Role of Trustees in the Capital Markets in Kenya, & Cytonn Weekly #31/2021

By Cytonn Research, Aug 8, 2021

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 99.8%, an increase from the 69.6% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 6.1 bn against the Kshs 4.0 bn offered, which translates to a subscription rate of 152.3%, a decline from the 252.1% recorded the previous week. Investors’ continued interest in the 91-day paper during the week is mainly attributable to the paper’s higher return on a risk adjusted basis. The subscription rate for the 182-day paper increased to 150.2%, from 32.1% recorded the previous week, while the subscription rate for the 364-day paper declined to 28.3%, from 34.0% recorded the previous week. The yields on the 91-day and 182-day papers increased by 2.7 bps and 8.0 bps to 6.5% and 7.0%, respectively, while the yields on the 364-day paper declined by 2.7 bps to 7.4%.

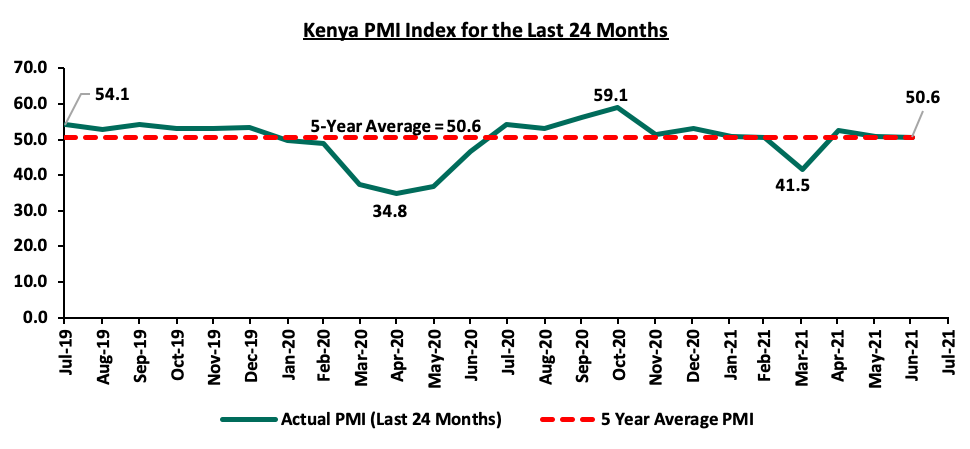

During the week, Stanbic Bank released its monthly Purchasing Managers’ Index (PMI) highlighting that the index for the month of July 2021 decreased to 50.6 from the 51.0 recorded in June 2021, which was a second decline in a row, indicating that the business conditions in the Kenyan private sector recorded an expansion but at a slower rate than that seen in June 2021;

Equities

During the week, the equities market recorded a mixed performance, with NASI and NSE 25 gaining by 0.6% and 0.7%, respectively, while NSE 20 remained unchanged, taking their YTD performance to gains of 17.4%, 5.4% and 14.9% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was mainly driven by gains recorded by banking stocks such as KCB Group, Equity Group and Standard Chartered Bank Kenya (SCBK) which gained by 2.3%, 2.2% and 1.2%, respectively. The gains were however weighed down by losses recorded by stocks such as BAT, ABSA and NCBA which declined by 2.4%, 1.4% and 1.3%, respectively;

Real Estate

During the week, the Central Bank of Kenya (CBK) released the Monetary Policy Committee Hotel Survey-July 2021, a survey intended to assess the extent of the recovery of the hospitality sector, highlighting an increase in the number of operational hotels and bed occupancies. In the residential sector, Centum Real Estate, a real estate developer, partnered with NCBA Bank Kenya to provide mortgage financing to both qualified salaried and self-employed Kenyans to access over 5,000 units under development by the firm;

Focus of the Week

On 29th June 2021, the President of Kenya assented to the Finance Act, 2021 which amongst other changes, introduced provisions for the registration and regulation of corporate trustees in the retirement benefits industry. The Act further gave the Retirements Benefits Authority (RBA) powers to refine the eligibility and suitability requirements for registration of a corporate trustee for example setting out the minimum capital requirements. Additionally, in 2020, the Capital Markets Authority (CMA) granted a no-objection to Goal Advisory Africa Limited, the first non-banking institution, to act as a Collective Investment Scheme (CIS) Corporate Trustee. It is due to these recent developments that we chose to take an in-depth look into the roles of trustees in the Kenyan capital markets and the legal framework around the operations of trustees, with a recommendation that CMA needs to follow the footsteps of RBA and clearly set out and enact the eligibility requirements of a trustee and the application process.

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.70%. To invest, just dial *809#;

- Cytonn High Yield Fund closed the week at a yield of 15.59% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest you just dial *809#;

- We continue to offer Wealth Management Training daily, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns. See further details here: Summary of Investment-ready Projects;

- For recent news about the group, see our news section here.

Hospitality Updates:

- We currently have promotions for Staycations, visit cysuites.com/offers for details or email us at sales@cysuites.com;

- Share a meal with a friend during the Sunday Brunch at The Hive Restaurant at Cysuites Hotel and Apartment. Every Sunday from 11.00 AM to 4.00 PM at a price of Kshs 2,500 for Adults and Kshs 1,500 for children under 12 years;

Money Markets, T-Bills & T-Bonds Primary Auction:

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 99.8%, an increase from the 69.6% recorded the previous week. The 91-day paper recorded the highest subscription rate, receiving bids worth Kshs 6.1 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 152.3%, a decline from the 252.1% recorded the previous week. Investors’ continued interest in the 91-day paper during the week is mainly attributable to the paper’s higher return on a risk adjusted basis. The subscription rate for the 182-day paper increased to 150.2%, from 32.1% recorded the previous week, receiving bids worth Kshs 15.0 bn against the offered amounts of Kshs 10.0 bn, while the subscription rate for the 364-day paper declined to 28.3%, from 34.0% recorded the previous week, receiving bids worth Kshs 5.6 bn against the offered amount of Kshs 10.0 bn. The yields on the 91-day and 182-day papers increased by 2.7 bps and 8.0 bps to 6.5% and 7.0%, respectively, while the yields on the 364-day paper declined by 2.7 bps to 7.4%. The government continued to take advantage of the low yields and the high liquidity in the market by accepting Kshs 22.9 bn out of the Kshs 23.9 bn worth of bids received, translating to an acceptance rate of 95.8%.

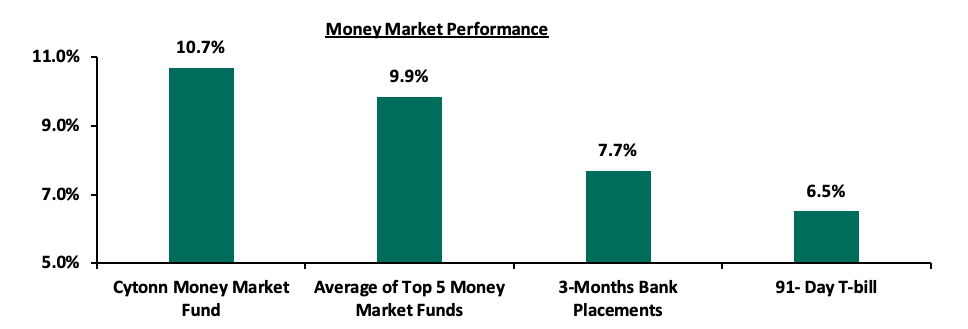

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 2.7 bps to 6.5%. The average yield of the Top 5 Money Market Funds increased marginally by 0.1% points to 9.9%, from the 9.8% recorded the previous week. The yield on the Cytonn Money Market Fund increased marginally by 0.1% points to 10.7%, from 10.6% recorded last week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 6th August 2021:

|

Money Market Fund Yield for Fund Managers as published on 6th August 2021 |

|||

|

Rank |

Fund Manager |

Daily Yield |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.16% |

10.70% |

|

2 |

Nabo Africa Money Market Fund |

9.52% |

9.95% |

|

3 |

Zimele Money Market Fund |

9.56% |

9.91% |

|

4 |

Madison Money Market Fund |

8.98% |

9.40% |

|

5 |

CIC Money Market Fund |

8.99% |

9.31% |

|

6 |

Sanlam Money Market Fund |

8.85% |

9.25% |

|

7 |

Co-op Money Market Fund |

8.35% |

8.71% |

|

8 |

GenCap Hela Imara Money Market Fund |

8.35% |

8.71% |

|

9 |

Dry Associates Money Market Fund |

8.34% |

8.66% |

|

10 |

Orient Kasha Money Market Fund |

8.28% |

8.60% |

|

11 |

British-American Money Market Fund |

8.20% |

8.51% |

|

12 |

ICEA Lion Money Market Fund |

8.01% |

8.34% |

|

13 |

NCBA Money Market Fund |

8.02% |

8.32% |

|

14 |

Apollo Money Market Fund |

8.40% |

8.27% |

|

15 |

Old Mutual Money Market Fund |

7.11% |

7.35% |

|

16 |

AA Kenya Shillings Fund |

6.58% |

6.79% |

Liquidity:

The money markets remained liquid during the week, with the average interbank rate coming in at 3.2%, similar to what was recorded the previous week, partly attributable to tax remittances which offset government payments. The average interbank volumes increased by 142.5% to Kshs 9.9 bn, from Kshs 4.1 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded mixed performance, with the yields on the 10-year bond issued in 2018 and 7-year bond issued in 2019 increasing to 5.3%, and 4.8% respectively, from 5.2% and 4.6% recorded the previous week, while the yield on the 30-year bond issued in 2018 and the 12-year bond issued in 2019 remained unchanged at 7.3% and 6.2%, respectively. On the other hand, the yields on the 10-year bond issued in 2014 and 12-year bond issued in 2021 declined to 3.2% and 6.1% from 3.3% and 6.2%, respectively. Below is a summary of the performance:

|

Kenya Eurobond Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

31-Dec-2020 |

3.9% |

5.2% |

7.0% |

4.9% |

5.9% |

- |

|

30-Jul-21 |

3.3% |

5.2% |

7.3% |

4.6% |

6.2% |

6.2% |

|

2-Aug-21 |

3.3% |

5.3% |

7.3% |

4.8% |

6.2% |

6.2% |

|

3-Aug-21 |

3.3% |

5.4% |

7.3% |

4.8% |

6.1% |

6.1% |

|

4-Aug-21 |

3.2% |

5.3% |

7.3% |

4.8% |

6.1% |

6.1% |

|

5-Aug-21 |

3.2% |

5.3% |

7.3% |

4.8% |

6.2% |

6.1% |

|

6-Aug-21 |

3.2% |

5.3% |

7.3% |

4.8% |

6.2% |

6.1% |

|

Weekly Change |

(0.1%) |

0.1% |

0.0% |

0.2% |

0.0% |

(0.1%) |

|

MTD Change |

(0.1%) |

0.1% |

0.0% |

0.2% |

0.0% |

(0.1%) |

|

YTD Change |

(0.7%) |

0.1% |

0.3% |

(0.1%) |

0.3% |

- |

Source: Reuters

Kenya Shilling:

During the week, the Kenyan shilling depreciated by 0.1% against the US dollar to close the week at Kshs 108.7, from Kshs 108.6 recorded the previous week, mainly due to dollar demand from commodity importers outweighing the supply of dollars from exporters. On a YTD basis, the shilling has appreciated by 0.4% against the dollar, in comparison to the 7.7% depreciation recorded in 2020. Despite the recent appreciation of the shilling, we expect the shilling to remain under pressure in 2021 as a result of:

- Rising uncertainties in the global market due to the Coronavirus pandemic, which has seen investors continue to prefer holding their investments in dollars and other hard currencies and commodities,

- The widened current account position which increased by 0.2% points to 5.4% of GDP in the 12 months to June 2021 from 5.2% of GDP for a similar period in 2020, and,

- Demand from merchandise traders as they beef up their hard currency positions in anticipation for more trading partners reopening their economies globally.

The shilling is however expected to be supported by:

- The Forex reserves, currently at USD 9.4 bn (equivalent to 5.7 months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and the EAC region’s convergence criteria of 4.5-months of import cover, and,

- Improving diaspora remittances evidenced by a 6.0% y/y increase to USD 305.9 mn in June 2021, from USD 288.5 mn recorded over the same period in 2020, which has continued to cushion the shilling against further depreciation.

Weekly Highlight:

Stanbic PMI Index July 2021

The headline Purchasing Managers’ Index (PMI) for the month of July 2021 decreased to 50.6 from the 51.0 recorded in June 2021, which was a second decline in a row, indicating that the business conditions in the Kenyan private sector recorded an expansion but at a slower rate than that seen in June 2021. The expansion in the business conditions is attributable to an improvement observed in sectors such as construction, agriculture and services which recorded growth in new orders and output. However, there was an increase in input and output cost which was attributable to the increase in oil prices and the introduction of new taxes in the month of July. See below a chart summarizing the evolution of the PMI over the last 24 months:

*** Key to note, a reading above 50.0 signals an improvement in business conditions, while readings below 50.0 indicate a deterioration

In line with the decline of the PMI index reading for the month of July 2021, we maintain a cautious outlook in the short-term owing to the increasing cost pressures, slowing sales growth and more worryingly, concerns of an uptick in Covid-19 infections. The discovery of new variants, especially the Delta variant, which is more easily transmissible might lead to another wave of infections and more restrictions that will affect the business environment.

Rates in the fixed income market have remained relatively stable due to the high liquidity in the money markets, coupled with the discipline by the government as they reject expensive bids. The government is 9.1% ahead its prorated borrowing target of Kshs 76.0 bn having borrowed Kshs 82.9 bn in FY’2021/2022. We expect a gradual economic recovery going into FY’2021/2022 as evidenced by KRA collecting Kshs 1.7 tn in FY’2020/2021, a 3.9% increase from Kshs 1.6 tn collected in the prior fiscal year. However, despite the projected high budget deficit of 7.5% and the lower credit rating from S&P Global to 'B' from 'B+', we believe that the monetary support from the IMF and World Bank will mean that the interest rate environment may stabilize since the government will not be desperate for cash.

Markets Performance

During the week, the equities market recorded a mixed performance, with NASI and NSE 25 gaining by 0.6% and 0.7%, respectively, while NSE 20 remained unchanged, taking their YTD performance to gains of 17.4%, 5.4% and 14.9% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was mainly driven by gains recorded by banking stocks such as KCB Group, Equity Group and Standard Chartered Bank Kenya (SCBK) which gained by 2.3%, 2.2% and 1.2%, respectively. The gains were however weighed down by losses recorded by stocks such as BAT, ABSA and NCBA which declined by 2.4%, 1.4% and 1.3%, respectively.

During the week, equities turnover decreased by 12.0% to USD 13.7 mn, from USD 15.6 mn recorded the previous week, taking the YTD turnover to USD 740.7 mn. Foreign investors remained net sellers, with a net selling position of USD 2.2 mn, from a net selling position of USD 1.3 mn recorded the previous week, taking the YTD net selling position to USD 28.4 mn.

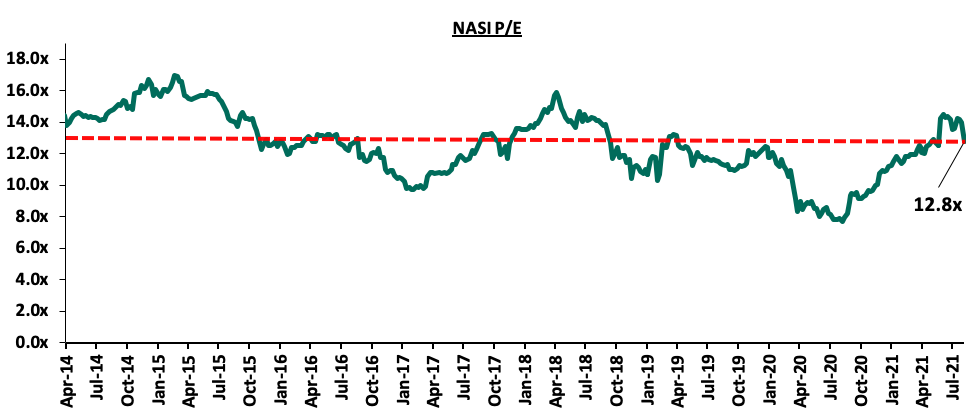

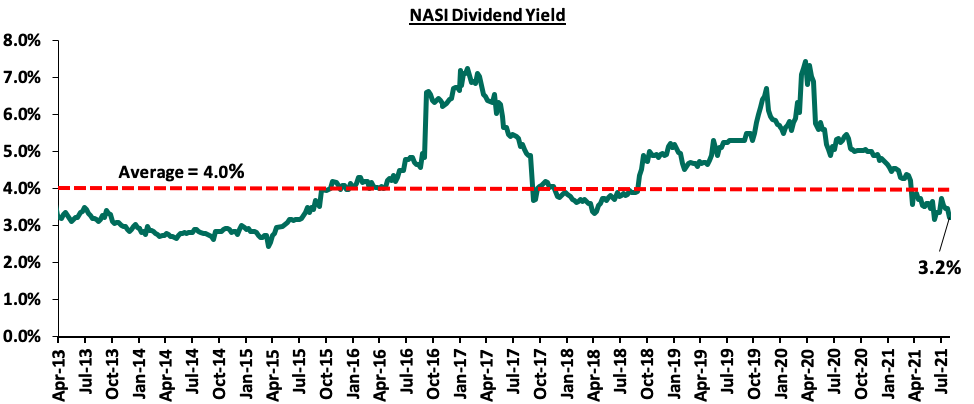

The market is currently trading at a price to earnings ratio (P/E) of 12.8x, 1.3% below the historical average of 12.9x, and a dividend yield of 3.2%, 0.8% points below the historical average of 4.0%. Key to note, NASI’s PEG ratio currently stands at 1.4x, an indication that the market is trading at a premium to its future earnings growth. Basically, a PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. Excluding Safaricom, the market is trading at a P/E ratio of 12.1x and a PEG ratio of 1.4x. The current P/E valuation of 12.8x is 65.7% above the most recent trough valuation of 7.7x experienced in the first week of August 2020. The charts below indicate the historical P/E and dividend yields of the market.

Universe of Coverage

Below is a summary of our universe of coverage and the recommendations:

|

Company |

Price as at 30/07/2021 |

Price as at 06/08/2021 |

w/w change |

YTD Change |

Year Open 2021 |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

I&M Group*** |

23.0 |

22.6 |

(1.7%) |

(49.7%) |

44.9 |

29.8 |

10.0% |

42.1% |

0.3x |

Buy |

|

Kenya Reinsurance |

2.6 |

2.6 |

0.4% |

11.7% |

2.3 |

3.1 |

7.8% |

27.9% |

0.3x |

Buy |

|

NCBA*** |

26.6 |

26.2 |

(1.3%) |

(1.5%) |

26.6 |

29.5 |

5.7% |

18.3% |

0.7x |

Accumulate |

|

Sanlam |

11.0 |

10.8 |

(1.8%) |

(16.9%) |

13.0 |

12.4 |

0.0% |

14.8% |

1.0x |

Accumulate |

|

Standard Chartered*** |

129.5 |

131.0 |

1.2% |

(9.3%) |

144.5 |

134.5 |

8.0% |

10.7% |

1.0x |

Accumulate |

|

ABSA Bank*** |

9.9 |

9.8 |

(1.4%) |

2.9% |

9.5 |

10.7 |

0.0% |

9.2% |

1.1x |

Hold |

|

Co-op Bank*** |

13.6 |

13.7 |

0.7% |

8.8% |

12.6 |

13.8 |

7.3% |

8.4% |

0.9x |

Hold |

|

Diamond Trust Bank*** |

65.8 |

65.8 |

0.0% |

(14.3%) |

76.8 |

70.0 |

0.0% |

6.5% |

0.3x |

Hold |

|

KCB Group*** |

45.7 |

46.8 |

2.3% |

21.7% |

38.4 |

48.6 |

2.1% |

6.1% |

1.1x |

Hold |

|

Equity Group*** |

48.9 |

50.0 |

2.2% |

37.9% |

36.3 |

51.2 |

0.0% |

2.4% |

1.5x |

Lighten |

|

Stanbic Holdings |

85.0 |

92.5 |

8.8% |

8.8% |

85.0 |

90.5 |

4.1% |

1.9% |

0.9x |

Lighten |

|

Liberty Holdings |

9.1 |

9.1 |

0.0% |

17.7% |

7.7 |

8.4 |

0.0% |

(7.3%) |

0.7x |

Sell |

|

Jubilee Holdings |

379.0 |

370.0 |

(2.4%) |

34.2% |

275.8 |

330.9 |

2.4% |

(8.1%) |

0.8x |

Sell |

|

HF Group |

3.8 |

3.8 |

(0.8%) |

19.4% |

3.1 |

3.2 |

0.0% |

(14.7%) |

0.2x |

Sell |

|

Britam |

7.9 |

7.9 |

0.5% |

12.9% |

7.0 |

6.7 |

0.0% |

(15.2%) |

1.5x |

Sell |

|

CIC Group |

3.0 |

3.1 |

4.7% |

46.9% |

2.1 |

1.8 |

0.0% |

(41.9%) |

1.1x |

Sell |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in Key to note, I&M Holdings YTD share price change is mainly attributable to the counter trading ex-bonus issue |

||||||||||

We are “Neutral” on the Equities markets in the short term. With the market currently trading at a premium to its future growth (PEG Ratio at 1.4x), we believe that investors should reposition towards companies with a strong earnings growth and are trading at discounts to their intrinsic value. Additionally, we expect the recent discovery of new strains of COVID-19 coupled with the introduction of strict lockdown measures in major economies to continue dampening the economic outlook.

- Industry Reports

During the week, the Central Bank of Kenya (CBK) released the Monetary Policy Committee Hotel Survey-July 2021, a survey intended to assess the extent of the recovery of the hospitality sector. Some of the key take-outs from the report include:

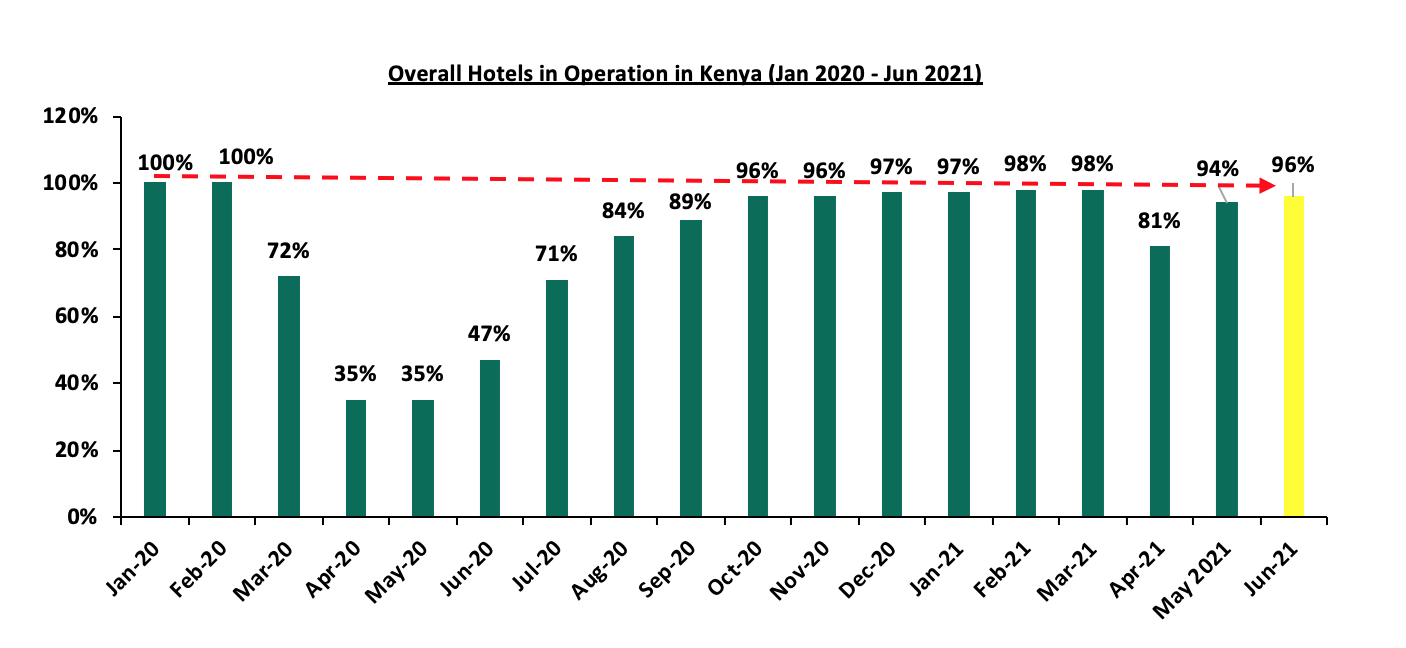

- On average, the number of operational hotels in June 2021 increased by 2.0% points to 96.0% from the 94.0% recorded in the May 2021, thereby reflecting recovery of the sector following the relaxation of the Covid-19 restriction measures such as re-opening of restaurant and entertainment joints, coupled with Kenya Airways (KQ) returning flights between Nairobi to Kisumu and Mombasa,

The graph below shows the number of operational hotels in Kenya from January 2020 to June 2021;

Source: Central Bank of Kenya

- Local guests continued to dominate the proportion of clientele for accommodation and restaurant services at 80.0% and 81.0%, representing an 18.0% and 12.0% points increase, compared to 62.0% and 69.0% recorded during the pre-Covid period, respectively. The above is attributed to the focus on local marketing, discounted rates on hotels and conference rooms for local clients and the decline in foreign clientele following travel bans and restrictions in some countries, and,

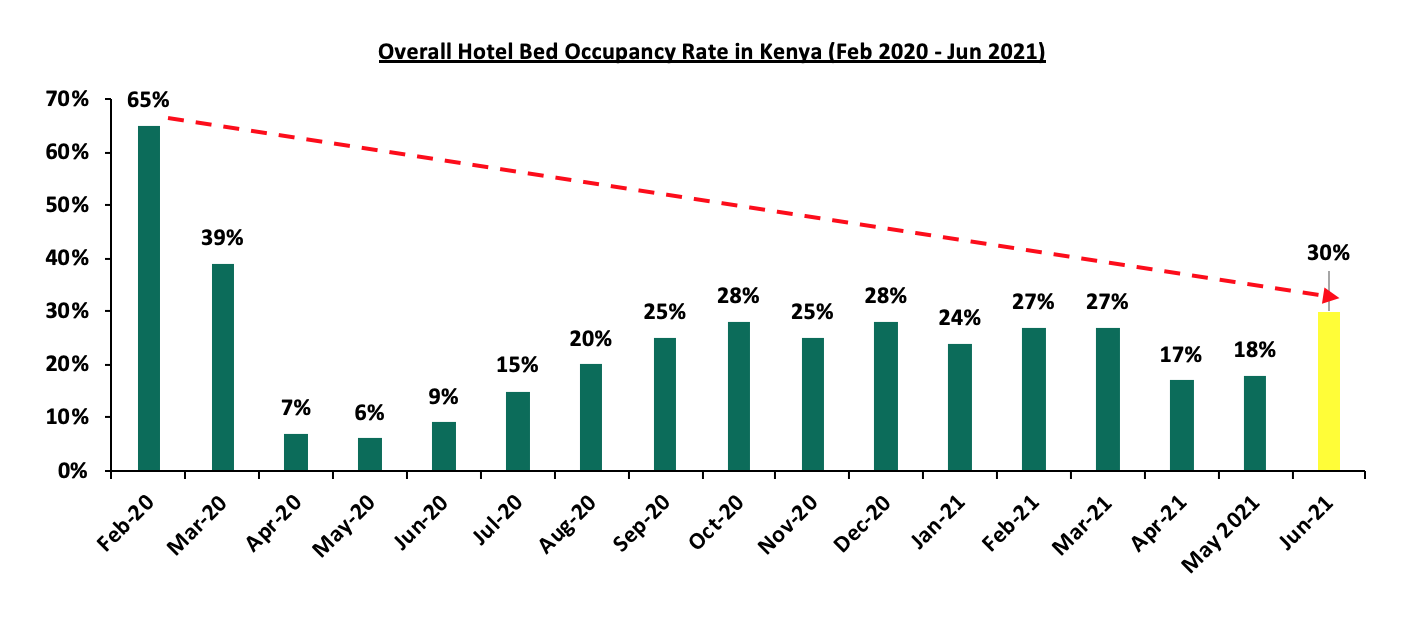

- The overall bed occupancy increased by 12.0% points to 30.0% in June 2021 from 18.0% recorded in May 2021 attributable to; i) events such as World Rally Championships (WRC) that saw hotels in the larger Nakuru region fully booked, ii) discounted rates on hotels and conference rooms and aggressive marketing thus increasing local clients, and, iii) boost in the number of tourists in tourist destinations attributed to warm climate and increased wildlife activities such as the wildebeest migration.

The graph below shows the number of hotel occupancies rates in Kenya from February 2020 to June 2021;

Source: Central Bank of Kenya

The survey indicates a path towards post-Covid recovery with performance of hotels expected to be on an upward trajectory for the rest of the year, as the number of foreign tourists rise supported by the; i) announced increase in direct flights from Frankfurt Germany to the Moi International Airport (MIA), ii) announcement by Jambo Jet to do four flights per week to the coastal town of Lamu at prices lower than market rates, iii) continued upgrade of the Moi International Airport to accommodate more flights, and, iv) increased wildlife activities boosting tourist arrivals.

- Residential Sector

During the week, Centum Real Estate, a real estate developer, partnered with NCBA Bank Kenya to provide mortgage financing for both qualified salaried and self-employed Kenyans to access over 5,000 units under development by the firm. The housing units are spread in areas along Thika Road, Kasarani and Two Rivers Mall which include villas, townhouses and apartments. NCBA has been on the forefront in provision of mortgage financing, fostering partnerships with property developers such as Mi Vida Homes in April 2021 to provide mortgage financing for purchase of over 3,000 homes in the Garden City Project over the next five years. Additionally, it partnered with Tatu City to provide mortgages to home buyers within their mixed use developments with a buy and build option receiving up to 80.0% financing with a maximum repayment period of 25 years depending on employment status.

The following table shows developments under the Centum Real Estate in the Nairobi Metropolitan Area;

|

Centum Real Estate Projects in the Nairobi Metropolitan Area |

|||

|

Project |

Area |

No of Units |

Typology Price Ranges |

|

26 Mzizi Court |

Gigiri, Nairobi |

1,650 |

1 bed - Kshs 4.9 to Kshs 5.8 mn 2 bed - Kshs 7.3 to Kshs 8.4 mn |

|

Cascadia Apartments |

Gigiri, Nairobi |

400 |

1 bed - Kshs 8.5 mn 2 bed - Kshs 12.8 mn 3 bed - Kshs 14.4 to Kshs 24.5 mn |

|

Riverbank |

Gigiri, Nairobi |

168 |

1 bed - Kshs 14.0 mn 2 bed - Kshs 20.0 mn 3 bed - Kshs 26.5 mn |

|

Loft Residences |

Gigiri, Nairobi |

56 |

Upper floors - Kshs 37.5 mn Lower floors - Kshs 44.0 mn |

|

265 Elmer One |

Kasarani |

268 |

1 bed – Kshs 4.2 mn 2 bed – Kshs 5.2 mn Studio – Kshs 2.2 mn |

|

365 Pavilion |

Thika Road, Near USIU |

365 |

1 bed - Kshs 4.8 mn 2 bed - Kshs 7.1 mn 3 bed - Kshs 10.1mn |

Source: Online Research

The partnership by Centum and NCBA Bank is expected to increase home ownership with a broader client base inclusive of self-employed Kenyans who have in the past been unable to secure mortgage loans due to credit information being below the required threshold for assessment by mortgage lenders.

Mortgage uptake in the country has remained low due to factors such as i) the high house prices which have led to the exclusion of low income earners, ii) the high interest rates that make it hard to meet the contractual obligations for mortgage financing, iii) the increase in the number of real estate non-performing loans leading to lenders tightening their risk provisions, and, iv) the constrained home ownership structured solutions by lenders leading to failure to incorporate more clients and boost mortgage accounts in the country. However, tremendous efforts are being made towards mortgage provisions especially by the primary mortgage lenders through i) partnering with private developers such as Centum Real Estate, ii) offering flexible loan repayment terms and periods, iii) increased capital liquidity from the minimized capital requirements to back mortgages, and, iv) incorporating self-employed Kenyans who have in the past been excluded in mortgage provisions due to lack of required threshold credit information.

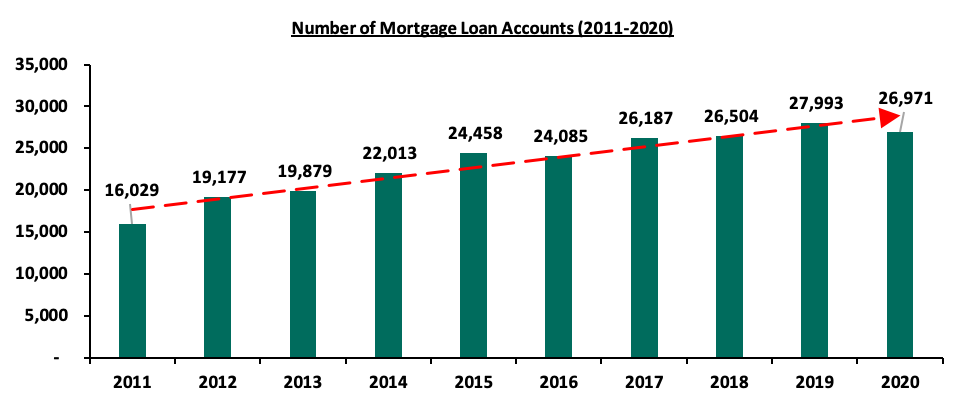

Mortgage accounts in the country declined by 1,022 accounts in the year 2020 to 26,971 from the 27,993 recorded in 2019, attributable to the tough economic environment leading to the low uptake.

To increase mortgage uptake, the Central Bank of Kenya introduced a reduction in capital requirement for mortgage backed loans from 50.0% to 35.0% effective from 1st July 2021. Banks will now have more liquidity for lending towards home ownership in an aim to boost mortgage accounts going forward. The move by Central Bank of Kenya is expected to boost mortgage uptake which has grown at a very low rate over the last 10 years, at a CAGR of 5.3%, adding just 10,942 accounts between 2011 and 2020, compared to an annual housing demand of 200,000 units.

The graph below shows the number of mortgage accounts over the last decade;

Source: Central Bank of Kenya

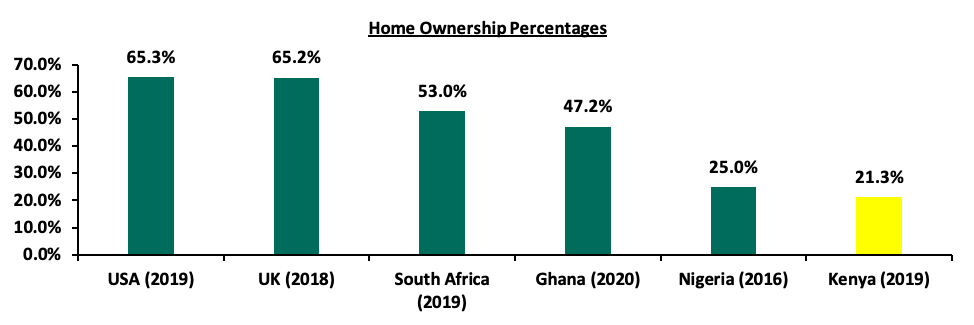

An increase in the mortgage uptake is expected to boost home ownership rate in the country which has remained relatively low at 21.3% of the urban dwellers as Kenya seeks to reach the levels of some of the African countries such as South Africa and Ghana which were 31.7% points and 25.9% points higher than Kenya, coming in at 53.0% and 47.2%, as recorded in 2019 and 2020, respectively.

The graph below shows the home ownership percentages in different countries compared to Kenya;

Source: Center for Affordable Housing Africa

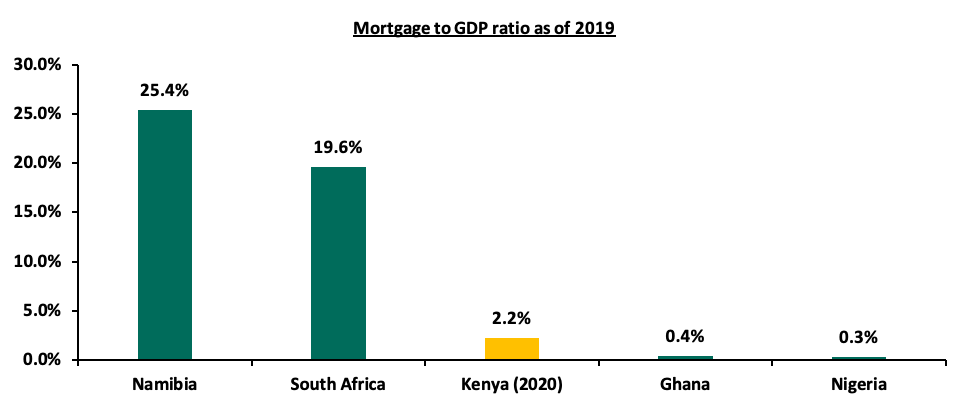

Despite efforts to increase home ownership the percentage has remained relatively low, resulting to a low mortgage to GDP ratio at 2.2% as at 2020 compared to South Africa and Namibia recording 17.4% points and 23.2% points higher mortgage to GDP ratios than Kenya, at 19.6% and 25.4%, respectively. The government, in an aim to improve this, set up a Mortgage Liquidity Facility (MLF) that is the Kenya Mortgage Refinance Company (KMRC) which was licensed for operations in September 2020, and aimed at enhancing mortgage affordability. The firm advances credit to primary mortgage lenders at a rate of 5.0% making it possible for them to offer long term mortgages at single digit rate of approximately 7.0%. It is however not clear how KMRC seeks to acquire these funds and at the same time lend at such low rates given that the government itself can only acquire 20 year funds at a 13.2% rate.

The graph below shows mortgage to GDP ratio of different countries compared to Kenya;

Source: Centre for Affordable Housing Africa

The residential sector continues to record increased activities supported by efforts of private sector players like banks to offer mortgage solutions in order to keep boosting their mortgage accounts with focus on the low and middle income earners in the country.

The real estate sector performance is expected to improve for the rest the year supported by increase in number of operational hotels and bed occupancy rates which are expected to aid the hospitality sector in its recovery following a tough environment from the onset of the Covid-19, and developers’ partnerships with financial institutions to offer flexible mortgage solutions in an aim to boost home ownership in the country.

On 29th June 2021, the President of Kenya assented to the Finance Act, 2021 which amongst other changes, introduced provisions for the registration and regulation of corporate trustees in the retirement benefits industry. While registered companies were allowed to act as corporate trustees under the previous Retirement Benefits Act, the Finance Act now clearly outlines the registration process of trustees, as well as the criteria for their suitability. Additionally, in 2020, the Capital Markets Authority (CMA) granted a no-objection to Goal Advisory Africa Limited, the first non-banking institution, to act as a Collective Investment Scheme (CIS) Corporate Trustee. Traditionally, only banks had been allowed to act as CIS trustees, with only 5 licensed banks approved to offer trusteeship services. Key to note, there are other types of trustees who do not need approval or licensing such as trustees of private trusts, charities, and endowment funds.

It is due to these recent developments that we chose to take an in-depth look into the roles of trustees in the Kenyan capital markets and the legal framework around the operations of trustees. We shall do this in five sections, namely:

- Introduction,

- Legal Framework and the Role of Trustees in the Kenyan Capital Markets,

- Case Study - India,

- Challenges in the Kenyan market and Recommendations, and,

- Conclusion.

Section I: Introduction

The main role of capital markets is to link suppliers of capital, for example individual investors, pension schemes or SACCOs with users of the capital i.e. people who are mainly in the production of goods and services across various sectors. See our previous release, The Role of Kenya’s Capital Markets on Economic Growth on this for more details. Investments can be through directly buying into capital market securities such as debt or equity securities or indirectly through investment vehicles managed by professional investments managers. The investment vehicles can be Unit Trust Funds, Pension Funds or Real Estate Investment Trusts.

We look below at these three investment vehicles and their respective governance structures:

|

Investment Vehicle |

Unit Trusts Funds (UTFs) |

Pension Funds |

Real Estate Investment Trusts (REITs) |

|

Objective |

Return generation and high liquidity |

Retirement savings and long term return generation |

Return generation through Real Estate investments |

|

Regulatory Body |

Capital Markets Authority (CMA) |

Retirement Benefits Authority (RBA) |

Capital Markets Authority (CMA) |

|

Governance Structure |

|

|

|

|

Established by |

Trust Deed |

Trust Deed |

Trust Deed |

|

Minimum Capital Requirement |

Not prescribed in law |

Kshs. 10.0 million |

Kshs. 100.0 million |

Section II: Legal Framework and the Role of Trustees in the Kenyan Capital Markets

The key role of Trustees is informed by the form of the trust as an investment vehicle. A trust is an unincorporated body unlike a company, and cannot hold assets or enter into contracts in its name. The Trustees, therefore, hold the legal title to the trust’s assets on behalf of the trust’s beneficiaries who in this case may be the persons contributing to the pension fund or the investors in a UTF.

Another key role of the trustee is to ensure that the trust is managed in accordance with the applicable laws and regulations (if regulated), the incorporation documents and in general with the requisite due diligence and care. For regulated funds this is done through exercising oversight on the Fund Manager and for UTFs the trustee is required to report annually to holders in the annual report on whether the fund manager has managed the scheme in accordance with the rules and if not what steps have been taken.

It is important to note that while a trustee may delegate some duties such as communication with stakeholders, they cannot delegate the functions of oversight or fiduciary responsibility in relation to the trust fund. It is also key to note that because the trust is not separately existent from its trustees, it is therefore implied that a trust must have active trustees at all times. This ensures that the trust does not cease even during a change of trustees exposing the beneficiaries to the risk of property loss. For unit trust funds, this is clearly outlined in the Capital Markets (Collective Investment Schemes) Regulations, 2001. Below we look at the different types of trustees in the Kenyan capital markets, their qualification requirements and industry statistics:

- Unit Trust Funds (UTFs) Trustees

UTF Trustees are tasked with ensuring that the Funds they are in charge of are running well and in accordance with the applicable laws and regulations. Similar to the Unit Trust Funds, UTF trustees are approved by the Capital Markets Authority (CMA) under the Capital Markets (Collective Investment Schemes) Regulations, 2001. As per the current regulations, the Trustee should be either a bank or a financial institution. The CMA is however considering expansion of the eligibility criteria to include institutions that have the requisite professional and technical capacity. Below are some of the qualifications being considered that a company has to meet before qualifying to be a UTF trustee:

- The applicant should demonstrate that the designated person(s) have adequate experience and understanding of the capital markets as well as operations of collective investment schemes,

- The applicant should have in place professional indemnity or lines of credit to fully cover the risk in the event of professional negligence,

- The applicant should demonstrate of the financial and technical capability to undertake trustee business effectively,

- The designated persons carrying out the trustee tasks within the institution should;

- Have adequate knowledge in capital markets operations and specifically the operation and management of Collective Investment Schemes,

- Have experience of not less than 5 years in managing investment portfolios, and,

- Be a holder of at least Chartered Institute for Securities & Investment (CISI) level two certification.

It is with this foresight that CMA, in 2020, approved – Goal Advisory Africa Limited – as a Trustee of a CIS. There are currently 6 approved Unit Trust Funds trustees and the table below provides a breakdown of the market-share of each approved trustee by number of Collective Investment Schemes overseen and Assets Under Management (AUM):

|

Collective Investments Scheme (CIS) Trustees Market Share |

|||

|

Year |

Collective Investment Scheme |

No. of Collective Investment Schemes |

Market Share by AUM |

|

1 |

KCB Trustee Services |

11 |

87.6% |

|

2 |

Stanbic Bank Kenya Ltd |

2 |

7.7% |

|

3 |

Cooperative Bank of Kenya |

2 |

2.5% |

|

4 |

Goal Advisory (A) Ltd |

1 |

0.9% |

|

5 |

HF Bank |

0 |

0.0% |

|

6 |

NatBank Trustee Services |

0 |

0.0% |

|

7 |

Others (Non-corporate trustees & not appointed, unclear) |

3 |

1.4% |

|

Total No. of Collective Investment Schemes |

19 |

100.0% |

|

From the above table, it’s clear that the market is concentrated with KCB Trustees controlling almost 90% of the market.

We view the beginning of acceptance of Corporate Trustees as a step in the positive direction since the structure of UTFs includes a Custodian / a Bank who holds custody of the assets on behalf of the Trust. The Trustee’s role should then be focused on oversight of the Fund Manager’s assets which is a professional and technical role, without focus on huge minimum capital requirements; this reduces the reliance on banks who to a large extent may be viewed as competitors in savings mobilization.

The most fundamental change that is need in UTF trust is to clearly enact eligibility and the process of becoming a UTF Trustee, similar to what RBA has done. It is noteworthy that while the UTF industry assets remain a paltry Kshs. 111.1 billion, pension assets now stand at Kshs. 1.4 trillion. Clarity and predictability is essential to capital markets growth.

- Real Estate Investment Trust (REITs) Trustees

As earlier discussed in our, Real Estate Investment Trusts (REITs) in Kenya research note, REITs are regulated collective investment vehicles which invest in real estate and whose promoters source funds to build or acquire real estate assets, which they sell or rent to generate income. The income generated is then distributed to the investors as returns from investing in REITs. The property is held by a trustee on behalf of unit holders and professionally managed by a REIT manager.

In Kenya, the Capital Markets Authority (CMA) is the governing and regulating body for REITs and as such, it is the body that registers and approves REIT trustees. According to the Capital Markets (Real Estate Investment Trusts) (Collective Investment Schemes) Regulations, 2013, a REIT trusteeship applicant must meet the following minimum requirements in order to be considered for licensing:

- The applicant should be a bank, or, a subsidiary of a bank; or a company that has sufficient financial, technical and operational resources and experience necessary to enable it to effectively conduct its business and carry out its obligations as a trustee of a real estate investment trust and real estate investment trust scheme,

- The applicant should be independent of the promoter, the REIT manager and any property manager, valuer or project manager certifier of the real estate investment trust scheme,

- The applicant should have a minimum issued and paid-up capital and non-distributable capital reserves of at least Kshs 100.0 mn

Due to the highly inhibitive minimum capital requirement of Kshs 100.0 mn, there are only 3 licensed REIT trustees in Kenya, namely, Housing Finance Company (K) Limited, Co-operative Bank of Kenya Limited and Kenya Commercial Bank Limited. It is not surprising that all of them are banks given the high capital requirements, essentially limiting the qualification of a REIT Trustees to a bank. According to a paper by Chartered Institute for Securities and Investments (CISI) UK, the reason for the dominance of banks and insurers as trustees of United Kingdom (UK) unit trusts is because the Trustee holds the assets of the Trust on behalf of the REIT unitholders, so you need an entity that unitholders can “trust” because it is heavily regulated or holds sufficient assets of its own. We note that with the use of a Custodian to hold legal title to these assets, on behalf of the Trustee, the Trustee’s role then becomes primarily oversight which is professional and technical in nature similar to that of a REIT Manager whose minimum capital requirement is Kshs 100.0 mn and the high minimum capital requirements fall away. In this regard, the use of a Professional Indemnity Cover can also be adopted.

The most fundamental change that is required in the reduction of minimum capital to allow for Corporate Trustees, the high levels of capital essentially reduce the Trustee role to banks. It is no wonder that the REIT market, after 8 years, has only managed to raise a paltry Kshs. 13.1 bn billion as of June 2021 and so far does not appear to be gaining traction.

- Pension Funds Trustees

The retirement industry in Kenya is governed and regulated by the Retirement Benefits Authority (RBA). RBA has been keen in promoting good governance by continuously updating the regulations and enforcing the same in the schemes.

The recently assented Finance Act, 2021, codified the eligibility requirements for a pension corporate trusteeship applicant, as below:

- The applicant must have such minimum paid up share capital as may be prescribed by the Retirement Benefits Authority. The required minimum paid up share capital is currently Kshs 10.0 mn,

- The applicant should be capable of meeting the obligations to members and sponsors as specified in the scheme rules,

- The applicant should have the professional and technical capacity and adequate operational systems to perform its functions,

- The applicant should not have been a corporate trustee of any scheme which has been deregistered, wound up or placed under an interim administrator due to any fault, either fully or partially, of the corporate trustee,

- The applicant should not have been involved in the management or administration of a scheme which was deregistered for any failure on the part of the management or the administration thereof,

- The applicant should have in its board of directors and senior management such number of persons as may be prescribed who are academically and professionally qualified in matters relating to administration of schemes, insurance, law, accounting, actuarial science, economics, banking, finance or investment of scheme funds, and,

- The applicant should meet any other requirements prescribed by the Retirement Benefits Authority during the application process.

It is important to note that in Kenya, umbrella pension funds and occupational pension schemes may make use of individual trustees to govern umbrella schemes while Individual Pension Schemes (IPPs) cannot. This is probably because for occupational and umbrella schemes, the Trustees are employees of the sponsoring employer if an occupational scheme or participating employers for Umbrella schemes, meaning they have a strong moral duty towards their fellow employees as opposed to IPPs where there is no common bond. It is indeed this principle that informs the member based governance structures of SACCOs.

There are currently at least 11 approved institutions acting or who have acted as pension corporate trustees in Kenya, it is noteworthy that unlike in UTFs and REITS where Trustees are mostly banks, Pensions has a balanced mix of both banks and corporates trustees, hence the larger pool of Trustees for pension funds to choose from:

- Corporate & Pension Trust Services Limited,

- ICEA Lion Trust Company Limited,

- Kenya Commercial Bank (KCB) Trustee limited,

- Kingsland Court Trust & Benefits Services Limited,

- Enwealth Financial Services Limited,

- Octagon Pension Services Limited,

- Natbank Trustee and Investment Services Limited,

- Stanbic Bank Kenya Ltd,

- Cooperative Bank of Kenya.

- Standard Chartered Bank Kenya, and,

- Jubilee Insurance.

- Bond Trustees

A bond trustee is a trustee that is appointed by the issuer of a corporate bond and acts as an intermediary between the issuer and the bondholders, representing the interests of the bondholders. The bond trustee also monitors the compliance of the bond issuer as per the trust deed set out. These trustees may also enforce the covenants of the trust deed on behalf of each bondholder, and, coordinating and disseminating information. However, in Kenya, they do not exercise any oversight role as once the funds are raised they are directly deployed to the bond issuer. Additionally, there is no approval regulations set out for bond trustees.

Some of the bond trustees active in the Kenyan market include; (i) MTC Trust & Corporate Services Limited, and, (ii) Ropat Trust Company Limited.

The most important improvement for Bond Trustees would be to have an approval process and a register of approved Bond Trustees.

- Payment Service Providers (PSPs) Trustees

The national payments system in Kenya is made up of the Central Bank of Kenya, the Government, commercial banks, financial institutions and the payment system providers. All payment service providers are licensed and regulated by the Central Bank of Kenya and some common examples of PSPs in Kenya include Mpesa, Paypal and PesaLink. A PSP establishes a trust through a trust deed and ensures all funds are held in the trust fund. The PSP must ensure that, in accordance with the trust deed and rules, it appoints a broad-based board of trustees which consists of people with adequate professional credentials and experience in offering trusteeship services, of credibility, integrity, and not contravened any provision made by or under any law designed to protect members of the public against financial loss due to dishonesty, incompetence or malpractice. The National Payment Systems Regulations, 2014, also allow a registered company to be a payment service provider trustee, provided that its designated staff meet the aforementioned criteria set out by the Central Bank of Kenya and similar to what is required a board of individual trustees. The trust deed for each payment service provider contains the duties, responsibilities and the extent of liability of Trustees and the particulars of the management arrangement between the trustee, the provider and the customers.

Some of the currently active PSP corporate trustees include: Goal Advisory, MTC Trust & Corporate Services Limited and Octagon Africa. There is currently no centralized database for the active payment service providers’ trustees licensed by the Central Bank of Kenya, which we believe should be remedied to ensure payment service providers customers and stakeholders can verify the licensing status of the personnel and companies in change of their funds.

The most important improvement for PSP Trustees would be to have an approval process and a register of approved PSP Trustees.

Regulatory framework Summary

In the exercise of their functions Trustees are primarily governed by the Trust Deed which sets out their powers and duties and where they are licensed or approved the sector specific laws for example for UTFs, the CIS Rules, and for pensions, the specific rules under the Retirements Benefits Act. We provide a summary below:

|

Trustees |

UTF Trustees |

Pension Funds Trustees |

Real Estate Investment Trusts (REIT) Trustees |

PSP Trustees |

|

Type of Trust |

Unit Trust Fund (UTF) |

Pension Funds |

Real Estate Investment Trusts |

Payment Service Providers |

|

Regulatory Body: Primary

|

Capital Markets Authority (CMA) |

Retirement Benefits Authority (RBA) |

Capital Markets Authority (CMA) |

Central Bank of Kenya (CBK) |

|

Secondary |

Central Bank of Kenya (CBK) |

Capital Markets Authority (CMA) |

Central Bank of Kenya (CBK) |

- |

|

Applicable Laws |

i) Capital Markets (Collective Investment Schemes) Regulations, 2001 – Provision of Trustee Services

ii) The Capital Markets Act

iii) Companies Act, 2015 – Registration of the company

iv) Income Tax Act – Tax purposes

v) Banking Act - Applicable to banking institutions |

i) Retirement Benefits Regulations – Provision of Trustee Services under the Individual retirement benefit schemes regulations, and the occupational retirement benefits schemes regulations.

ii) The Capital Markets Act

iii) Companies Act, 2015 – Registration of the company

iv) Income Tax Act – Tax purposes |

i) Capital Markets Real Estate Investment Trusts (CIS) Regulations, 2013 – Provision of Trustee Services

ii) Companies Act, 2015 – Registration of the company

iii) Income Tax Act – Tax purposes

iv) Banking Act - Applicable to banking institutions |

i) ) National Payment System Regulations, 2013 - Provision of Trustee Services

ii) Companies Act, 2015 – Registration of the company

iii) Income Tax Act – Tax purposes

iv) Banking Act – Applicable to banking institutions |

|

Tenor |

Determined by the Trust Deed |

Term shall not exceed 3 years, but may be renewed |

Determined by the Trust Deed |

Determined by the Trust Deed |

|

Remedies by the primary governing body in case of breach of trust |

- Fines, - Suspension, and, - Removal of Trustee |

- Fines, - Suspension, and, - Removal of Trustee |

- Fines, - Suspension, and, - Removal of Trustee |

- Fines, - Suspension, and, - Removal of Trustee |

In exercising their duties, trustees act as fiduciaries and have a duty of due diligence and care. Trustees are also governed by the Trustees Act, 2012. The Trustees Act of Kenya grants various powers to appointed trustees to enable them conduct their roles; some of the powers include such as (i) The power to make investments as authorized by the trust deed and in compliance with the Act. Trustees are expected to diversify the investments appropriately, and, choose investments suitable to the trust they manage, (ii) Power to employ agents such as advocates, banks, stockbrokers and fund managers to help them carry out their roles, (iii) power to delegate the trust to a temporary trustee during absence abroad of longer than one month. Here the delegation is made by power of attorney and begins immediately the trustee leaves the country and ends upon the coming back of the delegating trustee into the country. The delegating trustees remain liable for all acts and defaults of the temporary trustee, and, (iv) the power to act jointly with another trustee in holding the tenancy of properties under the trust. The Trustees Act limits the number of trustees running a trust to a maximum four, that is either four individuals or four corporate trustees. Key to note is that, the appointment of a trustee may in some instances be done by a court of law, whereby it is deemed inexpedient or difficult to replace or appoint a new trustee after the previous trustee has been convicted of a felony, has gone bankrupt or in cases of corporations, has been liquidated.

In the capital markets, however, trustees are governed primarily by the governing body of the type of trust they are in charge of. The regulatory framework for trustees in the Kenyan capital markets, in our view, could be streamlined and harmonized to make it easier for registration of Corporate Trustees with a view to enhancing options in the market and eventually contributing to expanding and deepening of capital markets.

Section III: Case Study – India

India commands a fair share of the global economy, 3.1% based on 2020 GDP figures provided by the World Bank, and as such its capital markets also play a significant role in the world’s financial markets. We chose India for our case study as it has a similar structure as Kenya’s when it comes to the trustees’ role in the capital markets that is both countries provide for a distinct role for a Custodian especially in the governance structure of a REIT. The roles of the trustee are generally very similar as well with the core duties being oversight, duty of care and to operate diligently, and, ensuring compliance to regulations. Key market regulators in the Indian capital markets include the Securities and Exchange Board of India (SEBI), the Reserve Bank of India (RBI), and the Department of Company Affairs (DCA).

Similar to Kenya, India’s has the Indian Trusts Act, 1882 that provides for the existence of trusts, trustees and regulations pertaining to the relationship between a trustee and beneficiaries. However, when it comes to the capital markets, the Securities and Exchange Board Of India (Debenture Trustees) Regulations, 1993 provides for the eligibility criteria of CIS, REITs and Bond trustees in the country. The qualifications for a trustee applicant include:

- The applicant must be one of the following four institutions; (i) a bank, (ii) a public financial institution, (iii) an insurance company, or (iv) a body corporate,

- The applicant must have a minimum capital of 2 crore rupees (Kshs 29.3 mn),

- The applicant should have the necessary infrastructure like adequate office space, equipment, and manpower to effectively discharge his activities,

- The applicant should have a minimum of two persons who have experience in matters which are relevant to a debenture trustee, and,

- The applicant should have at least one person qualified in law.

In the table below we provide a summary of the governance structure and the main roles of CIS and REIT trustees in India:

|

Investment Vehicle |

Collective Investment Schemes |

Real Estate Investment Trusts |

|

Promoter |

Collective Investment Management Company |

Sponsor (may be an individual or a company) |

|

Legal Document |

Trust Deed |

Trust Deed |

|

Key parties in the government structure |

|

|

|

Qualification to be a Trustee |

Persons registered as debenture trustees |

Persons registered as debenture trustees |

|

Removal of Trustees |

A trustee may be removed;

|

|

Lessons Kenya can borrow from India’s Capital Markets Trustee Regulations:

- Reduced minimum capital requirement for REITs trustees – The Indian legal framework requires the minimum capital to be Kshs 29.3 mn for REITs, CIS and Bond trustee. We believe that if Kenya were to mirror the same or reduce our capital requirement even further, it would allow for more corporate trustees to be licensed and incentivize offering of more investment products in the market. This is especially in lieu of the fact that in the past licensed REIT managers have been unable to launch REITs due to the limited trustees’ options and the Kshs. 100.0 mn capital requirement,

- Harmonize the capital requirements across various market – As discussed above, in India, REITS, CIS and Bonds Trustees have the same capital requirements. In Kenya the minimum for CIS and Bond trustees is not known, the REITs its Kshs. 100 mn and for Pensions is Kshs. 10.0 mn,

- Open up trustee qualification to non-banking institutions – India’s trustee requirements specifically mention that a body corporate that is not necessarily a banking institution, insurance firm or a public financial institution, may become a trustee. We can borrow from this as Kenya, especially to allow other technically and professionally capable firms to become trustees. This will reduce the current dependency on banking institutions to provide trustee services increasing competition and efficiency of the provision of trustee services, and,

- Creation of Bond Trustees regulations – The corporate bonds market in Kenya has struggled in recent years due to defaults and collapse of issuers such as Chase Bank and Imperial Bank Limited. In the period January to June 2021, the percentage of corporate bond turnover in the secondary bond markets stood at only 0.1%, indicating low investor interest and confidence. We believe, like in India, creation of clear Bond Trustee regulations that all bond trustees and bond issuers have to meet an adhere to, will help increase the effectiveness and performance of the corporate bonds market in Kenya boosting investor confidence.

Section IV: Challenges in the Kenyan market and Recommendations

While the regulatory framework of trustees is indeed adequate in the Kenyan markets, we believe that there are still challenges existing that if addressed would help trustees carry out their roles more effectively, and increase vibrancy in the Kenyan capital markets. These include:

- High minimum capital requirements for a REIT trustee of Kshs 100.0 mn: This essentially limits the eligible trustees to only banks, efficiently eliminating corporate trustees and other fund managers. A proposed solution, is to allow the use of a Custodian in the REIT structure who must be a bank or financial institution to hold legal title to the assets of the REIT on the Trustee’s behalf who holds beneficial ownership on the unitholders behalf. This way the role of the Trustee is primarily oversight, where emphasis can be placed on professional and technical expertise as opposed to assets holdings or capital and the minimum capital requirement can be reduced to match what is required of a fund manager, to Kshs. 10.0 mn,

- Lack of clear corporate trustee regulations: We note that apart from pension trustees, the registration requirements for corporate trustees in Kenya remain unclear or non-existent. We believe more specificity would go a long way, in reducing any ambiguity and subjectivity in the registration process and operations of trustees, especially for UTF and REIT Trustees,

- Low investor awareness: This is in relation to unit trusts and pension funds mainly which have a high number of retail clients who do not understand fully the governance structure of the unit trust and pension schemes, and do not understand fully the role of trustees. Given the importance of trustees in protecting these clients’ funds in their oversight role, we believe more can be done with regards to public information drives. One of the ways this can be done is through more webinars that are open to the public, and in which discussions are held on the various investment products and their respective governance structures. These may be conducted by the regulatory bodies as well as the industry players, and,

- Transparency of information: This is especially in relation to pension, UTF and payment service providers’ corporate trustees, where there is a lack of centralized database of licensed corporate trustees. This makes it hard for interested investors to verify the licensing and compliance status of the trustees.

Section V: Conclusion

According to the Organisation for Economic Co-operation and Development (OECD), “The growth of CIS is one manifestation of the growing reliance on capital markets and on institutional investors, as opposed to on-balance sheet lending by banks, in financial intermediation. Intermediation through the capital market has the potential to promote greater efficiency in the economy, provided that a sound institutional, legal and regulatory framework is in place. Additionally, intermediation though the capital markets can best promote efficiency in the real economy if institutional investors and asset managers can be relied upon to deploy assets on behalf of investors”. Further, according to a survey carried out by the Kenya National Bureau of Statistics (KNBS), safety of one’s investments was ranked the top consideration by the sampled Kenyans when choosing a savings instrument. Safe investments refer to investments whereby the chances of an investor losing their principal is very low and that is the main role of a trustee at all time – oversight to ensure the Fund Manager invests the fund’s assets with the necessary prudence and due care. In this regard the role of the Trustee as a critical party in the governance of CIS and other investment funds cannot be over-emphasized. Trustees also ensure that other service providers are performing their functions accordingly and facilitate communication with the investors.

As discussed in Section IV, more may be need to be done in order to increase vibrancy in the capital markets, especially improvements in investor awareness and reduction of minimum capital requirements. In the long term, more flexible forms of Collective Investment Schemes such as the corporate model that utilizes a custodian and an independent board of directors exercises the supervisory role, as opposed to a Trustee may be one of the models adopted as witnessed in the UK and USA.

In summary, a more competitive and predictable trustee environment, will likely lead to more innovation and better services by trustees and growth in capital markets.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.