Jan 13, 2019

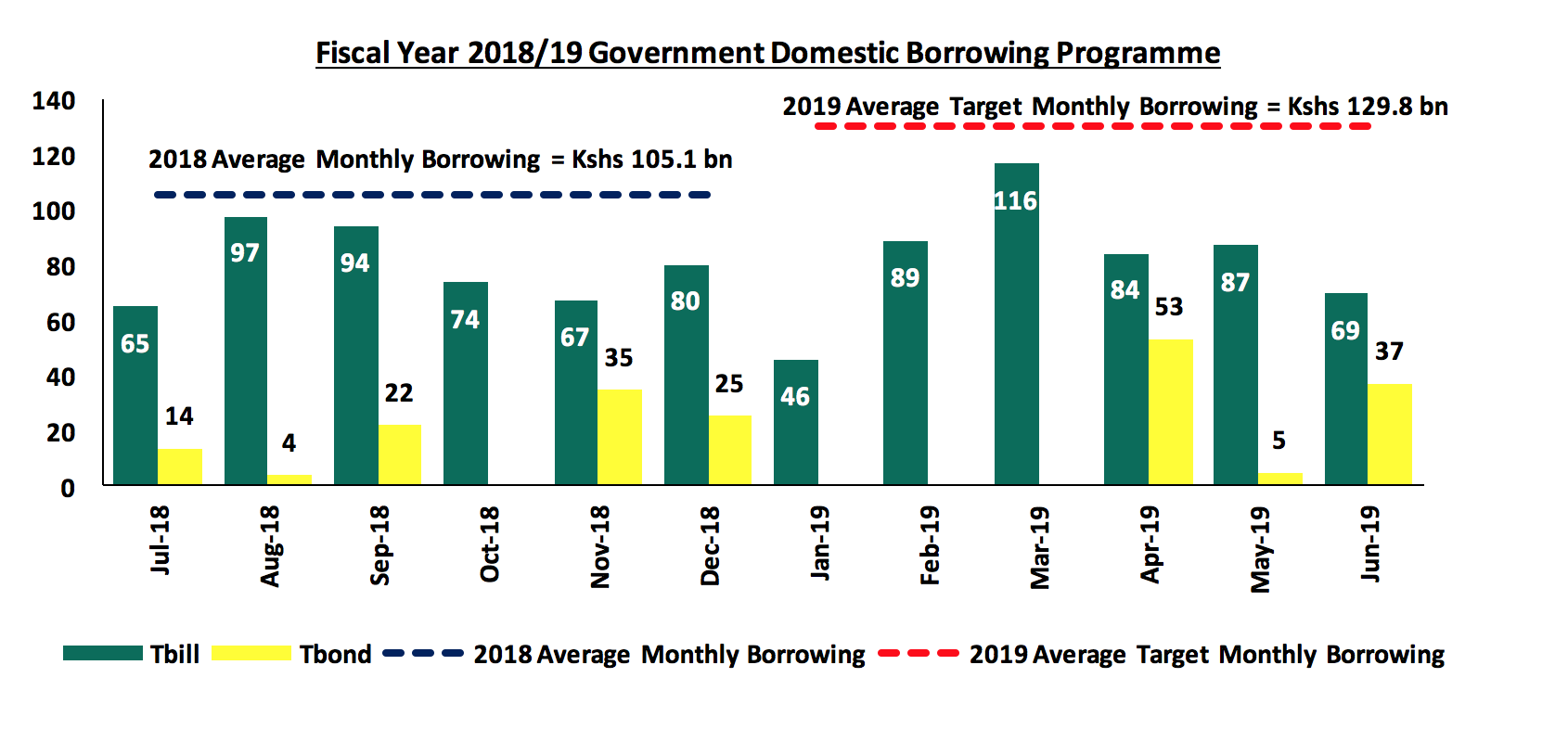

The government is currently 35.9% behind its domestic borrowing target, currently having borrowed Kshs 107.2 bn domestically, against the pro-rated target of Kshs 167.2 bn, going by the revised government domestic borrowing target of Kshs 299.8 bn as per the Budget Review and Outlook Paper (BROP) 2019. The result of this is expected average monthly borrowing of Kshs 129.8 bn in the 2nd half of the current fiscal year. We however do not expect this to lead to upward pressure on interest rates, with the increased demand on government securities, driven by improved liquidity, provided the government does not accumulate too much short term debt during the year, which would worsen the government’s debt maturity profile.

Below is a summary of treasury bills and bonds maturities and the expected borrowings over the same period. The government will need to borrow Kshs 129.8 bn on average each month for the rest of the fiscal year in order to meet the revised domestic borrowing target of Kshs 299.8 bn, and also cover arising T-bill and T-bond maturities, as illustrated in the graph below.

Fig: Schedule of Treasury bills and bonds maturities and the expected target borrowings in the 2018-2019 fiscal year to cater for the maturities and additional government borrowing.

In the first two auctions in 2019, T-Bill subscription has averaged 209.6% indicating improved demand. During the week, T-bills were over-subscribed, with the overall subscription coming in at 281.6%, compared to 137.6% recorded the previous week. Subscription rates for the 91, 182, and 364-day papers came in at 355.8%, 244.6%, and 288.8% from 31.6%, 73.3%, and 244.3%, the previous week, respectively. Yields on all the papers declined, with the weighted average interest rate of accepted bids coming in at 7.2%, 8.9% and 10.0% for the 91, 182, and 364-day papers, respectively. Despite the decline in yields, the government managed to raise Kshs 48.9 bn, higher than its weekly quantum of Kshs 24.0 bn, indicating the ability of the government to raise domestic debt while keeping rates low by rejecting expensive bids.

Rates in the fixed income market have remained stable as the government rejects expensive bids despite being behind their borrowing target. However, a budget deficit that is likely to result from depressed revenue collection creates uncertainty in the interest rate environment as any additional borrowing in the domestic market goes to plug the deficit. Despite this, we do not expect upward pressure on interest rates due to increased demand on government securities, driven by improved liquidity in the market owing to the relatively high debt maturities. Our view is that investors should be biased towards MEDIUM-TERM FIXED INCOME INSTRUMENTS to reduce duration associated with the long-term debt, coupled with the relatively flat yield curve on the long-end due to saturation of long-term bonds.