The Hustler Fund, & Cytonn Weekly #51/2022

By Research, Dec 26, 2022

Executive Summary

Fixed Income

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 69.9%, down from the 121.8% recorded the previous week, partly attributable to the tightened liquidity in the money market with the average interbank rate increasing to 6.2% from 5.1% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 13.9 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 347.9%, down from 487.7% recorded the previous week. The subscription rates for the 364-day and the 182-day papers also declined to 19.3% and 9.3% from 29.9% and 67.2% recorded the previous week, respectively. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day and 91-day papers increasing slightly by 1.1 bps, 0.4 bps and 1.4 bps to 10.3%, 9.8% and 9.4%, respectively. In the Primary Bond Market, the Central Bank of Kenya released the auction results for the tap sale of IFB1/2022/006 with an effective tenor to maturity of 5.9 years. The bond was undersubscribed, with the overall subscription rate coming in at 54.1%, with the government receiving bids worth Kshs 10.8 bn against offered Kshs 20.0 bn. The coupon rate and weighted average yield came in at 13.2%;

Additionally, during the week, the International Monetary Fund (IMF) announced that it completed the review of the Extended Credit Facility and Extended Fund Facility arrangements with Kenya and approved the disbursement of USD 447.4 mn (Kshs 55.1 bn) marking the 5th tranche of the USD 2.3 bn (Kshs 288.3 bn) loan amount to be disbursed.

We are projecting the y/y inflation rate for December 2022 to ease to a range of 9.3% - 9.7%, on the back of maintained fuel prices for the period between 15th December 2022 and 14th January 2023 and the upward revision of the Central Bank Rate during November 2022 sitting by 50.0 bps to 8.75% from 8.25% in September 2022;

Equities

During the week, the equities market recorded mixed performance with NASI declining by 0.3%, while NSE 20 and NSE 25 gained by 0.6% and 0.1%, respectively, taking YTD performance to losses of 23.3%, 13.1% and 16.7% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large cap stocks such as Safaricom, Equity Group, and ABSA Bank of 1.4%, 0.5%, and 0.4%, respectively. The losses were however mitigated by gains recorded by banking stocks such as NCBA Group, Standard Chartered Bank Kenya (SCBK) and KCB Group of 3.3%, 3.2% and 2.0%, respectively;

Real Estate

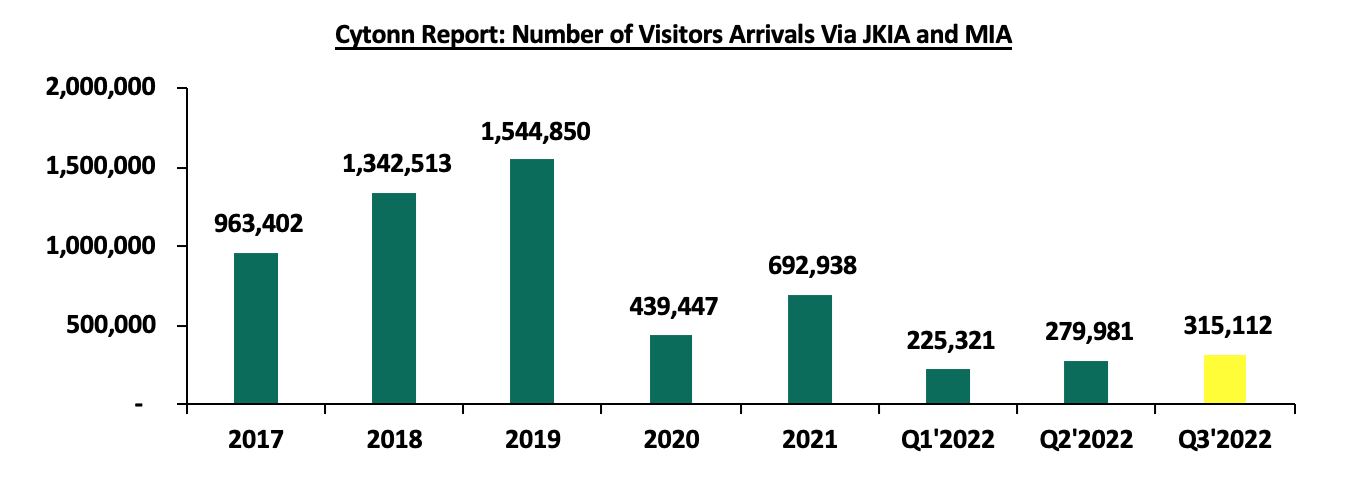

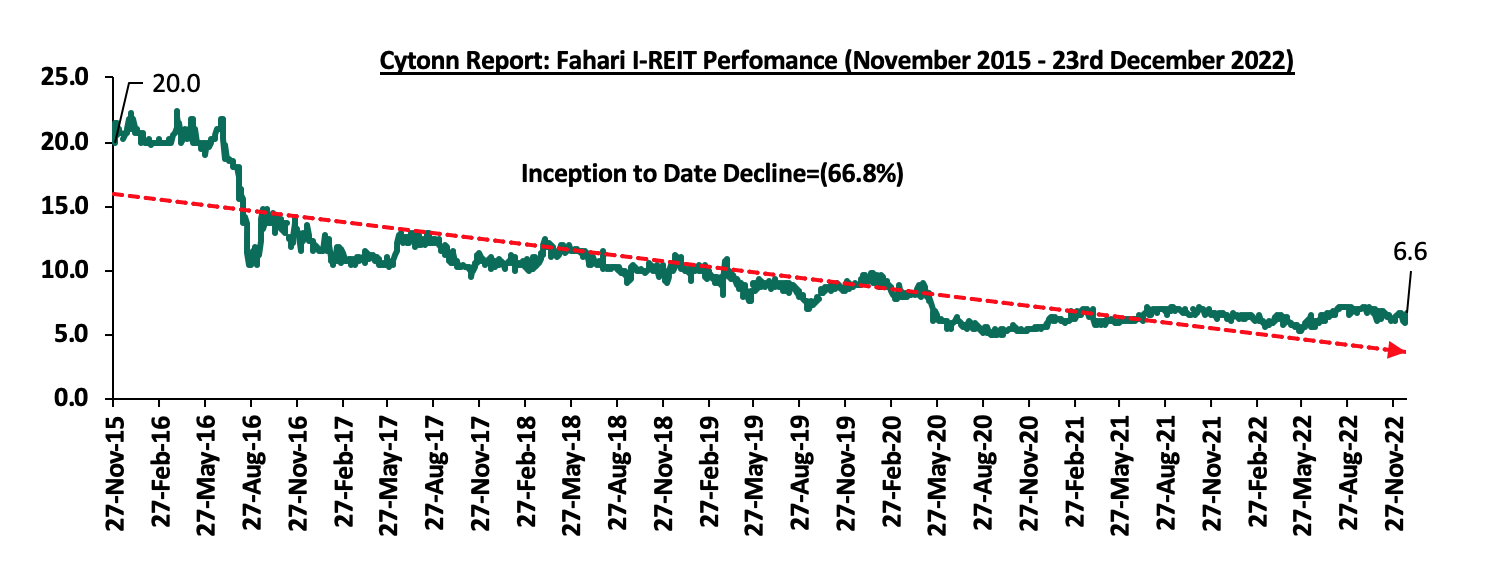

During the week, the Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) September 2022 and October 2022 reports highlighting that the number of international arrivals through Jomo Kenyatta International Airport (JKIA) and Moi International Airport (MIA) increased by 44.6% to 315,112 in Q3’2022, from the 217,873 recorded in Q3’2021. In the residential sector, Superior Homes, a Nairobi based housing developer where Cytonn is the second largest shareholder, launched a luxurious Conservancy Living Development project dubbed ‘Lukenya Wildlife Estate’ located within Swara Plains Conservancy, Machakos County. In the retail sector, local retailer Naivas Supermarket opened a new outlet at Shell-Express Uthiru located along Waiyaki Way Road on 15th December 2022 bringing its total number of outlets to 91. In the Real Estate Investment Trusts (REITs) segment, Fahari I-REIT closed the week trading at an average price of Kshs 6.6 per share on the Nairobi Stock Exchange, a 9.2% increase from Kshs 6.1 per share recorded the previous week. On the Unquoted Securities Platform as at 16th December 2022, Acorn D-REIT and I-REIT closed the week trading at Kshs 23.8 and Kshs 20.9 per unit, respectively, a 19.2% and 4.4% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price;

Focus of the Week

As highlighted in our topical on Private Sector Credit Growth, Kenya’s domestic credit extended to private sector as a percentage of GDP came in at 32.1% in 2020, compared to the 38.9% average for the Sub-Saharan African region, 111.2% for South Africa and 164.2% for advanced economies, highlighting the gap in credit availability for businesses. To achieve 100.0% Private Sector Credit to GDP, Kenya needs total credit to private sector of Kshs 12.1 tn, current credit to private sector is Kshs 3.4 tn, hence the current Kshs 8.7 tn deficit in credit to the private sector. The Hustler fund, at Kshs 50.0 bn, only resolves 0.6% of the problem, assuming it’s sustainable. One of the key inhibitors to credit growth has been the fact that in Kenya, banks provide 99.0% of credit, as compared to other developed economies where banks provide only 40.0% of credit with the vast majority of 60.0% coming from capital markets, both regulated and private markets. Key to note, individuals at the bottom of economic pyramid have suffered more in terms of access to credit mainly because of bureaucratic measures in borrowing from banks coupled with the high interest rates charged. When credit has been advanced by digital credit providers, it has been equally as expensive, with often punitive terms. In a bid to bridge the credit gap and in line with pre-election promises, the new administration launched the Financial Inclusion Fund, dubbed the “Hustler Fund” on 30th November 2022, with the fund’s main objective being to improve the credit access to citizens at the bottom of the pyramid who have often struggled to obtain affordable credit;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.92%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.88% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- We continue to offer Wealth Management Training every Wednesday, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for assignment, click here for the latest term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

Real Estate Updates:

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To rent please email properties@cytonn.com;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

Money Markets, T-Bills Primary Auction:

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 69.9%, down from the 121.8% recorded the previous week, partly attributable to the tightened liquidity in the money market with the average interbank rate increasing to 6.2% from 5.1% recorded the previous week. Investor’s preference for the shorter 91-day paper persisted as they sought to avoid duration risk, with the paper receiving bids worth Kshs 13.9 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 347.9%, down from 487.7% recorded the previous week. The subscription rates for the 364-day and the 182-day papers also declined to 19.3% and 9.3% from 29.9% and 67.2% recorded the previous week, respectively. The yields on the government papers were on an upward trajectory, with the yields on the 364-day, 182-day and 91-day papers increasing slightly by 1.1 bps, 0.4 bps and 1.4 bps to 10.3%, 9.8% and 9.4%, respectively. The Government continued to reject expensive bids, accepting a total of Kshs 13.8 bn worth of bids out of the Kshs 16.8 bn worth of bids received, translating to an acceptance rate of 82.5%.

In the Primary Bond Market, the Central Bank of Kenya released the auction results for the tap sale of IFB1/2022/006 with an effective tenor to maturity of 5.9 years. The bond was undersubscribed partly attributable to investor’s preference for shorter dated papers as they sought to avoid duration risk, with the overall subscription rate coming in at 54.1%, with the government receiving bids worth Kshs 10.8 bn against offered Kshs 20.0 bn. The coupon rate and weighted average yield of the bond came in at 13.2%.

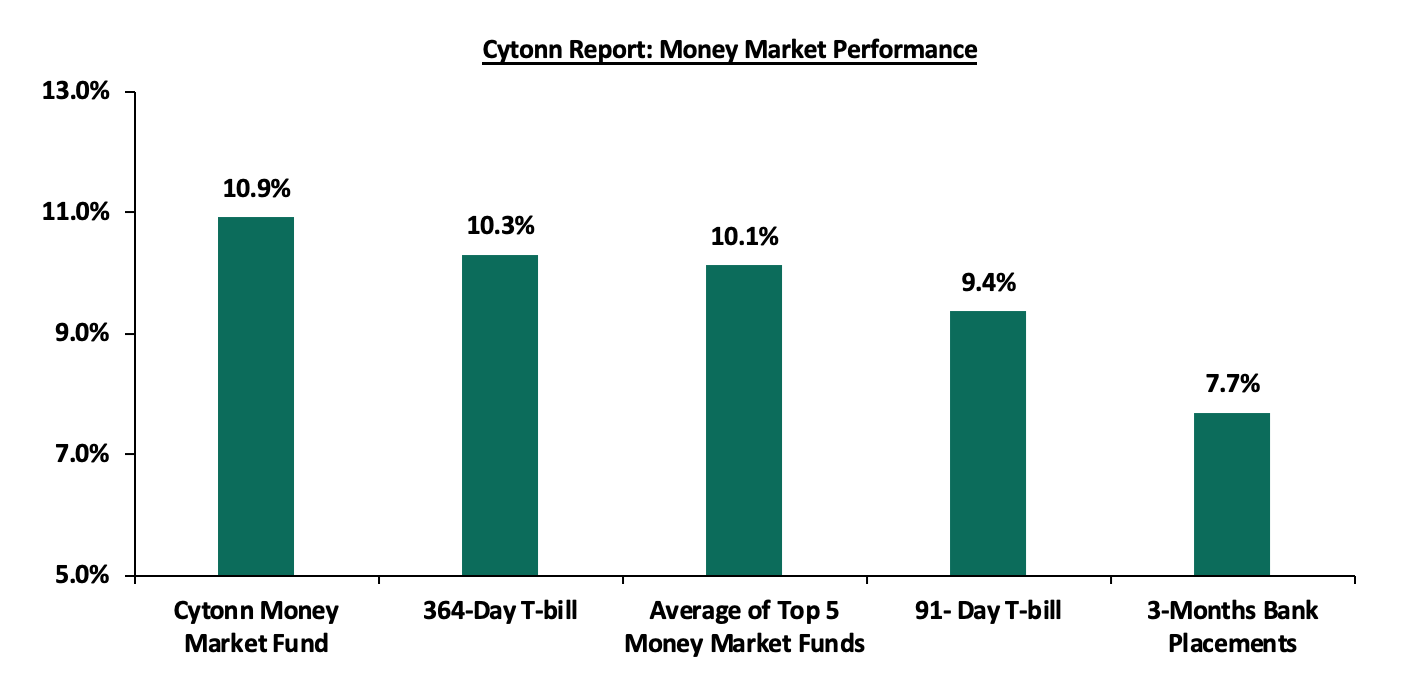

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 364-day T-bill and 91-day T-bill increased slightly by 1.1 bps and 1.4 bps to 10.3% and 9.4%, respectively. The average yield of the Top 5 Money Market Funds and Cytonn Money Market Fund increased by 19.6 bps and 21.0 bps to 10.1% and 10.9%, respectively.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 23rd December 2022:

|

Cytonn Report: Money Market Fund Yield for Fund Managers as published on 23rd December 2022 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund (dial *809# or download Cytonn App) |

10.9% |

|

2 |

GenCap Hela Imara Money Market Fund |

10.0% |

|

3 |

Apollo Money Market Fund |

9.9% |

|

4 |

Kuza Money Market fund |

9.9% |

|

5 |

Zimele Money Market Fund |

9.9% |

|

6 |

NCBA Money Market Fund |

9.8% |

|

7 |

Madison Money Market Fund |

9.5% |

|

8 |

Sanlam Money Market Fund |

9.5% |

|

9 |

Nabo Africa Money Market Fund |

9.5% |

|

10 |

Co-op Money Market Fund |

9.2% |

|

11 |

Dry Associates Money Market Fund |

9.2% |

|

12 |

AA Kenya Shillings Fund |

9.2% |

|

13 |

CIC Money Market Fund |

9.1% |

|

14 |

Old Mutual Money Market Fund |

9.1% |

|

15 |

British-American Money Market Fund |

9.0% |

|

16 |

ICEA Lion Money Market Fund |

8.7% |

|

17 |

Orient Kasha Money Market Fund |

8.6% |

|

18 |

Absa Shilling Money Market Fund |

7.7% |

|

19 |

Equity Money Market Fund |

5.4% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets tightened, with the average interbank rate increasing to 6.2% from 5.1% recorded the previous week, partly attributable to tax remittances that offset government payments. The average interbank volumes traded declined by 31.8% to Kshs 21.2 bn from Kshs 31.1 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds were on an upward trajectory with the yield on the 10-year Eurobond issued in 2014 and 10-year Eurobond issued in 2018 recording the largest increase having gained by 0.5% points to 13.1% and 10.4% from 12.6% and 9.9% respectively recorded the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as at 22nd December 2022;

|

Cytonn Report: Kenya Eurobonds Performance |

||||||

|

|

2014 |

2018 |

2019 |

2021 |

||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

3-Jan-22 |

4.4% |

8.1% |

8.1% |

5.6% |

6.7% |

6.6% |

|

30-Nov-22 |

12.0% |

10.1% |

10.8% |

10.7% |

10.4% |

9.6% |

|

15-Dec-22 |

12.6% |

9.9% |

10.6% |

10.4% |

10.3% |

9.4% |

|

16-Dec-22 |

13.3% |

10.2% |

10.7% |

10.7% |

10.5% |

9.6% |

|

19-Dec-22 |

13.4% |

10.3% |

10.8% |

10.8% |

10.5% |

9.7% |

|

20-Dec-22 |

13.5% |

10.5% |

10.9% |

11.2% |

10.8% |

9.9% |

|

21-Dec-22 |

13.5% |

10.5% |

11.0% |

11.0% |

10.8% |

9.9% |

|

22-Dec-22 |

13.1% |

10.4% |

10.9% |

10.8% |

10.7% |

9.8% |

|

Weekly Change |

0.5% |

0.5% |

0.3% |

0.4% |

0.4% |

0.4% |

|

MTD Change |

1.1% |

0.3% |

0.1% |

0.1% |

0.3% |

0.2% |

|

YTD Change |

8.7% |

2.3% |

2.8% |

5.2% |

4.0% |

3.2% |

Source: Central Bank of Kenya (CBK)

Kenya Shilling:

During the week, the Kenyan shilling depreciated by 0.2% against the US dollar to close the week at Kshs 123.2, from Kshs 123.0 recorded the previous week, partly attributable to increased dollar demand from importers, especially oil and energy sectors against a slower supply of hard currency. On a year to date basis, the shilling has depreciated by 8.9% against the dollar, higher than the 3.6% depreciation recorded in 2021. We expect the shilling to remain under pressure in 2022 as a result of:

- High global crude oil prices on the back of persistent supply chain bottlenecks coupled with high demand,

- An ever-present current account deficit estimated at 5.5% of GDP in the 12 months to October 2022, same as what was recorded in a similar period in 2021,

- The need for Government debt servicing which continues to put pressure on forex reserves given that 69.3% of Kenya’s External debt was US Dollar denominated as of October 2022, and,

- A continued hike in the USA Fed interest rates in 2022 to a range of 4.25%-4.50% in December 2022 which has strengthened the dollar against other currencies following capital outflows from other global emerging markets.

The shilling is however expected to be supported by:

- Improved diaspora remittances standing at a cumulative USD 4.0 bn as of November 2022, representing a 9.7% y/y increase from USD 3.7 bn recorded over the same period in 2021, and,

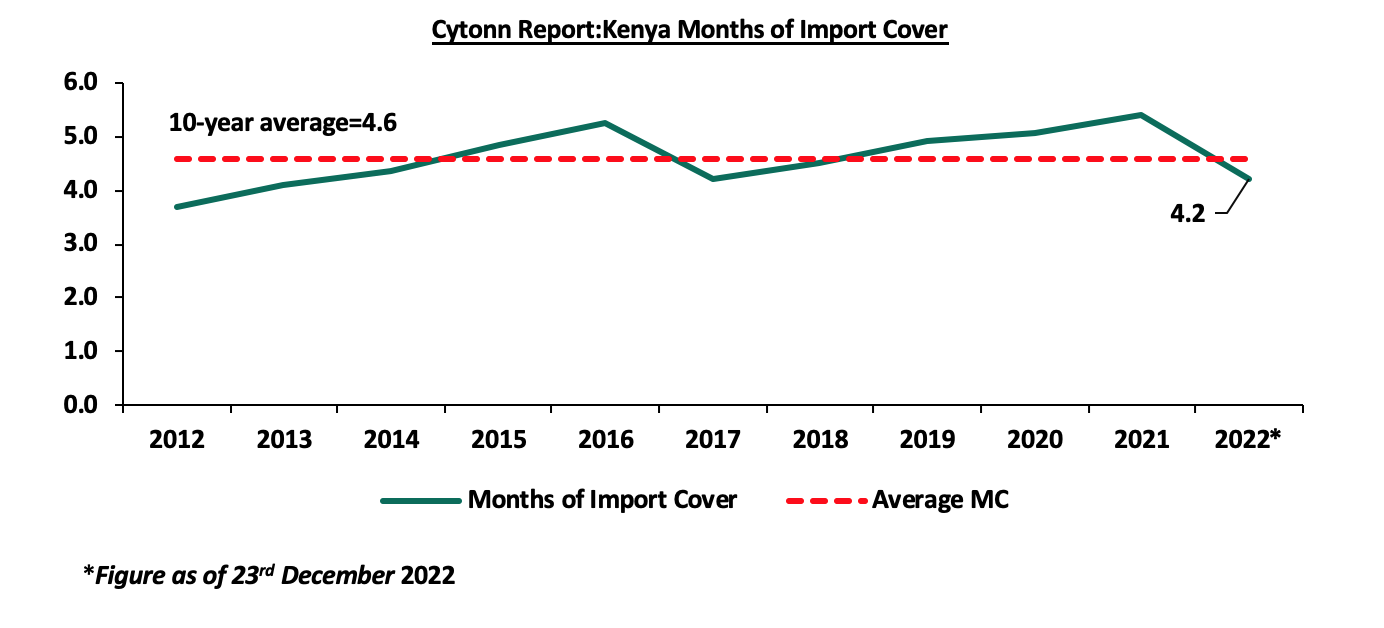

- Sufficient Forex reserves currently at USD 7.5 bn (equivalent to 4.2 months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover. However, despite the Forex reserves being adequate, it has dropped by 14.0% YTD from USD 8.8 bn. The chart below summarizes the evolution of Kenya months of import cover over the last 10 years;

Weekly Highlights:

- IMF approves USD 447.4 mn disbursement to Kenya under the Extended Credit Facility (ECF) and Extended Fund Facility (EFF)

During the week, the International Monetary Fund (IMF) announced that it completed the review of the Extended Credit Facility and Extended Fund Facility arrangement with Kenya and approved the disbursement of USD 447.4 mn (Kshs 55.1 bn), marking the 5th tranche of the USD 2.3 bn (Kshs 288.3 bn) loan amount to be disbursed. The receipt of the loan will offer budgetary support and serve to support the foreign reserves which are currently adequate but have been on a downward trajectory and currently stand at USD 7.5 mn. On YTD basis, this translates to a 14.0% decline from USD 8.8 bn recorded at the beginning of the year. Additionally, upon receipt, the amount will help to stabilize the Kenya shilling from immense weakening against the US dollar, having depreciated by 8.9% YTD. The funding also included an augmentation under the ECF arrangement of USD 215.8 mn (Kshs 26.6 bn). This takes Kenya’s cumulative disbursement under the EFF/ECF arrangement to USD 1.7 bn (Kshs 204.0 bn). Key to note, the first approval under the EFF/ECF arrangement was in April 2021 which was aimed to address Kenya’s debt vulnerabilities, response to COVID-19 pandemic and global shocks and also to enhance broader economic reforms. The table below outlines the total funding the government has received under the EFF/ECF financing programme:

|

Cytonn Report: International Monetary Fund (IMF) EFF and ECF Financing Programme |

||

|

Date |

Amount Received |

|

|

|

Amount in (USD mn) |

Amount in (Kshs bn, 1USD = 123.2) |

|

Apr -21 |

307.5 |

37.4 |

|

June-21 |

407.0 |

49.5 |

|

Dec-21 |

258.1 |

31.4 |

|

Jul-22 |

235.6 |

28.7 |

|

Dec-22 |

447.4 |

55.1 |

|

Total Amount Received |

1,655.6 |

204.0 |

|

Amount Pending |

684.4 |

84.3 |

Source: International Monetary Fund (IMF)

As part of the IMF Programme, the national treasury committed to end the fuel subsidy program by December 2022, which we have maintained is unsustainable and a burden to the country’s expenditure. Additionally, the Kenyan government has continued to reduce the support extended to State Owned Enterprises which have equally been a burden to the country’s expenditure. In FY’2021/2022, the support extended to SOEs has been capped at Kshs 17.5 bn, from Kshs 32.3 bn, earlier budgeted. We expect these amounts to reduce, with the new administration looking to offload SOEs through privatization.

In line with IMF expectations, we expect the government to aggressively pursue fiscal consolidation, which would go a long way in addressing the debt vulnerability concerns, with public debt to GDP ratio at 62.3%, as of October 2022, 12.3% points above the IMF recommendation of 50.0%. Additionally, we recommend that the government should prioritize multilateral and bilateral borrowing due to their low interest nature over the commercial borrowing in order to lower the debt servicing cost.

- December 2022 inflation projection

We are projecting the y/y inflation rate for December 2022 to decline to a range of 9.3%-9.7%. The key drivers include:

- Upward Revision of the Central Bank Rate (CBR): During the November 2022 sitting, the Monetary Policy Committee increased the CBR by 50.0 bps to 8.75%, from the previous 8.25% in September 2022 with the aim of anchoring inflation which is above the Central Bank of Kenya (CBK) range of 2.5% to 7.5%,

- Maintained Fuel Prices: Fuel prices for the period between 15thDecember 2022 and 14th January 2023 remained unchanged at Kshs 177.3, Kshs 162.0 and Kshs 145.9 per litres of Super Petrol, Diesel and Kerosene respectively.

However, the December electricity bills are expected to rise following the move by Energy and Petroleum Regulatory Authority to increase the fuel cost charge to Kshs 7.2 per unit from Kshs 6.4 in November. Whereas, the currently ongoing rains in various parts of the country is expected to increase maize production and ease food inflation with maize flour being major inflationary factor.

Despite our projection of a slight ease in the y/y inflation rate, we expect the inflationary pressures to remain elevated in the near term on the back of high fuel, food and electricity prices. However, following the move by Monetary Policy Committee (MPC) to raise its base lending rate by 50.0 bps in November to 8.75% we expect the pressures to ease in medium term but remain elevated above the target range of 2.5%-7.5%. Key to note, the inflationary pressures is largely pegged on how soon global inflationary pressures is restored mainly due to high global fuel prices with fuel being a major input in most businesses.

Rates in the Fixed Income market have remained relatively stable due to the relatively ample liquidity in the money market. The government is 12.4% ahead of its prorated borrowing target of Kshs 279.7 bn having borrowed Kshs 314.5 bn of the Kshs 581.7 bn borrowing target for the FY’2022/2023. We expect sustained gradual economic recovery as evidenced by the revenue collections of Kshs 789.3 bn in the FY’2022/2023 as at the end of November, equivalent to a 36.9% of its target of Kshs 2.1 tn. Despite the performance, we believe that the projected budget deficit of 6.2% is relatively ambitious given the downside risks and deteriorating business environment occasioned by high inflationary pressures. We however expect the support from the IMF and World Bank to ease the need for elevated borrowing and thus help maintain a stable interest rate environment since the government is not desperate for cash. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

Market Performance:

During the week, the equities market recorded mixed performance with NASI declining by 0.3%, while NSE 20 and NSE 25 gained by 0.6% and 0.1%, respectively, taking YTD performance to losses of 23.3%, 13.1% and 16.7% for NASI, NSE 20 and NSE 25, respectively. The equities market performance was mainly driven by losses recorded by large cap stocks such as Safaricom, Equity Group, and ABSA Bank of 1.4%, 0.5%, and 0.4%, respectively. The losses were however mitigated by gains recorded by banking stocks such as NCBA Group, Standard Chartered Bank Kenya (SCBK) and KCB Group of 3.3%, 3.2% and 2.0%, respectively.

During the week, equities turnover increased by 30.9% to USD 10.1 mn from USD 7.7 mn recorded the previous week, taking the YTD turnover to USD 787.9 mn. Additionally, foreign investors remained net sellers, with a net selling position of USD 4.0 mn, from a net selling position of USD 2.0 mn recorded the previous week, taking the YTD net selling position to USD 201.4 mn.

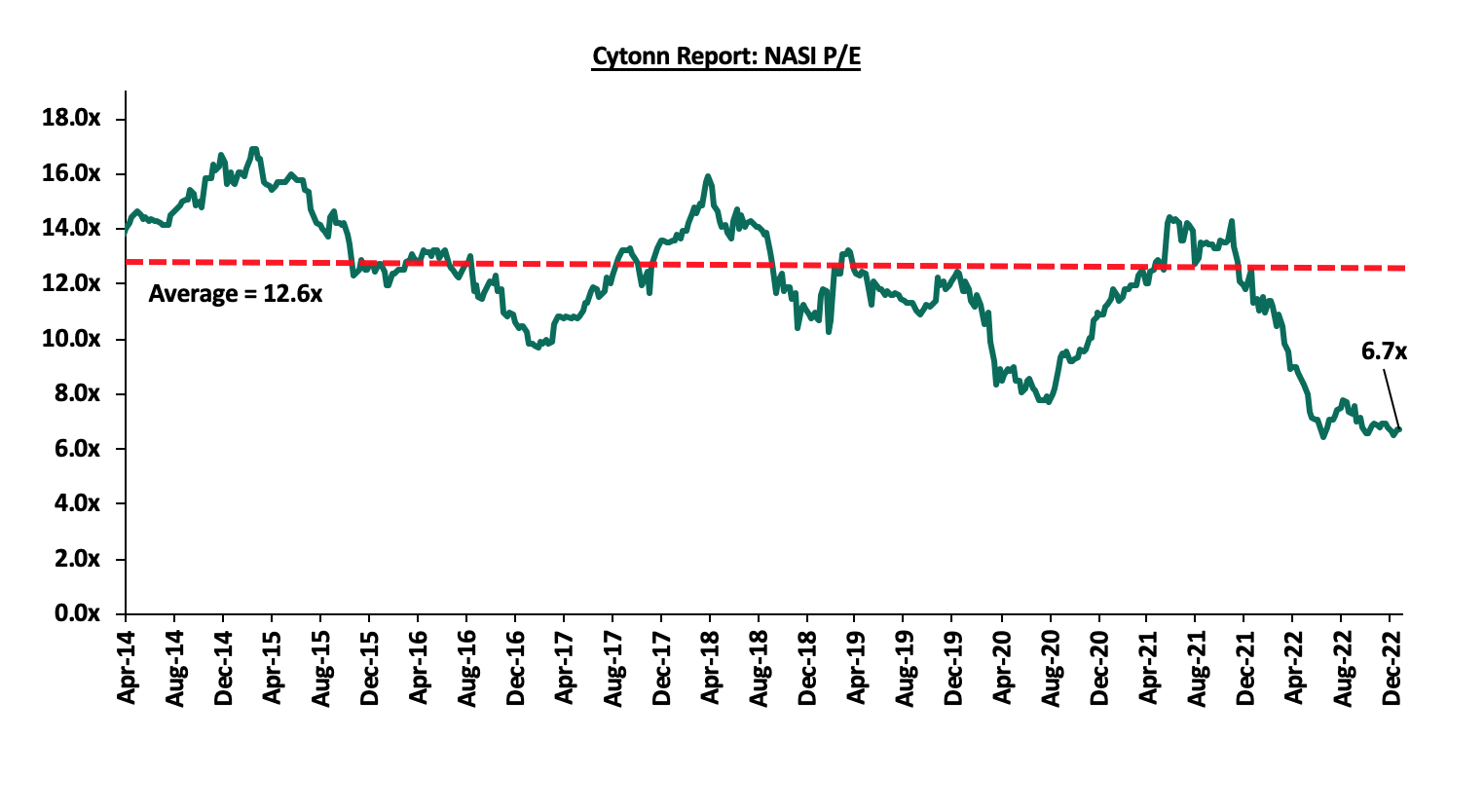

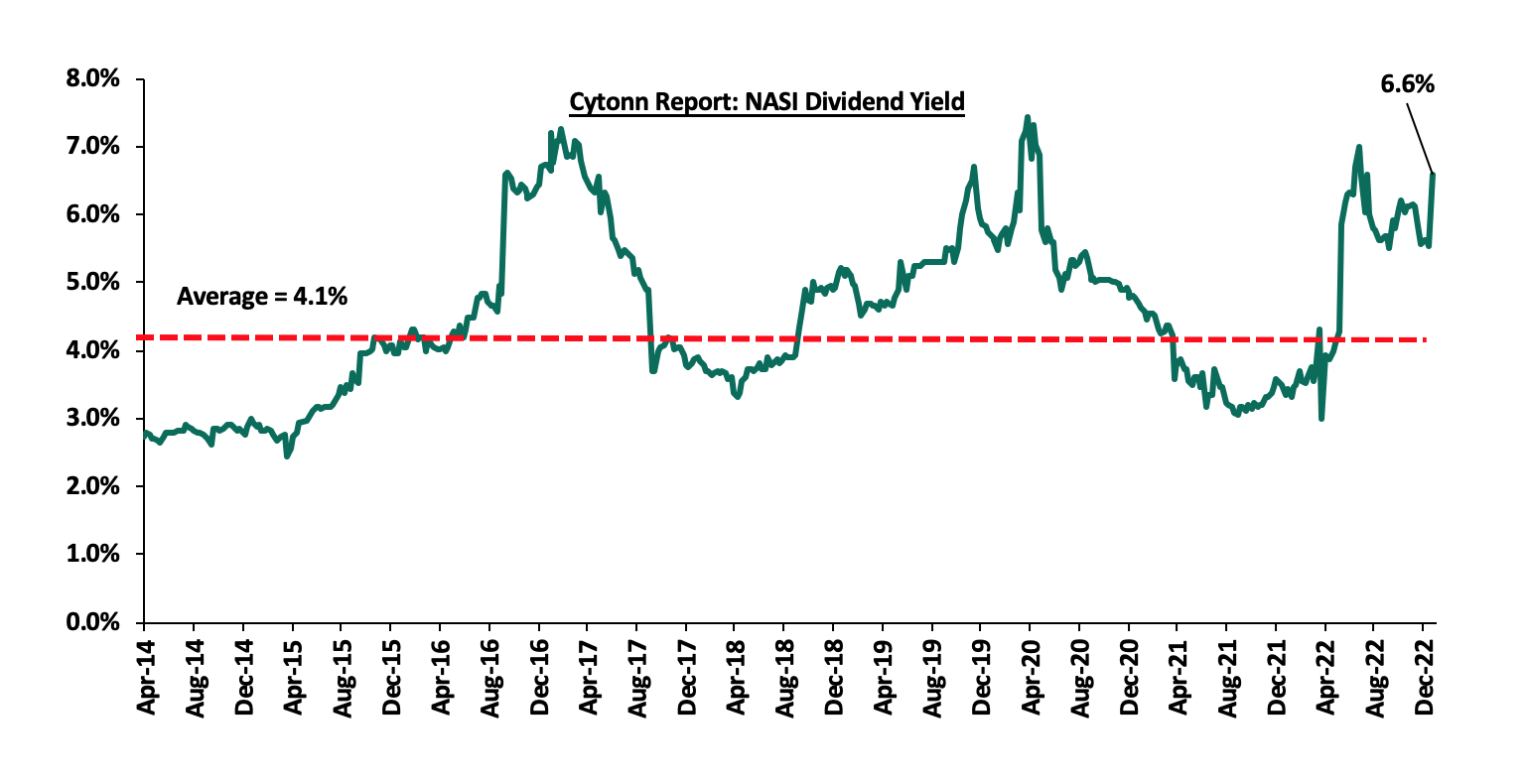

The market is currently trading at a price to earnings ratio (P/E) of 6.7x, 46.8% below the historical average of 12.6x, and a dividend yield of 6.6%, 2.5% points above the historical average of 4.1%. Key to note, NASI’s PEG ratio currently stands at 0.9x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market;

Universe of coverage:

|

Company |

Price as at 16/12/2022 |

Price as at 23/12/2022 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Jubilee Holdings |

200.0 |

190.0 |

(5.0%) |

(40.0%) |

305.9 |

0.5% |

61.5% |

0.4x |

Buy |

|

KCB Group*** |

37.3 |

38.0 |

2.0% |

(16.6%) |

52.5 |

10.5% |

48.7% |

0.6x |

Buy |

|

Kenya Reinsurance |

1.9 |

1.9 |

(0.5%) |

(19.2%) |

2.5 |

5.4% |

41.1% |

0.1x |

Buy |

|

Britam |

5.0 |

5.1 |

1.6% |

(32.8%) |

7.1 |

0.0% |

40.2% |

0.8x |

Buy |

|

ABSA Bank*** |

12.2 |

12.1 |

(0.4%) |

3.0% |

15.5 |

12.4% |

40.1% |

1.0x |

Buy |

|

Equity Group*** |

45.5 |

45.3 |

(0.5%) |

(14.2%) |

58.4 |

6.6% |

35.6% |

1.1x |

Buy |

|

Co-op Bank*** |

12.0 |

12.2 |

1.3% |

(6.5%) |

15.5 |

8.2% |

35.6% |

0.7x |

Buy |

|

I&M Group*** |

17.1 |

17.0 |

(0.6%) |

(20.6%) |

20.8 |

8.8% |

31.3% |

0.4x |

Buy |

|

NCBA*** |

36.1 |

37.3 |

3.3% |

46.6% |

43.4 |

11.4% |

27.7% |

0.8x |

Buy |

|

Sanlam |

9.6 |

9.6 |

0.0% |

(16.9%) |

11.9 |

0.0% |

24.1% |

1.0x |

Buy |

|

Diamond Trust Bank*** |

48.5 |

49.0 |

1.0% |

(17.6%) |

57.1 |

6.1% |

22.7% |

0.2x |

Buy |

|

CIC Group |

2.0 |

1.9 |

(2.0%) |

(11.5%) |

2.3 |

0.0% |

20.8% |

0.7x |

Buy |

|

Stanbic Holdings |

92.8 |

97.8 |

5.4% |

12.4% |

108.6 |

9.2% |

20.3% |

0.8x |

Buy |

|

Standard Chartered*** |

139.0 |

143.5 |

3.2% |

10.4% |

164.8 |

4.2% |

19.0% |

0.9x |

Accumulate |

|

Liberty Holdings |

5.7 |

5.7 |

0.0% |

(19.5%) |

6.8 |

0.0% |

18.8% |

0.4x |

Accumulate |

|

HF Group |

3.2 |

3.1 |

(3.1%) |

(18.7%) |

3.5 |

0.0% |

14.6% |

0.2x |

Accumulate |

|

*Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

|||||||||

We are “Neutral” on the Equities markets in the short term due to the current adverse operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.9x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs to continue weighing down the economic outlook in the short term.

- Industry Reports

The Kenya National Bureau of Statistics (KNBS) released the Leading Economic Indicators (LEI) September 2022 and October 2022 reports which highlighted the performance of major economic indicators such as international arrivals, building plan approvals, among others. The key highlights related to the Real Estate sector include;

- Overall international arrivals through Jomo Kenyatta International Airport (JKIA) and Moi International Airport (MIA) increased by 44.6% to 315,112 in Q3’2022, from the 217,873 recorded in Q3’2021. On a q/q basis, the performance was a 12.5% increase from 279,981 recorded in Q2’2022. The performance can be attributed to; i) continuous decrease in international travel advisories and restrictions from countries such as United States of America (USA) and United Kingdom (UK), ii) Positive accolades promoting tourism such as the 2021 World Travel Awards, which increased the visibility of Kenya as a holiday destination, raised awareness of Kenya’s rich cultural heritage, and continued making the country a desirable vacation spot enticing more visitors to venture the country, iii) the August general elections which were largely peaceful and also attracted several international election observers, dignitaries and experts, iv) improved roads, airports, airstrips, marine and railway infrastructure, and, v) Increased promotion of Kenya’s tourism and hospitality market through platforms such as the Magical Kenya Platform, Kenya Tourism Board, and paid partnerships with several international celebrities in boosting its marketing internationally, among others. The chart below shows the number of international arrivals in Kenya between 2017 and Q3’2022;

Source: Kenya National Bureau of Statistics (KNBS)

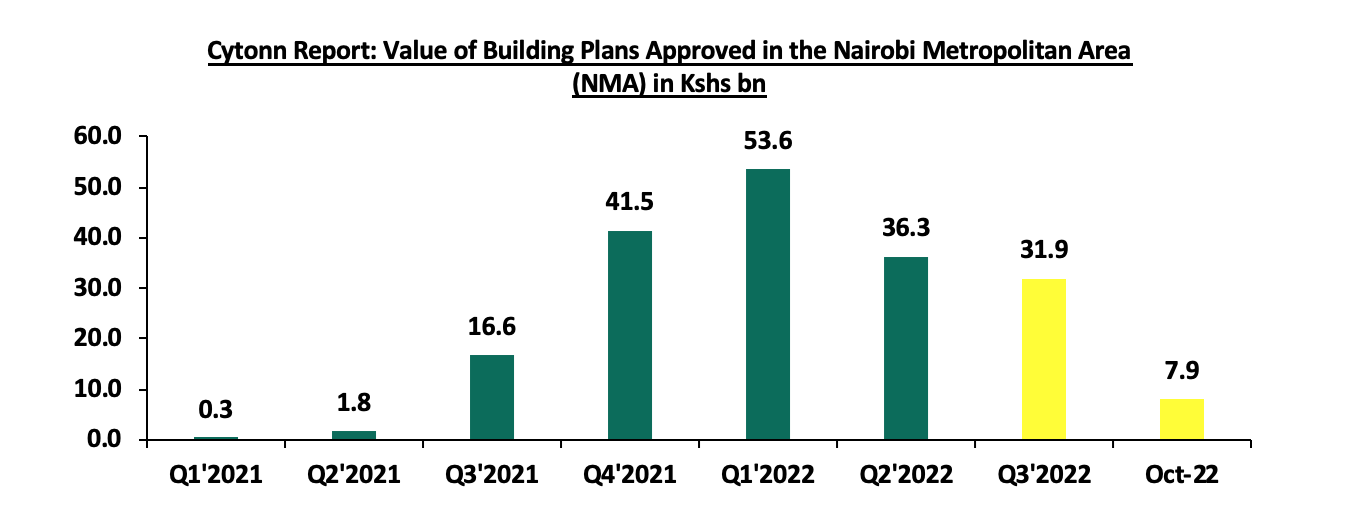

- The value of building plans approved in the Nairobi Metropolitan Area (NMA) increased by 91.9% to Kshs 31.9 bn in Q3’2022, from Kshs 16.6 bn recorded in Q3’2021 attributed to continuous improvement in construction activities in the post-COVID-19 period. On a q/q basis, the performance represented a 12.2% decline from Kshs 36.3 bn recorded in Q2’2022, whereas for the month of October, the performance also declined by 54.0% to Kshs 7.9 bn from Kshs 17.2 bn recorded in September 2022. This was attributable to pending of approvals amid delays in processing construction permits and enhanced by backlog of registry systems. The chart below shows the value of building plans approved in the Nairobi Metropolitan Area (NMA) between 2021 and October 2022;

Source: Kenya National Bureau of Statistics (KNBS)

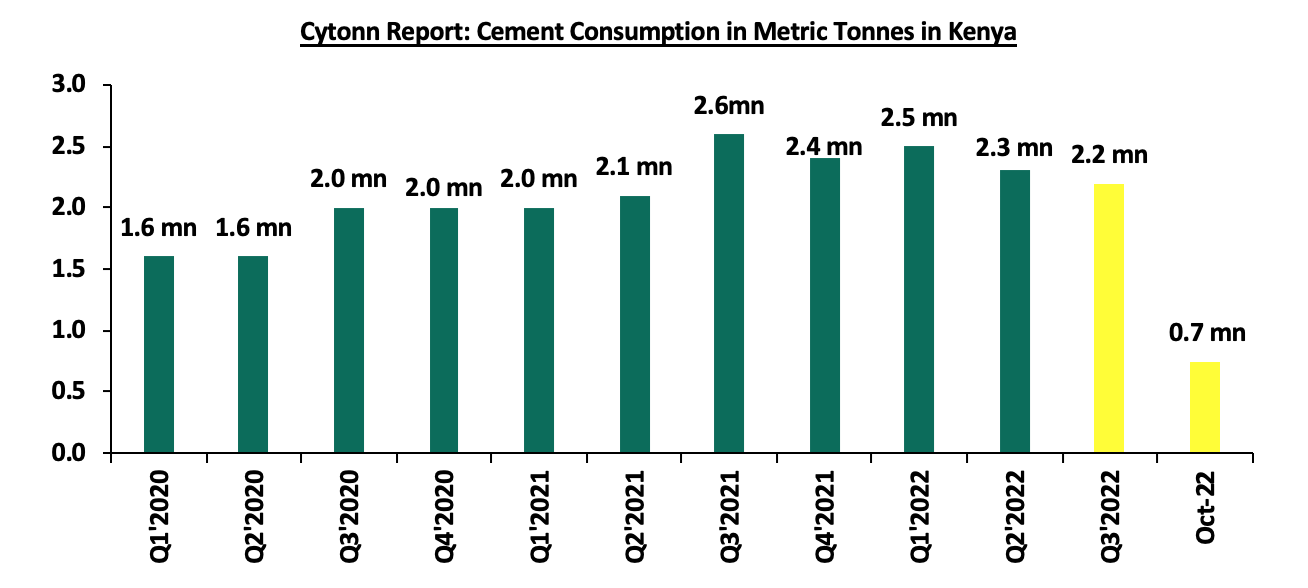

- Consequently, the consumption of cement declined by 14.7% to 2.2 mn metric tonnes in Q3’2022, from 2.6 mn metric tonnes realized in Q3’2021. On q/q basis, the performance declined by 4.3% from 2.3 mn metric tonnes realized in Q2’2022. Additionally, for the month of October, the performance decreased by 0.4% to 0.7 mn metric tonnes from 0.8 mn metric tonnes recorded in September 2022. The declining demand for cement was majorly driven by i) global inflationary pressure and the depreciating Kenyan currency on import of cement raw materials resulting to increase in production costs and prices of the commodity and, ii) reduced infrastructural development by the current government amid restructuring of the Ministries, Departments, and Agencies (MDAs) involved. The chart below shows cement consumption in Metric Tonnes in Kenya between 2020 and October 2022;

Source: Kenya National Bureau of Statistics (KNBS)

Following the improving confidence among investors in the construction sector and general business environment in the post electioneering period, we expect the Real Estate sector to register positive growth and increased performance mainly driven by;

- Surge in construction activities considerably in the infrastructure and residential sectors, with notable efforts by the current government to embrace the Affordable Housing Initiative in an endeavor mitigate Kenya’s housing deficit currently at 2.0 mn units, by delivering 250,000 units p.a., and,

- The increasing number of visitor arrivals into the country boosting performance of serviced apartments and hotels. This will be further stirred up by the festive season, as well as the positive recognition of Kenya as a business and tourist attraction in the 2022 World Travel Awards (WTA) event which was held at Nairobi’s Kenyatta International Convention Centre (KICC) on October 15th 2022.

- Residential Sector

During the week, Superior Homes, a Nairobi based housing developer where Cytonn is the second largest shareholder, launched a luxurious Conservancy Living Development project dubbed ‘Lukenya Wildlife Estate’. The new diversification investment in Real Estate will sit on a 100-acre piece of land within Swara Plains Conservancy located along Mombasa-Nairobi Highway, Machakos County. The project will comprise of 0.5-acre, 1-acre and 1.5-acre serviced plots. Investors will have the opportunity to construct their own houses on the serviced plots under strict architectural guidelines that will ensure sustainable integration with the flora and fauna environment. The table below shows the sizes and prices of the serviced plots in Lukenya Wildlife Estate;

|

Cytonn Report: Sizes and Prices of the Serviced Plots in Lukenya Wildlife Estate |

|

|

Plot Size (Acre) |

Plot Price (Kshs mn) |

|

0.5 |

8.8 |

|

1.0 |

15.8 |

|

1.5 |

20.8 |

Source: Cytonn Research

Lukenya Wildlife Estate will also incorporate developed high-end houses ranging from 3-bedroom to 5-bedroom maisonettes. Superior Homes has previously developed two master-planned community projects which include; GreenPark Estate located in Athi River, Machakos County, and Pazuri Estate located in Vipingo, Kilifi County. The table below shows the sizes and prices of the houses in Lukenya Wildlife Estate;

|

Cytonn Report: Sizes and Prices of the Houses in Lukenya Wildlife Estate |

||||

|

House Typology |

Plinth Area (SQM) |

Unit Prices (Kshs) as Per Lot Size |

||

|

0.5 Acre |

1 Acre |

1.5 Acre |

||

|

3-Bedroom |

313 |

30.0 mn |

37.3 mn |

42.3 mn |

|

4-Bedroom |

345 |

33.6 mn |

40.6 mn |

45.6 mn |

|

5-Bedroom |

386 |

- |

43.6 mn |

48.6 mn |

Source: Cytonn Research

Upon completion, we expect the development to increase activity in the sector by bringing more diversity in community based conservancies by creating a new market for high-end real estate. This would attract investors and buyers who want to live in a unique and exclusive setting, allowing them to take advantage of the natural beauty of the conservancy while also enjoying luxury amenities. Such kind of developments will as well see more growth in satellite towns due to the abundance of available development land in these areas compared to the Nairobi Central Business District. Additionally, the affordability of land in the Nairobi outskirts and the ongoing improvements to infrastructure make these locations more accessible and desirable for living. This would create a more attractive option for potential high-net-worth buyers and investors in Kenya.

- Retail Sector

Local retailer Naivas Supermarket opened a new outlet at Shell-Express Uthiru located along Waiyaki Way Road on 15th December 2022. This brings the retailer’s number of operating outlets countrywide to 91. It also comes a month after the retailer opened five new outlets at Meru’s Greenwood City Mall, Kahawa Sukari Junction, Ruai town, Parkland’s Boardwalk Mall, and, Nairobi West Shopping Centre in Nairobi West. Naivas has significantly showcased its rapid expansion in 2022 as it closes the year with 12 new outlets. The opening of Uthiru’s new can be attributed to:

- Urge to increase its presence in new regions where the retailer had not tapped into hence offering convenient shopping experience to customers,

- Bid to fill the market gap left by exiting retailers in the Uthiru like Tuskys,

- Strategic location of the outlet along the busy Waiyaki Way which connects to Nakuru enhancing its customer base and accessibility to the store,

- The continuous urge to stay ahead of the competition and retain a superior position in the market compared to other retailers like Carrefour and QuickMart, and,

- Increased access to financial strength following the sale of 40.0% stake worth Kshs 18.3 bn to a consortium comprising of IBL Group and other firms such as DEG Group and Proparco.

The table below shows the number of stores operated by key local and international retail supermarket chains in Kenya;

|

Cytonn Report: Main Local and International Retail Supermarket Chains |

|||||||||||

|

Name of retailer |

Category |

Branches as at FY’ 2018 |

Branches as at FY’ 2019 |

Branches as at FY’ 2020 |

Branches as at FY’ 2021 |

Branches opened in 2022 |

Closed branches |

Current branches |

Branches expected to be opened |

Projected branches FY’2022 |

|

|

Naivas |

Local |

46 |

61 |

69 |

79 |

12 |

0 |

91 |

0 |

91 |

|

|

QuickMart |

Local |

10 |

29 |

37 |

48 |

3 |

0 |

51 |

0 |

51 |

|

|

Chandarana |

Local |

14 |

19 |

20 |

23 |

3 |

1 |

26 |

1 |

27 |

|

|

Carrefour |

International |

6 |

7 |

9 |

16 |

0 |

0 |

16 |

0 |

16 |

|

|

Cleanshelf |

Local |

9 |

10 |

11 |

12 |

0 |

0 |

12 |

0 |

12 |

|

|

Tuskys |

Local |

53 |

64 |

64 |

3 |

0 |

61 |

3 |

0 |

3 |

|

|

Game Stores |

International |

2 |

2 |

3 |

3 |

0 |

0 |

3 |

0 |

3 |

|

|

Uchumi |

Local |

37 |

37 |

37 |

2 |

0 |

35 |

2 |

0 |

2 |

|

|

Choppies |

International |

13 |

15 |

15 |

0 |

0 |

13 |

0 |

0 |

0 |

|

|

Shoprite |

International |

2 |

4 |

4 |

0 |

0 |

4 |

0 |

0 |

0 |

|

|

Nakumatt |

Local |

65 |

65 |

65 |

0 |

0 |

65 |

0 |

0 |

0 |

|

|

Total |

|

257 |

313 |

334 |

186 |

18 |

179 |

204 |

1 |

205 |

|

Source: Cytonn Research

The retail industry in Kenya has been experiencing considerable growth as both local and international retailers strive for control of the Kenyan market, thus enhancing the sector's performance. However, the performance of the retail sector is being hindered by the fast-evolving e-commerce sector and the overabundance of retail space at approximately 3.0 mn SQFT in the NMA retail sector and 1.7 mn SQFT in the Kenyan retail sector excluding NMA, which affects the occupancy rates and total return to investors in property market.

- Real Estate Investment Trusts (REITs)

In the Nairobi Securities Exchange, ILAM Fahari I-REIT closed the week trading at an average price of Kshs 6.6 per share. The performance represented a 9.2% increase from Kshs 6.1 per share recorded the previous week, taking it to a 3.4% Year-to-Date (YTD) gain from Kshs 6.4 per share. However, the performance represented a 66.8% Inception-to-Date (ITD) loss from the Kshs 20.0 price. The dividend yield currently stands at 7.5%. The graph below shows Fahari I-REIT’s performance from November 2015 to 23rd December 2022;

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT traded at Kshs 23.8 and Kshs 20.9 per unit, respectively, as at 16th December 2022. The performance represented a 19.2% and 4.4% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 5.5 mn and 15.5 mn shares, respectively, with a turnover of Kshs 117.0 mn and Kshs 320.7 mn, respectively, since inception in February 2021.

We expect Kenya’s property market to continue on a trajectory of growth indicated by aggressive expansion of retailers in the retail sector and increased development activities in the residential sector. However, setbacks such as inflationary pressure, existing oversupply in select sectors, and minimal investor appetite for the REIT instruments continue to pose a challenge to the optimum performance of the sector.

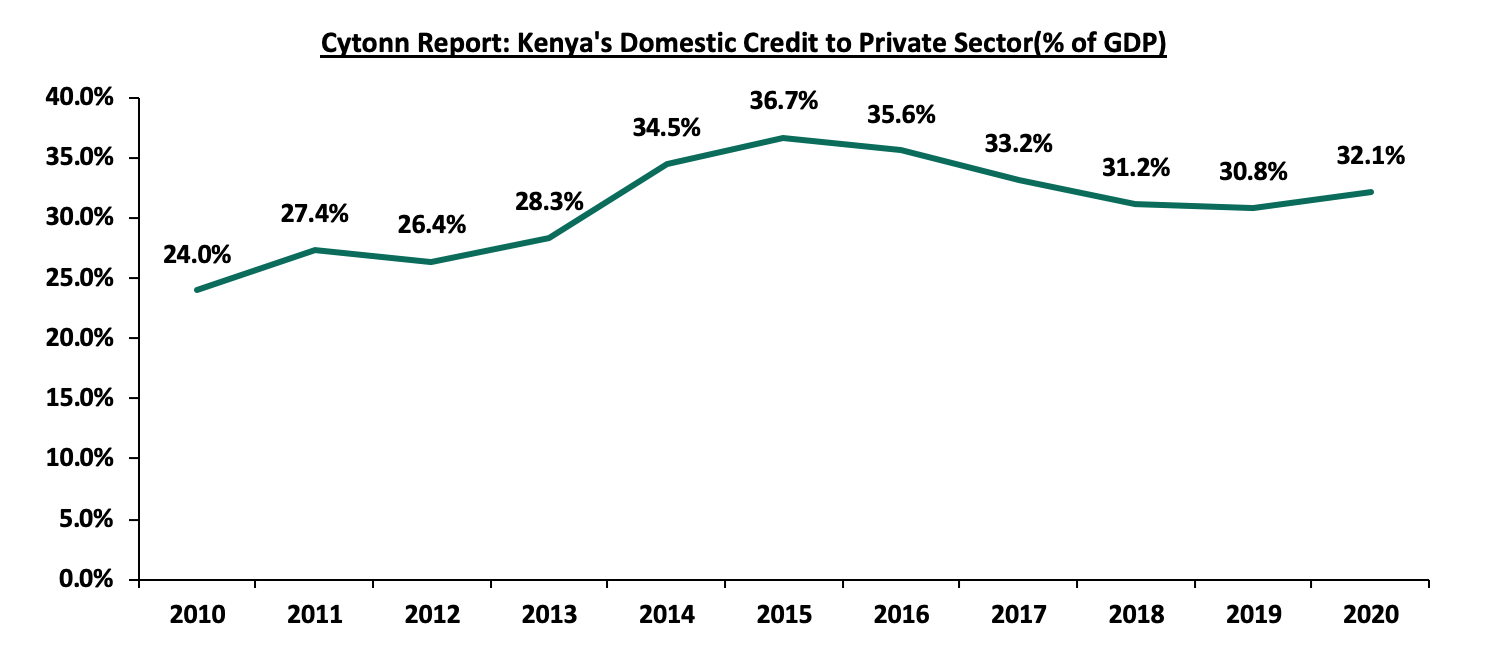

As highlighted in our topical on Private Sector Credit Growth, Kenya’s domestic credit extended to private sector as a percentage of GDP was at 32.1% in 2020, compared to the 38.9% average for the Sub-Saharan African region, 111.2% for South Africa and 164.2% for advanced economies, highlighting the gap in credit availability for businesses. To achieve 100.0% Private Sector Credit to GDP, Kenya needs total credit to private sector of Kshs 12.1 tn, current credit to private sector is Kshs 3.4 tn, hence the current Kshs 8.7 tn deficit in credit to the private sector. The Hustler fund, if sustainable, at Kshs 50.0 bn, would only resolve 0.6% of the problem. The graph below shows domestic credit extended to the private sector over the years;

Source: World Bank

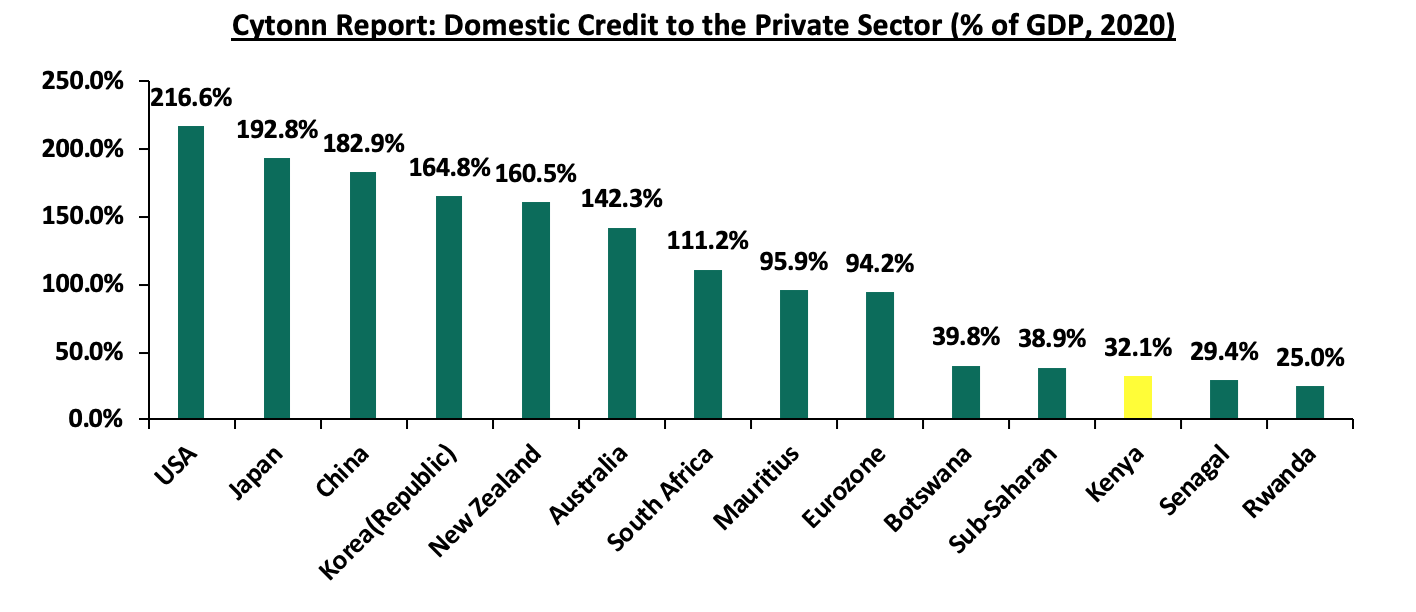

In 2020, Kenya’s Private Sector Credit growth at 32.1% of the GDP was outperformed when compared to advanced economies such as the United States of America and Japan at 216.6% and 192.8%, respectively, as well as Sub-Saharan economies such as South Africa and Mauritius at 111.2% and 95.9%, respectively. The graph below shows the comparison of Kenya’s domestic credit extended to the private sector as a % of Gross Domestic Product (GDP) in 2020 against other select economies;

Source: World Bank

One of the key inhibitors to credit growth has been the failure of our capital markets. In well-functioning markets, credit comes from both banking markets and capital markets with banking markets providing 40.0% of credit and capital markets (both regulated and unregulated) providing the majority balance of 60%. However, in Kenya banks provide 99.0% of credit, essentially, the 32.0% private sector credit to GDP in Kenya all comes from banking markets with no participation from capital markets. Key to note, individuals at the bottom of economic pyramid have suffered more in terms of access to credit mainly because of bureaucratic measures and need for collateral when borrowing from banks coupled with the high interest rates charged. When credit has been advanced by digital credit providers, it has been equally as expensive, with often punitive terms.

In a bid to address the credit gap and in line with pre-election promises, the new administration launched the Financial Inclusion Fund (Hustler Fund) on 30th November 2022, with the fund’s main objective being to improve the credit access to citizens at the bottom of the pyramid who have often struggled to obtain affordable credit. Key to note, the previous governments had introduced various special funds such as Uwezo Fund, Women Enterprise Fund and Youth Enterprise Development Fund in a bid to increase credit access to various target groups. However, success of these funds has been crippled by low recovery rates on advanced amounts, with the recovery rate for the funds at 52.2% and 35.8% for Youth Enterprise Development Fund and Uwezo Fund, respectively. Only the Women Enterprise Fund has recorded a relatively high recovery rate, at 93.3%. Given the first component of the Hustler Fund, the personal finance loan is up and running, this week we turn our focus to the Hustler Fund to have a deeper understanding of the fund by looking at the progress it has made, potential impact, and its sustainability. We shall undertake this by looking into the following;

- Introduction,

- Performance of historical Government Special Funds,

- Structure and Features of Hustler Fund,

- Potential Impact of the Hustler Fund,

- Sustainability of Hustler Fund,

- Recommendations

Section 1: Introduction

The Financial Inclusion Fund, commonly known as Hustler Fund, is a government special sponsored Fund targeting Kenyans of low income to access credit conveniently through their phones. In line with its campaign promise, the new regime launched the fund on 30th November 2022 with a start-up capital amounting to Kshs 50.0 bn. The main objective of the fund is to make credit affordable to majority of citizens who have been out of the formal credit cycle for a long duration. As such, the Fund will lend to all eligible persons at a rate of 8.0% per annum, representing the lowest interest rate in the country. Besides access to credit by people at the bottom of economic pyramid, the fund also aims to promote a savings culture by apportioning 5.0% of the borrowed amount to a savings account where 30.0% will be accessible 365 days after loan disbursement, and 70.0% will be accessible upon retirement. Notably, the fund comprises of four products, that is, Personal Finance, Micro Loan, (Small and Medium Enterprises (SMEs) Loan and Start Ups loan. The Personal Finance component was launched on 30th November 2022 and will offer amounts between Kshs 500 to Kshs 50,000 at a rate of 8.0%. The government also announced plans to launch the SMEs loan with an upper limit of Kshs 2.5 mn in March 2023. The fund is easy to access, and is leveraging on the high mobile penetration in Kenya of 132.5% in 2022 through the collaboration by telecommunication firms in Kenya such as Safaricom, Airtel and Telkom. To apply, citizens can dial a USSD code *254#. According to Co-operatives and MSME Development Ministry, the latest data on total amount borrowed from the fund stood at Kshs 10.1 bn of which Kshs 3.2 bn had already been repaid. The fund’s repayment rate by 16th December 2022 averaged 53.2%. The main objectives of the fund are;

- Promote Financial Inclusion – The fund shall promote financial inclusion through expansion of access to credit by persons, proprietors, MSMEs, SACCOs, and start-ups for economic growth and job creation,

- Ensure Responsible Lending Culture – The fund aims at addressing qualitative dimension of financial inclusion by ensuring responsible lending and borrowing, ethical practises, offering financial literacy and promoting consumer rights,

- Promote Affordable Credit - Come up with market interventions to enhance supply of affordable credit to MSMEs including credit worthiness based lending, risk pricing, business and financial management skills and cost of doing business, and,

- Enhance Health Coverage and Social Security - Improve the low participation of the non-formal wage workforce in health insurance and retirement benefit schemes to ensure universal health coverage and universal social security

Section 2: Performance of Historical Government Special Funds

In Kenya, Special Interest Groups (SIG) Enterprise Funds refer to fund allocation initiatives by the Government of Kenya aimed at improving economic equality and financial inclusion targeting the youth, women and people with disabilities (PWDs). Previous regimes have rolled out three main avenues targeting SIGs which include; Uwezo Fund, Women Enterprise Fund, and Youth Enterprise Development Funds. Below is a summary of the performance of the existing special funds;

- Uwezo Fund - Founded under the Legal Notice No. 21 under the Public Finance Management Regulations in September 2013 to enable women, youth and persons with disabilities to access finance and promote enterprises at the constituency level. Since inception to June 2021, the fund has disbursed a total of Kshs 6.9 bn to 74,884 groups comprising of 47,720 women groups, 25,264 youth groups, and 1900 PWD groups, resulting in an average loan size of Kshs 92,142.5. The fund’s cumulative repayment in the period under review stood at Kshs 2.4 bn, equivalent to a 35.8% repayment rate against a corresponding default rate of 64.2%. The allocation for the Uwezo Fund will be determined under the National Government Affirmative-Action Fund (NGAAF) which has a Kshs 2.1 bn budgetary allocation,

- Women Enterprise Fund – Established under the Legal Notice No. 147 of 2007, the fund has disbursed a cumulative loan amounting to Kshs 21.6 bn to 120,624 self-help groups and 1,882,252 individuals since inception, resulting in an average loan size of Kshs 10,784.5. Key to note in the FY’2020/2021, the fund disbursed Kshs 3.0 bn to 11,361 self-help groups and recovered Kshs 2.8 bn in the period, translating to 93.3% repayment rate against a corresponding default rate of 6.7%. Furthermore, the fund has cumulatively trained 1,516,822 women on entrepreneurship and supported 40,298 women by providing market access and linkages. The government has also allocated Kshs 170.0 mn for the Fund in FY’2022/2023, and,

- Youth Enterprise Development Fund (YEDF) – The YEDF was founded in May 2007 by the Legal Notice No. 63, under the Ministry of ICT, Innovation, and Youth Affairs. Since inception to June 2020, the fund had advanced loans amounting to 12.8 bn to 1,159,393 youths with the average loan size coming in at Kshs 11,040.3 Key to note, Kshs 5.6 bn of the total loan disbursed was directly from the fund itself and the remainder disbursed through financial intermediaries (FI). For FY’2019 /2020, the fund disbursed Kshs 473.3 mn and recovered Kshs 247.2 mn, translating to a repayment rate of 52.2% and a corresponding default rate of 47.8%. Additionally, the fund has facilitated and trained 460,000 youth on entrepreneurial skills, supported 8,191 youths to market their products in trade fairs and helped 28,250 youths get employment opportunities abroad. The government has allocated Kshs 175.0 mn for the FY’2022/2023.

Below is a table showing the funds’ performances:

|

Cytonn Report: Special Interest Groups Enterprise Funds Performance |

|||||

|

Fund |

Amount Disbursed |

Amount Recovered |

Amount Pending Recovery |

Recovery Rate |

Default Rate |

|

Uwezo Fund |

6.7 |

2.4 |

4.3 |

35.8% |

64.2% |

|

Women Enterprise Fund |

3.0 |

2.8 |

0.2 |

93.3% |

6.7% |

|

Youth Enterprise Fund |

0.5 |

0.2 |

0.2 |

52.2% |

47.8% |

|

Average Rates |

60.4% |

39.6% |

|||

*The performance of Uwezo Fund has been taken cumulatively since its inception to the period ending June 2021 while the performances for the Women Enterprise Fund and the Youth Enterprise Development Fund have been taken as per the last financial year of reporting.

**Amounts are in Kshs bn

Section 3: Structure and Features of Hustler Fund

As aforementioned, Hustler Fund has been established to realize the economic model of the new regime by offering credit line to individuals at the bottom of the economic pyramid. Key to note, the government, through the Cabinet Secretary for the National Treasury and Economic Planning tabled the PFM-Financial Inclusion Fund Regulation, 2022 as a guideline towards the operations of the Hustler Fund. The draft regulation provides information on the eligibility to qualify for the fund, the management structure and features of the fund as discussed below;

- Eligibility Criteria

The government has removed many of the administrative bottlenecks when applying for the fund by collaborating with already established telecom and bank platforms such as Safaricom, Airtel and Telkom and KCB bank and Family bank. However, it is important to note that for one to borrow, he/she must meet the prerequisites as stipulated below;

- Natural Person – For a natural person, that is, an individual and not an entity, the applicant shall be eighteen years of age and above and a holder of Kenyan national identity card and satisfy any other requirements that may be deemed necessary by the Board, and,

- MSMEs, SACCO Societies, Chama, Group, table banking group or any relevant association – The applicant within these categories should have all members aged eighteen and above, be registered by the appropriate government institution and comply with any set obligation as may be determined by the Board.

Additionally, an applicant must have a registered mobile number from a recognized mobile operator in Kenya and have mobile money account such as M-pesa, Airtel Money or T-Kash. The sim card to be used during the loan application must have been active for more than 90 days. Importantly, no collateral is required for the loan.

- Governance and Management of the Hustler Fund

The fund shall be managed by a board headed by a non-executive chairperson appointed by the President and shall perform oversight role and further help in formulation of new policies. The board shall consist of;

|

Cytonn Report: Hustler Fund Board Membership |

|

|

1 |

Chairperson (Non-Executive) |

|

2 |

Principal Secretary to the National Treasury or Representative |

|

3 |

The Principal Secretary of the State Department of Trade or his representative |

|

4 |

The Principal Secretary of the State Department for MSMEs or his representative |

|

5 |

The Attorney-General or his representative, |

|

6 |

Two non-public officers appointed by the Cabinet Secretary MSMEs |

|

7 |

Fund Administrator-Ex-officio member (Secretary to the board) |

Source: State Department of Trade

Key to note, the chairperson and all members shall serve for a term of three years and can be appointed for another one term depending on their performance. Additionally, the Fund shall have a Chief Executive Officer who will be competitively appointed by Cabinet Secretary to MSMEs upon recommendations by the board and meeting the relevant requirements. Given that appointees to the Hustler Fund board are either directly appointed by the president of his appointees, such as the CS MSMEs, it can be concluded that the fund is effectively wholly under the direct control of the Office of the President.

- Features of the Hustler Fund

The hustler fund principal loan structure for the Personal Finance product ranges between Kshs 500 - Kshs 50,000 and an individual will only be eligible upon meeting the conditions stated above. According to the Terms and Conditions of the Fund, the term of the loan shall be 14 days with interest charged at annual rate of 8.0% which shall be accrued daily until the full repayment of the loan amount and shall be advanced through the relevant Mobile Money Wallets.

Upon approval of the loan requested by an individual, the loan product shall have a savings component as discussed below;

- Savings Deduction - The fund will deduct 5.0% of the loan advanced that shall go towards savings,

- Short Term Savings – Key to note, 30.0% of the 5.0% savings deduction shall be applied to savings account which will be available to borrowers after 365 days from the disbursement date unless there is a default upon which the borrower can access the funds earlier,

- Pension Remittance – Notably, 70.0% of the 5.0% savings deduction shall be applied towards the customer pension that will be accessible to the borrower upon attainment of the prerequisite age, and,

- Government Contributions – Additionally, the Government of Kenya shall match the Pensions Remittance of a borrower who has not defaulted at a ratio of 2:1. Here, for every Kshs 2.0 saved, the government shall add Kshs 1.0 to a maximum government contribution of Kshs 6,000.0 annually.

Notably, the Hustler Fund has come up with the following precautionary measures to minimize the default rate;

- If the customer fails to pay within the 14 days from the date of disbursement, the loan will attract a higher interest of 9.5% annually with effect from the 15th If the customer further fails to repay by the 30th day from the disbursement date, the bank will review the customer’s credit rating thus affecting the assigned credit limit. Key to note, the interest rate shall apply daily from the date of loan disbursement for a year, or such earlier date when the repayment shall have been completed,

- In case the customer fails to repay the loan by the 30th day from the date of disbursement, he/she will not be eligible to borrow until the repayment of all outstanding debt obligations,

- Further, the fund shall retain 30.0% meant for short term savings in suspense account until full repayment of the loan to mitigate against the risk of total default by borrowers, and,

- Once the customer has settled the outstanding debt, he/she shall have access to amount in the suspended account and will be at liberty to withdraw or keep in savings account.

Section 4: Impact of the Fund

- Potential Impact of Hustler Fund

The Launch of the Hustler Fund Personal Finance Product is commendable and is set to impact Kenyans who are in the bottom pyramid of the economic status by ensuring access to credit at an affordable rate. Key to note, the fund was just recently launched and it is still early to analyze its impact. However, we shall look into the potential impact that the hustler fund will have if it is implemented based on the set objectives. The potential impacts include;

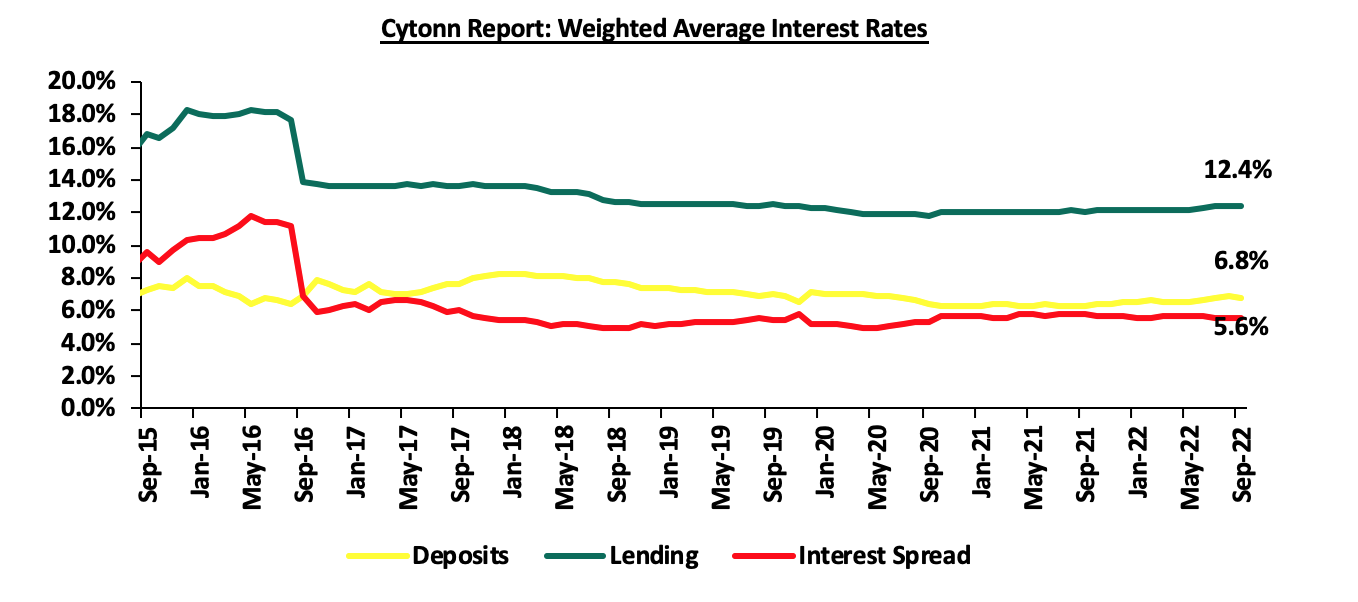

- Access to Cheaper Credit – As highlighted, banks provide 99.0% of credit to businesses in Kenya and is typically very expensive, evidenced by the average lending rate of 12.4% as of September 2022. Additionally, the approval of the Risk-Based Pricing Models for Commercial banks is set to edge the rates higher. Further, the digital loans offered are quite exorbitant leading to CRB listing of many Kenyans, which the government is trying to repair through regulation of digital lenders and the credit repair framework. As such, the 8.0% annual interest rate offered by the fund is cost-effective especially to the target group. Below is a chart showing the Kenya’s weighted average interest rates over the last 7 years;

Source: CBK

- Convenient Access to Loans – The government has made access to Hustler Fund easy through collaboration with the three major telephone companies such as Telkom, Airtel and Safaricom through mobile wallets. This is important as it will reduce the cost of credit when borrowing from banks or other digital lenders operating in the Kenyan market. Application for credit by other lenders involves a lot of bureaucracies and this has been minimized,

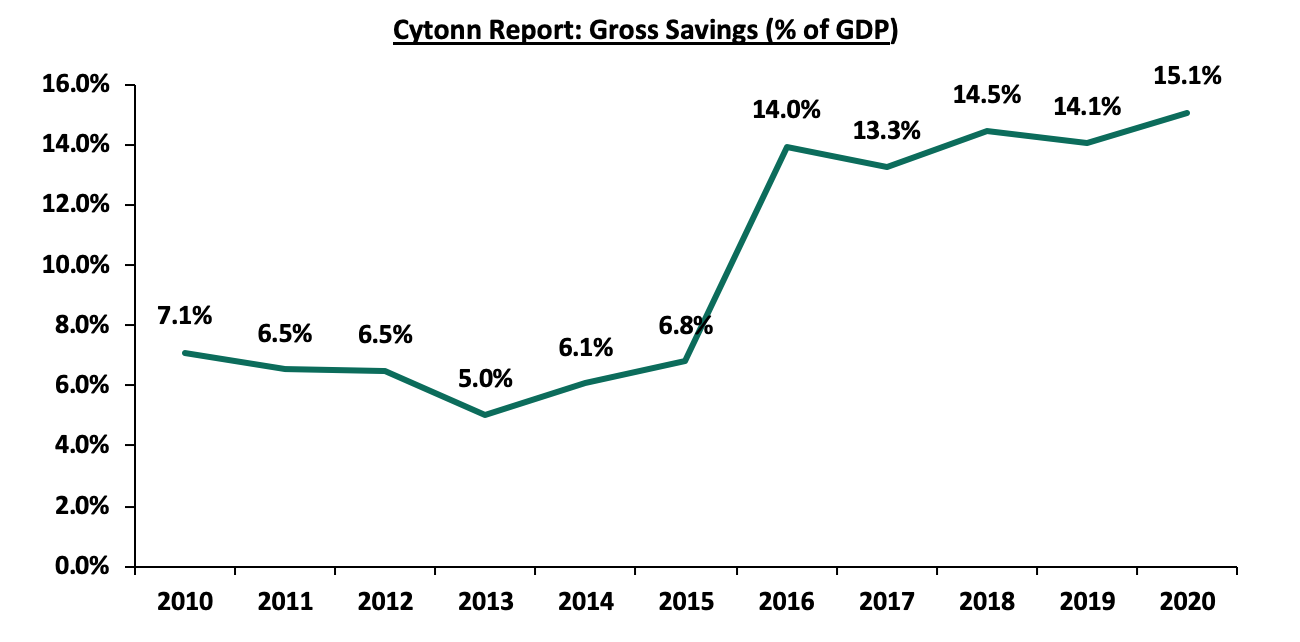

- Improving Savings Culture, Investment and Social Security to Vulnerable Members of the Society – The fund aims to improve the savings culture and investment in social security for Kenyans especially those within the informal sector. As at 19th December 2022, the total amount saved from the fund was Kshs 479.0 mn from Kshs 9.6 bn representing 5.0% of the amount disbursed. According to World Bank, Kenya’s gross saving as a percentage of GDP as of 2020 was 15.0% compared to an average of 23.0% for Sub-Saharan African region indicating the low savings culture in Kenya. As such, the 5.0% savings from Hustler Fund coupled with increasing awareness on the importance of savings will enhance savings culture in Kenya. Below is a chart showing Gross savings as a percentage of GDP in Kenya;

Source: World Bank

- Improving Economic Growth – Key to note, MSMEs contributes almost 40.0% of the GDP indicating the critical role played by this cadre in improving the economy of a country. As such, the fund will widen the access to credit especially in the informal sector consequently improving the economy in the long run.

- Expected challenges and bottlenecks

Kenya has various affirmative action schemes listed above which have been operating for some time. The funds have faced various challenges hence failure to meet their specific objectives. We expect the Hustler Fund, being a special fund to be faced by various challenges that the previous funds have grappled with, including;

- High Default Rate – The fund is likely to suffer from high default rate mainly attributable to tough economic times and unfavorable business environment. The fund’s current average repayment rate is 53.2%, having disbursed Kshs 10.1 bn and received repayments amounting to Kshs 3.2 bn, indicating a 46.8% default rate; the average default rate for the existing affirmative action funds is 39.7% indicating a potential challenge since the fund has not effectively addressed the legal mechanisms to enhance loan recovery,

- Low Loan Limits – Majority of the customers are receiving low loan limits because of the poor credit scores, by participating banks, especially those at the bottom of economic cadre. Additionally, based on the fund’s lending amounts, it is possible for the fund to be used for personal expenses rather than economic benefit which would expose it to high default rates. As such, this defy the logic of the fund since the amounts borrowed are insufficient to empower majority of the beneficiaries to start or expand businesses,

- Corruption and Mismanagement – Historically, government Affirmative Action Funds have been marred with corruption and mismanagement mainly arising from political interference. The auditor general raised questions on the accuracy of the FY’2021/2022 Uwezo Fund Financial Report with cash amounting to Kshs 7.1 bn not being able to be confirmed or reconciled. Similarly, the auditor general also raised queries on estimated Kshs 7.2 bn for the FY’2019/2020 Youth Enterprise Development Fund that could not be confirmed with the relevant documentation. Additionally, an estimated Kshs 3.7 bn from Women Enterprise Fund FY’2021/2022 Report could not be accounted for and there was also irregular procurement of motor vehicle parts. Key to note, Hustler Fund is not immune to this since the members of the board and the management structure are appointed based on political influence, and are all effectively under the control of the Office of the President hence the governance framework is lacking checks and balances. The fund is thus likely to suffer from lack of transparency unless the structures in place to mitigate such circumstances are faithfully implemented. However, its notable that digitization of the fund has reduced human interference

- Lack of Financial Literacy – Majority of the fund’s beneficiaries need financial literacy on dynamics of the growing business environment and how to run small business ventures. Notably, the government has failed on this and may result to misuse and mismanagement of the borrowed funds leading to high default rate rendering the fund unsustainable in the long run,

- High Cost of Operations – According to the draft regulations, the government has capped the cost of operations of the fund at 3.0% of the approved budget. However, failure to properly implement this policy can result to high cost of operations eating on the funds available for borrowing, and,

- Lack of Legal Framework to Recover Funds – The fund has no legal framework upon which to prosecute defaulters and fully recover the money. Additionally, the loan has no collateral and the potential high default rate may lead to unsustainability of the fund in future.

Section 5: Sustainability Analysis of the Hustler Fund

Since its inception, Hustler Fund has disbursed more than Kshs 10.1 bn as at 20th December 2022. The table below details the data on the fund’s transactions as reported by Cabinet Secretary to the Co-operatives and MSME Development Ministry;

|

Cytonn Report: Hustler Fund Transactions Data as of 20th Dec 2022 |

|

|

Amount Disbursed |

Kshs 10.1 bn |

|

Repayment Amount |

Kshs 3.2 bn |

|

Savings Amount |

Kshs 0.5 bn |

|

Total Transactions |

17.5 mn |

|

Opted in Customers |

16.8 mn |

|

Repeat Customers |

3.1 mn |

Source: Co-operatives and MSME Development Ministry

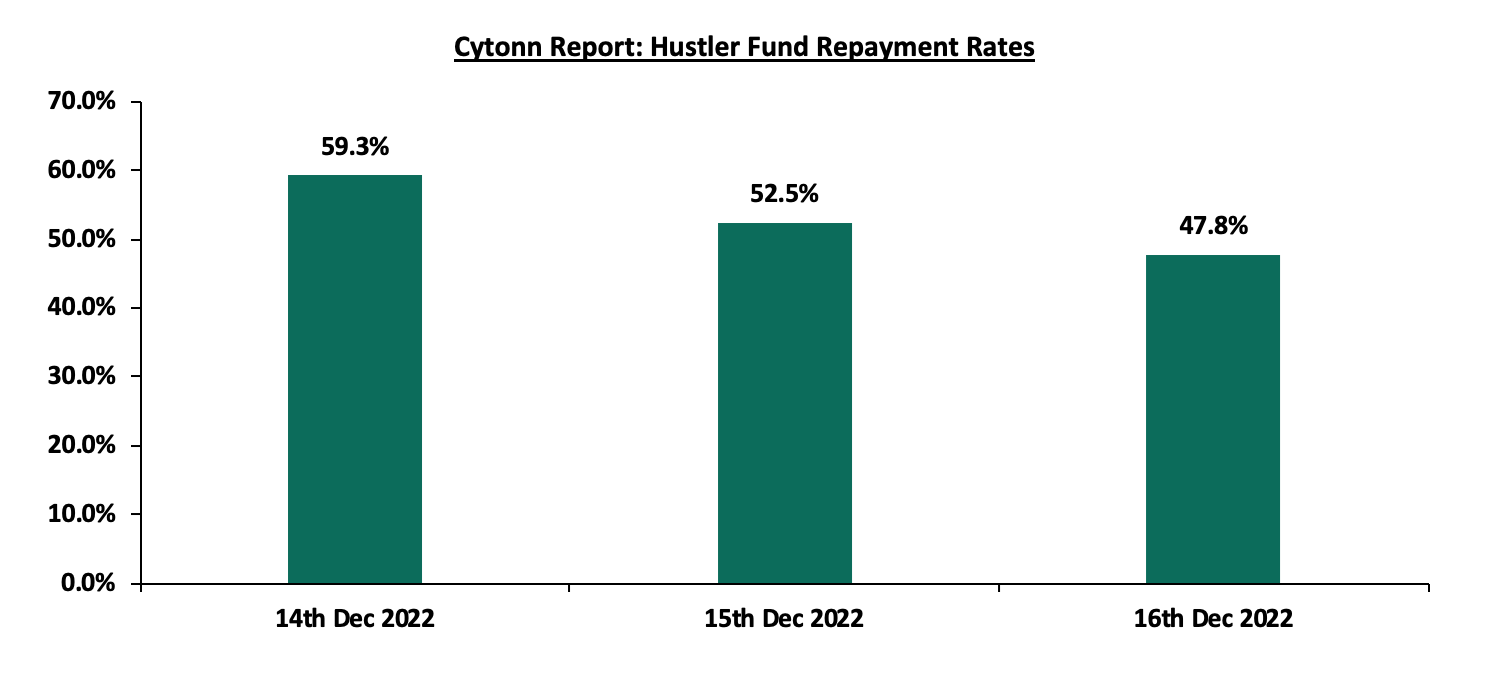

Further, the chart below shows the repayment rates as provided by the Co-operatives and MSME Development Ministry;

Source: Co-operatives and MSME Dev. Ministry

The objective of the Hustler Fund is to be a revolving fund hence the need to ensure its long-term sustainability. As such, we shall analyze the sustainability of the funds based on the following metrics;

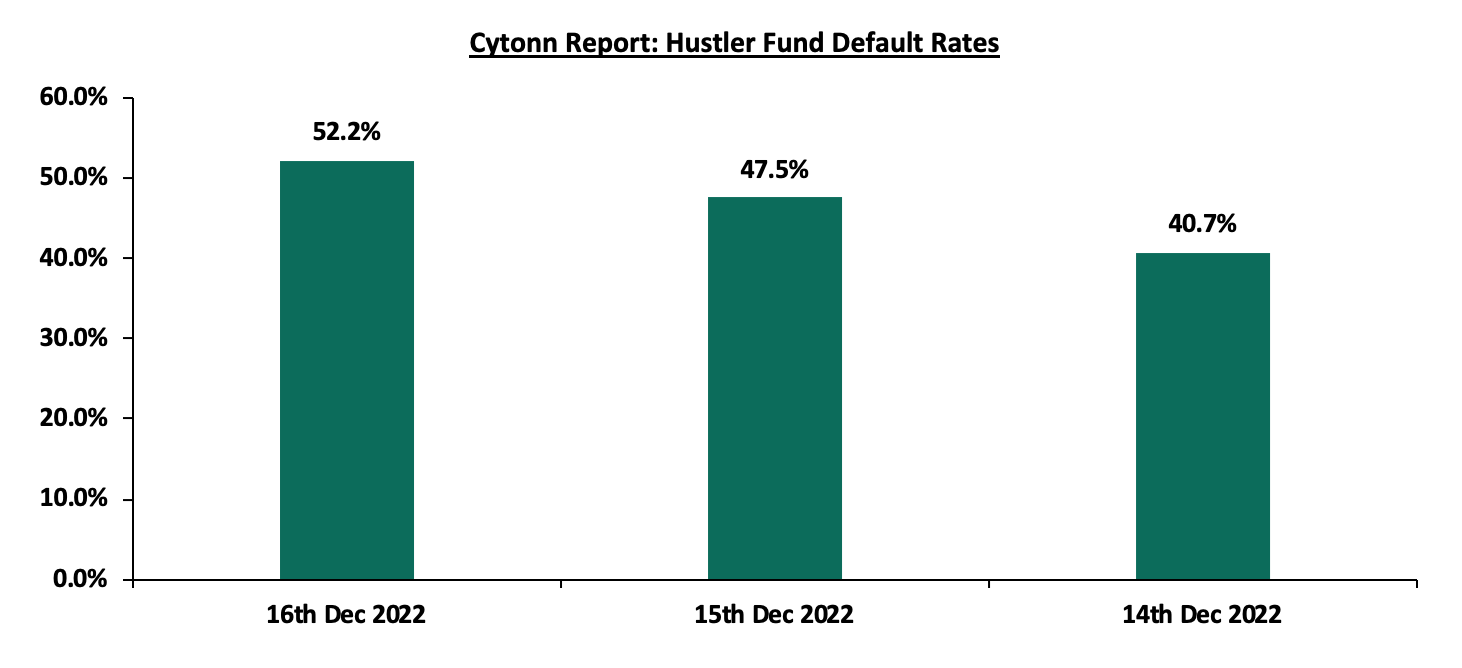

- Cost of Bad Loans – One of the major stumbling blocks affecting sustainability of Affirmative Action Funds is the high default rate. Based on the provided data on the performance of the fund, the average default rate is currently at 46.8%. This indicates that averagely, for every Kshs 100 lent out, Kshs 46.8 has been lost through bad loans. The chart below shows the default rates as provided by the Co-operatives and MSME Development Ministry;

Sources: Co-operatives and MSME Dev. Ministry

- Cost of Operations – The fund has set the cost of operations at 3.0% of the approved budget for a financial year indicating that for every Kshs 100.0 lent out, Kshs 3.0 will be used to cover for administration cost and various operations, and,

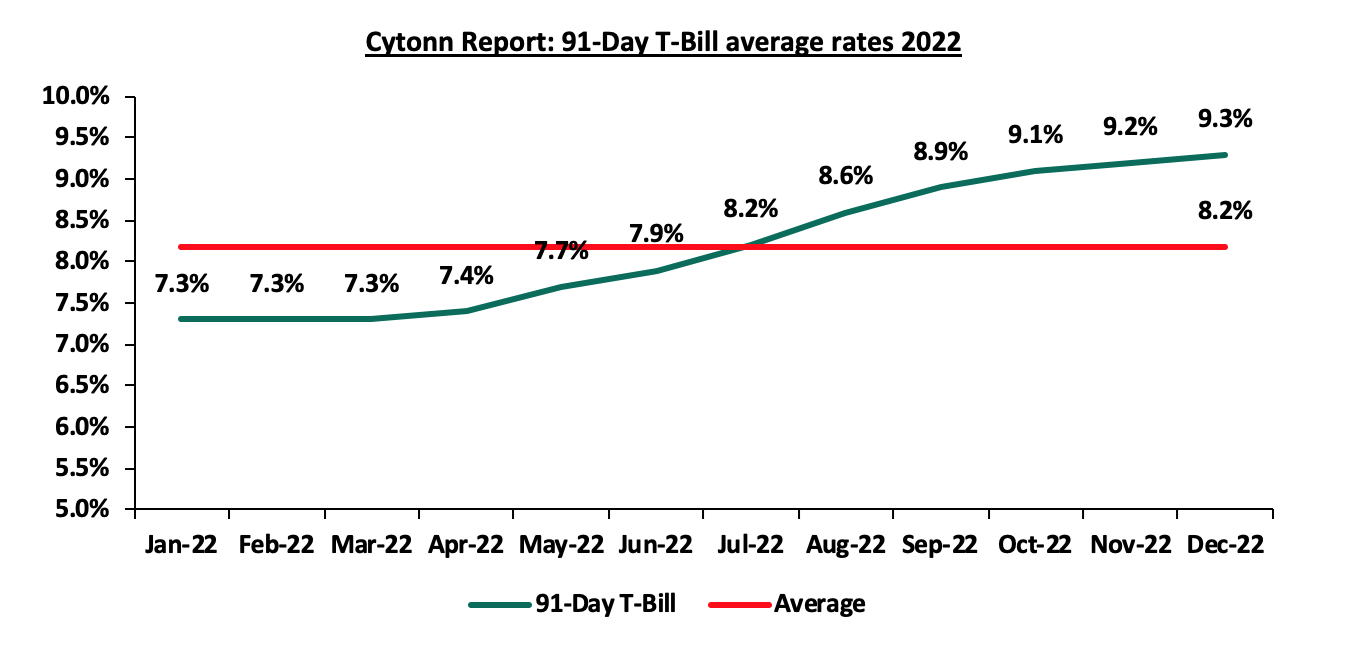

- Cost of Money – The cost of money refers to the expense that the government will incur when sourcing for funds. With Kenya already having a projected fiscal deficit of 6.2% of GDP in FY’2022/2023, it implies that financing the Hustler Fund is largely going to be financed through borrowing. Currently, the cost of short-term borrowing for the government, when using 91-day T-bill average is 8.2% for the year 2022. This indicates that for every Kshs 100.0 lent out, the government will use an estimated Kshs 8.2 to source for funds. The chart below shows the 91-day T-Bill rates for 2022;

Source: CBK

Key to note, summing up 46.8% for cost of bad loans, 3.0% for cost of operations and 8.2% for cost of money brings the cost of fund to 58.0%. This indicates that the government is lending out money at a cost of 58.0% compared to the interest rate of 8.0% charged on the fund. The table below highlights the cost of funding for the fund;

|

Cytonn Report: Hustler Fund Cost of Funds |

|

|

Cost of Bad loans |

46.8% |

|

Cost of Operations |

3.0% |

|

Cost of Money |

8.2% |

|

Cost of Funds |

58.0% |

|

Less the Interest Rate |

8.0% |

|

Net Loss |

50.0% |

As such, the government will probably have a net loss of 50.0% meaning that out of the Kshs 50.0 bn lent out, the government’s cost of funds will stand at Kshs 25.0 bn. From the analysis, the Hustler Fund appears unsustainable as it currently stands unless the government minimizes the potential risk of bad loans arising from high default rate for the sustainability of the fund.

Section 6: Conclusions and Recommendations

Based on the foregoing, we make the following conclusions.

- It’s a Great Initiative: The Hustler Fund is a good initiative because it attempts to address a key National Issue, access to credit is lacking and credit is expensive.

- Impact Remains Questionable: However, the Kshs. 50 billion has minor impact compared to the action problem which is a Kshs. 8.7 trilion of credit deficit required to reach 100.0% credit to GDP. The Hustler Fund addressed at best 0.6% of the problem before considering default rates.

- The Sustainability Remains Questionable: It appear the funds is set to lost about 50.0% of value mainly through default rates and costs of funds as discussed above, making it unsustainable unless the state decides to refinance the defaults on an annual basis.

Given above conclusions, we make the following recommendations both to address the issue of access to credit and the challenges to the fund;

- Stimulate Capital Markets to Contribute to Credit Markets – The most impactful action the government can take to address access to credit is to stimulate capital markets. The capital market in Kenya is under-developed as it contributes about 1.0% of total funding to businesses while the banking sector is already maxed out contributing 99.0% of funding. Key to note, the Kshs 50.0 bn fund, even if fully disbursed will only address 0.6% of the Kshs. 8.7 trillion credit deficit, hence it’s largely minimal because of the huge funding gap. Ideally, of the 12.1 tn credit to private sector that is needed to achieve Kshs. 12.1 tn credit to private sector, it should be a third from banking markets – roughly 4.0 tn; a second third from regulated capital markets – roughly 4.0 tn, and a final third – roughly 4.0 tn from private / alternative capital markets. With the current Kshs 3.6 tn coming from banking markets, the banking sector has essentially made its contribution leaving the capital markets to come in. As such, improving the capital markets framework is left as the only primary financing avenue that businesses can tap into. It is, thus, prudent for the government, in conjunction, with the financial sector regulators to develop a sound legal framework to promote transparency of the corporate bond market bonds, as well as investor education on key legislations that apply to the specific bond market,

- Sustainability –The fund’s model is likely to fail because of the low lending interest rates, coupled with higher cost of bad loans, cost of operations and cost of money. To ensure long-term sustainability, the fund should develop partnerships and collaborations with other public sectors and NGOs and use their competency, financial capacity and established networks to meet the objectives of the fund at cost-effective rates, and,

- Governance Framework – The government should ensure that the fund is professionally managed and free from political interference to ensure transparency and avoid mismanagement of funds which has been witnessed in the past. Any person found guilty of misappropriation of funds should be charged and prosecuted as spelt out in the draft regulations. The government can also set up an independent oversight body to ensure accountability at any point in time and ensure that the operations cost is maintained at a minimum level.