Restructuring & Insolvency in Kenya, & Cytonn Weekly #3/2025

By Cytonn Research, Jan 19, 2025

Executive Summary

Fixed Income

During the week, T-bills were undersubscribed for the first time in two weeks, with the overall undersubscription rate coming in at 76.8%, lower than the overall oversubscription rate of 138.1%, recorded the previous week. Investors’ preference for the shorter 91-day paper waned, with the paper receiving bids worth Kshs 3.4 bn against the offered Kshs 4.0 bn, translating to an undersubscription rate of 84.6%, significantly lower than the oversubscription rate of 333.1% recorded the previous week. The subscription rates for the 182-day and 364-day papers decreased to 54.5% and 100.3% respectively from 97.1% and 101.1% respectively recorded the previous week. The government accepted a total of Kshs 18.1 bn worth of bids out of Kshs 18.9 bn bids received, translating to an acceptance rate of 96.1%.The yields on the government papers recorded mixed performance, with the yields on the 182-day papers increasing by 0.5 bps to remain unchanged at 10.03% recorded the previous week, while the yields on the 364-day and 91-day papers declined by 3.0 bps and 2.9 bps respectively to 11.30% and 9.56% from the 11.33% and 9.59% respectively recorded the previous week.

During the week, the Central Bank of Kenya also released the auction results for the re-opened bonds, FXD1/2018/015 with a tenor to maturity of 8.3 years, and a fixed coupon rate of 12.7% and FXD1/2022/025 with a tenor to maturity of 22.7 years, and a fixed coupon rate of 14.2%. The bonds were oversubscribed with the overall subscription rate coming in at 196.7%, receiving bids worth Kshs 59.0 bn against the offered Kshs 30.0 bn. The government accepted bids worth Kshs 48.5 bn, translating to an acceptance rate of 82.2%. The weighted average yield for the accepted bids for the FXD1/2018/015 came in at 14.2% which was above our expectation of within a bidding range of 13.45%-13.85%, while that of the FXD1/2022/025 came in at 15.7%, which was within our expectation of within a bidding range of 15.65%-16.00%. Notably, the 14.2% yield on the FXD1/2018/015 was higher than the 12.7% rate recorded on the last sale in July 2021, while the yield on the FXD1/2022/025 was higher than the 14.2% recorded the last time it was offered in October 2022. With the Inflation rate at 3.0% as of December 2024, the real return of the FXD1/2018/015 and the FXD1/2022/025 is 11.2% and 12.7% respectively. Given the bonds’ tax rate is at 10.0%, compared to 15.0% withholding tax for shorter term bonds, the tax equivalent yield is 15.0% and 16.6% for the FXD1/2018/015 and FXD1/2022/025 respectively.

During the week, The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th January 2025 to 14th February 2025. Notably, the maximum allowed price for Super Petrol, Diesel and Kerosene increased by Kshs 0.3, Kshs 2.0 and Kshs 3.0 respectively. Consequently, Super Petrol, Diesel and Kerosene will now retail at Kshs 176.6, Kshs 167.1 and Kshs 151.4 per litre respectively, from Kshs 176.3, Kshs. 165.1 and Kshs 148.4 per litre respectively, representing increases of 0.2%,1.2% and 2.0% for Super Petrol, Diesel and Kerosene respectively;

During the week, the National Treasury released the Draft 2025 Budget Policy Statement, in line with section 25 of the Public Finance Management (PFM) Act, 2012 which mandates the Treasury to incorporate the views of stakeholders, including the public, during the preparation of the Budget Policy Statement (BPS). Following this consultative process, the Budget Policy Statement (BPS) is submitted to the Cabinet for approval and subsequently presented to Parliament for discussion and adoption. Revenue is projected to increase by 14.9% to Kshs 3.5 tn from Kshs 3.1 tn as per FY’2024/25 revised budget estimates, while total expenditure is projected to increase by 11.6% to Kshs 4.3 tn, from Kshs 3.9 tn FY’2024/25 revised budget estimates;

During the week, the National Treasury gazetted the revenue and net expenditures for the sixth month of FY’2024/2025, ending 31st December 2024, highlighting that the total revenue collected as at the end of December 2024 amounted to Kshs 1,161.3 bn, equivalent to 44.1% of the revised estimates of Kshs 2,631.4 bn for FY’2024/2025 and is 88.3% of the prorated estimates of Kshs 1,315.7 bn.

Equities

During the week, the equities market recorded a mixed performance, with NASI and NSE 20 gaining by 0.9% and 0.1% respectively, while NSE 25 and NSE 10 declined by 1.2% and 0.5% respectively, taking the YTD performance to gains of 4.3%, 4.3%, 0.4% and 0.3% for NSE 20, NASI, NSE 25 and NSE 10, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Bamburi, Safaricom and Equity Group Holdings of 5.6%, 2.8%, and 2.1% respectively. The gains were however, weighed down by losses recorded by large-cap stocks such as Stanbic, Absa and SCBK of 10.7%, 10.2%, and 6.6% respectively;

Real Estate

During the week, China Square expanded its presence in Kenya by launching its 7th store at Greenspan Mall in Donholm-Nairobi which follows the opening of a 6th store at Two Rivers Mall-Kiambu in the previous week. These additions bring the retailer’s total number of outlets in the country to seven since its entry at Kenyatta University’s Unicity Mall in 2022. The new outlet joins other China Square locations at the Waterfront Mall in Karen, Lang’ata Hyper Mall, Nyali Bazaar Mall in Mombasa, and Mega City Mall in Kisumu;

During the week, the National Social Security Fund (NSSF) announced plans to build a Mixed-Use development on its 3.8 acre prime piece of land located in Nairobi's central business district at the corner of Uhuru Highway and Kenyatta Avenue which has remained vacant for decades. The project will be implemented using an Engineering, Procurement, Construction, and Finance (EPC+F) model, where contractors handle the entire project from design to financing;

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 17th January 2025. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 17th January 2025, representing a 45.0% loss from the Kshs 20.0 inception price;

Focus of the Week

Insolvency refers to a financial situation where an individual or business is unable to meet their financial obligations or settle their debts as they become due. In most cases, the state of insolvency occurs due to an increase in business expenses, poor cash management, law suits, poor budgeting, fraud, business expansion, reduction in sales or uncontrollable phenomenon such as Covid 19. In Kenya, insolvency proceedings are primarily governed by the Insolvency Act of 2015. The act provides for how insolvent companies can be assisted to service creditors obligations and protect the interests of all stakeholders. The options available for such an insolvent company include Administration, Receivership, voluntary arrangements, and liquidation;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 16.55% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Tuesday, from 7:00pm to 8:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

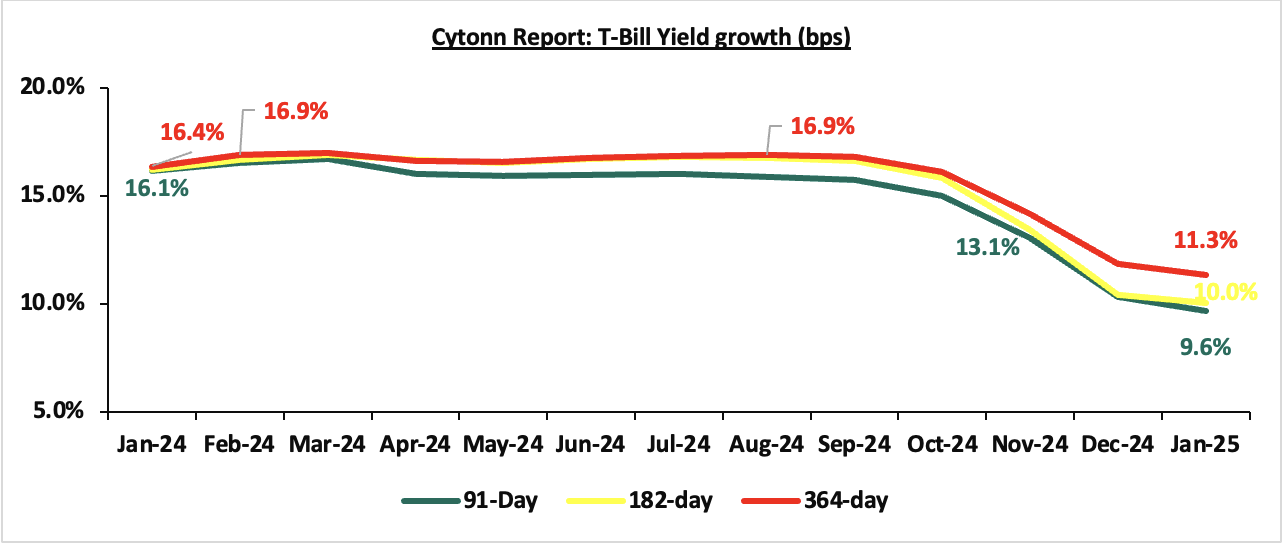

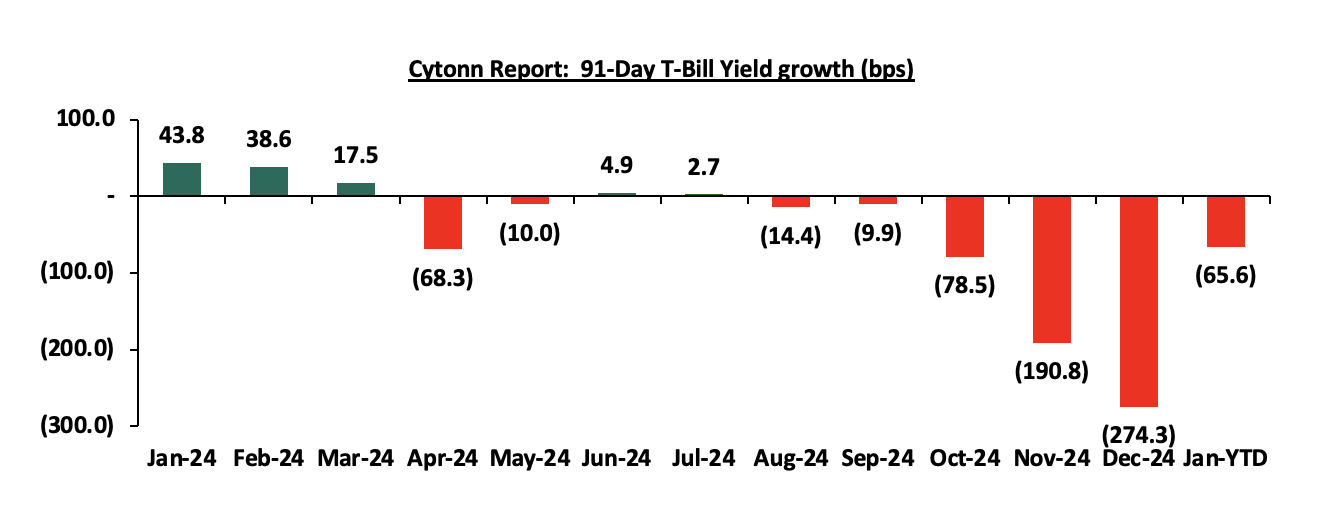

During the week, T-bills were undersubscribed for the first time in two weeks, with the overall undersubscription rate coming in at 76.8%, lower than the overall oversubscription rate of 138.1%, recorded the previous week. Investors’ preference for the shorter 91-day paper waned, with the paper receiving bids worth Kshs 3.4 bn against the offered Kshs 4.0 bn, translating to an undersubscription rate of 84.6%, significantly lower than the oversubscription rate of 333.1% recorded the previous week. The subscription rates for the 182-day and 364-day papers decreased to 54.5% and 100.3% respectively from 97.1% and 101.1% respectively recorded the previous week. The government accepted a total of Kshs 18.1 bn worth of bids out of Kshs 18.9 bn bids received, translating to an acceptance rate of 96.1%.The yields on the government papers recorded mixed performance, with the yields on the 182-day papers increasing by 0.5 bps to remain unchanged at 10.03% recorded the previous week, while the yields on the 364-day and 91-day papers declined by 3.0 bps and 2.9 bps respectively to 11.30% and 9.56% from the 11.33% and 9.59% respectively recorded the previous week.The charts below show the yields movement for the Treasury bills over the period:

The chart below compares the overall average T-bill subscription rates obtained in 2022,2023, 2024 and 2025 Year-to-date (YTD):

During the week, the Central Bank of Kenya also released the auction results for the re-opened bonds, FXD1/2018/015 with a tenor to maturity of 8.3 years, and a fixed coupon rate of 12.7% and FXD1/2022/025 with a tenor to maturity of 22.7 years, and a fixed coupon rate of 14.2%. The bonds were oversubscribed with the overall subscription rate coming in at 196.7%, receiving bids worth Kshs 59.0 bn against the offered Kshs 30.0 bn. The government accepted bids worth Kshs 48.5 bn, translating to an acceptance rate of 82.2%. The weighted average yield for the accepted bids for the FXD1/2018/015 came in at 14.2% which was above our expectation of within a bidding range of 13.45%-13.85%, while that of the FXD1/2022/025 came in at 15.7%, which was within our expectation of within a bidding range of 15.65%-16.00%. Notably, the 14.2% yield on the FXD1/2018/015 was higher than the 12.7% rate recorded on the last sale in July 2021, while the yield on the FXD1/2022/025 was higher than the 14.2% recorded the last time it was offered in October 2022. With the Inflation rate at 3.0% as of December 2024, the real return of the FXD1/2018/015 and the FXD1/2022/025 is 11.2% and 12.7% respectively. Given the bonds’ tax rate is at 10.0%, compared to 15.0% withholding tax for shorter term bonds, the tax equivalent yield is 15.0% and 16.6% for the FXD1/2018/015 and FXD1/2022/025 respectively.

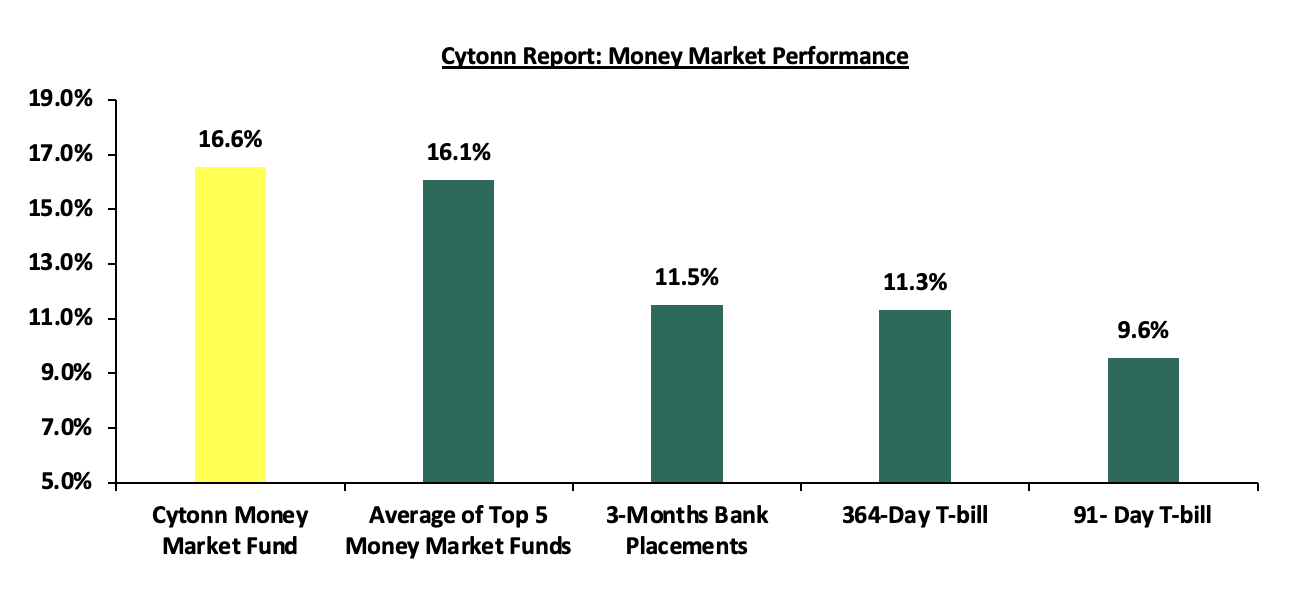

Money Market Performance:

In the money markets, 3-month bank placements ended the week at 11.5% (based on what we have been offered by various banks),and yields on the government papers recorded a mixed performance with the yields on the 182-day papers increasing by 0.5 bps to remain unchanged at 10.0% recorded the previous week, while the yields on the 364-day and 91-day papers declined by 3.0 bps and 2.9 bps respectively to remain relatively unchanged at 11.3% and 9.6% recorded the previous week. The yield on the Cytonn Money Market Fund decreased by 6.0 bps to close the week at 16.6%, remaining unchanged from the previous week, while the average yields on the Top 5 Money Market Funds decreased by 4.8 bps to close the week at 16.1%, same as last week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 17thth January 2025:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 17th January 2025 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn app) |

16.6% |

|

2 |

Gulfcap Money Market Fund |

16.3% |

|

3 |

Lofty-Corban Money Market Fund |

16.2% |

|

4 |

Etica Money Market Fund |

15.8% |

|

5 |

Ndovu Money Market Fund |

15.5% |

|

6 |

Kuza Money Market fund |

15.4% |

|

7 |

Mali Money Market Fund |

15.2% |

|

8 |

Arvocap Money Market Fund |

15.0% |

|

9 |

Absa Shilling Money Market Fund |

14.3% |

|

10 |

Madison Money Market Fund |

14.0% |

|

11 |

Orient Kasha Money Market Fund |

13.6% |

|

12 |

Sanlam Money Market Fund |

13.5% |

|

13 |

Jubilee Money Market Fund |

13.2% |

|

14 |

Genghis Money Market Fund |

13.1% |

|

15 |

Dry Associates Money Market Fund |

13.0% |

|

16 |

British-American Money Market Fund |

13.0% |

|

17 |

Faulu Money Market Fund |

12.9% |

|

18 |

Nabo Africa Money Market Fund |

12.9% |

|

19 |

Ziidi Money Market Fund |

12.9% |

|

20 |

GenAfrica Money Market Fund |

12.8% |

|

21 |

CIC Money Market Fund |

12.6% |

|

22 |

Co-op Money Market Fund |

12.6% |

|

23 |

ICEA Lion Money Market Fund |

12.5% |

|

24 |

KCB Money Market Fund |

12.5% |

|

25 |

Enwealth Money Market Fund |

12.3% |

|

26 |

Mayfair Money Market Fund |

12.1% |

|

27 |

Old Mutual Money Market Fund |

12.1% |

|

28 |

Apollo Money Market Fund |

11.6% |

|

29 |

AA Kenya Shillings Fund |

11.5% |

|

30 |

Stanbic Money Market Fund |

11.1% |

|

31 |

Equity Money Market Fund |

7.0% |

Source: Business Daily

Liquidity:

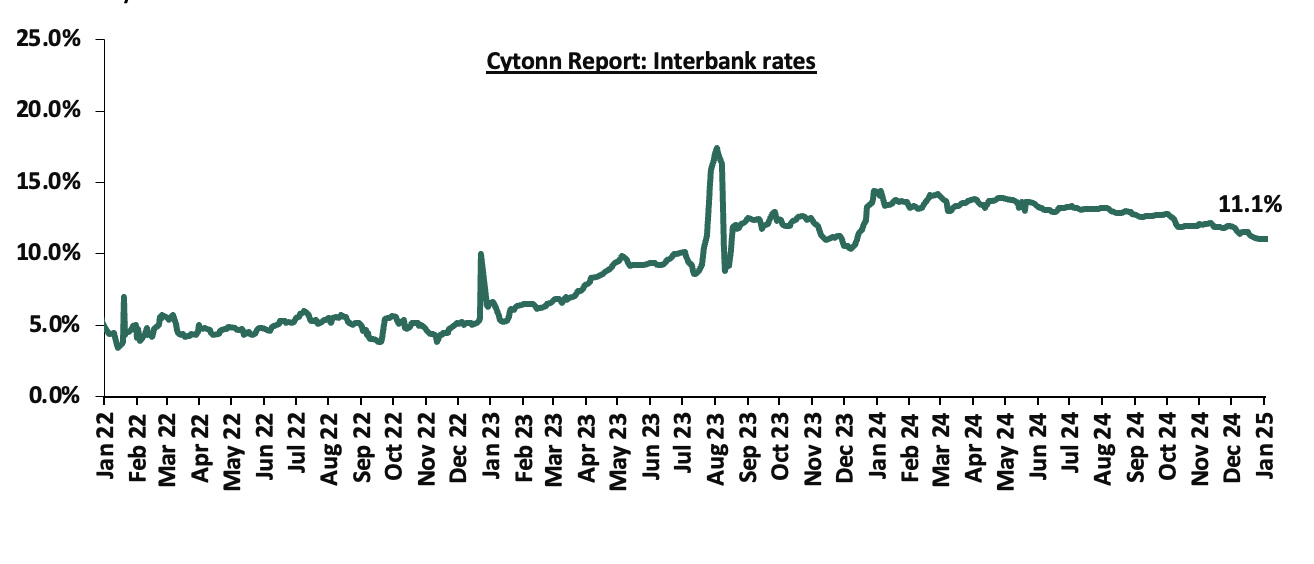

During the week, liquidity in the money markets tightened, with the average interbank rate increasing by 20.9 bps, to 11.3% from the 11.1% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded decreased by 11.3% to Kshs 29.9 bn from Kshs 34.6 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Kenya’s Eurobonds recorded mixed performance, with the yield on the 30-year Eurobond issued in 2018 increasing the most by 8.2 bps to 10.1% from 10.0% recorded the previous week, while the yield on the 7-year Eurobond issued in 2019 decreased by 8.4 bps to 8.2% from 8.3% recorded the previous week. The table below shows the summary performance of the Kenyan Eurobonds as of 16th January 2025;

|

Cytonn Report: Kenya Eurobond Performance |

||||||

|

|

2018 |

2019 |

2021 |

2024 |

||

|

Date |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

|

02-Jan-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.1% |

|

09-Jan-25 |

8.8% |

10.0% |

8.3% |

9.7% |

9.8% |

9.8% |

|

10-Jan-25 |

9.0% |

10.2% |

8.4% |

9.9% |

10.0% |

10.0% |

|

13-Jan-25 |

9.2% |

10.3% |

8.6% |

10.2% |

10.2% |

10.2% |

|

14-Jan-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.2% |

|

15-Jan-25 |

8.8% |

10.1% |

8.3% |

9.8% |

9.9% |

9.9% |

|

16-Jan-25 |

8.8% |

10.1% |

8.2% |

9.8% |

9.8% |

9.8% |

|

Weekly Change |

0.0% |

0.1% |

(0.1%) |

0.0% |

0.1% |

0.0% |

|

MTD Change |

(0.3%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.3%) |

|

YTD Change |

(0.3%) |

(0.2%) |

(0.3%) |

(0.3%) |

(0.3%) |

(0.3%) |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling depreciated marginally against the US Dollar by 6.5 bps, to close the week at Kshs 129.6, from 129.5 recorded the previous week. On a year-to-date basis, the shilling has depreciated by 0.2% against the dollar, a contrast to the 17.4% appreciation recorded in 2024.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,945.0 mn in 2024, 18.0% higher than the USD 4,190.0 mn recorded in 2023. The United States remained the largest source of remittances to Kenya accounting for 51.0% in the period, and,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 14.9% in the 12 months to October 2024, compared to a similar period in 2023.

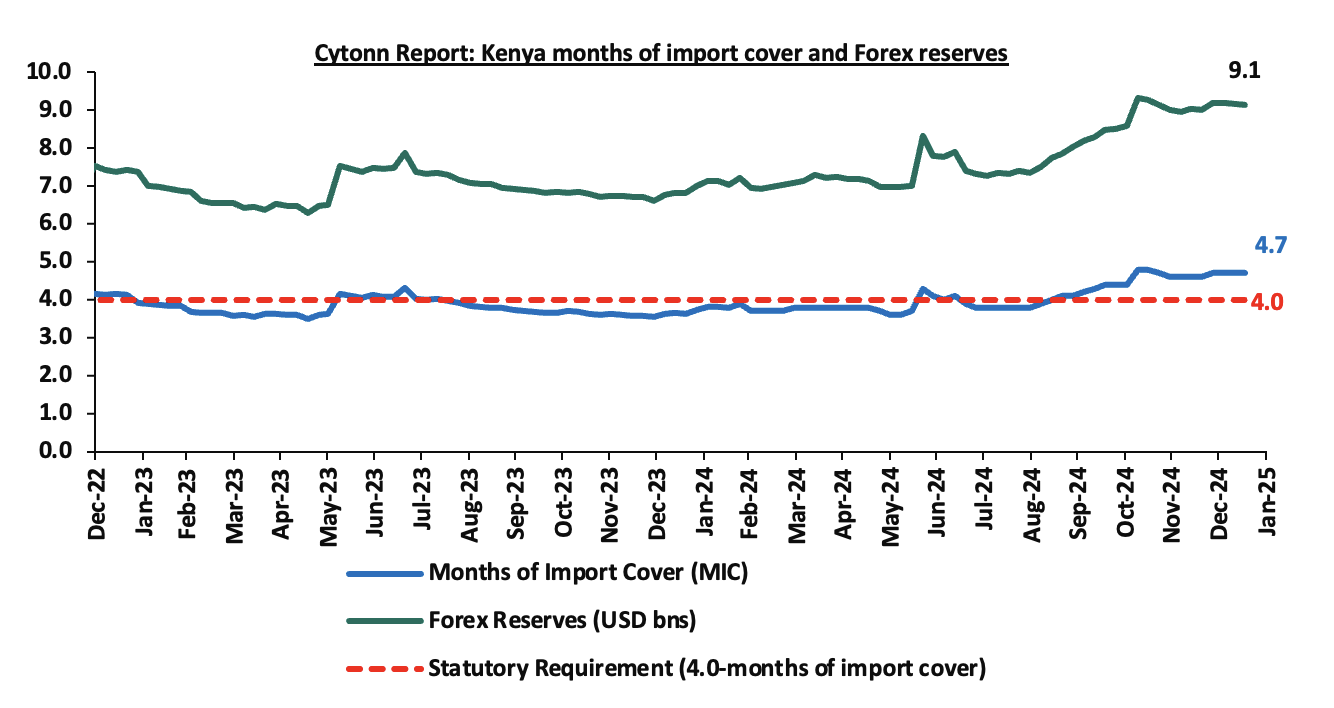

- Improved forex reserves currently at USD 9.1bn (equivalent to 4.7-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2025 as a result of:

- An ever-present current account deficit which came at 4.0% of GDP in Q3’2024 which remained relatively unchanged from Q3’2023 and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.2% of Kenya’s external debt is US Dollar-denominated as of June 2024.

Key to note, Kenya’s forex reserves decreased by 0.4% during the week, to USD 9.1 bn from the USD 9.2 bn recorded in the previous week, equivalent to 4.7 months of import cover and above the statutory requirement of maintaining at least 4.0-months of import cover. The recent increase in forex reserves is primarily attributed to the disbursement from the International Monetary Fund (IMF). On October 30, 2024, the IMF approved a combined disbursement of around USD 606.1 mn following the successful completion of Kenya’s seventh and eighth reviews under the Extended Fund Facility (EFF), Extended Credit Facility (ECF), and Resilience and Sustainability Facility (RSF) arrangements. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights

- Fuel Prices effective 15th January 2025 to 14th February 2025

During the week, The Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail fuel prices in Kenya, effective from 15th January 2025 to 14th February 2025. Notably, the maximum allowed price for Super Petrol, Diesel and Kerosene increased by Kshs 0.3, Kshs 2.0 and Kshs 3.0 respectively. Consequently, Super Petrol, Diesel and Kerosene will now retail at Kshs 176.6, Kshs 167.1 and Kshs 151.4 per litre respectively, from Kshs 176.3, Kshs. 165.1 and Kshs 148.4 per litre respectively, representing increases of 0.2%,1.2% and 2.0% for Super Petrol, Diesel and Kerosene respectively.

Other key take-outs from the performance include;

- The average landing costs per cubic meter for Diesel increased by 0.1% to USD 644.1 in December 2024, from USD 643.7 recorded in November 2024, while the average landing costs per cubic meter for Kerosene and Super Petrol decreased by 1.6% and 0.1% respectively, to USD 649.6 and USD 611.7 in December 2024, from USD 660.3 and USD 612.5 respectively, recorded in November 2024,

- The Kenyan shilling appreciated against the US Dollar by 0.2% to Kshs. 129.6 in December 2024, compared to the mean monthly exchange rate of Kshs 129.9 recorded in November 2024.

We note that fuel prices in the country have decreased in recent months largely due to the government's efforts to stabilize pump prices through the petroleum pump price stabilization mechanism which expended Kshs 9.9 bn in the FY’2023/24 to cushion the increases applied to the petroleum pump prices, coupled with the appreciation of the Kenyan Shilling against the dollar and other major currencies, as well as a decrease in international fuel prices. However, despite a decrease in international fuel prices and a stronger exchange rate in December, reduced spending by the government through the price stabilization mechanism, only subsidizing Kshs 2.2 and Kshs 4.2 per litre for Diesel and Kerosene respectively, compared to Kshs 3.0 and Kshs 7.9 per litre in December saw an increase in fuel prices for the period under review. Going forward, we expect that fuel prices will stabilize in the coming months as a result of the government's efforts to mitigate the cost of petroleum through the pump price stabilization mechanism and a stable exchange rate. As such, we expect the business environment in the country to improve as fuel is a major input cost, as well as continued stability in inflationary pressures, with the inflation rate expected to remain within the CBK’s preferred target range of 2.5%-7.5%.

- The Draft 2025 Budget Policy Statement

During the week, the National Treasury released the Draft 2025 Budget Policy Statement, in line with section 25 of the Public Finance Management (PFM) Act, 2012 which mandates the Treasury to incorporate the views of stakeholders, including the public, during the preparation of the Budget Policy Statement (BPS). Following this consultative process, the Budget Policy Statement (BPS) is submitted to the Cabinet for approval and subsequently presented to Parliament for discussion and adoption. The statement expresses the priority economic policies, structural reforms and the sectoral expenditure programs to be implemented under the Medium-Term Expenditure Framework for FY 2024/25– 27/28.

Below is a summary of the major changes as per the BPS 2025 from the expected FY’2025/2026 budget performance:

|

Comparison of 2024/25 and 2025/26 Fiscal Year Budgets as per the 2025 Budget Policy Statement |

||||

|

|

FY'2023/2024 Budget Outturn (Kshs bn) |

FY'2024/2025 Revised Estimates (Kshs bn) |

FY'2025/2026 BPS (Kshs bn) |

% change 2024/25 to 2025/26 |

|

Total revenue |

2,702.7 |

3,060.0 |

3,516.6 |

14.9% |

|

External grants |

22.0 |

52.3 |

53.2 |

1.7% |

|

Total revenue & external grants |

2,724.7 |

3,112.3 |

3,569.8 |

14.7% |

|

Recurrent expenditure |

2,678.4 |

2,826.2 |

3,076.9 |

8.9% |

|

Development expenditure & Net Lending |

546.4 |

599.5 |

804.7 |

34.2% |

|

County governments + contingencies |

380.4 |

455.1 |

447.7 |

(1.6%) |

|

Total expenditure |

3,605.2 |

3,880.8 |

4,329.3 |

11.6% |

|

Fiscal deficit including grants |

880.5 |

768.5 |

759.5 |

(1.2%) |

|

Deficit as % of GDP (Including grants) |

5.6% |

4.4% |

3.9% |

(0.5%) |

|

Net foreign borrowing |

222.7 |

355.5 |

213.7 |

(39.9%) |

|

Net domestic borrowing |

595.6 |

413.1 |

545.8 |

32.1% |

|

Total borrowing |

818.3 |

768.6 |

759.5 |

(1.2%) |

|

GDP Estimate |

15,826.4 |

17,434.5 |

19,272.8 |

10.5% |

Key take-outs from the table include:

- Total revenue inclusive of Ministerial Appropriation in Aid is projected to increase by 14.9% to Kshs 3.5 tn from Kshs 3.1 tn as per FY’2024/25 revised budget estimates, with proposals such as expanding the tax base and improving tax compliance already in place to work towards increasing the amount of revenue collected in the next fiscal year,

- The 2025 BPS points to a 11.6% increase of the total expenditure, to Kshs 4.3 tn from Kshs 3.9 tn in the FY’ 2024/25 revised budget estimates,

- Development expenditure is set to increase at a higher rate than recurrent expenditure; with development expenditure increasing by 34.2% to Kshs 804.7 bn from Kshs 599.5 bn as per the supplementary budget II, while recurrent expenditure is projected to increase by 8.9% to Kshs 3.1 tn from Kshs 2.8 tn as per the FY’2024/25 supplementary budget II. However, the recurrent expenditure will still constitute the largest allocation of 71.1% while development will be allocated 18.6%

- The budget deficit is projected to decline by 1.2% to Kshs 759.5 bn (3.9% of GDP) in FY’2025/2026, from the projected Kshs 768.5 bn (4.4% of GDP) in the FY’2024/25 revised budget; the decline is in line with the International Monetary Fund’s (IMF’s) recommendation for fiscal consolidation, as the country seeks to reduce Kenya’s public debt requirements,

- The total borrowing requirement is expected to decline by 1.2% to Kshs 759.5 bn from Kshs 768.5 bn as per the FY’2024/25 revised budget, in a bid to reduce Kenya’s public debt burden which is estimated at 65.5% of GDP as of June 2024, 15.5% points above the East African Community (EAC) Monetary Union Protocol, the World Bank Country Policy and Institutional Assessment Index, as well as, the IMF threshold of 50.0%, and,

- Debt financing for the 2025/26 budget is estimated to consist of 28.1% foreign debt and 71.9% domestic debt, a change from the 46.3% foreign debt and 53.7% domestic debt as projected in the revised FY’2024/25 budget, pointing towards increased domestic borrowing.

The 2025 Budget Policy Statement is the third to be prepared under the new administration with the main aim of realizing the administration’s main objective of achieving the Bottom-Up economic model. The BPS comes at a time when the country, is facing a deceleration in economic activity, reflected in the slower GDP growth in the first three quarters of 2024, and projected at 4.6% for FY’2024 from the 5.6% growth in FY’2023. As such, the formulation of the BPS is hinged on ascertain economic recovery projected at 5.3% GDP in 2025. In the event of an economic downturn, the measures would be negative discouraging entrepreneurship, growth of SME and depress earnings growth in the private sector. From the statement, the implementation of the budget will rely more on increased revenue collection with the treasury putting on proposals to achieve the revenue target of Kshs 3.6 tn. The statement has also indicated a reduction in government debt to ensure fiscal consolidation to ease on the debt burden of the country. In line with its manifesto, the Kenya Kwanza regime has also proposed a marginal increase in recurrent expenditure by 8.9%, but significantly increased the development expenditure by 34.2% to help push the key development agendas. The proposed budget is also set to have a deficit that will be met through a mix of domestic and foreign borrowing which is projected at Kshs 759.5 bn compared to Kshs 768.6 mn in the FY’2024/25 revised budget.

To read more of our analysis on the 2025 BPS, please click 2025 Budget Policy Statement Note

III. December Exchequer Release

The National Treasury gazetted the revenue and net expenditures for the sixth month of FY’2024/2025, ending 31st December 2024. Below is a summary of the performance:

|

FY'2024/2025 Budget Outturn - As at 31st December 2024 |

||||||

|

Amounts in Kshs Billions unless stated otherwise |

||||||

|

Item |

12-months Original Estimates |

Revised Estimates |

Actual Receipts/Release |

Percentage Achieved of the Revised Estimates |

Prorated |

% achieved of the Prorated |

|

Opening Balance |

|

|

1.2 |

|

|

|

|

Tax Revenue |

2,745.2 |

2,475.1 |

1,074.1 |

43.4% |

1,237.5 |

86.8% |

|

Non-Tax Revenue |

172.0 |

156.4 |

86.1 |

55.1% |

78.2 |

110.1% |

|

Total Revenue |

2,917.2 |

2,631.4 |

1,161.3 |

44.1% |

1,315.7 |

88.3% |

|

External Loans & Grants |

571.2 |

593.5 |

92.8 |

15.6% |

296.8 |

31.3% |

|

Domestic Borrowings |

828.4 |

978.3 |

477.2 |

48.8% |

489.1 |

97.6% |

|

Other Domestic Financing |

4.7 |

4.7 |

4.4 |

94.8% |

2.3 |

189.6% |

|

Total Financing |

1,404.3 |

1,576.5 |

574.4 |

36.4% |

788.2 |

72.9% |

|

Recurrent Exchequer issues |

1,348.4 |

1,307.9 |

654.5 |

50.0% |

654.0 |

100.1% |

|

CFS Exchequer Issues |

2,114.1 |

2,137.8 |

738.1 |

34.5% |

1,068.9 |

69.1% |

|

Development Expenditure & Net Lending |

458.9 |

351.3 |

129.8 |

37.0% |

175.6 |

73.9% |

|

County Governments + Contingencies |

400.1 |

410.8 |

191.6 |

46.6% |

205.4 |

93.3% |

|

Total Expenditure |

4,321.5 |

4,207.9 |

1,714.1 |

40.7% |

2,104.0 |

81.5% |

|

Fiscal Deficit excluding Grants |

1,404.3 |

1,576.5 |

552.7 |

35.1% |

788.2 |

70.1% |

|

Total Borrowing |

1,399.6 |

1,571.8 |

570.0 |

36.3% |

785.9 |

72.5% |

Amounts in Kshs bn unless stated otherwise

The Key take-outs from the release include;

- Total revenue collected as at the end of December 2024 amounted to Kshs 1,161.3 bn, equivalent to 44.1% of the revised estimates of Kshs 2,631.4 bn for FY’2024/2025 and is 88.3% of the prorated estimates of Kshs 1,315.7 bn. Cumulatively, tax revenues amounted to Kshs 1,074.1 bn, equivalent to 43.4% of the revised estimates of Kshs 2,475.1 bn and 86.8% of the prorated estimates of Kshs 1,237.5 bn,

- Total financing amounted to Kshs 574.4 bn, equivalent to 36.4% of the revised estimates of Kshs 1,576.5 bn and is equivalent to 72.9% of the prorated estimates of Kshs 788.2 bn. Additionally, domestic borrowing amounted to Kshs 477.2 bn, equivalent to 48.8% of the revised estimates of Kshs 978.3 bn and is 97.6% of the prorated estimates of Kshs 489.1 bn,

- The total expenditure amounted to Kshs 1,714.1 bn, equivalent to 40.7% of the revised estimates of Kshs 4,207.9 bn, and is 81.5% of the prorated target expenditure estimates of Kshs 2,104.0 bn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 654.5 bn, equivalent to 50.0% of the revised estimates of Kshs 1,307.9 and 100.1% of the prorated estimates of Kshs 654.0 bn,

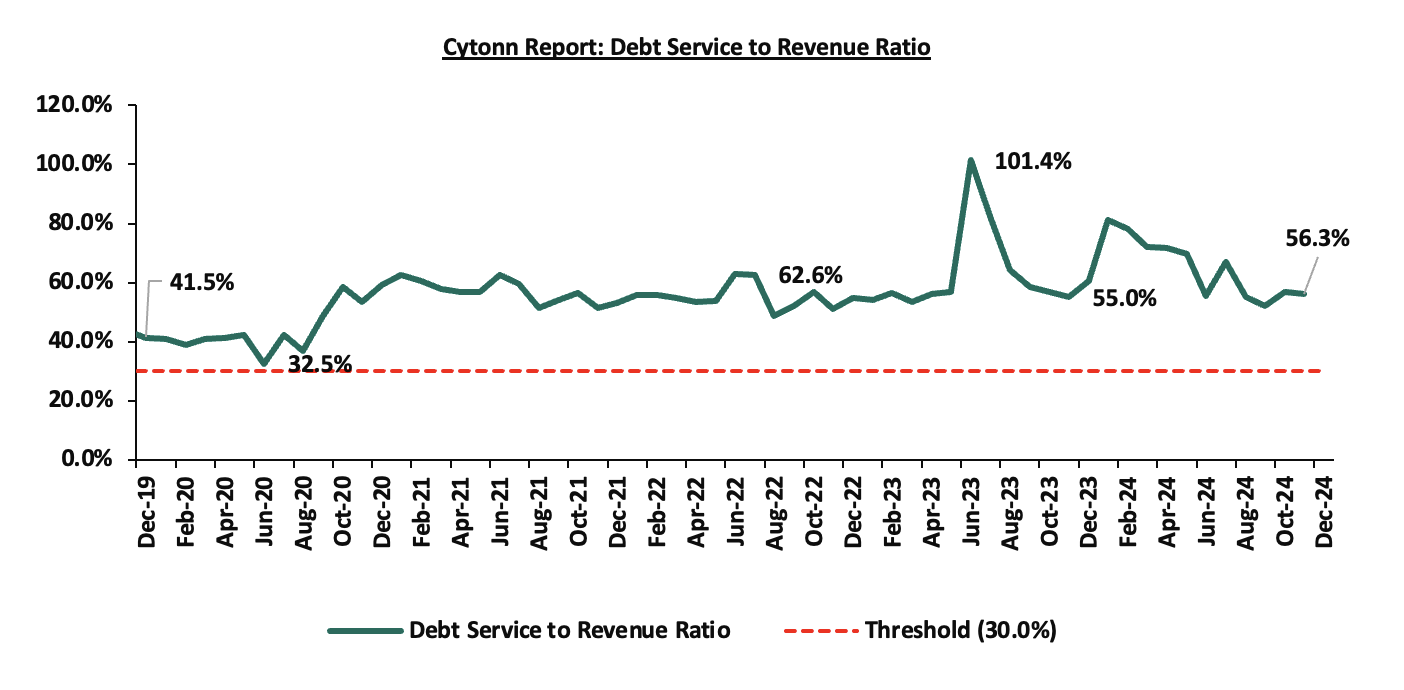

- Consolidated Fund Services (CFS) Exchequer issues came in at Kshs 738.1 bn, equivalent to 34.5% of the revised estimates of Kshs 2,137.8 bn, and are 69.1% of the prorated amount of Kshs 1,068.9 bn. The cumulative public debt servicing cost amounted to Kshs 635.5 bn which is 34.2% of the revised estimates of Kshs 1,910.5 bn, and is 68.4% of the prorated estimates of Kshs 955.2 bn. Additionally, the Kshs 653.5 bn debt servicing cost is equivalent to 56.3% of the actual cumulative revenues collected as at the end of December 2024. The chart below shows the debt servicing cost to revenue ratio over the period;

- Total Borrowings as at the end of December 2024 amounted to Kshs 570.0 bn, equivalent to 36.3% of the revised estimates of Kshs 1,571.8 bn for FY’2024/2025 and are 72.5% of the prorated estimates of Kshs 785.9 bn. The cumulative domestic borrowing of Kshs 978.3 bn comprises of Net Domestic Borrowing Kshs 408.4 bn and Internal Debt Redemptions (Rollovers) Kshs 569.9 bn.

The government missed its prorated revenue targets for the sixth consecutive month in FY’2024/2025, achieving only 88.3% of the revenue targets in December 2024. This shortfall is largely due to the challenging economic environment, exacerbated by high taxes and the elevated cost of living, despite an easing of inflationary pressures, with the year-on-year inflation for December 2024 rising marginally by 0.2% points to 3.0%, up from 2.8% in November 2024. However, the cost of living remains high, negatively impacting revenue collection despite the improving business environment, with the PMI coming to 50.6 in December, a slight deterioration from 50.9 in November 2024. Despite efforts to enhance revenue collection, such as broadening the tax base, curbing tax evasion, and suspending tax relief payments, the government has yet to fully benefit from these strategies. Future revenue collection will largely depend on the stabilization of the country’s business climate, which is expected to be supported by a stable Shilling, stable inflation rate, and a reduction in the cost of credit. This is in line with the Monetary Policy Committee’s (MPC) recent decision to lower the Central Bank Rate (CBR) by 75.0 basis points to 11.25%, down from 12.00%, following their meeting on December 5th, 2024.

Rates in the Fixed Income market have been on a downward trend given the continued low demand for cash by the government and the improved liquidity in the money market. The government is 141.9% ahead of its prorated net domestic borrowing target of Kshs 227.8 bn, and 34.9% ahead of the total FY’2024/25 net domestic borrowing target of Kshs 408.4 bn, having a net borrowing position of Kshs 551.0 bn. However, we expect a continued downward readjustment of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to normalize in the short to medium-term and hence investors are expected to shift towards the long-term papers to lock in the high returns.

Market Performance:

During the week, the equities market recorded a mixed performance, with NASI and NSE 20 gaining by 0.9% and 0.1% respectively, while NSE 25 and NSE 10 declined by 1.2% and 0.5% respectively, taking the YTD performance to gains of 4.3%, 4.3%, 0.4% and 0.3% for NSE 20, NASI, NSE 25 and NSE 10, respectively. The equities market performance was driven by gains recorded by large-cap stocks such as Bamburi, Safaricom and Equity Group Holdings of 5.6%, 2.8%, and 2.1% respectively. The gains were however, weighed down by losses recorded by large-cap stocks such as Stanbic, Absa and SCBK of 10.7%, 10.2%, and 6.6% respectively;

During the week, equities turnover decreased by 34.1% to USD 14.2 mn, from USD 21.5 mn recorded the previous week, taking the YTD total turnover to USD 38.1 mn. Foreign investors became net buyers for the first time in five weeks, with a net buying position of USD 0.7 mn, from a net selling position of USD 5.4 mn recorded the previous week, taking the YTD foreign net selling position to USD 4.8 mn.

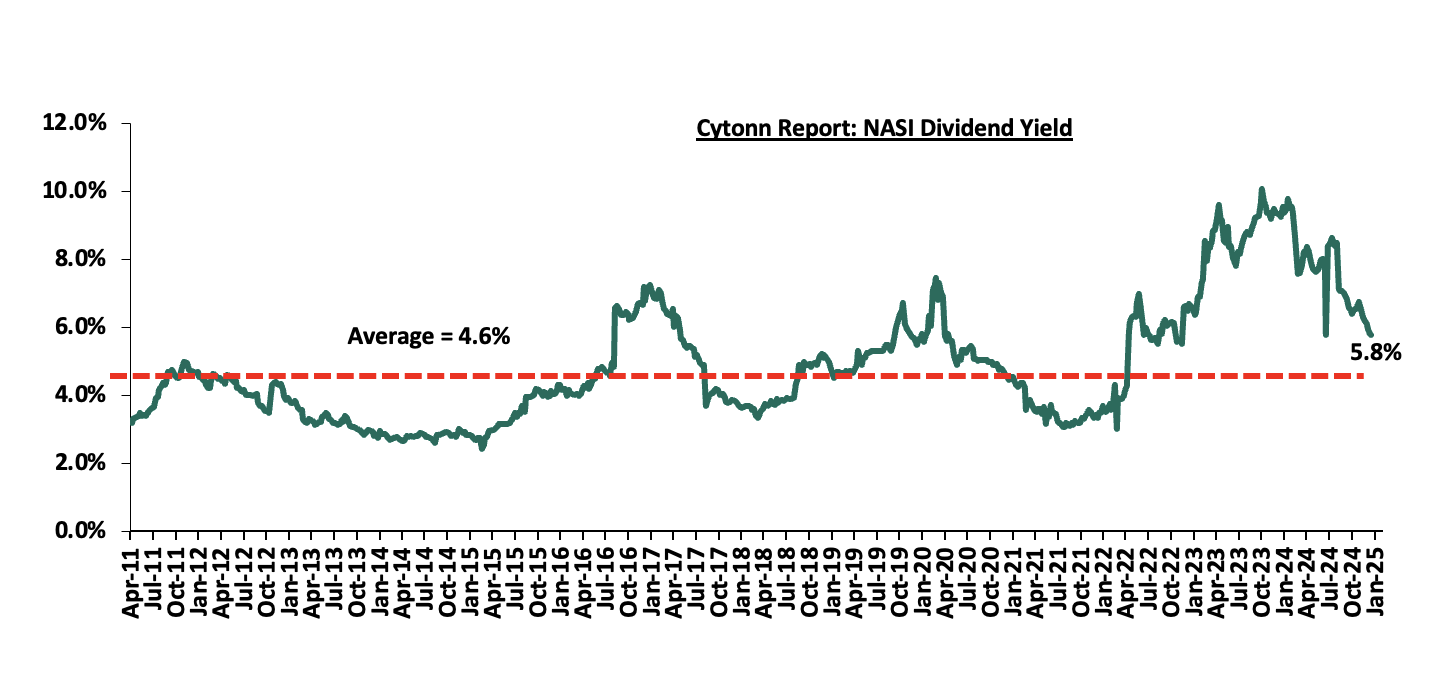

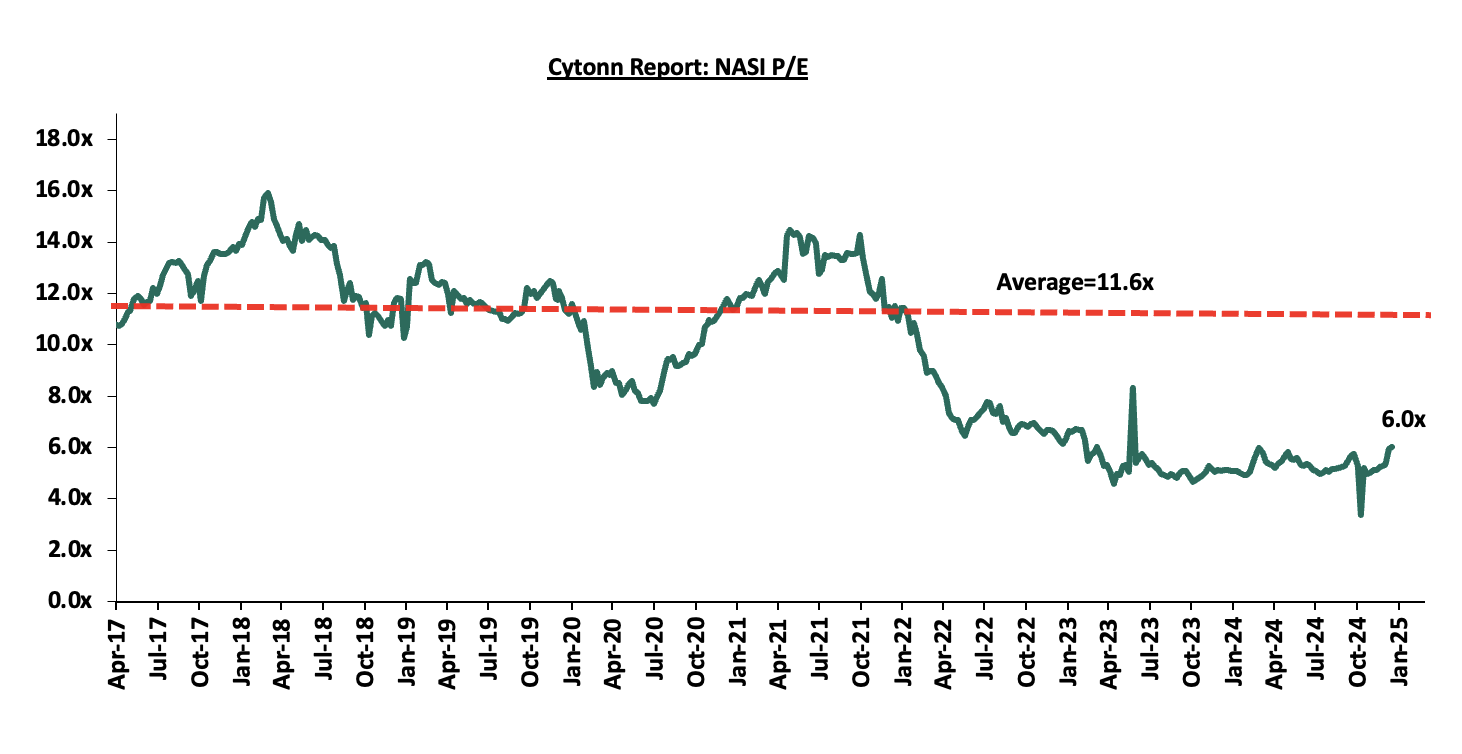

The market is currently trading at a price-to-earnings ratio (P/E) of 6.0x, 48.3% below the historical average of 11.6x. The dividend yield stands at 5.8%, 1.2% points above the historical average of 4.6%. Key to note, NASI’s PEG ratio currently stands at 0.8x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

||||||||||

|

Company |

Price as at 10/01/2025 |

Price as at 17/01/2025 |

w/w change |

YTD Change |

Year Open 2025 |

Target Price* |

Dividend Yield*** |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Jubilee Holdings |

190.5 |

194.3 |

2.0% |

11.2% |

174.8 |

260.7 |

7.4% |

41.5% |

0.3x |

Buy |

|

Equity Group |

47.5 |

48.5 |

2.1% |

1.0% |

48.0 |

60.2 |

8.2% |

32.4% |

1.0x |

Buy |

|

Co-op Bank |

16.6 |

16.2 |

(2.4%) |

(7.2%) |

17.5 |

18.8 |

9.3% |

25.3% |

0.7x |

Buy |

|

NCBA |

48.5 |

47.7 |

(1.7%) |

(6.6%) |

51.0 |

53.2 |

10.0% |

21.6% |

0.9x |

Buy |

|

ABSA Bank |

19.1 |

17.2 |

(10.2%) |

(9.0%) |

18.9 |

19.1 |

9.0% |

20.4% |

1.4x |

Buy |

|

KCB Group |

43.3 |

43.0 |

(0.8%) |

1.3% |

42.4 |

50.3 |

0.0% |

17.1% |

0.7x |

Accumulate |

|

CIC Group |

2.3 |

2.5 |

9.1% |

18.2% |

2.1 |

2.8 |

5.1% |

15.8% |

0.8x |

Accumulate |

|

Diamond Trust Bank |

70.0 |

66.3 |

(5.4%) |

(0.7%) |

66.8 |

71.1 |

7.5% |

14.9% |

0.3x |

Accumulate |

|

Stanbic Holdings |

157.0 |

140.3 |

(10.7%) |

0.4% |

139.8 |

145.3 |

10.9% |

14.5% |

0.9x |

Accumulate |

|

Standard Chartered Bank |

300.0 |

280.3 |

(6.6%) |

(1.8%) |

285.3 |

291.2 |

10.3% |

14.3% |

1.9x |

Accumulate |

|

I&M Group |

34.0 |

33.2 |

(2.2%) |

(7.8%) |

36.0 |

32.3 |

7.7% |

5.0% |

0.7x |

Lighten |

|

Britam |

6.6 |

7.5 |

13.4% |

28.2% |

5.8 |

7.5 |

0.0% |

0.5% |

1.0x |

Lighten |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Dividend Yield is calculated using FY’2023 Dividends |

||||||||||

We are “Bullish” on the Equities markets in the short term due to current cheap valuations, lower yields on short-term government papers and expected global and local economic recovery, and, “Neutral” in the long term due to the adverse operating environment and huge foreign investor outflows.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.8x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the economic outlook in the short term.

- Retail

During the week, China Square expanded its presence in Kenya by launching its 7th store at Greenspan Mall in Donholm-Nairobi which follows the opening of a 6th store at Two Rivers Mall-Kiambu in the previous week. These additions bring the retailer’s total number of outlets in the country to seven since its entry at Kenyatta University’s Unicity Mall in 2022. The new outlet joins other China Square locations at the Waterfront Mall in Karen, Lang’ata Hyper Mall, Nyali Bazaar Mall in Mombasa, and Mega City Mall in Kisumu. This expansion comes after China Square overcame challenges in early 2023 when its competitive pricing faced backlash from traders and some political groups.

ILAM Fahari I-REIT, which manages Greenspan Mall announced the inclusion of China Square in tenants portfolio, expressing enthusiasm for the growth and collaboration this partnership brings. Elsewhere, the Centum team, which co-owns Two Rivers Mall, highlighted that the addition of China Square is expected to raise the mall’s occupancy to around 95.0%, boosting foot traffic and benefiting other businesses. The table below shows a summary of the number of stores of the key local and international retailer supermarket chains in Kenya;

|

Cytonn Report: Main Local and International Retail Supermarket Chains |

|||||||||||||

|

# |

Name of retailer |

Category |

Branches as at FY’2018 |

Branches as at FY’2019 |

Branches as at FY’2020 |

Branches as at FY’2021 |

Branches as at FY’2022 |

Branches as at FY’2023 |

Branches as at FY’2024 |

Branches opened in FY’2025 |

Closed Branches |

Current Branches |

|

|

1 |

Naivas |

Hybrid* |

46 |

61 |

69 |

79 |

91 |

99 |

105 |

0 |

0 |

105 |

|

|

2 |

Quick Mart |

Hybrid** |

10 |

29 |

37 |

48 |

55 |

59 |

60 |

0 |

0 |

60 |

|

|

3 |

Carrefour |

International |

6 |

7 |

9 |

16 |

19 |

22 |

26 |

1 |

0 |

27 |

|

|

4 |

Chandarana |

Local |

14 |

19 |

20 |

23 |

26 |

26 |

26 |

0 |

0 |

26 |

|

|

5 |

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

12 |

13 |

13 |

0 |

0 |

13 |

|

|

6 |

China Square |

International |

0 |

0 |

0 |

0 |

0 |

2 |

5 |

2 |

0 |

7 |

|

|

7 |

Jaza Stores |

Local |

0 |

0 |

0 |

0 |

0 |

4 |

6 |

0 |

0 |

6 |

|

|

8 |

Tuskys |

Local |

53 |

64 |

64 |

6 |

6 |

5 |

5 |

0 |

59 |

5 |

|

|

9 |

Uchumi |

Local |

37 |

37 |

37 |

2 |

2 |

2 |

2 |

0 |

35 |

2 |

|

|

10 |

Panda Mart |

International |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

0 |

0 |

1 |

|

|

11 |

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

0 |

0 |

3 |

0 |

|

|

12 |

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

0 |

0 |

0 |

15 |

0 |

|

|

13 |

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

0 |

0 |

0 |

4 |

0 |

|

|

14 |

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

0 |

0 |

0 |

65 |

0 |

|

|

Total |

257 |

313 |

334 |

189 |

211 |

232 |

249 |

3 |

181 |

252 |

|||

|

*51% of Naivas Supermarket owned by IBL Group (Mauritius), Proparco (France), and DEG (Germany), while 49% owned by Gakiwawa Family (Kenya) |

|||||||||||||

|

**More than 50% of Quickmart Supermarket owned by Adenia Partners (Mauritius), while Less than 50% owned by Kinuthia Family (Kenya) |

|||||||||||||

Source: Cytonn Research

We expect that this expansion by China Square will boost foot traffic at both Two Rivers and Greenspan Malls, benefitting businesses within these locations. Additionally, by providing more convenient access to its diverse and affordable product offerings, China Square enhances retail options for customers while contributing to the local economy through job creation and increased commercial activity.

- Mixed Use Developments (MUDs)

During the week, the National Social Security Fund (NSSF) announced plans to build a Mixed-Use development on one of its prime pieces of land located in Nairobi's central business district at the corner of Uhuru Highway and Kenyatta Avenue which has remained vacant for decades. The project will be implemented using an Engineering, Procurement, Construction, and Finance (EPC+F) model, where contractors handle the entire project from design to financing. The NSSF aims to unlock the value of its underperforming assets and generate returns on its investments, which currently stand at Ksh 402.0 bn. Given this the company is seeking bids from firms interested in undertaking the mixed-use development and the project mix may include residential, commercial, hospitality, and specialized uses, with the goal of creating a landmark development in the capital.

We expect that on successful completion, this project has potential to generate significant long-term returns for NSSF, enhancing its investment portfolio and ensuring sustainable returns for its members. Additionally, this project can contribute to the government’s national development goals, such as urban renewal, job creation, and economic growth.

- Real Estate Investments Trusts (REITs)

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 25.4 and Kshs 22.2 per unit, respectively, as per the last updated data on 17th January 2025. The performance represented a 27.0% and 11.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at Kshs 12.7 mn and Kshs 34.7 mn shares, respectively, with a turnover of Kshs 323.5 mn and Kshs 722.8 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 17th January 2025, representing a 45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 138,600 shares for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015.

REITs offer various benefits, such as tax exemptions, diversified portfolios, and stable long-term profits. However, the ongoing decline in the performance of Kenyan REITs and the restructuring of their business portfolios are hindering significant previous investments. Additional general challenges include:

- Insufficient understanding of the investment instrument among investors leading to a slower uptake of REIT products,

- Lengthy approval processes for REIT creation,

- High minimum capital requirements of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, essentially limiting the licensed REIT Trustee to banks only

- The rigidity of choice between either a D-REIT or and I-REIT forces managers to form two REITs, rather than having one Hybrid REIT that can allocate between development and income earning properties

- Limiting the type of legal entity that can form a REIT to only a trust company, as opposed to allowing other entities such as partnerships, and companies,

- We need to give time before REITS are required to list – they would be allowed to stay private for a few years before the requirement to list given that not all companies maybe comfortable with listing on day one, and,

- Minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs. The significant capital requirements still make REITs relatively inaccessible to smaller retail investors compared to other investment vehicles like unit trusts or government bonds, all of which continue to limit the performance of Kenyan REITs.

We expect Kenya’s Real Estate sector to remain on a growth trend, supported by: i) demand for housing sustained by positive demographics, such as urbanization and population growth rates of 3.7% p.a and 2.0% p.a, respectively, against the global average of 1.7% p.a and 0.9% p.a, respectively, as at 2023,, ii) activities by the government under the Affordable Housing Program (AHP) iii) heightened activities by private players in the residential sector iv) increased investment by local and international investors in the retail sector. However, challenges such as rising construction costs, strain on infrastructure development (including drainage systems), high capital requirements for REITs, and existing oversupply in select Real Estate sectors will continue to hinder the sector’s optimal performance by limiting developments and investments.

Insolvency refers to a financial situation where an individual, business or entity, such as a fund, is unable to meet their financial obligations or settle their debts as they become due. In most cases, the state of insolvency occurs due to an increase in business expenses, poor cash management, law suits, poor budgeting, fraud, business expansion, or a reduction in sales. In Kenya, insolvency proceedings are primarily governed by the Insolvency Act of 2015. The act provides for how insolvent companies can be assisted to service creditors obligations and protect the interests of all stakeholders. The options available for such an insolvent company include Administration, Receivership, voluntary arrangements, and liquidation. In this week’s focus, we shall look into the following;

- Introduction,

- The Insolvency Act of 2015

- Financial health of a company and warning signs,

- Business restructuring options under the insolvency act,

- Case Study,

- Challenges affecting insolvency practice, and,

- Recommendations and Conclusion.

Section I: Introduction

Insolvency refers to a financial situation whereby an individual or business is unable to meet its financial obligations or settle its debts as they become due. In most cases, the state of insolvency occurs due to an increase in business expenses, poor cash management, law suits, poor budgeting, fraud, business expansion, or a reduction in sales. Consequently, these situations may lead to:

- Cash flow insolvency – whereby the company does not have enough cash or assets that can be easily converted into cash to settle its short-term obligations. This means that the company is struggling to pay its bills, creditors, and operating expenses on time. It occurs due to a delay in customers settling their invoices, cash disruption due to seasonality (for example, in the tourism industry), or a sudden increase in operating costs. However, the company’s total asset value may exceed its total liabilities, or,

- Balance sheet Insolvency – also known as technical Insolvency, whereby the company’s total liabilities exceed the value of its total assets and the company owes more than it owns. Therefore, the sale of all the company’s assets will not be sufficient to settle all the company’s liabilities. It usually occurs when the value of total assets decreases while the value of total liabilities increases or remains unchanged. However, balance sheet insolvency only looks at the current balance sheet position and fails to account for the business's cash flows. Therefore, the company may have a positive cash flow and be able to settle its short-term obligations.

In Kenya, insolvency proceedings are primarily governed by the Insolvency Act of 2015. This act provides for various mechanisms to address insolvency situations, including bankruptcy for individuals and winding up for companies. It aims to promote the efficient and fair resolution of insolvency cases while at the same time protecting the rights of creditors and debtors.

Prior to the enactment of the Insolvency Act in 2015, insolvency proceedings of both corporate entities and individuals were dealt with under the winding-up provisions of the Companies Act and the Bankruptcy Act. For corporations, the resolution of insolvency proceedings often involved the commencement of a winding-up proceeding, which involved the liquidation of the company under financial distress and paying the firm’s creditors. This effectively meant that creditors and other stakeholders in firms ran the risk of failing to recover total amounts of interest, especially in the event the company’s assets failed to cover the total amounts due. Thus, in an attempt to remedy this, the Insolvency Act was enacted in 2015. The Act consolidated the insolvency proceedings for both incorporated and unincorporated companies, previously under the Companies Act, and those of individuals, previously under the Bankruptcy Act, into one document. The Act focuses more on assisting insolvent corporate bodies whose financial position is deemed redeemable to continue operating as going concerns so that they may be able to meet their financial obligations to the satisfaction of their creditors.

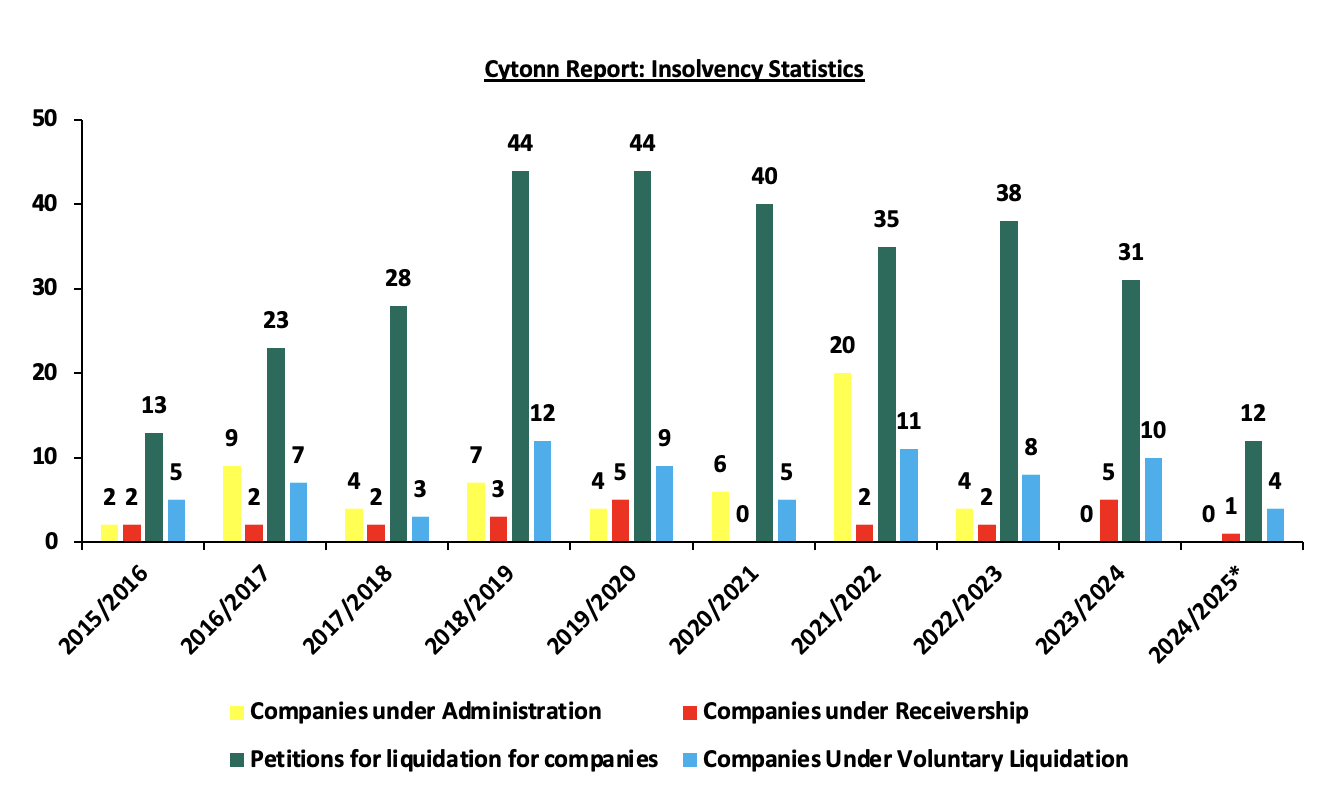

According to the latest statistics by the Kenya’s State Receiver’s office, the total number of petitions for liquidation of companies by courts has averaged 31 every year. Additionally, on average, the total number of companies under administration, companies under receivership, and companies under voluntary liquidation during each year is 6, 2, and 7, respectively. This situation is partly attributable to the increase in Gross non-performing loans, with the banking sector recording a 5-year CAGR growth of 14.4% to Kshs 670.6 bn in September 2024 from Kshs 342.5 bn in September 2019. Similarly, the Gross Non Performing Loans (NPL) ratio has increased to 16.3% as of June 2024, from 14.5% in Q2’2023. Additionally, the tough business operating environment characterized by the 5.7% decrease in average Purchasing Manager’s Index (PMI) to 49.6 in 2024 from 52.6 average recorded in 2019 has led to a significant increase in business operating expenses, which has affected the profitability of the business. The graph below shows the trend in the number of applications for insolvency during each year:

Source: Office of the Official Receiver

*data up to November 2024

Section II: The Insolvency Act of 2015

The Insolvency Act was assented into law in September 2015 and came in to assist insolvent companies in strategizing on the best possible solution to bring the company back to financial stability rather than liquidation, with a view to preserving businesses, jobs and tax base as much as possible. Prior to 2015, stakeholders faced the possibility of losing a significant amount, especially in the event that the company’s liability value was higher than the total assets held. The Insolvency Act of 2015 seeks to create a more robust and effective insolvency framework in Kenya by:

- Focusing on rehabilitating struggling businesses rather than liquidating them, allowing viable companies to recover and continue operations, which helps preserve jobs and economic value,

- Enhancing transparency and predictability in the insolvency process, promoting trust among creditors, investors, and the public, which is vital for attracting foreign investment.

- Offering options for business restructuring, the Act helps maintain access to credit, especially for SMEs, fostering economic growth and enabling businesses to repay debts.

- Ensuring fair treatment of both creditors and debtors, providing clear guidelines for asset distribution and allowing creditors a more active role in the restructuring process, and

- Aligning Kenya's insolvency laws with international best practices, improving the legal framework's efficiency and enhancing Kenya's attractiveness for cross-border trade and investment.

Some of the key features and provisions in the act include:

- Types of Insolvency Proceedings - The Act outlines various insolvency proceedings such as administration, receivership, liquidation, and company voluntary agreements. It provides procedures for initiating and filling claims in insolvency proceedings.

- Appointment of Insolvency Practitioners - Licensed insolvency practitioners are appointed to oversee insolvency cases. They are responsible for managing the assets and liabilities of the insolvent party, ensuring fair distribution to creditors, and facilitating the resolution process. They include the Official receiver, Bankruptcy Trustee, Liquidator and Administrator.

- Powers of Insolvency practitioners – The Insolvency practitioners have a fiduciary duty of acting in the best interest of the creditors and stakeholders involved in the insolvency process. The Act provides for the powers of insolvency practitioner with regard to carrying out the business of the insolvent company. Additionally, it also highlights some of the powers that can be excised with or without the approval of the courts or the creditors.

- Moratoriums - The Act allows for the issuance of a moratorium period during which creditors cannot take legal action against the debtor. This allows for an opportunity to reorganize and rehabilitate the debtor's financial position.

- Priority of payment to preferential creditors - In insolvency proceedings, claims are ranked based on their priority level and this is important in determining the order in which the claim will be paid from the available assets of the insolvent debtor to the stakeholders

- Cross-Border Insolvency - The Act provides mechanisms for dealing with cross-border insolvency cases, including cooperation with foreign courts and recognition of foreign insolvency proceedings.

- Role of the Courts in Insolvency Proceedings – The act has provided for the powers of the court to review, rescind the appointment of an insolvent practitioner, allow the substitution of the creditor, and stay the application of insolvency, among others.

Section III: Financial health of a company and warning signs

Assessing the financial health of a company is crucial for investors, creditors, and other stakeholders to understand the company’s ability to meet its financial obligations, manage risks, and sustain long term operations. It helps in identifying warning signs of potential financial distress and allows stakeholders to take corrective actions before the situation worsens. There are a number of indicators that are used in accessing the financial health of a company, which include:

- Profitability – This indicator measures the company’s ability to generate profit relative to its assets, equity, expenses, and revenue. It shows an investor whether the company can survive on its own in the long run without having to rely on additional financing from alternative sources. Some of the ratios used to assess profitability include Return on Assets (ROA), Return on Equity (ROE), EBITDA (Earnings Before Interest Income, Taxes, Depreciation, and Amortization), and Net Profit Margins. A positive ratio is an indication of a profitable company, and vice versa.

- Liquidity – This indicator measures the company’s ability to settle its short-term obligations relative to its available cash and the assets that can be easily converted to cash. A company should be able to settle its expenses and debts without delay. Some of the ratios used to assess liquidity include the current ratio and the quick ratio. A value greater than 1.0 indicates that the company can easily settle its short-term obligations without delays.

- Solvency - This indicator measures the company’s ability to settle its long-term obligations relative to its total assets, or equity. In the event of the winding up of a company, it is expected that both creditors and shareholders will be able to get back the funds they have lent and invested. Some of the ratios include the debt-to asset ratio and the debt-to Equity ratio. A value less than 1.0 indicates that the company is highly solvent and is able to meet all its long-term obligations.

- Efficiency – This indicator measures how well a company is able to utilize its assets to generate income and the management's ability to control the company’s expenses and liabilities. Efficiency has a high correlation with profitability, given that the more efficiently the company's resources are used, the more profitable the company becomes.

- Cash flow – This indicator measures the company’s ability to generate and manage cash to cover operational expenses, investments, and other financial obligations. Cash flow provides insights into a company's liquidity, solvency, and overall financial stability. A positive cash flow is an indication that the company is able to generate sufficient cash to run its operations, as it is generating more than it is spending.

These indicators provide a comprehensive view of a company's financial health. However, they only give relevant insight about the company when compared with the indicators of companies within the same industry or compared to the historical indicator values of the company. The analysis of the financial health of the company is crucial in identifying potential risks and enabling one to take the appropriate actions to address those risks. Some of the warning signs of Insolvency include:

- Persistent loss-making trend: A sustained loss trend over multiple periods can erode a company's equity base, thereby reducing its ability to cover its financial obligations and indicating a potential deterioration of its financial position.

- Increase in debt levels - Rapidly growing debt, especially short-term debt, will lead to the possibility of overextending loans and credit facilities, which will strain a company's finances, thus increasing the default risk.

- Delayed payments - Consistent delaying of payments to suppliers and employees can be an indication that the company is facing cash flow problems and is struggling to meet its short-term liabilities.

- Negative cash flow – When the company's operating cash flow is consistently negative, it indicates that it's not generating sufficient cash from its core operations. This could be partially attributable to the high level of obsolete or slow-moving inventory, which hinders the company's ability to generate cash from sales.

- Numerous legal actions – Lawsuits can have significant negative impacts on a company's financial health, reputation, operations, and overall stability. They can be expensive to defend, requiring legal fees, court costs, and potential settlement payments. The financial burden can strain a company's resources, affecting its cash flow and profitability.

- A low Credit score - A downgrade of a credit score by a Credit rating agency's company is a result of the company's deteriorating financial condition and indicates a higher default risk. This will lead to either the company taking more expensive risks, which will overburden its finances, or the company facing challenges in obtaining new loans.

It's important to note that while these indicators and warning signs can provide insights into a company's financial health and potential risk of insolvency, a comprehensive assessment should consider the company's industry, competitive landscape, and overall economic conditions. However, experiencing one or a few of these warning signs does not necessarily mean a company is insolvent. A combination of these indicators, especially if they persist over time, warrants careful analysis and consideration by stakeholders. In the event the company becomes insolvent, the Insolvency Act contains provisions for corporate rescue mechanisms to help financially troubled businesses restructure and avoid liquidation. The advantages of these provisions include:

- Preservation of the value of the assets - By addressing the financial issues and restructuring the company's operations, assets, and liabilities, it may be possible to preserve the underlying value of the business. This can prevent a complete collapse and potential liquidation, which could result in significant losses for all stakeholders

- Debt Reduction and Negotiation - Restructuring often involves negotiating with creditors to restructure debt repayment terms. This can lead to reduced debt burdens, extended payment periods, or even partial forgiveness of debt, making it more manageable for the company to recover.

- Continued Operations - A well-planned restructuring can enable the company to continue its operations, maintain relationships with customers and suppliers, and honor existing contracts. This can be especially important for businesses with ongoing projects or long-term partnerships.

- Improved Efficiency - Restructuring provides an opportunity to assess and optimize the company's operations, streamline processes, eliminate inefficiencies, and allocate resources more effectively. This can lead to improved profitability and competitiveness.

- Access to New Capital - In some cases, restructuring may attract new investors or lenders who are willing to provide capital to support the company's recovery efforts. This injection of funds can help stabilize the company's finances and fuel its growth.

- Creditor Satisfaction - Creditors may benefit from a structured repayment plan that is more likely to lead to higher recovery rates compared to liquidation. This can lead to more favorable outcomes for both secured and unsecured creditors.

Key to note is that the overall success of a restructuring process depends on various factors, including the severity of the financial distress, the willingness of stakeholders to cooperate, the expertise of the professionals involved, and the overall economic environment.

Section IV: Business Restructuring options under the Insolvency Act

Business restructuring for an insolvent company involves a series of strategic and operational changes aimed at improving the company's financial health, addressing its insolvency, and ensuring its long-term viability. The goal of a restructuring is to reorganize the company's operations, debt, and assets in a way that enables it to overcome financial challenges and continue its business activities. In Kenya, insolvency proceedings are primarily governed by the Insolvency Act of 2015. The act provides for how insolvent companies can be assisted to service creditor’s obligations and protect the interests of all stakeholders. The options available for such an insolvent company include;

- Administration –The primary objective of administration is to rescue the company as a going concern, preserve its value, and maximize returns for creditors rather than immediately liquidate its assets. It is headed by an Administrator, a certified Insolvency Practitioner, who may be appointed by an administration order of the court, unsecured creditors, or a company or its directors. Once an administration application is filed, an automatic moratorium (legal stay order) is imposed, preventing creditors from taking legal action to recover debts or seize assets. This moratorium allows the company and the administrator time to assess the situation, develop a restructuring plan, and implement necessary changes without immediate pressure from creditors. Once the administrator has achieved the objectives of administration, the company can exit administration, which could involve returning control of the company to its directors, implementing a restructuring plan, or transitioning to another form of insolvency proceedings if necessary.

- Company Voluntary Arrangements - This arrangement is entered into when a company is insolvent and the directors propose to the company’s creditors the best way to save the company from liquidation. The proposal consists of repayment plans where the company seeks to extend its repayment period and the debt is repaid through regular installments as opposed to settling the payment dues in full. The directors appoint an insolvency practitioner to supervise the voluntary arrangement. Once the proposal is approved by both the company, the creditors, and the Courts, the voluntary agreement remains binding on the company and the creditors until it ceases. Important to note: banking and insurance companies are not legally allowed to pursue this option.

- Receivership – In this process, the primary objective is to realize and sell the firm’s assets and help settle the outstanding debts. A firm’s creditors may appoint an independent certified Insolvency Practitioner to act as a fiduciary (a receiver’) for the firm to realize and sell the firm’s assets and help settle the outstanding debts. In the banking sector, the CBK can put banks under receivership, as in the case of Imperial Bank and Chase Bank. The Kenya Deposit Insurance Act, No. 10 of 2012, allows the CBK to appoint the Kenya Deposit Insurance Corporation (KDIC) as the sole and exclusive receiver of any institution.

- Liquidation – Liquidation is a common insolvency proceeding whereby a company is wound up after all its assets and liabilities are identified in order to pay off creditors to the greatest extent possible. Liquidation proceedings can be initiated by a court in Kenya or can be voluntary in nature, where the company members or creditors make a liquidation application.

During the insolvency process, the debts of a company are paid out in order of priority. The purpose of prioritization is to ensure that essential debts are settled before other claims are addressed. Under the Insolvency Act, the priority of payment for preferential creditors in Kenya is as follows:

- First Priority Claims – These consist of the expenses incurred in procuring the orders for the insolvency. They Include the fees for the Insolvency practitioner, the costs incurred by the person who applied to the court, and the costs incurred in protecting, preserving, and recovering the value of the assets.

- Second Priority Claims – These are paid out after the first priority claims are settled. They consist of all the wages and other compensations of the employees of the companies. They are given a second priority to ensure that employees are not left without their due compensation.

- Third Priority Claims – These claims rank third after the first and second priority claims have been settled. They consist of tax liabilities of the company, such as Income tax, Value Added Tax (VAT), and Excise tax, among others.

After preferential creditors have been paid, any remaining assets are used to settle the claims of secured creditors (those with collateral) and then the claims of unsecured creditors (those without collateral). Shareholders and equity holders are usually at the bottom of the priority list and are often the last to receive any remaining funds, if there are any left after satisfying higher-ranking claims.

Section V: Case studies

- Blueshield Insurance Company

Blue Shield Insurance Company Ltd was established on December 4, 1982, and quickly became a key player in Kenya’s insurance sector. In September 2011, due to significant financial challenges, Blue Shield was placed under statutory management by the Insurance Regulatory Authority (IRA). This intervention aimed to address the company's inability to meet its obligations to policyholders and other creditors. Mr. Eliud Muchoki Muriithi served as the first statutory manager from September 15, 2011, to July 4, 2014.

On May 22, 2017, the Insurance Regulatory Authority (IRA) filed a petition, to liquidate Blueshield Insurance Company Limited, citing that the company was insolvent and unable to meet its financial obligations to policyholders and creditors. They argued that Blueshield's liabilities far exceeded its assets, rendering it incapable of continuing operations as a going concern. Furthermore, they asserted that statutory management, which had been instituted to address the financial challenges and stabilize the company, had failed to yield any viable turnaround strategies.

In 2021, the shareholders submitted evidence suggesting that the company had become solvent again, claiming that it had Kshs 547.0 million in assets. They argued that the company could be revived by injecting new capital, aided by the potential sale of its prime property. They further argued that the company’s building, estimated to be worth Kshs 1.5 billion, was viewed as a potential asset to be liquidated and reinvested into the business. This was seen as a key element in the shareholders' argument that the company could be revived and its debts settled. Despite these claims, the company had verified liabilities amounting to Kshs 855.0 million, which included court judgments, service provider vouchers, and other financial obligations. This starkly contrasted with the company’s solvency claim and contributed to the call for liquidation. In addition, according to court documents, the statutory managers presented evidence from audits by the Auditor General and Parker Randall, which revealed that Kshs 767.5 million was improperly accounted for, coupled with Ksh 512.5 million relating to mismanagement in rent collection. Furthermore, as of 2013, the company’s capital was below this threshold by Kshs 23.0 million, contributing to its financial troubles. According to the Insurance Act, 11 assets are excluded from consideration when determining an insurer’s capital adequacy. This includes all fixed assets. In this regard, the company’s building valued at Kshs.1.5 billion could be taken into consideration.

On July 3, 2024, the High Court issued a liquidation order against Blueshield Insurance Company Ltd, concluding that the company could not be resuscitated. Mr. Long'et Terer, MBS, was appointed as the liquidator to manage the company's affairs, including securing and preserving its assets.

In our view, the 13 years of administration without a clear and effective restructuring plan for Blueshield Insurance reflect a failure in management and a missed opportunity for recovery. Despite considering several proposals, none were implemented, and shareholders did not inject the necessary capital to meet regulatory requirements. This lack of decisive action raises concerns about the transparency and accountability of the administration process.

- Mastermind Tobacco

Mastermind Tobacco (K) Ltd. is a Kenyan tobacco company that was established in 1986 by the late Wilfred Murungi. Over the years, it grew to become one of the largest tobacco manufacturers in Kenya, producing a range of well-known brands such as Dunhill, Marlboro, and Rothmans under license. The company is known for its dominance in the East African market, not only in Kenya but also across the region, with a significant market share in the tobacco sector. Mastermind Tobacco became one of Kenya's largest private companies, operating in a competitive market and employing a substantial workforce.

However, the company faced significant financial challenges over the years, both from Kenya Revenue Authority (KRA) and its lenders. In a gazette notice dated 22nd December 2023, I&M Bank placed Mastermind Tobacco under administration due to the company's inability to meet its debt obligations of an undisclosed amount effectively halting its operations and leading to the termination of approximately 1,000 employees. Pongangipalli Rao was appointed an insolvency practitioner in a bid to recover the amounts owed to them

The company’s troubles were further compounded by tax disputes with the Kenya Revenue Authority (KRA). In 2019, Mastermind agreed to sell prime assets to settle a KES 2.9 bn tax arrears. Additionally, in October 2024, the company lost an appeal against a decision by the Tax Appeals Tribunal that upheld a Kshs 517.8 mn tax demand issued by the KRA.

As of December 2024, assets owned by Mastermind Tobacco, including its head office and factory in Syokimau, Kimathi House in Nairobi, and various tracts of land, are scheduled for auction on January 24, 2025. This auction is anticipated to mark the end of an era for the tobacco manufacturer.

In our view, Mastermind Tobacco’s collapse highlights missed opportunities to address its financial challenges earlier, including negotiating with I&M Bank and resolving tax disputes with KRA, which might have prevented asset auctions and safeguarded value. Additionally, the auctioning of assets like the Syokimau factory and Kimathi House will likely yield less value than expected due to the short notice and the nature of distressed sales, leaving both creditors and other stakeholders with substantial losses, while the termination of 1,000 employees underscores the broader economic impact. The insolvency practitioner must ensure a transparent auction process to maximize recoveries and fairly allocate proceeds.

- Kaluworks

Kaluworks was set up in 1929 and was one of Kenya’s leading aluminium products such as utensils and roofing sheets, before the country started to see an influx of imports of similar materials. This came at a time when Kaluworks was on an aggressive expansion drive and had invested Kshs 1.8 bn to upgrade its factory in Mariakani Mombasa, both initiatives largely funded through debt from Commercial banks. This was also followed by interruptions brought about by the COVID-19 pandemic, which saw a slowdown in building activities in the country. In a gazette notice dated 18th June 2021, one of the main creditors, placed Kaluworks under receivership on May 27th 2021 by virtue of being holders of a qualifying floating charge. The creditors include NCBA Banks which was owed Kshs 4.3 bn, Cooperative Bank, which was owed Kshs 4.8 bn, while other unsecured lenders such as I&M Bank, commercial paper holders such as Sanlam Kenya held a combined of Kshs 3.5 bn. Pongangipalli Rao was appointed an insolvency practitioner in a bid to recover the amounts owed to them. On 25th August 2022, the High Court of Kenya in Nairobi, consented to the termination of administration of Kaluworks Limited under the Company Voluntary Agreement between Kaluwork’s and the secured creditors, with Orlando Mario da Costa-Luis appointed as the supervisor in the gazette notice dated 16th September 2022, effective 26th August 2022. NCBA Group and Cooperative Bank agreed with the administrator and Kaluworks Limited to write off a total Kshs 6.4 bn out of the total Kshs 9.1 bn owed to them, equating to a 70.0% haircut. In the agreement, NCBA was to receive Kshs 580.0 mn while Cooperative bank received Kshs 680.4 mn. In the tabled agreement, Kaluworks shareholders agreed to a Kshs 1.2 bn capital injection.