Real Estate Developers Regulatory Framework, & Cytonn Weekly #08/2023

By Research Team, Feb 26, 2023

Executive Summary

Fixed Income

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 81.0%, down from 191.3%, recorded the previous week, partly attributable to the continued tight liquidity in the money market with the average interbank rate increasing to 6.4% from 6.2% recorded the previous week. Key to note, this is the first time in seven weeks that T-bills were undersubscribed. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 11.4 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 284.1%, lower than the 552.2% recorded the previous week. The subscription rates for the 364-day and 182-day papers also declined to 36.7% and 44.0% from 63.0% and 175.3%, respectively, recorded the previous week. The yields on the government papers were on an upward trajectory, with the yields on the 364-day and 182-day papers both increasing by 3.8 bps to 10.7% and 10.1%, respectively, while yields on the 91-day paper increased by 3.2 bps to 9.7%;

We are projecting the y/y inflation rate for February 2023 to marginally ease to a range of 8.8% - 9.0%, on the back of maintained fuel prices for the period between 15th February 2023 and 14th March 2023 and maintenance of the Monetary Policy Committee Central Bank Rate (CBR) at 8.75% in January 2023 as the effects of a CBR hike by 50.0 bps in November 2022 continue to be felt in the economy;

Equities

During the week, the equities market was on a downward trajectory, with NASI and NSE 25 both declining by 1.2%, while NSE 20 declined by 1.5%, taking the YTD performance to losses of 0.7% and 1.2% for NASI and NSE 20 while NSE 25 has recorded a 0.4% YTD gain. The equities market performance was mainly driven by losses recorded by large cap stocks such as Diamond Trust Bank-Kenya (DTB-K), Bamburi, NCBA Group and EABL of 3.8%, 3.2%, 3.1% and 2.5% respectively. The losses were however mitigated by gains recorded by other large cap stocks such as Standard Chartered Bank of Kenya (SCBK) of 1.1%;

Real Estate

During the week, the Ministry of Tourism through the Tourism Research Institute released the Annual Tourism Sector Performance Report - 2022, highlighting that the number of international arrivals in Kenya rebounded by 70.5% to 1,483,752 persons in 2022 compared to 870,465 persons in 2021. The performance in 2022, represented a 72.4% recovery level compared to pre COVID-19 levels of 2,048,834 persons in 2019, 7.4% points higher than the average global recovery rate compared against the same period. In the residential sector, the County Government of Nairobi began the second phase of its plan of redeveloping old County estates through construction of 33,000 new low-cost units. In the office sector, JPMorgan Chase & Co, an American-based international investment bank, through State House Nairobi, announced plans to open its regional office in Nairobi, Kenya, serving as a central hub for its operations in East African region, with existing footprints in Nigeria and South Africa. Additionally, Commonwealth Enterprise and Investment Council (CWEIC), Commonwealth’s official business networking organization, opened its regional office in Nairobi, Kenya, that will serve as East Africa’s business hub for the organization which will help grow trade and investments in the region. In the Real Estate Investment Trusts (REITs) segment, Fahari I-REIT closed the week trading at an average price of Kshs 6.5 per share on the Nairobi Securities Exchange, a 4.5% gain from Kshs 6.2 per share recorded the previous week. On the Unquoted Securities Platform as at 24th February 2023, Acorn D-REIT and I-REIT closed the week trading at Kshs 23.9 and Kshs 20.9 per unit, respectively, a 19.4% and 4.4% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price;

Focus of the Week

The performance of Kenya’s Real Estate sector has been on a positive trajectory, with the sector’s contribution to the country’s GDP recording a 5-year Compounded Annual Growth Rate (CAGR) of 6.0% to Kshs 749.7 mn in Q3’2022 from Kshs 560.8 mn in Q3’2017. Additionally, the sector contributed 10.5% to the total GDP in Q3’2022, coming in as the second largest contributor to Kenya’s GDP, only behind the Agricultural sector that contributed 14.8%. This impressive performance of the Kenyan Real Estate sector in Q3’2022, surpassing perennial major contributors to GDP such as transport at 10.3%, both financial and insurance and product taxes at 8.9% each, while both manufacturing and trade contributed 8.5% each, points to the increased significance of Real Estate to the economy and paints a positive outlook. However, the lack of proper regulation and oversight over developers and other stakeholders poses significant challenges that could claw back the gains. One pertinent issue is that despite the existence of laws regulating players in the Real Estate sector, there are currently no specific regulations governing Real Estate developers. Without a developer regulatory framework in place, the sector is vulnerable to various risks and uncertainties, including non-compliance, lack of coordination during market turbulence, mismanagement of funds and unethical practices. Therefore, there is urgent need for Kenya to establish a regulatory platform, anchored in law, that addresses the unique needs of Real Estate developers, financiers, and other stakeholders in the sector. Consequently, this week, we turn our focus to addressing the regulatory gap by highlighting the existing legal frameworks that regulate the Real Estate sector in Kenya, and case studies from other countries to provide recommendations on a regulatory framework for developers in the sector;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.69%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.75% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Kevin Karobia, Lead Investment Analyst at Cytonn Investments moderated a Twitter space hosted by Sharp Daily discussing where to invest your money in 2023. Listen to the conversation here;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for assignment, click here for the latest term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

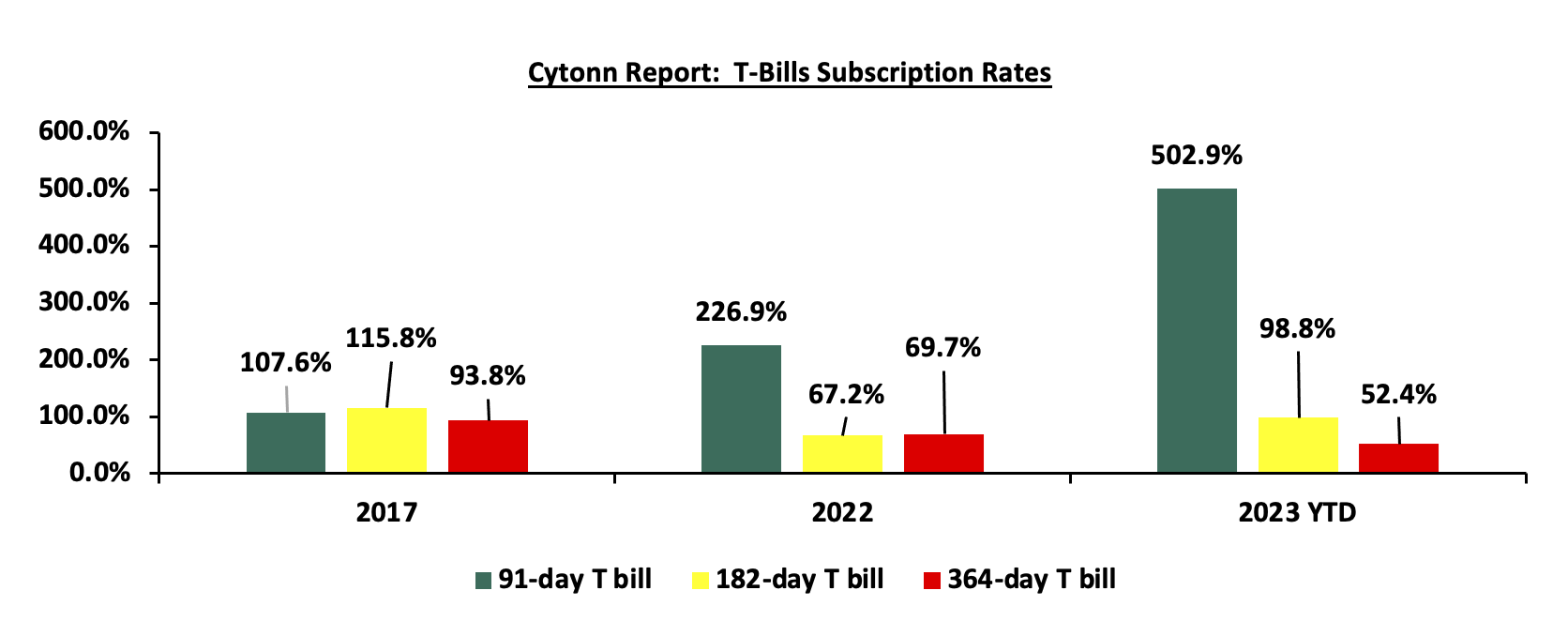

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 81.0%, down from 191.3%, recorded the previous week, partly attributable to the continued tight liquidity in the money market with the average interbank rate increasing to 6.4% from 6.2% recorded the previous week. Key to note, this is the first time in seven weeks that T-bills were undersubscribed. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 11.4 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 284.1%, lower than the 552.2% recorded the previous week. The subscription rates for the 364-day and 182-day papers also declined to 36.7% and 44.0% from 63.0% and 175.3%, respectively, recorded the previous week. The yields on the government papers were on an upward trajectory, with the yields on the 364-day and 182-day papers both increasing by 3.8 bps to 10.7% and 10.1%, respectively, while yields on the 91-day paper increased by 3.2 bps to 9.7%. The Government accepted Kshs 18.5 bn worth of bids out of the Kshs 19.4 bn worth of bids received, translating to an acceptance rate of 97.0%. The graph below compares the overall T- bills subscription rates obtained in 2017, 2022 and 2023 Year to Date (YTD):

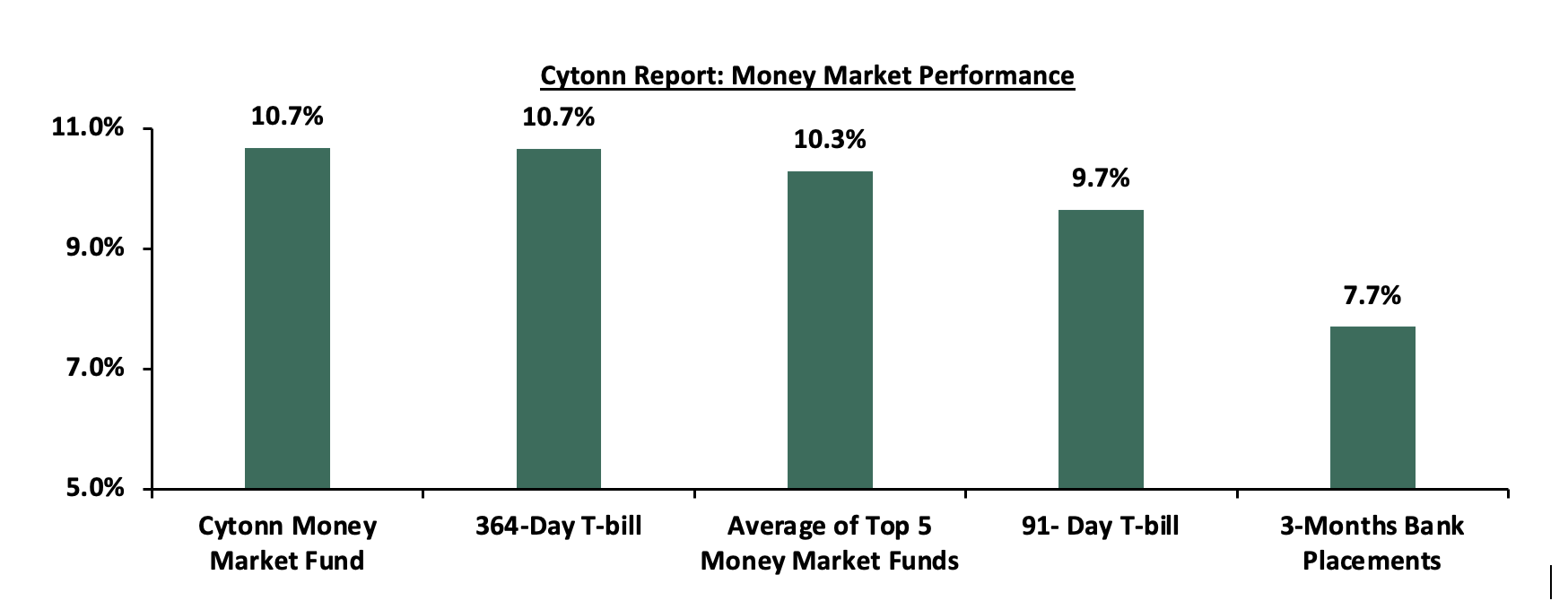

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 364-day T-bill and 91-day T-bill increased by 3.8 bps and 3.2 bps to 10.7% and 9.7%, respectively. The average yield on the Top 5 Money Market Funds remained relatively unchanged at 10.3%, similar to what was recorded the previous week, while that of Cytonn Money Market Fund declined slightly by 10.0 bps to 10.7% from 10.8% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 24th February 2023:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 24th February 2023 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (dial *809# or download Cytonn App) |

10.7% |

|

2 |

Madison Money Market Fund |

10.3% |

|

3 |

Dry Associates Money Market Fund |

10.3% |

|

4 |

GenCap Hela Imara Money Market Fund |

10.1% |

|

5 |

Apollo Money Market Fund |

10.1% |

|

6 |

NCBA Money Market Fund |

10.0% |

|

7 |

Zimele Money Market Fund |

9.9% |

|

8 |

Old Mutual Money Market Fund |

9.9% |

|

9 |

AA Kenya Shillings Fund |

9.8% |

|

10 |

Nabo Africa Money Market Fund |

9.8% |

|

11 |

Kuza Money Market fund |

9.8% |

|

12 |

Co-op Money Market Fund |

9.7% |

|

13 |

Sanlam Money Market Fund |

9.6% |

|

14 |

British-American Money Market Fund |

9.3% |

|

15 |

CIC Money Market Fund |

9.2% |

|

16 |

ICEA Lion Money Market Fund |

8.9% |

|

17 |

Orient Kasha Money Market Fund |

8.9% |

|

18 |

Absa Shilling Money Market Fund |

8.1% |

|

19 |

Equity Money Market Fund |

6.0% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets tightened, with the average interbank rate increasing to 6.4% from 6.2% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded increased by 13.8% to Kshs 24.5 bn from Kshs 21.5 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds were on upward trajectory partly attributable to increased perceived risks in the economy amid the country’s dwindling forex reserves raising concerns on the country’s ability to service its public debt obligations. The yields on the 10-year Eurobond issued in 2014, 10-year and 30-year Eurobonds issued in 2018, and 12-year Eurobond issued in 2019 recorded the largest gains, having gained by 0.2% points each to 11.9%, 10.7%, 11.0% and 10.8% from 11.7%, 10.5%, 10.8% and 10.6%, respectively, recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 23rd February 2023;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

Amount Issued (USD bn) |

2.0 |

1.0 |

1.0 |

2.1* |

1.0 |

|

|

Years to Maturity |

1.3 |

5.0 |

25.0 |

4.2 |

9.2 |

11.3 |

|

Yields at Issue |

6.6% |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

|

2-Jan-23 |

12.9% |

10.5% |

10.9% |

10.9% |

10.8% |

9.9% |

|

1-Feb-23 |

11.2% |

10.2% |

10.6% |

10.5% |

10.3% |

9.8% |

|

16-Feb-23 |

11.7% |

10.5% |

10.8% |

10.8% |

10.6% |

10.1% |

|

17-Feb-23 |

11.9% |

10.6% |

10.9% |

11.0% |

10.7% |

10.2% |

|

20-Feb-23 |

11.9% |

10.6% |

10.9% |

11.0% |

10.7% |

10.2% |

|

21-Feb-23 |

12.0% |

10.7% |

11.0% |

11.0% |

10.8% |

10.3% |

|

22-Feb-23 |

12.1% |

10.9% |

11.1% |

11.1% |

11.0% |

10.4% |

|

23-Feb-23 |

11.9% |

10.7% |

11.0% |

10.9% |

10.8% |

10.2% |

|

Weekly Change |

0.2% |

0.2% |

0.2% |

0.1% |

0.2% |

0.1% |

|

MTD Change |

0.6% |

0.5% |

0.4% |

0.4% |

0.5% |

0.5% |

|

YTD Change |

(1.0%) |

0.2% |

0.1% |

(0.0%) |

0.1% |

0.4% |

*2019 aggregate amount issued for the two issues was USD 2.1 bn

Source: Central Bank of Kenya (CBK)

Kenya Shilling:

During the week, the Kenyan shilling depreciated by 0.6% against the US dollar to close the week at Kshs 126.4, from Kshs 125.6 recorded the previous week, partly attributable to sustained high dollar demand from importers, especially oil and energy sectors against a slower supply of hard currency. On a year to date basis, the shilling has depreciated by 2.4% against the dollar, adding to the 9.0% depreciation recorded in 2022. We expect the shilling to remain under pressure in 2023 as a result of:

- High global crude oil prices on the back of persistent supply chain bottlenecks coupled with high demand,

- An ever-present current account deficit estimated at 4.9% of GDP in 2022, despite improving by 0.3% points from 5.2% recorded in 2021, and,

- The need for Government debt servicing which continues to put pressure on forex reserves given that 69.3% of Kenya’s External debt was US Dollar denominated as of October 2022.

The shilling is however expected to be supported by:

- Improving diaspora remittances standing at USD 349.4 mn as at January 2023, representing a 3.2% y/y increase from USD 338.7 mn recorded in a similar period in 2022.

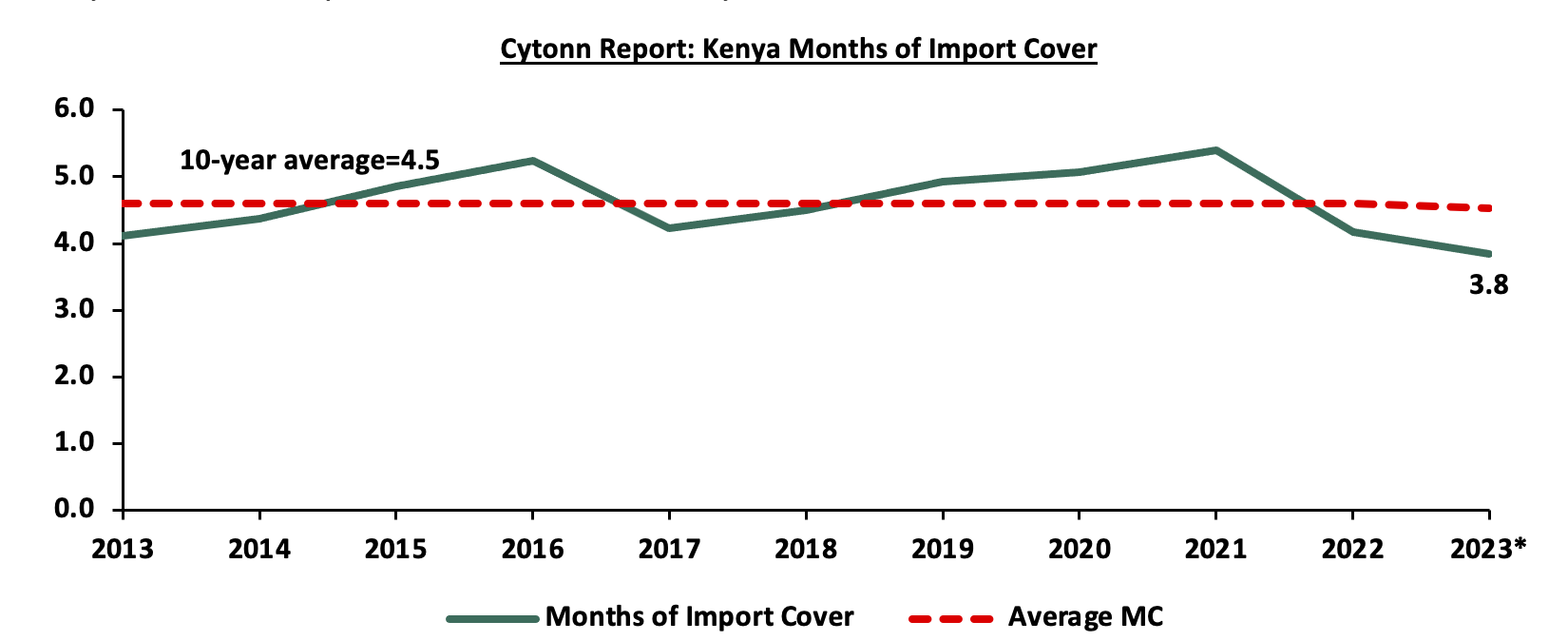

Key to note, Kenya’s forex reserves declined marginally by 0.2% to remain relatively unchanged at USD 6.9 bn as of 23rd February 2023. As such, the country’s months of import cover remained unchanged at 3.8 months similar to what was recorded the previous week, remaining marginally below the statutory requirement of maintaining at least 4.0-months of import. The chart below summarizes the evolution of Kenya months of import cover over the last 10 years;

*Figure as of 24th February 2023

Weekly Highlight: February 2023 inflation Projection

We are projecting the y/y inflation rate for February 2023 to ease to a range of 8.6%-9.0% mainly on the back of:

- Transmission of the Impact of the Tightened Monetary Policy - The Monetary Policy Committee has maintained a tightened monetary policy, maintaining the MPC rate at 8.75% in January 2023, which followed the 50.0 bps to 8.75% in November 2022, from 8.25% in September 2022. Key to note, the impact the tightened Monetary Policy Committee Central Bank rate is still transmitting in the economy, evidenced by the slight reduction in inflation to 9.0% in January 2023 from 9.1% in December 2022 and is expected to continue anchoring the inflation rate towards the CBK’s target range of 2.5%-7.5%,, and,

- Maintained Fuel Prices- For the third consecutive time, The Energy and Petroleum Regulatory Authority (EPRA) maintained the fuel prices for the period between 15th February 2023 to 14th March 2023, at Kshs 177.3, Kshs 162.0 and Kshs 145.9 per litres of Super Petrol, Diesel and Kerosene, respectively.

Kenya’s inflation has been easing over the last four months coming in at 9.0% in January 2023 from a peak of 9.6% in October 2022 pointing towards a gradual easing, in tandem with the cooling down of the global inflation. Further, the easing is attributable to the impact of the tightened monetary policy with the MPC increasing the rate to 8.75% in November 2022 and maintaining the same in January 2023. As such, the impact of the further tightening in November 2022 is still transmitting in the economy and will continue to anchor the elevated inflation towards the Central Bank’s target range of 2.5%-7.5%. Going forward, we expect the inflation to remain elevated in the short term but to continue easing at a gradual rate because of the high fuel and food prices. Notably, the government’s plan to do away with the subsidies as part of austerity measures, the erratic weather conditions in the country and high electricity prices will continue to increase the cost of living consequently slowing down the rate of inflation easing.

Rates in the Fixed Income market have remained relatively stable due to the relatively ample liquidity in the money market. The government is 5.6% behind its prorated borrowing target of Kshs 385.1 bn having borrowed Kshs 363.4 bn of the Kshs 581.7 bn borrowing target for the FY’2022/2023. We believe that the projected budget deficit of 5.7% is relatively ambitious given the downside risks and deteriorating business environment occasioned by high inflationary pressures. Further, revenue collections are lagging behind, with total revenue as at January 2023 coming in at Kshs 1.1 tn in the FY’2022/2023, equivalent to 53.3% of its target of Kshs 2.1 tn and 91.4% of the prorated target of Kshs 1.2 tn. Therefore, we expect a continued upward readjustment of the yield curve in the short and medium term, with the government looking to bridge the fiscal deficit through the domestic market. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the week, the equities market was on a downward trajectory, with NASI and NSE 25 both declining by 1.2%, while NSE 20 declined by 1.5%, taking the YTD performance to losses of 0.7% and 1.2% for NASI and NSE 20 while NSE 25 has recorded a 0.4% YTD gain. The equities market performance was mainly driven by losses recorded by large cap stocks such as Diamond Trust Bank-Kenya (DTB-K), Bamburi, NCBA Group and EABL of 3.8%, 3.2%, 3.1% and 2.5% respectively. The losses were however mitigated by gains recorded by other large cap stocks such as Standard Chartered Bank of Kenya (SCBK) of 1.1%.

During the week, equities turnover declined by 38.8% to USD 6.4 mn from USD 10.5 mn recorded the previous week, taking the YTD turnover to USD 95.9 mn. Foreign investors remained net sellers, with a net selling position of USD 1.9 mn, from USD 3.0 mn recorded the previous week, taking the YTD net selling position to USD 25.9 mn.

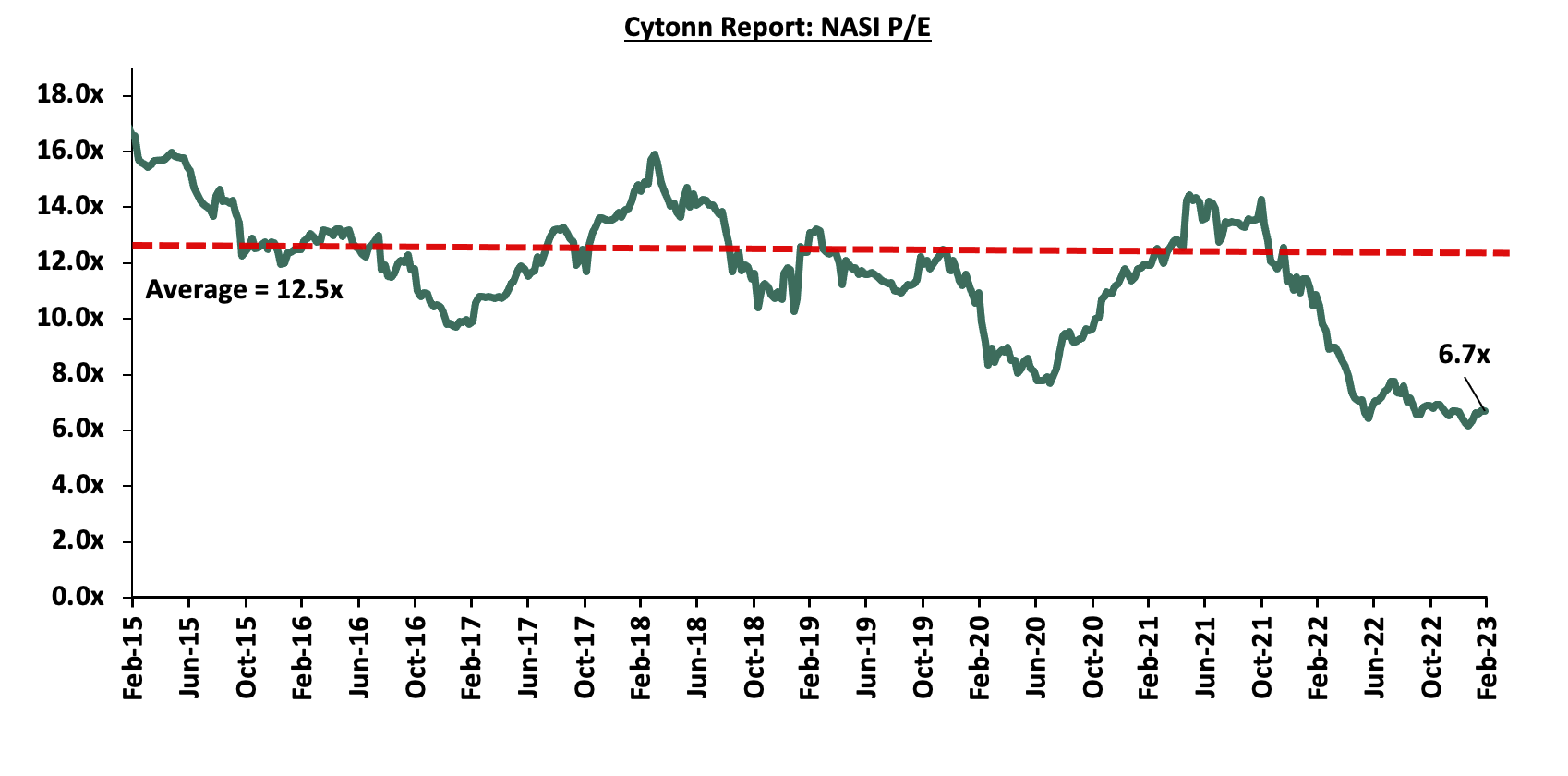

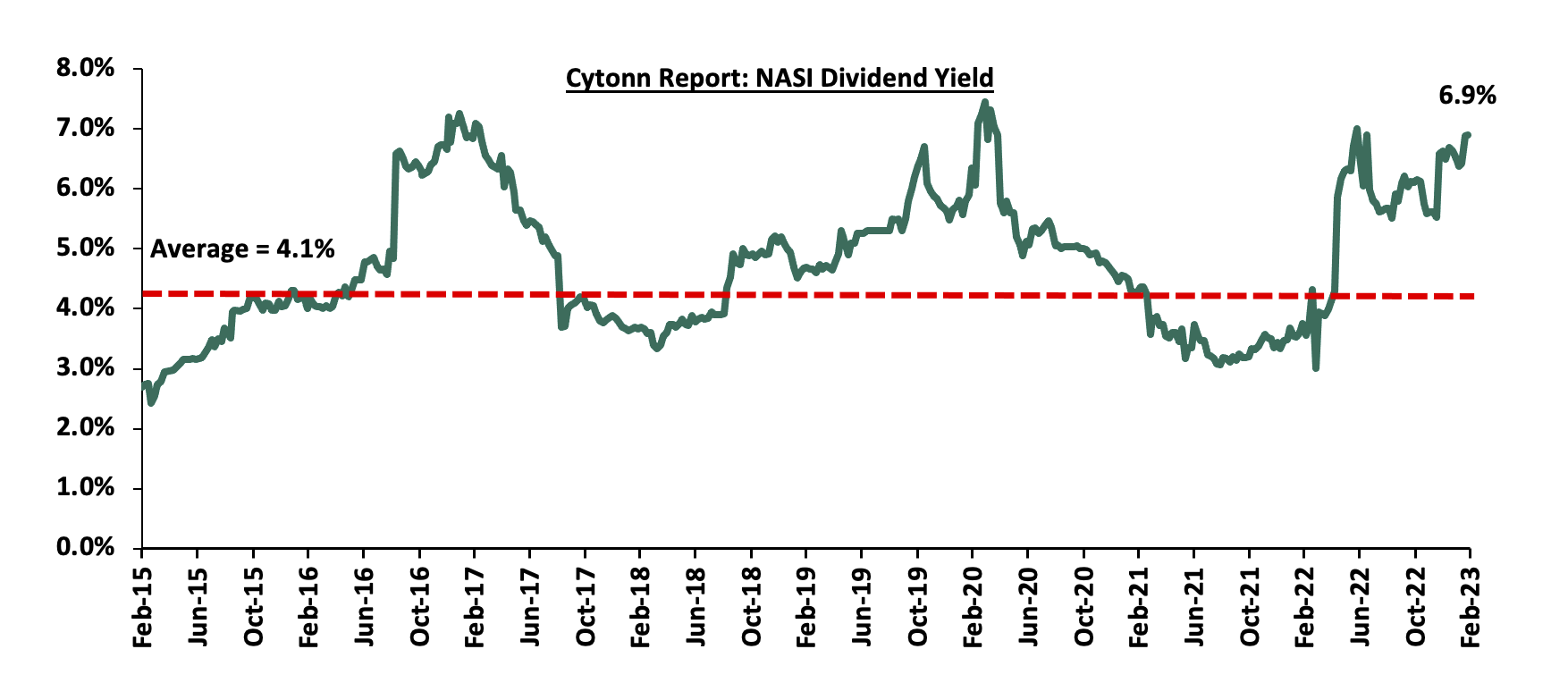

The market is currently trading at a price to earnings ratio (P/E) of 6.7x, 46.4% below the historical average of 12.5x, and a dividend yield of 6.9%, 2.8% points above the historical average of 4.1%. Key to note, NASI’s PEG ratio currently stands at 0.9x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of coverage:

|

Company |

Price as at 17/02/2023 |

Price as at 24/02/2023 |

w/w change |

YTD Change |

Year Open 2023 |

Target Price* |

Dividend Yield**** |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Jubilee Holdings |

183.0 |

182.3 |

(0.4%) |

(8.3%) |

198.8 |

305.9 |

7.7% |

75.6% |

0.3x |

Buy |

|

KCB Group*** |

38.6 |

38.3 |

(0.6%) |

(0.1%) |

38.4 |

52.5 |

7.8% |

44.9% |

0.6x |

Buy |

|

Kenya Reinsurance |

1.8 |

1.8 |

(2.7%) |

(5.3%) |

1.9 |

2.5 |

5.6% |

47.5% |

0.1x |

Buy |

|

Britam |

5.1 |

5.1 |

0.4% |

(1.2%) |

5.2 |

7.1 |

0.0% |

38.5% |

0.8x |

Buy |

|

Sanlam |

8.6 |

8.7 |

1.6% |

(9.0%) |

9.6 |

11.9 |

0.0% |

36.6% |

0.9x |

Buy |

|

Liberty Holdings |

5.0 |

5.0 |

0.0% |

(1.0%) |

5.0 |

6.8 |

0.0% |

35.3% |

0.4x |

Buy |

|

Equity Group*** |

46.5 |

46.0 |

(1.1%) |

2.0% |

45.1 |

58.4 |

6.5% |

33.5% |

1.1x |

Buy |

|

ABSA Bank*** |

12.6 |

12.6 |

0.0% |

2.9% |

12.2 |

15.5 |

8.8% |

31.9% |

1.1x |

Buy |

|

Co-op Bank*** |

12.6 |

12.6 |

(0.4%) |

3.7% |

12.1 |

15.5 |

8.0% |

31.2% |

0.7x |

Buy |

|

NCBA*** |

37.4 |

36.2 |

(3.1%) |

(7.1%) |

39.0 |

43.4 |

8.3% |

28.1% |

0.8x |

Buy |

|

I&M Group*** |

18.0 |

18.0 |

0.0% |

5.6% |

17.1 |

20.8 |

8.3% |

24.0% |

0.5x |

Buy |

|

Diamond Trust Bank*** |

50.0 |

48.1 |

(3.8%) |

(3.5%) |

49.9 |

57.1 |

6.2% |

25.0% |

0.2x |

Buy |

|

CIC Group |

2.0 |

2.0 |

1.0% |

5.2% |

1.9 |

2.3 |

0.0% |

15.4% |

0.7x |

Accumulate |

|

Standard Chartered*** |

161.3 |

163.0 |

1.1% |

12.4% |

145.0 |

166.3 |

11.7% |

13.7% |

1.1x |

Accumulate |

|

Stanbic Holdings |

111.0 |

109.0 |

(1.8%) |

6.9% |

102.0 |

112.0 |

8.3% |

11.0% |

1.0x |

Accumulate |

|

HF Group |

3.7 |

3.6 |

(3.0%) |

13.0% |

3.2 |

3.4 |

0.0% |

(3.7%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in ****Based on FY’2021 dividend |

||||||||||

We are “Neutral” on the Equities markets in the short term due to the current adverse operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.9x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the economic outlook in the short term.

- Industry Report

During the week, the Ministry of Tourism through the Kenya Tourism Research Institute released the Annual Tourism Sector Performance Report - 2022, highlighting the performance in the number of international visitor arrivals, inbound tourism earnings, bed and room occupancies, and the Meetings Incentives Conferences and Exhibition (MICE) subsector in local and international conferences in 2022 as discussed below;

-

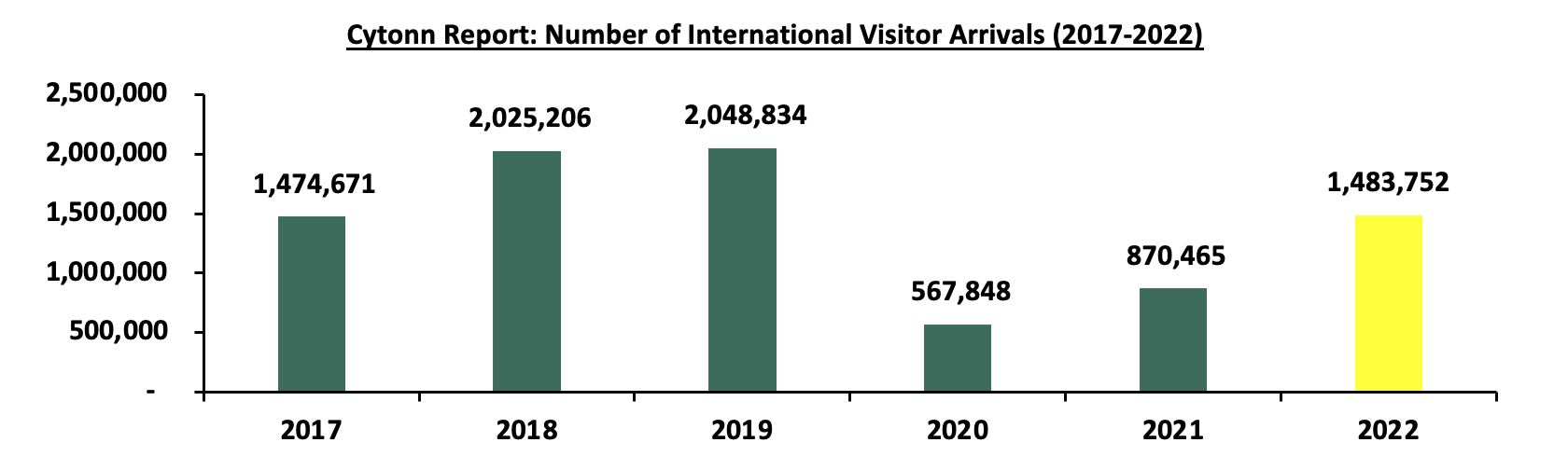

- Kenya registered a 70.5% increase in the number of international arrivals to 1,483,752 persons in 2022 compared to 870,465 persons in 2021. The performance in 2022, represented a 72.4% recovery level compared to pre COVID-19 levels of 2,048,834 persons in 2019, 7.4% points higher than the average global recovery rate compared against the same period. The impressive performance was attributed to; i) continuous easing of COVID-19 containment restrictions and flight travel advisories by many international markets and those imposed in the country, ii) the election season which attracted more regional and international expatriates and election observers, iii) peaceful post-electioneering period after the August general elections, with the subsequent months illustrating sustained improved performance fueled by the festive holidays, iv) resumption of the cruise tourism, v) intensive marketing of Kenya’s tourism market through platforms such as the Magical Kenya, Kenya Tourism Board, and implementation of key government initiatives such as the New Tourism Strategic for Kenya 2021-2025, and, vi) increased conferences and meetings from private sector businesses and companies. The graph below shows the number of international arrivals from 2017 to 2022;

Source: Kenya Tourism Research Institute (KTRI)

Source: Kenya Tourism Research Institute (KTRI) - The highest number of visitor arrivals were from the United States of America (USA) and Uganda, which registered total number of tourists at 209,360 and 151,121, respectively, attributed to the total lifting of air travel advisories and pandemic related lockdowns into the country. Australia recorded the highest recovery rate in the market, illustrating 253.0% growth to 11,931 persons in 2022 from 3,376 in 2021 in spite of the little efforts made towards marketing of Kenyan tourism to the source market,

- In terms of purpose of visit, 543,458 tourists entered the country for leisure, representing 36.6%, while 413,180 came in to visit friends or family members representing 27.8%, and 404,183 came in for business and MICE purposes. This was attributed to; i) lifting of all travel restrictions and lockdowns owing to reopening of the global economy which boosted recovery of the hospitality and tourism sectors, ii) increased leisure activities during the festive season and sporting activities with the hosting of 2022 Annual Safari Rally competition, and, iii) increased conferences and meetings from private sector businesses and companies with the peaceful election period attracting more expatriates,

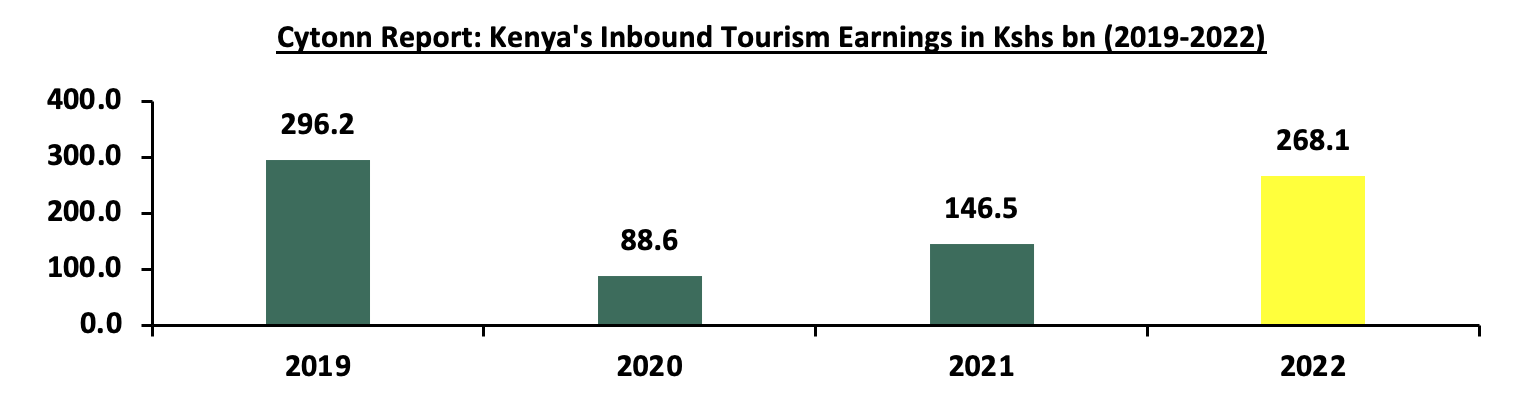

- In terms of inbound receipts, inbound tourism earnings increased by 82.9% to Kshs 268.1 bn in 2022 compared to Kshs 146.51 bn in 2021, achieving a 90.5% recovery rate compared to 2019 pre-COVID levels which raked in Kshs 296.2 bn. The rate of growth in revenues was majorly attributable to the 70.5% growth in number of international arrivals, as well as the continued weakening of the Kenyan shilling against other major currencies such as the United States Dollar, Sterling Pound and Euro. The graph below shows Kenya's Inbound Tourism Earnings from 2019 to 2022;

- Kenya registered a 70.5% increase in the number of international arrivals to 1,483,752 persons in 2022 compared to 870,465 persons in 2021. The performance in 2022, represented a 72.4% recovery level compared to pre COVID-19 levels of 2,048,834 persons in 2019, 7.4% points higher than the average global recovery rate compared against the same period. The impressive performance was attributed to; i) continuous easing of COVID-19 containment restrictions and flight travel advisories by many international markets and those imposed in the country, ii) the election season which attracted more regional and international expatriates and election observers, iii) peaceful post-electioneering period after the August general elections, with the subsequent months illustrating sustained improved performance fueled by the festive holidays, iv) resumption of the cruise tourism, v) intensive marketing of Kenya’s tourism market through platforms such as the Magical Kenya, Kenya Tourism Board, and implementation of key government initiatives such as the New Tourism Strategic for Kenya 2021-2025, and, vi) increased conferences and meetings from private sector businesses and companies. The graph below shows the number of international arrivals from 2017 to 2022;

. Source: Kenya Tourism Research Institute (KTRI)

. Source: Kenya Tourism Research Institute (KTRI)

-

-

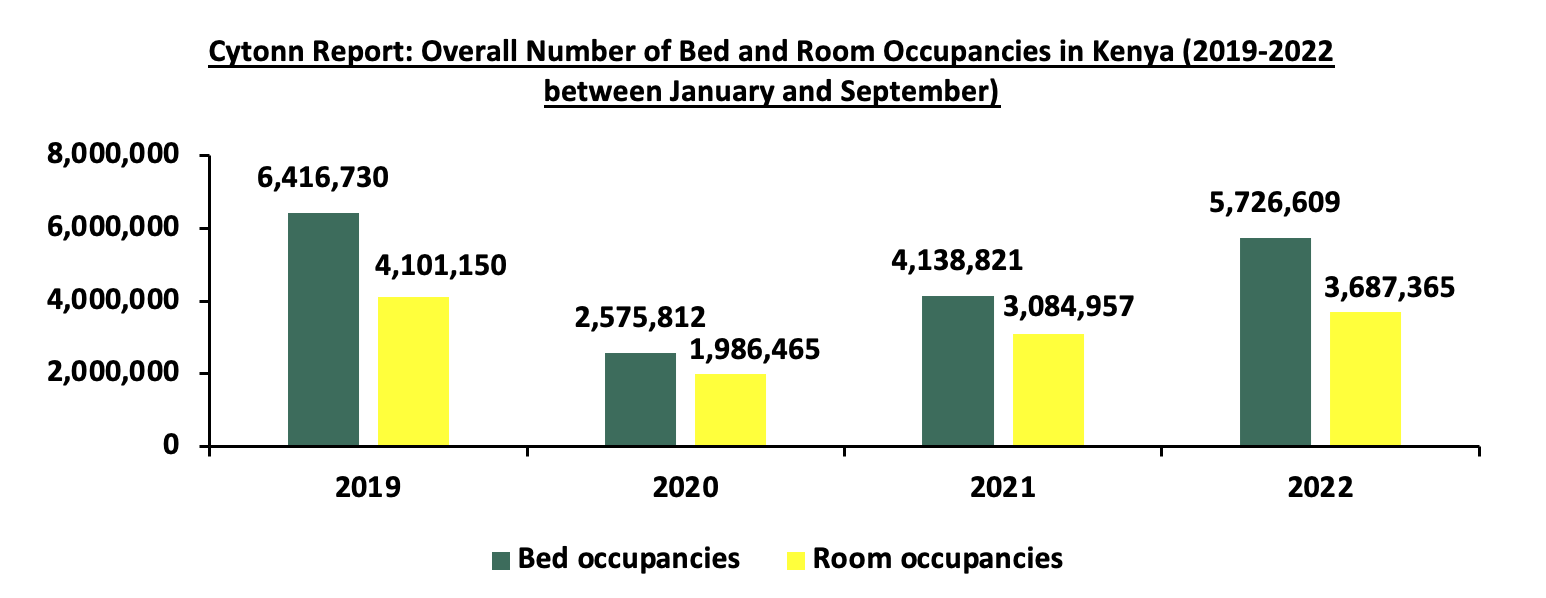

- In regard to number of both international and domestic bed and room occupancies, the bed occupancy grew by 38.4% to 5,726,609 beds in the period January to September 2022 from 4,138,821 beds the same period in 2021. This represented an 89.2% recovery a rate against 2019 which recorded 6,416,730 occupied beds. On the other hand, rooms occupancy increased by 19.5% to 3,687,365 in 2022 from January to September from 3,084,957 in the same period in 2021, achieving a recovery rate of 89.9% against 2019 pre-COVID levels which recorded 4,101,150 rooms occupied. The growth in occupancies were attributed to; i) reopening of the economy owing to relaxation of COVID-19 pandemic related protocols that resulted to full revamp of accommodation facilities which were temporarily shut down, ii) the rise in the number of international visitors arriving, and, iii) significant growth in the domestic tourism activity occasioned by aggressive marketing strategies such as the ‘Kenya Inanitosha Campaign’. The graph below shows the overall number of bed and room occupancies in Kenya between January and September, from 2019 to 2022;

Source: Kenya Tourism Research Institute (KTRI)

Source: Kenya Tourism Research Institute (KTRI)

- In regard to number of both international and domestic bed and room occupancies, the bed occupancy grew by 38.4% to 5,726,609 beds in the period January to September 2022 from 4,138,821 beds the same period in 2021. This represented an 89.2% recovery a rate against 2019 which recorded 6,416,730 occupied beds. On the other hand, rooms occupancy increased by 19.5% to 3,687,365 in 2022 from January to September from 3,084,957 in the same period in 2021, achieving a recovery rate of 89.9% against 2019 pre-COVID levels which recorded 4,101,150 rooms occupied. The growth in occupancies were attributed to; i) reopening of the economy owing to relaxation of COVID-19 pandemic related protocols that resulted to full revamp of accommodation facilities which were temporarily shut down, ii) the rise in the number of international visitors arriving, and, iii) significant growth in the domestic tourism activity occasioned by aggressive marketing strategies such as the ‘Kenya Inanitosha Campaign’. The graph below shows the overall number of bed and room occupancies in Kenya between January and September, from 2019 to 2022;

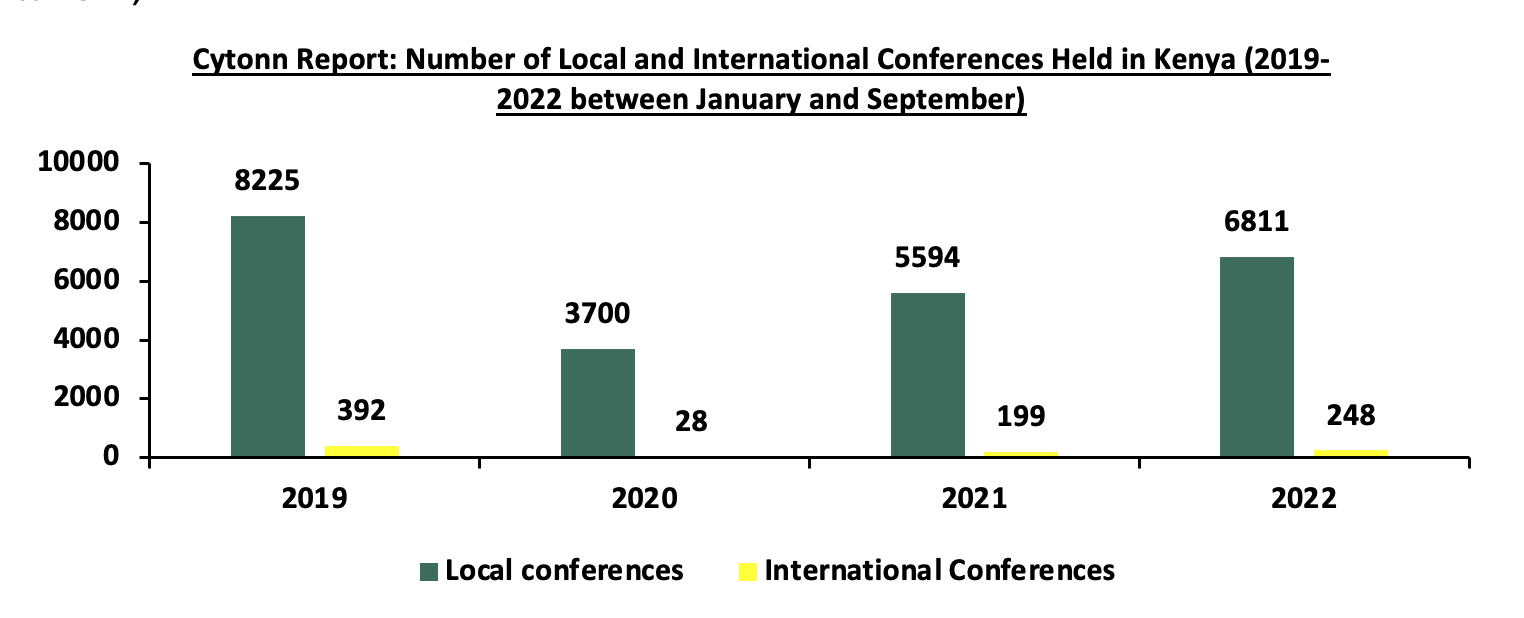

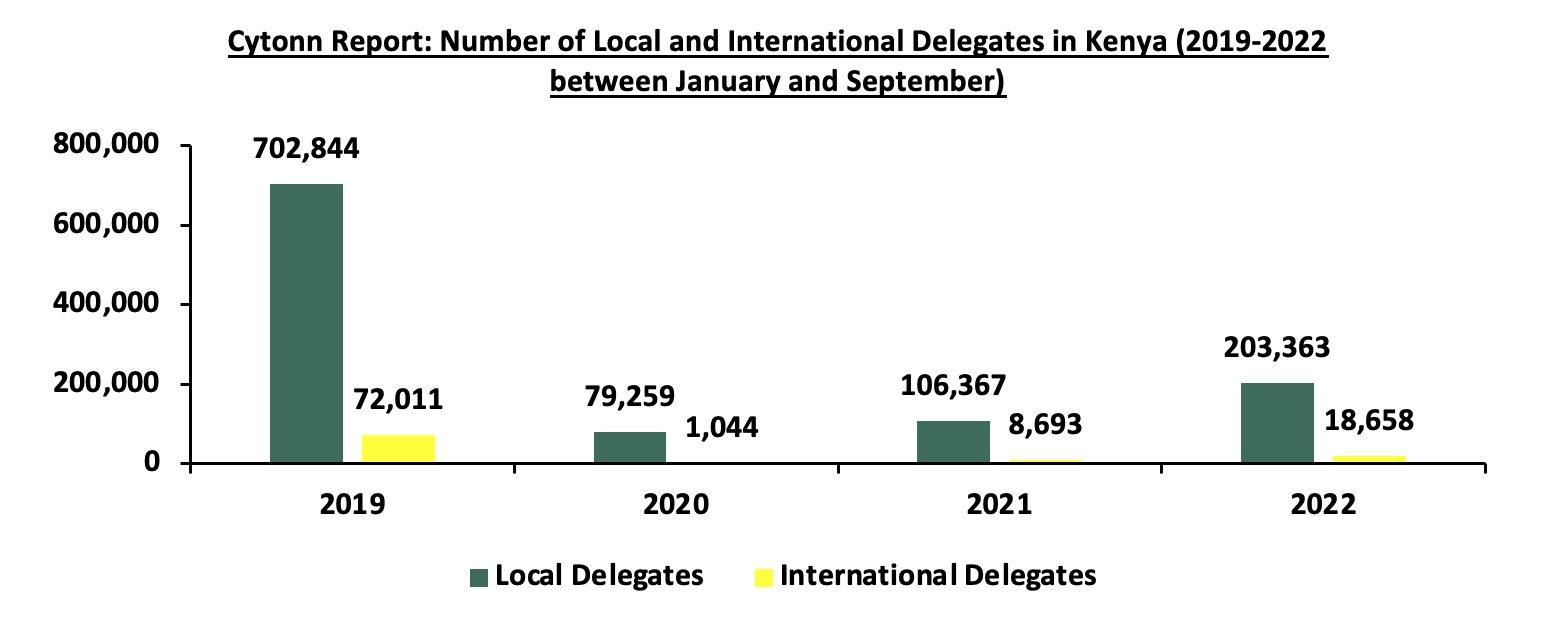

- The number of international conferences held in the country increased by 24.6% to 248 in the period between January and September 2022, from 199 within the same period in 2021, achieving a 63.2% recovery rate compared to 2019 pre-COVID levels of 392 conferences. This also led to an increase of 114.6% in number of international delegates to a total of 18,658 in the period between January and September 2022, from 8,693 within the same period in 2021. Both performances were attributed to; i) relaxation of travel advisories with increased health and safety measures in containing COVID-19 among the delegates, ii) peaceful electioneering period that also attracted election observers and expatriates, and, iii) increased marketing strategies put in place by the Government such as bidding for major international conferences like United Nations Environment Assembly, World Travels Award, Africities Summit, among others, and,

- On the other hand, the number of local conferences rose by 21.8% to 6,811 in the period between January and September 2022 from 5,594 within the same period in 2021, achieving recovery rate of 82.8% compared to 2019 pre-COVID levels of 8,225 conferences. This led to an increase of 91.2% in number of local delegates to a total of 203,363 in the period between January and September 2022, from 87,444 within the same period in 2021. The upward trajectory in performance was attributed to; i) lifting of the ban on physical gatherings, ii) government drive on the COVID-19 vaccination of citizens, iii) increased public and private expos, trainings, seminars, and, workshops organized by corporate organizations, County and national governments, iv) a return to normalcy in businesses, and, v) peaceful electioneering period. The graph below shows the overall number of local and international conferences held in Kenya between January and September, from 2019 to 2022;

-

. Source: Kenya Tourism Research Institute (KTRI)

. Source: Kenya Tourism Research Institute (KTRI)

The graph below shows the number of local and international delegates in Kenya between January and September, from 2019 to 2022;

. Source: Kenya Tourism Research Institute (KTRI)

. Source: Kenya Tourism Research Institute (KTRI)

Moving forward, we expect improved performance with increased activities in the tourism and hospitality sectors, supported by; i) continuous recovery of the economy in the post-COVID-19 and electioneering periods, increased business events, conferences, and meetings from the public and private sectors, ii) increased leisure and sporting activities such as the 2023 Annual World Safari Rally, iii) continued recognition of Kenya’s hospitality industry through positive accolades awarded to several local and foreign hotel brands based in Kenya which have boosted investors’ confidence in the sector such as the World Travel Awards 2022, MICE Awards, Fodor Finest Hotels, among others, and, iv) intensive marketing of Kenya’s tourism market through platforms such as the Magical Kenya and Kenya Tourism Board to local and international tourists. However, due to increased insecurity cases within the country and its neighbouring states such as Ethiopia, South Sudan, Democratic Republic of Congo (DRC) and Somalia, we anticipate factors such as the recently issued travel advisories regarding certain regions of the country by the United Kingdom (UK), United States of America (USA), Irish, and Canadian governments in February 2023 to have a negative impact on international arrivals in 2023. This is in consideration that the aforementioned countries are among top tourist markets for Kenya. Additionally, as part of the current government’s austerity measures, we expect the decision to indefinitely suspend hotel meetings, conferences and trainings by Ministries, Agencies and State Departments (MADs) will further weigh down the optimum performance of the conferencing, food and accommodation sub-sectors.

- Residential Sector

During the week, the County Government of Nairobi began the second phase of its plan of redeveloping old County estates through construction of 33,000 new low-cost units. The plan, which is under the Urban Renewal and Housing Program was formulated in FY’2015/2016 and is part of the general Nairobi Integrated Urban Development Master Plan (NIUPLAN) of 2013. The Housing and Urban Renewal program of Nairobi County is an initiative aimed at improving the living conditions of the low-income residents of Nairobi by addressing the challenges faced in the housing and urban development sector. The program seeks to achieve this goal by implementing various strategies such as; i) slum upgrading and improving the existing housing infrastructure, ii) developing new affordable and social housing units, iv) creating sustainable urban development solutions by encouraging the use of eco-friendly materials in housing construction, and, iv) developing the necessary infrastructure to support urban housing development such as roads, water supply systems, and sewage systems.

The County government, through its first and second phases of the plan, targets specific estates for redevelopment of housing infrastructure, focus on social housing, and upgrade of slums through joint venture, with the County government providing land as equity contribution and private investors funding it and providing technical expertise. The County Government has so far partnered with Japanese International Cooperation Agency (JICA) and the JICA Study Team (JST) for the technical support in preparing NIUPLAN. The programme will focus on increasing the general supply of affordable housing units for both rent and purchase purposes to residents within the targeted estates by taking advantage of large, public open land spaces that are underutilized to develop the new low-cost houses. Tenants residing in dilapidated structures where the redevelopments will take place will vacate to the new units on priority basis after completion of construction. Demolitions of the old vacated housing units will then be undertaken to create more space for the construction of more housing units. However, for full utilization of the land, some areas will experience minimal displacement of residents before the redevelopment. Developers will cater for the accommodation of those displaced until completion of construction. The table below shows targeted estates for redevelopment in Phase One and Two:

|

Cytonn Report: Targeted Estates for Housing and Urban Renewal Programme of Nairobi County |

||

|

Phase |

Estates |

Estimated Number of New Housing Units |

|

One |

Ngong’ Road Phase I and II, Uhuru Estate, New Ngara, Old Ngara, Suna Road, Pangani Jeevanjee/Bachelor Quarters |

17,000 |

|

Two |

Bahati, Maringo, Jericho, Lumumba, Ziwani, Bondeni, Embakasi, Kariobangi North, Woodley |

33,000 |

Source: Cytonn Research

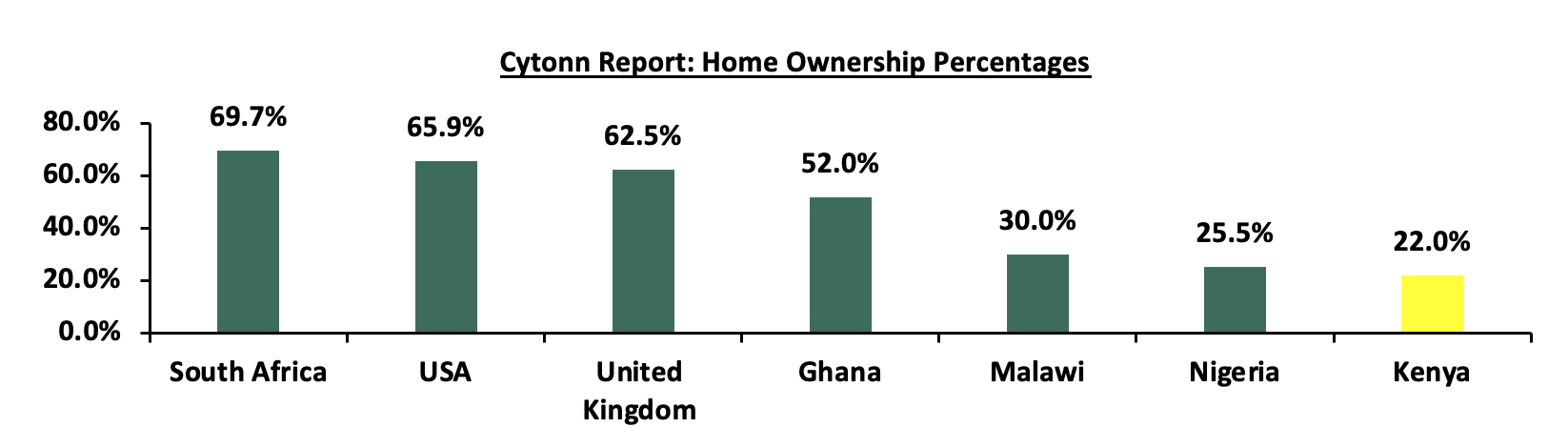

However, access to affordable financial resources still poses a major challenge to developers and County governments in undertaking development projects. This is coupled with an underdeveloped capital markets regime, and increasing construction costs on the back of elevated global and domestic inflation, which continue to hamper optimum development activities in the sector. For instance, according to Nairobi County Intergrated Development Plan (CIDP 2018-2022), the Nairobi County government managed to redevelop only 150 housing units and complete repair works of 1,000 units in the first phase of the programme, out of its target of 17,000 units, citing limited financial resources available to the County’s housing sector. Other factors that rendered the project unfeasible were; misappropriation of funds at County administration level due to increased corruption, lack of adequate planning and consultation with the affected communities which led to resistance and reluctance to vacation of residents in some parts of the County, poor urban planning which led to insufficient infrastructural development that would support the developments such as roads, water supply, electricity and sewerage systems. We therefore expect these challenges to continue weighing down on the progress towards curbing the low urban homeownership rate, which currently stands at 22.0% compared to other Sub-Saharan African countries such as South Africa and Ghana with urban homeownership rates of 69.7% and 52.0%, respectively, as shown below;

Source: Centre for Affordable Housing Africa, US Census Bureau, UK Office for National Statistics

Therefore, with the existence of comprehensive laid down plans for readjustment of the city, there is need for the County government to first address the key impediments hindering viability and success rates of affordable housing projects being executed by; i) increasing its partnership with private investors and international organizations with expertise in affordable housing and secure necessary funding for the projects, ii) instituting strict financial controls at County’s housing sector such as regular audits and financial reporting done publicly to ensure funds are utilized efficiently and transparently, iii) tough penalties to those found engaging in corrupt practices in the implementation of the projects, iv) increasing community engagement and consultations with affected residents to ensure their cooperation and support throughout the projects, implementation, and, v) prioritizing developments of necessary infrastructure to support the housing units and ensure the availability of basic services for the residents.

- Office Sector

- JPMorgan announced plans through State House Nairobi to open regional office in Nairobi, Kenya

During the week, JP Morgan Chase & Co, an American-based international investment bank, through State House Nairobi, announced plans to open its regional office in Nairobi, Kenya, serving as a central hub for its operations in the East African region with existing footprints in Nigeria and South Africa. The plan comes after an indication in 2018 by the CEO, Jamie Dimon, who expressed interests in opening representative offices in Kenya and Ghana. This is as the investment bank had sought to expand activity and conduct operations in the two countries, but faced regulatory challenges. The expansion of the investment bank into the Kenyan market is supported by; i) the brand’s need to increase its geographical and financial dominance across all regions in Africa, ii) step up its competitiveness against other multinational investment banks that have interests in Africa like Export-Import Bank (EXIM) of China, and, iii) Nairobi’s rise as a regional hub for multinational organizations such as United Nations, Microsoft, Google, Deloitte, Price Water Coopers (PwC), Ernst & Young (EY), and many more in serving their financial interest of handling large transactions where the local investment banking firms are not well furnished with the expertise.

- Commonwealth Enterprise and Investment Council opened its regional office in Nairobi, Kenya

Additionally, Commonwealth Enterprise and Investment Council (CWEIC), Commonwealth’s official business networking organization, opened its regional office in Nairobi, Kenya. The office will serve as East Africa’s business hub for the organization which will help grow trade and investments by offering opportunities such as; i) supporting businesses in the region seeking export markets for their goods and services in Europe and across the globe, and, ii) providing legal advice for firms eyeing cross-border deals. With a footprint of 56 country members across the world, the move by Commonwealth will create an enhanced business opportunity for firms in East Africa coupled with existing multilateral trade initiatives such as the East African Community Regional Trade Area and African Continental Free Trade Area (AfCFTA). Nairobi becomes the fourth hub for CWEIC in the African continent after Accra Ghana, Lagos Nigeria, and Douala Cameroon thus increasing its trade and investment dominance in Western and Eastern Africa.

In terms of performance, the Kenyan commercial office sector is expected to continue being supported by; i) the continuous drive of regional expansion by multi-national organizations such as JP Morgan and CWIEC which is geared to attract more organizations into the Kenyan market, ii) the rise of co-working spaces designed to accommodate freelancers, small businesses, and niche-centric spaces which are tailored according to a specific gender, profession, need or shared interests of clients, and, iii) full resumption of operations by most local firms and businesses amidst the improved economy in the post-COVID and peaceful post-electioneering period. However, the existing oversupply of office spaces currently at approximately 6.7 mn SQFT in the Nairobi Metropolitan Area (NMA) is expected to continue weighing down the overall occupancy rates and yields, thereby subduing optimum performance of the sector.

- Real Estate Investment Trusts (REITs)

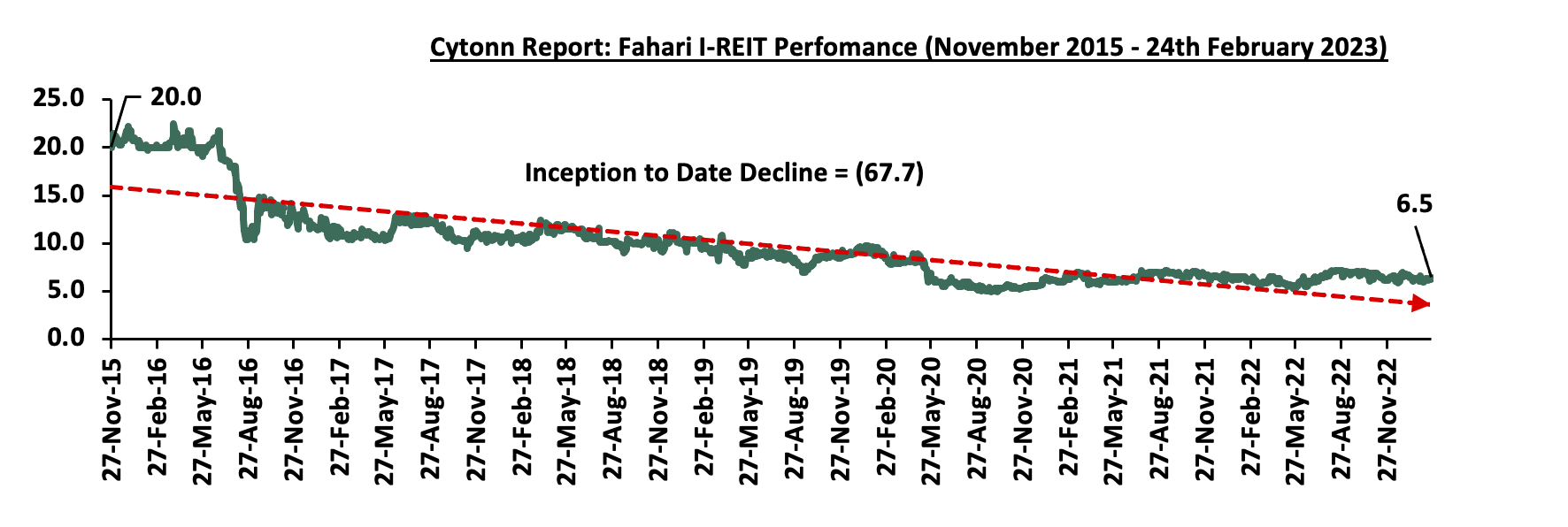

In the Nairobi Securities Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.5 per share. The performance represented a 4.5% gain from Kshs 6.2 per share recorded the previous week, taking it to a 4.7% Year-to-Date (YTD) decline from Kshs 6.8 per share recorded on 3rd January 2023. In addition, the performance represented a 67.7% Inception-to-Date (ITD) loss from the Kshs 20.0 price. The dividend yield currently stands at 7.7%. The graph below shows Fahari I-REIT’s performance from November 2015 to 24th February 2023;

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 23.9 and Kshs 20.9 per unit, respectively, as at 24th February 2023. The performance represented a 19.4% and 4.4% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 29.1 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 600.4 mn, respectively, since inception in February 2021.

REITs provide numerous advantages, including consistent and prolonged profits, tax exemptions, and diversified portfolios, among others. Despite these benefits, the performance of the Kenyan REITs market remains limited by several factors which include; i) insufficient investor understanding of the investment instrument, ii) time-consuming approval procedures, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and, iv) high minimum investment amounts set at Kshs 5.0 mn discouraging investments.

We expect the performance of Kenya’s Real Estate sector to continue on an upward trajectory, supported by factors such as; i) improved performance of the hospitality sector with increased tourist activities ii) efforts by County governments to rehabilitate housing assets, and, iii) expansion drive by multi-national organizations in the office sector. However, the presence of financial constraints amid the prevailing tough economic environment, the existing oversupply of physical space in selected sectors, and low investor appetite for REITs are expected to continue subduing the performance of the sector.

The performance of Kenya’s Real Estate sector has been on a positive trajectory, with the sector’s contribution to the country’s GDP recording a 5-year Compounded Annual Growth Rate (CAGR) of 6.0% to Kshs 749.7 mn in Q3’2022 from Kshs 560.8 mn in Q3’2017. Additionally, the sector contributed 10.5% to the total GDP in Q3’2022, coming in as the second largest contributor to Kenya’s GDP, only behind the Agricultural sector that contributed 14.8%. This impressive performance of the Kenyan Real Estate sector in Q3’2022, surpassing perennial major contributors to GDP such as transport at 10.3%, both financial and insurance and product taxes at 8.9% each, while both manufacturing and trade contributed 8.5% each, points to the increased significance of Real Estate to the economy and paints a positive outlook. However, the lack of proper regulation and oversight over developers and other stakeholders poses significant challenges that could claw back the gains. One pertinent issue is that despite the existence of laws regulating players in the Real Estate sector, there are currently no specific regulations governing Real Estate developers. Without a developer regulatory framework in place, the sector is vulnerable to various risks and uncertainties, including non-compliance, lack of coordination during market turbulence, mismanagement of funds and unethical practices. Therefore, there is urgent need for Kenya to establish a regulatory platform, anchored in law, that addresses the unique needs of Real Estate developers, financiers, and other stakeholders in the sector.

We have previously covered a topical on the Kenya Real Estate Developers Regulatory Board (REDRB), after a committee appointed by the then Principal Secretary of the State Department for Housing and Urban Development recommended the establishment of a developers regulatory Board by October 2020, through an executive order that was subject to the Cabinet's approval. However, that plan was not implemented. Therefore, to address the regulatory gap, this week we will analyze the performance of the Real Estate sector over the years, identifying key challenges faced by developers, financiers and stakeholders during Real Estate development, and highlighting the existing legal frameworks that are regulating the Real Estate sector in Kenya. Additionally, we will provide recommendations on a regulatory framework for developers in the sector by drawing insights from different countries that have successfully developed concrete legal bases for regulating developers and other stakeholders in Real Estate developments. This we shall cover through the following;

- Overview of Kenya’s Real Estate Sector,

- Real Estate Development Regulatory Framework in Kenya,

- Existing Regulatory Gap,

- Case Studies and Lessons Learnt, and,

- Recommendations and Conclusion

Section I: Overview of Kenya’s Real Estate Sector

Over the past few years, the Kenyan Real Estate sector has been expanding its activities, with its contribution to the country's GDP growing at a positive Compounded Annual Growth Rate (CAGR) of 6.0% to Kshs 749.7 mn in Q3’2022 from Kshs 560.8 mn in Q3’2017. This growth can be attributed to various factors such as; i) rapid population and urbanization rates leading to demand for Real Estate developments, ii) focus by the government and private sector on providing affordable housing, iii) increased mergers and acquisitions in the hospitality sector, iv) provision of long-term, low-interest home loans to potential buyers by the Kenya Mortgage Refinance Company (KMRC), v) increased popularity in Mixed Use Developments (MUDs) over the period due to their convenience, providing a comprehensive living experience for residents while also attracting more investors through combination of residential, commercial, and retail spaces, vi) rapid expansion drive by both local and international retailers boosting the retail sector, vii) efforts by public and private stakeholders in improving infrastructure across the country hence opening up new locations for property developments, and, viii) reopening and expansion of the hospitality sector and improved investor confidence in the sector on the back of economic recovery in the post-COVID-19 and post-election periods.

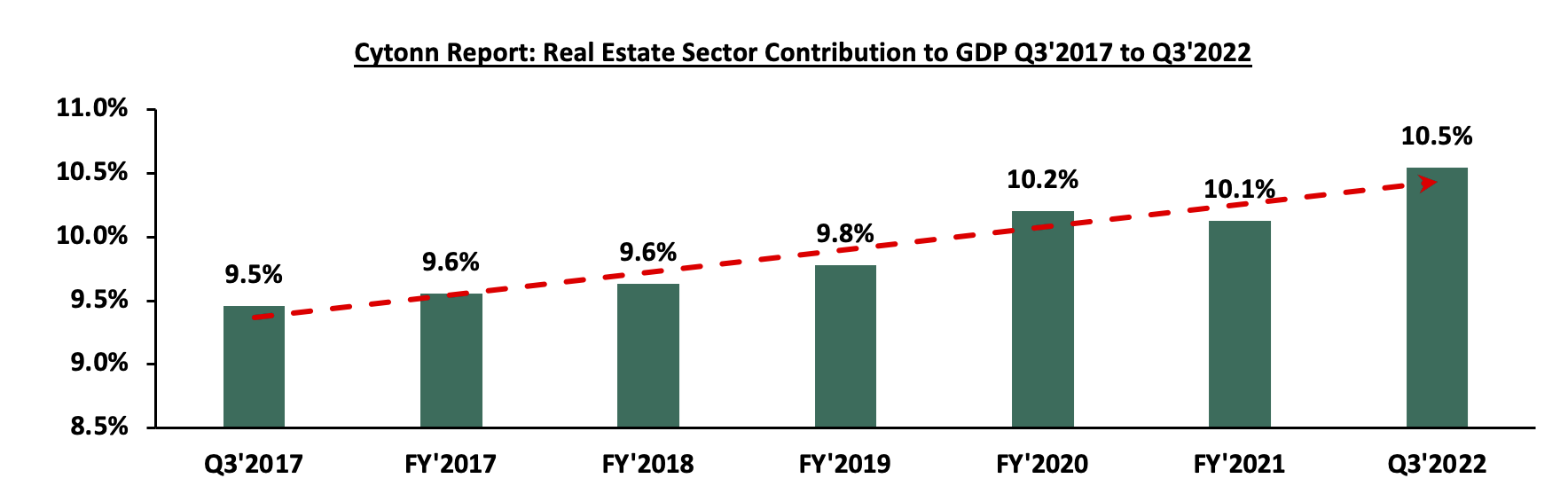

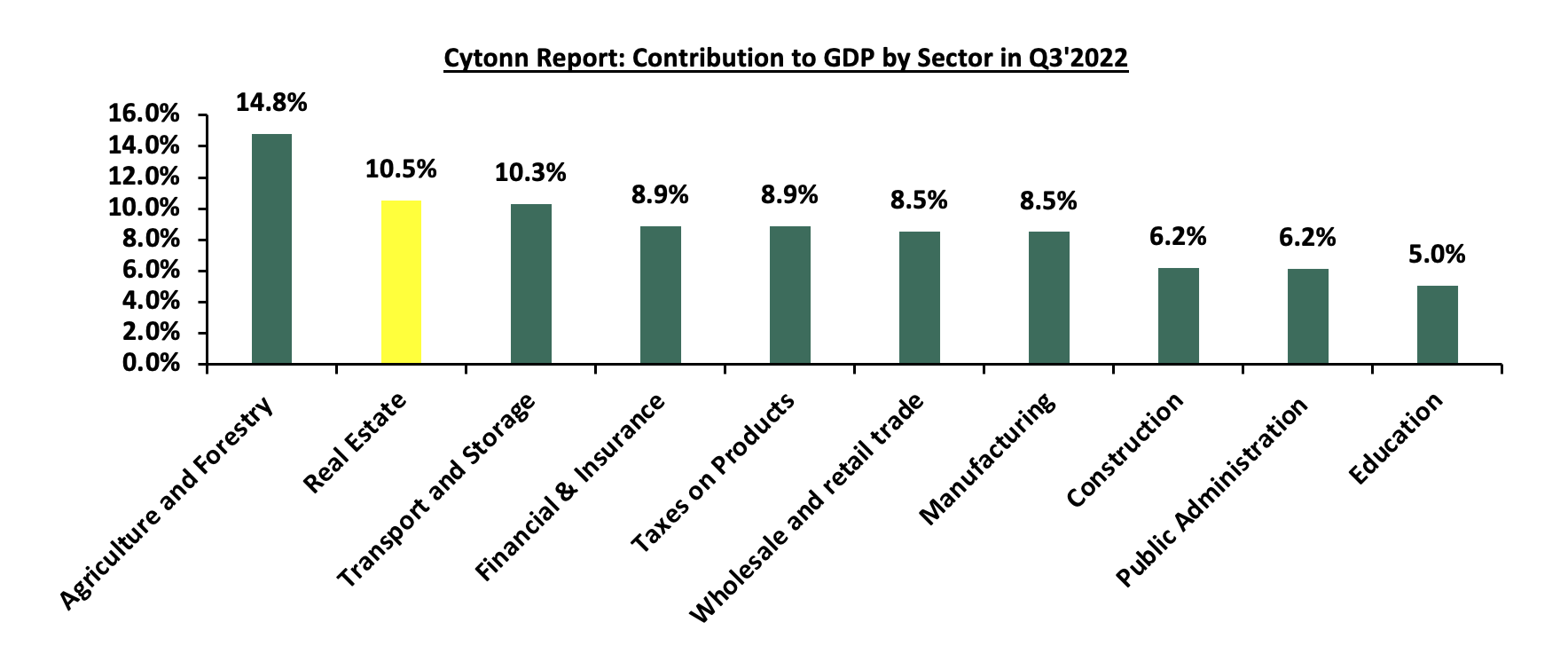

Additionally, the sector contributed 10.5% to the total GDP in Q3’2022, coming in as the second largest contributor to Kenya’s GDP, only behind the Agricultural sector that contributed 14.8%. This impressive performance of the Kenyan Real Estate sector in Q3’2022, surpassing perennial major contributors to GDP such as transport at 10.3%, both financial and insurance and product taxes at 8.9% each, while both manufacturing and trade contributed 8.5% each, points the increased significance of Real Estate to the economy and paints a positive outlook. This also presents lucrative opportunities for investors and developers to take advantage of the increasing demand for housing and other properties. The graph below shows the trend of Real Estate contribution to GDP between Q3’2017 and Q3’2022;

Source: Kenya National Bureau of Statistics (KNBS)

The graph below shows the top sectoral contributors to GDP during Q3’2022, with Real Estate being the #2 contributor;

Source: Kenya National Bureau of Statistics (KNBS)

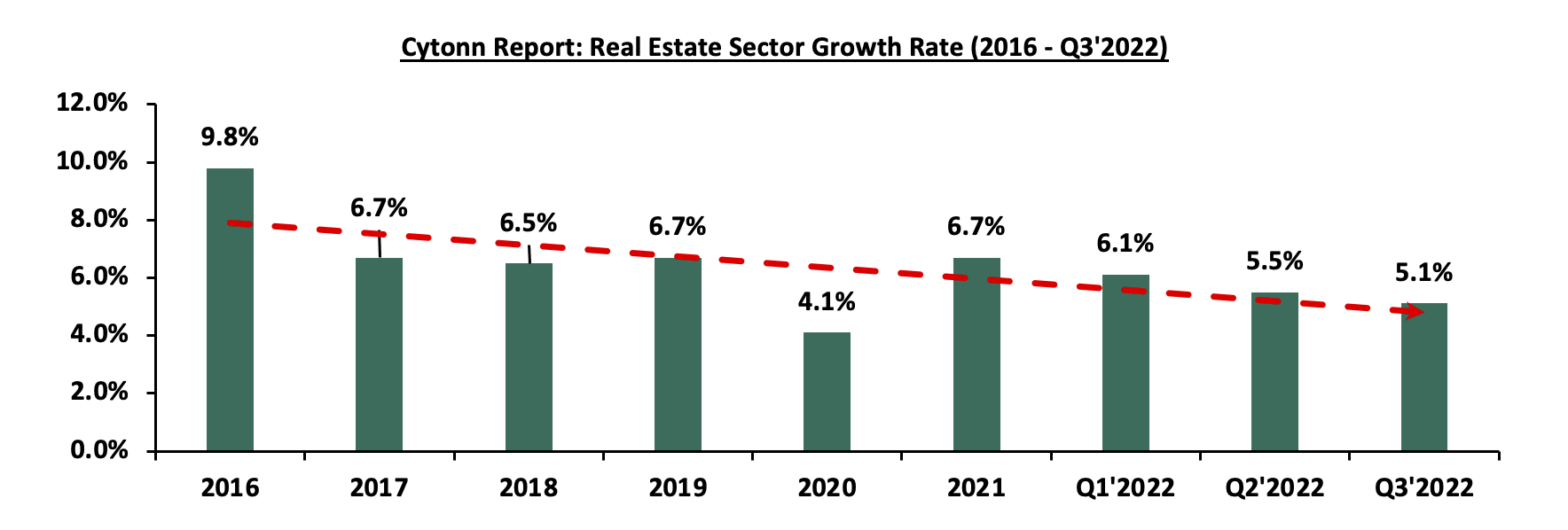

However, the sector’s GDP growth rate over the past 5 years has been lower than the growth rate in the pre-2017 period owing to several factors such as; i) the 2017 general elections and a further repeat election, ii) political instability occasioned in 2018, iii) entry and prevalence of COVID-19 pandemic in the country in 2020, and, iii) the Russian-Ukraine war that broke out in 2022, causing elevated inflationary pressures and supply chain disruptions, consequently increasing the cost of main construction materials both locally manufactured and those imported from abroad. Nevertheless, in 2021, the sector experienced a significant rebound in activities following the gradual reopening of the economy majorly occasioned by the lifting of health-related restrictions, lockdowns, and bans that were put in place due to the prevalence of COVID-19 pandemic. The full operationalization of many businesses and investments in the sector showcased gradual restoration of activity as the country continued to take steps towards a full economic recovery. Other factors that continue to weigh down on the optimal performance of the sector include; i) an oversupply of 6.7 mn SQFT in the Nairobi Metropolitan Area (NMA) commercial office market, 3.0 mn SQFT in the NMA retail market, and 1.7 mn SQFT oversupply in the overall Kenyan retail market as at 2022, and, ii) difficulty in the access of funding due to expensive financing from banks and subdued alternative sources of financing such as the capital markets. The graph below shows the Real Estate Sector Growth Rate between 2016 and Q3’2022;

Source: Kenya National Bureau of Statistics (KNBS)

In addition to the aforementioned factors affecting the Kenyan Real Estate sector, there are specific challenges narrowed down to Real Estate developers in the country. These challenges faced by developers and other stakeholders during Real Estate developments have illustrated the need for a regulatory body to address the impediments and oversee the activities of developers in the way of streamlining the Real Estate sector in Kenya. These challenges include;

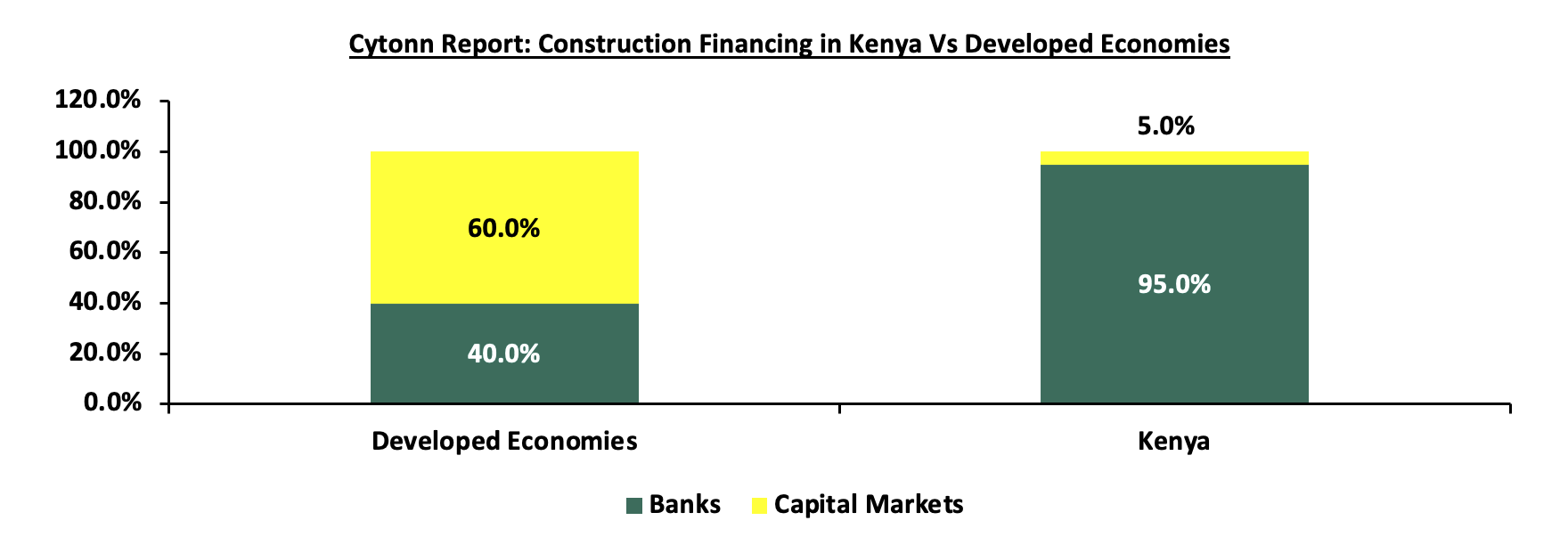

- Difficulty in accessing construction financing: Limited long-term financing options make it difficult for developers to access funding to start and complete their projects. Banks in Kenya are the primary source of funding for Real Estate developers, providing nearly 95.0% of funding for construction activities as opposed to 40.0% in developed countries. This means that capital markets contribute only 5.0% of Real Estate development funding, compared to 60.0% in developed economies. Additionally, banks and other lenders perceive Real Estate as a high-risk sector, recently driven by a 9.2% increase in gross non-performing loans (NPLs) in the sector to Kshs 75.6 bn in Q3’2022 from Kshs 69.2 bn recorded in Q3’2021. This has made banks to demand more collateral and have tighter lending requirements such as higher interest rates charged on the loans. The situation makes it more difficult for developers to access credit, which could lead to delays or cancellations of projects, forcing them to resort to off-plan financing which has been termed as risky. The graph below shows the comparison of construction financing in Kenya against developed economies;

Source: World Bank, Capital Markets Authority

- High total costs of development: Costs of construction in Kenya are high, due to high energy and transport costs, elevated inflationary pressure on commodities, supply chain disruptions of the key construction materials from overseas markets and raw materials used in local production by manufacturing companies, and high taxes including 16.0% VAT on the contract sum for residential delivery. According to Integrum, the average cost of construction is estimated at Kshs 34,650 to Kshs 77,500 per SQM in 2022 depending on various factors such as location of project and type of development up from a range of between Kshs 33,450 to Kshs 72,400 per SQM in 2021. The rising construction cost does not include professional fees, development management costs, land enhancement costs, marketing costs, financing costs and other incidental and acquisition costs that add up to the total cost of development,

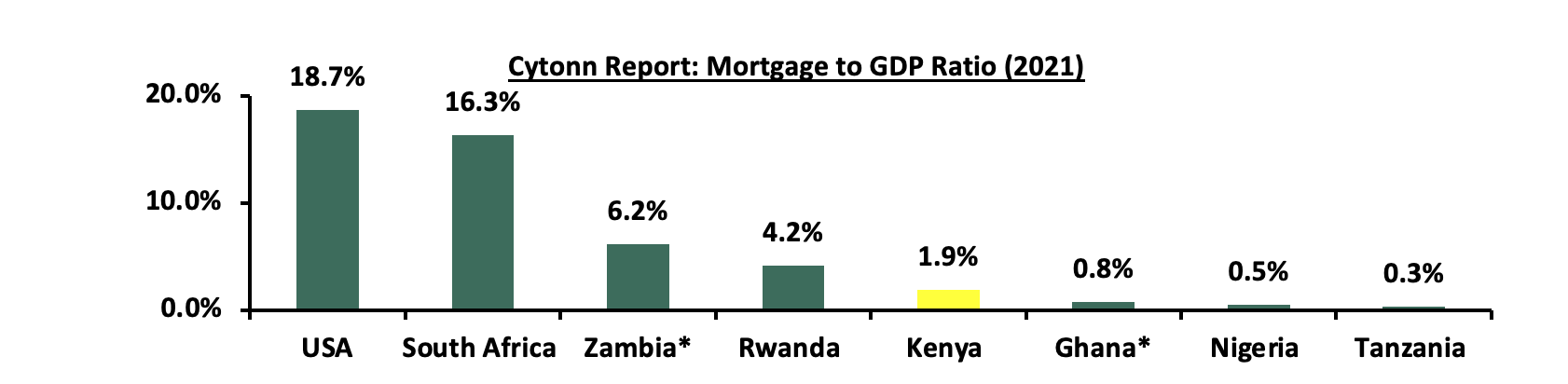

- Inefficiencies in the mortgage / off-take market: The limited development of the mortgage market in Kenya makes it difficult for developers and investors to sell properties, as homebuyer ability to purchase property is reduced with the inability to access home financing. As such, Kenya’s mortgage to GDP ratio remains depressed at 1.9%, compared to other African countries such as South Africa at 16.3%. Additionally, Kenya Mortgage Refinancing Company (KMRC), the only mortgage refinancing company in the country which officially began its lending in 2021, is yet to stamp its dominance in the mortgage market and increase its attractiveness to more stakeholders in the sector. KMRC only refinanced 1,948 mortgage loans valued at Kshs 5.8 bn in 2022, which was a 278.0% increase from 574 home loans disbursed in 2021 valued at Kshs 1.3 bn. Despite the increase, the numbers remain low at 7.3% of the total number of mortgage loans which stood at 26,723 accounts valued at Kshs 245.1 bn as at 2021. The graph below shows the mortgage to GDP ratio of Kenya compared to other countries as at 2021;

*(2020)

Source: Centre for Affordable Housing Africa

- Difficulty in sourcing well located, serviced land: In order to provide their clients with quality housing products, developers need to construct in areas that are serviced with sufficient roads, water, and electric supply, sewer lines, and utilities. Such land is often located in large urban centres, very expensive and scarce in supply. Additionally, providing such basic infrastructure to support new developments in areas away from the urban centers can be costly and challenging for both National and County governments to implement hence consuming more time for such far-flung areas to be upgraded. Such situations force private developers to dig deeper into their pockets and facilitate such infrastructural developments and amenities for their projects, increasing overrun hidden costs and bureaucracy in accessing the services,

- Unfavourable bureaucratic processes: Developers often face challenges navigating the complex bureaucratic processes needed in order to obtain the legal permits and approvals that are necessary for operation in the sector, which creates delays in project delivery and increases costs for developers,

- Limited innovation in the sector: The Real Estate sector in Kenya is slow to adopt new technologies and innovation, which impacts competitiveness and ability to attract investment. These innovations are meant to reduce development costs, increase efficiency and thereby drive profit margins. However, employing novel materials and construction technologies has been hindered by the high cost of sourcing equipment, materials, and skilled personnel, as well as the expenses incurred in training, utilization and maintenance of these innovations in the sector. Additionally, as the government continues to increase its tax revenue bases through the Kenya Revenue Authority, such innovations are attracting new avenues for the new taxes imposed on them making them more expensive alternatives for developers,

- Lack of transparency: Development practices in Kenya's Real Estate sector lack transparency with limited availability of reliable data and information on market trends, property values, and other key factors thereby increasing information asymmetry among stakeholders. This can make it difficult for developers to make informed decisions about which projects to pursue, where to invest, and how to price their developments. The lack of transparency can also create opportunities for corruption and other forms of fraud, further complicating the development process,

- Protracted land tenure issues and disputes: Land tenure issues are a significant challenge for Real Estate developers in Kenya. For instance, in some parts of the country, communal ownership of large tracts of land by pastoralist communities may hindering access to investors who wish to develop the land. This creates a problem for Real Estate developers, as they are unable to proceed with their projects until the government intervenes. Furthermore, legal disputes over land involving objections to title and property ownership can delay or totally prevent development projects, leading to increased costs and lost opportunities for developers. Such disputes handled by the judicial system drag on for years, exacerbating the problem,

- The presence of knowledge gaps: While there is existing professional expertise in sector, developing and executing Real Estate projects requires a wide range of skills and knowledge, including in areas such as design, construction, financing, and project management. The expertise is more limited in latest innovation and new technologies incorporated in the construction and Real Estate sectors, particularly in areas that would help reduce the cost of developments. The advancements in technology require ongoing education and training, as well as a willingness to invest in new tools and processes that can improve efficiency and cost-effectiveness in real estate projects. This is often resource and time consuming for most firms, limiting some developers from gaining a competitive edge in the market, and,

- The high non-compliance rate of developments in Kenya: According to Status of The Built Environment Report January - December 2022 Report, 69.8% of the inspected projects by National Construction Authority (NCA) were found to be non-compliant with building codes and regulations. This non-compliance could result from various factor such as lack of adherence to building codes, poor construction practices, and the use of substandard materials and unqualified contractors. Non-compliance lead to costly delays in project completion, hefty fines, and even punitive legal action against the developers.

Section II: Real Estate Development Regulatory Framework in Kenya

Real Estate development is a highly specialized process which entails division of labour and thus, encompasses multiple professionals. Therefore, it is crucial to establish a comprehensive regulatory framework that helps to regulate the activities of professionals involved as well as ensure that they comply with the laws and regulations governing their profession, thus providing high-quality services. Moreover, Real Estate development is subject to land use regulations which are dictated by zoning regulations, environmental considerations, or community planning efforts. Accordingly, the legal and regulatory framework that governs Real Estate development activities in Kenya and built industry professionals is multifaceted. It encompasses various laws and regulations that cover different aspects of land and Real Estate development through overseeing the activities of built professionals and the implementation of land use regulations enforced through zoning ordinances. The following section highlights the relevant laws and regulations pertaining to Real Estate development in Kenya;

- National Construction Authority (NCA) Act, Cap 486

Section 3 (1) of the Act enshrines the establishment of the National Construction Authority (NCA), which regulates the construction industry in Kenya. The Authority is responsible for overseeing the registration and licensing of contractors, supervising construction projects, and enforcing construction standards and regulations. The NCA also regulates the training, certification, subsequent accreditation and registration of construction workers and site supervisors. The Act was assented to on 2nd December 2011 and became effective on 8th June 2012, following the passing of the National Construction Authority Regulations, which operationalized the Act. However, origins of the body date far back as 1972 when the National Construction Bill was first introduced, and sought to register the National Construction Corporation (NCC), that later failed in 1988. NCA is also responsible for a range of other critical functions aimed at enhancing the construction industry's development and growth. These functions include; i) promoting and stimulating expansion of the construction industry, ii) commissioning research on construction-related matters, iii) providing consultancy and advisory services with respect to the construction industry, iv) promoting and ensuring quality assurance in the industry, v) encourage the standardization and improvement of construction techniques and materials, vi) developing and publishing a code of conduct for industry professionals, vii) establishing and maintaining a construction industry information system, and, viii) assist in the exportation of construction services.

- Engineer’s Act No. 43 of 2011

The Act which was assented to law on 27th January 2012 provides for the regulation of the engineering profession in Kenya through the training, registration and licensing of certified engineers, and development of the practice thereof. The Act however, became effective on 14th September 2012, through a special issue of the Kenya Gazette 3, repealing the Engineers Registration Act Cap 530 which was enacted in 1969. In section 3 (2), it establishes the Engineers Board of Kenya (EBK), which is a corporate body, created with a mandate of overseeing the registration and licensing of engineers, regulating engineering education and training, and enforcing engineering standards and codes of practice. Main functions of the EBK include; i) to receive, consider and make decisions on applications for registration of engineers, ii) keep and maintain a register of all registered engineers in Kenya, iii) publish the names of all registered and licensed engineers in accordance to the Act, iv) issue licenses to qualified and registered engineers, v) inspect construction sites where engineering works are in progress, vi) monitor professional engineering works, services and goods rendered by professional engineers, vi) establish a code of practice and ethics for engineers, vii) prepare detailed curriculum for registration of engineers and conduct professional examinations for the purposes of registration, and, viii) determine disputes relating to professional conduct or ethics of registered engineers.

- Architects and Quantity Surveyors Act, Cap 525

Section 4 of the Act establishes the Board of Registration of Architects and Quantity Surveyors (BORAQS) whose mandate is to regulate the professions of Architecture and Quantity Surveying through training, registration and enhancement of ethical practice. The Board constitutes of five committees namely;

- Architects & Quantity Surveyors Education Board (AQSEB) - established to execute the scheme and curriculum for professional education, examinations and other activities of matters of continuous training for the registered persons,

- Ethics and Practice Committee(E&P) which deals with all ethical issues in practice, complaints from other professionals, the construction industry and the public,

- Research and Publication Committee mandated to monitor the status of the practice of Architecture and Quantity Surveying, identify where industry research is required, and, develop industry-based research policies and framework,

- Welfare Committee whose mandate is to establish professional’s social welfare policy framework and promote the general welfare of its practitioners, and,

- Management Committee which ensures that the Board delivers in accordance with policies provided primarily by the Act, effective management of the Board in accordance with the strategic plan, and links the secretariat with the specific committees & the Board therein.

- Survey Act, Cap 299

The Act, in section 3, establishes the office of the Director of Surveys and such other officers as may be deemed to be necessary for the purposes of the Act. Section 7 further establishes the Land Surveyors Board (LSB) that is chaired by the Director of Surveys, and is responsible for regulating different aspects of the surveying profession in Kenya including professional practicing standards, licensing, and, professional conduct. The core duties of the LSB include; i) to conduct the examination of candidates for admission as licensed surveyors and their licensing thereof, ii) keep a register of all licensed surveyors, iii) oversee disciplinary proceedings brought against licensed surveyors, iv) determine any disputes arisen involving licensed surveyors and the director, or with client in relation to the fees chargeable, and, v) advise the Director on all matters relating to cadastral surveys in connection with the registration of land or of title to land.

- Valuers Act, Cap 532

It provides the legal framework for the registration of valuers as well as establishing the Valuers Registration Board (VRB), which is mandated to regulate the activities and conduct of registered valuers in Kenya. The Act; i) mandates the registrar of the Board to keep and maintain a register of all licensed valuers and eventually issue them with a certificate of registration in the prescribed form, ii) outlines the requirements and procedures for registration and deregistration of valuers, iii) establishes and highlights schedule of fees chargeable by registered valuers for professional services rendered, and, iv) determines any hearings relating to valuers professional misconduct. In addition, Valuers Rules No 32 of 1987 lays down all that constitutes professional misconduct in the valuation profession in Kenya.

- Physical Planning Act, Cap 286

The Act establishes the physical planning system in Kenya, and forms the main component of land use regulations in Kenya, along with zoning regulations which vary across county jurisdictions. It establishes the office of Director of Physical Planning who is the chief Government adviser on all matters relating to physical planning, and prepares regional and local physical development plans. The Act also provides for the establishment of planning liaison committees, whose main responsibility is to determine development applications, and determine appeals lodged by persons aggrieved by their decisions. The Act further confers powers to local authorities to control development through enactment of zoning ordinances as well as approving development projects through permit issuances, and requires that the preparation of land use and subdivision plans in relation to property be done by a registered physical planner and to be approved by the Director. Additionally, the Physical Planning (Building and Development Control) Rules, 1998 govern the construction, planning and development of buildings and structures in the country. These rules are administered by the National Construction Authority (NCA) and the County Governments of Kenya and are designed to ensure that all buildings and structures are structurally sound, and, sustainable.

- Environmental Management and Co-ordination Act (EMCA), Cap 387

The Act regulates Real Estate development in Kenya, specifically in relation to environmental issues. It establishes the National Environment Management Authority (NEMA), which is responsible for promoting and enforcing environmental policies and standards in the country. In accordance to EMCA regulations, 2003 Real Estate developers and owners are required to conduct Environmental Impact Assessments (EIAs) before commencing any development projects which generally entail activities out of character with its surrounding, comprise structures of a scale not in keeping with its surrounding and involve major changes in land use. In support of this, the Second Schedule of the Act lists all projects that require an EIA to be conducted before project commissioning.

Section III: Existing Regulatory Gap

The legal frameworks above provide the necessary regulatory oversight to ensure that activities around Real Estate development is done in compliance with standards and regulations, promoting public safety and welfare, protecting the environment, and ensuring the sustainable development of the country. They also establish professional bodies that are responsible for registering and licensing professionals in the built industry, setting standards for their training and certification, and ensuring that they adhere to ethical and professional standards in their practice. However, there is still a gap in the regulatory framework when it comes to the registration and licensing of Real Estate developers, who are the actual drivers and coordinators of development activities. Evidently, the current legal framework under the above Acts covered does not provide for a comprehensive regulatory framework for the regulation of Real Estate developers in Kenya, which makes it difficult to monitor their activities effectively.

As a result, there is a need for enacting legislation / an Act that is Real Estate developers specific, and that will provide for the establishment of a Real Estate Developers Regulatory Board. The Board would be instrumental in enforcing provisions of the Act which would ideally include; i) the registration and licensing of developers in Kenya, ii) development of a code of ethics for developers, iii) consequent enforcement of the developed code of ethics, iv) develop standard practices in the operation of Real Estate developers activities in Kenya such as standardization of sale agreements, trust accounts, disclosure of information among others, v) impose fines and penalties in case of non-compliance, vi) conducting investigation and enforcing disciplinary actions against developers who violate the code of ethics and conduct, vii) determining any disputes that arise in relation to developers, and, viii) regulation, auditing, and monitoring of escrow accounts for development activities, and approval of the banking and financial institutions qualified to manage these accounts.

In addition, the Board can assist in financing through; i) developing approved frameworks for accessing non-bank development finance through structured investment instruments, or, ii) through fostering partnerships and collaboration with other Real Estate stakeholders such as financiers through championing accessibility to financing for developers. Moreover, the Board can; i) commission research on developers related matters, ii) develop training and education programs that would benefit Real Estate developers, iii) champion for legislation geared towards increasing efficiency and optimizing the environment for Real Estate developers, iv) lobby for developers’ rights and concerns to be heard, v) provide consultancy and advisory services to the government, and, vi) promote the development and expansion of the profession in general. Such a framework would ensure that developers are duly regulated and operate within laid down laws, promote transparency and accountability, and ensure that Real Estate development continues to contribute to the overall development goals of the country.

Section IV: Case Studies and Lessons Learnt

Having looked at the legal framework in Kenya’s Real Estate sector and subsequently identifying an existing regulatory gap in regards to developers, we now look at several countries such as India, Jamaica and Malaysia, which have established comprehensive frameworks to oversee development activities. The provisions outlined in these frameworks mandate developers and other parties to conduct themselves in accordance with specific conditions so as to operate in their respective sectors, as follows;

- India - Real Estate (Regulation and Development) Act

The Real Estate (Regulation and Development) Act is a legislation that was passed by the Indian Parliament in 2016 to regulate and promote transparency in the Real Estate sector of India. The Act provides a comprehensive framework aimed at protecting the interests of parties during Real Estate projects in order to bring accountability and transparency to the sector. Some of the key take-outs from the Act include;

- Establishment of Regulatory Authorities: The Act mandates the establishment of Real Estate Regulatory Authorities (RERAs) in each state of India to oversee and regulate the Real Estate sector. The regulatory authorities are responsible for enforcing the provisions of the Act, including the registration of projects, the resolution of disputes, and the imposition of penalties for non-compliance,

- Establishment of an Appellate Tribunal: The Act establishes an appellate tribunal to hear appeals against orders passed by the regulatory authorities and decide whether to uphold or overturn them. The appellate tribunal is tasked with resolving disputes between buyers and developers by providing a fast and efficient mechanism for resolving disputes,

- Registration of Real Estate Projects: The Act makes it mandatory for all Real Estate projects with an area of 500.0 SQM or more to register with the regulatory authority in the subsequent state. The registration process requires developers to provide detailed information about the project, such as the land title, project plan, layout, and completion timeline,

- Requirement of Trust Accounts: The Act requires the promoter or developer to deposit 70.0% of the project funds in a separate account held on trust, which can only be used for project construction. The amounts can only be withdrawn after certification by the engineer, architect and chartered accountant in practice. In addition, promoters, developers and builders cannot ask for more than 10.0% of the property’s cost as an advance payment before the sale agreement is signed,

- Transparency in Project Advertisements: To ensure that buyers are not mislead by unlawful promoters, the Act mandates developers to sell their apartments depending on a standardized carpet area. According to the Act, carpet area is the total area of the floor that can be used within the walls of the apartment, excluding areas such as open terrace, shafts, and balconies. Promoters must disclose the carpet area, number of units, and facilities to be provided in the development,