Feb 10, 2019

Over the last 8-years, there has been various consolidation activities in the banking sector, as banks either acquire smaller banks or merge and form strategic partnerships with other banks to form relatively larger companies. Consolidation activity has picked up in the recent past as smaller banks that have struggled to operate under the interest rate cap regime are acquired by their larger counterparts, while some of the banks have been forming strategic partnerships. Some of the consolidation activity has also been driven by remediation of collapsed banks that had been under receivership, such as Imperial Bank Ltd, and Chase Bank Ltd. 2 deals are already in the pipeline in 2019, with Commercial Bank of Africa (CBA) issuing a cash buy-out offer of Kshs 1.4 bn to Jamii Bora Bank as analyzed in our CBA Acquisition Note, and CBA and NIC Group issuing a merger notice as analyzed in our NIC-CBA Merger Note. As such, we look at the factors that are driving the need for consolidation, and the expected impact of this activity in both the individual banks, and the banking sector on aggregate. As such, we shall look at the following:

- Background of Consolidation Activity,

- Types of Consolidation Arrangements and the Impact,

- Recent Consolidation in Kenya,

- Case Study of Consolidation in the Nigerian Banking Sector, and,

- Our View on Banking Consolidation

Section I: Background of Consolidation Activity

The Banking Sector in Sub Saharan Africa (SSA) has witnessed a considerable amount of consolidation activity over the last 10-years. The consolidation activity has been fueled by:

- The need to create larger enterprises able to take advantage of their larger financial muscle and an extensive deposit gathering capability, in order to achieve a competitive edge in the fiercely competitive sector, given the high number of players, and ultimately ensure the individual bank’s long-term survival,

- When organic growth seems untenable, companies pursue growth inorganically through consolidation,

- Various banks that had seen a reduction in their profitability due to lower net interest margins following the implementation of the Banking (Amendment) Act 2015, coupled with a harsh operating environment, become acquired by their stronger and larger counterparts, and,

- Banks have formed strategic partnerships through mergers, with the aim of leveraging on the synergies created under the merged entities to grow their market share, attain pricing power, and consequently ensure sustainable growth.

The resultant effect of this will be a banking sector that is stable and resilient to any shocks it may encounter.

Major economies in SSA have experienced consolidation activity, with Kenya, Nigeria and Ghana being the key examples. Most of the consolidations in Nigeria and Ghana were largely induced by regulation, fueled by the need to create a stable financial services sector, by weeding out weaker participants in the banking sector who were prone to be adversely affected by systemic risks such as industry wide asset quality deterioration, and were not serving their core banking mandate. Thus, to achieve this, the respective Central Banks have been consistently raising the minimum capital requirements, which has induced consolidation in the sector. The banking sector’s main role is the financial intermediation function, where they are granted funds from depositors and lend out to credit consumers. As such, banks have to ensure that the deposit funds are not eroded by cumulative impairments on their assets and operating losses, if any. Thus, they have to hold adequate capital to cover for the impairments and losses, so as to protect depositors’ funds. Therefore, both deposit mobilization capacity and capital base will determine the strength and stability of a bank.

Hence, on aggregate, a banking sector’s stability will depend on how well its players are capitalized. With well-capitalized players, the sector would be better positioned to withstand any systemic risks and shocks, as well as facilitating financial intermediation, resulting to an increase in their investments in both high and low risk assets such as loans and government securities, leading to capital formation, increased investment, and consequently driving economic growth.

The banking sector is at the core of any economy, given the reliance of other sectors on services and products offered by the banking sector. The sector’s main function of financial intermediation between depositors’ funds and credit provision serves as a catalyst of investment, by facilitating capital formation, thereby leading to economic growth and development. Moreover, the importance of banking is even more pronounced in Sub-Saharan Africa, where there is over-reliance on the banking sector for funding, which ranges between 90.0% - 95.0% for SSA economies as opposed to 40.0% bank funding in advanced economies.

Section II: Types of Consolidation Arrangements and the Impact

The term consolidation is loosely used to describe the combination of company assets and possibly even the liabilities, through various types of financial transactions. Key examples include:

- Mergers

A merger is an agreement that combines two existing separate companies into one new entity. Most mergers are done to gain market share in the industry, leverage on the economies of scale to reduce costs of operations, use the relatively larger capital base to expand to new territories or product lines, unite common products, with all of these aimed at obtaining a competitive advantage, and ensuring sustainable growth. After a merger, issued shares of the new company are distributed to existing shareholders of both original businesses in pre-agreed proportions. For example, the transaction between NIC Group and CBA is a merger.

- Acquisitions

An acquisition is a transaction where one company purchases a majority (more than 50.0%) or (in some instances) all of another company's shares in order to take control. As part of the exchange, the acquiring company often purchases the target company's equity, which allows the acquiring company to make decisions regarding the use of the newly acquired assets with/without the approval of the target company’s shareholders owing to the majority holding in the target company. Companies often acquire other companies when they intend to achieve quick inorganic growth, which may be more attainable, and does not pose any additional inefficiencies and logistic constrains that may arise from organic growth. For example, SBM Bank Kenya’s acquisition of Chase Bank Ltd.

- Tender Offers

Tender offer refers to when one company offers to purchase the equity directly from the shareholders of the target company, often at a premium, bypassing the target company’s board of directors and management. Tender offers are particularly common in listed companies where the acquiring company issues a takeover bid, subject to the approval of the target company’s shareholders. If there are no dissenting shareholders, tender offers have often resulted in acquisitions.

- Management Acquisitions

Management acquisitions refer to transactions where a company’s management team purchases the assets and consequently the operations of the company they manage. In this type of transaction, the management team pools resources, and acquire a stake, or even the entire company. The management may use their own individual financial resources or seek backing from external financiers such as private equity financiers, and financial institutions.

Section III: Recent Consolidation in Kenya

In the recent past consolidation has picked up in Kenya’s banking sector, as the relatively smaller banks become acquired by larger banks while relatively larger banks merge and form partnerships. The acquisitions have picked up, as the smaller tier 2 and tier 3 banks have found it difficult to operate in Kenya due to:

- The implementation of The Banking (Amendment) Act 2015, which saw the capping of interest chargeable on loans to 4.0% above the Central Bank Rate (CBR). This compressed their net interest margins, as they were unable to price loans higher for their riskier clients, and yet they have higher costs of deposits, which consequently saw most of them struggle to retain profitability,

- The implementation of the law saw the larger banks venture into the small banks’ niche markets such as Small and Medium Enterprises (SMEs) banking, and consequently, most have struggled to operate on declining top line revenue, leading to increased operational inefficiency, and operating losses, which has depleted capital,

- A tough operating environment caused by an abrasive political climate and prolonged droughts has made it even more difficult to operate, as it consequently lead to a deterioration in asset quality, and,

- The failure of Imperial bank prompted a flight to safety, making it hard for tier 2 and 3 banks to operate. This has led to acquisition of tier 3 banks such as Habib Bank Kenya by Diamond Trust Bank (DTBK), and mergers of tier 2 and tier 1 banks, such as the NIC and CBA deal.

Thus, in order to maintain a competitive edge and fast-track their growth, banks have either been acquiring the smaller counterparts, forming strategic partnerships, or merging together, so as to leverage on the synergies created to provide an adequate capital base, which will drive long term growth.

The banking sector acquisitions in Kenya over the past 5-years are highlighted in the table below:

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bns) |

Transaction Stake |

Transaction Value (Kshs bns) |

P/Bv Multiple |

Date |

|

CBA Group |

Jamii Bora Bank |

3.4 |

100.0% |

1.4 |

0.4x |

19-Jan* |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.2% |

5.1 |

1.0x |

19-Jan |

|

CBA Group |

NIC Group |

33.5** |

53:47*** |

Undisclosed |

N/A |

19-Jan* |

|

KCB Group |

Imperial Bank**** |

Unknown |

Undisclosed |

Undisclosed |

N/A |

18-Dec* |

|

SBM Bank Kenya |

Chase Bank ltd |

Unknown |

75.0% |

Undisclosed |

N/A |

18-Aug |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.0% |

1.8 |

0.8x |

17-Mar |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.0% |

2.8 |

1.6x |

16-Nov |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.0% |

1.3 |

1.4x |

16-Jun |

|

I&M Holdings |

Giro Commercial Bank |

3 |

100.0% |

5 |

1.7x |

16-Jun |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.0% |

2.6 |

2.3x |

15-Mar |

|

Centum |

K-Rep Bank |

2.1 |

66.0% |

2.5 |

1.8x |

14-Jul |

|

GT Bank |

Fina Bank Group |

3.9 |

70.0% |

8.6 |

3.2x |

13-Nov |

|

Average |

|

|

76.10% |

|

1.6x |

|

|

* Announcement date |

||||||

|

** Book Value as of the announcement date |

||||||

|

*** Shareholder swap ratio between CBA and NIC, respectively |

||||||

|

**** KCB acquired certain assets and liabilities of Imperial Bank, hence Imperial Bank remains in existence. |

||||||

Increased consolidation in the sector should see the formation of banks that have an adequate capital base, which will provide them with the requisite cover to partake in core banking activities, thereby catalyzing economic growth and development in the country. Furthermore, with an aggregate adequate capital cover, the banking sector will remain resilient to any internal or external systemic shocks that may affect the sector. Thus, it would be ideal for the sector to have even fewer, but stronger players.

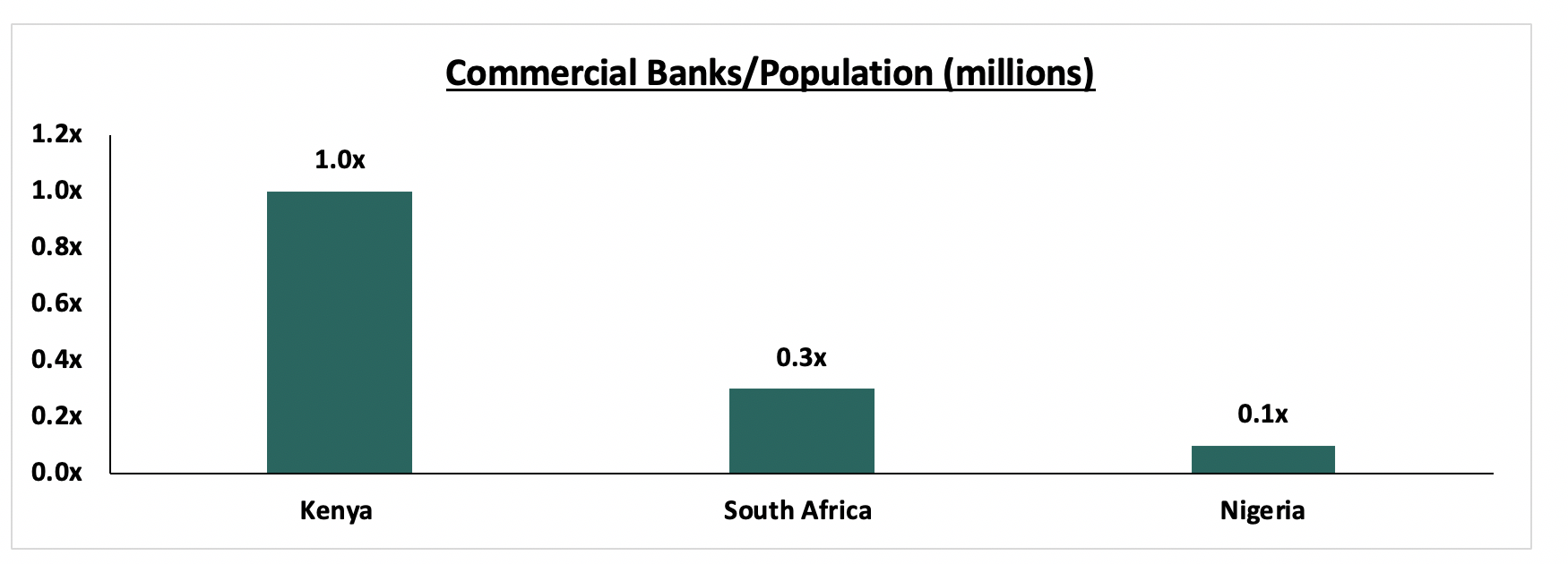

We have maintained our position that Kenya remains overbanked when compared to other major economies in Africa, and there is the need to trim the number to fewer more stable players. Furthermore, regulation, monitoring and oversight of the sector by the Central Bank of Kenya (CBK) would be made even easier with fewer players, thus reducing cases of fraud, poor governance and malpractice as witnessed in banks such as Imperial Bank Ltd and Chase Bank Ltd, which forced the banks into receivership.

Section IV: Case Study of Consolidation in the Nigerian Banking Sector

Before 2004, the Nigerian banking sector was served by 89 banks, whose landscape was characterized by an oligopolistic competition, where the sector was dominated by a few of the larger players. This was evidenced by the fact that the top 10 large banks accounted for more than 50.0% of the sector’s total assets, more than 51.0% of the total deposits and issued 46.0% of the total industry loans. Owing to the stiff competition, the relatively smaller banks were plagued by rising inefficiencies, thin capital bases, as they averaged NGN 1.4 bn (USD 10.0 mn) in capital, continuous loss making, an over-reliance on government deposits, with 20.0% of their deposits being sourced from government sources, illiquidity, poor corporate governance, and poor asset quality. The situation seemed to have stemmed from the relative ease of entry into the banking sector, owing to the relatively lower minimum capital requirements of NGN 2.0 bn (USD 14.3 mn). Consequently, due to the stiff competition, various banks sought to participate in non-banking activities such as real estate and commodities shipping. A review of the entire sector indicated that financially unsound banks accounted for 19.2% of the total industry assets, and 17.2% of the total deposits, thereby presenting concern of adverse effects to any systemic distress such as commodity price declines. Thus, to diffuse the situation, the Central Bank of Nigeria (CBN) fronted a strategic plan aimed at reducing the number of industry players into few players able to play their fundamental role of financial intermediation, and consequently support economic development.

The CBN proposed a reform agenda, which induced the consolidation phase in the banking sector. The major reforms included:

- Raising the minimum capital requirement to NGN 25.0 bn (USD 180.0 mn) from NGN 2.0 bn (USD 14.3 mn),

- Phased withdrawal of public sector funds from banks, beginning July 2004,

- Adoption of a risk-focused and rule-based regulatory framework, and,

- Zero tolerance for weak corporate governance, misconduct and lack of transparency.

This resulted in increased consolidation activity in the sector by way of mergers, acquisitions, and recapitalization from shareholders and external investors. Most activity was by way of mergers and acquisitions with most opting for this method as it presented the following benefits:

- Improved operating efficiency derived from the economics of scale as well as a more efficient allocation of resources,

- Faster revenue expansion, aided by the higher asset base, deposit liabilities and capital base,

- Risk reduction, due to change in organizational focus and structure, and,

- Globalization, which inculcated global practices and standards, and created a more globally interconnected financial services sector, which facilitated the provision of holistic financial services, and aided geographical expansion of banking operations in Nigeria, West Africa and Europe, for some of the larger players such as Zenith Bank and Guaranty Trust Bank.

As a result, from the wave of consolidation activity in 2005, which was mainly induced by regulation, the number of banks reduced to 25 relatively larger banks from 89. With size being an important ingredient of success, empirical analysis has shown that with the higher capital and asset bases, banks increased their risk appetites thereby increasing their lending activities, improved their operational efficiency by human resource restructuring and eliminating branch network overlaps. Furthermore, since banks were now endowed with larger capital bases, the sector was able to absorb both internal and external shocks, without adverse impacts. With fewer players, oversight was even easier for the CBN, which reduced incidences of malpractice and recourse actions from the Nigeria Deposit Insurance Corporation (NDIC). By engendering public confidence in the banking sector, the core financial intermediation function by banks was promoted, thereby aiding in capital formation, investment, and consequently driving economic growth.

Section V: Our View on Banking Sector Consolidation

As evidenced from the banking sectors in countries such as Nigeria, Ghana and the US, consolidation is always credit positive as it:

- Enhances the resilience of the sector to both external and internal shocks,

- Enhances the public’s confidence in the sector mainly in terms of deposit security,

- Enhances the entities’ capacity to conduct their core banking function of financial intermediation, which in turn pivots economic growth, and,

- Enables more oversight into the sector’s activities thereby reducing, and possibly eliminating cases of corporate governance malpractice.

We maintain our view that Kenya continues to be overbanked, necessitating a reduction in the number of players in the sector. Some of the larger banks are looking for acquisition targets to grow their market share. We lay out five criteria that would be used by these larger banks in their selection:

- Poorly Capitalized Banks - This includes challenges in meeting the statutory requirements, including capital adequacy and liquidity. With the injection of fresh capital, the acquiring entity can bolster the capital position of the bank, thereby meeting all statutory requirements,

- Locally owned Tier III banks- Since the banks are locally owned, the banks most likely have a particular niche or market segment that they serve in Kenya’s banking space. In addition, their market share is below 1.0% of the total market by deposit, indicating that they are largely non-competitive but there is lots of market share to potentially grow into and merge with existing business,

- Banks with a Low Return on Equity - This will favor the acquiring foreign entity as shareholders would be more willing to sell their stake owing to the low profits or operating losses possibly occasioned by highly inefficient operations, and cash out, as opposed to banks that deliver a high return on equity,

- Banks with High Non-Performing Loans - This is an area where the acquiring foreign entity can improve with their expertise and move with speed to rectify, and also restructure their loan book and debt, and,

- Banks with Shared Common Significant Shareholding - Local stable banks will also seek to acquire banks aligned with their strategies, and with a large common shareholding, especially banks where government holds significant stakes.

With acquisitions currently happening at cheaper valuations relatively to historical levels, we expect well-capitalized players to take advantage, which should see several deals completed. Thus, we continue to expect consolidation activity in Kenya’s banking sector.

We note that the pace of consolidation in the banking sector has picked up, and is likely to continue as banks merge to form strategic partnerships and struggling banks especially those that do not serve a niche, are acquired. This will lead to a more stable and safer banking sector.( If we were to move to a banking sector population to bank ratio similar to Nigeria, it means we need to reduce the number of banks from the current 39 to 5, which means 34 banks being acquired or merging.)

Disclaimer: The Cytonn Weekly is a market commentary published by Cytonn Asset Managers Limited, “CAML”, which is regulated by the Capital Markets Authority, CMA and the Retirement Benefits Authority, RBA. However, the views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only, and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.