Q3’2024 Unit Trust Funds Performance Note

By Investments Team, Nov 2, 2025

Unit Trust Funds (UTFs) are a form of Collective Investment Scheme that pools capital from multiple investors to invest in a diversified portfolio of assets, managed by a Fund Manager, with the goal of generating returns for the investors. Expert fund managers oversee these funds, allocating the pooled capital into a variety of securities such as equities, bonds, and other approved financial instruments. The objective is to achieve returns that match the fund’s specific goals. Following the release of the Capital Markets Authority (CMA) Quarterly CIS Report – Q3’2024, we examine the performance of Unit Trust Funds for the period ended 30th September 2024. These funds have seen consistent growth in total Assets Under Management (AUM) and are one of the preferred investment choices in Kenya. Additionally, we will delve into the performance of Money Market Funds, which are a sub-set of Unit Trust Funds.

In our previous focus on Unit Trust Funds, we looked at the Q2’2024 Unit Trust Funds Performance by Fund Managers, where we highlighted that their AUM stood at Kshs 251.4 bn, a 12.2% growth from Kshs 225.4 bn recorded in Q1’2024. In this topical, we focus on the Q3’2024 performance of Unit Trust Funds where we shall analyze the following:

- Performance of the Unit Trust Funds Industry,

- Performance of Money Market Funds,

- Comparing Unit Trust Funds AUM Growth with other Markets, and,

- Recommendations.

Section I: Performance of the Unit Trust Funds Industry

Unit Trust Funds (UTF) are Collective Investment Scheme that pools money from various investors and invests it in a diversified portfolio of assets such as stocks, bonds, and other securities. The primary purpose of unit trust funds is to provide individuals and institutional investors with an opportunity to access a professionally managed and diversified investment portfolio, even with relatively small amounts of capital. These funds are managed by professional fund managers who make investment decisions on behalf of the investors, aiming to generate returns and mitigate risks. In this report, we will delve into the performance of Unit Trust Funds in Q3’2024 following the release of the Capital Markets Authority (CMA) Quarterly CIS Report – Q3’2024. Our objective is to provide a comprehensive analysis of how different types of unit trust funds have performed during this period, shedding light on the key factors influencing their performance.

Unit Trust Funds (UTFs) come in various forms, each tailored to different investment objectives, time horizons, and risk tolerance levels. Understanding these distinctions is essential for investors to make informed decisions. The main types of Unit Trust Funds include:

- Money Market Funds - These funds invest in short-term, low-risk securities such as fixed deposits, Treasury bills, and commercial papers. They aim to provide stability and liquidity, making them suitable for preserving capital and minimizing risk.

- Equity Funds - These funds primarily invest in publicly traded securities with the goal of achieving high returns over the medium to long term. They focus on capital appreciation and dividend income while maintaining a portion of assets in liquid fixed-income instruments to ensure liquidity and meet redemption requests without depleting overall value.

- Balanced Funds - Balanced funds invest in both equities and fixed-income securities to achieve a mix of income and capital appreciation. They offer a balanced risk-reward profile, ideal for investors seeking a middle ground between risk and returns.

- Fixed Income Funds - These funds focus on generating income by investing in a portfolio of fixed-income securities, such as government and corporate bonds. They aim to provide a stable income stream while managing interest rate and credit risks.

- Special Funds - These funds concentrate on a specific sector or industry, offering heightened diversification within the chosen sector. They provide investors with targeted exposure to a particular market area that may not be easily accessible through other fund types.

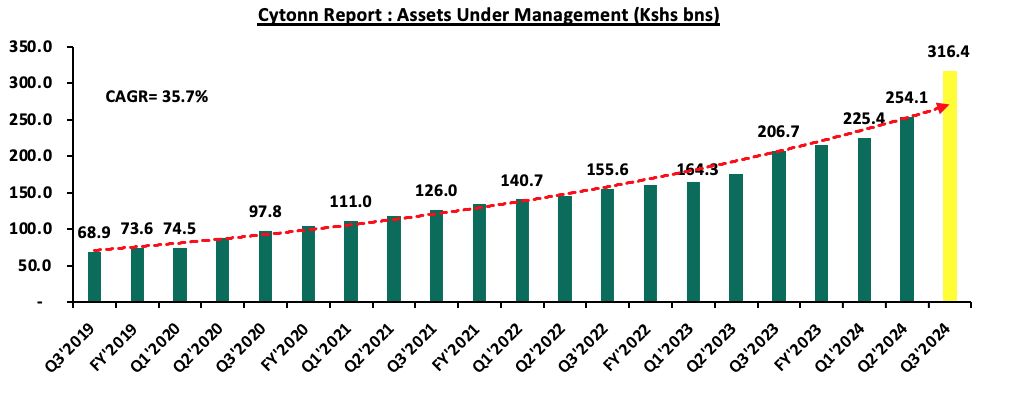

As per the Capital Markets Authority (CMA) Quarterly Collective Investment Schemes (CIS) Report-Q3’2024, the industry’s overall Assets under Management (AUM) grew by 24.5% on a quarter-on-quarter basis to Kshs 316.4 bn at the end of Q3’2024, from Kshs 254.1 bn recorded in Q2’2024. On a y/y basis, the total AUM increased by 53.1%, from Kshs 206.7 bn as at the end of Q3’2023. Key to note, Assets under Management of the Unit Trust Funds have registered an upward trajectory over the last five years, growing at a 5-year CAGR of 35.7% from Kshs 68.9 bn recorded in Q3’2019. The chart below shows the growth in Unit Trust Funds’ AUM over the last five years:

Source: Capital Markets Authority

The growth can be largely attributed to:

- Low Investments minimums: Most Unit Trust Funds Collective Investment Schemes (CIS) in the market have relatively low initial investment requirements, typically ranging from Kshs 100.0 to Kshs 10,000.0. This has promoted financial inclusion by enabling small-scale investors to access professionally managed investment opportunities,

- Diversified product offering: Unit Trust Funds are also advantageous in terms of providing investors with access to a wider range of investment securities through the pooling of funds. This allows for portfolio diversification that might not be achievable individually, helping investors mitigate the risks associated with market volatility in some asset classes,

- Competitive returns: The positive performance and competitive returns of unit trust funds have been key in attracting investors. As these funds consistently outperform certain traditional investment options, they draw more investors seeking to generate wealth over the long term,

- Increased product awareness: Investor education efforts, primarily led by the Capital Markets Authority (CMA) and fund managers, have focused on raising awareness about the various products offered by trust funds. This has resulted in a deeper understanding of investment options among the public, boosting their confidence and leading to increased participation. Consequently, the number of investors in collective investment schemes has surged significantly, recording a 605.0% growth to 1.3 million by September 2024, from 0.2 million in March 2021, according to the Capital Markets Authority (CMA) Quarterly Collective Investment Schemes (CIS) Report-Q3’2024,

- Regulatory Changes: We have had several regulatory changes that have spurred growth in the industry, such as allowing for Special Collective Investments Schemes and expanding eligibility for trustees to include non-bank trustees.

- Efficiency and High Liquidity: Investments in UTFs are managed as portfolios with various assets, and fund managers maintain a cash buffer. Unit trusts are highly liquid, making it easy to buy and sell units without being dependent on market demand and supply at the time of investment or exit, and,

- Adoption of Fintech: Digitization and automation within the industry have enhanced ease in cash accessibility, enabling investors to immediately access their investments via mobile payment platforms. According to the Central Bank of Kenya, more individuals are transacting through mobile money services as evidenced by the sustained growth in the total number of registered mobile money accounts. During the period under review, registered mobile money accounts recorded a 2.0% y/y increase to 78.6 mn accounts, from 77.1 mn accounts registered in Q3’2023. Notably, the total number of registered mobile money accounts also grew at a 5-year CAGR of 7.1% to 78.6 mn at the end of Q3’2024, from 55.7 mn recorded at the end of Q3’2019. The upward trajectory is attributable to Fintech incorporation which has increased the efficiency of processing both payments and investments for fund managers. As a result, Collective Investment Schemes have become more accessible to retail investors.

Source: Central Bank of Kenya (CBK)

Q3’2024* data as of August 2024

Spread of Investments:

|

Cytonn Report: Investment Allocation in Different Funds |

||||||

|

Fund |

Q2’2024 (Kshs bn) |

Q3’2024 (Kshs bn) |

Q3'2023 Investment Share (a) |

Q2’2024 Investment Share (b) |

Q3’2024 Investment Share (c) |

q/q % points Change in Investment Share (c-b) |

|

Money Market |

171.2 |

196.8 |

66.3% |

67.4% |

62.2% |

(5.2%) |

|

Fixed Income |

52.1 |

53.5 |

18.3% |

20.5% |

16.9% |

(3.6%) |

|

Equity Fund |

2.6 |

2.3 |

1.2% |

1.0% |

0.7% |

(0.3%) |

|

Balanced Fund |

1.4 |

1.3 |

1.0% |

0.5% |

0.4% |

(0.1%) |

|

Other |

26.8 |

62.4 |

13.3% |

10.6% |

19.7% |

9.2% |

|

Total |

254.1 |

316.4 |

100.0% |

100.0% |

100.0% |

|

Key take-outs from the table above include:

- Money Market Funds: MMFs remained with the largest investment allocation, coming in at 62.2% in Q3’2024, a decline from 67.4% recorded in Q2’2024. Similarly, the amounts invested in MMFs as of 30th September 2024 recorded a 15.0% increase to Kshs 196.8 bn, from Kshs 171.2 bn recorded at the end of Q2’2024. Notably, on a y/y basis the allocation in MMFs has declined by 4.1% points from 66.3% allocation recorded in Q3’2023 mainly attributable to the diversification of funds into other investment categories. Key to note, according to Collective Investments Schemes Regulations 2023, Section VIII, MMFs are required to invest only in interest-earning money market instruments which have a maximum weighted average tenor of eighteen (18) months, while fixed income funds invest a minimum of 80.0% of their market value of assets under management (AUM) in fixed income securities at all times hence concentrating most their investments in bonds. However, the high percentage of 62.2% in Q3’2024 is an indication of MMFs preference by the majority of investors due to their ease of investing and high liquidity, coupled with high returns,

- Fixed Income Funds recorded a 2.8% q/q growth to Kshs 53.5 bn in Q3’2024, up from Kshs 52.1 in Q2’2024. However, the allocation decreased by 3.6% points to 16.9%, from the 20.5% recorded the previous quarter, and,

- Equity Funds recorded declined performance with their investment allocation decreasing by 0.3% points to 0.7% at the end of Q3’2024, from 1.0% at the end of Q2’2024. Similarly, equity funds recorded a 11.0% decline to Kshs 2.3 bn in Q3’2024, down from Kshs 2.6 bn in Q2’2024. The decrease in equity fund’s portfolio holdings is largely attributable to reduced market activity, with the Nairobi All Share Index (NASI) registering a 2.2% q/q loss in Q3’2024 following a decline in corporate earnings by major listed companies in the Nairobi Securities Exchange such as Safaricom and BAT Kenya, as well as a tightened business environment as evidenced by Purchasing Manager’s Index (PMI) registering an average of 47.8 in Q3’2024, from an average of 49.7 in Q2’2024.

Notably, the overall UTFs portfolio remained predominantly invested in government securities, accounting for the largest share at 41.4% by the end of Q3’2024. Similarly, this represents 2.1% points increase from the 39.2% allocation in Q2’2024, with the total value increasing by 31.3% to Kshs 130.9 bn in Q3’2024 from Kshs 99.7 billion in Q2’2024. This was followed by Fixed deposits at 31.1% allocation, a marginal decrease from 33.4% allocation in Q2’2024 attributable to the lower deposit rates provided by banking institutions during the period. The table below represents asset allocations in different asset classes comparing Q3’2023, Q2’2024 and Q3’2024 in the UTF industry.

|

Cytonn Report: Distribution of Unit Trust Funds Investments in terms of Asset Classes (Kshs bn) |

||||||

|

Fund |

Q3'2023 |

Q3'2023 (%) |

Q2’2024 |

Q2’2024 (%) |

Q3’2024 |

Q3’2024 (%) |

|

Government Securities |

98.4 |

47.6% |

99.7 |

39.2% |

130.9 |

41.4% |

|

Fixed Deposits |

79.7 |

38.6% |

84.9 |

33.4% |

98.5 |

31.1% |

|

Cash and demand deposits |

8.9 |

4.3% |

35.2 |

13.9% |

46.5 |

14.7% |

|

Offshore Investments |

0.9 |

0.4% |

0.4 |

0.2% |

19.6 |

6.2% |

|

Unlisted Securities |

10.1 |

4.9% |

8.4 |

3.3% |

10.0 |

3.1% |

|

Listed Securities |

7.6 |

3.7% |

23.7 |

9.3% |

6.1 |

1.9% |

|

Immovable Property |

0.3 |

0.2% |

0.9 |

0.4% |

3.0 |

0.9% |

|

Other Collective Investments schemes |

0.7 |

0.4% |

0.8 |

0.3% |

1.9 |

0.6% |

|

Total |

206.7 |

100.0% |

254.1 |

100.0% |

316.4 |

100.0% |

According to the Capital Markets Authority, as of the end of Q3’2024, there were 41 Collective Investment Schemes (CISs) in Kenya, up from 36 recorded at the end of Q3’2023 and an increase from the 38 recorded at the end of Q2’2024. Out of the 41 schemes, 35 of them (equivalent to 85.4%) were active while 14 (14.6%) were inactive. The table below outlines the performance of the Collective Investment Schemes comparing Q2’2024 and Q3’2024;

|

|

Cytonn Report: Assets Under Management (AUM) for the Approved Collective Investment Schemes |

|||||

|

No. |

Collective Investment Schemes

|

Q2’2024 AUM |

Q2’2024 |

Q3’2024 AUM |

Q3’2024 |

AUM Growth |

|

(Kshs mns) |

Market Share |

(Kshs mns) |

Market Share |

Q2’2024 – Q3’2024 |

||

|

1 |

CIC Unit Trust Scheme |

66,802.9 |

26.3% |

70,321.8 |

22.2% |

5.3% |

|

2 |

Sanlam Unit Trust Scheme |

37,623.0 |

14.8% |

46,848.9 |

14.8% |

24.5% |

|

3 |

Mansa X |

0.0 |

0.0% |

34,231.8 |

10.8% |

- |

|

4 |

NCBA Unit Trust Scheme |

33,172.4 |

13.1% |

33,065.9 |

10.5% |

(0.3%) |

|

5 |

British American Unit Trust Scheme |

28,491.5 |

11.2% |

27,759.6 |

8.8% |

(2.6%) |

|

6 |

ICEA Unit Trust Scheme |

16,746.1 |

6.6% |

16,995.5 |

5.4% |

1.5% |

|

7 |

Old Mutual Unit Trust Scheme |

12,389.1 |

4.9% |

13,326.2 |

4.2% |

7.6% |

|

8 |

ABSA Unit Trust Scheme |

11,091.0 |

4.4% |

12,603.3 |

4.0% |

13.6% |

|

9 |

Co-op Unit Trust Scheme |

8,068.2 |

3.2% |

10,041.6 |

3.2% |

24.5% |

|

10 |

Madison Asset Managers |

6,791.8 |

2.7% |

7,370.6 |

2.3% |

8.5% |

|

11 |

Nabo Capital Limited |

5,645.0 |

2.2% |

5,954.5 |

1.9% |

5.5% |

|

12 |

KCB Asset Managers |

3,053.7 |

1.2% |

5,544.2 |

1.8% |

81.6% |

|

13 |

Jubilee Unit Trust Scheme |

2,660.4 |

1.0% |

5,072.9 |

1.6% |

90.7% |

|

14 |

Etica Capital Limited |

2,560.4 |

1.0% |

4,603.8 |

1.5% |

79.8% |

|

15 |

Dry Associates Unit Trust Scheme |

4,269.4 |

1.7% |

4,450.5 |

1.4% |

4.2% |

|

16 |

Zimele Asset Managers |

3,109.7 |

1.2% |

2,906.9 |

0.9% |

(6.5%) |

|

17 |

Mali Money Market Fund |

2,393.9 |

0.9% |

2,764.7 |

0.9% |

15.5% |

|

18 |

Lofty-Corban Unit Trust Scheme |

1,318.1 |

0.5% |

2,166.7 |

0.7% |

64.4% |

|

18 |

Apollo Asset Managers |

1,500.4 |

0.6% |

2,028.8 |

0.6% |

35.2% |

|

20 |

GenAfrica Unit Trust Scheme |

1,349.8 |

0.5% |

1,720.9 |

0.5% |

27.5% |

|

21 |

Cytonn Asset Managers |

1,288.8 |

0.5% |

1,540.4 |

0.5% |

19.5% |

|

22 |

African Alliance Kenya |

1,503.6 |

0.6% |

1,528.3 |

0.5% |

1.6% |

|

23 |

Kuza Asset Managers |

491.1 |

0.2% |

803.7 |

0.3% |

63.7% |

|

24 |

Genghis Unit Trust Fund |

700.9 |

0.3% |

767.9 |

0.2% |

9.6% |

|

25 |

Enwealth Capital Unit Trust |

497.5 |

0.2% |

690.2 |

0.2% |

38.7% |

|

26 |

Stanbic Unit Trust Scheme |

0.0 |

0.0% |

338.2 |

0.1% |

- |

|

27 |

Orient Collective Investment Scheme |

261.0 |

0.1% |

266.7 |

0.1% |

2.2% |

|

28 |

Faulu Unit Trust Scheme |

50.7 |

0.0% |

239.5 |

0.1% |

372.7% |

|

29 |

Arvocap Unit Trust Scheme |

- |

- |

170.3 |

0.1% |

- |

|

30 |

Equity Investment Bank |

137.7 |

0.1% |

138.9 |

0.0% |

0.9% |

|

31 |

Mayfair Asset Managers |

48.9 |

0.0% |

62.5 |

0.0% |

27.7% |

|

32 |

Amana Capital |

25.6 |

0.0% |

27.1 |

0.0% |

5.8% |

|

33 |

MyXeno Unit Trust Sheme |

16.1 |

- |

13.0 |

0.0% |

(19.3%) |

|

34 |

Taifa Unit Trust Scheme |

- |

- |

11.8 |

0.0% |

- |

|

35 |

Wanafunzi Investments |

0.9 |

0.0% |

0.9 |

0.0% |

3.9% |

|

36 |

Diaspora Unit Trust Scheme |

- |

- |

- |

- |

|

|

37 |

Dyer and Blair Unit Trust Scheme |

- |

- |

- |

- |

|

|

38 |

Masaru Unit Trust Fund |

- |

- |

- |

- |

|

|

39 |

Adam Unit Trust Fund |

- |

- |

- |

- |

|

|

40 |

First Ethical Opportunities Fund |

- |

|

- |

- |

|

|

41 |

Amaka Unit Trust (Umbrella) Scheme |

- |

|

- |

- |

|

|

|

Total |

254,059.7 |

100.0% |

316,378.6 |

100.0% |

24.5% |

Key take-outs from the above table include:

- Assets Under Management: CIC Unit Trust Scheme remained the largest overall Unit Trust Fund, accounting for 22.2% of the total market share. Similarly, the AUM recorded a 5.3% growth to Kshs 70.3 bn in Q3’2024, higher than the AUM of Kshs 66.8 bn in Q2’2024,

- Growth: In terms of AUM growth, Faulu Unit Scheme recorded the highest growth of 372.7% with its AUM increasing to Kshs 239.5 bn, from Kshs 50.7 bn in Q2’2024, attributable to the launch of Faulu MMF after receiving a significant capital injection of over 900.0 mn from the Old Mutual Group as well as the low base effect. On the other hand, MyXeno Unit Trust Scheme recorded the largest decline with its AUM declining by 19.3% to Kshs 13.0 bn in Q3’2024, from Kshs 16.1 mn in Q2’2024,

- Market Share: CIC Unit Trust Scheme remained the largest overall Unit Trust with a market share of 22.2%, 4.1% points decline from 26.3% recorded in Q2’2024. The decline in market share is an indication of increasing competition as new collective schemes enter the market,

- New Collective Investment Schemes: Stanbic Unit Trust Scheme, Arvocap Unit Trust Scheme and Taifa Unit Trust Scheme, with AUMs of Kshs 338.2 mn, Kshs 170.3 mn and Kshs 11.8 mn respectively, were approved as active collective investment schemes in the capital market during Q3’2024. Additionally, Mansa X funds by Standard Investment Bank converted to Mansa X special CIS funds, taking the total number of active collective schemes to 35, and,

- 6 UTFs remained inactive as at the end of Q3’2024: First Ethical Opportunities Fund, Adam Unit Trust Fund, Masaru Unit Trust Fund, Dyer and Blair Unit Trust Scheme, Diaspora Unit Trust and Amaka Unit Trust remained inactive as at the end of Q3’2024.

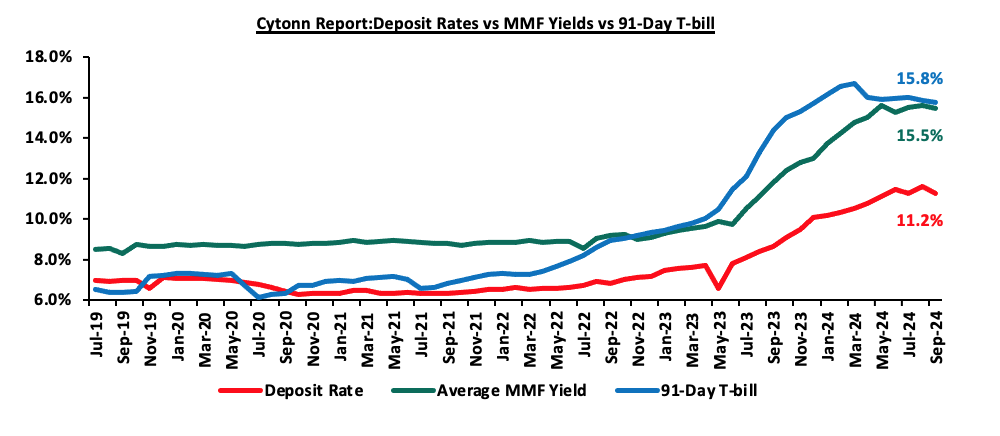

Section II: Performance of Money Market Funds

Money Market Funds (MMFs) have continued to gain popularity in Kenya, largely due to the higher returns they offer in comparison to bank deposits in addition to having a high degree of safety. According to the Central Bank of Kenya data, the weighted average deposit rate in September 2024 decreased to 11.2% from 11.6% recorded in August 2024, albeit lower than the Q3’2024 average yields of 91-day T-bill and Money Market Funds at 15.8% and 15.5% respectively. The graph below shows the performance of the Money Market Fund to other short-term financial instruments:

Source: Central Bank of Kenya, Cytonn Research

As per the regulations, funds in MMFs should be invested in short-term liquid interest-bearing securities with a weighted tenor to maturity of 18 months or less. The short-term securities include treasury bills, call deposits, commercial papers, and fixed deposits in commercial banks and deposit-taking institutions, among others as specified by CBK. As a result, Money Market Funds are best suited for investors who require a low-risk investment that offers capital preservation and liquidity, but with a high-income yield. The funds are also a good safe haven for investors who wish to switch from a higher-risk portfolio to a low-risk portfolio, especially during times of uncertainty.

Money Market Funds in Kenya accounted for Kshs 196.8 bn which makes up 62.2% of all the funds under management by Collective Investment Schemes for Q3’2024. This is 15.0% higher than the Kshs 171.2 bn recorded at the end of Q2’2024.

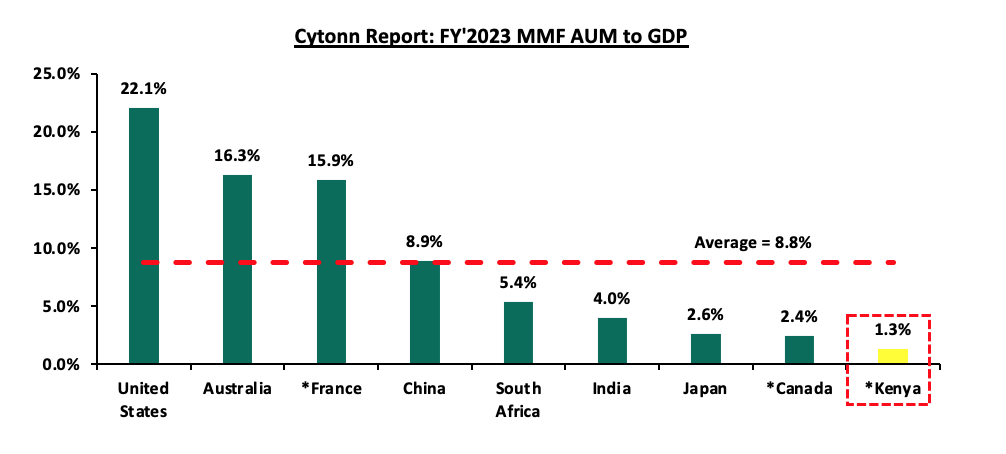

Money Market funds as an asset class are still below the potential, with Kenya’s MMF assets to GDP coming in at 1.3% as of Q3’2024, which is below the global average MMF assets to GDP ratio of 8.8% as of FY’2023. More needs to be done to increase the ratio, especially at a time when the government is trying to increase savings to GDP ratio. Notably, the 1.3% Money market AUM to GDP in Kenya represents a marginal 0.3% points increase from the 1.0% figure recorded in 2021. This is mainly attributable to the rising yields in Money markets which remain highly competitive compared to other traditional investment options. The chart below shows the performance of the Money Market Funds AUM to GDP comparing Kenya to other economies:

Source: World Bank, CMA, EFAMA

*Data as of Q3’2024

Top Five Money Market Funds by Yields

During the period under review, Cytonn Money Market Fund registered the highest average effective annual yield at 18.3% against the industry Q3’2024 average of 15.5%. Below is a table of the top five Money Market Funds with the highest average effective annual yield declared in Q3’2024;

|

Cytonn Report: Top 5 Money Market Fund Yield in Q3’2024 |

||

|

Rank |

Money Market Fund |

Effective Annual Rate (Average Q3'2024) |

|

1 |

Cytonn Money Market Fund |

18.3% |

|

2 |

Lofty-Corban Money Market Fund |

18.2% |

|

3 |

Etica Money Market Fund |

18.0% |

|

4 |

Kuza Money Market fund |

17.2% |

|

5 |

Arvocap Money Market Fund |

17.2% |

|

|

Average of Top 5 Money Market Funds |

17.8% |

|

Industry average |

15.5% |

|

Source: Cytonn Research, Daily Nation

Section III: Comparison between Unit Trust Funds AUM Growth and Other Markets

Unit Trust Funds’ assets recorded a q/q growth of 24.5% in Q3’2024. On the other hand, banks’ deposits recorded a growth of 8.3% in H1’2024 to Kshs 5.6 tn in H1’2024 from Kshs 5.5 tn in March 2023 for the banks recorded as per the last released data in June 2024, translating to 3.4% points increase from the 4.9% growth recorded in Q1’2024. For the Unit Trust Funds, the growth of 24.5% was an increase of 11.8% points, compared to the 12.7% q/q growth recorded in Q2’2024. The chart below highlights the quarter-on-quarter AUM growths for Unit Trust Funds AUM vs Listed banks’ deposits growth since 2023;

Source: Cytonn Research

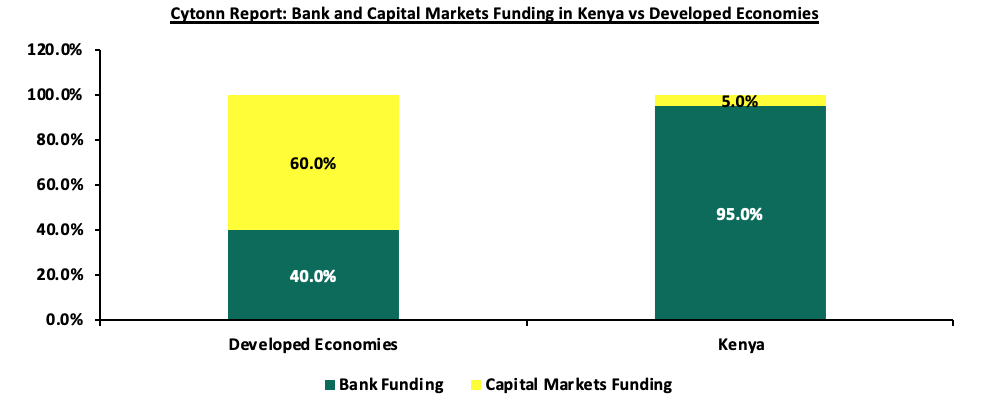

We note that there was an impressive 8.7% points q/q increase in UTF growth which can be attributed to the relatively higher returns in the collective investment schemes, especially the MMFs, which have continued to gain traction among investors. As at September 2024, average bank deposit rates stood at 11.2%, while Money Market Funds offered an average return of 15.5% for the same period. We therefore anticipate an expansion in business funding coming from capital markets from the current 5.0%, in the short-term to medium term. World Bank statistics reveal that in efficient economies, only 40.0% of business financing comes from banks, while a significant 60.0% is sourced from Capital markets. However, in Kenya, the scenario is quite different. The World Bank points out that Kenyan businesses depend on banks for a whopping 95.0% of their funding, with a negligible 5.0% being raised from the capital markets.

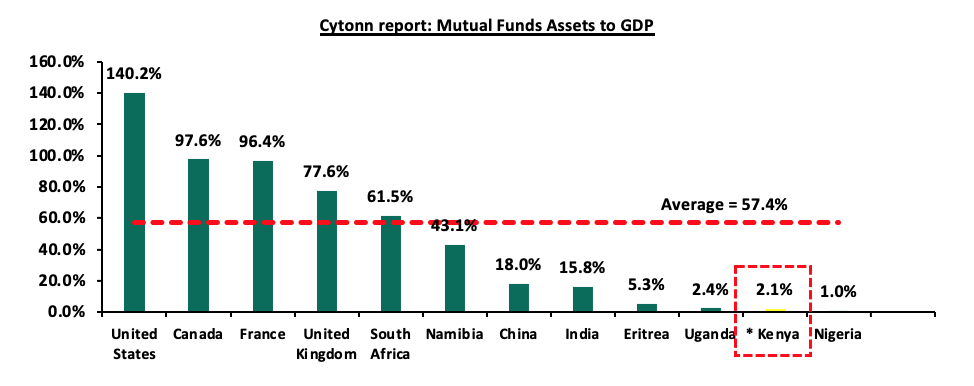

Source: World Bank

Notably, Kenya’s Mutual Funds/UTFs to GDP ratio at the end of Q3’2024 came in at 2.1%, significantly lower compared to an average of 57.4% amongst select global markets an indication of a need to continue enhancing our capital markets. Additionally, Sub-Saharan African countries such as South Africa and Namibia have higher mutual funds to GDP ratios coming in at 61.5% and 43.1%, respectively as of the latest data, compared to Kenya. The chart below shows select countries’ mutual funds as a percentage of GDP:

*Data as of December 2023

Source: World Bank Data

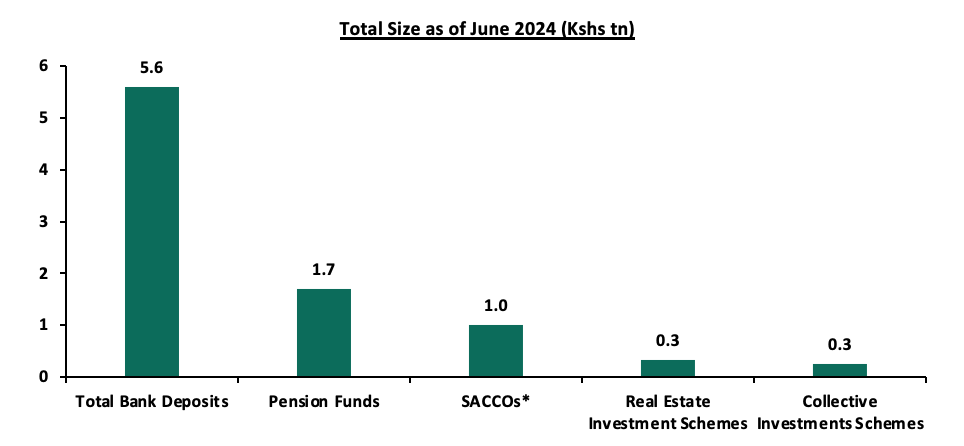

In the last five years, the Assets Under Management (AUM) of Unit Trust Funds (UTFs) have shown a remarkable performance, having grown at a 5-year CAGR of 34.7% to Kshs 316.4 bn in Q3’2024, from Kshs 71.4 bn recorded in Q3’2019. However, the industry is still dwarfed when compared to other deposit-taking institutions such as bank deposits, with the entire banking sector deposits coming in at Kshs 5.6 tn as at June 2024 from Kshs 5.8 tn recorded in December 2023. Similarly, the pension industry recorded an increase of 9.4%, to Kshs 1.7 tn as of December 2023 from Kshs 1.6 tn recorded in December 2022. Below is a graph showing the sizes of different saving channels and capital market products in Kenya;

*Data as of March 2024

Source: CMA, RBA, CBK, SASRA Annual Reports and REITs Financial Statements

Comparing other Capital Markets products like REITS, Kenya's REIT market faces additional challenges due to its relatively underdeveloped capital markets, especially when compared to countries like South Africa. Currently, there is only one listed REIT in Kenya, which is not actively trading. most property developers in Kenya continue to rely on traditional funding sources, such as banks, unlike in more developed markets. Since the establishment of REIT regulations, four REITs have been approved in Kenya, all structured as closed-ended funds with a fixed number of shares. However, none of these REITs are actively trading on the Main Investment Market Segment of the Nairobi Securities Exchange (NSE). Following the recent delisting of ILAM Fahari I-REIT, LAPTrust Imara I-REIT is the only listed REIT in the country, quoted on the restricted market sub-segment of the NSE's Main Investment Market. It is important to note that Imara did not raise funds upon listing. The ILAM Fahari I-REIT, Acorn I-REIT and D-REIT are not listed but trade on the Unquoted Securities Platform (USP), an over-the-counter market segment of the NSE. The table below outlines all REITs authorized by the Capital Markets Authority (CMA) in Kenya:

|

Cytonn Report: Authorized REITs in Kenya |

||||||

|

# |

Issuer |

Name |

Type of REIT |

Listing Date |

Market Segment |

Status |

|

1 |

ICEA Lion Asset Management (ILAM) |

Fahari |

I-REIT |

July 2024 |

Unquoted Securities Platform (USP) |

Trading |

|

2 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

I-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

3 |

Acorn Holdings Limited |

Acorn Student Accommodation (ASA) – Acorn ASA |

D-REIT |

February 2021 |

Unquoted Securities Platform (USP) |

Trading |

|

4 |

Local Authorities Pension Trust (LAPTrust) |

Imara |

I-REIT |

March 2023 |

Restricted Market Sub-Segment of the Main Invesment Market |

Restricted |

Source: Nairobi Securities Exchange, CMA

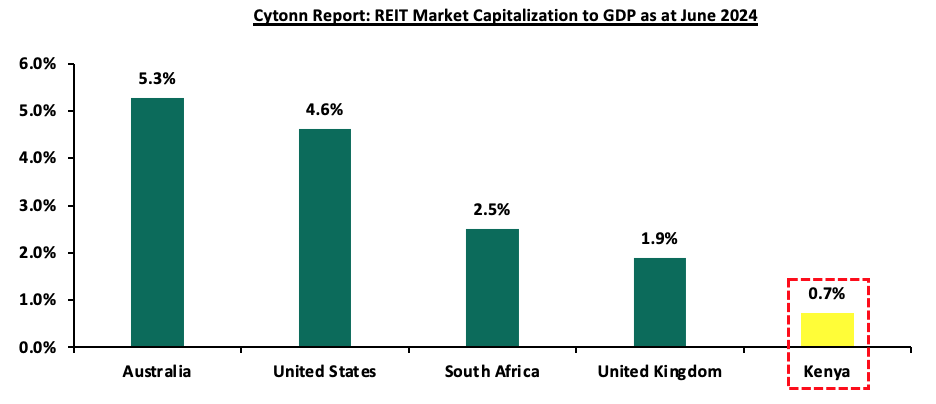

The listed REITs’ capitalization as a percentage of total market cap in Kenya stands at 0.7%, as compared to 5.3% in Australia and 2.5% in South Africa as of June 2024. The reflects the challenges faced by the Kenya's REIT market, especially when compared to countries like South Africa. Below is a graph showing a comparison of Kenya’s REITs to Market Cap Ratio to that of the US and South Africa:

Source: Online Research, Nairobi Securities Exchange (NSE)

*Kenya’s REIT combines both I-REITs and D-REITs

Section IV: Recommendations

The number of total registered Mobile Money Accounts has been growing steadily, recording a CAGR of 7.1%, increasing from Kshs 55.7 mn at the end of Q3’2019 to Kshs 78.6 mn at the end of August 2024. Consequently, there is a pressing need to leverage innovation and digitization to drive the expansion of unit trust funds in Kenya. Utilizing technology as a distribution channel for unit trust products enables these funds to reach the retail segment, which demands convenient and innovative products. To further promote the growth of Unit Trust Funds (UTFs) in the Kenyan capital market, we advocate the following recommendations:

- Encourage innovation and diversity of UTF investments: At the end of Q3’2024, investment in the money market fund segment accounted for 62.2 % of total investments by collective investment schemes, indicating concentration risk. Notably, 41.4% of UTFs' AUM was invested in securities issued by the Kenyan government and 31.1% in Fixed Deposits with Commercial Banks, a market that competes with Unit Trust Funds for deposit mobilization. As a result, there is a need to reassess laws and encourage fund managers to diversify investments, as well as improve investment vehicle innovation,

- Allow for sector funds: Under present capital markets regulations, UTFs must diversify. However, one must request specific permission in the form of sector funds such as a financial services fund, a technology fund, or a Real Estate Unit Trust Fund. Regulations permitting unit holders to invest in sector funds would go a long way towards widening the breadth of unit holders interested in participating,

- Encourage different players to enter the market to increase competition: Increased competition in capital markets will not only push Unit Trust Fund managers to provide higher returns for investors, but it will also eliminate conflicts of interest in markets and enhance the provision of innovative products and services,

- Fee optimization: Unit Trust Funds should continuously review and optimize management fees and other associated costs to ensure they are competitive while still covering operational expenses. The fee structure should be designed to align fund managers' interests with those of investors, while maintaining fairness and transparency,

- Provide Support to Fund Managers: We believe that the regulator, CMA, should incorporate market stabilization measures as part of the regulations/Act to assist fund managers in meeting fund responsibilities, particularly during times of distress, such as when there are a large number of withdrawals from the funds. We commend and appreciate the regulator's role in protecting investor interests. However, because fund managers play an important role in capital markets, the regulator should preserve the reputations of various fund managers in the business. This can be accomplished by partnering with industry participants to discover answers rather than openly rejecting and alienating industry players facing issues, that may not be in the best interests of investors,

- Improve fund transparency to provide more information to investors: To increase transparency for investors, each Unit Trust Fund should be required to publish their portfolio holdings on a quarterly basis and make the information available to the public. Providing more information to investors will increase accountability by enabling them to make more informed decisions, which will boost investor confidence, and,

- Allow non-financial institutions to participate as trustees and eliminate conflicts of interest in capital market governance: Capital market legislation should promote a governance structure that is more responsive to market participants and growth. In particular, confining Trustees of Unit Trust Schemes to Banks limits options, especially considering the direct competition between the banking industry and capital markets.

As Kenya's financial sector evolves, Unit Trust Funds play a critical role by offering diversity and accessibility to a wide range of investors. Emphasizing innovation, digitization, and product development in the capital markets will accelerate the growth of UTFs. Policymakers should support and enable UTF expansion and diversification to promote the overall growth of capital markets and attract new participants.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.