Jul 1, 2020

1. FUND PERFOMANCE

|

AVERAGE |

JUNE 2020 (ANNUALIZED RETURN) |

*PERFORMANCE SINCE INCEPTION (01-NOVEMBER-2017) |

|

Cytonn Money Market Fund (USD) |

3.0% |

3.0% |

|

Benchmark ( USD LIBOR + 2.0% Points) |

2.2% |

2.9% |

*Percentage you can expect to earn with the fund during one year of investment on basis of the so far realized monthly returns since inception.

2. FUND MANAGER’S REPORT AND OUTLOOK

Fund Objective

The Cytonn Money Market Fund is a low-risk fund that seeks to obtain a high level of current income while protecting investor’s capital and liquidity.

Portfolio Strategy

The portfolio objective will be to outperform the income yield available on money market call accounts and fixed deposit accounts by investing in interest-bearing securities and other short-term money market instruments. These securities are usually available to the wholesale or institutional clients. The Fund will also be managed conservatively with active management of duration, credit and liquidity risks.

Economic report and outlook

Economic growth has remained subdued due to the ongoing COVID-19 pandemic, which has disrupted various sectors. According to the recent pronouncement, from the June Monetary Policy Committee press release, most recent economic indicators points that growth in Q1’2020 was strong, as the impact of COVID-19 virus was majorly pronounced in April 2020. There was however a notable recovery in the economy in May 2020 driven by increased agricultural output and exports. There has been pressure on interest rates with the yield curve shifting upwards from the December levels, which has seen the FTSE NSE Kenya Government Bond Index shed 1.0% YTD, this is despite a cumulative 1.5% points’ downward revision of the Central Bank Rate (CBR) since the beginning of the year to the current rate of 7.0%. On the short end of the yield curve, the Central Bank of Kenya has managed to maintain the yields relatively stable with the 91 day T-Bill declining to 6.7% in June, from 7.3% recorded in May. Inflation has remained within the Central Bank’s target of between 2.5% and 7.5%, with the June inflation coming in at 4.6% a decline from 5.3% in May, driven by a 1.3% decline in the food and non-alcoholic drinks’ Index, coupled with a 0.8% decline in the housing, water, electricity, gas and other fuels’ index. Slight pressure has been recorded on the Kenyan Shilling on the back of increased dollar demand from merchandise importers as the easing of coronavirus restrictions jumpstart economic activities, thus boosting demand for hard currency but we do not foresee further declines as the Central Bank remains active in the market to cushion the shilling.

Portfolio Performance

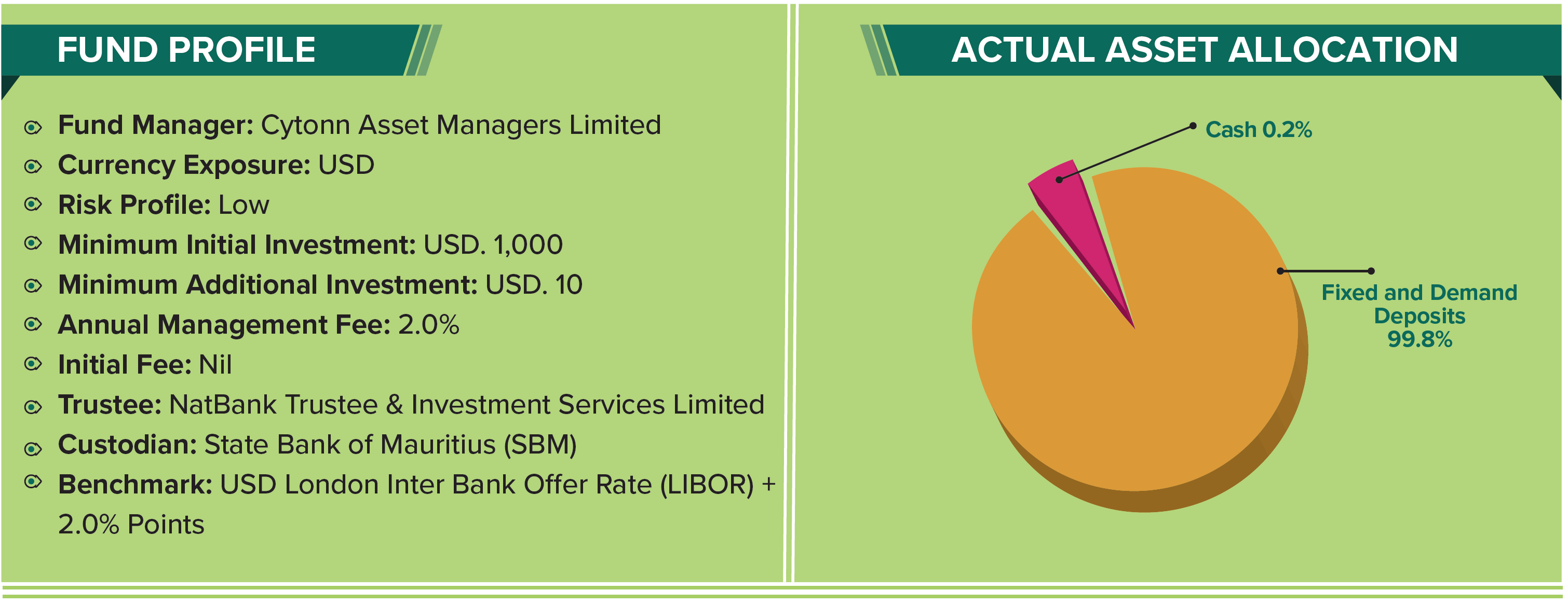

The Cytonn Money Market Fund successfully delivered returns in the month of June, averaging 3.0% p.a outperforming its benchmark (USD LIBOR +2.0% points) at 2.2%. Going forward, Cytonn Asset Managers Limited (CAML) expects the Cytonn Money Market Fund USD (CMMF-USD) to deliver above-average returns leveraging on optimal asset allocation in line with the Fund’s Investment Policy Statement.

Disclaimer: Past performance is not a guarantee of future performance and the value of the fund will fluctuate from time to time.