Jan 13, 2019

In 2018, the Kenyan equities market was on a downward trend, with NASI, NSE 25 and NSE 20 declining by 18.0%, 17.1% and 23.7%, respectively. Since the peak in February 2015, NASI and NSE 20 are down 20.9% and 48.4%, respectively. The only large cap gainer during the year was Barclays Bank, which gained 14.1%, while the largest losers were East Africa Breweries (EABL), Bamburi Cement, Diamond Trust Bank (DTB), NIC Group and Safaricom, which lost 26.6%, 26.4%, 18.5%, 17.6% and 17.0%, respectively.

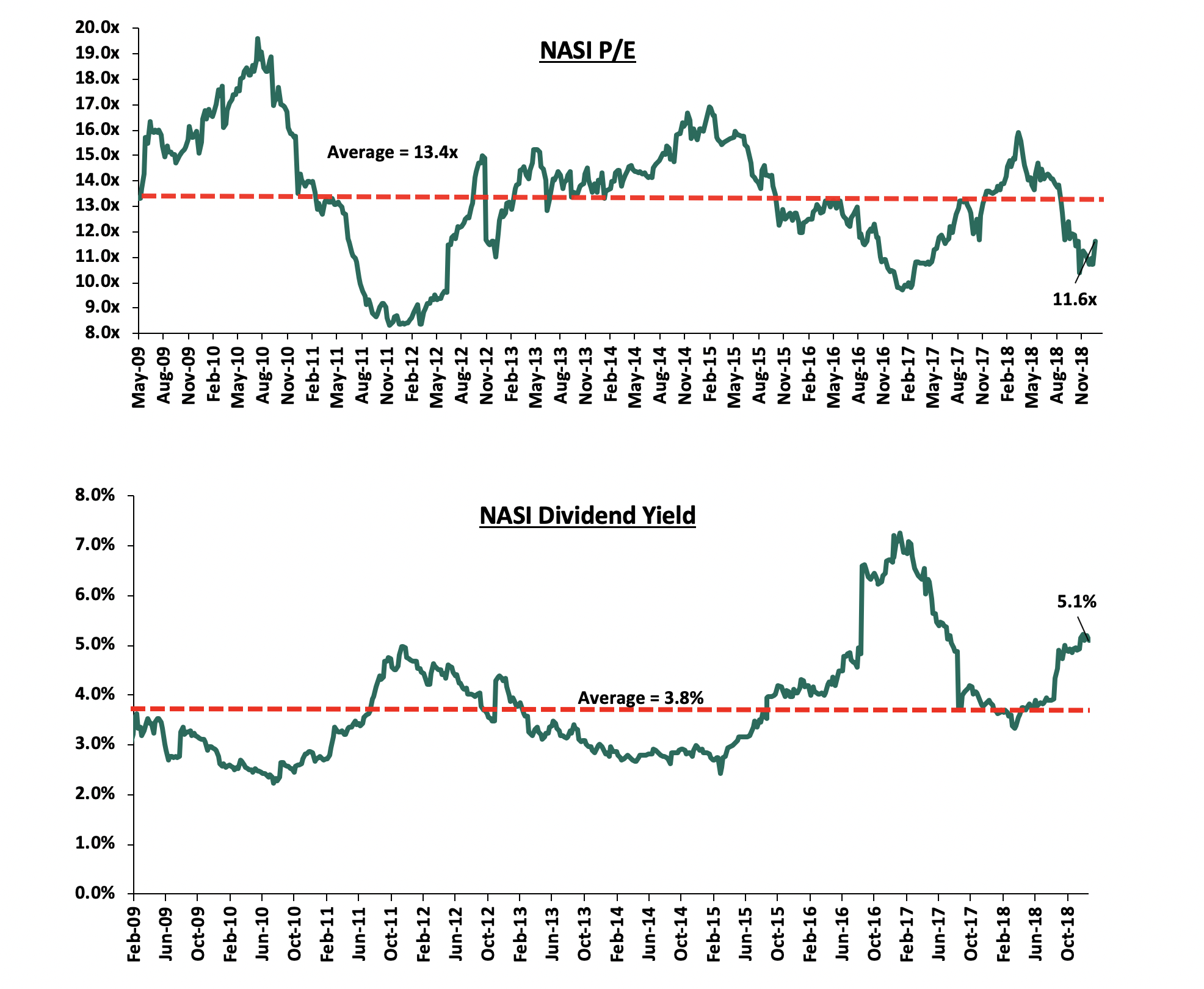

Following the sustained price declines, the market valuation declined to below its historical average with NASI P/E currently at 11.6x compared to the historical average of 13.4x. Equity turnover during the year rose by 2.3% to USD 1,723.8 mn from USD 1,684.4 mn in FY’2017. Foreign investors remained net sellers with a net outflow of USD 288.8 mn, a 146.6% increase compared to net outflows of USD 113.7 mn recorded in FY’2017. The foreign investor outflows during the year was largely due to negative investor sentiment, as international investors exited the broader emerging markets due to the rising US interest rates, improved corporate performance in the US, and the strengthening US Dollar.

The year also saw 8 companies issue profit warnings to investors, compared to 12 companies that issued profit warnings in 2017. The companies cited the relatively tougher operating environment, which affected the top-line revenue, leading to rising inefficiencies, and consequently declining net income. However, we note that 4 of the companies that issued profit warnings in 2018 also issued in 2017, suggesting their poor run in performance is due to specific company business models as opposed to the operating environment. The companies are summarized in the table below.

|

Companies that issued profit warning comparison |

||

|

No |

2017 |

2018 |

|

1 |

Bamburi Cement |

Bamburi Cement |

|

2 |

Britam Holdings |

Britam Holdings |

|

3 |

HF Group |

HF Group |

|

4 |

Deacons East Africa |

Deacons East Africa PLC |

|

5 |

Flame Tree |

Kenya Power & Lightning Company |

|

6 |

BOC Kenya |

Sanlam |

|

7 |

Standard Group |

UAP-Old Mutual |

|

8 |

Family Bank |

Sameer Africa |

|

9 |

Mumias Sugar |

|

|

10 |

Nairobi Business Ventures |

|

|

11 |

Unga Group |

|

|

12 |

Standard Chartered Bank Kenya |

|

Market Performance

During the week, the equities market was on an upward trend with NASI, NSE 20 and NSE 25 gaining 4.1%, 0.4% and 3.4%, respectively, taking their YTD performances to 1.6%, (1.4%) and 0.9%, for NASI, NSE 20 and NSE 25, respectively. The equities market performance during the week was driven by gains in large caps such as, Safaricom, Equity Group, Standard Chartered Bank Kenya (SCBK) and Barclays Bank, which gained 9.9%, 9.5%, 2.2% and 1.8%, respectively.

Equities turnover rose by 103.7% during the week to USD 21.9 mn from USD 10.7 mn the previous week, owing to a shortened trading week due to the New Year holiday, taking the YTD turnover to USD 29.2 mn. Foreign investors remained net sellers for the week, with a net selling position of USD 1.9 mn, a 30.6% decrease from last week’s net selling position of USD 2.8 mn.

The market is currently trading at a price to earnings ratio (P/E) of 11.6x, 13.4% below historical average of 13.4x, and a dividend yield of 5.1%, above the historical average of 3.8%. The current P/E valuation of 11.6x is 19.6% above the most recent trough valuation of 9.7x experienced in the first week of February 2017, and 39.8% above the previous trough valuation of 8.3x experienced in December 2011. In our view, at current valuations, there is value in the market, with the current P/E valuation being 27.0% below the most recent peak of 15.9x in March 2018. The charts below indicate the historical P/E and dividend yields of the market.

Weekly Highlights

During the week, the amendment to the Income Tax Act, included in the Finance Act 2018, was made public. The amendment makes it a requirement for Kenyan firms to pay a 30.0% tax on dividends received from their subsidiaries, and are redistributed to shareholders. Under the previous legislation, a holding company would receive dividends from its subsidiary, without paying the withholding tax, if its ownership in the subsidiary exceeded 12.5%. The tax is payable on dividends distributed out of net income that have not been previously taxed. The introduced amendments scrapped the requirement by companies to maintain a dividend tax account, effectively abolishing and replacing the compensating tax, which would be chargeable on distribution of untaxed gains or profits. The distribution of qualifying dividends attracts withholding tax at the rate of 5.0% for residents, and 10.0% for non-resident shareholders. However, distribution of dividends to a company controlling more than 12.5% of the distributing company is exempt from withholding tax. Thus, with the new regulation being enforced, it seems that companies distributing the tax-exempt dividends from subsidiaries to their holding companies, would not be exempted from the withholding tax even if the holding company owns more than 12.5% of the subsidiary, and effectively, in our view, creating a higher tax expense, which is a contradiction to the prevailing provision. Secondly this would also mean that there would be double taxation, given that dividends are obtained from after-tax income, and redistribution of the same, does not change the fact the income had undergone taxation. When enforced, it may also lead to a downgrade of the country’s investment attractiveness, given the relatively stricter tax profile that would effectively reduce the absolute dividend income received by investors.

Commercial Bank of Africa (CBA) has issued a cash buy-out offer of Kshs 1.4 bn to Jamii Bora bank. The Kshs 1.4 bn buyout represents a steep discount from the Kshs 3.4 bn book value as at Q1’2018. This essentially implies the transaction, if the offer is accepted and no further injections made, would happen at a Price to Book ratio (P/Bv) of 0.4x, significantly lower than the average P/B ratio of 1.6x of recent transactions in the banking sector. Jamii Bora had a deposit base of Kshs 5.0 bn, and a net loan book of Kshs 7.9 bn. The bank had a relatively solid capital base, with a total capital to risk-weighted assets ratio of 19.3%, exceeding the 14.5% statutory requirement by 4.8% points. The bank’s financial performance has been deteriorating since Q1’2017, possibly caused by the implementation of the Banking (Amendment) Act 2015, which capped interest chargeable on loans at 4.0% above the Central Bank Rate (CBR), with the bank’s loan book declining to Kshs 8.3 bn as at FY’2017, from Kshs 10.5 bn in FY’2016, in the first full year of the interest rate cap implementation. The declining loan book consequently saw the interest income decline by 36.2% to Kshs 1.4 bn in FY 2017, from Kshs 2.2 bn as at FY’2016. Consequently, operating income declined 57.8% to Kshs 0.5 bn from Kshs 1.3 bn in FY’2016. With the decline in operating income faster than the decline in total operating expenses of 28.0% to Kshs 1.3 bn from Kshs 1.8 bn, the bank consequently recorded losses, and the loss-making trend continued to Q1’2018. We are of the view that the bank’s acquisition presents the best-case scenario, to navigate the relatively tougher and competitive operating environment, amid expectation that Mshwari under CBA may be spun off and operate under Jamii Bora, with possibly the intention of sharping management’s focus on the corporate and Small and Medium Enterprise (SME) banking in the merged entity after the NIC-CBA merger. We are of the view that the huge discount to the equity value in the offer, may be due to (i) the possibility of an additional capital injection by CBA, with Jamii Bora operating at a negative liquidity position, and (ii) the high Non Performing Loans ratio (NPL) of 22.4% as at Q1’2018, with gross NPLs of Kshs 2.2 bn. In conclusion, we note that the pace of consolidation activity especially in the banking sector has picked up, and we expect this to continue, as banks merge to form strategic partnerships, or are acquired, especially those that do not serve a niche, and are struggling to operate in the current environment. We also expect acquisition transactions to take place at significantly cheaper multiples, going forward. The table below highlights the various transactions that have happened in the banking sector over the last 5-years.

|

Acquirer |

Bank Acquired |

Book Value at Acquisition (Kshs bns) |

Transaction Stake |

Transaction Value (Kshs bns) |

P/Bv Multiple |

Date |

|

CBA Group |

Jamii Bora Bank |

3.4 |

100.00% |

1.4 |

0.4x |

19-Jan* |

|

AfricInvest Azure |

Prime Bank |

21.2 |

24.20% |

5.1 |

1.0x |

19-Jan |

|

NIC Group |

CBA Group |

30.6** |

Undisclosed |

Undisclosed |

N/A |

Dec-18* |

|

KCB Group |

Imperial Bank |

Unknown |

Undisclosed |

Undisclosed |

N/A |

18-Dec |

|

SBM Bank Kenya |

Chase Bank ltd |

Unknown |

75.00% |

Undisclosed |

N/A |

18-Aug |

|

DTBK |

Habib Bank Kenya |

2.4 |

100.00% |

1.8 |

0.8x |

17-Mar |

|

SBM Holdings |

Fidelity Commercial Bank |

1.8 |

100.00% |

2.8 |

1.6x |

16-Nov |

|

M Bank |

Oriental Commercial Bank |

1.8 |

51.00% |

1.3 |

1.4x |

16-Jun |

|

I&M Holdings |

Giro Commercial Bank |

3 |

100.00% |

5 |

1.7x |

16-Jun |

|

Mwalimu SACCO |

Equatorial Commercial Bank |

1.2 |

75.00% |

2.6 |

2.3x |

15-Mar |

|

Centum |

K-Rep Bank |

2.1 |

66.00% |

2.5 |

1.8x |

14-Jul |

|

GT Bank |

Fina Bank Group |

3.9 |

70.00% |

8.6 |

3.2x |

13-Nov |

|

Average |

|

|

76.10% |

|

1.6x |

|

|

* Announcement date |

||||||

|

** Book Value as of the announcement date |

||||||

Kenya Equities Outlook

In 2019, the factors that will affect the direction of the Kenyan equities market include:

- Corporate Earnings: On average, we expect earnings growth for the year 2019 to come in at 8.1%, lower than our 2018 expectation of 12.0%. The expectation of lower earnings growth for 2019 is mainly due to (i) anticipation of depressed earnings from commercial banks as the full implementation of the new IFRS 9 standard, which uses a prospective approach to credit risk provisioning, is completed, thereby meaning that provisioning expense will likely be incurred on the income statement, rather than the balance sheet, as allowed in the initial year of IFRS 9 implementation. This, coupled with the rising Non Performing Loans (NPLs) will likely lead to lower earnings on a higher provisioning expense, and (ii) given the persistence of the tight operating environment, non-financials are also likely to report suppressed earnings weighed down by factors such as the limited credit access;

- Capital Markets Investor Sentiment: We expect the equities market to register increased foreign inflows in 2019, mainly supported by:

- Existence of value to be derived from stocks, with the market, and various counters trading at cheaper valuations relative to historical levels, which provide attractive entry opportunities for medium and long-term investors,

- With the slowdown in the global economy, we expect reduced capital flight from frontier and emerging economies into developed economies, and,

- Generally, Kenya remains more attractive compared to other frontier markets boosted by stronger economic growth compared to other economies in the region such as Nigeria, and Kenya’s rank at position 61 in the Ease of Doing Business, higher than regional peers Uganda and Tanzania, which will attract investors seeking the high growth in frontier markets;

- Diversification of Capital Markets and New Listings: We expect a number of activities to be undertaken by NSE in 2019 including (i) a possible commencement of derivatives trading at the bourse in Q2’2019, with the testing phase now completed, with the main types of derivatives being stock and index futures, (ii) the Central Depository and Settlement Corporation’s (CDSC) plan to launch a new trading platform that would allow a settlement cycle of 1 day (t+1), and possibly implementing margin trading, and, (iii) we expect both new listings (Initial Public Offerings (IPOs)), and cross listings of stocks from other African countries. Once implemented, these initiatives would result in; (i) increased liquidity in the market by increasing the volume of securities available for trading, and (ii) improve depth of the capital market by increasing product offerings at the exchange, and consequently attracting investors. Key challenges in the market, however, are the deferment of these initiatives without clear timelines, and the low uptake of the new products introduced in the exchange, such as the Barclays Gold ETF, which may be attributed to lack of proper investor education. We maintain our view that there remains the need for increased focus towards extensive public education, and engagement before rolling out new products;

- Monetary Policy Direction: We expect monetary policy to remain relatively stable in 2019, and lean to a possible easing, as the CBK monitors Kenya’s inflation rate, and the currency. The inflation rate is expected to remain within the government target of 2.5% - 7.5% due to improved weather conditions, leading to relatively lower food inflation, while the currency is expected to remain stable supported by improved diaspora remittances, and a narrowing current account deficit;

As can be seen in the table below, we expect equities market activity in 2019 to be driven by (i) continued economic recovery, with the GDP growth rate for the year projected at between 5.7% - 5.9% supported by agriculture and tourism, (ii) an 8.1% growth in corporate earnings, and (iii) attractive valuations in a majority of the counters, with the market currently trading at P/E of 11.6x, 13.4% below the historical average of 13.4x, thereby providing attractive entry point, and possibly a higher capital appreciation gain potential. Compared to 2018, we have maintained our “POSITIVE” outlook on the macroeconomic environment and valuations of the market. Our outlook on corporate earnings growth was however downgraded to “NEUTRAL”, on a slower expected corporate earnings growth of 8.1% compared to the 12.0% earnings growth in 2018. We have also changed our outlook on investor sentiment and security to “NEUTRAL” from “POSITIVE” last year due to expectations of a possible dampening of investor sentiment on equities given the expected global economic slowdown, leading to higher volatility. We however expect positive inflows especially in select large cap stocks as foreign investors take advantage of the cheap valuations whilst leveraging on dividend income earned. As such in consideration of the above, we have a “POSITIVE” outlook on Kenyan equities going into 2019.

|

Equities Market Indicators |

Outlook 2019 |

Current View |

|

Macro-economic Environment |

• GDP growth is expected to continue recovery in 2019, and come in at between 5.7%-5.9%. This will be driven by recovery of agriculture and tourism • Interest rates are expected to remain at the current levels, as the CBK monitors inflation and exchange rates |

Positive |

|

Corporate Earnings Growth |

• We expect corporate earnings growth of 8.1% in 2019, lower than the expected 12.0% growth for 2018, weighed down by the relatively tougher operating environment, as several firms cite lack of credit access, and the base effect of relatively higher earnings in 2018 |

Neutral |

|

Valuations |

• With the market currently trading at a P/E of 11.6x, and expected earnings growth of 8.1%, the market is currently trading at a forward P/E of 10.7x, representing a potential upside of 24.9% compared to historical levels. |

Positive |

|

Investor Sentiment and Security |

• We expect 2019 to register improved foreign inflows from the negative position in 2018, as investors possibly balance out the slower expected global growth, and mainly supported by long term investors who enter the market looking to take advantage of the current low/cheap valuations in the market • We expect security to be maintained in the country supported by government initiatives towards maintaining internal security |

Neutral |

Equities Universe of Coverage

Below is our Equities Universe of Coverage:

|

Equities Universe of Coverage |

||||||||

|

Banks |

Price as at 4/1/2019 |

Price as at 11/1/2019 |

w/w change |

YTD Change |

Target Price* |

Dividend Yield |

Upside/Downside** |

P/TBv Multiple |

|

Diamond Trust Bank |

156.0 |

152.0 |

(2.6%) |

(2.9%) |

283.7 |

1.7% |

88.4% |

0.9x |

|

NIC Bank |

27.4 |

27.6 |

0.5% |

(0.9%) |

48.8 |

3.6% |

80.8% |

0.7x |

|

Ghana Commercial Bank*** |

4.6 |

4.6 |

(0.2%) |

(0.2%) |

7.7 |

8.3% |

76.5% |

1.1x |

|

Access Bank |

5.8 |

5.7 |

(2.6%) |

(16.9%) |

9.5 |

7.1% |

75.2% |

0.4x |

|

KCB Group |

37.4 |

36.9 |

(1.2%) |

(1.5%) |

61.3 |

8.1% |

74.3% |

1.2x |

|

Zenith Bank*** |

21.7 |

21.9 |

0.7% |

(5.2%) |

33.3 |

12.4% |

64.9% |

1.0x |

|

Equity Group |

33.8 |

37.0 |

9.5% |

6.0% |

56.2 |

5.4% |

57.5% |

1.8x |

|

UBA Bank |

7.9 |

7.4 |

(7.0%) |

(4.5%) |

10.7 |

11.6% |

57.1% |

0.5x |

|

I&M Holdings |

90.5 |

91.0 |

0.6% |

7.1% |

138.6 |

3.8% |

56.2% |

0.9x |

|

Co-operative Bank |

13.9 |

13.9 |

(0.4%) |

(3.1%) |

19.9 |

5.8% |

49.5% |

1.2x |

|

CRDB |

150.0 |

140.0 |

(6.7%) |

(6.7%) |

207.7 |

0.0% |

48.4% |

0.5x |

|

Ecobank Ghana |

7.5 |

7.5 |

0.0% |

0.0% |

10.7 |

0.0% |

43.1% |

1.6x |

|

CAL Bank |

1.0 |

1.0 |

1.0% |

2.0% |

1.4 |

0.0% |

40.0% |

0.8x |

|

Union Bank Plc |

6.0 |

6.0 |

0.0% |

7.1% |

8.2 |

0.0% |

35.8% |

0.6x |

|

HF Group |

5.6 |

5.4 |

(3.9%) |

(2.5%) |

6.6 |

6.5% |

28.7% |

0.2x |

|

Stanbic Bank Uganda |

30.9 |

30.0 |

(3.0%) |

(3.2%) |

36.3 |

3.9% |

24.8% |

2.1x |

|

Barclays |

10.9 |

11.1 |

1.8% |

1.4% |

12.5 |

9.0% |

21.6% |

1.5x |

|

Guaranty Trust Bank |

33.5 |

33.5 |

0.0% |

(2.8%) |

37.1 |

7.2% |

17.9% |

2.1x |

|

SBM Holdings |

5.9 |

6.0 |

1.7% |

1.0% |

6.6 |

5.0% |

14.0% |

0.9x |

|

Bank of Kigali |

290.0 |

290.0 |

0.0% |

(3.3%) |

299.9 |

4.8% |

8.2% |

1.6x |

|

Standard Chartered |

190.3 |

194.5 |

2.2% |

0.0% |

196.3 |

6.4% |

7.4% |

1.6x |

|

Stanbic Holdings |

90.0 |

90.0 |

0.0% |

(0.8%) |

92.6 |

2.5% |

5.4% |

0.9x |

|

Bank of Baroda |

138.0 |

135.0 |

(2.2%) |

(3.6%) |

130.6 |

1.9% |

(1.4%) |

1.2x |

|

FBN Holdings |

7.5 |

7.4 |

(0.7%) |

(6.9%) |

6.6 |

3.4% |

(7.0%) |

0.4x |

|

Standard Chartered Ghana |

21.1 |

21.1 |

0.0% |

0.4% |

19.5 |

0.0% |

(7.7%) |

2.6x |

|

National Bank |

5.2 |

5.5 |

5.4% |

2.6% |

4.9 |

0.0% |

(10.3%) |

0.4x |

|

Stanbic IBTC Holdings |

47.0 |

46.2 |

(1.8%) |

(3.8%) |

37.0 |

1.3% |

(18.5%) |

2.4x |

|

Ecobank Transnational |

14.0 |

13.5 |

(3.6%) |

(20.6%) |

9.3 |

0.0% |

(31.3%) |

0.5x |

|

**Target Price as per Cytonn Analyst estimates* **Upside / (Downside) is adjusted for Dividend Yield* **Banks in which Cytonn and/or its affiliates are invested in** **Stock prices indicated in respective country currencies* |

||||||||

We are “POSITIVE” on equities for investors as the sustained price declines has seen the market P/E decline to below its historical average. With a number of counters in sectors such as Financial Services, trading at attractive prices relative to historical level, we expect increased market activity, and possibly increased inflows from foreign investors, as they take advantage of the attractive valuations, and repatriate funds from developed economies, which are expected to record economic slowdowns in 2019, thereby resulting in positive performance, relative to 2018.