Sep 8, 2019

Economic growth is largely influenced by factors such as capital, labour and technology. A well-functioning financial system permits an economy to fully exploit its growth potential, as it ensures that the best investment opportunities receive the necessary funding, while inferior opportunities are denied capital. We have previously covered this topic in our focus on The Role of Capital Markets in Economic Development, where we investigated the role capital markets play in economic and social development, and concluded on the need to develop our capital market so as to realize both economic and social-development goals. This week, we extend that Focus, as we investigate the current state and depth of the Kenyan Capital markets. In addition, we highlight some of the key challenges affecting the development of the capital markets, and the proposed solutions, as we continue to analyze how to leverage on capital markets to spur economic growth by addressing the topic as follows:

- Introduction to Capital Markets,

- Depth of Kenya’s Capital Market,

- The Role of Capital Markets in an Economy,

- Successful Capital Market Reforms Case Study - South Africa,

- How to Improve the Development of Local Capital Markets and Leverage on them for Economic Growth, and,

- Conclusion.

Section I: Introduction to Capital Markets

Capital markets are a category of markets that facilitate the buying and selling of securities with medium-term and long-term maturity. Instruments traded in capital markets include equities, derivatives, treasury bills and bonds, corporate bonds, and commercial papers, among others.

Capital markets are generally categorized into the following depending on the type of issue (new or pre-issued);

- Primary Markets - Primary markets are markets where equity (ordinary and preference), and debt securities are being issued to investors for the very first time. Primary markets enable institutions such as governments and companies raise funds for expansion or financing new projects. Through primary markets, funds can be raised using methods such as Public Issues, and Initial Public Offers, and,

- Secondary Markets- In secondary markets, pre-existing securities that have already been issued in a primary market are traded. Here, investors buy and sell securities such as equity securities, treasury bonds, corporate bonds and derivatives.

Of course, these operations would not be possible without key players who play specific roles to ensure that capital markets are operational, efficient and effective. The main roles of key players are highlighted below;

- Regulators - Are responsible for licensing market participants, enforcing regulations that are needed to develop capital markets and supervising the conduct of participants in order to uphold transparency, improve efficiency and protect investors,

- Investors (Individuals and Institutions) - They provide their net savings to the financial markets for a return on the capital provided. Examples include retail investors and institutional investors such as fund managers and retirement benefits schemes,

- Issuers of Securities - Domestic or foreign governments, corporations or other institutions mobilize funds from investors through the issuance of securities,

- Financial Intermediaries - Financial intermediaries such as commercial banks, dealers and brokers act as a counterparty or link between buyers and sellers by moving funds to parties with a deficit in capital from parties with excess capital. Other roles financial intermediaries play include underwriting services and provision of liquidity, and,

- Third Parties - These include authorized data vendor such as Bloomberg, Thomson Reuters, and Synergy, among others, who supply commercial information, and thus improve information asymmetry between the various players in capital markets.

Section II: Depth of Kenya’s Capital Market

Kenya’s official capital market began in 1997, with the first government security issuance, while the first company to be listed on a stock exchange was Kenya Commercial Bank in 1988. Since then, Kenya’s capital market has experienced robust growth, currently at 65 companies listed on the Nairobi Securities Exchange. To ensure proper functioning of the markets, the Capital Markets Authority of Kenya was formed through an Act of Parliament (CAP 485A, Laws of Kenya) in December 1989, mandated to supervise, license and monitor the activities of financial market intermediaries and all other players licensed under the Capital Markets Act. The Authority performs the following regulatory functions as governed by the Capital Markets Act and the Central Depositories Act (2002):

- Licensing and supervising all capital market intermediaries,

- Ensuring proper conduct of all licensed persons and market institutions,

- Regulating the issuance of capital market products,

- Promoting market development through research and introduction of new products,

- Promoting investor education and public awareness, and,

- Protecting investor’s interest.

We examine the depth of Kenya’s capital market using the following metrics;

- Pools of Capital - In order to achieve long-term impact, capital markets require long-term capital that is usually institution based driven, which includes capital from retirement benefits schemes, fund managers, and financial services companies. Compared to developed nations such as the United Kingdom with pension funds worth USD 15.6 tn, equivalent to 104.5% of GDP (OECD, 2018), Kenya’s retirement benefits assets over the same period totals to USD 11.5 bn, equivalent to 12.9% of GDP, highlighting the low penetration rate of retirement benefits schemes in Kenya. The level of capital available for investment in our capital market is still low compared to advanced economies and so, much has to be done in terms of increasing the level of savings through the various institutions we have in the country and buoying those efforts with adequate regulatory support,

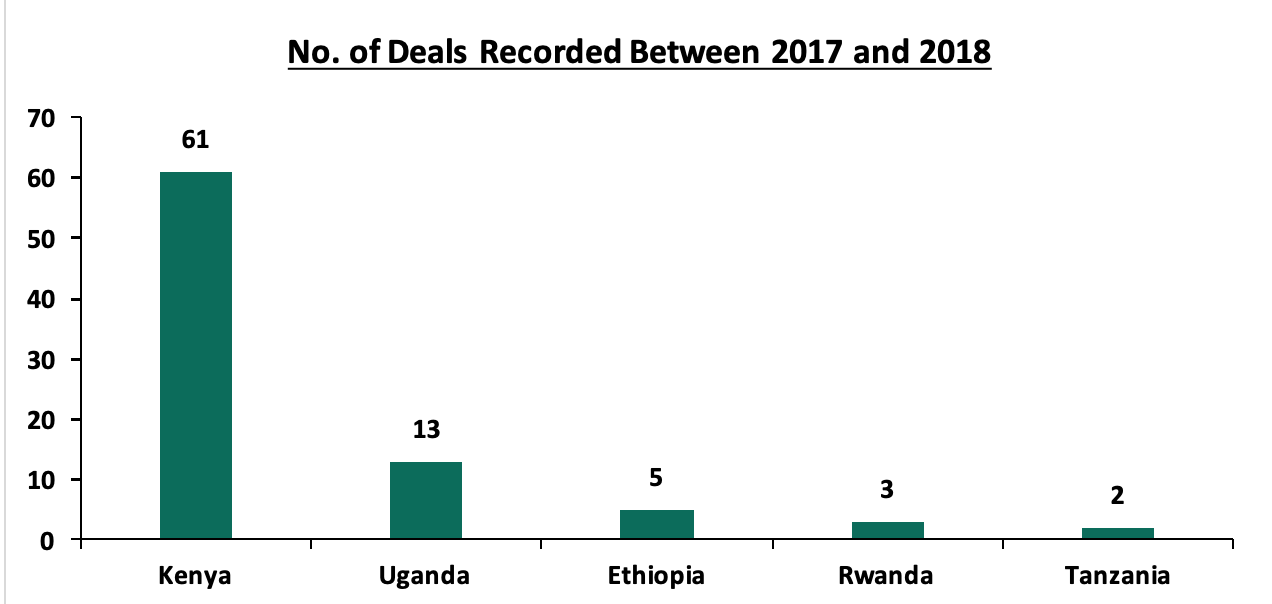

- Corporate Activity - There has been increased corporate activity in Kenya in the recent past, with consolidation in Kenya’s financial services industry mainly being witnessed in the banking sector over the past five years with large banks acquiring relatively smaller banks, which struggled to operate in the tough operating environment. Recent deals include those of KCB Group’s acquisition of National Bank of Kenya (NBK) and Commercial Bank of Africa’s (CBA) merger with NIC Group. In the non-financial sector, Rubis Plc concluded the acquisition of Kenol Kobil in April 2019, with the merger of Telkom and Airtel currently in the pipeline. Corporate activity in terms of private equity and venture capital saw Kenya record the highest number of deals and volumes totaling to 61 between 2017 and 2018 compared to the East African countries as illustrated in the chart below;

Source: AVCA

However, despite it being the highest, Kenya has not fully optimized the potential of its financial markets to boost the growth it envisions. For instance, while the maximum allocation of total Retirement Benefits assets in Kenya as per the RBA Investment Guidelines (Table G) to private equity is 10.0%, assets allocated to private equity stood at 0.04% of managed assets in 2018.

- New Debt Issuance- In terms of debt issuance, the Kenya’s capital market is dominated by government bonds, where during the financial year FY2018/2019, the Government of Kenya issued 23 treasury bonds, including 2 infrastructure bond issuance and 2 tap sales, raising Kshs 444.2 bn. However, the capital markets have not witnessed any corporate bond issuances since 2015 from local companies, although 4 medium term notes issued by KenGen, HF Group, NIC Group and CIC Insurance Group are expected to mature before the year ends, with the companies opting to redeem the debt holders and not issue any additional debt. The drought in issuances is attributable to defaults witnessed over the past five-years by issuers such as ARM Cement, Nakumatt, Chase Bank and Imperial Bank that caused losses to holders of the bonds, and notes. In a bid to spur activity, the CMA approved the first green bond issuance by Acorn, a property developer, to finance sustainable and climate-resilient student accommodation in Kenya. Green bonds are bonds essentially reserved for projects with environmental benefits and help align the investor’s interest with climate policies according to the Paris Agreement and at the same time, support the transition to a sustainable economy. Although the first issuance will be restricted to target investors, we laud the Authority and the NSE for the launch of the Green bond project plan which is a step towards the development of other green investment products such as green Islamic finance which will boost inclusivity, and,

- New Primary Equity Issuances i.e. Initial Public Offers (IPOs) and Rights Issues – The Nairobi Stock Exchange currently has 65 listed companies with a market capitalization of USD 22.3 bn as at June 2019. Since 2014 to date, Kenya has only recorded 2 IPOs, namely the Nairobi Stock Exchange (NSE) and Stanlib Fahari REIT valued at USD 42.0 mn, and 6 Further Offers (FO) by Diamond Trust Bank, NIC Bank, Uchumi, HF Group, Longhorn, and KenGen raising USD 0.4 bn in capital. Contrary to the Capital Markets Master Plan which had a target of at least four listings per year on the Nairobi Stock Exchange, Kenya has failed to attract any IPOs since 2016. South Africa, on the other hand, raised capital worth USD 5.8 bn through 33 IPOs between 2014 and 2018, while Nigeria raised USD 0.6 bn through 3 IPOs. To remedy this, the Nairobi Stock Exchange launched the NSE Ibuka Platform early this year to help Small, Medium and Large Enterprises who wish to list or raise funds on the bourse, build strong structures before listing or access various financing options available in capital markets. According to the program’s weekly report as at 2nd August 2019, 16 companies were under the Ibuka program, at different stages of the induction, acceleration and incubation processes. During the week, NSE announced that it plans to list at least one firm from the program on the Main Investment Market segment by the end of the first quarter of 2020, which in our view will be an optimistic step towards increasing market activity.

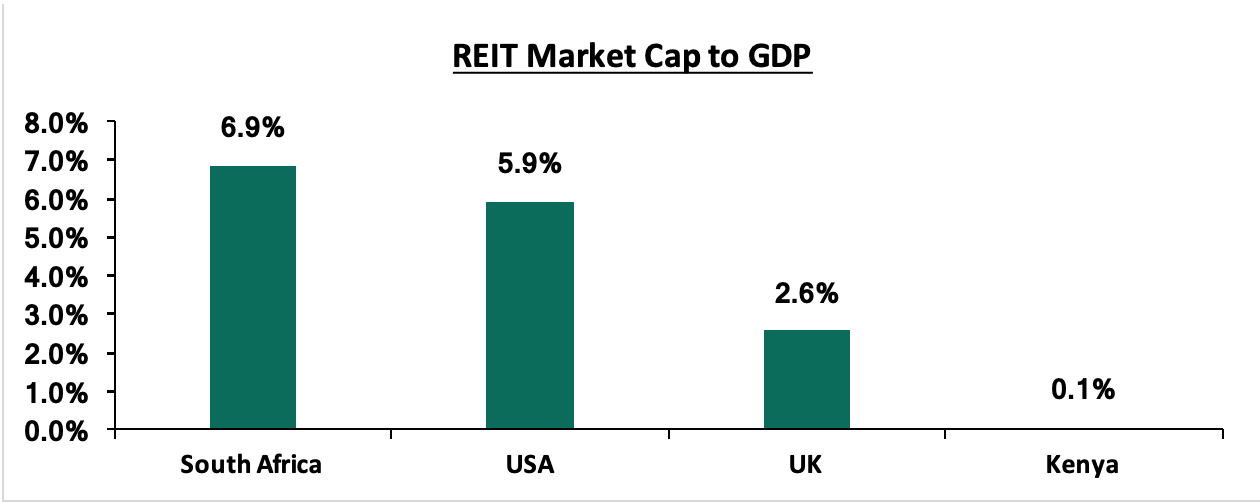

- Product Diversity - In terms of product diversity, Kenya’s capital market has increasingly developed new products for investors and issuers over the years as the market grows. Kenya has well-developed equity and debt market, and early this year NSE launched the Derivatives market that facilitates the trading of Equity Indices and Single Stock futures contracts and is set to launch Intraday Trading within the year, which we expect will further deepen Kenya’s financial markets. Other products such as Real Estate Investment Trusts (REITs) are gaining traction, as the past year has witnessed potential issuers engaging with the CMA. The REIT Market Cap to GDP for Kenya compared to other countries shows significant opportunity or REITs, which is currently 0.06% of GDP in Kenya compared to 6.9% in South Africa, indicating room for growth for Real Estate listings in the capital market hence making real estate an investible security.

Section III: The Role of Capital Markets in an Economy

Capital markets bring together suppliers and users of medium to long-term capital, through connecting the monetary sector with the real sector, which is the sector of the economy concerned with the production of goods and services. The capital markets thus play an important role in economic development as they facilitate growth in the real sector by enabling access to long-term financing for producers of goods and services, and entities tasked with infrastructure development.

The fundamental channels through which capital markets are connected to the economy, economic growth and development can be outlined as follows:

- Creating a Bridge Between Suppliers and Users of Capital: The contact between agents with a monetary deficit and the ones with monetary surplus can take place directly through direct financing, but also through a financial intermediary in form of indirect financing, which is a situation whereby specific operators facilitate the connection between the real economy and the financial market. In this case, the financial intermediaries could be banks, investment funds, pension funds, insurance companies, or other non-bank financial institutions.

- Promoting a Saving and Investments Culture: The capital markets increase the proportion of long-term savings (pensions, life covers, etc.) that is channeled to long-term investment. Capital markets enable the contractual savings industry (pension and provident funds, insurance companies, medical aid schemes, collective investment schemes, etc.) to mobilize long-term savings from individual households and retail clients, and channel them into long-term investments. It fulfills the transfer function of current purchasing power, in monetary form, from surplus sectors to deficit sectors, in exchange for reimbursing a greater purchasing power in the future. In this way, the capital markets enable corporations to raise funds to finance their investment in real assets. The implication will be an increase in productivity within the economy leading to more employment, increase in aggregate consumption and hence growth and development. It also helps in diffusing stress on the banking system by matching long-term investments with long-term capital. It encourages broader ownership of productive assets by small savers. It enables them to benefit from economic growth and wealth distribution and provides avenues for investment opportunities that encourage a thrift culture critical in increasing domestic savings and investments that translate to economic growth.

- Supporting Efficient Allocation of Resources: The capital markets facilitate the efficient allocation of scarce financial resources by offering a large variety of financial instruments with different risk and return characteristics. This competitive pricing of securities and large range of financial instruments allows investors to better allocate their funds according to their respective risk and return appetites, thereby supporting economic growth.

- Financing Utility and Infrastructure Development: The capital markets also provide equity capital, debt capital and infrastructure development capital that have strong socio-economic benefits through the development of essential utilities such as roads, water, and sewer systems, housing, energy, telecommunications, public transport, etc. These projects are ideal for financing through the capital markets via long-dated bonds and asset-backed securities. Infrastructure development is a necessary condition for long-term sustainable growth and development. In addition, capital markets increase the efficiency of capital allocation by ensuring that only projects that are deemed profitable can successfully attract funds. This will, in turn, improve the competitiveness of domestic industries and enhance the ability of domestic industries to compete globally, given the current momentum towards global integration. The result will be an increase in domestic productivity which may spill over into an increase in exports and, therefore, economic growth and development.

- Financing Private-Public Partnerships, “PPPs”: Capital markets promote PPPs, thereby encouraging the participation of private sector in productive investments. The need to shift economic development from the public to the private sector to enhance economic productivity has become inevitable as resources continue to diminish. It assists the public sector to close the resource gap and complement its effort in financing essential socio-economic development, through raising long-term project-based capital. It also attracts foreign portfolio investors who are critical in supplementing the domestic savings levels and who facilitate inflows of foreign financial resources into the domestic economy, thereby supporting economic growth.

Section IV: Successful Capital Market Reforms Case Study - South Africa

According to the Africa Financial Markets Index 2018, by Absa Group, while most capital markets in African countries are relatively underdeveloped, those countries which introduced reforms that are geared towards the development of capital markets have been able to grow at relatively higher and sustainable rates. The Africa Financial Markets Index tracks progress on financial market developments of selected African countries annually across a range of indicators. These indicators are:

- Market depth,

- Access to foreign exchange,

- Tax and regulatory environment,

- Market transparency,

- The capacity of local investors,

- Macroeconomic opportunity, and,

- Legality and enforceability of standard financial markets master agreements.

According to the first report published in 2017 and the subsequent report in 2018, South Africa ranked first in both occasions as the most developed financial market in Africa, hence the reason we have picked it as a case study. A summary of rankings from the ABSA report is highlighted in the table below, where the higher the score, the more developed the capital markets are based on the indicators above:

|

ABSA Africa Financial Markets index |

|||

|

2017 |

2018 |

||

|

Country |

Aggregate Score |

Country |

Aggregate Score |

|

South Africa |

92 |

South Africa |

93 |

|

Mauritius |

66 |

Mauritius |

65 |

|

Botswana |

65 |

Botswana |

65 |

|

Namibia |

62 |

Namibia |

62 |

|

Kenya |

59 |

Kenya |

61 |

The South African capital markets consist of:

- Equities: The Johannesburg Stock Exchange (JSE) is the largest exchange in Africa with over 400 listed firms and a market capitalization of USD 13.7 tn, which is 236.2% of GDP,

- Bonds: The South African-listed bond market is estimated to be ZAR 2.7 tn (USD 186.4 bn). It is largely dominated by bonds issued by the National Treasury, which account for 68.4% of the outstanding debt, followed by bonds issued by the financial sector (16.0%) and state-owned entities [parastatals] (11.2%). In terms of turnover, the monthly average amount traded on the JSE is ZAR 2.3 tn (USD 158.8 bn),

- Derivatives: Derivatives are traded in exchanges under the umbrella of the JSE, and over-the-counter (OTC). Exchange-traded products are standardized and free of counterparty risk. The JSE permits trading in equity, commodity (mainly agricultural), currency, and interest rate derivatives, and,

- Real Estate: South Africa has the largest and most established REITs market in Africa. The South African listed property sector has a market capitalization of approximately ZAR 380.0 bn (USD 26.2 bn) at the end of 2016, which is 6.4% of GDP.

To get here, South Africa made regulatory reforms, as well as the restructuring of the financial system, as outlined below:

- First, major changes were introduced in the operations of the financial markets where Johannesburg Stock Exchange (JSE) restructured its systems to provide for electronic screen trading, corporate and non-resident participation, and provision for negotiated commissions and principal, versus broking trade by members of the Exchange,

- Further, South Africa removed exchange controls, leading its foreign exchange market to become more competitive and active. The JSE in 1996 introduced the Johannesburg Electronic Trading (JET) system, which greatly improved the efficiency of the trading platform, which in turn improved market activity and liquidity,

- To improve transparency and investor confidence, the JSE introduced the real-time Stock Exchange News Service (SENS) in 1997, which required listed companies to disclose any corporate news and price-sensitive information through the service before releasing the information to the media,

- In terms of regulation, the most recent reform was the replacement of the Securities Services Act with the Financial Markets Act in 2012, designed to modernize the sector and have supervision up to date with international standards. As a member of the G20, South Africa continually reforms its offerings, such as the Over-the-Counter Derivatives market to be in line with G20 proposals and recommendations from IMF and World Bank, and,

- South Africa has been able to successfully raise a high level of their institutional funds as compared to their economic output, with some of these funds being directed into their capital markets as highlighted in the table below:

|

Country |

South Africa |

Kenya |

Nigeria |

|

Total Funds Managed (USD bn) |

333.0 |

12.1 |

24.5 |

|

GDP (USD bn) |

349.4 |

88.1 |

376.4 |

|

Funds Managed as a % of GDP |

95.3% |

13.7% |

6.5% |

South Africa continues to emerge top in Africa in terms of capital markets activity on the back of better supervision and strengthened regulatory frameworks. The Johannesburg Stock Exchange continues to lead in equity and debt market capital activity, over the years recording the highest number in Africa, in terms value. Despite the slowing economic growth, South Africa continues to instil investor confidence as one of the most popular investment destinations, with the most developed derivatives and bond markets in the region. A lot can be borrowed from South Africa in terms of regulation and supervision in order to make our capital markets accessible to international investors, local institutional investors as well as issuers of equity and debt instruments. Thus, in the next section, we recommend feasible solutions that will help elevate our capital market to the next level towards being one that is more developed.

Section V: How to Improve the Development of Local Capital Markets and Leverage on them for Economic Growth

In order to map a way out to improve our capital markets, we examine the challenges that these markets face then look at various ways we can improve them.

- Challenges Local Capital Markets Face

Economic growth in a modern economy hinges on an efficient and effective financial sector that pools domestic savings and mobilizes capital for productive projects. The absence of effective capital markets could leave most productive projects that carry developmental agendas unexploited. However, there are challenges in developing capital markets as they are to a large extent dependent on the level of economic and structural development of a country. Factors affecting the development of capital markets include:

- Country Fundamentals: The size of the economy in terms of aggregate gross domestic product and per capita income affects the development of capital markets. This explains in large part why, in general, capital markets are at an embryonic stage in smaller and low-income countries, while more developed countries have more robust capital markets. This can be explained as more developed economies have greater institutional development, a larger institutional investor base, and higher levels of contractual savings such as pension funds, political stability, and macroeconomic stability,

- Macroeconomic Policies Framework: An essential condition for well-functioning capital markets is the existence of sound macroeconomic policy frameworks. Capital markets depend on investor confidence. Strong institutions thrive in stable macroeconomic conditions and investors can also be confident that their capital will not be eroded by factors such as hyperinflation and exchange rate risks when there is a strong macroeconomic framework in place,

- Access to Information: Access to information is a major factor that affects the development of capital markets. Access to information gives investors’ confidence in the functioning of the capital markets. Access to information and transparency allows for the monitoring of users of funds, which increases investor confidence,

- Regulatory Framework: To reliably extract the benefits of well-functioning markets, adequate regulation of users of funds, investors, and intermediaries in addition to robust supervisory arrangements to protect investors, promote deep and liquid markets, and manage systemic risk are critical,

- Efficient Market Infrastructure: Lack of adequate and efficient market infrastructure for issuing, trading, clearing and settlement is a major issue for capital market development as it pushes away potential investors from an economy, and,

- Knowledge of Retail Investors: The lack of investor education for retail investors is another factor affecting the development of capital markets. It is important to educate retail investors on investment products and the benefits of saving, in order to channel savings to the capital markets.

- Ways to Improve the Local Capital Markets

The following recommendations provide feasible solutions to challenges facing the development of capital markets:

- Innovative Financial Products and Services - In order to drive investor participation in the capital markets, it is imperative that more sophisticated products and value adding services are created such as Shariah compliant products. Capital markets development should also be driven by advancements in technology, accompanied by the necessary regulatory policies and structures to support their growth.

- The Development of Structured Products in The Kenyan Market - These products have been a welcome alternative to banks for businesses seeking capital for growth. In developing markets such as Kenya, capital markets remain under developed, hence businesses are forced to source up to 95% of funding from banks, while only 5% from capital markets, compared to developed markets where banks provide on 40.0% of credit in the economy. As such, real estate development and investment is not being provided with adequate access to this source of capital, which if provided at competitive rates can increase the development of affordable housing,

- Improve Market Access and Efficiency - In order to achieve efficiency, there is need for high quality and timely information, which is derived from better disclosures by listed companies. Borrowing from South Africa, we recommend that the NSE develop policies which will require listed firms to disclose corporate news and price sensitive information to the bourse before going to the media,

- Tax Amendments to Level the Playing Field – Structured Products and non-bank funding need to be given favorable tax treatment as other funding methods, which will provide an incentive to capital providers to invest in capital markets. This is expected to spur development of alternative sources of funding at competitive rates available for business development,

- Investors and Issuers Education- In order to transform the culture of saving and investment, and build trust, it is important that capital markets regulators invest in investor education. The lack of investor education for retail investors is another factor affecting the development of capital markets. It is important to educate retail investors on investment products and the benefits of saving, in order to channel savings to the capital markets,

- Shifting Reliance Away from Bank Loans towards Capital Market Instruments - Banks are the primary source of business funding in the country, providing 95.0% of funding, with other alternative sources such as the capital markets providing a combined 5.0%, compared to developed markets where banks provide only 40.0% of the credit in the economy. Several SMEs have a poor understanding of the capital markets and are unaware of ways in which they can use them to raise funds. The first step towards achieving this would be investor education/ awareness campaigns in order to educate SMEs on how they can use the stock exchange better and build their confidence in the financial system of the capital markets,

- Reduce Minimum Amount Investable in all Real Estate Investment Trusts (REIT) - In order to attract capital into capital market vehicles such as Real Estate Investment Trusts (REIT’s) for real estate development, the minimum investment amount needs to be amended. The current regulations, which define the minimum subscription amount per investor at Kshs 5.0 mn for a Development REIT (D-REIT) is too high to attract significant interest from investors. An amount of Kshs 1.0 mn ensures the investor is sophisticated while also allowing a larger pool of investors to participate,

- Expand Tax Relief for Regular Savings Towards Home Purchase- Savings into Collective Investment Schemes regulated by the Capital Markets Authority (CMA) should qualify as HOSP (Home Ownership Savings Plan). Savings in CMA approved products, such as Money Market Funds currently don’t qualify as HOSP. Therefore, savers only have the option of banks, which pay low interest. There is need to expand the meaning of "approved institution" that hold deposits intended for the Home Ownership Savings Plan (HOSP) to include Fund Managers, thus enabling the potential homeowners making savings through the CIS to enjoy the tax relief provided under HOSP, and,

- HOSP Guidelines should include Capital Markets Authority (CMA) Investment Guidelines in Addition to Central Bank of Kenya (CBK) - HOSP guidelines only recognize investment guidelines per CBK. If Fund Managers are included, the guidelines would be as per CMA, so that an investor has a choice whether to save through a bank or an investment savings product. To include investment guidelines provided by the CMA regulations, in addition to the prudential guidelines issued by CBK to regulate investment of deposits under a registered HOSP.

Section VI: Conclusion

In conclusion, a well-developed capital market creates a sustainable, low-cost distribution mechanism for multiple financial products and services across the country. This, in turn, helps the business community to raise long-term funds that are used to purchase capital goods, thereby propelling their growth and supporting the country’s economic growth. In addition, capital markets improve financial inclusion by introducing new products and services tailored to suit investors’ preferences for risk and return, as well as borrowers’ project needs and risk appetite. To tap into this, there is a need to align regulatory frameworks for capital markets with economic policies in order to enhance efficient financial intermediation. A well-developed capital market will encourage the flow of long-term equity capital investment into infrastructure development that will go a long way to help achieve socio-economic development goals.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.