State Owned Enterprises Privatization & Cytonn Weekly #14/2024

By Research Team, Apr 7, 2024

Executive Summary

Fixed Income

During the week, T-bills were oversubscribed, with the overall oversubscription rate coming in at 118.7%, a reversal from the undersubscription rate of 66.0% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 8.7 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 217.3%, higher than the oversubscription rate of 134.5% recorded the previous week. The subscription rates for the 182-day paper and 364-day paper increased to 58.7% and 139.1%, from 27.0% and 77.5% respectively recorded the previous week. The government accepted a total of Kshs 26.2 bn worth of bids out of Kshs 28.5 bn of bids received, translating to an acceptance rate of 92.0%. The yields on the government papers were on a downward trajectory, with the yield on the 182-day paper decreasing the most by 1.4 bps to remain relatively unchanged at 16.9%, while the yields on the 91-day and 364-day papers decreased marginally by 0.5 bps and 0.01 bps to remain relatively unchanged at 16.7%, and 17.0%, respectively;

Also, during the week, the Central Bank of Kenya released the tap sale results for the FXD1/2023/05 and FXD1/2024/10 bonds with a tenor to maturity of 4.4 years and 10.0 years respectively, and coupon rates of 16.8% and 16.0% respectively. The bonds were oversubscribed with the overall subscription rate coming in at 191.2%, receiving bids worth Kshs 47.8 bn against the offered Kshs 25.0 bn. The government accepted bids worth Kshs 45.8 bn, translating to an acceptance rate of 95.9%. The weighted average yield of accepted bids for the FXD1/2023/005 and the FXD1/2024/010 remained unchanged at 18.4% and 16.5% respectively. With the Inflation rate at 5.7% as of March 2024, the real return of the FXD1/2023/005 and the FXD1/2024/010 is 12.7% and 10.8% respectively;

In the primary bond market, the government is seeking to raise an additional Kshs 40.0 bn for budgetary support by reopening the FXD1/2023/002 bond, with a tenor to maturity of 1.4 years and a coupon rate of 16.9%. The bidding process opened on 28th March 2024 and will close on 17th April 2024. The bond’s value date will be 22nd April 2024, with a maturity date of 18th August 2025. Given the bond is trading at 17.6% in the secondary market, we recommend a bidding range of between 16.55%-17.0% as the government is keen on bringing down the interest rates;

During the week, The Monetary Policy Committee (MPC) met on April 3, 2024, to review the outcome of its previous policy decisions against a backdrop of an improved global outlook for growth and inflation, despite persistent geopolitical tensions. The MPC decided to maintain the CBR at 13.00%, which was in line with our expectations. Our expectation to maintain the rate at 13.0% was mainly on the back of an eased inflation rate, coming in at 5.7% in March 2024 from 6.3% in February, remaining within the CBK preferred range of 2.5%-7.5% for the seventh consecutive month, a stronger Shilling, as well as the need to allow more time for the effects of the previous policy rate to transmit in the economy;

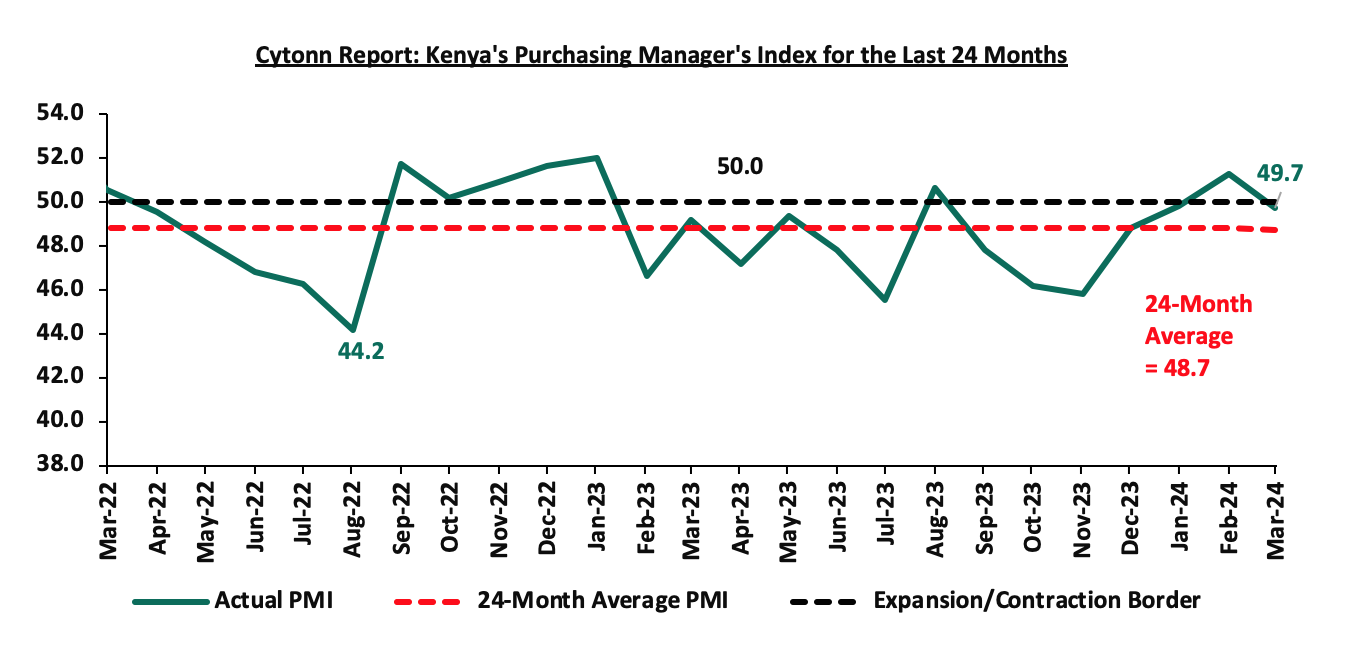

During the week, Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of March 2024 declined, coming in at 49.7, down from 51.3 in February 2024. The index was also at its lowest level in three months, signaling a decline in operating activities. Notably, private sector conditions softened, offsetting the expansion recorded in February, mainly on the back of heightened cost of living;

Equities

During the week, the equities market recorded mixed performances, with NSE 10, NSE 25, and NASI gaining by 1.2%, 0.8%, and 0.2% respectively, while NSE 20 declined by 0.2%, taking the YTD performance to gains of 28.3%, 25.7%, 23.3% and 15.9% for NSE 10, NSE 25, NASI and NSE 20 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as EABL, NCBA, and Standard Chartered Bank of 6.3%, 3.2% and 1.8% respectively. The gains were, however, weighed down by losses recorded by large cap stocks such as Bamburi Cement, DTB-K and Safaricom of 8.1%, 2.3%, and 1.1% respectively;

During the week, the board of directors of Bamburi Cement Plc announced a profit warning for the FY’2023, anticipating a decrease of at least 25.0% in net earnings compared to 2022. This decline is primarily attributed to one-off settlements of tax liabilities and legal disputes, notably in Hima Cement Limited, impacting the overall financial performance;

During the week, The Central Bank of Kenya (CBK) announced the cancellation of Bank of Kigali's (BoK) authority to operate a Representative Office in Kenya, effective April 2, 2024. BoK, headquartered in Kigali and founded in 1966, opted for the voluntary termination of its Kenya presence as part of a strategic shift towards prioritizing digital service delivery channels;

Real Estate

During the week, the Kenya Mortgage Refinance Company (KMRC) unveiled the Kenya Mortgage Guarantee Trust (KMGT), a pivotal initiative aimed at mitigating risks for banks and SACCOs providing home loans to high-risk individuals, particularly low- to mid-income workers. By providing a partial guarantee for mortgages, KMGT aims to instill confidence in lenders, thus catalyzing the provision of housing finance to income groups previously deemed high risk;

On the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 24.4 and Kshs 21.7 per unit, respectively, as of 22nd March 2024. The performance represented a 22.0% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price;

Focus of the Week

Privatization involves selling government-owned assets (including shares in state-owned companies) to private individuals or businesses. The proof of long-term inefficiencies, misconduct, poor financial management, and waste in state owned enterprises (SOEs) necessitates the need for privatization which typically tries to increase economic efficiency by increasing a company's performance, hence eliminating or reducing the need for government economic intervention, attract private investment and foster innovation. Furthermore, privatizations have been utilized to promote competition in monopolized industries. By transitioning from state control to private ownership, these enterprises are envisioned to become more agile, responsive to market dynamics, and better positioned to contribute significantly to the nation’s socio-economic development;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 17.08% p.a. To invest, dial *809# or download the Cytonn App from Google Play store here or from the Appstore here;

- We continue to offer Wealth Management Training every Monday, from 10:00 am to 12:00 pm. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonn Asset Managers Limited (CAML) continues to offer pension products to meet the needs of both individual clients who want to save for their retirement during their working years and Institutional clients that want to contribute on behalf of their employees to help them build their retirement pot. To more about our pension schemes, kindly get in touch with us through pensions@cytonn.com;

Real Estate Updates:

- For more information on Cytonn’s real estate developments, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To join the waiting list to rent, please email properties@cytonn.com;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

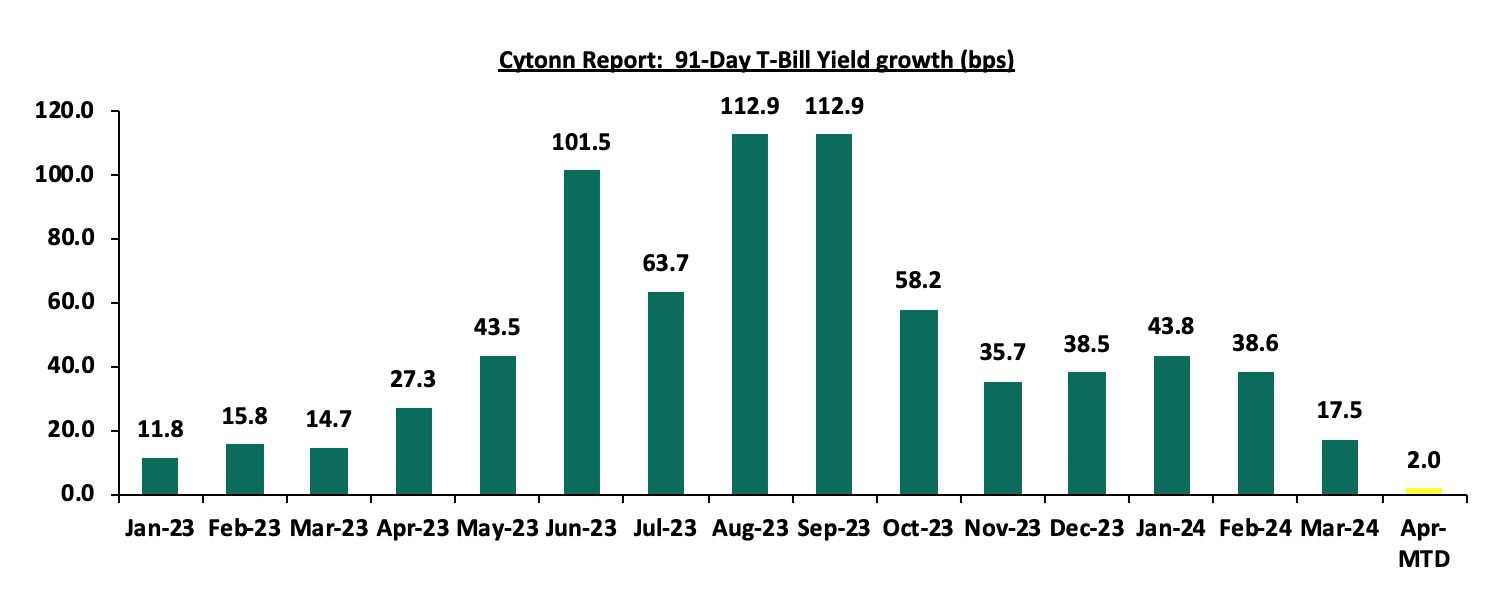

During the week, T-bills were oversubscribed, with the overall oversubscription rate coming in at 118.7%, a reversal from the undersubscription rate of 66.0% recorded the previous week. Investors’ preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 8.7 bn against the offered Kshs 4.0 bn, translating to an oversubscription rate of 217.3%, higher than the oversubscription rate of 134.5% recorded the previous week. The subscription rates for the 182-day paper and 364-day paper increased to 58.7% and 139.1%, from 27.0% and 77.5% respectively recorded the previous week. The government accepted a total of Kshs 26.2 bn worth of bids out of Kshs 28.5 bn of bids received, translating to an acceptance rate of 92.0%. The yields on the government papers were on a downward trajectory, with the yield on the 182-day paper decreasing the most by 1.4 bps to remain relatively unchanged at 16.9%, while the yields on the 91-day and 364-day papers decreased marginally by 0.5 bps and 0.01 bps to remain relatively unchanged at 16.7%, and 17.0%, respectively. The chart below shows the yield growth rate for the 91-day paper over the period:

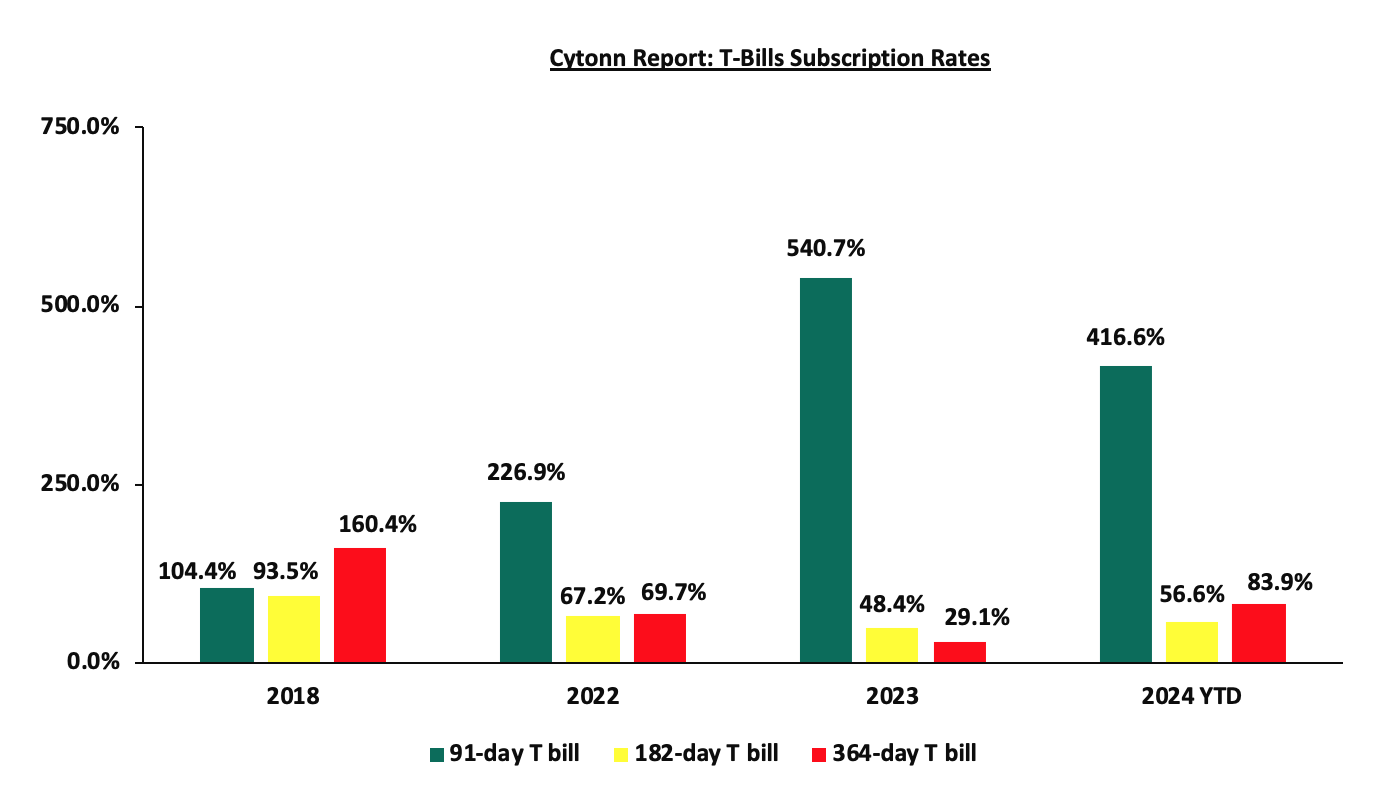

The chart below compares the overall average T-bill subscription rates obtained in 2018, 2022, 2023, and 2024 Year-to-date (YTD):

Also, during the week, the Central Bank of Kenya released the tap sale results for the FXD1/2023/05 and FXD1/2024/10 bonds with a tenor to maturity of 4.4 years and 10.0 years respectively, and coupon rates of 16.8% and 16.0% respectively. The bonds were oversubscribed with the overall subscription rate coming in at 191.2%, receiving bids worth Kshs 47.8 bn against the offered Kshs 25.0 bn. The government accepted bids worth Kshs 45.8 bn, translating to an acceptance rate of 95.9%. The weighted average yield of accepted bids for the FXD1/2023/005 and the FXD1/2024/010 remained unchanged at 18.4% and 16.5% respectively. With the Inflation rate at 5.7% as of March 2024, the real return of the FXD1/2023/005 and the FXD1/2024/010 is 12.7% and 10.8% respectively.

In the primary bond market, the government is seeking to raise an additional Kshs 40.0 bn for budgetary support by reopening the FXD1/2023/002 bond, with a tenor to maturity of 1.4 years and a coupon rate of 16.9%. The bidding process opened on 28th March 2024 and will close on 17th April 2024. The bond’s value date will be 22nd April 2024, with a maturity date of 18th August 2025. Given the bond is trading at 17.6% in the secondary market, we recommend a bidding range of between 16.55%-17.0% as the government is keen on bringing down the interest rates.

Money Market Performance:

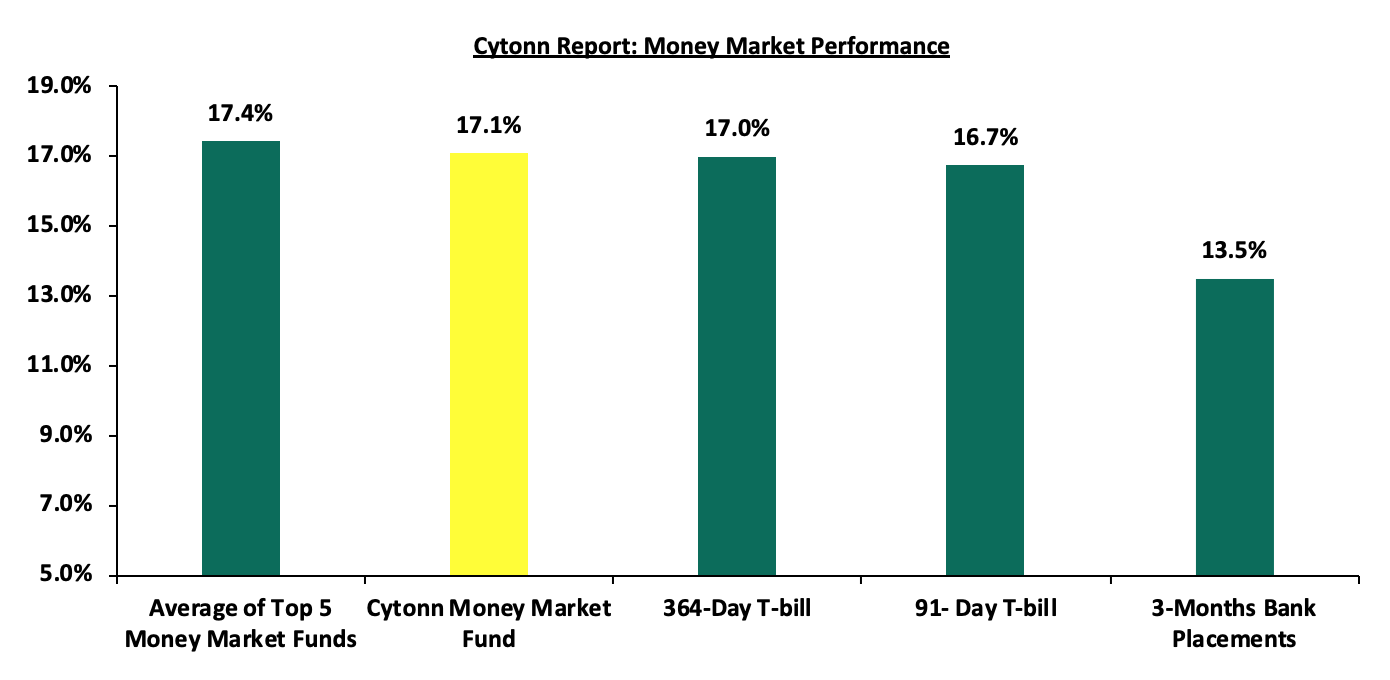

In the money markets, 3-month bank placements ended the week at 13.5% (based on what we have been offered by various banks), and the yields on the 364-day and 91-day papers decreased marginally by 0.01 bps and 0.5 bps to remain relatively unchanged at 17.0% and 16.7%, respectively. The yields of the Cytonn Money Market Fund increased by 2.0 bps to 17.08% from 17.06% recorded the previous week, while the average yields on the Top 5 Money Market Funds increased marginally by 5.6 bps to remain relatively unchanged at 17.4% recorded the previous week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 5th April 2024:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 5th April 2024 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Etica Money Market Fund |

18.2% |

|

2 |

Lofty-Corban Money Market Fund |

18.0% |

|

3 |

Cytonn Money Market Fund (Dial *809# or download the Cytonn App) |

17.1% |

|

4 |

GenAfrica Money Market Fund |

17.0% |

|

5 |

Nabo Africa Money Market Fund |

16.8% |

|

6 |

Kuza Money Market fund |

16.3% |

|

7 |

Enwealth Money Market Fund |

16.2% |

|

8 |

Apollo Money Market Fund |

15.9% |

|

9 |

Madison Money Market Fund |

15.6% |

|

10 |

Absa Shilling Money Market Fund |

15.4% |

|

11 |

Co-op Money Market Fund |

15.4% |

|

12 |

KCB Money Market Fund |

15.4% |

|

13 |

Jubilee Money Market Fund |

15.3% |

|

14 |

Mali Money Market Fund |

14.9% |

|

15 |

Sanlam Money Market Fund |

14.9% |

|

16 |

AA Kenya Shillings Fund |

14.9% |

|

17 |

Mayfair Money Market Fund |

14.7% |

|

18 |

GenCap Hela Imara Money Market Fund |

14.5% |

|

19 |

Old Mutual Money Market Fund |

13.6% |

|

20 |

Orient Kasha Money Market Fund |

13.6% |

|

21 |

Dry Associates Money Market Fund |

13.5% |

|

22 |

CIC Money Market Fund |

13.2% |

|

23 |

ICEA Lion Money Market Fund |

12.2% |

|

24 |

British-American Money Market Fund |

9.9% |

|

25 |

Equity Money Market Fund |

7.4% |

Source: Business Daily

Liquidity:

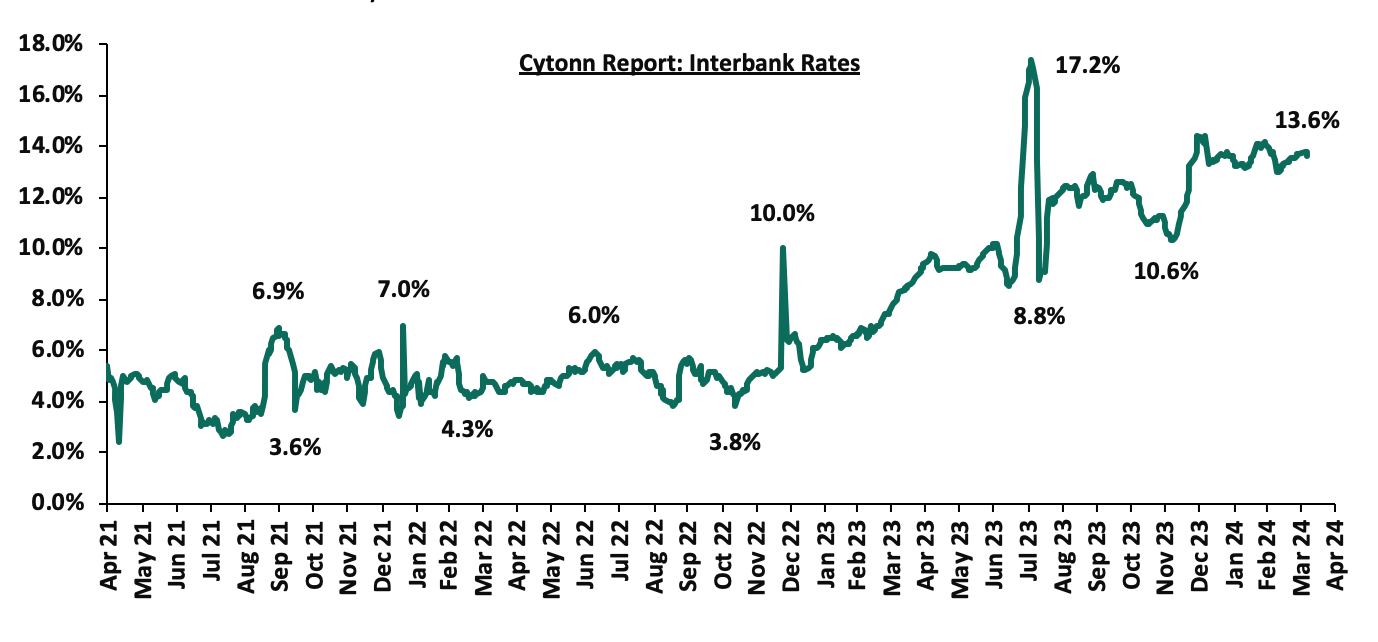

During the week, liquidity in the money markets marginally tightened, with the average interbank rate increasing by 9.2 bps, to 13.8%, from 13.7% recorded the previous week, partly attributable to the tax remittances that offset government payments. The average interbank volumes traded increased marginally by 2.5% to Kshs 24.5 bn from Kshs 23.9 bn recorded the previous week. The chart below shows the interbank rates in the market over the years:

Kenya Eurobonds:

During the week, the yields on Eurobonds recorded a mixed performance, with the yields on the 30-year Eurobond issued in 2018 decreasing the most by 41.4 bps to 9.4% from 9.8% recorded the previous week, while the yields on the 13-year Eurobond issued in 2021 increased the most by 7.3 bps to 9.4%, from 9.3% recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 4th April 2024;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2018 |

2019 |

2021 |

2024 |

||

|

Tenor |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

13-year issue |

6-year issue |

|

Amount Issued (USD) |

1.0 bn |

1.0 bn |

0.9 bn |

1.2 bn |

1.0 bn |

1.5 bn |

|

Years to Maturity |

3.9 |

23.9 |

3.1 |

8.1 |

10.2 |

6.9 |

|

Yields at Issue |

7.3% |

8.3% |

7.0% |

7.9% |

6.2% |

10.4% |

|

1-Jan-24 |

9.8% |

10.2% |

10.1% |

9.9% |

9.5% |

|

|

28-Mar-24 |

8.7% |

9.8% |

8.4% |

9.3% |

9.3% |

9.2% |

|

29-Mar-24 |

8.7% |

9.3% |

8.4% |

9.3% |

9.3% |

9.2% |

|

1-Apr-24 |

8.7% |

9.3% |

8.4% |

9.3% |

9.3% |

9.5% |

|

2-Apr-24 |

9.0% |

9.6% |

8.7% |

9.5% |

9.6% |

9.4% |

|

3-Apr-24 |

8.8% |

9.5% |

8.6% |

9.4% |

9.5% |

9.3% |

|

4-Apr-24 |

8.6% |

9.4% |

8.5% |

9.3% |

9.4% |

9.3% |

|

Weekly Change |

(0.0%) |

(0.4%) |

0.0% |

0.1% |

0.1% |

0.1% |

|

MTD Change |

(0.0%) |

0.1% |

0.0% |

0.1% |

0.1% |

(0.2%) |

|

YTD Change |

(1.2%) |

(0.8%) |

(1.7%) |

(0.6%) |

(0.1%) |

- |

Source: Central Bank of Kenya (CBK) and National Treasury

Kenya Shilling:

During the week, the Kenya Shilling gained against the US Dollar by 0.8%, to close at Kshs 130.7, from Kshs 131.8 recorded the previous week. On a year-to-date basis, the shilling has appreciated by 16.7% against the dollar, a contrast to the 26.8% depreciation recorded in 2023.

We expect the shilling to be supported by:

- Diaspora remittances standing at a cumulative USD 4,329.7 mn in the 12 months to February 2024, 7.5% higher than the USD 4,026.2 mn recorded over the same period in 2023, which has continued to cushion the shilling against further depreciation. In the February 2024 diaspora remittances figures, North America remained the largest source of remittances to Kenya accounting for 56.0% in the period, and,

- The tourism inflow receipts which came in at USD 352.5 bn in 2023, a 31.5% increase from USD 268.1 bn inflow receipts recorded in 2022, and owing to tourist arrivals that improved by 27.6% to 182,000 in the 12 months to January 2024, from 151,000 recorded during a similar period in 2023.

The shilling is however expected to remain under pressure in 2024 as a result of:

- An ever-present current account deficit which came at 3.5% of GDP in Q3’2023 from 6.4% recorded in a similar period in 2022,

- The need for government debt servicing, continues to put pressure on forex reserves given that 67.5% of Kenya’s external debt was US Dollar denominated as of September 2023, and,

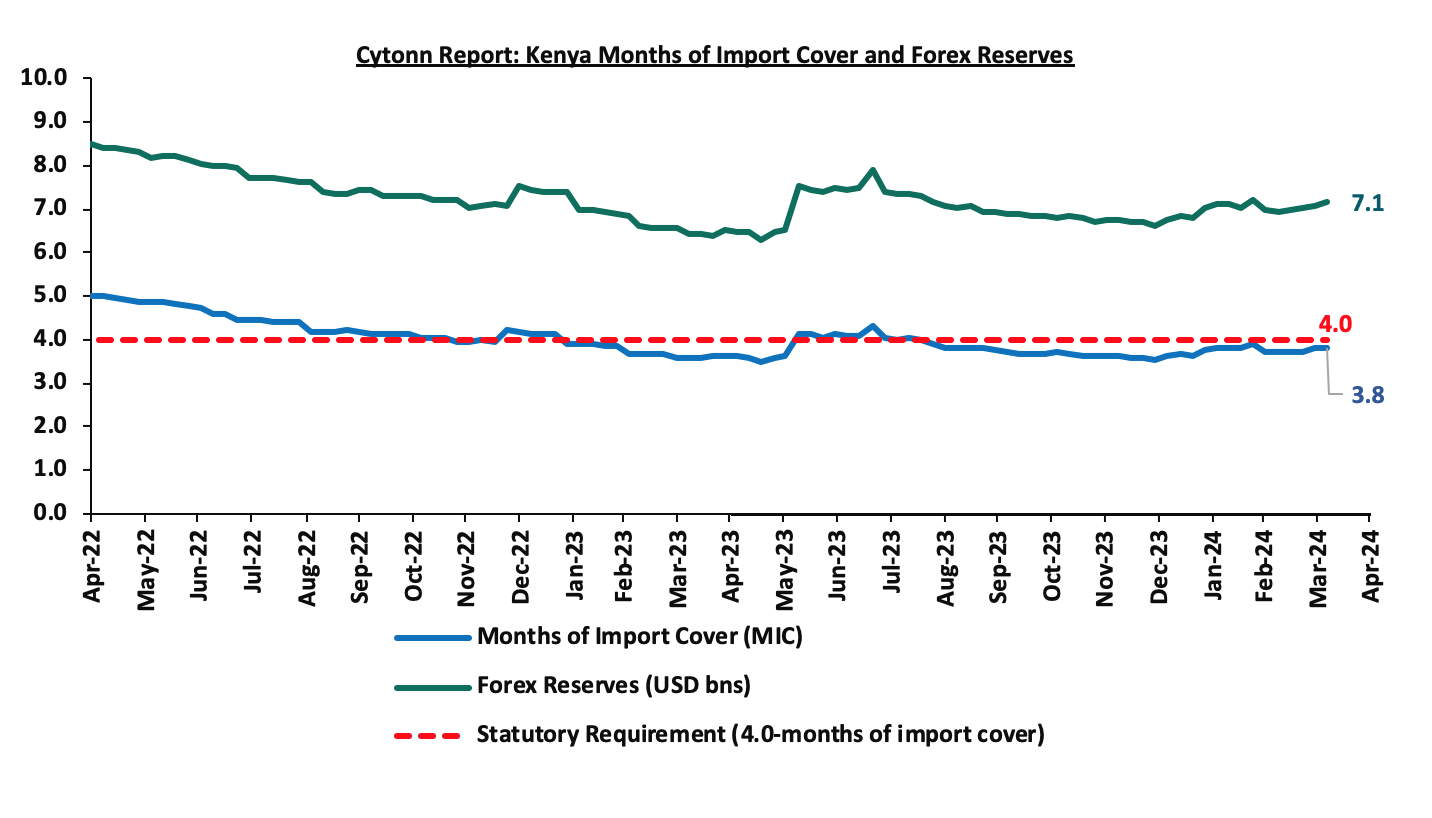

- Dwindling forex reserves, currently at USD 7.1 mn (equivalent to 3.8 months of import cover), which is below the statutory requirement of maintaining at least 4.0 months of import cover.

Key to note, Kenya’s forex reserves increased marginally by 0.8% during the week to remain relatively unchanged at USD 7.1 bn, equivalent to 3.8 months of import cover relatively unchanged from the months of import cover recorded the previous week, and remained below the statutory requirement of maintaining at least 4.0 months of import cover. The chart below summarizes the evolution of Kenya's months of import cover over the years:

Weekly Highlights

- Monetary Policy Committee (MPC) April Meeting

During the week, The Monetary Policy Committee (MPC) met on April 3, 2024, to review the outcome of its previous policy decisions against a backdrop of an improved global outlook for growth and inflation, despite persistent geopolitical tensions. The MPC decided to maintain the CBR at 13.00%, which was in line with our expectation. Our expectation to maintain the rate at 13.00% was mainly on the back of an eased inflation rate, coming in at 5.7% in March 2024 from 6.3% in February, remaining within the CBK preferred range of 2.5%-7.5% for the seventh consecutive month, stronger Shilling, as well as the need to allow more time for the effects of the previous policy rate to transmit in the economy. Key to note, the MPC had increased the CBR by 50.0 bps to 13.00% from 12.50% in the previous meeting. Below are some of the key highlights from the April meeting:

- The ongoing recovery in global growth remains supported by robust expansion in the United States and notable growth in select large emerging market economies, notably India. However, geopolitical tensions, such as those in the Israel-Palestinian and Russia-Ukraine conflicts, pose significant risks to both global growth and inflation outlooks. While global inflation has moderated overall, some advanced economies still experience persistent core inflation. On the other hand, food inflation continues to decrease due to improved supply of key food items, particularly cereals and edible oils. Yet, international oil prices present a significant risk to inflation, as they have been on an upward trend since January 2024, largely due to disruptions in shipping through the Red Sea and production cuts by OPEC+ and other allied oil producers,

- The overall inflation eased to 5.7% in March 2024, from 6.3% in January 2023, to remain on the higher bound of the preferred CBK range of 2.5%-7.5%, mainly driven by lower food and fuel inflation. Food inflation declined to 5.8% in March from 6.9% in February, reflecting lower prices of some food items, particularly maize and wheat products, carrots, kales/sukuma wiki, spinach, and cabbages, following improved supply attributed to ongoing harvests and favourable weather conditions. Fuel inflation declined to 12.3% in March from 13.4% in February, largely reflecting the impact of the shilling’s appreciation which resulted in a decrease in electricity prices and a downward adjustment in pump prices. Overall inflation is expected to moderate further in the near term, supported by easing food and energy prices, pass-through effects of the recent exchange rate appreciation, and the impact of monetary policy actions which continue to transmit in the economy,

- Leading indicators indicate ongoing strong performance of the Kenyan economy in the first quarter of 2024, driven by vigorous activity in the agriculture and service sectors, notably in accommodation and food services, as well as information and communication. Projections suggest that the economy will maintain its strength throughout 2024, propelled by the resilient services sector, robust performance in agriculture, sustained implementation of government initiatives aimed at boosting economic activity across priority sectors in alignment with the Bottom-up Economic Transformation Agenda (BETA), and an improved global growth outlook,

- According to the March 2024 Agriculture Sector Survey, participants anticipate a decline in inflation over the next three months. This expectation is attributed to the projected decrease in food prices, aligning with anticipated favourable weather conditions, the strengthening of the exchange rate, and the reduction in fuel costs,

- Ahead of the MPC meeting, both the CEOs Survey and Market Perceptions Survey indicated a surge in optimism regarding business activity and economic growth forecasts for the upcoming 12 months. This heightened positivity was credited to improved agricultural performance due to favourable weather conditions and government interventions, alongside decreasing inflation rates, a strengthening Kenya Shilling, and a robust private sector. However, participants expressed ongoing apprehension regarding taxation, elevated interest rates, and geopolitical uncertainties,

- The current account deficit was estimated 4.3% of GDP in the twelve months leading up to February 2024, a decrease from 4.7% recorded during the same period in 2023. Projections estimate the deficit to further decrease to 4.0% of GDP in 2024. Goods exports experienced a decline of 1.7% in the twelve months up to February 2024, in contrast to a 9.6% increase during the equivalent period in 2023. This decrease in exports was observed across various categories, except for food, petroleum products, and manufactured goods, which saw respective increases of 3.0%, 20.3%, and 1.4%. The rise in manufactured goods exports is attributed to strong regional demand. Likewise, goods imports declined by 8.5% in the twelve months leading up to February 2024, a contrast to the 3.5% growth seen during the same period in 2023. This decline was evident across all categories except for food and crude materials. Additionally, tourist arrivals witnessed a notable improvement, increasing by 27.6% in the twelve months up to January 2024 compared to the corresponding period in 2023, with a further 20.3% increase noted in January 2024 compared to January 2023. Remittances also saw an increase of 7.5%, reaching USD 4,329.7 mn in the twelve months leading up to February 2024, compared to USD 4,026.2 mn during the same period in 2023,

- The foreign exchange reserves of the CBK, totalling USD 7,136.0 mn, equivalent to 3.8 months of import cover, remain sufficient and serve as a safeguard against potential short-term shocks in the foreign exchange market,

- The banking sector demonstrates stability and resilience, characterized by robust liquidity and capital adequacy ratios. In February 2024, the ratio of gross non-performing loans (NPLs) to gross loans rose to 15.5% from 14.8% in December 2023. The uptick in NPLs was observed across various sectors including real estate, trade, personal and household, energy and water, and building and construction. Despite this, banks have maintained sufficient provisions for non-performing loans,

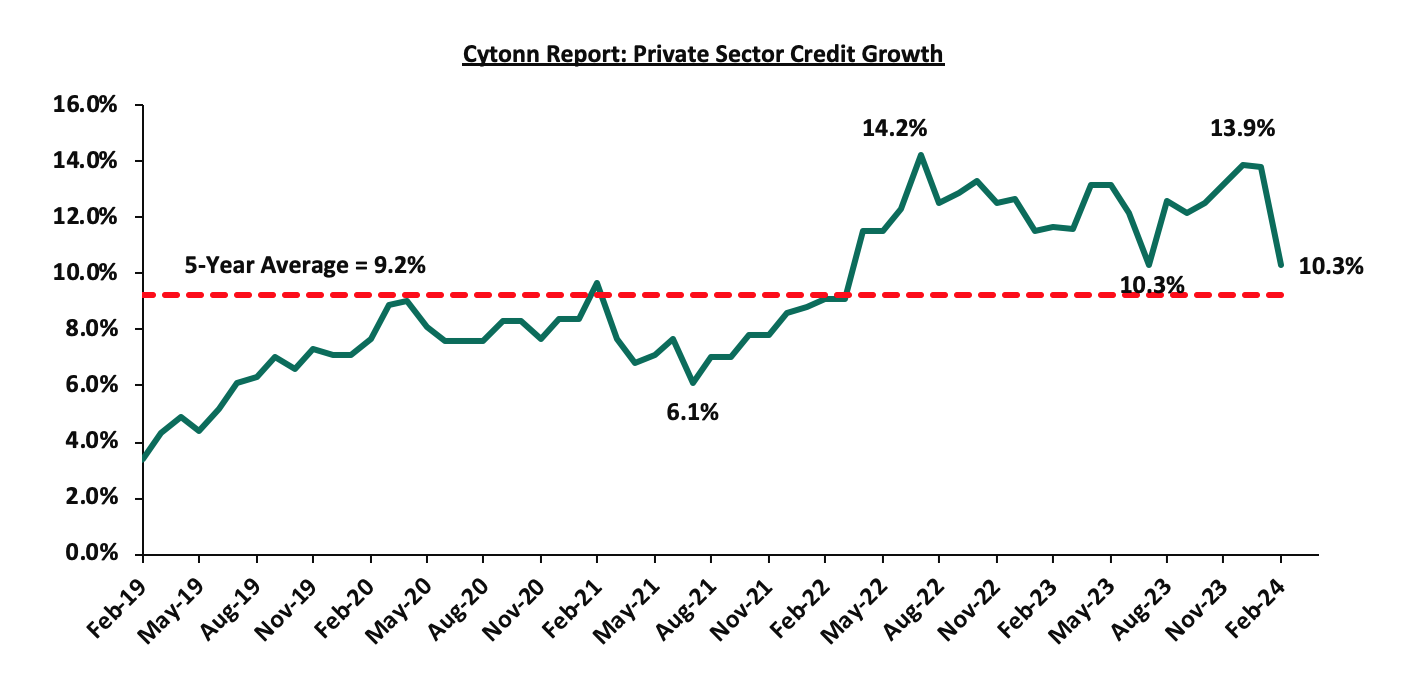

- In February 2024, the growth in commercial bank lending to the private sector was recorded at 10.3%, down from 13.8% in January 2024. Credit expansion to specific sectors saw the following rates: manufacturing at 13.6%, transport and communication at 7.5%, trade at 10.7%, and consumer durables at 7.4%. Despite this decrease, the volume of loan applications and approvals remained robust, indicating consistent demand, especially for working capital needs. The chart below shows the movement of the private sector credit growth over the last five years:

- The Committee observed the continued implementation of the Government Budget for the FY’2023/24, which remains focused on strengthening fiscal consolidation efforts.

The Monetary Policy Committee (MPC) observed that its previous interventions successfully curbed inflation, mitigated exchange rate pressures, and stabilized inflationary expectations. Additionally, the committee anticipated a continued decline in overall inflation in the near future, supported by reduced food and fuel prices, along with the effects of recent exchange rate improvements. Therefore, the MPC decided to maintain the Central Bank Rate (CBR) at 13.0%, ensuring that overall inflation moves towards the 5.0% mid-point of the target range. Going forward, the MPC will closely monitor the impact of its policy measures and economic developments, both globally and domestically, and stands prepared to take further action as needed in line with its mandate. We expect an ease in the CBR in the medium term as inflation remains to be anchored within the CBK target range of 2.5%-7.5% and towards the preferred target of 5.0%, coupled with a sustained strength of the Shilling. The Committee's next meeting is scheduled for June 2024.

- Stanbic Bank’s March 2024 Purchasing Manager’s Index (PMI)

During the week, Stanbic Bank released its monthly Purchasing Manager's Index (PMI) highlighting that the index for the month of March 2024 declined, coming in at 49.7, down from 51.3 in February 2024. The index was also at its lowest level in three months, signaling a decline in operating activities. Notably, private sector conditions softened, offsetting the expansion recorded in February, mainly on the back of heightened cost of living.

The private sector experienced a reversal in business activity after achieving its strongest upturn in over a year in February. Output slightly contracted, on the back of reduced new order intake and cash flow challenges. Despite a fractional decline in new orders reported by the survey, firms noted a reduction in price pressures which contributed to increased customer spending.

Price metrics indicated a continued deceleration in inflationary pressures by the end of Q1’2024, with the y/y inflation in March 2024 easing by 0.6% points to 5.7%, from the 6.3% recorded in February 2024. Input costs experienced a modest rise, marking the slowest pace since February 2021. This was due to lower import costs attributed to the strengthened exchange rate of the Kenyan shilling against the US dollar and the reduced fuel prices, with fuel prices decreasing by Kshs 7.2, Kshs 5.1, and Kshs 4.5 per litre for Super Petrol, Diesel, and Kerosene, respectively. This subdued growth in input prices resulted in a less pronounced increase in selling charges, the lowest since January 2022. Meanwhile, Kenyan companies cut back their procurement of inputs to align with declining sales, marking the quickest reduction since November.

Although there was a general decrease, the survey data highlighted some encouraging trends for businesses in Kenya. Employment numbers continued to rise for the third consecutive month in March, albeit at the slowest pace, while staff costs remained stable for the second month in a row. At the same time, businesses continued to increase their inventories for the second consecutive month, driven by expectations of a potential uptick in customer demand.

Despite the general downturn, overall business Sentiment towards future output reached a four-month high, rebounding from the lowest recorded sentiment in February. The outlook was on the back of decreasing inflation trends, which fueled increased demand and bolstered expansion intentions, particularly among services and wholesale & retail firms, who exhibited the highest levels of optimism. The chart below summarizes the evolution of PMI over the last 24 months:

Going forward, we anticipate that the business environment will be constrained in the short to medium term as a result of the tough economic environment driven by high interest rates from the tightened monetary policy, increased taxes, and overall rise in the cost of living. However, we expect businesses to be supported by the easing of inflationary pressures coupled with the appreciating Shilling, which are set to reduce input costs.

Rates in the Fixed Income market have been on an upward trend given the continued high demand for cash by the government and the occasional liquidity tightness in the money market. The government is 16.4% ahead of its prorated net domestic borrowing target of Kshs 365.2 bn, having a net borrowing position of Kshs 425.1 bn out of the domestic net borrowing target of Kshs 471.4 bn for the FY’2023/2024. However, we expect a soft downward readjustment of the yield curve in the short and medium term, with the government looking to increase its external borrowing to maintain the fiscal surplus, hence alleviating pressure in the domestic market. As such, we expect the yield curve to normalize in the long-term and hence investors are expected to shift towards the long-term papers eventually

Market Performance:

During the week, the equities market recorded mixed performances, with NSE 10, NSE 25, and NASI gaining by 1.2%, 0.8%, and 0.2% respectively, while NSE 20 declined by 0.2%, taking the YTD performance to gains of 28.3%, 25.7%, 23.3%, and 15.9% for NSE 10, NSE 25, NASI, and NSE 20 respectively. The equities market performance was driven by gains recorded by large-cap stocks such as EABL, NCBA, and Standard Chartered Bank of 6.3%, 3.2%, and 1.8% respectively. The gains were, however, weighed down by losses recorded by large cap stocks such as Bamburi Cement, DTB-K, and Safaricom of 8.1%, 2.3%, and 1.1% respectively.

During the week, equities turnover decreased by 49.1% to USD 18.2 mn from USD 35.8 mn recorded the previous week, taking the YTD total turnover to USD 48.6 mn. Foreign investors remained net sellers for the third consecutive week with a net selling position of USD 1.1 mn, from a net selling position of USD 7.4 mn recorded the previous week, taking the YTD foreign net selling position to USD 17.5 mn.

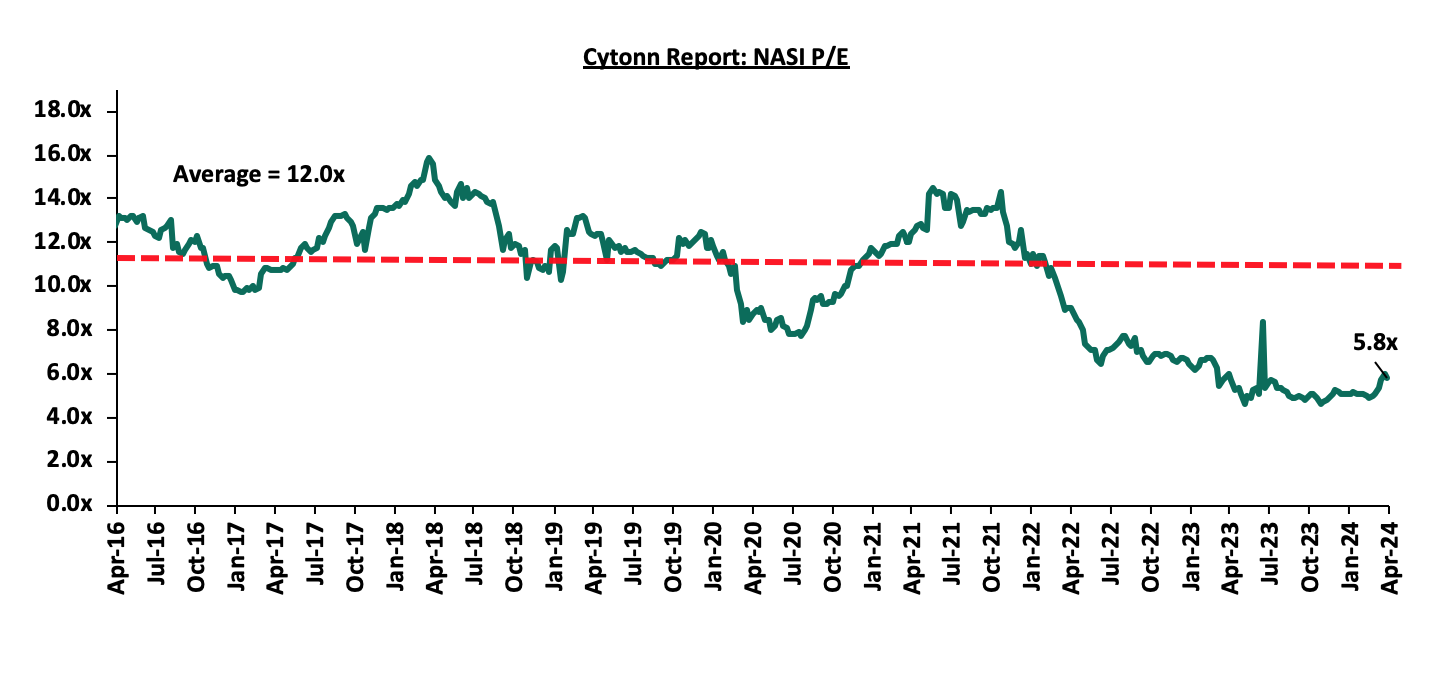

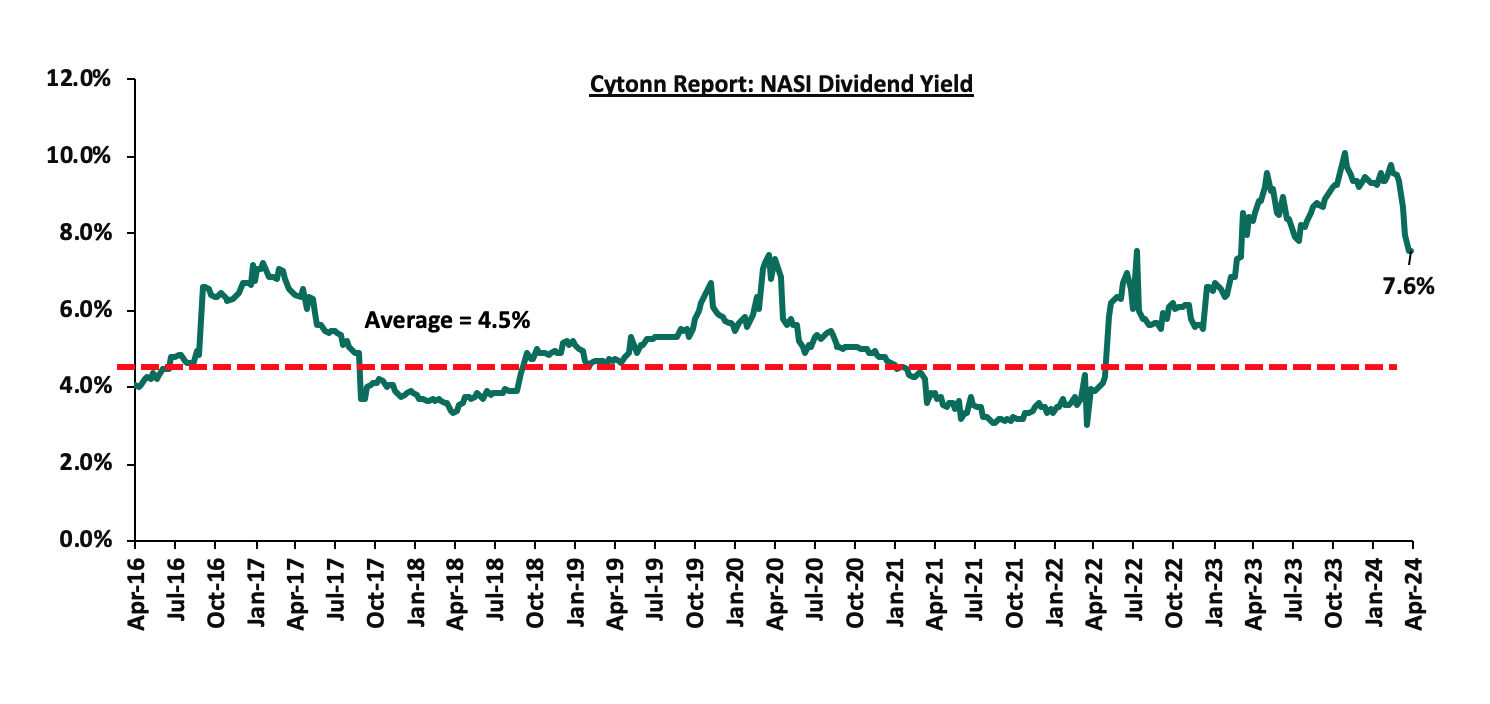

The market is currently trading at a price-to-earnings ratio (P/E) of 5.8x, 51.6% below the historical average of 12.0x. The dividend yield stands at 7.6%, 3.1% points above the historical average of 4.5%. Key to note, NASI’s PEG ratio currently stands at 0.7x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market is overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of Coverage:

|

Cytonn Report: Equities Universe of Coverage |

|||||||||

|

Company |

Price as at 28/03/2024 |

Price as at 05/04/2024 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Sanlam |

6.5 |

7.0 |

8.0% |

16.3% |

10.3 |

0.0% |

47.4% |

2.0x |

Buy |

|

Co-op Bank*** |

15.0 |

15.0 |

(0.3%) |

31.7% |

19.3 |

10.0% |

39.1% |

0.7x |

Buy |

|

Jubilee Holdings |

197.5 |

196.0 |

(0.8%) |

5.9% |

260.7 |

6.1% |

39.1% |

0.3x |

Buy |

|

Equity Group*** |

47.2 |

47.9 |

1.5% |

39.9% |

61.6 |

8.4% |

37.1% |

1.1x |

Buy |

|

Diamond Trust Bank*** |

55.0 |

53.8 |

(2.3%) |

20.1% |

67.8 |

9.3% |

35.4% |

0.2x |

Buy |

|

ABSA Bank*** |

14.0 |

14.0 |

0.4% |

21.2% |

17.3 |

11.1% |

34.6% |

1.1x |

Buy |

|

NCBA*** |

43.8 |

45.2 |

3.2% |

16.3% |

55.2 |

10.5% |

32.6% |

0.9x |

Buy |

|

Standard Chartered*** |

197.8 |

201.3 |

1.8% |

25.6% |

232.1 |

14.4% |

29.7% |

1.4x |

Buy |

|

I&M Group*** |

22.1 |

21.9 |

(0.7%) |

25.5% |

25.6 |

11.6% |

28.5% |

0.5x |

Buy |

|

Stanbic Holdings |

126.5 |

126.3 |

(0.2%) |

19.1% |

145.3 |

12.2% |

27.2% |

0.9x |

Buy |

|

Kenya Reinsurance |

2.2 |

2.1 |

(3.2%) |

15.7% |

2.5 |

9.3% |

26.6% |

0.2x |

Buy |

|

KCB Group*** |

30.1 |

30.1 |

0.2% |

37.1% |

37.2 |

0.0% |

23.6% |

0.5x |

Buy |

|

Liberty Holdings |

5.5 |

5.1 |

(6.6%) |

32.6% |

6.1 |

0.0% |

19.1% |

0.4x |

Accumulate |

|

Britam |

5.0 |

5.1 |

2.0% |

(0.8%) |

6.0 |

0.0% |

17.1% |

0.7x |

Accumulate |

|

CIC Group |

2.2 |

2.4 |

7.2% |

4.4% |

2.5 |

5.4% |

10.0% |

0.8x |

Accumulate |

|

HF Group |

4.2 |

3.9 |

(6.7%) |

13.9% |

3.9 |

0.0% |

(0.8%) |

0.2x |

Sell |

Weekly Highlights:

- Bamburi Cement Plc Issues Profit Warning

During the week, the board of directors of Bamburi Cement Plc announced a profit warning for the FY’2023, anticipating a decrease of at least 25.0% in net earnings compared to 2022. This decline is primarily attributed to one-off settlements of tax liabilities and legal disputes, notably in Hima Cement Limited, impacting the overall financial performance.

This announcement was in line with the requirements of the thirteenth schedule of the Capital Markets Regulations 2023, which demands that Companies issue profit warnings if they project a more than 25.0% decline in profits year-on-year.

In the previous week, the company had announced the successful completion of the sale of 1.3 mn ordinary shares in Hima Cement Limited, representing 70.0% of the total shares owned by Bamburi Cement Plc through its parent company Himcem Holdings Limited, to Sarrai Group Limited and Rwimi Holdings Limited. This development, the company says, requires settlements that are integral for the closure and would therefore significantly impact the financial results for the year 2023.

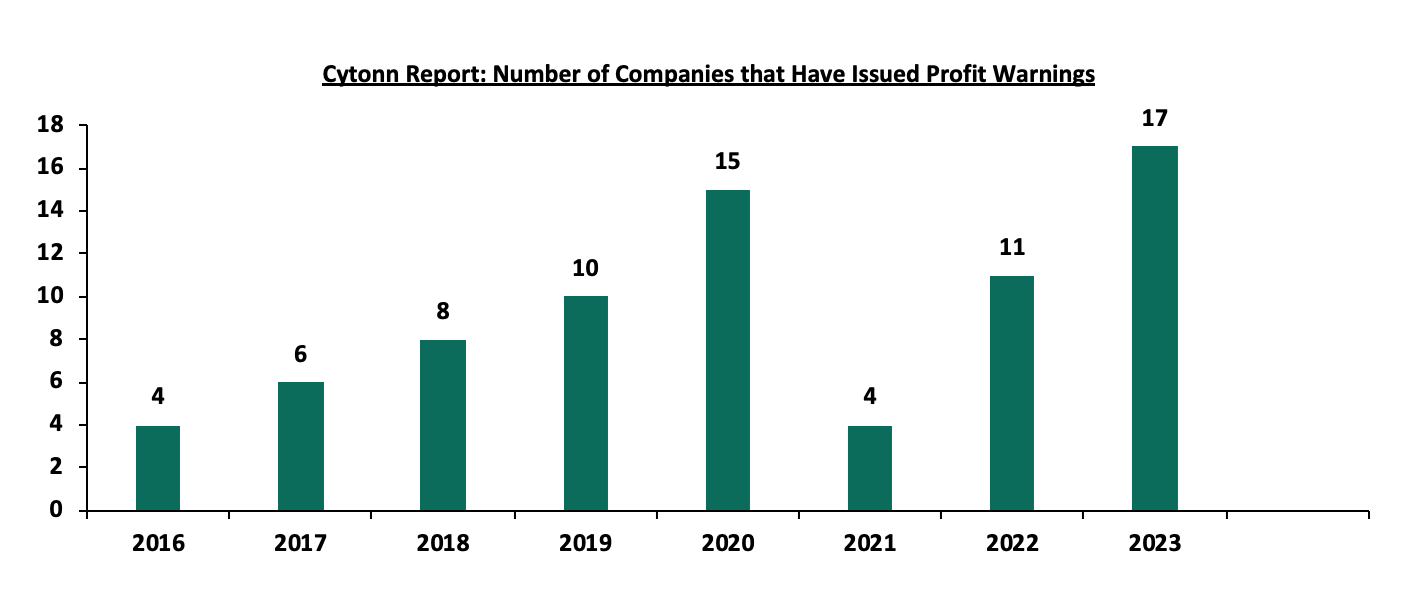

This is the second profit warning of the year, after Eagads Plc also issued their warning last month, citing a decline in coffee volumes offered in the market. It also adds to the 15 profit warnings that were issued by companies in 2023. The elevated number of companies that issued profit warnings in the last twelve months is an indication of tough economic conditions, occasioned by the high inflationary pressures and the currency depreciation which now show signs of recovery. Below is the summary of the companies that have issued profit warnings in recent years:

|

Cytonn Report: Companies that Issued Profit Warnings |

|||

|

No |

2023 |

2022 |

2021 |

|

1 |

Car & General |

Bamburi Cement PLC |

Centum Plc |

|

2 |

Centum Plc |

Centum Investments Co Plc |

Umeme Limited |

|

3 |

Crown Paints Kenya |

Crown Paints Kenya PLC |

Williamson Tea Kenya PLC |

|

4 |

Eveready |

Flame Tree Group Holdings Ltd |

WPP ScanGroup PLC |

|

5 |

Express Kenya |

Kakuzi Plc |

|

|

6 |

Kakuzi Plc |

Liberty Kenya Holdings Ltd |

|

|

7 |

Kenya Airways |

Nairobi Securities Exchange PLC |

|

|

8 |

KPLC |

Sameer Africa plc |

|

|

9 |

Longhorn Publishers Plc |

Sanlam Plc |

|

|

10 |

Nation Media Group |

The Limuru Tea Kenya Plc |

|

|

11 |

Sameer Africa Plc |

|

|

|

12 |

Sanlam Plc |

|

|

|

13 |

Sasini Plc |

|

|

|

14 |

Unga Plc |

|

|

|

15 |

WPP Scan Group |

|

|

|

16 |

Eagads Ltd |

|

|

|

17 |

Bamburi Cement Plc |

|

|

Below is a summary of the number of companies that issued profit warnings over the last 8 years:

- Bank of Kigali Closes Representative Office in Kenya

During the week, The Central Bank of Kenya (CBK) announced the cancellation of Bank of Kigali's (BoK) authority to operate a Representative Office in Kenya, effective April 2, 2024. BoK, headquartered in Kigali and founded in 1966, opted for the voluntary termination of its Kenya presence as part of a strategic shift towards prioritizing digital service delivery channels. The Bank of Kigali had been authorized to operate as a representative office in Kenya by the Central Bank back in February 2013.

A representative office is a type of organizational presence established by a company in a location outside its home country. Unlike subsidiaries or branches, a representative office typically does not engage in profit-generating activities or direct business transactions. Instead, its primary purpose is to serve as a liaison or conduit between the parent company and local stakeholders, facilitating communication, market research, and relationship-building.

In this communication, the Central Bank noted that this voluntary termination of BoK’s presence in Kenya followed a strategic decision made by the bank to focus more on digital service delivery channels. By consolidating resources and focusing on digital platforms, BoK seeks to adapt to evolving market dynamics and enhance its competitive edge in the digital banking landscape. This move comes ahead of the release of the bank’s FY’2023 audited results. The group is primarily listed in the Rwandan Stock market but has a secondary listing in the Nairobi Securities exchange.

We are “Neutral” on the Equities markets in the short term due to the current tough operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery. With the market currently being undervalued for its future growth (PEG Ratio at 0.7x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors’ sell-offs to continue weighing down the equities outlook in the short term.

- Residential Sector

During the week, the Kenya Mortgage Refinance Company (KMRC) unveiled the Kenya Mortgage Guarantee Trust (KMGT), a pivotal initiative aimed at mitigating risks for banks and SACCOs providing home loans to high-risk individuals, particularly low to mid-income workers. According to the latest SACCO Supervision Annual Report, regulated SACCOs disbursed Kshs 680.4 bn in loans during 2022, compared to banking institutions at Kshs 3,630.3 bn during the similar period. By providing a partial guarantee for mortgages, KMGT aims to instill confidence in lenders, thus catalyzing the provision of housing finance to income groups previously deemed high risk. In collaboration with private lenders and development financiers, this effort aligns with KMRC's broader objective of de-risking the mortgage market by offering long-term funds to participating lenders at a fixed interest rate of 5.0%, thereby enabling them to extend affordable financing to prospective homeowners earning a maximum monthly income of Kshs 200,000. By extending financing to qualifying homebuyers at a single-digit interest rate, the primary lenders will ensure affordability and stability in repayments. The credit-sharing facility is poised to expand KMRC’s reach to workers in the informal sector, encompassing approximately 84.0% of Kenya’s labour force, and represents a crucial step towards achieving inclusive access to housing finance. This strategic intervention addresses the challenges faced by low- to mid-income earners in accessing affordable housing financing, ultimately contributing to the realization of President William Ruto's ambitious agenda to construct 250,000 affordable housing units annually.

We expect that the establishment of the Kenya Mortgage Guarantee Trust (KMGT) will serve as a catalyst for revitalizing the housing finance landscape in Kenya. By providing a partial guarantee for mortgages extended to high-risk individuals, KMGT is poised to instill confidence in lenders and stimulate increased financing for homeownership, particularly among low- to mid-income workers. This innovative approach aligns with KMRC's mission to broaden access to housing finance and foster economic empowerment. Additionally, the expected expansion of KMRC's product offering to include workers in the informal sector further underscores the organization's commitment to promoting inclusivity and addressing the diverse needs of Kenya's labour force.

- Real Estate Investments Trusts (REITs)

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 24.4 and Kshs 21.7 per unit, respectively, as of 22nd March 2024. The performance represented a 22.0% and 8.3% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 12.3 mn and 30.7 mn shares, respectively, with a turnover of Kshs 257.5 mn and Kshs 633.8 mn, respectively, since inception in February 2021.

REITs provide various benefits like tax exemptions, diversified portfolios, and stable long-term profits. However, the continuous deterioration in the performance of Kenyan REITs and the restructuring of their business portfolios is hampering major investments that had previously been made. The other general challenges include; i) inadequate comprehension of the investment instrument among investors, ii) prolonged approval processes for REITs creation, iii) high minimum capital requirements of Kshs 100.0 mn for trustees, and, iv) minimum investment amounts set at Kshs 5.0 mn, continue to limit the performance of the Kenyan REITs market.

We anticipate the Real Estate sector in Kenya to receive significant support from various factors: i) expansion of initiatives and the advancement of affordable housing projects are set to stimulate growth in the residential segment, ii) favorable demographics, characterized by population growth and urbanization, are fueling increased demand for housing and Real Estate assets, and iii) ongoing infrastructure improvements are opening up new investment prospects in emerging areas. However, challenges such as rising construction costs, limited investor familiarity with Real Estate Investment Trusts (REITs), and existing oversupply in certain market segments may persist. These obstacles have the potential to hinder sectoral performance by constraining development and investment opportunities.

Privatization involves selling government-owned assets (including shares in state-owned companies) to private individuals or businesses. This excludes selling new shares to current shareholders or financial restructuring within a company that might reduce the government's ownership percentage. The proof of long-term inefficiencies, misconduct, poor financial management, and waste in state owned enterprises (SOEs) necessitates the need for privatization which typically tries to increase economic efficiency by increasing a company's performance, hence eliminating or reducing the need for government economic intervention, attract private investment and foster innovation. Furthermore, privatizations have been utilized to promote competition in monopolized industries. By transitioning from state control to private ownership, these enterprises are envisioned to become more agile, responsive to market dynamics, and better positioned to contribute significantly to the nation’s socio-economic development. As at the end of FY’2022/23, publicly guaranteed debt by SOEs stood at Kshs 170.2 bn, a 17.1% increase from Kshs 145.4 bn in FY’2021/22, contrary to the current regime’s target to reduce expenditure. As a result, privatization of state-owned enterprises (SOEs) has been identified as a fiscal enhancement option, and it is one of the requirements imposed by multilateral lenders such as the International Monetary Fund (IMF) for access to concessional lending facilities.

Kenya's privatization efforts have stalled for years. Although the previous government identified 26 state-owned companies for privatization in 2016, none were actually sold. However, the new regime is aiming to speed up the process to improve the government's financial health. In February 2024, Kenya’s Cabinet approved the sale of seven more state owned enterprises bringing the total number to seventeen. Additionally, the Privatization Bill 2023 was assented to the Privatization Act 2023 which replaced the Privatization Act 2005, introducing new regulatory dynamics for privatizing public companies in Kenya. The Act intends to speed up the privatization process, reducing the previously required steps by eliminating certain formalities. In this week’s focus, we shall cover the following:

- History of SOE Privatization of Kenya,

- The Privatization Act 2023,

- The Benefits of Privatizing State Owned Enterprises in Kenya,

- The Progress of SOE Privatization in Kenya, and,

- Recommendations and Conclusion.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.