Jan 6, 2019

The year 2018 was characterized by a flat global growth as the growth in the US was weighed down by the negative effects of the trade conflicts between the US, China and Eurozone, as well as a weaker outlook for some key emerging markets such as China and Brazil, arising from country-specific factors such as (i) country-wide industrial action in Brazil, (ii) political uncertainty in Britain due to the Brexit vote, and (iii) country-wide protests in France, tighter financial conditions, and geopolitical tensions. According to IMF, global GDP growth in 2018 is expected to come in at 3.7%, similar to the growth registered in 2017, and higher than the 5-year average of 3.5%. The IMF downgraded their expectations for global growth this year from 3.9% in June 2018 to 3.7% in October 2018, citing that the trade tensions between the U.S. and trading partners have started to hit economic activity worldwide.

In terms of trade, the World Trade Organization (WTO) downgraded their outlook for world trade growth in 2018 to 3.9% from their 4.4% expectation in April 2018, citing a rise in trade tariffs targeting a variety of exports from large economies, mainly the US, China and the Eurozone. The uncertainty generated by the continuous trade conflicts has had the impact of reducing international trade. Monetary policy tightening in developed economies has also contributed to volatility in exchange rates, especially in emerging markets, thereby further negatively affecting international trade.

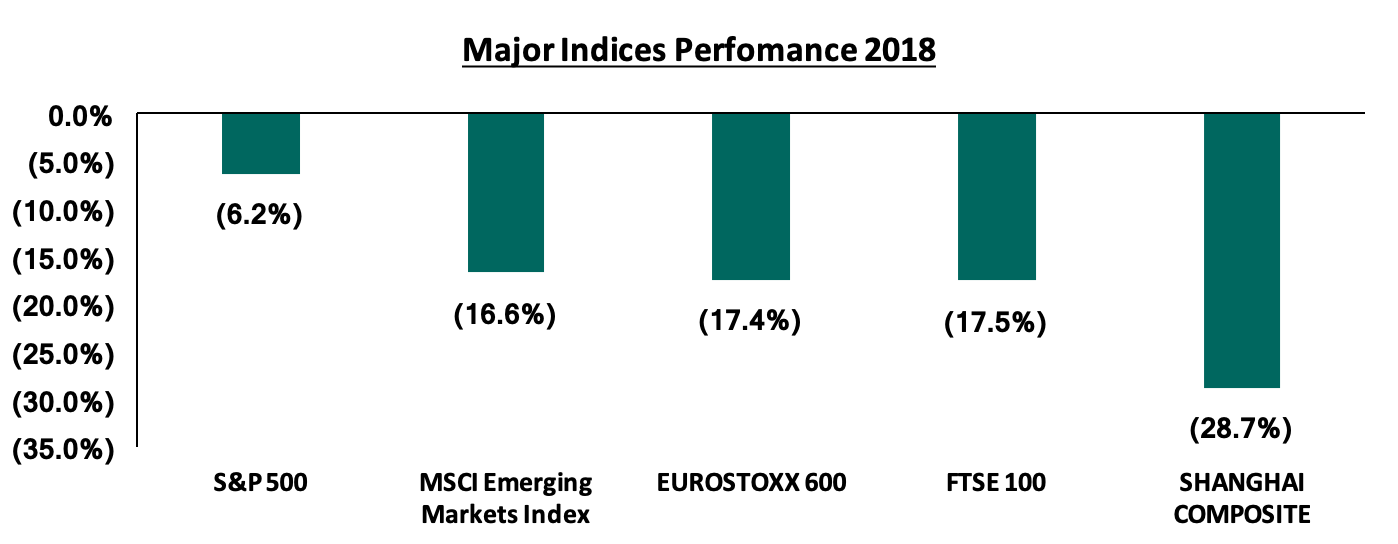

Global equity markets registered declines during the year, as shown in the chart below, as gains made during the first 9-months of the year were wiped-out by large declines in the fourth quarter of the year. The poor performance in the last quarter of the year was due to a slowdown in global economic growth prospects, following a persistence in trade conflict among major economies, increased geopolitical tensions and declining commodity prices, which dampened investor sentiment leading to sustained price declines.

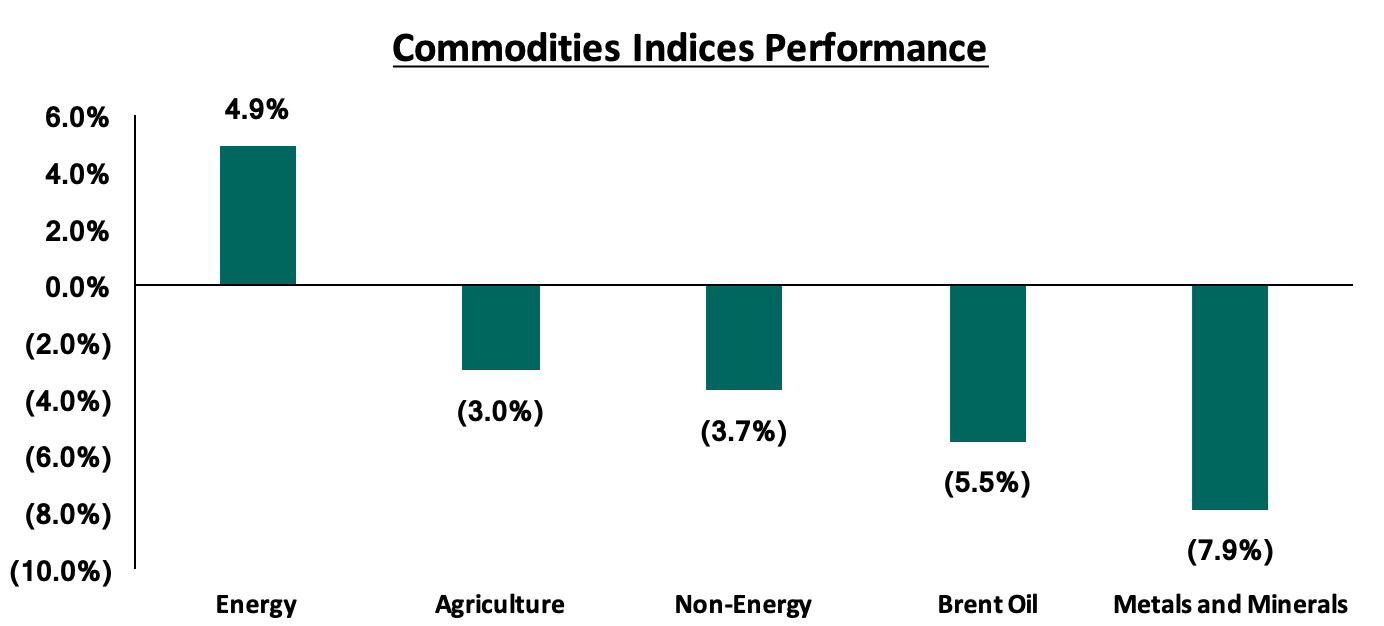

Global commodities registered declines in 2018, with agriculture, non-energy commodities, Brent oil and metals & minerals registering declines of 3.0%, 3.7%, 5.5%, and 7.9%, respectively, while energy gained by 4.9%, according to the World Bank Commodity Prices Index. The rise in energy prices was driven by gains in natural gas prices in US, Japan and Europe that rose 49.9%, 34.8%, and 15.8%, respectively, coupled with the 1.8% rise in crude oil prices. Below is a chart highlighting the performance of select commodity indices:

United States

The US economy continued to register strong growth with the growth for Q3’2018 coming in at 3.5%, slower than the 4.2% recorded in Q2’2018, but faster than the 2.8% recorded in Q3’2017. The growth has largely been attributed to the Trump administration’s USD 1.5 tn tax cut package, which has boosted consumer spending, and consequently supported business investment, as shown by the increased overall inventory accumulation. The labor market has remained strong, with Non-Farm Payroll (NFP) increasing by 155,000 in November 2018, and at an average monthly increase of 192,000 during the year. This has seen the unemployment rate remain at a 49-year low of 3.7%. Wage growth has also remained strong, coming in at a 0.9% q/q increase, and a 3.1% y/y increase, the highest since June 2009.

The Federal Reserve has continued implementing its tighter monetary policy, having started on a tightening cycle in December 2016. In 2018, the Fed implemented four hikes, of 25 bps each, in March, June, October and December, with the Federal Funds rate ending the year at a band of 2.25% - 2.50%, from a range of 1.25% - 1.5% at the beginning of the year. The rate hikes were driven by:

- A strong labor market, with an average of 192,000 new jobs added every month during the year and the unemployment rate at lows of 3.7% in December, compared to 5.0% unemployment rate that is considered full employment in the US economy,

- A relatively strong annual economic growth, which is projected to come in at 2.9% in 2018, higher than 2.3% recorded in 2017, driven by increased consumer spending, and,

- A desired rate of inflation in the economy. On a 12-month basis, both overall inflation and inflation for items other than food and energy have remained near the government’s preferred level of 2.0%, coming in at 2.2% in November 2018,

The stock market registered declines, with the S&P 500 declining by 6.2%, as 9.0% YTD gains to September 2018 were eroded during the fourth quarter of the year. The gains in the first 9 months of the year were supported by strong growth in corporate earnings, and expected implementation of pro-growth policies under the administration of President Trump, including tax reforms that have resulted in corporate tax rates falling to 21.0% from 35.0%, with the administration indicating the possibility of further tax declines. However, for the fourth quarter of the year, stock markets posted declines as increased concerns of a slower global economic growth, tighter monetary conditions, increased trade and geopolitical tensions, and the possibility of an economic recession in the US in 2019 dampened investor sentiment. In terms of valuations, the Cyclically Adjusted Price/Earnings (CAPE) ratio is currently at 29.0x, 72.6% above the historical average of 16.8x, indicating the market albeit on a declining trend, remains overvalued relative to historical levels.

Eurozone

Economic growth in the Eurozone slumped to a four year low in Q3’2018, as GDP expanded by 0.2%, slower than the 0.4% recorded in Q1’2018 and Q2’2018, and 0.7% in Q3’2017.The slowdown is due to:

- Reduced exports from the region, which contracted by 0.1% q/q from the 2.0% growth recorded in Q2’2018, owing to the cooling global trade,

- An increase in geopolitical tensions, which weighed on investment in the quarter, as fixed investment growth came in at 0.2%, significantly lower than the 1.5% recorded in Q2’2018, and,

- A slowdown in business activity, with the Eurozone’s Purchasing Managers Index (PMI) falling to a 49-month low of 51.3 in December 2018, from 60.6 in December 2017, indicating that growth of business activity in the euro area slowed to the weakest for over four years in December.

The region is expected to grow by 2.0% in 2018, compared to a 2.4% growth experienced in 2017, and a downward revision from the 2.2% expected growth rate as at June 2018 on slower expected growths in major economies such as Germany and France, of 1.9% and 1.6%, compared to earlier projections of 2.2% and 1.8%, respectively. The labor market recovery continued, with the unemployment rate dropping to 8.1% in October 2018, from 8.6% in December 2017. This, however, is still below the desired level of 5.0%

The European Central Bank (ECB) announced that it would stop its asset-bond buying program in December 2018. This is after the bank had accumulated EUR 2.6 tn in assets over nearly four-years, in a bid to stimulate the Eurozone’s economic recovery. The ECB reiterated that it would continue to reinvest the principal payments from maturing securities for an undefined extended period time, which should keep conditions accommodative. Throughout the year, the ECB left the refinancing rate at 0.0%, the marginal lending rate at 0.25% and deposit facility rate at -0.4%. Inflation remained stable during the year at 1.9% as at November 2018, within the target of 2.0%.

Eurozone stock markets were on a declining trend with The EuroStoxx 600 index declining by 17.4% during the year, driven by dampened investor sentiment owing to reduced global economic growth, and heightened geopolitical tensions, following civil unrest in France and increased uncertainty on Britain’s withdrawal from the EU (“Brexit”). In terms of valuations, the EuroStoxx 600 Index is currently trading at a P/E of 14.8x, 27.1% below its historical average of 20.3x, indicating markets are undervalued and are trading at cheap valuations relative to historical levels.

China

The World Bank expects China’s 2018 growth to come in at 6.6%, slightly lower than the 6.7% recorded in 2017. The economy recorded a 6.5% growth in Q3’2018, the lowest growth since Q1’2009, largely weighed down by reduced global trade owing to heightened geopolitical tensions and trade tensions. China and the US have been caught up in a trade war, with the US imposing a 10.0% tariff on goods worth USD 200.0 bn, and China imposing a further retaliatory 10.0% tariff on goods worth USD 60.0 bn, bringing the value of goods under imposed/proposed tariffs by China to USD 110.0 bn.

The government has adopted a more accommodative monetary policy as they reduced their pace in the campaign to reduce the government debt, amid concerns about the slowdown in investment, and negative impact of the trade war with the US. The central government is focusing on encouraging local governments to speed up spending of unused revenues and banks to ensure adequate financing for local government projects. The Chinese Government announced CNY 1.2 tn (USD 180.0 bn) in business tax cuts in addition to policies aimed at boosting infrastructure expenditure.

The stock market recorded a negative return during the year, with the Shanghai Composite declining by 28.7% in 2018, weighed down by the dampened investor sentiment owing to the prolonged trade tensions with the US, heightened geopolitical tensions, and an overall slower economic growth. In terms of valuations, the Shanghai Composite index is currently trading at a P/E of 11.6x, 24.7% lower than the historical average P/E of 15.4x, indicating the market is currently undervalued, and is currently trading at cheap valuations relative to historical levels.