Aug 11, 2024

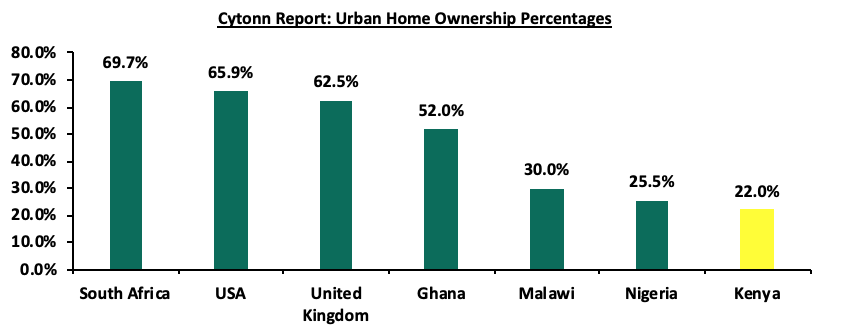

As reported by the World Bank, Kenya's urbanization rate stood at 3.7% in 2023, surpassing the global average of 1.7%. Additionally, the country's annual population growth rate averaged 2.0%, higher than the global average of 0.9%. This rapid urbanization and population growth have created a substantial demand for housing in Kenya, which greatly outstrips the available supply. The Centre for Affordable Housing Finance Africa (CAHF) estimates that Kenya faces an annual housing deficit of 80.0%. Currently, only 50,000 new houses are built each year, while the demand stands at approximately 250,000 units, leaving a shortfall of about 200,000 homes annually. The Centre for Affordable Housing Finance in Africa (CAHF) reports that 61.3% of Kenyans own homes, compared to other African countries like Angola and Algeria with 75.4% and 74.8% national home ownership rates respectively. The national homeownership rate stands at approximately 21.3% in urban areas sprawling the national average of 61.3% while 78.7% of urban dwellers rent. The government's push for affordable housing aims to improve this rate by making homes more accessible to lower and middle-income earners. The graph below shows the home ownership percentages for different countries compared to Kenya;

Source: Centre for Affordable Housing Finance Africa (CAHF), US Census Bureau, UK Office for National Statistics

To address this significant gap, the government launched various programs, policies, and strategies aimed at ensuring there is adequate housing for all citizens. Some of these initiatives included the following:

- Kenya Slum Upgrading Programme (KENSUP), designed to enhance the living conditions of residents in informal settlements across the country. The program focuses on constructing low-cost housing, installing social and physical infrastructure, promoting income-generating activities, improving tenant security, and managing the environment and solid waste through community and resource mobilization,

- Affordable Housing Programme (AHP), part of the Big Four Agenda, is a government initiative focused on boosting Kenya’s economic growth. The AHP aims to reduce the housing shortage in the country by leveraging both public and private resources to build affordable homes. The AHP aims to achieve this goal through several strategies, including;

- Incentives to Developers: These include: i) providing land to county governments for affordable housing construction, ii) exempting VAT on imported and locally purchased construction materials for affordable housing, iii) offering a reduced corporate tax rate of 15.0% for developers building over 100 units, iv) exempting first-time buyers from stamp duty (4.0% in urban areas and 2.0% in rural areas), and v) providing a 15.0% tax relief on savings to encourage home ownership contributions. These measures aim to advance the government’s goal of delivering affordable housing to Kenyans,

- The Kenya Mortgage Refinancing Company (KMRC): established in 2018 and operational since 2020, aims to provide long-term financing to primary mortgage lenders like banks, microfinance institutions, and SACCOs at low, fixed interest rates. KMRC’s goal is to enhance access to affordable housing finance by supplying lenders with the necessary liquidity to offer affordable mortgages to Kenyans. By August 2023, KMRC had disbursed Kshs 7.2 bn to nine primary mortgage lenders,

- The National Housing Development Fund (NHDF): established in 2018 via the Finance Act and managed by the National Housing Corporation (NHC), aims to gather funds from various sources to provide affordable housing for Kenyans. The fund helps mitigate risks for private developers by guaranteeing the purchase of units, facilitates buyer uptake by offering affordable financing options, and allows mortgage and cash buyers to save for affordable homes through the Home Ownership Savings Plan (HOSP), and,

- The Affordable Housing Levy: it was established on March 2024 through the assent of the Affordable Housing Act, 2024 (Act). The Act introduced the affordable housing levy at the rate of 1.5% on the gross salary of an employee, with a matching contribution from the employer. The National Assembly Finance and Planning Committee recommended the conversion of the NHDF into a levy, which meant that the money collected by the Kenya Revenue Authority (KRA) will not be refunded after collection. The Act established the Affordable Housing Fund (Housing Fund) into which the Levy, monies appropriated by the National Assembly, gifts and grants, voluntary contributions, investments made by the Fund, loans approved by the Cabinet Secretary in charge of the National Treasury and other incomes will be paid. The purpose of the Fund is to provide funds for the development of affordable housing and associated social and physical infrastructure.

The Housing Fund plays a critical role in the AHP initiative, which is part of the broader Big Four Agenda, by facilitating the financing and development of affordable housing projects across the country. The Housing Act Cap 117 1967 stipulates that a Housing Fund is a public funding platform for affordable housing. The amount of contributions to the fund is determined by the Parliament and may be changed periodically and be either rendered voluntary or mandatory. The fund is intended to:

- Mobilize Resources: Pool resources from various stakeholders, including the government, private sector, and international donors, to finance housing projects.

- Subsidize Housing Costs: Lower the cost of housing for beneficiaries through subsidies and financial incentives, making home ownership more accessible.

- Provide Infrastructure: Support the development of essential infrastructure such as roads, water, and electricity to create well-serviced residential areas.

- Stimulate Economic Growth: Generate employment opportunities in the construction and real estate sectors, contributing to broader economic growth.

One of the key features of the Housing Fund is its focus on inclusivity. The fund is designed to cater to a wide range of income groups, with different financing options available to suit the needs of various contributors. For instance, low-income earners can access subsidized loans with favorable repayment terms, while middle-income earners can benefit from affordable mortgage options. This approach ensures that the benefits of the Housing Fund are distributed equitably across different segments of the population. Despite its noble objectives, the Housing Fund has encountered several challenges that hinder its effectiveness. These challenges will be discussed in detail in the subsequent sections. By addressing these challenges and implementing strategic recommendations, the Housing Fund can be optimized to achieve its full potential and significantly contribute to resolving Kenya's housing crisis.

Section I: Challenges Faced by the Housing Fund

- Public Awareness and Perception

- Lack of Information Dissemination: One of the primary challenges is the inadequate dissemination of information regarding the Housing Fund. Many Kenyans, particularly those in the low and middle-income brackets (the intended beneficiaries) are not fully informed about the Housing Fund, its objectives, benefits, and how to access it. This lack of awareness stems from insufficient outreach efforts and poorly executed public education campaigns. When potential beneficiaries are unaware of the existence or the benefits of the Housing Fund, they are unlikely to participate. This leads to lower-than-expected uptake of housing units and underutilization of the resources allocated to the fund. In the absence of clear and accurate information from credible sources, misinformation spreads leading to misconceptions about the Housing Fund, further discouraging participation,

- Misconceptions and Mistrust: There is a widespread mistrust and misconceptions surrounding the Housing Fund. These issues are rooted in historical precedents where similar government initiatives have been marred by corruption, mismanagement, and unfulfilled promises. As a result, the public is skeptical about the Housing Fund's ability to deliver on its promises. The perceived lack of transparency in how the Housing Fund operates exacerbates public mistrust. Without clear communication on how funds are allocated, spent, and the progress of housing projects, the public is left to speculate, often assuming the worst. Many potential beneficiaries view the process of applying for and benefiting from the Housing Fund as overly complicated and bureaucratic. This perception discourages participation, as people feel they may not have the resources or knowledge to navigate the system successfully. Negative media coverage has further eroded public trust in the Housing Fund. Reports highlighting issues such as the National Housing Corporation’s (NHC) Kshs 1.3 bn in unsold housing stock, the Kenya Development Corporation’s (KDC) Kshs 490.0 mn in unsold units, and senior officials within the NHC allegedly manipulating the allocation process to their advantage have all contributed to growing public doubt. Additionally, stalled projects like the Starehe Point 1 Affordable Housing project, along with widespread reports of mismanagement and corruption, have only added to the mistrust. In 2017, the media also revealed that the NHC had Kshs 251.0 mn tied up in dormant projects, including Kanyakwar II in Kisumu and Makande Estate in Mombasa. Such reports amplify public fears and doubts, making it increasingly difficult to garner the necessary support for the Housing Fund. These factors collectively create a challenging environment for the Housing Fund to gain the trust and participation it needs to succeed,

- Financial Incentives

- Insufficient Incentives for Employers and Employees: The Housing Fund Regulations require mandatory contributions from both employers and employees, creating a system where these contributions accrue in individual Housing Fund Accounts. While this system is intended to build savings towards home ownership, the incentives for employers and employees to participate are not robust enough. Many employees and employers view the mandatory contributions as an additional financial burden rather than a beneficial investment. The lack of immediate or tangible benefits reduces the willingness of both parties to fully engage with the Housing Fund. While voluntary members can also contribute to the Housing Fund, the incentives for doing so are minimal, especially for those who are self-employed or not formally employed. Without attractive incentives, voluntary participation rates remain low, limiting the fund's overall effectiveness.

- Administrative and Operational Efficiency

- Inefficient Fund Management: Efficient fund management is essential to ensure that the resources allocated to the Housing Fund are utilized effectively and that the intended benefits reach the target population. However, the Housing Fund has encountered significant challenges in this area, raising concerns about mismanagement and the proper use of funds. The operations of the Housing Fund are often hindered by bureaucratic red tape. Complex and lengthy approval processes can delay project implementation, leading to increased costs and missed deadlines. This inefficiency is further compounded by the involvement of multiple government agencies, each with its own set of regulations and procedures. Our Affordable Housing Agencies Report highlighted a critical issue: the existence of various agencies with overlapping mandates, creating a sense of competition on both the supply and demand sides of the affordable housing agenda. For instance, the National Housing Corporation (NHC) is tasked with lending grants to local authorities, providing loans to individuals and organizations, acquiring land, and constructing and managing buildings for affordable housing. Meanwhile, the Kenya Mortgage Refinance Company (KMRC) is responsible for providing long-term funds to primary mortgage lenders (PMLs) to increase the availability of affordable home loans. Additionally, the State Department of Housing is charged with developing and managing affordable housing projects. These overlapping roles lead to confusion and inefficiencies in fund management, making it difficult to fulfill the Housing Fund’s objectives effectively. The lack of clear delineation of responsibilities among these agencies results in fragmented efforts and hinders the overall success of the affordable housing initiative,

- Lack of Transparency: There have been concerns about the transparency of the Housing Fund’s financial management. Without clear and accessible records of how funds are being spent, it is difficult for stakeholders to hold the managing bodies accountable, which can lead to misallocation or misuse of resources. Concerns have been raised about the transparency of the Housing Fund’s financial management, particularly in May 2024, when it was revealed that Kshs 20.0 bn from the fund had been invested in Treasury Bills. This decision, intended as a short-term measure to prevent funds from remaining idle during the legal disputes over the housing levy, sparked debate. Members of Parliament questioned whether the proper procedures were followed and whether the Housing Levy Fund Board was adequately consulted. While the Ministry of Housing defended the move as low-risk, the situation underscores broader issues of transparency and the challenges in managing large sums of collected funds that are not immediately deployable for housing projects. Further, it is not clear regarding the allocation of the approximately Kshs 6.5 bn in monthly contributions. Moreover, detailed information about the number of units currently under construction, broken down by project, is also not available. This lack of clarity makes it difficult for the public to vet the government’s communication of 103,000 houses under development.

- Market Dynamics

- Access to Finance: Rising non-performing mortgage loans (NPLs) signal major challenges in accessing finance, with outstanding NPLs increasing from Ksh 37.8 bn in 2022 to Ksh 8 bn in 2023. This rise reflects economic difficulties and the high cost of financing, making lenders more cautious and leading to stricter lending criteria. Consequently, securing mortgages has become harder for potential homeowners. In 2023, the average mortgage interest rate surged from 12.3% to 14.3%, with some rates reaching as high as 18.6%. These higher rates make mortgages less affordable, especially for low and middle-income earners—the primary targets of the Housing Fund. As borrowing costs rise, fewer people can afford mortgages, shrinking the pool of potential homeowners and slowing the housing market, including Housing Fund projects. Additionally, the lack of affordable long-term financing, compounded by low income levels and high property prices, significantly impedes access to homeownership. Many potential buyers struggle to save for a down payment or qualify for a mortgage, putting homeownership out of reach for a large portion of the population the Housing Fund aims to support.

Section II: Recommendations for Improving the Fund’s Acceptability

- Strengthening Public Awareness and Perception

- Launch Comprehensive Public Education Campaigns: To address the challenge of inadequate information dissemination, the Housing Fund should launch targeted public education campaigns. These campaigns should use a multi-channel approach, including social media, traditional media (radio, TV, newspapers), community outreach programs, and partnerships with local leaders to ensure that information reaches all segments of the population, particularly low and middle-income earners. The campaigns should focus on educating the public about the objectives, benefits, and accessibility of the Housing Fund. This will help dispel misconceptions and build a positive perception of the fund,

- Increase Transparency Through Regular Reporting: To combat public mistrust, the Housing Fund must commit to transparency in its operations. Regular updates on fund utilization, project progress, and the allocation of resources should be made publicly available. These reports could be published on the Boma Yangu website, shared through media outlets, and discussed in public forums. Transparent communication will help build trust with the public by demonstrating that the fund is managed responsibly and that the benefits are reaching the intended beneficiaries.

- Enhancing Financial Incentives

- Introduce a Tiered System of Levy Deduction: China’s Housing Provident Fund (HPF) allows cities to set different contribution rates based on their urban area limits, with major cities typically having higher rates than other parts of the country. Kenya’s Housing Fund could adopt a similar approach by implementing a tiered deduction system. For example, employees in Nairobi, Mombasa, and other large urban centers could face higher deduction percentages, while those in smaller towns and rural areas would have lower rates. This tiered system could be tailored to reflect the varying costs of housing and average incomes across different regions, ensuring that the levy is both affordable and fair for all employees, regardless of where they live,

- Introduce Tangible Benefits for Contributors: To enhance participation and address the lack of incentives for employers and employees, the Housing Fund should introduce immediate and tangible benefits for contributors. For instance, contributors could be offered preferential interest rates on home loans, tax incentives, or the option to use their contributions as collateral for other types of loans. A successful model can be seen in Singapore’s Central Provident Fund (CPF), a comprehensive social security system with a housing component. CPF contributors can use their savings to purchase homes, access preferential interest rates on public housing loans (HDB flats), and even use their contributions as collateral for home loans. Additionally, the Singaporean government provides grants and subsidies to further reduce housing costs. In Malaysia, Employees Provident Fund (EPF) contributors can withdraw from their retirement savings to purchase homes or to reduce or settle their housing loans. They also benefit from preferential interest rates for home loans under various government-backed housing schemes, such as the MyHome Scheme. By implementing similar benefits, the Housing Fund would become more attractive, encouraging both mandatory and voluntary contributions and ultimately strengthening the fund’s impact,

- Flexible Contribution Schemes: The Housing Fund should offer flexible contribution schemes that cater to different income levels. For instance, self-employed individuals and informal sector workers could be allowed to make irregular contributions that align with their income patterns. This flexibility would encourage more people to participate in the Housing Fund, particularly those who may not have a steady income,

- Expand Access to Voluntary Contributions: To increase voluntary participation, the Housing Fund should actively promote the benefits of voluntary contributions and provide incentives such as matching contributions or bonus interest rates for long-term savings.

- Improving Administrative and Operational Efficiency

- Streamline Fund Management and Reduce Bureaucracy: To improve operational efficiency, the Housing Fund must streamline its management processes. This can be achieved by simplifying the approval processes, reducing redundancies, and clearly defining the roles and responsibilities of all agencies involved in the affordable housing agenda. By eliminating overlapping mandates and fostering better inter-agency coordination, the fund can reduce delays, cut costs, and ensure that resources are allocated efficiently,

- Establish Clear Accountability Mechanisms: The Housing Fund should implement robust accountability mechanisms to ensure that funds are used effectively and for their intended purposes. This could include regular audits, performance evaluations, and the establishment of an independent oversight body to monitor the fund’s activities. By holding fund managers and implementing agencies accountable, the risk of mismanagement and corruption can be minimized, leading to better outcomes for the Housing Fund. The Housing Levy Fund Board should also prioritize the allocation of funds to ongoing and ready-to-launch housing projects to ensure that collected funds are promptly utilized for their intended purpose. They should avoid holding large sums in reserve or investing in non-construction activities, unless absolutely necessary and with full transparency,

- Adapting to Market Dynamics

- Implement Targeted Subsidies for Low-Income Earners: The UK’s Help to Buy scheme offers an equity loan in which the government lends a percentage of the property’s cost, thereby reducing the down payment required from the buyer. This scheme is specifically aimed at first-time buyers and those with limited income. Similarly, the Housing Fund should introduce targeted subsidies for low-income earners to bridge the affordability gap. These subsidies could help cover a portion of the down payment, lower monthly mortgage payments, or offer reduced interest rates for eligible applicants. By making housing more affordable for those who need it most, the fund can boost participation and decrease the number of unsold units,

- Conduct Regular Market Research and Feasibility Studies: To ensure that housing projects align with market needs, the Housing Fund should conduct regular market research and feasibility studies. These studies should analyze housing demand, income levels, location preferences, and economic conditions. By basing project decisions on solid data, the fund can better match supply with demand, avoid resource wastage, and ensure that projects are financially viable.

- Supplement the public housing fund program with a private housing fund program: We need to develop a private housing fund framework that allows investors and employees to contribute to privately managed housing funds; same way we have private pension funds. This will enable capital formation in the private sector to help alleviate the housing challenges.

Section III: Conclusion

The challenges facing Kenya's Housing Fund are complex, reflecting broader issues within the country’s housing sector and the economy as a whole. However, with targeted interventions and strategic reforms, the Housing Fund can be revitalized to better serve its intended purpose of making affordable housing a reality for millions of Kenyans. Key recommendations such as strengthening public awareness through comprehensive education campaigns, increasing transparency, and offering tangible financial incentives can significantly improve the fund’s acceptability and effectiveness. Moreover, implementing a tiered levy system, streamlining fund management, and introducing targeted subsidies for low-income earners will address some of the structural barriers that have hindered the fund's success. By focusing on these areas, the Housing Fund can not only bridge the affordability gap but also stimulate broader economic growth through increased homeownership and construction activity. With a renewed focus on efficiency, accountability, and market alignment, the Housing Fund has the potential to transform Kenya’s housing landscape, delivering on the promise of affordable, quality homes for all. This will not only improve the quality of life for many Kenyans but also contribute to the country’s long-term social and economic development goals.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which follows Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice, or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.