Nairobi Metropolitan Area Land Report 2018, & Cytonn Weekly #17/2018

By Cytonn Investments Team, Apr 29, 2018

Executive Summary

Fixed Income

T-bills were oversubscribed during the week with a subscription rate coming in at 106.1%, down from 162.5% the previous week. Yields on the 91, 182 and 364-day papers remained unchanged at 8.0%, 10.3% and 11.1%, respectively. Kenya’s economy expanded by 4.9% in 2017, as compared to 5.9% in 2016 according to the Economic Survey 2018 Report;

Equities

During the week, the equities market was on a downward trend with NASI and NSE 25 losing 1.8% and 1.6%, respectively. The NSE 20 however gained 0.3% during the week. For the last twelve-months (LTM), NASI, NSE 20 and NSE 25 have gained 34.7%, 17.7% and 32.8%, respectively. According to guidelines by the Central Bank of Kenya, banks will have a five-year transition period for the adoption of the new IFRS 9 reporting standard, to mitigate the impact on their capital ratios. During this transition period, banks are required to disclose in their financial statements, the core capital and total capital ratios including adjusted ratios, which are inclusive of the expected credit loss provisions, arising from the implementation of the standard;

Private Equity

Vantage Capital acquired an undisclosed stake in the Rosslyn Riviera Mall, located in Rosslyn on Limuru Road, for USD 8.0 mn (Kshs 800.0 mn). In the FinTech sector, Digital Financial Services (DFS) Lab is investing USD 200,000 (Kshs 20.0 mn) in four African start-ups, two of which are Kenyan: Cherehani Africa and another unnamed startup that focuses on digital lending. On the fundraising front, the International Finance Corporation (IFC), announced that it financed a USD 8.6 mn (Kshs 860.0 mn) Series A equity investment in Africa’s Talking, a Kenyan based communication-platform-as-a-service application programming interface (API) startup;

Real Estate

According to the Kenya Economic Survey 2018, the real estate and construction sectors recorded growth in their contribution to GDP, coming in at 14.1% in 2017, compared to 13.8% in 2016. The real estate sector however expanded by only 6.1%, which is 2.7% points lower than the 8.8% growth recorded in 2016. The slow growth is attributed to a tough operating environment as a result of uncertainty surrounding 2017 prolonged electioneering period and the lower credit growth to the private sector. The accommodation and food sector continued on a recovery trend recording the strongest sectoral growth of 14.7% and this was supported by the recovery of tourism sector whose earnings grew by 20.3% to Kshs 119.9 bn in 2017 from Kshs 99.7 bn in 2016, an increase of 2.5% points than the 2015/16 period;

Focus of the Week

This week, we focus on land performance as an investment, in our Annual Nairobi Metropolitan Area Land Report for 2018. We highlight the land sector’s 2017 performance, across 18 suburbs and 11 Satellite Towns in the Nairobi Metropolitan Area (NMA), based on annual capital appreciation, and compare this with the 6-year growth rates to enable us identify trends, and hence have an outlook for the sector, as well as an investment recommendation. According to the report, land in the Nairobi Metropolitan Area recorded an average capital appreciation of 3.7% in 2017, compared to the 6-year CAGR of 17.0%. The best performing submarkets were in the high end residential zone, which had an annual appreciation rate of 4.8%, followed by low end residential zone, which recorded an annual appreciation of 4.5%. Site and Service schemes in Satellite Towns had the lowest returns, recording annual appreciation rates of 2.7%. The opportunity in the sector is in markets with high returns such as Karen, Kilimani, Ridgeways, Juja and Kasarani, which recorded annual capital appreciation rates of more than 7.5% in 2017 and are thus the most attractive areas both for land investment and real estate development.

- Cytonn Investments Management Plc and Cytonn Cash Management Solutions LLP, shall hold their Annual General Meeting for the year that ended December 2017, on Friday, 18th May 2018, at 7:30 am at Radisson Blu Hotel, Upperhill. See the agenda here

- Our Senior Manager – Regional Markets, Johnson Denge discussed affordable housing in Kenya. Watch Johnson on KBC Channel here

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the trainings for their teams. The Wealth Management Trainings are run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.com or book through this link Wealth Management Training. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- We continue to beef up the team with ongoing hires for: Full Stack Software Engineer, Application Security Engineer and Distribution and Unit Managers for Nakuru and Kisumu, among others. Visit the Careers section at Cytonn’s Website to apply

During the week, T-bills were oversubscribed, with the subscription rate coming in at 106.1%, down from 162.5% the previous week. The subscription rates for the 91, 182 and 364-day papers came in at 26.8%, 115.6%, and 128.4% compared to 129.3%, 179.5%, and 158.6%, respectively, the previous week. Yields on the 91, 182 and 364-day papers remained unchanged at 8.0%, 10.3% and 11.1%, respectively. The acceptance rate for T-bills declined to 76.7% from 81.4%, the previous week, with the government accepting a total of Kshs 19.5 bn of the Kshs 25.5 bn worth of bids received, against the Kshs 24.0 bn on offer. The government is currently 28.5% ahead of its domestic borrowing target for the current fiscal year, having borrowed Kshs 316.3 bn, against a target of Kshs 246.1 bn (assuming a pro-rated borrowing target throughout the financial year of Kshs 297.6 bn).

This week, the Kenyan Government issued 2 bonds, FXD 1/2008/15 and FXD 1/2018/20, with 4.9-years and 19.9-years to maturity, and coupons of 12.5% and 13.2%, respectively, in a bid to raise Kshs 40.0 bn for budgetary support. The overall subscription rate for the issue came in at 81.9%, with the weighted average rate of accepted bids coming in at 12.3% and 13.3%, respectively, in line with our expectations of 12.1% to 12.3% and 13.0% to 13.3%, respectively. The government accepted a total of Kshs 26.9 bn of the Kshs 32.8 bn worth of bids received, translating to an acceptance rate of 82.2%. However, as detailed in our Cytonn Weekly #16/2018, we don’t expect the Government to come under pressure to borrow given that (i) the government is currently 28.5% ahead of its pro-rated domestic borrowing target, and has met 72.9% of their total foreign borrowing target and 88.1% of its pro-rated target for the current fiscal year, and (ii) the KRA is not significantly behind target, having collected 91.2% of its half year 2017/18 target.

Liquidity levels declined in the money market as indicated by the increase in the average interbank rate to 4.8% from 4.6% recorded the previous week, as banks made Value Added Tax (VAT) payments. There was a decline in the average volumes traded in the interbank market by 4.2% to Kshs 13.8 bn, from Kshs 14.4 bn the previous week.

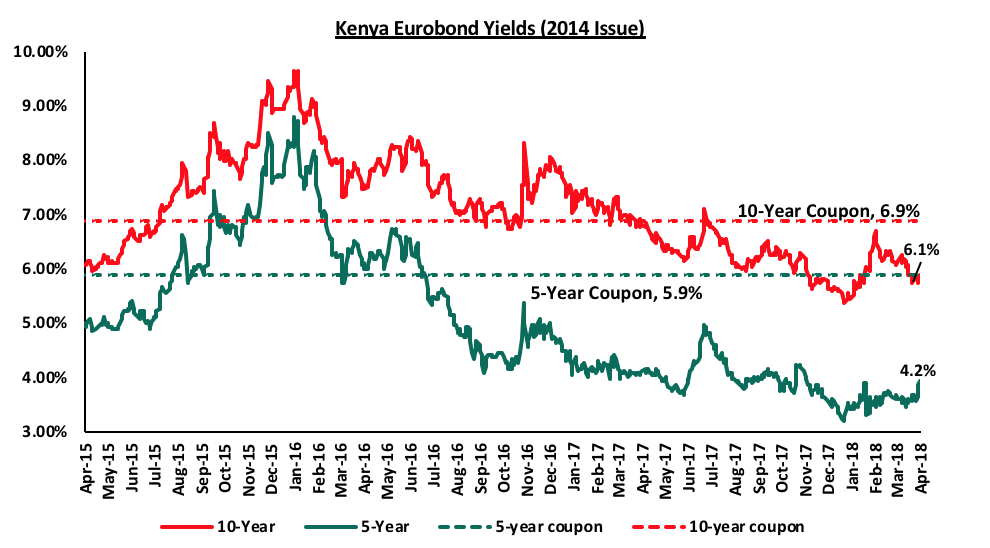

According to Bloomberg, yields on the 5-year and 10-year Eurobonds issued in June 2014 increased by 20 bps each to 4.2% and 6.1% from 4.0% and 5.9%, respectively, the previous week. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 4.6% and 3.6% for the 5-year and 10-year Eurobonds, respectively, due to the relatively stable macroeconomic conditions in the country. Key to note is that these bonds currently have 1.1 and 6.1 years to maturity for the 5-year and 10-year bonds, respectively.

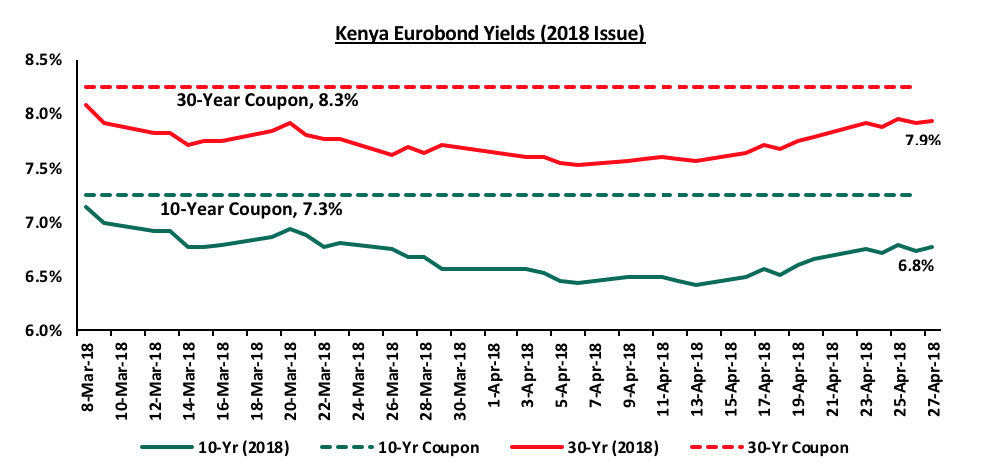

For the February 2018 Eurobond issue, during the week, the yields on the 10-year and 30-year Eurobonds increased by 10 bps each to 6.8% and 7.9% from 6.7% and 7.8% last week, respectively. Since the issue date, yields on the 10-year and 30-year Eurobonds have declined by 0.5% points and 0.3% points, respectively, indicating foreign investor confidence in Kenya’s macro-economic prospects.

Notably, the yields on Kenya Eurobonds increased across all tenors, the rise being attributed to varying market sentiments from foreign investors, according to the CBK.

The Kenya Shilling remained relatively stable declining marginally against the US Dollar during the week, to close at Kshs 100.3, supported by offshore investor inflows that met increased end month dollar demand from oil importers. On a YTD basis, the shilling has gained 2.8% against the USD. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- Weakening of the USD in the global markets as indicated by the US Dollar Index, which shed 9.9% in 2017, and has shed 0.5% YTD. Key to note is that the dollar has improved, from a 2.0% loss YTD last week, as the lower than expected growth in the Eurozone begin to take a toll on the Euro and the Sterling Pound performance,

- Stronger horticulture export inflows driven by increasing production and improving global prices,

- Improving diaspora remittances, which increased by 47.5% to USD 210.4 mn in February 2018 from USD 142.7 mn in February 2017, and,

- High forex reserves, currently at USD 9.5 bn (equivalent to 6.4 months of import cover), and the USD 1.5 bn stand-by credit and precautionary facility by the IMF, still available until September 2018, after which a new facility will be discussed.

We are projecting the inflation rate for the month of April to range between 3.7% - 4.0%, from 4.2% in March. The y/y inflation rate is expected to decline as a result of a base effect but m/m inflation is expected to rise due to the increase in electricity prices brought about by the 50.0% rise in the forex levy to Kshs 1.4 per kilowatt hour (kWh), despite the fuel levy remaining unchanged. This however is expected to be countered by a decline in the transport index due to the 0.6% decline in petrol prices to Kshs 106.8 per liter from Kshs 107.5 in March. Kerosene prices declined by 0.9% to Kshs 76.7 per liter as well, while diesel prices remained unchanged at Kshs 97.9 per liter. Going forward, we expect inflation to average 7.0% over the course of the year down from 8.0% in 2017, which is within the government target range of 2.5% - 7.5%.

During the week, the Kenyan Government was expected to pay an outstanding USD 646.0 mn (Kshs 64.6 bn) of the USD 750.0 mn syndicated loan agreement with a consortium of lenders in October 28, 2015 which was set to mature on April 27, 2018. The loan was expected to be financed by the proceeds of the recently issued USD 2.0 bn Eurobond and is set to reduce the foreign reserves which hit an all-time high of USD 9.5 bn equivalent to 6.4 months of import cover as at 26 April 2018 possibly weakening the Kenyan shilling.

The Kenya National Bureau of Statistics (KNBS) released the Economic Survey 2018, with key take-outs from the report being:

- Kenya’s economy grew by 4.9% in 2017, compared to 5.9% in 2016 (this has been revised from their previous estimate of 5.8%). The decline in performance was attributed to (a) adverse effects of weather conditions due to the widespread drought experienced in Q4’2016 and suppressed long rains in 2017 that led to a decline in agriculture sector growth, and (b) uncertainty associated with the prolonged election period that led to a deceleration of growth in the manufacturing sector. For more details, see our Kenya 2017 GDP Growth and Outlook Note,

- The current account deficit widened to 6.7% of GDP from 5.2% in 2016, on account of faster growth of imports at 20.5%, as compared to export growth at 2.8%. The ratio of exports to imports deteriorated to 34.4% in 2017 from 40.4% in 2016,

- Imports grew by 20.5% to Kshs 1.7 tn in 2017 from Kshs 1.4 tn in 2016, driven by an increase in importation of industrial machinery, petroleum products, motor vehicles, and iron & steel. Asia accounted for 64.2% of total imports in 2017 with China, India, United Arab Emirates and Saudi Arabia having the lion’s share, accounting for 73.5% of the total Asian imports,

- Exports increased by 2.8% to Kshs 594.1 bn in 2017 from Kshs 578.1 bn in 2016. The major earners were tea and horticulture, collectively accounting for 49.1% of total domestic export earnings. Total export volumes of tea and horticulture, however, declined by 5.8% to 924,234 tons from 981,542 tons in 2016, on account of the adverse weather conditions experienced in the first half of 2017, and,

- Average deposit rates increased to 8.2% in December 2017 from 7.3% in December 2016, while commercial bank average lending rates remained unchanged at 13.6% in December 2017. Total domestic credit rose by 7.9% compared to 6.4% in 2016, primarily due to a 12.1% growth in credit to the national government, compared to the decline in private sector credit growth to 2.4% from 4.1% in 2016, indicating increased lending to the government.

The decline in GDP growth, increase in average inflation, widening of the current account deficit and decline of private sector credit growth all support the fact that 2017 was a tougher year than 2016. However, the outlook for 2018 remains positive, and we have since revised our GDP growth projection upwards to a range of 5.4% - 5.6% from an earlier 5.3% - 5.5%, driven by a recovery in the agriculture and manufacturing sectors, and continued growth in tourism, real estate and construction sectors.

Below is a table showing that the Kenyan economy is expected to grow by an average of 5.5% in 2018 according to updated projections by the organizations that we track as at Q2’2018, updated with our own projection. We shall continue to update this table as these organizations release their updated 2018 projections:

|

Kenya 2018 Annual GDP Growth Outlook |

|||

|

No. |

Organization |

Q1'2018 |

Q2'2018 |

|

1 |

Central Bank of Kenya |

6.2% |

|

|

2 |

Kenya National Treasury |

5.8% |

|

|

3 |

Oxford Economics |

5.7% |

|

|

4 |

African Development Bank (AfDB) |

5.6% |

|

|

5 |

Stanbic Bank |

5.6% |

5.6% |

|

6 |

Citibank |

5.6% |

|

|

7 |

International Monetary Fund (IMF) |

5.5% |

|

|

8 |

World Bank |

5.5% |

5.5% |

|

9 |

Fitch Ratings |

5.5% |

|

|

10 |

Barclays Africa Group Limited |

5.5% |

|

|

11 |

Cytonn Investments Management Plc |

5.4% |

5.5% |

|

12 |

Focus Economics |

5.3% |

|

|

13 |

BMI Research |

5.3% |

5.2% |

|

14 |

Standard Chartered |

4.6% |

|

|

|

Average |

5.5% |

5.5% |

Rates in the fixed income market have remained stable as the government rejects expensive bids. The government is under no pressure to borrow for this fiscal year due to: (i) they are currently ahead of their domestic borrowing target by 28.5%, (ii) they have met 72.9% of their total foreign borrowing target and 88.1% of its pro-rated target for the current fiscal year, and (iii) the KRA is not significantly behind target in revenue collection, and therefore we expect interest rates to remain stable. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium to long-term fixed income instruments.

During the week, the equities market was on a downward trend with NASI and NSE 25 losing 1.8% and 1.6%, respectively. The NSE 20 however gained 0.3% during the week. This takes the YTD performance of the NASI, NSE 20 and NSE 25 to 4.8%, 0.3% and 9.6%, respectively. This week’s performance was driven by declines in Standard Chartered, KCB Group and Equity Group that declined by 11.0%, 4.8%, and 4.4%, respectively. For the last twelve months (LTM), NASI, NSE 20 and NSE 25 have gained 34.7%, 17.7% and 32.8%, respectively.

Equities turnover remained flat this week at USD 41.2 mn. Foreign investors remained net sellers of large cap stocks such as Safaricom. We expect the market to remain resilient this year supported by positive investor sentiment, as investors take advantage of the attractive stock valuations in select counters.

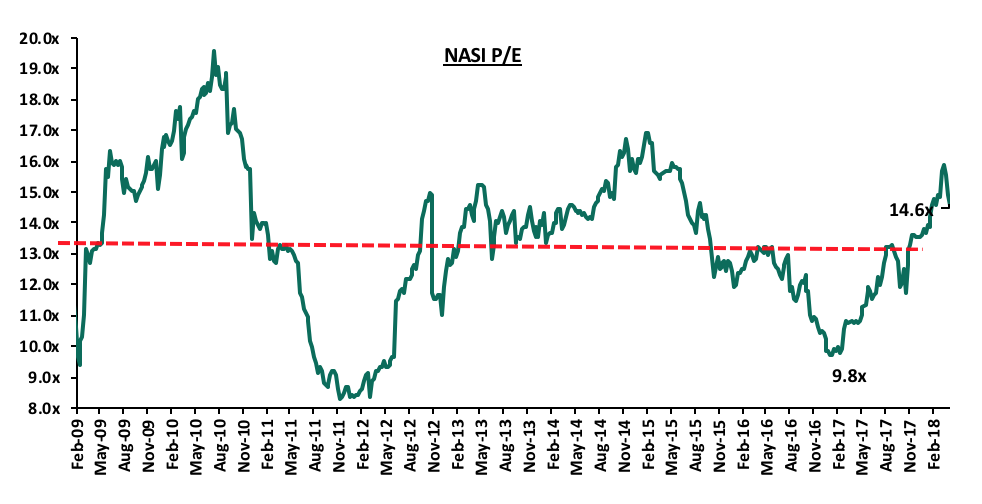

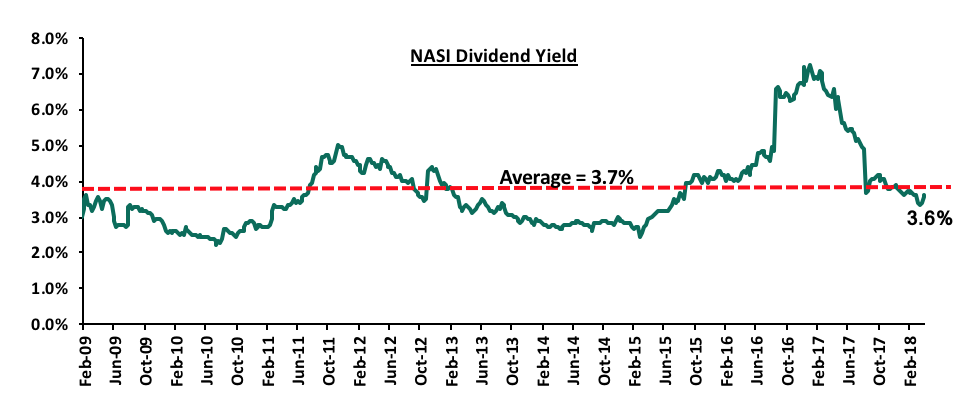

The market is currently trading at a price to earnings ratio (P/E) of 14.6x, which is 9.0% above the historical average of 13.4x, and a dividend yield of 3.6%, lower than the historical average of 3.7%. The current P/E valuation of 14.6x is 49% above the most recent trough valuation of 9.8x experienced in the first week of February 2017, and 76% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

The Central Bank of Kenya issued guidance on the implementation of the new IFRS 9 reporting standard by both commercial banks and microfinance banks (MFBs). The IFRS 9 replaced the International accounting standard (IAS) 39, regarding the methodology used to calculate the impairment provisions on financial instruments. Under the IFRS 9 standard, the impairment provisions shall be calculated under the Expected Credit Loss Model (ECL), replacing the previous Incurred Credit Loss Model (ICL). The ECL model requires provisions to be determined for expected future defaults on a loan portfolio. This is different from the previously used ICL model, which required the provisions to be set aside for only the incurred credit losses arising from non-performing loans. The new reporting standard is intended to improve credit risk provisioning by financial institutions, thereby enhancing these firms’ abilities to withstand any losses arising from poor asset quality. All provisions under the new ECL model will be charged from the income statement, thereby possibly impacting negatively some banks’ earnings. However, the provisions that shall be calculated from the performing loans shall be added back over a five-year period for the purposes of computation of capital. Banks will be required to start compliance with the new standard from 1st January 2018, with a five-year transition period. During this transition period, banks are required to disclose in their financial statements, the core capital and total capital ratios including the adjusted ratios, which are inclusive of the expected credit loss provisions. This will help in monitoring the impact of these additional provisions on banks’ capital position. In the event the provisions required to be in adherence to CBK regulatory requirements, on loan loss provisioning, are higher than those arising from the IFRS 9 standard, then the excess shall be treated as an appropriation of retained earnings and not expenses, when determining the profit and loss of the company. This excess, therefore, means that it shall be credited to the statutory loan loss reserve. The extended transition period is favorable to banks, especially the lower tier banks that are constrained on capital, and will be the worst affected during the ECL model implementation. We expect banks to adopt more stringent lending policies, thereby locking out risky borrowers, in order to mitigate the impact of expected credit losses on their respective capital position.

Plans to repeal the interest rate cap are gaining traction with legal amendments to the law set to be tabled in parliament. A legal framework is being drafted to not only address access to and cost of credit, but also to enhance consumer protection. Treasury is set to come up with a raft of reforms, whose main agenda would be to resolve the high cost of credit and in the process lead to the elimination of the Banking Amendment Act 2015. The law played a part in contributing to the accelerated decline in private sector credit growth, which had already started to decline even before the law was enacted, as banks adopted more stringent lending policies in a bid to tame the declining asset quality as reflected by the increase in non-performing loans. The act was drafted with the objective to address the high cost of credit, which according to the CBK, is an objective the act has failed to realize, after one year in force. Instead, the law has inhibited credit growth, with private sector credit growth for the 12-months to March 2018 growing by 3.3%, way below the optimal 12-15% that is required to stimulate economic growth.

Depositors in Chase Bank could start accessing their deposits locked in Chase Bank Limited through SBM Holdings. SBM Holdings recently completed the acquisition of Chase bank and the agreement was that they acquired 75% of Chase Bank’s deposits, together with a majority of staff and branches. SBM Bank Kenya will provide access to the deposits once the transaction process completes, and is approved by the Central Bank of Kenya (CBK). The bank was taken under the receivership of the CBK in 2016, with customer deposits of more than Kshs 100 bn. The acquisition will see SBM take control of the 62 Chase Bank branches, significantly increasing the foreign lender’s market share measured by number of branches in the Kenyan Banking sector. SBM has invested Kshs 2.6 bn in Chase bank, and is planning to invest a further Kshs 6 bn after the acquisition to revive the collapsed bank. The entire acquisition amount is yet to be disclosed. SBM Bank Kenya will absorb all the 1,300 employees of Chase Bank limited. This is the bank’s second acquisition in Kenya, having previously acquired Fidelity bank in 2016. The Kenyan banking sector has had 7 acquisitions since 2015. The transaction will see SBM Bank Kenya change status to become a tier II bank, ranked 11th on asset base, as Chase bank’s assets are valued in excess of Kshs 100 bn. SBM Holdings is adopting an inorganic growth model, with growth being driven by acquisitions, in its plan to diversify across geographies in Kenya and West Africa especially Ghana and Nigeria.

Below is our Equities Universe of Coverage:

|

all prices in Kshs unless stated otherwise |

||||||||||||

|

No. |

Company |

Price as at 20/04/18 |

Price as at 27/04/18 |

w/w Change |

YTD Change |

LTM Change |

Target Price* |

Dividend Yield |

Upside/ (Downside)** |

P/TBv Multiple |

||

|

1. |

NIC Group*** |

42.5 |

40.8 |

(4.1%) |

12.4% |

58.3% |

61.6 |

2.8% |

54.0% |

0.8x |

||

|

2. |

Union Bank Plc |

6.1 |

6.3 |

2.5% |

(19.9%) |

44.0% |

8.2 |

0.0% |

30.4% |

0.7x |

||

|

3. |

Zenith Bank |

27.0 |

27.4 |

1.5% |

6.9% |

85.1% |

33.3 |

10.0% |

31.6% |

1.2x |

||

|

4. |

Diamond Trust Bank |

212.0 |

215.0 |

1.4% |

12.0% |

73.4% |

272.9 |

1.2% |

28.2% |

1.2x |

||

|

5. |

Ghana Commercial |

6.3 |

6.3 |

0.3% |

25.0% |

21.3% |

7.7 |

6.0% |

28.3% |

1.7x |

||

|

6. |

KCB Group |

52.0 |

49.5 |

(4.8%) |

15.8% |

54.7% |

63.7 |

5.8% |

34.4% |

1.6x |

||

|

7. |

CRDB |

170.0 |

175.0 |

2.9% |

9.4% |

-5.4% |

207.7 |

5.7% |

24.4% |

0.7x |

||

|

8. |

I&M Holdings |

125.0 |

124.0 |

(0.8%) |

(2.4%) |

36.3% |

151.2 |

2.8% |

24.7% |

1.4x |

||

|

9. |

Stanbic Bank Uganda |

31.0 |

31.0 |

0.0% |

13.8% |

14.8% |

36.3 |

0.0% |

17.0% |

2.0x |

||

|

10. |

Equity Group |

51.0 |

48.8 |

(4.4%) |

22.6% |

44.4% |

54.3 |

3.9% |

15.4% |

2.5x |

||

|

11. |

Co-operative Bank |

18.5 |

18.5 |

0.0% |

15.6% |

58.5% |

20.5 |

4.3% |

15.2% |

1.7x |

||

|

12. |

Barclays Bank |

13.0 |

13.4 |

3.1% |

39.1% |

63.8% |

13.7 |

7.7% |

10.3% |

1.6x |

||

|

13. |

National Bank |

7.5 |

8.0 |

6.0% |

(15.0%) |

41.0% |

8.6 |

0.0% |

8.1% |

0.5x |

||

|

14. |

Bank of Kigali |

289.0 |

290.0 |

0.3% |

(3.3%) |

18.4% |

299.9 |

4.3% |

7.7% |

1.7x |

||

|

15. |

HF Group*** |

11.9 |

11.0 |

(8.0%) |

5.3% |

5.8% |

11.0 |

2.9% |

3.2% |

0.4x |

||

|

16. |

Stanbic Holdings |

90.0 |

91.0 |

1.1% |

12.3% |

45.6% |

87.1 |

5.8% |

1.5% |

1.1x |

||

|

17. |

Ecobank GH |

11.3 |

11.5 |

1.7% |

51.3% |

53.5% |

10.7 |

7.3% |

0.6% |

4.0x |

||

|

18. |

UBA Bank |

11.2 |

11.6 |

3.6% |

12.6% |

106.8% |

10.7 |

7.6% |

(0.2%) |

1.0x |

||

|

19. |

Standard Chartered KE |

236.0 |

210.0 |

(11.0%) |

1.0% |

7.1% |

192.6 |

7.2% |

(1.1%) |

1.8x |

||

|

20. |

Bank of Baroda |

140.0 |

134.0 |

(4.3%) |

18.6% |

21.8% |

130.6 |

0.0% |

(2.5%) |

1.1x |

||

|

21. |

SBM Holdings |

7.6 |

7.6 |

0.5% |

1.9% |

-0.5% |

6.6 |

5.3% |

(8.8%) |

0.9x |

||

|

22. |

Guaranty Trust Bank |

44.9 |

44.4 |

(1.1%) |

8.8% |

66.5% |

37.2 |

6.0% |

(10.1%) |

2.5x |

||

|

23. |

Access Bank |

11.2 |

11.4 |

1.3% |

8.6% |

72.5% |

9.5 |

5.8% |

(10.5%) |

0.8x |

||

|

24. |

Stanbic IBTC Holdings |

49.0 |

49.5 |

1.0% |

19.3% |

98.0% |

37.0 |

1.0% |

(24.2%) |

2.9x |

||

|

25. |

CAL Bank |

1.9 |

2.0 |

6.5% |

82.4% |

185.5% |

1.4 |

0.0% |

(28.9%) |

1.2x |

||

|

26. |

Stanchart GH |

35.1 |

35.0 |

(0.3%) |

38.6% |

126.2% |

19.5 |

2.8% |

(41.6%) |

5.0x |

||

|

27. |

FBN Holdings |

12.9 |

12.5 |

(3.1%) |

41.5% |

255.7% |

6.6 |

1.6% |

(45.1%) |

0.7x |

||

|

28. |

Ecobank Transnational |

19.5 |

20.1 |

3.1% |

18.2% |

157.7% |

9.3 |

3.1% |

(50.7%) |

0.9x |

||

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5th largest shareholder |

||||||||||||

We are “NEUTRAL” on equities for investors with a short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors such as Financial Services, which provide an attractive entry point for long-term investors, and with expectations of higher corporate earnings this year, we are “POSITIVE” for investors with a long-term investment horizon.

South African-based Vantage Capital, Africa’s largest mezzanine fund manager, has acquired an undisclosed stake in the Rosslyn Riviera Shopping Mall for USD 8.0 mn (Kshs 800.0 mn). The Kshs 2.9 bn mall located along Limuru Road sits on a 4.5-acre piece of land and measures approximately 116,000 SQFT. Currently, Nairobi is the leading city in Africa outside South Africa in terms of mall space, with 761,805 SQM of available retail space. The yield on investment in retail space along Kiambu and Limuru Roads, where Rosslyn Riviera is located, currently stands at 10.6% against an average yield of 9.6% for malls located in Nairobi Metropolitan Area, whereas occupancy rates stand at 96.3% compared to an average occupancy of 80.3%. The occupancy and yields are an indication of the viability of the investment in Rosslyn Riviera Mall by Vantage.

The investment is Vantage Capital’s 7th transaction in Mezz Fund III, a USD 280.0 mn (Kshs 28.0 bn) fund, with a 55.0% allocation to countries outside South Africa for investment in real estate projects. The firm recently invested USD 12.5 mn in Nigerian-based Purple Capital, which is the developer of 6,000 SQM Maryland Mall in Nigeria. The investment in Rossyln Riviera represents the 25th transaction executed by Vantage across three generations of mezzanine funds. Vantage manages funds in excess of USD 500.0 mn (Kshs 50.0 bn) invested in projects across Africa.

In the Fintech segment, Digital Financial Services (DFS) Lab, a Fintech accelerator supported by the Bill and Melinda Gates Foundation, is investing USD 200,000 (Kshs 20.0 mn) in four African start-ups, two of which are Kenyan: (i) Cherehani Africa, which relies on mobile-based tech to provide credit and distribute personalized financial literacy content to women and adolescent girls who own micro-enterprises, and (ii) another unnamed startup that focuses on digital lending. DFS Lab identifies promising entrepreneurs and invests in for-profit companies that focus on consumers in sub-Saharan Africa and Asia. Products from the four companies have been found to simplify processes for accessing financial information and cash via mobile phone. Cherehani Africa provides access to finances to women and adolescent girls with basic level education, aged 17-45 years.

On the fundraising front, the International Finance Corporation (IFC) announced that it led the USD 8.6 mn (Kshs 860.0 mn) Series A equity investment in Africa’s Talking, a Kenyan based communication-platform-as-a-service Application Programming Interface (API) startup. Africa’s Talking’s cloud-based software platform provides universal access to critical digital infrastructure that African start-ups and businesses need to scale. The software currently serves over 1,000 fast-growing digital companies, enabling them to create real-world applications faster and more efficiently. Africa Talking has operations in 7 African states including Kenya, Uganda, Tanzania, Nigeria, Ethiopia, Malawi and Rwanda. The funds will be used to expand to more countries. With more than 20,000 developers under its umbrella, the firm looks forward to adding more talent to this group as it gears to building more products.

Private equity investments in Africa remain robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic growth projections in Sub Saharan Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Saharan Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

During the week, Kenya National Bureau of Statistics (KNBS) released the Kenya Economic Survey 2018, which tracks the socio-economic factors affecting the Kenyan market over a 5-year period. The key take outs from the report were:

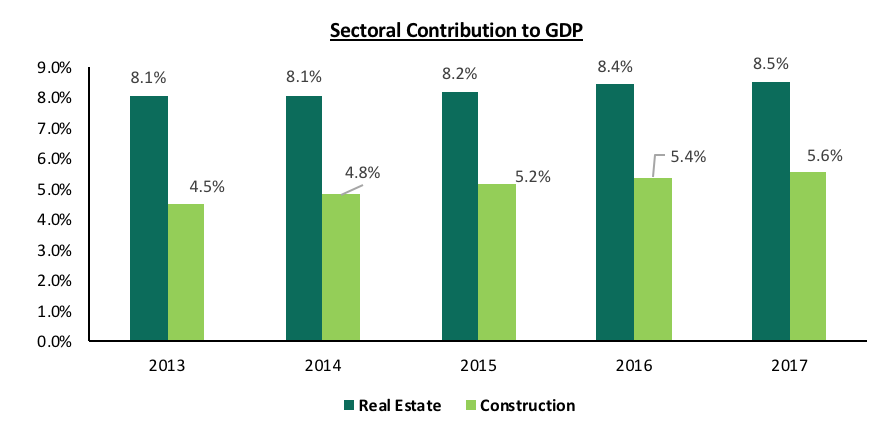

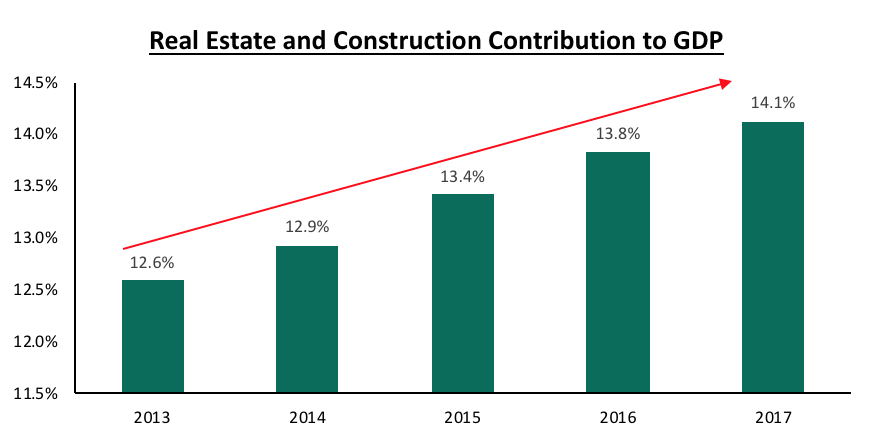

- Real Estate, Building and Construction Contribution to GDP: The real estate and construction sectors contribution to GDP increased to 14.1%, an increase of 0.3% points compared to 13.8% recorded in 2016; real estate sector’s contribution to GDP increased by 0.1% points to 8.5% from 8.4% in 2016, while building and construction to GDP increased by 0.2% points to 5.6% from 5.4% in 2016. However, both sectors slowed down in terms of growth rate, with the real estate sector recording 6.1% growth compared to 8.8% in 2016, and the building and construction sector growing by 8.6% compared to 9.8% in 2016. This slower growth rate is attributable to the tough operating environment experienced in the year 2017 following the negative effects of the protracted elections, as well as drought and inflationary pressures that dampened the country’s overall economic growth to 4.9%, from 5.9% recorded in 2016, hence affecting purchasing power of potential clients,

Source: KNBS

Source: KNBS

In terms of details of the report:

- Construction Sector: Cement consumption decreased by 8.2% to 5.8 mn tons in 2017 from 6.3 mn tons in 2016, indicating a slowdown in construction activity, mainly attributable to the prolonged elections period in Q3 and Q4 of 2017, that resulted in real estate investors adopting a wait-and-see attitude, as well as the decline in credit advancement to the private sector, which averaged at an estimated 2.4% in 2017, compared to 4.1% in 2016,

- Value of New Buildings and Approvals: The value of new private buildings issued with certificate of occupancy by Nairobi City County (NCC) increased by 10.2% to Kshs 85.6 bn in 2017 from Kshs 77.7 bn in 2016, attributable to continued increase in residential developments which accounted for 85.0% of all private completions. This is positive in the sense that we continue to see great efforts towards addressing the huge housing deficit of 2.0 mn units. Additionally, the number of public buildings completed increased by 9.6% to 1,164 units. The value of building plans approved by the NCC, however, decreased by 28.1% to Kshs 240.8 mn in 2017 from Kshs 308.4 mn in 2016 which in our view is due to constrained financing following tight lending standards employed by lending institutions,

- Infrastructure: In 2015/2016, the total development expenditure on roads by the National Government increased by 61.7% to Kshs 130.6 bn, however in 2016/17 the expenditure grew by 33.0% to Kshs 173.6 bn and in 2017/2018, the growth rate is expected to slow further to 14.2% as the government realizes its infrastructural plans. The most notable infrastructural developments in 2017 were: (i) Commissioning of the Standard Gauge Railway Phase 1 and the beginning of phase 2 in September 2017, (ii) expansion of Outer Ring Road and Ngong Road in Nairobi County, (iii) Planned construction of the Western Bypass, Dongo Kundu Bypass in Mombasa, as well as Nuno-Modogashe Road in North Eastern Kenya,

- Hospitality Sector: The accommodation and food sectors contribution to GDP grew by 0.1% points to 1.2% in 2017, from the 1.1% registered in 2016. The sector indicated strong signs of recovery, despite the harsh political climate, with growth coming in at 14.7% compared to 13.3% registered in 2016. This is mainly due to the recovery of the tourism sector where earnings grew by 20.3% to Kshs 119.9 bn in 2017 from Kshs 99.7 bn in 2016. The number of international visitor arrivals also increased by 8.1% to 1.4 mn in 2017 from 1.3 mn in 2016 with holiday travelers accounting for 68.4% while business travelers, in-transit and others accounted for 13.7%, 5.9% and 12.0%, respectively. However, the number of holiday and business travelers decelerated in Q3 and Q4 of 2017 by 1.8% and 2.4%, respectively, following the uncertain political period as well as negative travel advisories by western countries such as United States and United Kingdom (UK). Hotel bed-night occupancy rate increased by 0.9% points to 31.2% in 2017 from 30.3% registered in 2016 with the Coastal region and Nairobi accounting for most of the bed-night occupancy at 12.5% and 7.3%, respectively, of the total available rooms. The number of international conferences also reduced by 15.9% from 227 in 2016 to 191 in 2017 while local conferences increased by 2.4% from 3,755 to 3,844 over the same period. The report attributes the strong performance of the sector to enhanced security and intensified efforts by the government to market Kenya as the ultimate tourist destination.

The KNBS findings are in line with the Cytonn Hospitality Report 2017 which had projected that (i) international arrivals would come in at 1.4 mn in 2017, (ii) business tourists arrival would decline by 0.4%, and (iii) a slight increase in the accommodation and food sector’s contribution to GDP to 1.2%. The hospitality sector is set for more growth driven by growth in Meetings, Incentives, Conferences and Exhibitions (MICE) and domestic tourism as well as continued marketing efforts by the government.

As indicated in the Cytonn Annual Market Outlook for 2018, we expect the Kenyan real estate market performance to recover in 2018 driven by(i) attractive returns in the residential sector on the back of a high housing deficit and government incentives such as a 15.0% tax reduction for developers constructing more than 100 affordable housing units per annum, increased infrastructural development and increased focus by the government on affordable housing, and (ii) the expected growth of the hospitality sector.

Also during the week, JLL released the JLL East Africa Hotel Market Review 2018. The key take outs from the report were:

- The key factors shaping the hospitality sector in the region in 2017 include:

- Entrance of many international hotel operators, which has led to supply outpacing demand. The report noted that the supply growth is also softening thus creating an opportunity for the hotel market performance to recover,

- Hotel investors in the East Africa region are largely local investors who have access to prime land locations and easy access to capital, and,

- Due to the growth of international brands looking to penetrate the markets, the new and upcoming supply is increasingly of investment grade quality with the aim of attracting the foreign investors.

- Performance: Addis Ababa recorded the highest revenue per available room (RevPAR) at USD 192 compared to a regional average of USD 109, attributable to high demand from clients coming from non-governmental organizations, corporates and diplomats. In terms of occupancy, Kampala had the highest bed occupancy at 56.0% compared to a regional average of 51.6%, attributable to high demand from Uganda’s domestic tourism as well as regional tourists.

The table below shows the performance summary of the hotel markets in East Arica;

|

Hotel Market Performance in East Africa |

|||||

|

City |

Deal Pipeline (Rooms) (2018-2020) |

International Arrivals (2017) |

Average Daily Rate (USD) |

Average RevPAR (USD) |

Average Room Occupancy Rates |

|

Nairobi |

1,250 |

1.4 mn |

126 |

60 |

47.0% |

|

Addis Ababa |

3,500 |

1.2 mn |

192 |

104 |

54.0% |

|

Kampala |

200 |

1.3 mn |

167 |

94 |

56.0% |

|

Dar es Salaam |

700 |

1.2 mn |

119 |

62 |

52.0% |

|

Kigali |

250 |

0.9 mn |

148 |

73 |

49.0% |

|

Average |

1,180 |

1.2 mn |

150 |

79 |

51.6% |

|

· Addis Ababa and Nairobi have the highest number of rooms expected to be delivered in the 2018-2020 period · Ethiopia’s market recorded the highest RevPAR at USD 104 compared to regional average of USD 79, attributable to demand from diplomatic and corporate markets. Addis is home to the African Union offices, the UN Economic Commission for Africa, foreign missions, regional NGO’s as well as the UN Conference Centre and the fast paced growth of the Ethiopian Airlines which currently serves 101 destinations, · Dar es Salaam’s market performance has been dampened by the shift of government operations to Dodoma as well as stalled entry of foreign firms, registering a decline of 13.7% in the average RevPAR and a 5.6% decline in bed occupancy rates during the period · Kampala performed fairly well with average RevPAR increasing by 11.9% in 2017 to USD 4 compared to the East Africa average of USD 79, driven by increase in domestic and regional tourism · Kigali recorded a slight increase in average RevPAR of 2.8% to USD 73. However, as per the report, bed occupancy rates in Kigali recorded a decline in 3.9% attributable to the sharp increase in average daily rates which rose by 5.7% during the year · Nairobi’s performance was subdued registering the sharpest decline in RevPAR at 17.8% to USD 60 in 2017. However, it is expected to recover on the back of high tourist arrivals growth, public sector support for tourism, as well as new air routes in the long term. |

|||||

Source: JLL

Hass Consult also released the 2018 County Land Index which tracked trends in the land sector across 10 Kenyan Counties including Nairobi, Kiambu, Kisumu, Kwale, Nakuru, Mombasa, Machakos, Kilifi, Uasin Gishu and Kakamega as well as 75 towns from within the tracked Counties. The main take outs were:

- Land prices recorded a slow growth at 7.4% in 2017, compared to 12.1% in 2016 attributed to the protracted elections in 2017 as well as poor credit access in the private sector,

- Annual price appreciation in 2017 was highest in Kisumu and Mombasa with 14.7% and 9.9%, respectively. However, Kiambu and Kisumu counties recorded the strongest price increases with a 5-year cumulative growth of 98.7% and 88.2%, respectively. This was attributed to good economic performance as well as continued infrastructural developments in the said counties. Kiambu continued to attract investors due to affordable land prices with an average price per acre at Kshs 32.3 mn compared to Nairobi’s Kshs 189.0 mn (which is the highest nationally), good infrastructure and its close proximity to Nairobi CBD, as per the report,

- For the tracked towns, Ngata Town in Nakuru registered the strongest annual price growth recording 20.7% in 2017 attributed to high land prices in Nakuru town that have pushed investors to other areas away from the Nakuru CBD. This was followed by Utange in Mombasa County, which recorded 17.1% growth, Kitengela with 16.6%, Embakasi with 14.9% and Bamburi with 14.8%,

- The worst performing towns were Thika whose prices declined by 4.1%, followed by Gilgil, Thome, Naivasha town and Ridgeways, which declined by 1.9%, 1.7%, 1.1% and 0.8%, respectively, and,

- Upperhill recorded the sharpest price growth with the average price per acre coming in at Kshs 551.0 mn as of December 2017, from an average of Kshs 331.9 mn in 2012

|

2018 County Land Prices Summary |

|||

|

County |

5-year Growth (Uncompounded) |

Appreciation (2017) |

Current Average price per Acre (Kshs) |

|

Kisumu |

82.2% |

14.1% |

7.0 mn |

|

Mombasa |

50.6% |

9.9% |

49.8 mn |

|

Nakuru |

81.8% |

9.5% |

4.6 mn |

|

Machakos |

53.6% |

8.4% |

13.3 mn |

|

Kiambu |

98.7% |

7.3% |

32.3 mn |

|

Kilifi |

66.1% |

6.9% |

15.7 mn |

|

Kwale |

52.1% |

6.6% |

10.0 mn |

|

Nairobi |

68.3% |

4.2% |

189.0 mn |

|

Uasin Gishu |

67.1% |

3.8% |

5.2 mn |

|

Kajiado |

58.6% |

3.0% |

9.7 mn |

|

Average |

67.9% |

7.4% |

33.6 mn |

Source: Hass Consult

Other activities observed during the week included:

- In a bid to address the shortage of accommodation in Kenyan universities, five joint venture firms including Kesa, Meridiam, JV Unicamp, PDM-Roko-CBA Capital Consortiums and a Chinese company, Chinese Overseas Engineering, have been chosen to build 23,400 hostel rooms in various universities across the country including Moi University, Embu University and South Eastern Kenya Universities (SEKU). Moi University intends to build a 14,000-unit facility; Embu University will have a 4,000-bed facility while SEKU will have a 5,400-unit facility. Under the proposed PPP model, the hostels developers will gain returns on their investment through a built to rent operation for 15-20 years, after which they will recover their principal and interests then hand over the facility to the respective institutions of learning. The public-private partnership model has been floated over the last couple of years as the most efficient way to address the housing shortage in local universities but most partnerships such as the Kenyatta University and US-based Africa Integra for the construction of a 10,000-room facility at a tune of Kshs 5.1 bn, are yet to materialize due to the various challenges that face PPP models, but remain unaddressed, such as the inability to transfer public land to Special Purpose Vehicle, the long-term nature of PPPs, as well as vague compensation models for the private partners,

- In line with the government’s Affordable Housing Initiative, Tatu City developers, Rendeavour announced plans to incorporate a 300-acre affordable housing project within Tatu City that will see development of 10,000 affordable units that will be priced between Kshs 1.5 mn to 5.0 mn. The Development is set to commence by April 2019,

- The government through a concept paper in regards to the affordable housing initiative, intends to work with county governments and the National Social Security Fund(NSSF) to fasten the provision of affordable housing. The county governments will aid in developing the much-needed land banks as per the government target of a total of 6,800 acres across various counties; 3,000 acres in Nairobi, 1,200 in Mombasa, 1000 in Kisumu, 800 in Eldoret and 800 in Nakuru. To this end, the County Government of Homa Bay signed a memorandum of understanding during the week, with the National Government for the development of 2,000 affordable homes where the County will provide 18 acres for the cause,

- In a bid to further enhance the home affordability, the government has also proposed the following legal amendments:

- Amendments to the Stamp Duty Act to exempt first time home buyers from the tax when purchasing social and affordable homes,

- The NSSF Act to increase member contributions to Kshs 1,080 from the current Kshs 400. This will provide a broader capital base for the pension fund which has been at the forefront of social housing provision, and,

- The Income Tax Act to offer higher tax rebates of Kshs 8,000, under the Home Ownership Savings Plan, to employees saving with mortgage institutions. Currently the tax rebates stand at Kshs 4,000 also through the Home Ownership Savings Plan which has been in effect since 1996.

We commend the Kenyan Government’s concerted efforts, especially in the legal reforms front, aimed at driving the affordable housing initiative which is expected to bear fruits by matching the purchasing power of potential home buyers as well as pulling in the private sector in delivery of the 1.0 mn homes by 2022, as exemplified by various private developers such as Rendeavour who have committed to contribute to the initiative.

We expect the real estate sector to improve on its performance this year given the recovery of fundamentals that support the sector’s growth such as (i) a rebounding tourism sector, (ii) intensified infrastructural development, (iii) economic growth recovery, and (iv) increase in household income due to an expanding middle class.

In June 2017, we released the Nairobi Metropolitan Area Land Report - 2017, which focused on the performance of land in 18 suburbs and 11 Satellite Towns in the Nairobi Metropolitan Area (NMA). According to the report, land had increased in value substantially, with the asking prices growing with a 5-year Compounded Annual Growth Rate (CAGR) of 19.4% between 2011 and 2016. The main drivers for the growth were the rapid population growth of 2.6% p.a against a global average of 1.2%, a high urbanization rate of 4.4% against a global average of 2.1% p.a, as well as the robust growth of the real estate sector, which had delivered returns of on average 25.0% p.a over a 5-year period. In summary, the land price performance by zones was as follows;

- Commercial zones had the highest returns with prices growing by a CAGR of 24.3%,

- site and service schemes, grew with a 5-year CAGR of 20.4%,

- low rise residential areas recorded the lowest appreciation rates, with prices growing with a 5-year CAGR of 14.6%

This week, we update that report with our Nairobi Metropolitan Area Land Report - 2018. The report highlights the land sector’s performance in the Nairobi Metropolitan Area in 2017 based on annual capital appreciation and make comparison to the 6-year growth rate to enable us identify trends, and hence give an outlook for the sector, as well as an investment recommendation. In this focus note, we cover:

- brief introduction to the land sector in NMA,

- performance summary in 2017 based on zones and locations,

- Summary and the investment opportunity in the sector, and

- conclusion by highlighting the outlook and investment recommendation.

- Introduction

Land prices in NMA have been on an upward trend, growing by high rates of up to 19.4% p.a., over the last 6 years driven by:

- positive demographic such as a high population growth rates of 2.6% p.a, higher than global averages of 1.2%, and a rising middle class with increasing purchasing power,

- continued investments in infrastructure such as roads, water, sewer and power connection,

- reduced supply of development class land at affordable prices, and

- a robust real estate sector.

In 2017, however, land and real estate sector was affected by the tough economic environment attributed to,

- low private sector credit growth, which averaged 2.4% in the first 10 months to October 2017 compared to a 5-year growth rate of 14.4%,

- the protracted electioneering period, which led to investors adopting a wait and see attitude, and,

- increased supply in some themes such as commercial office, which saw the NMA record a growth of just 3.7% p.a, compared to the 6-year CAGR of 17.0%.

The sector’s performance varied, with some zones experiencing price corrections such as Upperhill and Riverside, and others demonstrating attractive price appreciations of up to 12.0%, such as in Karen. The detailed analysis of performance by the various nodes and zones is as summarized below.

- Performance Summary in 2017

In our analysis of the performance, we classified the various nodes based on the zoning regulations and locations as below;

- Commercial Zones: These areas include Nairobi CBD, Kilimani, Westlands, Riverside and Upperhill, they are characterized by commercial office buildings,

- High Rise Residential Areas: These are areas characterized by high rise residential developments mainly apartments and include: Kileleshwa, Dagoretti, Ridgeways, Githurai, Embakasi, Kahawa and Kasarani,

- Low Rise Residential Areas: These are areas zoned for low rise residential developments, mainly villas, townhouses and maisonettes and include; Kitisuru, Runda, Nyari, Karen and Spring Valley,

- Satellite Towns: Land in the area was categorized into serviced (site and service schemes) and unserviced land.

The land sector recorded positive growth rates in most areas in NMA, recording an annual appreciation of 3.7% y/y from 2016, attributable to the tough operating environment in 2017. High rise residential areas recorded the highest capital appreciation rates, growing by 4.8% y/y. The growth was supported by high returns per unit of land value as the areas allow for densification, and increased demand for housing from the growing middle-income population. Areas zoned for commercial development such as Westlands and Kilimani recorded annual appreciation rates of 3.4% y/y, down from a 6-year CAGR of 20.0%. The slowdown in growth is attributed to the increased supply of commercial developments, with offices having an oversupply of 4.7 mn SQFT in 2017 and therefore a decline in demand for land for commercial developments. Site and service schemes had the lowest appreciation rates with the asking prices growing by 2.7% y/y, lower than the 3.0% recorded for unserviced land in the same localities. This implies that buyers are not willing to pay a premium for the services provided, rather opting for unserviced land in areas such as Ngong, which is 36.0% cheaper, and provide the services for themselves.

The performance of the various zones and localities is as summarized below:

|

All Values in Kshs Unless Stated Otherwise |

||||||

|

Land Price Performance by Zones – Nairobi Metropolitan Area |

||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

6-Year CAGR |

2017 Capital Appreciation |

|

Nairobi Suburbs - High Rise Residential Areas |

49mn |

85mn |

102mn |

108mn |

14.7% |

4.8% |

|

Nairobi Suburbs - Low Rise Residential Areas |

39mn |

72mn |

84mn |

87mn |

14.4% |

4.5% |

|

Nairobi Suburbs - Commercial Areas |

156mn |

377mn |

458mn |

473mn |

20.5% |

3.4% |

|

Satellite Towns - Unserviced Land |

9mn |

16mn |

20mn |

20mn |

17.4% |

3.0% |

|

Satellite Towns - Site and service Schemes |

6mn |

13mn |

14mn |

14mn |

18.2% |

2.7% |

|

Average |

|

|

|

|

17.0% |

3.7% |

|

||||||

Source: Cytonn Research

High Rise Residential Areas

For high rise residential areas, the asking prices had an annual capital appreciation of 4.8% and this we attribute to the high returns in the areas, given that the areas allow densification. Kahawa had the highest appreciation rates of 8.3% attributed to increased demand for land in the area from developers looking to cater for the middle-income and student population. Embakasi recorded the lowest appreciation rates of 1.7%, attributable to i) traffic congestion into and out of the area making it unattractive for settlement, and thus development, and ii) reduced development activity and therefore demand for land as the area is already well developed. The performance of high rise residential zones is as summarized below:

|

All Values in Kshs Unless Stated Otherwise |

|||||||

|

Land Price Performance-High Rise Residential Zones in Nairobi Metropolitan Area |

|||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

6-Year CAGR |

% Price Change from 2011 |

2017 Capital Appreciation |

|

Kahawa |

33mn |

51mn |

60mn |

65mn |

12.0% |

2.0 |

8.3% |

|

Kileleshwa |

149mn |

227mn |

286mn |

306mn |

12.7% |

2.1 |

6.8% |

|

Kasarani |

32mn |

51mn |

60mn |

64mn |

12.0% |

2.0 |

6.1% |

|

Dagoretti |

28mn |

81mn |

95mn |

99mn |

23.6% |

3.6 |

4.0% |

|

Githurai |

21mn |

37mn |

45mn |

46mn |

14.2% |

2.2 |

2.2% |

|

Embakasi |

33mn |

61mn |

69mn |

70mn |

13.6% |

2.2 |

1.7% |

|

Average |

49mn |

85mn |

102mn |

108mn |

14.7% |

2.3 |

4.8% |

|

|||||||

Source: Cytonn Research

Low Rise Residential Areas

Low rise residential areas recorded an average price appreciation of 4.5%, which is 0.3% points lower than that of high rise residential areas, but higher than the 3.4% recorded in commercial zones. Karen recorded the highest appreciation rates of 12.2% against a submarket average of 4.5% attributed to its affordability as compared to other low rise residential nodes, with an average price per acre of land in Karen being Kshs 52 mn against a market average of Kshs 87mn for the low rise residential nodes. In Nyari, the prices reduced by 0.1% attributed to the high land and house prices, with an acre of land in Nyari being Kshs 109 mn against a market average of Kshs 87 mn hence less affordable as compared to the other low rise residential nodes. Given the high land prices in these nodes with the exception of Karen, for these regions to experience significant increase in prices, the zoning regulations need to be relaxed to allow for densification and thus more value can be derived per unit of land. The performance of the low rise residential node is as summarized below:

|

All Values in Kshs Unless Stated Otherwise |

|||||||

|

Land Price Performance- Low Rise Residential Zones in Nairobi Metropolitan Area |

|||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

6-year CAGR |

% Price change from 2011 |

2017 Capital Appreciation |

|

Karen |

25mn |

40mn |

46mn |

52mn |

12.9% |

2.1 |

12.2% |

|

Ridgeways |

24mn |

51mn |

62mn |

68mn |

19.0% |

2.8 |

9.2% |

|

Spring Valley |

64mn |

131mn |

147mn |

154mn |

15.7% |

2.4 |

4.7% |

|

Kitisuru |

32mn |

59mn |

70mn |

70mn |

13.9% |

2.2 |

0.2% |

|

Runda |

33mn |

58mn |

67mn |

68mn |

12.6% |

2.0 |

1.2% |

|

Nyari |

54mn |

93mn |

109mn |

109mn |

12.2% |

2.0 |

(0.1%) |

|

Average |

39mn |

72mn |

84mn |

87mn |

14.4% |

2.3 |

4.5% |

|

|||||||

Source: Cytonn Research

Commercial Areas

Commercial areas recorded a 3.4% annual increase in price, lower than both the high rise and low rise residential zones which recorded annual increments of 4.8% and 4.5%, respectively. We attribute this to decreased demand for commercial property given the existing oversupply of 4.7mn SQFT of office space. Kilimani had the highest annual appreciation rate among the commercial nodes of 7.5%, attributable to its relatively low price compared to the other office nodes, with average prices of Kshs 387 mn per acre against a market average of Kshs 473 mn for the nodes. Riverside recorded a slight decline in prices of 0.5%. Prices in Upperhill also corrected with the market recording a 0.5% decline in prices as a result of i) increased land prices over the last 6-years, recording a 16.9% CAGR%, ii) an oversupply of approximately 700,000 SQFT of office space in the node, and iii) traffic congestion into and out of the area that had led to many developers focusing on Kilimani, an upcoming office node with lower supply. The performance of the commercial zones is as summarized below;

|

All Values in Kshs Unless Stated Otherwise |

|||||||

|

Land Price Performance- Commercial Zones in Nairobi Metropolitan Area |

|||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

6-year CAGR |

% Price change from 2011 |

2017 Capital Appreciation |

|

Kilimani |

114mn |

294mn |

360mn |

387mn |

22.5% |

3.4 |

7.5% |

|

CBD |

200mn |

450mn |

600mn |

634mn |

21.2% |

3.2 |

5.7% |

|

Westlands |

150mn |

350mn |

453mn |

474mn |

21.1% |

3.2 |

4.6% |

|

Upper Hill |

200mn |

450mn |

512mn |

510mn |

16.9% |

2.6 |

(0.5%) |

|

Riverside |

116mn |

343mn |

362mn |

361mn |

20.8% |

3.1 |

(0.5%) |

|

Average |

156mn |

377mn |

458mn |

473mn |

20.5% |

3.1 |

3.4% |

|

|||||||

Source: Cytonn Research

Satellite Towns

Land in satellite towns recorded an annual price appreciation of 3.0% in 2017, lower than land in the suburbs which had an average annual price appreciation of 4.3%. This is attributable to a decline in speculation activity in 2017, as a result of growth of some towns such as Ruiru and Ruaka, and as a result of the wait and see attitude adopted by investors over the extended electioneering period. The best performing Satellite Town was Juja which recorded an annual appreciation of 8.7%, attributable to speculation in the area as investors moved from Ruiru, whose prices have matured. The worst performing as Utawala, where prices stagnated as the price growth had in previous years been driven by speculation, speculators have since moved to the new towns along Limuru and Thika Road which are undergoing infrastructural and real estate development. The performance of land in Satellite Towns is as summarized below:

|

All Values in Kshs Unless Stated Otherwise |

|||||||

|

Land Price Performance- Unserviced Satellite Towns in Nairobi Metropolitan Area |

|||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

6-year CAGR |

% Price change from 2011 |

Annual Appreciation 2017 |

|

Juja |

3mn |

7mn |

8.8mn |

9.6mn |

20.0% |

3.0 |

8.7% |

|

Athi River |

2mn |

3mn |

3.8mn |

4.1mn |

12.5% |

2.0 |

5.6% |

|

Ruaka |

40mn |

58mn |

74mn |

77mn |

11.6% |

1.9 |

4.3% |

|

Ruiru |

7mn |

15mn |

19.3mn |

19.7mn |

20.0% |

3.0 |

2.2% |

|

Ngong |

7mn |

12mn |

14.1mn |

14.4mn |

13.5% |

2.1 |

2.1% |

|

Limuru |

5mn |

13mn |

16.6mn |

16.7mn |

20.6% |

3.1 |

1.0% |

|

Ongata Rongai |

2mn |

10mn |

9.8mn |

9.9mn |

29.2% |

4.7 |

0.1% |

|

Utawala |

6mn |

9mn |

10.9mn |

11.0mn |

11.3% |

1.9 |

0.0% |

|

Average |

9mn |

16mn |

19.7mn |

20.3mn |

17.4% |

2.7 |

3.0% |

|

|||||||

Source: Cytonn Research

Site and Service Schemes

Site and service schemes recorded an annual appreciation rate of 2.7% over the last year, lower than the 3.0% recorded in unserviced land in the same localities indicating that the buyers are not willing to pay a premium for servicing. Thika recorded the highest appreciation rates of on average 9.7% attributable to speculative tendencies brought about by the growth potential of the area. Athi River recorded a decline in prices of 0.3%, attributable to decreased demand in the area as a result of poor infrastructure and availability of relatively cheaper unserviced land. The provision of trunk infrastructure in the individual plots without commensurate infrastructure in the surrounding area is therefore not attractive to buyers. Therefore, to boost site and service schemes, the government should provide this infrastructure in the areas. The performance of site and service schemes in Satellite Towns is as summarized below:

|

All Values in Kshs Unless Stated Otherwise |

|||||||

|

Land Price Performance- Site and Service Satellite Towns in Nairobi Metropolitan Area |

|||||||

|

Location |

*Price in 2011 |

*Price in 2015 |

*Price in 2016 |

*Price in 2017 |

6-Year CAGR |

% Price Change from 2011 |

Annual Appreciation 2017 |

|

Thika |

5mn |

7mn |

8.4mn |

9.2mn |

10.4% |

1.8 |

9.7% |

|

Ruai |

8mn |

12mn |

12.8mn |

13.1mn |

8.8% |

1.7 |

2.2% |

|

Syokimau-Mlolongo |

3mn |

12mn |

11.9mn |

12.1mn |

24.8% |

3.8 |

1.7% |

|

Ongata Rongai |

7mn |

16mn |

18.8mn |

19.1mn |

18.2% |

2.7 |

1.5% |

|

Ngong |

11mn |

18mn |

19.1mn |

19.4mn |

10.7% |

1.8 |

1.4% |

|

Athi River |

2mn |

11mn |

13.0mn |

12.9mn |

36.5% |

6.5 |

(0.3%) |

|

Average |

6mn |

13mn |

14mn |

14mn |

18.2% |

3.0 |

2.7% |

|

|||||||

Source: Cytonn Research

- Summary and Investment Opportunity

Karen, Kilimani, Ridgeways, Juja and Kasarani are among the best performing sub markets in terms of capital appreciation, recording annual rates of more than 5.0% in 2017, while Thika offers site and service investors the highest expected returns of on average 9.7% against a market average of 3.7% in 2017. The table below summarizes the performance of the various areas:

|

Summary and Conclusions- Capital Appreciation Nairobi Metropolitan Area |

|

|

Land Capital Appreciation |

|

|

2016 - 2017 |

Areas |

|

>5% |

Karen, Kilimani, Ridgeways, Athi River, Juja, CBD, Kahawa, Kileleshwa, and Kasarani |

|

1% -5% |

Ruaka, Ruiru, Ngong, Limuru, Westlands, Githurai, Dagoretti, Embakasi, Runda and Spring Valley |

|

< 1% |

Utawala, Ongata Rongai, Upperhill, Riverside, Kitisuru and Nyari |

|

Site and Service Schemes Capital Appreciation |

|

|

2016 - 2017 |

Location |

|

> 5% |

Thika |

|

1%-5% |

Ongata Rongai, Syokimau- Mlolongo, Ngong and Ruai |

|

<1% |

Athi River |

Source: Cytonn Research

Investment Opportunity

Given the above performance of the various areas, the investment opportunity in the sector is in markets with high returns such as Karen, Kilimani, Ridgeways, Juja and Kasarani which recorded annual capital appreciation rates of more than 5.0% in 2017, and Thika which offers site and service schemes investors the highest expected returns of on average 9.7% against a market average of 3.7% in 2017, thus making these areas the most attractive areas both for land and real estate development.

- Outlook for the Sector

The table below summarizes metrics that we expect to have possible impact on land prices in Nairobi, in 2018. All the four indicators are positive, and therefore, the general outlook for the sector in 2018 is positive:

|

Indicator |

2017 Projections |

2018 Projections |

2017 Outlook |

2018 Outlook |

|

Infrastructure Development |

It was expected that the government expenditure on infrastructure would increase by 35.6% in 2017 to Kshs. 342.2bn from Kshs. 252.6bn in 2016. This was exceeded by 1.5% to Kshs. 347.4bn in 2017 |

The government expenditure on infrastructure expected to increase by 14.2% in 2018 to Kshs. 396.8bn from Kshs. 347.4bn in 2017, therefore opening up areas along these corridors, translating to an increase in land value |

Positive |

Positive |

|

Legal Reforms |

Relaxation of the zoning regulations in some submarkets. Zoning regulations relaxed in Kyuna, Loresho and Spring Valley translating to higher returns, with Spring Valley recording an annual appreciation of 4.7% 1.0% points the market average Scrapping of land search fees which was done |

The digitization of the land ministry expected to enhance transparency and efficiency of land transactions hence reduced transaction cost |

Positive |

Positive |

|

Credit Supply |

We expected if the Banking Amendment Act 2015 is not reversed, to continue constraining credit supply to the sector thus reducing both development and off take of real estate. This was witnessed where we saw private sector credit growth decline to 2.4% as at October 2017 from a 5-year average of 14.4% with the number of active mortgage accounts dropping by 1.5% to 24,085 from 24,458 in 2015 |

In the case the Banking Amendment Act 2015 review is not successful, we expect low credit supply to continue hindering access to funds reducing both development and off take of real estate. However, we expect developers to embrace alternative funding such as Real Estate Investment Trusts (REITs), |

Negative |

Neutral |

|

Real Estate Activities |

Decreased activities due to elections uncertainty. This was evidenced with the value of building plans approved by the NCC, decreasing by 28.1% to Kshs 240.8 mn in 2017 from Kshs 308.4 mn in 2016 |

Increased real estate activities on the back of the calm conclusion of the prolonged electioneering period in 2017 and the government affordable housing initiative |

Negative |

Positive |

|

Performance |

We expected Land in Nairobi Metropolitan Area to grow with a 5-year CAGR of 19.4% between 2011 and 2016. Land prices, however recorded an annual capital appreciation of 3.7% in 2017 due to the prolonged electioneering period |

We expect land prices in Nairobi to record an annual capital appreciation of 10.2% in 2018 following the return to normalcy after the conclusion of the electioneering period |

Positive |

Positive |

Source: Cytonn Research

For the 2017 Land sector outlook, we had three out of the five metrics as positive, and two negative and thus a positive outlook for the land sector in Nairobi. For 2018, we have four of the metrics under consideration are positive and one neutral, thus we retain our positive outlook for the land sector in Nairobi and we expect the land and real estate market to record better performance in 2018.

We expect increased investments in the sector driven by i) infrastructural development with the government expenditure on infrastructure expected to increase by 14.2% in 2018 from 2017, ii) the conclusion of the electioneering period and iii) relaxation of zoning regulations in some markets thus making them more attractive for real estate development.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.