Oct 23, 2022

The former President Uhuru Kenyatta launched Kenya’s affordable housing initiative in 2017, as part of the key pillars of the ‘Big Four Agenda’ with the aim of delivering 500,000 units by December 2022. However, due to various setbacks, the government delivered less than 3,000 units through the Pangani and Park Road projects, indicating a massive deficit in the delivery. To support the initiative, President William Ruto outlined affordable housing as one of his main agenda with the aim of delivering 200,000 units per year, and a target of 5,000 units per county. Barely two months into his reign the president has; i) floated a mortgage plan that will allow tenants to own homes through monthly rental payments in the Mukuru Kwa Jenga project, and, ii) announced plans to commission an affordable housing project consisting of 5,000 units in Homa Bay County with a start date of November 2022.

We have been tracking the progress of affordable housing with the following reports:

- In April 2018 we covered the Affordable Housing in Kenya where we discussed whether the delivery of affordable housing can be a reality and concluded that the initial plan was very useful but some elements needed to be addressed to increase the likelihood of success,

- In May 2020 we covered a topical on Accelerating Funding to Affordable Housing where we discussed ways of accelerating funding for affordable housing and concluded that there was need to mobilize alternative sources of funding, particularly the opening up of capital markets access to developers, to provide a low-cost capital raising mechanism, and,

- The most recent topical being Affordable Housing in Kenya which was done in January 2022. Here, we focused on the status of affordable housing in the Nairobi Metropolitan Area (NMA) and benchmarked with more established case studies with the aim of giving recommendations on what can be done to achievement the initiative.

This week, we seek to review the initiative with a focus on the feasibility of the current government’s plan to deliver 200,000 housing units annually for the next five years, a total of one million units. We shall cover the topic by looking into the following:

- Introduction,

- Current State of housing in Kenya,

- The Affordable Housing Initiative in Kenya,

- Analysis of Affordable Housing in other countries, and,

- Recommendations and Conclusion.

Section I: Introduction to Affordable Housing

Affordable housing refers to a housing plan that is appropriate for the needs of a range of very low to moderate-income households and priced so that these households are also able to meet other basic living costs such as food, transport, clothing, medical care and education. According to the Kenya National Bureau of Statistics (KNBS), 74.4% of Kenyan employees in the formal sector earn a monthly median gross income of Kshs 50,000 or less, implying that a large percentage of these individuals would benefit from the plan. Using the UN Habitat definition of Affordable housing, assuming one is able to spend 30.0% of their income into housing, at a commercial mortgage rate of 12.0% and for a 25-year mortgage, it means an affordable house is a house that is valued at Kshs 1.0mn for a single income household and Kshs 2.0 mn for a double income household.

However, the government has developed its own definition of affordable housing as follows;

- Social Level: This category includes individuals with monthly income below Kshs 19,999, which represents 2.6% share of formally employed people in the country,

- Low Cost Level: This category includes individuals with monthly income between Kshs 20,000 – Kshs 49,999, which represents 71.8% share of formally employed people in the country, and,

- Mortgage Gap Level: This category includes individuals with monthly income between Kshs 50,000 – Kshs 149,000, which represents 22.6% share of formally employed people in the country.

Given the above, the initiative targets 97.0% of individuals in the formal sector, which is relatively high and signifies the need to provide affordable homes in a bid to curb Kenya’s housing deficit while also promoting home ownership rates in the country. The table below gives a summary of what constitutes the average sizes and prices of affordable housing units in comparison to the current apartment prices in the Nairobi Metropolitan Area;

|

Cytonn Report: Comparison of Affordable Housing Units and Apartment prices in the NMA |

||||||

|

Typology |

Size (SQM) |

Unit Price (Kshs mn) |

Price per SQM (Kshs) |

Unit Price of a similar apartment (Kshs mn) |

Price per SQM of a similar apartment (Kshs) |

Price Per SQM Difference |

|

1 |

30 |

1.0 |

33,333 |

2.4 |

80,573 |

58.6% |

|

2 |

40 |

2.0 |

50,000 |

3.5 |

87,500 |

42.9% |

|

3 |

60 |

3.0 |

50,000 |

5.5 |

91,667 |

45.5% |

|

Average |

|

|

44,444 |

|

86,580 |

49.0% |

Source: Boma Yangu

As seen above, the government program is 49.0% cheaper than similar apartments. In a bid to attract potential buyers of the affordable housing units, the National Housing Corporation Strategic Plan 2019-2023 outlines different ways in which buyers can be financed in order to purchase the units;

- Social level and low Cost buyers to be financed through the Tenant Purchase Scheme (TPS) for over 25-year’s period with a 3.0% - 7.0% interest,

- The Mortgage Gap buyers to be financed through affordable mortgages in the open market with intervention of the Kenya Mortgage Financing Corporation (KMRC), and,

- Housing loans for individuals living in rural and peri-urban areas capped at 7.0% interest rate to finance personal initiative of constructing housing units in those areas.

It is worth noting that it is not clear how 7.0% financing rates will be achieved since the government itself is borrowing at 14.0% for a 25-year bond, hence not clear how KMRC will be able lend the 7.0% unless it’s assumed that there will be a government subsidy.

Section II: Current State of Housing in Kenya

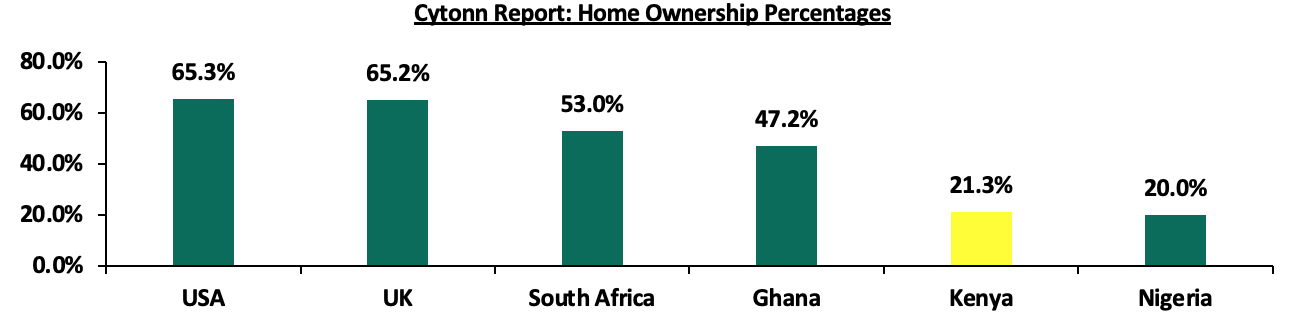

The National Housing Corporation estimates that the current housing deficit in Kenya stands at 2.0 mn housing units with nearly 61.0% of urban households living in informal settlements. The deficit continues to rise due to fundamental constraints on both the demand and supply side. The need for 250,000 housing units against an estimated supply of 50,000 units every year results into an annual deficit of 200,000 dwelling units. Additionally, KNBS indicates that 83.0% of the existing housing supply is distributed between the high income and upper-middle-income segments, with only 15.0% for the lower middle and the remaining 2.0% for the low-income population. Therefore, only 17.0% of the housing supply goes into serving the lower-middle income segment, which does not achieve the main objective of the initiative. Consequently, Kenya’s home ownership rates continue to lag behind, compared to other African countries such as South Africa and Ghana, as shown below;

Source: Centre for Affordable Housing Africa

Section III: Affordable Housing Initiative in Kenya

Kenya’s affordable housing initiative though not entirely new was launched in 2017 in order to provide citizens with low-cost decent homes while also reducing Kenya's housing deficit and increasing home ownership rates. The government thus implemented strategies to ensure that their objectives were met, such as;

- Closing the annual low-income housing gap by 60.0%,

- Reducing the cost of construction per SQM which in turn lowers cost of housing units,

- Increasing the construction sector contribution to GDP,

- Addressing interest rate and tenure in order to enhance affordability of homes, and,

- Increasing the budgetary allocation, among others.

Moreover, the government came up with various bodies and a platform to help realize its initiative such as;

- Boma Yangu Portal aimed at enhancing transparency of the initiative while also making it easier to track its progress,

- Kenya Mortgage Refinance Company (KMRC) mandated to provide home loans to potential buyers through Primary Mortgage Lenders such as commercial banks and Saccos among others, and,

- National Housing Cooperation (NHC) aimed at implementing policies and overseeing the development of initiated projects.

Despite this, the objectives of the initiative have not been fully met with approximately only 1.0% of the housing units delivered so far. This has been primarily on the back of various setbacks such as inadequate funding. Some of the projects in the pipeline within the Nairobi Metropolitan Area include;

|

Cytonn Report: Summary of Notable Ongoing Affordable Housing Projects in the Nairobi Metropolitan Area |

|||

|

Name |

Developer |

Location |

Number of Units |

|

Pangani Affordable Housing Program |

National Government and Tecnofin Kenya Limited |

Pangani |

1,562 |

|

River Estate Affordable Housing Program |

National Government and Edderman Property Limited |

Ngara |

2,720 |

|

Park Road Affordable Housing Program |

National Housing Corporation |

Ngara |

1,370 |

|

Mukuru Affordable Housing Program |

National Housing Corporation |

Mukuru, Enterprise Road |

15,000 |

Source; Boma Yangu Portal

In addition to the above, there exist various privately initiated affordable housing projects aimed at fast tracking the program such as;

|

Cytonn Report: Private Affordable Housing Projects in the Nairobi Metropolitan Area |

|||

|

Project Name |

Developer |

Location |

Number of Units |

|

Kentek Ventures |

Kentek Venture Limited |

Ruiru |

53,716 |

|

Moke Gardens |

Moke Gardens Real Estate |

Athi River |

30,000 |

|

Habitat Heights |

Afra Holding Limited |

Mavoko |

8,888 |

|

Tsavo Apartments |

Tsavo Real Estate |

Embakasi, Riruta,Thindigua, Roysambu and Rongai |

3,200 |

|

Unity West |

Unity Homes |

Tatu City |

3,000 |

|

RiverView |

Karibu Homes |

Athi River |

561 |

Source: Online Search

The under-supply of housing units continues to remain a challenge owing to factors such as;

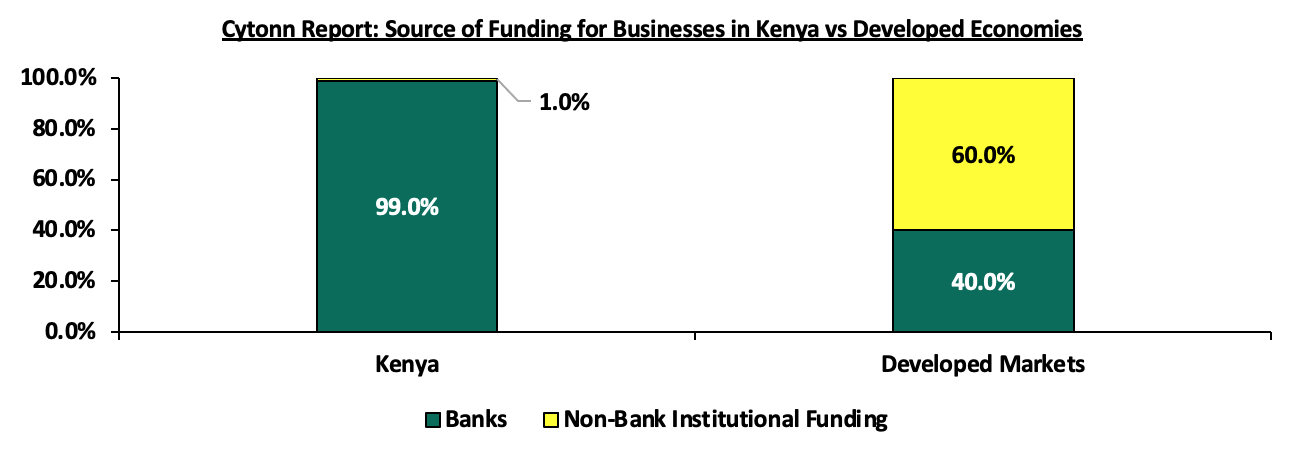

- Inadequate Funding: Assuming the average production cost for a house will be 2.0 mn, to produce 200,000 houses per year will cost the government Kshs. 400.0 billion yet only Kshs 20.3 bn was allocated to the housing sector with the affordable housing initiative only getting Kshs 2.7 bn in the FY’22/23 budget. If the initiative is taken seriously, it would mean allocating 12.1% of the Kshs 3,3 tn budget to housing, and it’s not clear from which budget allocation it would be taken from. Consequently, funding continues to be a major challenge. This has further been fueled by the overreliance on banks for funding by private developers hence making it difficult to raise funds for affordable housing projects, unlike developed countries where capital markets account for majority of funding as highlighted below;

- Increasing cost of construction: According to Integrum 2022 Construction Index, the average cost of construction per SQM in Kenya has risen by 3.6% to Kshs 34,650 in 2022 from Kshs 33,450 in 2021. This is attributable to rise in prices of key construction materials such as cement and steel which in turn increased the cost of development hence projects stalling,

- Rising demographics surpassing the existing supply: Kenya has a high urbanization and population growth rates at 4.0% and 2.3%, respectively, compared to global averages of 1.6% and 1.2%, respectively, as at 2021. This increases the demand for housing amidst an existing under supply,

- Inadequate supply of development land due to high cost of land: There is scarcity of affordable land for development due to rising land prices in urban areas with the average land prices in the NMA coming in at Kshs 130.42 mn as at Q3’2022, a 1.6% increase from Kshs 130.41 mn recorded in Q3’2021,

- Challenging access to construction finance loans due to adverse financial terms: There has been rising loan default rates which has seen financial institutions ask for more collateral from borrowers,

- Ineffectiveness of Public-Private Partnerships (PPPs) for affordable housing development owing to setbacks such as extended PPP timelines and lack of clarity on returns and revenue-sharing, among others,

- Longer transaction timelines: It takes 44 days to register a property in Kenya with the average cost to register the property standing at 5.9% of the property price. This is higher when compared to some African countries like Ghana, which takes 33 days, with the average cost coming in at 4.1%, illustrating the generally slow processes in Kenya,

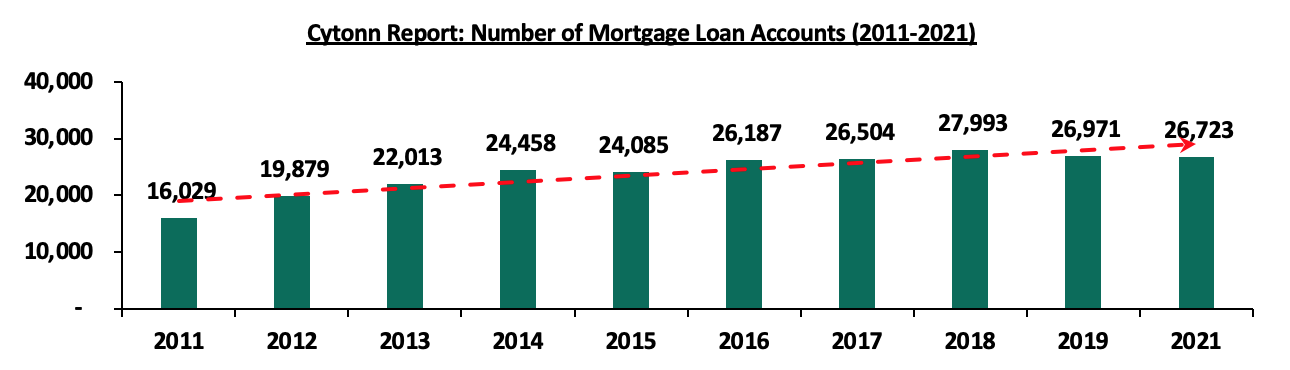

- Unaffordable and inaccessible mortgages for those willing to be homeowners: Accessing mortgage by low income earners is a difficult task, given that mortgages require decent formal employment, a piece of land or property to act as collateral, as well as the rising cost of construction making prices of developments high and in turn causing low mortgage accounts as shown below:

Source: Central Bank of Kenya

Given the above challenges, it is clear that for the affordable housing initiative to prosper, the government needs to address the challenges in a better and strategic way. So far, the President has outlined plans to achieve the initiative, as follows;

- Involvement of private sector developers in the delivery of the projects,

- Creation of mandatory housing funds by parliament to help develop the projects,

- Engagement of pension institutions to help provide mortgages to potential homebuyers, and,

- Release of land by county governments for construction,

Despite the above plans, it is still unclear where the funds will come from, given the high construction costs. In addition, no incentives have been put in place to encourage large numbers of private sector developers to participate in the initiative. Also, the uptake of homes under pension schemes has been low as the number of individuals exiting the scheme increases owing to various setbacks hence it is not clear to which extent the schemes will be of help. In our view, the affordable housing initiative heavily relies on the government’s effectiveness and given the bureaucracy of Kenya’s County governments, it is unclear how the President intends to synchronize the various counties in order to achieve this objective.

Section IV: Analysis of Affordable Housing in Other Countries

In our previous topicals on Affordable Housing in Kenya, Accelerating Funding to Affordable Housing and Affordable Housing in the Nairobi Metropolitan Area (NMA) covered in April 2018, May 2020, and January 2022 respectively, we highlighted several countries such as Singapore, Canada, South Africa, among others, that have achieved notable milestones in affordable housing. This week, we will look at various lessons that we can learn from the aforementioned countries on suitable affordable housing initiatives;

|

Country |

Cytonn Report: Key Take-Outs |

|

Singapore |

|

|

Estonia |

|

|

Canada |

|

|

South Africa |

|

|

Japan |

|

From the case studies, the number of housing units constructed per year in the selected countries is significantly higher than that in Kenya, with only 431 units having been completed in 2021. This is due to a number of factors in these countries, such as long-lasting government initiatives, ready monetization of housing assets, higher government subsidies and, better sector government regulation. However, we note that the average number of units on an annual basis for each of the countries is way below the 200,000 housing units targeted by the Kenyan government, hence calling into question the feasibility of the 200,000 per year target. The table below shows the number of affordable housing units delivered so far in the respective case study countries;

|

Cytonn Report: Summary of number of affordable housing units delivered in 2021 in the respective case study countries |

|

|

Name |

Number of Units Completed |

|

Singapore |

10,400 |

|

Estonia |

6,735 |

|

Canada |

56,207 |

|

South Africa |

6,000 |

|

Average |

7,578 |

N/B: Average done exclusive of Canada

Section V: Recommendations and Conclusion

From the above analysis, we recommend the following to be implemented to accelerate the affordable housing initiative in Kenya;

- Set a housing goal that is credible: It is not clear how the 200,000 units per year was arrived at, but it does not seem achievable looking at what other select countries have done given an average of 7,578 units per year, and these are more advance economies. For the initiative to gain traction, it needs to be taken seriously, and to be taken seriously the target needs to be something that is credible,

- Focus on Demystifying Capital Markets: Lack of funding is the biggest obstacle to provision of housing and for the housing agenda to be achieved, the majority of capital has to come from Capital Markets. As discussed above, it would require about Kshs 400.0 bn per year to meet the government target, yet in the latest financial year only Kshs. 2.7 bn was allocated to the sector, leaving a huge gap. The government should tap into capital market products such as infrastructure bonds, asset-backed securities, and Real Estate Investment Trusts (REITS). These can provide more funding for the ongoing and future housing projects, allow lenders to free up capital to make more loans, and, provide a way to earn income from the mortgage payments made by homeowners. However, these instruments still attract low interests from Kenyan investors due to numerous obstacles to capital formation in our capital market. For example, REITS legislation has been in existence for almost 10 years, and so far there is only one listed REIT,

- Increase Financing By Improving PPP Operation: Currently, the Kenyan government is employing PPPs to undertake the development of infrastructure and affordable housing projects in the country. However, various challenges such as high transaction costs, lengthy procurement processes, bureaucracy, and lack of focus towards public benefits hamper their optimal operation, leading to slowed delivery of projects. The government should address these challenges by increasing budgetary support for PPPs, decentralizing PPPs to the county level, and continually streamlining the Public Private Partnerships (PPP) Bill 2021,

- Reduce Construction Costs Through Innovation: Housing developers, contractors, and other industry participants should seize the chances for the development of affordable housing through technologies that implement standardized building designs, components, and alternative materials such as prefabricated concrete panels to make a difference in the housing situation in Kenya. By using these innovative methods, developers will increase the affordability of units through reduced costs, and further speed up the completion of construction projects. Canada has been using modular construction technology, which allows for speedier prefabrication of homes in a factory setting. This technology has less impact on the environment, can be applied in any type of modern construction, and reduces the cost of construction by reducing the amount of time and labor required on-site,

- Create a Better Quality-Control Policy Framework: There is need for a policy framework to ensure that developers comply with sustainable standards and that the units are affordable for low and middle-income households. There is also need for a policy framework to guide the standards the affordable housing units should achieve in terms of design, size of units, location and long-term maintenance. This should also ensure that there is no deterioration of housing standards over time and that those developers do not abandon or compromise the quality of housing they provide to low-income earners. In Japan, there are three important public systems related to sustainable housing design, namely the Housing Performance Indication System (HPIS), long-life quality housing (LQH) certification, and Comprehensive Assessment System for Built Environment Efficiency (CASBEE) for detached houses. The Japanese government has established a number of independent third-party organizations to monitor and audit compliance with the systems. The government also provides financial incentives to developers who comply, such as reduced interest rates on loans for affordable housing projects,

- Increase Serviced Land for Development: Affordable housing projects require land which is serviced with infrastructure and in economically viable. There is therefore need for the government to set up measures to increase the supply of serviced land, through increased investment in physical and social infrastructure especially in still developing areas of the country. The government should also encourage the construction of infrastructure by private developers through incentives such as rebates. The South African government has increased available serviced land for government housing projects by making it easier for municipalities to rezone land for housing purposes, and by establishing a fund to finance the infrastructure necessary to develop serviced land through the National Housing Development Agency (NHDA),

- Devolve the Management of Housing Assets: To ensure that even residents can easily acquire and maintain homes, the government should concentrate more on creating an environment that is favorable to owners and investors, by promoting management of housing through the private sector. This can reduce the burden on the government from continually maintaining housing units once developed, and diverting the funds towards initiation of other projects. In Estonia, homeowners are responsible for their apartments, but apartment associations take active role in the management and renovation process of the building and the living environment surrounding. This is through a board that oversees the maintenance of the building, whose decisions are passed by majority vote, thereby ensuring that all residents have access to essential amenities,

- Increase Stakeholder Engagement to Ease Challenges with Relocation: There should be more public participation and consultations to avoid relocation resistance by tenants to the new houses. The government should develop a policy to support tenant relocation to the subject affordable housing developments, which could help to ensure that the process is conducted in a more transparent and efficient manner. The government should also set up a fund to help with costs incurred by the target beneficiaries, which will offset the challenges associated with relocation and provide for a smoother transition for those relocated to the new houses. In South Africa, the Department of Human Settlements (DHS) manages the process of moving tenants to new government housing. The DHS engages with civic organizations and academia to share good practice, exchange knowledge and disseminate information regarding the access of housing for South African citizens. The department is also responsible for identifying accommodation for tenants, as well as coordinating the move itself, and,

- Creation of a Housing Finance Company to finance the supply side of Real Estate development, the same way we have KMRC to finance the demand side through provision of mortgages for potential home buyers.

In conclusion, the Kenyan government's affordable housing initiative is a welcome and necessary intervention in the provision of adequate housing for all Kenyan citizens. The initiative, if successful, will go a long way in addressing the housing crisis in the country and improving the lives of many Kenyans, even as it will create many jobs. Our assessment finds that the initiative is off to a good start, with a number of projects already underway. We expect that the projects undertaken in the initiative will enhance development in all sectors of the economy as the country further develops. However, we believe that 200,000 housing units annually is way ambitious given the existing challenges; put simply we don’t see a path to achieving that goal without radical action to remove the systemic obstacles to capital formation. As such, the government should execute comprehensive solutions to these challenges by taking lessons from other affordable housing initiatives, thereby allowing the affordable housing initiative to at least keep up with the other countries.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.