The Insolvency Act - A Second Chance for Struggling But Viable Businesses, & Cytonn Weekly #50/2018

By Cytonn Research Team, Dec 30, 2018

Executive Summary

Fixed Income

T-bills were under-subscribed during the week, with the overall subscription rate coming in at 65.0%, a decline from 93.9% recorded the previous week. Yields on the 91-day T-bill remained unchanged at 7.3% while the yields on the 182-day and 364-day papers increased to 9.0% and 10.0%, from 8.3% and 9.7% recorded the previous week, respectively.

Equities

During the week, the equities market was on an upward trend with NASI, NSE 20 and NSE 25 all increasing by 2.2%, 1.7% and 1.4%, respectively, taking their YTD performance to declines of 17.1%, 24.5% and 17.2%, respectively. The National Treasury and the National Social Security Fund are said to be in talks on the possibility of relinquishing the preference shares they hold in National Bank of Kenya (NBK) thus paving way for a rights issue, which would dilute the government’s stake in the state-owned institution;

Private Equity

In the financial services sector, Actis, a leading investor in growth markets across Africa, Asia and Latin America, has announced the sale of Compuscan, a South African provider of credit information in emerging markets, and ScoreSharp, a South African decision analytics company, to Experian, a global credit information services firm headquartered in Dublin, Ireland, for approximately USD 257.6 mn subject to approval by the Competition Commission of South Africa;

Real Estate

Kenya National Bureau of Statistics (KNBS) released its October issue of the Leading Economic Indicators, which indicated a 21.5% decline in the total value of building approvals for the first 10 months of the year 2018, by the Nairobi City County to Kshs 169.2 bn from Kshs 215.5 bn in a similar period in 2017. In the retail sector, Naivas officially opened its latest outlet at Mwembe Tayari Mall in Mombasa, while in the hospitality sector, Abu Dhabi-based Rotana Hotel Management Corporation inked a deal with Mullion Contractors Limited to manage a new hotel in Upperhill, set to open in 2021;

Focus of the Week

Since its enactment in September 2015, a number of companies have invoked the Insolvency Act 2015, including Nakumatt Holdings, Athi River Mining Cement (ARM) Limited, and Deacons East Africa PLC. In this week’s focus note, we look at the insolvency Act, and how companies are using the legislation in the restructuring process, as they navigate a period of financial distress, in an attempt at improving their financial health, and consequently protect the interests of creditors, and other stakeholders;

- The Ridge, a comprehensive lifestyle development at Ridgeways in Nairobi County, by Cytonn Real Estate, offers a live work play environment. To view show house images click here. The site is open to clients all week long.

- Following a successful transition to digital marketing, we shall progressively drop our outdoor advertisements, starting with the clock advertisements at Milimani, Upperhill and the Airport; we shall maintain street-pole advertisements;

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here;

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the training for their teams. The Cytonn Foundation, under its financial literacy pillar, runs the Wealth Management Training. If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com. To view the Wealth Management Training topics, click here;

- For recent news about the company, see our news section here;

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects;

- We continue to beef up the team with ongoing hires for Financial and Real Estate Advisors for our offices in Nairobi, Nakuru, Kisumu, and Nyeri. Visit the Careers Section on our website to apply;

- Cytonn Centre for Affordable Housing (CCFAH) is looking for a 2-acre land parcel for a joint venture in; Kiambu County (Ruiru, Kikuyu, and Lower Kabete), Nairobi County and its environs.

The parcel should be;- fronting a main road, or not more than 800 metres from the main road and

- priced at Kshs 20mn per acre or below. For more information or leads email us at affordablehousing@cytonn.com

T-Bills & T-Bonds Primary Auction:

T-bills were under-subscribed during the week, for the 8th week in a row, with the overall subscription rate coming in at 65.0%, a decline from 93.9% recorded the previous week despite increased liquidity, as evidenced by a decrease in the interbank rate, which declined by 1.1% points to 6.7%, from 7.8% last week. The decline in the subscription can be attributed to the slowdown in market activity during the festive season. There was a decrease in subscription rates across the board for the 91-day, 182-day and the 364-day paper with subscription falling to 25.6%, 54.2% and 91.6% from 70.1%, 70.3% and 126.9% recorded the previous week, respectively. The yields on the 91-day T-bill remained unchanged at 7.3% while the yields on the 182-day and 364-day papers increased by 0.7% points and 0.3% points to 9.0% and 10.0%, from 8.3% and 9.7% recorded the previous week, respectively. The acceptance rate declined to 70.0% from 87.3% recorded the previous week, with the government accepting Kshs 10.9 bn of the Kshs 15.6 bn worth of bids received.

Liquidity:

The average interbank rate declined to 6.7%, from 7.8% the previous week, while the average volumes traded in the interbank market fell by 24.0% to Kshs 11.7 bn from Kshs 15.4 bn the previous week. The lower interbank rate points to improved liquidity conditions, which can be partly attributed to government payments and net redemption of government securities, with T-bill redemptions of Kshs 16.5 bn, compared to total accepted bids of Kshs 10.9 bn.

Kenya Eurobonds:

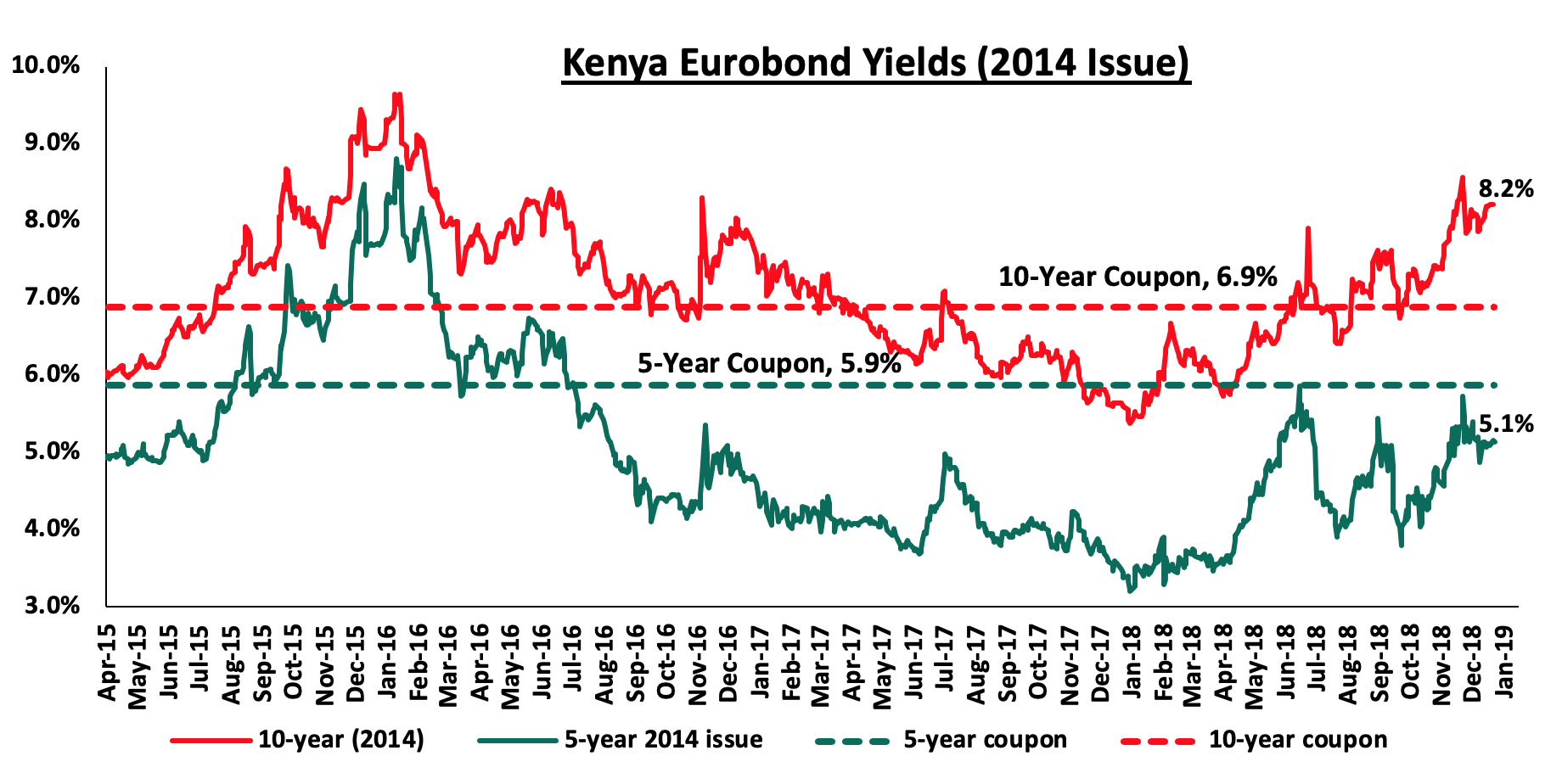

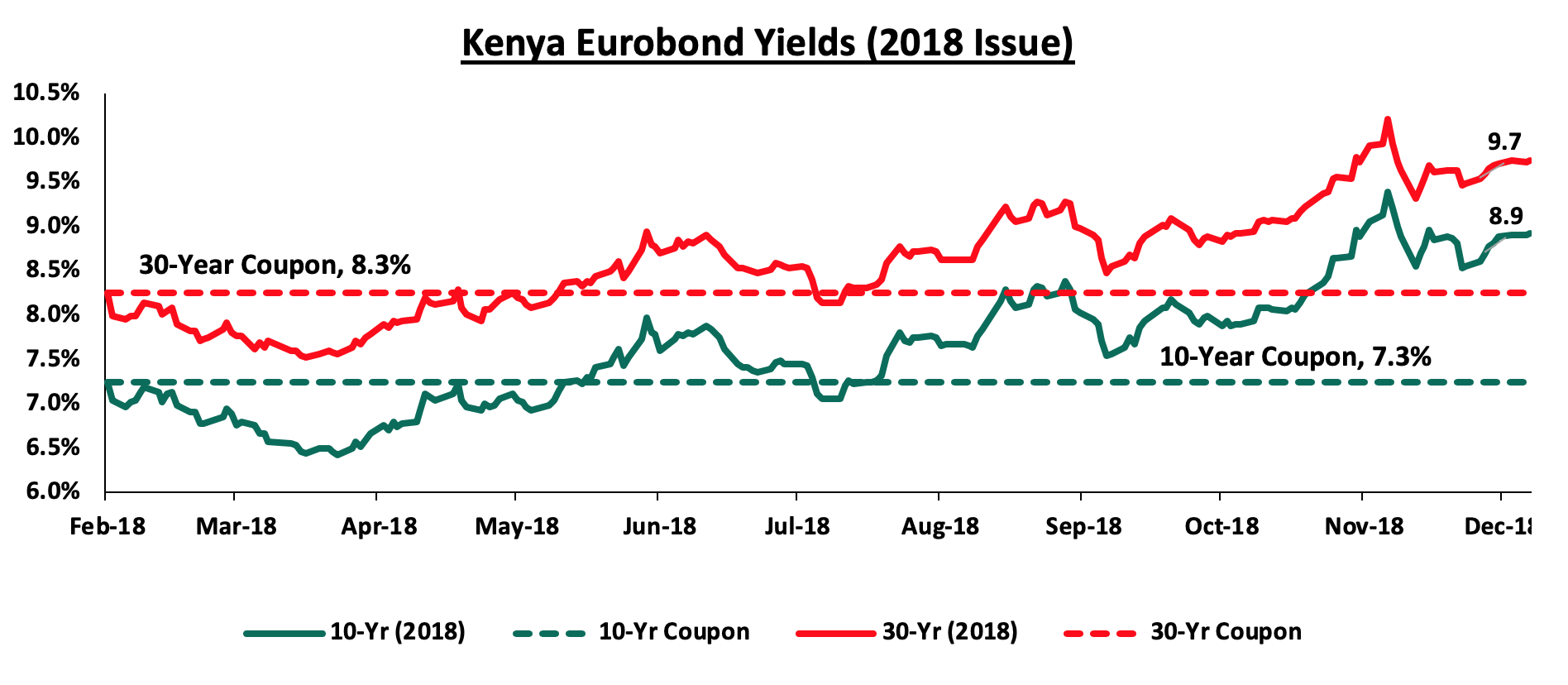

According to Bloomberg, the yields on the 5-year and 10-year Eurobonds issued in 2014 remained unchanged at 5.1% and 8.2%, respectively. Since the mid-January 2016 peak, yields on the Kenyan Eurobonds have declined by 1.4% points and 3.7% points for the 10-year and 5-year Eurobonds, respectively, an indication of the relatively stable macroeconomic conditions in the country. Key to note is that these bonds have 0.5 years and 5.5 years to maturity for the 5-year and 10-year, respectively.

For the February 2018 Eurobond issue, during the week, the yields on both the 10-year and 30-year Eurobonds remained unchanged from the previous week, at 8.9% and 9.7%, respectively. Since the issue date, the yield on the 10-year Eurobond has increased by 1.7% points while that of the 30-year Eurobonds has increased by 1.5% points.

Key to note however, yields of Eurobonds issued in the Sub-Saharan Region have been on the rise on a year-to-date basis, signalling higher risk perception by investors. This has partly been attributed to the increment in the Federal Funds Rate three times this year, which is currently at 2.5%. This has led to market correction in Eurobond yields in the emerging markets in the wake of rising US Treasury yields, and a stronger US Dollar.

Kenya Shilling:

During the week, the Kenya Shilling appreciated by 0.2% against the US Dollar to close at Kshs 101.7 from Kshs 101.9, recorded the previous week, supported by diaspora remittances. The Kenya Shilling has appreciated against the US Dollar by 1.5% year to date, and in our view the shilling should remain relatively stable to the dollar in the short term, supported by:

- The narrowing of the current account deficit to 5.3% in the 12-months to September 2018, from 6.5% in September 2017, attributed to improved agriculture exports, increased diaspora remittances, strong receipts from tourism, and lower food and SGR-related equipment relative to 2017,

- Improving diaspora remittances, which increased by 6.9% m/m in the month of October 2018 to USD 219.2 mn from USD 205.1 mn recorded in September. The y/y growth came in at 18.2% from USD 185.5 mn recorded in October 2017. Cumulatively, total diaspora remittances rose by 39.5% in the 12 months to October 2018, to USD 2.6 bn, from USD 1.9 bn recorded in a similar period in 2017. This has been attributed to; (a) recovery of the global economy, (b) increased uptake of financial products by the diaspora due to financial services firms, particularly banks, targeting the diaspora, and (c) new partnerships between international money remittance providers and local commercial banks making the process more convenient. For more analysis on this see our October Diaspora Remittances Note,

- CBK’s activities in the money market, such as repurchase agreements and selling of dollars, and,

- High levels of forex reserves, currently at USD 8.0 bn, equivalent to 5.2-months of import cover, compared to the one-year average of 5.1-months and above the EAC region’s convergence criteria of 4.5-months of imports cover.

Rates in the fixed income market have remained relatively stable despite the government being 30.3% behind its pro-rated domestic borrowing target for the current financial year, having borrowed Kshs 91.1 bn against a pro-rated target of Kshs 130.7 bn. The 2018/19 budget had given a domestic borrowing target of Kshs 271.9 bn, 8.6% lower than the 2017/2018 fiscal year’s target of Kshs 297.6 bn, which may result in reduced pressure on domestic borrowing. With the rate cap still in place, we maintain our expectation of stability in the interest rate environment. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium-term fixed-income instrument.

Market Performance

During the week, the equities market was on an upward trend with NASI, NSE 20 and NSE 25 increasing by 2.2%, 1.7% and 1.4%, respectively, taking their YTD performance to declines of 17.1%, 24.5% and 17.2%, respectively. The improvement in NASI was driven by increase in large cap stocks such as BAT, EABL, and NIC, which increased by 8.8%, 7.1%, and 2.0% respectively.

Equities turnover decreased by 81.2 % during the week to USD 4.2 mn from USD 22.2 mn the previous week, owing to a shortened trading week due to the Christmas holiday, taking the YTD turnover to USD 1.8 bn. Foreign investors remained net sellers for the week, with a net selling position of USD 1.5 mn, a 63.0% decrease from last week’s net selling position of USD 4.2 mn. We expect the market to remain subdued in the near-term as international investors exit the broader emerging markets due to the expectation of rising US interest rates, coupled with the strengthening of the US Dollar.

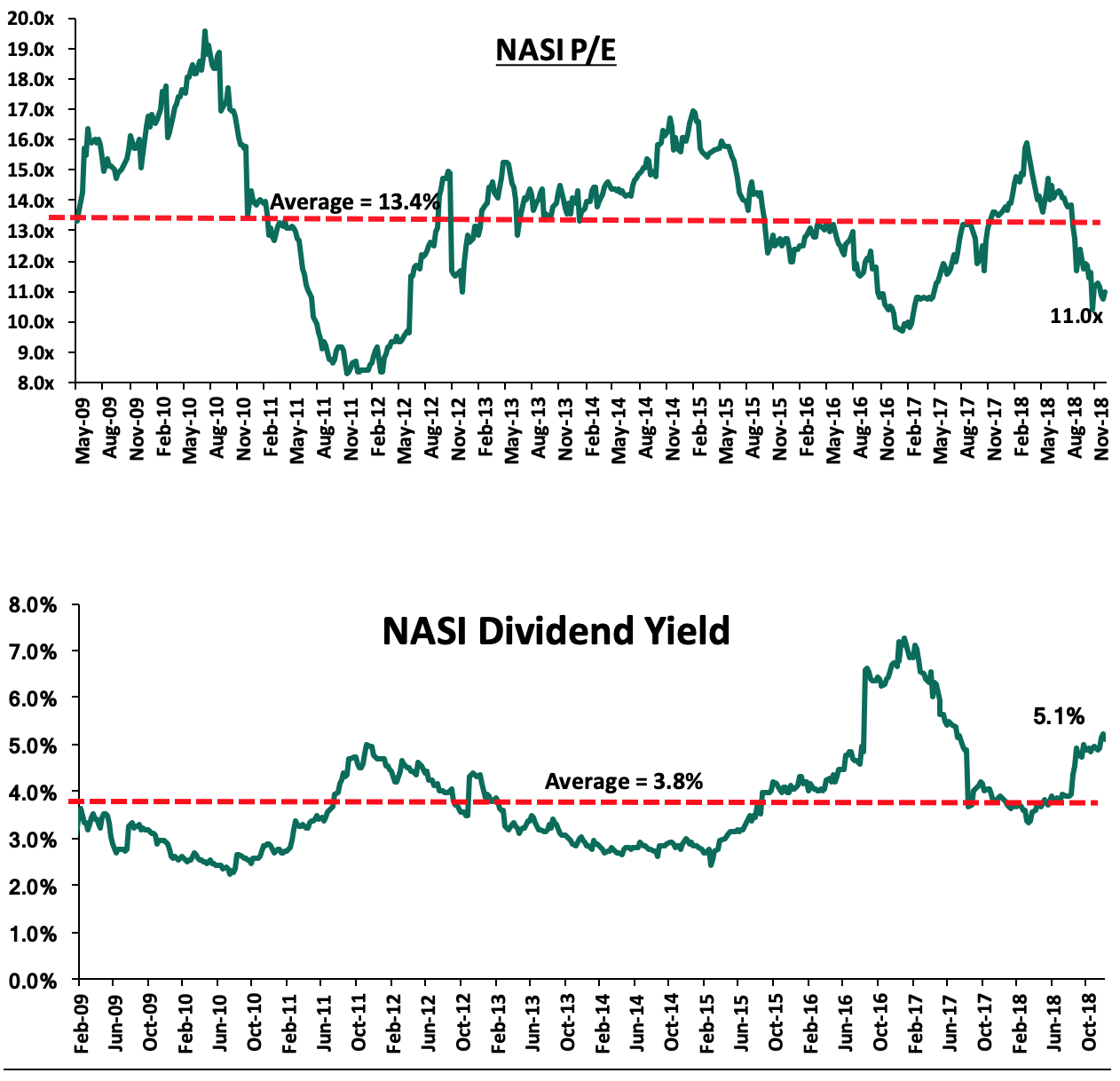

The market is currently trading at a price to earnings ratio (P/E) of 11.0x, 18.2% below the historical average of 13.4x, and a dividend yield of 5.1%, above the historical average of 3.8%. The current P/E valuation of 11.0x is 11.9% above the most recent trough valuation of 9.8x experienced in the first week of February 2017, and 32.0% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlights

Kenya’s National Treasury and the National Social Security Fund (NSSF) are said to be in talks on the possibility of relinquishing the preference shares they hold in National Bank of Kenya (NBK) thus paving way for a rights issue that would dilute the government’s stake in the state-owned institution. If successful, the move could result into recapitalization of the bank after the two major shareholders halted the initial plan to inject Kshs 4.2 bn in the form of a subordinated loan into the business, a proposal that had been in the pipeline since 2016. The two shareholders are currently considering the possibility of converting their preferred shares into ordinary shares. According to NBK’s annual report for the year ended 31st December 2017, the National Treasury and NSSF control a 22.5% and 48.1% shareholding in the bank, respectively, with a combined total of 239.0 mn ordinary shares of 338.8 mn issued shares.

NBK is currently severely undercapitalized, operating below statutory capital requirements as highlighted below;

|

National Bank of Kenya Capital Adequacy |

||

|

Capital Adequacy Ratios |

Q3'2017 |

Q3'2018 |

|

Core Capital/Total deposit Liabilities |

9.1% |

2.5% |

|

Minimum Statutory ratio |

8.0% |

8.0% |

|

Excess |

1.1% |

(5.5%) |

|

Core Capital/Total Risk Weighted Assets |

9.8% |

2.6% |

|

Minimum Statutory ratio |

10.5% |

10.5% |

|

Excess |

(0.7%) |

(7.9%) |

|

Total Capital/Total Risk Weighted Assets |

11.3% |

4.1% |

|

Minimum Statutory ratio |

14.5% |

14.5% |

|

Excess |

(3.2%) |

(10.4%) |

|

Liquidity Ratio |

34.0% |

38.8% |

|

Minimum Statutory ratio |

20.0% |

20.0% |

|

Excess |

14.0% |

18.8% |

|

Adjusted Core Capital/Total Risk Weighted Assets |

3.1% |

|

|

Adjusted Core Capital/Total Risk Weighted Assets |

4.5% |

|

Source: Cytonn Research

We are of the view that the bank may need to be privatized as the core step to address the severe undercapitalization. With the National Treasury and NSSF relinquishing their preference shares and diluting their stakes in NBK, this will make the bank more attractive for a strategic investor who can inject capital and privatize the bank. Privatization would also bring about a shake-up in governance, which has also been a core factor in the bank’s recent run of poor performance. The bank’s efforts of a rights issue has long since been delayed and privatization offers the bank an easier capital-raising route. Another initiative would be the sale of non-core assets such as land owned.

Financial services provider, UAP Old Mutual Holdings, has issued a profit warning for the full financial year ended December 2018, citing lower asset valuations and one-off retrenchment costs. As a result, the firm is expected to report at least 25.0 % (Kshs 300.0 mn) drop in earnings in the current financial year, on the back of a bearish performance in equities listed at the Nairobi Securities Exchange, and retrenchment costs. This comes a few weeks after the firm completed a restructuring process to unlock efficiencies in the business. The company reported a 61.6 % drop in after-tax profit for the half year to Kshs 190.7 mn from Kshs 496.8 mn in 2017. At least seven firms listed on the Nairobi Securities Exchange (NSE) have issued profit warnings in 2018 citing difficult market conditions. They include; Bamburi Cement , Housing Finance Group , Kenya Power and Lightning Company, Sanlam, Deacons East Africa PLC and Sameer Africa.

Changes in Corporate Governance

Standard Chartered Bank Kenya (SCBK) announced the exit of Mr. Lamin Manjang as the CEO after a 5-year stint at the bank, and consequently the appointment of Mr. Kariuki Ngari as his replacement. As a result the following are the changes in corporate governance score and ranking:

- Ethnic diversity declined from 75.0% to 66.6% and the score declined to 0.5 from 1,

- As a result, the comprehensive score declined from 79.2% to 77.1%, with the rank dropping from joint 6th position to joint 8th position.

Universe of Coverage

Below is a summary of our SSA universe of coverage:

|

Universe Of Coverage |

|||||||||

|

Banks |

Price as at 21/12/2018 |

Price as at 28/12/2018 |

w/w change |

YTD Change |

LTM Change |

Target Price* |

Dividend Yield |

Upside/Downside** |

P/TBv Multiple |

|

Equity Group |

36.0 |

35.2 |

(2.2%) |

(11.4%) |

(7.1%) |

65.8 |

5.7% |

74.6% |

1.7x |

|

KCB Group |

38.0 |

37.4 |

(1.4%) |

(12.5%) |

(11.2%) |

64.0 |

8.0% |

70.5% |

1.2x |

|

Ghana Commercial Bank*** |

4.8 |

4.8 |

0.6% |

(5.0%) |

(5.0%) |

7.7 |

7.9% |

69.1% |

1.1x |

|

I&M Holdings |

85.0 |

85.0 |

0.0% |

(33.1%) |

(33.1%) |

138.6 |

4.1% |

65.3% |

0.9x |

|

Diamond Trust Bank |

149.0 |

150.3 |

0.8% |

(21.7%) |

(22.4%) |

231.0 |

1.7% |

57.5% |

0.9x |

|

Zenith Bank*** |

22.7 |

23.0 |

1.3% |

(10.3%) |

(11.0%) |

33.3 |

11.7% |

56.6% |

1.0x |

|

NIC Bank |

27.4 |

27.9 |

1.8% |

(17.5%) |

(10.9%) |

40.7 |

3.6% |

56.6% |

0.7x |

|

UBA Bank |

7.9 |

7.9 |

0.0% |

(23.8%) |

(23.8%) |

10.7 |

10.8% |

52.5% |

0.5x |

|

CAL Bank |

1.0 |

1.0 |

0.0% |

(11.1%) |

1.6% |

1.4 |

0.0% |

48.9% |

0.8x |

|

Co-operative Bank |

13.9 |

14.1 |

1.1% |

(12.2%) |

(12.9%) |

19.4 |

5.7% |

43.3% |

1.2x |

|

Ecobank |

7.0 |

7.5 |

7.1% |

(1.3%) |

1.3% |

10.7 |

0.0% |

43.1% |

1.5x |

|

CRDB |

150.0 |

150.0 |

0.0% |

(6.3%) |

(6.3%) |

207.7 |

0.0% |

38.5% |

0.5x |

|

Barclays |

11.1 |

11.0 |

(0.9%) |

14.6% |

15.0% |

13.9 |

9.1% |

37.8% |

1.5x |

|

Union Bank Plc |

5.6 |

5.6 |

0.0% |

(28.2%) |

(25.2%) |

8.2 |

0.0% |

33.6% |

0.6x |

|

Access Bank |

7.1 |

6.8 |

(3.5%) |

(34.9%) |

(32.7%) |

9.5 |

5.9% |

33.4% |

0.5x |

|

HF Group |

5.3 |

5.5 |

3.0% |

(47.1%) |

(44.3%) |

6.9 |

6.4% |

31.8% |

0.2x |

|

Stanbic Bank Uganda |

31.5 |

31.0 |

(1.7%) |

13.8% |

15.7% |

36.3 |

3.8% |

23.2% |

2.2x |

|

SBM Holdings |

5.9 |

5.9 |

0.0% |

(20.8%) |

(20.8%) |

6.6 |

5.1% |

14.4% |

0.8x |

|

Stanbic Holdings |

88.5 |

95.0 |

7.3% |

17.3% |

9.3% |

102.7 |

2.4% |

14.0% |

0.9x |

|

Guaranty Trust Bank |

33.8 |

34.3 |

1.5% |

(15.8%) |

(16.6%) |

37.1 |

7.0% |

13.0% |

2.1x |

|

Bank of Kigali |

278.0 |

278.0 |

0.0% |

(7.3%) |

(7.3%) |

299.9 |

5.0% |

12.5% |

1.5x |

|

Standard Chartered |

196.5 |

194.0 |

(1.3%) |

(6.7%) |

(5.1%) |

192.0 |

6.4% |

5.0% |

1.6x |

|

Bank of Baroda |

140.0 |

140.0 |

0.0% |

23.9% |

23.9% |

130.6 |

1.8% |

(3.6%) |

1.2x |

|

Standard Chartered |

20.0 |

21.0 |

5.0% |

(16.8%) |

(7.5%) |

19.5 |

0.0% |

(4.1%) |

2.5x |

|

FBN Holdings |

7.9 |

7.6 |

(4.4%) |

(14.2%) |

(12.1%) |

6.6 |

3.3% |

(7.7%) |

0.4x |

|

National Bank |

5.8 |

5.9 |

1.4% |

(37.1%) |

(38.6%) |

5.0 |

0.0% |

(16.7%) |

0.4x |

|

Stanbic IBTC Holdings |

46.0 |

53.3 |

15.8% |

28.3% |

10.8% |

37.0 |

1.1% |

(17.6%) |

2.4x |

|

Ecobank Transnational |

14.3 |

14.0 |

(1.8%) |

(17.6%) |

(16.2%) |

9.3 |

0.0% |

(38.1%) |

0.5x |

|

*Target Price as per Cytonn Analyst estimates **Upside / (Downside) is adjusted for Dividend Yield ***Banks in which Cytonn and/or its affiliates holds a stake. ****Stock prices indicated in respective country currencies |

|||||||||

We are “NEUTRAL” on equities for investors with a short investment horizon. However, pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for medium to long-term investors, and with expectations of higher corporate earnings supported by sectors such as banking sector, we are “POSITIVE” for investors with a long-term investment horizon.

Actis, a leading investor in growth markets across Africa, Asia and Latin America, has announced the sale of Compuscan, a South African provider of credit information in emerging markets and ScoreSharp, a South African decision analytics company, to Experian, a global credit information services firm headquartered in Dublin, Ireland, for approximately USD 257.6 mn subject to approval by the Competition Commission of South Africa. Compuscan was established in 1994 as a credit bureau focused on helping micro-lenders to avoid financial loss by identifying clients’ repayment probability prior to processing of loans. The credit bureau, Compuscan, merged with ScoreSharp in 2011 to operate as a dual company. Actis through a special purpose vehicle, Credit Services Holdings (CSH), acquired a majority shareholding of 60% in Compuscan and ScoreSharp in 2014 with the aim of expanding the product offering, enhancing the firms’ scale of business, and creation of a dominant emerging market credit bureau. Following the acquisition in 2014, CSH injected an additional USD 100.0 mn for expansion purposes making Compuscan a full-service credit bureau and information services provider offering credit information services, marketing services, decision analytics services as well as loyalty and rewards services across seven African countries (South Africa, Lesotho, Botswana, Namibia, Ethiopia and Uganda), Philippines and Australia.

This transaction highlights recognition of untapped potential in credit and credit related industries in Africa. Data from the World Bank’s Global Financial Development Report 2017/2018 shows that credit extension lags in Africa compared to other world regions by a significant margin noting that the ratio of credit extension to GDP is only 18.0% in Sub-Saharan Africa compared to 37.0% in South Asia and 47.0% in Latin America. Credit extension firms, bureaus as well as policy makers in Sub-Saharan Africa therefore have a major role to play in strengthening credit markets in the region and enhance financial inclusivity and investors are keen to be part of this process.

The transaction is also in line with the trend of increased private equity exits in Africa. According to the 2018 survey by Earnest & Young (EY) and Africa Private Equity and Venture Capital Association (AVCA), the number of annual PE exits in Africa have steadily increased from 30 in 2011 to peak at 50 in 2016. Despite challenging exit environments in key African markets in 2017 (with elevated political uncertainty and a weak economic environment in South Africa, and continuing Nigerian currency challenges), PE activity remained resilient recording 49 exits, only slightly below the peak in 2016 (50 exits). Looking forward, we expect to see investment in the Fintech, Education, Consumer Products and services, and Energy sectors.

Despite the recent slowdown in growth, we maintain a positive outlook on private equity investments in Africa as evidenced by the increasing investor interest, which is attributed to; (i) Economic growth, which is projected to improve in Africa’s most developed PE markets, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, and, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets. Going forward, the increasing investor interest, stable macro-economic and political environment will continue to boost deal flow into African markets.

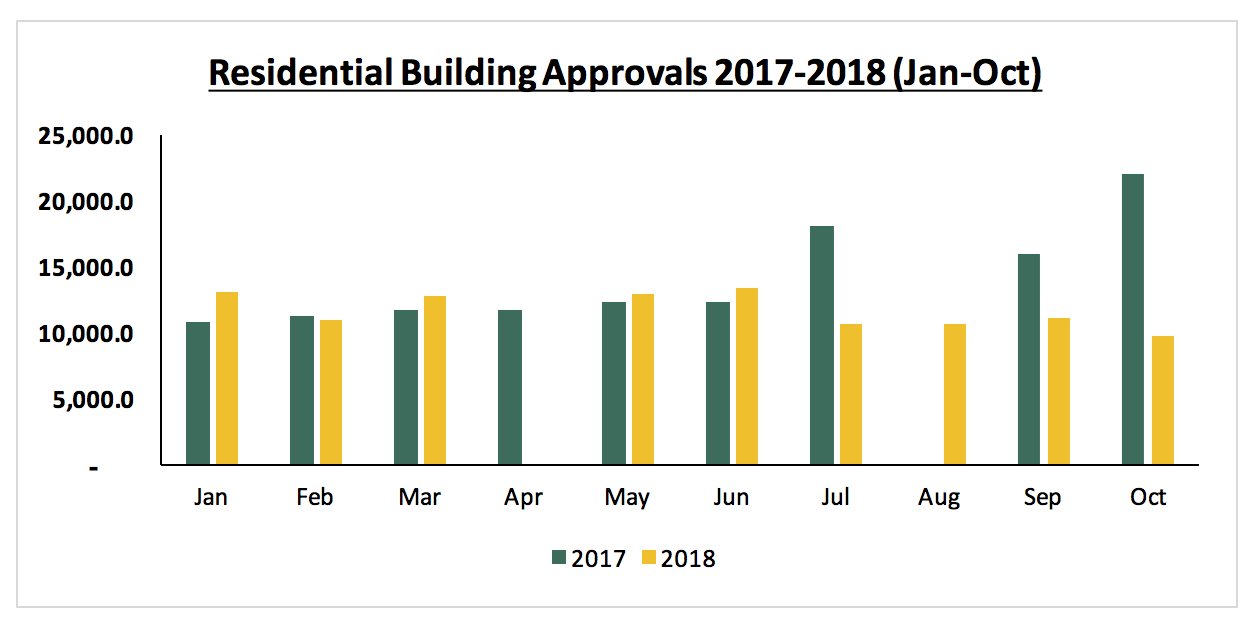

- Industry Reports

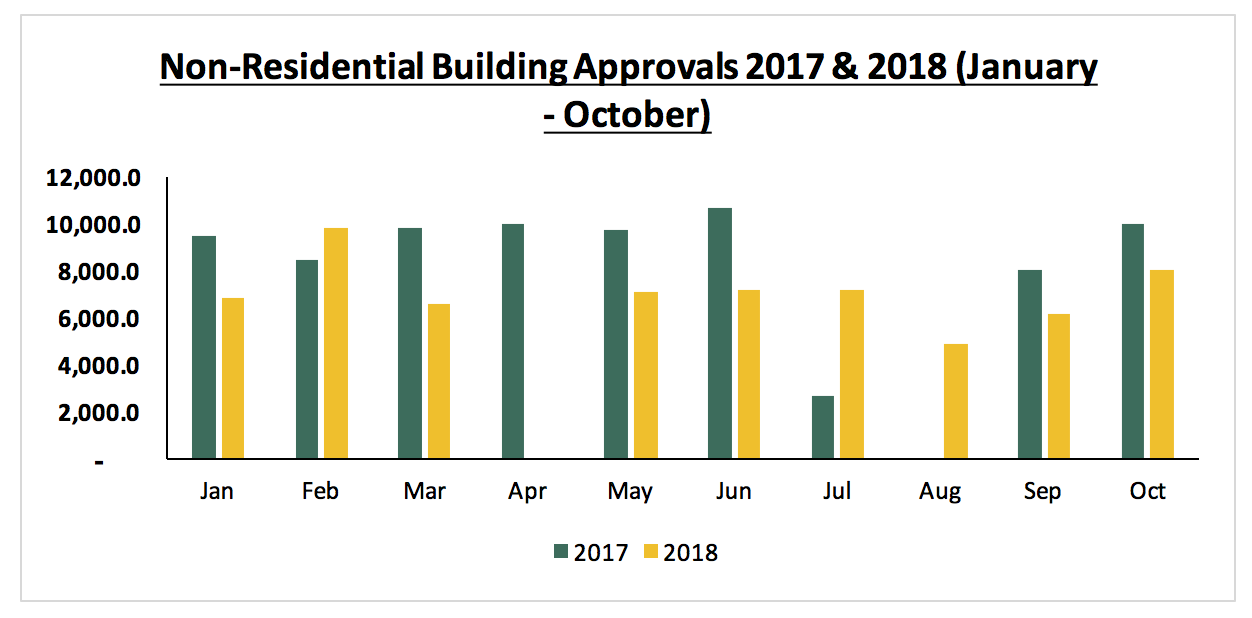

During the week, the Kenya National Bureau of Statistics (KNBS) released its October issue of Leading Economic Indicators Report. According to the report, the total value of building approvals by the Nairobi City County in 2018 for the period January to October fell by 21.5% to Kshs 169.2 bn, from Kshs 215.5 bn recorded in a similar period in 2017. The month of October recorded the lowest value for residential building approvals with Kshs 9.7 bn, which is 55.9% lower than kshs 22.0 bn recorded in the same month in 2017. The slowdown is attributed to several factors including, (i) the uncertainty surrounding statutory approvals – having seen several buildings that had approvals brought down and the County Government challenging its own approvals that it had previously given, (ii) a slow-down in the overall spending power and, (iii) the continuing credit crunch orchestrated by the 2015 rate cap legislation that has made it more attractive for banks to lend to the government rather than private lending. We, therefore, expect developers to continue being highly selective with areas and concepts they develop.

*no buildings approvals for April 2018 and August 2017 (KNBS)

Source: KNBS

- Hospitality

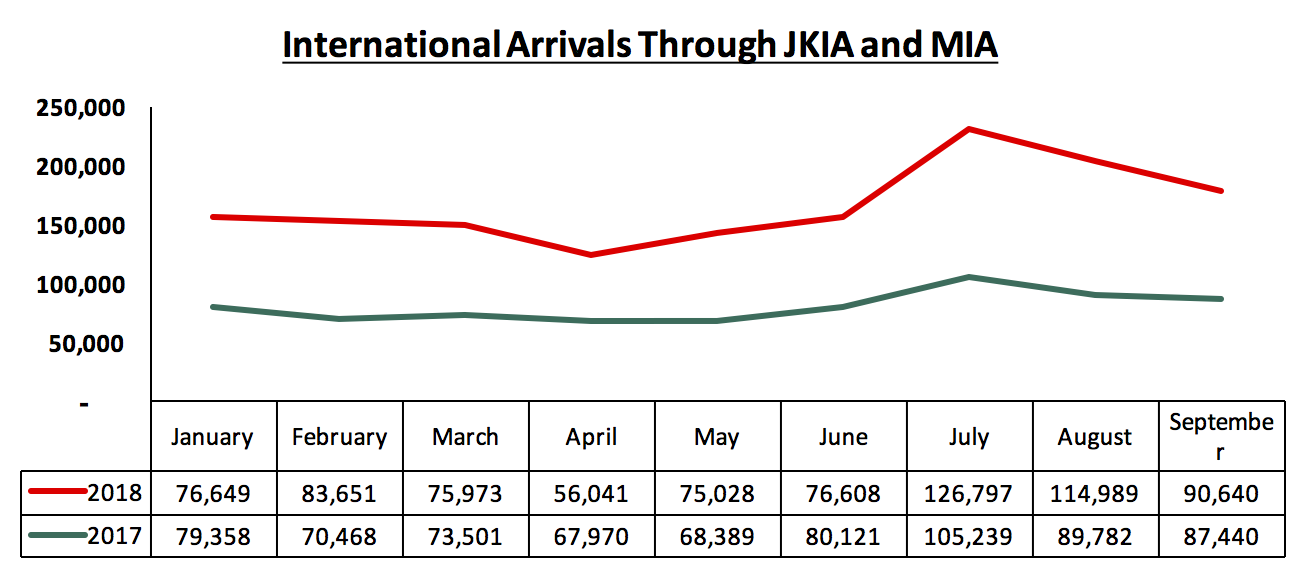

According to the KNBS Leading Economic Indicators Report, the number of international arrivals in Kenya in the month of September dipped by 21.2% to 90,640 from 114,989 in August. Important to note, however, is that this was 3.7% higher than the 87,440 recorded in September 2017. The period starting in July usually attracts relatively high tourist activity owing to the renowned Maasai Mara Wildebeest migration, marking the commencement of the holiday season for international tourists.

Source: KNBS

In our view, the number of international arrivals is bound to increase in the following months owing to a reduction in political risk, increase in top-notch accommodation facilities, improved infrastructure in key tourist areas such as Mombasa as well as the continued marketing efforts by the government through the Kenya Tourism Board.

Also during the week, Abu Dhabi-based Rotana Hotel Management Corporation inked a deal with Mullion Contractors Limited that will see a hotel of 200 rooms and 100-room apartment hotel managed under Rotana Group’s brands, Rotana Hotels & Resorts and Arjaan Apartments, respectively in Upperhill, Nairobi. The hotel is set to open in 2021. Currently, the Rotana brand Africa portfolio consists of properties in Sudan, Egypt and the Democratic Republic of Congo and plans to start operations in Kenya and Zambia by 2022 with other plans including starting operations in African countries such as Mauritania, Tanzania, Angola, and Nigeria. This attests to Nairobi’s attractiveness, especially to international hotel investors. Other notable international brands that have set up shop locally and have plans to expand their local footprint are Marriott International, Radisson Hotel Group and Accor Hotel’s Movenpick.

According to our 2017 Hospitality Report investment opportunity ranking, which was based on factors such as current supply of hotels and availability of amenities, Upperhill emerged as the most suitable for hotel investment. This is because Upperhill is a commercial hub with good transport network yet currently only has 8.6% share of the existing hotel room stock with hotels such as Radisson Blu and Crowne Plaza with 271 keys and 206 keys, respectively. The ranking is as shown below:

|

Hotel Investment Opportunity 2017/2018 |

|||||||

|

Location |

Supply |

Pipeline |

Commercial Hub |

UN Blue Zone |

Transport Network |

Points |

Rank |

|

Upperhill |

4 |

3 |

5 |

5 |

5 |

4.4 |

1 |

|

Kilimani |

2 |

3 |

4 |

5 |

5 |

3.7 |

2 |

|

Kiambu/Limuru Rd |

5 |

5 |

2 |

5 |

4 |

4.0 |

2 |

|

Westlands |

2 |

1 |

5 |

5 |

5 |

3.6 |

4 |

|

Thika Rd |

5 |

5 |

2 |

3 |

4 |

3.6 |

4 |

|

Nairobi CBD |

1 |

5 |

5 |

1 |

5 |

3.4 |

6 |

|

Karen/Lang'ata |

4 |

3 |

3 |

3 |

5 |

3.4 |

6 |

|

Mombasa Rd |

3 |

3 |

3 |

1 |

5 |

2.8 |

8 |

|

· Upperhill was the most viable for investment as it is a main commercial hub and yet has only 8.6% share of the existing hotel room stock. The main challenge with Upperhill, however, is inadequate social amenities such as shopping centers and thus investors ought to consider mixed-use developments that will provide the requisite social amenities |

|||||||

Source: Cytonn, STR

- Retail Sector

During the week, local retailer Naivas officially opened its latest outlet at Mwembe Tayari Mall in Mombasa, occupying 19.9% of the 135,600 SQFT mall, with 27,000 SQFT. This increases the retailer’s total number of branches in Mombasa County to 3, and 49 Countrywide. In our view, the continued expansion by Naivas and other local retailers is driven by increased purchasing power due to expanding middle class, vacation of prime spaces by fallen retail giants such as Nakumatt and Uchumi, as well as improved formal retail penetration in Kenya. This, in turn, results in better performance of retail real estate developments as main retailers such as Naivas act as anchor tenants driving footfall to malls, and thus, boosting space uptake from other retailers. According to Cytonn’s Kenya Retail Sector Report 2018, Mombasa ranked 4th in the retail sector performance after Mt Kenya, Kisumu and Nairobi, recording a 1.0% points increase y/y in rental yields to 8.3% in 2018, from 7.3% in 2017, and 13.5% points increase y/y in occupancy rates to 96.3% in 2018 from 82.8% in 2017. We expect the continued expansion by retailers to improve the performance of malls enabling investors and developers to recoup their investments.

|

Summary of Retail Market Performance in Key Urban Cities in Kenya |

||||||||

|

Region |

Avg Monthly Rent per SQFT |

Avg Occupancy Rate 2018 |

Rental yield 2018 |

Avg Rent 2017 per SQFT per Month |

Avg Occupancy Rate 2017 |

Rental yield 2017 |

Change in Occupancy Y/Y |

Change in Yield Y/Y |

|

Mt Kenya |

141.3 |

84.5% |

9.9% |

136.0 |

80.0% |

9.1% |

4.5% |

0.8% |

|

Kisumu |

148.2 |

88.0% |

9.7% |

157.2 |

76.4% |

9.1% |

11.6% |

0.6% |

|

Nairobi |

178.9 |

83.7% |

9.4% |

185.0 |

80.3% |

9.6% |

3.4% |

(0.2%) |

|

Mombasa |

103.7 |

96.3% |

8.3% |

130.3 |

82.8% |

7.3% |

13.5% |

1.0% |

|

Eldoret |

137.5 |

78.5% |

7.6% |

96.0 |

83.3% |

6.6% |

(4.8%) |

1.0% |

|

Nakuru |

83 .3 |

85.0% |

6.9% |

|

|

|

|

|

|

Average |

132 .1 |

86.0% |

8.6% |

140.9 |

80.2% |

8.3% |

5.6% |

0.6% |

Source: Cytonn Research

- Infrastructure Sector

During the week, the construction of the 2nd and 3rd phase of Dongo Kundu Bypass commenced as part of the Mombasa County’s ambitious Urban Roads Project. The Kshs 28.0 bn project that will connect the North and South Coast, is set to boost tourism in the region and reduce congestion at the Likoni ferry and thus, easing transit from the Mombasa Island to the South Coast. Mombasa has seen several infrastructural projects in the last few years, which has improved the ease of doing business and attracted investments. For example, upgrading of Moi International Airport, as well as the start of operation of the Standard Gauge Railway in June last year resulted in an increase in local tourism thus, pushing up demand for accommodation services. According to KNBS Economic Survey 2018, bed-occupancy by local tourists increased by 15.6% to 3.6 mn in 2017 from 3.1 mn in 2015. Plans are also underway to upgrade the Likoni Channel through construction of the Kshs 82.0 bn Mombasa Gate Bridge Project. Such projects, as well as the ongoing Makupa Causeway project, are bound to open up new areas for investment in Mombasa County, thereby pushing property prices up, as they boost accessibility and reduce traffic snarl-ups, thus setting up the region to attract more investments, including real estate.

We expect continued commitment to the development agenda as the government continues with its intensified efforts to upgrade infrastructure throughout the country. According to the National Treasury, National Budget allocation to infrastructural development has been on a steady growth recording a 6-year CAGR of 7.7% from 2012 to 2019. For the year 2018/2019, the budget allocation to infrastructure came in at Kshs 418.8 bn, which is 13.6% of the national budget, with 2019/2020 allocation estimated to be a 6.6% increase to Kshs 446.4 bn.

Other Highlights:

- During the week, Harambee Savings and Credit Co-operative Society announced that it had put several of its properties under auction (clear details on the properties are yet to be disclosed). The sale of properties valued at over Kshs 10.0 bn is meant to improve the liquidity position of the Sacco and comply with statutory investment guidelines that allow for a maximum of 25.0% real estate investments by SACCOs.

We expect the current real estate performance momentum to persist with the sector offering niche investment opportunities in areas with an undersupply of properties coupled by infrastructural improvements.

In this week’s focus note, we look at the Insolvency Act 2015, and how companies that are under financial distress are using the legislation to navigate through the restructuring process, and in the process protect the interests of creditors, and other stakeholders in the company such as shareholders. Since its enactment in September 2015, a number of companies have invoked the Insolvency Act 2015, including Nakumatt Holdings, as discussed in our focus note Restructuring an Insolvent Business, A Case Study of Nakumatt Holdings, and Athi River Mining Cement (ARM) Limited, and Deacons East Africa PLC

A business becomes insolvent when its liabilities exceed its assets. However, in practice, insolvency comes about when a business cannot raise enough funds to meet its obligations as they fall due. Properly called technical insolvency, it may occur even when the value of a business’ total assets exceeds its total liabilities. Mere insolvency does not afford enough ground for lenders to petition for involuntary bankruptcy of the borrower, or force liquidation of the business. Prior to the enactment of the Insolvency Act on September 11th 2015, liquidation was often the creditor’s only recovery option. The Insolvency Act improved the options by providing additional alternatives such as: (i) Administration, and (ii) Company Voluntary arrangements.

Since its enactment, we have seen several insolvent companies come under administration as prescribed in the law, thereby ensuring they remain a going concern, and in the process ensure all the stakeholder’s interests are protected. We shall look at the various companies that have invoked the Insolvency Act, and how it has assisted the companies’ in managing their financial distress situation. As such, we shall cover the following:

- Resolutions Mechanism Prior and After the Introduction of the Insolvency Act

- Case Studies, and,

- Our View

Section I: Resolutions Mechanism Prior and After the Introduction of the Insolvency Act

Prior to the enactment of the Insolvency Act in 2015, insolvency proceedings of both corporate entities and individuals, was dealt with under the winding-up provisions of the Companies Act, and the Bankruptcy Act. For corporations, the resolution of insolvency proceedings often involved the commencement of winding up proceeding, which involved the liquidation of the company under financial distress, and paying the firm’s creditors. This effectively meant that creditors and other stakeholders in firms ran the risk of failing to recover total amounts of interest, especially in the event the company’s assets failed to cover the total amounts due. Thus in an attempt to remedy this, the Insolvency Act was enacted in 2015. The Act consolidated the insolvency proceedings for both incorporated and unincorporated companies, previously under the Companies Act, and those of individuals, previously under the Bankruptcy Act, into one document. The Act seeks to redeem insolvent companies through administration as opposed to liquidation. It focuses more on assisting insolvent corporate bodies whose financial position is deemed as redeemable, to continue operating as going concerns so that they may be able to meet their financial obligations to the satisfaction of their creditors.

The rescue mechanisms under the Insolvency Act, 2015 include;

- Administration of Insolvent Companies,

- Company Voluntary Arrangements, and,

- Liquidation

- Administration of Insolvent Companies

Administration is a fairly new development in Kenyan Law. It was introduced by the Insolvency Act, No. 18 of 2015 as an alternative to liquidation, with the following key objectives;

- to maintain the company as a going concern,

- to achieve a better outcome for the company’s creditors than liquidation would offer, and

- to realize the property of the company in order to make distributions to secured or preferential creditors.

The process of administration is headed by an Administrator, a certified Insolvency Practitioner, who may be appointed by an administration order of the court, unsecured creditors, or a company or its directors. An administrator of a company is required to perform the administrator’s functions in the interests of the company’s creditors as a whole. The administrator is deemed an officer of the Court, whether appointed by the court or not.

Once the Administrator is appointed, they are entitled to all the records of the company and are required to present a proposal to the creditors on their plan to salvage the company. The Administrator assumes control of all the property the company is entitled to manage the affairs, and property of the company. While under administration, creditors may undertake procedures to enforce security over the company’s property, with an approval from the court, or an agreement with the administrator. The Administrator must therefore set a date for the creditors meeting and invite all the creditors that it knows of, having had access to the books of the company. Only creditors who have filed proof of debt before 4.00 pm of the day before the Creditors meeting are entitled to vote at the said creditor’s meeting.

At the Creditors’ meeting, the Administrator must present their proposal to the Creditors who shall vote on it. The percentage of an individual vote shall be determined by the amount of debt owed to the creditor. The creditor may opt to either vote for the proposal without amendments, vote for the proposal with amendments, or reject the proposal altogether. The decision of the creditors meeting shall be final.

- Company Voluntary Arrangements

Company Voluntary Arrangements were also introduced in Kenyan law by the Insolvency Act, No. 18 of 2015. This arrangement is entered into when a company is insolvent and the directors, administrator or liquidator as the case may be, make a proposal to the company’s shareholders and its creditors on the best way to save the company from liquidation. However, there are restrictions placed on Company Voluntary Arrangements, with the arrangement not being an option in the case of the following:

- banking and insurance companies,

- companies under administration or liquidation,

- a company in respect of which a voluntary arrangement has been carried out,

- companies in public-private partnerships, and

- companies with liabilities of over Kshs 1.0 bn.

The Directors must appoint a person, who must be a licensed insolvency practitioner, to supervise the company for the process of implementing the voluntary arrangement. The Supervisor must within 30 days of the proposal or a longer period allowed by court, submit a report to the court detailing their opinion on the viability of the proposal and whether a meeting of the creditors should be called to vote on it and the date and time of such a meeting.

On the date of the creditors’ meeting, the creditors shall appoint a chairperson who shall divide the creditors into groups of secured creditors, unsecured creditors and preferential creditors. The Creditors shall then vote either to approve the proposal as is, approve it with modifications or reject it altogether. The proposal is approved if voted for by a majority of the members and a majority of each group present at the meeting. The proposal if approved shall be binding on the company and the creditors.

- Liquidation

It is also worth noting that the Insolvency Act also provides liquidation as an option, for insolvent companies. There are two modes in which a company may be wound up:-

- Compulsory winding up by the court.

- Voluntary winding up:-

- Members’ voluntary winding up.

- Creditors’ voluntary winding up.

(i) Compulsory Winding Up by the court

A company may be wound up by a court under the following circumstances.

- The company has by special resolution resolved that the company be liquidated by the Court;

- Being a public company that was registered as such on its original incorporation-

- The company has not been issued with a trading certificate under the Companies Act, 2015; and

- More than twelve months has elapsed since the company was registered;

- The company does not commence its business within twelve months from its incorporation or suspends business for a whole year;

- Except in the case of a private company limited by shares or by guarantee, the number of members is reduced to below two;

- The company is unable to pay its debts;

- At the time at which a moratorium for the company ends, a voluntary arrangement made does not have effect in relation to the company; and,

- The Court is of the opinion that it is just and equitable that the company should be liquidated.

(ii) Voluntary Winding Up

A company’s members/ creditors may make an application for winding up, regardless of whether the company is insolvent or not. Under voluntary liquidation, liquidation is sought by the members or creditors of the company without the interference of the court. The purpose of voluntary liquidation is that the members and creditors are left free to settle without going to court. According to section 425 of the Insolvency Act, an application to the Court for the liquidation of a company may be made by any or all of the following:

- The company or its directors;

- A creditor or creditors (including any contingent/prospective creditor(s));

- A contributory or contributories of the company;

- A provisional liquidator or an administrator of the company;

- The liquidator- if the company is in voluntary liquidation,

- An Official Receiver or any other person authorized under the other the provisions of the Act, may make a liquidation application to the Court in respect of a company that is in voluntary liquidation.

Section II: Case Studies

In this section, we look at the various companies that have experienced financial distress and consequently invoked the Insolvency Act. We shall thus look at Nakumatt Holdings, Athi River Mining (ARM) limited, and Deacons East Africa PLC. The table below summarizes all the companies that have invoked the Insolvency Act 2015:

|

Companies That Have Invoked the Insolvency Act |

|||

|

Company |

Date taken under Administration |

Administrators |

Approximated Debt Amount (bn Kshs) |

|

Spencon Ltd |

9th January 2017 |

Kuria Muchiru & Muniu Thoithi of PwC |

Undisclosed |

|

Nakumatt Holdings |

22nd January 2018 |

Peter Kahi of PKF Consulting |

35.8 |

|

ARM Cement Ltd |

18th August 2018 |

Muniu Thoithi &George Weru of PwC |

21.7 |

|

Midland Energy |

16th November 2018 |

Anthony Makenzi &Julius Mumo of Ernst & Young LLP |

Undisclosed |

|

Deacons East Africa PLC |

18th November 2018 |

Peter Kahi & Atul Shag of PKF Consulting |

0.7 |

Case Study of Nakumatt Holdings

Nakumatt Holdings is a Kenyan supermarket chain. Until February 2017, Nakumatt was regarded as the largest Kenyan retailer, with 62 branches across the region, (45 in Kenya, 9 in Uganda, 5 in Tanzania and 3 in Rwanda) and a gross turnover of Kshs 52.2 bn. However, what was fueling Nakumatt’s rapid expansion was funded through debt. This included short-term borrowings, bank loans and letters of credit to its numerous suppliers. However, due to a number of reasons, Nakumatt started experiencing serious cash-flow difficulties in 2016. The retailer was therefore unable to meet its financial obligations to landlords, its suppliers and employees. It was for these reasons that the administrator was appointed by an order of the court pursuant to an application filed by unsecured creditors, and Nakumatt Holdings was placed under administration in January 2018.

PKF Consulting Limited (PKF) was appointed as Nakumatt Holdings’ administrator. This was in order to assess the possibility that the company could be revived after a full assessment of the company, and for all creditors of Nakumatt to come forward and register their claims with the retailer.

Following the assessment of Nakumatt’s financial position, the administrator determined that if a liquidation route was used, then out of the total creditors of Kshs 35.8 bn, Kshs 30.6 bn are unlikely to be paid. This represents a significant 85% potential loss to the creditors. In essence, all unsecured creditors, namely Trade Creditors, Commercial Paper Holders and Short Term Note holders, and private placement loan providers will suffer the maximum 100% loss of their debt amounts, as the available assets would first pay off secured creditors. Since the business model of Nakumatt can support a better outcome for all the creditors as compared to a liquidation scenario, the Administrator set out to come up with a restructuring proposal to achieve this outcome based on the company remaining a going concern.

Nakumatt’s administrator came back to creditors with proposals, which we highlighted in our focus note, Restructuring an Insolvent Business, that the creditors were supposed to take a vote on, and if deemed fit, the company shall adopt as the way forward. In our view, the proposals brought forth were not equitable and fair to all creditors. In addition, they failed to inspire confidence especially with the major stakeholders, required to turn around the business, especially suppliers, landlords, and employees. We thus concur with the creditors who rejected the deal in the current format.

We noted that the best-case scenario for all creditors is a debt to equity conversion of their creditor claims, as liquidation is not in the best interest of anyone. This should include even the banks who had taken preferential debt. Case in point being the recent restructuring of Kenya Airways. In the case of Kenya Airways’ restructuring, the Government and a number of banks converted their debt into equity to the tune of Kshs 59.0 bn. The Government’s stake in Kenya Airways rose to 46.5% from 29.8% before the debt to equity conversion, while the bank’s consortium (KQ Lenders Co.) ended up owning 35.7% of the company. Ordinary shareholders who did not inject additional equity were diluted by 95.0%. Kenya Airways recently reported a 28.8% decline in loss after tax, to Kshs 4.0 bn in H1’2018 from, Kshs 5.2 bn in H1’2017 results, although registering a negative Kshs 3.8 bn equity position, from a negative equity position of Kshs 44.9 bn in H1’2017, which can partly be attributed to the positive effects of the debt to equity conversion, owing to a significant reduction in the company’s debt servicing obligation.

In conclusion, we note that the proposed procedures, in line with the Insolvency Act, accorded Nakumatt with a second chance, to pursue the ongoing recovery strategy, dubbed “Nakumatt Bounce Back”, with the retailer recently opening a branch along Uhuru Highway, taking up 40,000 sqft. We are of the view that this presents the best scenario for the firm’s creditor’s to recoup their lent amounts to the retailer.

Case Study of Athi River Mining (ARM) Cement

ARM is a Kenyan manufacturing company listed at the Nairobi Securities Exchange, with operations in Kenya, Tanzania and Rwanda. The firm specializes in the production of cement, fertilizers, quicklime, and other industrial minerals. ARM cement, once a stable company, started experiencing difficulty in 2016, as the firm’s revenue lines started decreasing, with revenue declining by 32.0% from Kshs 12.8 bn in FY’2016 to Kshs 8.7 bn in FY’2017, coupled with the rising operating expenses, which rose by 34.8% to Kshs 3.1 bn from Kshs 2.3 bn in FY’2016. This saw the operating loss widen to Kshs 4.2 bn in FY’2017 from Kshs 0.3 bn in FY’2016, and consequently the loss after tax widened by 87.5% to Kshs 7.5 bn in FY’2017 from Kshs 4.0 bn in FY’2016. The shrinking revenue lines was largely attributed to stiff competition in the cement industry both in Kenya and Tanzania, the company’s main revenue contributors. The declining performance pushed the company into a negative working capital position, further exacerbating the poor performance, thereby rendering the company unable to service its debt obligations to various creditors, such as:-

- UBA Bank Kenya, which provided the company with a Kshs 500.0 mn short term loan,

- Africa Finance Corporation (AFC), which provided a Kshs 4.6 bn loan, and,

- Stanbic Bank Kenya, which provided the company with a Kshs 3.2 bn loan.

Unable to service these obligations, the company was then placed under administration in August 2018, with PwC’s Muniu Thoithi and George Weru appointed as the administrators. The administrators, having full control held a creditor’s meeting in October 2018, where creditors voted to give the administrators up to September 2019, to revive the company. The creditors also approved the sale of some or even all of the company’s assets, and capital injections from strategic investors as part of the strategies to revive the company. With the administrators writing off the Kshs 21.3 bn in loans advanced to its Tanzanian Subsidiary, due to alleged misrepresentation of the loan given that it had been non-performing for several years, and that the subsidiary was deemed unable to repay the loan any time soon, the company slipped to a negative equity position of Kshs 2.4 bn, effectively meaning a complete write-off for shareholders in the event of a liquidation, and that only secured lenders are now fully covered by the current Kshs 14.2 bn asset base. The administrators have appointed Knight Frank to undertake a valuation of the company’s fixed assets, amid concerns of misrepresentation, and suspicious dealings amounting to Kshs 153.0 mn. With the company currently operating at a 30.0% capacity in Kenya and 25.0% in Tanzania, it requires urgent capital injection, as it would not be sustainable for long, so as to boost its working capital position, and thereby normalize operations, and consequently improve the topline revenue, which has shrunk to Kshs 2.3 bn for the half year to June 2018. With the administrators currently engaged in the asset sales of the various subsidiaries, this would provide the company with a capital base to boost and streamline the core operations. We also note that the proposed move to look for a strategic investor may also provide reprieve, with several major companies such as Dangote Cement and Oman Based Raylat limited expressing interest in acquiring the troubled lender. The Insolvency Act has thus enabled the company to remain operational as it undertakes the turnaround strategy, focused on ensuring the company attains good financial health, and consequently improving its debt-servicing capability to its creditors.

Case Study of Deacons East Africa PLC

Deacons East Africa is a homeware and apparel retailer in Kenya that manages retail establishments, including franchise and department stores that sell ladies, men and children clothing, footwear, home-furnishings, cosmetics and sporting goods. The company started experiencing financial difficulty in 2016, on increased operating inefficiencies, as revenue lines started declining and costs rose, with revenue declining by 13.0% to Kshs 2.0 bn in FY 2017 from Kshs 2.3 bn in 2016, and operating expenses increasing by 15.4% to Kshs 1.5 bn from Kshs 1.3 bn in FY’2016. These coupled with the rising debt obligations saw the company’s loss after tax widen by 166.7% to Kshs 0.8 bn in FY’2017 from Kshs 0.3 bn in FY’2016. The firm attributed the declining performance in top line revenue to declining foot traffic in various malls where it was a tenant, coupled with other factors such as the selling of Kenya's Mr Price stores to South African franchise owner Mr Price Group of South Africa, and increased competition from other retailers. The financial distress led to the company invoking the Insolvency Act, in November 2018, as the company’s board resolved to place the company under administration, with the primary objective being to enable the administrators to explore the possibility of rescuing the company as a going concern, thereby achieving a better outcome for the creditors than would likely be the case if the company were to be liquidated. This saw the company appoint Peter Kahi and Atul Shah of PKF Consulting Limited as the firm’s joint administrators. With the creditors meeting yet to be held and other details yet to be divulged, it is worth noting that with the firm under administration, and consequently under moratorium, the firm’s debt servicing burden has been alleviated, as the administrators craft the turnaround strategy.

Section III: Our View

The insolvency Act has had two major impacts:

- First it has afforded struggling businesses a second chance to reorganize themselves and come out stronger and viable businesses, and,

- Secondly, it will encourage entrepreneurship by providing a path to redemption in the case of a viable venture that has run into turbulence and just needs room to restructure. Research has shown that the availability of reorganization frameworks encourages entrepreneurship.

In conclusion, we note that under the new Insolvency Act 2015, companies under financial distress have been using the legislation to ensure they remain a going concern as opposed to an outright liquidation. With the companies under administration and under moratorium after invoking the Act, they are not subject to debt repayment obligations, as the administrators focus purely on the best possible resolution strategy to the creditors, and possibly to the shareholders. This will possibly encourage entrepreneurship, as business owners will be accorded time to restructure, and possibly regain their financial stability. This then consequently ensures that creditors and possibly shareholders recoup their lent amounts, and invested capital. The previous resolution mechanism under the Companies Act mean that stakeholders faced the possibility of a wipeout of a significant amount, especially in the event the company’s assets failed to cover the liabilities. Thus given that these are the first instances of private sector insolvency restructuring in Kenya under the new Act, it is important that they are done professionally and with due care since they set a precedent for future cases.

Disclaimer: The Cytonn Weekly is a market commentary published by Cytonn Asset Managers Limited, “CAML”, which is regulated by the Capital Markets Authority. However, the views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only, and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.