Nairobi Metropolitan Area Commercial Office Report 2020, & Cytonn Weekly #17/2020

By Cytonn Research Team, Apr 26, 2020

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 81.7%, up from 59.5% the previous week. The undersubscription is partly attributable to the IFB1/2020/9 bond tap sale in the primary market, which had a subscription rate of 180.2%. The subscription rate of the 91-day and 182-day papers increased to 219.7% and 44.5%, respectively, from 65.5% and 8.1% recorded the previous week, respectively. The subscription rate of the 364-day paper came in at 63.8% from 108.6% recorded the previous week. We note that the oversubscription of the 91-day paper is attributable to the increased demand for shorter-dated papers, with demand for longer-dated papers expected to reduce due to the tap sale on the recently issued infrastructure bond. The Monetary Policy Committee (MPC) is set to meet on Wednesday, 29th April 2020, to review the outcome of its previous policy decisions and recent economic developments, and to make a decision on the direction of the Central Bank Rate (CBR). We expect the MPC to reduce the Central Bank Rate (CBR) by 25bps to 7.00% from 7.25%, this decision will be driven by factors such as Cost-Push Inflation which continues to be a threat to the economy due to the locust invasion which has plagued the country since the end of 2019. During the week, the National Assembly approved the Tax Amendment Bill 2020, which was necessitated by the Presidential directive dated 25th March 2020 and on 25th April 2020, President Uhuru Kenyatta signed the Bill into law. The Bill, which is now the Tax Amendments Act 2020, has amended the definition of “qualifying interest” to be any interest earned by a resident individual in any year of income. As such, interest earned from privately issued products such as the Cytonn High Yield Solutions (CHYS) and the Cytonn Project Notes (CPN), will now qualify as qualifying interest. During the week, the National Assembly approved the supplementary budget for the fiscal year 2019/20, leading to a Kshs 9.7 bn decline in the gross total supplementary budget to Kshs 2,803.1 bn, from Kshs 2,812.8 bn. The supplementary budget was necessitated by the coronavirus pandemic that has dampened economic activities, leading to significant revenue underperformance;

Equities

During the week, the equities market recorded mixed performances, with NASI and NSE 20 declining by 0.1% and 0.3%, respectively, while the NSE 25 rose by 1.0%, taking their YTD performance to losses of 18.4%, 25.9%, and 22.6%, for the NASI, NSE 20 and NSE 25, respectively. The losses recorded by NSE 20 and NSE 25, breach the threshold of a bear market, which is a condition in which securities prices fall by 20.0% or more from recent highs over a sustained period of time. During the week, NCBA Group, the third-largest bank by assets in Kenya, with an asset base of Kshs 494.8 bn as at December 2019, announced it would withhold the final dividend payment of Kshs 1.5 per share to shareholders, totaling to Kshs 2.2 bn for FY’2019. The dividend was to be paid to shareholders registered on the company’s register at the close of business (book closure) on 23rd April 2020. The lender’s board instead has recommended the payment of a stock dividend (Bonus Issue) and not a cash dividend, which will be issued to shareholders registered on the company’s register at the close of business on 12 May 2020; this is an indicator that businesses are looking to conserve cash in the midst of significant uncertainties related to the pandemic. The Bonus Issue will be 1 share for every 10 held. During the week, the Central Bank of Kenya (CBK) announced the acquisition of a 51.0% stake in Mayfair Bank Limited by Egyptian lender, Commercial International Bank (CIB), effective 1st May 2020 for an undisclosed amount following CBK’s approval on 7th April 2020;

Real Estate

During the week, the president assented the Tax Amendments Bill 2020, which amended the Retirement Benefits Act to allow the use of pension savings towards purchasing of a home in addition to acting as mortgage collateral. In the retail sector, Naivas Supermarket opened its 64th store in Kilimani, the third branch to be opened this year by the retailer after opening of Kamakis along the Eastern Bypass, and Mountain View along Waiyaki Way; and Tuskys supermarket announced that it would temporarily close three of its branches in Nairobi, Kitale, and Mombasa as it looks to reduce operating costs and net more profits;

Focus of the Week

This week we focus on the commercial office sector in Kenya, where we update our Nairobi Metropolitan Area (NMA) Commercial Office Report 2019. We analyze the current state of the commercial office market in terms of supply, demand, drivers, and challenges. The sector’s performance softened in 2019 with average rental yields declining by 0.7% points to 7.7%, from 8.3% recorded in 2018, while average occupancy rates fell by 3.3% points to 80.5%, from 83.8% recorded in 2018. With major nodes recording an oversupply, the investment opportunity in the sector remains in zones with low supply and high returns such as Gigiri and differentiated concepts such as serviced offices and Mixed-Use Developments (MUDs) recording rental yields of up to 12.3% and 7.9%, respectively.

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.04% p.a. To subscribe, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 14.25% p.a. To subscribe, email us at sales@cytonn.com;

- Having completed and handed over Phase 1 of The Alma, and on track to hand over Phase 2, we have now turned our attention towards construction of The Ridge in Ridgeways. The Ridge is Cytonn’s 800-unit residential mixed-use development on the Northern Bypass. For more information, please email us at sales@cytonn.com;

- Phase 1 of The Alma is now 100% sold with early buyers having achieved up to 55% capital appreciation. We are now running a promotion in Phase 2: Buy a unit in Phase 2 with a 15-year payment plan and 0% deposit. For inquiries, please email us on clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour and for more information, email us at sales@cytonn.com;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects.

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained undersubscribed, with the subscription rate coming in at 81.7%, up from 59.5% the previous week. The undersubscription is partly attributable to the IFB1/2020/9 bond tap sale in the primary market, which had a subscription rate of 180.2%. The subscription rate of the 91-day and 182-day papers increased to 219.7% and 44.5%, respectively, from 65.5% and 8.1% recorded the previous week, respectively. The subscription rate of the 364-day paper came in at 63.8% from 108.6% recorded the previous week. We note that the oversubscription of the 91-day paper is attributable to the increased demand for shorter-dated papers, with demand for longer-dated papers expected to reduce due to the tap-sale on the recently issued infrastructure bond. The yields on the 91-day, 182-day and 364-day papers remained unchanged at 7.2%, 8.1% and 9.1%, respectively, similar to what was recorded the previous week. The acceptance rate declined marginally to 99.5%, from 99.7% recorded the previous week, with the government accepting Kshs 19.5 bn of the Kshs 19.6 bn bids received.

The tap-sale for the 9-year infrastructure bond (IFB1/2020/9), that closed during the week, with a coupon rate of 10.9% in a bid to raise Kshs 21.0 bn for funding of infrastructure projects in the FY 2019/20 budget estimates was oversubscribed. The government received bids worth Kshs 37.8 bn, higher than the issue’s quantum of Kshs 21.0 bn, translating to a subscription rate of 180.2%. The high subscription was mainly attributable to its relatively short tenor, being an infrastructure bond, as well as the tax-free incentive for infrastructure bonds, translating to a higher return. The yield on the bond came in at 12.1%, with the government accepting Kshs 35.4 bn out of the Kshs 37.8 bn worth of bids received, translating to an acceptance rate of 93.5%. Given the tax-free nature of the bond, this is comparable to a Yield to Maturity (YTM) of 13.3%, on a normal bond with the assumption of a 10.0% withholding tax for a bond with the same effective tenor.

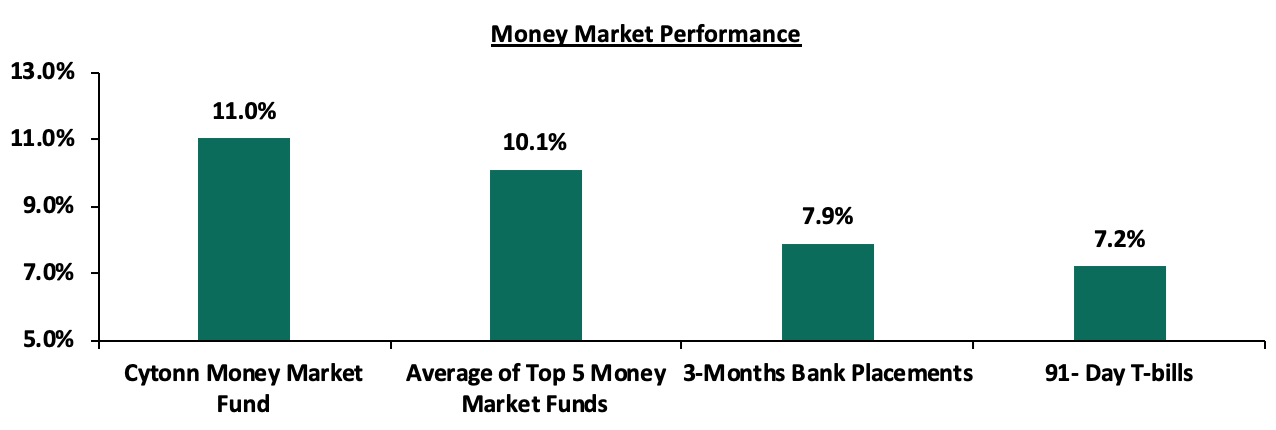

In the money markets, 3-month bank placements ended the week at 7.9% (based on what we have been offered by various banks), the 91-day T-bill remained unchanged at 7.2%, similar to what was recorded the previous week. The average of Top 5 Money Market Funds remained unchanged at 10.1%, similar to what was recorded the previous week. The yield on the Cytonn Money Market, however, declined by 0.1% points to 11.0% from 11.1% recorded the previous week,

Liquidity:

During the week, liquidity eased in the money market with the average interbank rate decreasing to 5.7%, from 5.9% recorded the previous week, supported by government payments in settling pending bills worth Kshs 13.0 bn as well as VAT refunds worth Kshs 10.0 bn to suppliers. Commercial banks’ excess reserves came in at Kshs 53.9 bn in relation to the 4.25% cash CRR. The average interbank volumes increased by 51.6% to Kshs 7.4 bn, from Kshs 4.9 bn recorded the previous week.

Kenya Eurobonds:

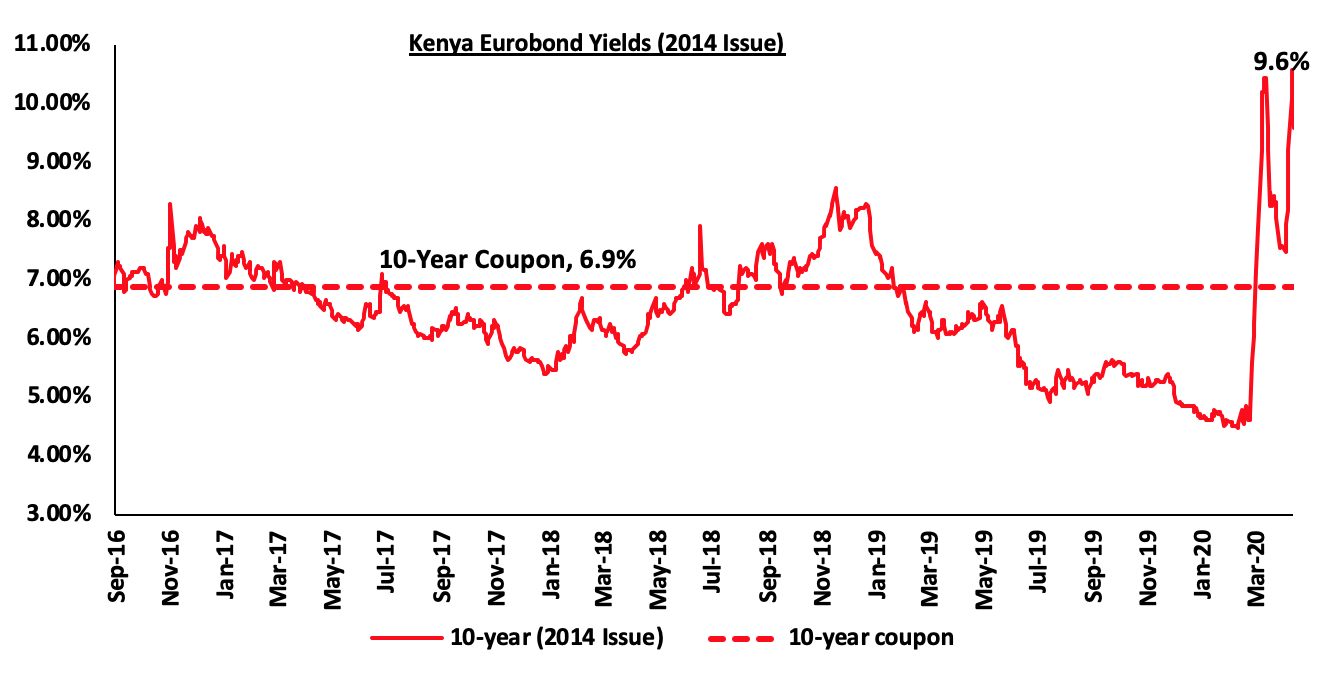

During the week, the yields on all the Eurobonds increased marginally, attributable to investors attaching a higher risk premium on the country due to the anticipation of slower economic growth attributable to the coronavirus pandemic as well as the locust invasion as highlighted in our Q1’2020 Eurobond Performance Note. According to Reuters, the yield on the 10-year Eurobond issued in June 2014 increased by 1.1% points to 9.6%, from 8.5% recorded the previous week.

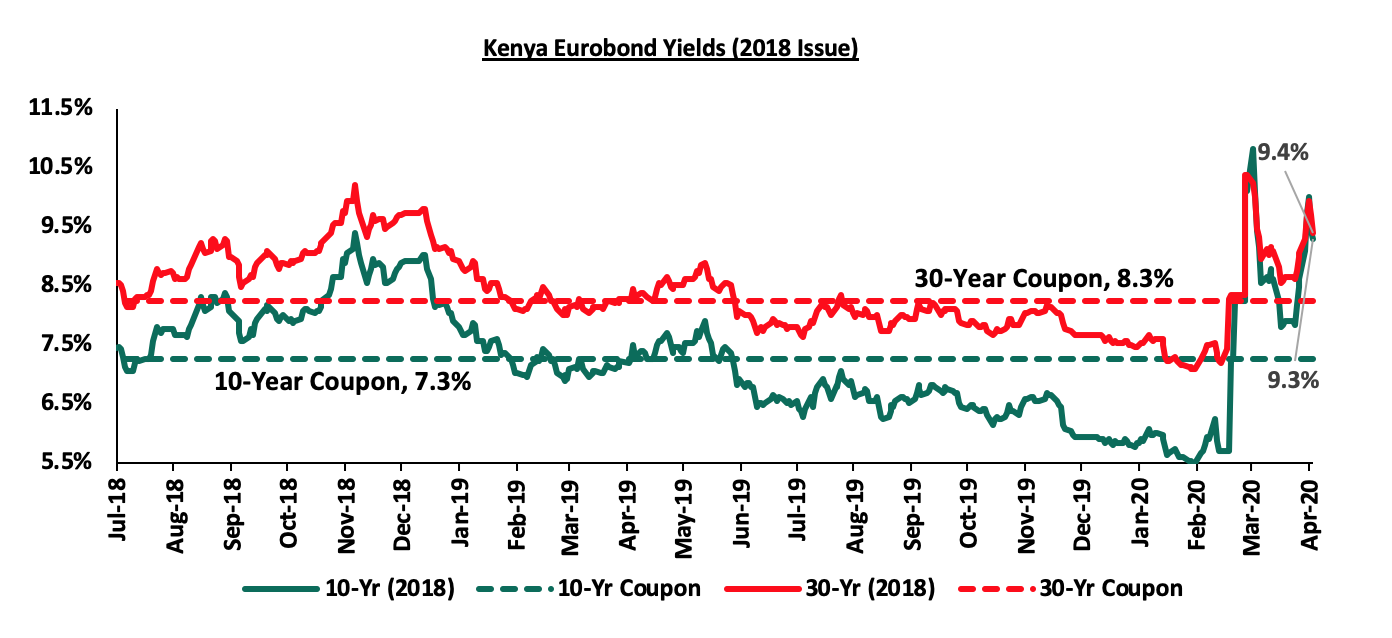

During the week, the yields on the 10-year and 30-year Eurobonds issued in 2018 increased by 0.7% points and 0.3% points to 9.3% and 9.4%, respectively, from 8.6% and 9.1% recorded previous week, respectively.

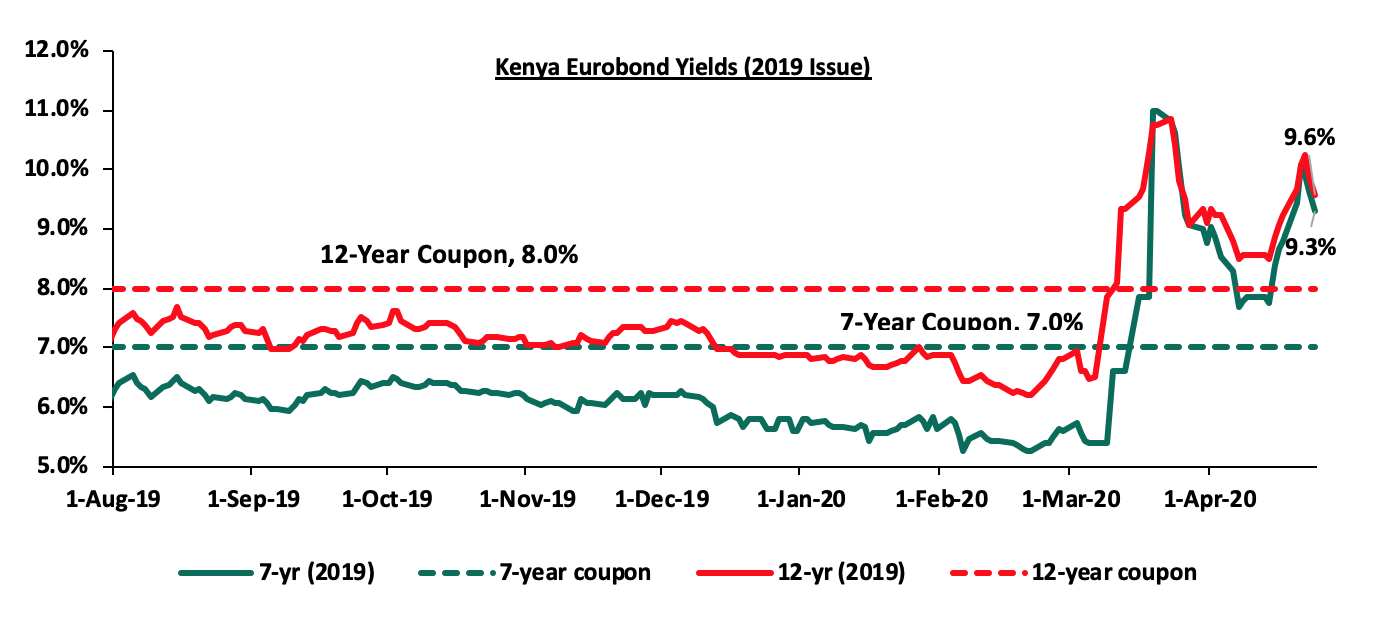

During the week, the yields on the 7-year and 12-year Eurobonds issued in 2019 increased by 0.5% points and 0.4% points, to 9.3% and 9.6%, respectively, from 8.8% and 9.2% recorded the previous week, respectively.

Kenya Shilling:

During the week, the Kenya Shilling depreciated by 1.0% against the US Dollar to close at Kshs 107.2, from Kshs 106.2 recorded the previous week, attributable to the increased dollar demand pressure from the energy and telecommunications sector on account of reduced foreign currency inflows. This is a 9-year low record with the last intra-day low record seen in October 11th 2011 when the Kenya Shilling traded at Kshs 107.0 against the US Dollar. On a YTD basis, the shilling has depreciated by 5.8% against the dollar, in comparison to the 0.5% appreciation in 2019. We expect continued pressure on the shilling in with our sentiments being on the back of:

- High dollar demand from foreigners exiting the market as they direct their funds to safer havens as well as merchandise, and energy sector importers beefing up their hard currency positions amid a slowdown in foreign dollar currency inflows to meet the dollar demand, and,

- Subdued diaspora remittances growth following the close of the 10.0% tax amnesty window in July 2019. We also foresee reduced diaspora remittances, owing to the decline in economic activities globally hence a reduction in disposable incomes. This coupled with increased prices of household items abroad might see a reduction in money expatriated into the country.

The shilling is however expected to be supported by:

- High levels of forex reserves, currently at USD 7.9 mn (equivalent to 4.8-months of import cover), above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover, and,

- CBK’s supportive activities in the money markets, with the CBK having already indicated that it’s looking to purchase USD 400.0 mn from banks for four months beginning from March 2020 to bolster the forex reserves.

Monetary Policy:

The Monetary Policy Committee (MPC) is set to meet on Wednesday, 29th April 2020, to review the outcome of its previous policy decisions and recent economic developments, and to make a decision on the direction of the Central Bank Rate (CBR). In their previous meeting held on 23rd March 2020, the committee decided to reconvene within a month for an early assessment of the impact of these measures and the evolution of the COVID-19 pandemic. In the last sitting, they lowered the CBR by 100 bps to 7.25% from 8.25% and reduced the Cash Reserve Requirement (CRR) to 4.25% from 5.25% citing that the Coronavirus pandemic was expected to adversely affect economic growth and as such, the need to cushion the economy against the effects of the pandemic and whilst preventing the COVID-19 health crisis from becoming a severe economic and financial crisis. This was in line with our expectations as per our MPC Note.

During the meeting on Wednesday, 29th April 2020, we expect the MPC to reduce the Central Bank Rate (CBR) by 25bps to 7.00% from 7.25%, with their decision mainly being supported by:

- Cost-Push Inflation which continues to be a threat to the economy due to the locust invasion which has plagued the country since the end of 2019. Experts have warned that the country is likely to experience a second wave of locust invasion and this may greatly affect the agricultural sector, causing a further increase in food prices which has a new weighting of 32.9% in the Consumer Price Index (CPI). Inflation may, however, be slowed down by the decline in oil prices across the globe due to a decline in demand. We, therefore, expect a decline in the transport index, which has a new weighting of 9.7% in the total consumer price index (CPI), due to the decrease in petrol and diesel prices,

- The instability of the Kenyan Shilling having already lost by 5.6% YTD in 2020 reflecting a less stable economic environment. The country is experiencing high dollar demand from foreigners exiting the market as they direct their funds to safer havens as well as merchandise, and energy sector importers beefing up their hard currency positions amid a slowdown in foreign dollar currency inflows from diaspora remittances and fewer offshore investors to meet dollar demand, and,

- The MPC may also cut the rate further to continue encouraging financial institutions to lend money to the private sector as most businesses may need to take up loans for business continuity purposes due to subdued revenues.

For our detailed MPC analysis, please see our MPC Note for the 29th April 2020 meeting here.

Weekly Highlight:

- Tax (Amendment) Act 2020:

During the week, the National Assembly approved the Tax Amendment Bill 2020, which was necessitated by the Presidential directive dated 25th March 2020 to mitigate the economic effects arising from the novel COVID-19 virus. On 25th April 2020, President Uhuru Kenyatta, signed into law the Tax Laws (Amendment) Bill.

The key amendments in the Tax (Amendment) Act 2020 include;

- 100.0% tax relief to employees earning less than Kshs 28,000 while those earning Kshs 35,000 will now pay a Pay As You Earn (PAYE) tax of Kshs 1,650, a Kshs 2,093 reduction from the previous Kshs 3,743 PAYE, thereby increasing the disposable income available to employees and increasing their purchasing power,

- A reduction of the turnover tax rate from the current 3.0% to 1.0% for all Micro, Small and Medium Enterprises (MSMEs), and a further increase in the threshold of the MSMEs qualifying for turnover tax to Kshs 1.0 mn from the proposed Kshs 0.5 mn,

- Reduction of the Corporate Tax rate to 25.0% from 30.0% in an effort to increase corporate tax savings, which is expected to act as an incentive to corporations to retain employees,

- On withholding tax, tax on dividends payable to non-residents has been adjusted to 15.0% from 10.0%, thereby discouraging equity investments from foreigners,

- An enhancement of the tax bands for taxation of withdrawals from the National Social Security Fund (NSSF), Registered Pension Funds and Provident Funds to 25.0% from 30.0%, thereby providing an incentive to employees to save for retirement as their retirement benefits will be more upon withdrawal,

- Items such as inputs for the manufacture of pesticides, by-products used in animal feed and fertilizer have been retained as exempt to support the agricultural sector,

- Services within the Tourism Industry i.e. entry fees into National Parks have been restored to exempt status, with the exclusion of in-house supplies. The restoration of the services to exempt status will provide significant help in the recovery process of the tourism industry which has been adversely affected by the coronavirus pandemic,

- A reduction of Value Added Tax (VAT) to 14.0% from 16.0% in an effort to lower the prices for basic commodities. Essential food items such as bread, milk and milk products etc. have been retained as zero-rated. Protective equipment such as face masks have been exempted from the current levying of 14.0% VAT thereby reducing their cost, as they are essential in the fight against COVID-19, and,

- The Act amended the definition of “qualifying interest” to be any interest earned by a resident individual in any year of income. The implication of the change is that all interest income will now have the 15.0% withholding tax (WHT) as the final tax; there was previously an obligation to pay an additional 15.0% WHT if interest was not earned from (i) a bank or financial institution licensed under the Banking Act or (ii) a building society registered under the Building Societies Act under which a housing bond required the approval of National Treasury CS, or (iii) the Central Bank of Kenya. As such, interest earned from privately issued products such as the Cytonn High Yield Solutions (CHYS) and the Cytonn Project Notes (CPN), will now qualify as qualifying interest.

In our view;

- We believe the amendment in the definition of “qualifying interest” to be any interest earned by a resident individual in any year of income is a welcomed move. We have long advocated for such a change, starting in May 2018, in our Topical on how the Interest Rate Cap Review Should Focus on Stimulating Capital Markets. The Amendment to the Income Tax Act will address the tax advantages that banks enjoy, and level the playing field by making tax incentives that were previously only available to banks to be also available to non-bank funding entities and capital markets products such as private investment funds e.g. real estate structured products. The amendment has provided alternative and capital markets funding organizations with the same withholding tax incentives that banking deposits enjoy, of a 15.0% final withholding tax so that depositors do not feel that they have to go to a bank to enjoy the 15.0% withholding tax. In our view, this will encourage individuals to save in more financial products issued by non-financial institutions,

- The implementation of the Tax Amendment Act 2020 will result in the government forfeiting Kshs 122.0 bn, leading to lower revenue collection. To plug in the deficit, the government will come under pressure, and as such we believe this is what has necessitated it to raise its domestic borrowing target to Kshs 404.4 bn, from the earlier Kshs 300.3 bn target,

- The National Assembly, in approving the corporate tax amendment, indicated that the savings on tax would be an incentive to businesses to retain their employees. However, with the tough economic environment and the reduction in revenues, most businesses have had to scale down their operations leading to massive job losses and reduced income,

- The exemption from levying protective equipment will increase the local production of masks and reduce the dependence on exports in the foreseeable future,

- The reduction of the turnover tax from 3.0% to 1.0% will reduce the tax burden for MSMEs and simplify the tax compliance requirement on account of the increase of the threshold to Kshs 1.0mn from the proposed Kshs 0.5 mn, and,

- Given the reduction of tax incentives for companies listed in the Nairobi Securities Exchange (NSE), businesses will incur more charges that are associated in the listing process such as the legal fees, rating expenses, etc., thereby diminishing the attractiveness of the NSE to companies wishing to list their shares.

We are of the view that given the tough operating environment, the approval of the tax amendment, while appreciated steps, will do little to shield Kenyan’s and businesses against the economic shocks brought about by the pandemic on account of, (i) reduced purchasing power to consumers, (ii) decline in revenue/loss of revenue attributable by job losses, and (iii) the reduction business revenue due to slowdown in business operations.

- Supplementary Budget:

During the week, the National Assembly approved the supplementary budget for the fiscal year 2019/20, leading to a Kshs 9.7 bn decline in the gross total supplementary budget to Kshs 2,803.1 bn from Kshs 2,812.8 bn. The supplementary budget was necessitated by the coronavirus pandemic that has dampened economic activities leading to significant revenue underperformance. As the business environment becomes more challenging, we expect a dip in tax revenues, despite the government being in dire need of raising finances to offer the requisite financial stimulus. The National Assembly will meet on 29th April 2020 to conclude the approval process of the Supplementary Appropriation Bill that will provide a legal framework for the supplementary estimates.

The State Department for Crop Development has seen its budget increased by Kshs 12.8 bn to Kshs 35.3 bn from the approved estimates of Kshs 22.5 bn to cater for the food insecurity brought about by the locust invasion and the COVID-19 pandemic. The funds will be used to facilitate the acquisition of strategic food reserves to cater for the locust invasion.

The approval of the 2019/20 supplementary budget will increase the fiscal deficit to an estimate of 7.8% of GDP, from the earlier estimated deficit of 6.3% of GDP for FY 2019/20. With less than two months to go before the end of the current fiscal year, we believe the government’s fiscal consolidation plan will remain elusive. Given the current market conditions, we expect a dip in tax revenues. For a more detailed analysis of the approved 2019/20 supplementary budget, see our Supplementary Budget II Note.

III. Inflation Projection:

We are projecting the y/y inflation rate for April 2020 to come in within the range of 6.0% - 6.2%, compared to 6.1% recorded in March attributable to the following factors:

- A decline in the housing, water, electricity, gas, and other fuels index mainly driven by the 19.0% decline in kerosene prices to Kshs 77.3 per litre, from 95.5 per litre previously,

- Despite the decline in petrol prices by 16.2% to Kshs 92.9 per litre from Kshs 110.9 per litre, and diesel prices having declined by 4.0% to Kshs 97.6 per litre from Kshs 101.7 per litre, transport prices have increased marginally due to the COVID-19 mitigation measures put in place by the government requiring 14-seater matatus to carry only eight passengers, and vehicles that carry more than 30 passengers will carry not more than 60% of their capacity, and,

- Food prices have remained relatively stable during the month with no major recorded changes. We, however, expect inflationary pressure to emanate from the locust invasion that has plagued the county since the end of 2019 greatly affecting the agricultural sector. The country is expecting a second wave of locust invasion and this is likely to cause a further increase in food prices which has a new weighting of 32.9% in the Consumer Price Index (CPI).

Rates in the fixed income market have remained relatively stable as the government rejects expensive bids. The government is 22.1% behind of its current domestic borrowing target of 404.4bn, having borrowed Kshs 266.5 bn against a prorated target of Kshs 342.2 bn. The uncertainty brought about by the novel Coronavirus will make it harder for the government to access foreign debt due to uncertainty affecting the global markets which might see investors attaching a high-risk premium on the country. A budget deficit is likely to result from the depressed revenue collection with the revenue target for FY’2019/2020 at Kshs 2.1 tn, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Owing to this uncertain environment, our view is that investors should be biased towards short-term fixed income securities to reduce duration risk.

Market Performance

During the week, the equities market recorded mixed performances, with NASI and NSE 20 declining by 0.1% and 0.3%, respectively, while the NSE 25 rose by 1.0%, taking their YTD performance to losses of 18.4%, 25.9%, and 22.6%, for the NASI, NSE 20 and NSE 25, respectively. The losses recorded by NSE 20 and NSE 25, breach the threshold of a bear market, which is a condition in which securities prices fall by 20.0% or more from recent highs over a sustained period of time. The performance of the NASI was driven by losses recorded by large-cap stocks such as BAT, Safaricom and Co-operative Bank of 7.2%, 1.6% and 0.4%, respectively.

Equities turnover increased by 76.8% during the week to USD 39.9 mn, from USD 22.5 mn recorded the previous week, taking the YTD turnover to USD 542.1 mn. Foreign investors remained net sellers for the week, with the net selling position increasing by 56.1% to USD 13.0 mn, from a net selling position of USD 8.4 mn recorded the previous week. The trend reflects the global equity markets with foreign investors disposing riskier assets in favor of safe havens.

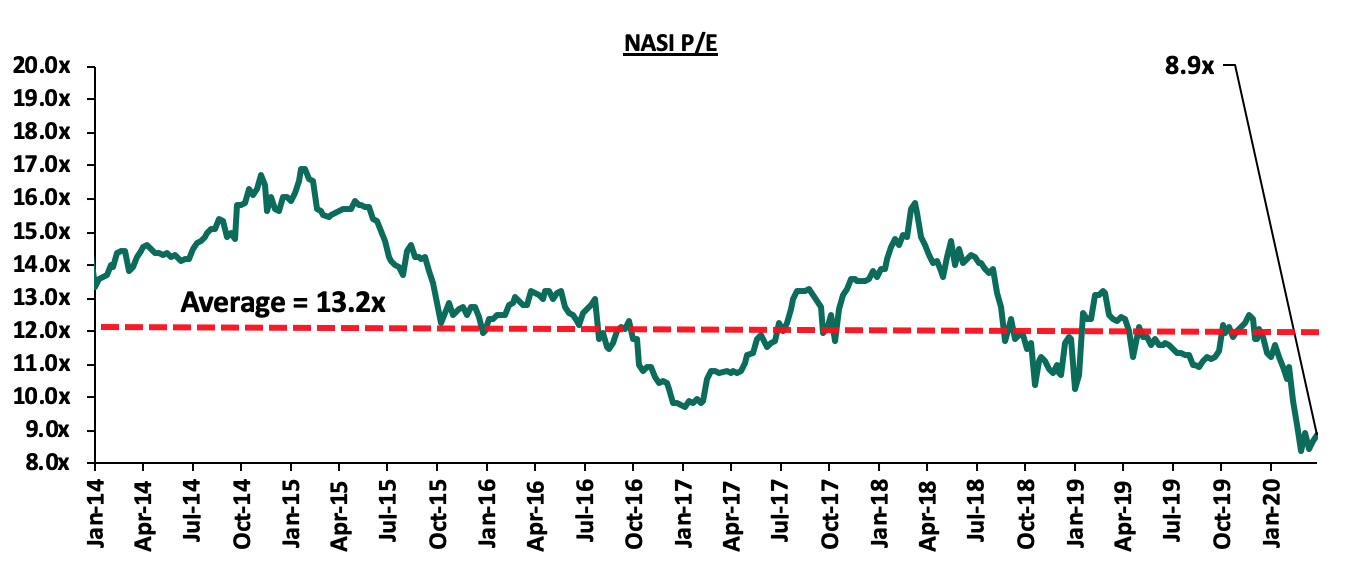

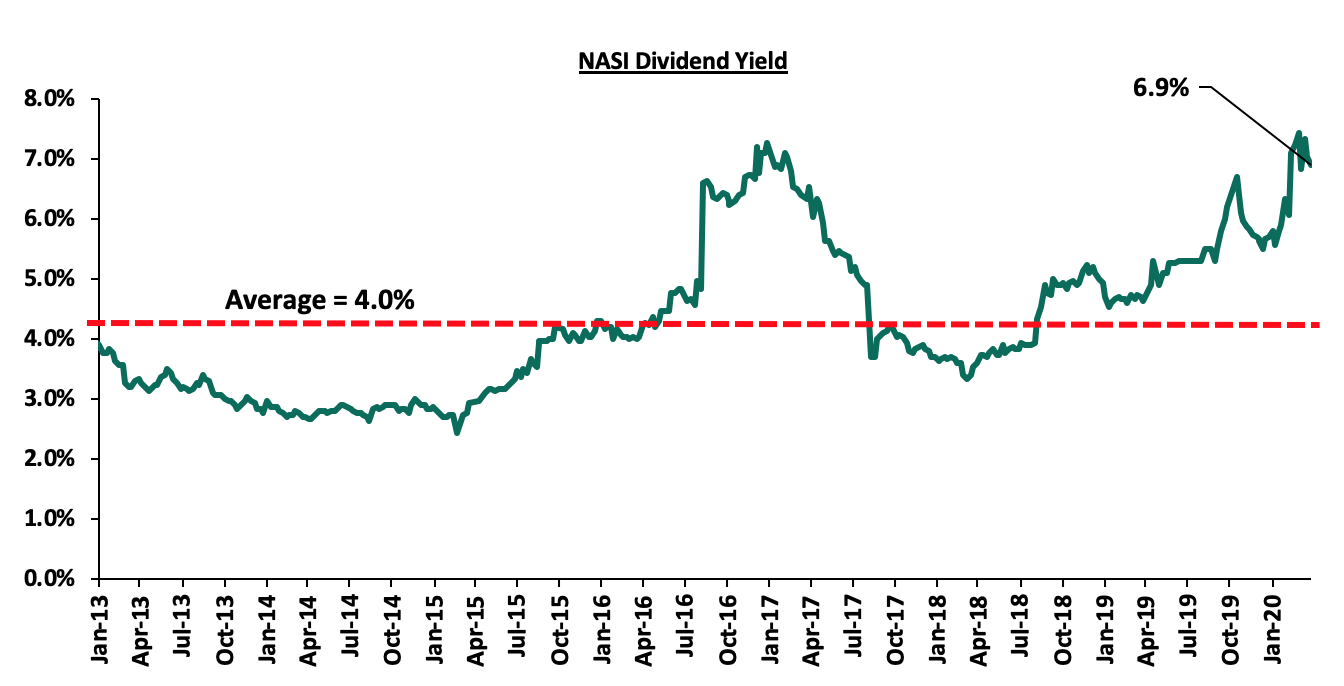

The market is currently trading at a price to earnings ratio (P/E) of 8.9x, 32.6% below the historical average of 13.2x, and a dividend yield of 6.9%, 2.9% points above the historical average of 4.0%. With the market trading at valuations below the historical average, we believe there is value in the market. The current P/E valuation of 8.9x is 8.4% below the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 7.1% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlight:

During the week, NCBA Group, the third-largest bank by assets in Kenya, with an asset base of Kshs 494.8 bn as at December 2019, announced it would withhold the final dividend payment of Kshs 1.5 per share, to shareholders totaling to Kshs 2.2 bn for FY’2019. The dividend was to be paid to shareholders registered on the company’s register at the close of business (book closure) on 23rd April 2020. The lender’s board instead has recommended the payment of a stock dividend (bonus Issue) and not a cash dividend, which will be issued to shareholders registered on the company’s register at the close of business on 12 May 2020. The bonus share issue will see shareholders receive one share for every ten held, creating 149.8 mn additional shares, given that the entity currently has 1.5 bn shares listed on the securities exchange. The additional shares are valued at Kshs 4.3 bn based on NCBA’s share price of Kshs 28.75 as at 24 April 2020. The stock dividend valued at Kshs 4.3 bn is more than what the lender would have paid in cash dividend of Kshs 2.2 bn and translates to Kshs 2.6 per share with a dividend yield of 9.1% at the current price of Kshs 28.75. In our view, the bonus issue is better for the shareholders of NCBA compared to the total dividend payout of Kshs 1.75, with the bank having recommended a final payout of Kshs 1.5 per share in addition to an interim of Kshs 0.25, and a dividend yield of 6.1% at the current price of Kshs 28.75. In addition, the Kshs 1.75 per share pay out was lower than the Kshs 2.1 per share, former Commercial Bank of Africa (CBA) shareholders earned in 2018 ahead of the merger.

The move by NCBA Group has been necessitated by the uncertainty caused by the ongoing global pandemic, which has prompted companies to hold onto cash in order to weather the financial turbulence caused by the pandemic. The move mirrors that of Nation Media Group (NMG) who also announced they would not pay out final dividends, instead, the group offered shareholders a bonus share issue of one share for every 10 held. This will create 18.9 mn additional shares, given the entity currently has 188.5 mn shares listed on the securities exchange, valued at Kshs 444.0 mn based on NMG’s share price of Kshs 23.55 as at 24 April 2020 and translates to Kshs 2.1 per share with a dividend yield of 8.9% at the current price of Kshs 23.55. NMG also announced the interim dividend of Kshs 1.5 per share will become the final dividend of the year, therefore in our view, the addition of the bonus issue is better for the shareholders, compared to only receiving the Kshs 1.5 per share. Below are some of the corporate actions, in relation to dividend payments, by companies listed in the stock exchange:

|

Company |

Corporate Action |

|

NCBA |

Suspends Cash Dividend, and does a Bonus Issue |

|

Nation Media Group |

Suspends Cash Dividend, and does a Bonus Issue |

|

Co-operative Bank |

Advanced payment of proposed dividends |

|

BAT Kenya |

Advanced payment of proposed dividends |

|

Kakuzi |

Advanced payment of proposed dividends |

Globally, both financial and non-financial businesses are frantically seeking ways to save money with several regulators around the world encouraging companies to cease the discretionary payments of dividends to shareholders amid the COVID-19 pandemic in order to boost capital. For instance, in the United Kingdom (UK), the seven largest banks sought to cancel dividend payouts despite having solid capital bases, due to fears of an economic recession. We expect more companies to take the same approach as NCBA and NMG and halt dividend payment, in the current environment of heightened uncertainty, so as to shore up their capital to enable them to retain their capacity to support and absorb losses.

During the week, the Central Bank of Kenya (CBK) announced the acquisition of a 51.0% stake in Mayfair Bank Limited by Egyptian lender, Commercial International Bank (CIB), effective 1st May 2020 for an undisclosed amount following CBK’s approval on 7th April 2020. The Central Bank of Kenya (CBK) welcomed the transaction, citing it will diversify and strengthen the resilience of the Kenyan banking sector. This is in line with our expectation of continued consolidation in the Kenyan banking sector as players with depleted capital positions become acquired by their larger counterparts or merge to form well-capitalized entities capable of navigating the relatively tough operating environment induced by stiff competition, as highlighted in our FY’2019 Banking Sector Report. In 2020, the banking sector has already witnessed two other acquisitions with the CBK giving a go-ahead to Nigerian lender, Access Bank PLC to acquire a 100% stake in Transnational Bank PLC for an undisclosed amount and Co-operative Bank of Kenya announcing it has opened talks to acquire 100.0% stake in Jamii Bora Bank Limited. Commercial International Bank, Egypt’s leading private sector bank, has an asset base of USD 24.2 bn (Kshs 2.5 tn) as at December 2019. CIB’s business model focusses on individuals, SMEs, institutions and corporates and will be the first Egyptian bank to establish a presence in Kenya. Mayfair Bank Limited, on the other hand, a tier III (category made up of 21 small banks that control 8.4% of the market and have a weighted index of below 1.0%) has an asset base of Kshs 8.7 bn as at December 2019. The deal will see CIB provide MLB with the requisite skills, resources and infrastructure to scale up its business. Below is a summary of the deals that have either happened, been announced or expected to be concluded. Transactions have been carried out at an average P/BV of 1.4x, compared to the current listed banking sector average of 1.0x:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs. Bns) |

Transaction Stake |

Transaction Value |

P/Bv Multiple |

Date |

|

Commercial International Bank |

Mayfair Bank Limited |

1.0 |

51.0% |

Undisclosed |

N/A |

May-20* |

|

Co-operative Bank |

Jamii Bora Bank |

3.4 |

100.0% |

Undisclosed |

N/A |

Mar-20* |

|

Access Bank PLC (Nigeria) |

Transnational Bank PLC |

1.9 |

100.0% |

Undisclosed |

N/A |

Jan-20** |

|

Oiko Credit |

Credit Bank |

3.0 |

22.8% |

1.0 |

1.5x |

Aug-19 |

|

KCB Group |

National Bank of Kenya |

7.0 |

100.0% |

6.6 |

0.9x |

Sep-19 |

|

CBA Group |

NIC Group |

33.5 |

53%:47% |

23.0 |

0.7x |

Sep-19 |

|

CBA Group** |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

Jan-19 |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

Jan-19 |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

Dec-18 |

|

SBM Bank Kenya |

Chase Bank Ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

Aug-18 |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

Mar-17 |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

Nov-16 |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

Jun-16 |

|

I&M Holdings |

Giro Commercial Bank |

3.0 |

100.0% |

5.0 |

1.7x |

Jun-16 |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

Mar-15 |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

Jul-14 |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

Nov-13 |

|

Average |

75.7% |

1.4x |

||||

|

*Announcement date ** Deals that were dropped |

||||||

Universe of Coverage

|

Banks |

Price at 17/04/2020 |

Price at 24/04/2021 |

w/w change |

YTD Change |

Year Open |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Diamond Trust Bank |

85.0 |

85.5 |

0.6% |

(21.6%) |

109.0 |

179.7 |

3.2% |

113.3% |

0.4x |

Buy |

|

Kenya Reinsurance |

2.5 |

2.6 |

2.8% |

(14.2%) |

3.0 |

4.8 |

4.2% |

88.8% |

0.2x |

Buy |

|

Jubilee Holdings |

281.5 |

271.3 |

(3.6%) |

(22.7%) |

351.0 |

453.4 |

3.3% |

70.5% |

0.9x |

Buy |

|

Equity Group*** |

33.0 |

34.6 |

5.0% |

(35.3%) |

53.5 |

55.3 |

7.2% |

67.1% |

1.2x |

Buy |

|

KCB Group*** |

34.6 |

36.6 |

5.8% |

(32.2%) |

54.0 |

55.8 |

9.6% |

62.0% |

0.9x |

Buy |

|

Co-op Bank*** |

12.4 |

12.4 |

(0.4%) |

(24.5%) |

16.4 |

18.2 |

8.1% |

55.5% |

1.0x |

Buy |

|

I&M Holdings*** |

52.8 |

51.3 |

(2.8%) |

(5.1%) |

54.0 |

73.6 |

5.0% |

48.6% |

0.7x |

Buy |

|

Sanlam |

15.0 |

15.0 |

0.0% |

(12.8%) |

17.2 |

21.7 |

0.0% |

44.7% |

1.3x |

Buy |

|

NCBA |

28.2 |

28.8 |

2.1% |

(22.0%) |

36.9 |

39.4 |

0.9% |

37.9% |

0.7x |

Buy |

|

ABSA Bank*** |

10.3 |

10.6 |

3.4% |

(20.6%) |

13.4 |

12.6 |

10.4% |

29.2% |

1.2x |

Buy |

|

Standard Chartered |

186.5 |

193.3 |

3.6% |

(4.6%) |

202.5 |

223.6 |

10.3% |

26.1% |

1.4x |

Buy |

|

Stanbic Holdings |

95.0 |

95.0 |

0.0% |

(13.0%) |

109.3 |

109.8 |

7.4% |

23.0% |

1.0x |

Buy |

|

Liberty Holdings |

8.4 |

8.2 |

(1.9%) |

(20.8%) |

10.4 |

10.1 |

0.0% |

22.7% |

0.7x |

Buy |

|

CIC Group |

2.2 |

2.2 |

0.5% |

(19.0%) |

2.7 |

2.6 |

0.0% |

21.6% |

0.8x |

Buy |

|

HF Group |

4.2 |

4.1 |

(2.4%) |

(37.3%) |

6.5 |

4.3 |

0.0% |

6.2% |

0.2x |

Hold |

|

Britam |

6.7 |

6.7 |

0.0% |

(25.6%) |

9.0 |

6.8 |

3.7% |

4.5% |

0.7x |

Lighten |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Positive” on equities for investors as the sustained price declines have seen the market P/E decline to below its historical average and as such, we believe that investors should take advantage of the current attractive valuations in the market.

- Retail Sector

During the week, Naivas Supermarket, a local retailer, opened a new branch in Kilimani. The store, which is located at Kilimani Mall along Tigoni Road, covers 10,000 SQFT (according to online sources) and marks its 64th store and also the third to be launched this year by the retailer after Kamakis along the Eastern Bypass and Mountain View along Waiyaki Way, opened in the months of January and March, respectively, with plans underway to open a branch in Imara Daima in Nairobi in the coming months. This comes after the retailer sold 30% of its stake to a global consortium that includes, International Finance Corporation (IFC) and French private equity firm, Amethis Finance, among other investors, for Kshs 1.5 bn. We expect the foreign investment will enhance the retailer’s efficiency, governance while offering the financial boost required for the ambitious expansion drive. Other factors that have enabled the retailer’s countrywide growth include:

- Supportive demographic trends characterized by a rapidly growing urban population at an annual rate of 4.3% as per the World Bank,

- Rising consumerism owing to an expanding middle class, which according to research firm, Sagaci, is expected to grow by a 4-year CAGR of 5.6%, in Nairobi alone, creating a niche for both local and international retailers alike, and

- Continued investment in infrastructure, which has encouraged growth in residential neighbourhoods thus, increasing the need for formal retail.

With Kenya’s consumer culture continuing to evolve towards formal retail, which currently stands at 35.0% in comparison to markets like South Africa with 60.0%, the opportunity for mall developers lies in residential areas with high shopping populations and low mall space. To attract tenancy, developers should also ensure that the location is prime, and easily accessible so as to attract footfall. Areas such as Kilimani remain an attractive investment market for the retail sector. The area has registered a marked population growth owing to the relaxed zoning regulations allowing for higher densities, this has encouraged real estate developers to invest in high rise apartment blocks and commercial offices, making it one of the most densely populated and mixed-use regions in Nairobi. It is also well endowed with both infrastructure and amenities given its proximity to the CBD and is an upper middle-income neighborhood, hosting individuals with a relatively high purchasing power.

According to the Cytonn Real Estate Report Q1’2020, Kilimani area recorded the highest occupancy at 85.5%, indicating retailer confidence in the area, attributed to the factors mentioned above.

(All values in Kshs unless stated otherwise)

|

Nairobi Metropolitan Area (NMA) Retail Submarket Performance Q1'2020 |

||||

|

Location |

Rent/SQFT Q1’ 2020 |

Occupancy Q1’ 2020 |

Rental Yield |

|

|

Westlands |

210.3 |

82.2% |

10.0% |

|

|

Karen |

220.0 |

81.9% |

9.6% |

|

|

Ngong Road |

186.3 |

80.5% |

8.5% |

|

|

Kilimani |

164.2 |

85.5% |

8.5% |

|

|

Kiambu Road |

175.4 |

70.3% |

7.3% |

|

|

Thika Road |

170.4 |

73.0% |

7.0% |

|

|

Eastlands |

148.2 |

71.8% |

6.8% |

|

|

Mombasa Road |

152.5 |

69.3% |

6.4% |

|

|

Satellite town |

135.0 |

74.5% |

6.0% |

|

|

Average |

172.7 |

76.3% |

7.7% |

|

Source; Cytonn Research 2020

Amid the spread of the Coronavirus, we expect to see retailers invest in their e-commerce infrastructure and also decentralize to locations that are easily accessible from people’s homes.

During the week, Tuskys, a local supermarket chain in Kenya announced the temporary closure of three of its branches in Nairobi, Kitale, and Mombasa. The move by Tuskys is aimed at consolidating its services to other branches which are more spacious to implement social distancing and personal hygiene measures more effectively. The affected branches include Tuskys Tom Mboya branch, Tuskys Kitale Mega Branch, and Tuskys Digo Branch. The retail sector in Kenya is one of the sectors that has been hit by the spread of Coronavirus as individuals are limiting themselves from going to retail stores and malls as a way of implementing the social distancing rules. However, major retailers are increasingly opting to use e-commerce as a way to serve their customers i.e French-based retailer Carrefour, Tuskys and Naivas have deals with e-commerce giant Jumia while Naivas and Zucchini use Spanish delivery firm Glovo. Coronavirus has presented a downside risk for the retail sector, however, the ultimate impact of the virus remains uncertain. Occupancy rates of major retail centers are expected to drop during this period as most retailers are shutting down their operations to cushion themselves against the impact of the Coronavirus. There is an expected reduced demand for services from retailers during this period mainly because the purchasing power of individuals has been affected during these tough economic times.

- Statutory Review

During the week, new amendments to the Retirement Benefits Act were passed into law, under the Tax Amendments Act 2020, which was assented on 25th April 2020 by President Uhuru Kenyatta. The Act allows the use of pension savings towards purchasing a residential home or securing a mortgage loan. Previously, the law only allowed the use of up to 60.0% of accumulated pension savings as mortgage collateral. While the Act does not dictate how salaried individuals will access the funds for home purchase, Kenya could use South Africa and Singapore as case studies. In South Africa, the Pension Funds Act allows an individual to access direct loans for housing purposes using their accumulated capital in the pension fund as a guarantee against a home loan covering up to 90% of the home value, while in Singapore, they allow for direct withdrawals of up to 120% of the home value. The new law will come as a boost to the Government’s big four agenda, which aims to improve homeownership rates and alleviate the current housing deficit of 2.0 mn units. Access to housing finance in Kenya remains a key challenge with mortgages remaining out of reach for the majority of the population. As of December 2018, Kenya had relatively low mortgage uptake with 26,504 active accounts according to the Central Bank of Kenya, attributable to lender’s strict underwriting rules, and relatively high-interest rates. The Kenyan Government, past and incumbent, has previously put in place measures to improve homeownership in the country. Some of the measures included;

- Increase of tax rebates issued to depositors to Kshs 96,000 from Kshs 48,000 annually (Kshs 8,000 per month from Kshs 4,000 per month) as per the initial Home Ownership Savings Plan (HOSP) regulations in 1995,

- Incorporation of the Kenya Mortgage Refinancing Company (KMRC) whose main function is enhancing mortgage affordability by creating liquidity for mortgage lenders, see our KMRC Topical

- Tax relief for mortgage borrowers on interests paid to a registered financial institution of up to a maximum of Kshs 300,000 per annum.

In our view, this is a step in the right direction towards providing alternative home financing solutions. With 20.0% per cent of Kenyan workforce enrolled in a pension scheme, successful implementation of the bill would lead to diversification of sources of funds to be used in purchasing residential houses by Kenyans, which will, in turn, improve homeownership in the country.

In light of the effects of the COVID-19 pandemic on the Kenyan economy, we retain a neutral outlook towards the performance of the real estate sector. However, we expect the sector to continue being supported by the continued investor confidence in sectors such as retail in addition to supportive government policies.

In 2019, we released the Nairobi Metropolitan Area (NMA) Commercial Office Report 2019, which highlighted the state of the commercial office market in terms of supply, demand, performance, and investment opportunities within the sector. According to the report, the sector recorded a 0.2%-points and 0.7%-points y/y increase in average rental yields and occupancy rates, to 8.1% and 83.3%, respectively, on account of an improved macroeconomic environment and the continued positioning of the Nairobi Metropolitan Area (NMA) as a regional hub, thus attracting investors who require office spaces.

This week, we update our report based on research conducted in 9 nodes in the Nairobi Metropolitan Area Commercial Office Market by looking at the following:

- Overview of the Commercial Office Sector,

- Commercial Office Supply in the Nairobi Metropolitan Area,

- Commercial Office Performance, by Location and by Grades, and,

- Office Market Outlook and the Investment Opportunity in the Sector.

Section I: Overview of the Commercial Office Sector

The Nairobi Metropolitan Area (NMA) commercial office market continues to be facilitated by the country’s economic climate with office tenants both large and small continuing to drive current demand levels. Demand for office spaces has been primarily driven by the growth of Small and Medium-Sized Enterprises (SMEs) and the entry of multinational corporations.

Some of the factors that have continued to drive the commercial office sector include:

- Kenya’s Growing Presence as a Regional Hub - Kenya’s ranking in the World Bank Ease of doing Business Report, has improved over time, improving by 19 positions to #61 in 2019, from #80 in 2018, and to #56 in 2020. The continued rise in ranking is attributed to the continued strengthening of access to credit, protection of minority investors and ease of paying taxes by merging all permits into a single unified business permit, and,

- Increased Entry of Multinational Corporations - Office space demand has persistently increased over time due to the entry of multinational corporations, therefore leading to increased development of commercial office spaces. Some of the multinational corporations that opened regional offices in 2019 include Cigna, a global health service company, MAC Mobile, an FMCG technology solutions company, Mauritius Commercial Bank (MCB) Group and Abbott, a US-based healthcare company, respectively,

Nevertheless, the sector continues to face challenges, mainly:

- The COVID-19 Pandemic - The current COVID-19 pandemic has slow down foreign investments as firms globally have put on hold expansion plans in anticipation of market developments. Also, the ongoing human movement restrictions due to the coronavirus have affected office demand reducing occupancies as several firms have resorted to working remotely,

- Insufficient Access to Finance - There was insufficient access to financing with private sector credit growth coming in at 7.1% in December 2019 compared to a 5-year (2013-2018) average of 14.0%. This affected the growth of SMEs in the country as some reduced the scale of operations and others cut down on expansion plans and thus reduced demand for office space,

- Oversupply in the Sector - Office space oversupply stood at 6.3 mn SQFT in 2019, a 21.6% increase from 5.2 mn in 2018, creating a bargaining chip for tenants by forcing developers to reduce or maintain prices and rents to remain competitive and attract occupants to their office spaces,

- Delay in the Processing of Construction Permits - Delays in the processing of construction permits by some county governments such as Nairobi and Kiambu, affected developers by prolonging project implementation timelines and increasing construction and fit-out costs for firms, and

- Insufficient Infrastructure - The rate of real estate development and increased commercial activity has by far exceeded the rate of infrastructural improvement causing strains on the trunk infrastructure driving up real estate development costs as developers resort to financing any infrastructural inadequacies.

Section II: Commercial Office Supply in the Nairobi Metropolitan Area

In 2019, total office stock in Nairobi increased by 2.2% to 36.3 mn SQFT, from 35.5 mn SQFT in 2018. However, the 1.5 mn SQFT of office stock delivered into the market in 2019, was 65.1% lower than in 2018, attributed to the delays in the issuance of approvals by the Nairobi County Government which resulted in a slowdown in construction activities.

Some of the notable office completions during the review period included:

|

Major Commercial Office Completions in 2019 |

|||

|

|

Office Development |

Location |

Size (SQFT) |

|

1 |

The Address |

Westlands |

243,000 |

|

2 |

Garden City Business Park (Phase I) |

Thika Road |

134,160 |

|

3 |

1 Park Avenue |

Parklands |

133,000 |

|

4 |

The Arch Place |

Kilimani |

120,000 |

|

5 |

Kenya Institute of Supplies Management(KISM) |

Kilimani (Ngong Road) |

105,000 |

|

6 |

Laxcon |

Westlands |

100,000 |

|

7 |

Capital Square |

Parklands |

90,000 |

|

8 |

19 Kabasarian Avenue |

Kilimani(Lavington) |

76,600 |

|

Total |

|

1,001,760 |

|

Source: Cytonn Research 2019, Knight Frank 2019

Office space supply has grown at 7-year CAGR of 24.7% to 36.3 mn SQFT in 2019, from 7.7 mn SQFT in 2012, driven by the positioning of Nairobi as a regional hub, thus increased entrance of multinationals as well as the growth of Small and Medium Enterprises (SMEs).

In 2019, the market had a supply of 6.7 mn SQFT against a demand of 0.3 mn SQFT, resulting in an oversupply of 6.3 mn SQFT. Demand was lowest in 2019 due to a tough economic environment and insufficient access to financing that affected the growth of SMEs in the country. Over the next few years, we expect a reduced rate of supply to a 2-year CAGR of 6.9% attributed to a market correction as the forces of demand and supply come into play.

The table below summarizes the commercial office space supply over time:

|

Commercial Office Space Supply Analysis (2011-2019) |

||||||||||||

|

Year |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020F |

2021F |

2022F |

|

Stock ( Mn SQFT) |

6.7 |

7.7 |

9.7 |

15.4 |

22.9 |

28.9 |

31.8 |

35.5 |

36.3 |

36.9 |

37.5 |

38.0 |

|

Completions ( Mn SQFT) |

1.2 |

2.1 |

5.9 |

7.8 |

6.5 |

3.5 |

4.3 |

1.5 |

1.4 |

1.3 |

1.3 |

|

|

Vacancy Rate (%) |

9.0% |

9.0% |

10.0% |

10.0% |

11.0% |

12.0% |

16.8% |

16.7% |

19.5% |

19.9% |

20.2% |

20.6% |

|

Vacant Stock ( Mn SQFT) |

0.6 |

0.7 |

1.0 |

1.5 |

2.5 |

3.5 |

5.3 |

5.9 |

7.1 |

7.2 |

7.3 |

7.4 |

|

Occupied Stock (Mn SQFT) |

6.1 |

7.1 |

8.8 |

13.9 |

20.3 |

25.4 |

26.5 |

29.6 |

29.2 |

29.7 |

30.2 |

30.6 |

|

Net Absorption |

1.0 |

1.7 |

5.1 |

6.5 |

5.1 |

1.0 |

3.1 |

(0.4) |

0.5 |

0.5 |

0.4 |

|

|

Demand (mn SQFT) |

1.1 |

1.9 |

5.3 |

6.8 |

5.6 |

1.6 |

3.7 |

0.3 |

1.3 |

1.2 |

1.2 |

|

|

Available Supply, AS(T) |

1.7 |

2.6 |

6.5 |

8.8 |

8.4 |

6.3 |

9.0 |

6.7 |

7.7 |

7.8 |

7.8 |

|

|

Under(Over)supply |

|

(0.5) |

(0.8) |

(1.2) |

(2.1) |

(2.9) |

(4.7) |

(5.2) |

(6.3) |

(6.5) |

(6.6) |

(6.7) |

|

||||||||||||

Source: Cytonn Research 2019, Building Plan Approvals Data from the Nairobi City County

Section III: Commercial Office Performance, by Location and by Grades

The commercial office sector performance softened in 2019 recording a 0.7%-points decline in average rental yields to 7.7% in 2019 from 8.3% in 2018. Occupancy rates declined by 3.3%-points to 80.5% in 2019, from 83.8%, in 2018. Asking rents declined by 4.3% to an average of Kshs 97 per SQFT from Kshs 101 per SQFT in 2018. The subdued performance was largely driven by:

- An introduction of 1.5 mn SQFT office space to the market resulting to an oversupply of 6.3 mn SQFT which has created a bargaining chip for potential tenants, forcing developers and landlords to reduce or maintain prices and rents to remain competitive and attract occupants to their office spaces, and,

- A decline in uptake of office space attributed to a challenging financial environment, leading to downsizing or business closures, especially for small and medium-sized enterprises (SMEs).

The table below summarizes the performance of the commercial office theme over time:

(All Values in Kshs Unless Stated Otherwise)

|

Commercial Office Market Performance Summary (2013 – 2019) |

||||||||

|

Year |

2013 |

2015 |

2016 |

2017 |

2018* |

2019 |

y/y ∆ 2018 |

y/y ∆ 2019 |

|

Occupancy (%) |

90.0% |

89.0% |

88.0% |

82.6% |

83.8% |

80.5% |

1.2% points |

(3.3%) points |

|

Asking Rents (Kshs/SQFT) |

95.0 |

97.0 |

103.0 |

101.0 |

101.4 |

97.2 |

0.4% |

(4.3%) |

|

Average Prices (Kshs/SQFT) |

12,433 |

12,776 |

13,003 |

12,649 |

12,407 |

12,552 |

(1.9%) |

1.2% |

|

Average Rental Yields (%) |

8.3% |

8.1% |

8.4% |

7.9% |

8.3% |

7.7% |

0.4% points |

(0.7%) points |

|

*Average rental yields for 2018 restated to include additional 2018 office completions

|

||||||||

Source: Cytonn Research 2019

- Commercial Office Performance by Nodes

For submarket analysis, we classified the main office nodes in the Nairobi Metropolitan Area into 9 nodes: i) Nairobi CBD, ii) Westlands, covering environs including Riverside, iii) Parklands, iv) Mombasa Road, v) Thika Road, vi) Upperhill, vii) Karen, viii) Gigiri, and ix) Kilimani, which includes offices in Kilimani, Kileleshwa and Lavington.

Gigiri, Karen and Westlands were the best performers in 2019 recording rental yields of 9.2%, 8.3%, and 8.3%, respectively, attributed to increased demand by businesses and multinational companies due to their proximity to the Central Business District (CBD) and other business nodes, relatively good infrastructure network, their superior locations and availability of quality Grade A offices, enabling them to charge a premium on rentals.

Thika Road and Mombasa Road were the worst performers recording rental yields of 6.3% and 5.5%, respectively, attributed to; (i) poor location as a result of traffic congestions, (ii) the Mombasa Road’s zoning for industrial use, and (iii) lower quality office space. This made the locations generally unattractive to firms.

The Nairobi Metropolitan Area sub-market office performance is as summarized in the table below:

(All Values in Kshs Unless Stated Otherwise)

|

Commercial Office Market Performance by Node 2018 - 2019 |

|||||||||||

|

Nodes |

Price Kshs/ SQFT 2019 |

Rent Kshs/ SQFT 2019 |

Occupancy 2019(%) |

Rental Yield (%) 2019 |

Price Kshs/ SQFT 2018 |

Rent Kshs/SQFT 2018 |

Occupancy 2018(%) |

Rental Yield (%) 2018 |

∆ Rent Y/Y |

∆ Occupancy Y/Y (% points) |

∆ Rental Yields Y/Y (% points) |

|

Gigiri |

13,833 |

117 |

80.4% |

9.2% |

13,833 |

123 |

85.0% |

10.0% |

(5.1%) |

(4.6%) |

(0.8%) |

|

Karen |

13,665 |

111 |

85.3% |

8.3% |

13,666 |

118 |

88.6% |

9.2% |

(6.5%) |

(3.2%) |

(0.9%) |

|

Westlands |

12,370 |

104 |

80.3% |

8.3% |

12,050 |

110 |

82.1% |

9.0% |

(5.2%) |

(1.8%) |

(0.7%) |

|

Parklands |

12,369 |

97 |

83.1% |

8.2% |

12,494 |

102 |

86.0% |

8.4% |

(4.8%) |

(2.9%) |

(0.2%) |

|

UpperHill |

12,397 |

98 |

80.0% |

7.5% |

12,560 |

100 |

84.0% |

8.2% |

(1.3%) |

(4.0%) |

(0.7%) |

|

Kilimani |

12,680 |

91 |

80.9% |

7.1% |

13,173 |

99 |

88.3% |

8.0% |

(8.5%) |

(7.4%) |

(0.9%) |

|

Nairobi CBD |

12,425 |

89 |

85.6% |

7.1% |

10,875 |

82 |

88.3% |

7.6% |

(7.5%) |

(2.7%) |

(0.5%) |

|

Thika Road |

12,600 |

84 |

80.4% |

6.3% |

12,517 |

86 |

81.5% |

6.7% |

(2.4%) |

(1.0%) |

(0.4%) |

|

Msa Road |

11,400 |

73 |

66.5% |

5.5% |

11,400 |

79 |

65.6% |

5.8% |

(8.2%) |

0.9% |

(0.3%) |

|

Grand Total |

12,638 |

97 |

80.3% |

7.5% |

12,507 |

101 |

83.8% |

8.3% |

(4.3%) |

(3.2%) |

(0.7%) |

|

|||||||||||

Source: Cytonn Research 2019

- Commercial Office Performance by Class/Grade:

Commercial office buildings are classified into three main categories based on the size and quality of office spaces. These are:

- Grade A: Office buildings with a total area ranging from 100,001 - 300,000 square feet that are pacesetters in establishing rents and that generally have ample natural good lighting, good views, prestigious finishing, and on-site undercover parking, and a minimum parking ratio of 3:1000 SQFT,

- Grade B: Office buildings with a total area ranging from 50,000 to 100,000 SQFT. They have good (but lower than Grade A) technical services and ample parking space, and,

- Grade C: These are buildings of any size, usually older, and in need of renovation, they lack lobbies and may not have on-site parking space. They charge below average rental rates.

The performance of the commercial sector softened with declines recorded across all the grades. This is largely attributed to oversupply which stood at 6.3 mn SQFT as at 2019. Commercial offices recorded an average rental yield of 7.7% at an average occupancy of 80.5%, monthly rental charges of Kshs 97 per SQFT, and price per SQFT of Kshs. 12,552.

Grade B office spaces recorded the highest rental yields at 7.9% as tenants prefer them due to their lower asking prices and similar amenities to grade A offices.

Despite declines recorded across all grades, grade A offices recorded the least declines in occupancy and rental yields at 0.4%-points and 0.6%-points, respectively, attributable to its preference by large firms. Their performance was slightly cushioned by the entry of various multinationals in the country in 2019 who prefer grade A offices due to their quality finishes, ample parking space, and high-end technical services.

The performance according to grades/class is as summarized in the table below:

(All Values in Kshs Unless Stated Otherwise)

|

Commercial Office Market Performance by Grade (2018 – 2019) |

|||||||||||

|

Office Grade |

Price 2019 Kshs/ SQFT |

Rent 2019 (Kshs/SQFT) |

Occupancy 2019 (%) |

Yield 2019(%) |

Price 2018 Kshs/ SQFT |

Rent 2018 (Kshs/SQFT) |

Occupancy 2018(%) |

Yield 2018 (%) |

∆ Rent Y/Y |

∆ Occupancy Y/Y (% points) |

∆ Rental Yields Y/Y (% points) |

|

Grade A |

12,860 |

105 |

73.8% |

7.4% |

13,070 |

111 |

74.1% |

7.9% |

(6.3%) |

(0.4%) |

(0.6%) |

|

Grade B |

12,706 |

99 |

82.7% |

7.9% |

12,388 |

102 |

86.1% |

8.5% |

(3.3%) |

(3.4%) |

(0.7%) |

|

Grade C |

10,920 |

82 |

80.4% |

7.2% |

10,920 |

85 |

87.0% |

7.9% |

(3.5%) |

(6.6%) |

(0.7%) |

|

Average |

12,552 |

97 |

80.5% |

7.7% |

12,407 |

101 |

83.8% |

8.3% |

(4.3%) |

(3.2%) |

(0.7%) |

|

|||||||||||

Source: Cytonn Research 2019

- Commercial Office Performance by Class and Node:

For Grade A offices in 2019, Gigiri and Karen offered the highest returns with average rental yields of 10.1% and 8.8%, respectively, as they enjoy a superior location characterized by a serene environment and low-rise developments.

For Grade B, Westlands and Karen offer the highest rental yield of 8.7% and 8.2%, respectively, due to the locations remaining as major priority areas for businesses, and hence offer an investment opportunity in the market.

For Grade C, Parklands and Westlands offer the highest average rental yields at 9.0% and 7.9%, respectively, attributed to preference by Small and Medium Enterprises (SMEs) as a result of more affordable rates compared to Grade A and B rates.

The performance according to class and node is as summarized in the table below with the best performing areas of each grade highlighted in yellow:

|

Commercial Office Performance in 2019 by Nodes and Grades |

||||||

|

Typology |

Grade A |

Grade B |

Grade C |

|||

|

Location |

Rental Yield (%) |

Occupancy (%) |

Rental Yield (%) |

Occupancy (%) |

Rental Yield (%) |

Occupancy (%) |

|

Gigiri |

10.1% |

81.3% |

7.9% |

79.0% |

|

|

|

Karen |

8.8% |

87.0% |

8.2% |

84.9% |

|

|

|

Parklands |

7.3% |

75.0% |

8.1% |

82.0% |

9.0% |

91.4% |

|

Westlands |

7.2% |

72.6% |

8.7% |

81.2% |

7.9% |

86.4% |

|

UpperHill |

6.9% |

69.1% |

7.9% |

85.1% |

6.6% |

82.5% |

|

Kilimani |

7.2% |

70.0% |

7.2% |

81.7% |

6.2% |

92.0% |

|

Msa Road |

6.0% |

79.0% |

6.3% |

71.3% |

4.8% |

58.6% |

|

Thika Road |

4.9% |

60.0% |

6.5% |

84.6% |

6.6% |

80.0% |

|

Nairobi CBD |

|

|

7.2% |

86.7% |

6.8% |

79.5% |

|

· Gigiri and Karen offered the highest returns with average rental yields of 10.1% and 8.8%, respectively · For Grade B, Westlands and Karen offer the highest rental yield of 8.7% and 8.2%, respectively |

||||||

Source: Cytonn Research 2019

- Serviced Offices Performance

Serviced (or shared) office spaces refer to fully furnished and equipped office spaces that are managed by a facility management company. Serviced offices have continued to gain popularity and account for approximately 0.9% of the total stock in the NMA commercial office market. Some of the new serviced office supplies in 2019 include (i) Nairobi Garage opening at Watermark Business Park in Karen, (ii) Kofisi, a subsidiary of Sunbird Group, which opened at 45 Africa Reit in Karen, and (iii) Workable Nairobi at Sanlam Towers in Westlands.

In 2019, serviced offices recorded yields of 12.3%, 4.3%-points higher than the un-serviced offices' yield of 8.0%. This is attributed to the attractiveness of the office setup to small businesses, start-ups and freelancers due to; (i) flexibility of the leases as they could range for short periods, (ii) no set-up costs required, and, (iii) opportunities for collaboration with other individuals/businesses in a competitive working environment.

The performance of serviced and unserviced offices is as summarized in the table below:

(All Values in Kshs Unless Stated Otherwise)

|

Serviced and Un-serviced Office Performance Comparison 2019 |

||||||

|

Location |

Revenue Per SQFT |

Occupancy (%) |

Yield |

|||

|

|

Serviced Offices |

Un-serviced Offices |

Serviced Offices |

Un-serviced Offices |

Serviced Offices |

Un-serviced Offices |

|

Westlands |

248 |

104 |

81.2% |

80.3% |

15.9% |

8.3% |

|

Upperhill |

199 |

98 |

79.7% |

80.0% |

12.2% |

7.5% |

|

Karen |

186 |

111 |

70.0% |

85.3% |

8.7% |

8.3% |

|

Average |

211 |

104 |

77.0% |

81.9% |

12.3% |

8.0% |

|

||||||

Source: Cytonn Research 2019

Section IV: Office Market Outlook and the Investment Opportunity in the Sector

In conclusion: having looked at supply, demand, and investor returns, we have a general NEGATIVE outlook for the commercial office sector theme in Nairobi Metropolitan Area (NMA) given the increased office space supply and expected stagnation in performance in 2020 depending on how fast the Coronavirus is contained. However, we expect a slowdown in construction activities allowing the existing demand to absorb the current supply in the long-run. The investment opportunity is in zones with low supply and high returns such as Gigiri and differentiated concepts such as MUDs and serviced offices recording rental yields of up to 7.9% and 12.3%, respectively.

The table below summarizes metrics that have a possible impact on the commercial office sector, that is the office space supply, performance, office space demand, and concluding with the market opportunity/outlook in the sector:

|

Commercial Office Outlook 2020 |

||||

|

Measure |

2018 Sentiment |

2019 Sentiment and 2020 Outlook |

2019 Review |

2020 Outlook |

|

Supply |

· We had an oversupply of 5.2 mn SQFT of office space in 2018, and it was expected to grow by 7.6% to 5.6 mn SQFT in 2019, compared to 10.8% in 2018 due to decreasing supply with completions expected to decrease by 21.4% from 4.3 mn SQFT to 3.4 mn SQFT in 2019 |

· We had an oversupply of 6.3 mn SQFT of office space in 2019, and it is expected to grow by 1.9% to 6.5 mn SQFT in 2020 due to reduced activity as a result of the COVID-19 pandemic and delay of approvals by the Nairobi County Government |

Negative |

Negative |

|

Demand |

· There was increased demand for office space in the Nairobi Metropolitan Area (NMA) evidenced by the 0.7% y/y increase in occupancy mainly attributable to political stability that has led to increased economic activities, positioning of the NMA as a regional hub and thus increased entrance of multinationals and improving macroeconomic environment, with the GDP growing at 6.0% in Q3’2018, higher than the 4.7% recorded in Q3’2017, and expected to close at 5.8% for the year 2018 |

· There was reduced demand for office space in the Nairobi Metropolitan Area (NMA) evidenced by the 3.3% y/y decline in occupancy mainly attributable to an oversupply and minimal growth in private sector credit. However, there exists demand in differentiated concepts such as serviced offices from start-ups and multinational firms due to their ability to offer flexible lease agreements and office space |

Neutral |

Neutral |

|

Office Market Performance |

· The performance of the office market improved with yields increasing by 0.2%-points to 8.1% in 2018 from 7.9% in 2017, and occupancy rates increased by 0.7%-points from 82.6% in 2017 to 83.3% in 2018 |

· Performance softened in 2019 recording 0.7%-points and 3.3%-points y/y decline in average rental yields and occupancy rates, to 7.7% and 80.5% in 2019, from 8.3% and 83.8%, in 2018, respectively. We expect rental prices to drop slightly over the short term due to downward pressure arising from the decline in effective demand from the existing oversupply in the market |

Neutral |

Negative |

|

We have a negative outlook for the commercial office theme in the Nairobi Metropolitan Area (NMA) given the increased office space supply and expected stagnation in performance in 2020 depending on how fast the Coronavirus is contained. However, we expect a slowdown in construction activities allowing the existing demand to absorb the current supply Investments should be made in zones with low supply and high returns such as Gigiri and in differentiated concepts such as MUDs and serviced offices recording rental yields of up to 7.9% and 12.3%, respectively, to boost returns |

||||

For 2020, our outlook for the commercial office sector is NEGATIVE with two out of three metrics we looked at being negative and one metric being neutral. Due to an oversupply of office space and the uncertainty brought about by the novel Coronavirus, investments in the sector should, therefore, be aimed towards long-term gains when the market picks up. The investment opportunity is in mixed-use developments (MUDs) and serviced offices that attract yields of 7.9% and 12.3%, respectively. We continue to track the performance of the office sector, and as per our Cytonn Q1’2020 Markets Review, the sector recorded 0.3% and 1.5%-points increase in average rental yields and occupancy rates, to 7.8% and 81.7%, respectively, an indicator of slow recovery. For more information click here. For the full Commercial Office Report 2020, click here.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.