Jun 30, 2019

Introduction

According to the World Bank, the global economy experienced a slower growth, downgrading its 2019 economic growth forecast by 0.3% points to 2.6%, from the projected 2.9% as at January 2019. This is as a result of increased policy uncertainty, a recent re-escalation of trade tensions between major economies such as US and China, and increased geopolitical tensions, such as that between the US and Iran. This has led to reduced confidence, and consequently a deceleration in global investment. The International Monetary Fund (IMF) also downgraded its 2019 growth projections by 0.2% points to 3.3%, from the estimated 2019 growth of 3.5% as at January 2019, weighed down by the weakening financial market sentiments owing to (i) the current uncertainty on the direction of trade policy between the US and China, (ii) country-specific uncertainty such as Britain’s exit (“Brexit”) from the European Union, (iii) heightened geopolitical tension between the US and Iran, disrupting the mid-stream and down-stream oil supply channel, and (iv) overall slowing global trade, which, according to World Bank, is expected to record a 2.6% growth in 2019, a 1.0% points downward revision from the 3.6% growth expected as at January 2019. Reduced consumption expenditure in major global economic regions such as Asia has also been touted as a major reason for reduced economic growth, as it has resulted in a reduction in global trade.

United States

The US economy is expected to grow by 2.5% in 2019, slower than the 2.9% growth recorded in 2018. The slower growth this year is due to the removal of the one-off tax benefits enjoyed in 2018, and the fiscal stimulus injected by the increased government spending in 2018. In Q1’2019, the US economy grew at a rate of 3.1% y/y, supported by increased local government spending, higher exports and business inventories. The slower pace of growth for the rest of the year is expected to be weighed down by reduced exports to major traditional partners such as China and the Eurozone, owing to uncertainty regarding trade between the US, China and the Eurozone. The Federal Open Monetary Committee (FOMC) held 4 meetings during H1’2019, and maintained the Federal Funds Rate at the range of 2.25% - 2.50%, citing:

- The current inflation rate of 1.8%, being in line with the government’s target of 2.0%,

- Low unemployment rate currently at 3.6%, which is below the Non-Accelerating Inflation Rate of Unemployment (NAIRU) of 4.6%. A reading of below 4.0% is considered to be close to full employment, and

- Economic activity “rising at a modest rate”, which did not require any stimulus injection in the form of a rate cut to support growth.

The stock market had been on an upward trend, with the S&P 500 gaining by 17.1% during the first half of 2019. The gain was largely supported by improved corporate earnings performance by a majority of counters in financial services, oil and gas, consumer goods and technology, largely attributed to the implemented tax reforms by the current administration, as the corporate tax rate was reduced to a uniform rate of 21.0% from the previous revenue-based tiered system that had the lowest tax rate for corporations at 25.0%. US valuations are still higher than their long-term historical average with the Shiller Cyclically Adjusted P/E (CAPE) multiple currently at 30.2x, which is 78.7% above the historical average of 16.9x.

Eurozone:

According to the World Bank, the Eurozone is expected to grow at rate of 1.2% and 1.4% in 2019 and 2020, respectively, lower than the 1.6% growth recorded in 2018. The projected 2019 growth was revised lower by 0.4% points, following dampened sentiments in major economies such as Germany, which has seen reduced private consumption, and declining industrial production, as shown by the Purchasing Managers Index (PMI) reading of 45.4 in June 2019, indicating a contraction in manufacturing activity especially in the automobiles sector, following the introduction of the revised auto-emission standards amid subdued foreign demand. Uncertainty over Britain’s exit from the European Union (“Brexit”) has also led to increased uncertainty in the Eurozone regarding its impact, and the type of exit deal to be adopted by the UK, as well as elections for the incoming Prime Minister expected on 22nd July 2019, following the resignation of Prime Minister Theresa May. Germany, France and Italy recently highlighted plans for accommodative fiscal policy, through limited tax plans and increased government spending, to boost economic performance.

The European Commercial Bank (ECB) maintained the base lending rate at 0.0%, and the rates on the marginal lending facility and deposit facility at 0.25% and (0.40%), respectively, indicating that it was unlikely to make changes to the policy rate until the end of the year, adopting an easing stance from its earlier expectations of an interest rate hike in Q3’2019. With the ECB having completed its Quantitative-Easing program, they are likely to adopt a more accommodative monetary policy through the use of Targeted Long-Term Refinancing Operations (TLTRO), which essentially involves the Central Bank issuing loans to commercial banks, for onward lending to commercial enterprises and households, so as to consequently spur economic activity and boost spending. Inflation has remained subdued, currently at 1.2%, below the 2.0% target. The bank highlighted its plan to push the inflation to close to its 2.0% target, largely through increased accommodative monetary policy.

The Stoxx 600 index rose by 13.8% in H1’2019, with the P/E ratio currently at 17.0x, 13.1% below the historical average of 19.5x, indicating markets are currently trading at relatively cheaper valuations.

China:

The World Bank projects the Chinese economy to grow by 6.2% in 2019, unchanged from the January 2019 projection, and lower than the 6.6% growth in FY’2018. The economy recorded a 6.4% growth in Q1’2019, largely aided by the subsiding of the prolonged trade dispute with the US, which culminated in a 90-day truce in January 2019, as US and China negotiated trade terms, coupled with intellectual property ownership, a major issue used by the US to instigate tariffs against China. Growth is however expected to remain subdued, owing to a resurfacing of the trade dispute with the US, which has dampened trade, and consequently affected the manufacturing sector, as shown by the decline in the official Manufacturing Purchasing Managers Index (PMI) to 49.4 in May 2019, from 50.1 in April 2019, with a reading of below 50 indicative of a contraction in manufacturing activity.

The Chinese government has adopted a more accommodative stance, with the aim of attaining the target GDP growth of “around 6.5%” by injecting liquidity in the economy by reducing the reserve requirements for banks, and resuming public investment, which should result in increased liquidity and consequently higher domestic consumption.

The Shanghai Composite has gained by 20.2% in H1’2019, supported by an abating of the trade tension in Q1’2019, coupled with increased capital injection by the government, which improved investor confidence. The gains have led to the market’s valuation rising by 1.4% above the historical average to 14.7x compared to the historical average of 14.5x.

Commodity Prices:

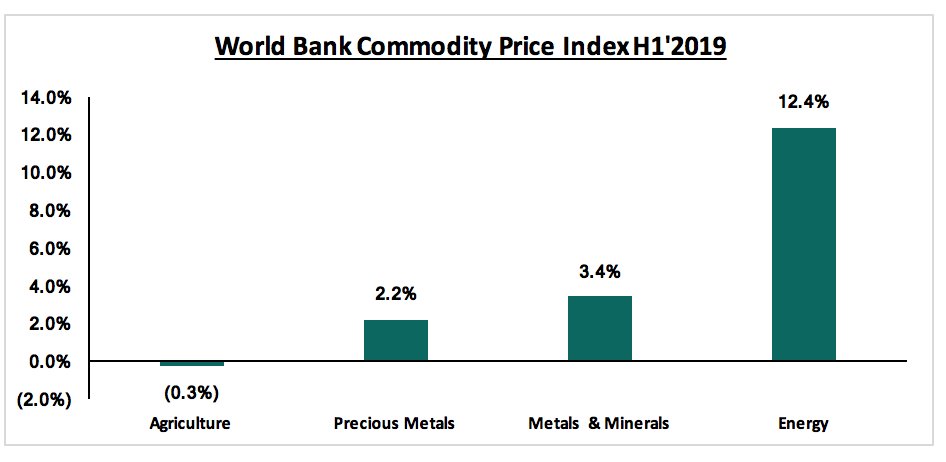

According to the World Bank Commodity Prices Index, energy, metals, precious metals and agriculture segments gained (declined) by 12.4%, 3.4%, 2.2% and (0.3%), respectively, in H1’2019. Below is a chart showing the performance of select commodity groups for H1’2019.

As per the chart above:

- All the highlighted commodity groups recorded increased prices with the exception of agriculture, with the gains in energy majorly driven by the recovery in crude prices, as Crude WTI and Crude Brent gained by 24.9% and 24.3%, respectively to USD 60.8 and USD 70.5 per barrel in May 2019, from USD 49.0 and USD 56.5, in December 2018.

- The decline in agriculture was largely driven by the declines in oils & meals and food, which recorded declines of 4.1% and 1.3%, respectively.