Sep 15, 2019

Housing is an important aspect of the economy. However, this has been a challenge in Kenya with a housing deficit of 2.0 mn units, with demand growing at 200,000 units per annum, but supply only providing 50,000 units per annum as per the National Housing Corporation (NHC). The Ministry of Housing indicates that 83.0% of the existing housing supply is for the high income and upper-middle-income segments, with only 15.0% for the lower-middle and 2.0% for the low-income population. The Kenyan Government, through their Big 4 Agenda, which covers affordable housing as one of the pillars have, therefore, been seeking to deliver 500,000 units by 2022, costing between Kshs 0.6 mn and Kshs 3.0 mn aimed at 74.5% of Kenyans earning below Kshs 50,000 per month. However, financing for end-buyers towards the purchase of affordable housing remains a challenge in Kenya, both on the absolute value of the unit, and the financing structures available for a first-time buyer to access capital towards their unit purchase.

In this topical, we seek to demystify the issue of affordability in Kenya, with a focus on Home Ownership Savings Plans, and as such we shall cover the following:

- Challenges with Affordability of Housing in Kenya,

- Availability of Affordability Options in Kenya,

- Introduction and Historical Development of Home Ownership Savings Plans in Kenya,

- House Savings Plans in Other Countries,

- The Benefits and Limitations of Home Ownership Savings Plan Schemes, and,

- How to Improve Home Ownership Savings Plan in Kenya.

Section I: Challenges with Affordability of Housing in Kenya

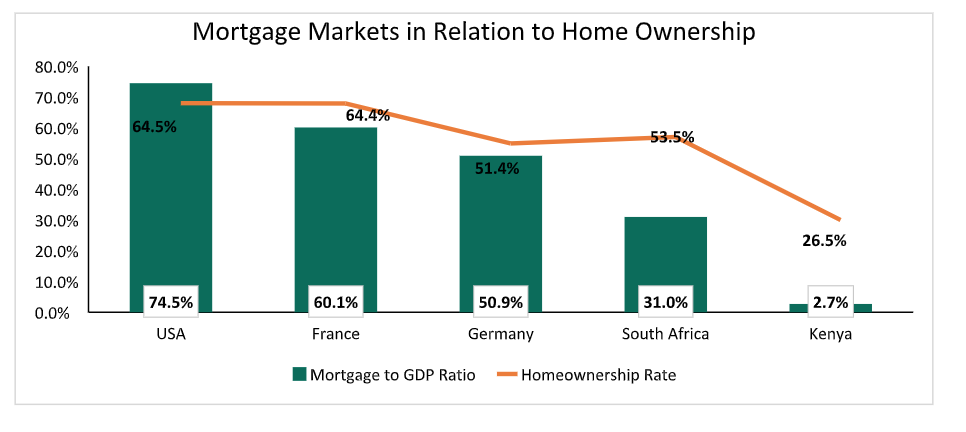

According to the 2015/16 Kenya Integrated Household Budget Survey (KIHBS), only 26.1% of Kenyans living in urban areas own the homes they live in. This is in comparison to countries like South Africa with 53.5% or the United States with 64.5%. This is attributable to the unaffordability of housing units in the market. Those who own homes rely mainly on savings and other sources of financing including mortgage loans, commercial bank loans, and local investment groups commonly referred to as chamas, and Savings & Credit Co-operative Societies (SACCOs).

Access to housing finance in Kenya remains lacking mainly due to:

- Low-income levels that cannot service a mortgage - according to Kenya National Bureau of Statistics, only 2.9% of Kenyans earn above Kshs 100,000 per month,

- Soaring property prices boosted by the demand-supply forces,

- Exclusion of informal sector employees who, as per KNBS data, make up approximately 83.4% of Kenya’s workforce, due to insufficient credit risk information,

- Lack of capital markets funding, which tend to be long-term, and can enable real estate purchases for end-buyers,

- High-interest rates and deposit requirements for mortgage loans, which lockout majority of potential borrowers, and,

- Underdeveloped mortgage market - According to Central Bank of Kenya, there were only 26,187 mortgages in Kenya as at December 2017 out of a total adult population of approximately 23 mn persons, with the mortgage to GDP ratio standing at 2.7% compared to countries such as South Africa and USA, which have a ratio of above 30.0% and 70.0%, respectively.

Section II: Availability of Affordability Options in Kenya

To enable homeownership, the government for the past three decades has continued to introduce policy and fiscal reforms aimed at enhancing homeownership. Key among them are:

- Mortgage Relief: As per the 1995 Income Tax Act cap 470, borrowing money from a registered financial institution to purchase a home or to improve a home guarantees the borrower a tax relief on interests paid to the registered financial institution of up to a maximum of Kshs 300,000 p.a.,

- Home Ownership Savings Plan, “HOSP”: Introduced in 1995 in the Income Tax Act, Home Ownership Savings Plan is a tax instrument aimed at first time homebuyers, where savings with a Registered Home Ownership Savings Plan for a maximum of ten-years allows the subscribers tax rebates of up to Kshs 8,000 per month or Kshs 96,000 annually and tax relief on interest income of up to Kshs 3.0 mn after the ten-years,

- National Housing Development Fund: The Housing Fund was established under the Housing Act 2018 Section 6 (1), under the control of National Housing Corporation (NHC) as provided for in Housing Act Cap 117. The aim of the fund is to allow mortgage and cash buyers to save towards the purchase of an affordable home through the affordable housing Home Ownership Savings Plan,

- Affordable Housing Relief: The Income Tax Act was amended in 2018 to allow 15.0% tax relief up to a maximum of Kshs 108,000 p.a., or Kshs 9,000 p.m., to affordable home buyers,

- Stamp Duty Act: Amended in 2018, the Act allows for exemption of first-time homebuyers under the affordable housing scheme from paying the Stamp Duty Tax, which is normally set at 2.0% - 4.0% of the property value depending on location, and,

- Kenya Mortgage Refinancing Company: The company is set to enhance mortgage affordability in Kenya by enabling long-term loans at attractive market rates through the provision of affordable long-term funding and capital market access to primary mortgage lenders such as banks and financial co-operatives,

However, the development of the Kenyan housing finance market has been relatively slow, and not up to pace with the registered housing demand backlog creating the need for more reforms.

Section III: Introduction and Historical Development of Home Ownership Savings Plans in Kenya

Of the various legislations in place to enhance affordability, this note focuses on the Home Ownership Savings Plan. The Income Tax Act cap 470 defines a Home Ownership Savings Plan (HOSP) as a savings plan established by an ‘approved institution’ and registered with the commissioner for Income Tax for receiving and holding funds in trust for depositors. It is a tax-sheltered savings, plan whose main objective was to enable individual depositors to save for home acquisition or development and was introduced in Kenya in 1995. As per Section 22C (8) of the Income Tax Act, an ‘approved institution’ means a bank or financial institution registered under the Banking Act (Cap. 488), an insurance company licensed under the Insurance Act (Cap. 487) or a building society registered under the Building Societies Act (Cap. 489).

The regulation was effective on 1st January 1996, and from the initial regulations, depositors were allowed tax rebates of Kshs 4,000 per month maximum or Kshs 48,000 per annum (effectively reducing an individual’s taxable income by the amount of their monthly contribution) with the condition that it is with a Registered Home Ownership Savings Plan. In 2007, the Income Tax Act was amended to allow any interest earned on the deposits to be tax exempted upon withdrawal albeit at a maximum of Kshs 3.0 mn.

However, as part of the government’s measures to fulfill its pledge to promote low-cost housing, the tax-deductible contributions by a depositor to a registered home ownership savings plan were increased from Kshs 48,000 to Kshs 96,000 annually (Kshs 4,000 per month to Kshs 8,000 per month), effective 1st July 2018, and effective for an individual’s savings for the subsequent ten-years. Registered Home Ownership Savings accounts in Kenya are restricted to first time home buyers and to purchase of a ‘permanent house’, which the Income Tax Act defines as a residential house that a financial institution would accept as collateral for a mortgage, and includes any part or portion of a building, used or constructed, adapted or designed to be used solely for human habitation. The accumulated funds are withdrawn tax-free to strictly purchase or construct a house. However, if the depositor utilizes the funds for any other purpose other than to acquire a house, they become taxable in the year of withdrawal.

So far, unfortunately only one institution, Housing Finance Company (HFC), offers Home Ownership Savings Plans in Kenya. It is not clear why other banks have not offered HOSP, and we also believe it is important that other savings vehicles such as Money Market Funds and investment banks should qualify as Home Ownership Savings Plans.

Section IV: House Savings Plans in Other Countries

Globally, Home Ownership Savings Plan are referred to as Contractual Savings for Housing (CSH) schemes, which are defined as a contractual agreement between a financial institution and a customer that grants the customer the right to obtain a preferential mortgage after a minimal saving period (World Bank). Depending on the contractual agreement and the laws of a country, these savings can be used for land acquisition, housing construction, home improvement, or to purchase a new home. Globally, they are characterized by contractual deposits, tax deductions for mortgage interest payments and tax exclusion for capital gains for owner-occupier residential property, government subsidies, and direct provision of homeownership loans for low and middle-income households.

There are two main types of CSH schemes:

- Closed systems, where home loans are funded wholly with savings pooled together by the individual under the CSH scheme, and,

- Open systems, where a lender is permitted to access other funding sources (such as capital markets) in case the inflow of savings is not enough to meet loan demands.

Contractual Savings for Housing Schemes originated in Europe where they have been considerably successful. For instance, the French Plan Épargne Logement (PEL) and the German Bauspar system, both established in the 20th century.

Although not very common in Africa, Contractual Savings for Housing has been adopted in countries like Nigeria, Tunisia, Ethiopia, and Morocco:

- In Nigeria, depositors are required to save with the Nigerian National Housing Fund (NHF) for at least six months before acquiring a home loan from the fund

- In Morocco, only banks are permitted to offer CSH schemes where the maximum amount that can be saved is Kshs 4.0 mn. Depositors, who must be first time home buyers, are required to make a minimum deposit of Kshs 5,000 and subsequent top-ups of at least Kshs 30,000 per year. At the end of the savings phase, the depositor can acquire a loan of at least three times their savings. The interest rate charged on these loans is 0.5% points lower than the interest rate applied to a normal housing loan

- In Ethiopia, CSH scheme has been relatively successful enabling uptake of over 175,000 affordable units since 2006. The scheme was introduced by the government in a bid to provide housing for low and mid-income families and promote a culture of savings among Ethiopians. However, these funds are used for government’s affordable housing project, together with proceeds from housing bonds, and therefore subscribers are strictly limited to purchasing a house under the government’s Integrated Urban Housing Development Program (IUHDP). The scheme, managed by the state-owned Commercial Bank of Ethiopia (CBE), offers three saving options depending on an individual’s income class, with minimum monthly contributions of Kshs 800 to Kshs 12,200 for 3-7 years, which are remunerated at approximately 6.0%. Subscribers are then offered a housing loan with repayment periods of 17-25 years and interest rates of 7.5% - 9.5%, in comparison to 18.0% offered by other financial institutions

Generally, CSH schemes are still nascent in Africa and with minimal success. This attributable to (i) lack of public knowledge, (ii) general lack of appropriate regulatory and technical structures, and (iii) they are mainly led by government-controlled institutions whereas, in developed countries such as France and Germany, they are mainly managed by private financial institutions and building societies, with minimal government restrictions.

Section V: The Benefits and Limitations of HOSP Schemes

Home Ownership Savings Plans have various benefits for the lenders, government and the savers. For the government, the schemes alleviate the housing problem by availing the much-needed housing finance. As it is, there exists a direct correlation between the existing housing finance system and the level of informal settlements in the country which the World Bank estimated to be 61.0% of urban dwellers as at 2017.

Benefits for Mortgage Lenders:

- Minimal Credit Risk: To a large extent, Home Ownership Saving Plans minimize credit risk, as depositors can demonstrate their ability to make timely payments by saving a portion of their income throughout an extended period. As a result, lending to a HOSP subscriber is often less risky than lending to other borrowers. In Ethiopia, there were zero non-performing loans (NPLs) under the CSH plan as of November 2014, as reported by Commercial Bank of Ethiopia (CBE) officials,

- Lower Loan-to-Value Ratio: Given the substantial down payments made by subscribers through their consistent savings, the loan-to-value (LTV) ratio is often significantly lower, which reduces the probability of mortgage defaults.

Benefits for HOSP Subscribers:

- Tax Rebates: According to the Income Tax Act, individuals in a Registered Home Savings Plan are guaranteed tax rebates of up to Kshs 8,000 per month or Kshs 96,000 per annum, while interest income of up to Kshs 3.0 mn are tax-exempt upon withdrawal. With this, assuming a median income of Kshs 50,000, an individual depositing Kshs 8,000 per month with a registered HOSP account pays 28.1% less PAYE (Pay as You Earn) than one without HOSP account, as shown below:

|

PAYE Remittances Scenario |

||

|

HOSP Employee |

||

|

Monthly Gross Salary |

|

50,000 |

|

HOSP Remittance (Kshs) |

8,000 |

|

|

PAYE (Kshs) |

|

5,459 |

|

|

||

|

Non-HOSP Employee |

||

|

Monthly Gross Salary |

|

50,000 |

|

HOSP Remittance (Kshs) |

- |

|

|

PAYE (Kshs) |

|

7,596 |

ii. Credit Profile: The contracted savings made by a subscriber act as proof to the financial institution of their creditworthiness, thus raising their chances of accessing a mortgage loan upon maturity of the savings, and,

iii. Positive Savings Culture: With an effective regulatory environment, the scheme encourages a savings culture which ultimately makes it easier for an individual to acquire a home by efficiently raising a deposit for a house loan. According to the World Bank, inability to raise deposits required to access mortgage has been proven as one of the reasons behind the small number of home loans, necessitating the need for tax incentives to boost savings for property acquisition.

In spite of this, Home Ownership Savings Plan in Kenya has not been very successful in its overarching objective which was to avail housing finance and promote a culture of savings for aspiring homeowners. This is evidenced by the fact that only one institution currently offers the product, the low homeownership rates in the country as illustrated above, and the relatively low mortgage uptake with 26,187 mortgage accounts recorded as at 2017, despite the existing housing deficit estimated at 2.0 mn by the National Housing Corporation.

The major limitations have been:

- Few Product Offerings: According to the Income Tax Act the product is restricted to a few approved institutions. These include; a bank or financial institution registered under the Banking Act, an insurance company licensed under the Insurance Act or a building society registered under the Building Societies Act. So far, only one institution, Housing Finance Company (HFC), offers the product and at relatively unattractive rates as there is no other competition. For the past two decades, the scheme has been a preserve of specialist lending institutions such as banks and building societies as stipulated in the Income Tax Act since 1996. Linking the schemes to capital market capable of offering attractive rates to depositors will enhance financial liberalization and assist low-income earners to efficiently save towards homeownership as part of the overall development strategy,

- Relatively Low Yields: Currently banks offer interest rates of 7.0% on average for fixed savings accounts. This in comparison to the inflation rate which has been oscillating between 4.1% - 6.6% means much of the benefits accrued are eroded,

- Little Public Knowledge: With the product being offered by one institution, Housing Finance, there is little information available to the public about Home Ownership Savings Plan. Fewer people know that it is one of the ways of reducing payable tax in Kenya,

- Savings/Loan Mismatch: In countries such as Ethiopia, individuals are required to either save 10%, 20%, or 40% of the unit value and the remainder is issued out as a loan. However, under the Kenyan framework, getting a mortgage after the ten years is not guaranteed. This means savers have to have other funding options such as other personal savings, SACCO loan, inheritance or other methods,

- Mortgage Market/Housing Deficit Mismatch: The availability of mortgage products is a prerequisite for Home Ownership Savings Plans to be fully effective as upon maturity the savings only serve as a deposit. House prices in Kenya are relatively high in comparison to what individuals can afford to save due to the low-income levels, necessitating the need for more funding options after the saving period. Additionally, mortgage interest rates must be close to the savings return rate. As it is, few banking institutions offer mortgages, evidenced by the few mortgages registered and the interest rates are considered to be relatively high in comparison to the yields they offer for savings accounts,

- Liquidity Risk: In Kenya where the median income is relatively low at Kshs 50,000, the savings and the loan repayments could also be insufficient to fund more loan demands from subscribers completing their savings phase creating a liquidity risk for the deposit-taking institutions. The tax rebates incentivize savers meaning the product would have a high demand if properly placed in Kenya. This was the case in Ethiopia where the house savings scheme as of 2013 had a waiting list of 900,000 subscribers.

To stimulate the housing finance segment, there is a need to close the large gap in the sector which can be fulfilled by creating access to other innovative financial markets products which have more compelling returns.

Section VI: How to Improve Home Ownership Savings Plan in Kenya

To improve housing affordability, there is a need to provide channels through which individuals in the low and middle-income bracket can use to raise capital to purchase homes. Collective Investment Schemes are common among this population, as individuals are required to make relatively low contributions and are able to top-up their savings through a flexible and accommodative program in terms of minimum amounts. However, under the current law, CIS schemes are not considered under the Home Ownership Savings Plans (HOSP) in spite of their potential to revolutionize housing finance. For instance, the money market funds offer relatively attractive risk-adjusted returns with competitive rates of as high as 11.0%. Additionally, the rates are not fixed which means they are always up to pace with the macro-economic environment conditions unlike the fixed rates offered by banks and other financial institutions. Essentially, collective investment schemes are pools of funds that are managed on behalf of investors by a professional money manager. They are specialized market players licensed to mobilize savings through financial assets and to enhance access to capital markets by small investors. They include unit trusts, mutual funds, investment trusts et al. For investors, they offer a unique opportunity in terms of professional management, economies of scale, and diversification of portfolio and risk. Fund managers invest in various industries and sectors;therefore, the portfolio gets diversified, resulting in relatively high returns as compared to banks which largely generate returns from lending members’ deposits.In Kenya, most banks require borrowers to provide cash equivalent to 15% of the value of a home before accessing mortgages, which leads to most people borrowing from savings and loan cooperatives, which are funded by member deposits. Under the affordable housing initiative, homebuyers will be required to pay a 12.5% deposit.

Below we illustrate an individual savings plan for a three-bedroom unit under the affordable housing scheme, whose cost is set at Kshs 3.0 mn, through: (i) a bank-based HOSP, which is likely to offer a 2.5% return per annum, (ii) the National Housing Development Fund, and (iii) a Fund Manager’s Collective Investment Scheme such as a money market fund offering 10.0% yield per annum; the purpose of the example is to show how long it would take save the requisite Kshs 375,000 over a 5 year period:

(All Values in Kshs Unless Stated Otherwise)

|

Saving Scenarios Under a Bank-based HOSP, a Collective Investment Scheme, and the National Housing Development Fund |

|||

|

|

Collective Investment Schemes (CIS) |

Bank-based HOSP |

National Housing Development Fund (NHDF) |

|

House Value |

3,000,000 |

3,000,000 |

3,000,000 |

|

12.5% Deposit |

375,000 |

375,000 |

375,000 |

|

Tenor (Years) |

5 |

5 |

5 |

|

Rate of Return |

10.0% |

2.5% |

0.0% |

|

Monthly Payments |

4,843 |

5,874 |

6,250 |

|

· For a 12.5% deposit of Kshs 375,000, assuming a five-year savings period, a depositor with NHDF is required to make monthly deposits of at least Kshs 6,250. This is 29.1% more than Kshs 4,843 required of an individual investing with a money market fund, which offers 10.0% yield per annum. On the other hand, a depositor saving with Registered HOSP such as a bank would get an interest rate of about 2.5% p.a. and therefore, would have to make monthly deposits of Kshs 5,874, which is 21.3% more than CIS deposits |

|||

To boost Home Ownership Savings Plan in Kenya, a well-developed capital market and income tax framework are required to enable a sustainable, low-cost capital raising mechanism for affordable housing in Kenya for both developers and potential homeowners. This can be achieved through:

- Creating adequate consumer information, which is imperative to encourage households to take up the various incentives offered. Additionally, households should have adequate information to make comparisons and make informed decisions when choosing a depositing institution,

- Fund Managers and Investment Banks should qualify as HOSP approved institutions, Section 22 C (8) Income Tax Act 2018,

- Collective Investment Scheme Trustees should not only be banks but a person who holds a license issued by the Authority, Regulation 26 (1) and (2) Capital Markets (CIS) Regulations 2011,

- Allow for specialized Collective Investment Schemes that can focus on investing only in the specific sectors such as the housing sector by amending CMA Act CIS Regulations 139 (1) to allow setting up of specialized collective investment schemes for investment in a specific sector or for a specific purpose.

In conclusion, HOSP is a very commendable and important initiative towards the President’s Big Four Agenda of providing affordable housing. However, for HOSP to have an impact we need to:

- Expand HOSP eligible savings to include capital markets savings, and

- Educate potential homeowners on HOSP benefits.

Disclaimer: The views expressed in this publication are those of the writers where particulars are not warranted. This publication, which is in compliance with Section 2 of the Capital Markets Authority Act Cap 485A, is meant for general information only and is not a warranty, representation, advice or solicitation of any nature. Readers are advised in all circumstances to seek the advice of a registered investment advisor.