Nov 11, 2018

The World Bank Group released the Doing Business 2019 Report, which investigates the regulations that enhance business activity in a country and those that constrain it. The report analyses survey results across 190 economies. The report covers regulations affecting 11 areas of the life of a business which include: starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts, resolving insolvency, and labor market regulation.

We have previously covered Ease of Doing Business in our Ease of Doing Business in Kenya , when we spoke about Kenya’s improved score, and concluded with the areas we expect the government to improve upon.

In this note, we analyze the findings of the report with a focus on Kenya’s overall performance, specific areas that performed well, and those areas that need to be improved. This note breaks down the analysis as follows:

- Introduction to the Doing Business Report,

- Doing Business Report 2019:

- Kenya’s Ranking,

- Kenya’s Performance in Specific Areas and Reforms Highlighted, and,

- Areas of Improvement,

- Outlook on Kenya’s Doing Business Environment.

Section I: Introduction to the Doing Business Report

Launched in 2002, the Doing Business project by the World Bank provides objective measures of business regulations and their enforcement across 190 economies. By gathering and analyzing comprehensive quantitative data to compare business regulation environments across economies and over time, Doing Business encourages economies to compete towards more efficient business regulation and offers measurable benchmarks for reform. Doing Business measures the processes for business incorporation, getting a building permit, obtaining an electricity connection, transferring property, getting access to credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts, resolving insolvency and labor market regulation. Each of the measured business regulatory areas is important to nascent and existing entrepreneurs. Details of these are highlighted below;

|

Ease of Doing Business Indicators |

||

|

No. |

Indicator |

Details (What is Measured) |

|

1. |

Starting a business |

Procedures, time, cost and paid-in minimum capital to start a limited liability company for men and women |

|

2. |

Dealing with construction permits |

Procedures, time and cost to complete all formalities to build a warehouse and the quality control and safety mechanisms in the construction permitting system |

|

3. |

Getting electricity |

Procedures, time and cost to get connected to the electrical grid, the reliability of the electricity supply and the transparency of tariffs |

|

4. |

Registering property |

Procedures, time and cost to transfer a property and the quality of the land administration system for men and women |

|

5. |

Getting credit |

Movable collateral laws and credit information systems |

|

6. |

Protecting minority investors |

Minority shareholders’ rights in related-party transactions and in corporate governance |

|

7. |

Paying taxes |

Payments, time and total tax and contribution rate for a firm to comply with all tax regulations as well as post-filing processes |

|

8. |

Trading across borders |

Time and cost to export the product of comparative advantage and import auto parts |

|

9. |

Enforcing contracts |

Time and cost to resolve a commercial dispute and the quality of judicial processes for men and women |

|

10. |

Resolving insolvency |

Time, cost, outcome and recovery rate for a commercial insolvency and the strength of the legal framework for insolvency |

|

11. |

Labour market regulation |

Flexibility in employment regulation and aspects of job quality |

Source: World Bank Doing Business Report 2019

Section II: Doing Business Report 2019

As opposed to previous years, the Doing Business report 2019 did not include labor market regulation data in the ranking. As a result, countries were ranked based on an average score of 10 metrics.

- Kenya’s Ranking:

Of the 190 countries, Kenya’s ranking improved by 19 positions to #61 from #80 in the 2018 Report. In Africa, Kenya maintained its 4th position from last year’s report after Mauritius, Rwanda and Morocco. The score improved by 5.1 points to 70.3 from 65.2 in the 2018 Report. Over the last 5-years, Kenya has improved by a total of 15.3 points and 75 positions as highlighted below:

|

Ease of Doing Business Kenya Ranking (Past 5-Years) |

||||||||

|

2015 |

2016 |

2017 |

2018 |

2019 |

||||

|

Ease of Doing Business Rank (1-190) |

136 |

113 |

92 |

80 |

61 |

|||

|

Ease of Doing Business Score (0-100) |

55.0 |

58.1 |

62.4 |

65.2 |

70.3 |

|||

|

Ease of Doing Business Average Score |

60.0 |

60.3 |

61.1 |

61.6 |

62.7 |

|||

Source: World Bank Doing Business Report 2019

- Kenya’s Performance in Specific areas and Key Reforms Highlighted:

With 5 reforms implemented among the 11 areas of focus, since the last report, Kenya was the 7th most improved country in terms of comprehensive ranking in ease of doing business. The three main drivers of this improvement were:

- Protection of Minority Investors – Kenya’s score increased by 20.0 points and improved by 51 positions to #11 from #62 in the 2018 report

- Getting Credit - Kenya’s score increased by 15.0 points and improved by 21 positions to #8 from 29 in the 2018 report

- Resolving Insolvency - Kenya’s score increased by 14.3 points and improved by 38 positions to #57 from #95 in the 2018 report

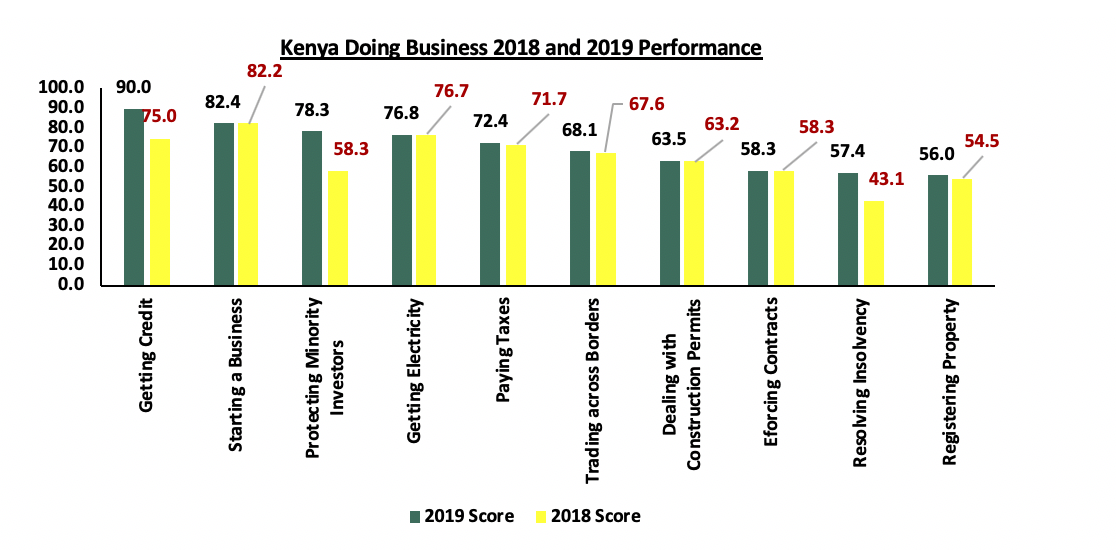

In Africa, Kenya was the 3rd most improved behind Djibouti and Togo, which increased their score by 8.9 and 6.3 points, respectively. These reforms were reflected in the significant improvement in the specific areas as highlighted in the chart below:

Source: World Bank Doing Business Report 2019

The areas credited for this improvement, as highlighted in the report, include:

- Registering Property

|

Registration of Property (Kenya) |

||

|

|

2018 |

2019 |

|

Registering Property (rank) |

125 |

122 |

|

Score for Registering Property (0-100) |

54 |

56 |

|

Procedures (number) |

9 |

9 |

|

Time (days) |

61 |

49 |

|

Cost (% of property value) |

6 |

6 |

|

Quality of land administration index (0-30) |

16 |

16 |

Source: World Bank Doing Business Report 2019

Kenya’s ranking Improved to positon 122 in 2019 from #125 in 2018 with the score improving by 2 points to 56 from 54 in the 2018 report. The World Bank acknowledged the following reforms as the cause of improvement:

Reforms: Kenya made registering property easier by introducing an online system to clear land rent rates. The Ministry of Lands and Physical Planning implemented an online land rent financial management system on the eCitizen portal, enabling property owners to determine the amount owed in land rent, make an online payment and obtain the land rates clearance certificate digitally. As a result, the rent payment process has been streamlined and now requires a lesser number of procedures and takes less time.

- Getting Credit

|

Getting Credit |

||

|

|

2018 |

2019 |

|

Getting Credit (rank) |

29 |

8 |

|

Score for Getting Credit (0-100) |

75 |

90 |

|

Strength of legal rights index (0-12) |

7 |

10 |

|

Depth of credit information index (0-8) |

8 |

8 |

|

Credit bureau coverage (% of adults) |

30 |

30 |

|

Credit registry coverage (% of adults) |

0 |

0 |

Source: World Bank Doing Business Report 2019

Kenya’s ranking Improved to #8 in 2019 from #29 in 2018 with the score improving by 15 points to 90 from 75 in the 2018 report. The World Bank acknowledged the enactment of the Movable Property Security Rights Act, 2017 as a major step and the main cause of improvement;

Reform: Kenya strengthened access to credit by introducing a new secured transactions law ‘The Movable Property Security Rights Act, 2017, which creates a unified secured transactions legal framework, and establishes a new unified collateral registry. This new law facilitates the use of movable property as collateral for credit facilities, establishes the office of the Registrar of Security Rights and provide for the registration of security rights in movable property. This Act also benefits small and medium-sized enterprises, which experience difficulty in accessing finance from the formal sector.

- Protecting Minority Investors

|

Protecting Minority Investors |

||

|

|

2018 |

2019 |

|

Protecting Minority Investors (rank) |

62 |

11 |

|

Score for Protecting Minority Investors (0-100) |

58 |

78 |

|

Extent of disclosure index (0-10) |

6 |

10 |

|

Extent of director liability index (0-10) |

5 |

10 |

|

Ease of shareholder suits index (0-10) |

9 |

9 |

|

Extent of shareholder rights index (0-10) |

5 |

7 |

|

Extent of ownership and control index (0-10) |

6 |

6 |

|

Extent of corporate transparency index (0-10) |

4 |

5 |

Source: World Bank Doing Business Report 2019

Kenya’s ranking Improved to #11 in 2019 from #62 in 2018 with the score improving by 20 points to 78 from 58 in the 2018 report. The CMA’s code of corporate governance was the primary reason for this improvement. The code is strict on the required levels of disclosure and pushes for more transparency by Kenyan companies;

Reforms: Kenya strengthened minority investor protections by increasing disclosure requirements, regulating the approval of transactions with interested parties and increasing available remedies if said transactions are prejudicial, increasing shareholders’ rights and role in major corporate decisions and requiring greater corporate transparency. Kenya enacted the Companies Amendment Act 2017, which holds directors liable for transactions with interested parties valued at 10% or more of a company’s assets and that cause damages to the company. Directors involved in prejudicial transactions are now required to pay damages, disgorge profits and may be disqualified from holding similar office for up to five years. Execution of this was witnessed In April 2018 when the Board of CMA issued a statement that it had taken administrative action against the NBK Board Members and former Senior Managers who served at the bank as at 31st December 2015 for the alleged misrepresentation of financial statements and embezzlement of funds at NBK. The Authority also recommended to the Office of the Director of Public Prosecutions the prosecution of some of the Senior Managers and further criminal investigations of additional individuals.

- Resolving Insolvency

|

Resolving Insolvency |

||

|

|

2018 |

2019 |

|

Resolving Insolvency (rank) |

95 |

57 |

|

Score for Resolving Insolvency (0-100) |

43 |

57 |

|

Time (years) |

5 |

5 |

|

Cost (% of estate) |

22 |

22 |

|

Recovery rate (cents on the dollar) |

28 |

31 |

|

Strength of insolvency framework index (0-16) |

9 |

13 |

Source: World Bank Doing Business Report 2019

Kenya’s ranking Improved to #57 in 2019 from #95 in 2018 with the score improving by 14 points to 57 from 43 in the 2018 report.

Reforms: Kenya made resolving insolvency easier by facilitating the continuation of the debtor’s business during insolvency proceedings, providing for equal treatment of creditors in reorganization proceedings and granting creditors greater participation in the insolvency proceedings. According to the Kenyan Insolvency Act, Administration is a proceeding intended to maintain the company as a going concern. The powers of the Board transfer to the Administrator who owes its duties to the company, and to the court. This is in contrast with receivership, where the Administrator owes duty to creditors. Implementation of this has been witnessed with the case of ARM Cement PLC, which was placed under administration in August 2018 following an application by the secured lenders. The running of the Company is now placed in the hands of PwC who have been named the Administrators of ARM Cement Plc

- Paying Taxes

|

Paying Taxes |

||

|

|

2018 |

2019 |

|

Paying Taxes (rank) |

92 |

91 |

|

Score for Paying Taxes (0-100) |

72 |

72 |

|

Payments (number per year) |

26 |

25 |

|

Time (hours per year) |

186 |

180 |

|

Total tax and contribution rate (% of profit) |

37 |

37 |

|

Post filing index (0-100) |

62 |

62 |

Source: World Bank Doing Business Report 2019

Kenya’s ranking Improved slightly to #91 in 2019 from #92 in 2018 with the score remaining flat at 72 points. Although no improvement in score, the World Bank acknowledged the fact that Kenya made a positive stride by streamlining the tax paying process through merging of all permits into a single unified business permit and by simplifying the value added tax schedule on its iTax platform.

- Areas of Improvement:

Despite the overall improvement, there remain areas that need to be improved. Below we highlight these areas and reforms for the same that have been implemented by other countries in sub-Saharan Africa within the coverage period of the 2019 report;

- Trading Across Borders:

|

Trading Across Borders |

||

|

|

2018 |

2019 |

|

Trading Across Borders (rank) |

106 |

112 |

|

Score for Trading Across Borders (0-100) |

68 |

68 |

|

Time to export |

||

|

Documentary compliance (hours) |

19 |

19 |

|

Border compliance (hours) |

21 |

16 |

|

Cost to export |

||

|

Documentary compliance (USD) |

191 |

191 |

|

Border compliance (USD) |

143 |

143 |

|

Time to import |

||

|

Documentary compliance (hours) |

60 |

60 |

|

Border compliance (hours) |

180 |

180 |

|

Cost to import |

||

|

Documentary compliance (USD) |

115 |

115 |

|

Border compliance (USD) |

833 |

833 |

Source: World Bank Doing Business Report 2019

Kenya’s rank declined to #112 from #106 in the 2018 report with the score remaining constant at 68 points. In our view, the performance in this metric can be improved through efficiency measures such as automation of custom procedures and establishment of proper controls to prevent corruption by custom officials. Other reforms as witnessed in other countries in Sub-Saharan Africa include;

- Employing electronic submission and processing of documents for exports: Uganda fully implemented the Centralized Document Processing Centre, an electronic processing platform that centralizes all documentary checks. Traders in Uganda also began using the Uganda Electronic Single Window, which allows for electronic submission of documents as well as for the exchange of information between trade agencies.

- Strengthening of border infrastructure for exports: Rwanda reduced border compliance time to 83 hours from 97 hours by having staff from the Rwanda Revenue Authority and the Tanzania Revenue Authority at the Rusomo one-stop border post, the result of the implementation of the Single Customs Territory.

- Enhancement of customs administration and inspections for exports and imports: Mauritius made exporting easier by introducing a risk-based management system which reduced border compliance time by 14 hours.

- Dealing with Construction Permits:

|

Dealing with Construction Permits |

||

|

|

2018 |

2019 |

|

Dealing with Construction Permits (Rank) |

124 |

128 |

|

Score for Dealing with Construction Permits (0-100) |

63 |

63 |

|

Procedures (number) |

16 |

16 |

|

Time (days) |

159 |

159 |

|

Cost (% of warehouse value) |

5 |

5 |

|

Building quality control index (0-15) |

9 |

9 |

Source: World Bank Doing Business Report 2019

Kenya’s rank declined to #128 from #124 in the 2018 report with the score remaining the same at 63 points. In our view, the performance in this metric can be improved through quality control reforms as witnessed in other countries in Sub-Saharan Africa. Some of the reforms include;

- Adopting new building regulations: Ghana strengthened construction quality control by imposing stricter qualification requirements for professionals in charge of technical inspections.

- Improved transparency: Burundi increased the transparency of dealing with construction permits by publishing regulations related to construction online and free of charge.

- Enforcing Contracts:

|

Enforcing Contracts |

||

|

|

2018 |

2019 |

|

Enforcing Contracts (rank) |

90 |

88 |

|

Score for Enforcing Contracts (0-100) |

58 |

58 |

|

Time (days) |

465 |

465 |

|

Cost (% of claim) |

42 |

42 |

|

Quality of judicial processes index (0-18) |

9 |

9 |

Source: World Bank Doing Business Report 2019

Kenya’s rank improved to #88 from #90 in in the 2018 report. Despite the improvement in rank, the score remained the same at 58.0, well below Kenya’s comprehensive score of 70.3. This indicates that Kenya still has room for improvement in this regard. This can be done through automation, digitization and improvement of judicial processes. Examples of reforms implemented in other countries in Sub-Saharan Africa to enhance enforcement of contracts include;

- Introducing a specialized commercial court: Djibouti and Ethiopia introduced dedicated benches to resolve commercial disputes.

- Automation of court processes: Madagascar introduced an electronic case management system, which employs random and automatic assignment of cases to judges throughout the courts.

- Expanding the alternative dispute resolution framework: Djibouti adopted laws that regulate all aspects of mediation as an alternative dispute resolution mechanism. Sudan recognized voluntary conciliation and mediation as ways of resolving commercial disputes.

Section III: Outlook on Kenya’s Doing Business Environment

Kenya has made significant political and economic reforms that have driven sustained economic growth and social development over the past decade. The same continues to be witnessed and the improvement in both ranking and score is a reflection of the same. Behind only Morocco (#60), Rwanda (#29) and Mauritius (#20) in the ranking, Kenya’s economy remains among the most attractive business environments in Africa. As highlighted in the report however, there exists room for Kenya to improve its business climate to attract more entrepreneurs and investors to start businesses and foreign direct investment. This can be achieved by;

- Streamlining the processes involved in starting a company by; (i) setting up a one-stop shop for all services required in starting a company, (ii) automating the processes involved, and (iii) eliminating minimum capital requirements.

- Improved sharing of credit information to facilitate lending decisions especially towards the private sector. Kenya should adopt additional sources of customer data, which generates incentives to improve borrower discipline especially following the enactment of Banking Act Amendment 2015 that effectively placed an interest rate cap on loans by commercial banks.

- The tax paying process can be made easier by (i) consolidating payments and filings of taxes, (ii) establishing taxpayer service centres, and (iii) allowing for more deductions, exemptions or lower tax rates.

- Kenya can improve on the efficiency of contract enhancement through (i) reducing the current case backlog by clearing inactive cases from the docket, (ii) automation of court and judicial procedures, (iii) complaints being filed electronically through a dedicated platform within the competent court, (iv) court fees being paid electronically within the competent court enforcing contracts, and (v) reducing the number of days taken to deliver case verdicts.

- Corruption remains an adverse factor in the country and has had a great impact on the economy. We analyzed this in detail in our focus on corruption. During the release of the Doing business report the World Bank gave a disclaimer that it does not factor in corruption in the ranking. As a result, the score does not indicate the extent to which corruption affects Kenya’s doing business environment. Comprehensive measures to handling corruption include (i) proper vetting of public officials by the Ethics and Anti-Corruption Commission, (ii) educating people on the effect corruption has on development, and (iii) independence of the judiciary in handling cases.

Disclaimer: The Cytonn Weekly is a markets report published by Cytonn Asset Managers Limited, “CAML”, which is regulated by the Capital Markets Authority. CAML is also an affiliate of Cytonn Investments Management Plc. However, the views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.