Privatization of State Enterprises, & Cytonn Weekly #12/2023 Executive Summary

By Research Team, Mar 26, 2023

Executive Summary

Fixed Income

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 49.2%, a significant decline from the 121.6% recorded the previous week, attributable to persisting tightened liquidity in the money market with the average interbank rate increasing to 7.2% from 6.9% recorded the previous week. The last time interbank rate was this high was in October 2019. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 7.1 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 179.4%, albeit slightly lower than the 182.3% recorded the previous week. Notably, the 182-day and 364-day papers recorded undersubscriptions of 36.9% and 9.3% from an oversubscription rate of 174.7% and an undersubscription rate of 44.3% respectively, recorded the previous week. The government accepted bids worth Kshs 11.5 bn and rejected Kshs 0.3 bn out of the total Kshs 11.8 bn bids received, translating to an acceptance rate of 97.5%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day paper, 182-day and 91-day papers increasing by 1.0 bps, 5.9 bps and 4.9 bps to 10.8%, 10.3% and 9.8%, respectively;

We are projecting the y/y inflation rate for March 2023 to ease to a range of 8.6% - 9.0%;

During the week, the Central Bank of Kenya announced the issuance of the Foreign Exchange Code (the FX Code) on 22nd March 2023 to commercial banks, in a move to regulate wholesale transactions of the foreign exchange market in Kenya;

Additionally, the Monetary Policy Committee (MPC) is set to meet on Wednesday, 29th March 2023, to review the outcome of its previous policy decisions and recent economic developments, and to decide on the direction of the Central Bank Rate (CBR). We expect the MPC to increase the Central Bank Rate (CBR) by 25.0 bps to 9.00% from the current 8.75%;

Equities

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 7.3%, 2.2% and 4.5%, respectively, taking the YTD performance to losses of 12.9%, 6.6%, and 9.9% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by gains recorded by large cap stocks such as Safaricom of 15.6%, while banking stocks such as KCB Group, Co-operative Bank and Equity Group recorded gains of 14.5%, 2.4% and 1.3%, respectively. The gains were however weighed down by losses recorded by other banking stocks such as NCBA and Diamond Trust Bank (DTB-K) of 3.8% and 1.4%, respectively, while BAT declined by 1.2%;

Also, during the week, Diageo UK, through its wholly-owned indirect subsidiary Diageo Kenya, announced that it had successfully completed the partial tender offer to acquire an additional 15.0% stake in East African Breweries Plc (EABL). Following the completion of the Tender Offer, Diageo Kenya now holds the largest stake in EABL at 65.0%;

Real Estate

During the week, NCBA Bank Kenya, a local commercial bank, announced a partnership with state-backed financier, Kenya Mortgage Refinancing Company (KMRC) for an initiative to provide low-cost mortgages starting from an interest rate of 9.5%, which is 1.8% points lower than the market average of 11.3% in 2021. In the Real Estate Investment Trusts (REITs) segment, Local Authorities Pension Trust (LAPTRUST), the oldest pension scheme in Kenya, listed the LAPTRUST Imara I-REIT on the Nairobi Securities Exchange (NSE) at a bell-ringing ceremony officiated by President William Ruto. Additionally, Fahari I-REIT closed the week trading at an average price of Kshs 6.3 per share on the NSE, remaining relatively unchanged from the previous week. On the Unquoted Securities Platform as at 17th March 2023, Acorn D-REIT and I-REIT closed the week trading at Kshs 23.9 and Kshs 20.9 per unit, respectively, a 19.4% and 4.4% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price;

Focus of the Week

Privatization generally refers to transfer of ownership of an entity or a corporation from public to private sector. Privatization typically aims at enhancing economic efficiency by improving a company’s performance, cease or reduce the need for government economic intervention. Further, privatizations have been used to induce competition in monopolized sectors. Globally, one of the notable privatization of State Owned Enterprises (SOEs) was British Airways in 1987 when it was listed on the London Stock Exchange. Closer home in developing nations such as Kenya, State Owned Enterprises have been touted as major contributors to the nations expenditure and public debt, given that whenever these companies borrow, the state guarantees the debt. As at the end of FY’2021/22, publicly guaranteed debt by SOEs stood at Kshs 145.4 bn, a 7.5% decline from Kshs 157.2 bn in FY’2020/21. To put this in perspective, the current regime targets to reduce government expenditure by Kshs 300.0 bn, and the current stock of debt guaranteed for SOEs stands at 48.4% of the austerity target. As a result, privatization of SOEs has been earmarked as a fiscal enhancement strategy and has been one of the conditions set by multilateral lenders such as the International Monetary Fund (IMF) to access concessional borrowing facilities. This week, following the approval of the Privatization Bill 2023 by the Cabinet in a move that is also aimed at revitalizing capital markets and spurring new listings at the Nairobi bourse, we turn our focus to looking at the components of the bill;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 11.03%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.95% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 49.2%, a significant decline from the 121.6% recorded the previous week, attributable to persisting tightened liquidity in the money market with the average interbank rate increasing to 7.2% from 6.9% recorded the previous week. The last time interbank rate was this high was in October 2019. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 7.1 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 179.4%, albeit slightly lower than the 182.3% recorded the previous week. Notably, the 182-day and 364-day papers recorded undersubscriptions of 36.9% and 9.3% from an oversubscription rate of 174.7% and an undersubscription rate of 44.3% respectively, recorded the previous week. The government accepted bids worth Kshs 11.5 bn and rejected Kshs 0.3 bn out of the total Kshs 11.8 bn bids received, translating to an acceptance rate of 97.5%. The yields on the government papers were on an upward trajectory, with the yields on the 364-day paper, 182-day and 91-day papers increasing by 1.0 bps, 5.9 bps and 4.9 bps to 10.8%, 10.3% and 9.8%, respectively. The chart below compares the overall average T- bills subscription rates obtained in 2017, 2022 and 2023 Year to Date (YTD):

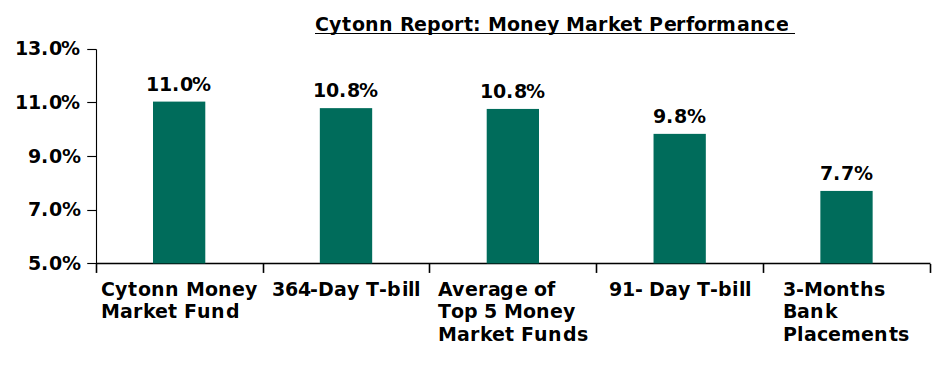

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 364-day and 91-day T-bill remained relatively unchanged at 10.8% and 9.8% respectively, similar to what was recorded the previous week. The average yields of the Top 5 Money Market Funds increased by 38.4 bps to close the week at 10.8%, from 10.4% recorded the previous week. The yield on Cytonn Money Market Fund remained relatively unchanged at 11.0%, from what was recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 24th March 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 24th March 2023 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (dial *809# or download Cytonn App) |

11.0% |

|

2 |

Madison Money Market Fund |

11.0% |

|

3 |

Jubilee Money Market Fund |

10.8% |

|

4 |

Apollo Money Market Fund |

10.6% |

|

5 |

Dry Associates Money Market Fund |

10.4% |

|

6 |

Kuza Money Market fund |

10.3% |

|

7 |

NCBA Money Market Fund |

10.2% |

|

8 |

Old Mutual Money Market Fund |

10.1% |

|

9 |

Nabo Africa Money Market Fund |

10.0% |

|

10 |

Zimele Money Market Fund |

9.9% |

|

11 |

KCB Money Market Fund |

9.8% |

|

12 |

GenCap Hela Imara Money Market Fund |

9.8% |

|

13 |

Sanlam Money Market Fund |

9.7% |

|

14 |

Co-op Money Market Fund |

9.7% |

|

15 |

AA Kenya Shillings Fund |

9.6% |

|

16 |

CIC Money Market Fund |

9.3% |

|

17 |

British-American Money Market Fund |

9.2% |

|

18 |

GenAfrica Money Market Fund |

9.1% |

|

19 |

ICEA Lion Money Market Fund |

9.0% |

|

20 |

Orient Kasha Money Market Fund |

8.9% |

|

21 |

Absa Shilling Money Market Fund |

8.4% |

|

22 |

Mali Money Market Fund |

8.0% |

|

23 |

Equity Money Market Fund |

6.6% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets tightened, with the average interbank rate increasing to 7.2% from 6.9% recorded the previous week, partly attributable to tax remittances that offset government payments. Key to note, the average interbank rate on 24th March 2023 came in at 7.4%, which is the highest average daily interbank rate since 22nd October 2019. Despite the tightened liquidity, the average interbank volumes traded increased by 43.5% to Kshs 25.1 bn from Kshs 17.5 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded mixed performance with the yield on the 10-year Eurobond issued in 2018 increasing the most, having gained by 1.4% points to 12.8% from 11.4% recorded the previous week. The rise in the country’s Eurobond yields is mainly on the back of increased concerns about the accelerated depreciation of the Kenyan shilling, United States dollar shortages currently experienced in the economy, coupled with increased debt servicing concerns and S&P Global Ratings downgrading of Kenya’s outlook to negative from stable last month, citing a weakening liquidity position. On the other hand, the yield on the 30-year Eurobond issued in 2018 declined the most, declining by 0.3% to 12.0% from 12.3% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 23rd March 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD bn) |

2.0 |

1.0 |

1.0 |

0.9 |

1.2 |

1.0 |

|

Years to Maturity |

1.3 |

5.0 |

25.0 |

4.2 |

9.2 |

11.3 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

2-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

1-Mar-23 |

12.1% |

10.7% |

11.0% |

10.9% |

10.8% |

10.2% |

|

16-Mar-23 |

14.0% |

11.4% |

12.3% |

13.4% |

12.5% |

11.6% |

|

17-Mar-23 |

13.6% |

11.5% |

12.2% |

13.5% |

12.5% |

11.7% |

|

20-Mar-23 |

14.1% |

11.9% |

12.4% |

13.8% |

12.8% |

12.0% |

|

21-Mar-23 |

15.0% |

12.2% |

12.4% |

13.7% |

12.7% |

11.8% |

|

22-Mar-23 |

14.6% |

12.8% |

12.3% |

13.9% |

12.5% |

11.8% |

|

23-Mar-23 |

14.2% |

12.8% |

12.0% |

13.7% |

12.3% |

11.7% |

|

Weekly Change |

0.2% |

1.4% |

(0.3%) |

0.3% |

(0.2%) |

0.1% |

|

MTD Change |

2.2% |

2.1% |

1.0% |

2.8% |

1.6% |

1.5% |

|

YTD Change |

1.3% |

2.4% |

1.1% |

2.8% |

1.6% |

1.8% |

Source: Central Bank of Kenya (CBK) and National Treasury

The chart below compares the current yields to the tenure to maturity of the various Eurobond issuances by Kenya, highlighting that the shorter-tenure issuances have higher yields as compared to the long-tenure Eurobonds, attributable to servicing concerns;

Kenya Shilling:

During the week, the Kenya Shilling depreciated by 1.1% against the US dollar to close the week at Kshs 131.3, from Kshs 129.9 recorded the previous week, partly attributable to increased dollar demand from manufacturers and importers, especially oil and energy sectors against a slower supply of hard currency. On a year to date basis, the shilling has depreciated by 6.4% against the dollar, adding to the 9.0% depreciation recorded in 2022. We expect the shilling to remain under pressure in 2023 as a result of:

- High global crude oil prices on the back of persistent supply chain bottlenecks coupled with high demand. The high crude oil prices have inflated Kenya’s import bill and as a result, petroleum products imports have continued to weigh heavily on the country’s import bill, and accounted for 27.6% of the total import bill in Q3’2022, up from 25.6% in Q2’2022 and much higher than 15.2% recorded in Q3’2021,

- An ever-present current account deficit estimated at 4.9% of GDP in the 12 months to January 2023, from 5.6% recorded in a similar period last year,

- The need for Government debt servicing which continues to put pressure on forex reserves given that 69.3% of Kenya’s External debt was US Dollar denominated as of October 2022, and,

- A continued interest rate hikes in the USA and the Euro Area with the Fed and European Central Bank increasing their benchmark rates to 4.75%-5.00% and 3.50% respectively in March 2023, which has strengthened the dollar and sterling pound against other currencies following capital outflows from other global emerging markets.

The shilling is however expected to be supported by:

- Diaspora remittances standing at a cumulative USD 658.6 mn in 2023 as of February 2023, albeit 0.3% lower than the USD 660.3 mn recorded over the same period in 2022, and,

- The tourism inflow receipts that came in at USD 268.1 bn in 2022, a significant 82.9% increase from USD 146.5 bn inflow receipts recorded in 2021.

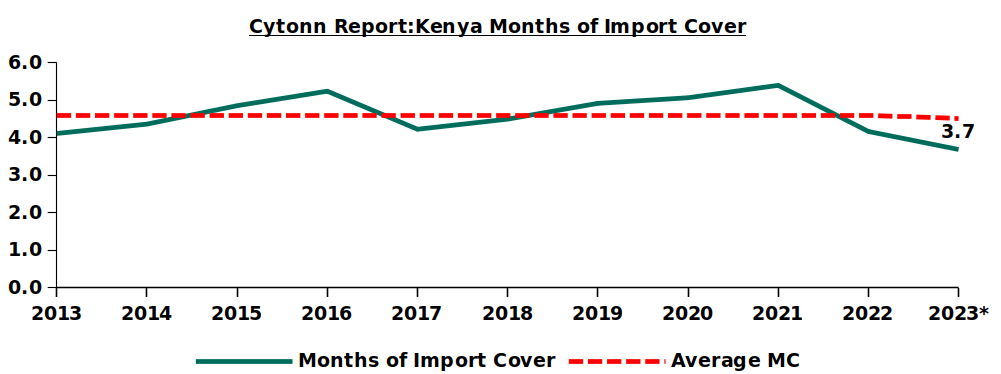

Key to note, Kenya’s forex reserves remained relatively unchanged at USD 6.6 bn as at 23rd March 2023, similar to what was recorded the previous week. As such, the country’s months of import cover also remained unchanged at 3.7 months, similar to what was recorded the previous week, and below the statutory requirement of maintaining at least 4.0-months of import. The chart below summarizes the evolution of Kenya months of import cover over the last 10 years:

*Figure as at 23rd March 2023

Weekly Highlights:

- March 2023 inflation Projection

We are projecting the y/y inflation rate for March 2023 to decline to a range of 8.6%-9.0% mainly on the back of:

- Maintained Tightened Monetary Policy - The Monetary Policy Committee maintained a tightened monetary policy, at 8.75% in January 2023, following the 50.0 bps interest hike to 8.75% in November 2022, from 8.25% in September 2022. Key to note, while the committee cited that the impact of the tightened Monetary Policy Committee Central Bank rate was still transmitting in the economy, the inflation rate of February 2023 increased by 0.2% points to 9.2%, reversing the easing in inflationary pressures experienced in the months of November-December 2022 and January 2023. However, the reversal is not significantly above the January’s inflation rate that came in at 9.0%, an indication of price stability of major commodities, and,

- Constant fuel prices- From the EPRA’s fuel prices release for the period 15th March to 14th April, prices of Diesel and Kerosene remained unchanged for the fourth consecutive month at Kshs 162.0 and Kshs 145.9 per litres, respectively while the price of Super Petrol increased by Kshs 2.0 per litre to Kshs 179.3. The increase in Super-petrol is attributable to the cross-subsidization measure currently in place to cushion consumers from the high Diesel prices. While Kenya’s fuel prices remain elevated above the historic levels, the constant fuel prices especially of Diesel and Kerosene for four consecutive months indicate price stability in the medium term.

Going forward, we expect the inflation rate to remain elevated and above the Government’s upper ceiling of 7.5%, but to gradually ease in the medium to long term. We expect the ongoing measures by the government such as fertilizer subsidization and importation of duty-free maize and rice to lower the cost of agricultural production and ease prices of key commodities, respectively. The government through the Ministry of Agriculture will import 500,000.0 metric tonnes of white maize and another 500,000.0 metric tonnes of Grade 1 milled rice to meet the shortage of maize and alternative starch in the country from March 2023 to 6th August 2023. Additionally, the currently ongoing rains in various parts of the country is expected to increase maize production and ease food inflation with maize flour being a major inflationary factor. Notably, the government’s plan to do away with the fuel subsidies as part of its austerity measures may keep fuel prices elevated in the medium term. However, the full anchoring of the domestic inflationary pressures is largely pegged on how soon the global supply chain is restored.

- Kenya Foreign Exchange Code

The Central Bank of Kenya announced the issuance of the Foreign Exchange Code (the FX Code) on 22nd March 2023 to commercial banks, in a move to regulate wholesale transactions of the foreign exchange market in Kenya. The measure is in response to the wide variation of exchange rate spread in the market, as discussed in our currency review note, and comes as a control measure following the dollar shortage witnessed in the months of February and March. The country’s forex reserves have been declining, coming in at USD 6.6 bn as at 23rd March 2023, equivalent to only 3.7 months of import cover and below the statutory requirement of maintaining at least 4.0 months of import cover. Due to the U.S dollar shortages, majority of commercial banks were quoting exorbitantly high exchange rates especially on the selling rates of the US dollar as compared to the official rates quoted by the Central Bank necessitating the need for uniform regulations to control the situation. For instance, as of 10th March 2023, the Central Bank’s mean rate was Kshs 128.9, as Tier 1 banks average came in at Kshs 133.7, while the average for all banks was Kshs 133.3. The FX Code, issued under the Section 33(4) of the Banking Act Cap 488 Laws of Kenya, has stipulated standards that commercial banks and other financial institutions must adhere to in conducting foreign exchange business in Kenya. The FX Code aims to promote a robust and transparent foreign currency market through the following reporting guidelines;

- Compliance with FX Code - All market participants (commercial banks and foreign exchange brokers) will be required to conduct a self-assessment and submit to the CBK a report on an institution’s level of compliance with the FX Code by 30th April 2023. Further, all market participants will be required to submit to CBK a detailed compliance implementation plan that is approved by its Board by 30th June 2023, and each participant must be fully compliant with the aforementioned code by 31st December 2023,

- Reporting Mechanism – All market participants will be required to submit a quarterly report to CBK, on the level of compliance to the FX Code within 14 days after the end of every calendar quarter, with the first report due by July 14, 2023,

- In the event of non-compliance, CBK may take appropriate enforcement and other administrative action including monetary penalties as provided for under the Banking Act against any market participant, and,

- Prohibitive Practices – The FX Code is majorly to identify practices that are geared towards market disruptions such as price quotations or manipulating price movements creating artificial delays, or false impression on market depth and liquidity by any market participants will result in heavy penalties. Additionally, market participants are not to engage in position or points parking (artificial transactions to conceal positions or transfer profits or losses).

The move by the Central Bank of Kenya to introduce the FX Code, effective 23rd March 2023 is a step in the right direction following the hoarding of the US dollars witnessed in the months of February and March, however more measures need to be put in place to ensure transparency of exchange market. While the FX Code highlights Prohibitive practices that will attract enforcement, the code neither identifies the individual non-compliance practices, nor does it gives practices that will be termed as price manipulations. Consequently, the code does not give the appropriate enforcement measures the Central Bank will take on each non-compliant participants with regard to the degree of offense. As a result, introducing the FX code of conduct is unlikely to be effective if such practices are not identified, classified, and made known to the public. Further, providing the FX Code is not enough if the current administration does not strengthen the core structures that anchor the value of the Kenyan currency. As a result, the government needs to increase its exports volume while minimizing on imports. As it stands, the imports bill as of December 2022 came in at Kshs 200.1 bn, 2.9 times the exports amount that was Kshs 68.8 bn in the same period. Additionally, the government must manage external debt levels that was Kshs 4.7 tn as of December 2022, which is 51.1% of total debt; and of the external debt, 69.3% is United States Dollar denominated. A reduction of external debt levels will reduce the costs of servicing such debts and consequently ease the dollar demand in the country.

- March MPC Meeting

The Monetary Policy Committee (MPC) is set to meet on Wednesday, 29th March 2023, to review the outcome of its previous policy decisions and recent economic developments, and to decide on the direction of the Central Bank Rate (CBR). We expect the MPC to increase the Central Bank Rate (CBR) by 25.0 bps to 9.00% from the current 8.75% with their decision mainly being supported by;

- The need to bring down inflation to the government’s target range of 2.5%-7.5%. Inflation for the month of February 2023 increased to 9.2%, a reversal from the ease in inflation experienced in the months of November, December and January 2023. Going forward, inflation is expected to remain elevated in the short term driven by the high fuel and food prices. Additionally, we expect the fuel prices to rise as the current administration plans to completely do away with the fuel subsidy program and adjust the domestic fuel prices to ease pressure on expenditure. Further, we expect food prices to remain elevated in the short term, following the erratic weather patterns. Further the measures being taken by the current administration to address food security concerns such as fuel subsidization, and importation of duty free maize and rice are yet to take effect. As such, we expect the MPC to increase the CBR as it seeks to anchor inflation, given that its main role is maintaining price stability, and,

- The need to support the shilling from further depreciation as other Central Banks raise their rates. Year to date, the Kenyan shilling has depreciated by 6.4% to an all-time low of Kshs 131.3 as at 24th March 2023, from Kshs 113.1 recorded at the beginning of 2023, adding to the 9.0% depreciation recorded in 2022. The depreciation is mainly attributable to increased dollar demand in the oil and energy sectors as a result of high fuel prices. The high crude oil prices have inflated Kenya’s import bill and as a result, petroleum products imports have continued to weigh heavily on the country’s import bill, and accounted for 27.6% of the total import bill in Q3’2022, up from 25.6% in Q2’2022 and much higher than 15.2% recorded in Q3’2021. Moreover, the recent interest rates hike in developed economies such as the USA and the Euro Area in March 2023 is expected to significantly put pressure on the Kenyan shilling due to capital flights. Majority of the investors are likely to withdraw from emerging markets in pursuit of the high rates in the developed world. Key to note, forex reserves have been under pressure coming in at USD 6.6 bn as at 23rd March 2023, representing 3.7 months of import cover, below the statutory requirement of maintaining at least 4.0-months of import. As such, this put pressure on the Central Bank to pursue additional policy measures to slow the accelerated depreciation of the shilling.

For a more detailed analysis, please see our March 2023 MPC note.

Rates in the Fixed Income market have remained relatively stable due to the relatively ample liquidity in the money market. The government is 20.4% ahead of its prorated borrowing target of Kshs 314.2 bn having borrowed Kshs 378.2 bn of the new domestic borrowing target of Kshs 425.1 bn as per the February 2023 revised domestic borrowing target for FY’2022/23. We believe that the projected budget deficit of 5.7% is relatively ambitious given the downside risks and deteriorating business environment occasioned by high inflationary pressures. Further, revenue collections are lagging behind, with total revenue as at February 2023 coming in at Kshs 1.3 tn in the FY’2022/2023, equivalent to 59.8% of its target of Kshs 2.1 tn and 89.7% of the prorated target of Kshs 1.4 tn. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to bridge the fiscal deficit through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the week, the equities market was on an upward trajectory, with NASI, NSE 20 and NSE 25 gaining by 7.3%, 2.2% and 4.5%, respectively, taking the YTD performance to losses of 12.9%, 6.6%, and 9.9% for NASI, NSE 20, and NSE 25, respectively. The equities market performance was mainly driven by gains recorded by large cap stocks such as Safaricom of 15.6%, while banking stocks such as KCB Group, Co-operative Bank and Equity Group recorded gains of 14.5%, 2.4% and 1.3%, respectively. The gains were however weighed down by losses recorded by other banking stocks such as NCBA and Diamond Trust Bank (DTB-K) of 3.8% and 1.4%, respectively, while BAT declined by 1.2%.

During the week, equities turnover increased significantly by 773.8% to USD 197.0 mn from USD 22.5 mn recorded the previous week taking the YTD turnover to USD 335.1 mn. The increase in turnover during the week was mainly attributable to the block transfer of 118.4 mn shares to Diageo Kenya, EABL’s majority shareholder, after it completed acquisition of additional 15.0% stake from EABL’s minority shareholders, making Diageo Kenya the majority shareholder with 65.0% stake in EABL. Foreign investors remained net sellers, recording a net selling position of USD 1.6 mn, from a net selling position of USD 8.0 mn recorded the previous week, taking the YTD net selling position to USD 37.6 mn.

The market is currently trading at a price to earnings ratio (P/E) of 5.7x, 54.1% below the historical average of 12.5x. The dividend yield stands at 8.0%, 3.8% points above the historical average of 4.2%. Key to note, NASI’s PEG ratio currently stands at 0.7x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Weekly highlight;

Diageo Kenya Plc announces results of tender offer to acquire up to 15.0% of additional stake in EABL PLC

During the week, Diageo UK, through its wholly-owned indirect subsidiary Diageo Kenya, announced that it had successfully completed the partial tender offer to acquire an additional 15.0% stake in East African Breweries Plc (EABL). Prior to the tender offer, Diageo Kenya PLC held 395.6 mn shares out of the total 790.8 mn outstanding shares, equivalent to 50.0% of the entire shareholding. The tender offer comprised of two phases with Diageo Kenya receiving valid tenders from 1,697 shareholders amounting to a total of 143.5 mn Ordinary Shares. This translated to an oversubscription rate of 121.2% with Diageo Kenya accepting the maximum 118.4 mn Ordinary Shares, as specified in the tender offer. The table below shows the shares accepted for purchase in the two phases:

|

Cytonn Report: EABL Tender Offer Results |

||||

|

Shares accepted under the Guaranteed Allocation Pool (mn) |

Shares accepted under the Early acceptance Pool (mn) |

Shares accepted under the Final Allocation Pool (mn) |

Total Shares (mn) |

|

|

First closing |

6.4 |

55.0 |

41.5 |

102.9 |

|

Second closing |

1.6 |

- |

13.9 |

15.5 |

|

Total Shares Accepted for purchase |

8.0 |

55.0 |

55.4 |

118.4 |

Source: Diageo Plc website, NSE

Following the completion of the Tender Offer, Diageo Kenya now holds the largest stake in EABL at 65.0% with 514.0 mn shares, which includes the 118.4 mn Ordinary Shares that Diageo Kenya accepted to purchase and 395.6 mn Ordinary Shares it owned prior to commencement of the Tender Offer.

Key to note, Diageo purchased each share at Kshs 192.0, which represented a 39.1% premium on the EABL’s stock price of Kshs 138.0 a day before the announcement of the tender offer. As such, we expected EABL’s stock price to rally as investors sell their stake at a premium, however the tender closed when the stock was trading at Kshs 170.5 per share, 11.2% below the offer price of Kshs 192.0 per share.

The move by Diageo Kenya to increase its shareholding in EABL affirms the importance of EABL to the larger group and confidence in its future growth despite the challenging macroeconomic environment occasioned by elevated inflationary pressures as well as government’s decision to increase excise taxes. Notably, EABL has continued to display strong financial performance as evidenced by the EABL’s Profit After Tax of Kshs 15.6 bn and Kshs 8.7 bn in FY’2022 and H1’2023, respectively. Additionally, Earnings per share increased by 172.2% to Kshs 15.0 in FY’2022, from Kshs 5.5 in FY’2021 and a 2.1% increase in earnings per share to Kshs 17.3 H1’2023, from 16.9% in H1’2022. Further, EABL board of directors announced a total of Kshs 11.0 dividend per share in FY’2022, translating to a dividend yield of 6.4% and lately recommended an interim dividend of Kshs 3.75 in H1’2023. As such, we expect this to continue boosting investor confidence in the Group’s stock which has recorded a YTD gain of 0.4%.

There has been increased activity on share repurchase and buyback in the bourse with Standard Africa Holdings Limited acquiring additional stake in Stanbic Holdings in February 2022 while in February 2023, Centum Investments Company gained approval from its shareholders to buy back up to 10.0% of its issued shares. In our view, we expect to witness more share repurchase and buyback activity in the bourse especially from companies whose prices and valuations are currently low. We also commend the CMA for granting exemptions from making full take overs as it allows for majority investors to increase their shareholding by carrying out on-market trading to acquire a higher stake, as compared to having to acquire the entire entities.

Universe of coverage:

|

Company |

Price as at 17/03/2023 |

Price as at 24/03/2023 |

w/w change |

YTD Change |

Year Open 2023 |

Target Price* |

Current Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Jubilee Holdings |

151.5 |

150.0 |

(1.0%) |

(24.5%) |

198.8 |

305.9 |

9.3% |

113.3% |

0.3x |

Buy |

|

Equity Group*** |

38.2 |

38.7 |

1.3% |

(14.2%) |

45.1 |

58.4 |

7.8% |

58.7% |

0.9x |

Buy |

|

KCB Group*** |

31.0 |

35.5 |

14.5% |

(7.4%) |

38.4 |

52.5 |

5.6% |

53.5% |

0.6x |

Buy |

|

Britam |

4.6 |

4.7 |

2.6% |

(10.2%) |

5.2 |

7.1 |

0.0% |

52.5% |

0.8x |

Buy |

|

Kenya Reinsurance |

1.6 |

1.8 |

14.5% |

(2.7%) |

1.9 |

2.5 |

5.5% |

43.4% |

0.1x |

Buy |

|

Liberty Holdings |

4.8 |

4.8 |

(0.8%) |

(5.6%) |

5.0 |

6.8 |

0.0% |

41.8% |

0.4x |

Buy |

|

NCBA*** |

34.1 |

32.8 |

(3.8%) |

(15.9%) |

39.0 |

43.4 |

9.2% |

41.6% |

0.7x |

Buy |

|

ABSA Bank*** |

12.0 |

11.9 |

(0.8%) |

(2.5%) |

12.2 |

15.5 |

11.3% |

41.2% |

1.0x |

Buy |

|

Co-op Bank*** |

12.3 |

12.6 |

2.4% |

4.1% |

12.1 |

15.5 |

11.9% |

34.7% |

0.6x |

Buy |

|

I&M Group*** |

17.1 |

17.1 |

0.0% |

0.0% |

17.1 |

20.8 |

8.8% |

30.9% |

0.4x |

Buy |

|

Sanlam |

8.7 |

9.1 |

4.6% |

(4.8%) |

9.6 |

11.9 |

0.0% |

30.6% |

1.0x |

Buy |

|

Diamond Trust Bank*** |

48.5 |

47.8 |

(1.4%) |

(4.2%) |

49.9 |

57.1 |

6.3% |

25.9% |

0.2x |

Buy |

|

CIC Group |

1.9 |

2.0 |

3.7% |

3.1% |

1.9 |

2.3 |

0.0% |

17.8% |

0.7x |

Accumulate |

|

Stanbic Holdings |

110.5 |

109.0 |

(1.4%) |

6.9% |

102.0 |

112.0 |

11.6% |

14.3% |

1.0x |

Accumulate |

|

Standard Chartered*** |

167.0 |

167.8 |

0.4% |

15.7% |

145.0 |

166.3 |

13.1% |

12.2% |

1.1x |

Accumulate |

|

HF Group |

3.5 |

3.4 |

(2.0%) |

8.6% |

3.2 |

3.4 |

0.0% |

0.3% |

0.2x |

Lighten |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

||||||||||

We are “Neutral” on the Equities markets in the short term due to the current adverse operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.7x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the equities outlook in the short term.

- Residential Sector

During the week, NCBA Bank Kenya, a local commercial bank, announced a partnership with state-backed financier, Kenya Mortgage Refinancing Company (KMRC) for an initiative to provide low-cost mortgages starting from an interest rate of 9.5%, which is 1.8% points lower than the market average of 11.3% in 2021. NCBA customers will obtain a 105.0% home financing to acquire or construct new homes, with a loan limit of Kshs 6.0 mn, and a 25 years of repayment period, 13 years more than the average loan duration of 12 years in 2021. The financing plan is available to individuals with a gross income of Kshs 150,000 or less, targeting the mass market. Couples may also combine incomes as long as they are within the Kshs 150,000 threshold.

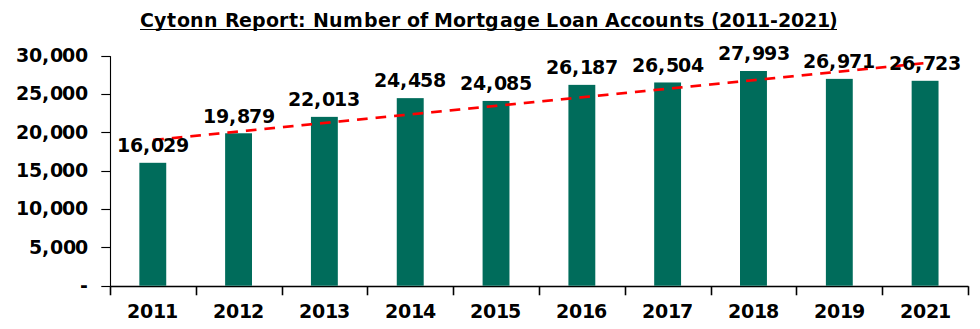

We expect that the 105.0% financing option will reduce the down payment required in traditional mortgages, providing NCBA customers with financing for the associated costs such as legal and stamp duty fees. However, the Kshs 6.0 mn upper loan limit is still lower than the average home loan size which stood at Kshs 9.2 mn as at 2021. On the other hand, the move comes to supplement the government’s commitment to increase homeownership by Kenyans through the provision of long-term, sustainable home financing through the KMRC. Currently, KMRC is the sole institution licensed to carry out Mortgage Liquidity Facility (MLF) activities in Kenya, which include provision of long-term funds to Primary Mortgage Lenders (PMLs) such as banks, microfinance institutions and SACCOs. In 2022, KMRC refinanced 1,948 mortgage loans valued at Kshs 6.8 bn, which was a 278.0% increase from 574 home loans disbursed in 2021 valued at Kshs 1.3 bn. Despite the increase, the numbers remain low at 7.3% of the total number of mortgage loans which stood at 26,723 accounts valued at Kshs 245.1 bn as at 2021. The graph below shows the number of mortgage loan accounts in Kenya;

Source: Central Bank of Kenya

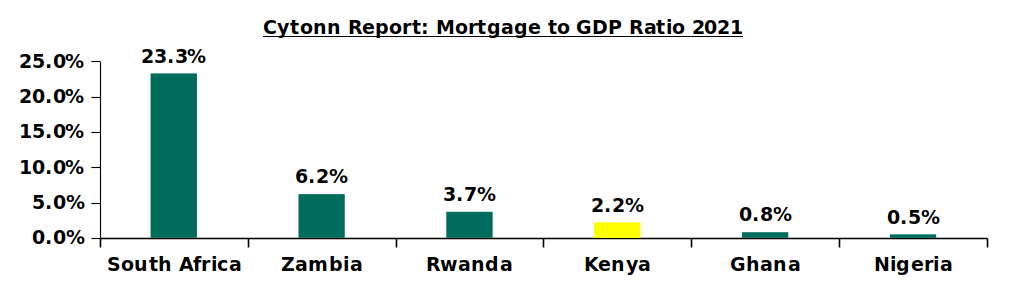

Consequently, Kenya’s mortgage to GDP continues to underperform at approximately 2.2% compared to countries such as South Africa, which is at approximately 23.3% as of 2021, as shown below;

Source: Centre for Affordable Housing Africa

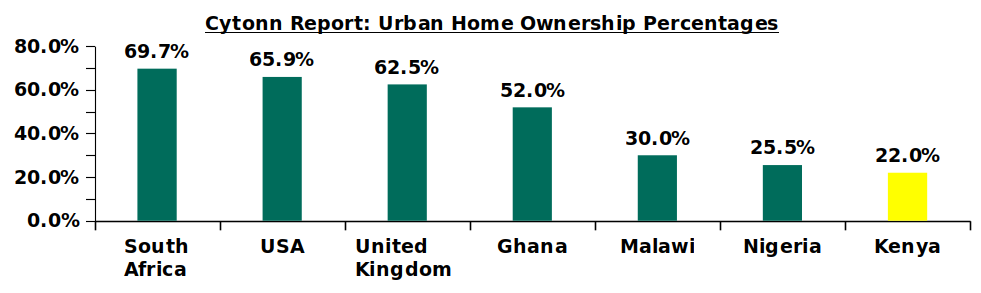

Furthermore, the percentage of urban residents who own homes in Kenya is relatively low at 22.0%, in comparison to other countries such as South Africa and Ghana where home-ownership rates in urban areas are much higher at 69.7% and 52.0%, respectively, as shown below;

Source: Centre for Affordable Housing Africa, US Census Bureau, UK Office for National Statistics

The relatively low homeownership rate in Kenya is mainly due to; i) high costs of construction perpetuated by difficulty in accessing development financing, ii) increasing property prices undermining the maximum loan amounts offered at affordable rates, iii) elevated interest rates and sizable deposit demands hindering access to mortgages, iv) low income levels preventing majority of citizens from being able to afford loan repayments, and, v) insufficient credit information in informal sectors leading to individuals being left out of sustainable mortgage programs offered by financial institutions. We therefore expect the government and other stakeholders to continue exerting efforts to increase homeownership rates through more home financing partnerships and the launching of affordable housing projects, in a bid to also curb the existing housing deficit, currently standing at 80.0% in the country.

- Real Estate Investment Trusts (REITs)

During the week, Local Authorities Pension Trust (LAPTRUST), the oldest pension scheme in Kenya, listed the LAPTRUST Imara I-REIT on the Nairobi Securities Exchange (NSE) at a bell-ringing ceremony officiated by President William Ruto. This comes four months after the Capital Markets Authority (CMA) announced the approval for the listing of the Imara I-REIT on the NSE's Main Investment Market, under the Restricted Sub-Segment. The Imara I-REIT is a close-ended fund consisting of 346,231,413 units valued at Kshs 20.0 each, totaling Kshs 6.9 bn, and LAPTRUST will not initially offer the securities to the public. Open trading of the securities will be restricted for a three-year period, in a bid to provide the I-REIT sufficient time to build a performance track record, allowing investors to gain confidence in the asset class. In addition, the units can only be traded to persons qualifying as professional investors, confined to high net-worth individuals and institutions. On the day of listing, LAPTRUST made an opening trade of 250,000 units to an undisclosed pension fund at Kshs 20.0 each, valued at Kshs 5.0 mn, meeting the REIT’s minimum investment amount. Imara is the first I-REIT to be issued by a pension fund in the country, and will therefore provide LAPTRUST investors the unique opportunity to diversify their portfolio with income-generating Real Estate assets. The properties that that will be held under the Imara I-REIT portfolio include; CPF Metro Park, CPF House, Pension Towers, Freedom Heights which encompasses a mall and apartments, Man Apartment and Nova Eldoret. Our market source at LAPTRUST estimates that the Imara I-REIT portfolio currently offers a yield of about 5.0% pa, hence will need to be improved before it can be attractive to the market, given that commercial yields are at about 7.0 to 8.0% pa.

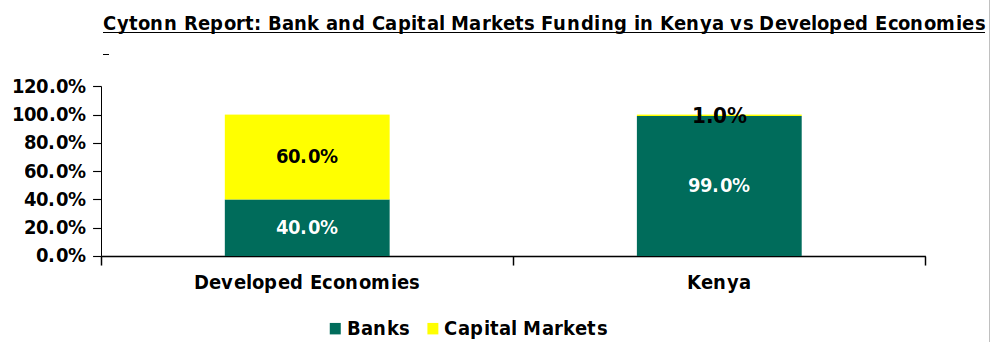

However, this is great development and we expect that the listing will boost the Kenyan REITs segment by; i) increasing investor confidence in REITs as an investment class with more REITs in the market, ii) fostering market transparency with the Imara I-REIT subject to regulatory oversight and disclosure of financials, and, iii) creating awareness of investment opportunities offered by REITs, thereby attracting more pension funds and other institutional investors. The listing is also a positive development for capital markets, which provide investment opportunities by unlocking more liquidity. Notably, capital markets in Kenya, only account for 1.0% of funding in the economy, with banks funding 99.0% of enterprises. This is in contrast to developed economies where most funding is availed through capital markets at 60%, with banks accounting for the remaining 40.0%, as shown in the chart below;

Source: Cytonn Research

Consequently, most Kenyan property developers rely on funding from banks, who have tightened lending terms and ask for more collateral due to increasing default rates, with gross Non-Performing Loans (NPLs) in the Real Estate sector increasing by 9.2% to Kshs 75.6 bn in Q3’2022 from Kshs 69.2 bn recorded in Q3’2021. As such, the increase in the number of REITs in the market and the entry of institutions such as pension funds, with the likelihood to attract more institutional investors into the REITs market are expected to increase the size and depth of the segment. This will ultimately increase capital flows into the Kenyan Real Estate industry, thereby boosting activity in the sector.

The listing of Imara I-REIT on the NSE marks a positive step for capital markets in the country, given that REITs offer various benefits including; access to more capital pools, consistent and prolonged profits, tax exemptions, diversified portfolios, transparency, liquidity, and flexibility as an asset class. However, their performance has been subdued over time owing to various setbacks such as; i) insufficient investor understanding of the investment instrument, ii) time-consuming approval procedures for REIT creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees which limits the role to banks, and, iv) high minimum investment amounts set at Kshs 5.0 mn discouraging investments.

Additionally, in the Nairobi Securities Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.3 per share, remaining relatively unchanged from the previous week. The performance represented a 6.8% Year-to-Date (YTD) decline from Kshs 6.8 per share recorded on 3rd January 2023. In addition, the performance represented a 68.4% Inception-to-Date (ITD) loss from the Kshs 20.0 price. The dividend yield currently stands at 7.9%. The graph below shows Fahari I-REIT’s performance from November 2015 to 24th March 2023;

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 23.9 and Kshs 20.9 per unit, respectively, as at 17th March 2023. The performance represented a 19.4% and 4.4% gain for the D-REIT and IREIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 29.4 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 600.4 mn, respectively, since inception in February 2021.

We expect the performance of Kenya’s Real Estate sector to remain on an upward trajectory, supported by factors such as; i) efforts by the KMRC through partnerships to provide long-term and sustainable housing finance in a bid to avail affordable housing, and, ii) diversification by institutions such as pension funds towards investment in Real Estate trusts. However, the prevailing financial constraints curtailing development activities, and low investor appetite for REITs due to high minimum investment amounts set at 5.0 mn are expected to continue subduing the performance of the sector.

Privatization generally refers to transfer of ownership of an entity or a corporation from public to private sector. Privatization typically aims at enhancing economic efficiency by improving a company’s performance, cease or reduce the need for government economic intervention. Further, privatizations have been used to induce competition in monopolized sectors. Globally, one of the notable privatization of State Owned Enterprises (SOEs) was British Airways in 1987 when it was listed on the London Stock Exchange. Closer home in developing nations such as Kenya, State Owned Enterprises have been touted as major contributors to the nations expenditure and public debt, given that whenever these companies borrow, the state guarantees the debt. As at the end of FY’2021/22, publicly guaranteed debt by SOEs stood at Kshs 145.4 bn, a 7.5% decline from Kshs 157.2 bn in FY’2020/21. To put this in perspective, the current regime targets to reduce government expenditure by Kshs 300.0 bn, and the current stock of debt guaranteed for SOEs stands at 48.4% of the austerity target. As a result, privatization of SOEs has been earmarked as a fiscal enhancement strategy and has been one of the conditions set by multilateral lenders such as the International Monetary Fund (IMF) to access concessional borrowing facilities.

Kenya privatization process has been exceedingly slow over the years, despite the previous regime earmarking 26 parastatal to be privatized in 2016, none was achieved. However, the new Kenya Kwanza regime has been keen on fast tracking the process as part of its fiscal consolidation measures. In October 2022, the new administration announced plans to privatize 6 to 10 of State Owned Enterprises (SOEs) in the agricultural, energy and financial sectors, within 12 months. As a result, a new Privatization Bill 2023 was introduced, and if approved by the parliament, it will replace the Privatization Act 2005. The bill is set to address the long ambiguous process of privatization stipulated in the privatization act 2005 by eliminating the multi-level approvals. Some of the entities lined up for state divesture by the Privatization Commission includes; the Kenya Pipeline Company, the Kenya Ports Authority, the Consolidated Bank, the Development Bank of Kenya and the Kenya Tourist Development Corporation among others. As such, the initiative is expected to revitalize capital markets and spur new listing at the Nairobi bourse. In this week’s focus, we shall cover the following;

- History of privatization of Kenya,

- Privatization bill 2023,

- The goals of Privatizing State Owned Enterprises,

- Privatization strategies and procedures,

- Recommendations and Conclusion.

Section I: History of privatization in Kenya

After independence, many parastatals were established in order to expedite economic and social development while also addressing regional economic imbalances. However, following a comprehensive review of public enterprises performance through the Report on the Review of Statutory Boards in 1979 and the Report of the Working Party on Government Expenditures in 1982, the reports revealed evidence of prolonged inefficiency, financial mismanagement, and malpractices in many parastatals. The report further stated that private sector initiatives had been hampered due to existence of parastatals in commercial activities. As a result, various recommendations were made, including the government to divest from its investments in commercial and industrial enterprises and to transfer active participation to the private sector through shareholding. In addition, it was recommended that the government to reduce exposure to risk in areas in which the Private Sector could assume risk without government intervention.

Following the review, several measures were put in place, such as the enactment of state corporation act, the purposes of the act was to streamline the management of SOEs. Nevertheless, the strategy did not bear fruit, as most corporations’ performance continued to deteriorate. The state enterprises relied on public sector finance which was not adequate. They relied on government loans that were ultimately channeled into equity, some of the state enterprises borrowed loans on government guarantees and later defaulted, requiring the National Treasury to settle the debt on their behalf. Furthermore, the entities internally generated funds were inadequate due to huge debt burdens, high expenses, non-viable ventures that siphoned away resources from the enterprises, as well as corruption and mismanagement.

In July 1992, the government outlined the scope of public sector reform Programme, the institutional framework and guidelines of privatizing State Owned Enterprise. A total of 240 commercial SOEs were classified into two categories; the first category contained 207 non-strategic SOEs that were to be privatized and the second category contained 33 strategic commercial SOEs which were to be restructured and retained under the state control. Although numerous SOEs were privatized during the first phase of the implementation of the framework, its impact was limited mainly because most of the SOEs privatized during the phase were small and self-sufficient, most large companies were considered strategic and therefore not privatized. Furthermore, there were institutional and process weaknesses associated with the programme arising from failure to entrench the procedures and accusation of corruption. There were also limited participation by individual Kenyans due to the transaction methods applied.

A new strategy, the Economic Recovery Strategy for Wealth and Employment Creation (ERSWEC) was put in place from 2003 to 2007. Under ERSWEC, a number of key privatization took place as outlined in the table below;

|

Cytonn Report: Government of Kenya Completed Privatizations |

|||||

|

Company |

Year |

Method of Privatization |

Government Share Before |

Government Share After |

Sector |

|

Kenya Electricity Generating Company |

2006 |

IPO |

100.0% |

70.0% |

Energy |

|

Telkom Kenya |

2007 |

Strategic Sale |

100.0% |

49.0% |

Telecommunication |

|

Kenya Railways Corporation |

2006 |

Concessioning |

100.0% |

100.0% |

Transport |

|

Mumias Sugar Company 2nd Offer |

2006 |

IPO |

38.4% |

20.0% |

Manufacturing |

|

Safaricom |

2008 |

IPO |

60.0% |

35.0% |

Telecommunication |

|

Kenya Reinsurance Corporation |

2007 |

IPO |

100.0% |

60.0% |

Insurance |

Source: Privatization Commission of Kenya

Kenya privatization process has been exceedingly slow over the years and despite the previous regime earmarking 26 parastatal to be privatized in 2016, none was achieved. In October 2022, the new administration announced plans to privatize 6 to 10 of State Owned Enterprises (SOEs) in the agricultural, energy and financial sectors, within 12 months. In a bid to expedite the process, the Privatization bill 2023 was brought up and it is set to replace the current privatization act 2005 if approved by parliament.

Section II: Privatization Bill 2023

Recently, the Kenya Cabinet approved the Privatization bill 2023 that is set to replace the Privatization Act 2005 if approved by the parliament. The new bill is set to address the inhibiting legislative and regulatory framework provided in the privatization Act 2005 that led to long processes of approval of SOEs for privatization. Among other key objectives of the bill includes;

- Encourage more participation of the private sector in the economy by shifting the production and delivery of products and services from the public sector to the private sector. Furthermore, broadening the base of ownership in the Kenyan economy by encouraging private ownership of entities,

- Improve the infrastructure and the delivery of public services through the involvement of private capital and expertise,

- Generate additional revenue for the government through proceeds from privatizations and reduce the demand for government resources by non-strategic SOEs,

- Improve the regulation of the economy by reducing conflicts between the public sector’s regulatory functions and commercial functions, and,

- Improve the efficiency of the Kenyan economy by making it more responsive to market forces and enhance development of the capital markets in Kenya.

The key provisions that have been amended include;

- Establishment of the Privatization Authority: The new authority shall be responsible for advising the government on aspects of privatization of SOEs as well as implementation of the privatization programme. The authority will be headed by a chairperson appointed by the President,

- Privatization programme: A new programme shall be formulated by the Cabinet Secretary for the National Treasury and approved by the cabinet, specify the SOEs identified and approved for privatization and to serve as the basis point upon which privatization shall be undertaken,

- Identification of entities for privatization: The Cabinet Secretary for the National Treasury shall identify and determine the entities to be included in the privatization programme, taking into consideration the need to avoid a privatization that may result in an unregulated monopoly, the expected benefits to be gained from the privatization and sustainable development and protection of the economy.

- Approval of the privatization proposal: Upon preparation of the privatization proposal, the authority with the concurrence of the Cabinet Secretary for the National Treasury shall approve it. This is a major change from the current process which entails different levels of approval including the consideration and approval by the parliament. Under the proposed bill, the privatization authority will have the sole power to identify a public entity for privatization, prepare the privatization proposal and approve it, thus removing ambiguity with respect to the role and functions of parliament.

- Methods of Privatization: The bill proposes three methods of privatization;

-

- Through the initial public offering of shares which shall be undertaken in accordance with the capital markets act,

- Through sell of shares by public tendering, a new method proposed in the bill which will involve publishing the notice of invitation to tender on the sale of shares in the Government tenders’ portals or on the Authority’s website and in at least two newspapers of nationwide circulation. Upon closure of the tendering period, the tender evaluation committee shall prepare an evaluation report containing a summary of the evaluation and comparison of tenders which shall be approved by the Board with the concurrence of the Cabinet Secretary for the National Treasury and

- Through sale resulting from the exercise of pre-emptive rights.

Section III: The goals of Privatizing State Owned Enterprises

- Fiscal benefits

Privatization has often been recommended by international organizations such as International Monetary Fund (IMF) and World Bank as a strategy of fiscal enhancement. In the medium term, it is a way of raising capital while reducing huge subsidies and bailout to loss-making SOEs that weigh on the government budget. According to the public debt management report 2021/2022, the government outstanding guaranteed debt to SOEs stood at Kshs 145.4 bn as at the end of June 2022. The SOEs that had been issued guarantees include Kenya Electricity Generation Company (KENGEN) (Kshs 34.0 bn), Kenya Ports Authority (KPA) (Kshs 33.5 bn), and Kenya Airways (KQ) (Kshs 77.8 bn). In particular, KQ defaulted on the loan repayment forcing the government to intervene and the cabinet gave approval for government to repay the loan arrears on behalf of KQ, thus weighing on government budget.

- Effective control

Privatization has been widely used as a way of improving performance of SOEs. As the control of the entity is shifted from the public sector to private sector, exposing it to competitive environment forcing it to maximize returns and production. Furthermore, the company will be compelled to report in a standard format to investors on a regular basis and are susceptible to analysis and criticism from investors and analysts as such encouraging corporate efficiency.

- Development of capital markets

Privatization of SOEs is one way of encouraging participation in the stock market by individual investors as well as attracting foreign direct investment and stimulate development of the private sector and financial markets in general.

Section IV: Privatization Strategies and Procedures

- Public Offers

Privatization through public offers is one of the widely used methods to transfer ownership of SOEs to the private sector. It is mostly preferred since it promotes wide ownership as all members of the public are invited to participate in the offer. However, one drawback of this method is the difficulty in pricing the issue due to relatively little information available to the government or its advisors as to the likely demand of the shares.

- Tenders

Pricing privatization of SOEs is usually a hard task, as such tenders are used to help in collecting market’s collective estimates of the value of the SOEs. Therefore, this method helps the government to maximize revenue as it is a superior way of estimating the value of the company compared to an individual investment banker estimates.

- Exercise of Pre-Emptive Rights

This method entails giving the existing shareholders the right but not obligation to purchase additional shares in the future issue before they are offered to the public. The method is useful as it shield investors against dilution of their shares in the future, by giving them the first priority during additional issuance of a company shares.

Section V: Recommendation and Conclusion

While the proposed bill is positive, we recommend to allow for sale by a direct negotiations where an IPO, public tender and pre-emptive rights all fail to achieve a privatization. We also recommend the government to embark on measures to improve the operating efficiency of the cash strapped SOEs in order to make them more attractive to investors during privatization. As a result, the government will be able to raise decent amount of revenue from the privatization and use the proceeds to enhance public service delivery. However, in our view, the removal of the parliamentary approval stage in privatization of SOEs, might lead to lack of transparency due to lack of enough oversight and as such may limit public participation. All issues considered, we expect upon ratification of the Privatization Bill 2023 by the Parliament, the government will be able to expedite the privatization process and easily offload the non-strategic SOEs that continue to burden public expenditure. We also expect the move to spur new listings at the Nairobi bourse, which will increase activity and diversify the bourse’ offerings which will subsequently attract foreign investors.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.