Nairobi Metropolitan Area (NMA) Serviced Apartments Report 2024, and Cytonn Weekly #47.2024

By Research team, Nov 24, 2024

Executive Summary

Fixed Income

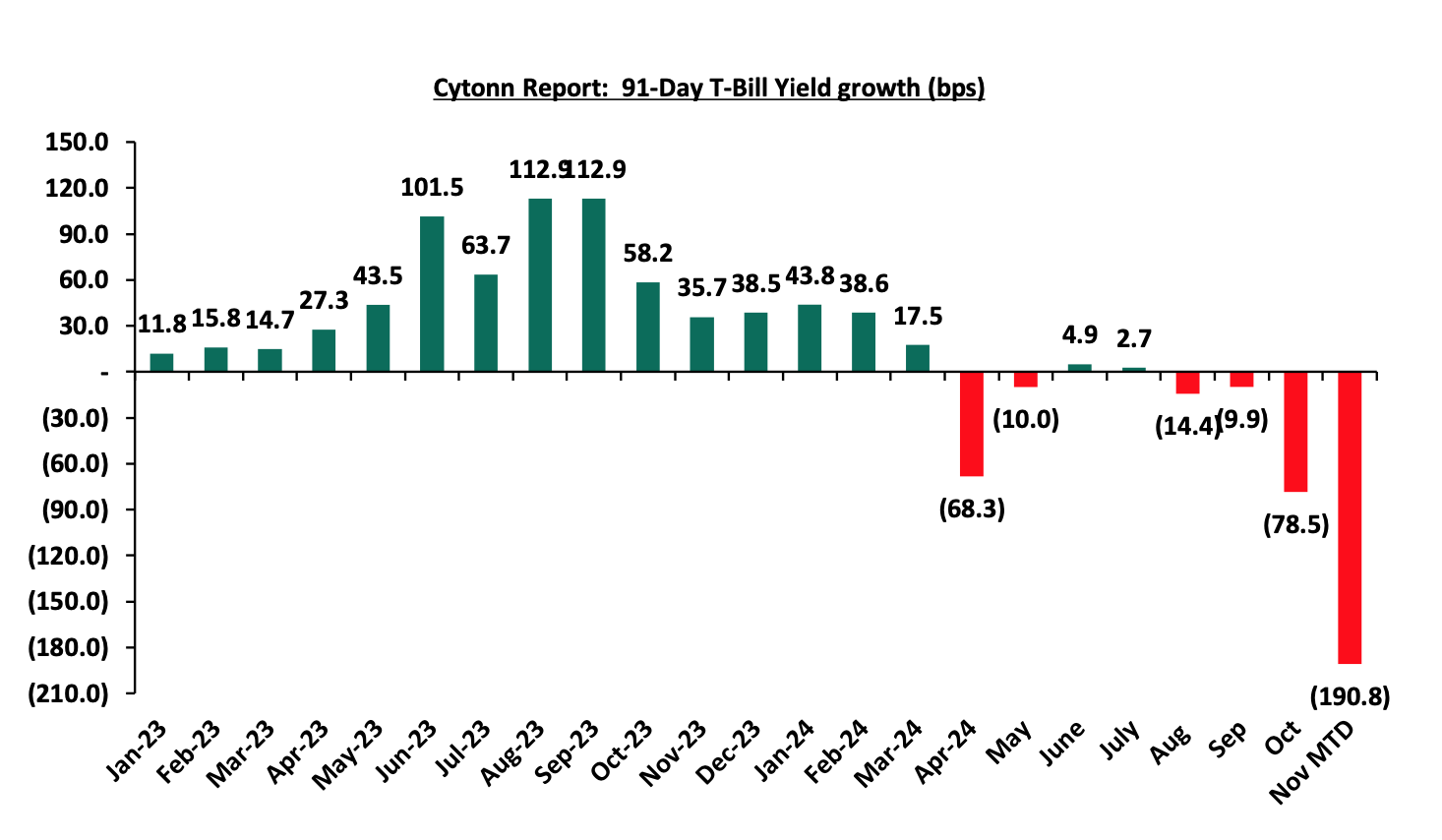

During the week, T-bills were oversubscribed for the eighth consecutive week, with the overall oversubscription rate coming in at 321.8%, albeit lower than the oversubscription rate of 398.1% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 24.9 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 623.3%, albeit lower than the oversubscription rate of 759.7% recorded the previous week. The subscription rate for the 182-day paper decreased to 171.4% from 323.3% recorded the previous week, while that of the 364-day paper increased to 351.6% from 328.2% recorded the previous week. The government accepted a total of Kshs 46.4 bn worth of bids out of Kshs 77.2 bn bids received, translating to an acceptance rate of 60.0%. The yields on the government papers were on a downward trajectory, with the yields on the 364-day, 182-day and 91-day papers decreasing by 60.4 bps, 84.9 bps and 75.7 bps to 13.3%, 12.2% and 12.0% respectively from 13.9%, 13.1% and 12.8% respectively recorded the previous week;

In the primary bond market, the government is looking to raise Kshs 45.0 bn through the reopened two-ten years and twenty years fixed coupon bonds; FXD1/2023/10, FXD1/2024/010 and FXD1/2018/20 with tenors to maturity of 8.2 years,9.3 years and 13.3 years respectively. The bonds will be offered at fixed coupon rates of 14.2%,16.0% and 13.2% respectively. Our bidding range for the reopened bonds are 13.20%-13.75%, 14.95%-15.35% and 16.35%-16.55% for the FXD1/2023/10, FXD1/2024/010 and FXD1/2018/20 respectively;

We are projecting the y/y inflation rate for November 2024 to increase within the range of 2.8% - 3.2% mainly on the back of Slight depreciation of the Kenya Shilling against the US Dollar and Increase in electricity prices

During the week, the National Treasury gazetted the revenue and net expenditures for the fourth month of FY’2024/2025, ending 31st October 2024, highlighting that the total revenue collected as at the end of October 2024 amounted to Kshs 768.8 bn, equivalent to 29.2% of the revised estimates of Kshs 2,631.4 bn for FY’2024/2025 and is 87.7% of the prorated estimates of Kshs 877.1 bn;

Equities

During the week, the equities market was on a downward trajectory, with NSE 10, declining the most by 2.9%; while NSE 25, NASI and NSE 20 declined by 2.4%, 2.0% and 2.0%, taking the YTD performance to gains of 31.9%, 30.6%, 25.3% and 22.6% for NSE 10, NSE 25, NSE 20 and NASI respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as Equity Group, Stanbic, and Bamburi of 7.9%, 5.9%, and 3.4% respectively. The losses were however mitigated by gains recorded by large-cap stocks such as SCBK, NCBA and DTBK of 2.1%, 0.6%, and 0.5% respectively;

Also, during the week, five of the listed banks released their Q3’2024 results.

- KCB Group’s core earnings per share (EPS) grew by 49.0% to Kshs 14.2, from Kshs 9.6 in Q3’2023, driven by the 21.9% increase in total operating income to Kshs 142.9 bn, from Kshs 117.3 bn in Q3’2023, which outpaced the 11.5% increase in total operating expenses to Kshs 85.5 bn from Kshs 76.7 bn in Q3’2023

- Stanbic Holding’s core earnings per share (EPS) grew by 9.3% to Kshs 25.7, from Kshs 23.5 in Q3’2023, driven by the 13.9% decrease in total operating expenses, which outpaced the 4.5% decrease in total operating income.

- Absa’s core earnings per share increased by 19.8% to Kshs 2.7, from Kshs 2.3 in Q3’2023, mainly driven by the 16.5% increase in total operating income to Kshs 46.8 bn, from Kshs 40.2 bn in Q3’2023 which outpaced the 15.2% increase in total operating expenses to Kshs 25.7 bn, from Kshs 22.3 bn in Q3’2023.

- I&M Group’s core earnings per share increased by 21.3% to Kshs 6.0 from Kshs 5.0 in Q3’2023, mainly driven by 19.8% growth in total operating income to Kshs 35.8 bn in Q3’2024 from Kshs 29.9 bn in Q3’2023; operating income growth outpaced operating expense growth of 16.5% to Kshs 22.4 bn, from Kshs 19.2 bn in Q3’2023.

- Finally, SCBK’s core earnings per share increased by 62.7% to Kshs 41.9, from Kshs 25.8 in Q3’2023, mainly driven by the 32.7% increase in total operating income to Kshs 39.1 bn, from Kshs 29.4 bn in Q3’2023 which outpaced the 5.4% increase in total operating expenses to Kshs 16.6 bn, from Kshs 15.8 bn in Q3’2023;

Real Estate

During the week, the Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) September 2024 Reports, which highlighted the performance of major economic indicators such as tourist arrival, value of approved building plans and cement consumption.

Additionally, Marriott International has announced plans to invest approximately Kshs 1.2 bn in a new 180-room hotel near Jomo Kenyatta International Airport (JKIA) in Nairobi dubbed Courtyard hotel. This project aligns with Marriott's strategy to expand its footprint in Africa and cater to the rising demand for premium accommodations in Kenya, particularly targeting travelers seeking proximity to major transport hubs. This will be the second facility after the Four Points operated by Sheraton within the airport. The development is aimed to be completed within 30 months and the hotel will have 174 standard suite rooms and six junior suites.

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 31st October 2024. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 31st October 2024, representing a 45.0% loss from the Kshs 20.0 inception price;

Focus of the Week

In 2023, we published the Nairobi Metropolitan Area Serviced Apartments Report 2023, which highlighted that the average rental yield for serviced apartments within the NMA increased by 0.6% points to 6.8% in 2023 from 6.2% in 2022. The improvement in performance was primarily on the back of improved occupancy rates and monthly charges by 0.5% points and 10.9%, to 66.3% and Kshs 3,045 per SQM, respectively, in 2023. This week, we update our report using 2024 market research data, in which we discuss and determine the progress, performance, and investment opportunities for serviced apartments in the NMA. In terms of performance, the average rental yield for serviced apartments within the NMA increased by 0.5% points to 7.3% in 2024 from 6.8% in 2023. The improvement in performance was primarily on the back of improved occupancy rates and monthly charges by 5.8% points and 4.0%, to 72.2% and Kshs 3,155 per SQM, respectively, in 2024;

Investment Updates:

- Weekly Rates: Cytonn Money Market Fund closed the week at a yield of 18.03 % p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Tuesdays, from 7:00 pm to 8:00 pm and Saturdays, from 10:00 am to 11:00 am. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

During the week, T-bills were oversubscribed for the eighth consecutive week, with the overall oversubscription rate coming in at 321.8%, albeit lower than the oversubscription rate of 398.1% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 24.9 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 623.3%, albeit lower than the oversubscription rate of 759.7% recorded the previous week. The subscription rate for the 182-day paper decreased to 171.4% from 323.3% recorded the previous week while that of the 364-day paper increased to 351.6% from 328.2% recorded the previous week. The government accepted a total of Kshs 46.4 bn worth of bids out of Kshs 77.2 bn bids received, translating to an acceptance rate of 60.0%. The yields on the government papers were on a downward trajectory, with the yields on the 364-day, 182-day and 91-day papers decreasing by 60.4 bps, 84.9 bps and 75.7 bps to 13.3%, 12.2% and 12.0% respectively from 13.9%, 13.1% and 12.8% respectively recorded the previous week.

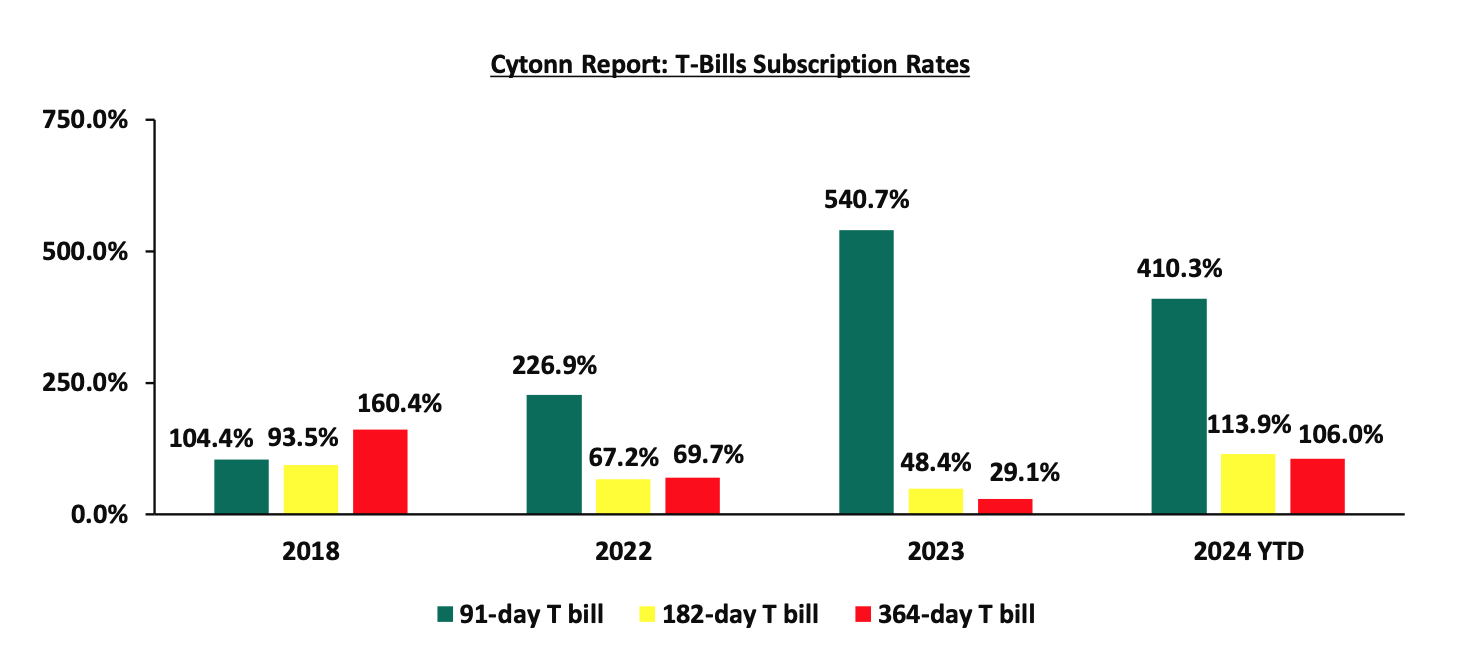

The chart below compares the overall average T-bill subscription rates obtained in 2018, 2022, 2023, and 2024 Year-to-date (YTD):

In the primary bond market, the government is looking to raise Kshs 45.0 bn through the reopened two-ten years and twenty years fixed coupon bonds; FXD1/2023/10, FXD1/2024/010 and FXD1/2018/20 with tenors to maturity of 8.2 years,9.3 years and 13.3 years respectively. The bonds will be offered at fixed coupon rates of 14.2%,16.0% and 13.2% respectively. Our bidding range for the reopened bonds are 13.20%-13.75%, 14.95%-15.35% and 16.35%-16.55% for the FXD1/2023/10, FXD1/2024/010 and FXD1/2018/20 respectively.

Money Market Performance:

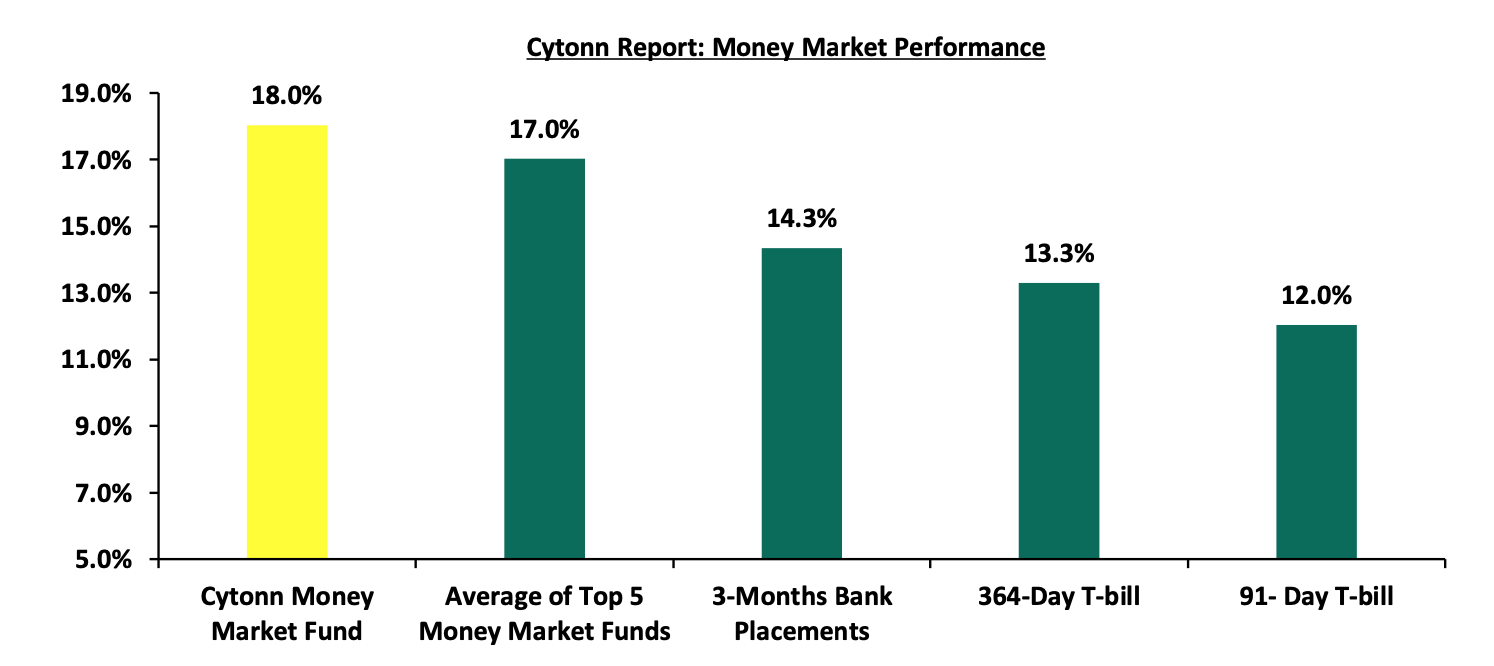

In the money markets, 3-month bank placements ended the week at 14.3% (based on what we have been offered by various banks), and the yields on the government papers were on a downward trajectory, with the yields on the 364-day and 91-day papers decreasing by 60.4 bps and 75.7 bps to 13.3% and 12.0% respectively, from 13.9% and 12.8% respectively recorded the previous week. The yields on the Cytonn Money Market Fund remained unchanged to close the week at 18.0%, while the average yields on the Top 5 Money Market Funds decreased by 7.8 bps to close the week at 17.0%, from 17.1% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 22nd November 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 22nd November 2024 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn App) |

18.0% |

|

2 |

Lofty-Corban Money Market Fund |

17.2% |

|

3 |

Etica Money Market Fund |

17.1% |

|

4 |

Arvocap Money Market Fund |

16.5% |

|

5 |

Kuza Money Market fund |

16.4% |

|

6 |

Ndovu Money Market Fund |

15.5% |

|

7 |

KCB Money Market Fund |

15.4% |

|

8 |

Mali Money Market Fund |

15.2% |

|

9 |

Faulu Money Market Fund |

15.1% |

|

10 |

Jubilee Money Market Fund |

15.0% |

|

11 |

Madison Money Market Fund |

14.9% |

|

12 |

Nabo Africa Money Market Fund |

14.9% |

|

13 |

Apollo Money Market Fund |

14.8% |

|

14 |

Mayfair Money Market Fund |

14.7% |

|

15 |

Genghis Money Market Fund |

14.6% |

|

16 |

Orient Kasha Money Market Fund |

14.6% |

|

17 |

Enwealth Money Market Fund |

14.5% |

|

18 |

Sanlam Money Market Fund |

14.5% |

|

19 |

Co-op Money Market Fund |

14.2% |

|

20 |

GenAfrica Money Market Fund |

14.1% |

|

21 |

Dry Associates Money Market Fund |

14.0% |

|

22 |

Old Mutual Money Market Fund |

13.8% |

|

23 |

ICEA Lion Money Market Fund |

13.5% |

|

24 |

British-American Money Market Fund |

13.5% |

|

25 |

CIC Money Market Fund |

13.5% |

|

26 |

Absa Shilling Money Market Fund |

13.5% |

|

27 |

AA Kenya Shillings Fund |

13.3% |

|

28 |

Stanbic Money Market Fund |

13.1% |

|

29 |

Equity Money Market Fund |

11.4% |

Source: Business Daily

Liquidity:

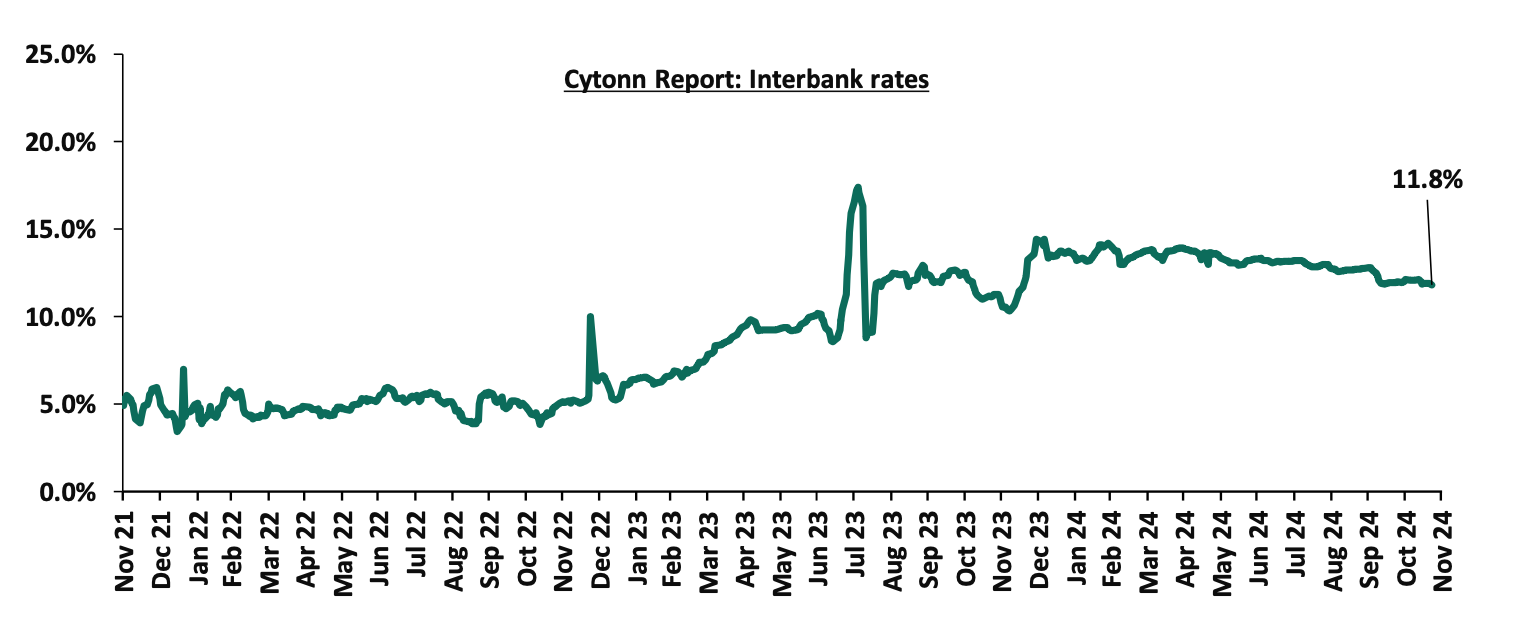

During the week, liquidity in the money markets marginally eased, with the average interbank rate decreasing by 13.3 bps, to 11.9% from the 12.0% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded increased by 30.2% to Kshs 28.3 bn from Kshs 21.7 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Eurobonds were on an upward trajectory, with the yields on the 7-year Eurobond issued in 2019 increasing the most by 20.5 bps to 8.5% from 8.3% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 21st November 2024;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2018 |

2019 |

2021 |

2024 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

|

Years to Maturity |

3.3 |

23.3 |

2.5 |

7.5 |

9.6 |

6.2 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

|

01-Jan-24 |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

|

|

01-Nov-24 |

9.1% |

10.2% |

8.3% |

9.9% |

9.8% |

9.9% |

|

14-Nov-24 |

9.0% |

10.2% |

8.3% |

9.9% |

9.8% |

10.0% |

|

15-Nov-24 |

9.2% |

10.3% |

8.5% |

10.1% |

10.0% |

10.2% |

|

18-Nov-24 |

9.3% |

10.4% |

8.7% |

10.2% |

10.2% |

10.3% |

|

19-Nov-24 |

9.2% |

10.4% |

8.6% |

10.1% |

10.1% |

10.2% |

|

20-Nov-24 |

9.2% |

10.3% |

8.6% |

10.1% |

10.0% |

10.2% |

|

21-Nov-24 |

9.1% |

10.3% |

8.5% |

10.1% |

10.0% |

10.1% |

|

Weekly Change |

0.1% |

0.0% |

0.2% |

0.1% |

0.1% |

0.1% |

|

MTD Change |

0.0% |

0.1% |

0.1% |

0.1% |

0.2% |

0.2% |

|

YTD Change |

(0.7%) |

0.1% |

(1.6%) |

0.2% |

0.5% |

- |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling depreciated against the US Dollar by 18.1 bps, to Kshs 129.6 from the Kshs 129.3 recorded the previous week. On a year-to-date basis, the shilling has appreciated by 17.5% against the dollar, a contrast to the 26.8% depreciation recorded in 2023.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,804.1 mn in the 12 months to October 2024, 15.3% higher than the USD 4,165.1 mn recorded over the same period in 2023, which has continued to cushion the shilling against further depreciation. In the October 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 56.7% in the period, and,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 7.2% in the 12 months to September 2024, compared to a similar period in 2023.

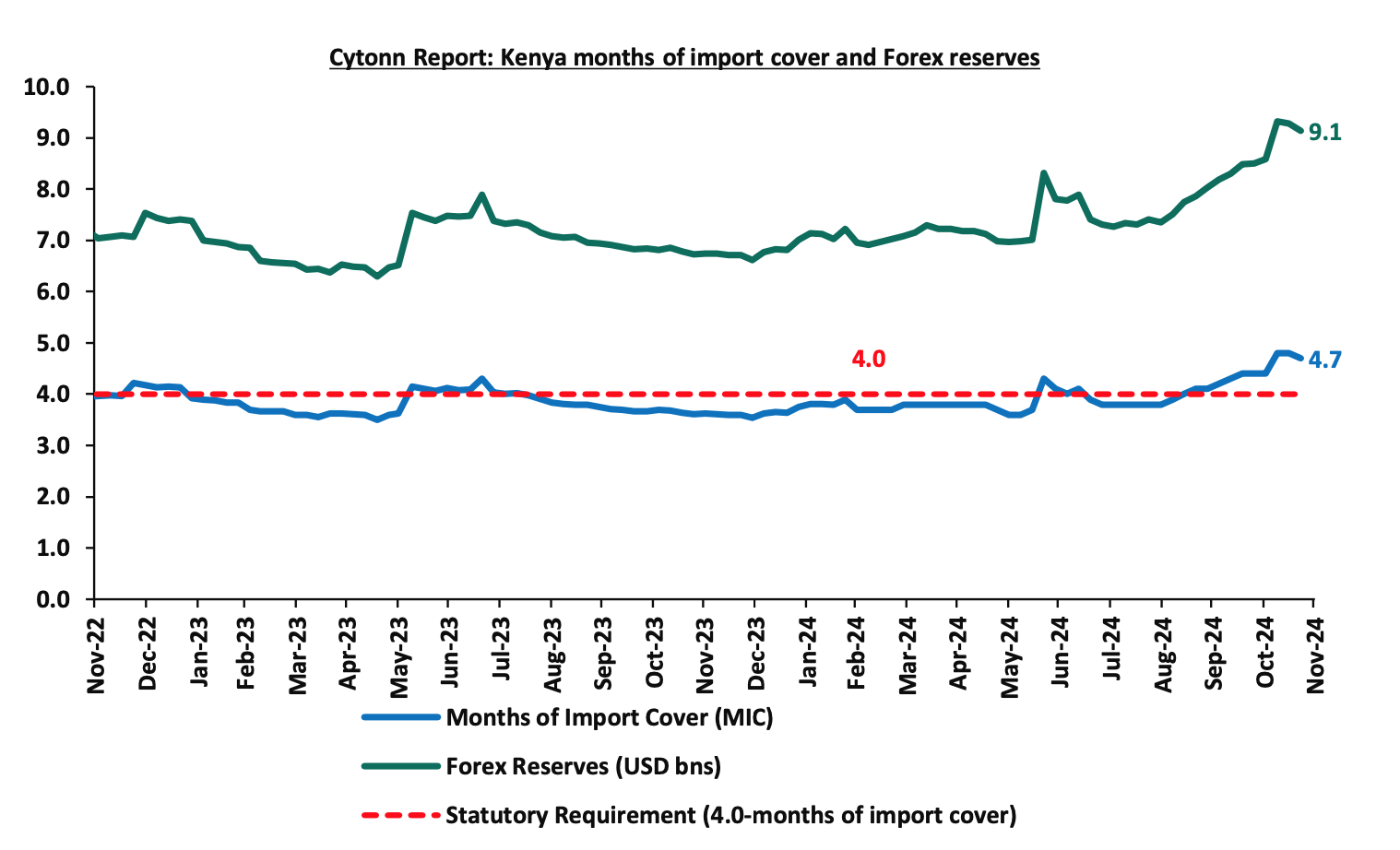

- Improved forex reserves currently at USD 9.1 bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 3.8% of GDP in Q2’2024 from 3.7% recorded in Q2’2023, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.2% of Kenya’s external debt is US Dollar-denominated as of June 2024.

Key to note, Kenya’s forex reserves declined marginally by 1.4% during the week, to USD 9.1 bn from USD 9.3 bn recorded in the previous week, equivalent to 4.7 months of import cover, from 4.8 months recorded last week, and above to the statutory requirement of maintaining at least 4.0-months of import cover. The recent increase in forex reserves is primarily attributed to the disbursement from the International Monetary Fund (IMF). On October 30, 2024, the IMF approved a combined disbursement of around USD 606.1 mn following the successful completion of Kenya’s seventh and eighth reviews under the Extended Fund Facility (EFF), Extended Credit Facility (ECF), and Resilience and Sustainability Facility (RSF) arrangements. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights:

- November Inflation projection

We are projecting the y/y inflation rate for November 2024 to increase within the range of 2.8% - 3.2% mainly on the back of:

- The decrease in the Central Bank Rate (CBR) by 75.0 bps to 12.00% from 12.75% – Earlier this year, the monetary policy committee noted that, there was need to tighten the monetary policy following the sustained depreciation of the Kenyan shilling as well as the heightened inflationary pressures. Over a number of meetings, the CBK Monetary Policy Committee raised the rates to a high of 13.00%, with cuts starting in the August meeting, which cut the CBR by 25 bps to 12.75%. In their last meeting on 8th October 2024, the committee went for an even bigger cut, reducing the CBK rate by 75.0 bps to 12.00% from 12.75%. This reduction in the CBR is likely to increase the money supply through lower borrowing costs, which may cause a slight rise in inflation rates as the effects of the CBR gradually take hold in the broader economy, and,

- Increase in electricity prices – In October 2024, EPRA announced the electricity prices would increase slightly on account of foreign exchange adjustment, with the adjustment being made by a slight at Kshs. 114.9 cents per kWh for the month of October. With electricity being one the major inputs of inflation, this increase is expected to increase production costs for businesses as well as increase electricity costs for households and thus tightening inflation.

- Slight depreciation of the Kenya Shilling against the US Dollar – The Kenya Shilling has recorded a 0.3% month-to-date decline as of 22nd November 2024 to Kshs 129.6 from Kshs 129.2, and a 17.5% year-to-date gain from the Kshs 157.0 recorded at the beginning of the year. This depreciation in the exchange rate, though slight, could increase inflationary pressures.

We, however, expect that inflation rate will, however, be supported by:

- Stable Fuel Prices in November– In their last fuel prices release, EPRA announced that the maximum allowed price for Super Petrol, Diesel and Kerosene remain unchanged. Consequently, Super Petrol, Diesel and Kerosene will continue to retail at Kshs 180.7, Kshs. 168.1 and Kshs 151.4 per litre respectively. This followed the government's efforts to stabilize pump prices through the petroleum pump price stabilization mechanism which expended Kshs 9.9 bn in the FY2023/24 to cushion the increases applied to the petroleum pump prices, and further supported by a stronger Shilling . This stability in fuel prices is likely to provide a stabilizing effect on consumer purchasing power as well as business operational costs, since fuel is a major input cost for businesses.

Going forward, we expect inflationary pressures to remain anchored in the short term, remaining within the CBK’s target range of 2.5%-7.5% aided by the reduced fuel prices, decreased energy costs and stability in the exchange rate. However, risks remain, particularly from the potential for increased demand-driven inflation due to accommodative monetary policy. The decision to lower the CBR to 12.00% during the latest MPC meeting will likely increase money supply, in turn increasing inflation, especially with further cuts expected in the coming meetings. The CBK’s ability to balance growth and inflation through close monitoring of both inflation and exchange rate stability will be key to maintaining inflation within the target range.

- Exchequer Highlights October 2024

During the week, the National Treasury gazetted the revenue and net expenditures for the fourth month of FY’2024/2025, ending 31st October 2024, highlighting that the total revenue collected as at the end of October 2024 amounted to Kshs 768.8 bn, equivalent to 29.2% of the revised estimates of Kshs 2,631.4 bn for FY’2024/2025 and is 87.7% of the prorated estimates of Kshs 877.1 bn.

The National Treasury gazetted the revenue and net expenditures for the fourth month of FY’2024/2025, ending 31st October 2024. Below is a summary of the performance:

|

FY'2024/2025 Budget Outturn - As at 31st October 2024 |

||||||

|

Amounts in Kshs Billions unless stated otherwise |

||||||

|

Item |

12-months Original Estimates |

Revised Estimates |

Actual Receipts/Release |

Percentage Achieved of the Revised Estimates |

Prorated |

% achieved of the Prorated |

|

Opening Balance |

|

|

1.2 |

|

|

|

|

Tax Revenue |

2,745.2 |

2,475.1 |

696.7 |

28.1% |

825.0 |

84.4% |

|

Non-Tax Revenue |

172.0 |

156.4 |

71.0 |

45.4% |

52.1 |

136.2% |

|

Total Revenue |

2,917.2 |

2,631.4 |

768.8 |

29.2% |

877.1 |

87.7% |

|

External Loans & Grants |

571.2 |

593.5 |

29.8 |

5.0% |

197.8 |

15.1% |

|

Domestic Borrowings |

828.4 |

978.3 |

231.7 |

23.7% |

326.1 |

71.0% |

|

Other Domestic Financing |

4.7 |

4.7 |

4.3 |

92.6% |

1.6 |

277.8% |

|

Total Financing |

1,404.3 |

1,576.5 |

265.8 |

16.9% |

525.5 |

50.6% |

|

Recurrent Exchequer issues |

1,348.4 |

1,307.9 |

413.2 |

31.6% |

436.0 |

94.8% |

|

CFS Exchequer Issues |

2,114.1 |

2,137.8 |

446.0 |

20.9% |

712.6 |

62.6% |

|

Development Expenditure & Net Lending |

458.9 |

351.3 |

79.0 |

22.5% |

117.1 |

67.4% |

|

County Governments + Contingencies |

400.1 |

410.8 |

94.4 |

23.0% |

136.9 |

69.0% |

|

Total Expenditure |

4,321.5 |

4,207.9 |

1,032.6 |

24.5% |

1,402.6 |

73.6% |

|

Fiscal Deficit excluding Grants |

1,404.3 |

1,576.5 |

263.8 |

16.7% |

525.5 |

50.2% |

|

Total Borrowing |

1,399.6 |

1,571.8 |

261.4 |

16.6% |

523.9 |

49.9% |

Amounts in Kshs bn unless stated otherwise

The Key take-outs from the release include;

- Total revenue collected as at the end of October 2024 amounted to Kshs 768.8 bn, equivalent to 29.2% of the revised estimates of Kshs 2,631.4 bn for FY’2024/2025 and is 87.7% of the prorated estimates of Kshs 877.1 bn. Cumulatively, tax revenues amounted to Kshs 696.7 bn, equivalent to 28.1% of the revised estimates of Kshs 2,475.1 bn and 84.4% of the prorated estimates of Kshs 825.0 bn,

- Total financing amounted to Kshs 265.8 bn, equivalent to 16.9% of the revised estimates of Kshs 1,576.5 bn and is equivalent to 50.6% of the prorated estimates of Kshs 525.5 bn. Additionally, domestic borrowing amounted to Kshs 231.7 bn, equivalent to 23.7% of the revised estimates of Kshs 978.3 bn and is 71.0% of the prorated estimates of Kshs 326.1 bn,

- The total expenditure amounted to Kshs 1,032.6 bn, equivalent to 24.5% of the revised estimates of Kshs 4,207.9 bn, and is 73.6% of the prorated target expenditure estimates of Kshs 1,402.6 bn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 413.2 bn, equivalent to 31.6% of the revised estimates of Kshs 1,307.9 and 94.8% of the prorated estimates of Kshs 436.0 bn,

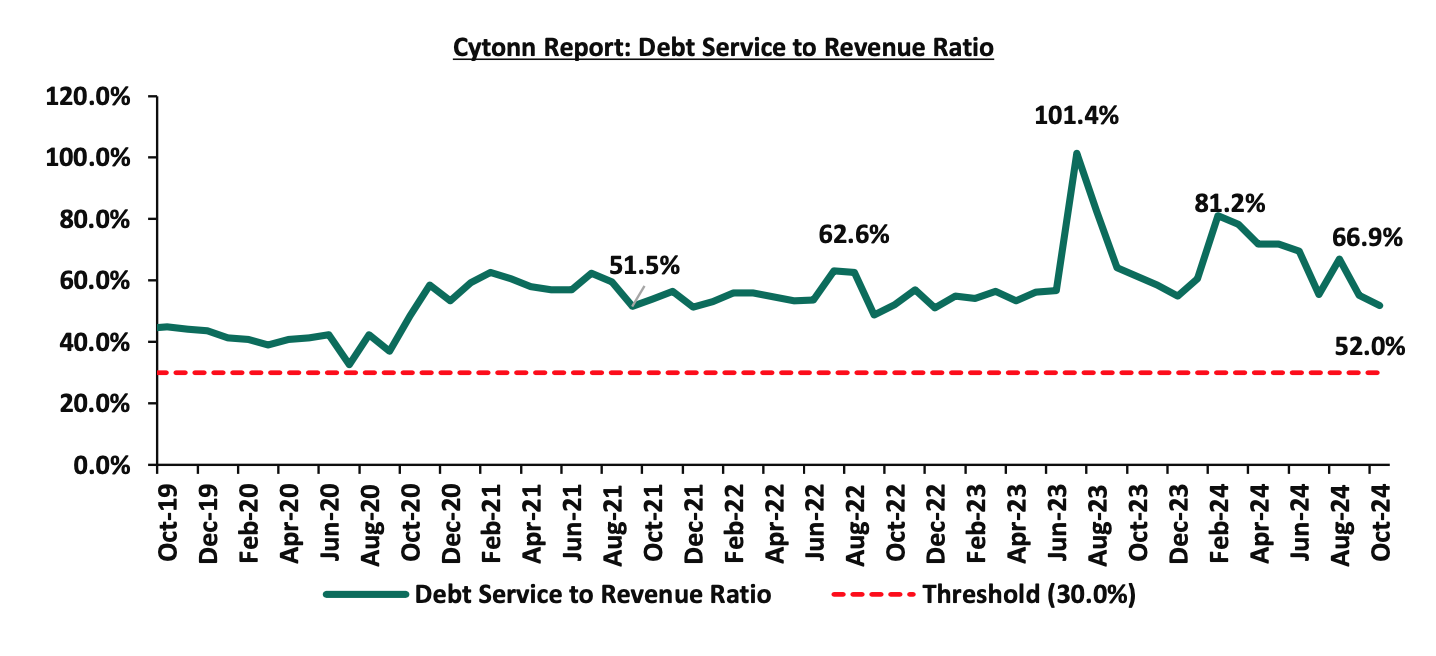

- Consolidated Fund Services (CFS) Exchequer issues came in at Kshs 446.0 bn, equivalent to 20.9% of the revised estimates of Kshs 2,137.8 bn, and are 62.6% of the prorated amount of Kshs 712.6 bn. The cumulative public debt servicing cost amounted to Kshs 399.5 bn which is 20.9% of the revised estimates of Kshs 1,910.5 bn, and is 62.7% of the prorated estimates of Kshs 636.8 bn. Additionally, the Kshs 399.5 bn debt servicing cost is equivalent to 52.0% of the actual cumulative revenues collected as at the end of October 2024. The chart below shows the debt servicing cost to revenue ratio over the period;

- Total Borrowings as at the end of October 2024 amounted to Kshs 261.4 bn, equivalent to 16.6% of the revised estimates of Kshs 1,571.8 bn for FY’2024/2025 and are 49.9% of the prorated estimates of Kshs 523.9 bn. The cumulative domestic borrowing of Kshs 978.3 bn comprises of Net Domestic Borrowing Kshs 408.4 bn and Internal Debt Redemptions (Rollovers) Kshs 569.9 bn.

The government missed its prorated revenue targets for the fourth consecutive month in FY’2024/2025, achieving only 87.7% of the revenue targets in October 2024. This shortfall is largely due to the challenging economic environment, exacerbated by high taxes and the elevated cost of living, despite an easing of inflationary pressures, with the year-on-year inflation for October 2024 dropping by 0.9% points to 2.7%, down from 3.6% in September 2024. However, the cost of living remains high, negatively impacting revenue collection despite the improving business environment, with the PMI increasing to 50.4 in October from 49.7 in September 2024. Despite efforts to enhance revenue collection, such as broadening the tax base, curbing tax evasion, and suspending tax relief payments, the government has yet to fully benefit from these strategies. Future revenue collection will largely depend on the stabilization of the country’s business climate, which is expected to be supported by a stable Shilling, continued easing of inflation, and a reduction in the cost of credit. This is in line with the Monetary Policy Committee’s (MPC) recent decision to lower the Central Bank Rate (CBR) by 75.0 basis points to 12.00%, down from 12.75%, following their meeting on October 8, 2024.

Rates in the Fixed Income market have been on a downward trend given the continued low demand for cash by the government and the improved liquidity in the money market. The government is 144.4% ahead of its prorated net domestic borrowing target of Kshs 164.9 bn, having a net borrowing position of Kshs 403.1 bn. However, we expect a downward readjustment of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to normalize in the medium-term and hence investors are expected to shift towards the long-term papers to lock in the high returns.

Market Performance:

During the week, the equities market was on a downward trajectory, with NSE 10, declining the most by 2.9%; while NSE 25, NASI and NSE 20 declined by 2.4%, 2.0% and 2.0%, taking the YTD performance to gains of 31.9%, 30.6%, 25.3% and 22.6% for NSE 10, NSE 25, NSE 20 and NASI respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as Equity Group, Stanbic, and Bamburi of 7.9%, 5.9%, and 3.4% respectively. The losses were however mitigated by gains recorded by large-cap stocks such as SCBK, NCBA and DTBK of 2.1%, 0.6%, and 0.5% respectively.

During the week, equities turnover increased by 83.1% to USD 9.9 mn from USD 5.4 mn recorded the previous week, taking the YTD turnover to USD 548.7 mn. Foreign investors remained net sellers for the eighth consecutive week, with a net selling position of USD 0.03 mn, from a net selling position of USD 0.8 mn recorded the previous week, taking the YTD net selling position to USD 4.7 mn.

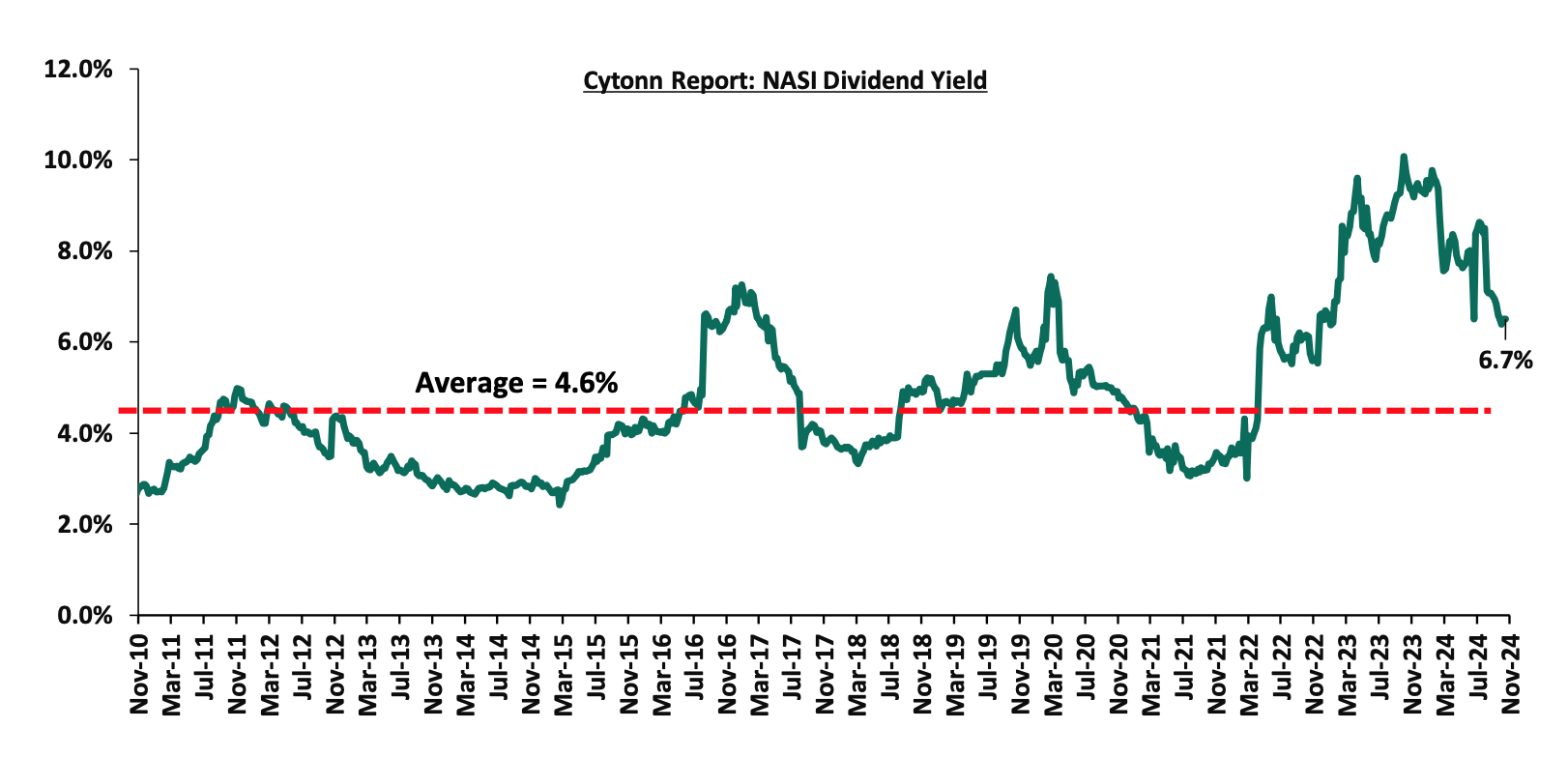

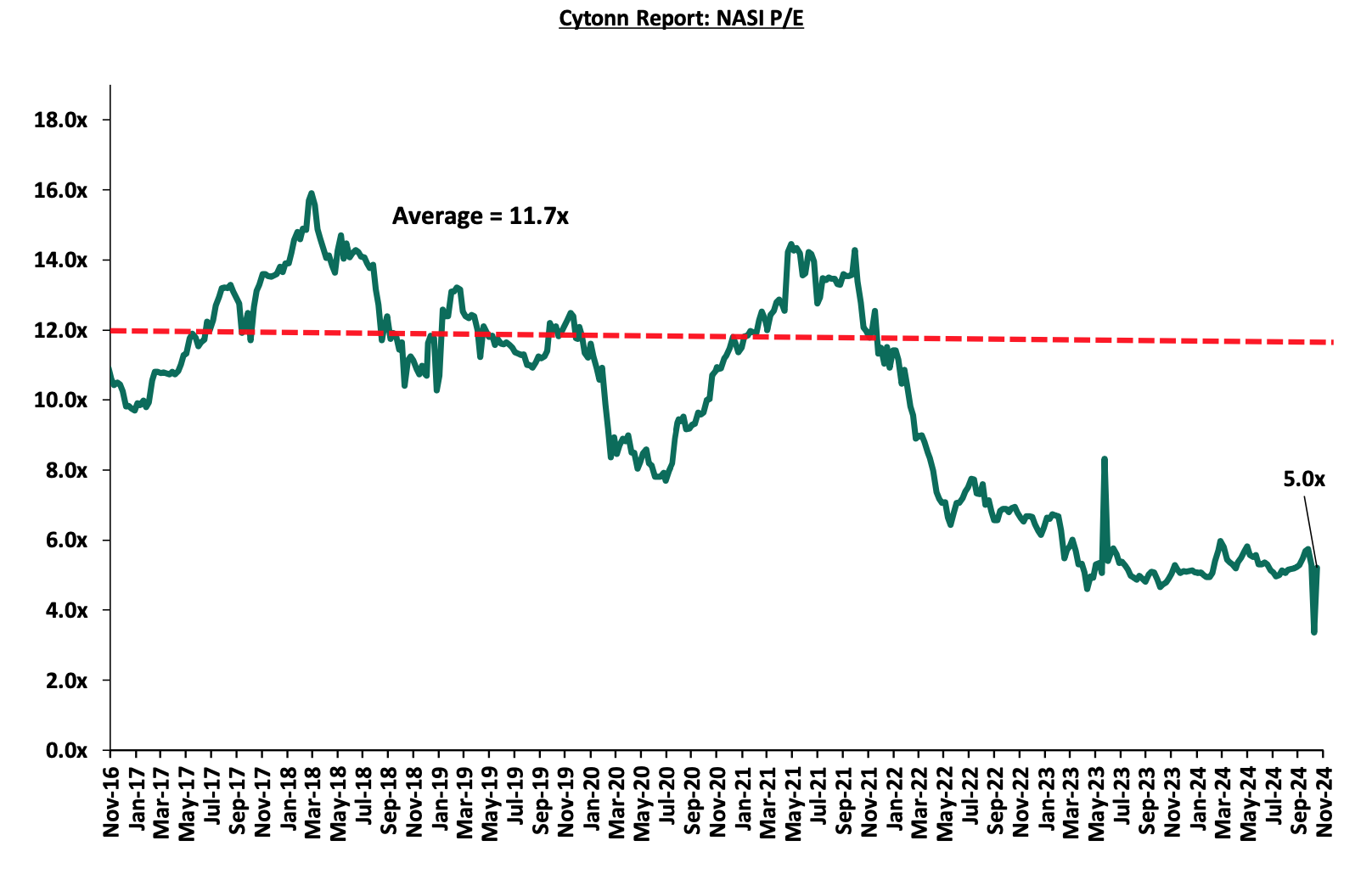

The market is currently trading at a price-to-earnings ratio (P/E) of 5.0x, 57.7% below the historical average of 11.7x, and a dividend yield of 6.7%, 2.1% points above the historical average of 4.6%. Key to note, NASI’s PEG ratio currently stands at 0.6x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued.

The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

||||||||||

|

Company |

Price as at 15/11/2024 |

Price as at 22/11/2024 |

w/w change |

YTD Change |

Year Open 2024 |

Target Price* |

Dividend Yield*** |

Upside/ Downside** |

P/TBv Multiple |

Average |

|

Jubilee Holdings |

164.0 |

170.0 |

3.7% |

164.0 |

185.0 |

260.7 |

8.4% |

61.7% |

0.3x |

Buy |

|

Equity Group |

49.9 |

46.0 |

(7.9%) |

49.9 |

34.2 |

60.2 |

8.7% |

39.7% |

0.9x |

Buy |

|

NCBA |

43.8 |

44.1 |

0.6% |

43.8 |

38.9 |

55.2 |

10.8% |

36.1% |

0.8x |

Buy |

|

CIC Group |

2.2 |

2.2 |

(1.4%) |

2.2 |

2.3 |

2.8 |

6.0% |

34.4% |

0.7x |

Buy |

|

Diamond Trust Bank |

52.3 |

52.5 |

0.5% |

52.3 |

44.8 |

65.2 |

9.5% |

33.7% |

0.2x |

Buy |

|

ABSA Bank |

15.5 |

15.4 |

(0.6%) |

15.5 |

11.6 |

18.9 |

10.1% |

33.2% |

1.2x |

Buy |

|

Co-op Bank |

14.5 |

14.1 |

(3.1%) |

14.5 |

11.4 |

17.2 |

10.7% |

33.1% |

0.6x |

Buy |

|

KCB Group |

39.1 |

39.1 |

(0.1%) |

39.1 |

22.0 |

50.3 |

0.0% |

28.8% |

0.6x |

Buy |

|

Britam |

5.8 |

5.9 |

1.0% |

5.8 |

5.1 |

7.5 |

0.0% |

27.6% |

0.8x |

Buy |

|

Stanbic Holdings |

135.8 |

127.8 |

(5.9%) |

135.8 |

106.0 |

145.3 |

12.0% |

25.8% |

0.9x |

Buy |

|

Standard Chartered Bank |

236.5 |

241.5 |

2.1% |

236.5 |

160.3 |

260.9 |

12.0% |

20.0% |

1.6x |

Buy |

|

I&M Group |

28.2 |

29.9 |

6.0% |

28.2 |

17.5 |

31.4 |

8.5% |

13.7% |

0.6x |

Accumulate |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Dividend Yield is calculated using FY’2023 Dividends |

||||||||||

Weekly Highlights

Earnings Release

- KCB Group Kenya Q3’2024 Financial Performance

During the week, KCB Bank Kenya released their Q3’2024 financial results. Below is a summary of the performance:

|

Balance Sheet Items |

Q3’2023 |

Q3’2024 |

y/y change |

|

Government Securities |

371.3 |

361.1 |

(2.7%) |

|

Net Loans and Advances |

1,047.9 |

1,053.2 |

0.51% |

|

Total Assets |

2,099.5 |

1,993.1 |

(5.1%) |

|

Customer Deposits |

1,656.4 |

1,538.4 |

(7.1%) |

|

Deposits per branch |

2.7 |

2.6 |

(5.7%) |

|

Total Liabilities |

1,873.4 |

1,736.4 |

(7.3%) |

|

Shareholders’ Funds |

218.8 |

249.0 |

13.8% |

|

Key Ratios |

Q3’2023 |

Q3’2024 |

% point change |

|

Loan to Deposit ratio |

63.3% |

67.8% |

4.5% |

|

Government Securities to Deposits ratio |

22.4% |

23.5% |

1.1% |

|

Return on Average Equity |

20.2% |

22.4% |

2.3% |

|

Return on Average Assets |

2.4% |

2.6% |

0.1% |

|

Income Statement |

Q3’2023 (Kshs bn) |

Q3’2024 (Kshs bn) |

y/y change |

|

Net interest Income |

74.9 |

92.8 |

23.9% |

|

Net non-interest income |

42.4 |

50.1 |

18.3% |

|

Total Operating income |

117.3 |

142.9 |

21.9% |

|

Loan loss provision |

(15.8) |

(17.8) |

12.2% |

|

Total Operating expenses |

(76.7) |

(85.5) |

11.5% |

|

Profit before tax |

40.6 |

57.4 |

41.5% |

|

Profit after tax |

30.7 |

45.8 |

49.0% |

|

Core EPS |

9.6 |

14.2 |

49.0% |

|

Income Statement Ratios |

Q3’2023 |

Q3’2024 |

y/y change |

|

Yield from interest-earning assets |

10.1% |

11.3% |

1.2% |

|

Cost of funding |

3.5% |

4.6% |

1.1% |

|

Net Interest Spread |

6.6% |

6.7% |

0.1% |

|

Net Interest Margin |

6.8% |

7.0% |

0.2% |

|

Cost of Risk |

13.5% |

12.4% |

(1.1%) |

|

Net Interest Income as % of operating income |

63.9% |

64.9% |

1.1% |

|

Non-Funded Income as a % of operating income |

36.1% |

35.1% |

(1.1%) |

|

Cost to Income Ratio |

65.4% |

59.8% |

(5.6%) |

|

Cost to Income Ratio (without LLP) |

51.9% |

47.4% |

(4.5%) |

|

Capital Adequacy Ratios |

Q3’2023 |

Q3’2024 |

% points change |

|

Core Capital/Total Liabilities |

13.0% |

14.5% |

1.5% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess |

5.0% |

6.5% |

1.5% |

|

Core Capital/Total Risk Weighted Assets |

14.5% |

16.5% |

2.0% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess |

4.0% |

6.0% |

2.0% |

|

Total Capital/Total Risk Weighted Assets |

17.8% |

19.3% |

1.5% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess |

3.3% |

4.8% |

1.5% |

|

Liquidity Ratio |

50.3% |

47.2% |

(3.1%) |

|

Minimum Statutory ratio |

20.0% |

20.0% |

0.0% |

|

Excess |

30.3% |

27.2% |

(3.1%) |

Key Take-Outs:

- Increased earnings - Core earnings per share (EPS) grew by 49.0% to Kshs 14.2, from Kshs 9.6 in Q3’2023, driven by the 21.9% increase in total operating income to Kshs 142.9 bn, from Kshs 117.3 bn in Q3’2023, which operating income growth outpaced operating expense growth of 11.5% from xxx to xxx .

- Deteriorated asset quality –The bank’s Asset Quality deteriorated, with Gross NPL ratio increasing to 18.1% in Q3’2024, from 16.1% in Q3’2023, attributable to a 15.1% increase in Gross non-performing loans to Kshs 215.3 bn, from Kshs 187.0 bn in Q3’2023, compared to the 2.3% increase in gross loans to Kshs 1,190.5 bn, from Kshs 1,164.0 bn recorded in Q3’2023.

- Contracted Balanced sheet - The balance sheet recorded a contraction as total assets declined by 5.1% to Kshs 1,993.1 bn, from Kshs 2,099.5 bn in Q3’2024, driven by a 2.7% decrease in governments securities holdings to Kshs 361.1 bn, from 371.3 bn in Q3’2023.

For a more detailed analysis, please see the KCB Group’s Q3’2024 Earnings Note

- Stanbic Holdings Q3’2024 Financial Performance

During the week, Stanbic Holdings released their Q3’2024 financial results. Below is a summary of the performance:

|

Balance Sheet |

Q3'2023 (Kshs bn) |

Q3'2024 (Kshs bn) |

y/y change |

|

Net Loans and Advances |

251.0 |

218.8 |

(12.8%) |

|

Kenya Government Securities |

37.0 |

54.6 |

47.4% |

|

Total Assets |

414.3 |

462.6 |

11.7% |

|

Customer Deposits |

305.7 |

327.8 |

7.3% |

|

Deposits Per Branch |

10.9 |

10.9 |

0.1% |

|

Total Liabilities |

358.6 |

401.0 |

11.8% |

|

Shareholders' Funds |

55.7 |

61.5 |

10.6% |

|

Key Ratios |

Q3'2023 |

Q3'2024 |

% point change |

|

Loan to Deposit ratio |

82.1% |

66.7% |

(15.4%) |

|

Government securities to deposits ratio |

12.1% |

16.7% |

4.5% |

|

Return on average equity |

21.4% |

22.2% |

0.8% |

|

Return on average assets |

2.9% |

3.0% |

0.1% |

|

Income Statement |

Q3'2023 (Kshs bn) |

Q3'2024 (Kshs bn) |

y/y change |

|

Net interest Income |

18.1 |

19.0 |

4.8% |

|

Non-interest income |

12.6 |

10.4 |

(17.8%) |

|

Total Operating income |

30.7 |

29.3 |

(4.5%) |

|

Loan loss provision |

(4.5) |

(2.7) |

(40.2%) |

|

Total Operating expenses |

(17.8) |

(15.3) |

(13.9%) |

|

Profit before tax |

13.0 |

14.1 |

8.4% |

|

Profit after tax |

9.3 |

10.1 |

9.3% |

|

Core EPS |

23.5 |

25.7 |

9.3% |

|

Income Statement Ratios |

Q3'2023 |

Q3'2024 |

y/y change |

|

Yield from interest-earning assets |

9.9% |

13.3% |

3.4% |

|

Cost of funding |

3.3% |

6.7% |

3.5% |

|

Net Interest Margin |

7.1% |

7.0% |

(0.1%) |

|

Net Interest Income as % of operating income |

59.0% |

64.7% |

5.7% |

|

Non-Funded Income as a % of operating income |

41.0% |

35.3% |

(5.7%) |

|

Cost to Income Ratio |

57.8% |

52.1% |

(5.7%) |

|

CIR without LLP |

43.2% |

42.9% |

(0.3%) |

|

Cost to Assets |

3.2% |

2.7% |

(0.5%) |

|

Capital Adequacy Ratios |

Q3'2023 |

Q3'2024 |

% points change |

|

Core Capital/Total Liabilities |

15.7% |

16.5% |

0.8% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

|

|

Excess |

7.7% |

8.5% |

0.8% |

|

Core Capital/Total Risk Weighted Assets |

13.2% |

14.7% |

1.5% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

|

|

Excess |

2.7% |

4.2% |

1.5% |

|

Total Capital/Total Risk Weighted Assets |

16.9% |

17.8% |

0.9% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

|

|

Excess |

2.4% |

3.3% |

0.9% |

|

Liquidity Ratio |

40.5% |

50.0% |

9.5% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

|

|

Excess |

20.5% |

30.0% |

9.5% |

Key Take-Outs:

- Improved efficiency – The bank’s total operating expenses decreased by 13.9% to Kshs 15.3 bn, from Kshs 17.8 bn in Q3’2023, mainly attributed to a 40.2% decrease in loan loss provisions and 12.5% decrease in other operating expenses to Kshs 6.4 bn, from Kshs 7.3 bn, which outpaced the 4.1% increase in staff costs,

- Improved earnings - Core earnings per share (EPS) grew by 9.3% to Kshs 25.7, from Kshs 23.5 in Q3’2023, driven by the 13.9% decrease in total operating expenses, which outpaced the 4.5% decrease in total operating income,

- Deteriorated asset quality – The bank’s gross NPL ratio increased to 10.4% in Q3’2024 from 9.0% in Q3’2023, attributable to the 3.2% increase in Gross non-performing loans to Kshs 24.8 bn, from Kshs 24.0 bn in Q3’2023, compared to the 10.9% decrease in gross loans to Kshs 237.7 bn, from Kshs 266.9 bn recorded in Q3’2023,

For a more detailed analysis, please see the Stanbic Holding’s Q3’2024 Earnings Note

- Absa Bank Kenya Plc Q3’2024 Financial Performance

During the week, Absa Bank Kenya released their Q3’2024 financial results. Below is a summary of the performance:

|

Balance Sheet Items |

Q3’2023 |

Q3’2024 |

y/y change |

|

Government Securities |

77.7 |

72.4 |

(6.7%) |

|

Net Loans and Advances |

330.9 |

311.5 |

(5.9%) |

|

Total Assets |

504.9 |

484.4 |

(4.1%) |

|

Customer Deposits |

354.3 |

351.8 |

(0.7%) |

|

Deposit per Branch |

4.7 |

4.1 |

(11.2%) |

|

Total Liabilities |

439.6 |

407.0 |

(7.4%) |

|

Shareholder's Funds |

65.3 |

77.3 |

18.4% |

|

Balance Sheet Ratios |

Q3’2023 |

Q3’2024 |

% points change |

|

Loan to Deposit Ratio |

93.4% |

88.5% |

(4.9%) |

|

Govt Securities to Deposit ratio |

21.9% |

20.6% |

(1.3%) |

|

Return on average equity |

25.8% |

26.4% |

0.6% |

|

Return on average assets |

3.3% |

3.8% |

0.5% |

|

Income Statement |

Q3’2023 |

Q3’2024 |

y/y change |

|

Net Interest Income |

29.3 |

34.5 |

17.7% |

|

Net non-Interest Income |

10.8 |

12.2 |

13.0% |

|

Total Operating income |

40.2 |

46.8 |

16.5% |

|

Loan Loss provision |

(6.8) |

(8.0) |

18.7% |

|

Total Operating expenses |

(22.3) |

(25.7) |

15.2% |

|

Profit before tax |

17.8 |

21.1 |

18.1% |

|

Profit after tax |

12.3 |

14.7 |

19.8% |

|

Core EPS |

2.3 |

2.7 |

19.8% |

|

Income Statement Ratios |

Q3’2023 |

Q3’2024 |

% points change |

|

Yield from interest-earning assets |

11.7% |

14.8% |

3.1% |

|

Cost of funding |

3.7% |

5.0% |

1.3% |

|

Net Interest Spread |

2.7% |

3.9% |

1.2% |

|

Net Interest Margin |

8.8% |

10.5% |

1.6% |

|

Cost of Risk |

16.8% |

17.2% |

0.3% |

|

Net Interest Income as % of operating income |

73.0% |

73.8% |

0.8% |

|

Non-Funded Income as a % of operating income |

27.0% |

26.2% |

(0.8%) |

|

Cost to Income |

55.6% |

55.0% |

(0.6%) |

|

Cost to Income (Without LLPs) |

38.7% |

37.8% |

(0.9%) |

|

Capital Adequacy Ratios |

Q3’2023 |

Q3’2024 |

% points change |

|

Core Capital/Total Liabilities |

16.5% |

19.1% |

2.6% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess |

8.5% |

11.1% |

2.6% |

|

Core Capital/Total Risk Weighted Assets |

13.4% |

15.6% |

2.2% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess |

2.9% |

5.1% |

2.2% |

|

Total Capital/Total Risk Weighted Assets |

17.7% |

19.4% |

1.7% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess |

3.2% |

4.9% |

1.7% |

|

Liquidity Ratio |

29.8% |

38.1% |

8.3% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

0.0% |

|

Excess |

9.8% |

18.1% |

8.3% |

Key Take-Outs:

- Increased earnings - Core earnings per share increased by 19.8% to Kshs 2.7, from Kshs 2.3 in Q3’2023, mainly driven by the 16.5% increase in total operating income to Kshs 46.8 bn, from Kshs 40.2 bn in Q3’2023 which outpaced the 15.2% increase in total operating expenses to Kshs 25.7 bn, from Kshs 22.3 bn in Q3’2023.

- Declined asset quality – The bank’s Asset Quality deteriorated, with Gross NPL ratio increasing to 12.6% in Q3’2024, from 9.8% in Q3’2023, attributable to the 23.5% increase in gross non-performing loans to Kshs 42.7 bn, from Kshs 34.5 bn in Q3’2023, relative to the 4.2% decrease in gross loans to Kshs 339.3 bn, from Kshs 354.2 bn recorded in Q3’2023.

-

Decreased Lending – The bank’s loan book recorded a contraction of 5.9% to Kshs 311.5 bn, from Kshs 330.9 bn in Q3’2023.

For a more detailed analysis, please see the Absa Bank’s Q3’2024 Earnings Note

- I&M Group Q3’2024 Financial Performance

During the week, I&M Group released their Q3’2024 financial results. Below is a summary of the performance:

|

Balance Sheet Items |

Q3’2023 |

Q3’2024 |

y/y change |

|

Government Securities |

84.6 |

96.2 |

13.6% |

|

Net Loans and Advances |

287.3 |

281.3 |

(2.1%) |

|

Total Assets |

544.1 |

567.7 |

4.3% |

|

Customer Deposits |

402.4 |

413.8 |

2.8% |

|

Deposits/branch |

4.8 |

4.9 |

0.4% |

|

Total Liabilities |

458.8 |

473.6 |

3.2% |

|

Shareholders’ Funds |

79.1 |

87.6 |

10.8% |

|

Balance Sheet Ratios |

Q3’2023 |

Q3’2024 |

% points change |

|

Loan to Deposit Ratio |

71.4% |

68.0% |

(3.4%) |

|

Government Securities to Deposit Ratio |

21.0% |

23.2% |

2.2% |

|

Return on average equity |

15.9% |

14.9% |

(1.0%) |

|

Return on average assets |

2.6% |

2.4% |

(0.2%) |

|

Income Statement |

Q3’2023 |

Q3’2024 |

y/y change |

|

Net Interest Income |

19.1 |

26.3 |

37.4% |

|

Net non-Interest Income |

10.7 |

9.5 |

(11.5%) |

|

Total Operating income |

29.9 |

35.8 |

19.8% |

|

Loan Loss provision |

(4.6) |

(5.5) |

18.9% |

|

Total Operating expenses |

(19.2) |

(22.4) |

16.5% |

|

Profit before tax |

11.4 |

14.1 |

24.1% |

|

Profit after tax |

8.2 |

9.9 |

21.3% |

|

Core EPS |

5.0 |

6.0 |

21.3% |

|

Dividend Payout ratio |

26.2% |

21.6% |

(4.6%) |

|

Annualized Dividend Yield |

30.5% |

17.4% |

(13.1%) |

|

Income Statement Ratios |

Q3’2023 |

Q3’2024 |

% points change |

|

Yield from interest-earning assets |

10.4% |

14.3% |

3.9% |

|

Cost of funding |

4.3% |

6.3% |

2.0% |

|

Net Interest Margin |

6.2% |

7.8% |

1.6% |

|

Net Interest Income as % of operating income |

63.9% |

72.8% |

9.0% |

|

Non-Funded Income as a % of operating income |

36.1% |

27.2% |

(9.0%) |

|

Cost to Income Ratio |

65.6% |

63.0% |

(2.6%) |

|

CIR without LLP |

48.8% |

47.7% |

(1.1%) |

|

Cost to Assets |

1.9% |

1.9% |

0.1% |

|

Capital Adequacy Ratios |

Q3’2023 |

Q3’2024 |

% points change |

|

Core Capital/Total Liabilities |

16.5% |

17.4% |

0.9% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

0.0% |

|

Excess |

8.5% |

9.4% |

0.9% |

|

Core Capital/Total Risk Weighted Assets |

13.0% |

14.6% |

1.6% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

0.0% |

|

Excess |

2.5% |

4.1% |

1.6% |

|

Total Capital/Total Risk Weighted Assets |

17.7% |

18.0% |

0.3% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

0.0% |

|

Excess |

3.2% |

3.5% |

0.3% |

|

Liquidity Ratio |

48.2% |

51.5% |

3.3% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

0.0% |

|

Excess |

28.2% |

31.5% |

3.3% |

Key Take-Outs:

- Strong earnings growth - Core earnings per share increased by 21.3% to Kshs 6.0 from Kshs 5.0 in Q3’2023, mainly driven by 19.8% growth in total operating income to Kshs 35.8 bn in Q3’2024 from Kshs 29.9 bn in Q3’2023. The performance was however weighed down by the 16.5% increase in total operating expenses to Kshs 22.4 bn, from Kshs 19.2 bn in Q3’2023.

- Increased Provisioning – The group’s provisioning increased by 18.9% to Kshs 5.5 bn from Kshs 4.6 bn recorded in Q3’2023. The increase in provisioning is attributable to the increased credit risk as a result of a deteriorated economic environment as evidenced by the average Q3’2024 Purchasing Managers Index (PMI) of 47.8, down from an average of 48.0 in Q3’2023,

- Declaration of dividends - The directors of I&M Group Holdings have announced an interim dividend of Kshs 1.3 per share translating to a dividend payout ratio of 21.6% and an annualized dividend yield of 17.4%

For a more detailed analysis, please see the I&M Group’s Q3’2024 Earnings Note

- Standard Chartered Bank Kenya Q3’2024 Financial Performance

During the week, Standard Chartered Bank Kenya released their Q3’2024 financial results. Below is a summary of the performance:

|

Balance Sheet Items |

Q3’2023 |

Q3’2024 |

y/y change |

|

Net loans |

143.6 |

151.3 |

5.4% |

|

Government Securities |

55.6 |

68.1 |

22.4% |

|

Total Assets |

369.7 |

370.9 |

0.3% |

|

Customer Deposits |

298.8 |

284.4 |

(4.8%) |

|

Deposits per Branch |

8.3 |

8.9 |

7.1% |

|

Total Liabilities |

310.0 |

304.4 |

(1.8%) |

|

Shareholder's Funds |

59.7 |

66.5 |

11.4% |

|

Balance Sheet Ratios |

Q3’2023 |

Q3’2024 |

% points change |

|

Loan to deposit ratio |

48.0% |

53.2% |

5.1% |

|

Government securities to deposit ratio |

18.6% |

23.9% |

5.3% |

|

Return on Average Equity |

22.7% |

31.6% |

8.9% |

|

Return on Average Assets |

3.6% |

5.4% |

1.8% |

|

Income Statement |

Q3’2023 |

Q3’2024 |

y/y change |

|

Net Interest Income |

21.2 |

24.8 |

17.0% |

|

Net non-Interest Income |

8.2 |

14.2 |

73.5% |

|

Total Operating income |

29.4 |

39.1 |

32.7% |

|

Loan Loss provision |

1.8 |

2.0 |

7.4% |

|

Total Operating expenses |

15.8 |

16.6 |

5.4% |

|

Profit before tax |

13.7 |

22.5 |

64.3% |

|

Profit after tax |

9.7 |

15.8 |

62.7% |

|

Core EPS (Kshs) |

25.8 |

41.9 |

62.7% |

|

Dividend Per Share (Kshs) |

6.0 |

8.0 |

33.3% |

|

Dividend Payout Ratio |

23.3% |

19.1% |

(18.1%) |

|

Annualized Dividend Yield |

15.0% |

13.3% |

(11.4%) |

|

Income Statement Ratios |

Q3’2023 |

Q3’2024 |

% points change |

|

Yield from interest-earning assets |

9.4% |

11.8% |

2.4% |

|

Cost of funding |

1.0% |

1.7% |

0.7% |

|

Net Interest Spread |

8.4% |

10.1% |

1.7% |

|

Net Interest Margin |

8.5% |

10.2% |

1.7% |

|

Cost of Risk |

6.2% |

5.0% |

(1.2%) |

|

Net Interest Income as % of operating income |

72.1% |

63.6% |

(8.6%) |

|

Non-Funded Income as a % of operating income |

27.9% |

36.4% |

8.6% |

|

Cost to Income Ratio |

53.5% |

42.5% |

(11.0%) |

|

Cost to Income Ratio without LLP |

47.3% |

37.5% |

(9.9%) |

|

Capital Adequacy Ratios |

Q3’2023 |

Q3’2024 |

% points change |

|

Core Capital/Total Liabilities |

15.7% |

20.2% |

4.5% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

|

|

Excess |

7.7% |

12.2% |

4.5% |

|

Core Capital/Total Risk Weighted Assets |

17.1% |

20.9% |

3.9% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

|

|

Excess |

6.6% |

10.4% |

3.9% |

|

Total Capital/Total Risk Weighted Assets |

17.8% |

21.0% |

3.2% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

|

|

Excess |

3.3% |

6.5% |

3.2% |

|

Liquidity Ratio |

66.7% |

65.4% |

(1.3%) |

|

Minimum Statutory ratio |

20.0% |

20.0% |

|

|

Excess |

46.7% |

45.4% |

(1.3%) |

Key Take-Outs:

- Strong earnings growth - Core earnings per share increased by 62.7% to Kshs 41.9, from Kshs 25.8 in Q3’2023, mainly driven by the 32.7% increase in total operating income to Kshs 39.1 bn, from Kshs 29.4 bn in Q3’2023 which outpaced the 5.4% increase in total operating expenses to Kshs 16.6 bn, from Kshs 15.8 bn in Q3’2023,

- Improved asset quality – The bank’s Asset Quality improved, with Gross NPL ratio decreasing to 7.5% in Q3’2024, from 14.4% in Q3’2023, attributable to the 48.4% decrease in gross non-performing loans to Kshs 12.1 bn, from Kshs 23.6 bn in Q3’2023, relative to the slower 0.9% decrease in gross loans to Kshs 161.6 bn, from Kshs 163.1 bn recorded in Q3’2023

-

Improved Lending – The bank’s loan book increased by 5.4% to Kshs 151.3 bn, from Kshs 143.6 bn in Q3’2023, highlighting the bank’s strategy to increase lending through digital transformation, while at the same time managing its non-performing loan book, and,

-

Declaration of dividends – The Board of Directors declared an interim dividend of Kshs 8.0 per share for Q3’2024, compared to Kshs 6.0 per share Q3’2023. This translates to a dividend payout ratio of 19.1% and an annualized dividend yield of 13.3% as of 22nd November 2024, compared to a dividend payout ratio of 23.3% and an annualized dividend yield of 15.0% in a similar period in 2023.

For a more detailed analysis, please see the Standard Chartered Bank’s Q3’2024 Earnings Note

Asset Quality:

The table below shows the asset quality of listed banks that have released their Q3’2024 results using several metrics:

|

Cytonn Report: Listed Banks Asset Quality in Q3’2024 |

||||||

|

|

Q3'2024 NPL Ratio* |

Q3'2023 NPL Ratio** |

% point change in NPL Ratio |

Q3'2024 NPL Coverage* |

Q3'2023 NPL Coverage** |

% point change in NPL Coverage |

|

KCB Group |

18.1% |

16.1% |

2.0% |

63.8% |

62.1% |

1.7% |

|

Co-operative Bank of Kenya |

16.5% |

14.9% |

1.7% |

60.5% |

62.1% |

(1.6%) |

|

Equity Group |

14.4% |

13.6% |

0.7% |

56.8% |

53.4% |

3.4% |

|

Absa Bank Kenya |

12.6% |

9.8% |

2.8% |

65.3% |

67.4% |

(2.1%) |

|

I&M Group |

11.8% |

11.8% |

(0.0%) |

61.3% |

51.8% |

9.5% |

|

Stanbic Holdings |

10.4% |

9.0% |

1.4% |

76.5% |

66.3% |

10.2% |

|

Standard Chartered Bank |

7.5% |

14.4% |

(6.9%) |

85.3% |

83.0% |

2.3% |

|

Mkt Weighted Average* |

13.6% |

13.1% |

0.5% |

65.6% |

62.0% |

3.6% |

|

*Market cap weighted as at 22/11/2024 |

||||||

|

**Market cap weighted as at 22/12/2023 |

||||||

Key take-outs from the table include;

- Asset quality for the listed banks that have released declined during Q3’2024, with market-weighted average NPL ratio increasing by 1.7% points to 14.8% from 13.1% in Q3’2023, and,

- Market-weighted average NPL Coverage for the listed banks increased by 0.1% points to 62.0% in Q3’2024 from 62.1% recorded in Q3’2023. The decrease was attributable to Absa Bank’s coverage ratio decreasing by 2.1% to 65.3% from 67.4% in Q3’2023, coupled with Coop’s NPL coverage ratio decreasing by 1.6% points to 60.5% from 62.3% in Q3’2023. The performance was however supported by Stanbic Bank’s NPL Coverage ratio increasing by 10.2% to 76.5% from 66.3% in Q3’2023.

Summary Performance

The table below shows the performance of listed banks that have released their Q3’2024 results using several metrics:

|

Cytonn Report: Listed Banks Performance in Q3’2024 |

||||||||||||||

|

Bank |

Core EPS Growth |

Interest Income Growth |

Interest Expense Growth |

Net Interest Income Growth |

Net Interest Margin |

Non-Funded Income Growth |

NFI to Total Operating Income |

Growth in Total Fees & Commissions |

Deposit Growth |

Growth in Government Securities |

Loan to Deposit Ratio |

Loan Growth |

Return on Average Equity |

|

|

Standard Chartered Bank |

62.7% |

24.0% |

91.7% |

17.0% |

10.2% |

73.5% |

36.4% |

30.4% |

(4.8%) |

22.4% |

53.2% |

5.4% |

31.6% |

|

|

KCB Group |

49.0% |

30.8% |

44.0% |

23.9% |

7.0% |

18.3% |

35.1% |

10.7% |

(7.1%) |

(2.7%) |

67.8% |

0.5% |

22.4% |

|

|

I&M Group |

21.3% |

43.5% |

51.2% |

37.4% |

7.0% |

(11.5%) |

26.5% |

15.1% |

2.8% |

13.6% |

68.0% |

(2.1%) |

14.9% |

|

|

Absa Bank Kenya |

19.8% |

24.3% |

43.8% |

17.7% |

10.5% |

13.0% |

26.2% |

1.1% |

(0.7%) |

(6.7%) |

88.5% |

(5.9%) |

26.4% |

|

|

Equity Group |

13.1% |

13.3% |

17.7% |

11.0% |

7.7% |

5.8% |

43.1% |

9.5% |

9.0% |

6.8% |

60.8% |

(5.4%) |

23.7% |

|

|

Stanbic Holdings |

9.3% |

48.6% |

147.4% |

4.8% |

7.0% |

(17.8%) |

35.3% |

(3.1%) |

7.3% |

47.4% |

66.7% |

(12.8%) |

22.2% |

|

|

Co-operative Bank of Kenya |

4.4% |

25.2% |

50.6% |

12.3% |

8.0% |

8.2% |

37.7% |

1.7% |

18.7% |

14.3% |

74.2% |

0.9% |

20.0% |

|

|

Q3'24 Mkt Weighted Average* |

27.4% |

26.0% |

53.0% |

16.9% |

8.2% |

15.9% |

35.9% |

10.2% |

3.1% |

9.9% |

67.1% |

(2.4%) |

23.7% |

|

|

Q3'23 Mkt Weighted Average** |

11.2% |

29.7% |

47.9% |

21.3% |

7.0% |

17.0% |

37.7% |

27.7% |

24.4% |

(4.3%) |

70.6% |

19.1% |

21.1% |

|

|

*Market cap weighted as at 22/11/2024 |

||||||||||||||

|

**Market cap weighted as at 22/12/2023 |

||||||||||||||

Key take-outs from the table include:

- The listed banks recorded a 27.7% growth in core Earnings per Share (EPS) in Q3’2024, compared to the weighted average growth of 11.2% in Q3’2023, an indication of improved performance despite the deteriorated operating environment experienced during Q3’2024,

- Interest income recorded a weighted average growth of 26.2% in Q3’2024, compared to 29.7% in Q3’2023. Similarly, interest expenses recorded a market-weighted average growth of 54.0% in Q3’2024 compared to a growth of 47.9% in Q3’2023,

- The Banks’ net interest income recorded a weighted average growth of 16.8% in Q3’2024, a decrement from the 21.3% growth recorded over a similar period in 2023, while the non-funded income grew by 16.1% in Q3’2024 slower than the 17.0% growth recorded in Q3’2023 despite the revenue diversification strategies implemented by most banks, and,

- The Banks recorded a weighted average deposit growth of 3.8%, lower than the market-weighted average deposit growth of 24.4% in Q3’2023.

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery. With the market currently being undervalued for its future growth (PEG Ratio at 0.6x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current foreign investors’ sell-offs to continue weighing down the equities outlook in the short term.

- Industry Report

During the week, the Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) September 2024 Reports, which highlighted the performance of major economic indicators. Key highlights related to the Real Estate sector include;

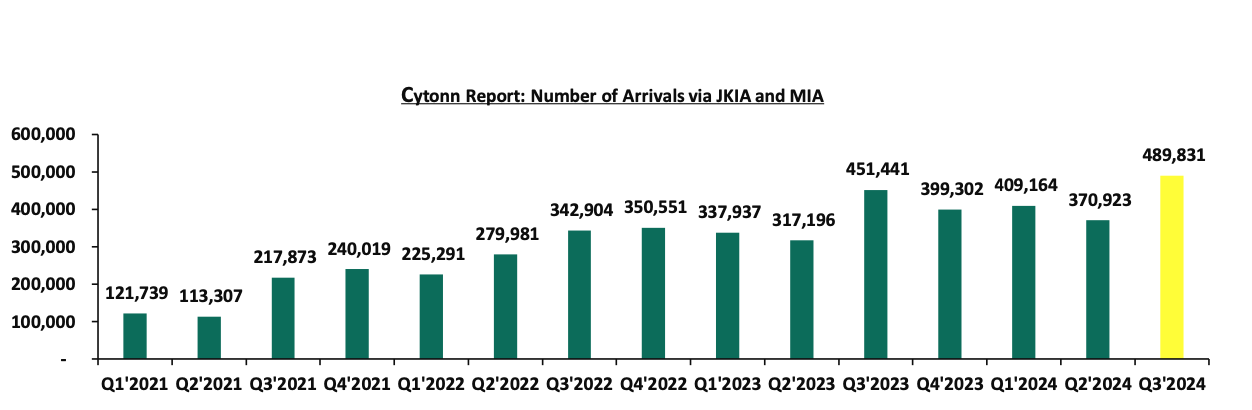

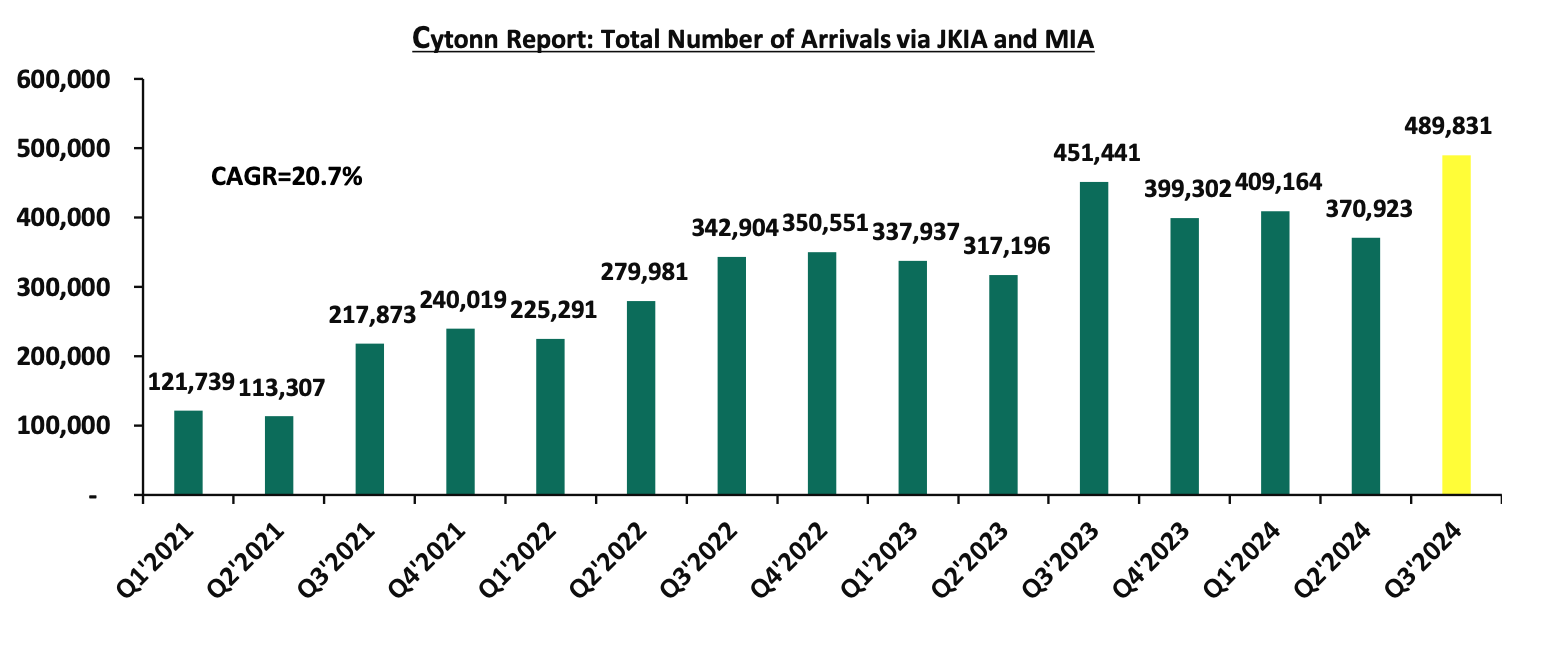

- In September 2024, the number of arrivals was 144,996, reflecting a 17.2% decrease from 175,113 in August 2024. The linked month decrease can be attributed to i) end of summer holidays, ii) global economic factors such as inflation, and, iii) operational disruptions by the JKIA striking workers. However, on a year-on-year basis, this represented a 7.2% increase compared to 135,248 arrivals in September 2023. The improved performance can be attributed to several factors; i) Recovery in the global tourism industry, combined with an effective marketing campaign, ii) enhanced visa accessibility following the rollout of the Electronic Tourist Authorization (ETA) earlier in the year, iii) improved air connectivity with the launch of new routes, increased frequencies by major airlines, and the addition of direct flights by three new airlines—IndiGo (Mumbai-Nairobi), Fly Dubai (Dubai-Mombasa), and Airlink (Johannesburg-Nairobi), iv) development of specialized tourism offerings, including cruise, adventure, cultural, and sports tourism, v) expanded international promotion of Kenya's tourism spearheaded by the Ministry of Tourism and the Kenya Tourism Board, leveraging platforms such as Magical Kenya. On a q/q basis, the Q3’2024 performance represented a 32.1% increase to record the highest number since 2021 of 489,831 in Q3’2024 from 370,923 arrivals recorded in Q2’2024. The performance can be attributed to the cessation of anti-government protests experienced in June and May. The chart below shows the number of international arrivals in Kenya between Q1’2021 and Q3’2024;

Source: Kenya National Bureau of Statistics (KNBS)

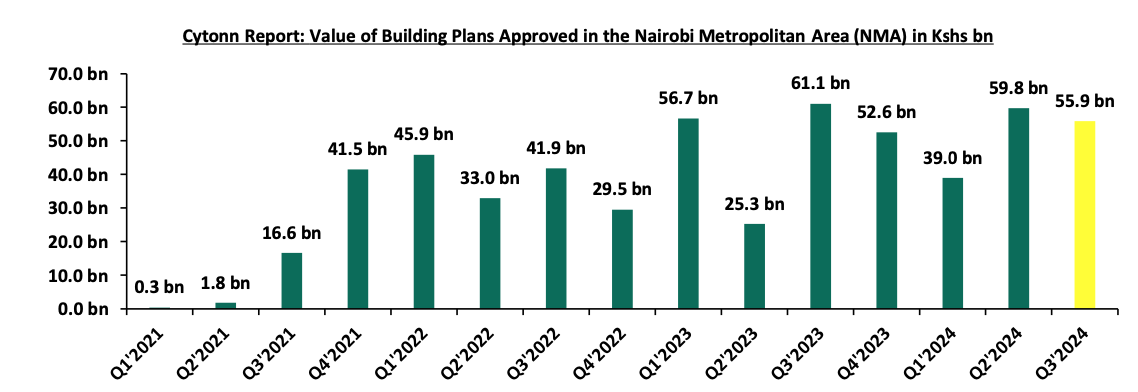

Source: Kenya National Bureau of Statistics (KNBS) - The total value of building plans approved in the Nairobi Metropolitan Area (NMA) decreased y/y basis by 8.4% to Kshs 55.9 bn in Q3’2024, from Kshs 61.1 bn recorded in Q3’2023. In addition, on a q/q basis, the performance represented a 6.5% decrease from Kshs 59.8 bn recorded in Q2’2024. The decrease in performance was attributable to; i) input prices for construction materials, such as reinforcement steel and cement, increased significantly year-on-year, ii) tighter monetary policies, creating a tough economical evironment to work on large scale developments iii) political demonstrations and insecurity in major urban areas, such as Nairobi, disrupted construction and business activities, negatively affecting investor confidence and decision-making regarding new projects, and iv) developers and investors shifted strategies, emphasizing operational efficiency and sustainability rather than embarking on new large-scale developments. The chart below shows the value of building plans approved in the Nairobi Metropolitan Area (NMA) between Q1’2021 and Q3’2024;

Source: Kenya National Bureau of Statistics (KNBS)

-

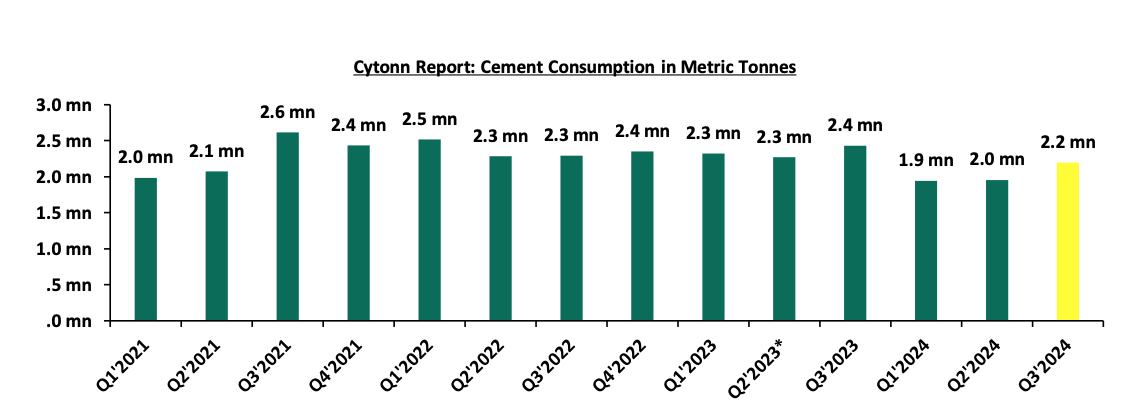

The consumption of cement came in at 2.1 bn metric tonnes in Q3’2024, a 12.2% increase from 2.0 bn metric tonnes recorded in Q2’2024. On a y/y basis, the performance represented a 9.6% decrease from 2.4 bn metric tonnes recorded in Q3’2023. The decline in performance was attributable to; i) increased costs of the construction due to increase in prices of inputs ii) disruption of the global market supply chain due to war for instance Russia-Ukraine war, iii) the government changed the shift to affordable housing neglecting public infrastructure developments, and iv) reduced government spending on infrastructure projects contributed to a downturn that affected the construction sector. The chart below shows cement consumption in metric tonnes in Kenya between Q1’2021 and Q3’2024;

Source: Kenya National Bureau of Statistics (KNBS)

Source: Kenya National Bureau of Statistics (KNBS)

- Hospitality Sector

During the week, Marriott International has announced plans to invest approximately Kshs 1.2 bn in a new 180-room hotel near Jomo Kenyatta International Airport (JKIA) in Nairobi dubbed Courtyard hotel. This project aligns with Marriott's strategy to expand its footprint in Africa and cater to the rising demand for premium accommodations in Kenya, particularly targeting travelers seeking proximity to major transport hubs. This will be the second facility after the Four Points operated by Sheraton within the airport. The development is aimed to be completed within 30 months and the hotel will have 174 standard suite rooms and six junior suites.

The proposed hotel will feature state-of-the-art facilities, including luxury suites, conference rooms, and recreational spaces. It is aimed at providing convenience for transit passengers, business travelers, and tourists. This development reflects Marriott's broader growth strategy, which includes the introduction of new properties and brands across Africa, such as JW Marriott, Tribute Portfolio, and Delta Hotels.

The investment also ties into Kenya's vision of enhancing tourism and hospitality infrastructure. The addition of direct flight routes and the growing reputation of Nairobi as a business and tourism hub are driving demand for upscale accommodations. Marriott has been capitalizing on this by introducing globally recognized luxury and select-service brands to key locations in the country

We expect the hospitality industry to continue improving in performance due to factors such as i) continuous recovery of the tourism industry post COVID-19 with number of tourist arrivals increasing to 489,831 reaching the highest since 2021 in Q3’2024, ii) major international hospitality brands are investing in Kenya, signaling confidence in the country's growth potential like Marriott, Accor and pan pacific hotels, and iii) increased hotel infrastructure directly benefits the construction and service industries.

- Real Estate Investments Trusts (REITs)

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 31st October 2024. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at Kshs 12.3 mn and Kshs 31.6 mn shares, respectively, with a turnover of Kshs 311.5 mn and Kshs 702.7 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 31st October 2024, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 138,600 for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015.

REITs offer various benefits, such as tax exemptions, diversified portfolios, and stable long-term profits. However, the ongoing decline in the performance of Kenyan REITs and the restructuring of their business portfolios are hindering significant previous investments. Additional general challenges include: i) insufficient understanding of the investment instrument among investors leading to a slower uptake of REIT products, ii) lengthy approval processes for REIT creation, iii) high minimum capital requirements of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, iv) limiting the type of entity that can form a REIT to only a trust company, and, v) minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs. The significant capital requirements still make REITs relatively inaccessible to smaller retail investors compared to other investment vehicles like unit trusts or government bonds, all of which continue to limit the performance of Kenyan REITs.

We expect the performance of Kenya’s Real Estate sector to be sustained by: i) increased investment from local and international investors, particularly in the residential sectors ii) favorable demographics in the country, leading to higher demand for housing and Real Estate, (iii) continued improvement of the hospitality sector driven by tourism and recovery of the global economy, However, challenges such as rising construction costs, strain on infrastructure development, and high capital demands in REIT sector will continue to impede the sector’s optimal performance by restricting developments and investments.

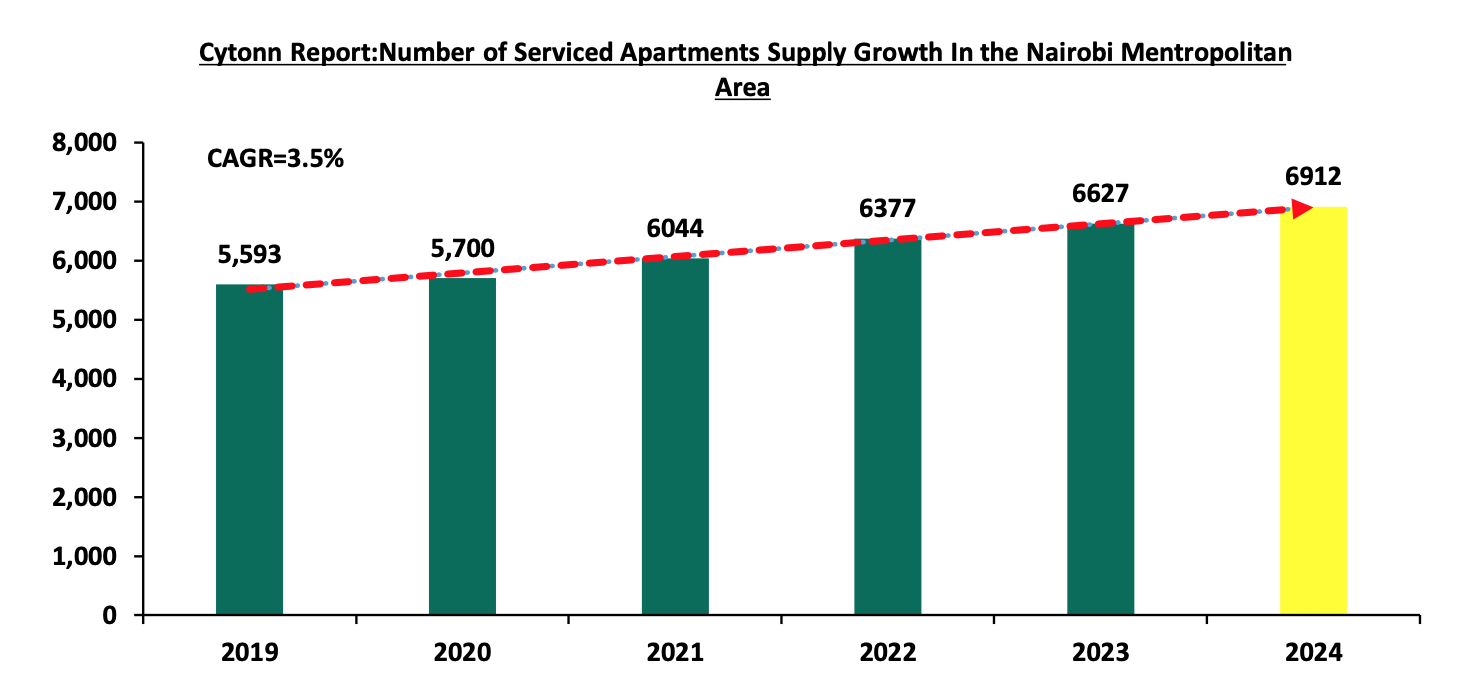

In 2023, we published the Nairobi Metropolitan Area Serviced Apartments Report 2023, which highlighted that the average rental yield for serviced apartments within the NMA increased by 0.6% points to 6.8% in 2023 from 6.2% in 2022. The improvement in performance was primarily on the back of improved occupancy rates and monthly charges by 0.5% points and 10.9%, to 66.3% and Kshs 3,045 per SQM, respectively, in 2023. This week, we update our report using 2024 market research data and by focusing on;

- Overview of the Kenyan Hospitality Sector,

- Introduction to Serviced Apartments,

- Supply and Distribution of Serviced Apartments within the NMA,

- Performance of Serviced Apartments in the NMA,

- Serviced Apartments Performance by Node

- Comparative Analysis - 2023/2024 Market Performance

- Performance per Typology

- Recommendations and Outlook.

Section I: Overview of the Kenyan Hospitality Sector

In 2024, Kenya's hospitality sector continues to display remarkable resilience in the aftermath of the COVID-19 pandemic. Its performance is largely supported by Nairobi's emergence as a regional business hub, attracting multinational companies to set up offices and hosting major international conferences. Additionally, Kenya’s status as a leading tourist destination has further driven recovery and growth, with increased business travel and tourism playing a significant role in strengthening the sector's contribution to the economy.

In terms of international arrivals, Kenya National Bureau of Statistics’ Leading Economic Indicators – September 2024 report highlighted that arrivals through Jomo Kenyatta International Airport (JKIA) and Moi International Airport (MIA) registered an increase of 8.5% to 489,831 visitors in Q3’ 2024 from 451,441 visitors recorded in Q3’ 2023. This was a result of i) The country effecting a Visa free policy at the start of the year for all visitors in a bid to boost numbers, ii) Kenya Tourism Board (KTB) launching the ‘Ziara campaign’ seeking Kenyans in the Diaspora to help market their motherland through their networks in the host countries in exchange for incentives, iii) increased international marketing of Kenya’s tourism market by the Ministry of Tourism in collaboration with the Kenya Tourism Board, through platforms such as the Magical Kenya Loyalty Rewards Program, iv) Route marketing collaboration with low-cost carriers such as Air Asia X targeting visitors where the flights operates such as Southeast Asia, Northern Asia and Australia, v) continuous efforts to promote local and regional tourism, vi) development of niche products such as cruise tourism, adventure tourism, culture and sports tourism and, vii) an increase in corporate and business Meetings, Events, and Conferences from both the public and private sectors. For the months of August and September 2024, the number of international visitors arriving through Jomo Kenyatta International Airport (JKIA) and Moi International Airports (MIA) came in at a cumulative 320,109 persons, representing a 9.1% increase, compared to the 293,341 visitors recorded during a similar period in 2023. The graph below shows the number of international arrivals in Kenya between Q1’2021 and Q3’ 2024;

Source: Kenya National Bureau of Statistics

Some of the factors that continue to cushion the hospitality sector include;

- Active promotion of Kenya as a Tourist Hub: The government continues to market the country as leading tourist destination. Initiatives such as Magical Kenya Travel Expo, Ziara campaign and strategic partnership with airlines have been instrumental in attracting a broad range of visitors strengthening the industry.

- Diverse tourist attractions: The country boasts of rich variety of attractions—including its iconic wildlife reserves, cultural landmarks, and stunning landscapes—continues to draw global attention. Key sites such as the Lake Turkana National Parks, Lake Nakuru national park, Mount Kenya National Park, Lamu Old Town, and Fort Jesus remain popular due to ongoing conservation efforts and innovative tourism experiences that offer travelers authentic and immersive adventures.

- Lifting of all Travel Restrictions post-Covid 19: The lifting of travel restrictions related to the pandemic, both locally and internationally, has been pivotal in revitalizing Kenya's tourism and hospitality sector. This has re-established global and domestic connectivity, fostering a favorable environment for travel and driving a surge in tourist arrivals and related activities within the country.

- Hosting Global Sports Events: Kenya has continued to host various events such as the World Rally Championship (WRC) held in March-2024, These events continue to boost visitor arrivals, hotel bookings and the general performance of the hospitality industry,

- Recognition of Excellence in the Hospitality Industry: The hospitality sector in Kenya has earned notable recognition on the global stage, enhancing its reputation as a premier destination for leisure and business travel. Accolades in 2024 included Nairobi city being awarded Africa’s leading business travel destinations at the 2024 World Travel Awards. Also the country received honor at the Germany’s Annual Citizen’s Festival 2024 showcasing its culture and investment opportunities to over 130,000 attendees.