Feb 17, 2019

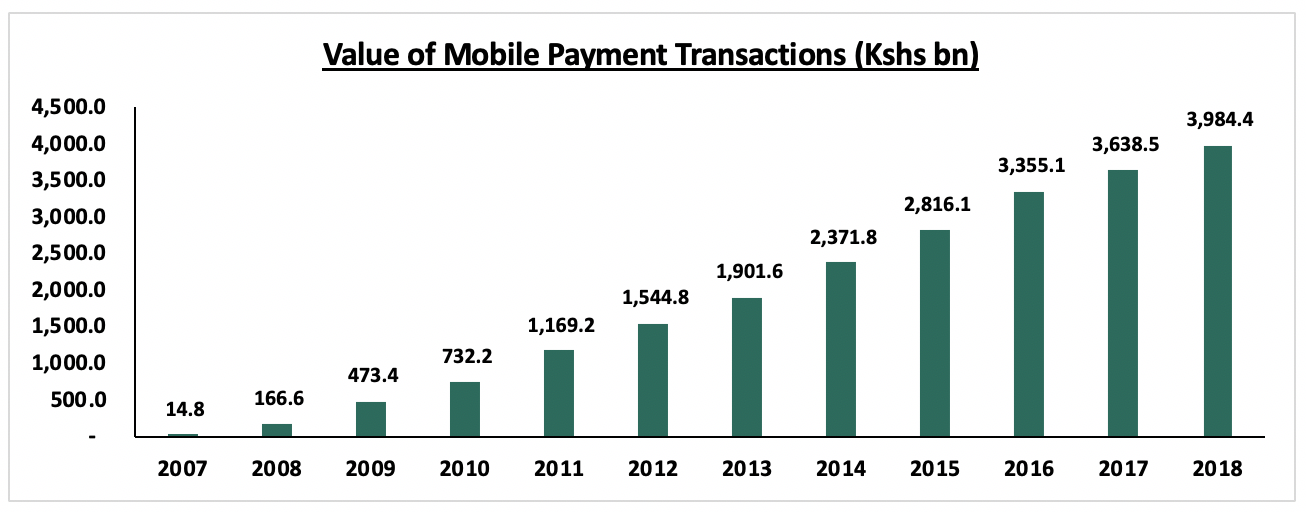

Technological disruptions have greatly affected the Kenyan financial services industry in recent years. Mobile money is by far the most significant, as underlined by data from the Central Bank of Kenya (CBK), which indicates that the value of mobile transactions has grown at a CAGR of 66.3% since inception in 2007, from Kshs 14.8 bn of transaction volume, to Kshs 4.0 tn of transaction volume in 2017. Online banking has also gained traction and majority of banks are now aligning their business models to towards online channels as opposed to the traditional brick and mortar. The most recent innovation to shake up the industry is digital lending, which has been, to some part, a response to the slow growth in private sector credit following the capping of interest rates on loans offered by banks. Globally, decentralization of currency has been a topic of interest, pegging the question on whether these emerging digital currencies have a place in the industry.

Financial services being one of our primary industries of focus, in this week’s focus note we aim to analyze the technological innovations that will define its trajectory in the long term. As such, we shall look at the following:

- History and Evolution of the Financial Services Industry

- Recent Significant Technological Adoptions in the Kenyan Financial Services Industry

- Emerging Technological Trends in the Industry and Their Expected Impact

- Outlook on the Extent to Which Technology Will Shape the Future of the Industry

Section I: History and Evolution of the Financial Services Industry

- The Banking Industry

The concept of banking has existed for centuries and has continuously evolved with changing human needs. Banking, in the modern sense and the practice of issuing banknotes emerged in the 17th century. Wealthy merchants would store their gold with goldsmiths of London in secure vaults, and at a fee. The goldsmiths would issue a receipt for each deposit based on quality and quantity of the gold. If a customer wanted to spend the gold, they could use the piece of paper to draw it from the vault. In time, they were able to simply use the paper as payment in shops. Paper receipts were soon seen as being as good as metal, and paper money was born. Over time, commodity backed currency was replaced by fiat currency which was no longer pegged to gold. In the 1960s, the first Automated Teller Machines (ATM) were developed and first machines started to appear by the end of the decade. Banks started to become heavy investors in computer technology to automate much of the manual processing, which began a shift by banks from large clerical staffs to new automated systems. By the 1970s the first payment systems started to develop, that would lead to electronic payment systems for both international and domestic payments. The international SWIFT payment network was established in 1973 and domestic payment systems were developed around the world by banks working together with governments. In today’s digital age, we have seen a major transformation in the financial services industry. What was for many decades a largely unchanging industry is now constantly evolving, with many banks battling to keep up.

- The Insurance Industry

The insurance industry as we see it today is modern and in an advanced stage, which has been attained in a phased manner over a long period. Like banking, the roots of insurance can be traced back to ancient period. Insurance as we now know it on the institutional level started in the late 1800s. In the early twentieth century, industry-collectives arose, coming together to pool resources and share risks. Unlike banking, the traditional insurance model has been mostly immune to drastic changes. Apart from support aspect like database management, payment channels and process streamlining, the fundamentals of insurance practices are yet to be fully disrupted. The distribution aspect still mainly relies on agents, although new innovations like bancassurance have begun to emerge. Investigation and processing of claims is also reliant on manpower. Efforts have been made to automate the process of actuarial modelling but with little success, since no computer can provide the judgement and inventiveness that actuaries do.

Section II: Recent Significant Technological Adoptions in the Kenyan Financial Services Industry

In Kenya, the financial services sector has undergone the following major technologically driven transformations:

Mobile Money:

Mobile money is an electronic wallet service that allows users to store, send, and receive money using their mobile phone. In Kenya, mobile money was introduced in 2007 through Safaricom’s M-pesa platform. Since then, the service has managed countrywide adoption. According to September 2018 data from the Communications Authority of Kenya, Kenya’s mobile penetration rate (total number of active sim cards to total population) stood at 100.1% with the number of active mobile money subscribers being 64.5% of the population. By transaction value, the Central Bank of Kenya (CBK) reported a total of Kshs 4.0 tn exchanged through mobile money in the year 2018, equivalent to 45.3% of the country’s GDP.

Source: CBK

Source: CBK

Online Banking:

Online / internet banking is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the institution's website or smartphone application. In Kenya, the online banking revolution has caused a restructuring of the traditional banking model, as highlighted below:

|

Top 3 Kenyan Banks’ Transaction Volume by Channel |

|||||

|

Bank |

KCB |

Equity Bank |

Cooperative Bank |

Average |

Combined |

|

CBK Market Share Index* |

14.1% |

9.9% |

9.9% |

|

33.9% |

|

Mobile and internet |

55.0% |

79.0% |

28.1% |

54.0% |

|

|

Agency |

20.0% |

12.0% |

32.2% |

21.4% |

|

|

ATM |

13.0% |

4.0% |

28.7% |

15.2% |

|

|

Branch |

12.0% |

3.0% |

10.6% |

8.5% |

|

|

Others |

|

2.0% |

0.4% |

1.2% |

|

Source: Individual Banks’ Q3’2018 Investor Briefing / CBK

*Market Share weighted by total assets, total deposits, shareholders’ funds, number of deposit accounts, and number of loan accounts

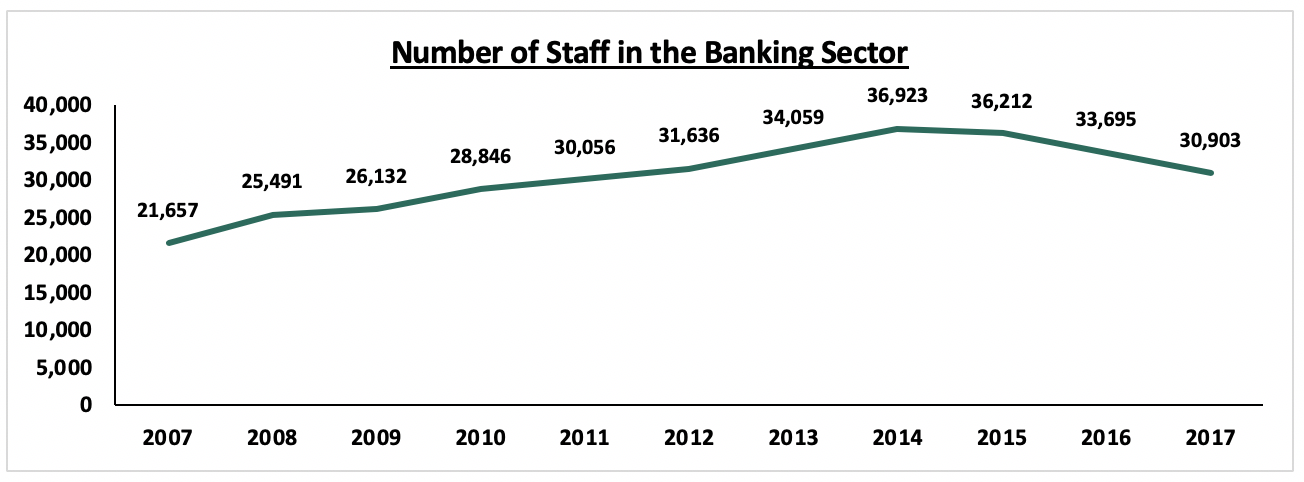

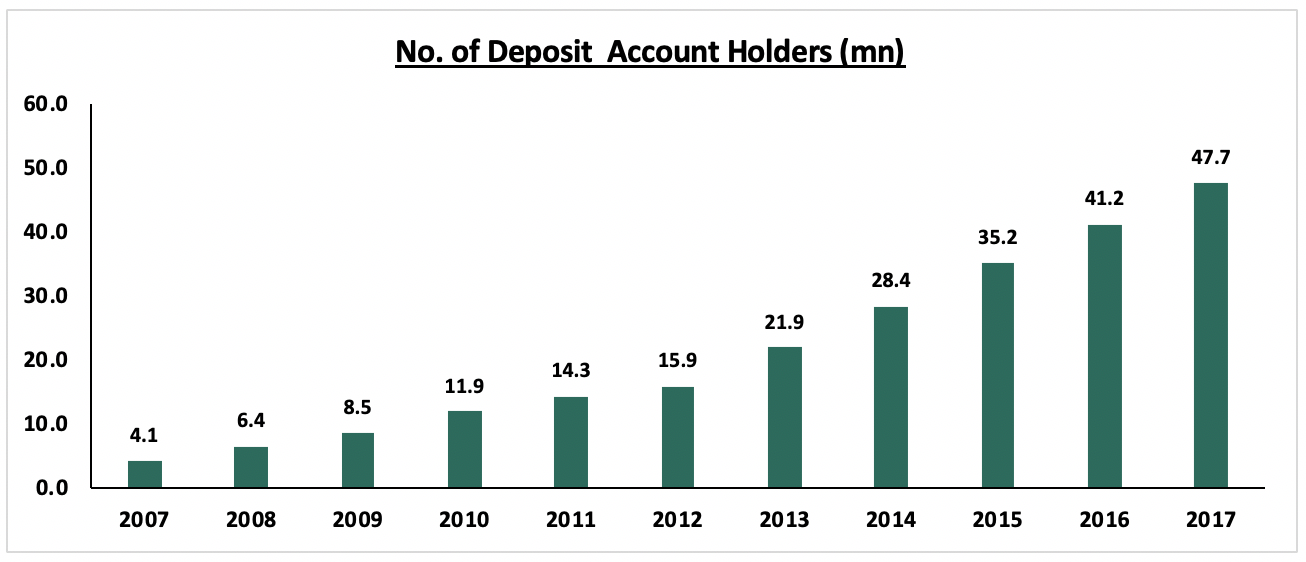

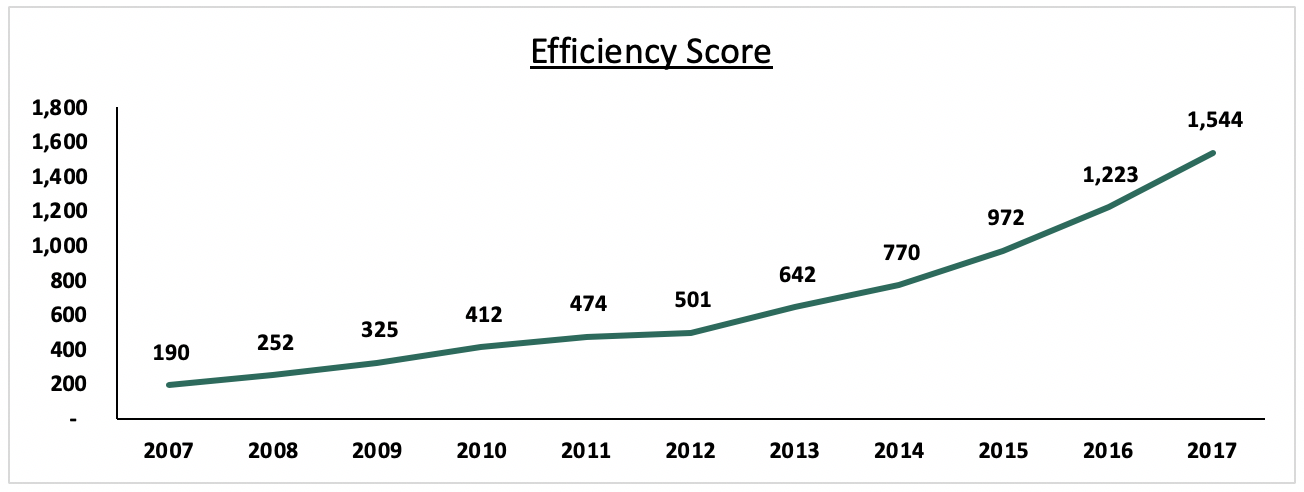

Among the Top 3 banks by market share, on average, mobile and internet banking is the most active transaction channel at 54.0% of the total number of transactions. This has resulted to low branch activity, which averages 8.5% of the total number of transactions. Banks view technological innovation as means of improving efficiency and reducing costs. The downside of this however has been the negative impact on employment, following branch closures and mass retrenchments. According to the CBK, the banking sector’s efficiency, measured by the number of deposit accounts per employee, has increased by 100.5% from 770 in 2014 to 1,544 in 2017, driven by a decline in the number of staff in the banking sector by 16.3 % from 36,923 in 2014 to 30,903 in 2017, against an increase of 67.8% in deposit accounts. The charts below highlight the trends in the efficiency score and the number of staff in the banking sector.

*Number of Deposit Accounts per Employee

Source: CBK annual report 2017

Digital Lending:

The digital lending space has grown at an accelerating pace in recent years. Since the launch of the M-Shwari platform in 2012, a vast number of platforms offering these services have emerged. Most recently, Safaricom launched Fuliza, an overdraft facility that enables M-Pesa customers to send or complete mobile payment transactions even if their M-Pesa balance is below the required amount. In the first week of its launch, more than one million customers signed up and borrowed Kshs 1.0 bn, and after one month of operation had borrowed Kshs 6.2 bn. This growth in digital lending can be in part, attributed to the following;

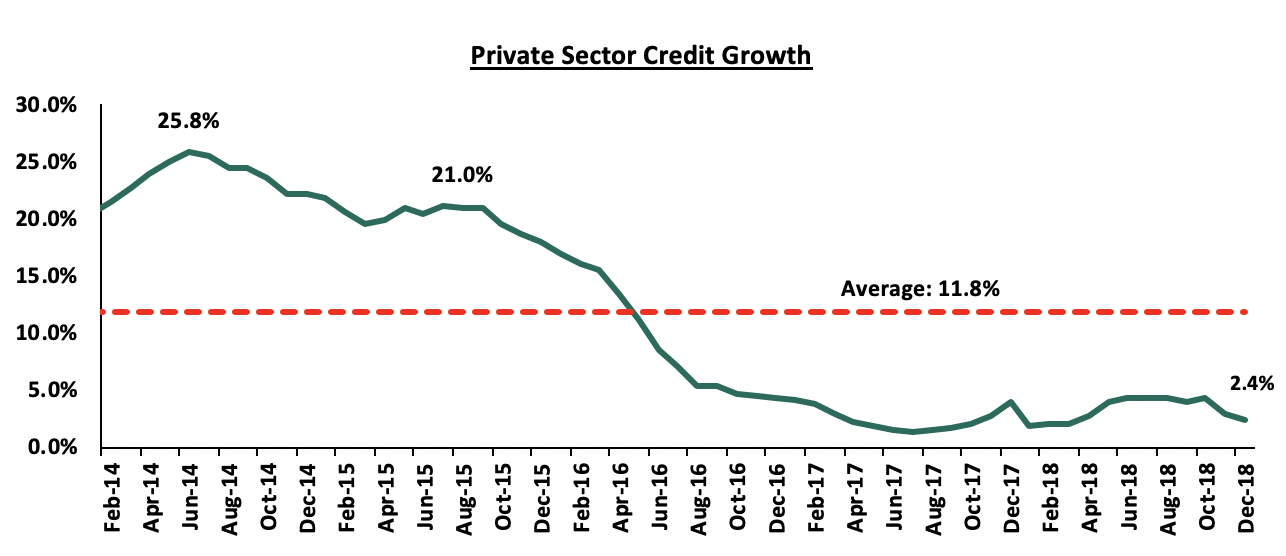

- Implementation of the Interest Rate Cap: The interest rate cap came into effect on September 14th, 2016, limiting the borrowing rates to 4.0% points above the Central Bank Rate, currently at 9.0%. It was implemented following concerns raised by the public regarding the high cost of credit in Kenya, which was viewed as a hindrance to credit access by a large segment of the population. Implementation of the law, was therefore, expected to lower the cost of credit and increase access to credit. The result however, has been a substantial decline in credit growth, as indicated by a declining private sector credit growth, which has declined to 2.4% in December 2018 compared to a 5-year average of 11.8%, and prior to the rate cap legislation, the 3-year average was 11.8%. Majority of individuals and SME’s have been locked out from accessing credit, as banks have preferred to lend to the government as opposed to the public they perceive as high risk.

- High Mobile Penetration Rate:

According to the Communications Authority report for September 2018, Kenya’s mobile penetration stands at 100.1%. Data from the Jumia Mobile report estimates smartphone penetration to be approximately 45.5% of mobile users.

The above factors result in: (i) a gap in credit supply, and (ii) a channel to deliver the required services to the target market. Digital lending addresses this issue by providing instant unsecured loans through mobile platforms. The entire process beginning from customer registration, loan application, underwriting, disbursements and repayment can be fully automated. As such, various start-ups are now betting on this approach to disrupt traditional models of lending.

Section III: Emerging Technological Trends in the Industry and Their Expected Impact

Having looked at the existing technological trends and their impact on the industry, we will now look at emerging trends and how we expect them to shape the future of the industry.

Blockchain Technology: This is simply a computer technology that enables information to be shared within a group in such a manner that all records are permanent and visible to all stakeholders. Combining shared databases and cryptography, blockchain technology allows multiple parties to have simultaneous access to a constantly updated digital ledger that cannot be altered. Although initially treated with skepticism, banks and other firms have begun to test this technology in various aspects such as:

- Clearing and Settlement: This is where the technology can be used to improve efficiency. An example of this implementation is where The Australian Securities Exchange announced its aim to shift much of its post-trade clearing and settlement on to a blockchain system.

- Customer Identity: Banks have been trying for years to set up a shared digital utility to record customer identities and keep them updated. Blockchain could offer a solution because of its cryptographic protection and its ability to share a constantly updated record with many parties.

- Cryptocurrency: Cryptocurrencies are an implementation of block chain technology to create a digital currency that is not held in any centralized database. In this case, the currency database is held by each individual coin holder. This way, each exchange transaction is recorded and updated on everyone’s ledger and the information cannot be altered afterwards without all parties being in consent. As such, this makes crypto currencies secure. Similar to fiat currency that is purely backed by the government’s assurance, cryptocurrencies don’t have an underlying asset. Their value is derived purely from the law of supply and demand and, having no regulating body, are highly sensitive to public sentiment making them highly volatile.

- Smart contracts: Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. The code and the agreements contained therein exist across a distributed, decentralized blockchain network. Smart contracts permit trusted transactions and agreements to be carried out among anonymous parties without the need for a central authority, legal system, or external enforcement mechanism. They render transactions traceable, transparent, and irreversible.

Despite its misguided sole association to cryptocurrencies, block chain has much more to offer and will play a key role in transforming the financial services sector.

Open Banking: Open banking, also known as open bank data, is a system that provides a user with a network of financial institutions’ data through the use of application programming interfaces (APIs). The Open Banking Standard defines how financial data should be created, shared and accessed. By relying on networks instead of centralization, open banking helps financial services customers to securely share their financial data with other financial institutions. Benefits include more easily transferring funds and comparing product offerings to create a banking experience that best meets each user’s needs in the most cost-effective way. In Kenya, Equity Bank, launched the Jenga Payment Gateway API. The API provides access between telcos, mobile wallets, card associations, governments, credit bureaus, and banks. Between such entities, users can send and receive money, check balances and statements, open accounts and among other functions. Businesses can utilize the API for payments, charges, collections, and more.

Fintech Regulation: Financial regulation is becoming increasingly complex and intrusive, with major financial institutions facing multiple regulatory jurisdictions, and regulators requesting increasing amounts of data from firms. Rapid improvements in technology are enabling financial services’ business models that were simply not possible 15 to 20 years ago. However, these innovations in finance operate within a regulatory system that is struggling to keep pace. In 2018 the government of Kenya announced plans to set up a fintech regulatory sandbox. This will provide a testing environment for new business models that are not protected by current regulation, or supervised by regulatory institutions. These testing grounds are especially relevant in the fintech world, where there is a growing need to develop regulatory frameworks for emerging business models. The purpose of the sandbox is to adopt compliance with strict financial regulations to the growth and pace of the most innovative companies, in a way that does not smother the fintech sector with rules, but also does not diminish consumer protection.

Section IV: Outlook on the Extent to Which Technology Will Shape the Future of the Industry

Given the impact of the highlighted innovations, our outlook on the Kenyan financial services sector going forward in this regard is as follows:

- Increased Leverage on Technology to Increase Operational Efficiency: We expect financial institutions to push their bias towards digital channels with aim of reducing costs. The efficiency score in banking is expected to continue increasing and employment in the sector will consequently be adversely affected. We expect more staff layoffs and branch closures as business continue to streamline their models.

- Automation of Investment and Advisory Services: The investments management industry’s main challenge is lack of public awareness. Those with wealth are unaware of where and how to allocate their investments. To tackle this, investment managers rely on financial advisors to seek out these individuals at a commission. In developed markets, a new tool has been deployed to better tackle this challenge; Robo-advisors are a class of financial advisors that provide financial advice or Investment management online with moderate to minimal human intervention. By bringing services to a broader audience, at a lower cost compared to traditional human advice Robo-advisors are bound to cause a major disruption. As computer literacy becomes more widespread, we also expect the process of investing to be fully automated. Investors of the future will have the ability to invest their funds, monitor the performance of their portfolio, and liquidate their investments in real time using their smart phone or personal computers.

- Small Scale Adoption of Cryptocurrencies: Various cryptocurrencies have already been adopted by isolated groups as an authorised means of exchange. Their fundamental basis however is the fact that no governing body can regulate them, making governments unwilling to adopt them. In its annual report, the CBK reiterated that it does not recognize cryptocurrencies as legal tender and is of the opinion that despite the positive influence of technology, there lies a potential of great risk in the event that the technology fails or is misused. There is thus the need to ensure that robust controls are in place to ensure that the risks and opportunities associated with emerging technologies are balanced. We expect the CBK to maintain its stance on the same and do not expect cryptocurrencies to have any full-scale implementation in the near future. We however expect small groups of individuals and businesses to experiment with various digital currencies.

- Increased Focus on Cyber Security: We expect businesses to be heavily reliant on digital systems. It therefore follows that measures will be taken to protect sensitive information from cyberattacks. We expect a well-defined regulatory guidance to be put in place to ensure that cybersecurity protocols are observed. In Kenya, CBK made a step towards addressing this issue in a guidance note on cybersecurity in 2017. The note set out the regulatory standards to industry participants on assessment and mitigation of cybersecurity threats. Applying to all payment service providers (PSPs) authorized under the National Payment System, the guidelines were aimed at:

- Creating a safer and more secure cyberspace that underpins information system security priorities, to promote stability of the Kenyan payment system sub-sector,

- Establishment of a co-ordinated approach to the prevention and combating of cybercrime,

- Up-scaling the identification and protection of critical information infrastructure (CII);

- Promoting compliance with appropriate technical and operational cybersecurity standards.

In closing, we expect the financial services industry to advance its digital evolution as financial institutions learn and integrate with technology.

Disclaimer: The Cytonn Weekly is a market commentary published by Cytonn Asset Managers Limited, “CAML”, which is regulated by the Capital Markets Authority, CMA and the Retirement Benefits Authority, RBA. However, the views expressed in this publication are those of the writers where particulars are not warranted. This publication is meant for general information only, and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.