Oct 5, 2025

Global Economic Growth:

According to the World Bank the global economy is projected to grow at 2.3% in 2025, lower than the 2.7% growth recorded in 2024. This forecast marks a significant downward revision from earlier projection in January of 2.7%, reflecting anticipated economic downturn, particularly due to rising international trade disputes and policy uncertainties. The World Bank’s growth projection of 2.3% is 0.5% points lower than the IMF’s 2025 forecast of 3.0%, which was also revised from the April 2025 projection of 2.8%. In their last Global Economic Prospects Report in June 2025, the World Bank revised their global growth forecasts downward due to weakening global trade, largely driven by rising U.S. tariffs and the resulting trade tensions, which disrupted global supply chains and slowed cross-border economic activity. Notably, advanced economies are expected to record a 1.2% growth in 2025, down from the 1.7% expansion recorded in 2024. Additionally, emerging markets and developing economies are projected to expand by 3.8% in 2025, down from the 4.2% expansion recorded in 2024. On the other hand, the IMF revised their projection upwards to 3.0% from the April 2025 projection of 2.8% due to faster-than-expected early activity ahead of anticipated tariffs, lower actual U.S. tariff rates than initially announced, improved financial conditions helped by a weaker dollar, and fiscal expansion spending in key economies.

The downturn in global economic growth in 2025 as compared to 2024 is majorly attributable to;

- Heightened trade tensions and rising U.S. tariffs. Escalating U.S. tariffs, particularly on imports from China and key trading partners have disrupted global supply chains and increased the cost of goods. This has led to the slowdown in international trade volumes and weakened export-driven growth in the emerging markets and developing economies. However, if the major economies settle their trade disputes, it could ease global economic pressures, and,

- Trade policy uncertainty. The global economic landscape in 2025 is clouded by unpredictable trade policies, especially from major economies such as the United States, China and the European Union. Sudden tariff hikes, retaliatory measures and inconsistent enforcement have created a volatile environment for global trade. Developing countries, particularly those reliant on exports are facing reduced trading volumes and lower commodity prices.

The global economy is expected to remain subdued in 2025, mainly as a result of rising global trade tensions as well as volatile and unclear trade policies, which are expected to slow down economic growth.

Global Commodities Market Performance:

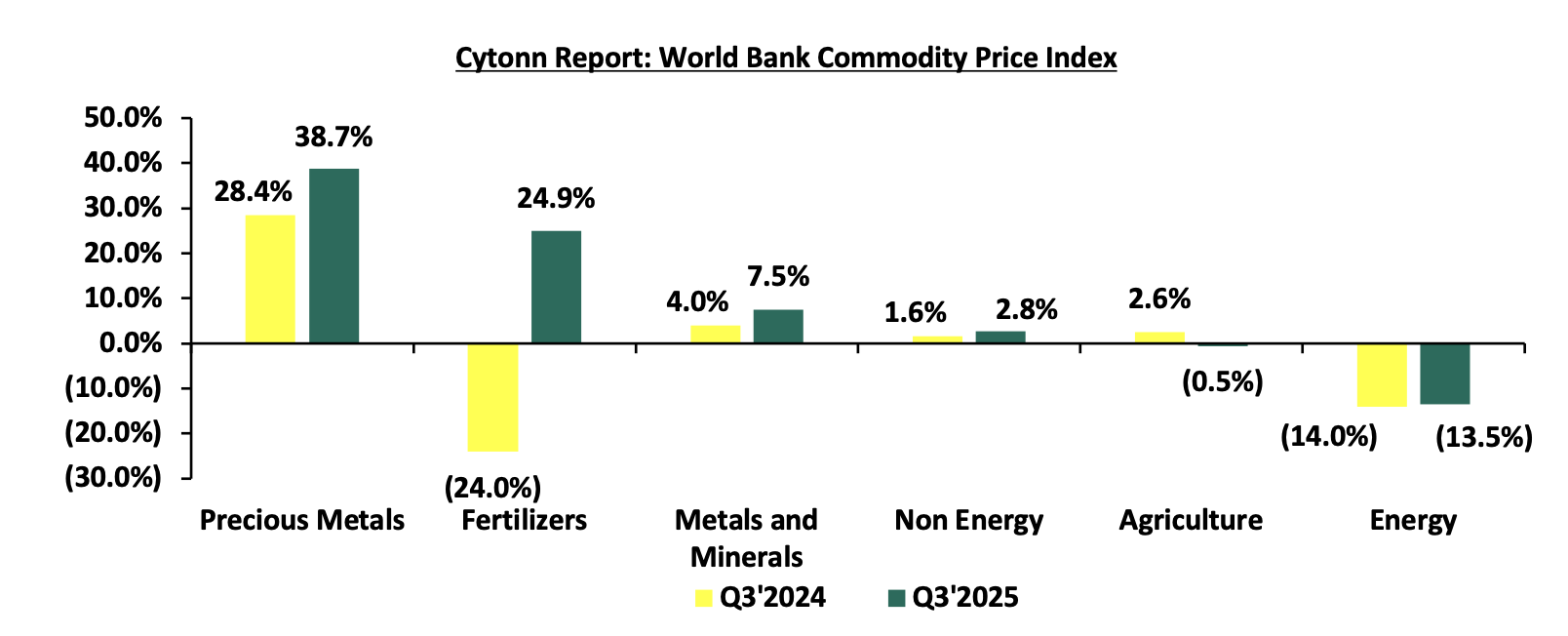

Global commodity prices registered mixed performance in Q3’2025, with prices of energy declining by 13.5%, compared to the 14.0% decrease recorded in Q3’2024, mainly as a result of due to a surge in oil and gas supply outpacing slowing demand growth, with renewable energy expansion further intensifying the oversupply and downward pressure. Additionally, prices of agriculture declined by 0.5% compared to the 2.6% increase recorded in Q3’2024 due to reduced demand and purchase orders. On the other hand, prices of precious metals increased by 38.7% in Q3’2025, compared to the 28.4% growth recorded in Q3’2024, mainly due to ongoing geopolitical tensions, a weakening U.S. dollar, and strong demand from both retail investors and central banks. Prices of Fertilizers, Metals and Minerals, and Non-Energy increased by 24.9%, 7.5% and 2.8% respectively, on the back of geopolitical tensions (especially in the Middle East), extreme weather impacting crop yields, rising input costs for fertilizers, and strong demand from clean-energy sectors. Tariffs and supply disruptions have further fueled these increases. Below is a summary performance of various commodities;

Source: World Bank

Global Equities Market Performance:

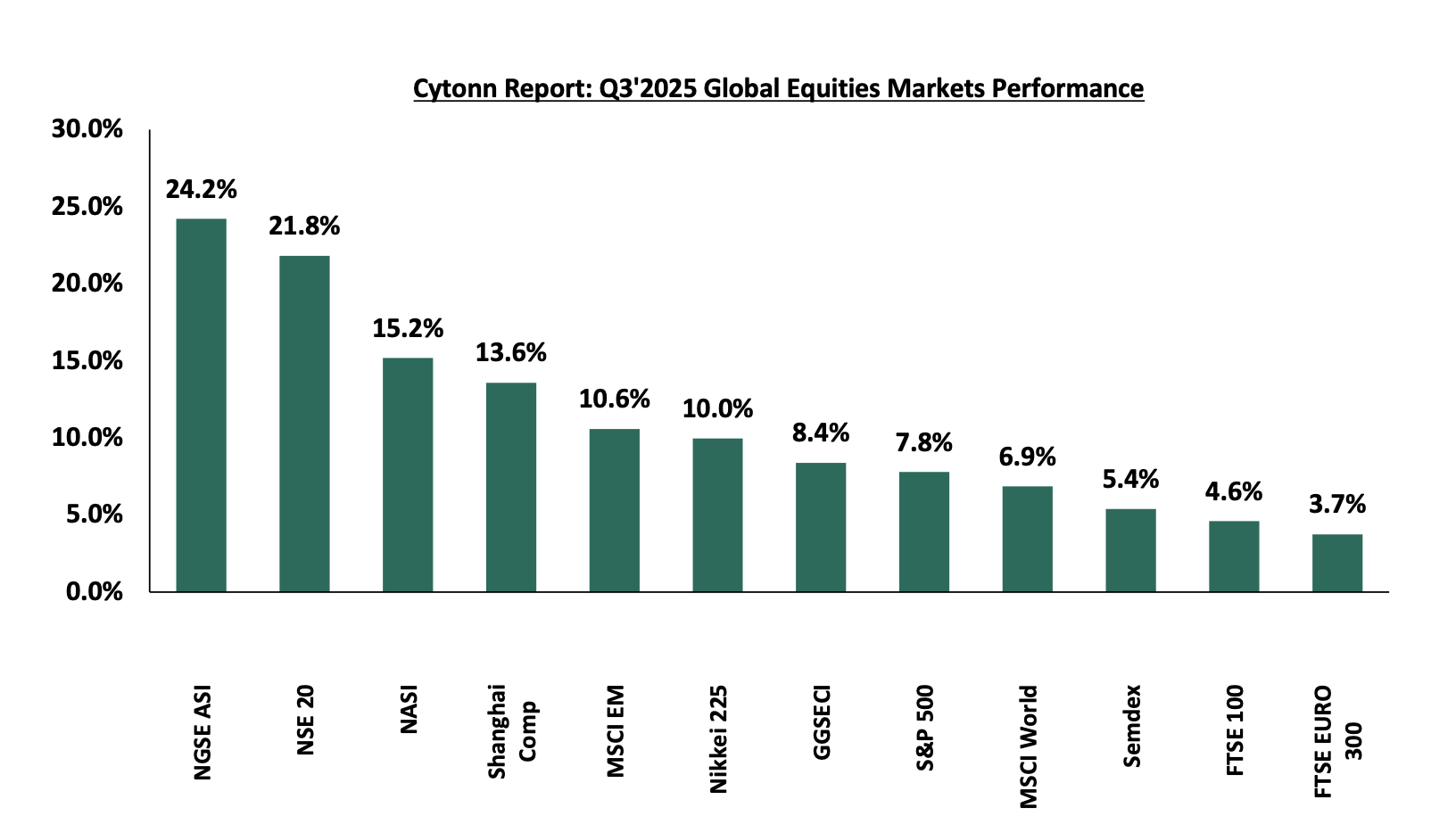

The global stock market was on an upward trajectory in Q3’2025, with most indices recording gains during the period, largely attributable to strong dividend growth, a weaker U.S. dollar boosting multinational earnings, resilient consumer spending, and rising investor confidence. Additionally, geopolitical tensions like tariff threats temporarily subsided and investors rotated into undervalued European and emerging markets. Notably, NGSEASI was the best performer during the period, recording a gain at 24.2% in Q3’2025 largely driven by gains in the large-cap stocks such as BUA Foods, Dangote Cement and MTN Nigeria gaining by 37.2%, 19.3% and 18.3% respectively, following improved earnings during the period, supported by easing inflation. Below is a summary of the performance of key indices as at the end of Q3’2025:

*Dollarized performance