Dec 21, 2025

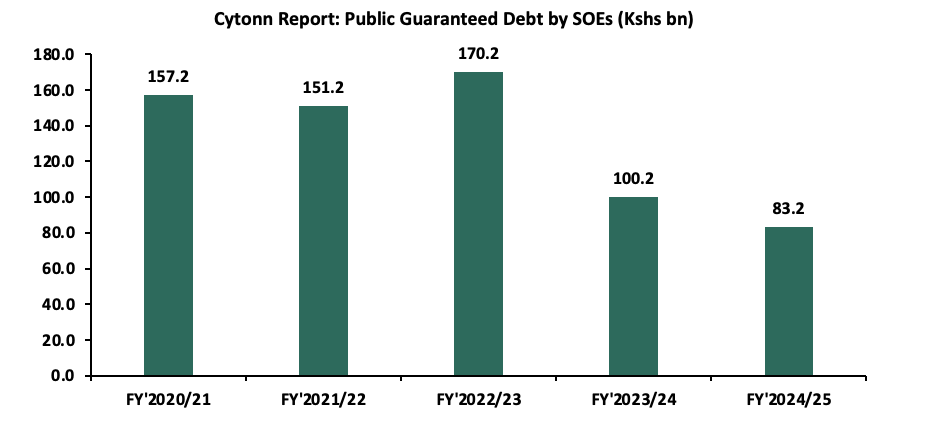

Privatization involves selling government-owned assets (including shares in state-owned companies) to private individuals or businesses. This excludes selling new shares to current shareholders or financial restructuring within a company that might reduce the government's ownership percentage. The proof of long-term inefficiencies, misconduct, poor financial management, and waste in state owned enterprises (SOEs) necessitates the need for privatization which typically tries to increase economic efficiency by increasing a company's performance, hence eliminating or reducing the need for government economic intervention, attract private investment and foster innovation. Furthermore, privatizations have been utilized to promote competition in monopolized industries. By transitioning from state control to private ownership, these enterprises are envisioned to become more agile, responsive to market dynamics, and better positioned to contribute significantly to the nation’s socio-economic development. SOEs fund their budgets through Government transfers (recurrent grants), Appropriation-in-Aid (A-in-A) and loans. As at the end of FY’2024/25, publicly guaranteed debt by SOEs stood at Kshs 83.2 bn, a 16.2% decrease from Kshs 100.2 bn in FY’2023/24, though it remains elevated despite the decline. As a result, privatization of state-owned enterprises (SOEs) has been identified as a fiscal enhancement option, and it is one of the requirements imposed by multilateral lenders such as the International Monetary Fund (IMF) for access to concessional lending facilities.

Kenya's privatization efforts have stalled for years. Although the previous government identified 11 state-owned companies for privatization in 2023, none were actually sold. However, the new regime is aiming to speed up the process to improve the government's financial health. In February 2024, Kenya’s Cabinet approved the sale of seven more state owned enterprises bringing the total number to eighteen. Additionally, the Privatization Bill 2025 was assented to the Privatization Act 2025 which replaced the Privatization Act 2023, introducing new regulatory dynamics for privatizing public companies in Kenya. The Act intends to establish the Privatization Authority, streamline the regulatory framework for privatization, prohibit unfair trade practices, and promote transparency and public participation in Kenya’s privatization programme. In this week’s focus, we shall cover the following:

- History of SOE Privatization of Kenya,

- The Privatization Act 2025,

- The benefits of privatizing state-owned enterprises in Kenya,

- The progress of SOE privatization in Kenya, and,

- Recommendations and conclusion.

Section I: History of SOE Privatization in Kenya

The history of privatization in Kenya reflects a journey from the initial enthusiasm for state control and ownership of enterprises to a recognition of the inefficiencies and limitations of such a model. After gaining independence in 1963, Kenya established parastatals driven by various national goals outlined in Sessional Paper No. 10 of 1965 on African Socialism and its application in Kenya. These goals included accelerating economic and social development, addressing regional economic imbalances, promoting indigenous entrepreneurship, and encouraging both Kenyan and foreign investments. However, over time, it became evident that the state-controlled enterprises had significant shortcomings. Reviews conducted in 1979 and 1982 highlighted widespread inefficiencies, financial mismanagement, and political interference within parastatals. There was a realization that state ownership stifled private sector initiatives, resulted in low productivity, and burdened the government with excessive fiscal responsibility.

In response to these challenges, the Kenyan government-initiated measures to reform its public enterprises. The enactment of the State Corporations Act was one such effort aimed at streamlining management. However, despite these efforts, the performance of most state corporations continued to decline due to reliance on limited public sector financing, over-employment, corruption, and mismanagement.

The turning point came in July 1992 with the issuance of the Policy Paper on Public Enterprise Reform and Privatization. This marked the beginning of a structured privatization program aimed at divesting the government's ownership of commercial enterprises. The program categorized enterprises into non-strategic and strategic ones, with the former slated for privatization. During the first phase of privatization, which concluded in 2002, most non-strategic commercial enterprises were either fully or partially privatized. However, the impact on the economy was limited due to institutional weaknesses and the exclusion of large strategic companies from privatization.

Subsequent phases of privatization, including initiatives under the Economic Recovery Strategy for Wealth and Employment Creation (ERSWEC) and Vision 2030, focused on key transactions such as initial public offers (IPOs), concessioning, and strategic partnerships. These transactions aimed to mobilize investment resources, modernize infrastructure, and support the country's economic recovery and development agenda. Privatization under Vision 2030 sought to enhance efficiency, competitiveness, and market orientation in Kenya's economy. It aimed to subject more production to market forces, attract investment for infrastructure development, and increase government revenue through privatization proceeds and improved enterprise performance. Under ERSWEC, a number of key privatizations took place as outlined in the table below;

|

Cytonn Report: Government of Kenya Completed Privatizations |

|||||

|

Company |

Year |

Method of Privatization |

Government Share Before |

Government Share After |

Sector |

|

Safaricom |

2008 |

IPO |

60.0% |

35.0% |

Telecommunication |

|

Kenya Reinsurance Corporation |

2007 |

IPO |

100.0% |

60.0% |

Insurance |

|

Telkom Kenya |

2007 |

Strategic Sale |

100.0% |

49.0% |

Telecommunication |

|

Kenya Electricity Generating Company |

2006 |

IPO |

100.0% |

70.0% |

Energy |

|

Kenya Railways Corporation |

2006 |

Concessioning |

100.0% |

100.0% |

Transport |

|

Mumias Sugar Company 2nd Offer |

2006 |

IPO |

38.4% |

20.0% |

Manufacturing |

Source: Privatization Commission of Kenya

The history of privatization in Kenya reflects a transition from state control to a more market-oriented approach, driven by the recognition of the limitations of state-owned enterprises and the need for greater private sector participation in the economy.

Section II: The Privatization Act 2023

Kenya’s privatization of StateOwned Enterprises (SOEs) is now governed by the Privatization Act 2025, which the President assented to in October 2025, replacing the 2023 Act, which had repealed the 2005 Act. The new Act establishes the Privatization Authority under the National Treasury to oversee asset sales, directs proceeds toward national development, and introduces a more transparent framework with public participation and parliamentary oversight, while also speeding up the process by reducing steps and eliminating certain formalities. Supporting policies include the GovernmentOwned Enterprises (GOE) Act, 2025, which establishes a framework that governs the performance, accountability, and management of governmentowned enterprises, ensuring they operate efficiently, transparently, and in line with constitutional principles.

- Objectives of the Act

The Act establishes Kenya’s modern framework for privatization, ensuring that the process is not only about transferring ownership but also about strengthening governance, promoting transparency, and aligning with national development priorities. Its roles include:

- Streamline the regulatory and institutional framework for the implementation of privatization programmes - The Act creates a clear and structured system for how privatization should be carried out. By defining the institutions responsible, the procedures to be followed, and the checks and balances required, it eliminates ambiguity and duplication. This ensures that privatization is implemented in a consistent, predictable, and legally sound manner, thereby boosting investor confidence and protecting public resources.

- Prohibit restrictive or unfair trade practices that undermine competition and public interest - Privatization is not meant to create monopolies or allow private actors to exploit markets. The Act explicitly prohibits practices that restrict fair competition, such as collusion, insider dealing, or discriminatory access. This ensures that privatization contributes to a healthy, competitive economy where efficiency and innovation thrive, while safeguarding consumers and the wider public interest.

- Promote openness and public participation in privatization programmes to build trust and accountability - Transparency is central to the Act. It requires that privatization processes be open to public scrutiny, with opportunities for stakeholders, including workers, communities, and civil society, to participate. This builds legitimacy and trust, ensuring that privatization decisions are not made behind closed doors but reflect the voices and concerns of the people affected.

- Safeguard national interests and strategic assets while enabling private sector efficiency and innovation - The Act recognizes that not all public assets should be privatized. Strategic enterprises, such as those tied to national security, essential infrastructure, or constitutional obligations are protected. At the same time, it encourages private sector involvement in areas where efficiency, innovation, and investment can deliver better outcomes. This balance ensures that Kenya’s sovereignty and long-term interests are preserved while unlocking private sector dynamism.

- Mobilize resources for economic growth and fiscal stability, reducing the burden of underperforming state enterprises - Many state-owned enterprises have historically drained public finances through inefficiency and losses. The Act positions privatization as a way to relieve this fiscal burden by attracting private capital, generating revenue for the government, and redirecting resources toward priority areas such as infrastructure, healthcare, and education. This role ties privatization directly to Kenya’s broader economic growth and fiscal sustainability agenda.

The Privatization Act, 2025 transforms privatization into a comprehensive governance reform. By combining efficiency, transparency, competition, and social safeguards, it ensures that privatization strengthens Kenya’s fiscal health while protecting citizens and national interests.

- Institutional Framework of the Act

The Privatization Act 2025 introduces significant changes to the process and oversight of privatization in Kenya. Here are the key features of the new Act:

- Formation of the Privatization Authority: The Act establishes the Privatization Authority to replace the existing Privatization Commission. This new authority is endowed with expanded duties and roles, aimed at providing centralized oversight of privatization initiatives. The Privatization Authority is mandated to advise the government on all matters of privatization, facilitate the implementation of related policies, and oversee the Privatization Programme by executing specific proposals. It collaborates with local and international organizations, prepares longterm divestiture plans, monitors and evaluates progress, ensures compliance with the Act, and performs any other functions conferred under this or other legislation. The Authority shall be managed by a Board comprising a chairperson appointed by the President, the Principal Secretary responsible for privatization (or representative), the AttorneyGeneral (or representative), six competitively appointed members, and the Managing Director as a nonvoting exofficio member,

- Appointments of the Members: Similar to the Privatization Act 2005, the Cabinet Secretary is responsible for appointing of the six members of the Privatization Authority while the President is in charge of appointing the Board’s chairperson. Members are required to possess relevant skills and competencies outlined in the Act,

- Privatization Programme: The Act mandates the Cabinet Secretary to develop a comprehensive privatization programme, employing specific criteria for identifying entities for privatization, subject to approval by the Cabinet and subsequently by the National Assembly. This includes considerations such as alignment with government policies, strategic importance, and potential benefits,

- Privatization Strategies and Agreements: The Authority is tasked with approving policies related to the Authority and creating detailed privatization proposals, including financial health, valuation, and socio-economic impact assessments. The Act introduces privatization methods such as share sales via public tendering and emphasizes competitive bidding processes overseen by a designated committee. Privatization agreements must be prepared and approved, with provisions for regulating potential monopolies,

- Objections and Appeals: Individuals dissatisfied with decisions or implementations under the Act can file objections, which are assessed according to specified procedures. Further appeals can be made to the Privatization Review Board and, if necessary, to the High Court, and,

- Proceeds of Privatization: All proceeds generated from the sale of shares directly owned by the National Government shall be remitted to the Consolidated Fund, ensuring that the revenues are centrally accounted for and utilized to support national development priorities, fiscal sustainability, and the overall public interest.

Although the Privatization Act, 2025 closely mirrors the 2023 Act, it introduces two notable differences and improvements, as highlighted in the table below:

|

Cytonn Report: Key Differences between the 2023 and 2025 Privatization Acts |

|||

|

# |

|

2023 Act |

2025 Act |

|

1. |

Parliamentary Approval |

Under the 2023 Act, the privatization programme was formulated by the Cabinet Secretary and approved by the Cabinet, with the National Assembly’s role limited to ratification before implementation. Parliament could refuse to ratify and provide reasons, but if no action was taken within 90 days, the programme was automatically deemed ratified |

The privatization programme under this Act requires approval from both the Cabinet and the National Assembly. The National Assembly is vested with the authority to reject or propose amendments to any privatization proposal. |

|

2. |

Board Composition |

The Board included the Principal Secretary to the National Treasury, the Principal Secretary for investment promotion, the Secretary to the State Corporations Advisory Committee, and four competitively appointed professionals with specific qualifications and experience. |

The Board composition was streamlined to include only the Principal Secretary responsible for privatization, the AttorneyGeneral, six competitively appointed members without prescribed qualifications, and excluded the Treasury, investment promotion, and State Corporations Advisory Committee representatives |

Source: Privatization Commission of Kenya

The Privatization Act, 2023 was declared unconstitutional, null and void by the High Court on 24th September 2024 due to lack of adequate public participation, the unconstitutionality of Section 22(5) on automatic ratification after 90 days without parliamentary action, and the unlawful decision to privatize the Kenyatta International Conference Centre, a protected national monument. The Kenyan Privatization Act of 2025 marks a significant refinement in the management and procedures governing privatization efforts within the country. Notable changes include the strengthening of the Privatization Authority as a corporate body vested with extensive powers and responsibilities, building on the reforms of 2023. This restructuring reinforces corporate governance through the establishment of a professional oversight board and key positions such as the managing director and corporate secretary, ensuring accountability and operational efficiency. Additionally, the Act continues to grant the Cabinet Secretary for the National Treasury a pivotal role in formulating and ratifying privatization programs, but now introduces clearer checks and timelines to streamline approvals and mitigate bureaucratic delays. Concerns remain, however, regarding the potential concentration of power in the Cabinet Secretary’s office and the risk of monopolization in certain sectors, prompting calls for stronger parliamentary oversight and enhanced safeguards to guarantee transparency and accountability.

Moreover, the Act refines the scope of privatization options, emphasizing Initial Public Offerings and negotiated sales while maintaining the exclusion of concessions, leases, and management contracts. It strengthens provisions aimed at preventing unregulated monopolies and embeds dispute resolution mechanisms to address conflicts arising from privatization transactions. Importantly, the Act allows for the utilization of privatization proceeds to offset costs, introduces stricter penalties for offenses such as falsified information, insider trading, or collusion, and aligns privatization with constitutional values of equity, inclusivity, and fiscal responsibility. While the Act represents a long-awaited reform to address inefficiencies in state-owned enterprises, concerns persist regarding the balance of power and the potential for abuse, underscoring the need for vigilant oversight.

Overall, the Privatization Act of 2025 represents a significant step forward in Kenya’s privatization framework, aiming to streamline processes, enhance efficiency, and stimulate economic growth while raising important questions about accountability, transparency, and the equitable distribution of benefits.

- Methods of Privatization of State-Owned Enterprises

The Privatization Act, 2025 outlines several approaches through which government-owned enterprises can be transferred to private ownership. Each method serves a distinct purpose in balancing efficiency, transparency, and public interest.

- Initial public offer of shares - This involves offering shares of the SOE to the public for the first time through the stock exchange. It allows broad participation, giving ordinary citizens and institutional investors a chance to own part of the enterprise. The IPO method promotes transparency, market discipline, and inclusivity, while also deepening capital markets. In the past, the Government of Kenya undertook IPOs in KenGen and Safaricom, divesting 25.0% and 30.0% of its shareholding while maintaining residual stakes of 35.0% and 70.0% respectively. These privatizations were driven by the need to generate revenue, plug budget deficits, and stimulate activity at the Nairobi Stock Exchange (NSE).

- Sale of shares by public tender - Here, the government invites bids (offers) from interested buyers and sells shares to the highest or most suitable bidder, following strict rules in the Public Procurement and Asset Disposal Act (PPADA). This method ensures competitive pricing and fairness, as the process is open and transparent. It is often used when the government wants to attract strategic investors with proven capacity to manage and grow the enterprise. An example of this privatization strategy is the strategic sale of Telkom Kenya in 2007, which was facilitated by the IFC through a restructuring package that emphasized transparency and the need to balance the interests of multiple stakeholders, both public and private.

- Sale resulting from the exercise of pre-emptive rights - Pre‑emptive rights give existing shareholders the first opportunity to buy additional shares before they are offered to the general public or other external third parties. In privatization, this means current investors or partners in the SOE can increase their stake when the government divests. This method protects existing shareholders from dilution and maintains continuity in ownership and governance. In 1997, General Motors was privatized through the exercise of preemptive rights, with shares sold to existing shareholders and the government receiving proceeds amounting to Kshs 333.5 mn.

- Such other method determined by the cabinet - The Act provides flexibility by allowing the Cabinet to approve alternative methods of privatization when necessary. This could include innovative approaches such as public share floatation, management and employee buyouts and any other method the Cabinet seems fit. Public Share Floatation is a privatization method where shares are offered to the general public through the stock market, while Management and Employee Buyouts involve managers or employees acquiring shares or assets of a stateowned enterprise to gain controlling ownership. The role of the Cabinet here is to ensure that privatization remains aligned with national interests, economic priorities, and constitutional safeguards.

These methods reflect a balance between market-driven approaches (IPO, tender) and protective mechanisms (pre‑emptive rights, Cabinet discretion). Together, they ensure privatization is not only about raising revenue but also about deepening capital markets, safeguarding fairness, and protecting strategic interests.

Section III: The Benefits of Privatizing State-Owned Enterprises in Kenya

- Reduced fiscal burden - According to the Annual Public Debt Management Report for FY’2024/25, the government’s outstanding guaranteed debt to SOEs stood at Kshs 83.2 bn as at the end of June 2025. The SOEs that had been issued guarantees by the government include Kenya Ports Authority (KPA), Kshs 46.2 bn (55.5%), Kenya Electricity Generation Company (KENGEN), Kshs 27.4 bn (32.9%), and Kenya Airways (KQ), Kshs 9.7 bn (11.6%) shown in the table below:

|

Cytonn Report: List of Guaranteed Stock Balances in FY’2024/2025 |

|||

|

|

Agency |

Amount (Kshs mn) |

Percentage |

|

1. |

Kenya Ports Authority |

46,159.0 |

55.5% |

|

2. |

Kenya Electricity Generating Company (KENGEN) |

27,392.0 |

32.9% |

|

3. |

Kenya Airways |

9,690.0 |

11.6% |

|

Total |

83,241.0 |

100.0% |

|

Source: National Treasury

Additionally, the total publicly guaranteed debt by SOEs has recorded a 5- year CAGR of (11.9%), decreasing to Kshs 83.2 bn as at the end of June 2025 from the Kshs 157.2 bn recorded as at the end of June 2021. The decline in governmentguaranteed debt by June 2025 was mainly due to repayments of outstanding guaranteed loans. In particular, after Kenya Airways defaulted on its USD 525.0 mn aircraft loan, the debt was novated to the Government, which then settled arrears and repaid Kshs 19.7 billion in FY2024/25, reducing the overall guaranteed debt stock. Below is a graph showing the total publicly guaranteed debt by SOEs over the last five years.

Source: National Treasury

Privatization can help alleviate the financial burden on the government by transferring the responsibility of financing and operating SOEs to the private sector. Government funding for other essential services like healthcare, education, and infrastructure development may be freed up as a result,

- Raising revenue - Revenue raising is a key reason for the privatization of SOEs. The most immediate form of revenue comes from the proceeds of the sale, where the government collects substantial capital from selling its interest in enterprises to private investors, especially in the case of large and successful SOEs. Over time, privatized companies tend to become more efficient and profitable under private ownership and market discipline, thereby generating higher corporate tax revenues for the government. In addition, the funds raised from privatization can be directed toward debt reduction, lowering future interest payments and easing the overall public debt burden. Finally, privatization demonstrates a government’s commitment to market‑oriented reforms, which attracts both domestic and foreign investment, stimulates economic activity, and broadens the tax base,

- Increased efficiency - Privatization has been a popular strategy for enhancing SOE performance. When the entity's ownership moves from the public to the private sector, it is exposed to a competitive environment that drives it to optimize profits and output. In addition, the corporation will have to report to investors on a regular basis in a standard format, making it open to scrutiny and criticism from analysts and investors as a means of promoting corporate efficiency and accountability. Privatization can also lead to higher service quality and customer satisfaction as businesses seek to match consumer wants and remain competitive in the market. This can result in improved products, services, and innovation, eventually benefiting customers,

- Reduced political interference in management of SOEs - Kenyan state-owned enterprises (SOEs) are regularly utilized for political patronage. Government leaders exploit these enterprises to reward supporters and enrich themselves, rather than delivering critical services for citizens. This has led to mismanagement, corruption, and poor service delivery. Privatization can limit government meddling and promote business-like administration of these firms. Private firms prioritize profit and great services over political agendas. This eliminates corruption and promotes transparent and responsible management of state-owned enterprises (SOEs),

- Enhancement of capital markets - Privatizing state-owned enterprises in Kenya can benefit the capital markets by increasing market activity, diversifying investment opportunities, deepening market capitalization, boosting investor confidence, improving corporate governance standards, and facilitating capital formation. These benefits can help to improve the overall development and maturity of financial markets, hence boosting economic growth and prosperity, and,

- Unlocking value and asset utilization - Privatization's role in unlocking value and asset utilization lies in its ability to transform underperforming or mismanaged state assets into productive, profitable entities. By transferring ownership to private owners, who often possess the expertise, resources, and incentive structures necessary for efficient operation, privatization can catalyze the revitalization of dormant or underutilized assets. These new owners are typically driven by profit motives, thus incentivized to maximize the asset's potential, whether through operational improvements, strategic investments, or innovative approaches. As a result, privatization can lead to heightened asset productivity, optimal resource allocation, and improved financial performance, ultimately generating greater returns for both the private owners and the broader economy.

Section IV: Progress of SOE Privatization in Kenya

Since 2008, the Privatization Commission has been unable to successfully privatize any state-owned enterprises, owing in part to operational issues such as a lack of a board and external challenges such as legal and stakeholder opposition. Kenya last privatized a state-owned corporation in 2008 with an initial public offering (IPO) of 25.0% of the shares in telecommunications firm Safaricom. In November 2023, following the approval of the Privatization Act 2023 to lead the process, the government was preparing to privatize 35 state-owned firms. The National Treasury and Economic Planning Ministry declared 11 government parastatals slated for privatization. In a public notice issued on 27th November 2023, the exchequer claimed that the proposal was consistent with Section 21(1) of the Privatization Act of 2023, which requires the Treasury Cabinet Secretary to select and designate firms for inclusion in the Privatization Programme. The corporations included:

- Kenyatta International Convention Centre (KICC),

- Kenya Pipeline Company (KPC),

- New Kenya Cooperative Creameries (KCC),

- Kenya Literature Bureau (KLB),

- National Oil Corporation of Kenya (NOCK),

- Kenya Seed Company Limited (KSC),

- Mwea Rice Mills Ltd (MRM),

- Western Kenya Rice Mills Ltd (WKRM),

- Numerical Machining Complex Limited (NMC),

- 35.0% of Vehicle Manufacturers Limited (KVM), and,

- Rivatex East Africa Limited (REAL).

However, the privatization process for the initial 11 parastatals was temporarily halted by the High Court pending further deliberation. This decision followed a case filed by Mr. Raila Odinga’s Orange Democratic Movement (ODM), asserting that these entities are of strategic national interest and necessitate a referendum for public approval. Additionally, the court's intervention reflects broader concerns regarding the potential impact of privatization on employment and service provision, prompting a reassessment of the privatization strategy's implications for citizens' welfare and economic stability.

In February 2024, Kenya’s Cabinet approved the privatization of seven more state-owned enterprises, expanding the total count of entities slated for privatization to 18. The additional seven that adds up to 18 were:

- Development Bank of Kenya

- Golf Hotel Limited

- Sunset Hotel Limited

- Mt Elgon Lodge Limited

- Kabarnet Hotel Limited

- Mombasa Beach Hotel

- Ngulia Safari Lodge

This decision, ratified during a session chaired by President William Ruto at State House, Nairobi, reflects the government's commitment to harnessing private sector investment for the advancement of crucial sectors. Notably, among the enterprises earmarked for privatization is the Development Bank of Kenya, which has evolved into a fully-fledged commercial bank under the regulatory purview of the Central Bank of Kenya (CBK). This move underscores a strategic alignment with the government's agenda to invigorate economic growth and development through private sector participation. In addition to the Development Bank, other entities marked for privatization include Golf Hotel Limited, Sunset Hotel Limited, Mt Elgon Lodge Limited, and Kabarnet Hotel Limited. Furthermore, properties under the Kenya Safari Lodges and Hotels Limited umbrella, specifically Mombasa Beach Hotel, Ngulia Safari Lodge, and Voi Safari Lodge, are also slated for sale. The Cabinet anticipates that privatization will catalyze expansion within the hospitality sector, fostering job creation and bolstering business opportunities. This strategic initiative harmonizes with the ongoing revitalization of the tourism industry, propelled by Kenya’s Visa-Free entry policy. Additionally, the decision to privatize these enterprises followed an earlier proposal by the Kenya Kwanza administration to privatize 11 entities.

The National Treasury announced that it targets to raise Kshs 149.0 bn in FY’2025/26 through the privatization of StateOwned Corporations. Among the headline privatization moves are the planned sale of a 65.0% stake in Kenya Pipeline Company (KPC) through an IPO by 31st March 2026 and the offloading of a 15.0% stake in Safaricom.

- Kenya Pipeline Company (KPC) Privatization

The Kenya Pipeline Company (KPC) is fully owned by the government of Kenya, with 99.9% of the shares held by the National Treasury and 0.1% by the Ministry of Energy and Petroleum. The company is responsible for transporting, storing, and distributing petroleum products from the coast (Mombasa) inland to various towns and neighboring countries, using an extensive pipeline network of 1,342 kilometres of pipeline. The government aims to get proceeds of approximately Kshs 100.0 bn from the IPO. It is important to note that KPC has no debt liability guaranteed by the government nor is it a loss‑making SOE, as evidenced by a 52.6% increase in profit after tax to Kshs 6.9 bn in FY’2024 from Kshs 4.5 bn in FY’2023. Additionally, in FY'2024 the total assets for the company came in at Kshs 120.7 bn while the tangible book value was at Kshs 89.0 bn. The privatization of Kenya Pipeline Company through a public share offering is intended to unlock the company’s potential, raise funds for the FY’2025/26 budget, provide access to longterm capital for infrastructure growth and technology upgrades, attract foreign direct investment, job creation, and diversification of investment risk. These outcomes will reduce government bureaucracy, strengthen corporate governance, enhance the company’s capacity to meet rising domestic and regional energy needs, and broaden the government’s revenue base without diminishing private sector wealth.

- Safaricom Privatization

Safaricom announced on 4th December 2025 that Vodafone Kenya Limited intends to acquire 15.0% of the Government of Kenya’s 35.0% stake in Safaricom PLC, amounting to 6,009,814,200 shares at Kshs 34.0 per share, valued at Kshs 204.3 bn. Additionally, the government will sell its rights to future dividends from the remaining 20.0% stake for an upfront payment of Kshs 40.2 bn, bringing the total value of the transaction to Kshs 244.5 bn. Notably, in FY’2025, the government received dividends worth Kshs 16.8 bn from Safaricom. In the short term, ceding future dividends provides the government with immediate liquidity of Kshs 40.2 bn to meet urgent budgetary needs, fund strategic projects such as infrastructure and the Sovereign Wealth Fund, and reduce reliance on highinterest debt while mitigating risks from market volatility. However, in the long term, this decision forfeits a reliable revenue stream, effectively discounts future earnings, reduces fiscal flexibility, and risks undervaluing Safaricom’s potential growth, leaving future governments without a steady source of dividend income. The offer has attracted public criticism, with concerns that it should have been executed through a public offering and that the sale was undervalued, given Safaricom’s all‑time high of Kshs 44.7 in August 2021. In response, the government has justified the sale to Vodacom by arguing that the general public would likely bid below the current market price and that a local sale could have flooded the market, leading to further dilution of Safaricom’s share price.

Prior to the acquisition, Vodafone Kenya held 39.9% of the shareholding with 16.0 bn shares while the government held 35.0% stake with 14.0 bn shares. Following the acquisition, Vodafone’s shareholding will increase to 54.9% with 22.0 bn shares, while the government’s stake will decline to 20.0% with 8.0 bn shares. The table below shows the top shareholders in Safaricom (ordinary shares only):

|

Cytonn Report: Safaricom Plc shareholding structure |

|||||

|

|

|

Before Acquisition |

After acquisition |

||

|

|

Agency |

Number of shares |

% Shareholding |

Number of shares |

% Shareholding |

|

1. |

Vodafone Kenya Ltd |

16,000,000,000 |

39.9% |

22,009,814,200 |

54.9% |

|

2. |

CS National Treasury |

14,022,572,580 |

35.0% |

8,012,758,380 |

20.0% |

|

3. |

Others |

10,042,855,420 |

25.1% |

10,042,855,420 |

25.1% |

|

Total |

40,065,428,000 |

100.0% |

40,065,428,000 |

100.0% |

|

Source: Safaricom Annual Report

Additionally, since the payment will be made in US dollars, it will boost Kenya’s foreign reserves and further support the stabilization of the Kenyan shilling. The funds from this transaction will serve as the seed capital for both the National Infrastructure Fund and the Sovereign Wealth Fund, providing the initial resources needed to finance large‑scale development projects and strengthen long‑term investment capacity. By channeling proceeds into these strategic funds, the government aims to accelerate infrastructure modernization, diversify revenue streams beyond traditional taxation, and enhance economic resilience against external shocks.

The Government of Kenya’s proposed partial divestiture in Safaricom reflects the growing strength and maturity of the economy and capital markets, while providing an innovative financing mechanism to support priority infrastructure projects without increasing debt or taxation. At this critical turning point, private sector participation is essential to bridge infrastructure gaps, enhance service delivery, and promote sustainable development. The transaction will raise capital at a premium to market value, attract foreign currency inflows, and accelerate economic growth, allowing the government to retain a significant stake and influence in Safaricom. By partnering with Vodafone, one of the world’s leading telecommunications companies, Safaricom will benefit from global best practices and expertise, strengthening its operations in Kenya and Ethiopia.

The trajectory of privatization of state-owned enterprises (SOEs) in Kenya has been marked by notable challenges and progress since 2008. Despite the Privatization Commission's previous inability to effectively privatize any SOEs due to operational issues and external opposition, the approval of the Privatization Act 2025 signified a renewed commitment to the process. While the initial privatization efforts faced legal hurdle, recent developments, including the progress with the Safaricom and Kenya Pipeline Company privatizations, underscore the government's determination to leverage private sector investment for economic advancement. As Kenya navigates the complexities of privatization, careful consideration of stakeholder interests and economic implications remains paramount to ensure sustainable progress and inclusive development in the years ahead.

Section V: Recommendations and Conclusion

In our analysis, we have identified several key recommendations aimed at enhancing the effectiveness and transparency of Kenya's privatization efforts. These include:

- Transparency and Accountability – The Privatization Act 2023, did not include the parliamentary approval stage in the privatization of SOEs, which led to concerns on lack of transparency due to insufficient oversight and limitation of public participation. The government should therefore ensure that information about the privatization process, including the selection criteria, valuation methods, and decision-making processes, is made accessible to the public. Additionally, mechanisms for monitoring the performance of privatized entities and accountability for the use of privatization proceeds should be established. Through the Privatization Act 2025, we have observed tighter regulatory oversight with mandatory approvals of Privatization Programmes by the National Assembly. While this embeds transparency and accountability, the risk lies in the potential downsides of having Parliament as the final approver, such as political influence over economic decisions, the danger of a ‘captured’ legislature serving vested interests, and the possibility of delays that could stall or derail timely implementation of privatization programmes,

- Developing Vibrant Capital Markets: One of the key avenues for privatization is through sales of shares through listing. However, our capital markets, save for government debt markets, are as good as dead with the last IPO having been done ten years ago. The most recent entry to the NSE was by way of introduction, not an IPO, when Shri Krishana Oversees joined in July 2025. Consequently, the planned KPC IPO will mark the first true public offering in a decade. In tandem with privatization initiatives, the government needs to take specific steps to reactivate our capital markets. Some of the steps include:

- Reducing red tape and bureaucracy associated with listing Reducing the minimum amounts required for raising

- capital in some sectors such as real estate from Kshs. 5 million

- Allow for sector specific funds such as technology, telecoms and housing funds so that there is a pool of capital dedicated to specific sectors

- Remove banks as the supervisors for mutual funds but allowing for corporate trustees rather than limiting trustees to only banks

- Supplement capacity in CMA with industry experience in actual capital markets

- Capacity Building - Building institutional capacity within the Privatization Authority and other relevant government agencies is essential for effective implementation of the privatization program. This includes developing expertise in areas such as valuation, transaction structuring, legal frameworks, and regulatory oversight. Investing in training and professional development for staff involved in privatization activities can enhance their ability to manage complex transactions efficiently,

- Safeguarding Public Interest - While privatization aims to enhance efficiency and stimulate private sector participation, it's crucial to ensure that public interest is safeguarded. This includes protecting consumer rights, ensuring access to essential services, and preventing monopolistic practices. The Government can do this by collaborating with Civil Societies (CSOs). CSOs can ensure that the privatization process is transparent and that the interests of all stakeholders are considered. CSOs can provide input on the terms and conditions of the concession agreements, which can help to ensure that the privatization process is fair and equitable,

- Justification of Privatization Methods - Privatization methods, whether trade sales, public share offerings, or management and employee buyouts, must be objectively justified on a case‑by‑case basis. The choice of approach should reflect the size of the enterprise, prevailing market conditions, and the overall goals of the privatization program. Governments should prioritize competitive bidding, with trade sales conducted through auctions among potential investors and buyouts allowing for bids beyond those of corporate insiders. Enterprises slated for privatization should be permitted to restructure their capital as needed, while strong governance frameworks must be in place to ensure SOE management continues to act in the best interests of the government as owner. The government should be transparent and provide the public with clear justification for the privatization method chosen, as this builds trust, enhances accountability, and ensures that stakeholders understand how the selected approach serves national interests and maximizes value, and,

- Debt Restructuring - We recommend the government to embark on measures to improve the operating efficiency of the cash-strapped SOEs in order to make them more attractive to investors during privatization. The government can take into consideration converting part of the company’s debt into equity, with the government taking an ownership stake in the companies. It is evident that Kenya's privatization efforts have yielded mixed results. This suggests a need to focus on implementing well-targeted programs effectively to ensure they meet their intended goals.

Privatization of state-owned enterprises is a critical policy tool for Kenya, not only to ease fiscal pressures by reducing debt and budget deficits, but also to stimulate economic growth through private sector investment. Strategic divestitures deepen capital markets, attract foreign inflows, and enable the government to realize optimal value from mature assets while avoiding future dilution risks. By leveraging private sector efficiency and global expertise, privatization supports infrastructure financing, strengthens Kenya’s competitiveness as an investment hub, and safeguards the long-term growth of enterprises like Safaricom. To maximize these benefits, privatization must be pursued transparently, guided by clear objectives, and aligned with national development priorities. Kenya's endeavour to privatize its loss-making State-Owned Enterprises (SOEs) holds promise for fostering economic growth and development, but it necessitates meticulous planning and execution to circumvent the pitfalls witnessed in similar processes elsewhere. Additionally, if Kenya successfully addresses the challenges of integrity and governance culture, the Privatization Authority’s mandate should be broadened to include regular reviews of privatized enterprises and, based on those assessments, determine whether targets and goals have been achieved, identify challenges, and provide guidance for subsequent privatizations. Transparency, capacity building, and safeguarding the public interest are crucial elements. We expect the government to be able to expedite the privatization process and easily offload the non-strategic SOEs that continue to burden public expenditure. We also expect the move to spur new listings at the Nairobi Securities Exchange (NSE), which will increase activity and diversify the bourse’s offerings which will subsequently attract foreign investors.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.