The Kenya Mortgage Refinancing Company, & Cytonn Weekly #14/2018

By Cytonn Research Team, Apr 8, 2018

Executive Summary

Fixed Income

Treasury bills were oversubscribed during the week, with the overall subscription rate coming in at 107.0%, from an undersubscription of 52.8% recorded the previous week. Yields on the 91 and 364-day T-bills remained unchanged at 8.0% and 11.1%, respectively, while the yield on the 182-day paper declined by 10 bps to 10.3% from 10.4%, the previous week. The National Treasury has decided to maintain the country’s Value Added Tax (VAT) rate at 16.0%, against suggestions from a report by the Institute of International Finance (IIF) to raise the rate to 18.0%, to match VAT charged by other East African Community (EAC) countries;

Equities

During the week, the equities market registered mixed performance, with NASI and NSE 25 rising by 1.9% and 0.5%, respectively, while NSE 20 declined by 0.6%. For the last twelve-months, NASI, NSE 20 and NSE 25 have gained 46.9%, 23.2% and 41.7%, respectively. In a bid to ensure the index is reflective of the market, the Nairobi Securities Exchange (NSE) board reviewed the list of constituent stocks of NSE 20 and NSE 25 share indices. CIC Insurance, Sasini Ltd and Stanbic Holdings Plc were dropped from the NSE 20 index and replaced with Kenya-Reinsurance, NIC Group Plc and Nairobi Securities Exchange Plc, while Nairobi Securities Exchange Plc replaced HF Group in the NSE 25 share index;

Private Equity

In the fintech investment space, France-based Proparco, the private sector financing arm of the French Development Agency, announced an equity investment of USD 3.0 mn in JUMO, an emerging market technology start-up that offers access to credit through their mobile application, while in the fundraising space, Asoko Insight, an information services company, raised USD 3.6 mn in Series A funding, the first round of financing given to a new business after the initial capital used to start the business;

Real Estate

The Competition Authority of Kenya (CAK) announced that Tuskys had backed out of the proposed Nakumatt merger deal that was set to revive the troubled retailer, while the court-appointed administrator is set to table a proposal for Nakumatt’s creditors on 9 th April 2018. The creditors are more likely to seek its liquidation as they stand a better chance of recovering some of their funds through a tax write off. Currently, Nakumatt has a debt of Kshs 35.8 bn against assets worth Kshs 5.2 bn, and it is not clear how much of the assets are actually realizable;

Focus of the Week

During the week, the National Treasury Cabinet Secretary, Hon. Henry Rotich, announced plans of setting up a Mortgage Liquidity Facility in Kenya, The Kenya Mortgage Refinancing Company (KMRC), set to be launched by May this year. The company is aimed at enhancing liquidity for primary mortgage lenders thus promoting more mortgages at competitive market rates and for longer tenures. In light of this, this week we look at the proposed mortgage liquidity facility, case studies in other countries in Africa, namely Egypt, Tanzania and Nigeria, that have similar mortgage refinancing companies, how they have performed and the key lessons KMRC should adopt.

- Our Investments Manager, Maurice Oduor discussed bilateral trade among five African Countries. Watch Maurice on NTV here

- Cytonn Foundation, the Corporate Social Investment (CSI) arm of Cytonn Investments, has signed a Memorandum of Understanding (MoU) with the University of Eldoret (UoE), to offer training and mentorship to its students after they graduate. This brings to a total of 4 MoUs signed between Cytonn and Universities; University of Embu, Moi University, University of Eldoret and Nairobits School of Design. Read the Event Note here

- Our Investments Analyst, Caleb Mugendi, discussed I&M finalizing the acquisition of Youjays Insurance Brokers. Watch Caleb on CNBC here

- We continue to hold weekly workshops and site visits on how to build wealth through real estate investments. The weekly workshops and site visits target both investors looking to invest in real estate directly and those interested in high yield investment products to familiarize themselves with how we support our high yields. Watch progress videos and pictures of The Alma, Amara Ridge, The Ridge, and Taraji Heights. Key to note is that our cost of capital is priced off the loan markets, where all-in pricing ranges from 16.0% to 20.0%, and our yield on real estate developments ranges from 23.0% to 25.0%, hence our top-line gross spread is about 6.0%. If interested in attending the site visits, kindly register here

- We continue to see very strong interest in our weekly Private Wealth Management Training (largely covering financial planning and structured products). The training is at no cost and is open only to pre-screened participants. We also continue to see institutions and investment groups interested in the trainings for their teams. The Wealth Management Trainings are run by the Cytonn Foundation under its financial literacy pillar. If interested in our Private Wealth Management Training for your employees or investment group please get in touch with us through wmt@cytonn.com or book through this link Wealth Management Training. To view the Wealth Management Training topics, click here

- For recent news about the company, see our news section here

- We have 10 investment-ready projects, offering attractive development and buyer targeted returns of around 23.0% to 25.0% p.a. See further details here: Summary of Investment-Ready Projects

- We continue to beef up the team with ongoing hires for: Clerks of Works, Financial Advisor and Unit Manager for Mt Kenya Region, among others. Visit the Careers section at Cytonn’s Website to apply

Treasury bills were oversubscribed during the week, with the overall subscription rate coming in at 107.0%, from an undersubscription of 52.8% recorded the previous week. The subscription rates for the 91, 182 and 364-day papers came in at 73.9%, 71.6%, and 155.6% compared to 44.1%, 37.5%, and 71.5%, respectively, the previous week. Yields on the 91 and 364-day T-bills remained unchanged at 8.0% and 11.1%, respectively, while the yield on the 182-day paper declined by 10 bps to 10.3%, from 10.4% the previous week. The overall acceptance rate increased to 99.4% compared to 92.9% the previous week, with the government accepting a total of Kshs 25.5 bn of the Kshs 25.7 bn worth of bids received, against the Kshs 24.0 bn on offer. The government is currently 20.3% ahead of its domestic borrowing target for the current fiscal year, having borrowed Kshs 275.3 bn, against a target of Kshs 228.9 bn (assuming a pro-rated borrowing target throughout the financial year of Kshs 297.6 bn).

During the week, liquidity levels declined in the money market as indicated by the rise in the average interbank rate to 6.3%, from 5.8% recorded the previous week, owing to government security pricipal payments for the T-bond tap sale and T-bills, both value dated 2 nd April 2018. There was an increase in the average volumes traded in the interbank market by 40.1% to Kshs 20.7 bn, from Kshs 14.8 bn the previous week.

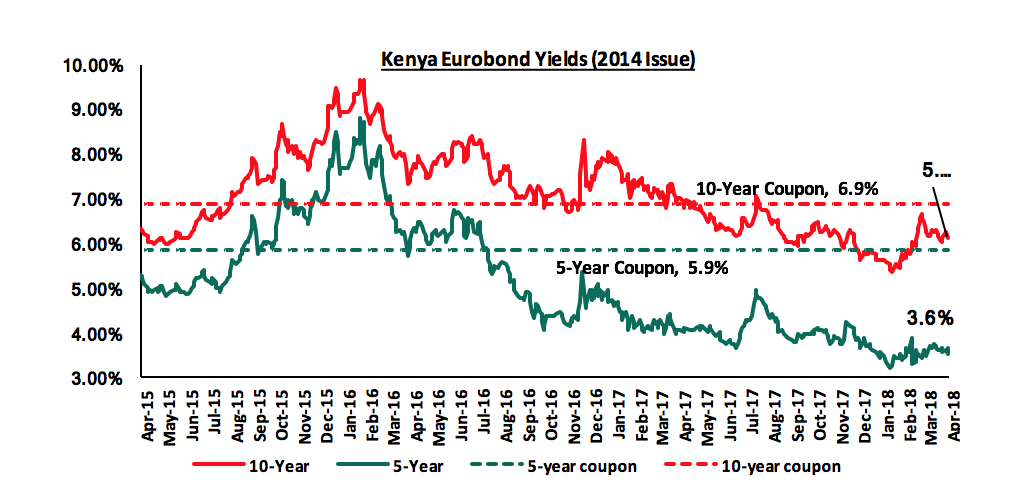

According to Bloomberg, the yield on the 5-year Eurobond issued in June 2014 increased by 10 bps to 3.6% from 3.5%, while the yield on the 10-year Eurobond declined by 20 bps to 5.7%, from 5.9% the previous week. Since the mid-January 2016 peak, yields on the Kenya Eurobonds have declined by 5.2% points and 3.9% points for the 5-year and 10-year Eurobonds, respectively, due to the relatively stable macroeconomic conditions in the country. Key to note is that these bonds currently have 1.2 and 6.2-years to maturity for the 5-year and 10-year, respectively.

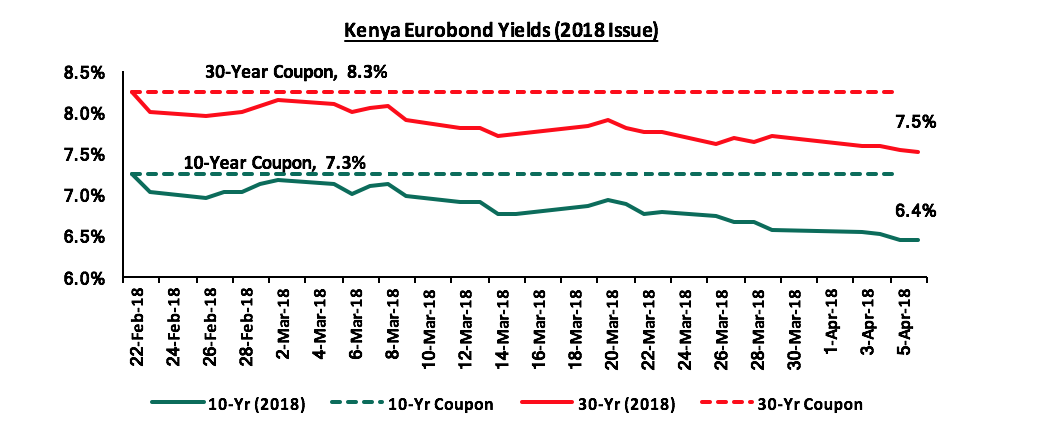

For the February 2018 Eurobond issue, during the week, the yields on the 10-year and 30-year Eurobonds declined by 20 bps each to 6.4% and 7.5% from 6.6% and 7.7%, respectively, the previous week. Since the issue date, yields on the 10-year and 30-year Eurobonds have declined by 0.8% points and 0.7% points, respectively, indicating foreign investor confidence in Kenya’s macro-economic prospects.

The Kenya Shilling depreciated by 0.2% against the US Dollar during the week, to close at Kshs 101.0 from Kshs 100.8 the previous week, driven by increased dollar demand from importers. On a YTD basis, the shilling has gained 2.1% against the USD. In our view, the shilling should remain relatively stable against the dollar in the short term, supported by:

- Weakening of the USD in the global markets as indicated by the US Dollar Index, which shed 9.9% in 2017, and has shed 2.1% YTD, as the Euro and the Sterling Pound continue to strengthen against the USD with the continued recovery of the Eurozone,

- Improving diaspora remittances, which increased by 47.5% to USD 210.4 mn in February 2018 from USD 142.7 mn in February 2017, driven by continued marketing of Kenya as an attractive investment destination for Kenyans in the diaspora, and,

- CBK’s intervention activities, as they have sufficient forex reserves, currently at USD 8.8 bn (equivalent to 5.9 months of import cover), and the USD 1.5 bn stand-by credit and precautionary facility by the IMF, still available until September 2018, after which a new facility will be discussed.

The National Treasury decided to maintain the country’s Value Added Tax (VAT) rate at 16.0%, against suggestions from a report by the Institute of International Finance (IIF) to raise the VAT rate to 18.0% to match VAT charged by other East African Community (EAC) countries. The tax rise would be in line with plans to reduce the country’s budget deficit through increased tax collection and reduced recurrent spending, as recommended by the International Monetary Fund (IMF) in March, and in turn reduce public borrowing. This comes after the decision to introduce VAT on petroleum products in September 2018, in a bid to increase revenue collections and reduce the budget deficit in the next fiscal year. This is a good decision since it is meant to cushion consumers from a rapidly rising cost of living and possibly maintain Kenya’s trade competitiveness. The Treasury however still needs to maintain the path towards fiscal consolidation by reducing the budget deficit. This will be achieved through (i) reduction in expenditure, especially recurrent expenditure and the rising public wage bill, (ii) increased revenue collection through either improved administrative efficiency in the tax collection process by the Kenya Revenue Authority (KRA), widening of the tax base to include the large informal sector, increased tax rates, or a combination of all, and (iii) privatisation of some of the state corporations to realise cash and increase efficiency.

Rates in the fixed income market have remained stable as the government rejects expensive bids. The MPC met on 19 th March 2018 and lowered the CBR by 0.5% to 9.5% from 10.0%. With the government under no pressure to borrow for this fiscal year as (i) they are currently ahead of their domestic borrowing target by 20.3%, (ii) have met 72.9% of their total foreign borrowing target and 94.8% of its pro-rated target for the current fiscal year, and (iii) the KRA is not significantly behind target in revenue collection, we expect interest rates to remain stable. With the expectation of a relatively stable interest rate environment, our view is that investors should be biased towards medium to long-term fixed income instruments.

During the week, the equities market exhibited mixed trends with NASI and NSE 25 gaining 1.9% and 0.5%, respectively, while NSE 20 lost 0.6% taking their YTD performance to 13.9%, 16.7% and 3.1% for NASI, NSE 25 and NSE 20, respectively. This week’s performance was driven by gains in Safaricom and KCB Group that rose 4.0% and 3.8%, respectively. For the last twelve months (LTM), NASI, NSE 20 and NSE 25 have gained 46.9%, 23.2% and 41.7%, respectively.

Equities turnover decreased by 25.9% to USD 28.3 mn, from USD 38.2 mn the previous week. We expect the market to remain supported by positive investor sentiment this year, as investors take advantage of the attractive stock valuations in select counters.

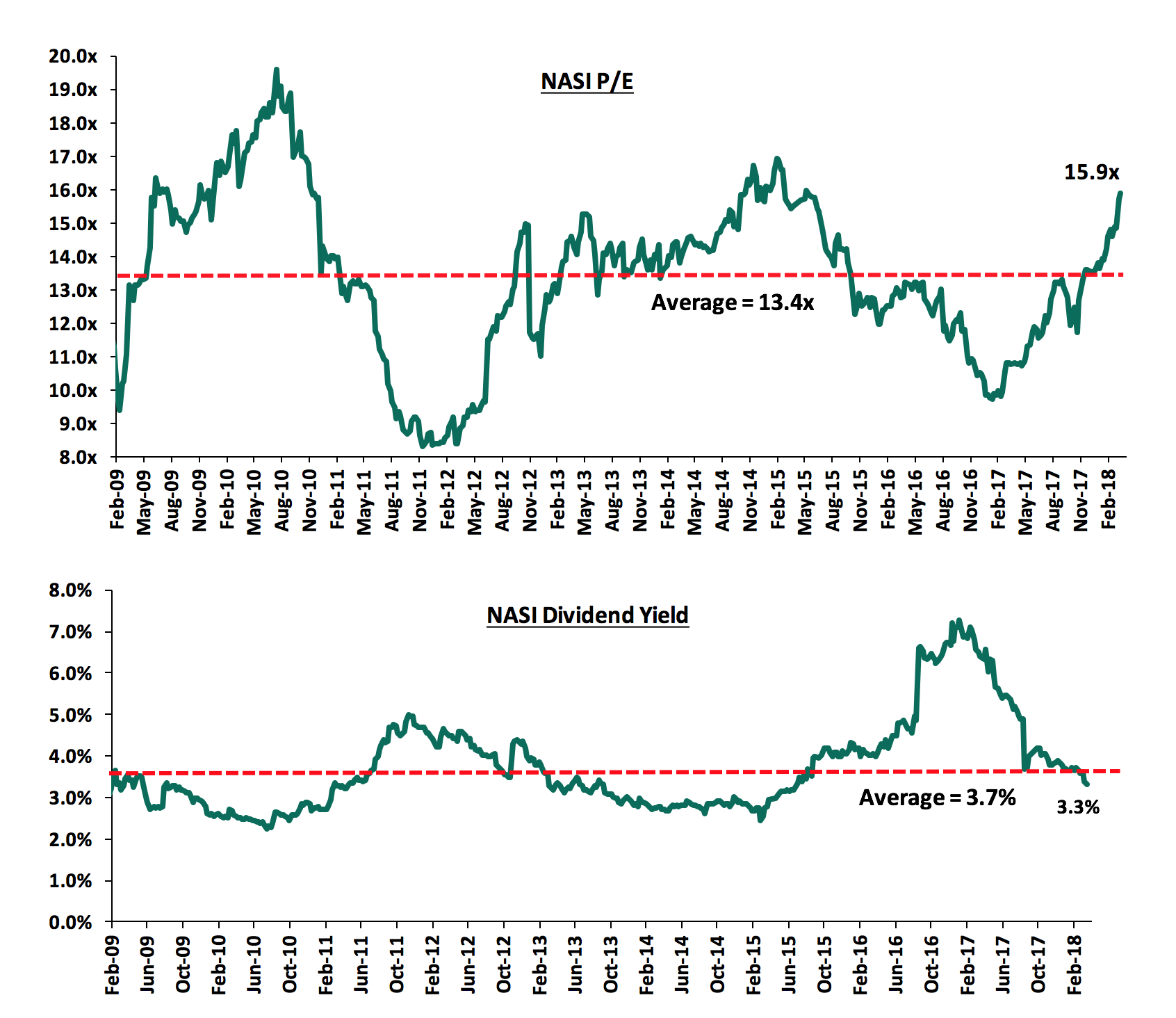

The market is currently trading at a price to earnings ratio (P/E) of 15.9x, which is 18.7% above the historical average of 13.4x, and a dividend yield of 3.3%, lower than the historical average of 3.7%. The current P/E valuation of 15.9x is 63.9% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 91.6% above the previous trough valuation of 8.3x experienced in December 2011. The charts below indicate the historical P/E and dividend yields of the market.

The Nairobi Securities Exchange (NSE) board reviewed the list of floated companies that constitute the NSE 20 and NSE 25 share indices to ensure that it reflects an accurate picture of market performance. CIC Insurance Group, Sasini Ltd, and Stanbic Holdings Plc were dropped from the NSE 20 index and replaced with Kenya-Reinsurance, NIC Group Plc, and Nairobi Securities Exchange Plc. The NSE 20 Index new constituents were measured on: trading activity, market capitalization, shares traded, number of deals and turnover during the period under review. The weighting ratio for the aforementioned parameters were 4:3:2:1, respectively. Nairobi Securities Exchange Plc replaced HF Group in the NSE 25 share index.

Following the review, the respective Index constituent companies are highlighted in the table below:

|

Sector |

NSE 25 Constituents |

NSE 20 Constituents |

|

Commercial & Service Sector |

1. Nation Media Group 2. WPP Scangroup Limited |

1. Nation Media Group 2. WPP Scangroup Limited |

|

Banking Sector |

3. KCB Group Plc 4. Cooperative Bank 5. Diamond Trust Bank 6. Barclays Bank of Kenya 7. Equity Group Holdings Plc 8. NIC Group Plc 9. Stanbic Holdings Plc 10.I&M Holdings 11.Standard Chartered Bank |

3. KCB Group Plc 4. Cooperative Bank 5. Diamond Trust Bank 6. Barclays Bank of Kenya 7. Equity Group Holdings Plc 8. NIC Group Plc

|

|

Manufacturing & Allied Sector |

12.East African Breweries 13.British American Tobacco 14.ARM Cement Plc 15.Bamburi Cement Limited |

9. East African Breweries 10.British American Tobacco 11.ARM Cement Plc 12.Bamburi Cement Limited |

|

Energy & Petroleum Sector |

16.KenolKobil Limited 17.Kenya Power & Lighting Ltd 18.Kengen Limited |

13.KenolKobil Limited 14.Kenya Power & Lighting Ltd 15.Kengen Limited |

|

Insurance Sector |

19.Britam Holdings Plc 20.Kenya Reinsurance Ltd 21.CIC insurance Group Limited 22.Liberty Kenya Holdings |

16.Britam Holdings Plc 17.Kenya Reinsurance Ltd

|

|

Telecommunication and Technology Sector |

23.Safaricom Plc |

18.Safaricom Plc |

|

Investment Sector |

24.Centum Investment Co. |

19.Centum Investment Co. |

|

Investment Services Sector |

25.Nairobi Securities Exchange |

20.Nairobi Securities Exchange |

I&M Holdings has completed a full buyout of Youjays Insurance Brokers for an undisclosed amount. This move was made in a bid to strengthen the Group’s bancassurance business. Youjays Insurance Brokers deals in both life and general insurance products and has been in operation since 1987. It has a portfolio of about Kshs 400 mn in premiums with a clientele of 400 firms. I&M Holdings acquired Giro Bank in February 2017 and bought a controlling 65% stake in a corporate finance advisory firm, Burbidge Capital. The acquisition of these businesses should support growth in the bank’s Non-Funded Income (NFI), with I&M Holdings reporting a 15.9% growth in NFI in FY’2017 to Kshs 5.8 bn from Kshs 5.0 bn in FY’2016, outpacing the increase in Net Interest Income that came in at 0.6%; however, it is not clear whether growth in NFI is driven by fees from the acquired non-banking businesses. The revenue mix stood at 73:27 funded to non-funded income compared to 76:24 recorded last year. In our view, this is a positive move by I&M Holdings aimed at diversifying its revenue streams by focusing on NFI especially in the current regime of interest rate caps.

Mobile money subscribers will be able to transfer and receive money across Safaricom and Airtel networks following a successful pilot interoperability test, in a bid to enhance customer experience and reduce the dominance by Safaricom’s mobile money. Telkom through its T-Kash will join Airtel Money and Safaricom’s M-pesa at a later date. The number of active mobile transfer subscriptions stood at 28.1 million and the registered agents stood at 184,537 according to the Communication Authority of Kenya sector statistics for the first quarter of 2017/18, with M-pesa having a market share of 80.8%. Equitel money came in second with a market share of 6.8%, while MobiKash came in third with 6.3%. Safaricom also accounted for 67.0% of all mobile money agents, which translates to 123,640 agents.

Below is our Equities Universe of Coverage:

|

all prices in Kshs unless stated otherwise |

||||||||||||

|

No. |

Company |

Price as at 29/03/18 |

Price as at 06/04/18 |

w/w Change |

YTD Change |

LTM Change |

Target Price* |

Dividend Yield |

Upside/ (Downside)** |

P/TBv Multiple |

||

|

1. |

NIC Group*** |

41.3 |

40.8 |

(1.2%) |

20.7% |

64.6% |

61.4 |

3.1% |

53.7% |

0.8x |

||

|

2. |

Diamond Trust Bank |

219.0 |

214.0 |

(2.3%) |

11.5% |

72.6% |

281.7 |

1.2% |

32.9% |

1.3x |

||

|

3. |

Ghana Commercial |

6.1 |

6.1 |

0.2% |

20.8% |

19.8% |

7.7 |

6.2% |

32.8% |

1.7x |

||

|

4. |

Zenith Bank |

29.3 |

27.3 |

(6.8%) |

6.5% |

95.0% |

33.3 |

9.9% |

31.9% |

1.4x |

||

|

5. |

I&M Holdings |

125.0 |

120.0 |

(4.0%) |

(5.5%) |

29.7% |

150.4 |

2.9% |

28.3% |

1.3x |

||

|

6. |

CRDB |

170.0 |

170.0 |

0.0% |

6.3% |

(8.1%) |

207.7 |

5.7% |

27.9% |

0.7x |

||

|

7. |

Union Bank Plc |

6.7 |

6.7 |

(0.7%) |

(14.7%) |

53.2% |

8.2 |

0.0% |

22.6% |

0.7x |

||

|

8. |

Stanbic Bank Uganda |

30.0 |

30.3 |

0.8% |

11.0% |

16.3% |

36.3 |

0.0% |

19.9% |

2.0x |

||

|

9. |

KCB Group |

52.0 |

54.0 |

3.8% |

26.3% |

63.6% |

59.7 |

5.6% |

16.1% |

1.6x |

||

|

10. |

Bank of Kigali |

290.0 |

290.0 |

0.0% |

(3.3%) |

18.9% |

299.9 |

4.2% |

7.7% |

1.7x |

||

|

11. |

Barclays |

12.6 |

13.0 |

3.2% |

34.9% |

44.7% |

12.8 |

7.7% |

6.6% |

1.6x |

||

|

12. |

Bank of Baroda |

120.0 |

125.0 |

4.2% |

10.6% |

13.6% |

130.6 |

0.0% |

4.5% |

1.1x |

||

|

13. |

Ecobank |

11.2 |

11.2 |

0.4% |

47.4% |

53.4% |

10.7 |

7.3% |

3.1% |

4.0x |

||

|

14. |

HF Group*** |

11.7 |

11.8 |

0.9% |

13.0% |

15.8% |

11.7 |

3.0% |

2.6% |

0.4x |

||

|

15. |

Co-operative Bank |

19.6 |

19.8 |

1.0% |

23.8% |

72.8% |

18.6 |

4.0% |

(2.0%) |

1.7x |

||

|

16. |

UBA Bank |

11.8 |

11.9 |

1.3% |

15.5% |

106.6% |

10.7 |

7.1% |

(2.9%) |

1.0x |

||

|

17. |

Standard Chartered KE |

228.0 |

229.0 |

0.4% |

10.1% |

3.6% |

201.1 |

7.4% |

(4.8%) |

1.8x |

||

|

18. |

Stanbic Holdings |

92.5 |

91.0 |

(1.6%) |

12.3% |

44.4% |

79.0 |

5.8% |

(7.4%) |

1.1x |

||

|

19. |

SBM Holdings |

7.7 |

7.7 |

(0.3%) |

2.1% |

7.9% |

6.6 |

5.2% |

(9.2%) |

0.9x |

||

|

20. |

Guaranty Trust Bank |

44.7 |

44.1 |

(1.3%) |

8.2% |

74.0% |

37.2 |

6.1% |

(9.5%) |

2.7x |

||

|

21. |

CAL Bank |

1.5 |

1.6 |

7.2% |

51.9% |

234.7% |

1.4 |

0.0% |

(14.6%) |

1.2x |

||

|

22. |

Access Bank |

11.1 |

12.0 |

8.6% |

14.8% |

93.5% |

9.5 |

5.4% |

(15.4%) |

0.8x |

||

|

23. |

Equity Group |

54.0 |

54.5 |

0.9% |

37.1% |

67.7% |

42.3 |

3.7% |

(18.7%) |

2.4x |

||

|

24. |

Stanbic IBTC Holdings |

48.5 |

48.0 |

(1.0%) |

12.1% |

166.7% |

37.0 |

1.0% |

(21.9%) |

2.9x |

||

|

25. |

National Bank |

9.2 |

9.0 |

(2.2%) |

(4.3%) |

49.2% |

5.6 |

0.0% |

(37.4%) |

0.5x |

||

|

26. |

StanChart Ghana |

35.1 |

35.1 |

1.0% |

39.0% |

127.2% |

19.5 |

3.2% |

(41.4%) |

5.0x |

||

|

27. |

Ecobank Transnational |

16.4 |

17.0 |

4.0% |

0.0% |

95.4% |

9.3 |

3.6% |

(41.8%) |

0.9x |

||

|

28. |

FBN Holdings |

12.5 |

12.2 |

(2.8%) |

38.1% |

299.7% |

6.6 |

1.7% |

(43.8%) |

0.7x |

||

|

*Target Price as per Cytonn Analyst estimates |

||||||||||||

|

**Upside / (Downside) is adjusted for Dividend Yield |

||||||||||||

|

***Banks in which Cytonn and/or its affiliates holds a stake. For full disclosure, Cytonn and/or its affiliates holds a significant stake in NIC Bank, ranking as the 5 th largest shareholder |

||||||||||||

We are “NEUTRAL” on equities for investors with a short-term investment horizon since the market has rallied and brought the market P/E slightly above its’ historical average. However, pockets of value exist, with a number of undervalued sectors like Financial Services, which provide an attractive entry point for long-term investors, and with expectations of higher corporate earnings this year, we are “POSITIVE” for investors with a long-term investment horizon.

France-based Proparco, the private sector financing arm of the French Development Agency (Agence Française de Développement), announced an equity investment of USD 3.0 mn in JUMO, an emerging market technology start-up that offers access to credit through their mobile application. JUMO currently operates in Africa (Tanzania, Kenya, Uganda, Zambia and Ghana) and recently launched its first activities in Asia (Pakistan). In 2017 alone, the start-up handled 12.2 mn loan transactions to customers. Similar deals in the past include the funding of Kenya’s Musoni Microfinance Limited by Fonds Européen de Financement Solidaire (Fefisol), a Luxembourg-based private equity (PE) firm, which invested Kshs 100.0 mn in the deal for an undisclosed stake. The continued increase in investments and funding of microfinance institutions in Kenya is in a bid to grow the institutions loan books to achieve competitive low-cost lending in the country at a time where bank funding continues to be relatively expensive (with the cheapest banks having an average Annual Percentage Rate (APR) of 15.1% while the most expensive banks having an average APR of 18.7% as at January 2018) and as the private sector credit growth remains below the government target of 18.3%, having come in at 2.1% in February. Bank funding accounts for 95% of business funding in Kenya compared to 40% business funding by banks in developed markets, which highlights the need to diversify funding sources, and enable borrowers to tap into alternative avenues of funding that are more flexible and pocket-friendly.

Nigeria based Asoko Insight, an information services company, raised USD 3.6 mn in Series A funding, the first round of financing given to a new business after the initial capital used to start the business, from LC Partners, ZephyrAcorn, Outlierz Ventures, Spice Capital, North Base Media, Singularity Investments, Lateral Capital and CRE VC. The funding is to expedite their product roadmap. They expect to use these funds to (i) ramp up their company coverage from 11,000 to well over 100,000, (ii) introduce a wide set of new platform features, and (iii) scale-up their technology to enhance the analysis and delivery of data. The continued interest by foreign investors in Africa is driven by expected strong economic growth in Sub-Saharan Africa whose GDP is expected to grow by 3.3% in 2018, and 3.5% in 2019, from an expected 2.7% in 2017.

Private equity investments in Africa remains robust as evidenced by the increasing investor interest, which is attributed to; (i) rapid urbanization, a resilient and adapting middle class and increased consumerism, (ii) the attractive valuations in Sub Saharan Africa’s private markets compared to its public markets, (iii) the attractive valuations in Sub Saharan Africa’s markets compared to global markets, and (iv) better economic projections in Sub Sahara Africa compared to global markets. We remain bullish on PE as an asset class in Sub-Sahara Africa. Going forward, the increasing investor interest and stable macro-economic environment will continue to boost deal flow into African markets.

Nakumatt’s Recovery path seems to be hitting some snags as the Competition Authority of Kenya (CAK) announced that Tuskys had backed out of the proposed merger deal with Nakumatt that was set to aid in the revival of the troubled retailer. Tuskys, one of the leading supermarket chains in Kenya, had signed a management contract with Nakumatt, the specifics of which have never been disclosed, with the core aim being to enable Nakumatt have stock in its remaining branches. Tuskys cited the nature of the proposed deal by Nakumatt’s administrator as the reason for reconsidering the commitment. Some of the proposals that they were not comfortable with included; (i) conversion of debt to equity for some of the creditors, and (ii) a creation of a separate entity to own the Nakumatt and Tuskys shares, among others. As it is, the Administrator has a difficult task at hand in determining the manner in which the proposal, as is, will survive the loss of Tuskys. According to local dailies, Tuskys was interested in majority stake, which would see it as the lead in Nakumatt’s business operations and management. The collapse of the deal could also be attributed to management disputes within the family-owned Tuskys holding company, Orakam Holdings, where a faction of the shareholding siblings cited Tuskys as financially incapable of aiding Nakumatt. The proposed merger between Nakumatt and Tuskys that was to be overseen by the Competition Authority of Kenya, has to have the full support of all key stakeholders.

On the Creditors front, the Administrator was to present a proposal to the Creditors on 23rd March 2018 however this was extended by the court during its mention on the 26th of March, to the 9th of April. The decision of the court on whether or not to extend the said term shall determine the course of Nakumatt. In the event that the term for the proposal is not extended, the most logical route would be to liquidate the company. The effect of liquidation would be that all the steps to revive Nakumatt would stop. The creditors would be entitled to a share of the assets of the company based on the percentage of the company’s total debt that they are owed. The secured creditors shall have first priority of repayment. The creditors would only be able to claim interest up to the date on which the liquidation proceedings commenced.

It should be noted that majority of the creditors are in favor of liquidation as they shall be indemnified against the loss they suffered for their insured goods, moreover the creditors will be entitled to a 30% tax deduction for bad debts as per Section 15 of the Income Tax Act, as well as a 16% tax refund for bad debts under Section 31 of the VAT Act. The Suppliers therefore stand to regain up to 46% of the total amount owed, and the other creditors up to 30%, should Nakumatt be declared legally insolvent. The creditors are therefore likely to seek liquidation as there is a chance of recovery of some of their funds, rather than the proposal which may prove unprofitable in the long run. If the time for the administration is extended, the proposal will go before the creditors meeting again with the amendments that had been suggested by the creditors. The creditors will then have the choice to either vote for the proposal, vote to amend it, or reject the proposal altogether.

Also during the week, Nairobi County Government, County Executive Committee Member (CEC), Charles Kerich, announced the commencement of the 10,000-low-cost housing project to take off by May this year. The take-off is for two of the seven earmarked projects, Suna and Pangani, for the urban redevelopment plan. Suna is where the popular Toi Market will be cleared of over 5,000 traders to pave way for over 1,000 units of 1, 2 and 3-bedrooms. Other earmarked estates include the new and old Ngara, Uhuru Road and Jeevanjee-Bachelors.

The table below shows the various contracts awarded as at 2016 by the Nairobi City County Government for the project:

|

Nairobi Urban Redevelopment Plan |

||||

|

Estate |

Location |

Contractor |

Number of Units |

Development Cost (Kshs) |

|

Jeevanjee-Bachelors |

Eastlands |

Jabavu Village Ltd |

1,500 |

9.1 bn |

|

Ngong Road |

Kibra |

Lordship Africa |

2,520 |

24.6 bn |

|

New Ngara |

Kamkunji |

KCB/ S&L |

1,500 |

9.0 bn |

|

Pangani |

Starehe |

M/S Sovereign Group |

1,000 |

Approx. 3.0 bn |

|

Uhuru Road |

Eastlands |

Stanlib Group |

|

3.5 bn |

|

Old Ngara |

Kamkunji |

Kiewa Group |

1,050 |

7.0 bn |

|

Suna Road |

Kibra |

Directline Assurance Limited |

1,050 |

3.5 bn |

Source: Online Sources

Other highlights in the week include;

- Genghis Capital, a Capital Markets Authority licensed investment Bank, in partnership with a private real estate development firm, Paradigm Projects, announced plans to aid home owners make purchases without the conventional bank loans through a tenant purchase/rent-to-own programme dubbed ‘Home Ownership Made Easy” (HOME). In this programme, clients will be provided with a long-term purchasing facility with monthly payments equal to the rental rate. No more details have been revealed about this programme. However, Paradigm projects owns projects such as Wema Villas in Athi River and other upcoming developments in Utawala and Karen,

- Krishna Estates Limited announced plans to put up a Kshs 1.2 bn residential flats project on 2-acres, comprising of 64 two-bedrooms and 180 three-bedroom units, in Thindigua, along Kiambu Road,

- Transport Cabinet Secretary, Hon. James Macharia, announced the commencement of the long-awaited Bus Rapid Transport System (BRTS) with Thika Road and Mombasa Road having lanes outlined specifically for the public service vehicles that will include buses of high capacities of up to 100 passengers. According to the Cabinet Secretary, 50 buses will be deployed within the next 4-weeks and will serve areas along Thika Road and Mombasa Road with key drop off points in the CD including Tom Mboya Posta, Community, Hospital Road, Kenyatta National Hospital and GPO,

- The newly constructed Outer Ring Road, to be commissioned in July this year, is set for further improvements that will see interchanges, service lanes and 11 footbridges added onto the highway. This will help in easing human traffic on the road, which is meant to ease traffic to the Jomo Kenyatta International Airport and is estimated to have a total cost of Kshs 8 bn, as per the Kenya Urban Roads Authority.

We expect the real estate sector to experience a shake up with the mortgage liquidity facility enabling more home purchases, and thus, boosting investor confidence in the sector, with the continued investment in infrastructure opening up more areas for investment grade real estate.

In a bid to support the Affordable Housing Initiative, Treasury Cabinet Secretary Hon. Henry Rotich announced plans of setting up a Mortgage Liquidity Facility (MLF) i.e. The Kenyan Mortgage Refinancing Company (KMRC), which is aimed at enhancing mortgage affordability and enabling long-term loans at attractive market rates in the country. KMRC is an initiative of National Treasury and the World Bank, and will be owned by the state, commercial banks and financial co-operatives as a Limited Liability Company and is expected to be licensed by CBK in February next year, with initial debt financing of USD 160 mn from the World Bank for lending on to financial institutions. It will be a newly created, non-bank financial institution, that is restricted to providing long-term funding and capital market access to mortgage lenders and issuing bonds to investors and will be under the CBK’s supervision, while its bond issuance operations will be overseen by the Capital Markets Authority of Kenya. This week therefore, we look at the proposed mortgage liquidity facility, by looking at the following:

- Introduction to Mortgage Liquidity Facilities

- Mortgage Refinancing Companies in Africa; their Achievements, Challenges and Key Lessons for Kenya

- The Current Kenyan Situation

- The Conditions Necessary for KMRC to Thrive

A. Introduction to Mortgage Liquidity Facilities

As per the World Bank, a mortgage liquidity facility is a financial institution that is meant to support long-term lending activities by Primary Mortgage Lenders (PML) –such as banks, credit unions and mortgage brokers with the core function being to act as an intermediary between PMLs and the bond market. In Kenya, mortgage lenders are banks, with KCB and Standard Chartered being the leading banks in mortgage lending as per the Residential Mortgage Survey by Central Bank of Kenya, as well as one mortgage finance institution, I.e., Housing Finance. Mortgage refinancing works by:

- Borrowers cede their property as security for a long-term mortgage loan,

- The mortgage liquidity facility will lend its funds to PMLs with the mortgages as collateral,

- The mortgage liquidity facility provides a bond to private institutions and investors, with the mortgages as collateral, and,

- Institutions with medium to long-term liabilities buy the bonds at a margin above the usual government securities. On bond issuance, investors are likely to buy into the long-term mortgage-backed bond for 13.9%-14.1%, assuming a 1.0% margin above the minimum of the risk-free rate for a 10-year bond, which currently stands at 12.9%, or 13.1% for a 15-year bond.

Refinancing facilities act as suitable intermediaries between primary mortgage lenders and capital markets. In this way, they enable countries with nascent mortgage markets to boost the supply of long-term capital and thus expand mortgage lending, through:

- Legislative reforms, especially to improve land titling and property registration are critically important for the expansion of mortgage lending. Refinancing facilities cannot expand their operations quickly in the absence of an adequate pool of mortgage loans;

- Refinancing facilities foster competition in the mortgage market by promoting the entry of new primary lenders;

- Refinancing facilities have the potential to offer lower interest rates than primary mortgage lenders.

B. Mortgage Refinancing Companies in Africa; their Achievements, Challenges and Key Lessons for Kenya

I. The Egyptian Mortgage Refinancing Company (EMRC)

The EMRC came about from structural reform programs by the Egyptian Government aimed at improving the investment climate and enhance economic growth in Egypt. This was given a boost by the World Bank, which funded the Egypt Mortgage Finance Project (EMFP) with USD 39.1 mn. While this helped in raising the liquidity, banks were still reluctant to write mortgages for two main reasons: (i) the maturity mismatch between their short-term deposits and long-term mortgage loans, and (ii) the lack of registered titles – partly due to the costly and time-consuming process to obtain good title. The government of Egypt in 2015 introduced the idea of contracting out a nation-wide streamlining and digitization of the existing property registration system in a bid to curb the informal and quasi-legal land processes. However, this has not yet come to effect and a paltry 7% -10% of property is formally registered in Egypt. The issues facing the growth of the mortgage market necessitated the government to step in and attempt to create a more enabling environment for lenders to provide home mortgages with attractive rates. For this reason, the Egypt Mortgage Refinance Company was formed under the EMFP in 2006. The EMRC’s aim was to provide a low risk residential mortgage finance system in which mortgage lenders would be able compete on a market basis in order to make housing finance available on economically attractive terms and conditions.

Achievements:

- The EMRC saw outstanding mortgage loans increase by a 5-year CAGR of 73.0% from USD 16.9 mn in 2006 to USD 265.8 mn in 2011,

- The number of primary mortgage lenders increased by a 5-year CAGR of 43.0% to 12 in 2011 from 2 in 2006,

- The average loan-to-maturity period for mortgages increased to 16-years 2011 from a 2006’s average of 7-years, and,

- In 2016, EMRC received USD 28.2 mn from the Government of Egypt to re-invest into PMLs home loan reserves as part of the government’s USD 1.4 bn mortgage initiative.

Challenges:

- Lack of a buoyant and growing domestic institutional investor base,

- Poor macroeconomic environment worsened by the 2008 global crisis and Egypt’s political instability that saw the fall of two governments in 2011 and 2013, and,

- Inefficient regulation of the mortgage industry players.

Lessons for Kenya from Egypt:

- The government should call for the key participation of private institutions by offering them equity and significant governance in the entity, this will ensure that the MRC has the full cooperation of institutional investors,

- Formation of non-partisan group with representatives from all sectors to oversee the regulation of the body will be crucial in ensuring it remain relevant and on track.

II. Tanzania Mortgage Refinancing Company (TMRC)

The Tanzania Mortgage Refinancing Company was formed after the Tanzanian Government, through the Ministry of Lands, Housing and Human Settlements, initiated the Housing Finance Project (HFP) to promote an active mortgage finance market. An agreement with the International Development Association was signed in 2011 with the main aim being to promote the housing mortgage finance market through the provision of medium and long-term mortgage lenders. For this purpose, the World Bank issued a debt of USD 30 mn and like the Egyptian Mortgage Refinancing Company, it was expected that the TMRC would begin issuing bonds in the capital markets to help fund its operations on a market sustainable basis.

Achievements:

- As at June 2017, the mortgage market registered a 7% growth from march 2017 with the outstanding loan value at USD 199 mn (Kshs 20.1bn),

- The number of mortgage accounts also stood at 3,915 with Kenya’s Equity banks having the largest market share at 25.5%,

- The number of mortgage lenders has increased to 30 as at June 2017, from 2 in 2011,

- Mortgage loans' average duration also increased since the creation of the TMRC, from 5 to 10 years to 15 to 20 years.

Challenges:

- Government imposing new tax regimes on sale of properties, thus pushing home prices upwards

- Unfriendly land laws and lack of developer financing thus limiting housing supply,

- Due to unavailability of sufficient mortgage schemes, private developers have shied away from middle income housing opting rather for high end properties,

- Limited affordable housing coupled by high interest rates prevailing at 16-19%. To this end, Tanzania’s national corporations such as National Housing Corporation and Watumishi Housing have been at the forefront of providing affordable Housing and currently, NHC accounts for 70% of residential homes in Dar es salaam and continues to unveil low cost housing projects aimed at low income earners. By this year, National Housing alone is expected to deliver over 2,000 homes for low to medium income earners through such projects as Kawe’s 711, and Mwongozo Estate,

- In Tanzania, only 3.9% of housing units are provided by the private sector, with over 70% being individually owned homes. However, home construction and land purchase loans remain out of reach for most due to low income and the high interest rates.

Lessons for Kenya from Tanzania:

- With the housing deficit growing annually at approximately 200,000 units, and only 40% of urban dwellers and 7% of rural dwellers can afford a Kshs 1.7 mn mortgage loan, the government should channel its efforts towards provision of low cost homes as it has access to free land as well as infrastructure, compared to private developers who have to incur the extra costs,

- The government should also work towards improving lives by easing the rate of unemployment in Kenya which currently stands at 11.0% as at 2016, compared to a global average of 5.7%.

III. Nigeria Mortgage Refinancing Company (NMRC)

The Nigeria Mortgage Refinance Company Plc (NMRC) was incorporated in 2013 with the sole aim of providing affordability of good housing to Nigerians by enhancing increased liquidity in the mortgage market though mortgage and commercial banks. This was through a concessional USD 300 mn 40-year loan by the International Development Association (IDA) loan at 0.75% to the dollar. It was incorporated as part of the Nigeria Housing Finance Programme, by Federal Ministry of Finance (FMOF), the Central Bank of Nigeria (CBN), Federal Ministry of Lands & Urban Development & Housing and the World Bank/international Finance Corporation as a public company registered with the Securities & Exchange Commission (SEC). Of key to note is that, the World Bank in a bid to avoid the same mistakes in Tanzania and Egypt of not tapping into the capital market, mandated for the International Development Association loan to the NMRC to be disbursed in phases as subordinate debt financing with the funds being invested in securities to cover the NMRCs operational costs and grow its capital base.

Achievements:

- In 2014, Financial Markets Dealers Association trading platform, Nigeria’s Securities Exchange, listed the NMRC Naira 8bn Series 1, a 15-year 14.9% fixed rate bond. The 15-year bonds are meant to refinance existing mortgages that meet specified underwriting requirements,

- By 2015, NMRC refinanced approximately Naira 1 bn (Kshs 280.8 mn) of existing mortgages of Imperial Homes Nigeria,

- As at 2017, NMRC’s liquidity stood at Naira 440 bn (Kshs 123.5 bn).

Challenges:

- The leading challenge for Nigeria’s MRC remains the macroeconomic environment. As at 2017, the lending rates were still high at an average of 24-27% for mortgage borrowers and double-digit inflation rates,

- The volatility of the Naira against the US Dollar,

- Limited access to finance by the end users, and in addition,

- High costs of construction and infrastructure,

- Limited public understanding of its key role in the mortgage industry. To this end, NMRC last year announced partnership with Centre for Affordable Housing Finance in Africa, that will enable (i) data exchange towards the mutual development of the NMRC Mortgage Market Information Portal, (ii) building a Housing Economic Model for Nigeria, (iii) data analysis to assess mortgage access, performance and profitability in Nigeria.

Lessons for Kenya from Nigeria:

- Nigeria has ensured a sufficient regulatory system that has private, state and federal players thus ensuring transparency and effectiveness,

- The MRC should uphold innovation to enable it to address the problem as per Kenya market’s special needs,

- Additionally, the government and the private sector should come up with institutions that will see a fair analysis of the mortgage market in Kenya, and the subsequent performance of KMRC.

Based on the case studies, the key issues affecting mortgage liquidity facilities include:

- Inefficient regulation schemes over MLFs,

- Unestablished capital markets and institutional investors base,

- Unfavorable government policies affecting the real estate sector such as monetary policies that promote high interest rates as well as tax regimes,

- Poor macroeconomic environments,

- Insufficient supply of affordable homes, and,

- Lack of an efficient land titling process.

C. The Current Kenyan Situation

In Kenya, mortgages declined by 1.5% as of December 2016 to 24,085 from 24,458 in December 2015 attributed to the interest rates cap law. As property prices rose, the value of mortgage loan assets outstanding increased to Kshs 219.9 bn in December 2016 from Kshs 203.3 bn in December 2015, an increase of 8.1%. However, following the interest rate cap law, average mortgage interest rates dropped to 10.5%-18.0%, from 11.9%-23.0% in 2015. As per the 2016 Kenya Mortgage Survey by Central Bank of Kenya, factors hindering the maturity of the Kenyan mortgage market despite its potential include: (i) high costs of houses against low incomes, (ii) high lending rates, (iii) difficulties with property registration and titling, (iv) undeveloped standardization of loan underwriting, documentation or servicing procedures, and (v) lack of access to long term financing. To address this; (i) the Ministry of lands is currently undertaking the land registration digitization process and effecting a computerized titling system and to enable multiple land titling, and (ii) According to Hon. Henry Rotich, the National Treasury is in the process of revising the interest rate cap law from the current 13.5% due to the negative effect it has had in the credit sector, such as the decline of private sector credit growth which dropped to 2.1% as at February 2018.

In our view, the key conditions necessary for the success of Kenya Mortgage Refinancing Company will be:

- Transparent and effective regulation of KMRC by a regulatory body. To this end, the government announced that the MRC will be supervised by the Central Bank of Kenya and regulation by the Capital Markets Authority. Of key to note however, is that there is need for inclusion of the private sector in the oversight as they will make up the investor base,

- Governance rules designed to ensure its efficiency, especially now that the government is the biggest shareholder,

- A clear and efficient land titling process,

- Sufficient support from the private sector, especially in regards to bond issuance, and,

- Provision of affordable homes (we shall address affordable housing in a future focus note).

With this in mind, we are of the view that for KMRC to have a meaningful impact, we need to address the cost of housing to make it more affordable. On bonds issuance, investors are likely to buy into the long-term mortgage-backed bond for 13.9% - 14.1%, assuming a 1.0% margin above the minimum of the risk-free rate for a 10-year bond, which currently stands at 12.9%, or 13.1% for a 15-year bond. In or view, this is still high for financing end user mortgages as it might mean high costs of debt thus locking out low income earners. The assumption is based on the typical corporate premium charged above the risk-free rate. This however, should be guided by the Capital Markets Authority’s Policy Guidance Note (PGN) which is aimed at facilitating the issuance of Asset-Backed Securities (ABS). Kenya Mortgage Refinancing Company is a step in the right direction towards making the Government initiative of providing 500,000 homes per year till 2022 come to effect. We expect the body to result to a rise in (i) number of mortgage lenders, (ii) the number of mortgage undertakings, and thus (iii) increased uptake of homes by the low-income population.

Disclaimer: The views expressed in this publication, are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.