent exceeds Kshs 1,000 a month on any point of mixed fact or law. The LTA provides for appeals at the ELC.

viii. Agent

- Where a landlord hires an agent, their duties shall be in writing and also supplied to the tenant failure to which the landlord shall be answerable for that omission

ix. Exclusion of the Act

- Like the LTA, the Bill provides that any agreement relating to a condition in a tenancy is void in so far as it purports to; preclude the operation of the Bill, provide for termination or surrender of the tenancy where the tenant makes an application to the tribunal, provide for the imposition of any penalty or liability on applying to the tribunal, or terminate without issuing notice to either party.

x. Subletting/Assignments

- The Bill grants the tenant the right, with the landlord’s consent which must not be unreasonably withheld, to assign or sublet the premises.

- Where the landlord refuses to consent or is unresponsive to this request within 7 days after receipt, the tenant may issue a termination notice.

Introduction of a consolidated Bill is a welcomed improvement as it promises convenience in the access of the laws relating to tenancies in Kenya. Further, the added powers of the tribunals would encourage ease and efficiency in the access of justice in cases of dispute. However, it is not clear how the tribunals will operate given the numerous rentals all over the country and the ability to sit for hearings. Despite this, we expect the above provision to help in resolving landlord- tenant disputes by protecting both parties.

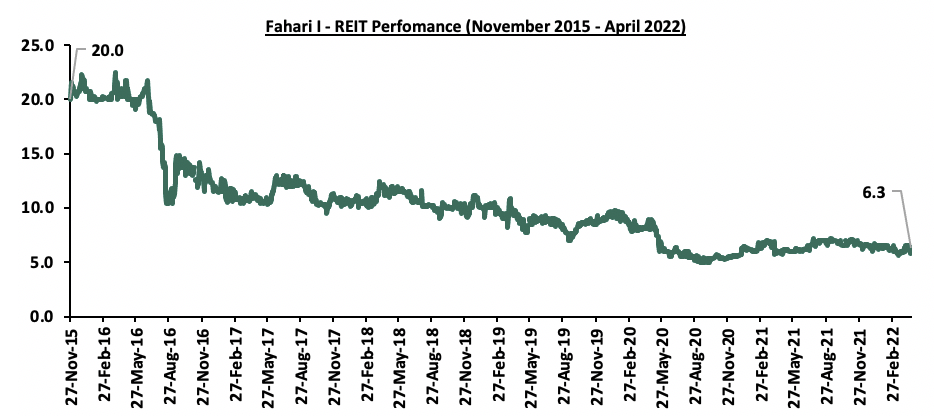

III. Listed Real Estate

During the week, in the Nairobi Stock Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.3 per share. This represented a 4.5% and 1.6% Week-to-Date (WTD) and Year-to-Date (YTD) decline respectively, from Kshs 6.6 per share and Kshs 6.4 per share, respectively. On Inception-to-Date (ITD) basis, the REIT’s performance continues to be weighed down having realized a 68.5% decline from Kshs 20.0. The graph below shows Fahari I-REIT’s performance from November 2015 to April 2022:

We expect the Real Estate sector performance to be supported by focus on infrastructure development, and formulation of comprehensive rules and regulations governing Real Estate transactions. However, negative performance of the REIT market continues to weigh down performance of the sector due to; i) a general lack of knowledge on the financing instrument, ii) general lack of interest of the REIT by investors, and, iii) lengthy approval processes to get all the necessary requirements thus discouraging those interested in investing in it.

On 7th April 2022, the National Treasury presented Kenya’s FY’2022/2023 National Budget, to the National Assembly two months earlier than the usual June date in a bid to provide Parliament with ample time to discuss and approve the Budget, before it winds down ahead of the upcoming August 9th elections. Additionally, the Cabinet Secretary for the National Treasury tabled the Finance Bill 2022 in Parliament for consideration and if the Parliament approves the bill, it will be forwarded for presidential assent, after which the proposals will come into effect. Notably, the total budget estimates for FY’2022/23 will increase by 10.3% to Kshs 3.3 tn from the Kshs 3.0 tn in FY’2021/2022 while the total revenue will increase by 20.0% to Kshs 2.4 tn from the Kshs 2.0 tn in FY’2021/2022. The increase is mainly due to a 25.4% increase in ordinary revenue to Kshs 2.1 tn for FY’2022/2023, from the Kshs 1.8 tn in FY’2021/22.

Kenya’s budget focuses mainly on economic recovery from the effects of the COVID-19 pandemic, increasing revenues and reducing the fiscal deficit to 6.2% of GDP in the FY’2022/23, from the estimated 8.1% of GDP in the FY’2021/2022. As such, this week, we shall discuss the recently released budget and the tabled Finance Bill 2022 with a key focus on Kenya’s fiscal components. We shall do this in four sections, namely:

- FY’2021/2022 Budget Outturn as at February 2022

- Comparison between FY'2021/2022 and FY'2022/2023 Budget estimates,

- Analysis and House-view on Key Aspects of the 2021 Budget,

- Key tax changes in the Finance Bill 2022 and their impact, and,

Section I: FY’2021/2022 Budget Outturn as at February 2022

The National Treasury gazetted the revenue and net expenditures for the first eight months of FY’2021/2022, ending 28th February 2022. Below is a summary of the performance:

|

FY'2021/2022 Budget Outturn - As at 28th February 2022 |

|||||

|

Amounts in Kshs billions unless stated otherwise |

|||||

|

Item |

12-months Original Estimates |

Actual Receipts/Release |

Percentage Achieved |

Prorated Estimates |

% achieved of prorated |

|

Opening Balance |

- |

21.3 |

- |

- |

- |

|

Tax Revenue |

1,707.4 |

1,126.4 |

66.0% |

1,138.3 |

99.0% |

|

Non-Tax Revenue |

68.2 |

45.1 |

66.1% |

45.5 |

99.2% |

|

Total Ordinary Revenues |

1,775.6 |

1,192.8 |

67.2% |

1,183.8 |

100.8% |

|

External Loans & Grants |

379.7 |

50.0 |

13.2% |

253.1 |

19.7% |

|

Domestic Borrowings |

1,008.4 |

631.1 |

62.6% |

672.3 |

93.9% |

|

Other Domestic Financing |

29.3 |

5.5 |

18.8% |

19.5 |

28.2% |

|

Total Financing |

1,417.4 |

686.6 |

48.4% |

944.9 |

72.7% |

|

Recurrent Exchequer issues |

1,106.6 |

709.3 |

64.1% |

737.7 |

96.2% |

|

CFS Exchequer Issues |

1,327.2 |

750.9 |

56.6% |

884.8 |

84.9% |

|

Development Expenditure and Net Lending |

389.2 |

191.8 |

49.3% |

259.5 |

73.9% |

|

County Governments and Contingencies |

370.0 |

193.7 |

52.3% |

246.7 |

78.5% |

|

Total Expenditure |

3,193.0 |

1,845.7 |

57.8% |

2,128.7 |

86.7% |

|

Fiscal Deficit excluding Grants |

(1,417.4) |

(652.9) |

46.1% |

(944.9) |

69.1% |

|

*Fiscal Deficit as a % of GDP |

8.1% |

5.3% |

|

|

|

|

Total Borrowing |

1,388.1 |

681.1 |

49.1% |

925.4 |

73.6% |

|

*Projected Fiscal Deficit as a % of GDP |

|||||

The key take-outs from the report include:

- Total ordinary revenues collected as at the end of February 2022 amounted to Kshs 1,192.8 bn, equivalent to 67.2% of the original estimates of Kshs 1,775.6 bn and is 100.8% of the prorated estimates of Kshs 1,183.8 bn. Notably, the performance is a decline from the 103.8% outperformance recorded in the first seven months to January 2021, mainly attributable to a 26.9% decline in the monthly revenue collection to Kshs 117.6 bn in February 2022, as compared to a monthly average of Kshs 160.9 bn in the first seven months to January 2021. Cumulatively, tax revenues amounted to Kshs 1,126.4 bn, equivalent to 66.0% of the original estimates of Kshs 1,707.4 bn and 99.0% of the prorated estimates of Kshs 1,138.3 bn,

- Total financing amounted to Kshs 686.6 bn, equivalent to 48.4% of the original estimates of Kshs 1,417.4 bn and is equivalent to 72.7% of the prorated estimates of Kshs 944.9 bn. Additionally, domestic borrowing amounted to Kshs 631.1 bn, equivalent to 62.6% of the original estimates of Kshs 1,008.4 bn and is 93.9% of the prorated estimates of Kshs 672.3 bn,

- The total expenditure amounted to Kshs 1,845.7 bn, equivalent to 56.5% of the original estimates of Kshs 3,193.0 bn, and is 84.7% of the prorated expenditure estimates of Kshs 2,128.7 bn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 709.3 bn, equivalent to 64.1% of the original estimates and 96.2% of the prorated estimates of Kshs 737.7 bn, and development expenditure amounted to Kshs 191.8 bn, equivalent to 49.3% of the original estimates of Kshs 389.2 bn and is 73.9% of the prorated estimates of Kshs 259.5 bn,

- Consolidated Fund Services (CFS) Exchequer issues lagged behind their targets of Kshs 1,327.2 bn after amounting to Kshs 750.9 bn, equivalent to 56.6% of the original estimates, and are 84.9% of the prorated amount of Kshs 884.8 bn. The cumulative public debt servicing cost amounted to Kshs 667.2 bn which is 57.1% of the original estimates of Kshs 1,169.2 bn, and is 85.6% of the prorated estimates of Kshs 779.4 bn, and,

- Total Borrowings as at the end of February 2022 amounted to Kshs 681.1 bn, equivalent to 49.1% of the original estimates of Kshs 1,388.1 bn and are 73.6% of the prorated estimates of Kshs 925.4 bn. The cumulative domestic borrowing target of Kshs 1.0 tn comprises of adjusted Net domestic borrowings of Kshs 661.6 bn and Internal Debt Redemptions (Roll-overs) of Kshs 346.8 bn.

The revenue performance in the first eight months of the current fiscal year point towards continued economic recovery following the ease of COVID-19 containment measures and the effectiveness of the KRA in revenue collection. We believe that the current measures such as the implementation of the Finance Act 2021 which led to the upward readjustment of the Excise Duty Tax, Income Tax as well as the Value Added Tax will continue playing a big role in expanding the tax base and consequently enhance revenue collection. We expect the government to ramp up its revenue collection initiatives in the remaining months of the current fiscal year as well as look increasingly to the domestic market to plug in the deficit. The emergence of new COVID-19 variants both locally and with trading partners globally continues to pose risks to the economic recovery, should they necessitate imposition of tighter containment measures.

Section II: Comparison between FY’2021/2022 and FY’2022/2023 Budgets estimates

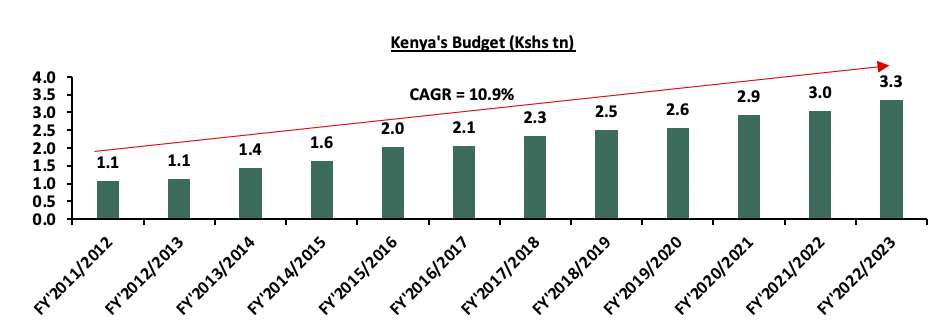

The Kenyan Government budget has been on the rise over the years on the back of increasing recurrent and development expenditure. The chart below shows the evolution of the government budget over an eleven-year period:

For the FY’2022/2023, the budget increased by 10.3% to Kshs 3.3 tn, from Kshs 3.0 tn in FY’2021/22. The expenditure will be funded by revenue collections of Kshs 2.4 tn and borrowings amounting to Kshs 862.4 bn.

The table below summarizes the key buckets and the projected changes:

|

Item |

FY'2021/22 Budget Estimates |

FY'2022/23 Budget Estimates |

Change y/y (%) |

|

Total revenue |

2,038.7 |

2,447.0 |

20.0% |

|

Total grants |

62.0 |

33.3 |

(46.3%) |

|

Total revenue & grants |

2,100.7 |

2,480.3 |

18.1% |

|

Recurrent expenditure |

1,286.6 |

1,387.9 |

7.9% |

|

Development expenditure & Net Lending |

655.4 |

711.5 |

8.6% |

|

County Transfer & Contingencies |

370.0 |

374.0 |

1.1% |

|

CFS Exchequer Issues |

718.3 |

869.3 |

21.0% |

|

Total expenditure |

3,030.3 |

3,342.7 |

10.3% |

|

Fiscal deficit inclusive of grants |

(929.7) |

(862.4) |

(4.2%) |

|

Projected Deficit as % of GDP |

8.1% |

6.2% |

(1.9%) pts |

|

Net foreign borrowing |

271.2 |

280.7 |

3.5% |

|

Net domestic borrowing |

658.5 |

581.7 |

(11.7%) |

|

Total borrowing |

929.7 |

862.4 |

(7.2%) |

|

Source: Financial Statements for the fiscal year 2021/2022 , Budget Mwananchi Guide– National Treasury of Kenya |

|||

Some of the key take-outs include;

- The government projects total revenue for FY’2022/23 to increase by 20.0% to Kshs 2.4 tn (equivalent to 17.5% of GDP), from the Kshs 2.0 tn (equivalent to 16.3% of GDP) FY’2021/2022 estimates. The increase is mainly due to a 25.4% increase in ordinary revenue to Kshs 2.1 tn (equivalent to 15.3% of GDP), from the Kshs 1.8 tn (equivalent to 14.4% of GDP) target in FY’2021/22,

- Total expenditure is set to increase by 10.3% to Kshs 3.3 tn (equivalent to 23.9% of GDP), from Kshs 3.0 tn (equivalent to 24.0% of GDP) in the FY’2021/22 Budget estimates,

- Recurrent expenditure is set to increase by 7.9% to Kshs 1.4 tn in FY’2022/23, from Kshs 1.3 tn in the FY’2021/22 budget estimates, while Consolidated Funds Services (CFS) expenditure is expected to increase by 21.0% to Kshs 869.3 bn, from Kshs 718.3 bn in the FY’2021/2022 budget estimates. Development expenditure increased by 8.6% to Kshs 711.5 bn from Kshs 655.4 bn in the FY’2021/2022 budget estimates,

- Public debt is expected to continue growing in FY’2022/23, as the approximate Kshs 862.4 bn fiscal deficit will be financed through domestic debt totaling Kshs 581.7 bn and foreign debts totaling Kshs 280.7 bn. However, total borrowing is expected to reduce by 7.2% to Kshs 862.4 bn in the FY’2022/23 from Kshs 929.7 bn as per the FY’2021/22 budget, in a bid to reduce Kenya’s public debt burden which was estimated to stand at 66.2% of GDP as of December 2021, surpassing the 50.0% recommended threshold by 16.2% points, and,

- The budget deficit is projected to decline to 6.2% of GDP from the projected 8.1% of GDP in the FY’2021/22 budget, mainly as growth in revenues outpace growth in expenditure.

Section III: Analysis and House-view on Key Aspects of the FY’2022/2023 Budget

Below we give our analysis and view on various aspects of the FY’2022/2023 Budget Estimates:

a. Revenue

Revenue is projected to increase by 20.0% to Kshs 2.4 tn in FY’2022/23, from Kshs 2.0 tn in the FY’2021/22 budget attributable to the continued economic recovery and the easing of COVID-19 containment measures following an increase in vaccination rates and reduced infections. The increased revenue projections in the FY’2022/23 are mainly attributable to the projected 25.4% growth in ordinary revenue to Kshs 2.1 tn in FY’2022/23, from Kshs 1.8 tn in the FY’2021/22 budget. The main sources of revenue will be:

- Income Tax which remains the highest contributor to government revenue, contributing 40.8% of the total revenue projections of Kshs 2.4 tn, is expected to increase by 19.5% to Kshs 997.3 bn in FY’2022/2023, from Kshs 834.5 bn in FY’2021/2022,

- Value Added Tax (VAT) contributing 23.9% of the projected revenue collections is projected to increase by 23.6% to Kshs 584.7 bn in FY’2022/23 budget, from Kshs 472.9 bn in the FY’2021/22 budget, and,

- Excise Duty contributing 12.1% to the projected revenues for the FY’2022/2023 is expected to increase by 23.3% to Kshs 297.2 bn, from Kshs 241.0 bn in FY’2021/2022 budget estimates.

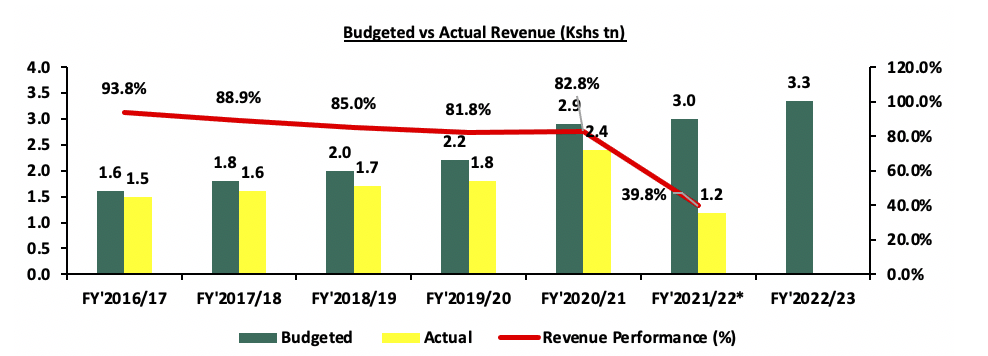

The government relies on the effectiveness of the Kenya Revenue Authority in collecting taxes as well as increase in some of the existing taxes to meet its revenue target. Historically, the government has struggled to meet its target revenue collections resulting to an ever-present fiscal deficit. As such, there are still concerns about the government's ability to meet its revenue collection targets in FY’2022/2023, in light of the already high cost of living. The chart below shows the revenue performance in the previous fiscal years:

Source: National Treasury of Kenya

*Total Revenue collection as of 28th February 2022

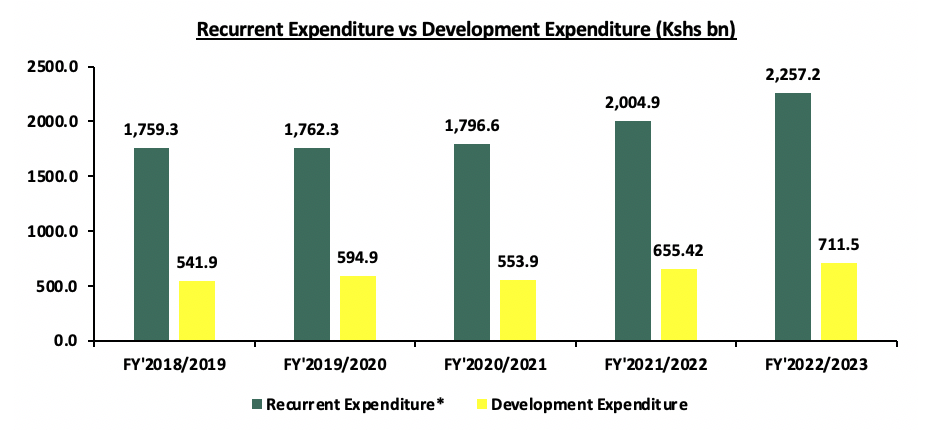

b. Expenditure

Expenditure is expected to increase by 10.3% to Kshs 3.3 tn, from Kshs 3.0 tn in the FY’2021/22 budget with recurrent expenditure taking up 67.5% of the total expenditure for FY’2022/2023, in comparison to the 66.2% in FY’2021/2022. The chart below shows the comparison between the recurrent expenditure allocations and development expenditure allocations over the past five fiscal years:

*Recurrent Expenditure includes the Consolidated Fund Services (CFS) Expenditure

Some of the key take-outs include;

- Recurrent expenditure takes the largest chunk of expenditure over the last five fiscal years growing at a 5-year CAGR of 5.1% to Kshs 2.3 tn in FY’2022/2023, from Kshs 1.8 bn in FY’2018/2019. For the FY’2022/2023, the recurrent expenditure increased by 12.6% to Kshs 2.3 tn, from Kshs 2.0 tn in FY’2022/2023 mainly due to a 21.0% increase in Consolidated Fund Services (CFS) expenditure to Kshs 869.3 bn from Kshs 718.3 bn in FY’2022/2023. The increase can be mainly attributed to the increased debt servicing cost which represented 88.1% of the CFS FY’2021/2022 budgetary allocation as of December 2021. We expect the debt servicing cost to continue increasing as the Kenyan shilling depreciates against the dollar, given that 67.0% of the country’s external debt is denominated in US Dollars, and,

- Development expenditure on the other hand continues to lag behind contributing only 21.3% of the FY’2022/2023 expenditure estimates. Allocation to infrastructure remains the highest taking 58.5% of the development expenditure. In the FY’2022/2023, infrastructure expenditure is set to increase by 8.6% to Kshs 416.4 bn, from Kshs 383.3 bn in FY’2021/2022 in line with the government’s agenda of increasing the development of critical infrastructure in the road, rail, energy, and water sectors in a bid to facilitate the movement of people and goods, lower the cost of doing business, improve access to social amenities, and increase Kenya's competitiveness. The table below shows the sectors with the highest expenditure allocation over the last five fiscal years:

|

Item |

FY'2018/2019 |

FY'2019/2020 |

FY'2020/2021 |

FY'2021/2022 |

FY'2022/2023 |

y/y Change |

5-Year CAGR |

|

Interest Payments, pensions & Net Lending |

493.0 |

553.3 |

586.5 |

718.3 |

869.3 |

21.0% |

12.0% |

|

Education |

444.1 |

494.8 |

505.1 |

503.9 |

544.4 |

8.0% |

4.2% |

|

Infrastructure |

418.8 |

435.1 |

363.3 |

383.3 |

416.4 |

8.6% |

(0.1%) |

|

County shareable Revenue |

314.0 |

310.0 |

316.5 |

370.0 |

370.0 |

0.0% |

3.3% |

|

Public Admin & Int. Relations |

270.1 |

298.9 |

289.3 |

299.7 |

342.2 |

14.2% |

4.8% |

Notably, the allocation to agriculture and food security declined by 9.6% to Kshs 66.8 bn, from Kshs 73.9 bn in the FY’2021/2022. This is despite food security being one of the government’s big four agenda and the erratic weather conditions that have led to an increase in food prices in the country. As such, we expect the prices of food items to continue increasing and consequently lead to an increase in inflation, given that food is a key contributor to the inflation basket.

In our view, the Government should increase its efforts in minimizing the recurrent expenditure growth in order to achieve its fiscal deficit target of 3.6% in FY’2024/25. Key to note, development expenditure accounted for only 20.6% of the total expenditure in comparison to the 67.5% allocation to recurrent expenditure, an indication that we are not investing much for the future. As such, development projects need to be more prioritized and better planning incorporated to match fund availability to project execution, and measures taken to improve the public procurement process.

c. Public Debt

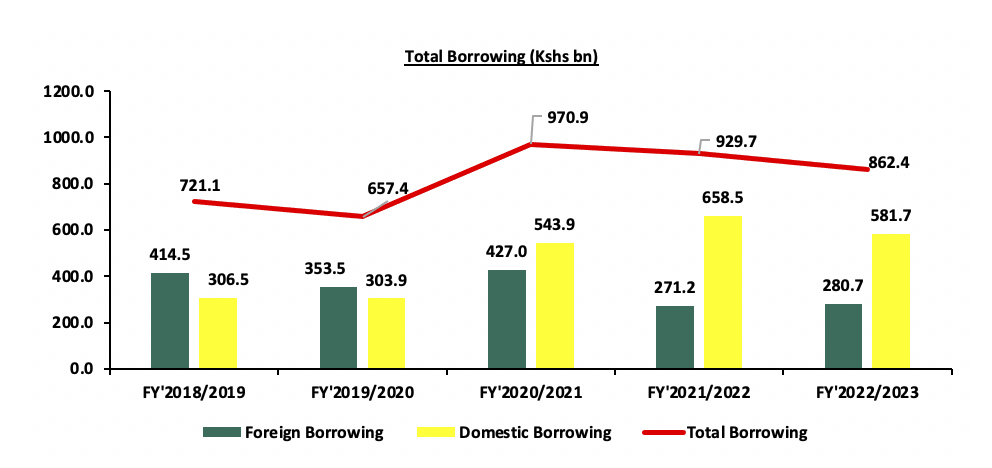

The total public debt requirement for the FY’2022/23 is set to reduce by 7.2% to Kshs 862.4 bn, from Kshs 929.7 bn, in FY’2021/22 budget estimates. The public debt mix is projected to comprise of 32.5% foreign debt and 67.5% domestic debt, from 29.2% foreign financing and 70.8% domestic financing as per the FY’2021/2022 budget. The debt servicing costs are set to rise by 17.7% to Kshs 659.2 bn in FY’2022/23, from Kshs 560.3 bn in the FY’2021/22 budget. The rise in debt servicing expenses may be partly attributable to the depreciation of the Kenyan shilling given that 67.5% of debt was denominated in US dollars as of December 2021. The chart below shows the evolution of public borrowing to fill the fiscal deficit gap over the last five years:

The key take-outs from the chart include:

- The proportion of foreign financing has been declining over time standing at 32.5% in FY’2022/2023 from 57.5% in FY’2018/2019. The decline is expected to reduce Kenya’s exposure to external shocks, as the less we owe in foreign currency, the less exposed we are to any shocks in the foreign markets. However, the increased domestic borrowing by the government may lead to slow growth in the private sector lending as banks prefer lending to the government as opposed to the private sector which is considered riskier, and,

- The total borrowing has been declining in the last two years, reflecting the government’s fiscal consolidation efforts aimed at reducing the fiscal deficit and dependence on debt through rationalization of tax expenditures and ensuring the sustainability and value for money from the available resources.

The main driver of the growing public debt is the fiscal deficit occasioned by the lower revenues as compared to expenditure. As such, implementing robust fiscal consolidation would help the government bridge the deficit gap. This can be achieved by minimizing spending through the implementation of structural reforms and the reduction of amounts extended to recurrent expenditure. Fiscal consolidation would also allow the government to refinance other critical sectors, such as agriculture, resulting in increased revenue. Capital expenditure should also be restricted to projects with a high social impact or a high Economic Rate of Return (ERR), indicating that the economic benefits outweigh the costs. Additionally, we expect that the government will fully explore alternative means of funding the ambitious development agenda such as Private Public Partnerships (PPPs) which do not necessitate the incurring of additional debt.

Section IV: Key Tax changes in the Finance Bill and their impact

The Cabinet Secretary for the National Treasury tabled the Finance Bill 2022 in Parliament for discussion and consideration. The proposed tax measures in the Finance Bill, 2022, are expected to add Kshs 50.4 bn to the exchequer for the fiscal year 2022/23 and if Parliament approves the finance bill, it will be forwarded for presidential assent, after which the proposals will come into effect. Some of the proposals include;

Under the Income Tax Act;

- The Finance Bill 2022 proposes to increase digital service tax (DST) to 3.0% from the current 1.5% of either consideration received in respect of the service provided in the case of a digital service provider or the commission or fee paid for the use of the platform in the case of a digital marketplace provider excluding VAT charged for the service. The bill also proposes to exempt non-resident entities with a permanent establishment in Kenya from DST. Key to note, the global proliferation of digital platforms, products and services, have played a big role in the growth of businesses as such things like advertising costs have declined, making it easier for small businesses to reach their target audiences. Simultaneously, digital services have enabled small, local businesses to achieve a global reach that would previously have required much more expensive advertising options in more competitive national outlets. As much as the increase in DST by the government is impressive, the increase is likely to raise the overall cost of doing business, as large tech companies may raise their ad prices to recoup the cost of these taxes. As such, we expect the increased taxes to be borne by domestic consumers and markets rather than the tech giants targeted as the costs will be passed on to the end users,

- The Finance bill proposes to increase the Capital Gains Tax (CGT) on transfer or sale of property by an individual or company to 15.0% from the current 5.0%. Key to note, the government had proposed to increase capital gains tax to 12.5% in the Finance Bill 2019, but the proposal was rejected by parliament. An increase in CGT rate would be unfavorable for individuals and companies dealing in sale of property and would result in increased dealing and transaction costs. The Bill also proposes to tax gains from financial derivatives for foreigners under the CGT rate of 15.0%. We expect that taxing gains from financial derivatives for foreigners will worsen their uptake, which has been slow since their introduction in 2019, and,

- The Finance Bill 2022 seeks to limit the allowable deductions on investments made outside Nairobi and Mombasa Counties to expenditure on investments in hotel buildings, buildings used for manufacturing and machinery used for manufacturing, from the current 100.0% of start-up expenditure. The incentives were in place to encourage investments outside Nairobi and Mombasa Counties in order to spur economic growth. Rolling back of the incentives is expected to reduce the attractiveness of investments outside the two counties.

Under the Excise Duty Act;

- The Finance Bill proposes to empower the Kenya Revenue Authority’s Commissioner General to exempt specific excisable products from the annual inflation adjustments depending on the economic circumstances in the relevant year. Key to note, KRA had gazetted an inflationary adjustment of 5.0% in November 2021 on specific products in a bid to raise Kshs 3.7 bn in excise duty tax. However, the inflation adjustment was frozen by the High Court of Kenya. We expect that this provision will allow the Commissioner general to exempt critical products like fuel from inflationary adjustment particularly for periods when fuel prices are high, in order to prevent further increase in the cost of living,

- The Finance Bill 2022 seeks to increase excise duty on various goods such as bottled water and non-alcoholic beverages by 9.5% to Kshs 6.6 per litre, from the current Kshs 6.0 per litre. Excise duty on fruit and vegetable juices will increase by 9.3% from Kshs 13.3 per litre from Kshs 12.2 per litre. The bill further proposes to increase excise duty on items such as cosmetic and beauty products, powdered beer and spirits, among others. Should the bill be passed, we expect the contribution of excise duty tax to total tax revenue to increase from the current 13.8% as estimated for the Fiscal Year 2022/2023 in the Budget Statement and consequently aid in narrowing the gap between revenues and expenditure, and,

- The Finance Bill 2022 seeks to add various goods such as hatching eggs imported by licensed hatcheries, neutral spirits imported by registered pharmaceutical manufacturers and locally manufactured passenger motor vehicles to the list of tax exempt items. Currently, hatching eggs contribute 25.0% in excise duty while locally manufactured motor vehicles contribute 20.0% - 35.0% depending on the cc rating. We expect this to have a downward effect on excise duty collected but act as an incentive to local manufacturers of passenger motor vehicles. In general, the move will aid in boosting the manufacturing and health sectors which are part of the big four agenda.

Under the Value Added Tax Act;

- The Finance Bill 2022 proposes to remove maize flour, cassava flour, wheat and meslin flour from the list of tax exempt goods under the Second Schedule to the Value Added Tax (VAT) Act 2013. This would see the named goods subjected to the VAT at a rate of 16.0% and a subsequent increase in food prices. The implication of this increase will be an increase in the already high cost of living with maize flour being a staple meal in Kenyan households. We also expect this changes to exert upward pressure on the inflation basket as food is a headline contributor to Kenya’s inflation.

The proposed tax measures in the Finance Bill 2022 and the FY’2022/2023 budget, are in consistence with the government’s focus on reducing the fiscal deficit from the current 8.1% of GDP to the targeted 6.2% in FY’2022/2023, which is key in the path towards fiscal consolidation. All the taxes that contribute to the ordinary revenues are expected to increase with income tax, the largest contributor increasing by 19.5% to Kshs 997.3 bn, from Kshs 834.5 bn while the Value Added Tax (VAT) is projected to increase by 23.6% to Kshs 584.7 bn in FY’2022/23 budget, from Kshs 472.9 bn in the FY’2021/22 budget. The net import duty is also expected to increase by 21.7% to Kshs 144.9 bn from Kshs 119.0 bn in FY’2021/2022 while the excise duty is expected to increase by 23.3% to Kshs 297.2 bn, from Kshs 241.0 bn. Additionally, the Finance Bill 2022 proposes additional reporting requirements for Multinational Enterprises (MNEs) with operations in Kenya in reporting their activities within Kenya and in other jurisdictions to the Commissioner General, Kenya Revenue Authority (KRA). The proposal follows the ratification and deposit of the Multilateral Convention on Mutual Administrative Assistance in Tax Matters (MAC) with the Global Forum on Transparency and Exchange of Information on Tax Matters in July 2020 and which became effective in November 2020. We expect the exchange of information between participating member countries to result in greater tax transparency among MNEs and consequently effective tax collection. We further expect the increase to significantly contribute to the projected Kshs 50.4 bn in additional tax revenue for the FY’2022/23 and consequently reduce over-reliance on debt financing.

Section IV: Conclusion

Kenya’s GDP is estimated to have grown at a rate of 7.6% in 2021 and is expected to grow at a rate of 6.0% in 2022. The performance is pegged on the global recovery, reduced COVID-19 infections and increased vaccination. With the expected rebound in economic activity, the government projects increased revenue collections, which shall be supported by tax measures aimed at reducing funding from debt. However, the Kenyan budget is expansionary as the government intends on spending more in the coming financial year to accelerate economic recovery and improve the livelihoods of Kenyans. The key concern remains on how the government will be able to meet its revenue collection targets given the already high cost of living, the resurgence of COVID-19 infections in the country’s trading partners and the fact that the budget will be implemented in an electioneering period. Additionally, the country’s borrowing appetite remains elevated with its current public debt burden at 66.2% as of December 2021. As such, we expect the government to perform a balancing act on the expenditure and revenues collected to ensure that we do not rely too much on borrowings to finance our expenditure. The government can also seek alternative ways of funding rather than concentrating solely on domestic borrowing to ensure that it does not crowd out the private sector as banks will prefer lending to the government to minimize their risks of losses.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.