Mar 31, 2019

T-Bills & T-Bonds Primary Auction:

During the first quarter of 2019, T-bills were oversubscribed, with the overall subscription rate coming in at 157.2%, up from 74.3% in Q4’2018. The oversubscription was partly attributable to improved liquidity in the market during the quarter, which saw the average interbank rate declining to an average of 3.1%, from an average of 5.1% in Q4’2018, supported by government payments and debt maturities. Overall subscriptions for the 91, 182, and 364-day papers came in at 110.0%, 111.4% and 221.9% in Q1’2019, from 107.1%, 37.7% and 97.7% in Q4’2018, respectively, with investors’ participation remaining skewed towards the longer dated paper. The demand for the longer-dated paper is attributable to the scarcity of newer short-term bonds in the primary market. Yields on the 91-day T-bill rose by 20 bps to close at 7.5% in Q1’2019, from 7.3% in Q4’2018, while yields on the 182-day and the 364-day T-bills declined by 80 bps and 60 bps to close at 8.2% and 9.4% from 9.0% and 10.0% at the end of 2018, respectively. The average acceptance rate for the quarter came in at 73.0%, down from 91.1% recorded in Q4’2018, with the government accepting a total of Kshs 330.5 bn of the total bids received during the quarter of Kshs 452.7 bn.

During the week, T-bills recorded an over-subscription, with the subscription rate coming in at 183.7%, down from 198.9% recorded the previous week. The oversubscription was partly attributed to favorable liquidity in the market. The yield on the 91-day paper declined by 20 bps to 7.5% from 7.7% recorded the previous week, while the yields on the 182-day and 364-day papers remained stable at 8.2% and 9.4%, respectively. The government continues to reject expensive bids as evidenced by the acceptance rate having declined to 69.3%, from 73.3% recorded the previous week, with the government accepting Kshs 30.5 bn of the Kshs 44.1 bn worth of bids received.

During Q1’2019, the Kenyan Government had five Treasury Bond primary issues and two bonds were re-opened, with the details in the table below:

|

No. |

Date |

Bond Auctioned |

Effective Tenor to Maturity (Years) |

Coupon |

Amount to be Raised (Kshs bn) |

Actual Amount Raised (Kshs bn) |

Average Accepted Yield |

Subscription Rate |

Acceptance Rate |

|

1 |

28/1/2019 |

FXD1/2019/2 |

2.0 |

10.7% |

40.0 |

23.8 |

10.7% |

192.3% |

30.9% |

|

28/1/2019 |

FXD1/2019/15 |

15.0 |

12.9% |

40.0 |

14.7 |

12.9% |

62.7% |

58.7% |

|

|

2 |

11/2/2019 |

FXD1/2019/2 (Re-open) |

2.0 |

10.7% |

12.0 |

7.5 |

10.3% |

418.3% |

97.3% |

|

11/2/2019 |

FXD1/2019/15 (Re-open) |

15.0 |

12.9% |

12.0 |

16.0 |

12.8% |

136.7% |

14.9% |

|

|

3 |

25/2/2019 |

FXD1/2019/5 |

5.0 |

11.3% |

50.0 |

20.6 |

11.3% |

83.9% |

49.1% |

|

25/2/2019 |

FXD1/2019/10 |

10.0 |

12.4% |

50.0 |

32.8 |

12.4% |

72.7% |

90.3% |

|

|

4 |

25/3/2019 |

IFB1/2019/25 |

25.0 |

12.2% |

50.0 |

16.3 |

12.7% |

58.8% |

55.5% |

|

Average |

146.5% |

56.7% |

|||||||

Primary T-bond auctions in Q1’2019 were oversubscribed, with the subscription rate averaging 146.5% for the quarter, higher than the average subscription rate for Q4’2018, which was 64.5%. The average acceptance rate for the quarter came in at 56.7%, as the CBK continued to reject bids deemed expensive in order to maintain the rates at low levels, with government reopening two bonds, namely the FXD1/2019/2 and the FXD1/2019/15 to plug in any deficits from the initial issuances. The re-opened bonds were better received by the market, recording a higher subscription rate averaging 213.0%, compared to 94.0% for first issuances. The government accepted Kshs 131.6 bn against a target of Kshs 254.0 bn during the quarter.

Secondary Bond Market Activity:

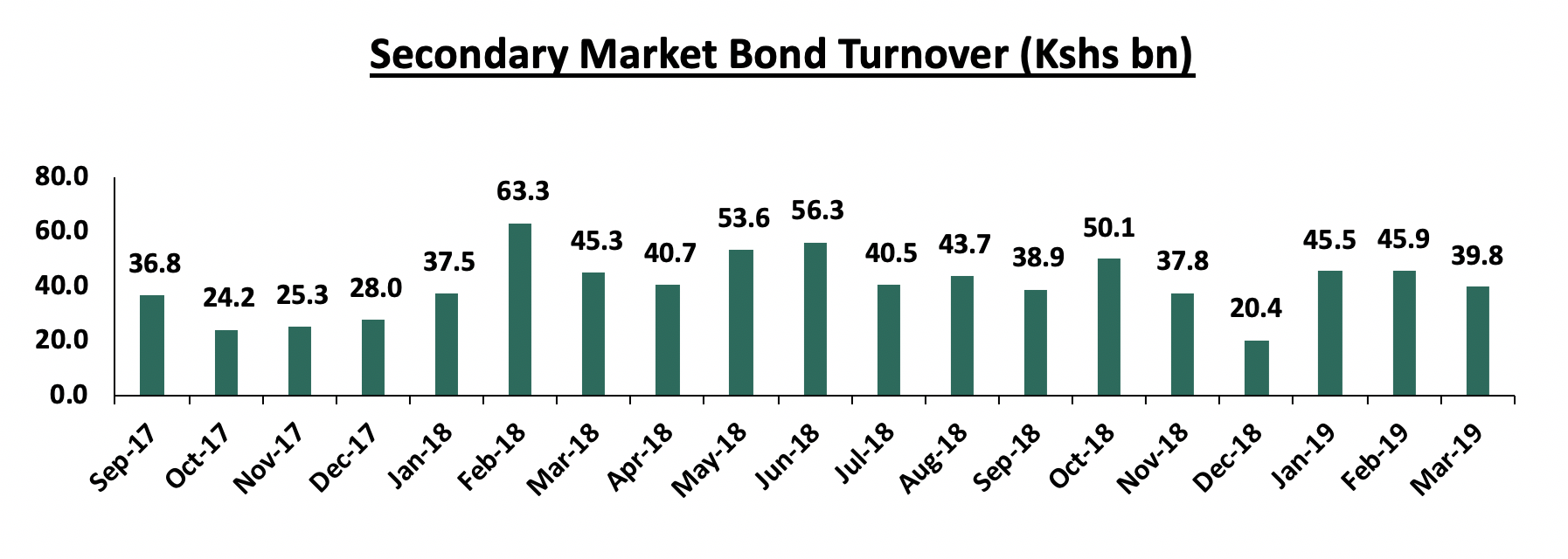

The NSE FTSE bond index recorded a 1.3% gain in Q1’2019, with the secondary bond market recording increased activity, with the turnover having increased by 21.1% to Kshs 131.2 bn from Kshs 108.2 bn in Q4’2018, as the local institutional investors increased their allocation to treasury bonds, mostly attributed to the interest rate cap that has seen banks shy away from lending due to the associated risk and instead increasing their allocation to government securities.

Liquidity:

In this quarter, liquidity levels remained stable and well distributed in the market as indicated by the 47.9% decline in the average volumes traded in the interbank market to Kshs 9.7 bn, from Kshs 18.6 bn recorded in Q4’2018, and the subsequent decline in the interbank rate to 3.1%, from 6.7% the previous quarter. During the week, liquidity tightened with the average interbank rate rising to 3.1%, from 2.3% recorded the previous week. There was a decrease in the average volumes traded in the interbank market by 54.3% to Kshs 1.6 bn, from Kshs 3.4 bn the previous week.

Kenya Eurobonds:

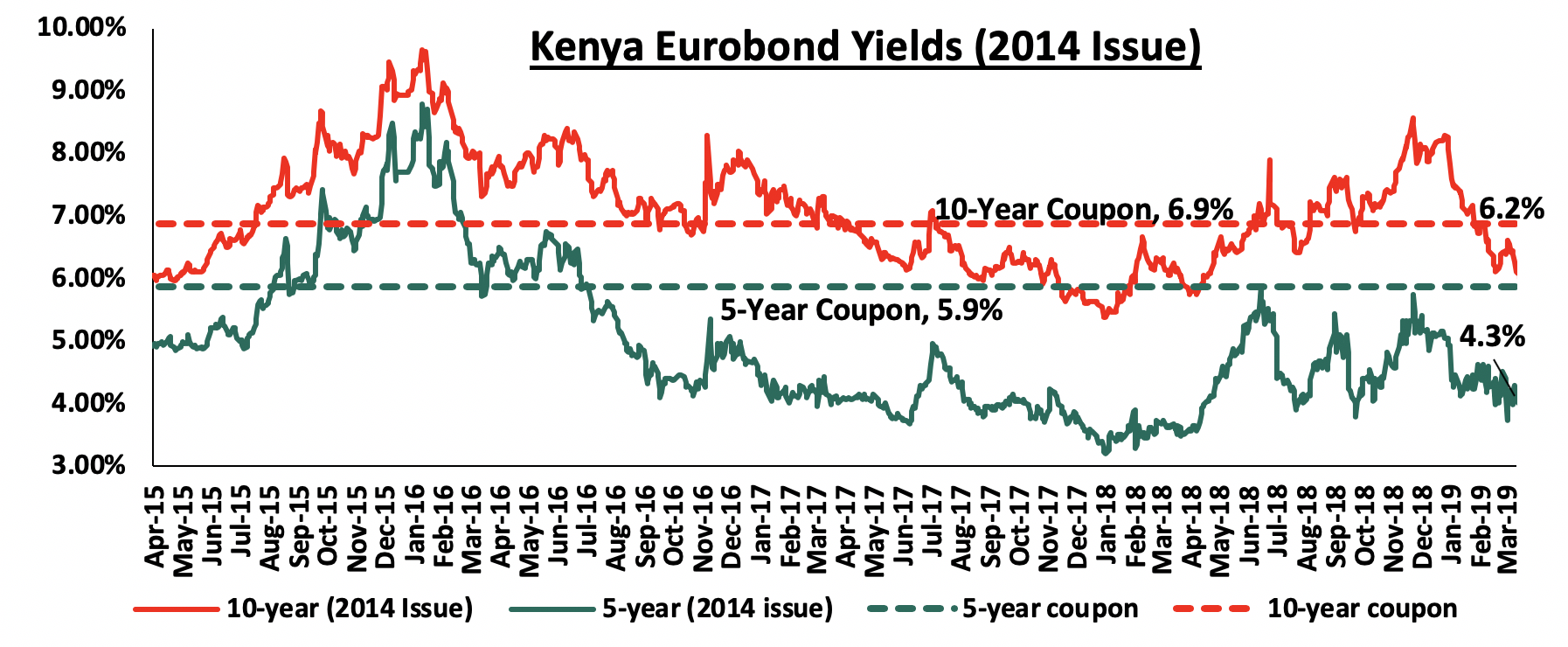

According to Bloomberg, yields on the 5-year and the 10-year Eurobond issued in 2014 declined by 0.7% points and 2.0% points to close at 4.3% and 6.2% in Q1’2019, from 5.0% and 8.2% in Q4’2018, respectively an indication of improved investor risk perception. Since the mid-January 2016 peak, yields for both the 5-year and 10-year Eurobonds have declined by 2.2% points, due to the relatively stable macroeconomic conditions in the country. Key to note is that these bonds have 0.3-years and 5.3-years to maturity for the 5-year and 10-year, respectively.

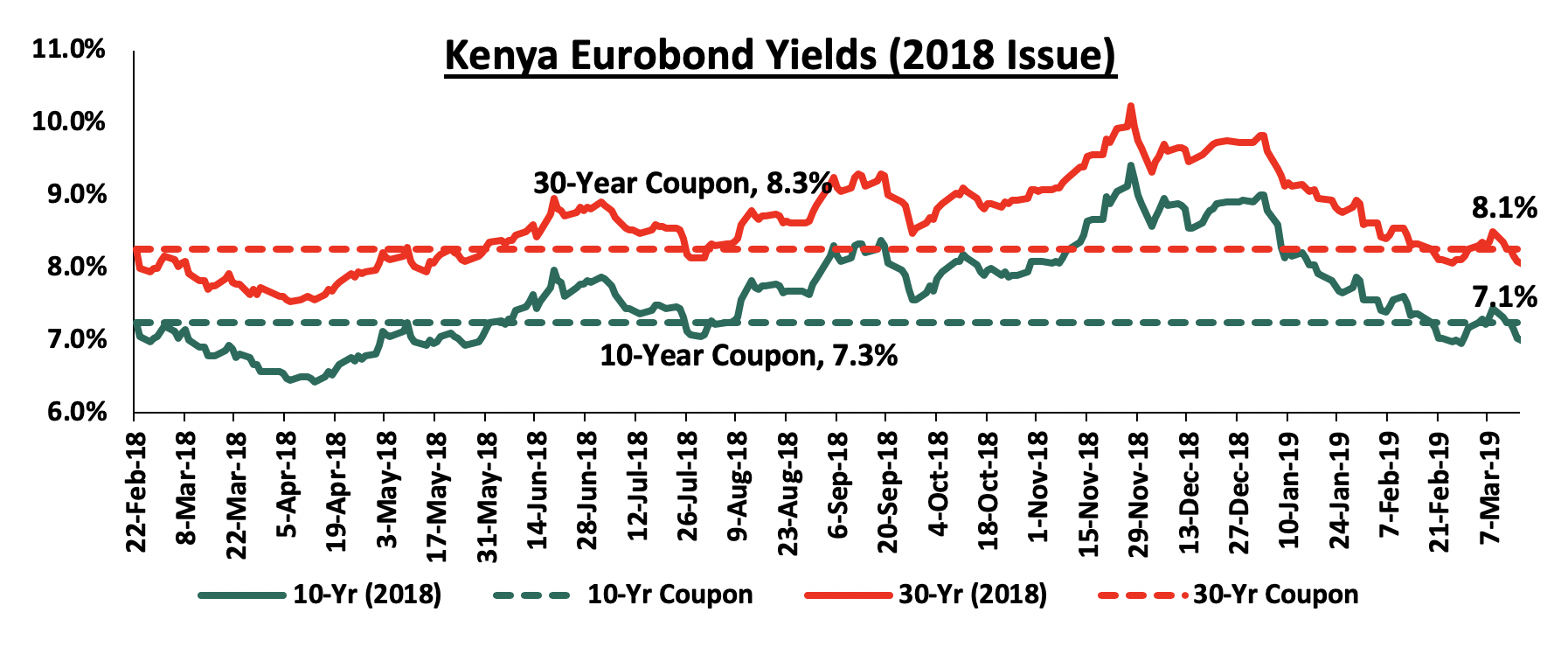

For the February 2018 Eurobond issue, the yields on the 10-year Eurobond and the 30-year Eurobond declined by 1.8% points and 1.6% points to close Q1’2019 at 7.1% and 8.1% from 8.9% and 9.7% at the end of Q4’2018, respectively.

Rates in the fixed income market have remained stable as the government rejects expensive bids, being currently 8.8% ahead of its domestic borrowing target for the current financial year, having borrowed Kshs 259.5 bn against a pro-rated target of Kshs 238.5 bn. A budget deficit is likely to result from depressed revenue collection, creating uncertainty in the interest rate environment as additional borrowing from the domestic market goes to plug the deficit. Despite this, we do not expect upward pressure on interest rates due to increased demand for government securities, driven by improved liquidity in the market owing to the relatively high debt maturities. Our view is that investors should be biased towards medium-term fixed income instruments to reduce duration risk associated with long-term debt, coupled with the relatively flat yield curve on the long-end due to saturation of long-term bonds.