Kisumu Real Estate Investment Opportunity, & Cytonn Weekly #28/2018

By Cytonn Research Team, Jul 22, 2018

Executive Summary

Fixed Income

T-bills were oversubscribed during the week with the overall subscription rate coming in at 207.6%, a decline from 218.9% recorded the previous week. Yields on the 91-day, 182-day and 364-day papers declined by 4.5 bps, 12.8 bps, and 14.3 bps to 7.7%, 9.2% and 10.2%, respectively. The Kenya Revenue Authority (KRA) is set to increase excise duty charged on a variety of goods including water, beer cigarettes, wines, and spirits by 5.0%, effective August 2018;

Equities

During the week, the equities market recorded mixed performance, with NASI and NSE 25 gaining 0.6% and 1.3%, respectively, while NSE 20 declined by 0.6%. For the last twelve months (LTM), NASI and NSE 25 have gained 11.7% and 8.7%, respectively, while NSE 20 has declined by 10.0%. The High Court has suspended the implementation of the Robin Hood tax on bank transactions of Kshs 0.5m and above, proposed by the Treasury in the budget statement for 2018/19 fiscal year;

Private Equity

In the Financial Technology (FinTech) sector, GreenTec Capital Partners, a German investment firm that targets African start-ups and Small and Medium Enterprises (SMEs), has invested an undisclosed amount for an undisclosed stake in Bismart Insurance, a Kenyan insurance aggregator start-up. Insurance aggregators are digital platforms that collect information on various insurance products, their coverage, features, and prices in order to avail them to consumers through their website and mobile applications. It enables the consumers to select the best insurance products that meet their needs. The capital investment by GreenTec is expected to facilitate the upscaling of Bismart’s digital platform to reach out to more clients and establish itself as the first Pan African Block Chain - powered insurance aggregator;

Real Estate

Buyers of affordable homes are now set to receive significant financial reliefs related to tax burdens after President Uhuru Kenyatta signed into law amendments to the Income Tax Act that will allow buyers to get a 15.0% tax relief to a maximum of Kshs 108,000 p.a., or Kshs 9,000 p.m., under the newly introduced Affordable Housing Relief section. Additionally, the President also signed into law an amendment to the Stamp Duty Act, which will exempt first time home buyers from paying the 2.0% - 4.0% Stamp Duty Tax; a move that will likely encourage uptake of housing units as it lightens the financial burden especially for lower middle-income earners and the first-time home buyers;

Focus of the Week

In line with our regional expansion strategy, we continue to assess investment opportunities in the Kenyan Counties, to enable us to diversify our portfolio of real estate investments for our clients, and this week we update the 2016 Kisumu Market Research. Market performance remained relatively stable, with the overall rental yields coming in at 7.2%, 0.2% points higher than the 7.0% recorded in May 2016. For the specific themes, commercial office and residential yields remained unchanged from May 2016, averaging at 7.0% and 5.1%, respectively, while in retail the yields increased by 0.4% points from 9.0% in May 2016 to 9.4% in May 2018. Price appreciation in the market declined by 3.3% points from 5.1% in May 2016 to 1.8% in May 2018. The Kisumu market, therefore, remains largely a renter’s market. The investment opportunity in the market is in specific pockets of value such as Grade A and B commercial offices driven by devolution, and growth in SME’s. Opportunity in the land sector is driven by demand from developers as they expand from the CBD to suburbs such as Riat Hills.

- Cytonn Investments held its annual Investments Analyst & Investors Open Day on 19th July 2018 at the Intercontinental Hotel. The forum targeting investments analysts and investors, sought to educate the market on our structured finance business model, and our operating structure. See Event Note

- Cytonn Investments held their quarter three Company and Market Outlook Updates Breakfast on July 21st 2018 at The Alma, a Kshs 4.7 bn development in the heart of Ruaka. View the project’s progress here

- The Q2’2018 issue of our quarterly Sharp Cents Magazine is out. Read the issue here or email clientservices@cytonn.com to get a copy

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. The Wealth Management Training is run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- We continue to beef up the team with ongoing hires for IT Network Engineer and Unit Managers- Mt. Kenya Region. Visit the Careers section on our website to apply.

- Cytonn Real Estate is looking for a 0.75-acre land parcel for a joint venture in Lavington, Karen or Kiambu Road. The parcel should be in a good location with frontage to a tarmac road. For more information or leads, email us at rdo@cytonn.com

T-Bills & T-Bonds Primary Auction:

T-bills were oversubscribed during the week with the overall subscription rate coming in at 207.6%, a decline from 218.9%, recorded the previous week. Yields on the 91-day, 182-day and 364-day papers declined by 4.5 bps, 12.8 bps, and 14.3 bps to 7.7%, 9.2%, and 10.2%, respectively. T-bill yields have continued to decline as a result of increased demand evidenced by the high subscription rates, attributable to improved liquidity, which saw the interbank rate decline to an average of 5.2% in H1’2018 compared to 7.2% recorded in H2’2017. The acceptance rate for T-bills improved to 71.8% from 61.0% the previous week, with the government accepting Kshs 35.8 bn of the Kshs 49.8 bn worth of bids received. The subscription rates for the 91-day and 182-day papers increased to 105.9% and 137.9% compared to 61.1% and 123.6%, respectively the previous week while the subscription rate for the 364-day paper declined to 318.1% from 377.3% the previous week, but still recorded the highest performance as investors’ participation remains skewed towards the longer-dated papers.

For the month of July 2018, the Kenyan Government has issued a new 20-year Treasury bond (FXD 2/2018/20) with the coupon rate set at 13.2%, in a bid to raise Kshs 40.0 bn for budgetary support. The government has been issuing longer-dated bonds in a bid to increase its local debt maturity profile since the average term to maturity for all government securities has been on the decline, hitting 4.4 years as at April 2018 from an average of 6.2 years in 2009 as stated in the Medium Term Debt Management Strategy for 2018 to 2021. The performance of longer-dated bonds has been on the decline with the 25-year bond issued in June attracting a subscription of 25.3%, which has been attributed to the uncertainties in the interest rate environment due to the tabling of the Finance Bill 2018, which proposes the repeal of interest rate cap, which might result into an upward pressure on interest rates. As such, we expect the current issue to also have a lacklustre performance. Given that the treasury bonds with the same tenor to maturity are currently trading at a yield of 13.3%, we expect bids to come in at between 13.3% and 13.5%.

Kenya Eurobonds:

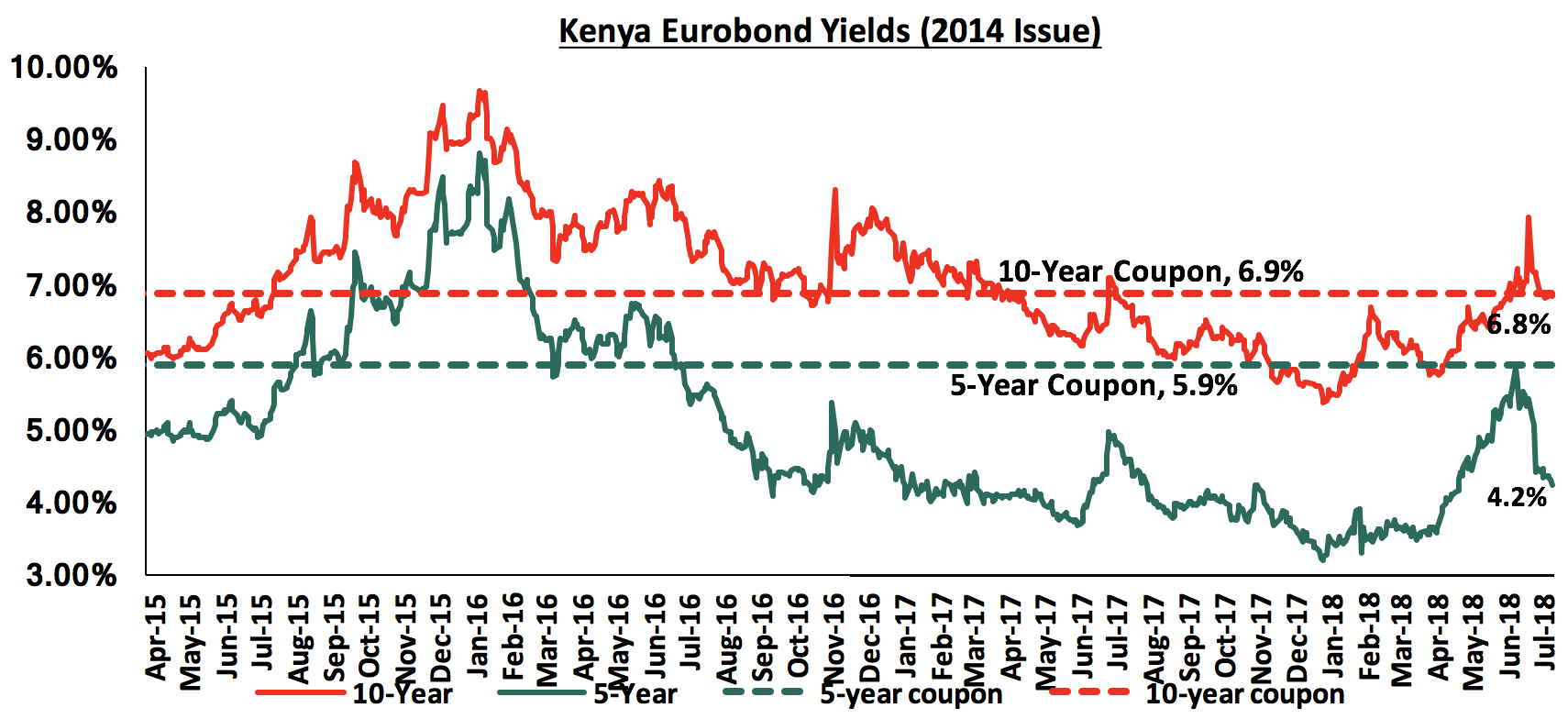

According to Bloomberg, the yield on the 10-year Eurobond issued in 2014 remained unchanged at 6.8% from the previous week, while the 5-year Eurobond declined by 20 bps to 4.2%, from 4.4% the previous week. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 4.6% points and 2.8% points for the 5-year and 10-year Eurobonds, respectively, an indication of the relatively stable macroeconomic conditions in the country. Key to note is that these bonds have 1 year and 6 years to maturity.

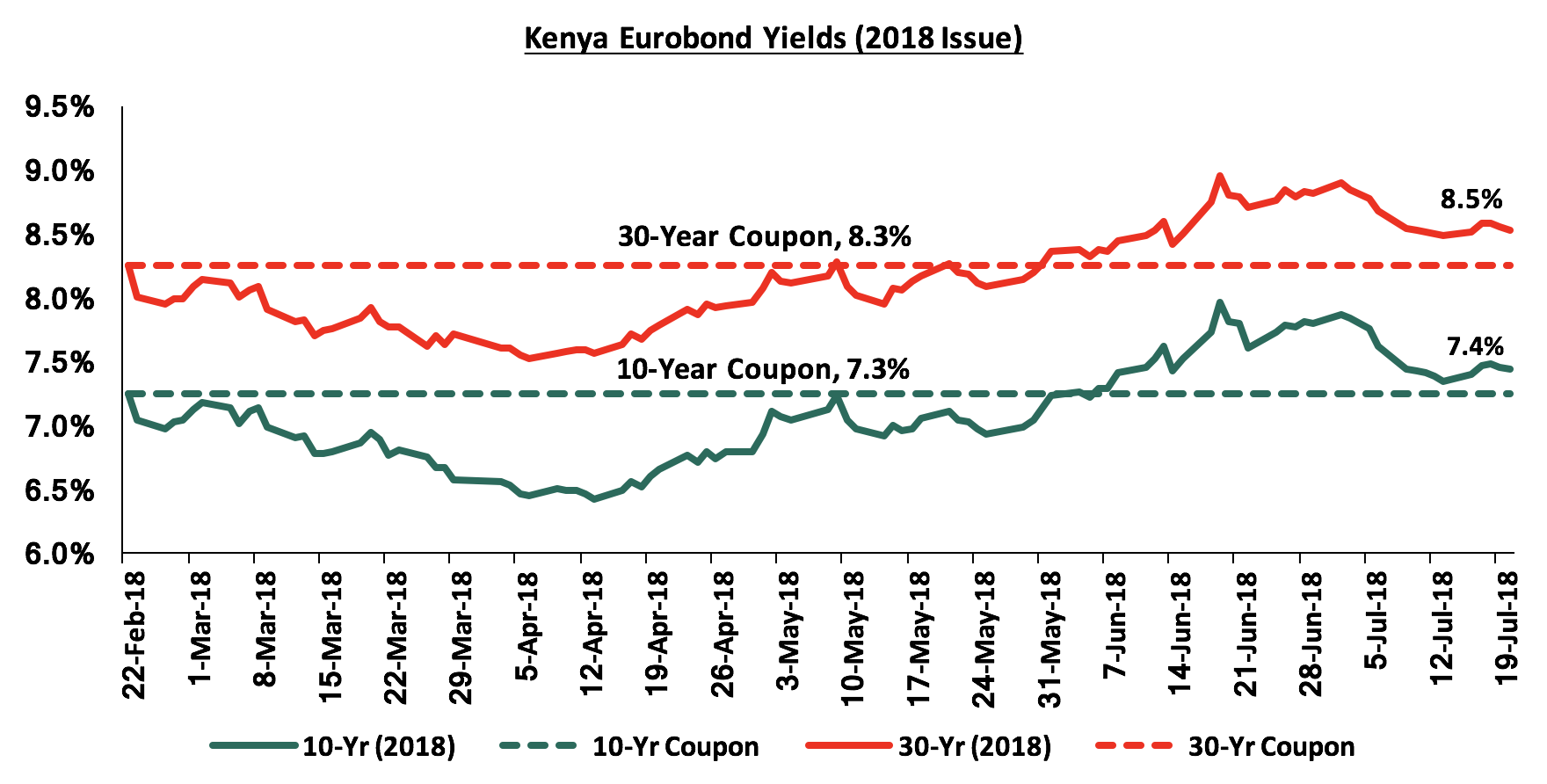

For the February 2018 Eurobond issue, during the week, the yields on the 10-year and 30-year Eurobonds remained unchanged at 7.4% and 8.5% from the previous week. Since the issue date, the yield on the 10-year Eurobond has declined marginally by 0.1% points while the yields on the 30-year Eurobond has increased by 0.2% points.

We have noted the Kenyan Eurobond yields have been on the decline in the recent weeks, which has been attributed to improved liquidity in the global markets and lower risk perception as a result of improved investor sentiments based on the stable macroeconomic conditions evidenced by the strong economic growth of 5.7% in Q1’2018, compared to 4.8% in Q1’2017.

The Kenya Shilling:

During the week, the Kenya Shilling gained by 0.1% against the US dollar to close at Kshs 100.7 from Kshs 100.8 the previous week supported by inflows from offshore investors amid high liquidity in the money market. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit, to 8.9% of GDP in Q1’2018 compared to 11.3% in Q1’2017 on account of the faster growth of exports at 7.1%, compared to import growth of 6.5%,

- Stronger inflows from principal exports, which include coffee, tea and horticulture, which increased by 9.3% during the month of April to Kshs 21.9 bn from Kshs 20.0 bn in a similar period the previous year, with the exports from coffee, and horticulture increasing by 6.7%, and 25.0% y/y, respectively, while tea exports have declined marginally by 1.6% y/y,

- Improving diaspora remittances, which increased by 16.9% to USD 253.7 mn in May 2018, from USD 217.1 mn in April 2018, with the largest contributor being North America at USD 122.8 mn attributed to (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient, and,

- High forex reserves, currently at USD 8.9 bn (equivalent to 5.9 months of import cover) and the USD 1.5 bn stand-by credit and precautionary facility by the IMF, still available until September 2018.

Key to note, The International Monetary Fund (IMF) recently completed the review of the USD 1.5 bn stand-by credit and precautionary facility. It, however, did not disclose the results of the review and their recommendations, stating that it had submitted the report to the government, which needed more time to consider its publication. The Executive Board of the International Monetary Fund (IMF) had approved Kenyan government’s request for a 6-month extension of the Stand-By Arrangement (SBA) on 12th March 2018, to allow more time for the completion of the outstanding reviews. Since the initial approval of the credit facilities on 14th March 2016, only the 1st review had been completed on 25th January 2017 while the 2nd and 3rd reviews were still pending as the balance of payments which is a performance criterion had not been met as at the end of December 2016 and June 2017 attributed to the shortfall in revenues and pressure on government spending which was partly due to the challenging operating environment. An understanding could not be reached on corrective measures the Government was to undertake to tackle the problems on account of the prolonged electioneering period thus the request for an extension. In a letter to the IMF dated 6t March 2018, signed by the National Treasury Cabinet secretary and the Governor of the Central Bank of Kenya that sought the extension of the stand-by arrangement to September 14, 2018, the Kenyan government highlighted that it was aiming at:

- Narrowing the fiscal deficit to 5.7% of GDP in the 2018/2019 financial year,

- Strengthening the monetary policy framework in the country which would include the introduction of an interest rate corridor, and

- Modifying interest rate controls to resolve the negative impact of the interest rate cap to private sector credit growth as well as enhance the effectiveness of monetary policy.

To resolve the fiscal deficit problem, the government highlighted its intention to reduce the expenditure as well as increase revenues through the introduction of the finance bill which would have several tax reforms. The finance bill has already been tabled in the National Assembly awaiting debate and approval.

Weekly Highlights:

The Kenya Revenue Authority (KRA) is set to increase excise duty charged on a variety of goods including water, beer, cigarettes, wines, and spirits among others by up to 5.0% effective August 2018. In the new tax system, excise duty will be rising in tandem with inflation thus reflecting the current economic reality as well as ensure that excise rates charged do not erode the public’s purchasing power during periods of inflation. The move is in accordance with the Excise Act that was passed in 2015 but has not been implemented since then, due to fears of price instability as it would lead to a rise in prices of basic commodities in the country and a net effect of inflationary pressure. The new tax system is set to be a boost to the government’s effort of increasing revenue in the 2018/2019 financial year by 17.5% to Kshs 1.9 tn, from the Kshs 1.7 tn target in the 2017/2018 financial year, by widening of the tax base through various tax reforms as outlined in the Finance Bill tabled in parliament, as the excise duty increments will be automatic and will not require any additional approval from Parliament. Excise duty on petroleum products was however not adjusted with the expected introduction of 16.0% VAT tax from September, as it would further escalate fuel prices in the country, which are already expected to rise.

We are projecting the inflation rate for the month of July to come in between 4.9% - 5.3%, from 4.3% in June. The y/y inflation rate is expected to increase as a result of a base effect while m/m inflation is expected to rise mainly due to:

- A rise in electricity costs due to an increase in forex and inflation charges to Kshs 1.2 per kilowatt hour (kWh) and Kshs 0.5 per unit from Kshs 1.1 and Kshs 0.4 in the previous month, respectively. Fuel levy linked to power produced by diesel generators has continued to drop, though marginally in July by Kshs 0.2 to Kshs 4.6 attributed to increased HEP generation due to the heavy rains experienced in the 1st half of the year reducing reliance on diesel-generated electricity. The decline, however, is marginal and thus not sufficient to counter the rise in forex and inflation charge, and

- An increase in the price of petrol by 3.1% due to an increase in super petrol landing cost by 5.5%, which will result in a rise in the transport index. Prices of diesel and Kerosene, however, have decreased by 0.3% and 1.8% brought about by a decline in landing costs for diesel and kerosene by 1.1% and 1.9%, respectively. Charcoal prices are also expected to rise attributed to the enforcement of the anti-logging.

There has been a decline in prices of some items in the food basket such as tomatoes and a rise in others such as vegetables. But prices of a majority of items in the food basket have remained stable. We still expect the inflation to average 7.5% over the course of the year down from 8.0% in 2017, which is within the government target range of 2.5% -7.5%.

Rates in the fixed income market have been on a declining trend, as the government continues to reject expensive bids due to increased demand evidenced by the high subscription rates, attributable to improved liquidity, which saw the interbank rate decline to an average of 5.2% in H1’2018 compared to 7.2% recorded in H2’2017. The government is however likely to remain behind its borrowing target for the better part of the first half of the 2018/19 financial year as per historical experience. The 2018/19 budget gives a domestic borrowing target of Kshs 271.9 bn, 8.6% lower than the 2017/2018 fiscal year’s target of Kshs 297.6 bn, which may result in reduced pressure on domestic borrowing. However, the National Treasury has proposed to repeal the interest rate cap, which if repealed can result in upward pressure on interest rates, as banks would resume pricing of loans to the private sector based on their risk profiles. With the cap still in place, we maintain our expectation of stability in the interest rate environment. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium-term fixed-income instruments.

Market Performance:

During the week, the equities market recorded mixed performance, with NASI, and NSE 25 gaining 0.6% and 1.3%, respectively, while NSE 20 declined by 0.6%, taking their YTD performance to 0.7%, (10.7%) and 4.3%, for NASI, NSE 20 and NSE 25; respectively. This week’s performance was driven by marginal gains in large-cap counters in the financial sector; with NIC Group, Diamond Trust Bank, Equity Group and Barclays gaining 0.7%, 0.5%, 0.5%, and 0.4%, respectively. For the last twelve months (LTM), NASI, NSE 20 and NSE 25 have gained 11.7%, (10.0%) and 8.7%, respectively.

Equities turnover increased by 4.2% this week to USD 20.4 mn from USD 19.6 mn the previous week, with foreign investors dominating market activity during the week. We expect the market to remain resilient this year supported by positive investor sentiment, as investors take advantage of the attractive stock valuations in select counters.

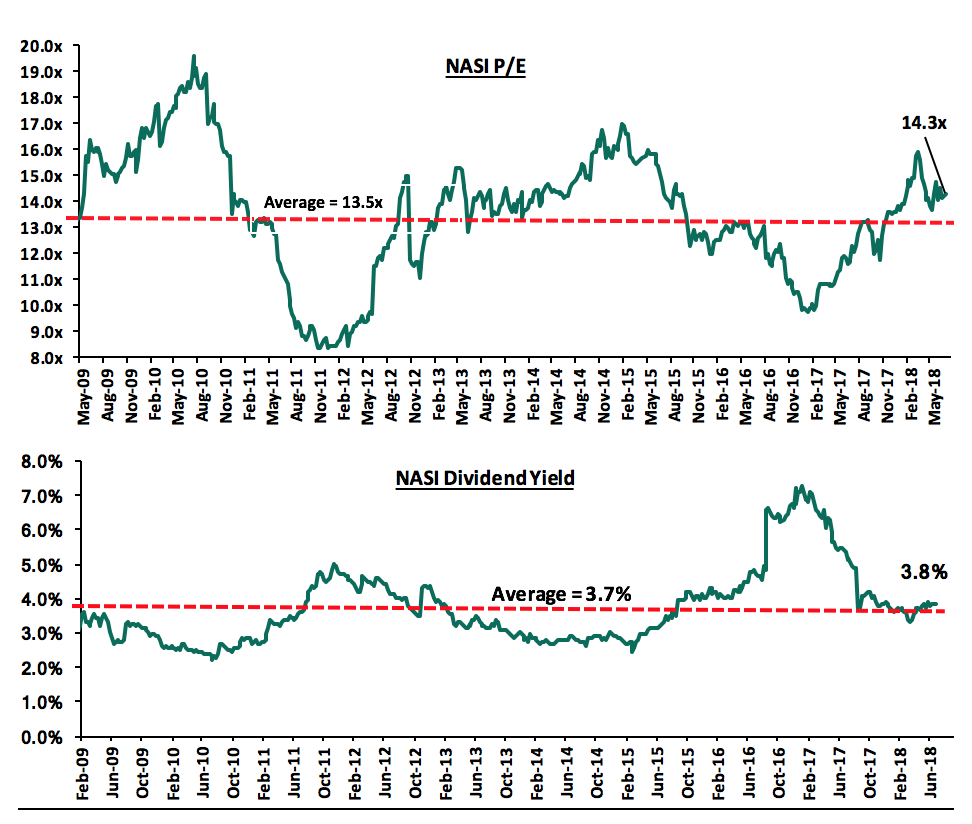

The market is currently trading at a price to earnings ratio (P/E) of 14.3x, which is 6.0% above the historical average of 13.5x, and a dividend yield of 3.8%, which is higher than the historical average of 3.7%. The current P/E valuation of 14.3x is 45.9% above the most recent trough valuation of 9.8x experienced in the first week of February 2017, and 72.3% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlights:

Pro Credit Bank, a subsidiary of Equity Group with operations in the Democratic Republic of Congo, has changed its name to Equity Bank Congo, three years after Equity first announced the acquisition of the SME-focused lender. Equity first acquired a 79.0% stake in Pro Credit Bank in September 2015 for Kshs 4.5 bn in a share swap deal that saw the bank issue 70.8 mn shares to investors exiting the subsidiary. The transaction effectively valued the DRC-based lender at Kshs 5.7 bn, equivalent to Kshs 80.5 per share. Equity Group then acquired another 7.0% stake for Kshs 2.2 bn in cash, an indication of its confidence in the future prospects of the bank. Equity is among Kenyan lenders with ambitious growth strategies to gain market share in retail banking both locally and in the Eastern Africa market, as they seek fresh income streams in the wake of a tighter regulatory environment in the local market, which has capped the pricing of loans to 4.0% above the Central Bank Rate(CBR).

The implementation of the "Robin Hood" tax of 0.05% on transactions worth Kshs 500,000 and above has been suspended by the High Court, following a move by the Kenya Bankers Association (KBA) seeking to suspend the implementation of the tax. Justice Wilfrida Okwany, in the conservatory orders issued on Thursday, noted that the petition raised fundamental constitutional concerns, among them being the principle of public participation. The Attorney-General, Mr. Kihara Kariuki, had termed the quest to suspend the Robin Hood tax premature as Parliament has not passed the relevant Bill into law. The Attorney General took the position in response to KBA’s opposition to the tax on grounds that there was no stakeholder engagement prior to the operationalization of the law as required by the Constitution. The AG and the Kenya Revenue Authority (KRA), argued that Parliament has already invited public participation on the Finance Bill 2018, according banks an opportunity to present their views on the Bill.

Equities Universe of Coverage:

Below is our Equities Universe of Coverage:

|

Banks |

Price as at 20/07/2018 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/Downside** |

P/TBv Multiple |

|

Ghana Commercial Bank*** |

5.0 |

0.2% |

(0.8%) |

7.7 |

7.6% |

62.0% |

1.2x |

|

NIC Bank*** |

34.8 |

0.0% |

3.0% |

54.1 |

2.9% |

58.6% |

0.8x |

|

I&M Holdings*** |

114.0 |

3.6% |

9.6% |

169.5 |

3.2% |

57.3% |

1.1x |

|

Zenith Bank*** |

23.0 |

(4.2%) |

(10.3%) |

33.3 |

11.3% |

50.1% |

1.0x |

|

Diamond Trust Bank*** |

196.0 |

0.5% |

2.1% |

280.1 |

1.3% |

45.0% |

1.1x |

|

Union Bank Plc |

5.8 |

(2.5%) |

(25.6%) |

8.2 |

0.0% |

37.0% |

0.6x |

|

Ecobank |

8.2 |

2.1% |

7.5% |

10.7 |

0.0% |

34.1% |

2.3x |

|

KCB Group*** |

48.3 |

1.0% |

12.9% |

60.9 |

6.3% |

33.8% |

1.5x |

|

Barclays |

11.5 |

0.4% |

19.8% |

14.0 |

8.7% |

31.0% |

1.4x |

|

CRDB |

160.0 |

0.0% |

0.0% |

207.7 |

0.0% |

29.8% |

0.5x |

|

HF Group*** |

8.5 |

0.0% |

(18.3%) |

10.2 |

3.8% |

23.8% |

0.3x |

|

UBA Bank |

9.6 |

(4.5%) |

(7.3%) |

10.7 |

15.0% |

22.0% |

0.7x |

|

Co-operative Bank |

16.8 |

(1.2%) |

5.0% |

19.7 |

4.7% |

20.6% |

1.5x |

|

Equity Group |

49.5 |

1.5% |

24.5% |

55.5 |

4.1% |

17.9% |

2.5x |

|

Stanbic Bank Uganda |

33.0 |

3.1% |

21.1% |

36.3 |

3.7% |

17.0% |

2.0x |

|

Bank of Kigali |

290.0 |

0.0% |

(3.3%) |

299.9 |

4.8% |

8.2% |

1.6x |

|

CAL Bank |

1.3 |

(0.8%) |

19.4% |

1.4 |

0.0% |

7.7% |

1.1x |

|

Stanbic Holdings |

92.0 |

2.2% |

13.6% |

85.9 |

5.8% |

1.3% |

1.1x |

|

Guaranty Trust Bank |

38.0 |

(4.4%) |

(6.7%) |

37.2 |

6.0% |

(0.3%) |

2.2x |

|

Access Bank |

10.1 |

(1.0%) |

(3.3%) |

9.5 |

3.9% |

(2.9%) |

0.7x |

|

Standard Chartered |

204.0 |

0.5% |

(1.9%) |

184.3 |

6.2% |

(3.1%) |

1.6x |

|

SBM Holdings |

7.3 |

2.8% |

(2.1%) |

6.6 |

4.2% |

(3.9%) |

1.0x |

|

Bank of Baroda |

140.0 |

(3.4%) |

23.9% |

130.6 |

1.7% |

(8.2%) |

1.3x |

|

Standard Chartered |

26.0 |

0.0% |

3.0% |

19.5 |

0.0% |

(25.2%) |

3.3x |

|

Stanbic IBTC Holdings |

48.8 |

(5.2%) |

17.6% |

37.0 |

1.2% |

(27.0%) |

2.7x |

|

FBN Holdings |

9.1 |

(13.0%) |

2.8% |

6.6 |

2.4% |

(33.8%) |

0.6x |

|

Ecobank Transnational |

20.7 |

1.5% |

21.5% |

9.3 |

0.0% |

(54.4%) |

0.7x |

|

National Bank |

5.6 |

(9.8%) |

(40.6%) |

2.8 |

0.0% |

(54.5%) |

0.4x |

|

*Target Price as per Cytonn Analyst estimates |

|||||||

|

**Upside / (Downside) is adjusted for Dividend Yield |

|||||||

|

***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5th largest shareholder ****Stock prices indicated in respective country currencies |

|||||||

We are “NEUTRAL” on equities for investors with a short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for long-term investors, and with expectations of higher corporate earnings this year, we are “POSITIVE” for investors with a long-term investment horizon.

German investment firm, GreenTec Capital Partners, has invested an undisclosed amount for an undisclosed stake in Bismart Insurance, a Kenyan insurance aggregator start-up. The capital investment is expected to facilitate upscaling of Bismart’s digital platform to reach more clients and secure a strong foothold as the first Pan African blockchain - powered insurance aggregator. Blockchain technology, a digital database system, will enable the platform to generate digital ledgers containing insurance transactions that are well secured and easily verifiable. In April 2018, the company received seed capital of Kshs 1.0 mn (USD 10,000.0) from Standard Chartered’s Women in Tech Program.

GreenTec Capital Partners, which primarily invests in African start-ups and SMEs with a focus on transformative venture building, has made investments in Kenya, Uganda, Nigeria, Ghana, and Rwanda. Prior funding deals include investments in Ugandan start-ups Safarini Translators, Wazi Vision and Divine Masters Limited of USD 100,000.0 (Kshs 10.0 mn), USD 800,000.0 (Kshs 80.0 mn), and USD 5.0 mn (Kshs 500.0 mn) for the start-ups, respectively.

Founded in 2017, Bismart Insurance leverages cutting-edge technology to provide a digital interface to connect their customers to the best insurance services and investment solutions in the market. The company aims to provide transparency in the insurance process in a bid to increase the insurance penetration level in Kenya and across Africa. According to the Swiss Re Institute, insurance penetration in Kenya in 2017 was 2.6%. This is below the average in African countries of 3.0%, that in emerging markets of 3.3%, and the global average of 6.1%.

The investment in Bismart Insurance comes at the wake of the accelerated development of mobile start-ups in Sub-Saharan Africa and increased funding for tech start-ups in the region. According to The Mobile Economy: Sub-Saharan Africa 2018 Report, funding for Sub-Saharan Africa mobile start-ups increased by 52.7% to Kshs 56.4 bn (USD 563.5 mn) from Kshs 36.9 bn (USD 369.1mn) in 2016. Of the Kshs 56.4 bn (USD 563.5 mn), Kenyan mobile start-ups raised Kshs 14.8 bn (USD 147.0 mn) in 27 deals in the last year. This endorses the increasing investor interest in solutions that work towards bridging the financial inclusion gaps in the region.

Private equity investments in Africa remains robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and a stable macroeconomic environment will continue to boost deal flow into African markets.

Buyers of affordable homes are now set to receive significant financial relief related to tax burdens, after President Uhuru Kenyatta signed into law amendments to the Income Tax Act that will allow the buyers get a 15.0% tax relief to a maximum of Kshs 108,000 p.a., or Kshs 9,000 p.m., under the newly introduced Affordable Housing Relief section. Additionally, the president also signed into law an amendment to the Stamp Duty Act, which will exempt first time home buyers from paying the Stamp Duty Tax which normally is 2.0% - 4.0% of the property value. In our opinion, the move is a step in the right direction towards facilitating home ownership and offtake of the affordable homes that are to be delivered over the next five years. Taking the average price for an apartment unit in the lower-middle segment which is Kshs 8.6 mn, as per our research, a home buyer would pay stamp duty tax of either Kshs 171,000 or Kshs 342,000, depending on whether it is in an urban or a rural area; for a detached unit in the same segment, the average price is Kshs 13.6 mn, and thus a first time home buyer would pay a stamp duty tax of Kshs 272,000 or Kshs 544,000. Therefore, it is evident that the exemption of the stamp duty, while not necessarily increasing the affordability of the house, will result in significant financial savings. Since the inclusion of affordable housing as part of the Big Four Agenda, the government has introduced a raft of measures and proposals to support the initiative, which have affected both the demand side (buyers and offtake) and supply side (developers). Some of these Include;

For the demand side

- Formation of the National Housing Development Fund which will see employees contribute 0.5% of their basic salaries, with their employers topping that with a similar contribution, to the fund which is expected to facilitate offtake of the delivered affordable homes, as well as their construction,

- 15% tax relief, up to a maximum of Kshs 108,000 p.a for buyers of units developed under the affordable housing scheme,

- Exemption of first time home buyers from stamp duty tax, amounting to 2.0% - 4.0% of property value,

- Tenant-purchase scheme for social housing, and,

- Provision of multi-generational mortgages that have long tenors and can be passed on to one’s heir.

For the Supply side;

- 15.0% corporate tax cut for developers of 100 low-cost housing units p.a.,

- Scrapping off of NEMA and NCA levies, which has encouraged developers to deliver more units to the market,

- Formation of the Kenya Mortgage Refinancing Company (KMRC) which is aimed at enhancing mortgage affordability and facilitating long-term loans at attractive rates

- Partnerships with developers through availing of public land for development,

- Land swaps that entail the exchange of public and private land between the government and developers, enabling the developers to access development class land that would have been tied down, and,

- Public-Private Partnerships (PPPs) agreements between the government and the private sector, to facilitate development.

These initiatives are a step in the right direction, and the onus will, therefore, be on the government and other stakeholders, to ensure their successful implementation, enabling the government to meet its objective of delivering 1.0 mn housing units by 2022. Currently, Kenya has a housing deficit of 2.0 mn units, growing by 200,000 units p.an and it is largely concentrated in the low to the mid-income segment.

Also during the week, the National Housing Co-operatives Union board (NACHU) announced that it would be embarking on the establishment of a regulated mortgage Sacco in a model that is set to see the board access mortgage funding from the Kenya Mortgage Refinancing Company. NACHU mainly represents persons from the low-income class, rural cooperatives, persons with informal employment and irregular income among others. The body currently represents more than 11,000 individuals, of which 84.0% are low-income earners while 16.0% are modest income earners. To this end, the board plans on establishing various bodies to drive its investments and operations such as Nacho Plaza, Nacho Insurance Agency, Nacho Development Agency. Over the past two decades, the society has been funded by institutions such as Homeless International, Centre for Housing Finance International, USAID among others; with projects such as the 228-unit Malaa Affordable Housing Project in Ruai. The board also plans to launch into the REITs market to be able to raise funds for its mass housing initiative. In our view, this will enable the board which mainly focuses on providing affordable and decent housing and infrastructure to the low-income communities, by giving it a stable financial muscle.

In the retail sector, local retail chain, Naivas, announced plans to open its 4th outlet in Mombasa which will start operations from September this year. The outlet which will occupy 27,000 SQFT at Mwembe Tayari Mall in Mombasa will bring Naivas’ total store count in Kenya to 47, bucking the trend that has characterized the local retail scene where locally owned chains have been experiencing financial constraints and mismanagement issues leading to a closure of stores. Mombasa is an attractive prospect for retailers due to, (i) minimal supply of mall space compared to counties such as Nairobi, meaning less competition from other retailers, (ii) relatively high demand, as per World Bank data, Mombasa had the fifth highest GDP per Capita in Kenya as at 2015 of USD 935.0 compared to a national average of USD 1,455.0, and (iii) the region benefits from a 100.0% urbanized population, which boosts demand for formal shopping outlets. For developers, Mombasa offers the best investment opportunity as per Cytonn’s Retail Report 2017, due to attractive returns with average rental yields of 9.7% for neighborhood malls compared to a market average of 9.0% and also had the highest occupancy rates of 98.4% compared to a market average of 87.4%. We thus expect to witness more developers and retailers, expand to Mombasa, from Nairobi, which is sufficiently supplied, with an estimated total mall space of 5.8 mn thousand SQFT as per the report, the highest in Sub Saharan Africa, excluding South Africa.

The table below shows the performance of the retail sector in various counties;

|

Kenya Regional Retail Performance Summary as at November 2017 |

||||||

|

|

Neighborhood Malls |

Community Malls |

Destination Malls |

|||

|

Region |

Occupancy |

Yield |

Occupancy |

Yield |

Occupancy |

Yield |

|

Nairobi |

80.9% |

9.7% |

79.7% |

9.3% |

77.3% |

10.3% |

|

Kisumu |

87.5% |

9.7% |

66.7% |

8.7% |

||

|

Mombasa |

98.4% |

9.7% |

75.0% |

6.1% |

||

|

Mt Kenya |

80.0% |

9 .1% |

||||

|

Eldoret |

90.0% |

7.0% |

70.0% |

5.8% |

||

|

Average |

87.4% |

9.0% |

72.9% |

7.5% |

77.3% |

10.3% |

Source: Cytonn Retail Report 2017

Infrastructure

In infrastructure, the key highlights during the week included;

- The Capital Markets Authority announced that Kiambu, Meru, and Machakos Counties might spearhead the country into an initiative that will see counties raise funds from the public for the financing of their infrastructural projects through the sale of bonds. In our view, this is a step in the right direction towards reducing external borrowing as has been called for by the IMF, and towards finding alternative financing solutions for government activities, and promoting self-reliance for counties,

- During the week, Nairobi hosted over 20 African states’ representatives together with private sector stakeholders for the Africa50 conference, during which the Kenyan Government doubled its stake in the fund to Kshs 10.1 bn. Africa50 is a pan-African infrastructure fund that focuses on high-impact national and regional infrastructural projects mainly (i) Power, that is, renewable and conventional generation, power transmission and distribution, and gas infrastructure; and (ii) Transport, that is, roads, airports, ports, and logistics. The fund avails project finance by providing equity and quasi-equity while accessing preferential debt from the African Development Bank and Development Finance Institutions. The fund also provides development expertise to its members by doing feasibility studies, obtaining permits and approvals for land acquisition, negotiating contracts and so forth. This move will enable the Kenyan Government access funding for its high-growth infrastructural plans, which in our view will help to reduce its external borrowings,

- The government has committed Kshs. 40bn for the provision of requisite infrastructure within Konza City in Machakos County. The funds will be allocated to the development of infrastructure in the city which will include a 40km road network, fiber cable connectivity and electrification reticulation, and an additional Kshs 17 bn for the establishment of a data center in the city. The Konza City Complex in Makueni is set to be complete by November this year. The project is set to change the face of Machakos county, especially in terms of real estate and we expect once the project starts coming to fruition, property prices such as land to increase significantly in an area such as Athi River where currently, the land value is approximately Kshs 4.1 mn, as per our research,

- Elsewhere, the government has sourced for Kshs 4.0 bn from the Arab Development Bank for construction of sewerage systems in Murang’a County and also announced that the Northern Water Collector Tunnel (NWCT), that was implemented with the sole aim of enhancing water supply to Nairobi County by at least 140.0 mn liters per day from the Aberdares, is 55.0% complete. The project was meant to run from 2012 to 2016. However, this has been pushed to the end of 2019, as the government pushes for its high-growth infrastructural agenda meant to drive the Big 4 Agenda,

- Plans are underway for the establishment of nine major cities along the ongoing Kshs 2.5 tn LAPSSET Corridor. The towns which will include Lamu, Isiolo, Lodwar, and Mandera, are set to be game-changers in terms of economic and social development, and will include transport rails and highways as well as international airports in Lamu and Lodwar, in addition to the Isiolo International Airport. According to LAPSSET authorities, 7 of the cities are set to be complete by 2020. The infrastructural improvement is set to open up these areas for real estate investment with the jobs to be created and improved livelihoods pushing demand for formal and decent dwelling units in these cities,

- The government also announced plans of constructing a 2km flyover, in partnership with Japanese International Co-operation Agency (JICA), that will link industrial area’s Enterprise Road to the City Centre, making it the county’s longest flyover. This will go a long way in easing traffic along the busy Mombasa Highway which has been an impediment to the performance of real estate sector, especially for the commercial office sector along the road due to intense traffic snarl-ups. Per Cytonn Office Report 2018, Mombasa Road came in last in 2017’s performance, with average rental yields of 8.5% compared to the market average of 9.2%, and average occupancy rates of 74.2% compared to a market average of 83.9%.

Other Highlights:

- In a bid to address the shortage of accommodation in Kenyan universities, there have been calls for bidding contractors for the construction of 23,400 hostel rooms in various universities across the country including Moi University, Embu University and South Eastern Kenya Universities (SEKU). Moi University intends to build a 14,000-unit facility; Embu University will have a 4,000-bed facility while SEKU will have a 5,400-unit facility. The government has announced that the winning bids will be announced by end of 2018. Under the proposed PPP model, the hostels’ developers will gain returns on their investment through a built to rent operation for 15-20 years, after which they will recover their principle and interests then hand over the facility to the respective institutions of learning,

- In the hospitality sector, KQ during the week signed a memorandum with Fairmont Hotels & Resorts, where travelers will be accommodated in the luxurious Fairmont facilities; The Norfolk, Fairmont Mount Kenya Safari Club; and Fairmont Mara Safari Club, a move aimed at benefitting both institutions in terms of attracting high end clientele and also more tourist activity for the country; Also, Air France announced plans to increase its flight's frequency from Paris to Nairobi to five times a week as from March 2019, from the current three flights. This is an indication of a positive sentiment for tourist activity, especially from Europe which as at 2017, was the largest source of tourist travels to Kenya with 517,300 departures, compared to other regions such as Africa with 285,000, Asia with 198,000 and North America with 180,700. This follows moves by other smaller airlines such as Ethiopia Airline which recently increased its flight frequency to Mombasa to twice per week, as well as KQ’s launch of direct flights to the US, Mauritius, and Cape Town.

Listed Real Estate

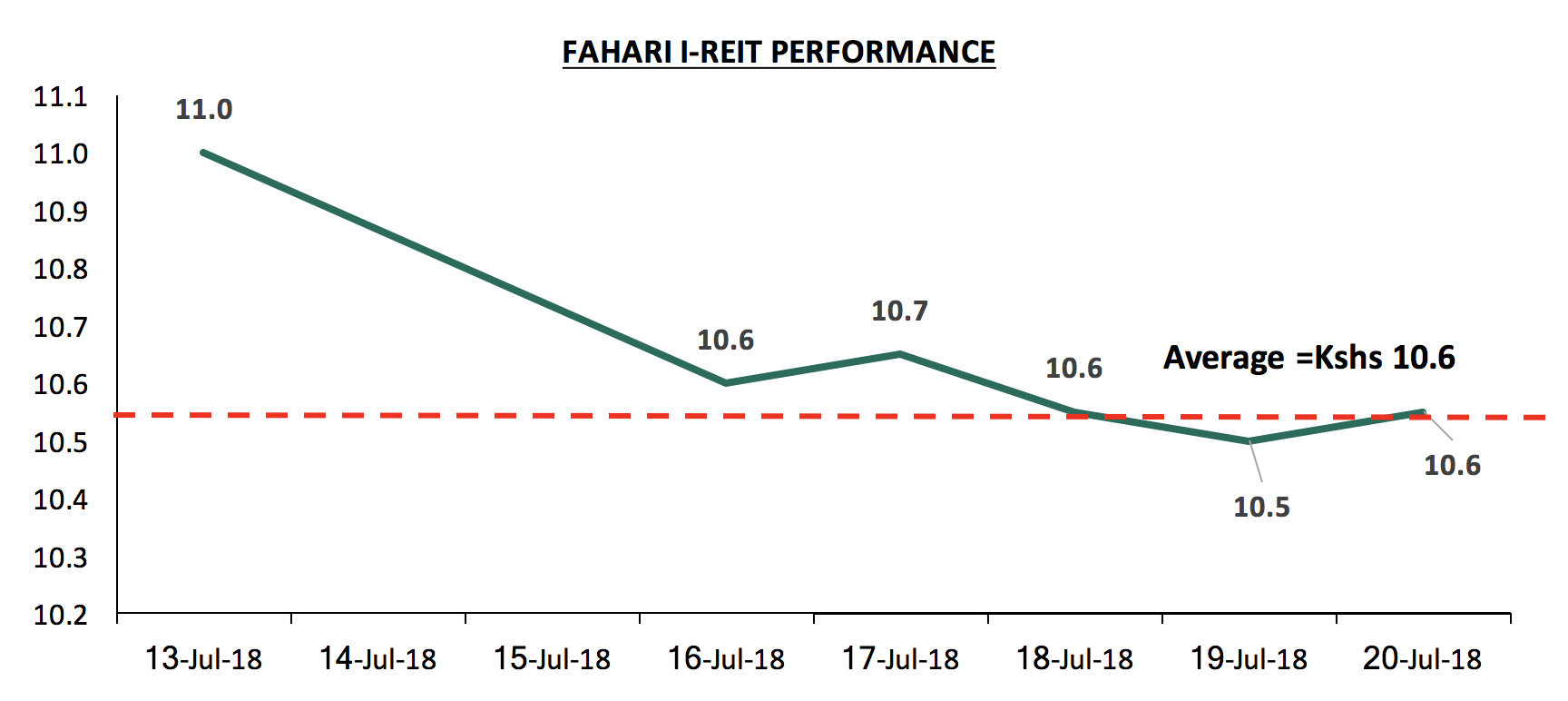

During the week, the Fahari I-REIT recorded a decline in performance with a weekly trading average of Kshs 10.6 after closing at Kshs 11.0 last week. However, this week, the REIT closed at Kshs 10.6, shedding 48.9% of its initial value. This is an indication of the continued lack of investor appetite for the instrument.

Source: Bloomberg

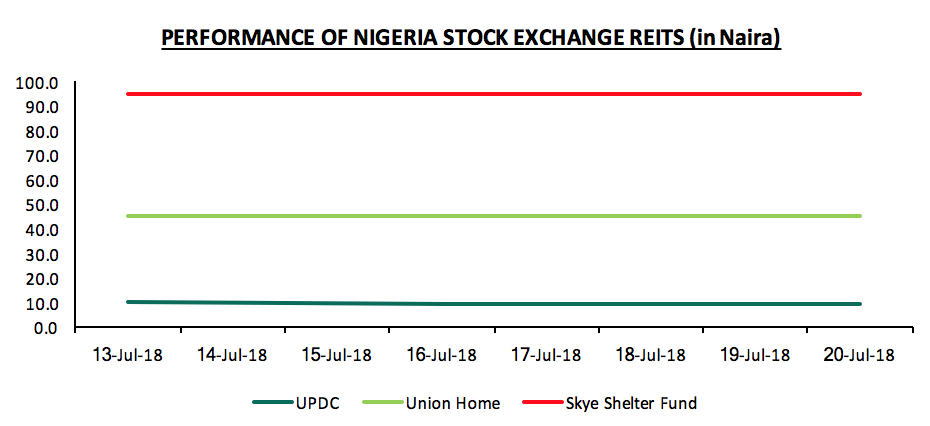

West Africa

In Nigeria, the REITs market continued to remain flat. Of the three REITs we cover, two, that is, Union Home and Skye Shelter, remained the same, while the UPDC REIT declining marginally by 1.0% to open the week at N9 from last week’s closing of N10. Nigeria’s REITs market has plateaued indicating a stalled demand for the past couple of years which is attributable to shallow investor knowledge, poor market regulation amidst a high-interest rate environment; and therefore, we expect the performance to continue on this trend for the long term.

Source: Bloomberg

We expect to see more activity in the real estate sector, especially in (i) end-user purchases, thus a rebound in the price appreciation rates, (ii) more government initiatives towards making housing affordable, and (iii) regions outside Nairobi gaining in real estate investments on the back of the increased infrastructural development.

In line with our regional expansion strategy, we continue to assess investment opportunities in the Kenyan Counties, to enable us to diversify our portfolio of real estate investments for our clients. So far, we have covered 13 Kenyan Counties, including; Nyeri, Laikipia, Meru, Mombasa, Narok, Homabay, Kisii and Uasin Gishu. In line with this, in August 2016 we released the Kisumu Real Estate Investment Opportunity 2016, a research note that focused on the real estate market performance in Kisumu covering the residential, commercial offices, retail and hospitality themes. According to the research note, the market recorded average rental yields of 7.0%, with office, retail, and residential themes recording average rental yields of 7.0%, 9.0%, and 5.1%, respectively. In this focus, we update that research note with data collected in May 2018. We will cover the performance in terms of rental yields, price appreciation, uptake and occupancy rates and compare with the performance in May 2016 to gauge trends, opportunities, outlook and hence investment opportunities in Kisumu. We will start by giving a general overview of Kisumu City, and then cover the key drivers and challenges facing the real estate market, followed by an analysis of the performance of the various themes, before finally concluding by giving our outlook, and the real estate investment opportunity.

- Overview of Kisumu City

Kisumu City is the principal city of Western Kenya, situated approximately 341.6 km West of Kenya's capital city, Nairobi. It is the third largest city in Kenya after Nairobi and Mombasa. The City serves as the headquarters of Kisumu County, and it was formerly the central administrative headquarters of Nyanza Province. Kisumu has witnessed growth in infrastructure and amenities, with the development of roads such as the Nyamasaria - Magadi- Manyatta Road, Kisumu - Kisian Highway, and the upgrading of Kisumu International Airport to international status. In terms of real estate, Kisumu offers a unique blend of upper-mid to low-income residential units, commercial malls and office blocks, which mainly host county headquarters and serve the Kisumu urban population.

The main factors driving the real estate market in Kisumu are:

- Positive Economic Growth – Kisumu County ranks as the 17th richest county in Kenya with a GDP per Capita of USD 625, against a Kenyan average of USD 634 according to a 2015 survey by World Bank. This is boosted by tourism, trade and commerce, as well as agriculture, hence increasing the disposable income and boosting demand for real estate products in Kisumu City,

- Devolution – Devolution has opened up Kisumu City, attracting government institutions, private investors, and entrepreneurs to the county headquarters. This has therefore created demand for office space, retail space and residential units to host all the investors and government officials. Devolution has also placed the onus on the Kisumu County Government to spearhead development in the county, leading to the upgrading of housing developments in a bid to make them more habitable, such as in Okore, Migosi, Celtel, Mosque, Makasembo and Arina Estates,

- Positive Demographics – Kisumu City has a growing population, both organic and from immigration. The population has been growing at a rate of 2.8% p. a, compared to the Kenya average of 2.6% p.a. This results in higher demand for residential real estate products, resulting in the growth of the real estate sector in Kisumu City, as this population looks to purchase residential units,

- Infrastructural Development – Kisumu City has seen a lot of infrastructural developments in the recent years, which have opened it up for development. These include upgrading of the airport to international status, slum-upgrading programs by National Youth Service (NYS), and development of roads such as the Nyamasaria - Magadi- Manyatta Road and Kisumu - Kisian Highway. The area is also connected to mains water and sewerage connection from Kisumu Water and Sewerage Company (KIWAS), hence allowing for high densities.

However, despite all the factors supporting the real estate sector in Kisumu, there are still a number of factors, which if not properly addressed will present challenges to real estate development in the county, and these include:

- Unstructured Planning Regulations - The city is poorly planned, and is based on a Town Plan developed in 1974. There is little clarity on policies guiding the planning; in the past, expansion of roads led to a disruption of sewer and water lines in the city. If this is not addressed, it may lead to urban sprawl in urban centers and reduce land use maximization,

- Lack of Space for Expansion – As a result of the poor planning, residential developments in areas such as Milimani are close to the city center and hence the city’s commercial hub cannot expand outwards. This problem can be solved by rezoning Milimani to be a commercial center, with Riat Hills being the main high-end residential zone, hence enabling expansion of the CBD,

- Poor Land Administration – According to the Agricultural Sector Development Support Program (ASDSP), only 63% of the land parcels in Kisumu actually have title deeds and many buyers have been conned off land or settled in land parcels belonging to other people, and hence landowners are losing their property. This is a trend that has also made investors wary of investments in the city, and,

- Political Instability and Intolerance - In times of political instability, property destruction has resulted in large losses. This discourages investments in the real estate sector by investors for fear of destruction, in times of violence

- Kisumu Market Performance:

Our market research focused on:

- Plinth Area - Research on the size of the units found in the market allows us to gauge the current offering, and put into consideration the home buyer’s preferences for sizes of houses,

- Prices - Research on prices will be used in the comparison of our products against the market prices,

- Rental Rates - Research on rental income allows us to inform potential investors on the current rental rates in other developments and also inform the investors on the prospective rental yield they can gain from investing in Kisumu, and,

- Annual Uptake - This allows the investor to appreciate the rate at which available homes are sold over a specific period, allowing the investor to gauge on whether it is profitable to invest in a given area.

The key themes covered are:

- Residential

Generally, the residential sector in Kisumu is nascent with most of the mega developments such as Victoria Gardens in Riat Hills, Translakes Estate in Mamboleo, and Lake View Breeze in Milimani Estate coming up in the last 5-years. The increase in developments is attributable to government decentralization and urbanization. As at May 2018, the sector’s performance softened, with the sector recording a decline of 3.2% points in total returns from 10.1% in May 2016 to 6.9% in May 2018, attributable to political uncertainties in the area over the 2017 election.

In our residential sector analysis, we classified the various suburbs in Kisumu into two segments:

- High-End Segment – Consists of prime suburbs in Kisumu, such as Milimani and its environs, housing mainly high net worth individuals. Houses in this segment have price points of between Kshs 11.2 mn and Kshs 14.3 mn, and,

- Middle-Income Segment – Consists of suburbs such as Kibos Estate, Kanyakwar, and Mamboleo, characterized by both high rise and low-density houses, housing mainly the middle-class. Houses in this segment have price points of between Kshs 6.3 mn and Kshs 7.6 mn.

To note:

- Detached Units refer to stand-alone houses such as townhouses, maisonettes and bungalows, and,

- Apartments refer to a self-contained housing unit occupying part of a building, also called flats

The performance of the residential theme in Kisumu is as summarized below:

- Apartments

Apartments recorded an average total return of 8.5%, with a rental yield of 5.5% and price appreciation of 3.0%. This is a 0.1% points increase in rental yield from 5.4% in May 2016, and a 1.3%points annualized decline in price appreciation from 5.6% in the same period, attributable to the political uncertainties over the 2017 election period.

The performance of the various market segments is as summarized below:

- High-End Market

The high-end segment consists of prime suburbs in Kisumu, such as Milimani and its environs. The segment recorded a decline in performance, with the rate of growth of price appreciation declining by 1.8% points p.a. from 5.9% in May 2016 to 2.4% in May 2018, and rental yields declining by 0.1% points p.a. from 5.7% to 5.6% in the same period. The decline in performance is attributable to wait and see attitude by investors over the prolonged 2017 electioneering period, which reduced economic activity in the city.

The performance of high-end apartments is as summarized below;

All values in Kshs, unless stated otherwise

|

Kisumu Apartments Performance Summary and Analysis - May 2018 |

|||||||||||||||||

|

Unit |

Unit Plinth Area (SQM) |

Price 2018 (mn) |

Price Per SQM 2018 |

Rent 2018 |

Rent Per SQM 2018 |

Annual Uptake |

Price App. 2018 |

Rental Yield 2018 |

Total Return 2018 |

Price Per SQM 2016 |

Rent Per SQM 2016 |

Annual Price App. 2016 |

Rental Yield 2016 |

Total return 2016 |

∆ in Price App. p.a |

∆ in Rental Yield p.a |

∆ in Total Return p.a |

|

2 Bed |

115 |

11.2 |

100,175 |

52,143 |

475 |

15.4% |

2.4% |

5.6% |

8.0% |

88,696 |

424 |

5.7% |

5.7% |

11.4% |

(1.7%) |

(0.1%) |

(1.7%) |

|

3 Bed |

149 |

14.3 |

99,812 |

65,000 |

449 |

16.7% |

2.3% |

5.5% |

7.8% |

90,604 |

419 |

6.1% |

5.6% |

11.7% |

(1.9%) |

0.0% |

(1.9%) |

|

Mean |

99,994 |

462 |

16.1% |

2.4% |

5.6% |

7.9% |

89,650 |

422 |

5.9% |

5.7% |

11.5% |

(1.8%) |

(0.1%) |

(1.8%) |

|||

|

|||||||||||||||||

Source: Cytonn Research May 2018

- Mid – End Market

Mid-end segment consists of estates such as Kibos, Kanyakwar, and Mamboleo, and are characterized by both high-rise and low-density houses mainly for the middle-class population of the city. This segment recorded an annual uptake of 23.4%, higher than the high-end segment at 16.1%, attributable to mid-end apartments’ affordability as they are 29.4% cheaper than the high-end segment, with a price per SQM of Kshs 99,994, against an average of Kshs 77,250 per SQM for mid-end apartments.

The performance of mid-end apartments in Kisumu is as summarized below:

All values in Kshs, unless stated otherwise

|

Kisumu Mid–End Apartments Performance Summary and Analysis - May 2018 |

|||||||||||||||||

|

Unit |

Unit Plinth Area (SQM) |

Price 2018 (mn) |

Price Per SQM 2018 |

Monthly Rent 2018 |

Rent Per SQM 2018 |

Annual Uptake |

Price App. 2018 |

Rental Yield 2018 |

Total Return 2018 |

Price Per SQM 2016 |

Rent Per SQM (2016) |

Annual Price App. 2016 |

Rental Yield 2016 |

Total Return 2016. |

∆ in Price App. p.a |

∆ in Rental Yield p.a |

∆ in Total Return p.a |

|

2 Bed |

75 |

6.3 |

84,000 |

26,667 |

356 |

23.6% |

4.2% |

5.2% |

9.4% |

74,667 |

396 |

5.3% |

4.6% |

9.9% |

(0.6%) |

0.3% |

(0.3%) |

|

3 Bed |

108 |

7.6 |

70,501 |

34,600 |

321 |

23.2% |

2.9% |

5.6% |

8.5% |

64,935 |

371 |

5.0% |

5.3% |

10.3% |

(1.1%) |

0.2% |

(0.9%) |

|

Average |

77,250 |

338 |

23.4% |

3.6% |

5.4% |

9.0% |

69,801 |

383 |

5.2% |

5.0% |

10.1% |

(0.8%) |

0.2% |

(0.6%) |

|||

|

|||||||||||||||||

Source: Cytonn Research May 2018

- Detached Units

The detached unit’s performance softened between May 2016 - May 2018, with the rate of growth of price appreciation declining by 2.4% points p.a. from 4.2% to (0.7%) and rental yields declining by 0.1% points p.a. from 4.5% to 4.4%. The decline in performance is attributable a tough operating environment, characterized by low credit supply, as a result of the implementation of the Banking (Amendment) Act 2015, which resulted in declining private sector credit growth from 25.8% in June 2014 to 1.7% as at September 2017. This led to some of the developments stalling, and a wait and see attitude by investors over the 2017 electioneering period.

The performance of detached units is as summarized below;

All values in Kshs, unless stated otherwise

|

Kisumu Residential Detached Units Performance Summary and Analysis - May 2018 |

|||||||||||||||||

|

Unit |

Unit Plinth Area (SQM) |

Price 2018 (mn) |

Price Per SQM (2018) |

Rent (2018) |

Rent per SQM (2018) |

Annual Uptake |

Price App. |

Rental Yield 2018 |

Total Return 2018 |

Price per SQM (2016) |

Rent per SQM (2016) |

Annual Price App. 2016 |

Rental Yield 2016 |

Total Return 2016 |

∆ in Price App. p.a |

∆ in Rental Yield p.a |

∆ in Total Return p.a |

|

3 Bed |

159 |

13.6 |

85,684 |

50,000 |

317 |

13.4% |

(0.6%) |

4.4% |

3.8% |

104,480 |

397 |

3.9% |

4.8% |

8.7% |

(2.3%) |

(0.2%) |

(2.4%) |

|

4 Bed |

276 |

22.0 |

78,898 |

76,667 |

292 |

7.90% |

(0.7%) |

4.4% |

3.7% |

86,372 |

355 |

4.4% |

4.2% |

8.6% |

(2.6%) |

0.1% |

(2.4%) |

|

Average |

82,291 |

305 |

10.7% |

(0.7%) |

4.4% |

3.8% |

95,426 |

376 |

4.2% |

4.5% |

8.7% |

(2.4%) |

(0.1%) |

(2.4%) |

|||

|

|||||||||||||||||

Source: Cytonn Research May 2018

- Residential Sector Summary

In terms of overall market performance, the residential sector recorded total returns of 6.9%, a 3.2% point (1.6% points annualized) decline from the 10.1% total returns recorded in May 2016. The performance is attributable to a decline in price appreciation, which dropped by 1.7% points y/y.

The residential sector performance is as summarized below;

All values in Kshs, unless stated otherwise

|

Kisumu Residential Sector Performance Summary- May 2018 |

|||||||||||||||

|

Segment |

Unit Type |

Average Price Per SQM 2018 |

Average Rent Per SQM 2018 |

Annual Uptake |

Price App. 2018 |

Rental Yield 2018 |

Average Total Returns 2018 |

Average price Per SQM 2016 |

Average Rent Per SQM 2016 |

Price App. 2016 |

Rental Yield 2016 |

Average Total Returns 2016 |

∆ in Price App. p.a |

∆ in Rental Yield p.a |

∆ in Total Return p.a |

|

Middle income-End |

Apartments |

70,501 |

338 |

23.4% |

3.6% |

5.4% |

9.0% |

69,801 |

383 |

5.2% |

5.0% |

10.1% |

(0.8%) |

0.2% |

(0.6%) |

|

High-End |

Apartments |

99,994 |

462 |

16.1% |

2.4% |

5.6% |

7.9% |

89,650 |

422 |

5.9% |

5.7% |

11.6% |

(1.8%) |

(0.1%) |

(1.8%) |

|

Apartments Average |

85,247 |

400 |

19.7% |

3.0% |

5.5% |

8.5% |

79,725 |

402 |

5.5% |

5.3% |

10.9% |

(1.3%) |

0.1% |

(1.2%) |

|

|

Detached Units |

82,291 |

305 |

10.7% |

(0.7%) |

4.4% |

3.8% |

95,426 |

376 |

4.2% |

4.5% |

8.7% |

(2.4%) |

0.0% |

(2.4%) |

|

|

Average |

84,262 |

368 |

16.7% |

1.8% |

5.1% |

6.9% |

84,959 |

394 |

5.1% |

5.1% |

10.1% |

(1.7%) |

0.0% |

(1.6%) |

|

|

|||||||||||||||

Source: Cytonn Research May 2018

- Commercial Properties

- Office Space

Over the last 2-years, the performance of commercial offices in Kisumu has picked up, with average rental yields for Grade C offices in the sector increasing by 0.3% points p.a., from 7.0% in May 2016 to 7.6% in May 2018. The occupancy rates were also in an upward trend, increasing by 1.5% points from 90.6% in May 2016 to 93.3% in May 2018. The better performance is as a result of an increase in demand for office space in the city, driven by devolution and growth in SME’s. Generally, Kisumu City lacks good commercial buildings with most of the buildings being Grade C, however over the last year, the market welcomed Grade B buildings such as Mega Plaza and University of Nairobi building located along Oginga Odinga Rd.

The summary of the sector’s performance is as below:

All values in Kshs, unless stated otherwise

|

Kisumu Commercial Office Space Analysis – May 2018 |

|||||||||

|

Office Grade |

Rent per SQFT Per Month (2018) |

Occupancy Rate 2018 |

Rental Yield 2018 |

Rent Per SQFT Per Month 2016 |

Occupancy Rate 2016 |

Rental Yields 2016 |

∆ in Rental Charges p.a |

∆ in Occupancy Rate p.a |

∆ in Rental Yield p.a |

|

Grade B |

80 |

80.0% |

6.4% |

||||||

|

Grade C |

78 |

93.3% |

7.6% |

76 |

90.6% |

7.0% |

1.6% |

1.5% |

0.3% |

|

Average |

79 |

86.7% |

7.0% |

76 |

90.6% |

7.0% |

1.6% |

1.5% |

0.3% |

|

|||||||||

Source: Cytonn Research May 2018

- Retail Space

The retail sector in Kisumu recorded 0.2% points annualized increase in rental yields from 9.0% in May 2016 to 9.4% in May 2018, attributable to 1.7% points increase in occupancy rates from 75.8% in May 2016 to 78.3% in May 2018. This was driven by the area’s high urbanisation rate averaging at 5.5% p.a. compared to Kenya’s average urbanisation rate of 4.4% attributable to devolution, which is the pull factor for growth in population in the area, and a key driver for the retail sector.

The summary of the sector’s performance is as below:

All values in Kshs, unless stated otherwise

|

Kisumu Commercial Retail Space Performance Summary and Analysis - May 2018 |

|||||||||

|

Office Grade |

Rent Per SQFT Per Month 2018 |

Occupancy Rate 2018 |

Rental Yield 2018 |

Rent Per SQFT Per Month 2016 |

Occupancy Rate 2016 |

Rental Yields 2016 |

∆ in Rental Charges p.a |

∆ in Occupancy Rate p.a |

∆ in Rental Yield p.a |

|

Neighbourhood mall |

168 |

73.3% |

10.4% |

179 |

78.3% |

10.9% |

(3.3%) |

(3.2%) |

(0.3%) |

|

Community Mall |

135 |

83.3% |

8.4% |

126 |

73.3% |

7.0% |

3.8% |

6.6% |

0.7% |

|

Average |

151 |

78.3% |

9.4% |

152 |

75.8% |

9.0% |

0.3% |

1.7% |

0.2% |

|

|||||||||

Source: Cytonn Research May 2018

- Land Analysis Summary

The land sector recorded an annualized capital appreciation of 8.9%, attributed to speculations and increased demand for land in residential zones such as Riat Hills as the residents shift to the outskirts of Kisumu City due to congestion in estates around Kisumu CBD

The summary of the sector’s performance is as below:

All values in Kshs, unless stated otherwise

|

Land Performance in Kisumu - May 2018 |

|||||

|

Developer |

Price Per Acre 2016 |

Price Per SQM 2016 |

Price Per Acre - 2018 |

Price Per SQM 2018 |

Annualized Capital Appreciation |

|

Riat Hills |

10,000,000 |

2,500 |

12,680,000 |

3,170 |

12.6% |

|

Milimani |

120,000,000 |

30,000 |

138,333,000 |

34,583 |

7.4% |

|

Mamboleo |

15,000,000 |

3,750 |

17,083,000 |

4,271 |

6.7% |

|

Average |

8.9% |

||||

|

|||||

Source: Cytonn Research May 2018

- Kisumu Market Summary Analysis

The Kisumu real estate sector recorded a total return of 16.1%, with a rental yield of 7.2% and a capital appreciation at 8.9% p.a.

The summary of the real estate sector performance is as below;

|

Kisumu Real Estate Market Performance Summary and Analysis - May 2018 |

|||||||

|

Theme |

Annual Uptake 2018 |

Occupancy Rates 2018 |

Rental Yields 2018 |

Annualized Price Appreciation |

Annualized Capital Appreciation |

||

|

Retail Space |

78.3% |

9.4% |

|||||

|

Commercial offices |

86.7% |

7.0% |

|||||

|

Residential |

16.7% |

75.1% |

5.1% |

1.8% |

|||

|

Land |

8.9% |

||||||

|

Average |

80.0% |

7.2% |

1.8% |

8.9% |

|||

|

|||||||

Source: Cytonn Research May 2018

- Comparative Analysis

Comparison with other Counties in Kenya:

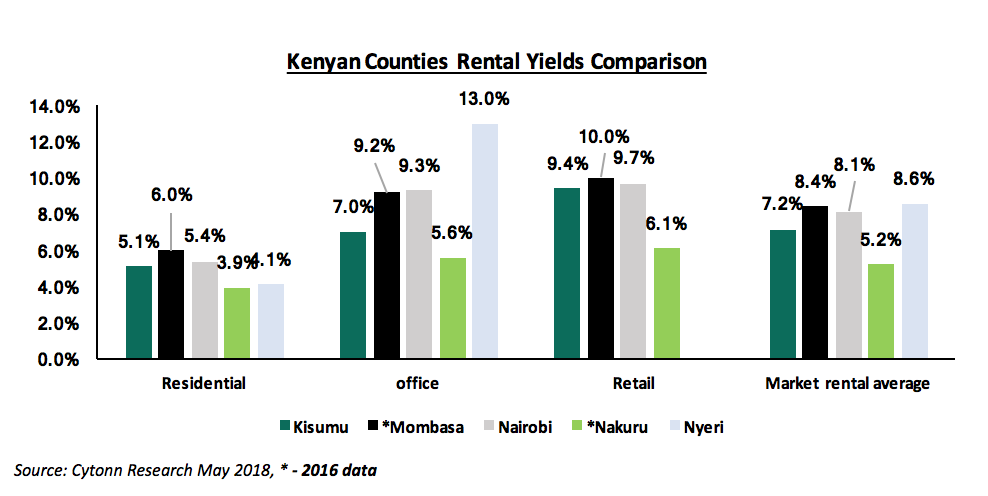

- Across all real estate sectors, Kisumu real estate recorded average rental yields of 7.2%, which is lower than Nyeri, Mombasa and Nairobi Counties by 1.4% points, 1.2% points, and 0.9% points, respectively, and 2.0% points higher than Nakuru County.

- For the residential sector, Kisumu recorded average rental yields of 5.1%, higher than Nakuru and Nyeri which recorded average rental yields of 3.9% and 6.1%, respectively, and lower than Mombasa and Nairobi with average rental yields of 6.0% and 5.4%, respectively.

- For the commercial office sector, Kisumu has average rental yields of 7.0%, higher than Nakuru Town, which has average rental yields of 5.6%, and lower than Mombasa, Nairobi and Nyeri, which have average rental yields of 9.2%, 9.3% and 13.0%, respectively.

- In the retail sector, Kisumu recorded average rental yields of 9.4%, outperforming Nakuru with 6.1%, but lower than Mombasa and Nairobi which have average rental yield of 10.0% and 9.7%, respectively.

Below is a summary of the analysis;

- Market Performance and Outlook

We have analyzed and identified the investment opportunity in Kisumu City, based on May 2016 and May 2018 performance as shown below;

|

Kisumu Real Estate Market Performance and Outlook |

||||

|

Theme |

Performance (May 2016) |

Performance (May 2018) |

Investment Opportunity |

Outlook |

|

Residential |

The residential sector had total returns of 10.2% on average; with average rental yields of 5.1% and a price appreciation of 5.1%. |

The residential sector has total returns of 6.9% on average, with rental yield of 5.1% and price appreciation of 1.8%. Residential sector has recorded a 3.3% decline in total return attributed to a 1.7% annualized decline in price appreciation due to political uncertainties that adversely affected the real estate sector |

Apartments for rent in suburbs such as Milimani, Lolwe, Migosi and Mamboleo suburbs, which record an average rental yield of 5.5% |

|

|

Commercial Offices |

Most offices in the market were Grade C, with average rental yields of 7.0% and an occupancy rate of 90.6% |

Grade C offices in the market have an average rental yield of 7.6%, which is an increase of 0.3% points p.a. and an average occupancy rate of 93.3%. The office sector has witnessed entry of Grade B office space that have an average rental yield of 6.4% at an average occupancy of 80.0% |

The sector is still nascent and presents an opportunity for Grade A & B offices, recording higher rental charges at Kshs 80 compared to Grade C at Kshs 78 and have an average occupancy rate of 80.0% in the first year of operation |

|

|

Retail Space Sector |

The commercial retail sector recorded rental yields of 9.0% at an average occupancy rate of 75.8% |

The commercial retail sector has rental yields of 9.4% at an average occupancy of 78.3%. This is an annualized increase of 0.2% points in rental yield, the increase is driven by a 1.7% points annual increase in occupancy rates on the back of growing SME’s. |

We remain neutral over the sector given the increased supply of malls translating to 149 SQM per 1,000 urban persons compared to other counties such Nairobi with 145 SQM per 1,000 urban persons and Kiambu at 45 SQM per 1,000 persons |

|

|

Land |

Land in Kisumu City recorded an annual capital appreciation of 8.9% over the last 2-years |

The opportunity in the sector is in emerging residential zones such as Riat Hills driven by speculation and the market exodus from congested Kisumu city CBD |

||

Out of the four real estate themes under evaluation in Kisumu, 2 themes, that is commercial offices and land have a positive outlook, retail sector has a neutral outlook, while residential has a negative outlook, thus we retain a neutral outlook for the Kisumu real estate market. The market, however, has pockets of value in sectors such as Grade A and B commercial offices driven by devolution and growth in SMEs while the land sector is driven by demand from developers as they expand from the CBD to relatively new suburbs such as Riat Hills.

Disclaimer:The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.