Retirement Benefits Schemes Q3’2025 Performance Report, & Cytonn Weekly #49/2025

By research team, Dec 7, 2025

Executive Summary

Fixed Income

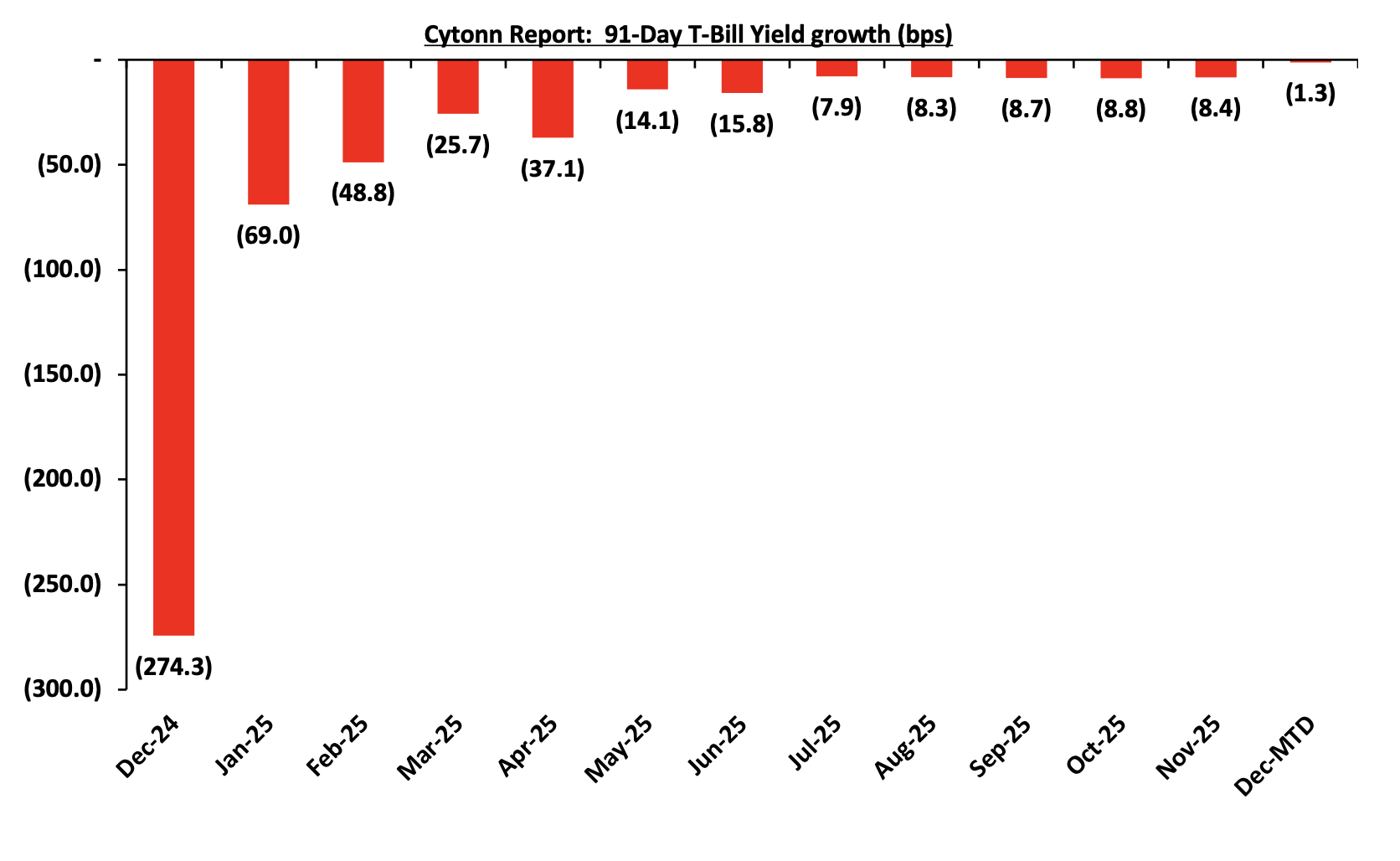

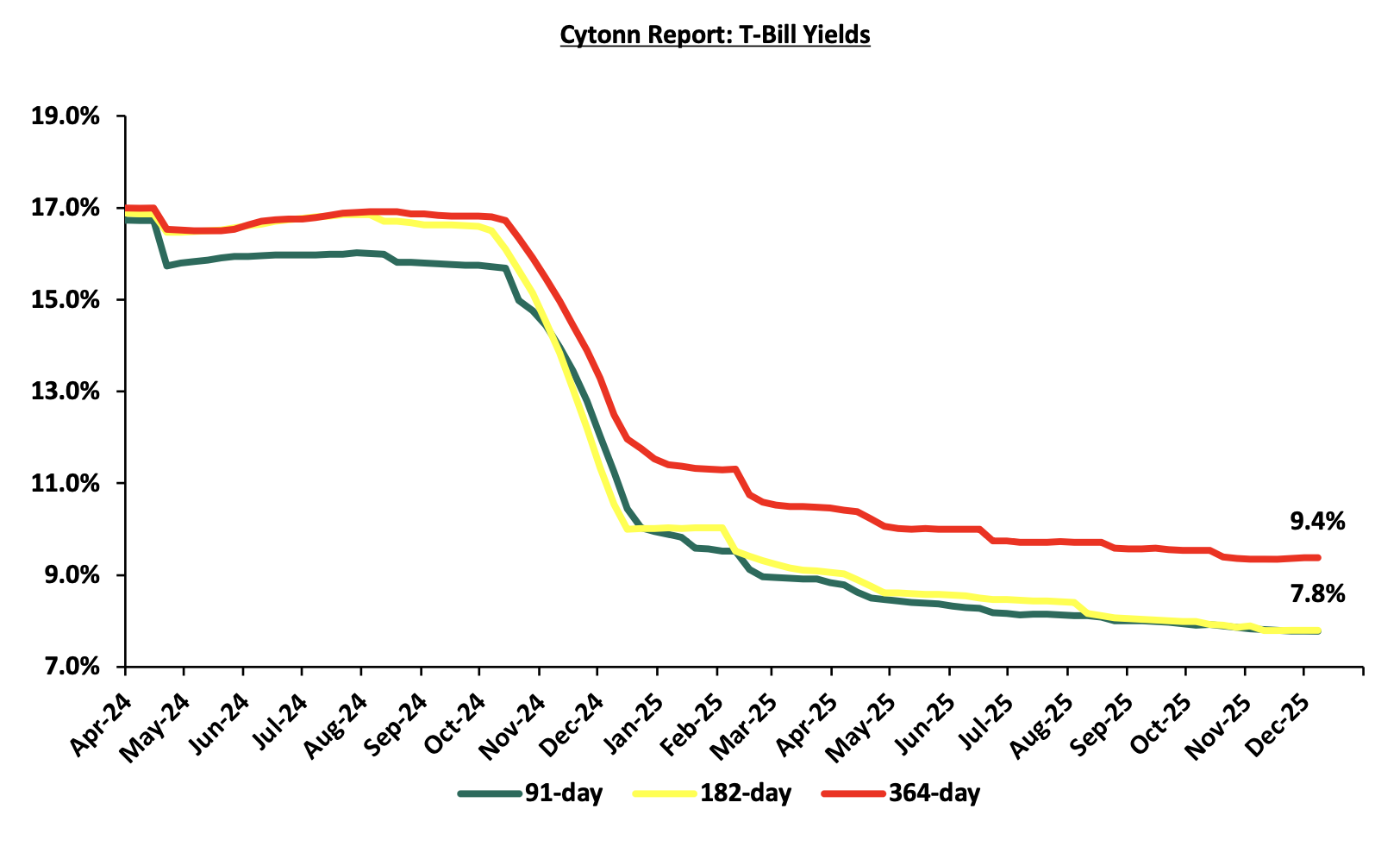

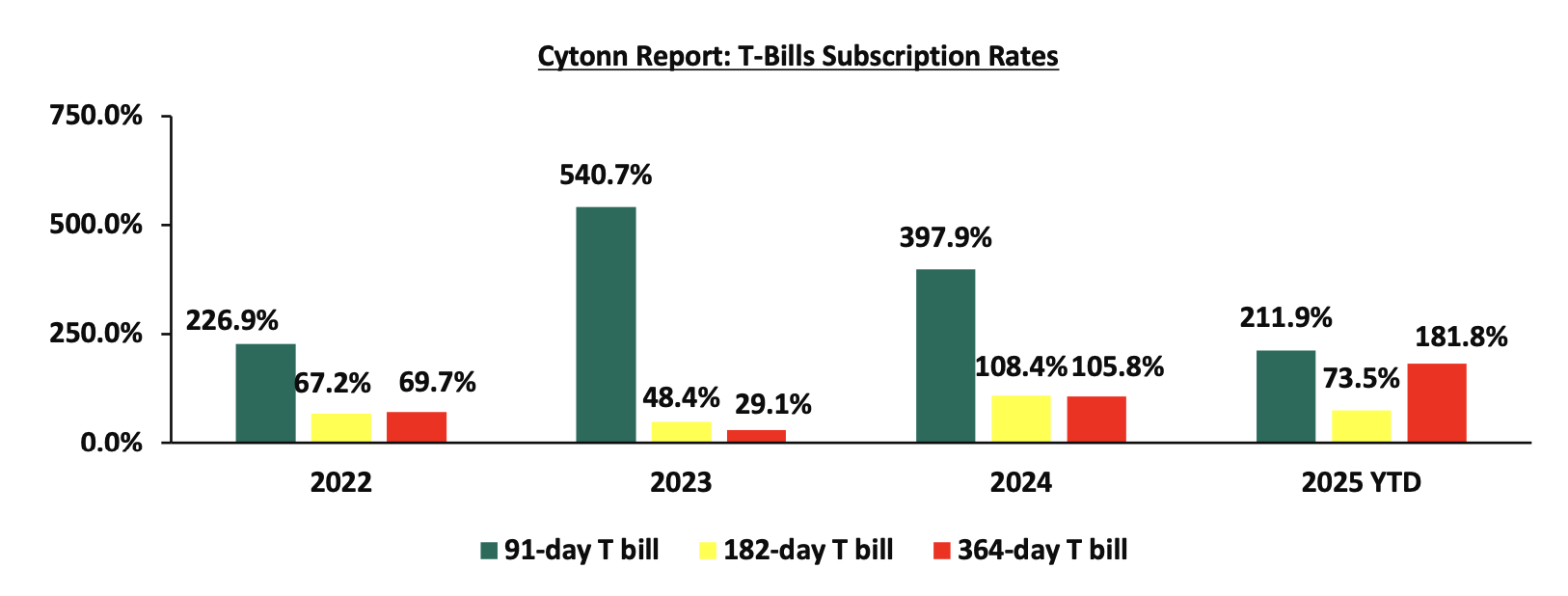

During the week, T-bills were oversubscribed for the ninth consecutive week, with the overall subscription rate coming in at 220.2%, higher than the subscription rate of 186.7% recorded the previous week. Investors’ preference for the shorter 91-day paper waned, with the paper receiving bids worth Kshs 8.5 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 212.2%, significantly lower than the subscription rate of 448.6%, recorded the previous week. The subscription rates for the 182-day paper increased to 140.0% from 5.2% recorded the previous week, while that of the 364-day papers increased to 303.7% from 263.5% recorded the previous week. The government accepted a total of Kshs 40.4 bn worth of bids out of Kshs 52.9 bn bids received, translating to an acceptance rate of 76.4%. The yields on the government papers recorded a mixed performance with the yields on the 364-day paper decreasing the most by 0.8 bps to 9.37% from the 9.38% recorded the previous week, while the yields on the 182-day and 91-day papers increased marginally by 0.4 bps and 0.1 bps respectively to 7.804% and 7.780% from the 7.80% and 7.779% respectively recorded the previous week;

During the week, the Central Bank of Kenya released the auction results for the re-opened treasury bonds SDB1/2011/030 and FXD1/2021/025 with tenors to maturities of 15.2 years and 20.4 years respectively and fixed coupon rates of 12.0% and 13.9 % respectively. The bonds were oversubscribed, with the overall subscription rate coming in at 132.8%, receiving bids worth Kshs 53.1 bn against the offered Kshs 40.0 bn. The government accepted bids worth Kshs 47.1 bn, translating to an acceptance rate of 88.7%. The weighted average yield for the accepted bids for the SDB1/2011/030 and FXD1/2021/025 came in at 13.3% and 13.6% respectively. Notably, the 13.3% on the SDB1/2011/030 was lower than the 14.0% recorded the last time the bond was reopened in June 2025 while the 13.6% on the FXD1/2021/025 was lower than the 13.8% recorded the last time the bond was reopened in October 2021;

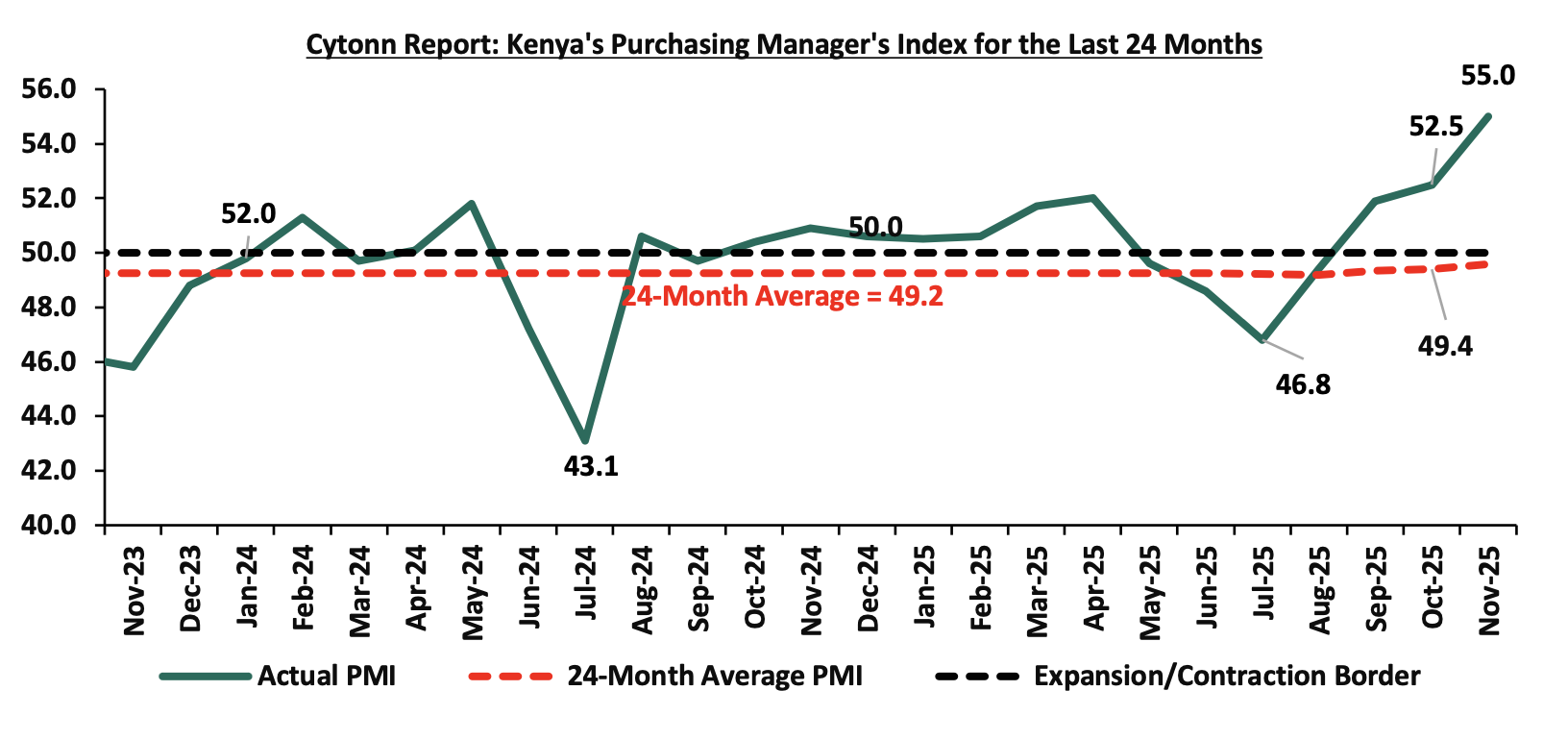

During the week, Stanbic Bank released its monthly Purchasing Managers’ Index (PMI) highlighting that the index for November 2025 rose further into expansion territory, coming in at 55.0, up from 52.5 in October 2025. This marked the third consecutive month of improvement and the highest since February 2022, signaling a solid upturn in business conditions across Kenya’s private sector. The improvement was mainly driven by stronger demand, higher new orders and increased output levels, supported by easing inflationary pressures and improved supply chain efficiency;

The Monetary Policy Committee (MPC) is set to meet on Tuesday, 9th December 2025, to review the outcome of its previous policy decisions and recent economic developments, and to decide on the direction of the Central Bank Rate (CBR). We expect the MPC to cut the Central Bank Rate (CBR) to within a range of 9.00% - 8.75%;

Equities

During the week, the equities market was on a downward trajectory, with NSE 20, NSE 25, NASI and NSE 10 declining by 2.8%, 1.0%, 0.8% and 0.7% respectively, taking the YTD performance to gains of 44.8%, 43.3%, 38.3% and 38.0% of NSE 20, NASI, NSE 10 and NSE 25 respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as NCBA, KCB and Equity, of 7.8%, 4.3% and 2.8% respectively. The performance was, however, supported by gains by large cap stocks such as Stanbic, EABL and Absa of 7.1%, 1.6% and 0.9% respectively;

Also, during the week, the banking sector index declined by 1.5% to 189.1 from 191.9 recorded the previous week. This is attributable to losses recorded by stocks such as NCBA, KCB and Equity, of 7.8%, 4.3% and 2.8% respectively. The performance was, however, supported by gains recorded by stocks such as Stanbic and Absa of 7.1% and 1.6% respectively;

During the week Safaricom received a notice from Vodafone Kenya Limited indicating its intention to acquire 15.0% of Safaricom’s shares from the Government of Kenya (GOK), totaling 6,009,814,200 shares at a price of Kshs 34.00 per share, valued at Kshs 204.3 bn;

Real Estate

During the week, the department of roads reported that Kenya recorded a significant drop in road maintenance activity, falling to a six-year low representing a 28.0% decline in the year to June 2025 after funding for repairs and routine works was reduced. Only 35,965 km of roads were maintained in the year to June 2025, down from 49,758 km the previous year, as allocations to KeRRA, KeNHA and KURA were cut and part of the Road Maintenance Levy Fund was diverted to salaries, administrative costs and loan repayments;

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 27.4 and Kshs 23.2 per unit, respectively, as per the last updated data on 21st November 2025. The performance represented a 33.4% and 14.5% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 21st November 2025, representing a45.0% loss from the Kshs 20.0 inception price;

Focus of the Week

According to the ACTSERV Q3’2025 Retirement Benefits Schemes Investments Performance Survey, segregated retirement benefits schemes recorded a 7.2% return in Q3’2025, from the 0.4% return recorded in Q3’2024. The performance was largely supported by the performance of Equities with the average return coming in at 19.6% compared to 2.1% return recorded in Q3’2024. The good return reflects the string performance of the market as the Nairobi All Share Index (NASI) had gained by 15.2%- This week, we shall focus on understanding Retirement Benefits Schemes and look into the quarterly performance and current state of retirement benefits schemes in Kenya with a key focus on Q3’2025.

Investment Updates:

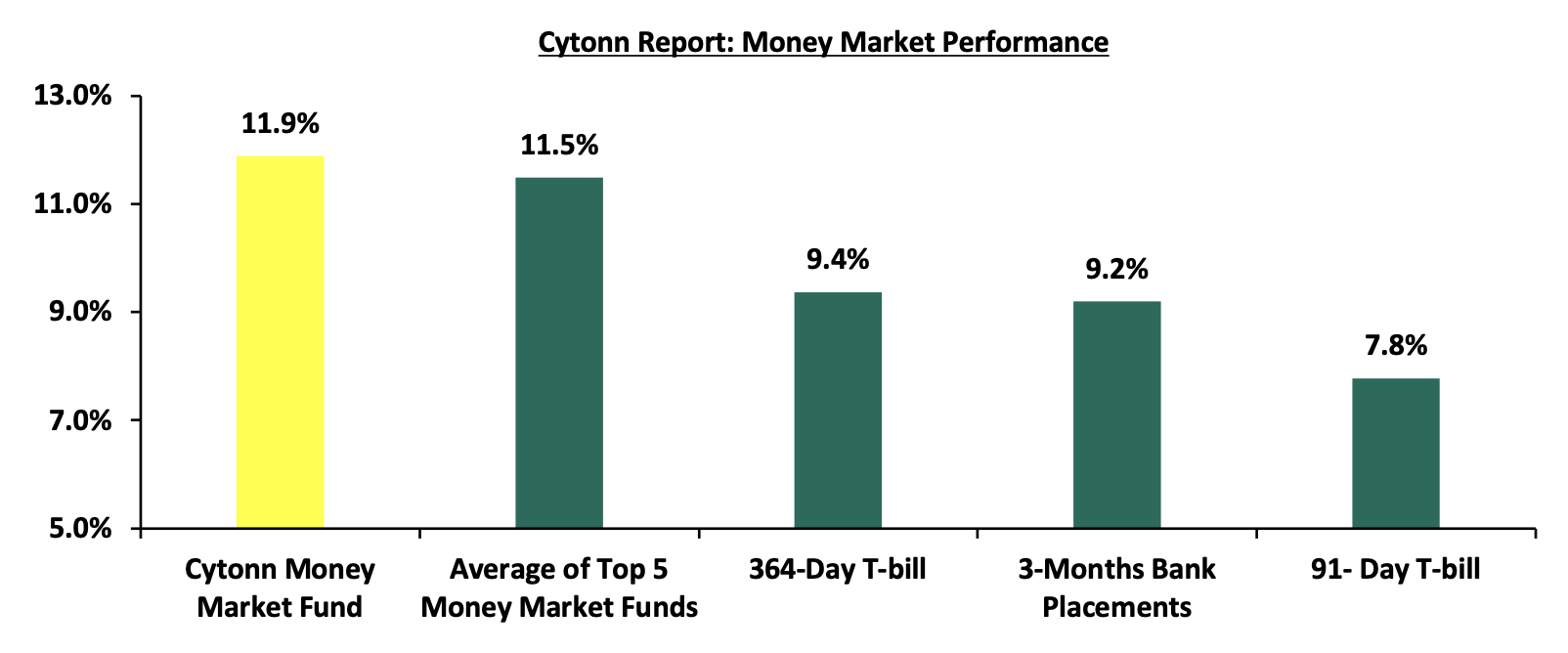

- Weekly Rates: Cytonn Money Market Fund closed the week at a yield of 11.9% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Monday, from 10:00 am to 12:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Money Markets, T-Bills Primary Auction:

This week, T-bills were oversubscribed for the ninth consecutive week, with the overall subscription rate coming in at 220.2%, higher than the subscription rate of 186.7% recorded the previous week. Investors’ preference for the shorter 91-day paper waned, with the paper receiving bids worth Kshs 8.5 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 212.2%, significantly lower than the subscription rate of 448.6%, recorded the previous week. The subscription rates for the 182-day paper increased to 140.0% from 5.2% recorded the previous week, while that of the 364-day papers increased to 303.7% from 263.5% recorded the previous week. The government accepted a total of Kshs 40.4 bn worth of bids out of Kshs 52.9 bn bids received, translating to an acceptance rate of 76.4%. The yields on the government papers recorded a mixed performance with the yields on the 364-day paper decreasing the most by 0.8 bps to 9.37% from the 9.38% recorded the previous week, while the yields on the 182-day and 91-day papers increased marginally by 0.4 bps and 0.1 bps respectively to 7.804% and 7.780% from the 7.80% and 7.779% respectively recorded the previous week.

The chart below shows the yield growth rate for the 91-day paper from December 2024 to December month-to-date:

The charts below show the performance of the 91-day, 182-day and 364-day papers from January 2024 to December 2025:

The chart below compares the overall average T-bill subscription rates obtained in 2022,2023, 2024 and 2025 Year-to-date (YTD):

The Central Bank of Kenya released the auction results for the re-opened treasury bonds SDB1/2011/030 and FXD1/2021/025 with tenors to maturities of 15.2 years and 20.4 years respectively and fixed coupon rates of 12.0% and 13.9 % respectively. The bonds were oversubscribed, with the overall subscription rate coming in at 132.8%, receiving bids worth Kshs 53.1 bn against the offered Kshs 40.0 bn. The government accepted bids worth Kshs 47.1 bn, translating to an acceptance rate of 88.7%. The weighted average yield for the accepted bids for the SDB1/2011/030 and FXD1/2021/025 came in at 13.3% and 13.6% respectively. Notably, the 13.3% on the SDB1/2011/030 was lower than the 14.0% recorded the last time the bond was reopened in June 2025 while the 13.6% on the FXD1/2021/025 was lower than the 13.8% recorded the last time the bond was reopened in October 2021. With the Inflation rate at 4.5% as of November 2025, the real returns of the SDB1/2011/030 and FXD1/2021/025 are 8.8% and 9.1%. Given the 10.0% withholding tax on the bonds, the tax equivalent yields for shorter term bonds with 15.0% withholding tax are 14.1% and 14.4% for the SDB1/2011/030 and FXD1/2021/025 respectively.

Money Market Performance:

In the money markets, 3-month bank placements ended the week at 9.2% (based on what we have been offered by various banks). The yields on the 91-day paper increased marginally by 0.1 bps to remain relatively unchanged from 7.78% recorded the previous week with yields on the 364-day paper decreasing by 0.8 bps to 9.37% from the 9.38% recorded the previous week. The yield on the Cytonn Money Market Fund decreased by 11.0 bps to 11.9% from 12.0% recorded in the previous week, while the average yields on the Top 5 Money Market Funds decreased by 4.8 bps to remain unchanged from 11.5% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 5th December 2025:

|

Money Market Fund Yield for Fund Managers as published on 5th December 2025 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund ( Dial *809# or download Cytonn App) |

11.9% |

|

2 |

Etica Money Market Fund |

11.8% |

|

3 |

Nabo Africa Money Market Fund |

11.6% |

|

4 |

Enwealth Money Market Fund |

11.1% |

|

5 |

Lofty-Corban Money Market Fund |

11.1% |

|

6 |

Ndovu Money Market Fund |

11.1% |

|

7 |

Jubilee Money Market Fund |

10.8% |

|

8 |

Gulfcap Money Market Fund |

10.8% |

|

9 |

Kuza Money Market fund |

10.8% |

|

10 |

Orient Kasha Money Market Fund |

10.7% |

|

11 |

Old Mutual Money Market Fund |

10.5% |

|

12 |

British-American Money Market Fund |

10.4% |

|

13 |

Madison Money Market Fund |

10.3% |

|

14 |

GenAfrica Money Market Fund |

9.8% |

|

15 |

Dry Associates Money Market Fund |

9.8% |

|

16 |

Apollo Money Market Fund |

9.5% |

|

17 |

SanlamAllianz Money Market Fund |

9.5% |

|

18 |

Arvocap Money Market Fund |

9.4% |

|

19 |

Faulu Money Market Fund |

9.4% |

|

20 |

KCB Money Market Fund |

9.0% |

|

21 |

Genghis Money Market Fund |

8.7% |

|

22 |

ICEA Lion Money Market Fund |

8.6% |

|

23 |

CIC Money Market Fund |

8.5% |

|

24 |

Co-op Money Market Fund |

8.3% |

|

25 |

CPF Money Market Fund |

8.3% |

|

26 |

Mali Money Market Fund |

8.1% |

|

27 |

Mayfair Money Market Fund |

8.0% |

|

28 |

Absa Shilling Money Market Fund |

7.7% |

|

29 |

AA Kenya Shillings Fund |

6.6% |

|

30 |

Ziidi Money Market Fund |

6.5% |

|

31 |

Stanbic Money Market Fund |

6.3% |

|

32 |

Equity Money Market Fund |

5.0% |

Source: Business Daily

Liquidity:

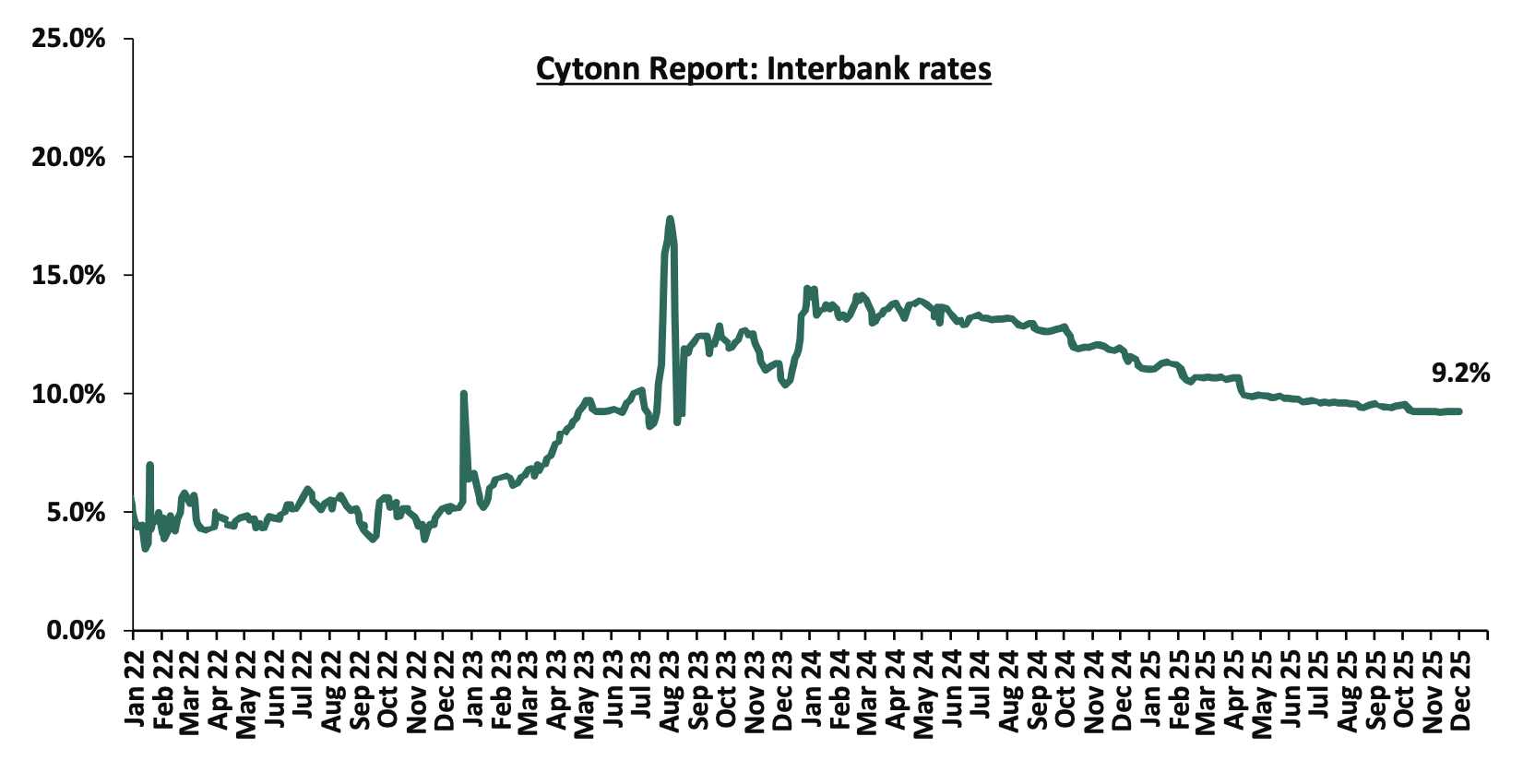

During the week, liquidity in the money markets tightened with the average interbank rate decreasing by 0.3 bps to remain unchanged from 9.2% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded decreased by 27.0% to Kshs 11.9 bn from Kshs 16.2 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on the Eurobonds were on a downward trajectory with the yield on the 12-year Eurobond issued in 2019 decreasing the most by 46.1 bps to 7.7% from 8.2% recorded the previous week. The table below shows the summary performance of the Kenyan Eurobonds as of 4th December 2025;

|

Cytonn Report: Kenya Eurobond Performance |

|||||||

|

|

2018 |

2019 |

2021 |

2024 |

2025 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

7-year issue |

11-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

1.5 bn |

|

Years to Maturity |

2.5 |

22.5 |

1.7 |

6.7 |

8.8 |

5.5 |

10.5 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

9.9% |

|

2-Jan-25 |

9.1% |

10.3% |

8.5% |

10.1% |

10.1% |

10.1% |

|

|

3-Nov-25 |

6.0% |

9.2% |

- |

8.1% |

8.4% |

7.8% |

|

|

27-Nov-25 |

6.2% |

9.2% |

- |

8.2% |

8.7% |

8.0% |

|

|

28-Nov-25 |

6.2% |

9.1% |

- |

8.1% |

8.6% |

7.9% |

|

|

1-Dec-25 |

6.3% |

9.2% |

- |

8.2% |

8.7% |

8.0% |

|

|

2-Dec-25 |

6.3% |

9.1% |

- |

8.0% |

8.6% |

8.0% |

|

|

3-Dec-25 |

6.2% |

9.0% |

- |

7.9% |

8.5% |

7.9% |

10.0% |

|

4-Dec-25 |

6.1% |

8.9% |

- |

7.7% |

8.3% |

7.8% |

|

|

Weekly Change |

(0.1%) |

(0.2%) |

- |

(0.5%) |

(0.3%) |

(0.2%) |

- |

|

MTD Change |

(0.1%) |

(0.3%) |

- |

(0.5%) |

(0.4%) |

(0.2%) |

0.0% |

|

YTD Change |

(2.9%) |

(1.3%) |

- |

(2.3%) |

(1.8%) |

(2.3%) |

0.0% |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling appreciated against the US Dollar by 39.3 bps, to close the week at Kshs 129.3, from Kshs 129.9 recorded the previous week. On a year-to-date basis, the shilling has depreciated by 0.3 bps against the dollar, lower than the 17.6% appreciation recorded in 2024.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 5,081.6 mn in the twelve months to October 2025, 5.8% higher than the USD 4,804.1 mn recorded over the same period in 2024. This has continued to cushion the shilling against further depreciation. In the October 2025 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 59.9% in the period,

- The tourism inflow receipts which are projected to reach KSh 560.0 bn in 2025 up from KSh 452.2 bn in 2024 a 23.9% increase, and owing to tourist arrivals that improved by 9.9% to 2,424,382 in the 12 months to June 2025 from 2,206,469 in the 12 months to June 2024, and,

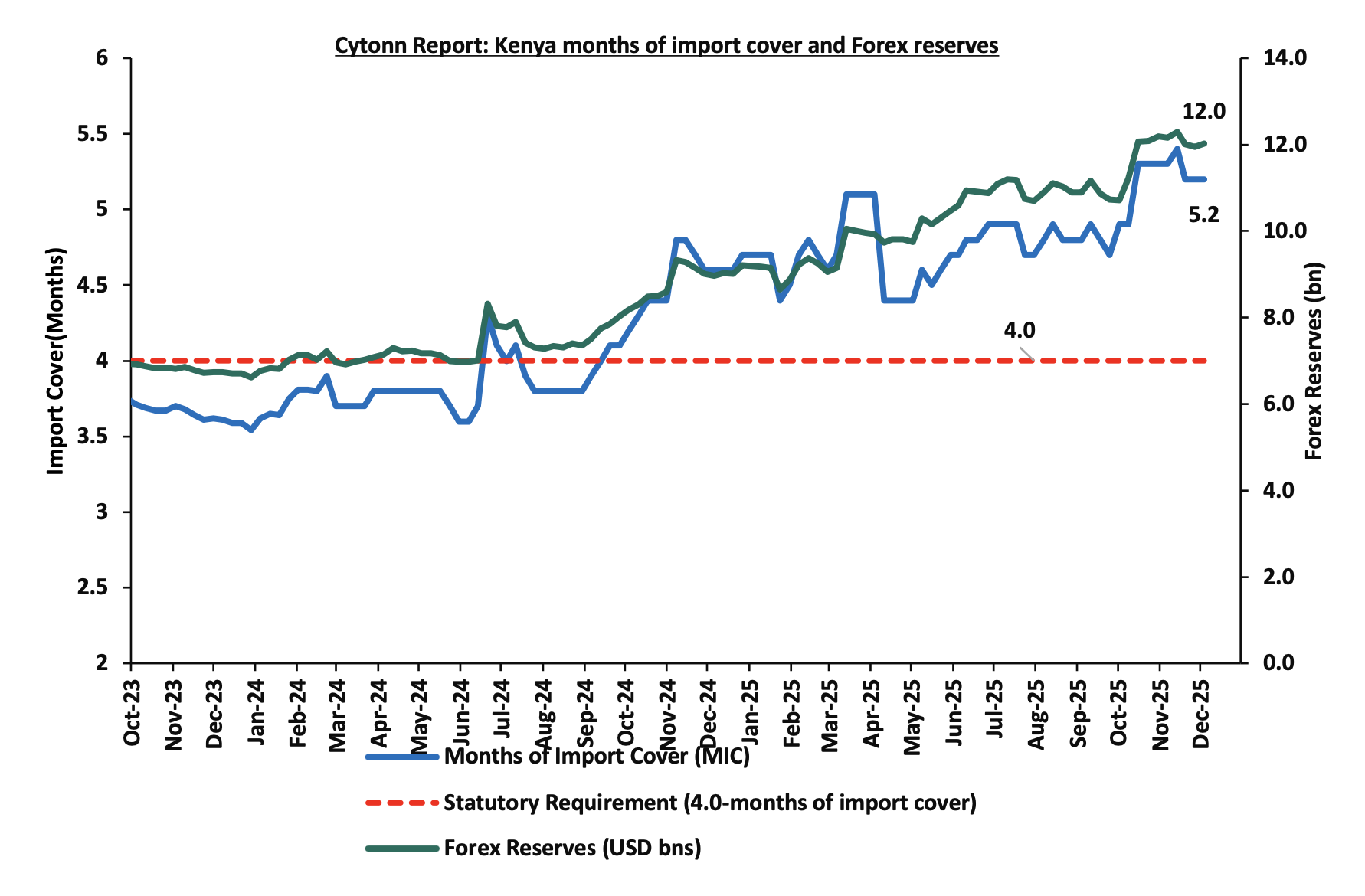

- Improved forex reserves currently at USD 12.0 bn (equivalent to 5.2-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover and above the EAC region’s convergence criteria of 4.5-months of import cover.

The shilling is however expected to remain under pressure in 2025 as a result of:

- An ever-present current account deficit which came at 2.1% of GDP in the twelve months to August 2025, and,

- The need for government debt servicing, continues to put pressure on forex reserves given that 59.7% of Kenya’s external debt is US Dollar-denominated as of June 2025.

Kenya’s forex reserves decreased by 2.3% during the week to USD 12.0 bn from the USD 12.3 bn recorded the previous week, equivalent to 5.2 months of import cover, and above the statutory requirement of maintaining at least 4.0-months of import cover.

The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights

- Stanbic Bank’s November 2025 Purchasing Manager’s Index (PMI)

During the week, Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of November 2025 improved further into expansion territory, coming in at 55.0, up from 52.5 in October 2025, marking the third consecutive month the index remained above the 50.0 neutral mark, signaling an improvement in business conditions, mainly attributable to increased output and new orders. On a year-to-year basis, the index recorded an 8.1% growth from the 50.9 recorded in November 2024, indicating a significant improvement in business conditions compared to the same period last year. The improvement was largely driven by a faster pace of growth in output and new orders, as firms benefited from robust demand, promotional pricing and new product launches. Input prices rose marginally, with inflation rate decreasing marginally by 0.1% points to 4.5% in November from 4.6% as of October 2025 and improved supply chain efficiency, while output charges increased modestly as firms sought to maintain competitiveness and support sales.

In November, business output continued to expand, marking the third consecutive month of growth. Firms reported stronger demand conditions, with all main sectors monitored by the survey including manufacturing, services, wholesale & retail, and agriculture recording an upturn in activity. New business intakes increased for the second consecutive month, attributed to higher customer demand, favorable economic conditions, and successful promotional campaigns, while some businesses also reported gains from new client acquisitions. Inventory restocking and broad-based sectoral expansion helped reinforce the overall upturn.

Employment levels strengthened in November, with most firms maintaining their workforce to sustain operations and clear outstanding orders. This followed October’s moderate hiring activity, when job creation had reached its fastest pace since May 2023.

Purchasing activity increased in November, as firms boosted input procurement to meet rising demand and replenish stocks. Consequently, inventories expanded as businesses prepared for anticipated future orders. Supplier delivery times shortened during the November which can be attributed to increased competition among vendors which drove faster deliveries as they sought to strengthen business relationships. Input prices rose greatly. This was mainly driven by increased client demand and boosting of inventory. Output prices increased slightly as well, though several firms continued to offer discounts to attract customers, keeping pricing pressures mild.

Going forward, we anticipate that the business environment will remain supportive in the short to medium term as a result of the strengthening economic environment, driven by lower inflationary pressures, improving political stability, and a more accommodative monetary policy stance by the Central Bank of Kenya (CBK) following the Monetary Policy Committee’s decision to ease the Central Bank Rate (CBR) to 9.25% in October 2025 from 9.50% in August 2025. However, we expect businesses to be weighed down by elevated taxation and subdued consumer purchasing power, which are set to constrain profit margins and overall growth. Overall, the private sector is expected to continue its recovery, albeit with potential headwinds in the coming months.

- 9th December 2025 Monetary Policy Committee Meeting

We expect the MPC to cut the Central Bank Rate (CBR) to within a range of 9.00% - 8.75%, with their decision mainly being supported by:

- Rate cuts by global giant economies: The US Federal Reserve lowered its benchmark interest rate to 3.75% - 4.00% on 29th October 2025, down from 4.00%-4.25%, marking its second rate cut of the year. Meanwhile, the European Central Bank, in its most recent meeting on 30th October 2025, opted to hold its benchmark rate steady at 2.00% for the second consecutive time. With global central banks either easing or maintaining policy rates, we anticipate that the MPC could follow suit by introducing a rate cut in the near term, albeit cautiously, to ensure that domestic economic conditions align with such an adjustment,

- The need to support the economy: A more accommodative monetary policy remains critical, particularly to enhance financing activities and bolster private sector lending. In September 2025, private sector credit grew by 5.5%, up from 3.3% in August, an encouraging sign of recovery. However, this growth remains well below the 5-year average of 7.9%, indicating that credit expansion is still relatively subdued. A reduction in the Central Bank Rate (CBR) would help unlock the full potential of the private sector, allowing it to play a more significant role in driving economic recovery and supporting sustained growth. Given the still-muted business environment, a rate cut would also stimulate economic activity, boost money supply, and improve overall business confidence and investment.

- The continued stability of the Shilling against major currencies: Despite the October rate cut, the Kenyan Shilling has remained stable, only depreciating marginally by 5.4 bps against the US Dollar to Kshs 129.3 from the Kshs 129.2 recorded on 7th October 2025. This stability, supported by foreign exchange reserves currently at 5.2 months of import cover (above the 4.0 months statutory requirement), provides the MPC with the flexibility to maintain the current rate without risking currency volatility or capital outflows.

For more information please see our Cytonn Note on the 9th December 2025 Monetary Policy Committee Meeting

Rates in the Fixed Income market have been on a downward trend due to high liquidity in the money market which allowed the government to front load most of its borrowing. The government is 134.3% ahead of its prorated net domestic borrowing target of Kshs 279.0 bn, having a net borrowing position of Kshs 653.8 bn (inclusive of T-bills). However, we expect a stabilization of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to stabilize in the short to medium-term and hence investors are expected to shift towards the long-term papers to lock in the high returns

Market Performance:

During the week, the equities market was on a downward trajectory, with NSE 20, NSE 25, NASI and NSE 10 declining by 2.8%, 1.0%, 0.8% and 0.7% respectively, taking the YTD performance to gains of 44.8%, 43.3%, 38.3% and 38.0% of NSE 20, NASI, NSE 10 and NSE 25 respectively. The equities market performance was mainly driven by losses recorded by large-cap stocks such as NCBA, KCB and Equity, of 7.8%, 4.3% and 2.8% respectively. The performance was, however, supported by gains by large cap stocks such as Stanbic, EABL and Absa of 7.1%, 1.6% and 0.9% respectively;

Also, during the week, the banking sector index declined by 1.5% to 189.1 from 191.9 recorded the previous week. This is attributable to losses recorded by stocks such as NCBA, KCB and Equity, of 7.8%, 4.3% and 2.8% respectively. The performance was, however, supported by gains recorded by stocks such as Stanbic and Absa of 7.1% and 1.6% respectively.

During the week, equities turnover decreased by 17.1% to USD 20.2 mn from USD 24.4 mn recorded the previous week, taking the YTD total turnover to USD 1,001.8 mn. Foreign investors remained net sellers for the ninth consecutive week with a net selling position of USD 3.2 mn, from a net selling position of USD 4.7 mn recorded the previous week, taking the YTD foreign net selling position to USD 96.2 mn, compared to a net selling position of USD 93.0 mn recorded the previous week.

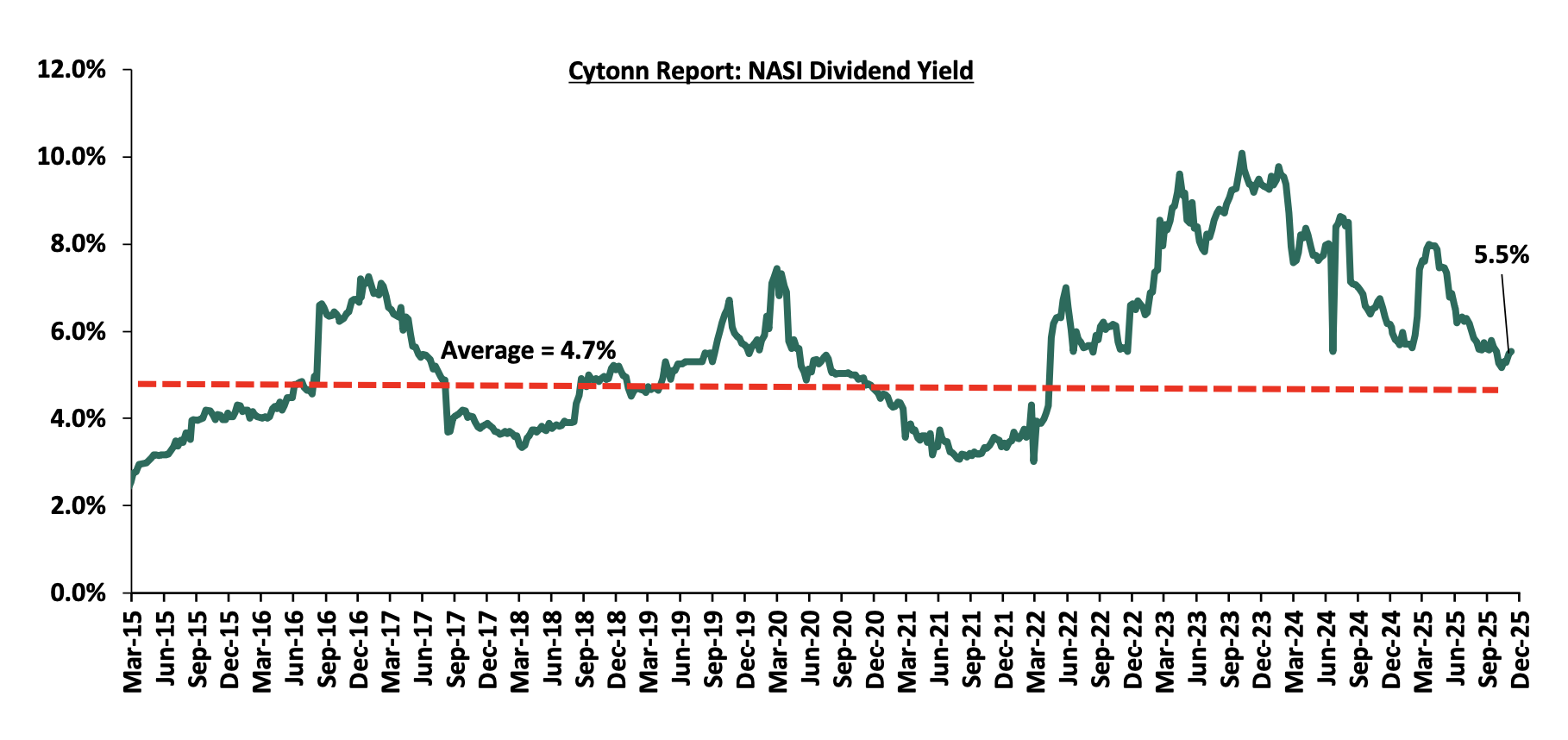

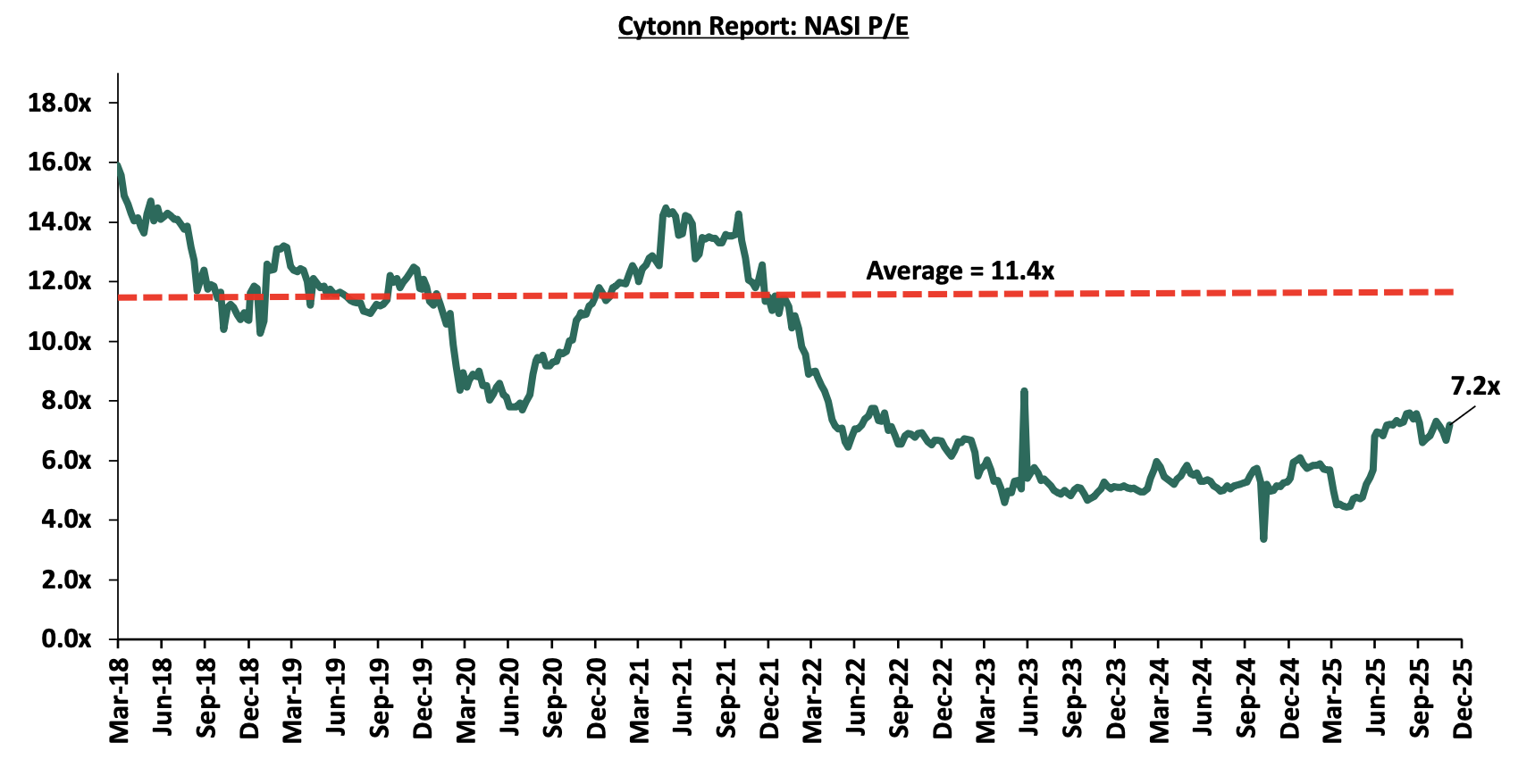

The market is currently trading at a price to earnings ratio (P/E) of 7.2x, 36.7% below the historical average of 11.4x, and a dividend yield of 5.5%, 0.8% points above the historical average of 4.7%. Key to note, NASI’s PEG ratio currently stands at 0.9x, an indication that the market is slightly undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued.

The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

|||||||||||

|

Company |

Price as at 28/11/2025 |

Price as at 05/12/2025 |

w/w change |

YTD Change |

Year Open 2025 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

|

Equity Group |

62.8 |

61.0 |

(2.8%) |

27.1% |

48.0 |

76.1 |

7.0% |

31.7% |

1.1x |

Buy |

|

|

Standard Chartered Bank |

287.5 |

287.0 |

(0.2%) |

0.6% |

285.3 |

320.0 |

15.7% |

27.2% |

1.6x |

Buy |

|

|

KCB Group |

58.8 |

56.3 |

(4.3%) |

32.7% |

42.4 |

67.4 |

5.3% |

25.2% |

0.7x |

Buy |

|

|

Diamond Trust Bank |

110.5 |

110.0 |

(0.5%) |

64.8% |

66.8 |

128.3 |

6.4% |

23.0% |

0.4x |

Buy |

|

|

ABSA Bank |

21.9 |

22.1 |

0.9% |

17.0% |

18.9 |

25.3 |

7.9% |

22.7% |

1.4x |

Buy |

|

|

I&M Group |

43.9 |

45.2 |

3.0% |

25.6% |

36.0 |

49.3 |

6.6% |

15.6% |

0.8x |

Accumulate |

|

|

Stanbic Holdings |

183.0 |

196.0 |

7.1% |

40.3% |

139.8 |

202.3 |

10.6% |

13.8% |

1.2x |

Accumulate |

|

|

Co-op Bank |

22.9 |

22.8 |

(0.4%) |

30.7% |

17.5 |

23.9 |

6.6% |

11.4% |

0.8x |

Accumulate |

|

|

NCBA |

83.0 |

76.5 |

(7.8%) |

50.0% |

51.0 |

79.0 |

7.2% |

10.5% |

1.2x |

Accumulate |

|

|

Britam |

8.7 |

8.7 |

(0.2%) |

49.1% |

5.8 |

9.5 |

0.0% |

9.7% |

0.8x |

Hold |

|

|

Jubilee Holdings |

325.0 |

305.3 |

(6.1%) |

74.7% |

174.8 |

312.9 |

4.4% |

6.9% |

0.5x |

Hold |

|

|

CIC Group |

4.6 |

4.4 |

(3.5%) |

107.0% |

2.1 |

4.0 |

2.9% |

(6.1%) |

1.2x |

Sell |

|

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***Dividend Yield is calculated using FY’2024 Dividends |

|

||||||||||

Weekly Highlights

- Proposed Acquisition by Vodafone Kenya Limited of 15.0% of the government's stake in Safaricom

During the week Safaricom received a notice from Vodafone Kenya Limited indicating its intention to acquire 15.0% of Safaricom’s shares from the Government of Kenya (GOK), totaling 6,009,814,200 shares at a price of Kshs 34.00 per share, valued at Kshs 204.3 bn. As of the date of announcement on 4th December 2025, Safaricom was trading at Kshs 29.45. This marks the second time the Government of Kenya is offloading part of its Safaricom shares. The first was in 2008, when it conducted an Initial Public Offering (IPO) and sold 25% of its stake, reducing its shareholding from 60% to 35%. In that transaction, the government sold 10 billion shares at Kshs 5 per share, raising a total of Kshs 50 billion.

Below are the key takeaways from the notice;

- Concurrent to the GOK Share Acquisition, Vodacom Group Limited the 87.5% majority shareholder of Vodafone Kenya, will be increasing its stake in Vodafone Kenya to 100%, via an internal reorganisation that will involve the purchase of Vodafone International Holdings B.V’s fifty (50) ordinary shares representing a 12.5% stake in Vodafone Kenya and resulting in the acquisition of a 4.99% indirect stake in Safaricom.

- Prior to the intention of acquisition, Vodafone Kenya had a 39.9% stake in Safaricom, while the government of Kenya held a 35.0% stake.

- The GOK Share Acquisition, in combination with the Vodafone Kenya Acquisition, will result in Vodafone Kenya holding a 54.9% shareholding in Safaricom with 22.0 bn shares. The GOK and the general public investors will hold 20.0% and 25.1% of Safaricom’s shareholding, respectively as shown in the table below;

|

|

Before Acquisition |

After acquisition |

||

|

Name of shareholder |

Number of shares |

% Shareholding |

Number of shares |

% Shareholding |

|

Vodafone Kenya Ltd |

16,000,000,000 |

39.9% |

22,009,814,200 |

54.9% |

|

CS National Treasury |

14,022,572,580 |

35.0% |

8,012,758,380 |

20.0% |

|

Kenya Commercial Bank Nominees Limited A/C 9158 Kenya |

345,582,886 |

0.9% |

345,582,886 |

0.9% |

|

Kenya Commercial Bank Nominees Limited A/C 1019D |

330,463,100 |

0.8% |

330,463,100 |

0.8% |

|

Standard Chartered Kenya Nominees Limited A/C KE004667 |

303,523,306 |

0.8% |

303,523,306 |

0.8% |

|

Stanbic Nominees Limited A/C NR1031458 |

191,930,759 |

0.5% |

191,930,759 |

0.5% |

|

Standard Chartered Nominees Nominees RESD A/C KE11401 |

189,350,800 |

0.5% |

189,350,800 |

0.5% |

|

Stanbic Nominees Limited A/C NR1030824 |

188,160,853 |

0.5% |

188,160,853 |

0.5% |

|

Stanbic Nominees Limited A/C R6631578 |

140,208,207 |

0.3% |

140,208,207 |

0.3% |

|

Others |

8,353,635,509 |

20.8% |

8,353,635,509 |

20.8% |

|

Total |

40,065,428,000 |

100.0% |

40,065,428,000 |

100.0% |

- In FY’2025, the government received dividends worth Kshs 16.8 bn from Safaricom. Vodafone will also purchase the rights to future dividends from the remaining 20.0% stake through an upfront payment of Kshs 40.2 bn. In total the government will receive Kshs 244.5 bn from the acquisition.

- Vodafone Kenya’s acquisition of Safaricom shares will be treated as gaining effective control of the company under Kenya’s Capital Markets (Take‑overs & Mergers) Regulations, 2002. In regulatory terms, this automatically triggers provisions that normally require a formal take‑over bid to all shareholders. Therefore, even if Vodafone is not buying 100% of Safaricom, crossing the threshold of “effective control” places them under rules designed to protect minority shareholders by ensuring transparency and fairness in ownership changes.

- Completion of the Proposed Transaction is subject to approval from certain governmental and regulatory authorities in Kenya including the Kenyan Cabinet, Kenyan National Assembly, Capital Markets Authority (CMA), Communications Authority of Kenya, Central Bank of Kenya, COMESA Competition Commission and the East African Community Competition Authority. Because Safaricom is a strategic company in Kenya and the region, regulators want to ensure the deal does not harm competition, financial stability, or national interests. This multi‑layered approval process reflects the company’s importance to Kenya’s economy and regional markets.

- Although Vodafone Kenya will be deemed to have effective control, it has stated that it does not intend to launch a full take‑over offer for Safaricom. Instead, it will apply to the CMA for an exemption from the mandatory take‑over procedures. Vodafone intends to avoid the costly and complex process of offering to buy out all other shareholders. By seeking an exemption, it signals that its interest is limited to the agreed stake and dividend rights, not full ownership. This approach allows Vodafone to strengthen its influence without triggering a complete buy‑out of Safaricom.

The Government of Kenya has announced plans to privatize several state‑owned corporations, with the sale of its 15.0% stake in Safaricom marking the beginning of this broader privatization program. The decision to sell is driven by the need by the government to raise cash from its assets with due to limited room for additional taxes. Selling its future Safaricom dividends gives the Government a large cash boost now, which helps ease immediate budget pressures and reduces the need for short-term borrowing. However, it also means the Government loses a steady stream of future income, so while its finances look stronger in the short term, it may face tighter budgets later and could need to rely more on taxes or borrowing in the future.

Although the Safaricom note issuance and the proposed Vodafone acquisition are separate transactions, they align strategically and signal a coordinated push to strengthen the company during a major ownership shift. The note programme provides Safaricom with fresh, long-term capital to fund network expansion, and regional growth, while the acquisition consolidates control under a committed majority shareholder with deeper financial and operational capacity.

The proposed acquisition (if successful) is likely to boost activity and confidence in the Kenyan equities market. Safaricom is the largest company by market cap on the NSE, so Vodafone Kenya’s move to increase its stake signals strong foreign investor belief in the company and in Kenya’s long-term outlook. This should lift market sentiment, attract more foreign inflows, and support prices across the exchange. While short-term volatility may occur as investors react to the news, the avoidance of a full takeover reduces uncertainty, and the government’s cash inflow eases fiscal pressure creating a more stable environment for equities to perform.

We are “Bullish” on the Equities markets in the short term due to current cheap valuations, lower yields on short-term government papers and expected global and local economic recovery, and, “Neutral” in the long term due to persistent foreign investor outflows. With the market currently trading at a discount to its future growth (PEG Ratio at 0.9x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the economic outlook in the short term.

- Infrastructure Sector

Kenya’s Road Maintenance Drops to Six-Year Low Following Budget Cuts

During the week the department of roads reported that road maintenance output declined sharply by 28.0% in the year to June 2025, with agencies maintaining 35,965.0 km of roads compared to 49,758.0 km in the previous financial year. This significant drop followed substantial budget cuts that constrained the capacity of KeRRA, KeNHA and KURA to execute planned routine and periodic works across the country, leading to widespread delays and reduced upkeep on key national, urban and rural road networks.

It was also highlighted that the Road Maintenance Levy Fund continued to be diverted toward recurrent expenditures and loan obligations, which further reduced the funds available for actual road repair and rehabilitation. The ongoing diversion of resources caused the authorities to fall short of their maintenance targets, worsening the deterioration of road surfaces, increasing transport inefficiencies and prolonging access challenges in several regions.

The decline in road maintenance is expected to slow activity in the residential and land Real Estate sectors, where reliable infrastructure and ease of mobility are core drivers of demand. Poor road conditions tend to reduce property values, weaken buyer and investor appetite in peri-urban and emerging development zones, delay project uptake, and generally diminish confidence in location-based investments, particularly in fast-growing areas that rely heavily on improved accessibility to attract development.

- Real Estate Investments Trusts

- REITS Weekly Performance

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 27.4 and Kshs 23.2 per unit, respectively, as per the last updated data on 21st November 2025. The performance represented a 33.4% and 14.5% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at Kshs 12.8 mn and Kshs 40.6 mn shares, respectively, with a turnover of Kshs 323.5 mn and Kshs 791.5 mn, respectively, since inception in February 2021. Additionally, ILAM Fahari I-REIT traded at Kshs 11.0 per share as of 21st November 2025, representing a45.0% loss from the Kshs 20.0 inception price. The volume traded to date came in at 1.2 mn shares for the I-REIT, with a turnover of Kshs 1.5 mn since inception in November 2015.

REITs offer various benefits, such as tax exemptions, diversified portfolios, and stable long-term profits. However, the ongoing decline in the performance of Kenyan REITs and the restructuring of their business portfolios are hindering significant previous investments. Additional general challenges include:

- Insufficient understanding of the investment instrument among investors leading to a slower uptake of REIT products,

- Lengthy approval processes for REIT creation,

- High minimum capital requirements of Kshs 100.0 mn for REIT trustees compared to Kshs 10.0 mn for pension funds Trustees, essentially limiting the licensed REIT Trustee to banks only

- The rigidity of choice between either a D-REIT or and I-REIT forces managers to form two REITs, rather than having one Hybrid REIT that can allocate between development and income earning properties

- Limiting the type of legal entity that can form a REIT to only a trust company, as opposed to allowing other entities such as partnerships, and companies,

- We need to give time before REITS are required to list – they would be allowed to stay private for a few years before the requirement to list given that not all companies maybe comfortable with listing on day one, and,

- Minimum subscription amounts or offer parcels set at Kshs 0.1 mn for D-REITs and Kshs 5.0 mn for restricted I-REITs. The significant capital requirements still make REITs relatively inaccessible to smaller retail investors compared to other investment vehicles like unit trusts or government bonds, all of which continue to limit the performance of Kenyan REITs.

We expect the performance of Kenya’s Real Estate sector to remain resilient, supported by several factors: i) improving investor confidence in structured real estate securities, evidenced by gains in Acorn D-REIT and I-REIT. However, challenges such as weak investor appetite in listed REITs like ILAM Fahari I-REIT, high capital requirements, and the decline in road maintenance will continue to constrain the sector’s optimal performance.

According to the ACTSERV Q3’2025 Retirement Benefits Schemes Investments Performance Survey, segregated retirement benefits schemes recorded a 7.2% return in Q3’2025, from the 0.4% return recorded in Q3’2024. The performance was largely supported by the performance of Equities investments made by the schemes which recorded an 19.6% gain, 17.5% points above from the 2.1% return recorded in Q3’2024, on the back of strong gains posted by the Nairobi All Share Index (NASI) of 15.2%, driven by robust corporate earnings, favourable valuations, increased foreign investor inflows, and continued monetary policy easing. This week, we shall focus on understanding Retirement Benefits Schemes and look into the quarterly performance and current state of retirement benefits schemes in Kenya with a key focus on Q3’2025.

In our previous report, we highlighted that, treasury data revealed that for the first nine months of the FY’2024/2025, as of March 2025, Kshs 30.1 bn of pension perks had not been released to pensioners, citing delays in funding pensions and system downtime. This brought back to light the biggest challenge that the country’s civil servants' pension system has had, the overreliance on the exchequer for payment of benefits. As of 30th June 2025, pensions and gratuities Exchequer issues came in at Kshs 207.2 bn, equivalent to 92.9% of the revised estimates III of Kshs 223.1 bn. Additionally, the National Treasury highlighted that the claims processing fell behind with only 85.0% of the claims being processed as of 30th June 2025. Notably, in FY 2024/25, all pensions and gratuities processed for payment, together with Government of Kenya remittances to the Public Service Superannuation Scheme (PSSS), were fully funded. As of 30th June 2025, the Public Service Superannuation Scheme (PSSS) reported Assets Under Management (AUM) of Kshs 242.8 billion, with 85.5% invested in government securities, 6.9% in equities, and 3.0% in offshore investments. The Government had operated a defined benefits (non-contributory) Pension Scheme since independence fully financed through the Exchequer. Given the clear challenges that this system had and the need for reforms in the Public Service Pensions Sector, the Government enacted the Public Service Superannuation Scheme Act 2012. The Act set up the Public Service Superannuation Scheme in 2021, converting all the defined benefit schemes in the public sector to one defined contributions scheme to align with the best practices in the industry. The now new system took in all government officers below 45 years, and gave those above that age the option to join the new system while closing any new entrants to the previous system. Currently, employees in the scheme contribute 7.5% of their basic salary, while the government contributes 15.0%.

We have been tracking the performance of Kenya’s Pension schemes with the most recent topicals being, The Progress of Retirement Benefits Schemes in Kenya, done in September 2025. This week, we shall focus on understanding Retirement Benefits Schemes and looking into the historical and current state of retirement benefits schemes in Kenya and what can be done going forward. We shall also analyze other asset classes that the schemes can tap into to achieve higher returns. Additionally, we shall look into factors and challenges influencing the growth of the RBSs in Kenya as well as the actionable steps that can be taken to improve the pension industry. We shall do this by looking into the following:

- Introduction to Retirement Benefits Schemes in Kenya,

- Historical and Current State of Retirement Benefits Schemes in Kenya,

- Factors Influencing the Growth of Retirement Benefits Scheme in Kenya,

- Challenges that Have Hindered the Growth of Retirement Benefit Schemes, and,

- Recommendations on Enhancing the Performance of Retirement Benefits Schemes in Kenya;

Section I: Introduction to Retirement Benefits Schemes in Kenya

A retirement benefits scheme is a savings avenue that allows contributing individuals to make regular contributions during their productive years into the scheme and thereafter get income from the scheme upon retirement. These schemes offer a range of benefits, including income replacement to maintain one’s lifestyle post-employment, compounded and tax-free interest that accelerates savings growth, and substantial tax incentives, such as monthly reliefs of up to Kshs 30,000 and exemptions on pension withdrawals after 20 years, under the Tax Amendment Act, 2024. Beyond financial independence, which reduces reliance on family support, the schemes also support home ownership through structured access to pension savings, allowing members to either assign up to 60% of their benefits for mortgage guarantees or utilize up to 40% (capped at Kshs 7 million) for direct residential house purchases. These features make retirement benefits schemes a vital pillar of personal financial planning and national economic resilience.

Section II: Historical and the Current State of Retirement Benefits Schemes in Kenya

- Growth of Retirement Benefits Schemes

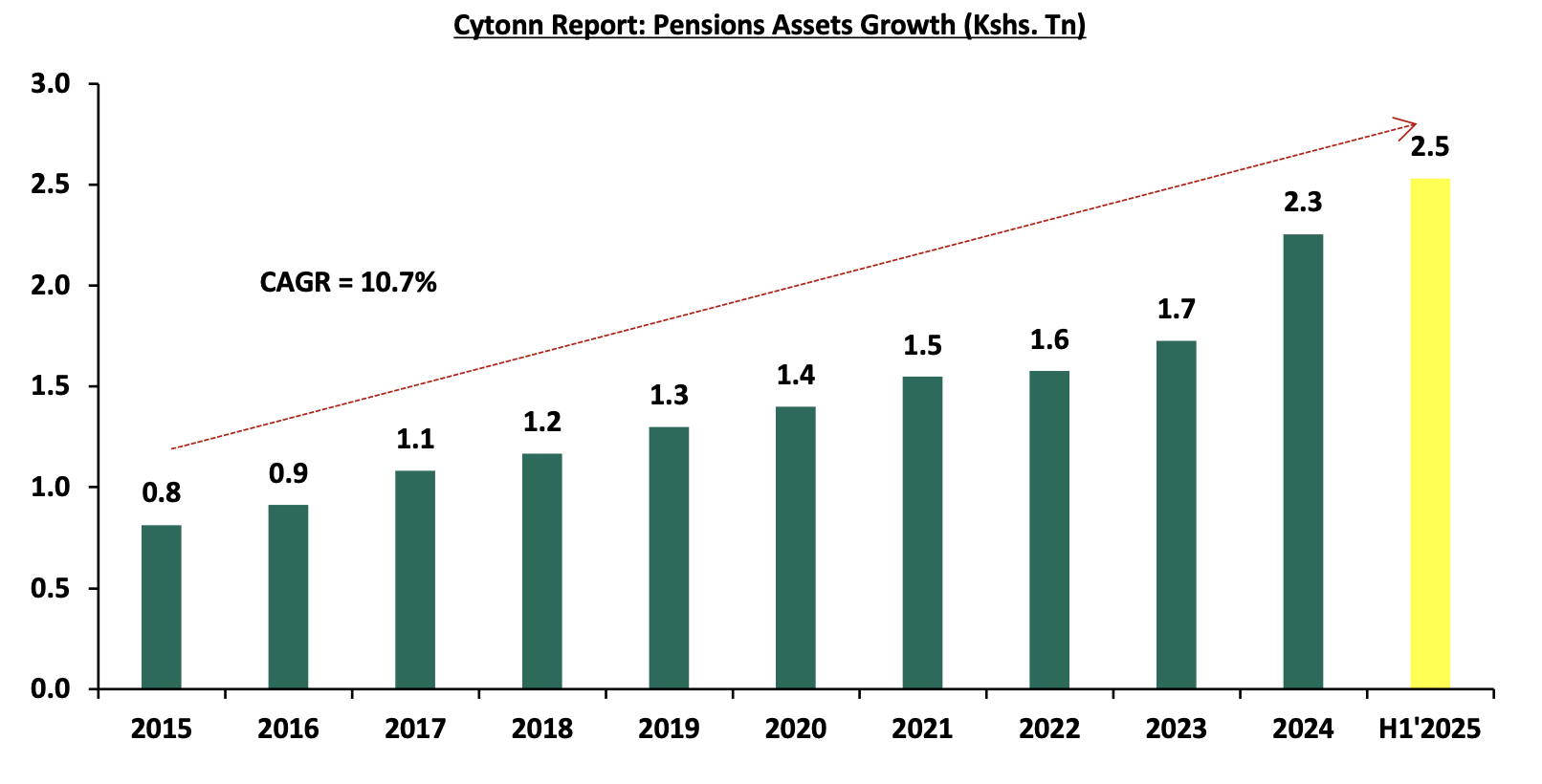

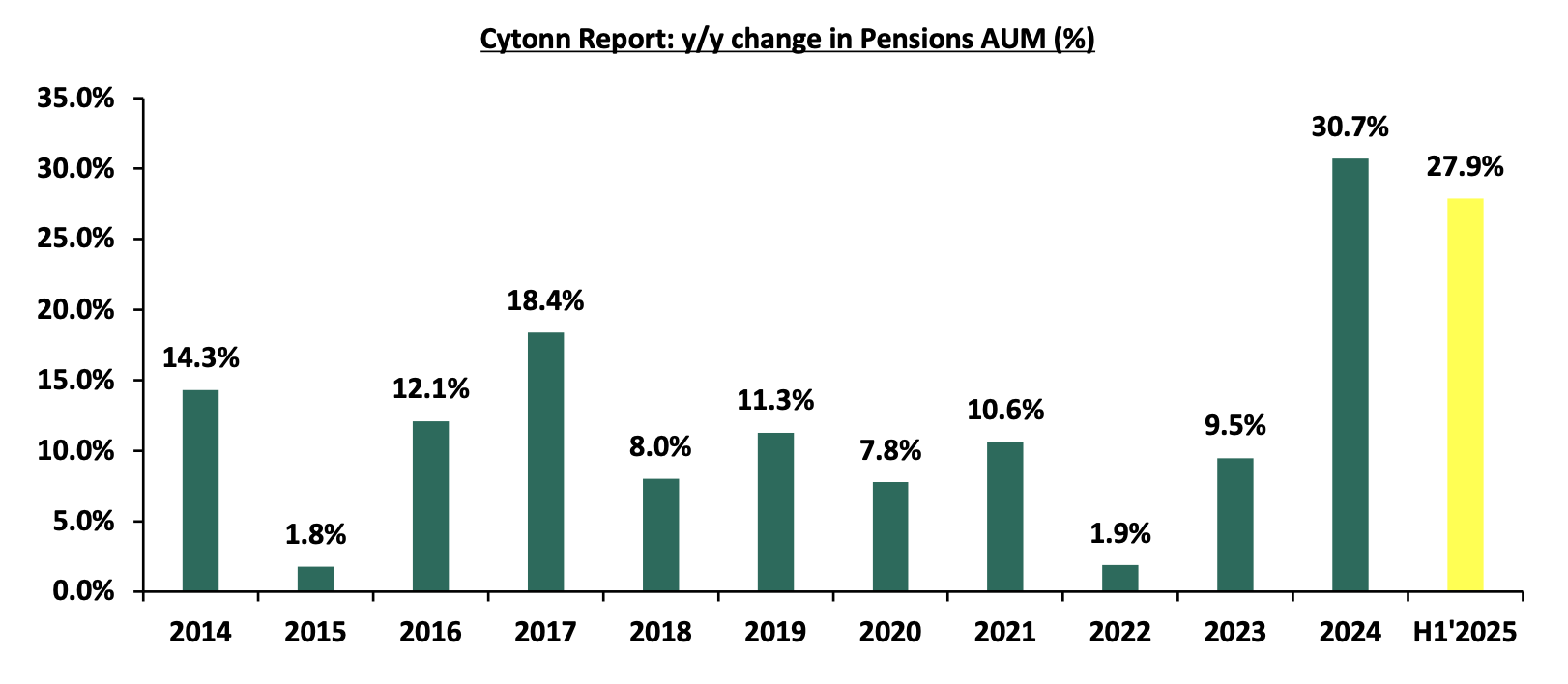

According to the latest Retirement Benefits Authority (RBA) Industry Report for June 2025, assets under management increased by 12.2% to Kshs 2.5 tn from the Kshs 2.3 tn recorded in December 2024. The growth of the assets was majorly attributed to the increase in contributions to the mandatory National Social Security Fund (NSSF) scheme, through the rollout of the third phase of the NSSF Act, 2013 which took effect in February 2025 significantly boosting retirement savings. Under Phase 3, the lower earnings limit increased from Kshs 7,000.0 to Kshs 8,000.0, while the upper earnings limit doubled from Kshs 36,000.0 to Kshs 72,000.0. As such, the NSSF AUM increased by 17.2% to Kshs 558.1 bn in June 2025, from Kshs 476.0 bn in December 2024. Additionally, the improved market and economic conditions during the period as evidenced by improved business conditions, eased inflationary pressures and stability of the exchange rate led to the growth in investment income for the schemes. In February 2025, the third phase of the NSSF contribution limit adjustment was successfully implemented, marking a significant milestone in Kenya’s pension reform journey. This upward revision has already begun to strengthen the retirement benefits sector by boosting individual savings and accelerating the growth of overall Assets Under Management (AUM). The enhanced contributions are expected to deepen long-term investment capacity and improve income security for future retirees, reinforcing the sector’s role in national economic development. Notably, the AUM increased by 27.9% to Kshs 2.5 tn in June 2025 from the Kshs 2.0 tn recorded in June 2024.

The graph below shows the growth of Assets under Management of the retirement benefits schemes over the last 10 years:

The consistent YoY increase demonstrates the significant role that the enhanced NSSF contributions made to the industry’s performance, following the implementation of the NSSF Act of 2013. The primary goal of the Act was to broaden the NSSF’s benefit coverage, range, and scope as well as improve the adequacy of benefits paid out of the scheme by the Fund amongst others.

The chart below shows the y/y changes in the assets under management for the schemes over the years.

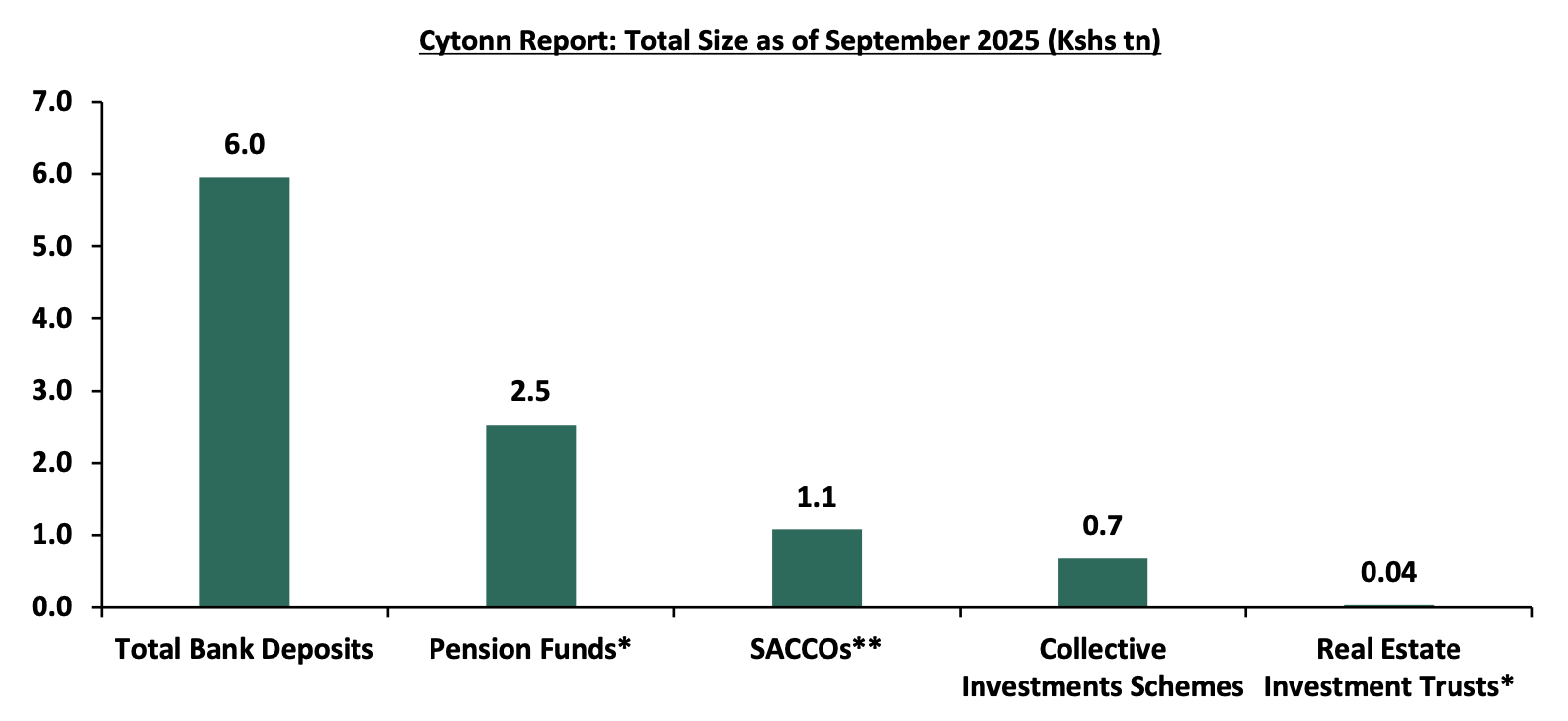

In Kenya, pension funds hold a substantial share of financial assets, consistently growing due to mandatory and voluntary contributions under the National Social Security Fund (NSSF) Act of 2013 regulations. In comparison, bank deposits remain the largest financial pool, reflecting their role as the primary savings vehicle driven by their liquidity, security, and accessibility, though they offer lower returns. Capital markets products, including unit trusts, REITs, are relatively smaller highlighting the nascent stage of capital markets in Kenya, but expanding as investors seek diversification and higher yields. Key to note, the Collective Investments Scheme’s industry’s overall Assets under Management (AUM) grew by 14.0% quarter‑on‑quarter to Kshs 679.6 bn in Q3’2025 from Kshs 596.3 bn in Q2’2025, while on a year‑on‑year basis AUM rose by 114.8% from Kshs 316.4 bn in Q3’2024. SACCOs play a crucial role in cooperative-based savings and credit access, especially for middle-income earners.

The graph below shows the Assets under Management of Pensions against other Capital Markets products and bank deposits:

*Data as of June 2025, **Data as of December 2024

Sources: CMA, RBA, SASRA and REIT Financials

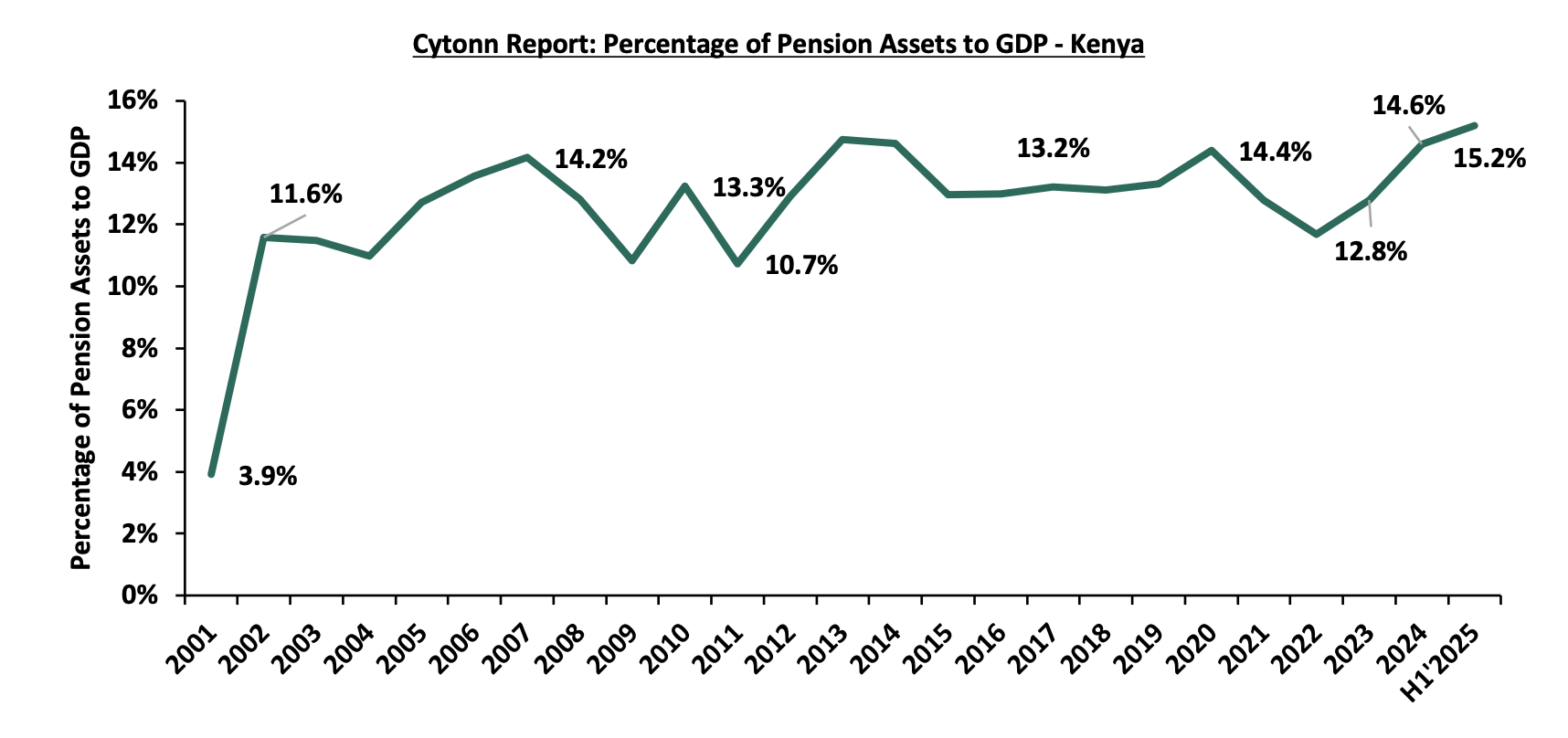

As of the latest available data by RBA, Kenya’s pension-to-GDP ratio increased by 0.6% points to 15.2% in H1’2025 from 14.6% in 2024, driven by a 12.2% increase in pension Assets Under Management (AUM) to Kshs 2.5 bn, significantly outpacing the country’s GDP growth rate, which recorded a growth of 5.0% in Q2’2025, compared to 4.7% in FY’2024. This disparity implies that the pension sector is expanding at a much faster rate than the broader economy, reflecting stronger savings mobilization, improved investment returns, and possibly increased compliance or contribution levels following regulatory reforms. However, the 15.2% is significantly lower than that of developed countries such as the United States at 169.5%, Australia at 132.6%, and the United Kingdom at 124.2%, reflecting the maturity and depth of their pension systems. In Sub-Saharan Africa region, Kenya outperforms countries like Malawi at 11.7%, Uganda at 9.0% and Nigeria at 8.0%, but still lags behind Namibia at 100.4% and South Africa at 83.8%. This positioning indicates that while Kenya’s pension sector is growing steadily, particularly with recent reforms, there remains considerable room for expansion and deeper integration into the national economy. The graph below shows select countries’ pension assets to GDP ratio as per the latest published data by World Bank:

Sources: World Bank, RBA *data as of June 2025

The graph below shows Kenya’s pension to GDP ratio over the years:

- Retirement Benefits Schemes Allocations and Various Investment Opportunities

Retirement Benefits Schemes aim to protect members’ savings while achieving competitive long-term returns by investing across various asset classes. Schemes have invested in traditional asset classes such as equities and fixed income securities, which offer a balance between risk and return. However, to enhance portfolio performance and diversify risk, they have increasingly explored alternative asset classes such as real estate, private equity, offshore funds and other non-traditional asset classes. Investing in alternative assets provides opportunities for higher returns, hedge against inflation and exposure to long-term growth sectors. The choice and proportion of these investments are determined by each scheme’s Investment Policy Statement (IPS), which sets out guidelines for risk tolerance, liquidity needs and return objectives. As such, the performance of Retirement Benefits Schemes in Kenya depends on a number of factors such as;

- Asset allocation,

- Selection of the best-performing security within a particular asset class,

- Size of the scheme,

- Risk appetite of members and investors, and,

- Investment horizon.

The Retirement Benefits (Forms and Fees) Regulations, 2000 offers investment guidelines for retirement benefit schemes in Kenya in terms of the asset classes to invest in and the limits of exposure to ensure good returns and that members’ funds are hedged against losses. According to RBA’s Regulations, the various schemes through their Trustees should formulate their own Investment Policy Statements (IPS) to Act as a guideline on how much to invest in the asset option and assist the trustees in monitoring and evaluating the performance of the Fund. However, the Investment Policy Statements often vary depending on risk-return profile and expectations mainly determined by factors such as the scheme’s demography and the economic outlook.

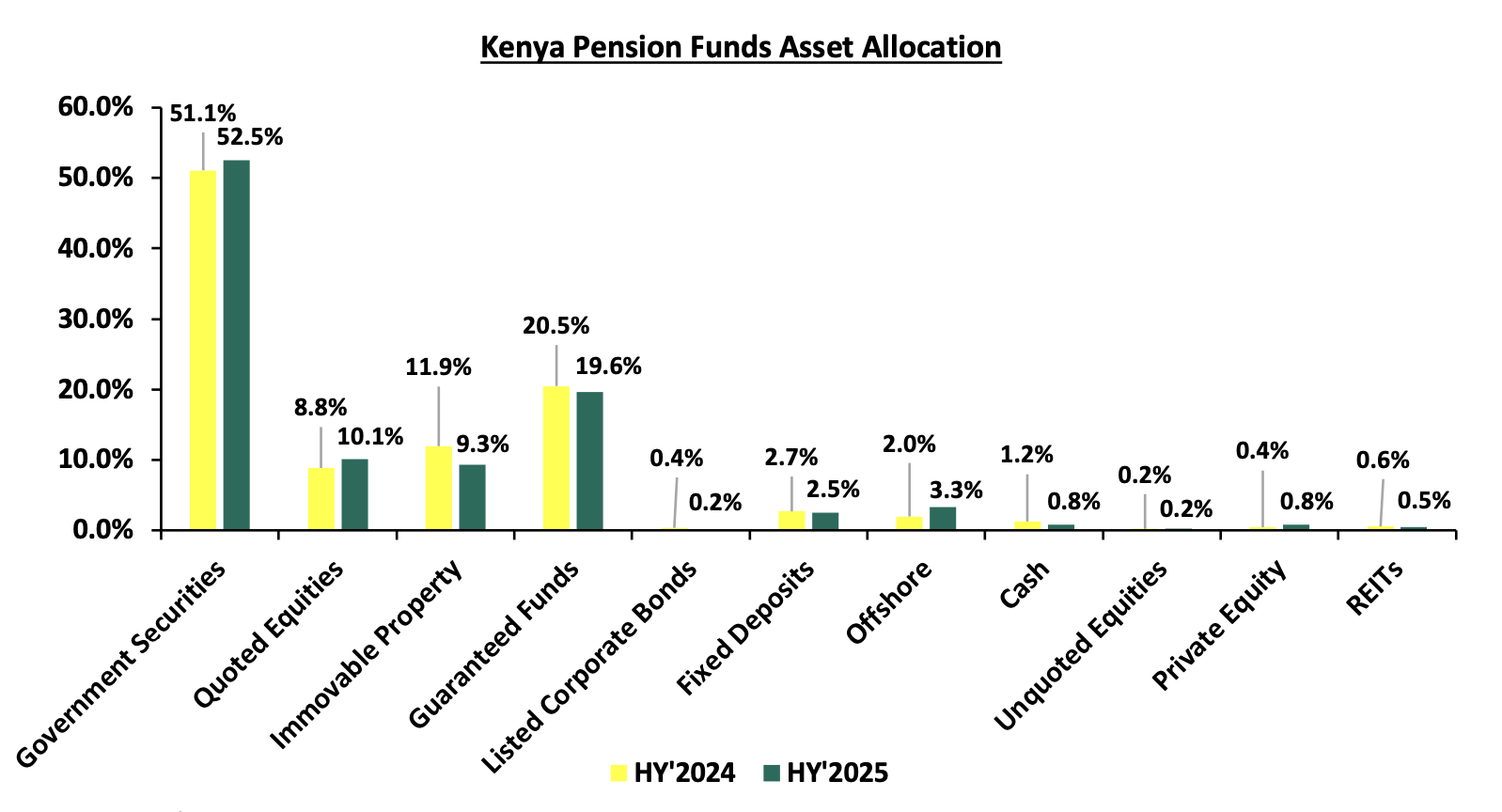

The RBA’s Investments regulations and policies underscore diversification as a foundational strategy for managing pension fund assets. Schemes are constrained by explicit exposure limits across different asset classes, helping mitigate market risks and ensuring that no single investment dominates the fund’s performance. To guide investment decisions and risk management, trustees must draft and regularly update an Investment Policy Statement (IPS), typically every three years, to reflect evolving market conditions, economic trends, and the shifting priorities and demographics of scheme members. This dynamic stewardship promotes alignment with long-term objectives, accountability, and transparency. Under current regulations, schemes may invest up to: 90% in government bonds, 70% in quoted equities, 30% in immovable property, 15% in offshore markets and 10% in private equity. While these broad boundaries support prudent diversification and inflation protection, schemes historically skew allocations toward traditional assets like government securities and equities. The IPS plays a critical role in encouraging broader inclusion of alternative and offshore investments to enhance returns and resilience. The table below represents how the retirement benefits schemes have invested their funds in the past:

|

Cytonn Report: Kenyan Pension Funds’ Assets Allocation |

|||||||||||||

|

Asset Class |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

H1’2025 |

Average |

Limit |

|

Government Securities |

29.8% |

38.3% |

36.5% |

39.4% |

42.0% |

44.7% |

45.7% |

45.8% |

47.5% |

52.5% |

52.5% |

43.8% |

90.0% |

|

Quoted Equities |

23.0% |

17.4% |

19.5% |

17.3% |

17.6% |

15.6% |

16.5% |

13.7% |

8.4% |

9.0% |

10.1% |

14.7% |

70.0% |

|

Immovable Property |

18.5% |

19.5% |

21.0% |

19.7% |

18.5% |

18.0% |

16.4% |

15.8% |

14.0% |

11.1% |

9.3% |

16.1% |

30.0% |

|

Guaranteed Funds |

12.2% |

14.2% |

13.2% |

14.4% |

15.5% |

16.5% |

16.8% |

18.9% |

20.8% |

19.4% |

19.6% |

16.8% |

100.0% |

|

Listed Corporate Bonds |

5.9% |

5.1% |

3.9% |

3.5% |

1.4% |

0.4% |

0.4% |

0.5% |

0.4% |

0.3% |

0.2% |

1.9% |

20.0% |

|

Fixed Deposits |

6.8% |

2.7% |

3.0% |

3.1% |

3.0% |

2.8% |

1.8% |

2.7% |

4.8% |

2.4% |

2.5% |

3.2% |

30.0% |

|

Offshore |

0.9% |

0.8% |

1.2% |

1.1% |

0.5% |

0.8% |

1.3% |

0.9% |

1.6% |

2.9% |

3.3% |

1.4% |

15.0% |

|

Cash |

1.4% |

1.4% |

1.2% |

1.1% |

1.2% |

0.9% |

0.6% |

1.1% |

1.5% |

1.0% |

0.8% |

1.1% |

5.0% |

|

Unquoted Equities |

0.4% |

0.4% |

0.4% |

0.3% |

0.3% |

0.2% |

0.2% |

0.3% |

0.2% |

0.2% |

0.2% |

0.3% |

5.0% |

|

Private Equity |

0.0% |

0.0% |

0.0% |

0.1% |

0.1% |

0.1% |

0.2% |

0.2% |

0.3% |

0.7% |

0.8% |

0.3% |

10.0% |

|

REITs* |

0.0% |

0.1% |

0.1% |

0.1% |

0.0% |

0.0% |

0.0% |

0.0% |

0.6% |

0.5% |

0.5% |

0.2% |

30.0% |

|

Commercial Paper, non-listed bonds by private companies* |

- |

- |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.2% |

0.1% |

10.0% |

|

Others e.g. Unlisted Commercial Papers |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.0% |

0.1% |

0.2% |

- |

0.0% |

0.0% |

0.0% |

10.0% |

|

Total |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

100.0% |

Source: Retirement Benefits Authority

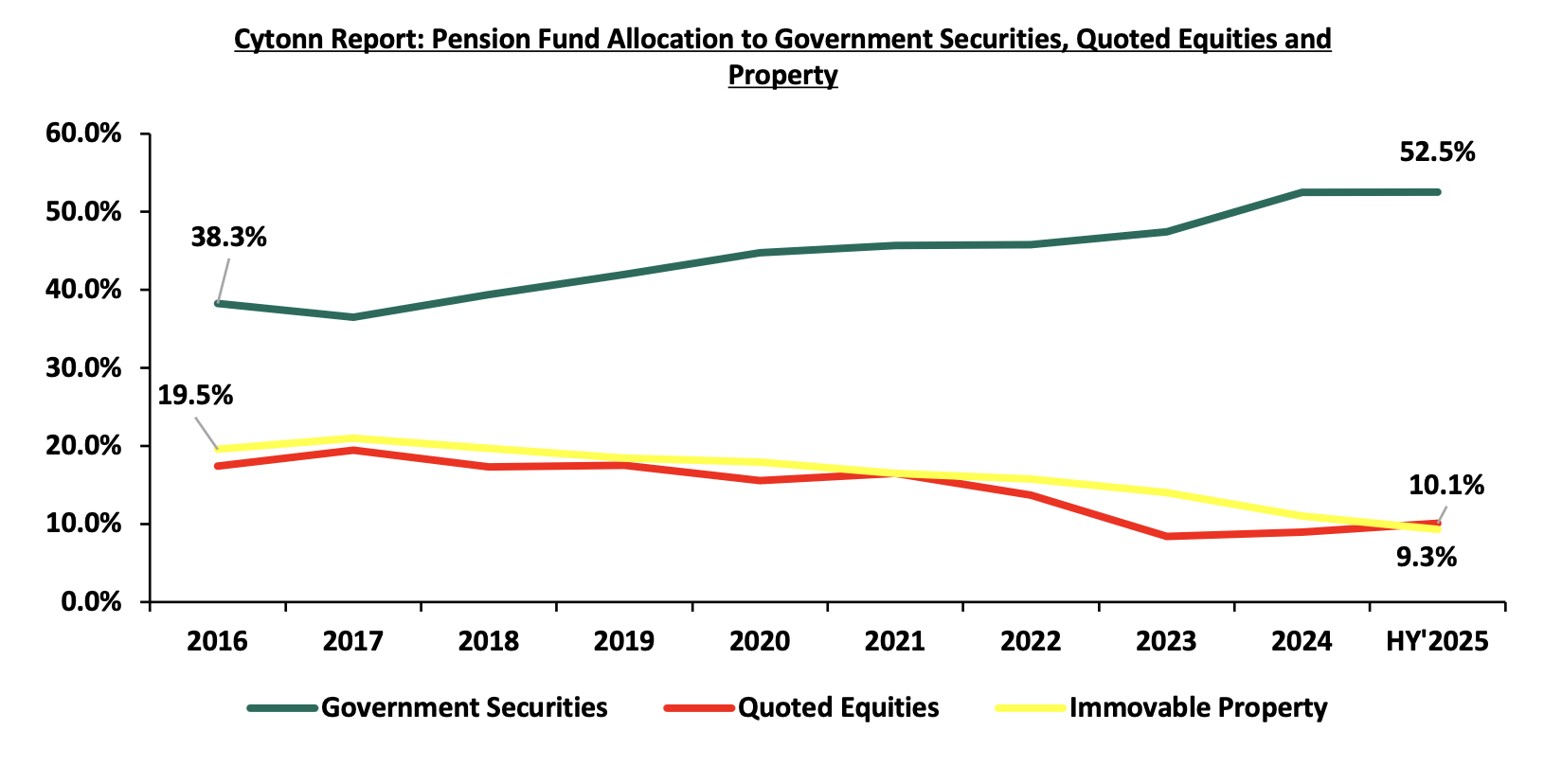

Retirement benefits schemes have for a long time skewed their investments towards traditional assets, mostly, government securities and the equities market, averaging 58.5% between 2015 and 30th June 2025 for the two asset classes, leaving only 41.5% for the other asset classes. However, as pension schemes seek higher returns, diversification, and inflation hedging, there has been a growing shift towards alternative investments that include immovable property, private equity and Real Estate Investments Trusts (REITs). It is vital to note, that in H1’2025 there was an increase recorded in investments in private equity by 24.1% to Kshs 20.1 bn from Kshs 16.2 bn recorded in FY’2024 while investments in Real Estate Investments Trusts increased by 8.5% to Kshs 12.7 bn in 2024 from Kshs 11.7 bn in FY’2024. However, allocation to immovable property decreased by 5.5% to Kshs 235.6 bn in 2024 from Kshs 249.2 bn in FY’2023.

Key Take-outs from the table above are;

- Schemes in Kenya allocated an average of 58.5% of their members’ funds towards government securities and Quoted Equities between the period of 2015 and end of June 2025. The 42.8% average allocation to government securities is the highest among the asset classes attributable to safety assurances of members’ funds because of low-risk associated with government securities. Notably, allocation towards government remained relatively unchanged from 52.5% recorded in FY’2024 attributable to high yields by the government papers and increased issuance of treasury bonds to finance fiscal deficits as well as increase domestic borrowing during the period,

- The allocation towards quoted equities increased by 1.1% points to 10.1% in H1’2025, from 9.0% in FY’2024 on the back of improved performance in the Kenyan equities market as evidenced by 22.4% gain by the NASI index in H1’2025, driven by a recovery in corporate earnings and increased investor confidence. Favourable macroeconomic conditions, such as stable inflation and a stable shilling, boosted market sentiment, have encouraged trustees to allocate more funds to equities during the period, and,

- Retirement Benefits Schemes investments in offshore markets increased by 0.4% points to 3.3% in H1’2025, from 2.9% in FY’2024 as a result of the opportunities in developed and emerging markets, and currency hedging strategies that allowed schemes to benefit from foreign exchange gains.

The chart below shows the allocation by pension schemes on the three major asset classes over the years:

Source: RBA Industry report

For the segregated schemes, according to ACTSERV, in Q3’2025, the segregated pension schemes maintained a conservative asset allocation strategy, with 80.7% of investments directed toward fixed income instruments, reflecting a strong preference for stability and predictable returns. Equities accounted for 16.0%, indicating moderate exposure to growth opportunities, while offshore investments stood at 3.1%, suggesting limited diversification beyond domestic markets. This allocation mix highlights a cautious investment approach focused on capital preservation and steady income generation. This relatively low exposure to alternative and international asset classes highlights a conservative investment posture, with the majority of assets still concentrated in fixed income and domestic equities. While offshore investments have delivered strong returns over multi-year periods, their limited uptake suggests untapped potential for diversification and long-term growth within the pension sector.

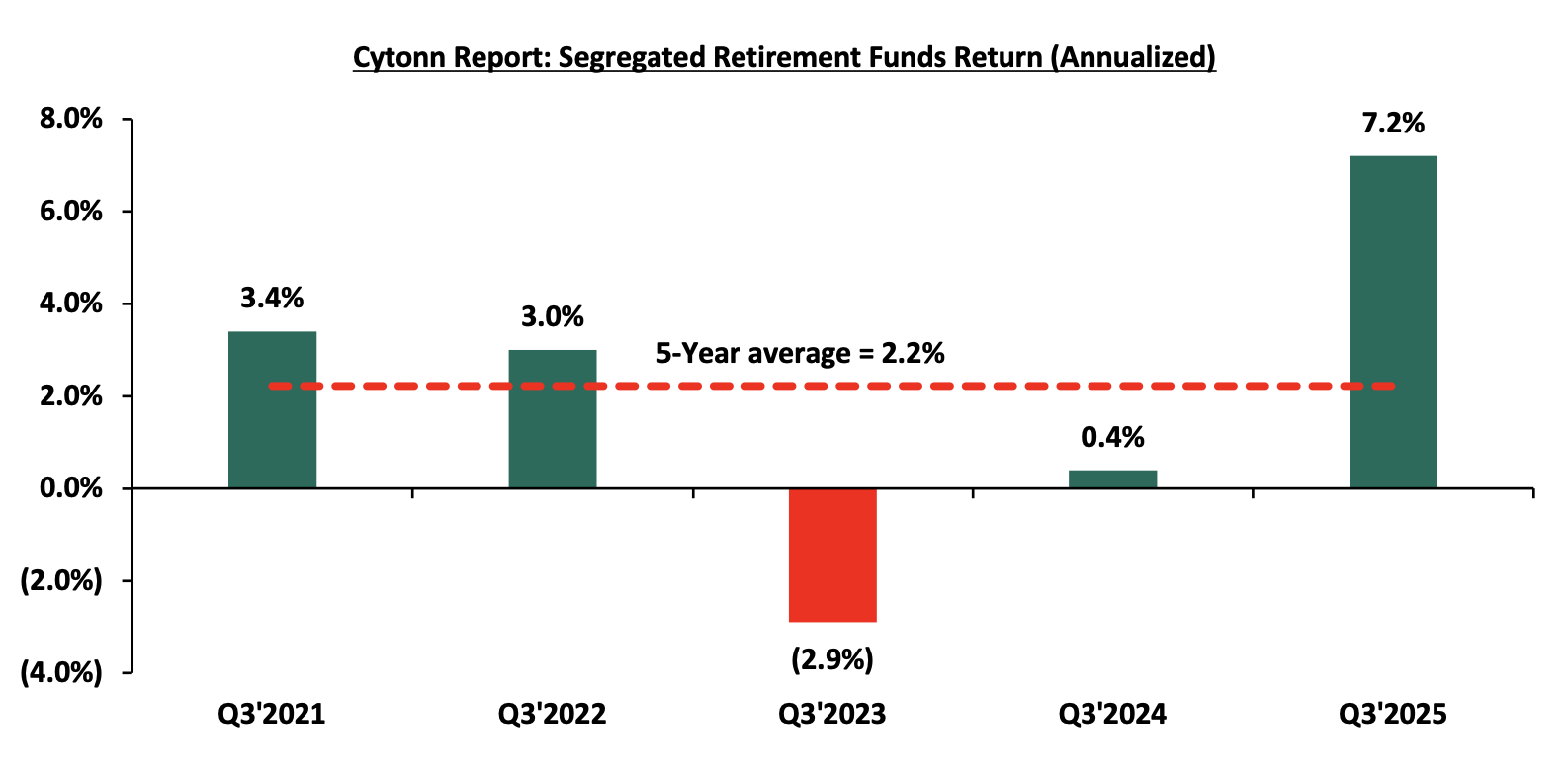

Performance of the Retirement Benefit Schemes

According to the ACTSERV Q3’2025 Pension Schemes Investments Performance Survey, the five-year average return for segregated schemes over the period 2021 to 2025 was 2.2% with the performance fluctuating over the years to a high of 7.3% in Q3’2025, and a loss of 2.9% in Q3’2023 reflective of the markets performance. Notably, segregated retirement benefits scheme returns increased to 7.2% return in Q3’2025, up from the 0.4% gain recorded in Q3’2024. The y/y growth in overall returns was largely driven by the 17.5% points increase in returns from Equities to 19.6% from a gain of 2.1% in Q3’2024 attributable to the increased corporate earnings and attractive valuations as well as the 5.1% gain from fixed income. The 5.1% gain in Fixed Income returns was a 5.1% points increase from the 0.04% loss recorded in Q3’2024. The chart below shows the quarterly performance of segregated pension schemes since 2021:

The key take-outs from the graph include:

- Schemes recorded an increase of 6.8% points to 7.2% in Q3’2025 from the 0.4% gain recorded in Q3’2024. The performance was largely driven by a 19.6% gain in equities investments in comparison to the 2.1% gain recorded in Q3’2024, largely attributable to easing of the monetary policy, stable inflation and declining bond yields which led to relatively stronger investor confidence in equities compared to interest‑bearing assets. Offshore assets also registered increased returns, recording a 6.5% in Q3’2025, from the 4.7% gain recorded in Q3’2024, a 1.8% points increase, majorly on the back of resilient economy, strong corporate earnings and easing monetary policies, and,

- Returns from segregated retirement funds have exhibited significant fluctuations over the last five years, ranging from a high of 7.2% recorded in Q3’2025 to a low of (2.9%) in Q3’2023, highlighting the sensitivity of fund performance to market and economic conditions.

The survey covered the performance of asset classes in three broad categories: Fixed Income, Equity, Offshore, and Overall Return. Below is a graph showing the third quarter performances over the period 2021-2025:

|

Cytonn Report: |

Quarterly Performance of Asset Classes (2021 – 2025) |

|

|

||||

|

|

Q3'2021 |

Q3'2022 |

Q3'2023 |

Q3'2024 (a) |

Q3'2025 (b) |

Average (Q3'2021-Q3'2025) |

% points change (b-a) |

|

Fixed Income |

2.9% |

2.3% |

(1.5%) |

(0.04%) |

5.1% |

1.8% |

5.1% |

|

Equity |

5.2% |

6.3% |

(10.4%) |

2.1% |

19.6% |

4.6% |

17.5% |

|

Offshore |

1.9% |

(2.8%) |

1.7% |

4.7% |

6.5% |

2.4% |

1.8% |

|

Overall Return |

3.4% |

3.0% |

(2.9%) |

0.4% |

7.2% |

2.2% |

6.8% |

Source: ACTSERV Surveys

Key take-outs from the table above include;

- Returns from Fixed Income recorded a growth of 5.1% points to 5.1% in Q3’2025 from the 0.04% loss recorded in Q3’2024. The change is mainly due to the change in the accounting treatment of fixed income assets from the Mark to Market to the Hold To maturity. Fixed income has continued to offer stable returns with some volatility over the years, recording losses in Q3’2023 and Q3’2024, but also achieving its highest return in Q3 2024,

- Notably, returns from Equity investments recorded a sizeable increase by 17.5% points to a 19.6% gain in Q3’2025, from the 2.1% gain recorded in Q3’2024. The performance was partly attributable to favourable stock valuations and ongoing support from accommodative monetary policies, and,

- Returns from the Offshore investments also, recorded a gain of 1.8% in Q3’2025, to a 16.5% return from the 4.7% recorded in Q3’2024. The performance was partly attributable to the increase in positive earnings growth as a result of the easing of monetary policies in major economies.

Other Asset Classes that Retirement Benefit Schemes Can Leverage on

- Alternative Investments (Immovable Property, Private Equity and REITs)

Retirement benefits schemes have for a long time skewed their investments towards traditional assets, mostly, government securities and the equities market, 58.5% as of 30th June 2025, leaving only 41.5% for all the other asset classes. In the asset allocation, alternative investments that include immovable property, private equity as well as Real Estate Investments Trusts (REITs) account for an average of only 16.6% against the total allowable limit of 70.0%. It is vital to note, however, that in H1’2025 the largest increase in allocation was recorded in investments in private equity by 129.2% to Kshs 20.1 bn from Kshs 8.8 bn recorded in H1’2024. Allocation to immovable property decreased by 0.3% to Kshs 235.6 bn in H1’2025 from Kshs 236.1 bn in H1’2024, while investments in Real Estate Investments Trusts increased by 14.2% to Kshs 12.7 bn in H1’2025 from Kshs 11.1 bn in H1’2024. In terms of overall asset allocation, alternative investments still lagged way behind the other asset classes, as demonstrated in the graph below;

Source: RBA Industry Report

Alternative Investments refers to investments that are supplemental strategies to traditional long-only positions in equities, bonds, and cash. They differ from traditional investments on the basis of complexity, liquidity, and regulations and can invest in immovable property, private equity, and Real Estate Investment Trusts (REITs) to a limit of 70.0% exposure. We believe that there is value in the alternative markets that schemes can take advantage of. Some of the key advantages of alternatives investments include:

- Diversification: Investing in a variety of asset classes such as REITs, fixed income securities and equities helps to reduce risk when incorporated into a single investment, as it spreads the investments across diverse locations, sectors, platforms, and classes. REIT institutions typically own physical assets such as land and buildings, and frequently enter into lengthy leases with their tenants. This makes REITs some of the most dependable investments on the market. This diversification creates the opportunity for a blended portfolio to earn higher returns while reducing the potential for negative or low returns, and,

- Competitive Long-Term Returns: REITs provide robust and long-term yields, by its ability to generate stable cash flows through rental income and capital appreciation. Alternatives can outperform traditional investments like fixed-income. This makes them an ideal component of a successful and efficient portfolio.

- Inflation hedging – Assets such as real estate often provide returns that move with inflation, protecting members’ savings from erosion of purchasing power. These assets ensure that returns grow alongside the cost of living, protecting members from the risk of diminished real value in their benefits. In essence, inflation-hedging investments help preserve the stability and sustainability of pension portfolios, ensuring retirees maintain their standard of living even in inflationary environments.

- Public Private Partnerships

According to the Retirement Benefits Authority Investment Regulations and Policies, pension schemes can invest up to 10.0% of their total assets under management in debt instruments for the financing of infrastructure or affordable housing projects approved under the Public Private Partnerships Act. In FY’2024/2025, Kshs 17.7 bn in private capital investments through Public Private Partnerships (PPPs) was mobilized, bringing the cumulative total mobilized since 2013 to Kshs 145.0 bn as of June 2025. Additionally, Kenya's pension schemes are increasingly investing in infrastructure projects to diversify their portfolios, achieve stable long-term returns, and contribute to national development. A significant initiative in this direction is the Kenya Pension Funds Investment Consortium (KEPFIC), established in 2018. KEPFIC is a collective of prominent Kenyan retirement benefit funds that have united to make long-term investments in infrastructure and alternative assets within the region. As of the latest report, KEPFIC has mobilized over USD 113.0 mn into projects such as roads (Northern Kenya Road Project Bond), student housing (Acorn Student Accommodation REITs), and affordable housing (KMRC Affordable Housing Bond), involving 88 local pension funds. Despite there being 1,075 registered pension schemes in Kenya, only 88 have actively participated in infrastructure investments through KEPFIC, highlighting a significant untapped opportunity. With the Retirement Benefits Authority allowing schemes to allocate up to 10.0% of their assets into such projects, there remains substantial room for more pension funds to diversify into infrastructure and affordable housing.

A prime example of this opportunity is the joint partnership by the National Social Security Fund (NSSF) and China Road and Bridge Corporation (CRBC) to upgrade and dual the Rironi-Nakuru-Mau Summit Road, a 175 km brownfield infrastructure project estimated to cost over Ksh 90.0 bn. NSSF will commit to invest up to Kshs 25.0 n in the project, underscoring its strategic role in supporting long‑term infrastructure development Under the DBFOMT model, NSSF will utilize pension funds to finance the development, aiming to generate long-term returns for contributors while enhancing national transport infrastructure. This initiative reflects a growing trend of leveraging pension assets for strategic investments, though it has sparked public debate over the appropriateness and risk of deploying retirement savings into large-scale infrastructure.

Section III: Factors Influencing the Growth of Retirement Benefit Schemes

The retirement benefit scheme industry in Kenya has registered significant growth in the past 10 years with assets under management growing at a CAGR of 10.7% to Kshs 2.3 tn in FY’2024, from Kshs 0.8 tn in FY’2015. Notably, the AUM increased by 27.9% to Kshs 2.5 tn in June 2025 from the Kshs 2.0 tn recorded in June 2024. The growth is attributable to:

- Legislation - The National Assembly, on 26th December 2024, assented to the Tax Laws (Amendment) Bill 2024. The Bill amended the Income Tax Act by increasing the deductible amount for contributions to registered pension, provident, and individual retirement funds or public pension schemes to Kshs 360,000 annually from Kshs 240,000 and introduced provisions that allow contributions to post-retirement medical funds up to Kshs 15,000 per month to be tax-deductible. Additionally, income from registered retirement benefits schemes is now tax-exempt for individuals who have reached the retirement age set by their scheme, those withdrawing benefits early due to ill health, or those exiting a registered scheme after at least 20 years of membership. These changes aim to adjust for inflation and modernize deductions that have remained unchanged for over a decade. The revisions are expected to reduce individual taxable income and enhance retirement benefits. In addition, the implementation of the National Social Security Fund Act, 2013 is entering its third year and is expected to foster the growth of the pension industry by allowing both the employees in the formal and informal sector to save towards their retirement. The upward revision of the NSSF Tier 1 and Tier 2 contribution limits effective from February 2025, to Kshs 8,000 and 72,000 respectively from Kshs 7,000 and Kshs 36,000 respectively is expected to enhance retirement savings, improving pension adequacy for retirees,

- Public-Private partnerships - Public-private partnerships can be instrumental in expanding financial inclusion in the Kenyan pension sector. Collaborations between the government and private financial institutions can lead to the development and promotion of inclusive pension products. In Kenya, the National Social Security Fund (NSSF) is currently licensing and partnering with the private sector (Pension Fund Managers) to invest and manage NSSF Tier II contributions. This is a good example that the government is giving employees, employers, and persons in the informal sector to invest and save for their retirement in the private sector,

- Increased Pension Awareness – More people are becoming increasingly aware of the importance of pension schemes and as such, they are joining schemes to grow their retirement pot which they will use during their golden years. Over the last 20 years, pension coverage has grown from 12.0% to about 26.0% of the labour force. The Retirement Benefits Authority, through their Strategic Plan 2024-2029, aims to further expand this coverage to0% by 2029. This growth reflects industry-wide initiatives to increase awareness among Kenyan citizens on the need for retirement planning and innovations,

- Tax Incentives - Members of Retirement Benefit Schemes are entitled to a maximum tax-free contribution of of Kshs 30,000 monthly, equivalent to Kshs 360,000. Consequently, pension scheme members enjoy a reduction in their taxable income and pay less taxes. This incentive has motivated more people to not only register but also increase their regular contributions to pension schemes,

- Micro-pension schemes - Micro-pension schemes are tailored to address the needs of Kenyans in the informal sector with irregular earnings. These schemes allow people to make small, flexible contributions towards their retirement. By accommodating their financial realities, micro-pensions can attract a broader segment of the population into the pension sector. Examples of these pension schemes are Mbao Pension Plan and Individual Pension Schemes where one can start saving voluntarily and any amount towards their retirement,

- Relevant Product Development – Pension schemes are not only targeting people in formal employment but also those in informal employment through individual pension schemes, with the main aim of improving pension coverage in Kenya. To achieve this, most Individual schemes have come up with flexible plans that fit various individuals in terms of affordability and convenience. Additionally, the National Social Security Fund Act, 2013 contains a provision for self-employed members to register as members of the fund, with the minimum aggregate contribution in a year being Kshs 4,800 with the flexibility of making the contribution by paying directly to their designated offices or through mobile money or any other electronics transfers specified by the board,

- Technological Advancement – The adoption of technology into pension schemes has improved the efficiency and management of pension schemes. A notable example of pension technology in Kenya is the M-Akiba This is a mobile-based platform that was developed by the government to enable Kenyans to save for their retirement using their mobile phones. Additionally, the improvement of mobile penetration rate and internet connectivity has enabled members to make contributions and track their benefits from the convenience of their mobile phones, and,

- Financial literacy programs - Financial literacy programs play a vital role in promoting the growth of retirement benefit schemes by enhancing financial inclusion among the public. Educating the public about the benefits of retirement savings and how to navigate pension schemes can empower individuals to take control of their financial future. The Retirement Benefits Authority (RBA) is at the forefront of ensuring the public is educated on financial literacy by organizing free training.

Section IV: Challenges that Have Hindered the Growth of Retirement Benefit Schemes

Despite the expansion of the Retirement Benefit industry, several challenges continue to hinder its growth. Key factors include:

- Market Volatility – In segregated schemes, investment returns are not guaranteed and are subject to market fluctuations. A large portion of pension assets in Kenya are invested in fixed income instruments, particularly government securities. While these are traditionally considered stable, they are not immune to market fluctuations. For instance, in segregated schemes, investment returns are not guaranteed and are subject to market fluctuations. In Q3’2025, the returns in the fixed income market recorded gains of 5.1%, following a 0.04% loss in Q3’2024 and a 1.5% loss in Q3’2023. This level of volatility introduces uncertainty in the growth of retirement savings. When interest rates fall, bond yields may fall but equity returns rise, affecting overall portfolio performance. Such volatility creates uncertainty in retirement savings growth,

- Inadequate Contributions - Even when individuals are covered by retirement schemes, their contributions are often inadequate to meet future financial needs due to factors such as low disposable income, delayed enrolment in schemes and inadequate contribution rates. Insufficient contributions translate directly into lower payouts upon retirement. For retirees, this can result in financial insecurity, dependence on family or government assistance and inability to meet basic living expenses. Low contributions may be insufficient to sustain post-retirement life,