Review of the Kenyan Shilling Performance, & Cytonn Weekly #50/2021

By Research Team, Dec 19, 2021

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 87.4%, up from 65.7% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 4.5 bn against the offered Kshs 4.0 bn. This translated to a subscription rate of 113.3%, a decline from the 126.9% recorded the previous week. The subscription rate for the 182-day and 364-day papers increased to 112.2% and 52.3%, from 55.2% and 51.7%, respectively. The yields on the Treasury bills recorded mixed performance, with the 91-day and 182-day papers yields declining by 1.5 bps and 0.7 bps to 7.3%, and 8.0%, respectively, while the yield on the 364-day paper increased by 7.3 bps to 9.2%;

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the Maximum retail prices in Kenya effective 15th December 2021 to 14th January 2021 highlighting that the prices of Super Petrol, Diesel and Kerosene remained unchanged at Kshs 129.7, Kshs 110.6 and Kshs 103.5 respectively. Also during the week, the National Treasury gazetted the revenue and net expenditures for the first five months of FY’2021/2022, highlighting that the total revenue collected as at the end of November 2021 amounted to Kshs 740.0 bn, equivalent to 41.7% of this financial year’s budget of Kshs 1.8 tn and is 100.0% of the prorated estimates of Kshs 739.8 bn. Additionally, the International Monetary Fund (IMF) completed the second review of the 38-month Extended Fund Facility (EFF) and Extended Credit Facility (ECF) - funded program allowing Kenya to access approximately USD 258.1 mn (Kshs 29.2 bn), bringing the total support from IMF to Kenya to USD 972.6 mn (Kshs 109.9 bn) in 2021;

Equities

During the week, the equities market recorded mixed performance, with NSE 25 and NASI gaining by 0.9% and 0.5%, respectively, while NSE 20 declined marginally by 0.1%. This week’s performance took their YTD performance to gains of 7.6% and 6.3% for NASI and NSE 25, respectively, with NSE 20 shedding by 1.0% on a YTD basis. The equities market performance was driven by gains recorded by banking stocks such as NCBA, Equity and KCB of 4.2%, 2.4% and 2.0%, respectively. The gains were however weighed down by losses recorded by other large cap stocks such as EABL and Standard Chartered Bank (SCB-K) which declined by 0.5% and 0.4%, respectively. During the week, the Central Bank of Kenya (CBK), in collaboration with the Kenya National Bureau of Statistics (KNBS) and Financial Sector Deepening Trust (FSD) Kenya released the 2021 FinAccess Household Survey, highlighting that financial inclusion expanded by 0.8% points to 83.7% in 2021, from 82.9% in 2019;

Real Estate

During the week, the National Government through the Principal Secretary for Housing, Honourable Charles Hinga, announced plans to begin the construction of 5,360 affordable units in Machakos County, dubbed ‘Mavoko Affordable Housing Programme’. In the Infrastructure sector, the National Government through the Kenya Rural Roads Authority (KeRRA) announced plans to revamp the 36.4 Km Lurambi road in Kakamega County;

Focus of the Week

In 2021, on a YTD basis, the Kenyan shilling has depreciated by 3.5% against the US Dollar (USD) after a 7.7% depreciation in 2020. This depreciation can mainly be attributable to the increased dollar demand by energy and general importers with Kenya and also the global economic uncertainty due to the ongoing pandemic. Global oil prices have also increased during the year, further inflating the country’s import bill and further weakening the shilling. The shilling has touched an all-time low of Kshs 113.0 to the USD as at 17th December 2021, and as such, this week we sought to have an in-depth look at the factors that have led to this performance;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.41%. To invest, dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 13.92% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809#;

- We continue to offer Wealth Management Training Monday through Saturday, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert is welcome to consider one of the five projects currently available for conversion, click here for the latest conversion term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s Real Estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation. To rent, please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Share a meal with a friend during the Sunday Brunch at The Hive Restaurant at Cysuites Hotel and Apartment. Every Sunday from 11.00 AM to 4.00 PM at a price of Kshs 2,500 for Adults and Kshs 1,500 for children under 12 years;

Money Markets, T-Bills Primary Auction:

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 87.4%, up from 65.7% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 4.5 bn against the offered Kshs 4.0 bn. This translated to a subscription rate of 113.3%, a decline from the 126.9% recorded the previous week. The subscription rate for the 182-day and 364-day papers increased to 112.2% and 52.3%, from 55.2% and 51.7%, respectively. The yields on the Treasury Bills recorded mixed performance, with the 91-day and 182-day papers yields declining by 1.5 bps and 0.7 bps to 7.3%, and 8.0%, respectively, while the yield on the 364-day paper increased by 7.3 bps to 9.2%. The government continued to reject expensive bids, accepting Kshs 17.9 bn of the Kshs 21.0 bn worth of bids received, translating to an acceptance rate of 85.5%.

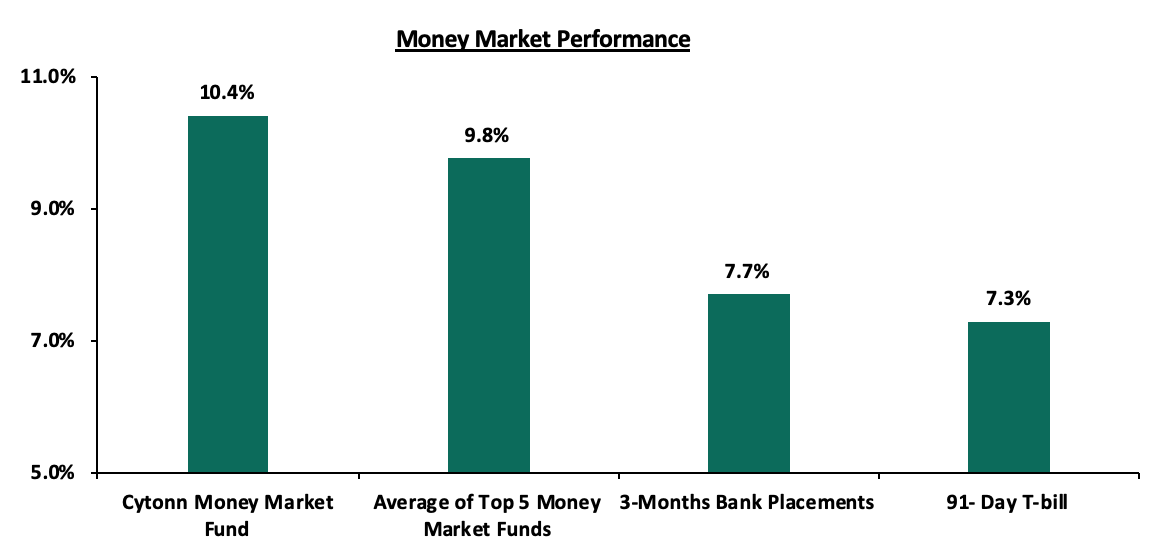

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yields on the 91-day T-bill decreased by 1.5 bps to 7.3%. The average yield of the Top 5 Money Market Funds remained relatively unchanged at 9.8%, while the yield on the Cytonn Money Market Fund decreased marginally by 0.1% points to 10.4%, from 10.5% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 17th December 2021:

|

|

Money Market Fund Yield for Fund Managers as published on 17th December 2021 |

|

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.4% |

|

2 |

Zimele Money Market Fund |

9.9% |

|

3 |

Nabo Africa Money Market Fund |

9.7% |

|

4 |

Sanlam Money Market Fund |

9.5% |

|

5 |

CIC Money Market Fund |

9.3% |

|

6 |

Madison Money Market Fund |

9.3% |

|

7 |

Apollo Money Market Fund |

9.0% |

|

8 |

GenCapHela Imara Money Market Fund |

8.8% |

|

9 |

Co-op Money Market Fund |

8.7% |

|

10 |

Dry Associates Money Market Fund |

8.7% |

|

11 |

British-American Money Market Fund |

8.5% |

|

12 |

Orient Kasha Money Market Fund |

8.4% |

|

13 |

ICEA Lion Money Market Fund |

8.3% |

|

14 |

NCBA Money Market Fund |

8.3% |

|

15 |

Old Mutual Money Market Fund |

7.3% |

|

16 |

AA Kenya Shillings Fund |

7.0% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets eased, with the average interbank rate declining to 4.3% from the 4.8% recorded the previous week, partly attributable to government payments, including Term Auction Deposits (TADs) maturities of Kshs 49.9 bn, which offset tax remittances and settlements of government securities. The average interbank volumes traded increased by 203.6% to Kshs 19.7 bn, from Kshs 6.5 bn recorded the previous week partly attributable to the eased liquidity ahead of the upcoming festive season.

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded mixed performance, with yields on the 12-year bond issued in 2019 and the 30-year bond issued in 2018 increasing marginally by 0.1% points to 6.8% and 8.2%, from 6.7% and 8.1%, respectively. The yields on the 10-year bond issued in 2014, 10-year bond issued in 2018, 7-year bond issued in 2019 and 12-year bond issued in 2021, remained unchanged at 4.4%, 5.9%, 5.7% and 6.6%, respectively. Below is a summary of the performance:

|

Kenya Eurobond Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

31-Dec-20 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

- |

|

30-Nov-21 |

4.4% |

6.2% |

8.4% |

6.0% |

7.1% |

7.0% |

|

10-Dec-21 |

4.4% |

5.9% |

8.1% |

5.7% |

6.7% |

6.6% |

|

13-Dec-21 |

4.4% |

5.9% |

8.2% |

5.7% |

6.8% |

6.6% |

|

14-Dec-21 |

4.4% |

5.9% |

8.2% |

5.8% |

6.8% |

6.7% |

|

15-Dec-21 |

4.4% |

6.0% |

8.2% |

5.8% |

6.9% |

6.7% |

|

16-Dec-21 |

4.4% |

5.9% |

8.2% |

5.7% |

6.8% |

6.6% |

|

Weekly Change |

0.0% |

0.0% |

0.1% |

0.0% |

0.1% |

0.0% |

|

MTD Change |

0.0% |

(0.3%) |

(0.2%) |

(0.3%) |

(0.4%) |

(0.3%) |

|

YTD Change |

0.5% |

0.7% |

1.2% |

0.8% |

0.9% |

- |

Source: CBK

Kenya Shilling:

During the week, the Kenyan shilling depreciated marginally by 0.1% against the US dollar to close the week at Kshs 113.0, from Kshs 112.9 recorded the previous week, mainly attributable to increased dollar demand from the oil and energy sectors. Key to note, this is the lowest the Kenyan shilling has ever depreciated against the dollar. On a YTD basis, the shilling has depreciated by 3.5% against the dollar, in comparison to the 7.7% depreciation recorded in 2020. We expect the shilling to remain under pressure for the remainder of 2021 as a result of:

- Rising uncertainties in the global market due to the Coronavirus pandemic, which has seen investors continue to prefer holding their investments in dollars and other hard currencies and commodities,

- Increased demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally,

- Widening current account deficit which stood at 5.4% of GDP in the 12-months to October 2021 compared to the 4.8% of GDP in the 12 months to October 2020 attributable to a higher import bill which offset increased receipts from agricultural and services exports and remittances, and,

- Rising global crude oil prices on the back of supply constraints at a time when demand is picking up with the easing of COVID-19 restrictions and as economies reopen. Key to note, risks abound this global recovery following the emergence of the new COVID-19 Omicron variant. We are of the view that should the variant continue to spread; most nations will respond swiftly by adopting stringent containment measures to curb the spread.

The shilling is however expected to be supported by:

- The Forex reserves, currently at USD 8.6 bn (equivalent to 5.3-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover. Key to note, the forex reserves have been steadily declining and are currently at a 3-month low. In addition, the reserves were boosted by the USD 1.0 bn proceeds from the Eurobond issued in July 2021 coupled with the USD 407.0 mn IMF disbursement and the USD 130.0 mn World Bank loan financing received in June 2021, and,

- Improving diaspora remittances evidenced by a 24.2% y/y increase to USD 320.1 mn in November 2021, from USD 257.7 mn recorded over the same period in 2020, which has continued to cushion the shilling against further depreciation.

Weekly Highlights:

- Fuel Prices

During the week, the Energy and Petroleum Regulatory Authority (EPRA) released their monthly statement on the maximum retail prices in Kenya effective 15th December 2021 to 14th January 2022. Notably, fuel prices remained unchanged at Kshs 129.7 per litre for Super Petrol, Kshs 110.6 per litre for Diesel and Kshs 103.5 per litre for Kerosene. Below are the key take-outs from the statement:

- The performance in fuel prices was attributable to:

- The fuel subsidy program under the Petroleum Development Fund which resulted in subsidies of Kshs 18.3 on Super Petrol, Kshs 21.9 on Diesel and Kshs 23.5 on Kerosene,

- Removal of suppliers margins of Kshs 6.3 on Super Petrol, Kshs 5.5 on Diesel and Kshs 7.7 on Kerosene, and,

- The decline in the Free on Board (FOB) price of Murban crude oil in October 2021 by 5.1% to USD 69.7 per barrel, from USD 73.5 per barrel in September 2021.

- The retention of fuel prices was despite:

- An increase in the average landed costs of Super Petrol by 3.6% to USD 627.8 per cubic meter in November 2021, from USD 606.1 per cubic meter in October 2021,

- Increase in the average landed costs of diesel by 7.0% to USD 600.2 per cubic meter in November 2021, from USD 561.1 per cubic meter in October 2021,

- Increase in the average landed costs of Kerosene by 15.8% to USD 604.4 per cubic meter in November 2021, from USD 522.1 per cubic meter in October 2021, and,

- Depreciation of the Kenyan shilling by 1.1% to Kshs 112.3 in November 2021, from Kshs 111.1 in October 2021.

Global fuel prices declined by 8.1% in the first two weeks of December 2021, but have increased by 46.8% on a YTD basis, to USD 73.7 from USD 50.2 at the end of 2020. The decline in global prices in December 2021 is attributable to reduced oil demand following the emergence of the Omicron corona virus variant which is expected to weigh down the global economic recovery as countries embark on restrictive measures to curb the spread of the virus.

Going forward, we expect muted pressure on the inflation basket as fuel prices which are among the major contributors to Kenya’s headline inflation remain constant following the Fuel Subsidy program. However, we believe the stabilization under the fuel subsidy program by the National Treasury will be unsustainable should the average landed costs of fuel keep rising. The National Treasury will also have to compensate the Oil Marketing companies and suppliers whose margins were decreased by 100.0% in the most recent review putting further strain on the program's viability.

- Revenue and Net Exchequer for FY’2021/2022

The National Treasury gazetted the revenue and net expenditures for the first five months of FY’2021/2022, ending 30th November 2021. Below is a summary of the performance:

|

FY'2021/2022 Budget Outturn - As at 30th November 2021 |

|||||

|

Amounts in Kshs billions unless stated otherwise |

|||||

|

Item |

12-months Original Estimates |

Actual Receipts/Release |

Percentage Achieved |

Prorated Estimates |

% achieved of prorated |

|

Opening Balance |

|

21.3 |

|

|

|

|

Tax Revenue |

1,707.4 |

688.1 |

40.3% |

711.4 |

96.7% |

|

Non-Tax Revenue |

68.2 |

30.7 |

45.0% |

28.4 |

108.0% |

|

Total Revenue |

1,775.6 |

740.0 |

41.7% |

739.8 |

100.0% |

|

External Loans & Grants |

379.7 |

11.8 |

3.1% |

158.2 |

7.5% |

|

Domestic Borrowings |

1,008.4 |

430.1 |

42.6% |

420.2 |

102.4% |

|

Other Domestic Financing |

29.3 |

4.2 |

14.2% |

12.2 |

34.0% |

|

Total Financing |

1,417.4 |

446.1 |

31.5% |

590.6 |

75.5% |

|

Recurrent Exchequer issues |

1,106.6 |

432.6 |

39.1% |

461.1 |

93.8% |

|

CFS Exchequer Issues |

1,327.2 |

472.5 |

35.6% |

553.0 |

85.4% |

|

Development Expenditure & Net Lending |

389.2 |

123.8 |

31.8% |

162.2 |

76.3% |

|

County Governments + Contingencies |

370.0 |

108.5 |

29.3% |

154.2 |

70.4% |

|

Total Expenditure |

3,193.0 |

1,137.4 |

35.6% |

1,330.4 |

85.5% |

|

Fiscal Deficit excluding Grants |

(1,417.4) |

(397.4) |

28.0% |

(590.6) |

67.3% |

|

Fiscal Deficit as a % of GDP* |

7.5% |

3.2% |

|

|

|

|

Total Borrowing |

1,388.1 |

441.9 |

31.8% |

578.4 |

76.4% |

|

*Projected Fiscal Deficit as a % of GDP |

|||||

The key take-outs from the report include:

- Total revenue collected as at the end of October 2021 amounted to Kshs 740.0 bn, equivalent to 41.7% of the original estimates of Kshs 1.8 tn and is 100.0% of the prorated estimates of Kshs 739.8 bn. Cumulatively, Tax revenues amounted to Kshs 688.1 bn, equivalent to 40.3% of the target of Kshs 1,707.4 bn and are 96.7% of the prorated estimates of Kshs 711.4 bn. Notably, this is the first time the revenues have not outperformed the prorated target in the first five months of the current fiscal year,

- Total financing amounted to Kshs 446.1 bn, equivalent to 31.5% of the original estimates of Kshs 1,417.4 bn and is 75.5% of the prorated estimates of Kshs 590.6 bn. The drag is on the external borrowings which is only at 7.5% of the prorated amounts as the government continues to seek cheaper debts and minimize servicing costs. Additionally, domestic borrowing amounted to Kshs 430.1 bn, equivalent to 42.6% of the original estimates of Kshs 1.0 tn and is 102.4% of the prorated estimates of Kshs 420.2 bn,

- The total expenditure amounted to Kshs 1,137.4 bn, equivalent to 35.6% of the original estimates of Kshs 3,193.0 bn, and is 85.5% of the prorated expenditure estimates of Kshs 1.3 tn. Additionally, the net disbursements to recurrent expenditures came in at Kshs 432.6 bn, equivalent to 39.1% of the original estimates and 93.8% of the prorated estimates of Kshs 461.1 bn, and development expenditure amounted to Kshs 123.8 bn, equivalent to 31.8% of the original estimates of Kshs 389.2 bn and is 76.3% of the prorated estimates of Kshs 162.2 bn,

- Consolidated Fund Services (CFS) Exchequer issues lagged behind their target of Kshs 1,327.2 bn after amounting to Kshs 472.5 bn, equivalent to 35.6% of the target, and are 85.4% of the prorated amount of Kshs 553.0 bn. The cumulative public debt servicing cost amounted to Kshs 417.8 bn which is 35.7% of the original estimates of Kshs 1,169.2 bn, and is 85.8% of the prorated estimates of Kshs 487.2 bn, and,

- Total Borrowings as at the end of November 2021 amounted to Kshs 441.9 bn, equivalent to 31.8% of the Kshs 1,388.1 bn target and are 76.4% of the prorated estimates of Kshs 578.4 bn. The cumulative domestic borrowing target of Kshs 1.0 tn comprises of adjusted Net domestic borrowings of Kshs 661.6 bn and Internal Debt Redemptions (Roll-overs) of Kshs 346.8 bn.

The revenue performance in the first five months of the current fiscal year point towards continued economic recovery following the ease of COVID-19 containment measures. Further, the total expenditures have remained below the prorated target in line with the government’s efforts to rationalize spending in a bid to narrow the fiscal deficit. Given that this is the first time revenues have not outperformed the prorated target, we expect KRA to implement more measures to boost revenue collection in the coming months. We also believe that the current measures as well as the implementation of the Finance Act 2021 which brought changes to the Excise Duty Tax, Income Tax as well as the Value Added Tax will play a big role in expanding the tax base and consequently enhance revenue collection. Additionally, should the government continue channelling funds to priority programmes, the expenditure levels are expected to remain below the target and consequently reduce the fiscal deficit. However, risks abound the outlook owing to the emergence of the Omicron variant which is expected to bring about new restrictive measures that will likely lead to a slowdown in economic recovery.

- IMF Second Review on Kenya’s Extended Fund Facility and Extended Credit Facility

During the week, the International Monetary Fund (IMF) completed the second review of the 38-month Extended Fund Facility (EFF) and Extended Credit Facility (ECF) - funded program. The completion of the review allows Kenya to access approximately USD 258.1 mn (Kshs 29.2 bn), bringing the total support from IMF to Kenya to USD 972.6 mn (Kshs 109.9 bn) in 2021. The decision follows Kenya’s sustained economic recovery from the COVID-19 pandemic especially in the second half of 2021 coupled with the improving revenue performance. We believe that the program will continue supporting Kenya’s COVID-19 response as well as the government's economic restructuring efforts, which were hampered by the pandemic. Furthermore, we believe that shifting from expensive commercial debts to concessional loans will reduce borrowing costs since such loans have more favourable terms and conditions than those offered by commercial finance markets, such as lower interest rates and deferred or income-contingent repayments. However, concerns remain elevated as more virus variants emerge, global financial conditions tighten and potential pressures ahead of the 2022 August elections heat up posing a downside risk to the economic recovery.

Rates in the fixed income market have remained relatively stable due to the tightened but sufficient levels of liquidity in the money markets. The government is 20.7% ahead of its prorated borrowing target of Kshs 316.6 bn having borrowed Kshs 382.1 bn of the Kshs 658.5 bn borrowing target for the FY’2021/2022. We expect a gradual economic recovery going into FY’2021/2022 as evidenced by KRAs collection of Kshs 740.0 bn in revenues during the first five months of the current fiscal year, which is equivalent to 100.0% of the prorated revenue collection target. However, despite the projected high budget deficit of 7.5% and the lower credit rating from S&P Global to 'B' from 'B+', we believe that the support from the IMF and World Bank will mean that the interest rate environment will remain stable since the government is not desperate for cash.

Markets Performance

During the week, the equities market recorded mixed performance, with NSE 25 and NASI gaining by 0.9% and 0.5%, respectively, while NSE 20 declined marginally by 0.1%. This week’s performance took their YTD performance to gains of 7.6% and 6.3% for NASI and NSE 25, respectively, with NSE 20 shedding by 1.0% on a YTD basis. The equities market performance was driven by gains recorded by banking stocks such as NCBA, Equity and KCB of 4.2%, 2.4% and 2.0%, respectively. The gains were however weighed down by losses recorded by other large cap stocks such as EABL and Standard Chartered Bank (SCB-K) which declined by 0.5% and 0.4%, respectively.

During the week, equities turnover declined by 41.6% to USD 20.5 mn, from USD 35.0 mn recorded the previous week, taking the YTD turnover to USD 1.2 bn. Foreign investors remained net sellers, with a net selling position of USD 4.3 mn, from a net selling position of USD 12.5 mn recorded the previous week, taking the YTD net selling position to USD 84.8 mn.

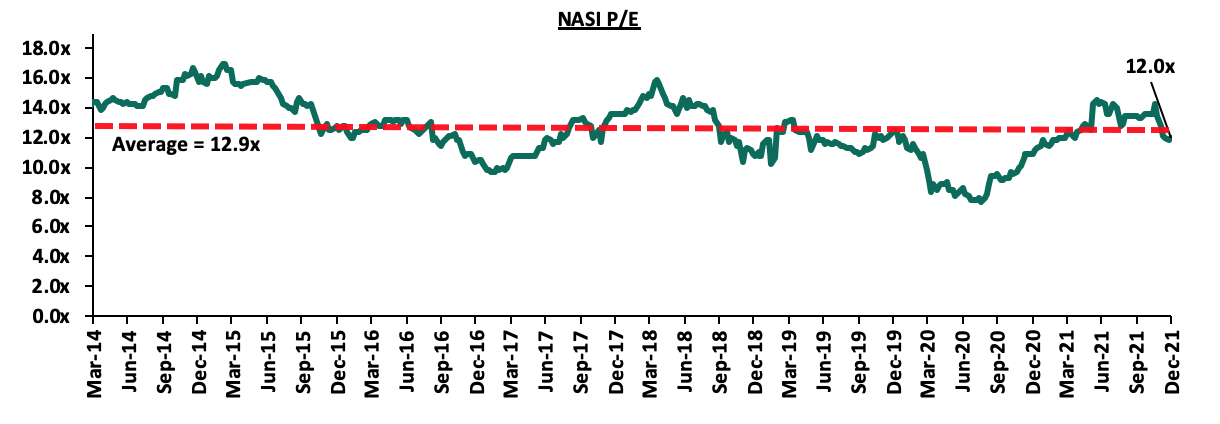

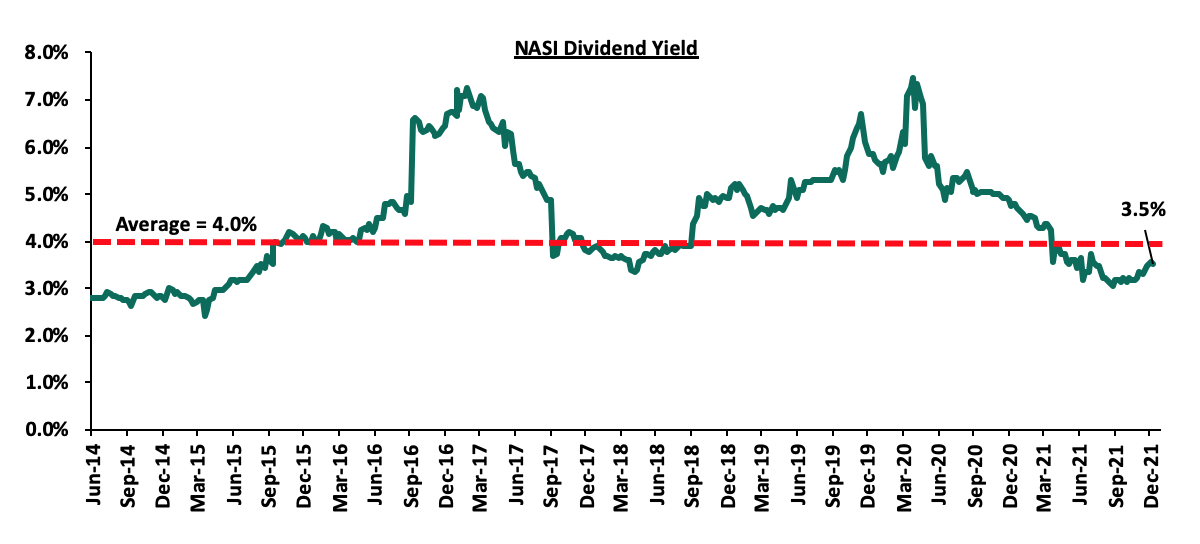

The market is currently trading at a price to earnings ratio (P/E) of 12.0x, 7.0% below the historical average of 12.9x, and a dividend yield of 3.5%, 0.5% points below the historical average of 4.0%. Key to note, NASI’s PEG ratio currently stands at 1.4x, an indication that the market is trading at a premium to its future earnings growth. Basically, a PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The current P/E valuation of 12.0x is 56.2% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Weekly highlight:

During the week, the Central Bank of Kenya (CBK), in collaboration with the Kenya National Bureau of Statistics (KNBS) and Financial Sector Deepening Trust (FSD) Kenya released the 2021 FinAccess Household Survey, highlighting that financial inclusion expanded by 0.8% points to 83.7% in 2021, from 82.9% in 2019. The Survey measures Financial Inclusion based on four main dimensions: Access, Usage, Quality and Impact/Welfare. Technological advances and innovations especially in mobile money and mobile banking has led to financial inclusion increasing significantly since the baseline survey conducted in 2006 when financial inclusion stood at 26.7%. During the period under review, mobile banking and bank services recorded the highest proportion of usage at 81.4% and 44.1%, from 79.4% and 40.8% in 2019, respectively. Other key highlights from the report are:

- 10.7% of those who reported to have borrowed, had defaulted (did not pay at all the loan borrowed), while those who indicated to have paid late on any loan taken/outstanding in 12 months to the Survey period was 38.2%. Mobile banking loans, digital loans and loans from friends/family recorded the highest rate of loan defaults at 50.9%, 46.3% and 41.8%, respectively,

- 14.4% of respondents who had a performing loan from banks and financial institutions applied for loan restructuring, with 76.8% of them being successful, and the period granted ranging between 4 months to 1 year, and,

- Mobile money users who reported loss of money stood at 47.4% in 2021, a significant increase from 8.4% in 2019, while loss of money through SACCOSs and Mobile Banking also increased to 15.6% and 11.5% in 2021, from 3.2% and 1.5% in 2019, respectively. The increase in risk of losing money was attributable to sending money to the wrong number, fraud and cyber-crime.

With financial inclusion increasing by 57.0% points to 83.7% over the last 15 years, we believe that the advancement in technological innovation will continue to drive growth in the Fintech industry. The COVID-19 pandemic created an acute demand for contactless financial solutions, and as a result, digital solutions proved essential in allowing clients to access their funds. However, we believe that the rate of loan defaults in the digital lending space will continue to be a concern in the medium term. Additionally, the suspension of the Credit Reference Bureau (CRB) listing by the CBK for loans under Kshs 5.0 mn will lead to opaqueness in the loan market and consequently lead to a slowdown of private sector credit as lenders become more risk averse.

Universe of coverage:

|

Company |

Price as at 10/12/2021 |

Price as at 17/12/2021 |

w/w change |

YTD Change |

Year Open 2021 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Kenya Reinsurance |

2.3 |

2.2 |

(3.1%) |

(3.9%) |

2.3 |

3.3 |

9.0% |

58.4% |

0.2x |

Buy |

|

I&M Group*** |

21.0 |

20.8 |

(0.7%) |

(53.6%) |

44.9 |

24.4 |

10.8% |

28.0% |

0.6x |

Buy |

|

KCB Group*** |

43.3 |

44.1 |

2.0% |

14.8% |

38.4 |

51.4 |

2.3% |

18.7% |

0.9x |

Accumulate |

|

Britam |

7.0 |

7.1 |

1.7% |

1.4% |

7.0 |

8.3 |

0.0% |

17.5% |

1.2x |

Accumulate |

|

Standard Chartered*** |

127.0 |

126.5 |

(0.4%) |

(12.5%) |

144.5 |

137.7 |

8.3% |

17.2% |

1.0x |

Accumulate |

|

Jubilee Holdings |

336.0 |

329.8 |

(1.9%) |

19.6% |

275.8 |

371.5 |

2.7% |

15.4% |

0.6x |

Accumulate |

|

Co-op Bank*** |

12.2 |

12.3 |

0.8% |

(2.0%) |

12.6 |

13.1 |

8.1% |

14.3% |

0.9x |

Accumulate |

|

NCBA*** |

24.1 |

25.1 |

4.2% |

(5.8%) |

26.6 |

26.4 |

6.0% |

11.3% |

0.6x |

Accumulate |

|

Diamond Trust Bank*** |

56.0 |

57.0 |

1.8% |

(25.7%) |

76.8 |

61.8 |

0.0% |

8.4% |

0.2x |

Hold |

|

Equity Group*** |

47.5 |

48.7 |

2.4% |

34.2% |

36.3 |

52.5 |

0.0% |

8.0% |

1.3x |

Hold |

|

Liberty Holdings |

7.2 |

7.2 |

1.1% |

(6.0%) |

7.7 |

7.8 |

0.0% |

7.4% |

0.5x |

Hold |

|

Stanbic Holdings |

92.3 |

92.5 |

0.3% |

8.8% |

85.0 |

94.7 |

4.1% |

6.5% |

0.8x |

Hold |

|

ABSA Bank*** |

11.1 |

11.2 |

1.4% |

17.6% |

9.5 |

11.9 |

0.0% |

6.3% |

1.1x |

Hold |

|

Sanlam |

11.5 |

11.5 |

0.0% |

(11.5%) |

13.0 |

12.1 |

0.0% |

5.3% |

1.2x |

Hold |

|

CIC Group |

2.2 |

2.1 |

(0.9%) |

1.4% |

2.1 |

2.0 |

0.0% |

(4.5%) |

0.7x |

Sell |

|

HF Group |

4.0 |

3.7 |

(5.8%) |

19.1% |

3.1 |

3.0 |

0.0% |

(21.0%) |

0.2x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in Key to note, I&M Holdings YTD share price change is mainly attributable to the counter trading ex-bonus issue |

||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.4x), we believe that investors should reposition towards companies with a strong earnings growth and are trading at discounts to their intrinsic value. We expect the discovery of new COVID-19 variants coupled with slow vaccine rollout in developing economies to continue weighing down the economic outlook. On the upside, we believe that the recent relaxation of lockdown measures in the country will lead to improved investor sentiments in the economy.

- Residential Sector

During the week, the National Government through the Principal Secretary for Housing, Honorable Charles Hinga, announced plans to begin the construction of 5,360 affordable units in Machakos County, dubbed ‘Mavoko Affordable Housing Programme’. The project is expected to take approximately 4 years and cost slightly above Kshs 20.0 bn. It will lie on a 55-acre piece of land adjacent to the just concluded Mavoko Sustainable Housing Development. The project is a partnership with the United Nations Habitat, with the main contractor being Epco Builders Limited, and will consist of 560-studio units, 960-one bedroom units, 2,400-two bedroom units, and, 1,440-three bedroom units.

The government of Kenya continues to initiate and implement various affordable housing projects which continue to gain momentum. This is supported by the high number of applicants registered in the Boma Yangu portal currently at 325,136. Some of the key affordable housing projects by the government include; i) Stoni Athi River Waterfront City housing project, ii) Park Road Project in Ngara, iii) Buxton Housing Project in Mombasa, and, iv) Starehe Affordable Housing project, among others. Conversely, challenges such as financial constraints, and inadequate infrastructure continue to impede the performance of the projects causing them to stall. Despite this, the completion of the project will;

- Provide affordable homes to citizens targeting affordable units,

- Improve living standards of citizens by enabling accessibility to decent houses, and,

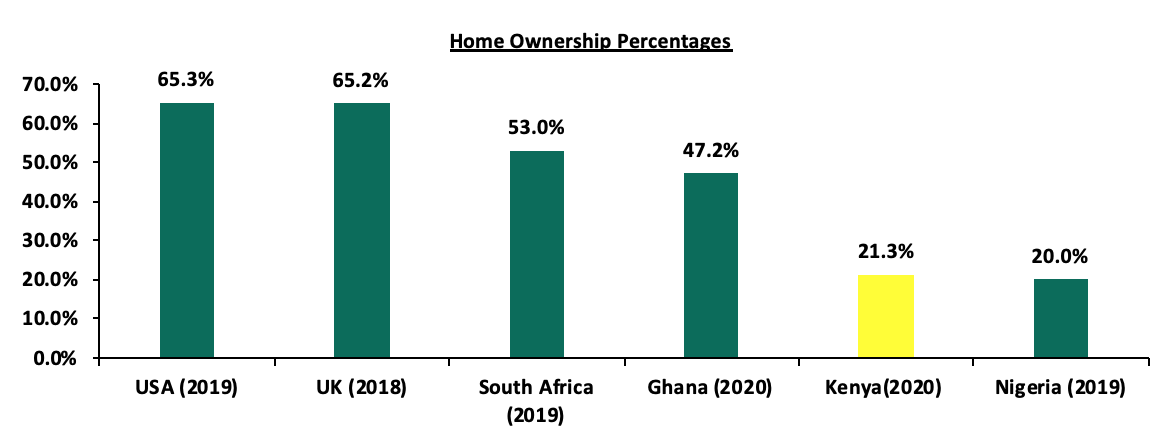

- Boost home ownership rates in Kenya which is currently low in the urban regions at 21.3% as at 2020, compared to other African countries such as South Africa and Ghana with 53.0% and 47.2% rates, respectively. The graph below shows the home ownership percentages of different countries compared to Kenya;

Source: Centre for Affordable Housing Africa, Federal Reserve Bank

We expect the residential sector to continue recording increased activities mainly supported by government’s efforts to initiate and develop affordable housing units for residents. Moreover, in November 2021, the Capital Markets Authority (CMA) approved the issuance of a Kshs 3.9 bn Medium Term Note (MTN) with an 18-month tenor and an interest rate of 11.0% p.a, which will be used to finance the construction of the ongoing Pangani Affordable Housing Project. This is a step in the right direction as it will boost the Affordable Housing (AH) program in the medium term.

- Infrastructure

During the week, the national government through the Kenya Rural Roads Authority (KeRRA) announced plans to revamp the 36.4 Km Lurambi road in Kakamega County. The construction which will cost approximately Kshs 1.7 bn, will take three years to complete and will be done in 4 phases in the following order; i) 15.0 Km Ikonyero-Akatsa section, ii) 8.0 Km Lunza-Ikolomani market stretch, iii) 5.6 Km Kwisero-Eshibinga section, and, iv) 7.8 Km Manyulia-Dudi section.

The improvement of the road infrastructure in Kakamega County is expected to spur the growth of Real Estate through;

- Opening up Surrounding Areas for Development: We believe that this will open up areas which were otherwise unattractive for investments through promoting accessibility,

- Reducing Development Costs: Infrastructural costs in Kenya account for approximately 14.0% of construction costs, according to the Centre for Affordable Housing Finance in Africa. Improving infrastructure therefore relieves the cost burden that would have otherwise been incurred by the developer, and,

- Higher Property Values: The existence of good road network will make the surrounding areas attractive for investments, and thus boost the demand and prices for the existing properties.

The government continues to initiate and implement numerous infrastructure projects in the country. Some of the ongoing projects include; i) Nairobi-Western Bypass, ii) Eastern Bypass dualing, and iii) Nairobi Expressway among many others. These have mainly been supported by the various strategies deployed by the government in order to realize its objective such as;

- Partnership strategies such as Joint Ventures and Public Private Partnerships that are cost effective ways of implementing projects,

- Issuing of infrastructure bonds in order to raise funds for construction purposes, and,

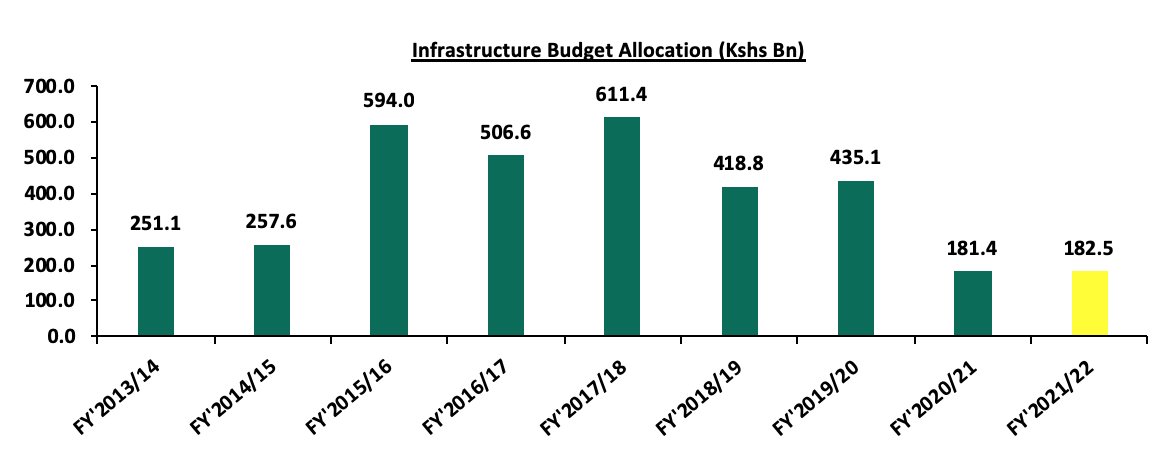

- Prioritizing projects in the yearly budget allocations such as the 6% points increase to Kshs 181.4 bn in FY’2020/21.

The graph below shows the budget allocation to the infrastructure sector over last nine financial years;

Source: National Treasury of Kenya

We expect the infrastructure sector to continue recording more construction, rehabilitation, and maintenance activities mainly driven by government’s aggressiveness to initiate and implement the same.

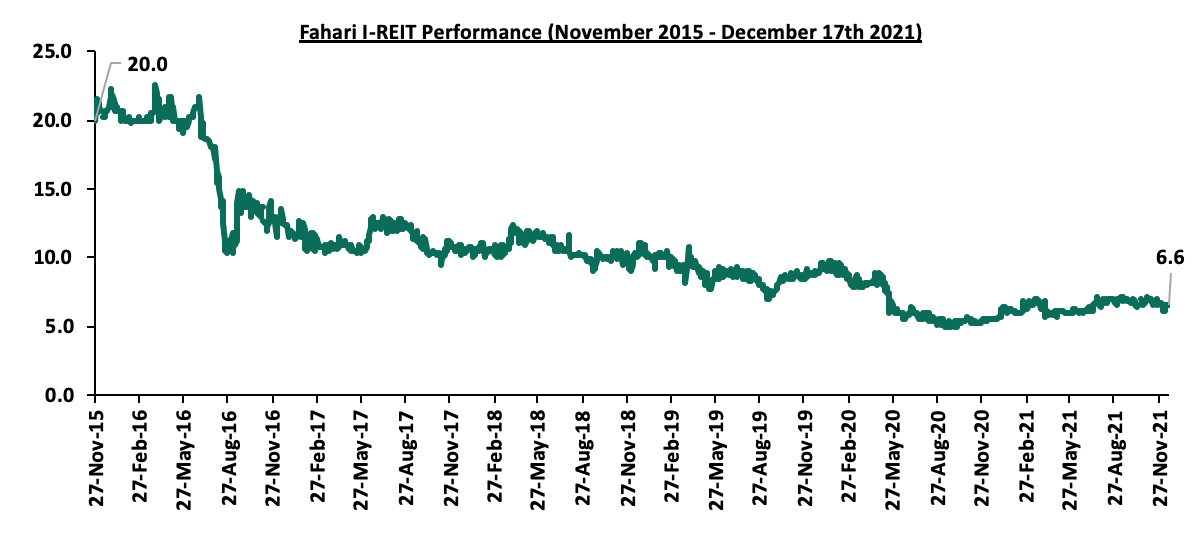

- Listed Real Estate

In the Nairobi Stock Exchange, ILAM Fahari I-Reit closed the week trading at an average price of Kshs 6.6 per share. This represented a 1.5% and 13.8% Week-to-Date (WTD) and Year-to-Date (YTD) increase, respectively, from Kshs 6.5 per share and Kshs 5.8 per share, respectively. However, on Inception-to-Date (ITD) basis, the REIT’s performance continues to be weighed down having realized a 67.0% decline from Kshs 20.0. This is attributed to; i) a general lack of knowledge on the financing instrument, ii) general lack of interest of the REIT by investors, and, iii) lengthy approval processes to get all the necessary requirements thus discouraging those interested in investing in it. The graph below shows Fahari I-REIT’s performance from November 2015 to 17th December 2021:

The performance of Kenyan Real Estate market is expected to be boosted by government’s continued efforts to develop low cost homes thereby improving the current home ownership rates, and continued focus on infrastructure developments opening various areas for investments. However, the low investor appetite in the Real Estate Investments Trusts (REITs) continues to be a challenge affecting real estate investments.

In 2021, the Kenyan shilling has depreciated by 3.5% against the US Dollar (USD), mainly attributable to the increased dollar demand by energy and general importers with Kenya largely being a net importer. Key to note, this decline, though lower than the 7.7% depreciation in 2020, has pushed the Kenyan Shilling to new all-time lows, with the shilling closing at Kshs 113.0 as at 17th December 2021. This poor performance of the shilling is mainly attributable to the increased dollar demand by energy and general importers, with Kenya largely being a net importer. Global oil prices have also increased during the year, attributable to the reopening of economies globally, which has seen demand outpace fuel supply, further inflating the country’s import bill and consequently weakening the shilling.

In the East African region, the currency markets have recorded a mixed performance, with the Ugandan and Tanzanian shillings gaining against the USD by 2.2% and 0.1% YTD, respectively, while the Rwandan Franc has recorded a YTD depreciation of 3.6%. With the Ugandan and Tanzania shillings appreciating amid the COVID-19 environment while the Kenyan shilling continues to depreciate is a cause for concern as Kenya has traditionally been the region’s economic powerhouse. Various concerns have also been raised on the country’s currency being overvalued, with the International Monetary Fund (IMF) in 2018 stating that the Kenyan currency is overvalued by 17.5%, based on several macroeconomic factors such the widening current account.

In this focus, we shall be focusing in detail the factors that have driven the performance of the Kenyan shilling in 2021. We shall cover the following:

- Historical Performance of the Kenyan Shilling,

- Factors driving the recent currency Performance,

- Outlook, and,

- Conclusion and recommendation.

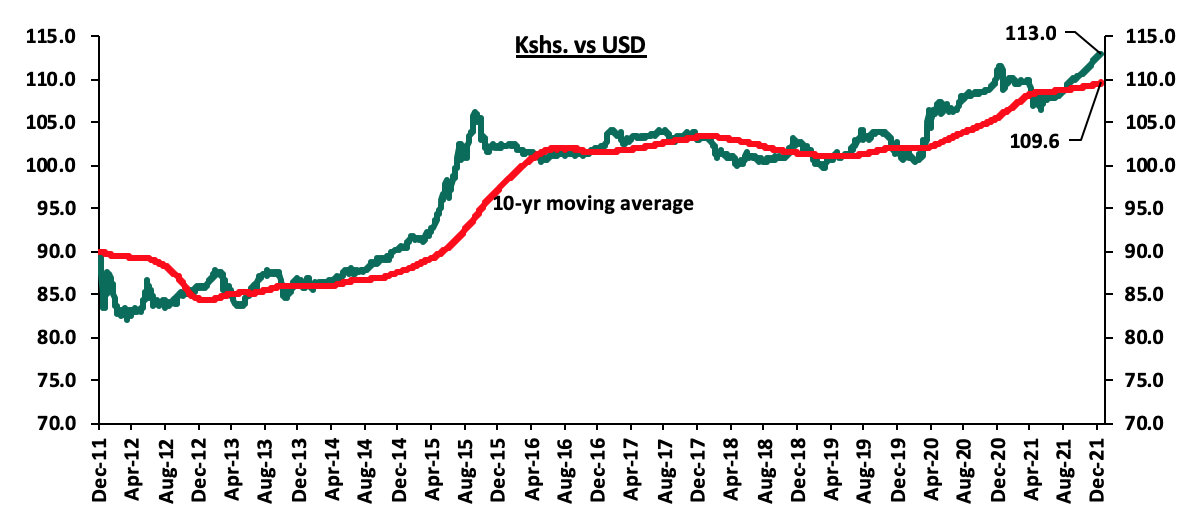

Section I: Historical Performance of the Kenyan Shilling

In the period 2013-2019, the Kenyan shilling remained relatively stable against the USD, however, the economic shocks occasioned by the COVID-19 pandemic in 2020 caused volatility of the shilling leading to a depreciation of 7.7% in 2020 and a further 3.5% in 2021, on a YTD Basis. The 2020 depreciation was mainly on the back of increased dollar demand as investors preferred holding onto hard currencies during the period, coupled with a decline in dollar inflows from both exports of goods and services like tourism. The chart below illustrates the performance of the Kshs against the USD over the last 8 years;

Source: Central Bank of Kenya

Below are some of the factors that have been supporting the shilling from further depreciation;

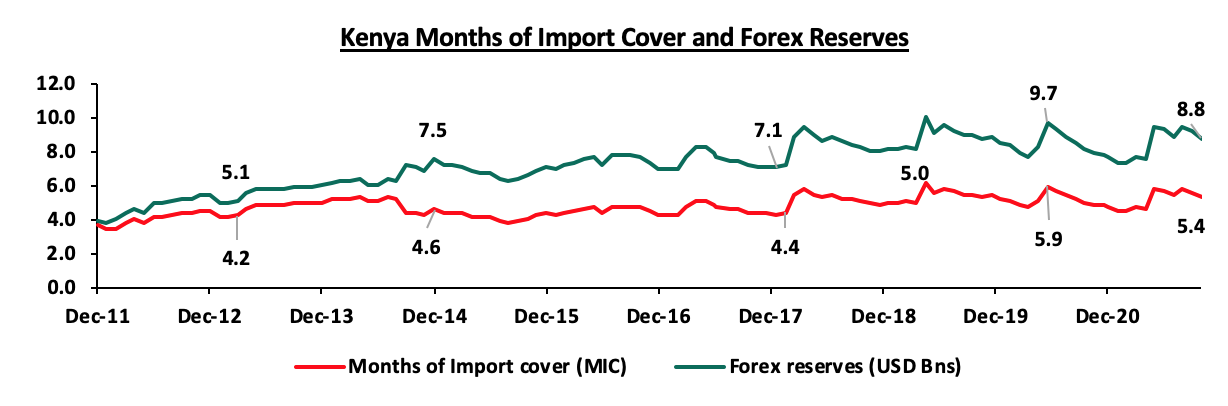

- Forex reserves held by the Central bank which are above the statutory requirement of 4.0-months of import cover, having grown by a 10-Year CAGR of 8.5% to USD 8.7 bn, equivalent to 5.4 months of import cover in November 2021, from USD 3.9 bn, equivalent to 3.4 months of import cover in November 2011.

The chart below shows the trend of the evolution of the forex reserves:

Source: Central Bank of Kenya

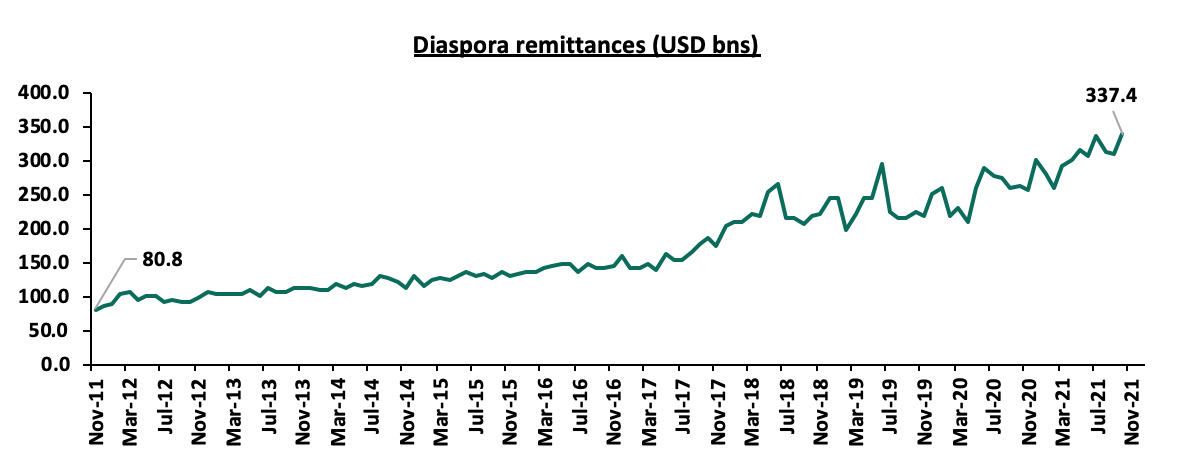

- Improving diaspora remittances, which have grown by a 10-year CAGR of 14.8% to USD 320.1 mn in November 2021, from USD 80.8 mn recorded in November 2011, attributable to the increasing Kenyan population in the diaspora and advancing technology that makes transfer of money easier and faster. The chart below shows the trend of the evolution of the Diaspora Remittances:

Source: Central Bank of Kenya

- Increase in value of some of the country’s principal exports such as horticulture exports which have grown by a 10-year CAGR of 7.9% to an estimate of Kshs 14.4 bn in September 2021, from Kshs 7.8 bn recorded in September 2011,

- Improved investment into the country as measured by the FDI flows into the country which had grown significantly by a 4-year CAGR of 16.4% to USD 1.1 bn in 2019, from USD 0.6 bn in 2015. However in 2020, FDI flows into the country declined by 34.7% to USD 0.7 bn mainly attributable to muted investor activity during the COVID-19 peak and tightened ownership rules that required companies such as those in the technology sector to have a 30.0% local ownership, and,

- Inflows from the Multilateral lenders for various loan facilities such as the USD 750.0 mn (Kshs 8.2 bn) from the World Bank and the USD 2.3 bn (Kshs 256.0 bn) from the IMF advanced to the country to boost COVID-19 recovery efforts.

Despite these factors, the shilling has been put under pressure mainly by fluctuating Global oil prices leading to a high dollar demand from energy and oil suppliers which outweighs supply, and a growing import bill, that has grown by a 10-year CAGR of 5.6% to Kshs 190.3 bn in September 2021, from Kshs 123.7 bn in September 2011.

Section III: Factors behind current currency performance

In 2021, the shilling has recorded an YTD depreciation of 3.5% against the USD, after a 7.7% depreciation in 2020. The shilling has been recording all-time lows against the USD since November 9th 2021. In this section, we will analyze the key factors behind the performance of the Kenyan Shilling in 2021:

- Increased global oil prices

The main reason behind the current Kenyan shilling performance can be attributed to the increasing global crude oil prices, with crude oil accounting for 17.7% of total imports as of September 2021. The high prices have increased the demand for dollars from oil and energy importers who have to increase the amounts they pay for oil imports and hence depleting dollar supply in the market. As a result, this has continued to exert downward pressure on the shilling. On a YTD basis, the Murban Oil that Kenya imports has increased by 45.0% to USD 74.7 per barrel, from USD 51.5 per barrel recorded on 31st December 2020, mainly attributable to reopening of economies as COVID-19 infection rates reduced during the year and supply chain bottle necks.

However, following discovery of new strains around the globe, oil prices have slightly reduced from levels witnessed in October when the price of Murban Oil was at USD 85.6 per barrel. The slight reduction in prices is mainly attributable to reduced oil demand in Europe as a result of the Omicron COVID-19 variant that has necessitated lockdowns and restrictions in some economies. Prices of crude oil are expected to remain relatively high and as such will continue to exert downward pressure on the shilling.

- Shortage of the USD following reopening of economies in 2021

Following the peak of COVID-19 pandemic in 2020, most global economies went on a slowdown due to restrictions and lockdowns that curbed economic growth. However, in 2021, following the discovery of vaccines, vaccine accessibility and vaccine inoculation, most economies have continued to rebuild hence increasing the global demand for the USD for global trade. Dollar demand around the globe has starved dollar supply in developing markets leading to depreciation of most currencies against the dollar.

- Balance of payments

According to the Q2’2021 Balance of Payments report released by the Kenya National Bureau of Statistics (KNBS), Kenya’s current account deficit expanded by 28.1% in Q2’2021, to Kshs 110.1 bn, from Kshs 85.9 bn recorded in a similar period of review in 2020. This was attributed to a robust increase in merchandise imports by 38.9% to Kshs 451.0 bn in Q2’2021, from Kshs 324.6 bn in Q1’2020 as compared to a 29.0% increase in merchandise exports to Kshs 179.7 bn, from Kshs 139.1 bn in Q2’2020. Though the exports gradually increased in Q2’2021 on account of increase in value of exports of horticulture which recorded increase of 47.0%, they were weighed down by declines in exports of other commodities such as tea and coffee which declined by 7.5% and 3.0%, respectively. The more aggressive growth in imports is still worrying and continues to put pressure on the shilling. Moreover, the high fuel prices currently witnessed in the country are likely to increase the import bill. During the period from January to September 2021, the import bill surged by 28.0% to Kshs 1.5 tn as compared to Kshs 1.2 tn in January to September 2020. We believe that this high import bill will continue weighing on the improving current account balance and as such, we expect the shilling to continue destabilizing against other currencies.

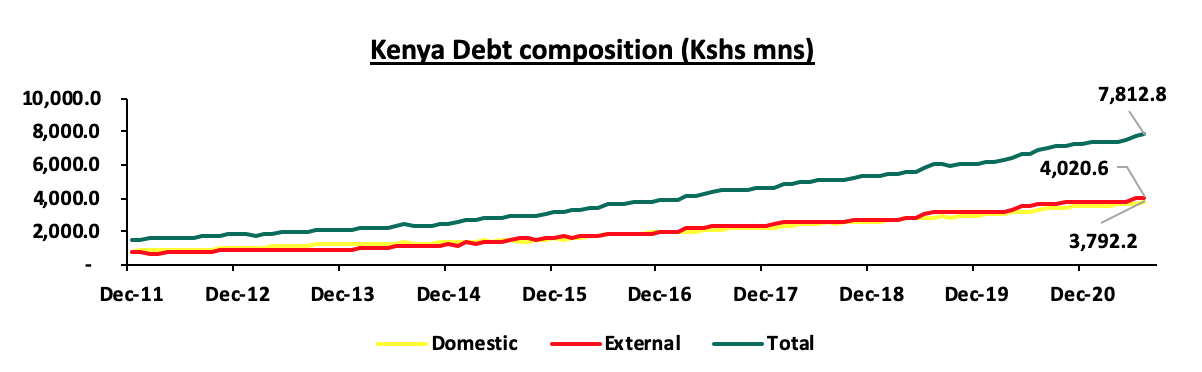

- Government debt

Kenya’s public debt has continued to grow aggressively, increasing at a 10-year CAGR of 17.7% to Kshs 7.8 tn in July 2021, from Kshs 1.5 tn in July 2011. Out of the current loan stock, external debt has grown at a faster 10-year CAGR of 18.4% to Kshs 4.0 tn in July 2021, from 0.7 tn in July 2021 as compared domestic debt, which has grown at a 10-year CAGR of 17.1% to Kshs 3.8 tn in July 2021, from Kshs 0.8 tn in July 2011. The rising external debt, whose composition is currently 66.6% USD denominated, has continued to weigh down on the shilling as the government through the CBK has to continually dig into its forex reserves for external debt servicing. Also, demand for hard dollars to meet debt servicing requirements is bound to increase upon formal expiry of the Debt Servicing Suspension Initiative (DSSI) in December 2021. Currently, Kenya’s debt stands at Kshs 7.8 tn, of which Kshs 4.0 tn is external debt as highlighted in the chart below:

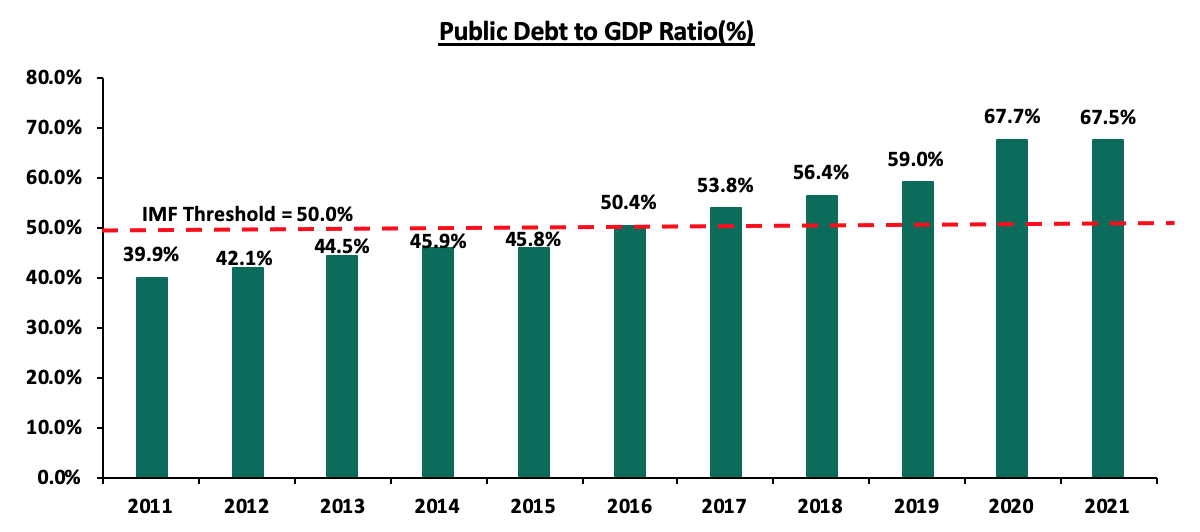

Kenya’s debt to GDP ratio came in at 67.5% in June 2021, 17.5% points above the IMF’s recommended threshold of 50.0% for developing countries. Below is a graph highlighting the trend in the country’s debt to GDP ratio;

Source: Central Bank of Kenya, Kenya National Bureau of Statistics

- Forex Reserves

In the period leading to May 2021, Kenya’s Forex Reserves were dwindling, with May 2021 recording a 9.4% decline to USD 7.5 bn (4.6 months import cover), from USD 8.3 bn (5.2 months imports cover) in May 2020. The dwindling forex reserves seen during the period can be attributed to low inflows from key sectors such as tourism. However, the USD 314.0 mn disbursement from the International Monetary Fund (IMF) to the government earlier in April and the USD 407.0 mn approved by the IMF under the Extended Fund Facility and Extended Credit Facility in June 2021 supported the reserves as they increased by 26.4% to Kshs 9.5 bn in June 2021 from Kshs 7.5 bn in May 2021. However, the reserves have come under increasing pressure partly due to debt service obligations and release of dollars into the market to act as buffers against volatility of the shilling.

Currently, the forex reserves stand at Kshs 8.6 bn as at 16th Dec 2021, equivalent to 5.3 months of import cover, which is an 8.0% decline from the Kshs 9.5 bn in June 2021, equivalent to 5.8 months of import cover. Going forward, the elevated debt levels witnessed in the country are likely to put forex reserves under pressure as a significant amount will be used to repay the debts. As a consequence, the Kenyan shilling will be exposed to foreign exchange volatility causing it to weaken. However, we expect the reserves to be supported by increasing diaspora remittance inflows, continued investor capital inflows and increasing exports as the key trading partners continue to contain the virus and re-open their economies.

- Monetary Policy

The Central Bank Rate (CBR) was revised down to 7.00% from 8.25% in January 2020 to support the local economy. Despite this, the yields on government securities have remained high and attractive. Inflation rates have also remained relatively stable and within the government’s target of 2.5% - 7.5%. This is mainly attributable to fuel prices having remained stable due to the application of fuel subsidies under the Petroleum Development Fund despite increase in global fuel prices. As such, we do not expect the CBK to increase the rates as the Central Bank is mainly focused on the continuous recovery of the economy.

Outlook:

|

Driver |

Outlook |

Effect on the currency |

|

Balance of Payments |

·We expect gradual improvement in the export sector as Kenya’s trading partners continue to reopen. However, the high import bill is expected to weigh down on the Current Account balance due to an increase in merchandise trade deficit attributable to the increase in global fuel prices, persistent disruptions in supply chains and logistical bottlenecks. |

Neutral |

|

Government Debt |

·We expect the government to borrow aggressively to plug in the high fiscal deficit which is projected at 7.5% of GDP for the FY’2021/22 budget. Also, Kenya’s debt to GDP ratio came in at an estimated 71.7% as of June 2021, 21.7% points above the IMF recommended threshold of 50.0% for developing nations. Slow revenue growth amid weak fiscal consolidation places the country at risk of debt distress, and, ·The high debt burden especially external debt will continue to expose the shilling to exchange rate shocks and will, in turn, emanate pressure on the shilling to weaken during the repayment period. |

Negative |

|

Forex Reserves |

·Elevated debt levels witnessed in the country are likely to put forex reserves under pressure as most of it will be used to finance the debts and the expiry of the Debt Service Suspension Initiative is set to increase amounts due and put the shilling under more pressure, and, ·In our view, forex reserves will continue to be supported by; debt relief from institutions such as the IMF, increasing diaspora remittance inflows, continued investor capital inflows with hope for an economic recovery and increasing exports as the key trading partners continue to re-open their economies, |

Negative |

|

Monetary Policy |

·Inflation rates have remained within the government’s target of 2.5% - 7.5% despite the high fuel prices and as such, we do not expect the CBK to increase the rates as the Central Bank is mainly focused on reviving the economy, and, ·Domestic investment activities have declined as Kenya’s financial and capital assets have become less appealing to investors on account of the lower real rate of return. |

Neutral |

From the above currency drivers, 2 are negative (Government Debt, Forex reserves), while 2 are neutral (Balance of Payment, Monetary Policy) indicating that currency rates remain uncertain and will likely edge upwards.

Section V: Conclusion and our view going forward

Based on the factors discussed above and factoring in the discovery of new strains of COVID-19 that continue to hamper economic development;

- We expect the Kenyan shilling to weaken within a range of Kshs 109.1 and Kshs 116.6 against the USD in the medium term based on the Purchasing Power Parity (PPP) and Interest Rate Parity (IRP) approach. In 2021, we expect the shilling to close the year at a range of Kshs 112.1 to Kshs 114.1, with a bias of a 3.9% depreciation on account of:

- High global oil prices which continue to lead to high costs of oil imports,

- Persisting supply chain bottle neck constraints that continue to increase the costs of imports, and,

- Ever present current account deficit due to an imbalance between imports and exports.

In our view, the current pressure on the shilling is a cause of concern and is unlikely to reduce in the near term. Continuous depreciation of the shilling is set to have a negative effect on the economy as imports costs will continue to increase, and this will be passed on to consumers hence elevating the current inflation levels. In as much as most of the factors contributing to depreciation of the shilling during the year are external, we are of the opinion that the Government and the CBK should take actionable steps to mitigate further depreciation of the shilling. These include;

- Building an export driven economy - This can be achieved by promoting export oriented policies and manufacturing to increase exports, thus improving the current account while at the same time reducing imports to preserve our foreign exchange reserves. Exports should also undergo value addition before leaving the country in order to increase purchase value and competitiveness. This will go a long way to stabilize the exchange rate,

- Reducing the mix of commercial loans which attract high interest rates - The Kenyan government should move towards reducing the share of commercial borrowing as compared to concessional borrowing so as to reduce amounts paid in debt service. Reduced debt service amounts would greatly help to bring down demand for the greenback and stabilise the exchange rate,

- Diversification of the economy to avoid over-reliance on agriculture and tourism - Kenya’s brand, location and skilled workforce uniquely positions the country to be a financial hub, but we will have to fundamentally rethink our capital markets infrastructure and regulatory frameworks. We have seen Mauritius, which is primarily a financial hub, benefit greatly from the diversification of their economy. Mauritius has a developed mixed economy hinged on different sectors such as manufacturing, financial services which have been increasing their share of GDP and has constantly been diversifying from agriculture and tourism unlike earlier years,

- Capital Markets Authority to encourage local capital formation rather than foreign capital, which has to be repatriated – The current Capital markets structure in Kenya is foreign investors and capital dominated and as such, companies have to repatriate profits and dividend in dollars which starves the market dollars and further weakens the shilling, and,

- Work with the private sector to encourage Kenyan’s living abroad to invest back in the country - Despite the fact that the remittances have increased, there is potential for much more to come into the country if we develop and implement an active diaspora investment strategy and engagement.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.