The Kenyan National Social Security Fund (NSSF) & Cytonn Weekly #38/2022

By Cytonn Research, Sep 25, 2022

Executive Summary

Fixed Income

During the week, T-bills remained undersubscribed, with the overall subscription rate coming in at 46.6%, a decline from the 97.0% recorded the previous week. The undersubscription was partly attributable to the tightened liquidity in the money market, with the average interbank rate increasing to 4.5% from 4.0% recorded in the previous week. Investor’s preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 4.7 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 117.8% down from 248.4% recorded in the previous week. The subscription rate for the 364-day and 182-day papers declined to 10.4% and 54.3% from 19.6% and 113.9%, respectively, recorded the previous week. The yields on the government papers recorded mixed performance, with the yields on the 182-day and 91-day papers increasing by 1.0 bp and 0.1 bps to 9.6% and 9.0%, respectively, while the yields on the 364-day paper declined by 0.4 bps to 9.9%;

In the primary bond market, the government re-opened two bonds namely; FXD1/2017/10 and FXD1/2020/15 and opened a new FXD1/2022/25, with effective tenors of 4.9 years, 12.3 years and 25 years respectively, in a bid to raise Kshs 60.0 bn for budgetary support. The period of sale for the bonds runs from 21st September 2022 to 4th October 2022 for FXD1/2017/10 and FXD1/2020/15 and from 21st September 2022 to 18th October 2022 for FXD1/2022/25. For the month of September 2022;

We are projecting the y/y inflation rate for the month of September to fall within the range of 8.7% - 9.1%;

Equities

During the week, the equities market recorded mixed performance with NASI and NSE 25 gaining by 1.9% and 1.2%, respectively while NSE 20 declined by 0.1%, taking their YTD performance to losses of 19.3%, 15.0% and 8.8%, for NASI, NSE 25 and NSE 20, respectively. The equities market performance was mainly driven by gains recorded by large-cap stocks such as NCBA, Safaricom, BAT, and Standard Chartered Bank of Kenya of 8.4%, 3.2%, 2.2% and 1.1%, respectively. The gains were weighed down by losses recorded by stocks such as Co-operative Bank and ABSA of 2.4% and 1.3%, respectively;

Real Estate

During the week, Gulf African Bank entered into a mortgage financing agreement with property developer Mi Vida Homes, with an aim of financing mortgages to potential home buyers of their recently completed Mi Vida Phase I housing project at Garden City. Additionally, Stanbic Bank Kenya partnered with three Real Estate developers namely; Superior Homes Kenya, Avic International Real Estate Ltd, and, Safaricom Staff Pension Scheme, to provide mortgages to their potential home buyers. Also, Shelter Afrique, a Pan-African development financier based in Nairobi’s Upperhill District, approved a Kshs 2.2 bn corporate loan towards Maison Super Development (MSD) firm to finance the construction of three ongoing projects in the Democratic Republic of Congo (DRC). In the retail sector, local eye-wear Optica Limited opened a new outlet along Waiyaki Way bringing its total outlets countrywide to 66. For Real Estate Investment Trusts (REITs), Fahari I-REIT closed the week trading at an average price of Kshs 7.0 per share on the Nairobi Stock Exchange, while Acorn D-REIT and I-REIT closed the week trading at Kshs 23.8, and Kshs 20.8 per unit, respectively on the Unquoted Securities Platform, as at 2nd September 2022;

Focus of the Week

For many people, retirement means settling into a more relaxed lifestyle and having time to enjoy things they did not have time for before retirement, such as hobbies, family and recreational activities. This lifestyle necessitates careful planning in advance through having a solid retirement plan which can either be signing up to a social security fund, enrolling into a pension scheme or investing in other assets like real estate. In Kenya, there are several pension schemes and a National Social Security Fund, NSSF, that allows people to save for retirement. There has been recent discussions surrounding the effectiveness of NSSF, primarily on the the contribution amounts. As such, this week we turn our focus to the Kenyan National Social Security Fund to shed light on its state and what needs to be done to achieve a win-win situation;

Investment Updates:

- Weekly Rates:

- Cytonn Money Market Fund closed the week at a yield of 10.56%. To invest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- Cytonn High Yield Fund closed the week at a yield of 13.91% p.a. To invest, email us at sales@cytonn.com and to withdraw the interest, dial *809# or download the Cytonn App from Google Playstore here or from the Appstore here;

- On our bi-weekly Twitter Spaces session, we had a discussion on “Economic areas to be focused on post-election” which was moderated by Stellah Swakei, an Investment Analyst at Cytonn. Listen to the conversation here;

- We continue to offer Wealth Management Training every Wednesday and every third Saturday of the month, from 9:00 am to 11:00 am, through our Cytonn Foundation. The training aims to grow financial literacy among the general public. To register for any of our Wealth Management Trainings, click here;

- If interested in our Private Wealth Management Training for your employees or investment group, please get in touch with us through wmt@cytonn.com;

- Any CHYS and CPN investors still looking to convert are welcome to consider one of the five projects currently available for assignment, click here for the latest term sheet;

- Cytonn Insurance Agency acts as an intermediary for those looking to secure their assets and loved ones’ future through insurance namely; Motor, Medical, Life, Property, WIBA, Credit and Fire and Burglary insurance covers. For assistance, get in touch with us through insuranceagency@cytonn.com;

- Cytonnaire Savings and Credit Co-operative Society Limited (SACCO) provides a savings and investments avenue to help you in your financial planning journey. To enjoy competitive investment returns, kindly get in touch with us through clientservices@cytonn.com;

- For an exclusive tour of Cytonn’s real estate developments, visit: Sharp Investor's Tour, and for more information, email us at sales@cytonn.com;

- Phase 3 of The Alma is now ready for occupation and the show house is open daily. To rent please email properties@cytonn.com;

- We are currently hosting an Open-house event at the Alma today, 25th September 2022 where you can tour the property and speak to SBM Bank representatives on Mortgage financing;

- We have 8 investment-ready projects, offering attractive development and buyer targeted returns; See further details here: Summary of Investment-ready Projects;

- For Third Party Real Estate Consultancy Services, email us at rdo@cytonn.com;

- For recent news about the group, see our news section here;

Hospitality Updates:

- We currently have promotions for Staycations. Visit cysuites.com/offers for details or email us at sales@cysuites.com;

During the week, T-bills were undersubscribed, with the overall subscription rate coming in at 46.6%, a decline from the 97.0% recorded the previous week. The undersubscription was partly attributable to the tightened liquidity in the money market, with the average interbank rate increasing to 4.5% from 4.0% recorded in the previous week. Investor’s preference for the shorter 91-day paper persisted, with the paper receiving bids worth Kshs 4.7 bn against the offered Kshs 4.0 bn, translating to a subscription rate of 117.8% down from 248.4% recorded in the previous week. It is worth noting that the 91-day paper’s rate has been increasing, with the rate quickly heading to 9.0% levels which has consistently countered the need to invest in the longer tenor papers. The subscription rate for the 364-day and 182-day papers declined to 10.4% and 54.3% from 19.6% and 113.9%, respectively, recorded the previous week.

The yields on the government papers recorded mixed performance, with the yields on the 182-day and 91-day papers increasing by 1.0 bp and 0.1 bps to 9.6% and 9.0%, respectively, while the yields on the 364-day paper declined by 0.4 bps to 9.9%. We however believe that the 91-day paper rates are not sustainable and this will likely lead to a reversal in the rates in the short term. The government continued to reject expensive bids, accepting a total of Kshs 10.1 bn worth of bids out of the Kshs 11.2 bn worth of bids received, translating to an acceptance rate of 90.2%.

In the primary bond market, the government re-opened two bonds namely; FXD1/2017/10 and FXD1/2020/15 and opened a new FXD1/2022/25, with effective tenors of 4.9 years, 12.3 years and 25 years respectively, in a bid to raise Kshs 60.0 bn for budgetary support. The coupon rates for the bonds are 13.0% and 12.8% for FXD1/2017/10 and FXD1/2020/15 while the coupon rate for FXD1/2022/25 will be market determined. We expect the bonds to be undersubscribed as investors continue to attach higher risk premium on the country due to increased perceived risk arising from increasing inflationary pressures.

The bonds are currently trading in the secondary market at yields of 12.7% and 13.8% for FXD1/2017/10 and FXD1/2020/15, respectively. As such, our recommended bidding ranges for the three bonds is 12.7%-13.2% for FXD1/2017/10, 13.8%-14.3% for FXD1/2020/15 and 14.0%-14.5% for FXD1/2022/25 within which bonds of a similar tenor are trading at. The period of sale for the bonds runs from 21st September 2022 to 4th October 2022 for FXD1/2017/10 and FXD1/2020/15 and from 21st September 2022 to 18th October 2022 for FXD1/2022/25.

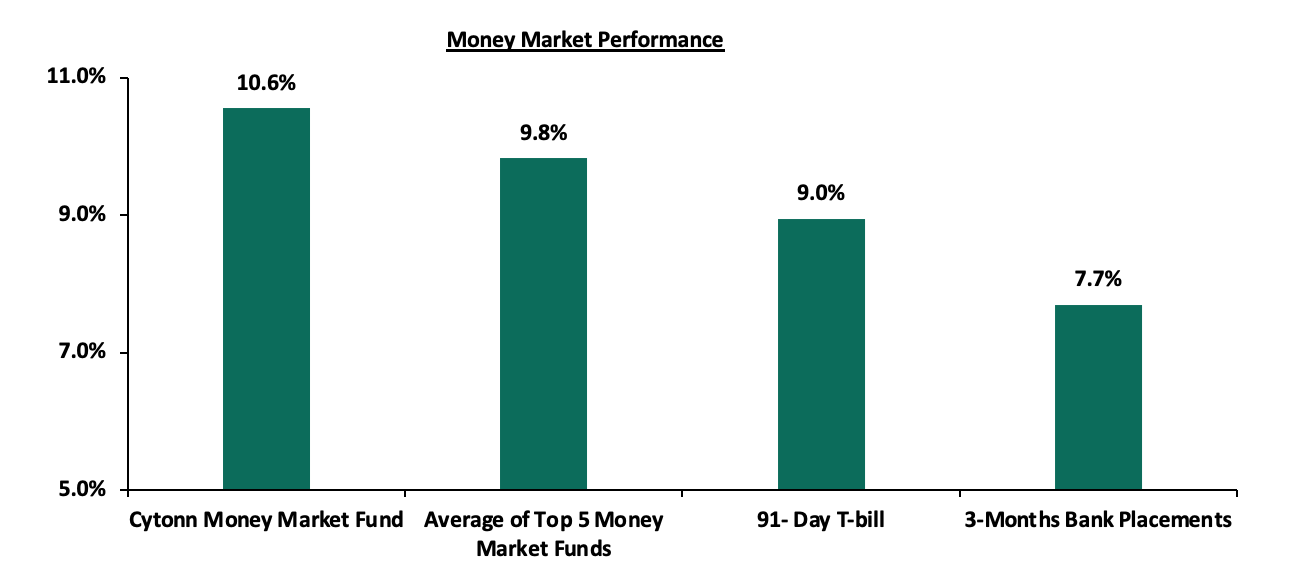

In the money markets, 3-month bank placements ended the week at 7.7% (based on what we have been offered by various banks), while the yield on the 91-day T-bill increased by 0.1 bps to 9.0%. The average yield of the Top 5 Money Market Funds increased by 4.0 bps to 9.8% while the Cytonn Money Market Fund remained relatively unchanged at 10.6%, as was recorded last week.

The table below shows the Money Market Fund Yields for Kenyan Fund Managers as published on 23rd September 2022:

|

Money Market Fund Yield for Fund Managers as published on 23rd September 2022 |

||

|

Rank |

Fund Manager |

Effective Annual Rate |

|

1 |

Cytonn Money Market Fund |

10.6% |

|

2 |

Zimele Money Market Fund |

9.9% |

|

3 |

Dry Associates Money Market Fund |

9.6% |

|

4 |

Madison Money Market Fund |

9.6% |

|

5 |

NCBA Money Market Fund |

9.5% |

|

6 |

Sanlam Money Market Fund |

9.4% |

|

7 |

Nabo Africa Money Market Fund |

9.4% |

|

8 |

GenCap Hela Imara Money Market Fund |

9.3% |

|

9 |

Old Mutual Money Market Fund |

9.3% |

|

10 |

Apollo Money Market Fund |

9.3% |

|

11 |

Co-op Money Market Fund |

9.2% |

|

12 |

CIC Money Market Fund |

9.0% |

|

13 |

Orient Kasha Money Market Fund |

8.7% |

|

14 |

ICEA Lion Money Market Fund |

8.5% |

|

15 |

AA Kenya Shillings Fund |

8.3% |

|

16 |

British-American Money Market Fund |

7.6% |

Source: Business Daily

Liquidity:

During the week, liquidity in the money markets tightened, with the average interbank rate increasing to 4.5% from 4.0% recorded the previous week, partly attributable to government payments that offset tax remittances. The average interbank volumes traded declined by 11.9% to Kshs 24.1 bn from Kshs 27.3 bn recorded the previous week.

Kenya Eurobonds:

During the week, the yields on Eurobonds were on an upward trajectory, partly attributable to increasing inflationary pressures and local currency depreciation with the yield on the 10-year Eurobond issued in 2014 recording the highest increase having increased by 0.7% to 12.8% from 12.1% recorded in the previous week. The table below shows the summary of the performance of the Kenyan Eurobonds as of 22nd September 2022;

|

Kenya Eurobond Performance |

||||||

|

2014 |

2018 |

2019 |

2021 |

|||

|

Date |

10-year issue |

10-year issue |

30-year issue |

7-year issue |

12-year issue |

12-year issue |

|

3-Jan-22 |

4.4% |

8.1% |

8.1% |

5.6% |

6.7% |

6.6% |

|

31-Aug-22 |

15.3% |

13.2% |

12.4% |

14.5% |

13.1% |

11.5% |

|

16-Sep-22 |

12.1% |

12.4% |

11.9% |

12.9% |

12.4% |

10.9% |

|

19-Sep-22 |

12.5% |

12.5% |

12.0% |

13.0% |

12.6% |

11.0% |

|

20-Sep-22 |

12.6% |

12.3% |

12.0% |

12.9% |

12.6% |

11.0% |

|

21-Sep-22 |

12.7% |

12.5% |

12.1% |

13.1% |

12.8% |

11.2% |

|

22-Sep-22 |

12.8% |

12.6% |

12.1% |

13.1% |

12.8% |

11.4% |

|

Weekly Change |

0.7% |

0.2% |

0.3% |

0.3% |

0.4% |

0.5% |

|

MTD Change |

(2.5%) |

(0.6%) |

(0.3%) |

(1.4%) |

(0.3%) |

(0.1%) |

|

YTD Change |

8.4% |

4.6% |

4.0% |

7.5% |

6.1% |

4.8% |

Source: Central Bank of Kenya (CBK)

Kenya Shilling:

During the week, the Kenyan shilling depreciated by 0.1% against the US dollar to close the week at Kshs 120.6, from Kshs 120.4 recorded the previous week, partly attributable to increased dollar demand from the oil and energy sectors against a slower supply of hard currency. On a year to date basis, the shilling has depreciated by 6.6% against the dollar, higher than the 3.6% depreciation recorded in 2021. We expect the shilling to remain under pressure in 2022 as a result of:

- High global crude oil prices on the back of persistent supply chain bottlenecks coupled with high demand as most economies gradually recover,

- An ever-present current account deficit due to an imbalance between imports and exports, with Kenya’s current account deficit estimated at 5.1% of GDP in the 12 months to July 2022 compared to the 5.2% within a similar period in 2021, and,

- The aggressively growing government debt which is not translating into GDP growth thus putting pressure on forex reserves to service some of the public debt. Notably, Kenya’s public debt has increased at a 10-year CAGR of 18.2% to Kshs 8.6 tn in May 2022, from Kshs 1.6 tn in May 2012 while the average GDP growth over the same period has been 3.9%.

The shilling is however expected to be supported by:

- Sufficient Forex reserves currently at USD 7.4 bn (equivalent to 4.2-months of import cover), which is above the statutory requirement of maintaining at least 4.0-months of import cover, and,

- Sufficient diaspora remittances evidenced by a 14.7% y/y increase to USD 3,992.0 mn cumulative remittances as of August 2022, from USD 3,481.0 mn recorded over the same period in 2021.

Weekly Highlight:

September 2022 inflation projections

We are projecting the y/y inflation rate for September 2022 to fall within the range of 8.7%-9.1%. The key drivers include:

- High Fuel Prices - Fuel prices for the period 15th September 2022 to 14th October 2022 increased by 12.7%, 17.9% and 15.7% to Kshs 179.3 per litre, Kshs 165.0 per litre and Kshs 147.9 per litre from Kshs 159.1 per litre, Kshs 140.0 per litre and Kshs 127.9 per litre for Super Petrol, Diesel and Kerosene, respectively. The increase was attributable to the partial removal of the fuel subsidy by the government. Notably, this is the highest fuel prices have ever been in Kenya and given that fuel is a major input to most sectors, we expect the high prices to weigh on the inflation basket in the short term,

- Increasing Food Prices - This was evidenced by the 15.3% y/y increase in the prices of food & non-alcoholic beverages as of August 2022 due to increased costs of production and erratic weather conditions. Given that the index constitutes 32.9% of the inflation basket, we expect the prevailing high food prices to exert pressure on the inflation rate, and,

- Higher Electricity Prices - The price of electricity increased by 15.7% in September 2022 to Kshs 25.3 per kWh from Kshs 21.9 recorded since January 2022, reversing the former President’s directive to cut the cost of electricity by 30.0% in order to reduce the cost of living. This is due to the unsustainable subsidies that were shelved by the new administration, and we expect the move to increase the cost of production and thus increase the prices of commodities.

Going forward, we expect the inflation rate to remain elevated on the back of high fuel, food and electricity prices as concerns remain high on the inflated import bill and widening trade deficit. Despite the decline in the average landed cost of fuel, the new administration is expected to fully eliminate the subsidies on fuel as they are unsustainable. Consequently, inflationary pressures will remain elevated owing primarily to the fact that fuel remains a substantial input cost.

Rates in the Fixed Income market have remained relatively stable due to the relatively ample liquidity in the money market. As it is still early in the financial year, the government is 1.9% ahead of its prorated borrowing target of Kshs 135.8 bn having borrowed Kshs 138.4 bn of the Kshs 581.7 bn borrowing target for the FY’2022/2023. We expect sustained gradual economic recovery as evidenced by the revenue collections of Kshs 2.0 tn in the FY’2021/2022, equivalent to a 2.8% outperformance. Despite the performance, we believe that the projected budget deficit of 6.2% is relatively ambitious given the downside risks and deteriorating business environment occasioned by high inflationary pressures. We however expect the support from the IMF and World Bank to finance some of the government projects and thus help maintain a stable interest rate environment since the government is not desperate for cash. Owing to this, our view is that investors should be biased towards short-term fixed-income securities to reduce duration risk.

During the week, the equities market recorded mixed performance with NASI and NSE 25 gaining by 1.9% and 1.2%, respectively while NSE 20 declined by 0.1%, taking their YTD performance to losses of 19.3%, 15.0% and 8.8%, for NASI, NSE 25 and NSE 20, respectively. The equities market performance was mainly driven by gains recorded by large-cap stocks such as NCBA, Safaricom, BAT, and Standard Chartered Bank of Kenya of 8.4%, 3.2%, 2.2% and 1.1%, respectively. The gains were weighed down by losses recorded by stocks such as Co-operative Bank and ABSA of 2.4% and 1.3%, respectively.

During the week, equities turnover declined by 5.5% to USD 20.3 mn, from USD 21.4 mn recorded the previous week, taking the YTD turnover to USD 641.9 mn. Additionally, foreign investors remained net sellers, with a net selling position of USD 6.8 mn, from a net selling position of USD 4.6 mn recorded the previous week, taking the YTD net selling position to USD 159.3 mn.

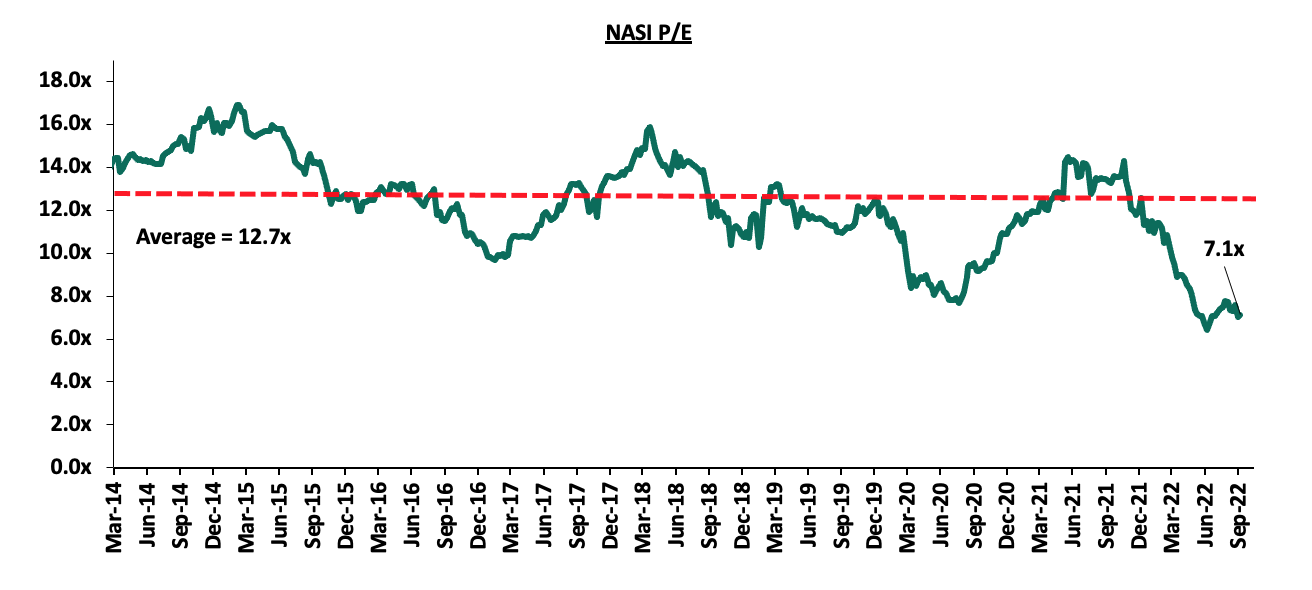

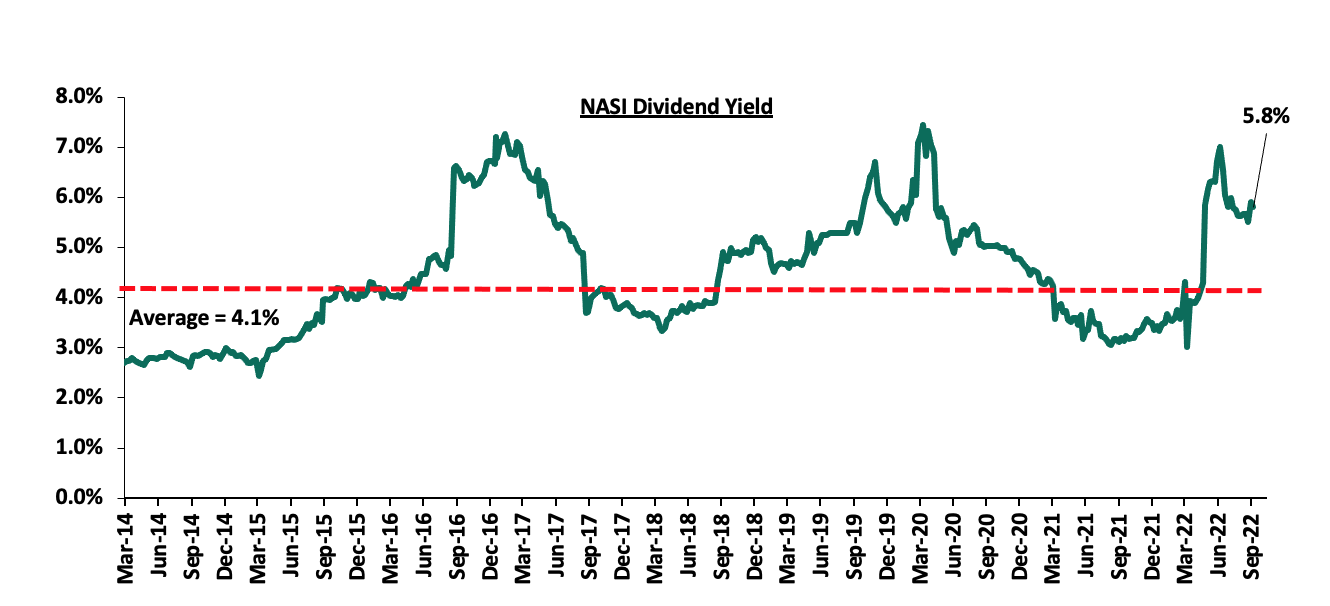

The market is currently trading at a price to earnings ratio (P/E) of 7.1x, 43.8% below the historical average of 12.7x, and a dividend yield of 5.8%, 1.7% points above the historical average of 4.1%. Key to note, NASI’s PEG ratio currently stands at 0.9x, an indication that the market is undervalued relative to its future growth. A PEG ratio greater than 1.0x indicates the market may be overvalued while a PEG ratio less than 1.0x indicates that the market is undervalued. The charts below indicate the historical P/E and dividend yields of the market:

Universe of Coverage

|

Company |

Price as at 16/09/2022 |

Price as at 23/09/2022 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/ Downside** |

P/TBv Multiple |

Recommendation |

|

Sanlam |

11.5 |

10.0 |

(13.0%) |

(13.4%) |

15.9 |

0.0% |

59.0% |

1.1x |

Buy |

|

Kenya Reinsurance |

2.1 |

2.1 |

(1.0%) |

(9.6%) |

3.2 |

4.8% |

58.4% |

0.2x |

Buy |

|

Jubilee Holdings |

245.3 |

245.3 |

0.0% |

(22.6%) |

379.4 |

0.4% |

55.1% |

0.4x |

Buy |

|

KCB Group*** |

39.1 |

39.2 |

0.3% |

(14.1%) |

53.5 |

7.7% |

44.3% |

0.7x |

Buy |

|

Equity Group*** |

47.2 |

47.1 |

(0.2%) |

(10.7%) |

62.2 |

6.4% |

38.5% |

1.1x |

Buy |

|

Co-op Bank*** |

12.4 |

12.1 |

(2.4%) |

(7.3%) |

15.6 |

8.3% |

37.8% |

0.7x |

Buy |

|

ABSA Bank*** |

11.6 |

11.5 |

(1.3%) |

(2.6%) |

14.9 |

1.7% |

31.9% |

1.0x |

Buy |

|

I&M Group*** |

17.0 |

16.9 |

(0.3%) |

(21.0%) |

20.5 |

8.9% |

30.4% |

0.4x |

Buy |

|

Diamond Trust Bank*** |

50.0 |

49.8 |

(0.4%) |

(16.3%) |

59.5 |

6.0% |

25.5% |

0.2x |

Buy |

|

Liberty Holdings |

7.0 |

6.3 |

(10.0%) |

(10.8%) |

7.8 |

0.0% |

23.8% |

0.5x |

Buy |

|

Britam |

6.5 |

6.3 |

(3.4%) |

(17.2%) |

7.7 |

0.0% |

23.0% |

1.0x |

Buy |

|

Standard Chartered*** |

136.3 |

137.8 |

1.1% |

6.0% |

155.0 |

10.2% |

22.7% |

0.9x |

Buy |

|

NCBA*** |

30.5 |

33.0 |

8.4% |

29.7% |

35.2 |

6.1% |

12.6% |

0.7x |

Accumulate |

|

HF Group |

3.5 |

3.3 |

(6.0%) |

(13.7%) |

3.6 |

0.0% |

9.1% |

0.2x |

Hold |

|

Stanbic Holdings |

94.3 |

100.0 |

6.1% |

14.9% |

99.9 |

9.0% |

8.9% |

0.8x |

Hold |

|

CIC Group |

2.1 |

2.1 |

(1.4%) |

(4.6%) |

2.1 |

0.0% |

1.4% |

0.7x |

Lighten |

|

Target Price as per Cytonn Analyst estimates **Upside/ (Downside) is adjusted for Dividend Yield ***For Disclosure, these are stocks in which Cytonn and/or its affiliates are invested in |

|||||||||

We are “Neutral” on the Equities markets in the short term due to the current adverse operating environment and huge foreign investor outflows, and, “Bullish” in the long term due to current cheap valuations and expected global and local economic recovery.

With the market currently trading at a discount to its future growth (PEG Ratio at 0.9x), we believe that investors should reposition towards value stocks with strong earnings growth and that are trading at discounts to their intrinsic value. We expect the current high foreign investors sell-offs, and the slow vaccine rollout to continue weighing down the economic outlook in the short term

- Residential Sector

- Mi Vida Homes and Gulf African Bank Enters into a Mortgage Financing Agreement

During the week, Gulf African Bank entered into a mortgage financing agreement with property developer Mi Vida Homes, with an aim of funding mortgages to potential home buyers of their recently completed Mi Vida Phase I project situated along Thika Road. The Kshs 12.0 bn project sits on the larger 47- acre piece of land at Garden City and comprises of 221 apartments distributed into one, two, and three bedroom typologies, with prices ranging between Kshs 8.8 mn and Kshs 15.7 mn. The Shari’ah-compliant mortgage facility will be capped at an 11.8% interest rate, with a faster approval period of 48 hours and a favorable repayment period of up to 20 years, which is longer than CBK’s benchmark period of 12 years. Notably, the deal will also be extended to Gulf non-clients, and to other projects by Mi Vida such as its incoming affordable housing project at Nairobi’s Riruta area, consisting of 800 units worth more than Kshs 2.0 bn.

- Stanbic Bank Kenya Partners with Three Property Developers to Provide Mortgages

During the week, Stanbic Bank Kenya partnered with three Real Estate developers namely; Superior Homes Kenya, Avic International Real Estate Ltd, and, Safaricom Staff Pension Scheme, to provide mortgages to their potential home buyers. Stanbic currently has a 1.1% stake at the Kenya Mortgage Refinance Company and plans to cap the home loans at a 9.5% interest rate, with a repayment period of up to 25 years. Moreover, the potential buyers will enjoy up to a 105.0% financing in both local and foreign currencies, with the bank aiming at providing a variety of funding options to the buyers.

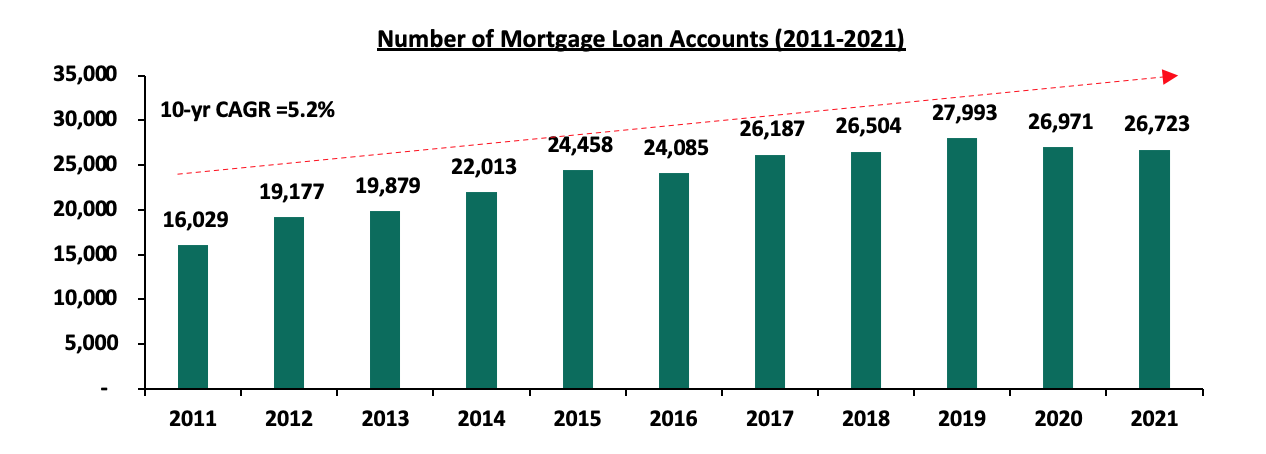

The aforementioned partnership agreements are expected to boost the overall mortgage loans accounts which recorded a 0.9% decline to 26,723 in 2021, from 26,971 recorded in 2020, as depicted below;

Source: Central Bank of Kenya

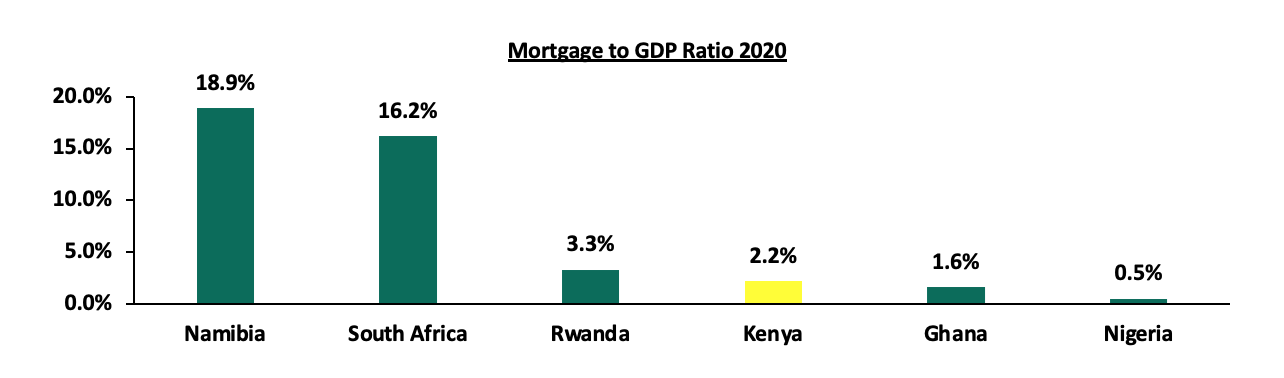

Based on the above, the Kenyan mortgage sector performance continues to lag behind owing primarily to the increasing property prices on the back of the rising construction costs, and interest rates, thus making it costly for majority of Kenyans to take up mortgages. Consequently, the mortgage to GDP ratio continues to lag behind at 2.2%, compared to countries such as Namibia and South Africa at 18.9% and 16.2%, respectively, as shown below;

Source: Centre for Affordable Housing Africa

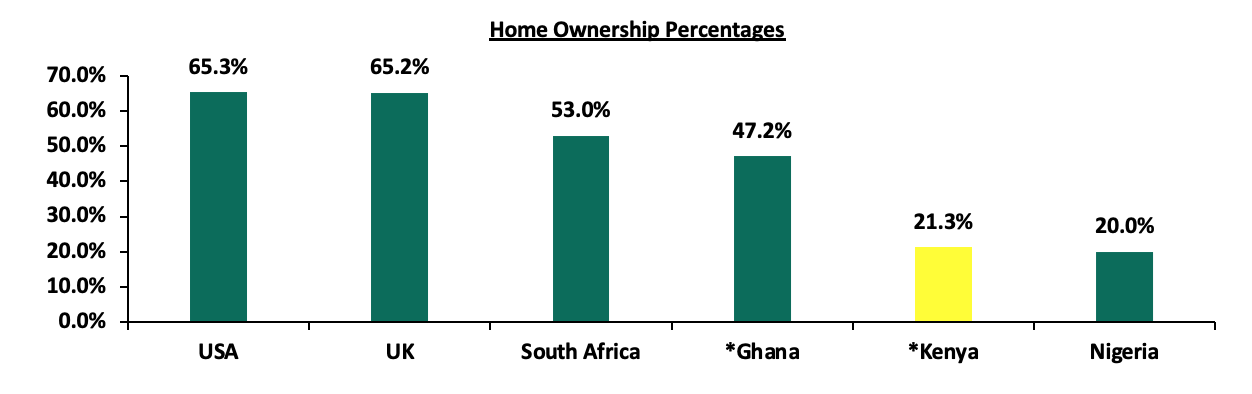

Despite this, the anticipated increase in mortgage availability and uptake is expected to boost home ownership rates in Kenya which is currently at 21.3% in urban areas as at 2020, compared to other African countries such as South Africa and Ghana at 53.0% and 47.2%, respectively, as shown below;

Source: Centre for Housing Africa, *figures as at 2020

- Shelter Afrique approves a corporate loan towards Maison Super Development Firm

During the week, Shelter Afrique, a Pan-African development financier based in Nairobi’s Upperhill District, approved a Kshs 2.2 bn corporate loan towards Maison Super Development (MSD) firm to finance the construction of three ongoing projects in the Democratic Republic of Congo (DRC). The projects to be constructed by A-One Builders include;

- Jumbo Office Building in Kolwezi city, to be completed by end of 2022,

- Alilac Office Building project in Lumbashi city, to be completed in 2023, and,

- Munua Housing project in Lubumbashi, to be completed in 2024.

This marks the third time Shelter Afrique has financed projects by MSD property firm since 2016, in addition to recently financing several other projects within DRC such as the Devimco’s 7-floor office building, La Tradition, Le Concorde, L’Ambassadeur, and, Azda among others, in support of its urban renewal plan in the country. In our view, the move by the lender is expected to boost investment confidence in the region which has been witnessing improved activities and developments in various sectors, with the most recent one being EA Limited, a subsidiary of the TransCentury PLC, an African infrastructure investment company based in Nairobi Kenya announcing plans to develop an affordable housing project worth USD 250.0 mn (Kshs 29.8 bn).

- Retail Sector

During the week, local eye-wear Optica Limited opened a new outlet along Waiyaki Way bringing its total outlets countrywide to 66. This comes barely three weeks after the retailer opened a new outlet at Nextgen Mall indicating its rapid expansion drive, with the other three outlets opened so far this year being at Rubis Business Block in Kitengela, and in Argwing’s Arcade in Kilimani, both in May 2022, and another in Ruiru’s Kamakis, opened in January 2022. The opening of the new outlet was driven by:

- Suitable location of the outlet along Waiyaki Way and near QuickMart supermarket which enhances the footfall and accessibility to the store,

- Its expansion strategy to further reach out its product and services to target clients, and,

- Increasing demand for prescription sunglasses which also offers protection from UV ray.

Kenya’s retail sector continues to witness rapid expansion activities by various retailers owing to their improving investment confidence, which in turn cushions the performance of the sector. However, the existing oversupply of retail spaces coupled with the existence of e-commerce continues to weigh down the optimum uptake of space and the overall performance of the sector.

- Real Estate Investment Trusts (REITs)

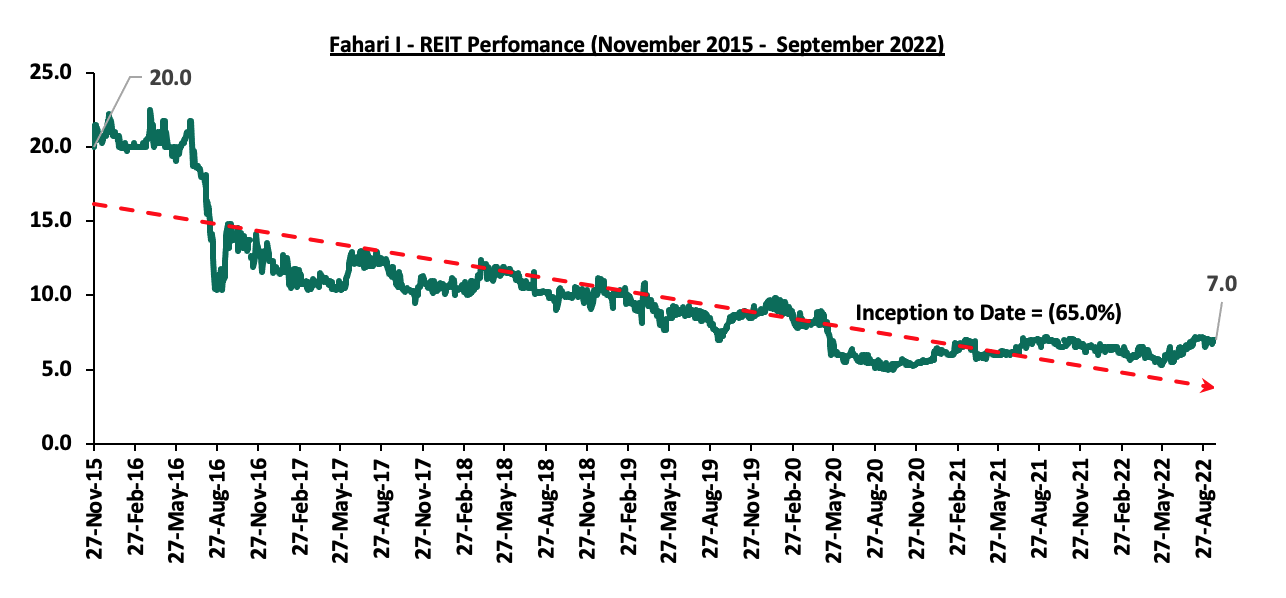

In the Nairobi Stock Exchange, ILAM Fahari I - REIT closed the week trading at an average price of Kshs 7.0 per share representing a 9.4% Year-to-Date (YTD) increase from Kshs 6.4 per share. On an Inception-to-Date (ITD) basis, the REIT’s performance continues to be weighed down having recorded a 65.0% decline from Kshs 20.0. The graph below shows Fahari I-REIT’s performance from November 2015 to September 2022:

In the Unquoted Securities Platform, Acorn D-REIT and I-REIT closed at Kshs 23.8 and Kshs 20.8 per unit, respectively, as at 2nd September 2022. The performance represented a 19.0% and 4.0% gain for the D-REIT and I-REIT, respectively, from the Kshs 20.0 inception price. The volumes traded for the D-REIT and I-REIT came in at 5.5 mn and 14.5 mn shares, respectively, with a turnover of Kshs 117.0 mn and Kshs 300.3 mn, respectively, since its Inception in February 2021.

We expect the performance of Kenya’s Real Estate sector to improve as a result of the anticipated increase mortgage availability and uptake, increasing investor confidence in the East African property market, and, rapid expansion drive in the retail sector. However, setbacks such as high construction costs, and investor’s inadequate appetite for the Kenyan REIT instrument continues to hinder optimum investments in the property market.