Market Post Interest Rate Cap & Cytonn Weekly #50/2019

By Research Team, Dec 15, 2019

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 53.5%, down from 55.3% the previous week. The undersubscription is attributable to reduced participation by banks who are now looking to lend to the private sector after the repeal of the rate cap legislation. The yield on the 91-day and 364-day paper remained unchanged at 7.2% and 9.8%, respectively, while that of the 182-day paper declined by 0.1% points to 8.1%, from 8.2% recorded last week. During the week, Fitch Ratings, an American credit rating agency, affirmed through a press release that Kenya’s Long-Term Foreign-Currency Issuer Default Rating was at B+ with a stable outlook. This rating is informed by the country’s high levels of debt, both domestic and external, against a strong and stable growth outlook. During the week, the Energy and Petroleum Regulatory Authority released their monthly statement on the maximum retail fuel prices in Kenya effective from 15th December 2019 to 14th January 2020. Petrol prices have declined marginally by 1.0% to Kshs 109.5 per litre from Kshs 110.6 per litre previously, while diesel prices have declined by 2.7% to Kshs 101.8 per litre, from Kshs 104.6 pre litre previously. Kerosene prices decreased by 1.7% to Kshs 102.3 per litre, from Kshs 104.1 per litre previously;

Equities

During the week, the equities market recorded mixed performance with NASI gaining by 0.1% and NSE 20 and NSE 25 recording losses of 1.3% and 0.6%, respectively, taking their YTD performance to gains/(losses) of 14.3%, (8.7%) and 11.0%, for the NASI, NSE 20 and NSE 25, respectively. The Insurance Regulatory Authority released Q3'2019 Insurance Industry Report summarizing the performance and financial position of the Kenya insurance industry. According to the report, industry Gross Written Premium grew by 6.5% to Kshs 174.9 bn as at the end of Q3’2019, from Kshs 164.3 bn recorded in Q3’2018. The Long-term Insurance segment recorded an 11.0% growth in Gross Written Premiums to Kshs 69.7 bn in Q3’2019, from Kshs 62.8 bn observed in a similar period last year, while the General Insurance segment’s Gross Written Premiums improved by 3.7% to Kshs 105.2 bn, from Kshs 101.5 bn in Q3’2018;

Real Estate

During the week, Kenya National Bureau of Statistics released the Leading Economics Indicator Report for the month of December 2019, which showed that the value of building approvals for the first half of the year increased compared to a similar period in 2018. In the residential sector, H.E President Uhuru Kenyatta launched the first phase of the 100,000-units affordable housing project initiated after signing a memorandum of understanding with the United Nations Office for Project Services (UNOPS) as a strategic partner and also issued a directive to officially make contributions to the National Housing Development Fund voluntary. And in the hospitality sector, Kenya Airports Authority revealed plans of revamping airstrips at the Kenyan Coast to allow accommodation of larger aircraft and international flights, while the government also announced plans to set up a tourism centre in partnership with the Jamaican Government that will help tackle challenges affecting the sector such as terrorism;

Focus of the Week

This week, we revisit the interest rate cap topic following the Presidential assent of the Finance Bill, 2019 into law, which repealed Section 33B of the Banking Act that provided for the capping of bank interest rates. In this topical, we review the effects the interest rate cap had in the economy and banking industry, and discuss our expectations going forward for the market, following the interest rate cap repeal in Kenya;

- Cytonn Asset Managers Limited (CAML), the regulated affiliate of Cytonn Investments, launched the first specialized and regulated Collective Investment Scheme in Kenya, focusing on financing mid to low-income housing, known as the Cytonn High Yield Fund (CHYF). The ceremony was graced by Mr. Charles Hinga, Principal Secretary, and State Department for Housing and Urban Development. To find out more about the launch, read the event note here;

- Edwin H. Dande, Chief Executive Officer, Cytonn Investments was interviewed by Metropol TV where he gave his remarks about the Cytonn High Yield Fund. Watch Edwin here;

- Beatrice Mwangi, Senior Research Analyst, Cytonn Investments was on NTV to talk about the economy outlook 2019. Watch Beatrice here;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, and The Ridge;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-Ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 53.5%, down from 55.3% the previous week. The undersubscription is attributable to reduced participation by banks who are now looking to lend to the private sector following the repeal of the rate cap legislation. The yield on the 91-day and 364-day paper remained unchanged at 7.2% and 9.8%, respectively, while that of the 182-day paper declined by 0.1% points to 8.1%, from 8.2% recorded last week. The acceptance rate increased to 99.2%, from 44.7% recorded the previous week, with the government accepting Kshs 12.7 bn of the Kshs 12.8 bn worth of bids received.

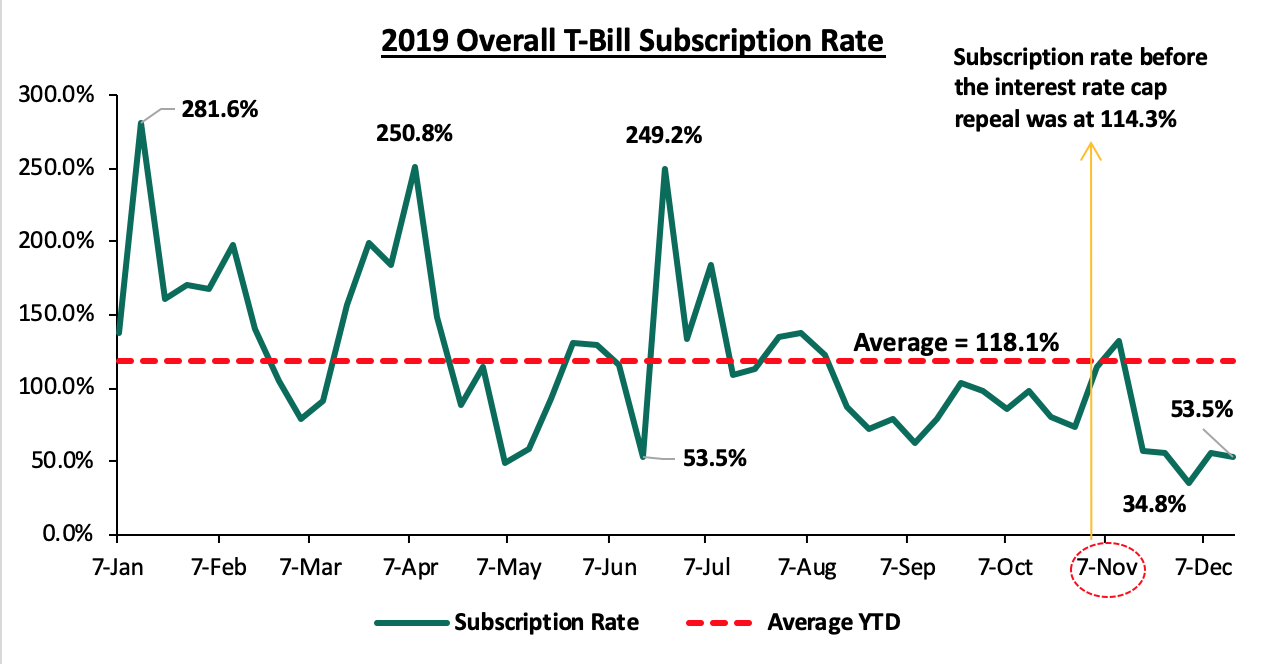

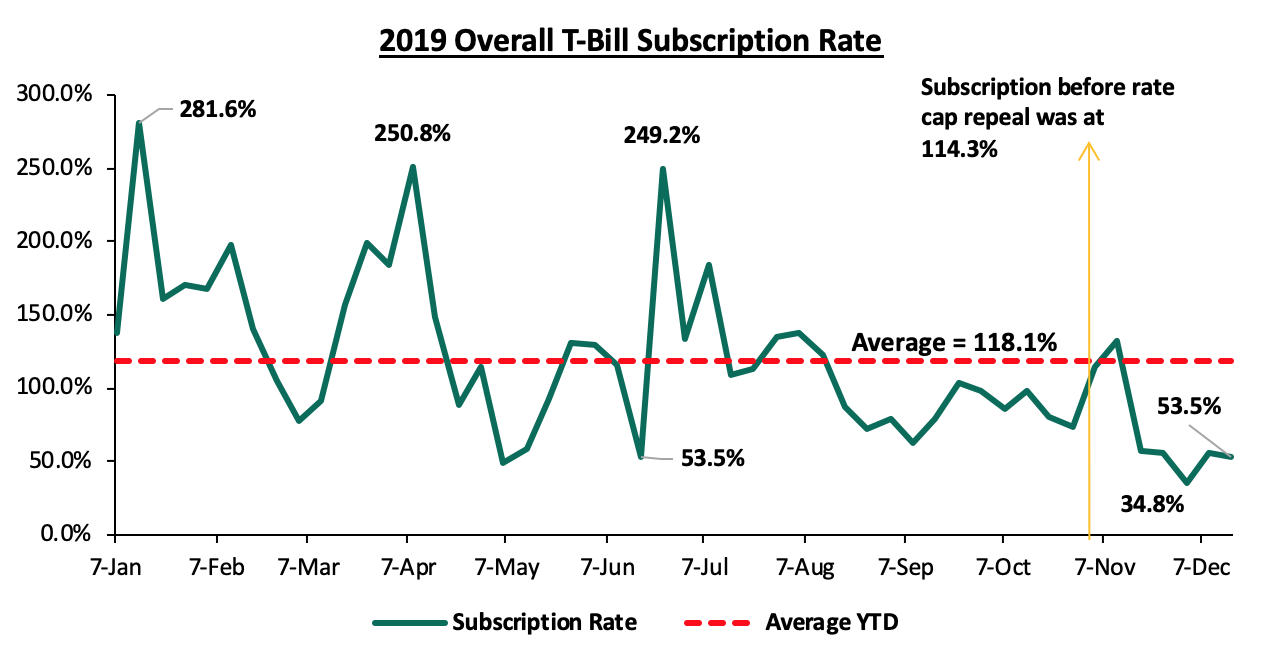

It is important to note that only a month after the repeal of the Interest Rate cap (7th Nov), the overall subscription rate has declined to lows of 34.8%, which is 83.3% points lower than the YTD average of 118.1%. We attribute this to reduced demand for government paper from the banking sector following the repeal of the interest rate cap. Below is a chart highlighting the performance through the year:

For the month of December, the National Treasury issued a 5-year bond of Kshs 25.0 bn (FXD 3/2019/5) with a coupon rate of 11.5%. The bond was oversubscribed, with the subscription rate coming in at 113.9%. The continued high demand for short tenor bonds has been attributable to the negative bias by investors on longer-tenor bonds due to the relatively flat yield curve on the long-end brought about by the saturation of long-term bonds, coupled with the duration risk associated with long-term papers, thus making the short tenor bonds more attractive. The bond yield for the issue came in at 11.6%, while the acceptance rate on the bond was 65.8%, with the government accepting Kshs 18.7 bn of the Kshs 28.5 bn worth of bids received.

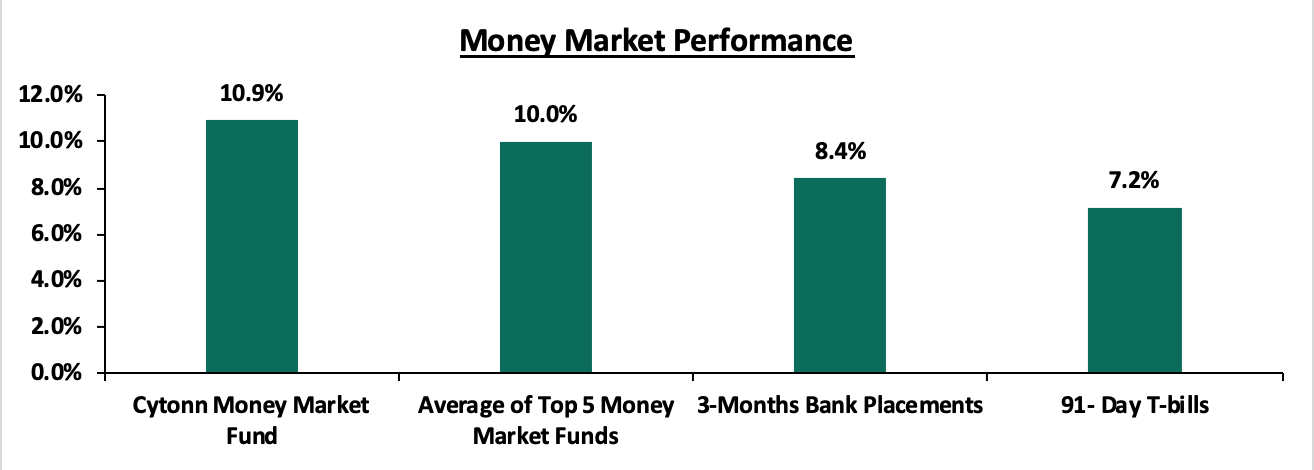

In the money markets, 3-month bank placements ended the week at 8.4% (based on what we have been offered by various banks), the 91-day T-bill came in at 7.2%, while the average of Top 5 Money Market Funds came in at 10.0% from 9.9% recorded the previous week. The Cytonn Money Market Fund, increased by 0.2% points to close the week at 10.9%, from 10.7% recorded in the previous week.

Liquidity:

During the week, the average interbank rate increased to 6.6%, from 6.3% recorded the previous week, pointing to tightened liquidity in the money markets; this performance was mainly driven by banks trading cautiously in the interbank market in order to meet their CRR cycle requirements for the period ending December 15th 2019. This saw commercial banks excess reserves come in at Kshs 13.1 bn in relation to the 5.25% cash reserves requirement (CRR). The average interbank volumes increased by 24.3% to Kshs 29.3 bn, from Kshs 23.6 bn recorded the previous week.

Kenya Eurobonds:

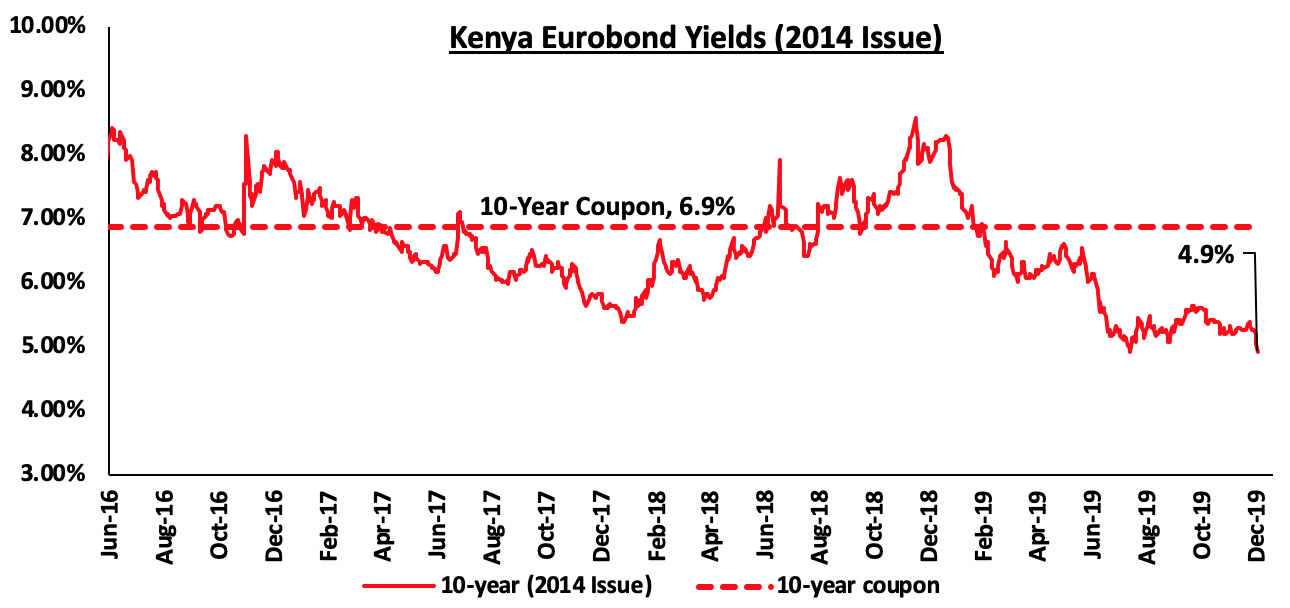

According to Reuters, the yield on the 10-year Eurobond issued in June 2014, decreased by 0.4% points to 4.9%, from 5.3%, as recorded in the previous week. Eurobond yields were on the decline as a result of the Fitch’s credit Rating released earlier during the week, affirming that Kenya’s Long-Term Foreign-Currency Issuer Default Rating was at B+ with a stable outlook.

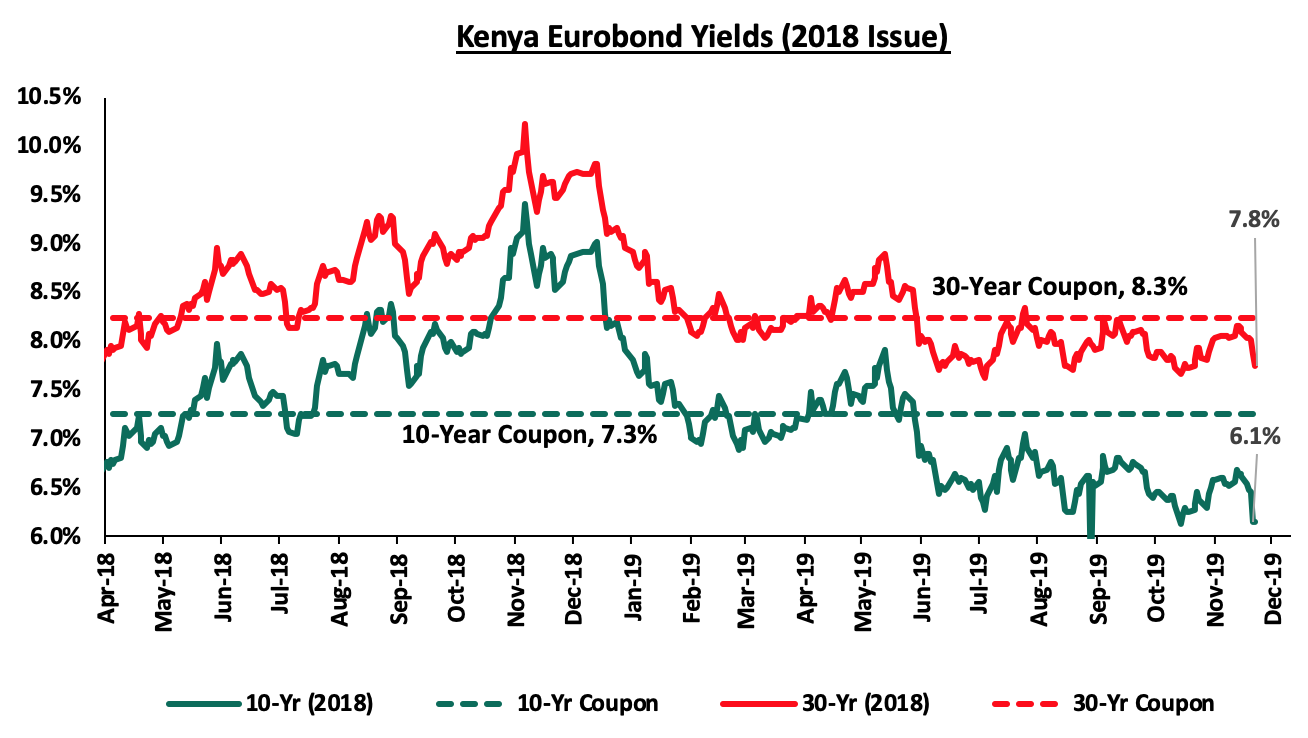

During the week, the yields on the 10-year Eurobond and the 30-year Eurobond both decreased by 0.5% points and 0.3% points, to 6.1% and 7.8%, from 6.6% and 8.1%, respectively.

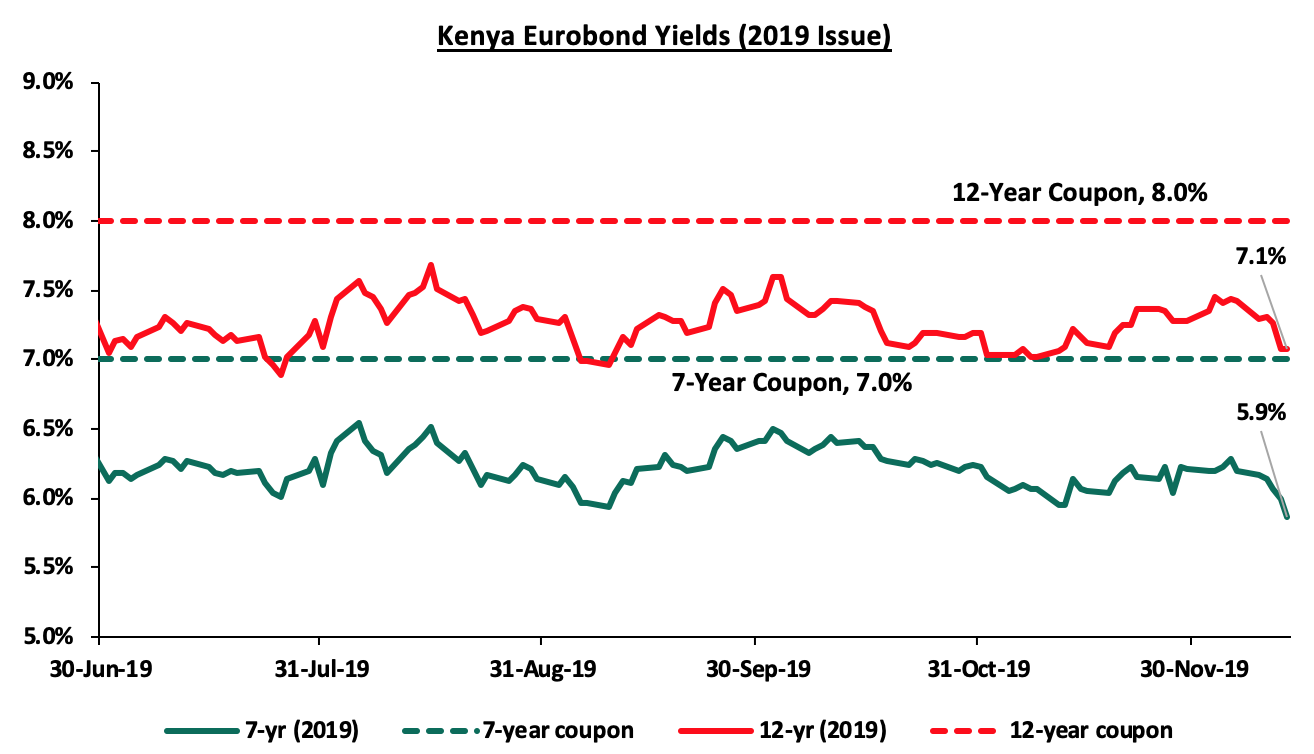

During the week, the yield on the 7-year Eurobond decreased by 0.4% points to 5.9%, from 6.3% recorded the previous week, while the yield on the 12-year Eurobond decreased by 0.3% points to 7.1%, from 7.4% recorded the previous week.

Kenya Shilling:

During the week, the Kenya Shilling appreciated marginally against the US Dollar to close at Kshs 101.7, from Kshs 101.8 recorded the previous week, mostly attributable to diaspora remittances which helped to meet increased dollar demand from merchandise importers. On an YTD basis, the shilling has appreciated by 0.1% against the dollar, in comparison to the 1.3% appreciation in 2018. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- The narrowing of the current account deficit, with preliminary data indicating that Kenya’s current account deficit improved by 11.8% during Q2’2019, coming in at a deficit of Kshs 107.6 bn, from Kshs 122.0 bn in Q2’2018, equivalent to 6.2% of GDP, from 7.6% recorded in Q2’2018. This was mainly driven by the narrowing of the country’s merchandise trade deficit by 1.7% and a rise in secondary income (transfers) balance by 5.1%,

- Improving diaspora remittances, which have increased cumulatively by 7.0% in the 12-months to October 2019 to USD 2.8 bn, from USD 2.6 bn recorded in a similar period of review in 2018,

- Foreign capital inflows, with investors looking to participate in the equities market,

- CBK’s supportive activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 8.8 bn (equivalent to 5.4-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover.

Weekly Highlights

During the week, Fitch Ratings, an American credit rating agency, affirmed through a press release that Kenya’s Long-Term Foreign-Currency Issuer Default Rating was at B+ with a stable outlook. This rating is informed by the country’s high levels of debt, both domestic and external, against a strong and stable growth outlook. Some of the weaknesses highlighted in the report include administrative issues such as weak tax compliance and expansion of tax exemptions that have hindered revenue growth. These issues have caused the government’s revenue collection to fall to an estimated 17.5% of GDP in the fiscal year ending June 2019, from highs of 19.0% seen in 2015. To curb this the government has, in the Finance Bill 2019;

- Increased capital gains tax,

- Introduced a new excise tax, and

- A widening of withholding tax.

In FY’2019, Kenya’s fiscal deficit expanded to 7.8%, higher than the 7.0% recorded in 2018. The slowdown in the large infrastructure development projects has lowered the capital expenditure costs, with capex falling below 6.0% of GDP from an average of 8.1% in FY’2015 to FY’2017. Fitch assumes in their release that the general government Debt-to-GDP ratio will continue increasing through FY’2022 to 64.8%, before easing very gradually to 60.5% by 2028.

In November 2019, Kenya's Parliament approved a change to the existing debt limit, moving it to a nominal limit of Kshs 9 tn, from 50.0% of GDP in net present value terms. The new debt limit is in line with the forecasts in the National Treasury's most recent Budget Review and Outlook Paper, which sees debt rising to just below the Kshs 9 tn ceiling by FY’2024. Fitch have forecasted a slower GDP growth to 5.6% in 2019, from 6.3% in 2018. This is informed by the slowdown in the economy, experienced in H1’2019 as drought impacted agricultural output, although growth in the services sector picked up.

The country has experienced an increase in inward Foreign Direct Investments (FDI), which rose to USD1.6 bn in 2018 after having fallen to USD400 mn in 2016. The inability to increase FDI has over the years increased Kenya's reliance on public external debt to finance the Current Account Deficit. Similarly, private sector credit growth has recovered to 7.0% as of September 2019, from 2.5% recorded in 2018. This recovery has been supported by the removal of the interest rate cap during the last quarter of the year. In our view, Kenya’s relatively favourable macro-economic conditions have had a significant impact on the country’s rating, despite the high levels of debt we are currently experiencing. This is good for the country since It builds the confidence in both local and foreign investors.

During the week, the Energy and Petroleum Regulatory Authority released their monthly statement on the maximum retail fuel prices in Kenya effective from 15th December 2019 to 14th January 2020. Below are the key take-outs from the statement:

- Petrol prices have declined marginally by 1.0% to Kshs 109.5 per litre, from Kshs 110.6 per litre previously, while diesel prices have declined by 2.7% to Kshs 101.8 per litre, from Kshs 104.6 per litre previously,

- Kerosene prices decreased by 1.7% to Kshs 102.3 per litre, from Kshs 104.1 per litre.

The changes in prices are attributable to:

- A decrease in the average landing cost of imported super petrol by 0.5% to USD 460.8 per cubic meter in November 2019, from USD 463.2 per cubic meter in October 2019,

- A decrease in the average landing costs of imported diesel by 3.4% to USD 485.3 per cubic meter in November 2019, from USD 502.2 per cubic meter in October 2019, and Kerosene decreasing by 3.8% to USD 481.1 per cubic meter in November 2019, from USD 499.9 per cubic meter in October 2019, and,

- The Free on Board (FOB) price of Murban crude oil lifted in November 2019 increased by 4.7% to USD 66.6 from USD 63.6, per barrel in October 2019.

We expect a decline in the transport index, which carries a weighting of 8.7% in the total consumer price index (CPI), due to the decreased petrol and diesel pump prices. Consequently, the decline in the transport index will ease inflationary pressures.

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 16.7 % ahead its domestic borrowing target, having borrowed Kshs 148.2 bn against a pro-rated target of Kshs 127.1 bn. We expect an improvement in private sector credit growth considering the repeal of the interest rate cap. This will result in increased competition for bank funds from both the private and public sectors, resulting in upward pressure on interest rates. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance

During the week, the equities market recorded mixed performance with NASI gaining by 0.1% and NSE 20 and NSE 25 recording losses of 1.3% and 0.6%, respectively, taking their YTD performance to gains/(losses) of 14.3%, (8.7%) and 11.0%, for the NASI, NSE 20 and NSE 25, respectively. The performance in NASI was driven by gains recorded by large-cap stocks such as Standard Chartered, Barclays, KCB Group and Safaricom of 3.3%, 2.8%, 1.5%, and 0.7%, respectively.

Equities turnover increased by 19.2% during the week to USD 33.0 mn, from USD 27.7 mn the previous week, taking the YTD turnover to USD 1,444.7 mn. Foreign investors became net buyers for the week, with a net buying position of USD 4.7 mn, an improvement from a net selling position of USD 0.1 mn recorded the previous week.

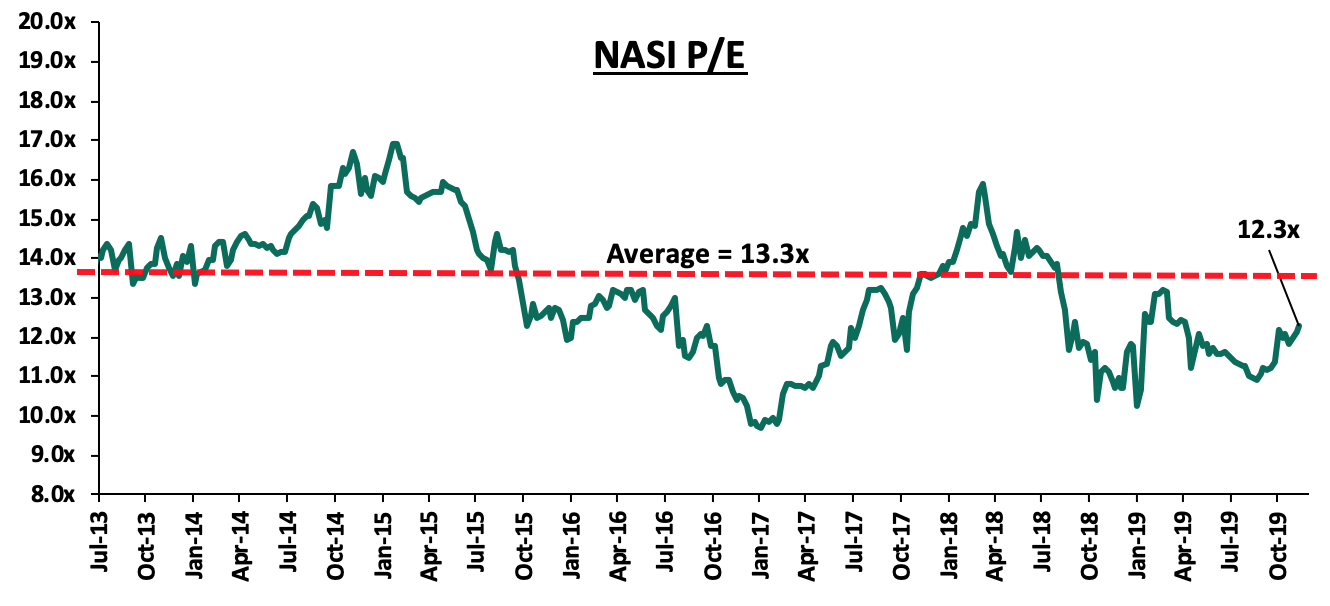

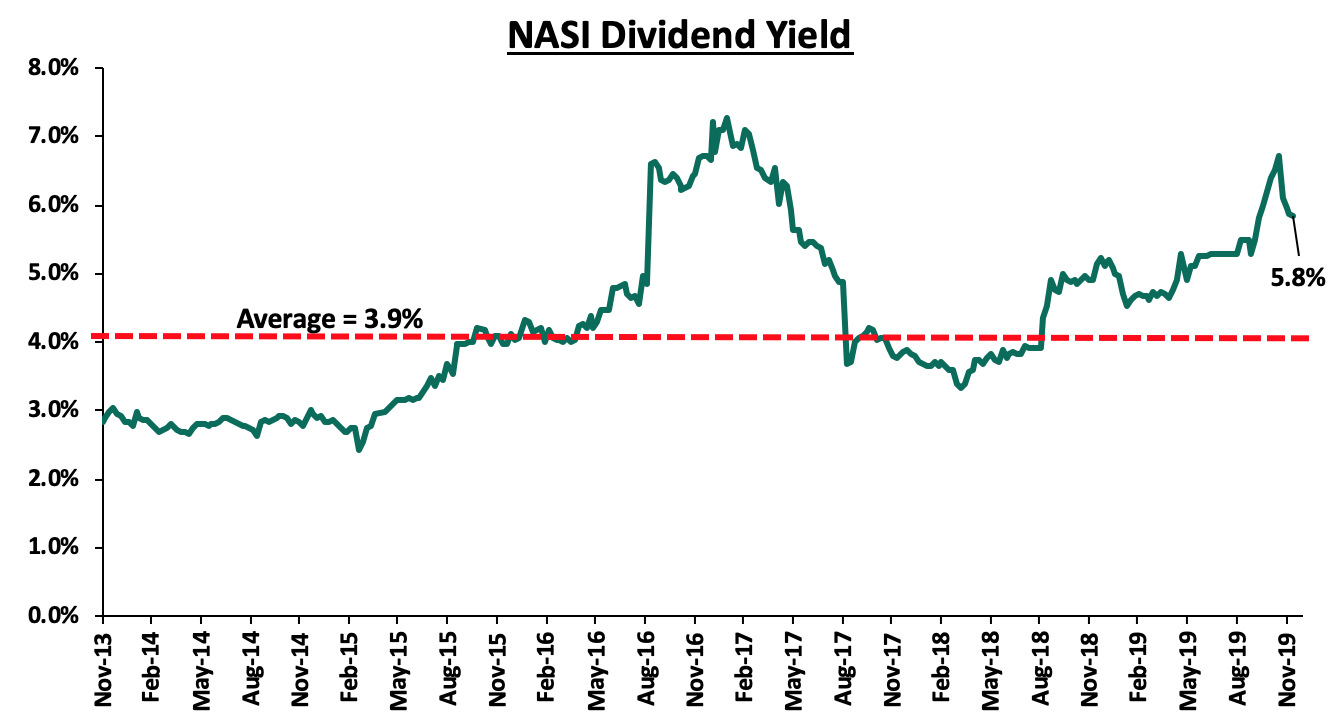

The market is currently trading at a price to earnings ratio (P/E) of 12.3x, 7.4% below the historical average of 13.3x, and a dividend yield of 5.8%, 1.9% points above the historical average of 3.9%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 12.3x is 26.6% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 48.0% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight

The Insurance Regulatory Authority released Q3'2019 Insurance Industry Report summarizing the performance and financial position of the Kenya Insurance industry. According to the report:

- Industry Gross Written Premium grew by 6.5% to Kshs 174.9 bn as at the end of Q3’2019, from Kshs 164.3 bn recorded in Q3’2018. The Long-term Insurance segment recorded an 11.0% growth in Gross Written Premiums to Kshs 69.7 bn in Q3’2019, from Kshs 62.8 bn observed in a similar period last year, while the General Insurance segment’s Gross Written Premiums improved by 3.7% to Kshs 105.2 bn, from Kshs 101.5 bn in Q3’2018,

- The General Insurance segment remained the largest contributor to the industry Gross Written Premium, contributing 60.2% of the Total Premium, with Motor Insurance and Medical Insurance businesses accounting for 34.5% and 32.0% of the Gross Premium Income under the General Insurance business, respectively,

- Long-term Insurance segment, on the other hand, contributed 39.8% of the Total Premium, with Pensions and Life Assurance businesses accounting for 38.5% and 29.1% of Total Long-Term Gross Insurance Premium, respectively,

- According to the quarterly claims statistics, in Q3’2019, the claims payment ratio, which is the proportion of the number of claims paid in relation to the total number of claims actionable during the quarter, for general liability increased by 1.8% points to 10.0%, from 8.2% recorded in Q3’2018. Claims payment ratio for general non-liability claims, on the other hand, also increased by 6.7% points to 71.4%, compared to 64.7% observed in Q3’2018. The claims payment ratio for the Long-Term Insurance business recorded an 8.6% points increased to 73.5% in Q3’2019, from 64.9% observed in Q3’2018. Generally, the overall claims payment for the industry improved in Q3’2019 as compared to a similar period in 2018,

- Profit after Tax (PAT) of insurers in the quarter improved by 97.7% to Kshs 6.1 bn, from Kshs 3.1 bn, thus, the sector’s Return on Assets (ROA) and Return on Equity (ROE) improved marginally to 1.7% and 4.7%, respectively, from 1.4% and 3.9%, respectively, recorded in Q3’2018,

- In terms of financial position, the industry’s Total Assets grew by 10.6% to Kshs 690.9 bn, from Kshs 624.9 bn recorded in a similar period last year, with Investments recording a growth of 13.0% to Kshs 577.0 bn, from 510.4 bn recorded in Q3’2018 with Government Securities (Treasury Bills and Bonds) and Investment property accounting for the highest allocations of 61.5% and 14.5%, respectively,

- Shareholder’s Funds increased by 6.1% to Kshs 158.0 bn, from Kshs 148.9 bn recorded in Q3’2018, with Total Liabilities recording a 12.0% increase to Kshs 532.8 bn, from Kshs 628.9 bn recorded in a similar period last year, driven by a 34.3% increase in Long-term Liabilities to Kshs 13.4 bn, from Kshs 10.0 bn recorded in Q3’2018, coupled with a 12.0% increase in Insurance Contract Liabilities to Kshs 360.6 bn, from Kshs 315.3 bn recorded in a similar period in 2018,

- Reinsurers, on the other hand, recorded a 31.4% increase in business volume with Gross Premium Income rising to Kshs 18.0 bn, from Kshs 13.7 bn in Q3’2018, with overall profitability declining by 56.3% to Kshs 1.2 bn, from Kshs 2.7 bn recorded in Q3’2018. The decline in profitability of reinsurers is attributable to a 36.7% rise in claims incurred to Kshs 9.1 bn, from Kshs 6.7 bn recorded in Q3’2018, which outperformed the 31.4% increase in Gross Premium Income, from Kshs 13.7 bn to Kshs 18.0 bn .

In light of various themes shaping the sector, including regulatory changes and technology and innovation, we expect to witness transition on these fronts which will drive the adoption of mobile and online underwriting platforms, enhancing convenience to customers in taking insurance policies thus raising the uptake of insurance products. These efforts, thus, will improve revenue channels for insurance firms and enhance the sustainability of profitable performance.

Universe of Coverage

|

Banks |

Price at 6/12/2019 |

Price at 13/12/2019 |

w/w change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

3.03 |

3.10 |

2.3% |

4.8 |

14.5% |

72.9% |

0.3x |

Buy |

|

Diamond Trust Bank |

112.00 |

110.00 |

(1.8%) |

189.0 |

2.4% |

71.1% |

0.5x |

Buy |

|

I&M Holdings*** |

51.75 |

50.00 |

(3.4%) |

75.2 |

7.8% |

53.1% |

0.9x |

Buy |

|

Jubilee Holdings |

350.00 |

350.75 |

0.2% |

453.4 |

2.6% |

32.1% |

1.1x |

Buy |

|

KCB Group*** |

51.50 |

52.25 |

1.5% |

64.2 |

6.7% |

31.4% |

1.4x |

Buy |

|

Sanlam |

17.00 |

16.50 |

(2.9%) |

21.7 |

0.0% |

27.6% |

0.7x |

Buy |

|

Co-op Bank*** |

15.70 |

15.55 |

(1.0%) |

18.1 |

6.4% |

21.7% |

1.3x |

Buy |

|

Standard Chartered |

195.00 |

201.50 |

3.3% |

211.6 |

9.4% |

17.9% |

1.5x |

Accumulate |

|

NCBA |

33.55 |

33.80 |

0.7% |

37.0 |

4.4% |

14.7% |

0.8x |

Accumulate |

|

Equity Group*** |

52.25 |

51.25 |

(1.9%) |

56.7 |

3.9% |

12.4% |

1.9x |

Accumulate |

|

Barclays Bank*** |

12.65 |

13.00 |

2.8% |

13.0 |

8.5% |

11.2% |

1.6x |

Accumulate |

|

Stanbic Holdings |

105.00 |

100.00 |

(4.8%) |

108.1 |

4.8% |

7.8% |

1.1x |

Hold |

|

Liberty Holdings |

10.45 |

10.50 |

0.5% |

10.1 |

4.8% |

1.1% |

0.9x |

Lighten |

|

CIC Group |

3.00 |

3.00 |

0.0% |

2.6 |

4.3% |

(7.7%) |

1.1x |

Sell |

|

Britam |

8.16 |

8.20 |

0.5% |

6.8 |

0.0% |

(17.2%) |

0.8x |

Sell |

|

HF Group |

5.52 |

5.54 |

0.4% |

4.2 |

0.0% |

(23.9%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average. We expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, to support the positive performance.

- Industrial Reports

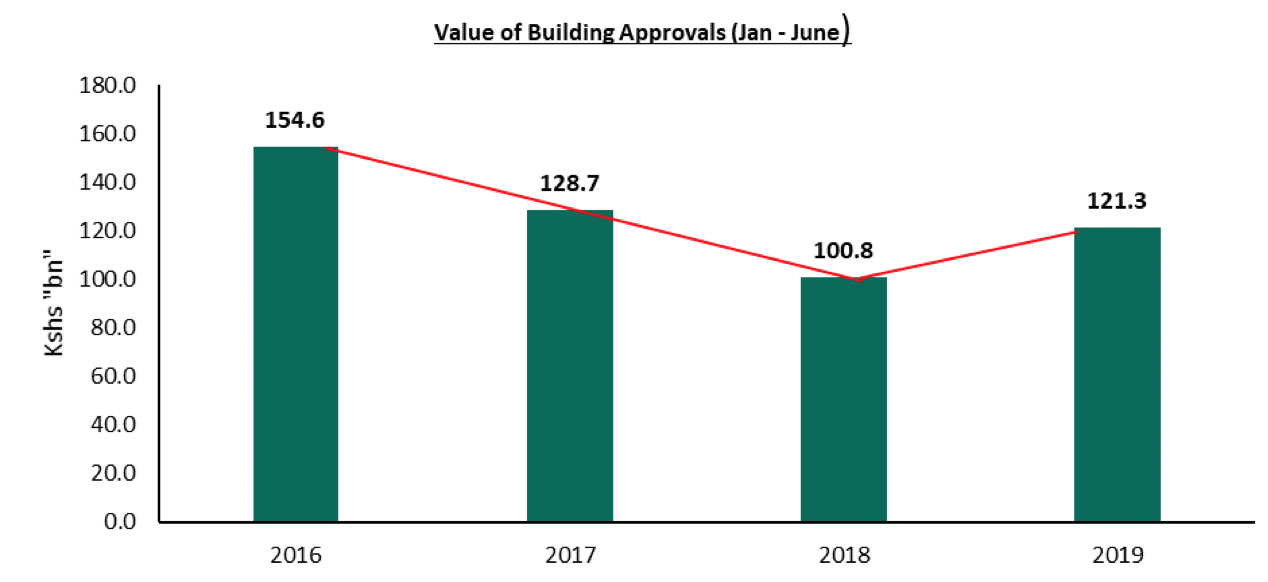

During the week, Kenya National Bureau of Statistics released the Leading Economic Indicators December 2019 Report. As per the report, the value of buildings approved during the first half of the year came in at Kshs 121.3 bn, a 20.3% increase from Kshs 100.8 bn during the same period in 2018, bucking the trend that has been witnessed over the past three years, as shown below:

Source: KNBS

The increase is largely attributable to the launching of mass affordable housing projects in the past two year. However, according to the report, consumption of cement dropped to 492,695 metric tons in August 2019 from 500,601 metric tons in July 2019, indicating a slowdown in real construction activity. This is attributable to;

- Reduced developer activity in sectors such as office and retail, which according to Cytonn Research, registered oversupplies of 5.2 mn and 2.0 mn SQFT, respectively, as of Q3’2019,

- Government delays in processing building approval permits especially in 2019, and

- Insufficient access to developer funding owing to a tough financial environment that has persisted for the past two years owing to the recently repealed interest rate capping law.

However, in our view with the repeal of the interest rate cap and the continued launch of mass affordable housing projects, we expect increased construction activities, and therefore, cement consumption, to pick up in 2020.

- Residential Sector

Following the signing of a Memorandum of Understanding with the United Nations Office for Project Services and the Kenya National Government for construction of a 100,000 affordable housing units, H.E President Kenyatta, during the week, launched construction of the project’s first phase, dubbed ‘Habitat Heights’, which will see 8,888 affordable housing units delivered in Lukenya, Mavoko sub-county within the next three to five years. The Habitat Housing Society is set to provide offtake guarantee to the developers of the project, Singapore-based consortium Afra Holdings, via their subsidiary Singapura Developers. The project will sit on 78-acres of land and will comprise of 576 studios of 22 and 28 SQM; 972 one-bedrooms of 44 SQM; 2,912 two-bedrooms of 75 SQM; and 4,368 three-bedroom units of 95 SQM.

In terms of pricing, the units have price points of Kshs 3.5 mn, 4.8 mn, and 5.8 mn, for one, two and three-bedroom units, respectively, which translates to an average price per SQM of Kshs 68,199, which is 3.1% higher than the average price per SQM for Athi River at Kshs 66,156; this indicates that affordable housing does not have to be outside the market parameters.

All Values in Kshs Unless Stated Otherwise)

|

|

Government Framework |

|

Habitat Heights |

|

|

|||

|

Typology |

Unit Plinth Area (SQM) |

Selling Price |

Price Per SQM |

Unit Plinth Area (SQM) |

Selling Price |

Price Per SQM |

Unit Size Difference |

Price per SQM Difference |

|

1 |

30 |

1.0mn |

33,333 |

44 |

3.5mn |

79,545 |

46.7% |

138.6% |

|

2 |

40 |

2.0mn |

50,000 |

75 |

4.8mn |

64,000 |

87.5% |

28.0% |

|

3 |

60 |

3.0mn |

50,000 |

95 |

5.8mn |

61,053 |

58.3% |

22.1% |

|

Average |

43 |

2.0mn |

44,444 |

71 |

4.7mn |

68,199 |

64.2% |

62.9% |

|

· Habitat Heights unit sizes are on average 64.2% larger than the government affordable housing units while the average price per SQM is on average 62.9% higher than the proposed government prices. This indicates that affordable housing projects for private developers do not have to be outside market parameters |

||||||||

Satellite Towns such as Mavoko, Athi River, and Ruiru continue to attract mass housing projects due to availability of land for development in bulk, and at relatively affordable prices. Additionally, in a bid to reduce the cost of construction inputs, and commensurately reduce the cost for homebuyers, the government has continued to offer incentives to affordable housing developers such as provision of bulk infrastructure, national land at no cost, waiving of National Environment Management Authority (NEMA) and National Construction Authority fees; and as per the Head of State, there’s also a proposal for waiving development fees at the county level. We therefore, expect to see more projects undertaken in 2020 as the government rushes to fulfil its objective of 500,000 units by 2022.

In a bid to ensure the full implementation of the National Housing Development Fund (NHDF), the President also, during the week, officially directed The National Treasury to revise the legal requirement for mandatory contributions of the National Housing Development Fund Levy and make it voluntary, with immediate effect. The Fund, which was launched in 2017 was aimed at providing offtake financing for developers while helping homebuyers save towards homeownership. So far, according to Housing Principal Secretary Charles Hinga, only 14,800 Kenyans have made voluntary contributions with the main challenge being attributable to a tough financial environment that has discouraged household savings. We expect the directive to come as a relief for the average Kenyans who were heavily opposed to the housing levy due to relatively huge tax burdens pushing the cost of living higher. We are supportive of the new direction to do away with the mandatory contribution for two reasons: first, it would have likely just been another pot of money susceptible to massive corruption and tenderprenuers, and second, given the significant tax incentives and enabling legislation that the government has put in place so far to enhance affordability, the affordable housing agenda is now very realizable even at market rates. Some of the incentives include:

- Stamp duty exemption for first time home buyers,

- Waiving for NCA and NEMA fees,

- Exemption of goods supplied for affordable housing from Value Added Tax (VAT),

- Reduction of Import Declaration Fee, IDF, on inputs for the construction of houses under the affordable housing scheme from 2.0% to 1.5%,

- Exemption of companies implementing projects under the affordable housing scheme from the application of thin capitalization rules,

- Allowing of Unit Trust Funds under the CMA Act to qualify as Home Ownership Saving Plan, and,

- The incorporation of the Kenya Mortgage Refinance Company (KMRC).

The sum total of the legislations and incentives is that the government has made the affordable housing achievable.

However there remains three key stumbling blocks to the President’s affordable housing agenda, which needs to be expeditiously addressed for the private sector to start a mass implementation of affordable housing projects:

- KMRC needs to be operationalized; KMRC would allow long tenor mortgages, and improve affordability by an estimated 14%, as discussed in our topical KMRC Update . It is not clear when KMRC will start its writing business. A certain date would enable developers to plan,

- Operationalization of the many legislations passed so that affordable housing developers can begin to access the incentives. The government has done a very good job passing enabling legislation, however the respective agencies need to operationalize the legislations. For example, the legislation to reduce corporate tax to 15% from 30% for those building at least 100 affordable housing units was passed in 2017, however, up to today it is not clear how this tax incentive can be accessed. There are no application forms and the application criteria remains unknown, so it remains an incentive on paper, but can’t be accessed by developers, and,

- Pass regulations that open up capital markets funding of real estate through Collective Investment Schemes regulated by the Capital Markets Authority. Specifically, (a) pass legislation allowing for specialized schemes focussed on real estate, and (b) allow for non-banks to be Trustees just as in the case with Pensions schemes. The current regulation, that a scheme trustee must be a bank, restricts the market, not to mention that it is discriminatory and unconstitutional.

- Retail Sector

During the week, cash-strapped retailer, Nakumatt, closed its Lavington and Ngong Road branches, leaving it with just two branches, that is, High Ridge in Parklands and Nakuru Westside Mall. This comes barely two weeks after it shut down its Kisumu Megacity Mall branch. The retailer’s woes are mainly due to unique challenges in strategy and governance as well as financial constraints, because we continue to see other brands like Quickmart, Naivas, and Carrefour continue to open branches. Such closures have also allowed international retailers to expand their local footprint as they take up vacated spaces, thus, cushioning developer returns in the sector. For instance, Carrefour has a branch in all arterial roads in Nairobi occupying spaces previously vacated by Nakumatt. We, however, expect the closures will manifest through (i) decline in rental yields due to the increased vacancy rates in affected nodes, such as Ngong Road and (ii) further expansion by international retailers such as Shoprite and Game as they move in to fill the vacuum left by Nakumatt. In terms of performance, according to the Cytonn Retail Report 2019, occupancy rates in Nairobi dropped by 4.8% points in 2019 to 75.0% from 79.8% in 2018 consequently leading to 1.0% drop in rental yields to 8.0% from 9.0% in 2018, as shown below attributable to decreased rental rates as developers attempt to reduce the rate of vacancies:

(all values in Kshs unless stated otherwise)

|

Summary of NMA’s Retail Market Performance 2018-2019 |

|||||||||

|

Location |

Rent Per SQFT 2019 |

Occupancy Rate 2019 |

Rental Yield 2019 |

Rent Per SQFT 2018 |

Occupancy Rate 2018 |

Rental Yield 2018 |

Change in Rents |

Change in Occupancy |

Change in Rental Yields |

|

Kilimani |

170.4 |

87.2% |

9.9% |

167.1 |

97.0% |

10.7% |

2.0% |

(9.8%) |

(0.9%) |

|

Ngong Road |

179.4 |

83.1% |

9.2% |

175.4 |

88.8% |

9.7% |

2.3% |

(5.7%) |

(0.5%) |

|

Westlands |

203.6 |

84.6% |

9.2% |

219.2 |

88.2% |

12.2% |

(7.1%) |

(3.6%) |

(3.0%) |

|

Karen |

207.9 |

77.0% |

9.1% |

224.9 |

88.8% |

11.0% |

(7.6%) |

(11.8%) |

(1.9%) |

|

Eastlands |

145.0 |

74.5% |

7.5% |

153.3 |

64.8% |

6.8% |

(5.4%) |

9.7% |

0.7% |

|

Thika road |

165.4 |

73.5% |

7.5% |

177.3 |

75.5% |

8.3% |

(6.7%) |

(2.0%) |

(0.8%) |

|

Kiambu Road |

166.0 |

61.7% |

6.8% |

182.8 |

69.5% |

8.1% |

(9.2%) |

(7.8%) |

(1.4%) |

|

Mombasa Road |

148.1 |

64.0% |

6.3% |

161.5 |

72.4% |

7.9% |

(8.3%) |

(8.4%) |

(1.6%) |

|

Satellite Towns |

131.4 |

70.3% |

6.0% |

142.1 |

73.7% |

6.7% |

(7.5%) |

(3.3%) |

(0.7%) |

|

Average |

168.6 |

75.1% |

8.0% |

178.2 |

79.8% |

9.0% |

(5.4%) |

(4.7%) |

(1.0%) |

Source: Cytonn Research 2019

- Hospitality Sector

Air transport is a crucial development driver bringing both economic benefits, and also has major rippling effects on trade and tourism sectors. More so, the availability of efficient airports in a region is identified as one of the key factors influencing investor’s decision on whether or not to invest in the region since air transport enables faster commute. To this end, the Mombasa tourism sector is set to receive a major boost after the Kenya Airports Authority revealed plans of revamping various airstrips in the region including the Ukunda and improving parking aprons at the Malindi airport at an estimated cost of Kshs 1.5 bn within the next three years. The expansion of Ukunda Airstrip, in particular, is aimed at enabling the accommodation of larger aircraft as local airlines expand to new international routes following demand for air travel, thus opening up Kwale County’s tourism sector and the overall South Coast region whose tourism sector has been hindered by the inefficient infrastructure as tourists have to use the Likoni Ferry crossing channel. We expect this will pave way for direct flights, especially from European nations and Eastern countries who have shown great interest in Kenyan travel evidenced by the introduction of direct flights from countries such as Qatar and United States.

To boost the tourism sector further, the government revealed plans of setting up a tourism centre at the Kenyatta University in partnership with the Jamaican Government. The centre, dubbed ”Global Tourism Resilience and Crisis Management Centre”, is set to help address challenges that affect the tourism sector, such as terrorism, and political tensions. We expect that the centre will play a key role in positioning Kenya as a leading hospitality hub globally, shielding the tourism sector’s performance from the negative effects of travel bans such as those issued in the past by Western nations due to insecurity hiccups thus, affecting the number of international visitor arrivals and consequently affecting the hospitality sector’s performance.

Our short-term outlook for the real estate sector remains neutral with a bias to positive. Investment opportunities are in (i) affordable housing in Satellite Towns such as Athi River, Ruiru, and Ruaka, (ii) serviced apartments in nodes such as Westlands and Kilimani, (iii) serviced offices in areas such as Karen and Limuru Road, and (iv) mixed-use developments in nodes such as Kilimani and Karen, as they continue to register above market returns to investors. We expect the sector to continue being boosted by continued improvements in infrastructure, increase in foreign direct investments, and the anticipated improvement of the credit environment following the rate cap law repeal.

This week, we revisit the interest rate cap topic following the Presidential assent of the Finance Bill, 2019 into law, which repealed Section 33B of the Banking Act that provided for the capping of bank interest rates. We, therefore, revisit the issue of the interest rate cap, focusing on:

- Background of the Interest Rate Cap Legislation - What Led to its Enactment?

- A Recap on our Analysis on the Subject,

- A Review of the Effects It Has Had So Far in Kenya,

- Recent Developments,

- Our Expectations Going Forward, and Conclusion.

Section I: Background of the Interest Rate Cap Legislation - What Led to Its Enactment?

The enactment of the Banking (Amendment) Act 2015 in September 2016, that capped lending rates at 4.0% above the Central Bank Rate (CBR), and deposit rates at 70.0% of the CBR, came against a backdrop of low trust in the Kenyan banking sector due to reasons such as:

- The total cost of credit was high, at approximately 17.7% per annum in August 2016. However, there was a notable decline to 16.6% per annum on average in FY’2016, after the rate cap was introduced, yet on the other hand, the interest earned on deposits placed in banks was still low, at approximately 7.1% per annum,

- Calls for capping interest rates were based on the high profitability in the banking sector because of high spreads between lending rates and deposits rates, which in 2016 was at a high of 9.5% according to the World Bank. As a result, in 2016, the Return on Equity of Kenyan banks stood at 24.5% above the 5-year Sub Saharan Africa (SSA) average of 15.4%. The Return on Assets, on the other hand, stood at 3.1%, above the 5-year SSA average of 1.5%, according to the IMF, and,

- The period was marred with several failures of banks such as Chase Bank Limited, Imperial Bank Limited and Dubai Bank, due to failures in corporate governance. The failure of these banks rendered depositors helpless and unable to access their deposits in these banks, leading to negative public sentiment that necessitated regulatory action in the banking sector.

Section II. A Recap on Our Analysis on the Subject

Our view has always been that the interest rate cap regime would have an adverse effect on the economy and by extension to Kenyans, and as popular as the regulation was, it needed to be repealed as highlighted in our previous reports as highlighted below:

- Interest Rate Cap is Kenya's Brexit- Popular But Unwise, dated 21st August 2016, highlighted our view that the interest rate cap would have a clear negative impact on the economy. We noted that free markets tend to be strongly correlated with stronger economic growth, emphasized by the lack of compelling evidence of an economy where interest rate capping was successful, as evidenced by the World Bank report on the capping of interest rates in 76 countries around the world. In Zambia, for example, interest rate caps were introduced in December 2012 and repealed 3-years later, in November 2015, after the impact was found to be detrimental to the economy. We called for the implementation of a strong consumer protection agency and framework, coupled with the promotion of initiatives for competing alternative products and channels. Below is a schedule of examples in Africa and what became of the rate caps:

|

Status of Interest Rate Caps in Sub Saharan Africa |

||

|

Country |

Year Implemented |

Status |

|

1. West Africa Economic & Monetary Union (WEAMU) |

1997 |

Still in effect with maximum interest rates chargeable by banks & MFIs |

|

2. Ethiopia |

1998 |

Still in effect for minimum deposit rates |

|

3. South Africa |

2007 |

Still in effect for different loan sub-categories with their own interest rates |

|

4. Zambia |

2012 |

Abolished capping in 2015 |

|

5. Monetary Community of Central Africa (CEMAC) |

2012 |

Still in effect with maximum interest rates chargeable by MFIs |

|

6. Kenya |

2016 |

Abolished capping in November 2019 |

|

7. Nigeria |

2017 |

Maximum cap on bank mortgages removed in September 2019 |

- Our second topical, Impact of the Interest Rate Cap, dated 28th August 2016, four days after the interest rate cap bill was signed into law, highlighted the immediate effects of the interest rate cap, as banking stocks lost 15.6% in 2-days. Having wrongly predicted that the President would never sign the rate cap Act into law , we re-iterated our stance on the negative effects of the interest rate cap, while identifying the winners and losers of the Banking (Amendment) Act 2015,

- The State of Interest Rate Cap, dated 14th May 2017, 9-months after the interest rate cap was signed into law, we assessed the interest rate cap and its effects on private sector credit growth, the banking sector, and the economy in general, following concerns raised by the IMF. We noted that the law had the effect of (i) inhibiting access to credit by SMEs and other “small borrowers” whom banks cited as being “risky”, and were unable to be fitted within the 4.0% margin imposed by the Law, and (ii) contributing to subdued private sector credit growth, which was recorded at 4.0% by March 2017. We suggested that policymakers ought to review the legislation, highlighting that there existed opportunities for structured financial products and private equity players to come in and provide capital for SMEs and other businesses to grow, and consequently improve private sector credit growth,

- In the Update of Effect on Interest Rate Caps on Credit Growth and Cost of Credit, dated 23rd July 2017, approximately 1-year after the Banking (Amendment) Act 2015 was signed into law, we analyzed the macroeconomic performance, on the back of the rate cap, the decline in private sector credit growth and lending by commercial banks, coupled with the elevated total cost of credit, which was still higher than the legislated 14.0%, as banks loaded excessive additional charges, while noting that the large banks, which control a substantial amount of the banking sector loan portfolio, were the most expensive. We suggested (i) A repeal or modification of the interest rate cap, (ii) Increased transparency on credit pricing, (iii) Improved and more accommodating regulation, (iv) Consumer education, (v) Diversification of funding sources into alternatives, and (vi) Enhanced consumer protection,

- In our note titled The Total Cost of Credit Post Rate Cap, dated 14th January 2018, we analyzed the true cost of credit, the initiatives put in place to make credit cheaper and more accessible, the impact of the interest rate cap on private sector credit growth, and we gave our view on what more can be done to remedy the effects of the interest rate cap, which included to implement strong consumer protection agencies and frameworks, and to diversify funding sources to include alternative products and channels,

- In Rate Cap Review Should Focus More on Stimulating Capital Markets, dated 13th May 2018, we revisited the interest rate cap following an announcement by the Treasury that they were in the process of completing a draft proposal that will address credit management in the economy, where we gave our views on how promoting competing sources of financing would lead to a self-pricing regulatory structure, which would effectively reduce credit prices, as opposed to relying on bank funding,

- In our note on the Status of the Rate Cap Review in Finance Bill 2018, 26th August 2018, we revisited the interest rate cap topic following the proposed amendments to the Finance Bill, 2018, tabled by the Parliamentary Committee on Finance and Planning in the National Assembly during its second reading. In this focus, we highlighted that legislation and policies to promote competing sources of financing should be the centerpiece of the repeal legislation,

- In our focus note Review of the Interest Rate Cap, dated 23rd June 2019, we revisited the interest rate cap topic following the proposal by the then, National Treasury Cabinet Secretary, Mr. Henry Rotich, in the Budget reading for the 2019/20 fiscal year, to repeal Section 33B of the Banking Act, which was included in the Finance Bill, 2019. In this focus, we discussed policy measures that can protect borrowers from excessive interest rates, including consumer education and protection measures, as well as promoting capital markets infrastructure to spur competition in the credit market through non-bank funding,

- In End of Interest Rate Caps?, dated 20th October 2019, we revisited the interest rate cap following the recommendation by President Uhuru Kenyatta to repeal the Interest Rate Cap, in a memorandum to Parliament in which he declined to assent the Finance Bill, 2019 into law, where we gave our views on how the economy would be impacted by the repeal of the cap. We highlighted that we expect to see a growth in private sector credit, higher GDP growth and increased monetary policy effectiveness.

Section III: A Review of the Effects It Has Had So Far in Kenya

The interest rate cap has had the following five key effects to Kenya’s Economy since its enactment, most of them clearly negative, save for spurring alternative financial services channels, which we believe will have long-term positive effects:

- Private Sector Credit Crunch

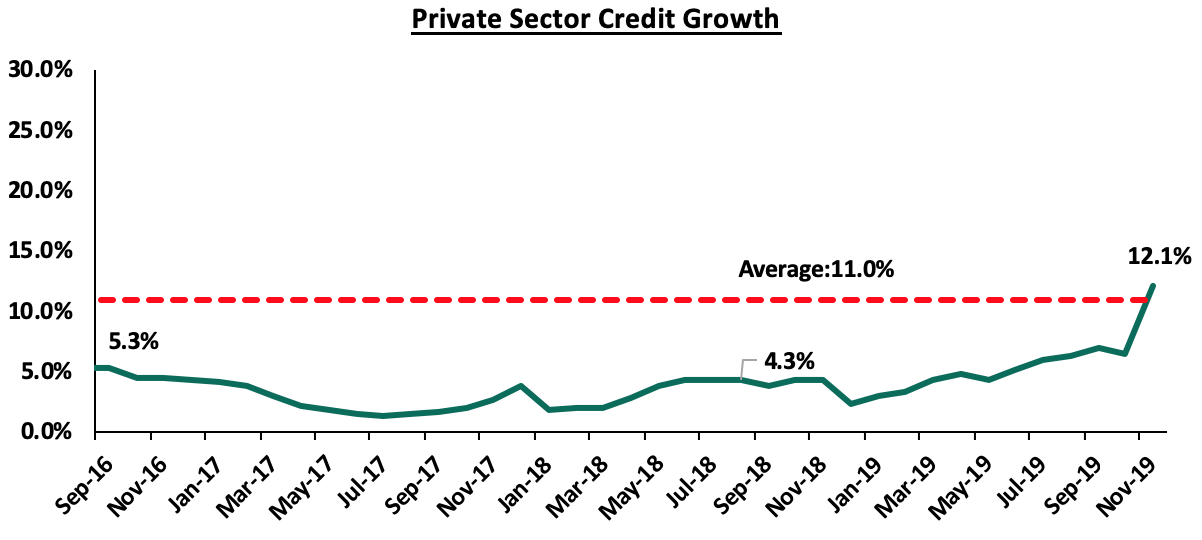

Private sector credit growth in Kenya has been declining, and the enactment of the Banking (Amendment) Act 2015, had the adverse effect of further subduing credit growth. The lending to MSMEs by banks declined to a low of 15.8% of the total banking sector loan portfolio in 2018, from a high of 23.4% in 2013 on account of difficulty for banks to price the SMEs within the set margins, as they were perceived “risky borrowers”. Banks thus invested in asset classes with higher returns on a risk-adjusted basis, such as government securities. Investment in government securities increased by 19.0% to Kshs 1,188.4 bn, from Kshs 998.4 bn recorded in 2017. Private sector credit growth touched a high of 25.8% in June 2014, and averaged 11.0% over the last five-years, but dropped to below 5.0% after the implementation of interest rates controls, rising slightly to 6.6% in October 2019. However, after the repeal of the rate cap, private sector credit growth improved to 12.1% of November 2019. The chart below highlights the trend in private sector credit growth.

- Loan Accessibility Reduced

Following the enactment of the Banking (Amendment) Act, 2015, banks recorded a rise in demand for loans, as did the number of loan applications, which increased by 20.0% in Q4’2016, according to the CBK Credit Officer Survey of October-December 2016. This was on account of borrowers attempting to access cheaper credit. However, the supply of loans by banks did not meet this rise in demand as evidenced by:

- Reduced Loan Growth: According to the Bank Supervision Annual Report 2017, the Net Loan growth declined by 7.7% since the implementation of the interest rate cap law to Kshs 2,013.6 bn, from Kshs 2,182.6 bn recorded in December 2016,

- The Decline in the Number of Loan Accounts: The number of loan accounts in large banks (Tier I) declined by 27.8%, the largest among the three tiers, followed by Tier II banks with a decline of 11.1% between October 2016 and June 2017,

- Increase in Average Loan Size: Despite a 26.1% decline in the industry’s number of loan accounts between October 2016 and June 2017, the average loan size increased by 36.3% to Kshs 548,000, from Kshs 402,000 between October 2016 and June 2017. This points to lower credit access by smaller borrowers, while also demonstrating that credit was extended to larger and more “secure” borrowers, and,

- Decrease in Average Loan Tenures: The average loan tenure declined by 50.0% to 18-24 months compared to 36-48 months prior to the introduction of the interest rate cap. This is due to bank’s increasing their sensitivity to risk, thereby opting to extend only short-term and secured lending facilities to borrowers, rather than longer-term loans to be used for investments, according to the latest survey by the Kenya Bankers Association (KBA) on the effects of the Banking (Amendment) Act, 2015.

- Banks’ Changed their Operating Models to Mitigate the Effects of the Rate Cap Legislation

The enactment of the Banking (Amendment) Act, 2015, saw banks changing their business and operating models to compensate for reduced interest income (their major source of income) as a result of the capped interest rates. This saw banks adapt to the tough operating environment by adopting new operating models through:

- Increased Focus on Non-Funded Income (NFI): This is evidenced by the fact that the proportion of non-interest income to total income stood at 28.4% in September 2016, and has risen to the current average of 38.0%, for listed commercial banks as at Q3’2019,

- Increased Lending to the Government Rather than the Private Sector: This is evidenced by the growth in allocations to government securities by 15.1% in the year after implementing the interest rate cap, compared to the 7.7% decline in loans, as government securities rose to 24.9% of total banking sector assets in FY’2017, from 23.4% prior to the caps. Q3’2019 saw a slower growth in government securities to come in at 3.3%, outpaced by the 11.6% loan growth,

- Cost Rationalization: Banks also stepped up their cost rationalization efforts by increasing the use of alternative channels by mainly leveraging on technology such as mobile money and digital banking to improve efficiency and consequently reduce costs associated with the traditional brick and mortar approach. This led to the closure of branches and staff layoffs in a bid to retain the profit margins in the tough operating environment, due to depressed interest income, which saw the cost to income ratio excluding loan loss provisions for the listed commercial banks in Q3’2019 come in at 49.4%, down from 59.4% recorded in 2015, and,

- Focus on Niche Segments: The implementation of the law saw the larger banks venture into the small banks’ niche markets, and consequently, most of the Tier II and Tier III banks have struggled to operate. The smaller banks have witnessed declining top-line revenue, leading to increased operational inefficiency, and operating losses; this has led to depleted capital, spurring an increase in the consolidation activity in the banking sector, which has seen smaller banks struggling to operate being acquired, merging or forming strategic relationships with larger banks in order to leverage on the synergies created.

- The Proliferation of Alternative Credit Markets

As a result of the private sector credit crunch, there was a rapid rise in the alternative credit markets as evidenced by the Mobile Financial Services (MFS) rising to become the preferred method to access financial services in 2019, with 79.4% of the adult population using the channels, up from 71.4% in 2016. According to Global Digital, in 2018 there were about 6.1 mn digital borrowers in the country coupled with 28.3 mn unique mobile users (which represents one installation of a mobile application). Players in this segment charge exorbitant interest rates, e.g. M-Shwari charges a facilitation fee of 7.5% on amounts borrowed, while Tala and Branch offer varying rates depending on the repayment period with a month’s loans offered at a monthly rate of 15.0%, with the annualized rates varying between 132.0% and 152.0%. While the immediate effects of these alternative channels has been predatory, we believe that the investments and progress made in developing the alternative channels will have positive long-term impact as an alternative financials services channel once the sector becomes regulated.

- Reduced Effectiveness of the Monetary Policy

Through its assessment of the impact of the interest rate cap in the rate cap era, the Monetary Policy Committee had noted that the implementation of the interest rate cap had weakened the transmission of monetary policy and thus had made it difficult for the CBK to adjust the monetary policy rates in response to economic developments. Before the interest rates were capped, the CBK was able to adjust the Central Bank Rate (CBR) in relation to changes in inflation and GDP growth. This is mainly because any alteration to the CBR would directly affect credit conditions. Expansionary monetary policy thereafter was difficult to implement since lowering the CBR had the effect of lowering the lending rates and as a consequence, banks found it even more difficult to price for risk at the lower interest rates, leading to pricing out of more risky borrowers, and hence further reducing access to credit. On the other hand, if the CBK was to employ a contractionary monetary policy, so as to reduce inflation and credit growth for example, then raising the CBR would have the reverse effect of increasing the supply of credit in the economy since banks would be able to admit riskier borrowers.

Section IV: Recent Developments

Presidential assent of the Finance Bill, 2019

The Finance Bill, 2019 was signed into law on 7th November, 2019, repealing section 33B of the Banking Act which provided for the capping of interest rates at 4.0% above the Central Bank Rate, pursuant to the failure of the National Assembly to raise a two-thirds majority to overturn President Uhuru Kenyatta’s memorandum to repeal the interest rate cap. The President’s decision to repeal the interest rate cap was on the back of the following reasons:

- Reduction of Credit to the Private Sector, Particularly the Micro, Small and Medium Enterprises (MSMEs). In the first year following the introduction of the interest rate cap, the stock of credit to MSMEs declined sharply by 10% y/y on account of difficulty for banks to price the SMEs within the set margins, as they were perceived “risky borrowers”. Most commercial banks adjusted their lending towards large corporates and the public sector.

- A Decline in Economic Growth. The crowding out of the private sector, especially the MSMEs is estimated to have lowered Kenya’s economic growth by 0.4% points in 2017, and 0.2% points in 2018, as Kenya’s GDP growth came in at 4.9% and 6.3% in 2017 and 2018, respectively.

- Weakening Effectiveness of Monetary Policy Transmission. A recent analysis by the CBK on the impact of interest rate capping showed a slowdown in the monetary policy transmission to growth and inflation. Monetary policy transmission takes 3-12 months to impact growth and 12-20 months to affect inflation, which is 3-5 months longer compared to the period before the introduction of interest rate capping. In addition, the analysis showed evidence of perverse outcomes following a monetary policy action, particularly a reduction in loan advances by some banks after a lowering of the Central Bank Rate (CBR), which is contrary to the expected outcome of an increase in credit extension after the adoption of expansionary monetary policy.

- Reduction in Loan Accessibility. Loan accessibility reduced following the introduction of the interest rate cap. According to the CBK’s Annual Banking Sector Supervision Report for 2017, loans and advances stood at Kshs 2.0 tn in FY’2017, a 7.7% decline from the Kshs 2.2 tn in loans at end of 2016. In addition, banks moved to increase the average loan size and decrease the average loan tenure, thus further lowering credit access to small borrowers. Furthermore, banks decreased the diversity of their loan products and withdrew lending to specific segments of the market.

- The Emergence of Shylocks and Other Unregulated Lenders. There was a rapid rise in the alternative credit markets as evidenced by the Mobile Financial Services (MFS) rising to become the preferred method to access financial services in 2019, with 79.4% of the adult population using the channels up from 71.4% in 2016. These unregulated lenders have taken advantage of the situation under the capped interest rates to lend to borrowers at exorbitant interest rates e.g. M-Shwari charges a facilitation fee of 7.5%, while Tala and Branch offer varying rates depending on the repayment period with a month’s loans offered at a rate of 15.0%, which are very expensive when annualized.

Section V: Our Expectations Going Forward

With the repeal of the interest rate cap law, we expect to see the following benefits accrue to the economy:

- Private Sector Credit Growth: As of November 2019, the private sector credit growth rate improved to 12.1%, from 11.4% recorded in September according to the MPC market perception survey. With the repeal of the rate cap law, there is an anticipation of improved market liquidity, coupled with improved macroeconomic environment, which is expected to support higher credit growth. We expect that access to credit by Micro, Small and Medium Enterprises (MSMEs) will continue increasing as banks will have sufficient margin to compensate for risks, further supported by the removal of the floor on deposits in 2018 that reduced the cost of funding for banks. Private sector credit growth will also be supported by government efforts, including use of the loan facility ‘Stawi’, that enables businesses to access unsecured loans ranging from Kshs 30,000 to Kshs 250,000 from five commercial banks (NIC Group, KCB Group, Diamond Trust Bank Kenya (DTBK), Co-operative Bank Kenya and Commercial Bank of Africa (CBA), with a repayment period of between 1 – 12 months. Priced at 9.0% p.a, the credit product will help address MSMEs challenges such as access to formal credit because of the informal nature of their businesses and lack of collateral. Equity Bank lined up Kshs 150.0 bn for lending to small businesses despite the interest rate cap environment and the continued efforts to finance the SMEs saw the lender awarded as the best bank in SME banking. According to Equity Bank’s CEO, 72.0% of Equity Bank’s lending is dedicated to SMEs. We expect that banks will emulate this and increase their lending to MSMEs now that the policy has shifted in their favor,

- Increased Loan Accessibility: With the rate cap in place, banks recorded a rise in demand for loans on account of borrowers trying to access cheaper credit. However, banks did not meet the demand evidenced by reduced loan growth and a decline in the number of loan accounts by 27.8% for Tier I banks and 11.1% for Tier II banks between October 2016 and June 2017. With the repeal of the interest rate cap, we expect to see an increase in the number of loan accounts as banks are expected to increase credit access to smaller borrowers. The repeal has seen commercial banks increase aggressiveness in marketing retail loans to customers and we expect more banks to continue with this trend. We also expect an increase in the average loan tenures since banks will reduce their sensitivity to risk given that they will be able to price risk according to each borrower’s risk profile,

- Higher GDP Growth: Credit and economic growth are positively correlated and we expect that with increased access to credit by MSMEs, the economy is bound to expand as MSMEs make a significant contribution to the economy. According to data from the KNBS, MSMEs account for approximately 28.4% of Kenya’s GDP. The real GDP contracted by 0.2% points in 2016 on account of the slowdown in credit to the economy, owing to the interest rate cap, and according to the CBK, a 10.0% change in sectoral credit results in between 0.1%-0.2% changes in sectoral growth in the respective sectors. Therefore an increase in credit to the various sectors including the SMEs will increase the overall economic growth,

- Banks Will Change Operating Models to Accommodate Effects of the Rate Cap Repeal: The repeal of the cap law will see banks recording higher interest income levels, as banks increase access to credit. We also expect banks to keep leveraging on technology such as mobile banking to improve efficiency and consequently save on costs associated with the traditional approach despite the easing operating environment. According to the CBK, the average savings interest rates fell to a 36-month low of 4.6% in the 12 months to September, from 6.3% in the same month last year when Parliament made changes to the banking law to remove the floor on deposit interest rates at 70.0% of the CBR. Since the removal of the floor, lenders have been riding on cheap deposits to grow profits. With the interest rate cap repeal, banks are expected to ride on higher interest rates on loans in addition to the lower deposit interest rates to drive growth and increase profitability,

- Continued Growth of Alternative Credit Markets: In addition to the private sector credit growth, we expect to see continued growth in the alternative credit markets. While the immediate effects of the alternative channels have been deemed predatory, we believe that the investments and progress made in developing the alternative channels will have positive long-term impact as an alternative financial services channel once the sector becomes regulated. Even with the rate cap repeal, we still expect alternative credit markets to keep growing, supported by their ease of accessibility compared to regular bank loans. The Government in its need to regulate the sector in 2018, sponsored a Bill proposing the licensing and regulation of digital lenders in a bid to regulate entities that neither fall under the Banking Act nor Microfinance Act but the Bill is still pending in Parliament. Mobile lenders bridge the gap for Kenyans who do not have formal accounts or whose incomes do not allow them to borrow from other formal financial institutions so even if the bill is passed, we expect access to loans through these platforms to continue increasing,

- Increased Monetary Policy Effectiveness: With the repeal of the rate cap law, the Central Bank of Kenya is free to adjust the monetary policy rate in response to economic developments such as inflation and growth. This is evidenced by the decision of the MPC to lower the Central Bank Rate by 50 bps to 8.5%, from 9.0% at their last meeting in response to the new law. The CBK will be able to exercise its constitutional mandate of formulating and implementing expansionary or contractionary monetary policy, without affecting the ability of banks to price risk or admitting riskier borrowers, thereby controlling money supply in the economy,

- Reduced Accessibility of Government Debt Locally: With the rate cap in place, banks preferred to lend to less risky borrowers including the government through the purchase of government securities, which saw high subscription rates on government securities. However with the rate cap repeal, we expect banks to increase their credit accessibility and admit riskier borrowers including SMEs and individuals, which will see a reduction in subscription rates for government securities. The subscription rate for government papers, has declined to 53.5%, from 123.2% recorded in 2018. The undersubscription is partly attributable to reduced participation by banks following the interest rate cap repeal, as banks are now looking to lend to the private sector. Below is a chart highlighting the performance through the year:

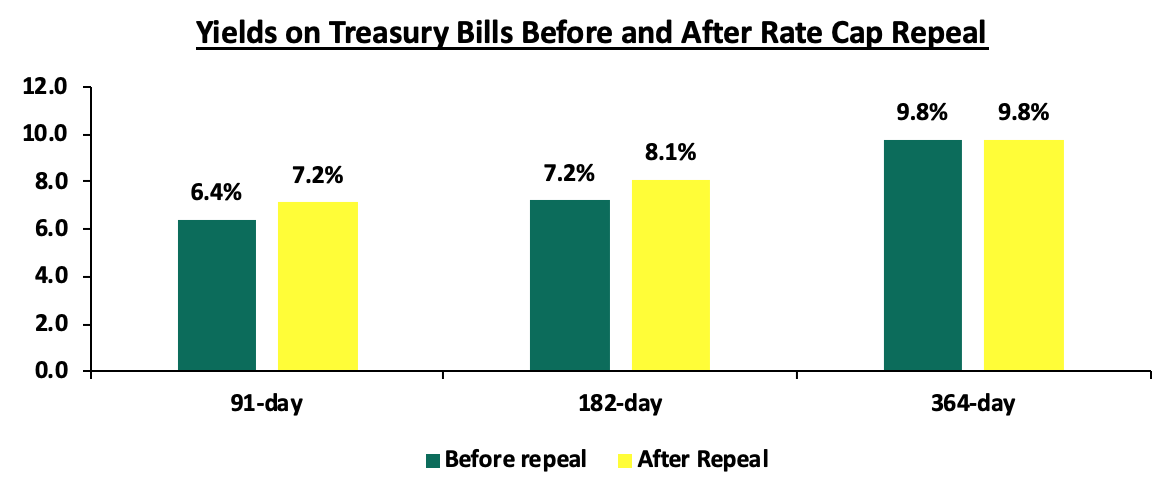

Yields on government securities has also been on the rise as the Government reprices its debt to make it attractive to lenders. Yields on government papers have increased between the period before the repeal, with the yield on the 91-day paper coming in at 7.2%, from 6.4%, yield on the 182-day paper increasing to 8.2% from 7.2% as well as the yields on the other long tenure bonds increasing to accommodate the impact of the removal of the ceiling on interest rates. If yields remain at lower levels, there will be reduced accessibility to government debt locally. Following the projected budget deficit of Kshs 689.3 bn in this financial year, equivalent to 6.4% of GDP, we expect increased pressure on the government debt front as it tries to meet its domestic debt target. This on the other hand is expected to put upward pressure on yields on government securities so as to incentivize investors to participate in the primary market. The chart below shows the yields for 91, 182 and 364-day papers immediately before rate cap repeal and post repeal:

- Increased Accessibility to Mortgages: The introduction of the interest rate cap in 2016 saw an increased demand for mortgage loans due to perceived affordability by borrowers. However, commercial banks introduced tighter credit standards so the actual mortgage disbursements were lower than the increased demand. Commercial banks also preferred investments in government securities under the cap legislation as compared to financing of mortgages. The value of mortgage loan assets outstanding increased by 0.8% to Kshs 224.9 bn in 2018, from Kshs 223.2% recorded the previous year. With the implementation of the affordable housing program by the government as part of its big 4 agenda, we expect to see a continued increase in the value of mortgage loan assets outstanding, due to increased appetite for home ownership. Although the rates charged for mortgages may be slightly higher, the increased accessibility to mortgage loans is expected to be supported by the Kenya Mortgage Refinance Company (KMRC), which is an initiative by the National Treasury to support the affordable housing agenda by providing secure long-term funding to the mortgage lenders, thereby providing liquidity and increasing affordability to borrowers. For more information on the mandate of the Kenya Mortgage Refinancing Company, see our Kenya Mortgage Refinancing Company Update.

Conclusion

The decision to repeal the rate cap law will be a boost to the economy because a free market, where interest rates are set by the forces of demand and supply coupled with increased competition from non-bank financial institutions for funding, will see a competitive environment with increased access to credit by borrowers and higher economic growth prospects, given that monetary policy tools will be more effective in response to the changing conditions.

Going forward, we do not expect banks to reprice loans taken during the rate cap era. According to the Kenyan Bankers Association, most banks will not readjust their new pricing on commercial loans since banks have accepted their risk profile as an industry, with the cost of credit being at 13.0%, offered before the law was overhauled. This comes as a relief to borrowers, who were concerned that there would be massive repricing on loans after the repeal of the interest rate cap. KCB Group also stated that commercial banks would behave responsibly and only raise rates for risky borrowers by only 2.0% or 3.0%. Commercial banks are still yet to validate their total cost of credit in response to the interest rate cap repeal.

However, we still recommend that we deal with two key outstanding issues of;

- Consumer Protection against Abuse by Banks, since the removal of the cap may set stage for the return of expensive loans that had risen to more than 25.0% before the rate cap. The Banking Sector Charter, a commitment from banks to practice responsible and disciplined banking cognizant of customer needs, is expected to aid in consumer protection in the easing operating environment for banks, and,

- Promoting Competing Alternative Funding Channels, which will further increase access to credit for borrowers who are unable to access formal loans from banks, due to the expected increase in banks’ loan books at the detriment of other loan providers post the rate cap era.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.